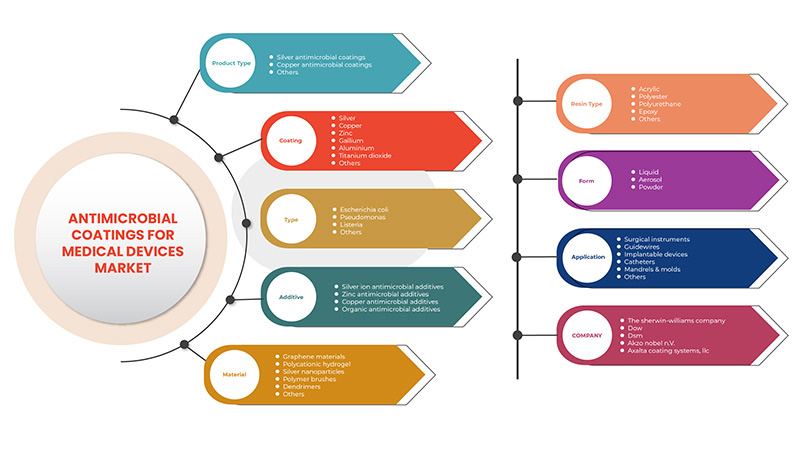

Asia-Pacific Antimicrobial Coating for Medical Devices Market, By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminium, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, Others), Industry Trends and Forecast to 2029

Market Analysis and Insights

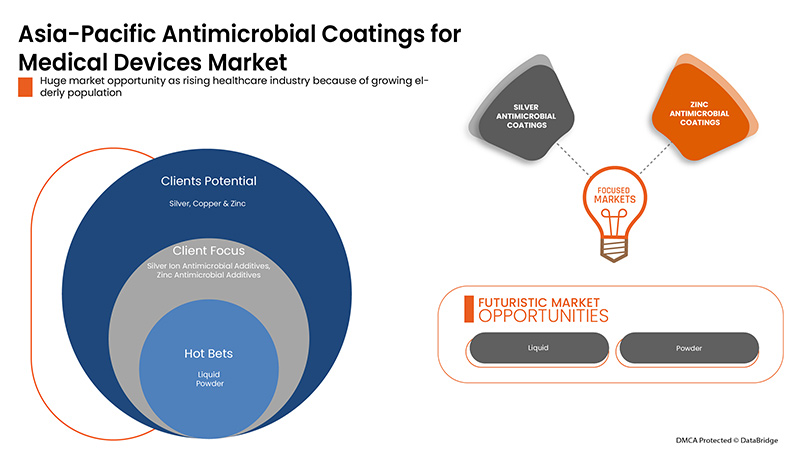

Nowadays, healthcare providers are continually tasked with improving patient health while reducing the risk of infection. The prominence of hospital acquired infections has fuelled the need for strategies and products that actively reduce the risk of patient infections. As such, the incorporation of antimicrobial additives into healthcare furnishings and medical equipment is increasingly being viewed as part of the solution to infection prevention and control in healthcare environments. Moreover, the rising demand for implantable devices has surged also surged the demand for antimicrobial coatings for medical devices. However, the limitations of silver ion coating may hamper the growth of market to some extent.

Growing technological advancement in antimicrobial coating are creating an opportunity for the growth of Asia-Pacific antimicrobial coating for medical devices market whereas adverse effect of antimicrobial coatings on human health may create challenge for the growth of the market.

