Europe Alpha Methylstyrene Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

64.29 Million

USD

80.98 Million

2024

2032

USD

64.29 Million

USD

80.98 Million

2024

2032

| 2025 –2032 | |

| USD 64.29 Million | |

| USD 80.98 Million | |

|

|

|

|

Segmentación del mercado europeo de alfa-metilestireno por pureza (superior al 99 %, 99 %, 98 % y 95 %), grado (estándar, técnico, industrial, etc.), cantidad de envase (100-200 kg, 50-100 kg, superior a 200 kg y 25-50 kg), envase (cisterna, bidón, IBC, etc.), aplicación (polímeros, productos químicos a granel y especiales), uso final (automoción, electrónica y electricidad, farmacéutica, construcción, petróleo y gas, agricultura, textil, alimentación y bebidas, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de alfa-metilestireno

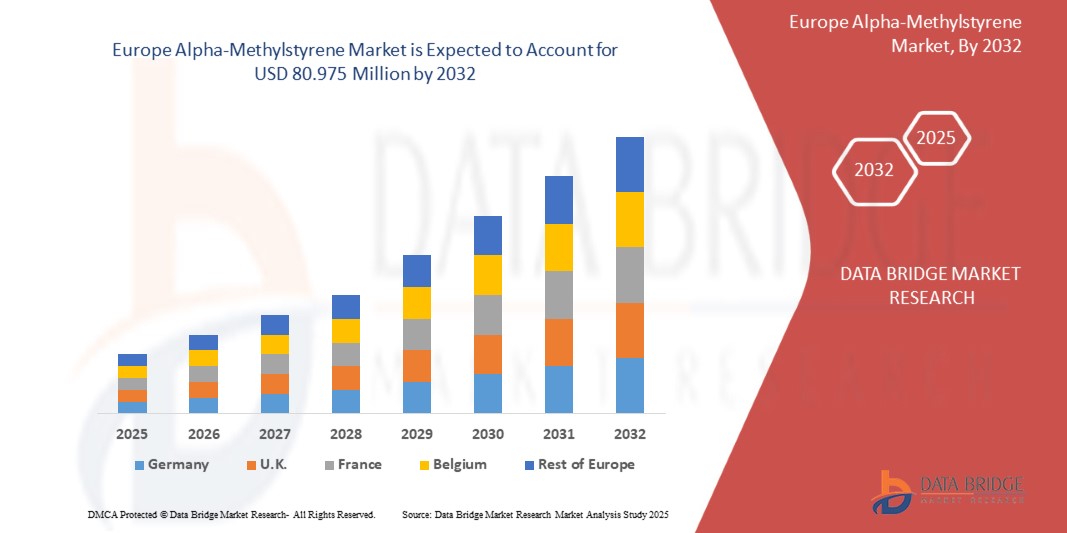

- El mercado europeo de alfa-metilestireno se valoró en USD 64,285 millones en 2024 y se espera que alcance los USD 80,975 millones para 2032 con una CAGR del 2,98%, durante el período de pronóstico.

- Este crecimiento está impulsado por factores como la creciente demanda de resinas ABS en la industria automotriz y de bienes de consumo, el crecimiento en las industrias de construcción y recubrimientos, la expansión de la industria del embalaje y los avances tecnológicos en la producción de polímeros.

Análisis del mercado del alfa-metilestireno

- La creciente demanda de AMS se debe a su uso en la producción de plásticos y resinas para componentes automotrices, lo que mejora el rendimiento y la durabilidad.

- Los sectores de la electrónica y el embalaje utilizan cada vez más adhesivos y recubrimientos basados en AMS, lo que impulsa un crecimiento constante del mercado debido a la confiabilidad y la resistencia química.

- Se espera que Alemania domine el mercado de alfa-metilestireno con una participación del 22,28% debido a la rápida industrialización, la expansión de la base de fabricación y la fuerte demanda de los sectores automotriz, electrónico y de embalaje.

