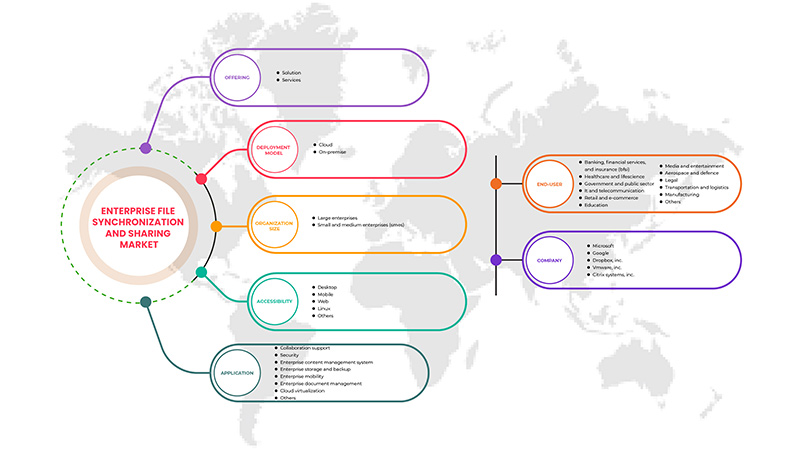

Mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico, por oferta (solución y servicios), por modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas [PYME]), accesibilidad (de escritorio, móvil, web, Linux y otros), aplicación (soporte de colaboración, seguridad, sistema de gestión de contenido empresarial, almacenamiento y respaldo empresarial, movilidad empresarial, gestión de documentos empresariales, virtualización en la nube y otros), usuario final (banca, servicios financieros y seguros [BFSI], atención médica y ciencias biológicas, gobierno y sector público, TI y telecomunicaciones, comercio minorista y electrónico, educación, medios y entretenimiento, aeroespacial y defensa, legal, transporte y logística, fabricación y otros), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado de sincronización y uso compartido de archivos empresariales en Asia y el Pacífico

Las empresas pueden utilizar la sincronización y el uso compartido de archivos empresariales para mejorar la gestión de contenidos, la colaboración y el uso compartido seguro de archivos entre empleados. Los servicios EFSS incluyen funciones como comentarios en directo, seguimiento de versiones de documentos y gestión de procesos de flujo de trabajo para ayudar a los usuarios a almacenar, editar, revisar y compartir archivos. Las organizaciones suelen adoptar EFSS como un medio para disuadir a los empleados de compartir datos corporativos a través de servicios de almacenamiento en la nube pública y de uso compartido de archivos orientados al consumidor que están fuera del control de TI.