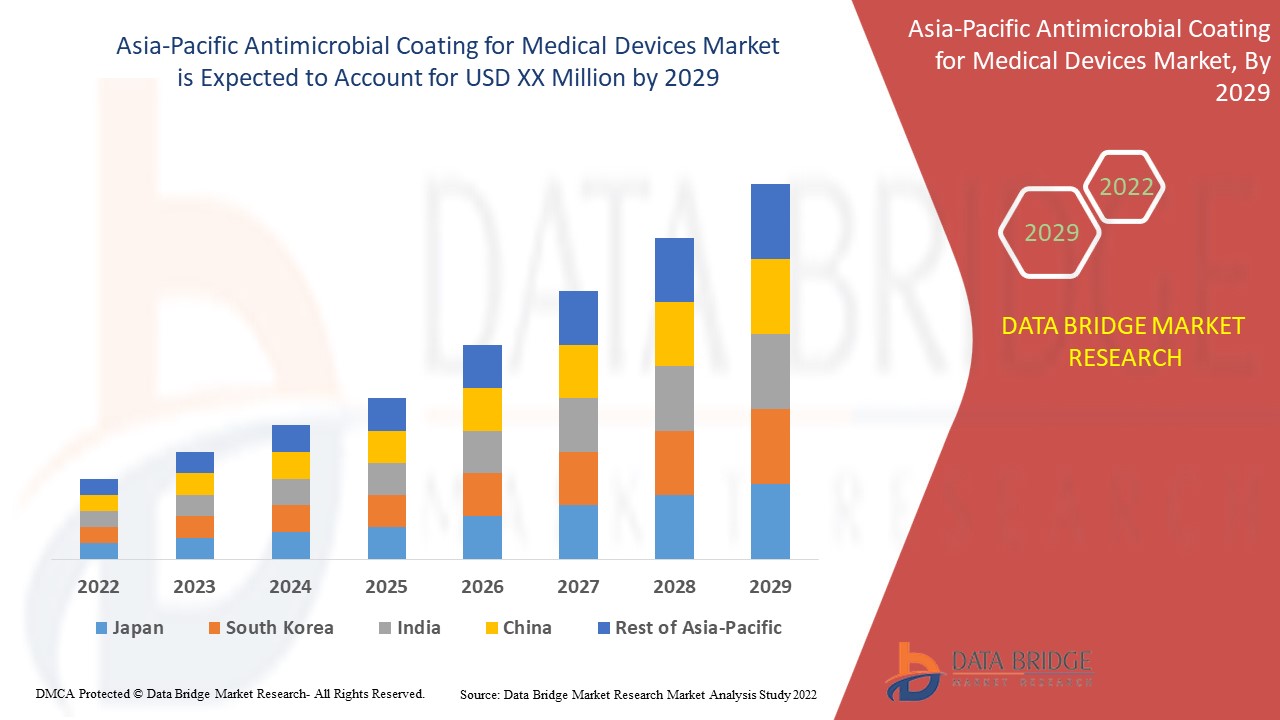

Increasing use of antimicrobial coatings for medical devices coupled with growing awareness regarding hospital acquired infections has surged its demand. Data Bridge Market Research analyses that the Asia-Pacific antimicrobial coating for medical devices will grow at a CAGR of 13.4% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

Por tipo de producto (recubrimiento antimicrobiano de plata, recubrimiento antimicrobiano de cobre, otros), recubrimiento (plata, quitosano , dióxido de titanio, aluminio, cobre, zinc, galio, otros), tipo (Escherichia coli, Pseudomonas, Listeria, otros), aditivos (aditivos antimicrobianos de iones de plata, aditivos antimicrobianos orgánicos, aditivos antimicrobianos de cobre, aditivos antimicrobianos de zinc), material (materiales de grafeno, nanopartículas de plata, hidrogel policatiónico, cepillos de polímero, dendrímeros, otros), tipo de resina ( epoxi , acrílico, poliuretano, poliéster, otros), forma (líquido, polvo, aerosol), aplicación ( instrumentos quirúrgicos , dispositivos implantables , guías, mandriles y moldes, catéteres , otros) |

|

Países cubiertos |

Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Indonesia, Malasia, Filipinas, resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

Entre otros, DSM, PPG Industries, Inc., Akzo Nobel NV, Specialty Coating Systems Inc., Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd., Sika, Harland Medical Systems, Inc., Biomerics y BioCote Limited. |

