Mercado de unidades de refrigeración para camiones de Asia y el Pacífico, por tipo (sistema dividido y sistema de montaje en techo), longitud (12 metros), aplicación (refrigerado y congelado), fuente de energía (con motor e independiente), capacidad de energía (menos de 5 kW, 5 kW - 19 kW y más de 19 kW), tipo de vehículo (vehículos comerciales ligeros (LCV), vehículos comerciales medianos y pesados, remolque (contenedor), autobús y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de unidades de refrigeración para camiones en Asia y el Pacífico

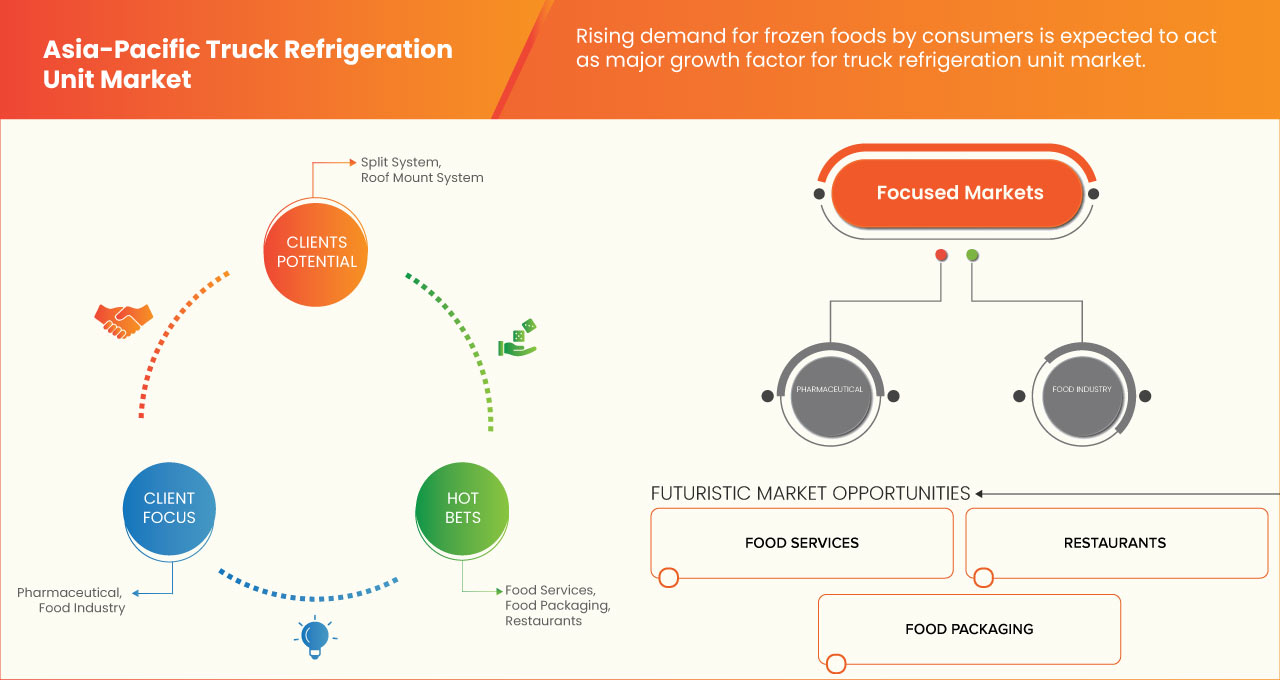

Un cambio en la preferencia de los consumidores por los productos alimenticios congelados ha dado lugar a una creciente demanda de unidades de refrigeración para camiones por parte de muchas industrias. Además, ha aumentado la adopción de frutas y verduras refrigeradas por parte de los consumidores y el transporte de medicamentos, vacunas , medicamentos generales y suplementos en todo el mundo.

