Asia Pacific Plant Based Milk Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.91 Billion

USD

27.13 Billion

2024

2032

USD

10.91 Billion

USD

27.13 Billion

2024

2032

| 2025 –2032 | |

| USD 10.91 Billion | |

| USD 27.13 Billion | |

|

|

|

|

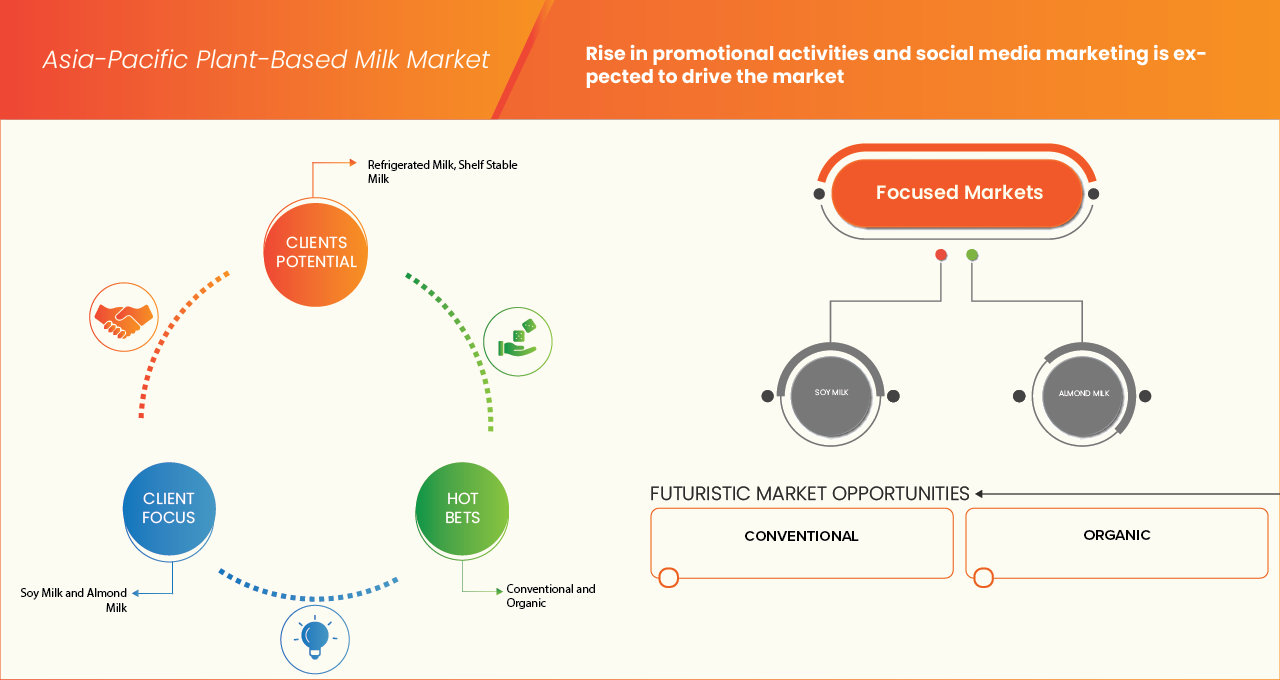

Segmentación del mercado de leches vegetales de Asia-Pacífico, por tipo de producto (leche de soja, leche de almendras, leche de coco, leche de avena, leche de arroz, leche de anacardo, leche de nueces, leche de avellanas, leche de lino, leche de guisantes, leche de macadamia, leche de cáñamo, leche de semillas de calabaza y otras), tipo (leche refrigerada, leche estable), naturaleza (convencional y orgánica), forma (líquida y en polvo), dulzor (sin azúcar y endulzado), sabor (original/sin sabor y saborizado), afirmaciones (con afirmación, sin afirmación), vida útil (1 a 6 meses, 2 a 4 semanas, más de 6 meses y 1 a 2 semanas), tipo de envase (tetrapacks, botellas, bolsas, latas, frascos, sobres y otros), material de envasado (vidrio, plástico y metal), cantidad de envase (1000 ml, 250 ml, 500 ml, 110 ml, más de 1000 ml y menos de 100 ml), precio (masivo, premium, de lujo), aplicación (doméstica y comercial), canal de distribución (con y sin tienda): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de leches vegetales en Asia-Pacífico

- El tamaño de la leche vegetal en Asia-Pacífico se valoró en USD 10.91 mil millones en 2024 y se espera que alcance los USD 27.13 mil millones para 2032 , con una CAGR del 12,2% durante el período de pronóstico.

- La creciente preferencia por las dietas veganas y flexitarianas y un mayor enfoque en la sostenibilidad son factores importantes que impulsan la demanda en toda la región.

- La expansión de las redes minoristas, la penetración del comercio electrónico y las aplicaciones de servicios de alimentos, en particular las leches de avena y almendras de calidad barista, están fortaleciendo aún más el alcance del mercado.

Análisis del mercado de leches vegetales en Asia-Pacífico

- El sector de las leches vegetales es un componente fundamental de la industria de alimentos y bebidas de Asia-Pacífico, ya que satisface la demanda de alternativas más saludables, sin lactosa y sostenibles. Abarca una amplia gama de productos, como soja, almendra, avena, coco, arroz y fórmulas mixtas, que satisfacen las necesidades nutricionales de las poblaciones urbanas y rurales. El crecimiento del mercado se ve impulsado por una mayor concienciación sobre la salud, las alergias a los lácteos y el aumento de los estilos de vida veganos y flexitarianos.

- La innovación de productos es fundamental, con fabricantes desarrollando leches vegetales fortificadas, enriquecidas con proteínas, calcio y vitaminas, para competir con la nutrición láctea. Características como fórmulas de etiqueta limpia, contenido reducido de azúcar y envases ambientalmente sostenibles están moldeando las preferencias de los consumidores. En los sectores minorista y de servicios de alimentación, la demanda de productos versátiles, fáciles de usar y de primera calidad que satisfagan diversos gustos y necesidades funcionales está en auge.

- Se proyecta que China será el país dominante y de mayor crecimiento en el mercado de leches vegetales de Asia-Pacífico, gracias a una sólida concienciación del consumidor, una rápida urbanización y una inversión continua en tecnologías de proteínas alternativas. La presencia de marcas nacionales líderes y el cumplimiento de las normas de seguridad alimentaria en constante evolución posicionan a China como un mercado maduro y en rápida expansión. Su énfasis en la sostenibilidad y los canales minoristas modernos impulsan aún más la demanda.

- En 2025, se prevé que el segmento de la leche de soya domine el mercado con una cuota de mercado del 38,71% gracias a su asequibilidad, su arraigada familiaridad con el consumidor y su alto contenido proteico. Las opciones a base de soya siguen siendo especialmente populares en China, Japón y el Sudeste Asiático. Al mismo tiempo, las leches de avena y almendras están experimentando un fuerte impulso gracias a su posicionamiento premium, su atractivo sabor y su creciente adopción en la cultura de las cafeterías.