Dinámica del mercado de recubrimientos antimicrobianos para dispositivos médicos

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la concienciación sobre las infecciones adquiridas en el hospital

La creciente incidencia de infecciones intrahospitalarias ha aumentado la carga sobre el sistema sanitario y ha generado preocupaciones en el sector sanitario. El creciente número de enfermedades infecciosas intrahospitalarias ha aumentado relativamente la carga sobre el sector sanitario. Los recubrimientos antimicrobianos ayudan a reducir las infecciones intrahospitalarias, ya que tienen diversas propiedades, como la biocompatibilidad.

- Aumento de la demanda de dispositivos implantables en Asia-Pacífico

La demanda de dispositivos implantables ha aumentado debido a la creciente prevalencia de enfermedades crónicas, junto con el rápido envejecimiento de la población, el aumento de los accidentes de tráfico y las mejoras en los dispositivos médicos implantables activos. Según la Asociación para la Seguridad en los Viajes por Carretera Internacionales, aproximadamente 4,4 millones de personas sufren lesiones lo suficientemente graves como para requerir atención médica.

Oportunidades

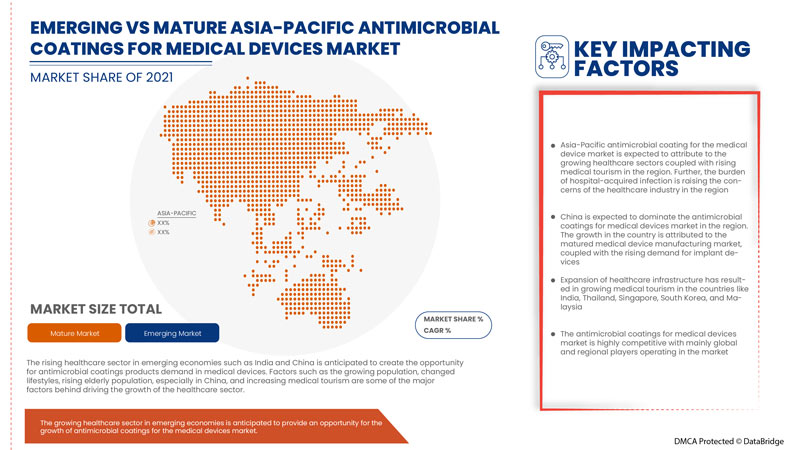

- El auge del sector sanitario en las economías emergentes

Se prevé que el creciente sector de la atención sanitaria en economías emergentes como India y China genere la oportunidad de que aumente la demanda de productos de recubrimientos antimicrobianos en los dispositivos médicos. Factores como el crecimiento de la población, los cambios en los estilos de vida, el aumento de la población de edad avanzada, especialmente en China, y el aumento del turismo médico son algunos de los principales factores que impulsan el crecimiento del sector de la atención sanitaria. Según el artículo publicado por India Brand Equity Foundation (IBEF), en marzo de 2022, alrededor de 6.97.300 turistas extranjeros llegaron a la India para recibir tratamiento médico en el año 2019 y también reveló que la India ocupa el décimo puesto entre 46 destinos en el Índice de Turismo Médico (MTI) para el año 2020-2021.

Restricciones/Desafíos

Sin embargo, la limitación del recubrimiento de iones de plata y las desfavorables reformas sanitarias de Estados Unidos afectarán la tasa de crecimiento del mercado. La baja capacidad de producción de las economías emergentes también planteará un gran desafío.

Este informe de mercado de recubrimientos antimicrobianos para dispositivos médicos proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de recubrimientos antimicrobianos para dispositivos médicos, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto posterior al COVID-19 en el mercado de recubrimientos antimicrobianos para dispositivos médicos

La enfermedad por coronavirus (COVID-19) es una enfermedad infecciosa causada por un virus SARS-CoV-2 recientemente descubierto, mientras que una gran parte de la población se ve afectada por el virus COVID-19. Las personas afectadas por el virus COVID-19 experimentarán una enfermedad respiratoria de leve a moderada y se recuperarán sin necesidad de un tratamiento especial. Sin embargo, la propagación del coronavirus (COVID-19) se ha expandido en Asia y el Pacífico durante los últimos meses y la población de pacientes ha aumentado enormemente.