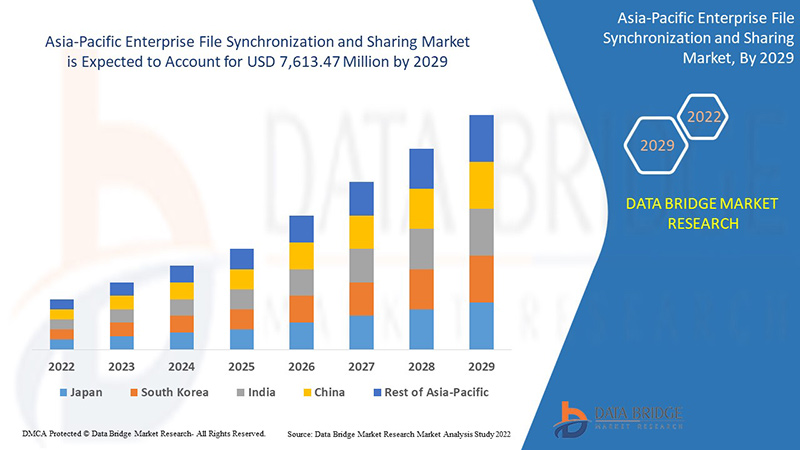

Data Bridge Market Research analiza que se espera que el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico alcance un valor de USD 7613,47 millones para 2029, con una CAGR del 26,6 % durante el período de pronóstico. El segmento de soluciones representa el segmento de oferta más grande en el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico. El informe del mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por oferta (solución y servicios), por modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas [PYME]), accesibilidad (de escritorio, móvil, web, Linux y otros), aplicación (soporte de colaboración, seguridad, sistema de gestión de contenido empresarial, almacenamiento y respaldo empresarial, movilidad empresarial, gestión de documentos empresariales, virtualización en la nube y otros), usuario final (banca, servicios financieros y seguros [BFSI], atención médica y ciencias biológicas, gobierno y sector público, TI y telecomunicaciones, comercio minorista y comercio electrónico, educación, medios y entretenimiento, aeroespacial y defensa, legal, transporte y logística, fabricación y otros) |

|

Países cubiertos |

China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico. |

|

Actores del mercado cubiertos |

IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ, entre otros. |

Definición de mercado

La sincronización y el uso compartido de archivos empresariales es un servicio que permite a los usuarios guardar archivos en la nube o en un almacenamiento local y luego acceder a ellos desde dispositivos móviles y de escritorio. Las herramientas de uso compartido de archivos empresariales permiten a los usuarios compartir de forma segura documentos, fotos, videos y más en varios dispositivos y con varias personas. Utilizan la sincronización o copia de archivos para permitir que los archivos se almacenen en un repositorio de datos aprobado y luego los empleados accedan a ellos de forma remota desde PC, tabletas o teléfonos inteligentes que admitan el producto EFSS.

El uso compartido puede darse entre personas dentro o fuera de la organización, así como entre aplicaciones. La búsqueda, recuperación y acceso sin problemas a archivos almacenados en múltiples repositorios de datos desde diferentes dispositivos cliente complementan estas ofertas, así como las capacidades de seguridad, protección de datos y colaboración. Las ofertas de EFSS permiten escenarios de colaboración y productividad de usuarios modernos para la creación de un lugar de trabajo digital. Las arquitecturas de implementación típicas para las ofertas de EFSS pueden ser nube pública, nube híbrida, nube privada o local.

Dinámica del mercado

Conductores

- El espacio de trabajo digital y la fuerza laboral móvil aumentan continuamente

Los lugares de trabajo han evolucionado y ya no se limitan a espacios físicos, como oficinas, sino que ahora se refieren a oficinas remotas a través de computadoras de escritorio, dispositivos móviles y otros. Muchos documentos y proyectos de oficina se han convertido en mensajería instantánea, que se ha convertido en una opción de comunicación popular en el sector de las oficinas. Las soluciones para lugares de trabajo digitales (DWS) crean conexiones y eliminan barreras entre las personas. El crecimiento en el área de lugares de trabajo digitales y fuerza de trabajo móvil está ayudando a que el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico crezca significativamente.

- Énfasis de las empresas en la seguridad de los datos corporativos

La seguridad de los datos siempre ha sido importante, pero su importancia aumenta cada día. La protección de datos es la medida defensiva de las empresas para evitar cualquier entrada no autorizada en bases de datos, sitios web y ordenadores. En los últimos días, las empresas se han visto en la necesidad de proteger los datos de cualquier tipo de ataque. Se ha convertido en un problema serio a tener en cuenta. El aumento de los ciberataques a las empresas está obligando a introducir plataformas EFSS, lo que está ayudando al crecimiento del mercado.

- Aumento de la colaboración entre empleados y empresas

Las soluciones de intercambio de archivos en línea están ganando popularidad en sectores como la atención sanitaria, el gobierno, las finanzas, el derecho, la ingeniería y más. La creciente necesidad de colaboración digital y de contenido en los puntos finales ayuda a los equipos a alcanzar sus objetivos y permite a los empleados seguir el ritmo de los requisitos de sus tareas. Las organizaciones se están orientando cada vez más hacia la colaboración de los empleados y los datos en diferentes niveles, lo que está impulsando el crecimiento del mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico hasta cierto punto.

