Asia-Pacific Ultra-Low-Power Microcontroller Market, By Peripheral Type (Analog Devices and Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs and Ultrasonic Sensing MCUs), Component (Hardware, Software and Services), Packaging Type (8 Bit Packaging, 16 Bit Packaging and 32 Bit Packaging), Network Connectivity (Wireless and Wired), RAM Capacity (Less Than 96 kb, 96 kb-512 kb and More Than 512 kb), retention power mode (1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and More Than 3.5 μW), Application (General Test & Measurement, Sensing, Flow Measurement and Others), End-User (Healthcare, Industrial, Manufacturing, It & Telecom, Military & Defence, Aerospace, Media & Entertainment, Automotive, Servers & Data Centers, Consumer Electronics and Others) Industry Trends and Forecast to 2029

Asia-Pacific Ultra-Low-Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others.

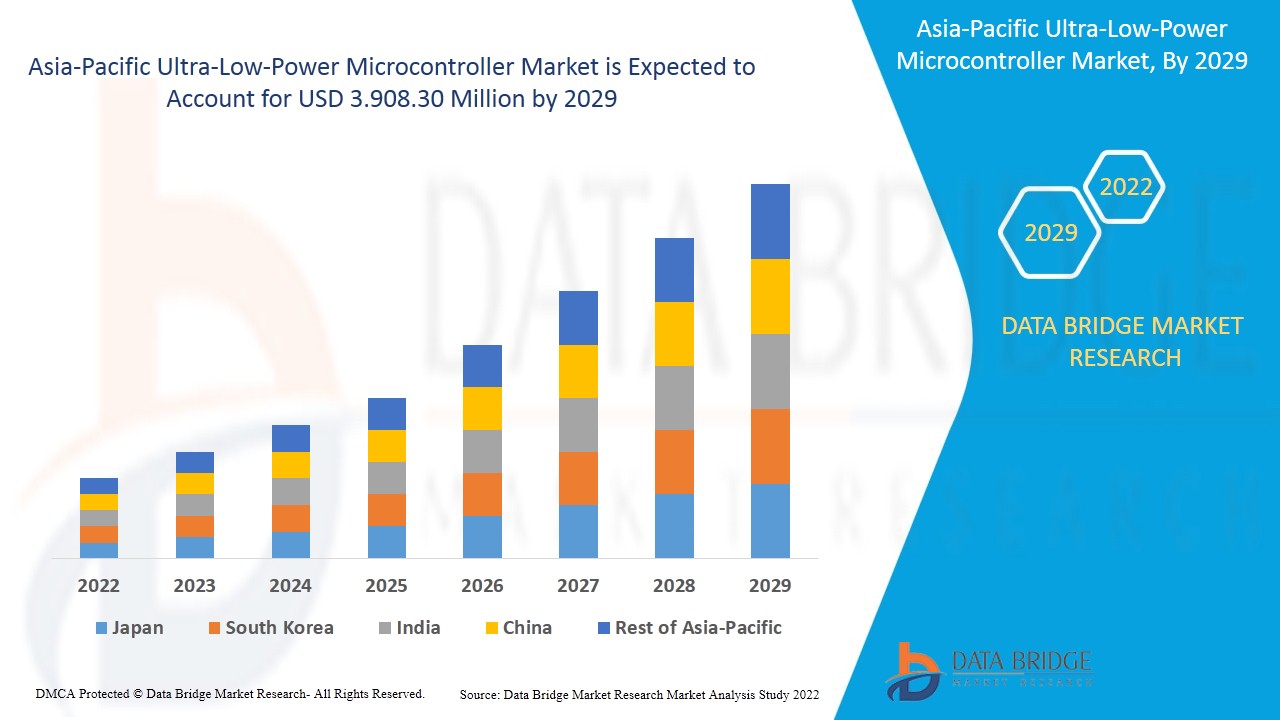

With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. Data Bridge Market Research analyses that the Asia-Pacific ultra-low-power microcontroller market is expected to reach the value of USD 3.908.30 million by the year 2029, at a CAGR of 11.5% during the forecast period. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Tipo (dispositivos analógicos y digitales), tipo (MCU de detección y medición de propósito general, MCU de detección táctil capacitiva y MCU de detección ultrasónica), componente (hardware, software y servicios), tipo de empaque (empaquetado de 8 bits, empaquetado de 16 bits y empaquetado de 32 bits), conectividad de red (inalámbrica y cableada), capacidad de RAM (menos de 96 kb, 96 kb-512 kb y más de 512 kb), modo de potencia de retención (1,6 μW- 2,4 μW, 2,4 μW- 3,5 μW y más de 3,5 μW), aplicación (prueba y medición general, detección, medición de flujo y otros), usuario final (asistencia sanitaria, industrial, fabricación, TI y telecomunicaciones, militar y defensa, aeroespacial, medios y entretenimiento, automoción, servidores y centros de datos, electrónica de consumo y otros), |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC) |

|

Actores del mercado cubiertos |