- La expansión del mercado también se ve impulsada por el crecimiento de la clase media en la región, la creciente prevalencia de la intolerancia a la lactosa y el mayor apoyo gubernamental a la agricultura sostenible. Además, la transición hacia dietas más saludables, el aumento de la inversión en innovación alimentaria y el apoyo regulatorio a las alternativas vegetales están impulsando a los fabricantes a ampliar sus carteras y fortalecer las cadenas de suministro en Asia-Pacífico.

Alcance del informe y segmentación del mercado de leches vegetales en Asia-Pacífico

|

Atributos |

Perspectivas clave del mercado de leches vegetales en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias en leches vegetales

“Integración de tecnologías inteligentes e innovación centrada en el consumidor”

- El mercado de leches vegetales en Asia-Pacífico está experimentando una fuerte transformación impulsada por los avances en las tecnologías de procesamiento, como el Procesamiento por Alta Presión (HPP), el tratamiento enzimático y las técnicas de fortificación. Estas innovaciones mejoran el valor nutricional, el sabor y la vida útil, haciendo que la leche vegetal sea más atractiva para los consumidores preocupados por su salud e intolerantes a la lactosa.

- La interoperabilidad de sistemas en la cadena de suministro está cobrando impulso a medida que los productores adoptan herramientas digitales para la trazabilidad, blockchain para la transparencia y controles de calidad basados en IA. Esto garantiza estándares consistentes en el abastecimiento, la producción y la distribución en mercados regionales muy diversos.

- La creciente demanda de líneas de productos personalizables y escalables (desde leche de soja, avena y almendras hasta bases de nicho como coco, arroz y guisantes) está dando forma a la innovación, con marcas que ofrecen sabores localizados y variantes fortificadas para satisfacer preferencias regionales específicas.

- El enfoque creciente en la accesibilidad del consumidor está impulsando el lanzamiento de envases fáciles de usar, formatos de porción individual y opciones sin lactosa, sin gluten y con contenido reducido de azúcar, que atienden a un amplio grupo demográfico, desde niños hasta consumidores mayores.

- Están surgiendo análisis basados en IA e información predictiva sobre el consumidor, lo que permite a las marcas anticipar los cambios en la demanda, personalizar el marketing y optimizar la distribución. Esto es especialmente crucial en Asia-Pacífico, donde la diversidad cultural y los patrones alimentarios varían considerablemente entre los mercados.

Dinámica del mercado de leches vegetales en Asia-Pacífico

Conductor

Aumento de la cultura vegana en todo el mundo

- El rápido auge de la cultura vegana a nivel mundial se ha convertido en un factor clave de la demanda del creciente mercado de leches vegetales en Asia-Pacífico. Las cambiantes preferencias de los consumidores, especialmente entre los jóvenes urbanos, han reducido el consumo de productos animales en sus dietas por razones de salud, medio ambiente y ética. Este cambio cultural se traduce en una mayor demanda minorista e institucional de leches vegetales de avena, soja, almendras y otras leches vegetales en Asia-Pacífico.

- Las autoridades públicas, los organismos multilaterales y los principales medios de comunicación han reconocido y respondido cada vez más a estos cambios mediante directrices, políticas de nutrición escolar, normas de etiquetado e inversión pública que, en conjunto, reducen las barreras para una adopción más amplia. Estas medidas políticas, sumadas a la visible cobertura mediática y las revisiones científicas, refuerzan la confianza del consumidor y aceleran el crecimiento del mercado en la región.

- Por ejemplo, en enero de 2025, la Administración de Alimentos y Medicamentos de los Estados Unidos informó que emitió un borrador de guía que aborda el etiquetado de alternativas de origen vegetal a alimentos derivados de animales, y concluyó que las bebidas de origen vegetal pueden seguir usando el término leche cuando estén claramente etiquetadas con su origen vegetal, una medida que reconoció la creciente aceptación de las leches no animales por parte de los consumidores.

Oportunidad

Crecientes lanzamientos de nuevos productos y nuevas asociaciones/adquisiciones

- El mercado de leche vegetal de Asia y el Pacífico se está beneficiando de una ola de innovación de productos, asociaciones estratégicas, expansiones de capacidad y adquisiciones ocasionales entre actores clave, todo lo cual está creando una dinámica competitiva más fuerte, carteras de productos más amplias y una creciente penetración en los mercados.

- Nuevas variantes (mezclas para baristas, alto contenido proteico, materias primas innovadoras), la expansión de las plantas de fabricación y las alianzas regionales ayudan a abordar tanto las limitaciones de la oferta (escala, costo, calidad) como las necesidades de la demanda (sabor, funcionalidad, novedad). A medida que las empresas compiten por satisfacer las cambiantes expectativas de los consumidores en cuanto a salud, sostenibilidad, sabor y experiencia, estos lanzamientos y alianzas actúan como multiplicadores de fuerza, permitiendo una difusión más rápida de las leches vegetales en el comercio minorista, la restauración y los canales online emergentes de Asia-Pacífico.

- Por ejemplo, en noviembre de 2021, China Daily informó que Oatly abrió su primera planta de producción en Ma'anshan, provincia de Anhui, con capacidad destinada a suministrar grandes volúmenes de bebidas a base de avena al mercado chino, un paso que expandió materialmente la fabricación local y la disponibilidad de leche de avena en Asia.

Restricción/Desafío

Alto precio de la leche vegetal en comparación con la leche de vaca

- Las leches de origen vegetal a menudo requieren materias primas (por ejemplo, almendras, avena, soja) que pueden tener que importarse, tecnologías de procesamiento que son más complejas o evitan el desperdicio, envases especializados, fortificación para que coincida con los perfiles de nutrientes y distribución a través de minoristas modernos o cadenas de frío que son más costosos.

- En muchos países de Asia y el Pacífico, donde la leche de vaca está fuertemente subsidiada o se produce localmente a bajo costo, el sobreprecio que se cobra por las alternativas vegetales se convierte en una barrera importante, especialmente en los segmentos de ingresos bajos y medios. Los consumidores sensibles al precio pueden optar por los lácteos o evitar por completo su consumo en lugar de comprar leche vegetal a un precio más alto.

- Por ejemplo, en mayo de 2023, The Guardian informó que las leches vegetales costaban en promedio el doble que la leche de vaca en los mercados que examinaron, lo que empujó a algunos consumidores a volver a los productos lácteos debido al costo.

Panorama del mercado de leches vegetales en Asia-Pacífico

El mercado de leche vegetal de Asia-Pacífico se clasifica en catorce segmentos notables que se basan en el tipo de producto, tipo, naturaleza, forma, sabor, dulzura, vida útil, reclamo, material de empaque, tipo de empaque, cantidad de empaque, precio, aplicación, canal de distribución.

• Por tipo de producto

Según el tipo de producto, el mercado de leches vegetales de Asia-Pacífico se segmenta en leche de soya, leche de almendras, leche de coco, leche de avena, leche de arroz, leche de anacardo, leche de nueces, leche de avellanas, leche de lino, leche de guisantes, leche de macadamia, leche de cáñamo, leche de semilla de calabaza, entre otras. En 2025, se espera que el segmento de leche de soya domine el mercado con una participación del 38,71% debido a su arraigada aceptación cultural, asequibilidad y alto contenido proteico en comparación con otras alternativas vegetales.