- Se espera que Alemania sea la región de más rápido crecimiento en el mercado de alfa-metilestireno y sus derivados debido al aumento de las actividades industriales, la creciente demanda de los consumidores, la expansión de los sectores automotriz y electrónico y las políticas gubernamentales de apoyo que promueven el desarrollo de la manufactura y la infraestructura.

- Se espera que el segmento de pureza superior al 99 % domine el mercado de alfa-metilestireno y sus derivados con una participación del 65,10 % en 2025 debido a su rendimiento superior, alta estabilidad y uso creciente en resinas, adhesivos y polímeros de alta calidad necesarios para aplicaciones automotrices, electrónicas y de embalaje premium.

Alcance del informe y segmentación del mercado de alfa-metilestireno

|

Atributos |

Perspectivas clave del mercado del alfa-metilestireno |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del alfa-metilestireno

Aumento de la producción de resina ABS

- La creciente demanda de plásticos ligeros y duraderos en los sectores automotriz y electrónico está impulsando la producción de resina ABS, donde el alfa-metilestireno desempeña un papel clave como intermedio que mejora el rendimiento en las formulaciones de polímeros.

- El aumento en la fabricación de productos electrónicos de consumo y electrodomésticos impulsa el uso de ABS, lo que aumenta el consumo de alfa-metilestireno debido a su contribución a la resistencia al impacto y la estabilidad térmica en los productos finales.

- La rápida industrialización en economías emergentes como India y China acelera la producción de ABS, lo que aumenta la necesidad de alfa-metilestireno a medida que los fabricantes buscan materiales plásticos rentables y de alta calidad para diversas aplicaciones industriales.

- La innovación en composiciones de resina ABS para impresión 3D y embalajes sustentables mejora la relevancia del alfa-metilestireno, alineándose con las tendencias globales hacia materiales de alto rendimiento y ecológicos en las prácticas de fabricación modernas.

Dinámica del mercado del alfa-metilestireno

Conductor

Creciente demanda de resinas ABS en la industria automotriz y de bienes de consumo

- La creciente demanda de resinas de alto rendimiento, particularmente en aplicaciones automotrices y de bienes de consumo, ha impulsado significativamente el uso de compuestos químicos específicos conocidos por su excelente estabilidad térmica, resistencia al impacto y resistencia mecánica.

- Estos compuestos son cruciales en la fabricación de productos duraderos y estéticamente atractivos, especialmente en industrias donde tanto la funcionalidad como el atractivo visual son claves.

- En el sector automotriz, estos compuestos se utilizan ampliamente para crear componentes como tableros, parachoques y molduras interiores. La creciente atención a la durabilidad, seguridad y ligereza de los vehículos está impulsando la adopción de estos materiales en diversas piezas de vehículos.

- Además, la demanda de soluciones energéticamente eficientes y respetuosas con el medio ambiente está impulsando innovaciones que mejoren aún más las propiedades de los materiales.

Por ejemplo,

- Un informe publicado en Polymer-Search destacó el creciente uso de polímeros de alto rendimiento en la electrónica de consumo. Su flexibilidad, resistencia al calor y propiedades de aislamiento eléctrico los hacen ideales para la producción de dispositivos avanzados. A medida que crece la demanda de dispositivos más ligeros, duraderos y sostenibles, estos materiales desempeñan un papel crucial en la innovación.

- La creciente demanda de resinas de alto rendimiento en los sectores de automoción y bienes de consumo está impulsando el uso de compuestos químicos con excelente estabilidad térmica, resistencia al impacto y resistencia.

Oportunidad

I+D en resinas ecológicas y de alto rendimiento

- Ante la creciente conciencia sobre el impacto ambiental, los fabricantes se están centrando en desarrollar resinas AMS que no solo sean más duraderas y eficientes, sino también sostenibles.