Español Marcas comerciales: Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc. |

Definición de mercado

El microcontrolador de consumo ultrabajo (ULP) permite que los nodos de borde procesen de manera inteligente los datos localizados con la menor cantidad de energía del sistema. Esto permite a los clientes extender la vida útil de la batería y el tiempo entre cargas, lo que permite un uso más prolongado. Los tamaños de batería más pequeños y el mayor tiempo entre los reemplazos de productos en el campo brindan ahorros de costos para los usuarios finales. El consumo de energía ultrabajo es un requisito muy importante para operar con fuentes de energía pequeñas (para reducir el tamaño) y no generar problemas de calentamiento local.

La dinámica del mercado de microcontroladores de consumo ultrabajo incluye:

- Aumento de la necesidad de componentes electrónicos de potencia energéticamente eficientes

Los avances en tecnología integrada han propiciado el desarrollo de microcontroladores de alta eficiencia. Los requisitos de potencia de estos microcontroladores han aumentado proporcionalmente a sus características y capacidades. Por lo tanto, para diseñar aplicaciones compactas y energéticamente eficientes mediante sistemas integrados, es necesario reducir el consumo de energía de los microcontroladores. El bajo consumo de energía también ayuda a que el dispositivo sea compacto al reducir la fuente de alimentación necesaria. Un dispositivo de consumo ultrabajo puede funcionar durante un largo período, incluso con una batería más pequeña. Esto ha animado a muchas empresas a producir microcontroladores de consumo ultrabajo y energéticamente eficientes sin comprometer su rendimiento, por lo que se espera que impulse el crecimiento del mercado.

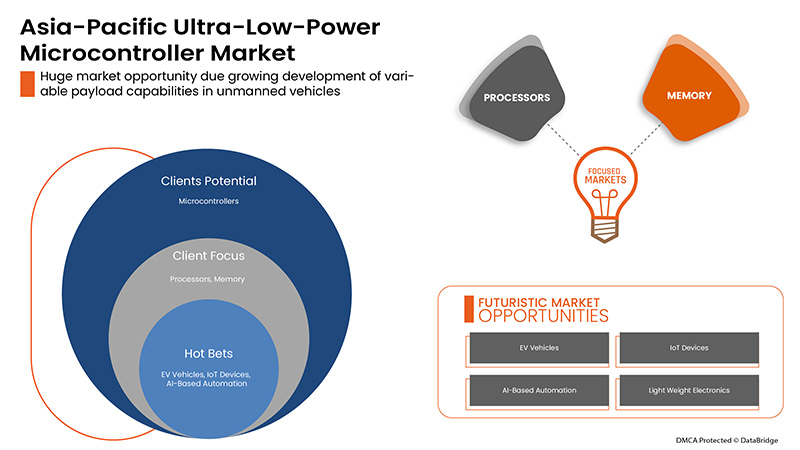

- Creciente popularidad de los dispositivos IoT que consumen poca batería

Existe una creciente demanda de microcontroladores de consumo ultrabajo en aplicaciones de IoT para aumentar la conservación de energía y hacer que el dispositivo sea más compacto. Se espera que esto impulse el crecimiento del mercado de microcontroladores de consumo ultrabajo en Asia-Pacífico.