Se espera que el segmento de la leche de soya crezca con una tasa de crecimiento anual compuesta (TCAC) del 13,5 % durante el período de pronóstico de 2025 a 2032, ya que la leche de soya sigue siendo ampliamente consumida tanto como bebida tradicional como alternativa láctea moderna. Su versatilidad en aplicaciones, desde el consumo directo hasta su uso en cocina, bebidas y alimentos procesados, ha consolidado aún más su posición en el mercado.

Por tipo

Según el tipo, el mercado de leche vegetal en Asia-Pacífico se segmenta en leche refrigerada y leche de larga duración. En 2025, se prevé que el segmento de leche refrigerada domine el mercado con una cuota de mercado del 86,53 %, gracias a su percepción de frescura, sabor superior y la creciente preferencia entre los consumidores urbanos preocupados por la salud.

Se espera que el segmento de leche refrigerada crezca con la CAGR más alta del 12,4 % en el período de pronóstico de 2025 a 2032, ya que los formatos refrigerados a menudo se asocian con una mayor calidad y un procesamiento mínimo, lo que los hace particularmente atractivos en los canales minoristas premium y entre los grupos demográficos más jóvenes que buscan alternativas lácteas más saludables.

Por naturaleza

En función de su naturaleza, el mercado de leches vegetales en Asia-Pacífico se segmenta en convencional y orgánica. En 2025, se prevé que el segmento convencional domine el mercado con una cuota de mercado del 71,83% gracias a su asequibilidad, amplia disponibilidad y gran aceptación entre los consumidores de diversos grupos demográficos.

Se prevé que el segmento convencional crezca con una tasa de crecimiento anual compuesta (TCAC) del 12,5 % durante el período de pronóstico de 2025 a 2032, ya que las variantes convencionales de leche de soja, coco y arroz han formado parte de la dieta tradicional en países como China, Japón y el Sudeste Asiático, lo que las hace más accesibles en comparación con las alternativas orgánicas o fortificadas especiales. Sus precios competitivos y su amplia distribución a través de supermercados, tiendas de conveniencia y minoristas locales refuerzan aún más su dominio, especialmente en los mercados de la región donde los precios son sensibles.

Por formulario

En cuanto a su presentación, el mercado de leches vegetales en Asia-Pacífico se segmenta en líquido y en polvo. En 2025, se prevé que el segmento líquido domine el mercado con una cuota de mercado del 89,56% gracias a su comodidad, amplia disponibilidad y la fuerte preferencia de los consumidores por los formatos listos para beber.

Se espera que el segmento líquido crezca con la CAGR más alta del 12,3% en el período de pronóstico de 2025 a 2032, ya que las leches líquidas de origen vegetal como la de soja, avena, almendras y coco se consumen ampliamente como alternativas lácteas directas y son parte integral de las dietas diarias en toda la región, particularmente en los centros urbanos donde el consumo para llevar y la cultura de los cafés se están expandiendo rápidamente.

Por dulzura

En función del dulzor, el mercado de leches vegetales en Asia-Pacífico se segmenta en sin azúcar y con azúcar. En 2025, se espera que el segmento sin azúcar domine el mercado con una cuota de mercado del 78,18 %, gracias a la creciente concienciación sobre la salud, la creciente demanda de dietas bajas en azúcar y la creciente atención a los productos de etiqueta limpia.

Se espera que el segmento sin azúcar crezca con la CAGR más alta del 12,5% en el período de pronóstico de 2025 a 2032, a medida que los consumidores de toda la región se vuelven más conscientes de las condiciones de salud relacionadas con el estilo de vida, como la obesidad y la diabetes, las variantes sin azúcar de la leche de soja, avena y almendras están ganando popularidad como alternativas más saludables tanto a la leche de vaca como a las opciones vegetales endulzadas.

Por sabor

En cuanto al sabor, el mercado de leches vegetales de Asia-Pacífico se segmenta en original/sin sabor y con sabor. En 2025, se espera que el segmento original/sin sabor domine el mercado con una cuota de mercado del 54,49% gracias a su versatilidad, amplia aceptación por parte del consumidor y su idoneidad para múltiples aplicaciones.

Se espera que el segmento original o sin sabor crezca con la CAGR más alta del 12,9 % en el período de pronóstico de 2025 a 2032, ya que las variantes originales o sin sabor de la leche de soja, avena, coco y almendras se utilizan comúnmente para cocinar, hornear, cereales, café y batidos, ya que proporcionan un perfil de sabor neutro que no altera el sabor de las recetas.

Por reclamaciones

En función de las afirmaciones, el mercado de leches vegetales de Asia-Pacífico se segmenta en con y sin afirmaciones. En 2025, se espera que el segmento con afirmaciones domine el mercado con una cuota de mercado del 64,16 %, debido a la creciente confianza de los consumidores en productos que destacan beneficios específicos para la salud, la nutrición y la sostenibilidad.

Se espera que el segmento con afirmaciones crezca con una CAGR máxima de 12,7 % en el período de pronóstico de 2025 a 2032, ya que las leches vegetales etiquetadas con afirmaciones como "alto en proteínas", "fortificado con calcio", "sin lactosa", "sin OGM" o "ambientalmente sustentable" están ganando una fuerte tracción, particularmente entre las poblaciones urbanas conscientes de la salud y los grupos demográficos más jóvenes que buscan transparencia en sus elecciones de alimentos.

Por vida útil

Según su vida útil, el mercado de leche vegetal en Asia-Pacífico se segmenta en: 1-6 meses, 2-4 semanas, y más de 6 meses, 1-2 semanas. En 2025, se espera que el segmento de 1-6 meses domine el mercado con una cuota de mercado del 42,81% gracias a su equilibrio entre frescura, conveniencia y adaptabilidad a las cadenas de suministro minoristas modernas.

Se espera que el segmento de 1 a 6 meses crezca con la CAGR más alta del 13,0 % en el período de pronóstico de 2025 a 2032, ya que los productos de esta categoría, generalmente envasados en cajas asépticas o formatos refrigerados, brindan a los consumidores una percepción de mayor calidad y seguridad en comparación con las opciones de vida útil ultracorta y, al mismo tiempo, siguen siendo accesibles a través de supermercados, hipermercados y tiendas de conveniencia.

Por tipo de embalaje

Según el tipo de envase, el mercado de leche vegetal en Asia-Pacífico se segmenta en tetrabriks, botellas, bolsas, latas, frascos, sobres y otros. En 2025, se prevé que el segmento de tetrabriks domine el mercado con una cuota de mercado del 55,42% gracias a su durabilidad, practicidad y capacidad para prolongar la vida útil del producto sin comprometer la calidad.