- Estas resinas están siendo diseñadas para cumplir con los estándares ambientales y la creciente demanda de materiales más fuertes, livianos y adaptables en industrias como la del embalaje, la automotriz y los bienes de consumo.

- El aumento de las inversiones en I+D está ampliando los límites de las resinas AMS. Las innovaciones permiten la producción de resinas que ofrecen mayor estabilidad térmica, resistencia química y reciclabilidad.

- Como resultado, las resinas AMS se están convirtiendo en una opción popular para soluciones sustentables que no comprometen el rendimiento.

Por ejemplo,

- En octubre de 2024, un artículo sobre Vertec Biosolvents destacó el creciente papel de las resinas ecológicas y de alto rendimiento en el mercado de AMS. Los esfuerzos de I+D se centran en el desarrollo de resinas AMS que cumplan con las normas ambientales, a la vez que ofrecen mayor durabilidad, estabilidad térmica y reciclabilidad, impulsando el crecimiento en industrias como la del embalaje y la automoción.

- Un informe de Knowledge Sourcing Intelligence LLP destaca los avances en I+D para resinas biodegradables, centrándose en materiales de alto rendimiento que ofrecen durabilidad y sostenibilidad. Este desarrollo está impactando especialmente en industrias como la del embalaje, la automoción y los bienes de consumo, donde las aplicaciones ecológicas de AMS se están volviendo esenciales en las estrategias de innovación de productos.

- En marzo de 2024, Super Resin Inc. presentó su resina epoxi de origen vegetal, una alternativa ambientalmente sostenible para la industria de los composites. Esta innovación resalta la importancia de los materiales sostenibles al reducir el impacto ambiental y mantener un alto rendimiento. Estos avances en I+D están orientando el mercado de AMS hacia soluciones más ecológicas con una funcionalidad mejorada.

- La investigación y el desarrollo en resinas ecológicas y de alto rendimiento impulsan el crecimiento del mercado de AMS. Las innovaciones mejoran la durabilidad, la estabilidad térmica y la reciclabilidad, lo que las convierte en ideales para soluciones sostenibles en los sectores del embalaje, la automoción y los bienes de consumo.

Restricción/Desafío

Volatilidad en los precios del petróleo crudo y las materias primas

- Dado que el AMS se deriva de productos derivados del petróleo, las fluctuaciones en los precios del crudo impactan directamente en sus costos de producción. Cuando los precios del crudo suben, el costo de las materias primas para la producción de AMS se incrementa, lo que resulta en mayores costos de producción y, en última instancia, precios más altos para los productos derivados del AMS.

- Estas fluctuaciones de precios pueden dificultar que los fabricantes mantengan márgenes de beneficio estables, especialmente cuando se enfrentan a incertidumbres del mercado.

- Además, las interrupciones del suministro de materias primas debido a tensiones geopolíticas, desastres naturales o barreras comerciales pueden exacerbar esta volatilidad.

- La incertidumbre en torno a la disponibilidad y los precios de las materias primas clave para la producción de AMS puede obstaculizar la capacidad de los fabricantes de planificar y operar de manera eficiente, lo que afecta la estabilidad general del mercado.

Por ejemplo,

- En octubre de 2024, una entrada de blog de Pearson analizó la volatilidad de los precios del petróleo crudo y su impacto directo en los costos de las materias primas. Estas fluctuaciones afectan significativamente la producción de resinas de alfa-metilestireno, lo que dificulta que los fabricantes mantengan márgenes de beneficio estables en un mercado impredecible.

- En noviembre de 2024, un artículo de The Economic Times analizó la volatilidad de los precios del petróleo crudo y su impacto en los costos de las materias primas. Estas fluctuaciones afectan la producción de resinas de alfa-metilestireno, incrementando los costos de producción y dificultando la estabilidad de precios, lo que supone un desafío para los fabricantes de sectores como el embalaje y la automoción.

