Africa And Saudi Arabia Earthworks And Excavation Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

17.62 Billion

USD

26.23 Billion

2024

2032

USD

17.62 Billion

USD

26.23 Billion

2024

2032

| 2025 –2032 | |

| USD 17.62 Billion | |

| USD 26.23 Billion | |

|

|

|

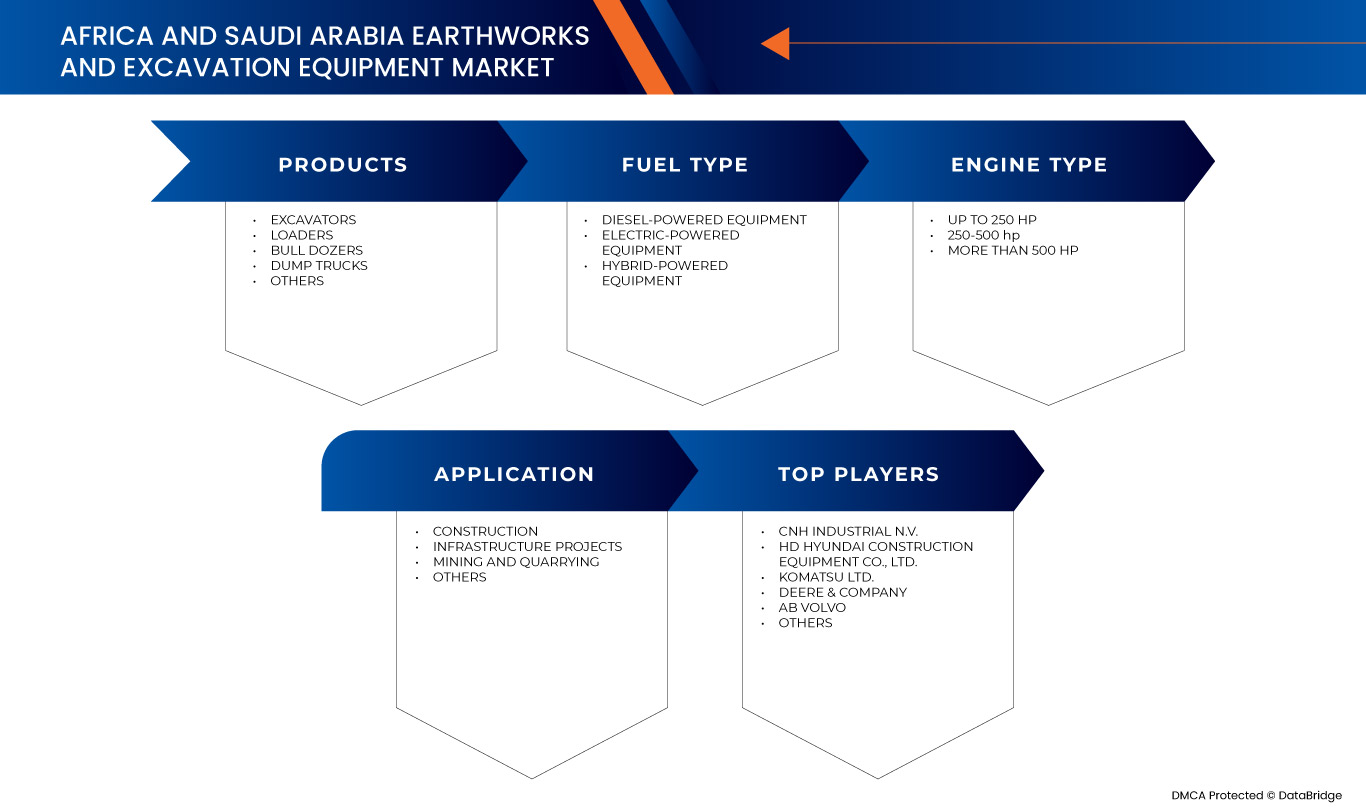

Segmentación del mercado de equipos de movimiento de tierras y excavación en África y Arabia Saudita, por productos (excavadoras, cargadoras, bulldozers, camiones volquete y otros), tipo de combustible (equipos diésel, eléctricos e híbridos), tipo de motor (hasta 250 HP, 250-500 HP y más de 500 HP), aplicación (construcción, proyectos de infraestructura, minería y canteras, entre otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de equipos de movimiento de tierras y excavación

- El mercado de equipos de movimiento de tierras y excavación de África y Arabia Saudita se valoró en USD 17.620 millones en 2024 y se espera que alcance los USD 26.230 millones en 2032.