- Creciente demanda de MCU de bajo consumo en dispositivos inteligentes

El mercado de dispositivos médicos portátiles y de bienestar personal está creciendo rápidamente. Los nuevos avances tecnológicos y los cambios en el estilo de vida han llevado a una mayor adopción de dispositivos inteligentes en todo el mundo, lo que aumenta la demanda de microcontroladores de consumo ultrabajo en el mercado.

- Creciente demanda de microcontroladores en la IA de borde

La demanda de microcontroladores de consumo ultrabajo para realizar aprendizaje automático en el borde se ha convertido en un área de desarrollo muy activa. Los fabricantes están trabajando para desarrollar microcontroladores de consumo ultrabajo que permitan ejecutar inferencias y, en última instancia, entrenamiento en dispositivos pequeños y de bajo consumo con recursos limitados, especialmente microcontroladores.

- Creciente demanda de aplicaciones de gestión de edificios y hogares inteligentes

Con los avances y la adopción del mercado de hogares inteligentes, aumenta la demanda de electrodomésticos más elegantes y delgados, con un formato más pequeño y con mayor eficiencia energética. Esto ha aumentado la demanda de microcontroladores de consumo ultrabajo.

Restricciones y desafíos que enfrenta el mercado de microcontroladores de consumo ultrabajo

- El enorme problema de la huella de carbono en el sector de fabricación de semiconductores

Los fabricantes de chips son los principales responsables de la crisis climática, ya que requieren enormes cantidades de energía y agua, por lo que el proceso de fabricación de un microcontrolador ULP, que requiere un uso intensivo de recursos, puede frenar el crecimiento del mercado.

- Escasez de suministro de chips

Los líderes y ejecutivos de las corporaciones multinacionales de Asia-Pacífico están preocupados por la escasez de semiconductores, que ha afectado la producción y las ventas en numerosos países y no se vislumbra una solución inmediata. Esto supone un importante desafío para el crecimiento del mercado.

Este informe de mercado de microcontroladores de potencia ultrabaja proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de microcontroladores de potencia ultrabaja, comuníquese con Data Bridge Market Research para obtener un informe de analista. Nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En junio de 2021, Texas Instruments Incorporated anunció sus planes de adquirir la fábrica de semiconductores de 300 mm de Micron Technology (o "fab") en Lehi, Utah, por 900 millones de dólares. Con ello, la empresa pretendía reforzar su ventaja competitiva en fabricación y tecnología, lo que le permitió ejercer un mayor control sobre su cadena de suministro.

- En febrero de 2021, STMicroelectronics anunció el lanzamiento de una nueva generación de microcontroladores (MCU) de ahorro de energía extremo. La serie STM32U5 de MCU de consumo de energía extremadamente bajo se diseñó para satisfacer los requisitos de potencia y rendimiento más exigentes de las aplicaciones inteligentes, incluidos los wearables, los dispositivos médicos personales, la automatización del hogar y los sensores industriales. La nueva serie STM32U5 combinó el eficiente núcleo Arm Cortex-M33 con las innovadoras funciones patentadas de ahorro de energía de ST y la propiedad intelectual en chip, lo que reduce la demanda de energía al tiempo que aumenta el rendimiento.

Alcance del mercado de microcontroladores de consumo ultrabajo en Asia y el Pacífico

El mercado de microcontroladores de consumo ultrabajo está segmentado en función del tipo de periférico, tipo, componente, tipo de empaque, conectividad de red, capacidad de RAM, modo de retención de energía, aplicación y usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento escaso en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo periférico

- Dispositivos analógicos

- Dispositivos digitales

Sobre la base del tipo de periférico, el mercado de microcontroladores de consumo ultra bajo se segmenta en dispositivos analógicos y dispositivos digitales.

Tipo

- MCU de detección y medición de propósito general

- MCU con detección táctil capacitiva

- Detección ultrasónica MCUS

Según el tipo, el mercado de microcontroladores de consumo ultrabaja se segmenta en MCUS de detección y medición de propósito general, MCUS de detección táctil capacitiva y MCUS de detección ultrasónica.

