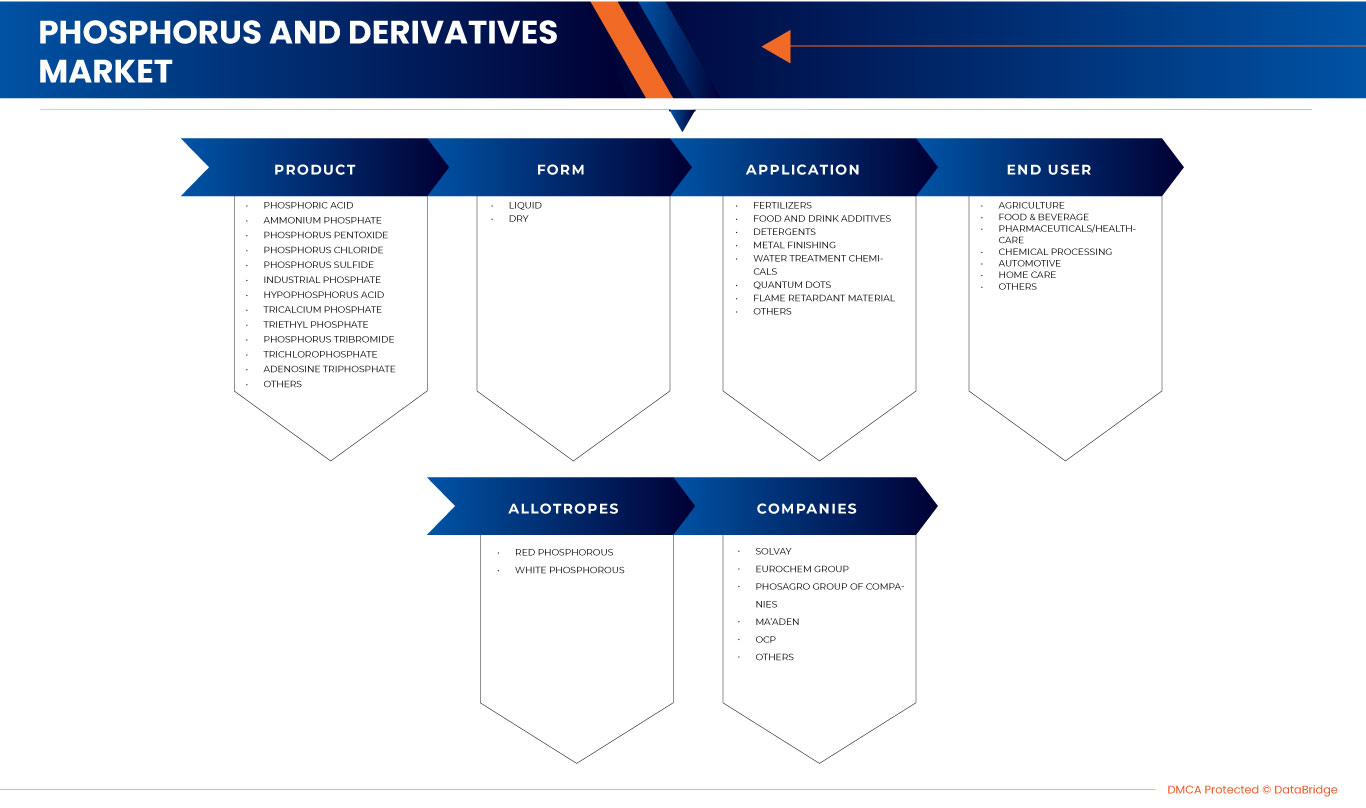

Mercado de fósforo y derivados de Asia y el Pacífico, por producto ( ácido fosfórico , fosfato de amonio, pentóxido de fósforo, cloruro de fósforo, sulfuro de fósforo, fosfato industrial, ácido hipofosforoso, fosfato tricálcico, fosfato de trietilo, tribromuro de fósforo, triclorofosfato, trifosfato de adenosina y otros), forma (seca y líquida), aplicación (fertilizantes, aditivos para alimentos y bebidas, detergentes, acabado de metales, productos químicos para el tratamiento del agua, puntos cuánticos, material ignífugo y otros), usuario final (agricultura, alimentos y bebidas, productos farmacéuticos/sanitarios, procesamiento químico, automoción, cuidado del hogar y otros), alótropos (fósforo rojo y fósforo blanco): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de fósforo y derivados de Asia y el Pacífico

El ácido fosfórico y el fósforo son ácidos cristalinos que, por lo general, son débiles, incoloros e inodoros. Estos materiales inorgánicos son corrosivos para los metales ferrosos y sus aleaciones y poseen una buena solubilidad en agua. Tienden a descomponerse a altas temperaturas y pueden formar vapores tóxicos cuando se combinan con alcohol. Le dan a los refrescos un sabor ácido y evitan el crecimiento de moho y bacterias, que pueden multiplicarse fácilmente en una solución azucarada. La mayor parte de la acidez de los refrescos también proviene del ácido fosfórico.