- En noviembre de 2024, un blog de Mercatus Energy analizó cómo la volatilidad de los precios del crudo afecta significativamente a las industrias que dependen de productos derivados del petróleo, como el alfa-metilestireno. La fluctuación de los costos de las materias primas incrementa los costos de producción de AMS, lo que complica los márgenes de beneficio y la planificación de los fabricantes, especialmente en sectores como la automoción y el embalaje.

- La volatilidad de los precios del petróleo crudo y de los costos de las materias primas impacta significativamente el mercado del alfa-metilestireno. Las fluctuaciones en los precios del petróleo crudo elevan los costos de producción, lo que afecta los márgenes de ganancia.

- Las interrupciones del suministro debido a cuestiones geopolíticas o barreras comerciales exacerban aún más esta volatilidad, lo que supone un desafío para los fabricantes y los consumidores en sectores como el embalaje, la automoción y los bienes de consumo.

Alcance del mercado del alfa-metilestireno

El mercado está segmentado en función de la pureza, el grado, la cantidad de envase, el embalaje, la aplicación y el uso final.

|

Segmentación |

Subsegmentación |

|

Por la pureza |

|

|

Por grado |

|

|

Por cantidad de embalaje |

|

|

Por embalaje

|

|

|

Por aplicación |

|

|

Por uso final |

|

En 2025, se proyecta que Más del 99% domine el mercado con la mayor participación en el segmento de pureza.

Se espera que el segmento Más del 99% domine el mercado de alfa-metilestireno en 2025 debido a su pureza superior, que es esencial para aplicaciones de alto rendimiento en plásticos, adhesivos y resinas, lo que impulsa una mayor demanda en los sectores de fabricación industrial.

Se espera que el grado estándar represente la mayor participación durante el período de pronóstico en el mercado de alfa metilestireno.

Se espera que en 2025, el segmento de grado estándar domine el mercado con una participación del 41,09 % debido a su alta pureza, lo que lo hace ideal para aplicaciones avanzadas en resinas, recubrimientos, adhesivos e industrias de fabricación de productos químicos especializados.

Análisis regional del mercado de alfa-metilestireno

Alemania es la región dominante en el mercado del alfa-metilestireno.

- Se espera que Alemania domine el mercado de alfa-metilestireno con una participación del 22,28% debido a la rápida industrialización, la expansión de la base de fabricación y la fuerte demanda de los sectores automotriz, electrónico y de embalaje.

- Alemania es el mayor productor de automóviles de Europa, con una importante demanda de resinas ABS para componentes de vehículos. La robusta industria automotriz del país impulsa el crecimiento del mercado de AMS.

- Alemania cuenta con un sector químico consolidado, que incluye instalaciones de producción de AMS. Esta infraestructura sustenta la alta demanda de AMS en diversas aplicaciones, lo que refuerza su dominio del mercado.

- Las empresas alemanas se centran en los avances tecnológicos y en los métodos de producción de AMS ecológicos. Este compromiso mejora la calidad y la sostenibilidad de los productos, consolidando el liderazgo de Alemania en el mercado de AMS.

Se proyecta que Alemania registre la mayor tasa de crecimiento.

- Se espera que Alemania sea el país de más rápido crecimiento en el mercado de alfa-metilestireno y sus derivados debido al aumento de las actividades industriales, la creciente demanda de los consumidores, la expansión de los sectores automotriz y electrónico y las políticas gubernamentales de apoyo que promueven el desarrollo de la manufactura y la infraestructura.

- Alemania está aumentando su producción de vehículos eléctricos (VE), con empresas como Ford inaugurando el Centro de Vehículos Eléctricos de Colonia. Este crecimiento en la fabricación de VE impulsa la demanda de AMS en componentes ligeros para automoción.

- Alemania prioriza las prácticas de fabricación sostenibles, en línea con las tendencias globales hacia el uso de materiales ecológicos. Este enfoque en la sostenibilidad impulsa la adopción de AMS en diversas industrias, impulsando su expansión en el mercado.

