La creciente demanda de electricidad impulsa la expansión y modernización de la red eléctrica. Las empresas de servicios públicos invierten en transmisión de alta tensión para mejorar la fiabilidad y fomentar la integración de las energías renovables. Este crecimiento incrementa la necesidad de transformadores de medida de alta tensión para una medición y protección precisas. Estos transformadores garantizan una transmisión eficiente de la energía a través de las redes de alta tensión. La expansión de los proyectos de infraestructura seguirá impulsando la demanda del mercado.

Data Bridge Market Research analiza que se espera que el mercado de transformadores de instrumentos de alto voltaje de EE. UU. alcance los USD 2,76 mil millones para 2032 desde USD 1,51 mil millones en 2024, creciendo con una CAGR del 7,9% en el período de pronóstico de 2025 a 2032.

Principales hallazgos del estudio

Inversiones gubernamentales en la modernización de redes inteligentes

Los proyectos de resiliencia de la red, el soterramiento de líneas eléctricas y la infraestructura de transmisión avanzada son factores clave para el mercado estadounidense de transformadores de medida de alta tensión. Estas iniciativas mejoran la eficiencia de la red, facilitan la integración de energías renovables y requieren una monitorización precisa de la tensión, lo que incrementa la demanda de transformadores de alto rendimiento. Con el impulso a la fiabilidad y expansión de la red, el mercado está preparado para un crecimiento sostenido, impulsado por la necesidad de soluciones avanzadas de medición y protección en un panorama energético en constante evolución.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2025 a 2032

|

Año base

|

2024

|

Años históricos

|

2023 (personalizable de 2013 a 2017)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Tipo (transformadores de corriente [TC], transformadores de potencial [TP] y transformadores de instrumentos combinados), tensión nominal (hasta 66 kV, 66-132 kV, 132-220 kV, 220-330 kV, 330-765 kV y superior a 765 kV), aislamiento dieléctrico (transformadores sumergidos en aceite, transformadores con aislamiento de gas SF6, transformadores de tipo seco), uso final (servicios eléctricos, petróleo y gas, fabricación, ferrocarriles, energías renovables, centros de datos e infraestructura de TI, entre otros).

|

Países cubiertos

|

PIOJO

|

Actores del mercado cubiertos

|

ABB (Suiza), GE Grid Solutions, LLC (parte de GE Vernova Company) (Japón), Trench Group (EE. UU.), NISSIN ELECTRIC Co., Ltd. (Japón), Hubbell (EE. UU.), Hitachi, Ltd. (Japón), Mitsubishi Electric Corporation (EE. UU.), ARTECHE (EE. UU.), Agile Magnetics (EE. UU.), RITZ US (EE. UU.), KONČAR dd (EE. UU.) y Pfiffner Group (EE. UU.), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado estadounidense de transformadores de instrumentos de alto voltaje está segmentado en cinco segmentos notables según el tipo, la clasificación de voltaje, el aislamiento dieléctrico y el uso final.

- Según el tipo, el mercado estadounidense de transformadores de instrumentos de alto voltaje se segmenta en transformadores de corriente (CT), transformadores de potencial (PT) y transformadores de instrumentos combinados.

Se espera que en 2025, el segmento de transformadores de corriente (CT) domine el mercado estadounidense de transformadores de instrumentos de alto voltaje.

Se espera que en 2025, el segmento de transformadores de corriente (CT) domine el mercado con una participación de mercado del 43,71 % debido a la creciente demanda de medición de energía eficiente y precisa, estabilidad de la red y seguridad en aplicaciones de alto voltaje.

- Sobre la base de la clasificación de voltaje, el mercado de transformadores de instrumentos de alto voltaje de EE. UU. está segmentado en hasta 66 KV, 66 – 132 KV, 132 – 220 KV, 220 – 330 KV, 330 – 765 KV y más de 765 KV.

En 2025, se espera que el segmento de hasta 66 KV domine el mercado de transformadores de instrumentos de alto voltaje de EE. UU.

Se espera que en 2025, el segmento de hasta 66 KV domine el mercado con una participación de mercado del 42,39% debido a la creciente demanda de infraestructura de distribución de energía en áreas urbanas e industriales.

- En función del aislamiento dieléctrico, el mercado estadounidense de transformadores de medida de alta tensión se segmenta en transformadores sumergidos en aceite, transformadores con aislamiento en gas SF6 y transformadores de tipo seco. En 2025, se prevé que el segmento de transformadores sumergidos en aceite domine el mercado con una cuota de mercado del 55,31 %.

- En función del uso final, el mercado estadounidense de transformadores de medida de alta tensión se segmenta en servicios públicos de energía, petróleo y gas, manufactura, ferrocarriles, energías renovables, centros de datos e infraestructura de TI, entre otros. En 2025, se prevé que el segmento de servicios públicos de energía domine el mercado con una cuota de mercado del 41,86 %.