Componente

- Hardware

- Software

- Servicios

Según el componente, el mercado de microcontroladores de consumo ultrabajo se segmenta en hardware, software y servicios.

Tipo de embalaje

- Empaquetado de 8 bits

- Empaquetado de 16 bits

- Empaquetado de 32 bits

Según el tipo de empaque, el mercado de microcontroladores de consumo ultrabaja se segmenta en empaques de 8 bits, empaques de 16 bits y empaques de 32 bits.

Conectividad de red

- Cableado

- Inalámbrico

Sobre la base de la conectividad de red, el mercado de microcontroladores de consumo ultrabajo se segmenta en inalámbricos y cableados.

Capacidad de RAM

- Menos de 96 kb,

- 96 kb-512 kb

- Más de 512 kb

En función de la capacidad de RAM, el mercado de microcontroladores de consumo ultrabajo se segmenta en menos de 96 kb, 96 kb-512 kb y más de 512 kb.

Modo de retención de potencia

- 1,6 μW - 2,4 μW,

- 2,4 μW - 3,5 μW

- Más de 3,5 μW

Sobre la base del modo de potencia de retención, el mercado de microcontroladores de potencia ultrabaja se segmenta en 1,6 μW - 2,4 μW, 2,4 μW - 3,5 μW y más de 3,5 μW.

Solicitud

- Pruebas y mediciones generales

- Detección

- Medición de caudal

- Otros

Sobre la base de la aplicación, el mercado de microcontroladores de potencia ultrabaja se segmenta en pruebas y mediciones generales, detección, medición de flujo y otros.

Usuario final

- Cuidado de la salud

- Industrial

- Fabricación

- Informática y telecomunicaciones

- Militar y defensa

- Aeroespacial

- Medios y entretenimiento

- Automotor

- Servidores y centros de datos

- Electrónica de consumo

- Otros

Sobre la base del usuario final, el mercado de microcontroladores de consumo ultra bajo se segmenta en atención médica, industria, fabricación, TI y telecomunicaciones, militar y defensa, aeroespacial, medios y entretenimiento, automotriz, servidores y centros de datos, electrónica de consumo y otros.

Análisis y perspectivas regionales del mercado de microcontroladores de consumo ultrabajo

Se analiza el mercado de microcontroladores de consumo ultrabaja y se proporcionan información y tendencias del tamaño del mercado por país, tipo de periférico, tipo, componente, tipo de empaque, conectividad de red, capacidad de RAM, modo de energía de retención, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de microcontroladores de consumo ultrabaja son China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas y el resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC).

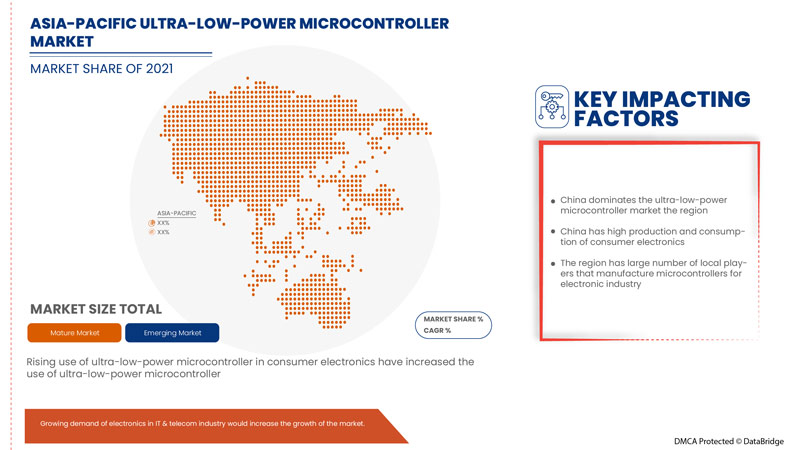

China domina el mercado de microcontroladores de consumo ultrabajo debido a la presencia de un gran número de fabricantes y fundiciones de fabricación en la región. La industria china de microcontroladores también busca avanzar en el mercado global mediante el suministro a fabricantes de automóviles chinos y el suministro a empresas conjuntas entre fabricantes de automóviles nacionales e internacionales.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los microcontroladores de consumo ultrabajo

El panorama competitivo del mercado de microcontroladores de consumo ultrabajo proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de microcontroladores de consumo ultrabajo.