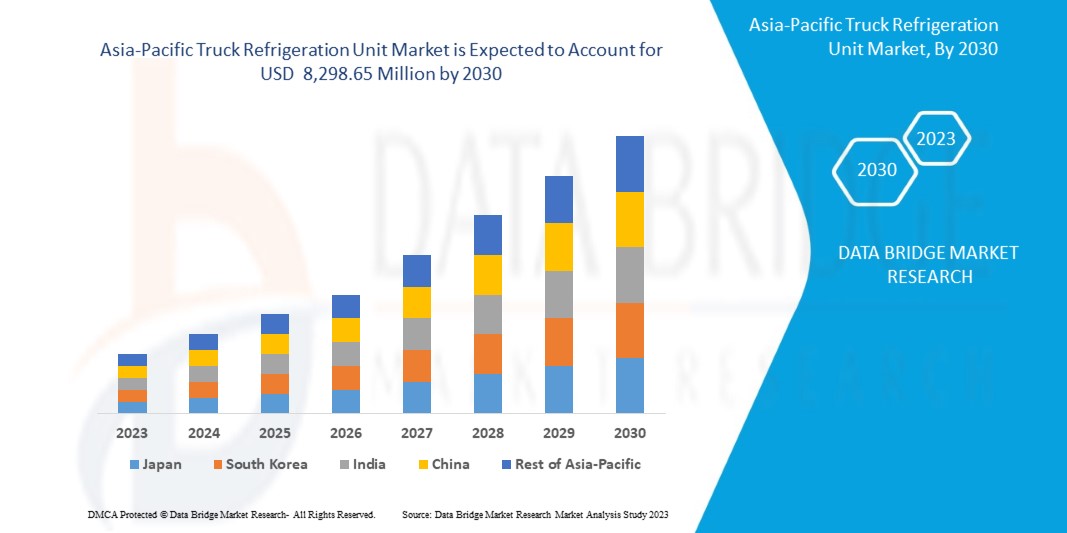

Data Bridge Market Research analiza que se espera que el mercado de unidades de refrigeración para camiones de Asia-Pacífico alcance un valor de USD 8.298,65 millones para 2030, a una CAGR del 6,4%, durante el período de pronóstico de 2023 a 2030. El mercado de unidades de refrigeración para camiones también cubre análisis de precios, análisis de patentes y avances tecnológicos en profundidad.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones, volúmenes en miles de unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo (sistema dividido y sistema de montaje en techo), longitud (<8 metros, 8-12 metros y >12 metros), aplicación (refrigerado y congelado), fuente de energía (motorizado e independiente), capacidad de energía (menos de 5 Kw, 5 Kw - 19 Kw y más de 19 Kw), tipo de vehículo (vehículos comerciales ligeros (LCV), vehículos comerciales medianos y pesados, remolque (contenedor), autobús y otros) |

|

Países cubiertos |

China, India, Japón, Corea del Sur, Australia, Singapur, Taiwán, Nueva Zelanda, Tailandia, Malasia, Vietnam, Filipinas y resto de Asia-Pacífico |

|

Actores del mercado cubiertos |

MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, DENSO CORPORATION, Grayson, SANDEN CORPORATION, Control de climatización móvil, ZHENGZHOU GUCHEN INDUSTRY CO., LTD., TRANE TECHNOLOGIES PLC, Subros Limited, Klinge Corporation, Webasto SE, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD y Schmitz Cargobull, entre otros. |

Definición de mercado

Los sistemas de refrigeración para camiones se utilizan como camiones refrigerados con sistemas de refrigeración mecánicos para transportar productos perecederos (como alimentos congelados, verduras, frutas, helados y vino) con el fin de mantener los productos refrigerados o congelados a temperaturas adecuadas hasta el punto de venta. Un refrigerador es un camión, remolque o contenedor de carga que tiene una unidad de refrigeración para transportar productos sensibles a la temperatura. Existen alternativas generales para soportar la carga en un rango de temperatura "fría" o "fresca" o en un rango de temperatura congelada para el envío LTL (carga parcial). Para cargas como alimentos frescos u otros productos perecederos, normalmente se utiliza un rango "frío". Los refrigeradores ocasionalmente mueven sus remolques con carga seca que no requiere refrigeración. Es fundamental tener en cuenta algunos detalles durante el transporte de mercancías. El transporte a larga distancia de productos perecederos y sensibles a la temperatura requiere el uso de camiones refrigerados. Los ejemplos más comunes son las carnes congeladas y los productos frescos.