Actores principales

Data Bridge Market Research analiza ABB (Suiza), GE Grid Solutions, LLC (una parte de GE Vernova Company) (Japón), Trench Group (EE. UU.), NISSIN ELECTRIC Co., Ltd. (Japón) y Hubbell (EE. UU.) son las principales empresas que operan en este mercado.

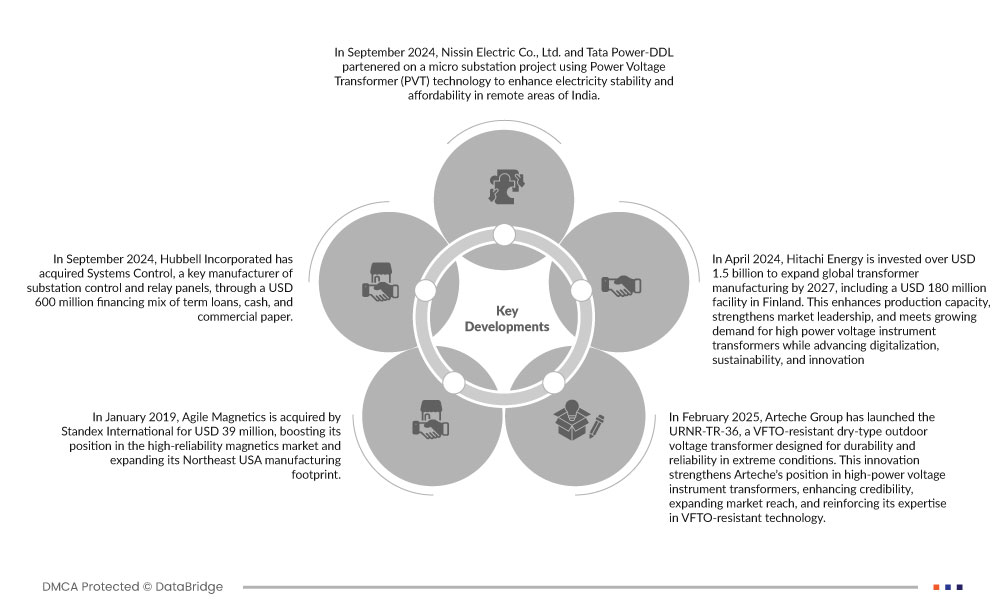

Desarrollos del mercado

- En septiembre de 2024, Nissin Electric Co., Ltd. y Tata Power-DDL se asociarán en un proyecto de microsubestación que utilizará tecnología de transformadores de tensión de potencia (PVT) para mejorar la estabilidad y la asequibilidad de la electricidad en zonas remotas de la India. Esta colaboración permitirá a Nissin Electric demostrar sus avanzadas soluciones PVT, consolidando su posición en el mercado de transformadores de medida de alta tensión de potencia.

- En septiembre de 2024, Hubbell Incorporated adquirió Systems Control, un fabricante clave de paneles de control y relés para subestaciones, mediante una financiación de 600 millones de dólares estadounidenses, compuesta por préstamos a plazo, efectivo y papel comercial. Esta adquisición fortalece la posición de Hubbell en el sector de transformadores de medida de alta tensión al ampliar sus soluciones de control de subestaciones, reforzar la fiabilidad de la red y fortalecer su papel en infraestructuras eléctricas críticas.

- En enero de 2019, Agile Magnetics fue adquirida por Standex International por 39 millones de dólares, lo que fortaleció su posición en el mercado de productos magnéticos de alta confiabilidad y expandió su presencia de fabricación en el noreste de EE. UU. El acuerdo le dio a Agile acceso a los recursos globales de Standex, lo que mejoró sus capacidades en transformadores de medida de alta tensión, fortaleció las alianzas con los clientes, optimizó la cadena de suministro y aumentó su competitividad en mercados de alto crecimiento.

- En febrero de 2025, el Grupo Arteche lanzó el URNR-TR-36, un transformador de tensión seco para exteriores resistente a VFTO, diseñado para ofrecer durabilidad y fiabilidad en condiciones extremas. Esta innovación refuerza la posición de Arteche en el sector de los transformadores de medida de alta tensión, reforzando su credibilidad, ampliando su alcance de mercado y consolidando su experiencia en tecnología resistente a VFTO.

- En abril de 2024, Hitachi Energy invertirá más de 1500 millones de dólares para expandir la fabricación global de transformadores hasta 2027, incluyendo una planta de 180 millones de dólares en Finlandia. Esto mejora la capacidad de producción, consolida el liderazgo en el mercado y satisface la creciente demanda de transformadores de medida de alta tensión, a la vez que impulsa la digitalización, la sostenibilidad y la innovación.

Según el análisis de investigación de mercado de Data Bridge:

Para obtener información más detallada sobre el mercado estadounidense de transformadores de instrumentos de alto voltaje, haga clic aquí: https://www.databridgemarketresearch.com/reports/us-high-voltage-instrument-transformer-market