Por ejemplo,

- Según la Organización Mundial de la Salud (OMS), hasta el 31 de marzo de 2022, se han detectado 481.756.671 casos confirmados de COVID-19, incluidas 6.127.981 muertes. Mientras que Europa tiene un alto ritmo de propagación de COVID-19 en comparación con otras regiones. Hasta el 31 de marzo de 2022, ha habido 199.889.200 casos confirmados de COVID-19 en Europa.

La pandemia de COVID-19 ha afectado negativamente a la cadena de suministro y a las actividades de fabricación. Además, cuando el mundo se paralizó y los servicios de transporte se detuvieron en todo el mundo, las fronteras se cerraron para evitar la propagación del virus. Las prácticas comerciales también enfrentaron desafíos importantes durante la pandemia. En consecuencia, el suministro de implantes, su importación, exportación y transporte local, y el suministro de materias primas se vieron gravemente afectados.

Acontecimientos recientes

- En septiembre de 2021, BioCote Limited presentó una innovadora tecnología de revestimiento antimicrobiano, incluidos sus últimos desarrollos para productos de revestimiento antimicrobiano de plástico. Esto mejoró los ingresos anuales de la empresa.

- En enero de 2022, la empresa inauguró su segunda planta de fabricación ubicada en Costa Rica. La planta se dedicará a la fabricación de soluciones de dispositivos médicos para procesos de extrusión, moldeo por inyección, micromaquinado, procesamiento de metales y ensamblaje final en salas blancas. Esta medida se tomó para satisfacer la creciente demanda de soluciones de dispositivos médicos en el mercado.

- En mayo de 2021, Hydromer anunció que había sido seleccionado como socio clave de recubrimientos y servicios para la empresa Avinger, Inc. Esta decisión ayuda a la empresa a impulsar su crecimiento en el mercado.

Alcance del mercado de recubrimientos antimicrobianos para dispositivos médicos en Asia y el Pacífico

El mercado de recubrimientos antimicrobianos para dispositivos médicos está segmentado por tipo de producto, recubrimiento, tipo, aditivo, material, tipo de resina, forma y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Recubrimientos antimicrobianos de plata

- Recubrimientos antimicrobianos de cobre

- Otros

Según el tipo de producto, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia-Pacífico está segmentado en recubrimientos antimicrobianos de plata, recubrimientos antimicrobianos de cobre y otros.

Revestimiento

- Plata

- Cobre

- Zinc

- Galio

- Aluminio

- Dióxido de titanio

- Otros

Sobre la base del recubrimiento, el mercado de recubrimiento antimicrobiano de Asia-Pacífico para dispositivos médicos está segmentado en plata, cobre, zinc, galio, aluminio, dióxido de titanio y otros.

Tipo

- Escherichia coli

- Pseudomonas

- Listeria

- Otros

Según el tipo, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia y el Pacífico está segmentado en Escherichia coli, Pseudomonas, listeria y otros.

Aditivo

- Aditivos antimicrobianos de iones de plata de tamaño pequeño

- Aditivos antimicrobianos de zinc

- Aditivos antimicrobianos de cobre

- Aditivos antimicrobianos orgánicos

Sobre la base de los aditivos, el mercado de recubrimiento antimicrobiano de Asia-Pacífico para dispositivos médicos está segmentado en aditivos antimicrobianos de iones de plata, aditivos antimicrobianos de zinc, aditivos antimicrobianos de cobre y aditivos antimicrobianos orgánicos.