Dinámica del mercado de unidades de refrigeración para camiones en Asia y el Pacífico

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

-

Aumento del transporte de productos perecederos, como alimentos y productos farmacéuticos.

Los productos alimenticios congelados requieren medios de transporte refrigerados para mantener la calidad de los productos a lo largo de distancias más largas. Los productos alimenticios que se transportan deben refrigerarse para que no se deterioren ni pierdan su valor original. Desde la granja hasta la fábrica y el tenedor, los productos alimenticios pueden encontrarse con numerosos peligros para la salud durante su recorrido por la cadena de suministro. Por ello, se aplican prácticas y procedimientos seguros de manipulación de alimentos en cada etapa del ciclo de vida de la producción de alimentos para reducir estos riesgos y evitar daños a los consumidores.

-

Creciente demanda de alimentos congelados por parte de los consumidores

Las características de conveniencia son el foco de los paquetes que mejoran la facilidad de uso, tanto en casa como en los viajes. Las características de conveniencia, como la apertura fácil, la portabilidad y el uso con una sola mano, siguen impulsando la innovación en el envasado de alimentos congelados para una amplia gama de alimentos procesados, incluidos platos principales, aperitivos e incluso productos de servicio de comidas. Como los alimentos procesados requieren un material de envasado fácil y flexible, los hace convenientes y fáciles de usar. Por lo tanto, se espera que la creciente demanda de alimentos congelados por parte de los consumidores impulse la demanda del mercado.

-

Crecimiento creciente de supermercados y restaurantes como KFC y Subway

El creciente crecimiento de los restaurantes y supermercados está promoviendo en mayor medida los productos alimenticios congelados. Después de la era del COVID, el uso de alimentos congelados ha aumentado enormemente debido al estilo de vida y a la falta de tiempo. Los servicios de entrega de alimentos se volvieron inmensamente importantes, pero trajeron consigo desafíos únicos. La confianza en el proceso de manipulación de alimentos, los métodos de entrega y la demanda de transacciones sin contacto se convirtieron en el centro de atención para quienes utilizan los restaurantes para la entrega a domicilio. Recordar que más de 900.000 personas murieron en los EE. UU. hace que la situación actual sea una consideración a largo plazo para los trabajadores de servicios de alimentos, los trabajadores de campo y otros empleados relacionados con el campo.

Oportunidades

-

Aumento de la inversión en el sector de servicios alimentarios por parte de países como India y China

La importancia del sector agroindustrial para los países en desarrollo se evalúa a la luz de dos tendencias diferentes. En primer lugar, los productos procesados congelados dominan actualmente el comercio de alimentos en Asia y el Pacífico, lo que se aplica tanto a las exportaciones como a las importaciones de los países en desarrollo. En segundo lugar, se ha producido un cambio significativo en la composición de las exportaciones de alimentos de los países en desarrollo, en la que predominan las "exportaciones no tradicionales". Estas exportaciones ofrecen nuevas oportunidades para las estrategias de desarrollo, aunque los países menos adelantados han pasado de ser exportadores netos de alimentos a ser principalmente importadores netos de productos procesados.

-

Gran demanda de productos alimenticios higiénicos y envases alimentarios.

La seguridad alimentaria es de suma importancia para los consumidores y los procesadores de alimentos, ya que ayudan a proteger la salud de los consumidores frente a enfermedades transmitidas por los alimentos e intoxicaciones alimentarias. La producción higiénica de productos alimenticios implica manipular, preparar y almacenar alimentos o bebidas de forma que se minimice el riesgo de que los consumidores enfermen a causa de enfermedades transmitidas por los alimentos. Las directrices de seguridad alimentaria tienen por objeto evitar que los alimentos se contaminen y provoquen intoxicaciones alimentarias.