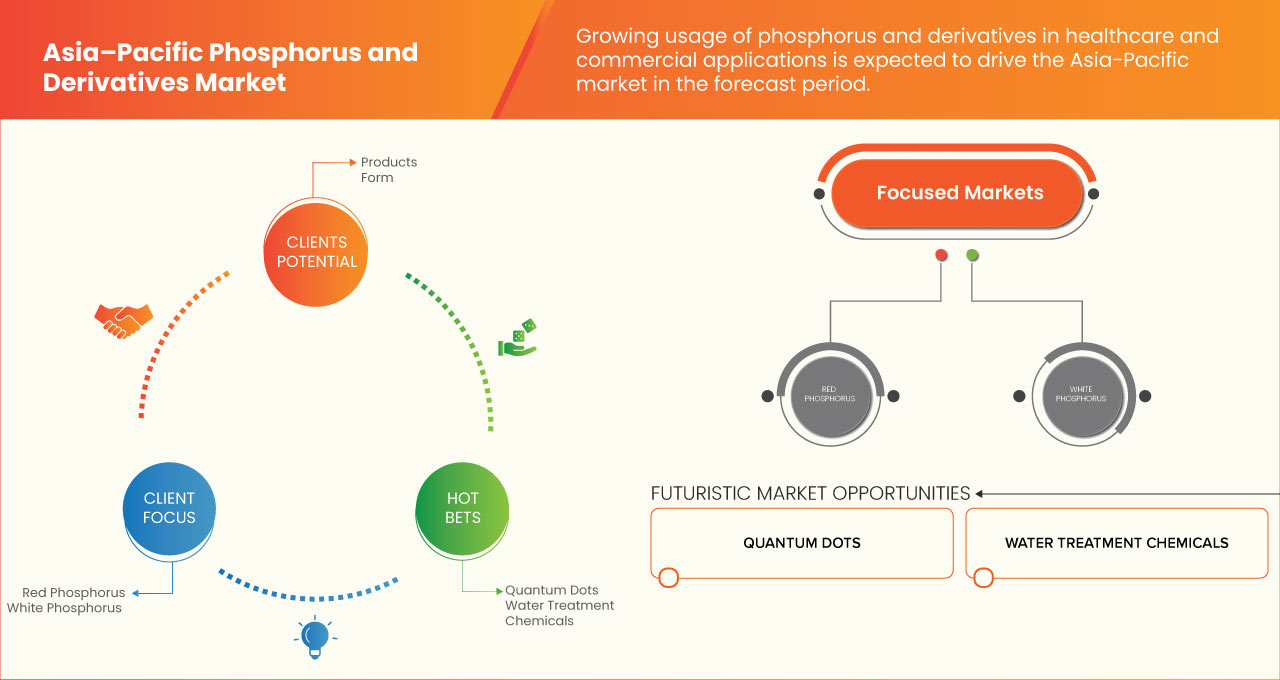

Los factores que pueden impulsar el crecimiento del mercado de fósforo y derivados en Asia-Pacífico son el rápido crecimiento del sector agrícola, alimentario y de alimentos y bebidas. Sin embargo, se espera que las estrictas regulaciones gubernamentales sobre el uso de fósforo y derivados limiten el mercado.

Por otra parte, las iniciativas estratégicas de los actores del mercado y el auge del sector agrícola y de las industrias de alimentos y bebidas pueden actuar como una oportunidad para hacer crecer el mercado de fósforo y derivados de Asia-Pacífico. Los riesgos asociados con el uso excesivo de productos a base de fosfato pueden crear desafíos para el mercado de fósforo y derivados de Asia-Pacífico. Hay algunos desarrollos recientes relacionados con el mercado de fósforo y derivados de Asia-Pacífico.