Algunos de los principales actores que operan en el mercado de microcontroladores de potencia ultrabaja son Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 PERIPHERAL TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS

5.1.2 GROWING POPULARITY OF LOW-BATTERY-POWERED IOT DEVICES

5.1.3 INCREASING DEMAND FOR LOW POWER CONSUMING MCU IN SMART DEVICES

5.1.4 RISING DEMAND FOR MICROCONTROLLERS IN EDGE AI

5.1.5 INCREASING DEMAND FOR SMART HOME AND BUILDING MANAGEMENT APPLICATIONS

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES IN ULTRA-LOW-POWER MICROCONTROLLER

5.2.1 HUGE CARBON FOOTPRINT ISSUES IN SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF POWER ELECTRONICS IN AUTOMOTIVE TECHNOLOGIES

5.3.2 SURGE IN GOVERNMENT INVESTMENTS TO SUPPORT IOT GROWTH ACROSS THE GLOBE

5.3.3 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LOWER ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE

6.1 OVERVIEW

6.2 ANALOG DEVICES

6.3 DIGITAL DEVICES

7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE

7.1 OVERVIEW

7.2 GENERAL PURPOSE SENSING AND MEASUREMENT MCUS

7.3 CAPACITIVE TOUCH SENSING MCUS

7.4 ULTRASONIC SENSING MCUS

8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 PROCESSORS

8.2.2 MEMORY

8.2.3 POWER SUPPLY UNIT

8.2.4 SENSORS

8.2.5 CONTROLLER

8.2.6 OTHERS

8.3 SOFTWARE

8.4 SERVICES

8.4.1 IMPLEMENTATION & INTEGRATION

8.4.2 TRAINING & CONSULTING

8.4.3 SUPPORT & MAINTENANCE

9 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 32 BIT PACKAGING

9.3 16 BIT PACKAGING

9.4 8 BIT PACKAGING

10 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.3 WIRED

11 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY

11.1 OVERVIEW

11.2 MORE THAN 512 KB

11.3 96 KB-512 KB

11.4 LESS THAN 96 KB

12 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE

12.1 OVERVIEW

12.2 2.4 ΜW- 3.5 ΜW

12.3 1.6 ΜW- 2.4 ΜW

12.4 MORE THAN 3.5 ΜW

13 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 GENERAL TEST AND MEASUREMENT

13.3 SENSING

13.4 FLOW MEASUREMENT

13.5 OTHERS

14 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER

14.1 OVERVIEW

14.2 CONSUMERS ELECTRONICS

14.2.1 SMARTPHONES

14.2.2 DESKTOP

14.2.3 TABLETS

14.2.4 LAPTOPS

14.2.5 SMART WATCHES

14.3 AUTOMOTIVE

14.3.1 INFOTAINMENT

14.3.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

14.4 HEALTHCARE

14.4.1 PORTABLE MEDICAL DEVICES

14.4.2 WEARABLE MEDICAL PATCHES

14.5 MEDIA & ENTERTAINMENT

14.6 INDUSTRIAL

14.6.1 BUILDING AUTOMATION

14.6.2 ROBOTICS

14.6.3 MACHINE VISION

14.6.4 AUTOMATED GUIDED VEHICLES

14.6.5 HUMAN–MACHINE INTERFACE (HMI)

14.7 IT & TELECOM

14.8 MANUFACTURING

14.9 SERVERS AND DATA CENTERS

14.1 MILITARY & DEFENSE

14.11 AEROSPACE

14.11.1 AVIONICS AND DEFENSE SYSTEMS

14.11.2 UNMANNED AERIAL VEHICLES

14.12 OTHERS

15 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 SOUTH KOREA

15.1.4 INDIA

15.1.5 AUSTRALIA

15.1.6 INDONESIA

15.1.7 MALAYSIA

15.1.8 SINGAPORE

15.1.9 THAILAND

15.1.10 PHILIPPINES

15.1.11 REST OF ASIA-PACIFIC

16 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEXAS INSTRUMENTS INCORPORATED

