Asia Pacific Blood Collection And Sampling Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

985.91 Million

USD

1,825.06 Million

2024

2032

USD

985.91 Million

USD

1,825.06 Million

2024

2032

| 2025 –2032 | |

| USD 985.91 Million | |

| USD 1,825.06 Million | |

|

|

|

Asia-Pacific Blood Collection And Sampling Devices Market Segmentation, By Product (Venous Blood Collection and Sampling Devices and Capillary Blood Collection and Sampling Devices) – Industry Trends and Forecast to 2032

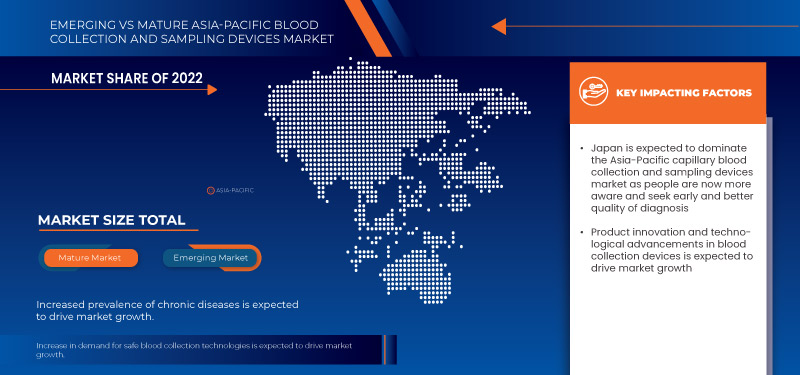

Blood Collection And Sampling Devices Market Analysis

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disordersIn May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Blood Collection And Sampling Devices Market Size

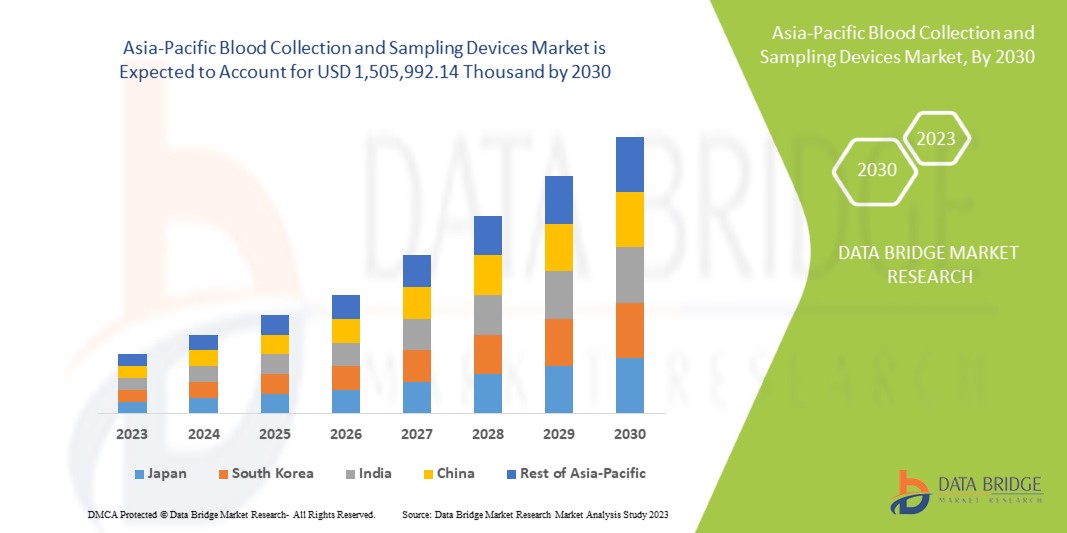

Asia-Pacific blood collection and sampling devices market size was valued at USD 985.91 million in 2024 and is projected to reach USD 1,825.06 million by 2032, with a CAGR of 8.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Blood Collection And Sampling Devices Market Trends

“Increased Prevalence Of Chronic Diseases”