Sin embargo, se espera que los efectos nocivos del fósforo y sus derivados sobre el medio ambiente obstaculicen el crecimiento del mercado de fósforo y sus derivados en Asia y el Pacífico en el período de pronóstico.

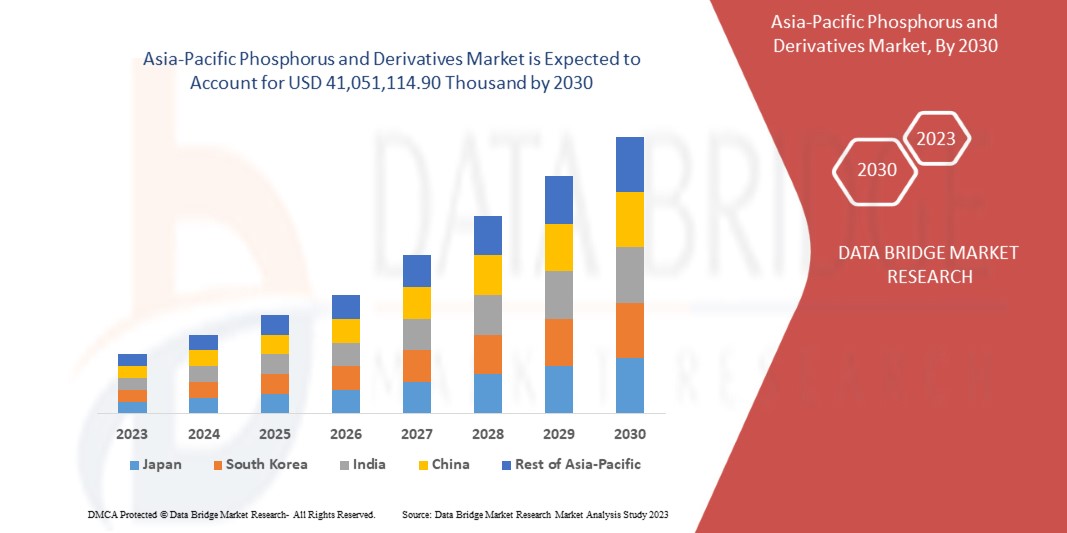

Data Bridge Market Research analiza que se espera que el mercado de fósforo y derivados de Asia-Pacífico alcance un valor de USD 41.051.114,90 mil para 2030, con una CAGR del 4,34% durante el período de pronóstico. El ácido fosfórico es el segmento de productos más grande del mercado debido al creciente uso de fósforo en el fósforo y sus derivados en Asia-Pacífico.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (2015-2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Producto (ácido fosfórico, fosfato de amonio, pentóxido de fósforo, cloruro de fósforo, sulfuro de fósforo, fosfato industrial, ácido hipofosforoso, fosfato tricálcico, fosfato de trietilo, tribromuro de fósforo, triclorofosfato, trifosfato de adenosina y otros), forma (seca y líquida), aplicación (fertilizantes, aditivos para alimentos y bebidas, detergentes, acabado de metales, productos químicos para el tratamiento del agua, puntos cuánticos, material ignífugo y otros), usuario final (agricultura, alimentos y bebidas, productos farmacéuticos/asistencia sanitaria, procesamiento químico, automoción, cuidado del hogar y otros), alótropos (fósforo rojo y fósforo blanco) |

|

Países cubiertos |

Japón, China, Corea del Sur, India, Australia, Singapur, Tailandia, Taiwán, Hong Kong, Nueva Zelanda, Malasia, Indonesia, Filipinas, Resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd. y Sekisui Diagnostics, entre otros. |

Definición del mercado de fósforo y derivados de Asia y el Pacífico

El fósforo es un elemento no metálico combustible que se encuentra generalmente en dos formas alotrópicas: fósforo blanco y fósforo rojo. El ácido fosfórico, el ácido fosforoso, el oxicloruro de fósforo, el pentacloruro de fósforo, el tribromuro de fósforo, el hipofosfito de sodio, el fosfato de tributilo y el fosfato de trietilo son derivados del fósforo. El ácido fosfórico, derivado del fósforo, es un ácido cristalino generalmente débil, incoloro e inodoro. Estos materiales inorgánicos son corrosivos para los metales ferrosos y sus aleaciones y poseen una buena solubilidad en agua. Tienden a descomponerse a altas temperaturas. Pueden formar vapores tóxicos cuando se combinan con alcohol. Le da a los refrescos un sabor ácido y evita el crecimiento de moho y bacterias, que pueden multiplicarse fácilmente en una solución azucarada. La mayor parte de la acidez de los refrescos también proviene del ácido fosfórico.