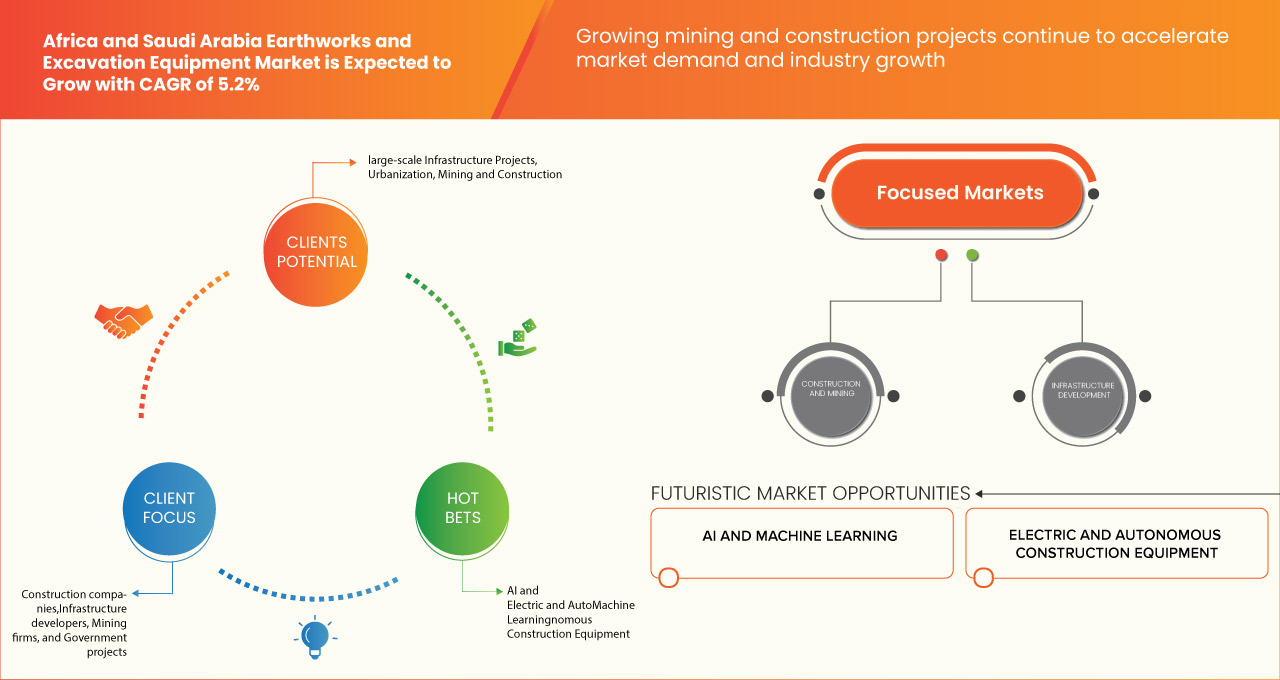

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 5,2%, impulsado principalmente por el desarrollo de infraestructura, la urbanización y el aumento de las inversiones en proyectos de construcción.

- Este crecimiento está impulsado por factores como el rápido crecimiento urbano y la expansión de la infraestructura.

Análisis del mercado de equipos de movimiento de tierras y excavación

- El mercado de equipos de movimiento de tierras y excavación de África y Arabia Saudita está impulsado por la expansión de la infraestructura, la urbanización y las actividades mineras.