Cuota de mercado del alfa-metilestireno

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Europa, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- INEOS Capital Limited (Reino Unido)

- Advansix (EE. UU.)

- Mitsubishi Chemical Group Corporation (Japón)

- LG Chem (Corea del Sur)

- Solvay (Bélgica)

- Kraton Corporation (EE. UU.)

- ROSNEFT (Rusia)

- ALTIVIA (EE. UU.)

- Evonik Industries AG (Alemania)

- Seqens (Francia)

- Domo Chemicals (Bélgica)

- Deepak (India)

- SI Group, Inc. (EE. UU.)

- Prasol Chemicals Limited (India)

- TIANJIN ZHONGXIN CHEMTECH CO., LTD. (Porcelana)

- KUMHO PandB CHEMICALS., INC. (Corea del Sur)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Grupo de empresas «Titan» (Rusia)

- Moeve (Alemania)

- Shanghai Theorem Chemical Technology Co., Ltd. (China)

- Equilex BV (Países Bajos)

- Otto Chemie Pvt. Ltd. (India)

- Eastindiachemicals (India)

- Industria química de Tokio (India) Pvt. Ltd. (India)

- SimSon Pharma Limited (India)

- Vizagchemical (India)

- rxchemical (India)

- Maha Automations (India)

Últimos avances en el mercado europeo del alfa-metilestireno

- En abril, Domo Chemicals inauguró una nueva fábrica en China con una inversión de 15,02 millones de dólares, lo que ha ampliado su capacidad de producción. La planta, ubicada al sur de Shanghái, duplicará su producción a corto plazo y podría triplicarla en el futuro.

- En abril, DOMO Chemicals inauguró una nueva línea de compuestos en sus instalaciones de Mahape, Navi Mumbai, ampliando su capacidad para satisfacer la creciente demanda de soluciones basadas en poliamida. Esta línea de vanguardia prestará servicio a sectores clave como la automoción, la electrónica y los bienes de consumo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE

4.5.3 SUPPLY CHAIN RELIABILITY

4.5.4 COMPLIANCE AND SUSTAINABILITY

4.5.5 COST AND PRICING STRUCTURE

4.5.6 FINANCIAL STABILITY

4.5.7 FLEXIBILITY AND CUSTOMIZATION

4.5.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 RAW MATERIAL COVERAGE

4.7.1 CUMENE

4.7.2 CUMYL ALCOHOL

4.7.3 PHENOL AND ACETONE

4.7.4 ALTERNATIVE FEEDSTOCKS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 SUPPLY DEMAND DYNAMICS

4.9.1 SUPPLY SIDE DYNAMICS

4.9.1.1 RAW MATERIAL DEPENDENCY

4.9.1.2 PRODUCTION CAPACITY AND INTEGRATION

4.9.1.3 GEOGRAPHIC CONCENTRATION

4.9.1.4 PRICE VOLATILITY

4.9.2 DEMAND SIDE DYNAMICS

4.9.2.1 KEY END-USE APPLICATIONS

4.9.2.2 REGIONAL DEMAND TRENDS

4.9.2.3 SUBSTITUTION AND SUSTAINABILITY PRESSURES

4.9.2.4 DEMAND VOLATILITY AND ELASTICITY

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP 5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION:

4.10.4.4 PRICE PITCHING AND POSITIONING IN THE MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.6.1 RAW MATERIAL DEPENDENCY

4.10.6.2 ENERGY AND LOGISTICS COSTS

4.10.6.3 REGIONAL SUPPLY-DEMAND GAPS

4.10.6.4 REGULATORY AND TRADE BARRIERS

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.10.8.1 FREE TRADE AGREEMENTS

4.10.8.2 STATUS ACCREDITATION (INCLUDING MFN)

4.10.9 DOMESTIC COURSE OF CORRECTION

4.10.9.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.9.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.11 TECHNOLOGY ADVANCEMENT BY MANUFACTURERS