- Aumento de la incidencia del robo de datos en el sector de la seguridad social y la salud

El robo de datos se ha convertido en uno de los principales delitos cibernéticos que se producen en el mundo digital desde el comienzo mismo del mundo virtual. Tanto las empresas de atención sanitaria grandes como las pequeñas son el objetivo de los ciberdelincuentes. La exigencia de seguridad de los datos entre las BFSI y el sector sanitario contribuirá en cierta medida al crecimiento del mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico.

Oportunidades

-

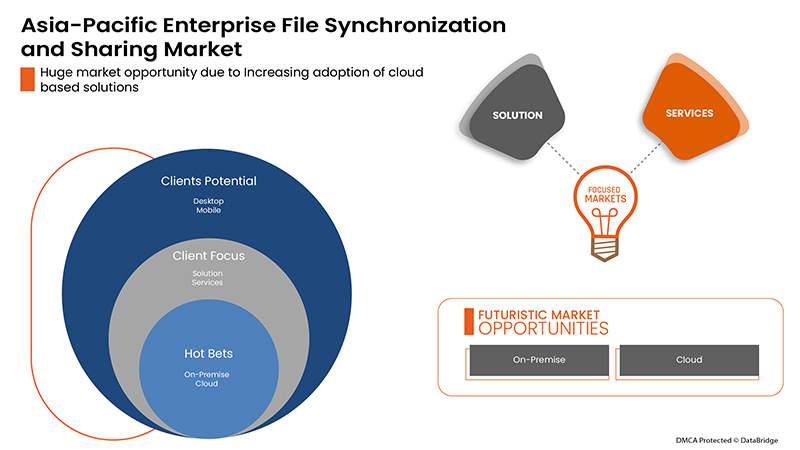

Creciente adopción de soluciones basadas en la nube

La solución EFSS basada en la nube ofrece varios beneficios, como escalabilidad, flexibilidad, facilidad de acceso, compatibilidad con múltiples dispositivos y menores costos. Además, como las soluciones locales tienen un costo elevado, se convierte en un obstáculo para las pymes a la hora de adoptar la solución EFSS. Sin embargo, con la aparición de los servicios basados en la nube, las pymes están implementando fácilmente las soluciones EFSS.

Restricciones/Desafíos

- Alto costo de la solución EFSS

El alto costo que esto implica es una barrera para la expansión del mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico, a pesar de los importantes beneficios asociados con la instalación de soluciones y servicios EFSS. Los proveedores ofrecen soluciones EFSS en forma de modelos de suscripción empresarial o modelos de licencia por usuario a costos muy altos. Para un solo usuario, el rango de precio de venta promedio (ASP) anual de los sistemas EFSS oscila entre USD 150 y USD 170 e incluye, entre otras cosas, la personalización, la integración, el costo de las capacidades en la nube y las herramientas de recuperación.

Impacto de la COVID-19 en el mercado de sincronización y compartición de archivos empresariales de Asia y el Pacífico

La COVID-19 ha tenido un gran impacto en varias industrias, ya que casi todos los países han optado por cerrar todas las instalaciones, excepto las que se dedican al segmento de bienes esenciales. El gobierno ha tomado algunas medidas estrictas, como el cierre de instalaciones y la venta de bienes no esenciales, el bloqueo del comercio internacional y muchas más para evitar la propagación de la COVID-19. Las únicas empresas que se enfrentan a esta situación de pandemia son los servicios esenciales a los que se les permite abrir y ejecutar sus procesos.

El brote de COVID-19 está causando una preocupación generalizada y dificultades económicas para los consumidores, las empresas y las comunidades de todo el mundo. El COVID-19 obligó a muchas organizaciones a transformar digitalmente sus lugares de trabajo y educación para operar de manera efectiva. Hoy en día, las empresas dependen cada vez más de tecnologías avanzadas, como la nube, la IA y la IoT, para el futuro para mantenerse en la carrera de la transformación digital y mantenerse por delante de los competidores. El comportamiento de la pandemia obligó a las empresas a adoptar el modelo de trabajo desde casa para poder seguir trabajando mientras se toman medidas para detener la propagación del virus. Las crecientes tendencias del lugar de trabajo digital y la fuerza laboral móvil entre las empresas se han convertido en las fuerzas impulsoras detrás del crecimiento del mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico en el período de la pandemia.