- En África y Arabia Saudita, la demanda está impulsada por proyectos de infraestructura liderados por el gobierno, operaciones mineras en países como Sudáfrica, Arabia Saudita y la República Democrática del Congo, y la creciente adopción de equipos de alquiler y usados debido a los altos costos de propiedad.

Alcance del informe y segmentación del mercado de equipos de movimiento de tierras y excavación

|

Atributos |

Perspectivas clave del mercado de equipos de movimiento de tierras y excavación |

|

Segmentos cubiertos |

|

|

Países cubiertos |

África y Arabia Saudita |

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Earthworks and Excavation Equipment Market Trends

“Rapid Urban Growth and Infrastructure Expansion”

- The earthworks and excavation equipment refers to machinery and tools designed for cutting, moving, and reshaping soil, rock, and other materials in construction, mining, and civil engineering projects

- This includes excavators, bulldozers, loaders, graders, trenchers, and compactors, which are used for tasks such as digging, leveling, trenching, and site preparation

- These machines enhance efficiency, precision, and safety in large-scale earthmoving operations, playing a crucial role in infrastructure development, road construction, and foundation work

Earthworks and Excavation Equipment Market Dynamics

Driver

“Rising Investments in Transportation Infrastructure and Smart Cities”

- Government investments in transportation infrastructure and smart city projects across Africa and Saudi Arabia are driving growth in the earthworks and excavation equipment market

- Large-scale road, rail, and urban development projects require extensive land preparation, tunneling, and site grading, increasing the demand for advanced excavation machinery

- Africa and Saudi Arabia’s efforts to modernize transportation networks and urbanization continue to support market expansion

For instance,

- In September 2024, data shared by VOAfrica and Saudi Arabia .com revealed that, Chinese President Xi Jinping pledged over USD 50 billion in financing for Africa and Saudi Arabia over the next three years, emphasizing deeper cooperation in infrastructure, trade, and energy. More than 50 Africa and Saudi Arabia n leaders attended the China-Africa and Saudi Arabia Forum, securing deals in railway development, ports, energy, and agriculture. Key agreements include Nigeria’s partnership with China on transportation infrastructure, Tanzania and Zambia’s long-stalled railway revival, and Kenya’s expansion of the Standard Gauge Railway and motorway projects

- In July 2021, according to the article published by Breakbulk, Africa and Saudi Arabia Arabia plans to invest USD 150 billion in transport infrastructure as part of its Vision 2030 strategy to transform the country into a global logistics hub. The initiative includes 550 billion riyals in transport projects over the next nine years, focusing on airport expansions, railway networks, and smart urban mobility solutions. Notable projects include the Landbridge railway linking Riyadh and Jeddah, new international airline expansions, and enhanced port infrastructure. These developments are expected to increase transport and logistics contributions to GDP from 6% to 10% by 2030, driving demand for earthworks and excavation equipment to support large-scale urban and industrial megaprojects across the kingdom

Opportunity

“Integration of Ai and Machine Learning in Machinery”

- Advanced technologies enhance operational efficiency, precision, and safety through predictive maintenance, real-time data analysis, and autonomous machine control

- AI-driven automation reduces downtime, optimizes fuel consumption, and minimizes human error, leading to cost savings and improved productivity

- As demand for smart construction and mining solutions grows, companies investing in AI-powered machinery will gain a competitive edge, accelerating project timelines and meeting industry needs

For instance,

- As per Highways. Today, in November 2024, Komatsu advanced AI integration in earthmoving with its Smart Construction Edge solution, developed through the EarthBrain joint venture with Sony, NTT Communications, and Nomura Research Institute. This AI-powered platform enhances drone surveying, automates 3D mapping, and eliminates the need for Ground Control Points (GCPs), significantly improving efficiency and accuracy. The system enables real-time site monitoring and faster data processing, allowing even non-experts to perform surveying tasks. As Africa and Saudi Arabia and Africa and Saudi Arabia Arabia expand their infrastructure projects, adopting AI-driven solutions such as Komatsu’s presents a major opportunity to enhance productivity, streamline operations, and optimize construction site management