Se espera que el segmento de envases Tetra Pack crezca con una tasa de crecimiento anual compuesta (TCAC) del 12,7 % durante el período de pronóstico de 2025 a 2032. Gracias a su ligereza, portabilidad y facilidad de almacenamiento, los envases Tetra Pack son ideales para los canales de distribución minorista y de comercio electrónico en expansión de la región. Su tecnología de envasado aséptico ayuda a conservar la frescura y el valor nutricional durante varios meses, satisfaciendo las necesidades de los consumidores tanto urbanos como rurales, donde la infraestructura de la cadena de frío puede ser limitada.

Por material de embalaje

En cuanto al material de envasado, el mercado de leche vegetal en Asia-Pacífico se segmenta en vidrio, plástico y metal. En 2025, se prevé que el segmento de vidrio domine el mercado con una cuota de mercado del 51,45 %, gracias a su atractivo premium, su imagen ecológica y la fuerte asociación entre los consumidores con la pureza y la calidad.

Se espera que el segmento de vidrio crezca con una tasa de crecimiento anual compuesta (TCAC) del 12,6 % durante el período de pronóstico de 2025 a 2032, ya que el vidrio suele ser la opción preferida en mercados nicho y urbanos, donde los consumidores preocupados por la salud y el medio ambiente están dispuestos a pagar un precio más alto por envases sostenibles y reutilizables. Su capacidad para preservar el sabor natural y la integridad nutricional de las leches vegetales, como las de soja, avena y almendras, aumenta aún más su atractivo en el segmento de productos premium.

Por cantidad de embalaje

Según la cantidad de envases, el mercado de leche vegetal de Asia-Pacífico se segmenta en 1000 ml, 250 ml, 500 ml, 110 ml, más de 1000 ml y menos de 100 ml. En 2025, se espera que el segmento de 1000 ml domine el mercado con una cuota de mercado del 53,55 %, gracias al mayor consumo doméstico, la rentabilidad por litro, la preferencia por envases familiares y la creciente disponibilidad en tiendas minoristas para el consumo diario.

Se espera que el segmento de 1000 ML crezca con una CAGR máxima de 12,7 % en el período de pronóstico de 2025 a 2032 debido a los crecientes estilos de vida urbanos, el aumento de los ingresos de la clase media y la preferencia del consumidor por los envases a granel y sostenibles que impulsan aún más la demanda, lo que convierte a 1000 ML en la opción más conveniente y económica para los hogares.

Por precio

En cuanto al precio, el mercado de leches vegetales en Asia-Pacífico se segmenta en gran consumo, premium y de lujo. En 2025, se prevé que el segmento gran consumo domine el mercado con una cuota del 53,48% gracias a su asequibilidad, accesibilidad y atractivo para la amplia base de consumidores de la región, sensibles al precio.

Se prevé que el segmento de consumo masivo crezca con una tasa de crecimiento anual compuesta (TCAC) del 12,6 % durante el período de pronóstico de 2025 a 2032, ya que las leches vegetales de consumo masivo, en particular las de soja, arroz y coco, se consumen ampliamente tanto en zonas urbanas como rurales, lo que las convierte en la opción más popular para el consumo diario. Su precio competitivo facilita una mayor adopción entre los hogares de ingresos medios, lo que garantiza que la leche vegetal siga siendo una alternativa atractiva a los lácteos para el consumo habitual.

Por aplicación

Según su aplicación, el mercado de leches vegetales en Asia-Pacífico se segmenta en comercial y doméstico. Se prevé que en 2025, el segmento doméstico domine el mercado con una cuota de mercado del 71,03 %, a medida que las alternativas vegetales se integren cada vez más en la dieta diaria de toda la región. Las familias están adoptando la leche de soja, avena, almendras y coco como sustitutos de los lácteos en usos cotidianos como beber, cocinar, hornear, preparar cereales y batidos.

Se espera que el segmento de hogares crezca con la CAGR más alta del 12,5 % en el período de pronóstico de 2025 a 2032, ya que la versatilidad de la leche de origen vegetal, combinada con la creciente conciencia de la salud, la prevalencia de la intolerancia a la lactosa y el cambio hacia dietas bajas en azúcar y sostenibles, ha posicionado a los hogares como el principal segmento de usuarios finales en Asia-Pacífico.

Por canal de distribución

Según el canal de distribución, el mercado de leches vegetales de Asia-Pacífico se segmenta en tiendas físicas y tiendas físicas. En 2025, se prevé que el segmento físico domine el mercado con una cuota de mercado del 76,72 %, gracias a la rápida expansión de las plataformas de comercio electrónico, las aplicaciones de compra online y los modelos de entrega directa al consumidor (D2C).

Se espera que el segmento sin tiendas físicas crezca con una CAGR máxima del 12,4 % en el período de pronóstico de 2025 a 2032. Debido al ajetreado estilo de vida urbano y a la creciente adopción digital, los consumidores han optado por comprar leche de soja, avena, almendras y coco en línea por la comodidad de la entrega a domicilio, una mayor variedad de productos y atractivos descuentos. Los servicios de suscripción y las opciones de entrega en el mismo día fomentan aún más la fidelidad del cliente, convirtiendo los canales en línea en la opción preferida para el consumo doméstico habitual.

Análisis regional del mercado de leches vegetales en Asia-Pacífico

- El mercado de leches vegetales en Asia-Pacífico se está expandiendo rápidamente, impulsado por la creciente concienciación sobre la salud, la creciente prevalencia de la intolerancia a la lactosa y la sólida aceptación cultural de las alternativas lácteas a base de soja y otras alternativas. Países como China, India, Japón y Australia están experimentando un aumento de la demanda, impulsado por la urbanización, la disponibilidad de productos premium y la penetración del comercio electrónico. La innovación en sabores, la fortificación con vitaminas y minerales, y la oferta local de productos son factores clave de crecimiento. Además, la leche vegetal es cada vez más adoptada por los consumidores más jóvenes y los grupos demográficos preocupados por el bienestar físico que buscan opciones sostenibles y libres de crueldad animal.

Información sobre la leche vegetal de China

En 2025, se espera que China domine con una participación de mercado del 31,22% debido a su larga aceptación de la leche de soya y una creciente preferencia por alternativas lácteas modernas. La rápida urbanización, el aumento de la población de clase media y la creciente demanda de bebidas saludables y funcionales impulsan el crecimiento del mercado. La innovación en sabores, empaques y productos lácteos vegetales fortificados está expandiendo la adopción por parte de los consumidores más allá de la soya tradicional. Grandes empresas nacionales como Vitasoy y Yili, junto con marcas internacionales, compiten por captar la lealtad del consumidor. El enfoque del gobierno en la sostenibilidad y la seguridad alimentaria se alinea con el crecimiento de las opciones vegetales, especialmente a medida que los consumidores se vuelven más conscientes del medio ambiente. Con su sólida base cultural para las bebidas no lácteas y la creciente demanda moderna, China se posiciona como el mercado más grande e influyente para la leche vegetal en la región.

Cuota de mercado de leche vegetal en Asia-Pacífico

La leche de origen vegetal está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Otsuka Foods Co., Ltd. (Japón)

- Corporación Kikkoman (Japón)

- Mondelēz International (EE. UU.)