Restricciones

-

Alto costo asociado con el sistema de aire acondicionado de eficiencia energética

Los costes del sistema de aire acondicionado de los vehículos de transporte de alimentos incluyen tanto el gasto en materias primas como los costes necesarios para transportar los productos terminados. Las empresas manufactureras operan en industrias altamente competitivas. Para competir, estas empresas buscan formas de reducir costes, lo que les permite ofrecer precios más bajos a los clientes. En el proceso de producción, la oferta y la demanda de materias primas juegan un papel muy importante a la hora de determinar el coste de la empresa.

-

Aumenta la preocupación por la salud a raíz del consumo de frutas y verduras congeladas

Los alimentos altamente procesados suelen incluir niveles poco saludables de azúcar, sodio y grasas añadidas. Estos ingredientes mejoran el sabor de los alimentos, pero su consumo excesivo provoca problemas de salud graves, como obesidad, enfermedades cardíacas, hipertensión y diabetes.

Desafíos

- Falta de conciencia sobre los efectos nocivos de los alimentos congelados

La higiene alimentaria es la condición y las medidas necesarias para garantizar la seguridad de los alimentos desde su producción hasta su consumo. La falta de higiene alimentaria puede provocar enfermedades transmitidas por los alimentos e incluso la muerte del consumidor. Cada año, millones de personas en el mundo sufren la transmisión de enfermedades por el consumo de alimentos no higiénicos.

- Falta de infraestructura

Muchos laboratorios de pruebas de seguridad de alimentos congelados carecen de infraestructura. Es muy difícil controlar la presencia de residuos de pesticidas altamente tóxicos, antibióticos o metales pesados y microorganismos peligrosos en las materias primas alimentarias. Durante el procesamiento, la implementación de controles microbiológicos, como en un programa HACCP o GMP, está básicamente fuera de discusión debido a las condiciones de planta e infraestructura inadecuadas, la capacitación del personal, el agua potable, las tecnologías modernas para las operaciones de envasado, el control de calidad y los procedimientos estándar de desinfección. Se espera que esto frene el crecimiento del mercado.

Desarrollo reciente

- En septiembre de 2019, MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD se adjudicó el contrato para suministrar equipos de tracción de alta tecnología para la empresa Construcciones y Auxiliar de Ferrocarriles, SA (CAF). La empresa suministró equipos de tracción para los 88 trenes que utilizan la red ferroviaria holandesa. Esta empresa mejoró el valor de su marca en el mercado y la base de clientes.

Alcance del mercado de unidades de refrigeración para camiones en Asia y el Pacífico

El mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en función del tipo, la longitud, la aplicación, la fuente de energía, la capacidad de energía y el tipo de vehículo. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Sistema dividido

- Sistema de montaje en techo

Según el tipo, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en sistema dividido y sistema de montaje en techo.

Longitud

- < 8 metros

- 8-12 metros

- >12 metros

Sobre la base de la longitud, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en <8 metros, 8-12 metros y >12 metros.

Solicitud

- Enfriado

- Congelado

Sobre la base de la aplicación, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en refrigerados y congelados.

Fuente de poder

- Accionado por motor

- Independiente

Sobre la base de la fuente de energía, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en unidades impulsadas por motor e independientes.

Capacidad de potencia

- Por debajo de 5 Kw

- 5 Kw - 19 Kw

- Más de 19 Kw

Sobre la base de la capacidad de energía, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en menos de 5 kW, 5 kW - 19 kW y más de 19 kW.

Tipo de vehículo

- Vehículos comerciales ligeros (LCV)

- Vehículos comerciales medianos y pesados

- Remolque (Contenedor)

- Autobús

- Otros

Sobre la base de la propiedad, el mercado de unidades de refrigeración para camiones de Asia-Pacífico está segmentado en vehículos comerciales ligeros (LCV), vehículos comerciales medianos y pesados, remolques (contenedores), autobuses y otros.

Análisis y perspectivas regionales del mercado de unidades de refrigeración para camiones en Asia y el Pacífico

Se analiza el mercado de unidades de refrigeración para camiones de Asia-Pacífico y se proporcionan información y tendencias sobre el tamaño del mercado por tipo, longitud, aplicación, fuente de energía, capacidad de energía y tipo de vehículo.