Los fabricantes están tomando diversas decisiones estratégicas para satisfacer la creciente demanda en el período de COVID-19. Los actores están involucrados en actividades estratégicas como asociaciones, colaboraciones, adquisiciones y otras para mejorar la tecnología involucrada en el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico. Con esto, las empresas traerán soluciones avanzadas y precisas al mercado. Además, las iniciativas gubernamentales para impulsar la digitalización en todas las industrias han llevado al crecimiento del mercado.

Acontecimientos recientes

- En septiembre de 2021, Google anunció el lanzamiento de dos productos, Google Filestore Enterprise y Backup for Google Kubernetes Engine (GKE). El servicio pretende ayudar a las empresas a migrar las necesidades comunes de almacenamiento en red de archivos desde las instalaciones locales a la nube sin tener que reconstruir a una escala mayor que sus niveles básicos y superiores anteriores. Así, con esto, la empresa está ampliando su cartera de productos en el mercado.

- En enero de 2021, Microsoft anunció que permitiría a los usuarios compartir archivos grandes de hasta 250 GB a través de SharePoint, Teams y OneDrive. La empresa también ha incluido la función de sincronización diferencial, que básicamente sincroniza los cambios realizados por el usuario o su compañero de trabajo en el archivo, de modo que el usuario no tenga que perder tiempo esperando a sincronizar archivos grandes solo para volver a cargarlos después de realizar un pequeño cambio. Por lo tanto, con esto, la empresa está atendiendo las necesidades de las personas y atrayendo a más clientes.

Alcance del mercado de sincronización y compartición de archivos empresariales en Asia y el Pacífico

El mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en función de la oferta, el modelo de implementación, el tamaño de la organización, la accesibilidad, la aplicación y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Al ofrecer

- Solución

- Servicios

Sobre la base de la oferta, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en soluciones y servicios.

Por modelo de implementación

- En las instalaciones

- Nube

Sobre la base del modelo de implementación, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en local y en la nube.

Por tamaño de la organización

- Grandes empresas

- Pequeñas y medianas empresas (PYME)

Sobre la base del tamaño de la organización, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en grandes empresas y pequeñas y medianas empresas (PYME).

Por Accesibilidad

- De oficina

- Móvil

- Web

- Linux

- Otros

Sobre la base de la accesibilidad, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en computadoras de escritorio, dispositivos móviles, web, Linux y otros.

Por aplicación

- Apoyo a la colaboración

- Seguridad

- Sistema de gestión de contenido empresarial

- Almacenamiento y respaldo empresarial

- Movilidad empresarial

- Gestión documental empresarial

- Virtualización de la nube

- Otros

Sobre la base de la aplicación, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en soporte de colaboración, seguridad, sistema de gestión de contenido empresarial, almacenamiento y respaldo empresarial, movilidad empresarial, gestión de documentos empresariales, virtualización en la nube y otros.

Por el usuario final

- Banca, servicios financieros y seguros (BFSI)

- Salud y ciencias biológicas

- Gobierno y sector público

- Informática y telecomunicaciones

- Comercio minorista y comercio electrónico

- Educación

- Medios y entretenimiento

- Aeroespacial y Defensa

- Legal

- Transporte y Logística

- Fabricación

- Otros

Sobre la base del usuario final, el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico está segmentado en banca, servicios financieros y seguros (BFSI), atención médica y ciencias de la vida, gobierno y sector público, TI y telecomunicaciones, comercio minorista y comercio electrónico, educación, medios y entretenimiento, aeroespacial y defensa, legal, transporte y logística, fabricación y otros.