4.11.1 ADVANCED CATALYTIC PROCESSES

4.11.2 AUTOMATION AND PROCESS CONTROL

4.11.3 SUSTAINABLE PRODUCTION PRACTICES

4.11.4 PURIFICATION AND QUALITY ENHANCEMENT

4.11.5 EXPANSION OF APPLICATION AREAS

4.11.6 STRATEGIC INVESTMENTS AND COLLABORATIONS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ABS RESINS IN AUTOMOTIVE AND CONSUMER GOODS

6.1.2 GROWTH IN CONSTRUCTION AND COATINGS INDUSTRIES

6.1.3 EXPANSION OF PACKAGING INDUSTRY

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN POLYMER PRODUCTION

6.2 RESTRAINTS

6.2.1 VOLATILITY IN CRUDE OIL AND RAW MATERIAL PRICES

6.2.2 STRINGENT ENVIRONMENTAL AND HEALTH REGULATIONS

6.3 OPPORTUNITIES

6.3.1 R&D IN ECO-FRIENDLY AND HIGH-PERFORMANCE RESINS

6.3.2 RISING DEMAND FOR SPECIALTY CHEMICALS AND CUSTOM POLYMERS

6.3.3 POTENTIAL IN RECYCLABLE AND SUSTAINABLE AMS DERIVATIVES

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN VULNERABILITIES DUE TO GEOPOLITICAL ISSUES

6.4.2 STIFF COMPETITION FROM BIO-BASED ALTERNATIVES

7 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY

7.1 OVERVIEW

7.2 MORE THAN 99%

7.3 0.99

7.4 0.98

7.5 0.95

8 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE

8.1 OVERVIEW

8.2 STANDARD GRADE

8.3 TECHNICAL GRADE

8.4 INDUSTRIAL GRADE

8.5 OTHERS

9 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY

9.1 OVERVIEW

9.2 100-200 KG

9.3 50-100 KG

9.4 ABOVE 200 KG

9.5 25-50 KG

10 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 TANKER

10.3 DRUM

10.4 IBC

10.5 OTHERS

11 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 POLYMERS

11.3 BULK AND SPECIALTY CHEMICALS

12 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE

12.1 OVERVIEW

12.2 AUTOMOTIVE

12.3 ELECTRONICS & ELECTRICAL

12.4 PHARMACEUTICALS

12.5 BUILDING & CONSTRUCTION

12.6 OIL & GAS

12.7 AGRICULTURE

12.8 TEXTILES

12.9 FOOD & BEVERAGES

12.1 OTHERS

13 EUROPE ALPHA-METHYLSTYRENE MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 NETHERLAND

13.1.5 BELGIUM

13.1.6 SPAIN

13.1.7 ITALY

13.1.8 RUSSIA

13.1.9 SWITZERLAND

13.1.10 TURKEY

13.1.11 SWEDEN

13.1.12 DENMARK

13.1.13 FINLAND

13.1.14 NORWAY

13.1.15 REST OF EUROPE

14 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 INEOS CAPITAL LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 ADVANSIX

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MITSUBISHI CHEMICAL GROUP CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LG CHEM

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 SOLVAY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ALTIVIA

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DEEPAK

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 DOMO CHEMICALS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 EASTINDIACHEMICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 EQUILEX BV

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EVONIK INDUSTRIES AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 GROUP OF COMPANIES «TITAN»

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HEFEI TNJ CHEMICAL INDUSTRY CO.,LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KRATON CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 KUMHO P&B CHEMICALS.,INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 MAHA AUTOMATIONS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MOEVE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 OTTO CHEMIE PVT. LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PRASOL CHEMICALS LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROSNEFT

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 RXCHEMICALS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SEQENS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SHANGHAI THEOREM CHEMICAL TECHNOLOGY CO., LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SI GROUP, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SIMSON PHARMA LIMITED