Increased Prevalence of Chronic Diseases is a significant driver in the growth of the Blood Collection and Sampling Devices market, particularly in Japan and other countries in the Asia-Pacific region. The trend of rising chronic conditions, such as diabetes, cardiovascular diseases, and hypertension, is contributing to the growing demand for regular diagnostic testing. As more individuals suffer from these long-term health issues, healthcare providers are increasingly relying on blood collection and sampling devices to monitor and manage these conditions. As the burden of chronic diseases increases, healthcare systems are becoming more reliant on accurate, consistent, and frequent testing, which requires advanced blood collection and sampling devices. These devices are essential for early detection, disease management, and ongoing monitoring of chronic conditions, as regular blood tests help in tracking the progression of diseases, adjusting treatments, and improving patient outcomes.

In response to this trend, medical device manufacturers are focusing on developing innovative blood collection technologies that ensure better patient comfort, higher accuracy, and quicker results. Additionally, the trend towards preventive healthcare further amplifies the need for blood tests as individuals seek early diagnosis and monitoring, thus propelling the demand for blood collection devices in both hospitals and home-care settings.

Overall, the rising prevalence of chronic diseases and the shift towards more frequent and advanced diagnostic testing are key factors driving the rapid expansion of the blood collection and sampling devices market. This trend emphasizes the need for accurate, efficient, and minimally invasive devices to collect blood samples for diagnostic testing and ongoing health management, driving market growth.

Report Scope and Blood Collection And Sampling Devices Market Segmentation

|

Attributes |

Blood Collection And Sampling Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (United Kingdom), Abbott (U.S.), Nipro Europe Group Companies (Japan), Greiner Bio-One International GmbH (Austria), SARSTEDT AG & Co. KG (Germany), Bio-Rad Laboratories, Inc. (U.S.), ICU Medical, Inc. (U.S.), CML Biotech (India), Narang Medical Limited (India), Hindustan Syringes & Medical Devices Ltd (India), Sparsh Mediplus (India), and B. Braun Medical Ltd (Germany) |

|

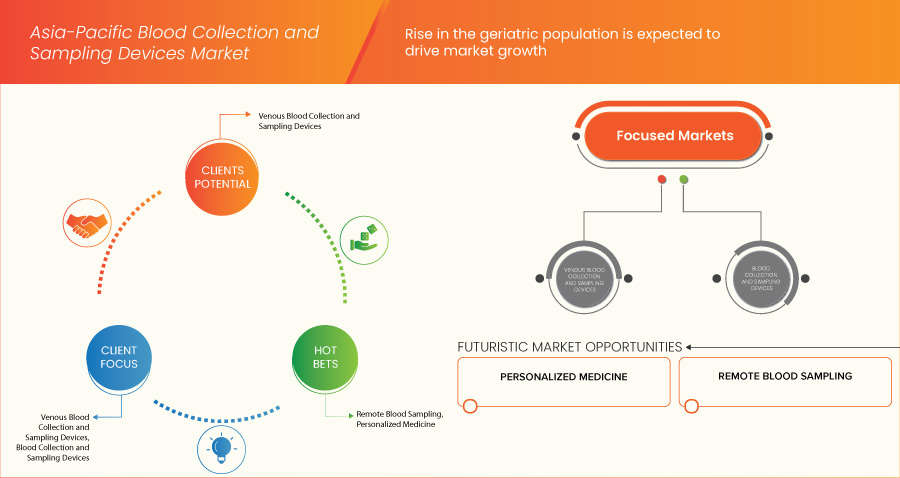

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Collection And Sampling Devices Market Definition

Capillary blood collection devices are defined as devices that are used for capillary blood withdrawal. Capillary blood can be obtained by puncturing in finger, earlobe, or heel. It can also be performed by giving an incision on the skin. Its procedure gained wide attention as it withdraws an accurate amount of blood and reduces the chances of anemia. There are various kinds of needles, lancets, and syringes offered by market players for capillary blood collection. The need for blood tests is increasing as the prevalence of chronic disease increases. Moreover, the rising geriatric population and neonates have put a challenge for invasive blood-collecting procedures. This is why minimal invasive capillary blood collection procedure has gained wide attention. Nowadays volumetric micro sampling technique has gained attention for capillary blood collection. Moreover, new technological advancements are taking place to fulfill the needs of physicians and consumers.