- Danone (Francia)

- General Mills Inc. (EE. UU.)

- Blue Diamond Growers (EE. UU.)

- Compañía de Salud y Bienestar Sanitarium (Australia)

- Marusan-Ai Co., Ltd. (Japón)

- Vitasoy International Holdings (Hong Kong)

- Yeo Hiap Seng Ltd. (Singapur)

- Hershey's (EE. UU.)

- Oatly (Suecia)

- PureHarvest (Australia)

- Granjas Califia (EE. UU.)

- De adentro hacia afuera (Australia)

- Productos nutritivos (Australia)

- Milklab (Australia)

- Prensa Raw (India)

- Tan bueno (Australia)

- Australia's Own (Australia)

- Arla Foods amba (Dinamarca)

- Ulu Hye (Australia)

- Epigamia (India)

- Bebidas Sunsip (India)

- Añadir Joi (EE. UU.)

- WhatIf F&I Pte Ltd (Singapur)

- Sólo la Tierra (India)

Últimos avances en el mercado de leches vegetales en Asia-Pacífico

- En enero de 2023, Califia Farms amplió su galardonada gama de productos sin lácteos con la introducción de avena y leche de almendras orgánicas con certificación del USDA. Los nuevos productos de la compañía se crearon para satisfacer la demanda de los clientes que buscan productos con menos ingredientes y están disponibles en Kroger Co., Whole Foods Market, Sprouts Farmers Market y otras tiendas de todo el país.

- En septiembre de 2021, Sanitarium y Life Education anunciaron una nueva colaboración. Esta colaboración creó e implementó un nuevo módulo de nutrición para estudiantes de primaria, que también incluirá herramientas para que profesores y padres enseñen a los jóvenes a elegir alimentos más saludables. Gracias a esta colaboración, la empresa logró atraer a una nueva base de consumidores.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC PLANT-BASED MILK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE

4.1.5 INDUSTRY RIVALRY

4.2 PRICING ANALYSIS

4.3 COST ANALYSIS BREAKDOWN

4.3.1 RAW MATERIAL COSTS

4.3.2 PROCESSING & MANUFACTURING

4.3.3 PACKAGING COSTS

4.3.4 DISTRIBUTION & LOGISTICS COSTS

4.3.5 MARKETING & BRANDING COSTS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 CONSUMPTION ANALYSIS

4.6 ASIA-PACIFIC PLANT-BASED MILK MARKET

4.6.1 RAW MATERIAL IMPACT ON MARGINS

4.6.2 MANUFACTURING & PROCESSING MARGINS

4.6.3 DISTRIBUTION & RETAIL MARGINS

4.6.4 PREMIUMIZATION & VALUE-ADDED MARGINS

4.7 IMPORT-EXPORT ANALYSIS

4.7.1 IMPORT ANALYSIS

4.8 EXPORT ANALYSIS

4.9 IMPORT EXPORT SCENARIO

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 PATENT FAMILIES

4.10.3 LICENSING AND COLLABORATIONS

4.10.4 REGION PATENT LANDSCAPE

4.10.5 IP STRATEGY AND MANAGEMENT

4.11 VALUE CHAIN ANALYSIS

4.11.1 RAW MATERIAL PROCUREMENT

4.11.2 MANUFACTURING & PROCESSING

4.11.3 PACKAGING & STORAGE

4.11.4 DISTRIBUTION & LOGISTICS

4.11.5 END-USE INDUSTRIES

4.12 VENDOR SELECTION CRITERIA

4.12.1 QUALITY AND CONSISTENCY

4.12.2 TECHNICAL EXPERTISE

4.12.3 SUPPLY CHAIN RELIABILITY

4.12.4 COMPLIANCE AND SUSTAINABILITY

4.12.5 COST AND PRICING STRUCTURE

4.12.6 FINANCIAL STABILITY

4.12.7 FLEXIBILITY AND CUSTOMIZATION

4.12.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.13 BRAND OUTLOOK

4.13.1 BRAND COMPARATIVE ANALYSIS OF ASIA-PACIFIC PLANT-BASED MILK MARKET

4.13.2 PRODUCT VS BRAND OVERVIEW

4.13.3 PRODUCT OVERVIEW

4.13.4 BRAND OVERVIEW

4.14 CLIMATE CHANGE SCENARIO

4.14.1 ENVIRONMENTAL CONCERNS

4.14.2 INDUSTRY RESPONSE

4.14.3 GOVERNMENT’S ROLE

4.14.4 ANALYST RECOMMENDATIONS

4.15 CONSUMERS BUYING BEHAVIOUR

4.15.1 HEALTH & WELLNESS ORIENTATION

4.15.2 PRICE SENSITIVITY & AFFORDABILITY

4.15.3 CULTURAL & TASTE PREFERENCES

4.15.4 CONVENIENCE & CHANNEL PREFERENCE

4.16 INDUSTRY ECO-SYSTEM ANALYSIS

4.16.1 PROMINENT COMPANIES

4.16.2 SMALL & MEDIUM-SIZED COMPANIES

4.16.3 END USERS

4.17 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.17.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.17.1.1 JOINT VENTURES

4.17.1.2 MERGERS AND ACQUISITIONS

4.17.1.3 LICENSING AND PARTNERSHIP

4.17.1.4 TECHNOLOGY COLLABORATIONS

4.17.1.5 STRATEGIC DIVESTMENTS

4.17.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.17.3 STAGE OF DEVELOPMENT

4.17.4 TIMELINES AND MILESTONES

4.17.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.17.6 RISK ASSESSMENT AND MITIGATION

4.17.7 FUTURE OUTLOOK

4.18 MARKET ENTRY STRATEGIES

4.18.1 STRATEGIC PARTNERSHIPS & ALLIANCES

4.18.2 JOINT VENTURES

4.18.3 ACQUISITION OF LOCAL PLAYERS

4.18.4 CONTRACT MANUFACTURING

4.18.5 PARTICIPATION IN EUROPEAN TRADE FAIRS

4.18.6 DIGITAL & E-COMMERCE SALES CHANNELS

4.18.7 COMPLIANCE WITH EU STANDARDS

4.18.8 CUSTOMIZATION FOR LOCAL PREFERENCES

4.18.9 PRICING STRATEGY ADAPTATION

4.19 RAW MATERIAL COVERAGE

4.19.1 PRIMARY FEEDSTOCKS

4.19.1.1 SOY

4.19.1.2 ALMOND

4.19.1.3 OAT

4.19.1.4 RICE

4.19.1.5 COCONUT

4.19.1.6 PEA / FABA / OTHER LEGUMES

4.19.1.7 NUTS & SEEDS (CASHEW, HEMP, SESAME)

4.19.2 SECONDARY INGREDIENTS

4.19.2.1 EMULSIFIERS

4.19.2.2 STABILIZERS / THICKENERS

4.19.2.3 FORTIFICATION AGENTS

4.19.2.4 SWEETENERS & FLAVORS

4.19.2.5 OILS & MOUTHFEEL AGENTS

4.19.2.6 PRESERVATIVES / ACIDITY REGULATORS

4.2 SUPPLY CHAIN ANALYSIS

4.20.1 OVERVIEW

4.20.2 LOGISTICS COST SCENARIO

4.20.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21 TECHNOLOGICAL ADVANCEMENTS