Análisis y perspectivas regionales del mercado de sincronización y uso compartido de archivos empresariales en Asia y el Pacífico

Se analiza el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado según la oferta, el modelo de implementación, el tamaño de la organización, la accesibilidad, la aplicación y el usuario final, como se mencionó anteriormente.

El mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico abarca países como China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico.

Se espera que China domine el mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico debido a la creciente adopción de soluciones basadas en la nube y a los mercados potenciales emergentes. Sin embargo, las estrictas regulaciones gubernamentales y el énfasis de las empresas en los aspectos de seguridad de los datos corporativos, especialmente en los países en desarrollo, incluidos India, Japón, China e Indonesia, han llevado al enorme crecimiento del mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico.

La sección de países del informe sobre el mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico también proporciona factores de impacto individuales en el mercado y cambios en las regulaciones del mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación son algunos de los indicadores importantes que se utilizan para pronosticar el escenario del mercado para los países individuales. Además, se consideran la presencia y disponibilidad de las marcas de Asia-Pacífico y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de sincronización y compartición de archivos empresariales en Asia-Pacífico

El panorama competitivo del mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de las empresas en el mercado de sincronización y uso compartido de archivos empresariales de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de sincronización y compartición de archivos empresariales de Asia-Pacífico son IBM Corporation, Axway, Citrix Systems, Inc., Google, Microsoft, Dropbox, Inc., Micro Focus, Nextcloud GmbH, Citrix Systems, Inc., Open Text Corporation, Qnext Corp., Thru, Inc., VMware, Inc., Thomson Reuters, FileCloud, Ziff Davis, Inc., Seafile Ltd., Files.com, ACCELLION, Egnyte, Inc., Intralinks, Inc., Box, ownCloud GmbH, MyWorkDrive LLC., CTERA Networks Ltd., DryvIQ, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)

4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

4.3 GENERAL DATA PROTECTION REGULATION (GDPR)

4.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) 27001

4.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONSTANT RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE

5.1.2 EMPHASIS OF BUSINESSES ON CORPORATE DATA SECURITY

5.1.3 INCREASE IN COLLABORATION AMONG EMPLOYEES AND ENTERPRISES

5.1.4 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.5 RISE IN INCIDENCE OF DATA THEFT IN BFSI & HEALTHCARE SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF EFSS SOLUTION