Blood Collection And Sampling Devices Market Dynamics

Drivers

- Increased Prevalence Of Chronic Diseases

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary and venous blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management or any other blood test.

For instance,

In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders

In May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Lower middle-income countries are the worst affected by chronic diseases therefore, the disease also becomes a financial burden for the underprivileged countries. The disease must be diagnosed accurately for the early detection and timely treatment of the disease. For this, efficient blood collection and sampling are necessary, creating a demand for technologically advanced capillary and venous blood testing devices. Thus, the increased prevalence of infectious and chronic diseases is expected to drive market growth.

- Rise In The Geriatric Population

The population is experiencing a significant demographic shift characterized by an increasing number of older adults. The rising geriatric population in the Asia-Pacific is primarily attributed to several factors, such as increased life expectancy, advancements in healthcare, improved living conditions, and better access to medical services, which have contributed to increased life expectancy in China. This means that people are living longer, leading to a more significant proportion of older adults in the population.

The older generation is prone to more chronic disease that requires regular blood tests and diagnostics tests.

For instance,

In March 2019, according to Japan's Internal Affairs and Communications Ministry, the population of people aged 65 years and above was 35.88 million in 2019, up by 3,20,000 from the previous year by 2050, the population of people who are 60

In July 2021, According to WHO, 69% of adults have two or more chronic conditions. These diseases can lower the quality of life of adults and can be a leading cause of death in this population and adults who are 65 years and above experience a higher risk of chronic diseases than the younger generation

In June 2019, According to the Census of India, the population aged 60 years and above accounted for approximately 8.6% of the total population at that time India's geriatric population will reach around 319 million, accounting for nearly 20% of the country's total population

It is essential to diagnose the disease at an early stage to treat adults with chronic disease. Regular, proper, and accurate blood tests must be done. The capillary and venous blood testing technique is preferred for them. Hence, the rising geriatric population is expected to drive market growth.

- Rising Availability Of Point-Of-Care Diagnostics

Point-of-care testing is a type of diagnostic testing that can be performed at home or anywhere at any time. Therefore, it is commonly known as bedside testing. Earlier, testing was only limited to laboratories and hospitals, where the specimen was sent and then it took hours to days to obtain the sample.

For instance,

According to various reports, the total worth of the market was USD 40.00 billion to USD 45.00 billion, out of which the contribution of POC diagnostics is USD 12.00 billion to USD 13.00 billion

According to a review from investment bank Morgan Stanley, 37% of the USD 3 billion POC market is dedicated to infectious disease testing

With the rise in health awareness and incidence of infectious diseases, there has been a rise in the demand for POC testing. Conventional blood collection methods are painful and invasive and have a higher risk of needlestick injuries and contamination if not performed by skilled people.

The POC devices are minimally invasive, cause less pain, and have significantly fewer side effects. Also, they do not require skilled professionals to carry out the blood sampling and collection procedure. With the rise in POC testing, there has also been advancement in capillary and venous collection devices.

For instance,

Neoteryx, LLC developed a Mitra cartridge device used for capillary blood sampling anywhere, anytime, and by anyone

Elabscience, Inc. is manufacturing and distributing COVID-19 IgG/IgM Rapid Test for testing COVID-19 symptoms

Less time consumption and enhanced efficiency improve healthcare performance, resulting in more significant economic advantages for healthcare providers and patients. Thus, techniques such as capillary blood sampling, which can be used at the POC are preferred. Therefore, the rising availability of POC diagnostics is expected to drive market growth.

Opportunities

- Favorable Medical Device Regulations

The U.S. Food and Drug Administration regulates all medical devices in the U.S. Any medical device manufactured, relabeled, imported, or repackaged by any company to sell in India has to meet Central Drugs Standard Control Organization (CDSCO) regulations.