Los países cubiertos en el informe del mercado de unidades de refrigeración para camiones de Asia-Pacífico son China, India, Japón, Corea del Sur, Australia, Singapur, Taiwán, Nueva Zelanda, Tailandia, Malasia, Vietnam, Filipinas y el resto de Asia-Pacífico.

Se espera que India domine el mercado debido al creciente número de empresas de entrega de alimentos en la región.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de Asia-Pacífico y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de unidades de refrigeración para camiones en Asia-Pacífico

El panorama competitivo del mercado de unidades de refrigeración para camiones de Asia-Pacífico proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Asia-Pacífico, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de unidades de refrigeración para camiones de Asia-Pacífico.

Algunos de los principales actores que operan en el mercado de unidades de refrigeración para camiones de Asia-Pacífico son MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, DENSO CORPORATION, Grayson, SANDEN CORPORATION, Mobile Climate Control., ZHENGZHOU GUCHEN INDUSTRY CO., LTD., TRANE TECHNOLOGIES PLC, Subros Limited, Klinge Corporation, Webasto SE, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD y Schmitz Cargobull, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION GRID

2.11 THE MARKET CHALLENGE MATRIX BY TYPE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 NATURAL REFRIGERANTS

4.2.2 ELECTRIC VEHICLES

4.2.3 TRAILER-TOP SOLAR

4.2.4 LIQUID NITROGEN

4.2.5 SMARTER REEFERS

4.2.6 ADVANCED THERMAL MATERIALS

4.3 VALUE CHAIN ANALYSIS

4.4 NUMBER OF UNITS IN THE MARKET

4.5 NUMBER OF UNITS BY TRUCK TYPE

4.6 NUMBER OF UNITS BY PLAYERS

4.7 NUMBER OF UNITS BY REGION

4.8 PRODUCT FLOW FROM UNIT SALE TO USER

4.9 BRAND ANALYSIS

4.1 ECOSYSTEM MARKET MAP

4.11 TOP WINNING STRATEGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TRANSPORTATION OF PERISHABLE GOODS SUCH AS FOOD ITEMS, PHARMACEUTICALS

5.1.2 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS

5.1.3 INCREASING GROWTH OF SUPERMARKETS AND RESTAURANTS SUCH AS KFC, SUBWAY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH ENERGY-EFFICIENT AC SYSTEM

5.2.2 GROWTH IN HEALTH CONCERNS ABOUT THE CONSUMPTION OF FROZEN FRUIT AND VEGETABLES

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN THE FOOD SERVICE SECTORS BY COUNTRIES LIKE INDIA AND CHINA

5.3.2 HUGE DEMAND FOR HYGIENIC FOOD PRODUCTS AND FOOD PACKAGING

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING THE HAZARDOUS EFFECTS OF FROZEN FOOD

5.4.2 LACK OF INFRASTRUCTURE

6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE

6.1 OVERVIEW

6.2 SPLIT SYSTEM

6.3 ROOF MOUNT SYSTEM

7 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH

7.1 OVERVIEW

7.2 < 8-METER

7.3 8-12-METER

7.4 >12-METER

8 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CHILLED

8.3 FROZEN

9 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ENGINE POWERED

9.3 INDEPENDENT

10 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY

10.1 OVERVIEW

10.2 BELOW 5 KW

10.3 5 KW - 19 KW

10.4 ABOVE 19 KW

11 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 LIGHT COMMERCIAL VEHICLES (LCV)