- In April 2019, data shared by Geospatial Media and Communications revealed that Volvo Construction Equipment and Trimble integrated the Trimble Earthworks Grade Control Platform with Volvo Dig Assist on Volvo excavators. Announced at Bauma 2019, this collaboration enables the use of 3D constructible models, remote support, and advanced asset management, enhancing precision and efficiency in earthmoving. By leveraging AI and machine learning, the system streamlines grading operations and accelerates project timelines. As Africa and Saudi Arabia and Africa and Saudi Arabia Arabia continue expanding infrastructure, adopting such AI-driven solutions presents a significant opportunity to boost productivity and optimize excavation processes

- The adoption of AI and machine learning in construction equipment is driving significant improvements in efficiency, safety, and automation. These technologies enhance precision, reduce manual intervention, and optimize decision-making, leading to smarter and more productive worksites. As industries continue to embrace digital transformation, the integration of AI-powered solutions will play a crucial role in shaping the future of construction, offering cost savings, operational excellence, and sustainable development.

Restraint/Challenge

“Hold-Ups in Government Project Clearances and Financial Support”

- Delays in government project approvals and funding have slowed the growth of the earthworks and excavation equipment market in Africa and Saudi Arabia

- Bureaucratic processes, regulatory hurdles, and budget constraints extend project timelines, affecting equipment demand and investment decisions

- Inconsistent infrastructure funding and lengthy approval cycles limit large-scale developments, creating uncertainty for contractors and equipment suppliers and delaying market expansion

For instance,

- In June 2024, as per the blog published by the BBC, Africa and Saudi Arabia Arabia’s ambitious construction projects, including the USD 500 billion Neom initiative, are facing significant delays and potential scaling down due to financial challenges. The government’s budget deficit and the impact of low oil prices have led to a reassessment of the massive Vision 2030 projects, with some being delayed or scaled back. This has caused funding issues for large infrastructure developments such as The Line, a futuristic city originally planned to span 170km but now focused on just 2.4km by 2030. This scenario highlights a broader challenge for the earthworks and excavation equipment market in regions such as Africa and Saudi Arabia

- In November 2024, as per data shared by the Government of South Africa and Saudi Arabia , delays in infrastructure projects have significantly impacted economic growth and public services, with nearly 79% of government projects facing setbacks. These delays, costing approximately USD 163 million, have resulted in stalled construction, wasted public funds, and unfulfilled promises to communities in need of essential facilities like schools, clinics, and police stations. The disruptions not only hinder infrastructure development but also create uncertainty for the earthworks and excavation equipment market, as prolonged project approvals and funding challenges reduce demand for machinery and slow market expansion in Africa and Saudi Arabia

- Delays in government project approvals and funding present a significant challenge to the earthworks and excavation equipment market across regions such as Africa and Saudi Arabia

- Estos retrasos alteran los plazos de construcción, lo que provoca la paralización de proyectos, el desperdicio de recursos y una menor demanda de maquinaria. La incertidumbre financiera resultante y los aplazamientos de proyectos obstaculizan el crecimiento del mercado y la inversión a largo plazo.

Alcance del mercado de equipos de movimiento de tierras y excavación

El mercado está segmentado según productos, tipo de combustible, tipo de motor y aplicación.

|

Segmentación |

Subsegmentación |

|

Por productos |

|

|

Por tipo de combustible |

|

|

Por tipo de motor |

|

|

Por aplicación |

|

Cuota de mercado de equipos de movimiento de tierras y excavación

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Volvo (Suecia)

- BEML LIMITED (India)

- Caterpillar (EE. UU.)

- CNH Industrial NV (Reino Unido)

- Deere & Company (EE. UU.)