El fósforo se convierte primero en pentóxido de fósforo mediante un proceso de fabricación química. Luego se trata nuevamente para convertirse en ácido fosfórico.

Dinámica del mercado de fósforo y derivados en Asia-Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de fertilizantes en la industria agrícola

El ácido fosfórico produce varios fertilizantes, incluidos DAP, MAP, NPK y SSP.

El fosfato diamónico (DAP) es el fertilizante fosfatado más popular debido a sus propiedades físicas. La composición del DAP es N-18% y P2O5 -46%. Los fertilizantes DAP son perfectos para cualquier cultivo agrícola para proporcionar una nutrición completa de fósforo durante el crecimiento y desarrollo del cultivo y una dosis inicial de nitrógeno y bajo contenido de azufre. Se puede aplicar en otoño para la labranza y en primavera durante la siembra y el cultivo previo a la siembra. La disolución en el suelo proporciona una alcalinización temporal del pH de la solución del suelo alrededor del gránulo de fertilizante, estimulando así una mejor absorción de fósforo de los fertilizantes en suelos ácidos. El azufre del fertilizante también contribuye a una mejor absorción de nitrógeno y fósforo por parte de las plantas.

Por lo tanto, se espera que los usos múltiples del ácido fosfórico para producir fertilizantes de fosfato impulsen el crecimiento del mercado de ácido fosfórico en Asia y el Pacífico.

- Demanda creciente en el sector farmacéutico

El ácido fosfórico se utiliza principalmente en muchas aplicaciones médicas, como cemento dental, para preparar derivados de albúmina, acidificar la orina, eliminar restos necróticos (células o tejidos muertos), medicamentos contra las náuseas, blanqueadores dentales y líquidos para enjuagar la boca.

El ácido fosfórico utilizado en el blanqueamiento dental puede alterar la superficie del diente. El uso de ácido fosfórico al 37 % después del blanqueamiento puede aumentar significativamente el efecto descalcificador del ácido en la superficie del esmalte, creando una superficie grabada irregular. Además, puede generar sensibilidad en los dientes.

Por lo tanto, se espera que el creciente uso de ácido fosfórico en aplicaciones médicas impulse el crecimiento del mercado de ácido fosfórico en Asia-Pacífico.

Restricción

- Normas gubernamentales estrictas sobre el uso de fósforo y derivados

Existen numerosas regulaciones por parte de diferentes organismos reguladores gubernamentales para el uso y la producción de ácido fosfórico.

La FDA protege la salud pública garantizando la seguridad, eficacia y protección de los medicamentos para uso humano y veterinario, productos biológicos, productos químicos y otros. La FDA de los EE. UU. ha establecido algunas normas para el uso de ácido fosfórico en alimentos y normas para su manipulación. A continuación, se presentan algunos de los parámetros establecidos por la FDA con fines de protección.

Por lo tanto, debido a las estrictas regulaciones gubernamentales sobre el ácido fosfórico, existen limitaciones en el uso de ácido fosfórico, lo que puede impedir el crecimiento del mercado en el período de pronóstico.

Oportunidad

Aumento de la innovación y lanzamientos de nuevos productos

Los principales actores del mercado han lanzado nuevos productos que presentan capacidades mejoradas. Los fabricantes han tomado las medidas necesarias para mejorar la precisión de los nuevos productos y la funcionalidad general.

Los actores del mercado se están centrando aún más en producir ácido fosfórico a nivel nacional y operar exportando a otras regiones para expandir su negocio.

Por lo tanto, se espera que las crecientes innovaciones y los lanzamientos de nuevos productos ofrezcan una oportunidad para el mercado de ácido fosfórico de Asia y el Pacífico.

Desafío

Riesgos asociados al uso excesivo de productos a base de fosfato

A nivel estatal, provisional y nacional, el suministro de ácido fosfórico está regulado por diversas normas gubernamentales, ya que varios riesgos podrían afectar el uso de fertilizantes y existen varios impactos ambientales durante la producción de ácido fosfórico.

Para la producción de fertilizantes fosfatados se suele utilizar como materia prima roca fosfórica sedimentaria, que contiene concentraciones de radionucleidos de la serie U entre 10 y 100 veces superiores a las de los suelos no perturbados.