Capillary and Venous blood collection devices used for diagnostics are regulated in India by the CDSCO, which operates under the purview of the Ministry of Health and Family Welfare. The regulatory framework for medical devices in India has been evolving and recent changes have been introduced to strengthen the regulation and ensure the safety and efficacy of medical devices, including capillary and venous blood collection devices.

In India, medical devices are classified into different categories based on risk level, and the regulatory requirements vary accordingly. Capillary and venous blood collection devices typically fall under the category of In vitro Diagnostic Devices (IVDs).

Las Normas sobre dispositivos médicos son la principal regulación que rige los dispositivos médicos en la India. Según estas normas, los fabricantes, importadores y distribuidores de dispositivos médicos, incluidos los dispositivos de extracción de sangre capilar y venosa, deben cumplir con los requisitos de registro y licencia según la clasificación de riesgo del dispositivo. El proceso regulatorio incluye la presentación de documentación técnica, datos clínicos (si corresponde) y el cumplimiento de los requisitos del sistema de gestión de calidad. Sin embargo, dichas normas no se aplican a las pruebas personales autoadministradas por empleados o residentes de un establecimiento. Por lo tanto, las personas que toman glucosa en sangre regularmente con lancetas no están cubiertas por esta ley.

Es importante tener en cuenta que los marcos regulatorios pueden cambiar con el tiempo. Se recomienda consultar las pautas y regulaciones más recientes publicadas por la CDSCO y otras autoridades regulatorias relevantes para obtener la información más actualizada sobre las regulaciones favorables para los dispositivos de recolección de sangre capilar y venosa en la India, que brindan una mejor oportunidad para que los fabricantes lancen sus productos al mercado.

- Innovación de productos y avances tecnológicos en dispositivos de recolección de sangre

La extracción de sangre es un paso de suma importancia para la prestación de servicios de salud. Entre el 70 y el 80 % de las decisiones clínicas que se toman se basan en el análisis de muestras de sangre. Con la creciente tendencia a la innovación en la extracción de sangre, muchas empresas están utilizando formas seguras, sencillas y más eficientes de extraer muestras de sangre.

La extracción de sangre capilar y venosa es una técnica ideal para las farmacias. Este método se prefiere a la venopunción debido a su facilidad de uso y seguridad. Además, elimina la necesidad de técnicos cualificados. Sin embargo, una de las desventajas de las punciones en el dedo es que existen variaciones entre las gotas de sangre. Esto se puede superar con el lanzamiento de productos novedosos e innovadores.

Por ejemplo,

En diciembre de 2024, según un artículo de IMetropolis Healthcare Limited, uno de los principales proveedores de servicios de diagnóstico de la India, lanzó el innovador equipo de extracción de sangre con botón pulsador UltraTouch (PBBCS), una tecnología pionera en el país. Este dispositivo de vanguardia cuenta con una aguja más fina diseñada para reducir significativamente el dolor de inserción, lo que hace que la extracción de sangre sea más cómoda, especialmente para pacientes primerizos, niños y personas mayores. La introducción de UltraTouch se alinea con la misión de Metropolis Healthcare de mejorar la atención al paciente a través de la innovación y la tecnología.

En enero de 2023, según un artículo de National Library Medicine, las técnicas de muestreo mínimamente invasivas, como el muestreo de sangre capilar, se utilizan de forma rutinaria para las pruebas en el punto de atención en el ámbito de la atención médica domiciliaria y en entornos clínicos como la Unidad de Cuidados Intensivos con menos dolor y heridas que la venopunción convencional.

La recolección de sangre capilar y venosa implica el uso de tecnología moderna y métodos de recolección innovadores para obtener resultados mejores y más eficientes. Por lo tanto, se espera que la innovación de productos y los avances tecnológicos en dispositivos de recolección de sangre brinden oportunidades para el crecimiento del mercado.