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STMICROELECTRONICS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ANALOG DEVICES, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 INFINEON TECHNOLOGIES AG

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MICROCHIP TECHNOLOGY INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 RENESAS ELECTRONICS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 NXP SEMICONDUCTORS

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMBIQ MICRO, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BROADCOM

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EM MICROELECTRONIC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 E-PEAS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 HOLTEK SEMICONDUCTOR INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 LAPIS SEMICONDUCTOR CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 NUVOTON TECHNOLOGY CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PROFICHIP USA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SEIKO EPSON CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SILICON LABORATORIES

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZILOG, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 3 ASIA PACIFIC ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 ASIA PACIFIC ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 17 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 19 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 ASIA PACIFIC SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 23 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 25 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 27 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 29 ASIA PACIFIC 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 31 ASIA PACIFIC 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 33 ASIA PACIFIC 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 35 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 37 ASIA PACIFIC WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 39 ASIA PACIFIC WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 41 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 43 ASIA PACIFIC MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 45 ASIA PACIFIC 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 47 ASIA PACIFIC LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 49 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 51 ASIA PACIFIC 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 53 ASIA PACIFIC 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 55 ASIA PACIFIC MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 57 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 59 ASIA PACIFIC GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 61 ASIA PACIFIC SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 63 ASIA PACIFIC FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 65 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 67 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 69 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 71 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 73 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 75 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 77 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 79 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 81 ASIA PACIFIC MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 83 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 85 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 ASIA PACIFIC IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 ASIA PACIFIC IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 89 ASIA PACIFIC MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 90 ASIA PACIFIC MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 91 ASIA PACIFIC SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 ASIA PACIFIC SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 93 ASIA PACIFIC MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 94 ASIA PACIFIC MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 95 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 97 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 99 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 100 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 101 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 103 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 104 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 105 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 107 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 109 ASIA-PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ASIA-PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 ASIA-PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ASIA-PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 113 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 114 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 115 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 116 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 117 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 118 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 119 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 120 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 121 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 123 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 125 ASIA-PACIFIC CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ASIA-PACIFIC CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 ASIA-PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 ASIA-PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 129 ASIA-PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ASIA-PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 131 ASIA-PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ASIA-PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 133 ASIA-PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ASIA-PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 135 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 137 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 139 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 140 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 141 CHINA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 CHINA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 143 CHINA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 CHINA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 145 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 146 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 147 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 148 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 149 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 150 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 151 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 152 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 153 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 155 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 157 CHINA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 CHINA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 CHINA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CHINA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 161 CHINA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 CHINA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 163 CHINA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 CHINA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 165 CHINA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 CHINA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 167 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 168 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 169 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 171 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 172 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 173 JAPAN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 JAPAN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 175 JAPAN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 JAPAN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 177 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 178 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 179 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 180 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 181 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 183 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 184 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 185 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 187 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 188 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 189 JAPAN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 JAPAN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 JAPAN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 JAPAN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 193 JAPAN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 JAPAN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 195 JAPAN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 JAPAN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 197 JAPAN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 JAPAN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 199 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 201 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 203 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 204 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 205 SOUTH KOREA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 SOUTH KOREA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 207 SOUTH KOREA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 SOUTH KOREA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 209 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 210 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 211 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 212 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 213 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 214 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 215 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 217 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 219 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 221 SOUTH KOREA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 SOUTH KOREA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 SOUTH KOREA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 225 SOUTH KOREA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SOUTH KOREA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 227 SOUTH KOREA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SOUTH KOREA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 229 SOUTH KOREA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SOUTH KOREA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 231 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 232 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 233 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 235 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 236 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 237 INDIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 INDIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 239 INDIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 INDIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 241 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 242 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 243 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 244 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 245 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 246 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 247 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 248 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 249 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 251 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 252 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 253 INDIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 INDIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 INDIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 INDIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 257 INDIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 INDIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 259 INDIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 INDIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 261 INDIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 INDIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 263 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 264 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 265 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 267 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 268 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 269 AUSTRALIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 AUSTRALIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 271 AUSTRALIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 AUSTRALIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 273 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 274 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 275 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 276 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 277 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 278 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 279 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 280 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 281 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 283 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 284 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 285 AUSTRALIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 AUSTRALIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 287 AUSTRALIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 289 AUSTRALIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 291 AUSTRALIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 293 AUSTRALIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 295 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 296 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 297 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 299 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 300 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 301 INDONESIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 INDONESIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 303 INDONESIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 INDONESIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 305 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 306 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 307 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 308 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 309 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 310 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 311 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 312 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 313 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 315 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 316 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 317 INDONESIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 318 INDONESIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 319 INDONESIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 320 INDONESIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 321 INDONESIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 322 INDONESIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 323 INDONESIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 INDONESIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 325 INDONESIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 326 INDONESIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 327 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 328 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 329 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 330 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 331 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 332 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 333 MALAYSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 334 MALAYSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 335 MALAYSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 336 MALAYSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 337 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 338 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 339 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 340 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 341 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 342 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 343 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 344 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 345 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 346 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 347 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 348 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 349 MALAYSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 350 MALAYSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 351 MALAYSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 352 MALAYSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 353 MALAYSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 354 MALAYSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 355 MALAYSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 356 MALAYSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 357 MALAYSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 358 MALAYSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 359 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 360 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 361 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 363 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 364 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 365 SINGAPORE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 366 SINGAPORE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 367 SINGAPORE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 368 SINGAPORE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 369 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 370 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 371 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 372 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 373 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 374 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 375 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 376 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 377 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 378 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 379 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 380 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 381 SINGAPORE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 382 SINGAPORE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 383 SINGAPORE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 384 SINGAPORE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 385 SINGAPORE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 386 SINGAPORE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 387 SINGAPORE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 388 SINGAPORE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 389 SINGAPORE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 390 SINGAPORE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 391 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 392 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 393 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 394 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 395 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 396 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 397 THAILAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 398 THAILAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 399 THAILAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 400 THAILAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 401 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 403 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 404 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 405 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 406 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 407 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 408 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 409 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 410 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 411 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 412 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 413 THAILAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 414 THAILAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 415 THAILAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 416 THAILAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 417 THAILAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 418 THAILAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 419 THAILAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 420 THAILAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 421 THAILAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 422 THAILAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 423 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 424 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 425 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 426 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 427 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 428 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 429 PHILIPPINES HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 430 PHILIPPINES HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 431 PHILIPPINES SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 432 PHILIPPINES SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 433 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 434 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 435 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 436 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 437 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 438 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 439 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 440 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 441 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 442 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 443 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 444 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 445 PHILIPPINES CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 446 PHILIPPINES CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 447 PHILIPPINES AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 448 PHILIPPINES AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 449 PHILIPPINES HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 450 PHILIPPINES HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 451 PHILIPPINES INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 452 PHILIPPINES INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 453 PHILIPPINES AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 454 PHILIPPINES AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 455 REST OF ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 456 REST OF ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

Lista de figuras

FIGURE 1 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS IS EXPECTED TO DRIVE THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 ANALOG DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET

FIGURE 16 SHARE OF ELECTRICITY FLOW THROUGH POWER ELECTRONICS IN THE U.S. (2005–2030) (IN %)

FIGURE 17 NUMBER OF WEARABLE DEVICES IN U.S. FROM 2014 TO 2019 (IN MILLIONS)

FIGURE 18 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2021

FIGURE 19 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2021

FIGURE 21 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2021

FIGURE 23 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2021

FIGURE 24 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2021

FIGURE 25 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2021

FIGURE 26 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2021

FIGURE 27 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SNAPSHOT (2021)

FIGURE 28 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021)

FIGURE 29 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY PERIPHERAL TYPE (2022-2029)

FIGURE 32 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.