Por lo tanto, debido a los efectos nocivos del ácido fosfórico en el aire, el agua, el suelo y la salud humana, muchos organismos gubernamentales han liderado la implementación de varias regulaciones, esquemas de certificación de alto estándar y registros de empresas para el uso de ácido fosfórico, lo que puede representar un desafío para el mercado de ácido fosfórico de Asia y el Pacífico.

Acontecimientos recientes

- En marzo de 2023, Solvay anunció que había sido reconocida como uno de los 60 principales proveedores para 2022 en la red de Asia-Pacífico de Northrop Grumman Corporation, compuesta por más de 10 000 proveedores. Esto mejorará la imagen de marca de la empresa, entre otras cosas.

- En marzo de 2023, el grupo Airedale anunció que la empresa seguiría creciendo con la adquisición de McCann Chemicals. Esto contribuirá a aumentar el crecimiento y la diversificación de la cartera de productos de la empresa.

Alcance del mercado de fósforo y derivados en Asia y el Pacífico

El mercado de fósforo y derivados de Asia-Pacífico está segmentado en cinco segmentos importantes, como producto, forma, aplicación, usuario final y alótropos. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Producto

- Ácido fosfórico

- Fosfato de amonio

- Pentóxido de fósforo

- Cloruro de fósforo

- Sulfuro de fósforo

- Fosfato industrial

- Ácido hipofosforoso

- Fosfato tricálcico

- Fosfato de trietilo

- Tribromuro de fósforo

- Triclorofosfato

- Trifosfato de adenosina

- Otros

Sobre la base del producto, el mercado de fósforo y derivados de Asia-Pacífico está segmentado en ácido fosfórico, fosfato de amonio, pentóxido de fósforo, cloruro de fósforo, sulfuro de fósforo, fosfato industrial, ácido hipofosforoso, fosfato tricálcico, fosfato de trietilo, tribromuro de fósforo, triclorofosfato, trifosfato de adenosina y otros.

Forma

- Seco

- Líquido

Según su forma, el mercado de fósforo y derivados de Asia-Pacífico está segmentado en seco y líquido.

Solicitud

- Fertilizantes

- Aditivos para alimentos y bebidas

- Detergentes

- Acabado de metales

- Productos químicos para el tratamiento del agua

- Puntos cuánticos

- Material retardante de llama

- Otros

Sobre la base de la aplicación, el mercado de fósforo y derivados de Asia-Pacífico está segmentado en fertilizantes, aditivos para alimentos y bebidas, detergentes, acabado de metales, productos químicos para el tratamiento del agua, puntos cuánticos, material retardante de llama y otros.

Usuario final

- Agricultura

- Alimentos y bebidas

- Productos farmacéuticos/asistencia sanitaria

- Procesamiento químico

- Automotor

- Cuidados en el hogar

- Otros

Sobre la base del usuario final, el mercado de fósforo y derivados de Asia-Pacífico está segmentado en agricultura, alimentos y bebidas, productos farmacéuticos/asistencia sanitaria, procesamiento químico, automoción, cuidado del hogar y otros.

Alótropos

- Fósforo rojo

- Fósforo blanco

Sobre la base de los alótropos, el mercado de fósforo y derivados de Asia-Pacífico está segmentado en fósforo rojo y fósforo blanco.

Análisis y perspectivas regionales del mercado de fósforo y derivados en Asia y el Pacífico

El mercado de fósforo y derivados de Asia-Pacífico está segmentado en cinco segmentos notables: producto, forma, aplicación, usuario final y alótropos.

Los países cubiertos en este informe de mercado de fósforo y derivados de Asia-Pacífico son Japón, China, Corea del Sur, India, Australia, Singapur, Nueva Zelanda, Malasia, Indonesia, Filipinas y el resto de Asia-Pacífico.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como las nuevas ventas, las ventas de reemplazo, la demografía del país, las leyes regulatorias y los aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de fósforo y sus derivados y los desafíos debido a las estrictas regulaciones al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del fósforo y sus derivados en Asia-Pacífico

El panorama competitivo del mercado de fósforo y derivados de Asia-Pacífico proporciona detalles de un competidor. Los detalles incluyen una descripción general de la empresa, información financiera, ingresos generados, potencial de mercado, expansión comercial, instalaciones de servicio, asociación, desarrollo estratégico, dominio de aplicaciones y curva de supervivencia tecnológica. Los puntos de datos anteriores solo se relacionan con el enfoque de la empresa en el mercado de fósforo y derivados de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de fósforo y derivados de Asia-Pacífico son ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd., Sekisui Diagnostics y otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 EUROPE PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 EUROPE PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 EUROPE