11.2.1 BY TYPE

11.2.1.1 SPLIT SYSTEM

11.2.1.2 ROOF MOUNT SYSTEM

11.3 MEDIUM & HEAVY COMMERCIAL VEHICLES

11.3.1 BY TYPE

11.3.1.1 SPLIT SYSTEM

11.3.1.2 ROOF MOUNT SYSTEM

11.4 TRAILER (CONTAINER)

11.4.1 BY TYPE

11.4.1.1 SPLIT SYSTEM

11.4.1.2 ROOF MOUNT SYSTEM

11.5 BUS

11.5.1 BY TYPE

11.5.1.1 SPLIT SYSTEM

11.5.1.2 ROOF MOUNT SYSTEM

11.6 OTHERS

11.6.1 BY TYPE

11.6.1.1 SPLIT SYSTEM

11.6.1.2 ROOF MOUNT SYSTEM

12 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 SINGAPORE

12.1.7 TAIWAN

12.1.8 NEW ZEALAND

12.1.9 THAILAND

12.1.10 MALAYSIA

12.1.11 VIETNAM

12.1.12 PHILIPPINES

12.1.13 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARRIER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DENSO CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DAIKIN INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SCHMITZ CARGOBULL.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADVANCED TEMPERATURE CONTROL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KRONE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 GRAYSON

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLINGE CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KIDRON

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MOBILE CLIMATE CONTROL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SUBROS LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 TRANE TECHNOLOGIES PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 UTILITY TRAILER MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDEN CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WEBASTO SE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ZHENGZHOU GUCHEN INDUSTRY CO., LTD.,

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NUMBER OF UNITS IN THE MARKET (THOUSAND)

TABLE 2 ACCORDING TO THE MARKET ESTIMATION DONE BY DBMR, THE NUMBER OF UNITS BY TRUCK TYPE ACROSS THE GLOBE ARE AS FOLLOWS

TABLE 3 NUMBER OF UNITS BY THE PLAYER (USD MILLION)

TABLE 4 NUMBER OF UNITS BY REGION (THOUSAND UNITS)

TABLE 5 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 7 ASIA PACIFIC SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 ASIA PACIFIC SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 9 ASIA PACIFIC ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA PACIFIC ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 11 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 12 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 13 ASIA PACIFIC < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA PACIFIC < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 15 ASIA PACIFIC 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA PACIFIC 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 17 ASIA PACIFIC >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA PACIFIC >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 19 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 21 ASIA PACIFIC CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA PACIFIC CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 23 ASIA PACIFIC FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA PACIFIC FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 25 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 26 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 27 ASIA PACIFIC ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA PACIFIC ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 29 ASIA PACIFIC INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA PACIFIC INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 31 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 32 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 33 ASIA PACIFIC BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 ASIA PACIFIC BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 35 ASIA PACIFIC 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 ASIA PACIFIC 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 37 ASIA PACIFIC ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 ASIA PACIFIC ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 39 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 40 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 41 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 43 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 ASIA PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 45 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 47 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 ASIA PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 49 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 51 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 ASIA PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 53 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 55 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 ASIA PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 57 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 59 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 ASIA PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 61 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 63 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 65 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 66 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 67 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 69 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 70 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 71 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 72 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 73 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 74 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 75 ASIA-PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 ASIA-PACIFIC LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 77 ASIA-PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 ASIA-PACIFIC MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 79 ASIA-PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 ASIA-PACIFIC TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 81 ASIA-PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 ASIA-PACIFIC BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 83 ASIA-PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 ASIA-PACIFIC OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 85 CHINA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 CHINA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 87 CHINA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 88 CHINA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 89 CHINA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 CHINA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 91 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 92 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 93 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 94 CHINA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 95 CHINA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 96 CHINA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 97 CHINA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 CHINA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 99 CHINA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 CHINA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 101 CHINA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 CHINA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 103 CHINA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 CHINA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 105 CHINA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 CHINA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 107 INDIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 INDIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 109 INDIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 110 INDIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 111 INDIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 INDIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 113 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 114 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 115 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 116 INDIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 117 INDIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 118 INDIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 119 INDIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 120 INDIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 INDIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 122 INDIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 INDIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 124 INDIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 INDIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 126 INDIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 INDIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 128 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 130 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 131 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 132 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 133 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 134 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 135 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 136 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 137 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 138 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 139 JAPAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 140 JAPAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 JAPAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 142 JAPAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 JAPAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 144 JAPAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 JAPAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 146 JAPAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 JAPAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 148 JAPAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 JAPAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 150 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 152 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 153 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 THOUSAND UNITS)