4.21.1 PRODUCT INNOVATION AND SENSORY ENHANCEMENT

4.21.2 PROCESSING AND FORTIFICATION TECHNOLOGIES

4.21.3 SUSTAINABLE AND EFFICIENT PRODUCTION METHODS

4.21.4 RESEARCH AND DEVELOPMENT INITIATIVES

4.21.5 CONSUMER-CENTRIC PRODUCT FORMATS

5 ASIA-PACIFIC PLANT-BASED MILK MARKET — TARIFFS & MARKET IMPACT

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.8 GEOPOLITICAL SITUATION

5.9 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.1 ALLIANCES ESTABLISHMENTS STATUS

5.11 ACCREDITATION (INCLUDING MFTN)

5.12 DOMESTIC COURSE OF CORRECTION

5.13 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.14 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN VEGAN CULTURE AROUND THE GLOBE

7.1.2 INCREASE IN LACTOSE INTOLERANT POPULATION

7.1.3 RISE IN PROMOTIONAL ACTIVITIES AND SOCIAL MEDIA MARKETING

7.2 RESTRAINTS

7.2.1 HIGH PRICE OF PLANT-BASED MILK IN COMPARISON TO DAIRY-BASED MILK

7.2.2 TASTE AND TEXTURE ISSUES ASSOCIATED WITH PLANT-BASED MILK

7.3 OPPORTUNITIES

7.3.1 GROWING NEW PRODUCT LAUNCHES AND NEW PARTNERSHIPS / ACQUISITIONS

7.3.2 RAPID GROWTH OF OAT & PREMIUM VARIANTS

7.3.3 E-COMMERCE & RETAIL EXPANSION

7.4 CHALLENGES

7.4.1 RISE IN NUT ALLERGIES AMONG CONSUMERS

7.4.2 REGULATORY & LABELLING RESTRICTIONS

8 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SOY MILK

8.3 ALMOND MILK

8.4 COCONUT MILK

8.5 OAT MILK

8.6 RICE MILK

8.7 CASHEW MILK

8.8 WALNUT MILK

8.9 HAZELNUT MILK

8.1 FLAX MILK

8.11 PEA MILK

8.12 MACADAMIA MILK

8.13 HEMP MILK

8.14 PUMPKIN MILK

8.15 OTHERS

9 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY TYPE

9.1 OVERVIEW

9.2 REFRIGERATED MILK

9.3 SHELF STABLE MILK

10 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FORM

11.1 OVERVIEW

11.2 LIQUID

11.3 POWDER

12 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SWEETNESS

12.1 OVERVIEW

12.2 UNSWEETENED

12.3 SWEETENED

13 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 ORIGINAL/UNFLAVOURED

13.3 FLAVOURED

14 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY CLAIMS

14.1 OVERVIEW

14.2 WITH CLAIMS

14.3 WITHOUT CLAIMS

15 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SHELF LIFE

15.1 OVERVIEW

15.2 1-6 MONTHS

15.3 2-4 WEEKS

15.4 ABOVE 6 MONTHS

15.5 1-2 WEEKS

16 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING TYPE

16.1 OVERVIEW

16.2 TETRA PACKS

16.3 BOTTLES

16.4 POUCHES

16.5 CANS

16.6 JARS

16.7 SACHETS

16.8 OTHERS

17 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL

17.1 OVERVIEW

17.2 GLASS

17.3 PLASTIC

17.4 METALS

18 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY

18.1 OVERVIEW

18.2 1000 ML

18.3 250 ML

18.4 500 ML

18.5 110 ML

18.6 MORE THAN 1000 ML

18.7 LESS THAN 100 ML

19 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRICE

19.1 OVERVIEW

19.2 MASS

19.3 PREMIUM

19.4 LUXURY

20 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 HOUSEHOLD

20.3 COMMERCIAL

21 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 NON-STORE BASED

21.3 STORE BASED

22 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY

22.1 ASIA-PACIFIC

22.1.1 CHINA

22.1.2 JAPAN

22.1.3 SOUTH KOREA

22.1.4 INDIA

22.1.5 AUSTRALIA

22.1.6 THAILAND

22.1.7 INDONESIA

22.1.8 MALAYSIA

22.1.9 PHILIPPINES

22.1.10 TAIWAN

22.1.11 SINGAPORE

22.1.12 NEW ZEALAND

22.1.13 HONG KONG

22.1.14 REST OF ASIA-PACIFIC

23 ASIA-PACIFIC PLANT-BASED MILK MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC DISTRIBUTORS

23.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC MANUFACTURER

24 SWOT ANALYSIS

25 COMPANY PROFILES

25.1 OTSUKA FOODS CO. LTD.

25.1.1 COMPANY SNAPSHOT

25.1.2 PRODUCT PORTFOLIO

25.1.3 RECENT DEVELOPMENT

25.2 KIKKOMAN CORPORATION

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENT

25.3 MONDELĒZ INTERNATIONAL

25.3.1 COMPANY SNAPSHOT

25.3.2 REVENUE ANALYSIS

25.3.3 PRODUCT PORTFOLIO

25.3.4 RECENT DEVELOPMENT

25.4 DANONE

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENT

25.5 GENERAL MILLS INC.

25.5.1 COMPANY SNAPSHOT

25.5.2 REVENUE ANALYSIS

25.5.3 PRODUCT PORTFOLIO

25.5.4 RECENT DEVELOPMENT

25.6 ARLA FOODS AMBA

25.6.1 COMPANY SNAPSHOT

25.6.2 REVENUE ANALYSIS

25.6.3 PRODUCT PORTFOLIO

25.6.4 RECENT DEVELOPMENT

25.7 AUSTRALIA'S OWN

25.7.1 COMPANY SNAPSHOT

25.7.2 PRODUCT PORTFOLIO

25.7.3 RECENT DEVELOPMENTS

25.8 BLUE DIAMOND GROWERS

25.8.1 COMPANY SNAPSHOT

25.8.2 PRODUCT PORTFOLIO

25.8.3 RECENT DEVELOPMENT

25.9 CALIFIA FARMS, LLC.

25.9.1 COMPANY SNAPSHOT

25.9.2 PRODUCT PORTFOLIO

25.9.3 RECENT DEVELOPMENT

25.1 EPIGAMIA

25.10.1 COMPANY SNAPSHOT

25.10.2 PRODUCT PORTFOLIO