16.1.1 RUSSIA

16.1.2 U.K.

16.1.3 GERMANY

16.1.4 FRANCE

16.1.5 ITALY

16.1.6 SPAIN

16.1.7 NETHERLANDS

16.1.8 POLAND

16.1.9 SWEDEN

16.1.10 BELGIUM

16.1.11 IRELAND

16.1.12 AUSTRIA

16.1.13 DENMARK

16.1.14 FINLAND

16.1.15 ROMANIA

16.1.16 CZECH REPUBLIC

16.1.17 PORTUGAL

16.1.18 GREECE

16.1.19 HUNGARY

16.1.20 SLOVAKIA

16.1.21 LUXEMBOURG

16.1.22 BULGARIA

16.1.23 CROATIA

16.1.24 LITHUANIA

16.1.25 SLOVENIA

16.1.26 LATVIA

16.1.27 ESTONIA

16.1.28 REPUBLIC OF CYPRUS

16.1.29 MALTA

17 EUROPE PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: EUROPE

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC EUROPE

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 CHINA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 CHINA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 CHINA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 CHINA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 CHINA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 INDIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 INDIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 INDIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 INDIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 INDIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 JAPAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 JAPAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 JAPAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 JAPAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 JAPAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 77 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 78 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 79 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 80 SOUTH KOREA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 81 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 82 SOUTH KOREA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 83 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 84 SOUTH KOREA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 85 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 86 SOUTH KOREA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 87 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 88 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 89 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 90 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 91 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 92 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 93 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 94 SOUTH KOREA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 95 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 96 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 97 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 98 INDONESIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 99 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 100 INDONESIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 101 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 102 INDONESIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 103 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 104 INDONESIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 105 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 106 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 107 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 108 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 109 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 110 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 111 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 112 INDONESIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 113 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 114 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 115 AUSTRALIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 116 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 117 AUSTRALIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 118 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 119 AUSTRALIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 120 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 121 AUSTRALIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 122 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 123 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 124 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 125 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 126 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 127 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 128 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 129 AUSTRALIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 130 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 131 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 132 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 133 SINGAPORE PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 134 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 135 SINGAPORE AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 136 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 137 SINGAPORE PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 138 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 139 SINGAPORE PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 140 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 141 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 142 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 143 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 144 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 145 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 146 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 147 SINGAPORE PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 148 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 149 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 150 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 151 PHILIPPINES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 152 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 153 PHILIPPINES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 154 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 155 PHILIPPINES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 156 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 157 PHILIPPINES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 158 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 159 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 160 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 161 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 162 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 163 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 164 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 165 PHILIPPINES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 166 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 167 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 168 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 169 THAILAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 170 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 171 THAILAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 172 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 173 THAILAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 174 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 175 THAILAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 176 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 177 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 178 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 179 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 180 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 181 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 182 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 183 THAILAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 184 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 185 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 186 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 187 MALAYSIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 188 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 189 MALAYSIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 190 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 191 MALAYSIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 192 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 193 MALAYSIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 194 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 195 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 196 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 197 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 198 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 199 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 200 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 201 MALAYSIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 202 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 203 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 204 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 205 NEW ZEALAND PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 206 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 207 NEW ZEALAND AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 208 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 209 NEW ZEALAND PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 210 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 211 NEW ZEALAND PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 212 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 213 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 214 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 215 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 216 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 217 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 218 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 219 NEW ZEALAND PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 220 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 221 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 222 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 223 HONG KONG PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 224 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 225 HONG KONG AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 226 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 227 HONG KONG PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 228 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 229 HONG KONG PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 230 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 231 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 232 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 233 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 234 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 235 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 236 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 237 HONG KONG PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 238 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 239 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 240 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 241 TAIWAN PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 242 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 243 TAIWAN AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 244 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 245 TAIWAN PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 246 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 247 TAIWAN PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 248 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 249 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 250 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 251 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 252 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 253 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 254 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 255 TAIWAN PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 256 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 257 REST OF ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

Lista de figuras

FIGURE 1 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2022 - 2030)

FIGURE 31 ASIA PACIFIC PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.