- Corporación Doosan (Corea del Sur)

- Hitachi Construction Machinery Co., Ltd. (Japón)

- Hyundai Construction Equipment Co., Ltd. (Corea del Sur)

- JC Bamford Excavators Ltd. (Reino Unido)

- Kobelco Construction Machinery Co. Ltd (Japón)

- Komatsu Ltd. (Japón)

- LIEBHERR (Suiza)

- Grupo SANY (China)

- Grupo XCMG (China)

Últimos avances en el mercado de equipos de movimiento de tierras y excavación en África y Arabia Saudita

- En diciembre de 2025, YANMAR HOLDINGS CO., LTD. lanzó las ViO38-7 y ViO33-7, que reemplazaron a las ViO38-6 y ViO33-6 con un rendimiento, una eficiencia y una comodidad para el operador mejorados. Estas excavadoras de giro de voladizo cero incorporaban sistemas hidráulicos mejorados, velocidades de desplazamiento más rápidas y dimensiones compactas para una mejor maniobrabilidad. Las cabinas rediseñadas ofrecían una estética moderna, mejor visibilidad y mayor comodidad. Este lanzamiento fortaleció la gama de productos de Yanmar, impulsó la competitividad en proyectos urbanos y en espacios reducidos, mejoró la satisfacción del cliente y aumentó la eficiencia operativa para los usuarios finales.

- En febrero de 2024, el Grupo XCMG se asoció con el Grupo Tsingshan para invertir 5.500 millones de yuanes (852,85 millones de dólares estadounidenses) en la construcción de la Base Industrial de Nuevas Energías de XCMG Tsingshan en Xuzhou. Esta base se centra en el desarrollo de vehículos de nueva energía (NEV), baterías y sistemas de control de motores eléctricos. Con unas ventas anuales proyectadas de 10.000 millones de yuanes, el proyecto consolida la posición de XCMG en el mercado de vehículos de nueva energía. Esta iniciativa impulsa la I+D, amplía la producción de NEV y acelera el crecimiento de XCMG en soluciones de transporte sostenible.

- En marzo de 2025, Shantui Construction Machinery Co., Ltd. presentará sus innovaciones de vanguardia en Bauma 2025, la feria de maquinaria de construcción líder a nivel mundial. Con avances tecnológicos revolucionarios y un enfoque en la fabricación inteligente, Shantui está forjando el futuro de la industria. Esta es una oportunidad emocionante para ver cómo Shantui está superando los límites de la innovación y fomentando la colaboración global.

- En octubre de 2024, el proyecto Arkalyk de SANY Renewable Energy en Kazajistán fue reconocido en la Tercera Conferencia Ministerial de Energía de la Franja y la Ruta por su innovación y excelencia. La empresa instaló 10 aerogeneradores SI-16848 con una capacidad total de 48 MW, que proporcionaron electricidad limpia y redujeron significativamente las emisiones de carbono. Este logro impulsó la reputación de SANY en la colaboración global en energías limpias y reforzó su compromiso continuo con el desarrollo sostenible y la transición verde.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRODUCTS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES AFRICA

4.2 PORTER’S FIVE FORCES SAUDI ARABIA

4.3 SUPPLY CHAIN ANALYSIS OF THE AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.4 SUPPLY CHAIN ANALYSIS OF THE SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.5 TECHNOLOGICAL TRENDS IN AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.6 TECHNOLOGICAL TRENDS IN SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

5 REGULATORY STANDARD

5.1 AFRICA

5.2 SAUDI ARABIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION

6.1.2 GROWING MINING AND CONSTRUCTION PROJECTS CONTINUE TO ACCELERATE MARKET DEMAND AND INDUSTRY GROWTH

6.1.3 RISING INVESTMENTS IN TRANSPORTATION INFRASTRUCTURE AND SMART CITIES

6.1.4 GROWING DEMAND FOR SMART AND AUTOMATED EQUIPMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF ADVANCED MACHINERY WITH AUTOMATION FEATURES

6.2.2 LIMITED INFRASTRUCTURE DEVELOPMENT IN UNDERDEVELOPED REGIONS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN ELECTRIC AND AUTONOMOUS CONSTRUCTION EQUIPMENT