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF CLOUD BASED SOLUTIONS

5.3.2 INCREASE IN USAGE OF SMARTPHONES

5.3.3 INCREASING BYOD TREND ACROSS ENTERPRISES

5.3.4 INCREASING PACE OF DIGITALIZATION IN BUSINESSES

5.4 CHALLENGES

5.4.1 CONCERNS REGARDING DATA SECURITY AND PRIVACY

6 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 INTEGRATED EFSS SOLUTION

6.2.2 STANDALONE EFSS SOLUTION

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 INTEGRATION AND DEPLOYMENT

6.3.1.2 TRAINING AND CONSULTING

6.3.1.3 SUPPORT AND MAINTENANCE

6.3.2 MANAGED SERVICES

7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.2.1 PUBLIC

7.2.2 HYBRID

7.2.3 PRIVATE

7.3 ON-PREMISE

8 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

9 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY

9.1 OVERVIEW

9.2 DESKTOP

9.2.1 WINDOWS

9.2.2 MAC

9.3 MOBILE

9.3.1 ANDROID

9.3.2 IOS

9.4 WEB

9.5 LINUX

9.6 OTHERS

10 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COLLABORATION SUPPORT

10.3 SECURITY

10.4 ENTERPRISE CONTENT MANAGEMENT SYSTEM

10.5 ENTERPRISE STORAGE AND BACKUP

10.6 ENTERPRISE MOBILITY

10.7 ENTERPRISE DOCUMENT MANAGEMENT

10.8 CLOUD VIRTUALIZATION

10.9 OTHERS

11 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.2.1 SOLUTION

11.2.2 SERVICES

11.3 HEALTHCARE AND LIFESCIENCE

11.3.1 SOLUTION

11.3.2 SERVICES

11.4 GOVERNMENT AND PUBLIC SECTOR

11.4.1 SOLUTION

11.4.2 SERVICES

11.5 IT AND TELECOMMUNICATION

11.5.1 SOLUTION

11.5.2 SERVICES

11.6 RETAIL AND E-COMMERCE

11.6.1 SOLUTION

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 SOLUTION

11.7.2 SERVICES

11.8 MEDIA AND ENTERTAINMENT

11.8.1 SOLUTION

11.8.2 SERVICES

11.9 AEROSPACE AND DEFENCE

11.9.1 SOLUTION

11.9.2 SERVICES

11.1 LEGAL

11.10.1 SOLUTION

11.10.2 SERVICES

11.11 TRANSPORTATION AND LOGISTICS

11.11.1 SOLUTION

11.11.2 SERVICES

11.12 MANUFACTURING

11.12.1 SOLUTION

11.12.2 SERVICES

11.13 OTHERS

12 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 INDONESIA

12.1.8 THAILAND

12.1.9 MALAYSIA

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DROPBOX, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 VMWARE, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 CITRIX SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 BOX, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCTS PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ZIFF DAVIS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ACCELLION

15.8.1 COMPANY SNAPSHOT

15.8.2 SOLUTION PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 AXWAY

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 CTERA NETWORKS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCTS PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DRYVIQ (SKYSYNC)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCTS PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EGNYTE, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FILECLOUD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILES.COM

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 IBM CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 INTRALINKS, INC.(SS&C)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 MICRO FOCUS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 MYWORKDRIVE (BY WANPATH LLC.)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCTS PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 NEXTCLOUD GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 OPEN TEXT CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OWNCLOUD GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCTS PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 QNEXT CORP.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SEAFILE, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 THOMSON REUTERS