Restricciones/Desafíos

- Alto riesgo asociado con las tecnologías de recolección de sangre

Las innovaciones en materia de toma de muestras a distancia y pruebas en el punto de atención han hecho popular la extracción de sangre mediante punción digital. Tiene varias ventajas con respecto a las prácticas tradicionales de recolección de sangre en laboratorios clínicos, laboratorios de hospitales y lugares que requieren la toma de muestras in situ. Si bien son más seguras y fáciles de usar que los dispositivos convencionales, tienen sus efectos secundarios. A medida que aumenta el número de procedimientos de punción digital, también aumentan los casos de lesiones accidentales y transmisión de patógenos a partir de sangre infectada.

Perforar los dedos de los pacientes y manipular las tiras reactivas usadas expone al médico a agentes infecciosos transmitidos por la sangre, que pueden provocar la transmisión de enfermedades como la hepatitis B.

Estos riesgos surgen de múltiples factores, entre ellos, preocupaciones por contaminación, manipulación inadecuada y la posibilidad de errores durante la recolección, almacenamiento y transporte de las muestras, todo lo cual puede comprometer la integridad de las muestras de sangre y dar lugar a resultados de diagnóstico inexactos. Estas imprecisiones son particularmente problemáticas en situaciones críticas, como el diagnóstico de enfermedades crónicas, el seguimiento de intervenciones terapéuticas o la realización de pruebas genéticas, donde es fundamental obtener resultados precisos y fiables. Además, la naturaleza invasiva de los métodos tradicionales de muestreo de sangre suele provocar incomodidad, miedo y ansiedad en los pacientes, lo que desalienta aún más a las personas a someterse a procedimientos de diagnóstico regulares.

En el caso de los sistemas de atención sanitaria de la región de Asia y el Pacífico, los distintos niveles de infraestructura y experiencia de los distintos países exacerban estos problemas, ya que los entornos sanitarios subdesarrollados pueden carecer de acceso a tecnologías avanzadas o programas de formación adecuados, lo que da lugar a prácticas inconsistentes y mayores riesgos. Estos desafíos contribuyen colectivamente al escepticismo entre los usuarios finales, incluidos los hospitales, los laboratorios de diagnóstico y los pacientes, lo que en última instancia afecta el ritmo de adopción y la trayectoria general de crecimiento del mercado de dispositivos de muestreo de sangre en esta región. Para abordar estos riesgos se requiere un esfuerzo concertado de las partes interesadas de todo el espectro, incluidos los proveedores de atención sanitaria, los fabricantes de dispositivos, los organismos reguladores y los responsables de las políticas, para implementar medidas de seguridad sólidas, invertir en investigación y desarrollo de tecnologías mínimamente invasivas o no invasivas y garantizar una educación generalizada sobre las prácticas adecuadas de muestreo de sangre .

- Aumento de las retiradas de productos

Los dispositivos de extracción de sangre son fundamentales para la industria de la salud. Si estos productos son inseguros o defectuosos, pueden tener efectos nocivos. Por ello, la FDA establece normas estrictas sobre el uso de estos productos. A pesar de las estrictas leyes, hay algunos casos en los que el producto se ha lanzado al mercado y luego se ha retirado del mercado para proteger la seguridad de las personas debido a sus efectos nocivos.

Por ejemplo,

En julio de 2021, según el artículo publicado por el Sistema de Comunicación de Difusión de Laboratorio (LOCS) de los CDC, Magellan Diagnostics amplió el retiro de sus kits de prueba de plomo en sangre LeadCare después de identificar un riesgo significativo de resultados falsamente bajos. Este defecto potencialmente retrasó la identificación y el tratamiento de la exposición al plomo en poblaciones vulnerables, en particular los niños.

En marzo de 2019, según el artículo publicado por Becton Dickinson (BD), la empresa retiró del mercado determinados lotes de sus tubos de extracción de sangre Vacutainer® debido a informes de elevaciones falsas en los niveles de carboxihemoglobina (COHb) cuando se analizaron muestras con instrumentos específicos. Este problema planteó riesgos de diagnóstico erróneo y tratamiento inadecuado para los pacientes.