Material

- Materiales de grafeno

- Hidrogel policatiónico

- Nanopartículas de plata

- Pinceles de polímero

- Dendrímeros

- Otros

Sobre la base del material, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia y el Pacífico está segmentado en materiales de grafeno, hidrogel policatiónico, nanopartículas de plata, cepillos de polímero, dendrímeros y otros.

Tipo de resina

- Acrílico

- Poliéster

- Poliuretano

- Epoxy

- Otros

Sobre la base del tipo de resina, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia-Pacífico está segmentado en acrílico, poliéster, poliuretano, epoxi y otros.

Forma

- Líquido

- Aerosol

- Polvo

Sobre la base de la forma, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia-Pacífico está segmentado en líquido, aerosol y polvo.

Solicitud

- Instrumentos quirúrgicos

- Alambres guía

- Dispositivos implantables

- Catéteres

- Mandriles y moldes

- Otros

Sobre la base de la aplicación, el mercado de recubrimiento antimicrobiano para dispositivos médicos de Asia-Pacífico está segmentado en instrumentos quirúrgicos, guías, dispositivos implantables, catéteres, mandriles y moldes, y otros.

Análisis y perspectivas regionales del mercado de recubrimientos antimicrobianos para dispositivos médicos

Se analiza el mercado de recubrimiento antimicrobiano para dispositivos médicos y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, recubrimiento, material, aditivo, tipo, tipo de resina, tipo y aplicación.

Los países cubiertos en el informe del mercado de recubrimientos antimicrobianos para dispositivos médicos de Asia-Pacífico son Japón, China, Corea del Sur, India, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, y el resto de Asia-Pacífico.

En términos de participación de mercado e ingresos, China domina el mercado de recubrimientos antimicrobianos para dispositivos médicos en Asia-Pacífico y seguirá manteniendo su dominio durante el período de pronóstico. Esto se atribuye al maduro mercado de fabricación de dispositivos médicos y a la creciente demanda de dispositivos de implantes, además del crecimiento de los sectores de la atención médica junto con el aumento del turismo médico en la región. Además, la carga de infecciones adquiridas en hospitales está aumentando las preocupaciones de la industria de la atención médica en la zona.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la alta competencia de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de recubrimientos antimicrobianos para dispositivos médicos

The antimicrobial coating for medical devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on antimicrobial coating for medical devices market.

Some of the major players operating in the antimicrobial coating for medical devices market are DSM, PPG Industries, Inc., Akzo Nobel N.V., Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited, and amongst others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In adition, market share analysis and key trend analysis are the major success factors in the market report.. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE

4.2 PESTEL ANALYSIS

4.2.1 POLITICS

4.2.2 ECONOMY

4.2.3 SOCIAL

4.2.4 TECHNOLOGY

4.2.5 ENVIRONMENTAL:

4.2.6 LEGAL

4.3 PORTER ANALYSIS

4.3.1 THREATS OF NEW ENTRANTS

4.3.2 POWER OF SUPPLIERS

4.3.3 BARGAINING POWER OF BUYERS

4.3.4 THREATS OF SUBSTITUTE PRODUCTS

4.3.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.4 REGULATION

4.4.1 FDA

4.5 PRODUCTION AND CONSUMPTION ANALYSIS

4.6 RAW MATERIAL ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 PRICE TREND ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN AWARENESS REGARDING HOSPITAL-ACQUIRED INFECTIONS (HAI)

5.1.2 RISE IN GOVERNMENT INITIATIVES FOR RESEARCH & FUNDING

5.1.3 RISE IN DEMAND FOR IMPLANTABLE DEVICES ASIA PACIFICLY

5.1.4 INCREASE IN THE BURDEN OF CARDIOVASCULAR DISEASES ACROSS THE GLOBE

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF SILVER ION COATING

5.2.2 UNFAVORABLE HEALTHCARE REFORMS IN THE U.S.

5.3 OPPORTUNITIES

5.3.1 THE RISING HEALTHCARE SECTOR IN EMERGING ECONOMIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN THE ANTIMICROBIAL COATING