25.10.3 RECENT DEVELOPMENT

25.11 HERSHEY INDIA PRIVATE LIMITED

25.11.1 COMPANY SNAPSHOT

25.11.2 PRODUCT PORTFOLIO

25.11.3 RECENT DEVELOPMENT

25.12 INSIDE OUT NUTRITIOUS GOODS

25.12.1 COMPANY SNAPSHOT

25.12.2 PRODUCT PORTFOLIO

25.12.3 RECENT DEVELOPMENT

25.13 JOI

25.13.1 COMPANY SNAPSHOT

25.13.2 PRODUCT PORTFOLIO

25.13.3 RECENT DEVELOPMENT

25.14 MARUSAN-AI CO., LTD.

25.14.1 COMPANY SNAPSHOT

25.14.2 REVENUE ANALYSIS

25.14.3 PRODUCT PORTFOLIO

25.14.4 RECENT DEVELOPMENT

25.15 MILKLAB

25.15.1 COMPANY SNAPSHOT

25.15.2 PRODUCT PORTFOLIO

25.15.3 RECENT DEVELOPMENT

25.16 OATLY GROUP AB

25.16.1 COMPANY SNAPSHOT

25.16.2 REVENUE ANALYSIS

25.16.3 PRODUCT PORTFOLIO

25.16.4 RECENT DEVELOPMENT

25.17 ONLY EARTH

25.17.1 COMPANY SNAPSHOT

25.17.2 PRODUCT PORTFOLIO

25.17.3 RECENT DEVELOPMENT

25.18 PUREHARVEST

25.18.1 COMPANY SNAPSHOT

25.18.2 PRODUCT PORTFOLIO

25.18.3 RECENT DEVELOPMENT

25.19 RAWPRESSERY

25.19.1 COMPANY SNAPSHOT

25.19.2 PRODUCT PORTFOLIO

25.19.3 RECENT DEVELOPMENT

25.2 SANITARIUM

25.20.1 COMPANY SNAPSHOT

25.20.2 PRODUCT PORTFOLIO

25.20.3 RECENT DEVELOPMENT

25.21 SO GOOD (LIFE HEALTH FOODS)

25.21.1 COMPANY SNAPSHOT

25.21.2 PRODUCT PORTFOLIO

25.21.3 RECENT DEVELOPMENT

25.22 SUNSIP BEVERAGES VIETNAM

25.22.1 COMPANY SNAPSHOT

25.22.2 PRODUCT PORTFOLIO

25.22.3 RECENT DEVELOPMENTS

25.23 ULU HYE

25.23.1 COMPANY SNAPSHOT

25.23.2 PRODUCT PORTFOLIO

25.23.3 RECENT DEVELOPMENT

25.24 VINASOY CORP.

25.24.1 COMPANY SNAPSHOT

25.24.2 PRODUCT PORTFOLIO

25.24.3 RECENT DEVELOPMENT

25.25 VITASOY INTERNATIONAL HOLDINGS LTD.

25.25.1 COMPANY SNAPSHOT

25.25.2 REVENUE ANALYSIS

25.25.3 PRODUCT PORTFOLIO

25.25.4 RECENT DEVELOPMENT

25.26 WHAT IF F&I PTE LTD

25.26.1 COMPANY SNAPSHOT

25.26.2 PRODUCT PORTFOLIO

25.26.3 RECENT DEVELOPMENT

25.27 YEO HIAP SENG LTD. ALL

25.27.1 COMPANY SNAPSHOT

25.27.2 REVENUE ANALYSIS

25.27.3 PRODUCT PORTFOLIO

25.27.4 RECENT DEVELOPMENT

25.28 FRESHDI GLOBAL INC

25.28.1 COMPANY SNAPSHOT

25.28.2 PRODUCT PORTFOLIO

25.28.3 RECENT DEVELOPMENT

25.29 KAISER FOODS

25.29.1 COMPANY SNAPSHOT

25.29.2 PRODUCT PORTFOLIO

25.29.3 RECENT DEVELOPMENT

26 QUESTIONNAIRE

27 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 3 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITRES)

TABLE 4 ASIA-PACIFIC SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 5 ASIA-PACIFIC ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 6 ASIA-PACIFIC COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 7 ASIA-PACIFIC OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 8 ASIA-PACIFIC RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 9 ASIA-PACIFIC CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 10 ASIA-PACIFIC WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 11 ASIA-PACIFIC HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 12 ASIA-PACIFIC FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 13 ASIA-PACIFIC PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 14 ASIA-PACIFIC MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 15 ASIA-PACIFIC HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 16 ASIA-PACIFIC PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 17 ASIA-PACIFIC OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 18 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 19 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 20 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 21 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 22 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 23 ASIA-PACIFIC FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 25 ASIA-PACIFIC WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 27 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 28 ASIA-PACIFIC TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 ASIA-PACIFIC SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 31 ASIA-PACIFIC PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 ASIA-PACIFIC METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 34 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 35 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 36 ASIA-PACIFIC COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 ASIA-PACIFIC RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 ASIA-PACIFIC INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 40 ASIA-PACIFIC NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 ASIA-PACIFIC STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 43 ASIA-PACIFIC PLANT-BASED MILK MARKET, BY COUNTRY, 2018-2032 (MILLION LITERS)