Las retiradas de productos suponen un obstáculo para los fabricantes de dispositivos médicos, ya que les suponen un coste excesivo. Además, los fabricantes también tienen que ofrecer una compensación que, a su vez, cuesta mucho. Por tanto, se espera que los elevados costes y la difamación del nombre de la empresa en el mercado supongan un reto para el crecimiento del mercado.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de dispositivos de recolección y muestreo de sangre

El mercado está segmentado en función del producto. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Dispositivos de recolección y muestreo de sangre venosa

- Por tipo

- Poc

- Por grupo de edad

- Bebés

- Pediatría

- Geriatría

- Adultos

- Por aplicación

- Enfermedades cardiovasculares

- Enfermedad respiratoria

- Enfermedad infecciosa

- Trastornos metabólicos

- Otros

- Convencional

- Por grupo de edad

- Bebés

- Pediatría

- Geriatría

- Adultos

- Por aplicación

- Enfermedades cardiovasculares

- Enfermedad respiratoria

- Enfermedad infecciosa

- Trastornos metabólicos

- Otros

- Por el usuario final

- Hospitales

- Laboratorios de patología

- Clínicas

- Bancos de sangre

- Configuración de atención domiciliaria

- Institutos académicos y de investigación

- Otros

- Dispositivos para la recolección y toma de muestras de sangre capilar

- Por tipo

- Poc

- Por grupo de edad

- Bebés

- Pediatría

- Geriatría

- Adultos

- Por aplicación

- Enfermedades cardiovasculares

- Enfermedad respiratoria

- Enfermedad infecciosa

- Trastornos metabólicos

- Otros

- Por tipo de punción

- Incisión

- Punción

- Punción en el dedo

- Perforación del talón

- Convencional

- Por grupo de edad

- Bebés

- Pediatría

- Geriatría

- Adultos

- Por aplicación

- Enfermedades cardiovasculares

- Enfermedad respiratoria

- Enfermedad infecciosa

- Trastornos metabólicos

- Otros

- Por tipo de punción

- Incisión

- Punción

- Punción en el dedo

- Perforación del talón

- Por el usuario final

- Hospitales

- Laboratorios de patología

- Clínicas

- Bancos de sangre

- Configuración de atención domiciliaria

- Institutos académicos y de investigación

- Otros

Blood Collection And Sampling Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country and product as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to its large aging population, high prevalence of cardiovascular diseases, and increased government investments in healthcare infrastructure and technology.

Japan is expected to be the fastest growing due to the rising health awareness, and strong government support for healthcare advancements.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Blood Collection And Sampling Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Blood Collection And Sampling Devices Market Leaders Operating in the Market Are:

- BD (U.S.)

- Terumo BCT, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (United Kingdom)

- Abbott (U.S.)

- Nipro Europe Group Companies (Japan)

- Greiner Bio-One International GmbH (Austria)

- SARSTEDT AG & Co. KG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- CML Biotech (India)

- Narang Medical Limited (India)

- Hindustan Syringes & Medical Devices Ltd (India)

- Sparsh Mediplus (India)

- B. Braun Medical Ltd (Germany)

Latest Developments in Blood Collection And Sampling Devices Market

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY

5.1 JAPAN –

5.2 CHINA –

5.3 INDIA –

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN THE GERIATRIC POPULATION

6.1.3 RISING AVAILABILITY OF POINT-OF-CARE DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH RISK ASSOCIATED WITH BLOOD ASSORTMENT TECHNOLOGIES