5.3.3 ANTIMICROBIAL COATINGS HAVE SHOWN GREAT POTENTIAL AGAINST NOSOCOMIAL INFECTIONS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUT TO COVID-19 PANDEMIC OUTBREAK

5.4.2 THE ADVERSE EFFECTS OF ANTIMICROBIAL COATINGS ON THE ENVIRONMENT

6 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATING

6.3 COPPER ANTIMICROBIAL COATING

6.4 OTHERS

7 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 FUNCTIONALIZED POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SURGICAL INSTRUMENTS

13.3 IMPLANTABLE DEVICES

13.4 GUIDEWIRES

13.5 MANDRELS & MOLDS

13.6 CATHETERS

13.7 OTHERS

14 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 AUSTRALIA & NEW ZEALAND

14.1.5 MALAYSIA

14.1.6 THAILAND

14.1.7 SOUTH KOREA

14.1.8 SINGAPORE

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PPG INDUSTRIES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SIKA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT UPDATE

17.3 AKZO NOBEL N.V

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 AXALTA COATING SYSTEMS, LLC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUS ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AST PRODUCTS, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BIOCOTE LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOINTERACTIONS LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOMERICS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 COVALON TECHNOLOGIES LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUS ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 HARLAND MEDICAL SYSTEMS, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HYDROMER

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MICROBAN INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SCIESSENT LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SPECIALTY COATING SYSTEMS INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCTION OF COPPER FROM 2017-TO 2021, THOUSAND METRIC TONS

TABLE 2 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 4 ASIA PACIFIC SILVER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC COPPER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SILVER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CHITOSAN IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC TITANIUM DIOXIDE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ALUMINUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC COPPER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC ZINC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC GALLIUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ESCHERICHIA COLI IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PSEUDOMONAS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC LISTERIA IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GRAPHENE MATERIALS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC SILVER NANOPARTICLES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC DENDRIMERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC EPOXY IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC ACRYLIC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC POLYURETHANE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC POLYESTER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC LIQUID IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC POWDER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC AEROSOL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SURGICAL INSTRUMENTS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC IMPLANTABLE DEVICES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC GUIDEWIRES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 48 ASIA PACIFIC MANDRELS & MOLDS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC CATHETERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 50 ASIA PACIFIC OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 55 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 65 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 66 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 68 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 CHINA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 71 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 CHINA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 75 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 76 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 78 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 JAPAN POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 JAPAN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 85 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 86 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 88 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 INDIA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 90 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 INDIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 95 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA & NEW ZEALAND POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 101 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 105 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 106 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 108 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 115 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 116 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 118 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 119 THAILAND POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 121 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 122 THAILAND ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 125 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 126 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 128 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 129 SOUTH KOREA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 130 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 131 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 SOUTH KOREA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 135 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 145 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 146 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 148 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 149 INDONESIA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 150 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 151 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 152 INDONESIA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 155 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 158 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 REST OF ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 REST OF ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

Lista de figuras

FIGURE 1 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET AND ASIA-PACIFIC GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING AWARENESS REGARDING HOSPITAL ACQUIRED INFECTION IS DRIVING THE ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SILVER ANTIMICROBIAL COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN 2022 & 2029

FIGURE 13 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET, BY PRODUCTION (USD MILLION)

FIGURE 14 CONSUMPTION OF ANTIMICROBIAL COATING IN MEDICAL DEVICES, BY REGION (USD MILLION)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

FIGURE 16 GROWTH TREND OF HEALTHCARE SECTOR IN INDIA, USD BILLION

FIGURE 17 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2021

FIGURE 19 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2021

FIGURE 21 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2021

FIGURE 22 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2021

FIGURE 23 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2021

FIGURE 24 ASIA PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2021

FIGURE 25 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 30 ASIA PACIFIC ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.