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 THRU, INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ON-PREMISE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC LARGE ENTERPRISES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC WEB IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LINUX IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC COLLABORATION SUPPORT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SECURITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ENTERPRISE CONTENT MANAGEMENT SYSTEM IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ENTERPRISE STORAGE AND BACKUP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC ENTERPRISE MOBILITY IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ENTERPRISE DOCUMENT MANAGEMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC CLOUD VIRTUALIZATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC HEALTHCARE AND LIFESCIENCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC RETAIL AND E-COMMERCE SEGMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC OTHERS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 ASIA-PACIFIC SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA-PACIFIC PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA-PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 69 ASIA-PACIFIC HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 70 ASIA-PACIFIC GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 71 ASIA-PACIFIC IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 ASIA-PACIFIC RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 73 ASIA-PACIFIC EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 ASIA-PACIFIC MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 76 ASIA-PACIFIC LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 77 ASIA-PACIFIC TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 ASIA-PACIFIC MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 79 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 CHINA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CHINA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 84 CHINA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 87 CHINA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CHINA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 CHINA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 CHINA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 CHINA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 93 CHINA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 CHINA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 95 CHINA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 CHINA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 97 CHINA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 98 CHINA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 99 CHINA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 CHINA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 101 CHINA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 102 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 103 JAPAN SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 JAPAN SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 JAPAN PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 107 JAPAN CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 109 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 110 JAPAN DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 JAPAN MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 JAPAN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 JAPAN BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 JAPAN HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 116 JAPAN GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 JAPAN IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 118 JAPAN RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 119 JAPAN EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 JAPAN MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 121 JAPAN AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 JAPAN LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 123 JAPAN TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 124 JAPAN MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 125 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 INDIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 130 INDIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 132 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 133 INDIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 INDIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 INDIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 138 INDIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 139 INDIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 140 INDIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 141 INDIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 INDIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 143 INDIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 144 INDIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 145 INDIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 146 INDIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 147 INDIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 148 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 166 SOUTH KOREA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 167 SOUTH KOREA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 168 SOUTH KOREA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 169 SOUTH KOREA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 170 SOUTH KOREA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 172 AUSTRALIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 AUSTRALIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 176 AUSTRALIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 178 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 179 AUSTRALIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 AUSTRALIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 AUSTRALIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 183 AUSTRALIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 184 AUSTRALIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 AUSTRALIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 186 AUSTRALIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 187 AUSTRALIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 188 AUSTRALIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 189 AUSTRALIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 190 AUSTRALIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 191 AUSTRALIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 192 AUSTRALIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 193 AUSTRALIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 194 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 195 SINGAPORE SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 SINGAPORE SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 SINGAPORE PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 199 SINGAPORE CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 201 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 202 SINGAPORE DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 SINGAPORE MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 205 SINGAPORE ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 206 SINGAPORE BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 207 SINGAPORE HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 208 SINGAPORE GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 SINGAPORE IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 210 SINGAPORE RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 211 SINGAPORE EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 212 SINGAPORE MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 213 SINGAPORE AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 214 SINGAPORE LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 215 SINGAPORE TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 216 SINGAPORE MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 217 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 218 INDONESIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 INDONESIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 INDONESIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 222 INDONESIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 224 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 225 INDONESIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 INDONESIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 INDONESIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 229 INDONESIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 230 INDONESIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 231 INDONESIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 232 INDONESIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 233 INDONESIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 INDONESIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 235 INDONESIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 236 INDONESIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 237 INDONESIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 238 INDONESIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 239 INDONESIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 240 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 241 THAILAND SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 THAILAND SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 THAILAND PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 245 THAILAND CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 247 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 248 THAILAND DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 THAILAND MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 251 THAILAND ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 252 THAILAND BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 253 THAILAND HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 254 THAILAND GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 255 THAILAND IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 THAILAND RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 257 THAILAND EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 258 THAILAND MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 259 THAILAND AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 260 THAILAND LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 261 THAILAND TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 262 THAILAND MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 268 MALAYSIA CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 270 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 271 MALAYSIA DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MALAYSIA MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 MALAYSIA ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 275 MALAYSIA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 276 MALAYSIA HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 277 MALAYSIA GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 278 MALAYSIA IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 279 MALAYSIA RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 280 MALAYSIA EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 281 MALAYSIA MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 282 MALAYSIA AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 283 MALAYSIA LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 284 MALAYSIA TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 285 MALAYSIA MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 286 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 287 PHILIPPINES SOLUTION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 PHILIPPINES SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 PHILIPPINES PROFESSIONAL SERVICES IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 291 PHILIPPINES CLOUD IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 293 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY ACCESSIBILITY, 2020-2029 (USD MILLION)

TABLE 294 PHILIPPINES DESKTOP IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 PHILIPPINES MOBILE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 297 PHILIPPINES ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 298 PHILIPPINES BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 299 PHILIPPINES HEALTHCARE AND LIFESCIENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 300 PHILIPPINES GOVERNMENT AND PUBLIC SECTOR IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 301 PHILIPPINES IT AND TELECOMMUNICATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 302 PHILIPPINES RETAIL AND E-COMMERCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 303 PHILIPPINES EDUCATION IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 304 PHILIPPINES MEDIA AND ENTERTAINMENT IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 305 PHILIPPINES AEROSPACE AND DEFENCE IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 306 PHILIPPINES LEGAL IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 307 PHILIPPINES TRANSPORTATION AND LOGISTICS IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 308 PHILIPPINES MANUFACTURING IN ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 309 REST OF ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SEGMENTATION

FIGURE 11 CONTINUOUSLY RISING DIGITAL WORKPLACE AND MOBILE WORKFORCE IS EXPECTED TO DRIVE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKETIN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET

FIGURE 15 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2017 TO 2022

FIGURE 16 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING, 2021

FIGURE 17 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: DEPLOYMENT MODEL, 2021

FIGURE 18 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY ACCESSIBILITY, 2021

FIGURE 20 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY END-USER, 2021

FIGURE 22 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: BY OFFERING (2022-2029)

FIGURE 27 ASIA PACIFIC ENTERPRISE FILE SYNCHRONIZATION AND SHARING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.