6.2.2 DISADVANTAGES OF MICRO-COLLECTION OF BLOOD

6.3 OPPORTUNITIES

6.3.1 FAVORABLE MEDICAL DEVICE REGULATIONS

6.3.2 PRODUCT INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN BLOOD COLLECTION DEVICES

6.4 CHALLENGE

6.4.1 INCREASING PRODUCT RECALLS

7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 VENOUS BLOOD COLLECTION AND SAMPLING DEVICES

7.2.1 CONVENTIONAL

7.2.2 GERIATRICS

7.2.3 INFANTS

7.2.4 PEDIATRICS

7.2.5 ADULT

7.2.6 INFECTIOUS DISEASES

7.2.7 METABOLIC DISORDERS

7.2.8 CARDIOVASCULAR DISEASE

7.2.9 RESPIRATORY DISEASES

7.2.10 OTHERS

7.2.11 POC

7.2.12 GERIATRICS

7.2.13 INFANTS

7.2.14 PEDIATRICS

7.2.15 ADULT

7.2.16 INFECTIOUS DISEASES

7.2.17 METABOLIC DISORDERS

7.2.18 CARDIOVASCULAR DISEASE

7.2.19 RESPIRATORY DISEASES

7.2.20 OTHERS

7.2.21 HOSPITALS

7.2.22 PATHOLOGY LABORATORIES

7.2.23 CLINICS

7.2.24 BLOOD BANKS

7.2.25 HOME CARE SETTINGS

7.2.26 RESEARCH & ACADEMIC LABORATORIES

7.2.27 OTHERS

7.3 CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES

7.3.1 POC

7.3.2 GERIATRICS

7.3.3 INFANTS

7.3.4 PEDIATRICS

7.3.5 ADULT

7.3.6 INFECTIOUS DISEASES

7.3.7 METABOLIC DISORDERS

7.3.8 CARDIOVASCULAR DISEASE

7.3.9 RESPIRATORY DISEASES

7.3.10 OTHERS

7.3.11 PUNCTURE

7.3.12 INCISION

7.3.13 FINGER PUNCTURE

7.3.14 HEEL PUNCTURE

7.3.15 CONVENTIONAL

7.3.16 GERIATRICS

7.3.17 INFANTS

7.3.18 PEDIATRICS

7.3.19 ADULT

7.3.20 INFECTIOUS DISEASES

7.3.21 METABOLIC DISORDERS

7.3.22 CARDIOVASCULAR DISEASE

7.3.23 RESPIRATORY DISEASES

7.3.24 OTHERS

7.3.25 PUNCTURE

7.3.26 INCISION

7.3.27 FINGER PUNCTURE

7.3.28 HEEL PUNCTURE

7.3.29 HOSPITALS

7.3.30 PATHOLOGY LABORATORIES

7.3.31 CLINICS

7.3.32 BLOOD BANKS

7.3.33 HOME CARE SETTINGS

7.3.34 RESEARCH & ACADEMIC LABORATORIES

7.3.35 OTHERS

8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET BY COUNTRIES

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 AUSTRALIA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 MALAYSIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 INDONESIA

8.1.9 PHILIPPINES

8.1.10 REST OF ASIA

9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BD

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CARDINAL HEALTH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENTS

11.3 THERMO FISHER SCIENTIFIC INC.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 TERUMO MEDICAL CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENTS

11.5 ABBOTT

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 BIO-RAD LABORATORIES INC

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 B. BRAUN SE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 CML BIOTECH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 GREINER BIO-ONE INTERNATIONAL GMBH

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ICUMEDICAL INC

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 NARANG MEDICAL LIMITED

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 NIPRO

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENT

11.14 OWEN MUMFORD LTD

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 SARSTEDT AG & CO. KG

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 SPARSH MEDIPLUS

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

Lista de Tablas

TABLE 1 CLINICAL LAB TESTS THAT ARE INFLUENCED BY HEMOLYSIS

TABLE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 20 JAPAN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 23 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 AUSTRALIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH KOREA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MALAYSIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 89 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 91 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 93 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MALAYSIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 101 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 108 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 110 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 114 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SINGAPORE PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 118 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 125 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 PHILIPPINES BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 163 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 INCREASED PREVALENCE OF CHRONIC DISEASES AND RISE IN THE GERIATRIC POPULATION ARE FACTORS EXPECTED TO DRIVE THE GROWTH OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 13 THE BLOOD SAMPLING DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN 2025 AND 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

FIGURE 15 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2024

FIGURE 16 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SNAPSHOT

FIGURE 20 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.