TABLE 154 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 155 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 156 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 157 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 158 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 159 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 160 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 161 SOUTH KOREA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 162 SOUTH KOREA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 SOUTH KOREA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 164 SOUTH KOREA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 SOUTH KOREA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 166 SOUTH KOREA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 SOUTH KOREA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 168 SOUTH KOREA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 SOUTH KOREA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 170 SOUTH KOREA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 SOUTH KOREA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 172 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 174 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 175 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 176 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 177 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 178 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 179 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 180 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 181 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 182 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 183 AUSTRALIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 184 AUSTRALIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 AUSTRALIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 186 AUSTRALIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 187 AUSTRALIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 188 AUSTRALIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 AUSTRALIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 190 AUSTRALIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 191 AUSTRALIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 192 AUSTRALIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 AUSTRALIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 194 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 196 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 197 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 198 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 199 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 200 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 201 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 202 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 203 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 204 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 205 SINGAPORE TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 206 SINGAPORE LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 SINGAPORE LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 208 SINGAPORE MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 SINGAPORE MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 210 SINGAPORE TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 SINGAPORE TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 212 SINGAPORE BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 SINGAPORE BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 214 SINGAPORE OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 215 SINGAPORE OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 216 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 217 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 218 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 219 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 220 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 221 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 222 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 223 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 224 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 225 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 226 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 227 TAIWAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 228 TAIWAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 TAIWAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 230 TAIWAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 TAIWAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 232 TAIWAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 233 TAIWAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 234 TAIWAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 TAIWAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 236 TAIWAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 TAIWAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 238 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 240 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 241 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 242 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 243 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 244 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 245 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 246 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 247 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 248 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 249 NEW ZEALAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 250 NEW ZEALAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 251 NEW ZEALAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 252 NEW ZEALAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 NEW ZEALAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 254 NEW ZEALAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 NEW ZEALAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 256 NEW ZEALAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 NEW ZEALAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 258 NEW ZEALAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 NEW ZEALAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 260 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 262 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 263 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 264 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 266 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 267 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 268 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 269 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 270 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 271 THAILAND TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 272 THAILAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 THAILAND LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 274 THAILAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 THAILAND MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 276 THAILAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 THAILAND TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 278 THAILAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 THAILAND BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 280 THAILAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 THAILAND OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 282 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 283 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 284 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 285 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 286 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 287 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 288 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 289 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 290 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 291 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 292 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 293 MALAYSIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 294 MALAYSIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 MALAYSIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 296 MALAYSIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 MALAYSIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 298 MALAYSIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 MALAYSIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 300 MALAYSIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 MALAYSIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 302 MALAYSIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 MALAYSIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 304 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 305 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 306 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 307 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 308 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 309 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 310 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 311 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 312 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 313 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 314 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 315 VIETNAM TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 316 VIETNAM LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 317 VIETNAM LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 318 VIETNAM MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 VIETNAM MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 320 VIETNAM TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 321 VIETNAM TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 322 VIETNAM BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 VIETNAM BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 324 VIETNAM OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 VIETNAM OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 326 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 328 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 329 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 330 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 331 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 332 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 333 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 334 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 335 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 336 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 337 PHILIPPINES TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 338 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 340 PHILIPPINES LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 PHILIPPINES MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 342 PHILIPPINES TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 PHILIPPINES TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 344 PHILIPPINES BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 PHILIPPINES BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 346 PHILIPPINES OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 PHILIPPINES OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 348 REST OF ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 349 REST OF ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

Lista de figuras

FIGURE 1 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS IS EXPECTED TO BE A KEY DRIVER FOR ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SPLIT SYSTEM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET

FIGURE 14 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY TYPE, 2022

FIGURE 15 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY LENGTH, 2022

FIGURE 16 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2022

FIGURE 17 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2022

FIGURE 18 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2022

FIGURE 19 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2022

FIGURE 20 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: SNAPSHOT (2022)

FIGURE 21 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022)

FIGURE 22 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 ASIA-PACIFIC TRUCK REFRIGERATION UNIT MARKET: BY TYPE (2023-2030)

FIGURE 25 ASIA PACIFIC TRUCK REFRIGERATION UNIT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.