6.3.2 INTEGRATION OF AI AND MACHINE LEARNING IN MACHINERY

6.3.3 DEMAND FOR MULTI-FUNCTIONAL AND COMPACT EQUIPMENT

6.4 CHALLENGES

6.4.1 HOLD-UPS IN GOVERNMENT PROJECT CLEARANCES AND FINANCIAL SUPPORT

6.4.2 STRICT REGULATORY COMPLIANCE AND SAFETY STANDARDS

7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 EXCAVATORS

7.2.1 CRAWLER EXCAVATORS

7.2.2 MINI EXCAVATORS

7.2.3 WHEELED EXCAVATORS

7.2.4 LONG REACH EXCAVATORS

7.2.5 DRAGLINE EXCAVATORS

7.2.6 SKID STEER EXCAVATORS

7.2.7 SUCTION EXCAVATORS

7.3 LOADERS

7.3.1 WHEEL LOADERS

7.3.2 BACKHOE LOADERS

7.3.3 SKID STEER LOADERS

7.3.4 BULL DOZERS

7.4 DUMP TRUCKS

7.5 OTHERS

8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE

8.1 OVERVIEW

8.2 DIESEL-POWERED EQUIPMENT

8.3 ELECTRIC-POWERED EQUIPMENT

8.4 HYBRID-POWERED EQUIPMENT

9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE

9.1 OVERVIEW

9.2 UP TO 250 HP

9.3 250-500 HP

9.4 MORE THAN 500 HP

10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CONSTRUCTION

10.2.1 COMMERCIAL

10.2.2 RESIDENTIAL

10.3 INFRASTRUCTURE PROJECTS

10.4 MINING AND QUARRYING

10.5 OTHERS

11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY

11.1 AFRICA AND SAUDI ARABIA

11.2 AFRICA

11.3 SAUDI ARABIA

12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AFRICA

12.2 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HD HYUNDAI CONSTRUCTION EQUIPMENT CO.,LTD.

14.1.1 COMPA.NY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS/NEWS

14.2 CATERPILLAR

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 BRAND PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 KOMATSU LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 BUSINESS PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 AB VOLVO

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 J C BAMFORD EXCAVATORS LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 BEML LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CNH INDUSTRIAL N.V.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS/NEWS

14.8 DEERE & COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 DOOSAN BOBCAT

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 HITACHI CONSTRUCTION MACHINERY CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS/NEWS

14.12 LIEBHERR

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 SANY GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS/NEWS

14.14 SHANTUI CONSTRUCTION MACHINERY CO.,LTD (SUBSIDIARY OF SHANDONG HEAVY INDUSTRY GROUP)

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS/NEWS

14.15 XCMG GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 YANMAR HOLDINGS CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS/NEWS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY STANDARDS RELATED TO AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 2 REGULATORY STANDARDS RELATED TO SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 3 KEY NEW MINING PROJECTS IN AFRICA (2023)

TABLE 4 SAUDI ARABIA UPCOMING MEGAPROJECTS

TABLE 5 ADVANCED FEATURES HEAVY EQUIPMENT IN SAUDI ARABIA

TABLE 6 DIFFERENT-SIZED EXCAVATOR PRICES

TABLE 7 TOP BRAND EXCAVATOR PRICES

TABLE 8 REGULATORY COMPLIANCE & SAFETY STANDARDS

TABLE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA AND SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA AND SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA AND SAUDI ARABIA CONSTRUCTION EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 SAUDI ARABIA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 2 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS (2024)

FIGURE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION IS EXPECTED TO DRIVE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE EXCAVATORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 18 AFRICA’S INFRASTRUCTURE DEVELOPMENT INDEX

FIGURE 19 SAUDI ARABIA - CONSTRUCTION INDUSTRY (IN USD BILLION)

FIGURE 20 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY PRODUCTS, 2024

FIGURE 21 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY FUEL TYPE, 2024

FIGURE 22 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY ENGINE TYPE, 2024

FIGURE 23 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 24 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

FIGURE 25 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.