TABLE 44 CHINA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 45 CHINA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 46 CHINA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 47 CHINA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 48 CHINA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 49 CHINA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 50 CHINA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 51 CHINA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 52 CHINA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 53 CHINA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 54 CHINA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 55 CHINA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 56 CHINA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 57 CHINA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 58 CHINA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 59 CHINA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 60 CHINA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 CHINA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 62 CHINA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 63 CHINA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 64 CHINA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 65 CHINA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 66 CHINA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 67 CHINA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 CHINA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 69 CHINA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 70 CHINA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 CHINA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 CHINA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 73 CHINA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 CHINA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 CHINA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 76 CHINA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 77 CHINA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 78 CHINA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 CHINA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 CHINA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 81 CHINA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 82 CHINA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 CHINA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 JAPAN PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 85 JAPAN PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 86 JAPAN SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 87 JAPAN ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 88 JAPAN COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 89 JAPAN OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 90 JAPAN RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 91 JAPAN CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 92 JAPAN WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 93 JAPAN HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 94 JAPAN FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 95 JAPAN PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 96 JAPAN MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 97 JAPAN HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 98 JAPAN PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 99 JAPAN OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 100 JAPAN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 101 JAPAN PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 102 JAPAN PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 103 JAPAN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 104 JAPAN PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 105 JAPAN FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 JAPAN PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 107 JAPAN WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 JAPAN PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 109 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 110 JAPAN TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 JAPAN SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 113 JAPAN PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 JAPAN METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 JAPAN PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 116 JAPAN PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 117 JAPAN PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 118 JAPAN COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 119 JAPAN RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 JAPAN INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 JAPAN PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 122 JAPAN NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 JAPAN STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 125 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 126 SOUTH KOREA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 127 SOUTH KOREA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 128 SOUTH KOREA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 129 SOUTH KOREA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 130 SOUTH KOREA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 131 SOUTH KOREA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 132 SOUTH KOREA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 133 SOUTH KOREA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 134 SOUTH KOREA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 135 SOUTH KOREA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 136 SOUTH KOREA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 137 SOUTH KOREA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 138 SOUTH KOREA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 139 SOUTH KOREA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 140 SOUTH KOREA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 SOUTH KOREA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 142 SOUTH KOREA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 143 SOUTH KOREA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 144 SOUTH KOREA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 145 SOUTH KOREA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 SOUTH KOREA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 147 SOUTH KOREA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 148 SOUTH KOREA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 149 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 150 SOUTH KOREA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 SOUTH KOREA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 153 SOUTH KOREA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 SOUTH KOREA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 SOUTH KOREA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 156 SOUTH KOREA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 157 SOUTH KOREA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 158 SOUTH KOREA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 159 SOUTH KOREA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 160 SOUTH KOREA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 SOUTH KOREA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 162 SOUTH KOREA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 SOUTH KOREA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 INDIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 165 INDIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 166 INDIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 167 INDIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 168 INDIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 169 INDIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 170 INDIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 171 INDIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 172 INDIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 173 INDIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 174 INDIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 175 INDIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 176 INDIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 177 INDIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 178 INDIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 179 INDIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 180 INDIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 INDIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 182 INDIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 183 INDIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 184 INDIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 185 INDIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 INDIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 187 INDIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 INDIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 189 INDIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 190 INDIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 INDIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 INDIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 193 INDIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 INDIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 INDIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 196 INDIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 197 INDIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 INDIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 INDIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 INDIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 INDIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 202 INDIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 INDIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 204 AUSTRALIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 205 AUSTRALIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 206 AUSTRALIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 207 AUSTRALIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 208 AUSTRALIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 209 AUSTRALIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 210 AUSTRALIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 211 AUSTRALIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 212 AUSTRALIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 213 AUSTRALIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 214 AUSTRALIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 215 AUSTRALIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 216 AUSTRALIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 217 AUSTRALIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 218 AUSTRALIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 219 AUSTRALIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 220 AUSTRALIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 AUSTRALIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 222 AUSTRALIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 223 AUSTRALIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 224 AUSTRALIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 225 AUSTRALIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 AUSTRALIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 227 AUSTRALIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 AUSTRALIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 229 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 230 AUSTRALIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 231 AUSTRALIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 233 AUSTRALIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 AUSTRALIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 AUSTRALIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 236 AUSTRALIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 237 AUSTRALIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 AUSTRALIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 AUSTRALIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 240 AUSTRALIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 AUSTRALIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 242 AUSTRALIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 AUSTRALIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 THAILAND PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 245 THAILAND PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 246 THAILAND SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 247 THAILAND ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 248 THAILAND COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 249 THAILAND OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 250 THAILAND RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 251 THAILAND CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 252 THAILAND WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 253 THAILAND HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 254 THAILAND FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 255 THAILAND PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 256 THAILAND MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 257 THAILAND HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 258 THAILAND PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 259 THAILAND OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 260 THAILAND PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 THAILAND PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 262 THAILAND PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 263 THAILAND PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 264 THAILAND PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 265 THAILAND FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 THAILAND PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 267 THAILAND WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 THAILAND PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 269 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 270 THAILAND TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 THAILAND SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 273 THAILAND PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 THAILAND METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 THAILAND PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 276 THAILAND PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 277 THAILAND PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 278 THAILAND COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 THAILAND RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 THAILAND INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 THAILAND PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 282 THAILAND NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 THAILAND STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 284 INDONESIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 285 INDONESIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 286 INDONESIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 287 INDONESIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 288 INDONESIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 289 INDONESIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 290 INDONESIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 291 INDONESIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 292 INDONESIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 293 INDONESIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 294 INDONESIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 295 INDONESIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 296 INDONESIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 297 INDONESIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 298 INDONESIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 299 INDONESIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 300 INDONESIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 INDONESIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 302 INDONESIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 303 INDONESIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 304 INDONESIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 305 INDONESIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 INDONESIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 307 INDONESIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 308 INDONESIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 309 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 310 INDONESIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 INDONESIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 313 INDONESIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 314 INDONESIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 INDONESIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 316 INDONESIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 317 INDONESIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 318 INDONESIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 INDONESIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 320 INDONESIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 321 INDONESIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 322 INDONESIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 INDONESIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 MALAYSIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 325 MALAYSIA PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 326 MALAYSIA SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 327 MALAYSIA ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 328 MALAYSIA COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 329 MALAYSIA OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 330 MALAYSIA RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 331 MALAYSIA CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 332 MALAYSIA WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 333 MALAYSIA HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 334 MALAYSIA FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 335 MALAYSIA PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 336 MALAYSIA MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 337 MALAYSIA HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 338 MALAYSIA PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 339 MALAYSIA OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 340 MALAYSIA PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 341 MALAYSIA PLANT-BASED MILK MARKET, BY NATURE, 2018-2032 (USD MILLION)

TABLE 342 MALAYSIA PLANT-BASED MILK MARKET, BY FORM, 2018-2032 (USD MILLION)

TABLE 343 MALAYSIA PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 344 MALAYSIA PLANT-BASED MILK MARKET, BY FLAVOR, 2018-2032 (USD MILLION)

TABLE 345 MALAYSIA FLAVORED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 MALAYSIA PLANT-BASED MILK MARKET, BY CLAIMS, 2018-2032 (USD MILLION)

TABLE 347 MALAYSIA WITH CLAIM IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 MALAYSIA PLANT-BASED MILK MARKET, BY SHELF LIFE, 2018-2032 (USD MILLION)

TABLE 349 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION)

TABLE 350 MALAYSIA TETRA PACKS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 MALAYSIA SACHETS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING MATERIAL, 2018-2032 (USD MILLION)

TABLE 353 MALAYSIA PLASTIC IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 MALAYSIA METAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 MALAYSIA PLANT-BASED MILK MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD MILLION)

TABLE 356 MALAYSIA PLANT-BASED MILK MARKET, BY PRICE, 2018-2032 (USD MILLION)

TABLE 357 MALAYSIA PLANT-BASED MILK MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 358 MALAYSIA COMMERCIAL IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 MALAYSIA RESTAURANTS IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 MALAYSIA INSTITUTIONAL FOOD SERVICES IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 MALAYSIA PLANT-BASED MILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 362 MALAYSIA NON-STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 MALAYSIA STORE BASED IN PLANT-BASED MILK MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 PHILIPPINES PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 365 PHILIPPINES PLANT-BASED MILK MARKET, BY PRODUCT TYPE, 2018-2032 (MILLION LITERS)

TABLE 366 PHILIPPINES SOY MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 367 PHILIPPINES ALMOND MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 368 PHILIPPINES COCONUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 369 PHILIPPINES OAT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 370 PHILIPPINES RICE MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 371 PHILIPPINES CASHEW MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 372 PHILIPPINES WALNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 373 PHILIPPINES HAZELNUT MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 374 PHILIPPINES FLAX MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 375 PHILIPPINES PEA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 376 PHILIPPINES MACADAMIA MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 377 PHILIPPINES HEMP MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 378 PHILIPPINES PUMPKIN SEED MILK IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)

TABLE 379 PHILIPPINES OTHERS IN PLANT-BASED MILK MARKET, BY SWEETNESS, 2018-2032 (USD MILLION)