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 TIANJIN ZHONGXIN CHEMTECH CO.,LTD.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 VIZAGCHEMICAL

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 3 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 4 EUROPE MORE THAN 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 5 EUROPE MORE THAN 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 6 EUROPE 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 7 EUROPE 99% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 EUROPE 98% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 9 EUROPE 98% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 EUROPE 95% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 11 EUROPE 95% IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 13 EUROPE STANDARD GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 14 EUROPE TECHNICAL GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 15 EUROPE INDUSTRIAL GRADE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 16 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 17 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 18 EUROPE 100-200 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 19 EUROPE 50-100 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 20 EUROPE ABOVE 200 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 21 EUROPE 25-50 KG IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 22 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 23 EUROPE TANKER IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 24 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 25 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 26 EUROPE IBC IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 27 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 28 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 29 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 30 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 31 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 32 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 33 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 34 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 35 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 36 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 37 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 38 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 39 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 40 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 41 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 42 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 43 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 45 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 46 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 47 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 48 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 49 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 50 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 51 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY REGION, 2018-2032 (USD)

TABLE 52 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 53 EUROPE ALPHA-METHYLSTYRENE MARKET, BY COUNTRY, 2018-2032 (USD)

TABLE 54 EUROPE ALPHA-METHYLSTYRENE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 55 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 56 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 57 EUROPE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 58 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 59 EUROPE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 60 EUROPE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 61 EUROPE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 62 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 63 EUROPE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 64 EUROPE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 65 EUROPE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 66 EUROPE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 67 EUROPE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 68 EUROPE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 69 EUROPE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 70 EUROPE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 71 EUROPE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 72 EUROPE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 73 EUROPE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 74 EUROPE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 75 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 76 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 77 GERMANY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 78 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 79 GERMANY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 80 GERMANY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 81 GERMANY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 82 GERMANY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 83 GERMANY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 84 GERMANY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 85 GERMANY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 86 GERMANY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 87 GERMANY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 88 GERMANY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 89 GERMANY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 90 GERMANY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 91 GERMANY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 92 GERMANY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 93 GERMANY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 94 GERMANY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 95 U.K. ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 96 U.K. ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 97 U.K. ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 98 U.K. ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 99 U.K. ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 100 U.K. DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 101 U.K. ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 102 U.K. POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 103 U.K. POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 104 U.K. BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 105 U.K. ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 106 U.K. AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 107 U.K. ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 108 U.K. PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 109 U.K. BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 110 U.K. OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 111 U.K. AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 112 U.K. TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 113 U.K. FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 114 U.K. OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 115 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 116 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 117 FRANCE ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 118 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 119 FRANCE ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 120 FRANCE DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 121 FRANCE ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 122 FRANCE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 123 FRANCE POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 124 FRANCE BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 125 FRANCE ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 126 FRANCE AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 127 FRANCE ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 128 FRANCE PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 129 FRANCE BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 130 FRANCE OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 131 FRANCE AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 132 FRANCE TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 133 FRANCE FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 134 FRANCE OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 135 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 136 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 137 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 138 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 139 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 140 NETHERLANDS DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 141 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 142 NETHERLANDS POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 143 NETHERLANDS POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 144 NETHERLANDS BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 145 NETHERLANDS ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 146 NETHERLANDS AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 147 NETHERLANDS ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 148 NETHERLANDS PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 149 NETHERLANDS BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 150 NETHERLANDS OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 151 NETHERLANDS AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 152 NETHERLANDS TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 153 NETHERLANDS FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 154 NETHERLANDS OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 155 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 156 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 157 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 158 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 159 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 160 BELGIUM DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 161 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 162 BELGIUM POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 163 BELGIUM POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 164 BELGIUM BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 165 BELGIUM ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 166 BELGIUM AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 167 BELGIUM ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 168 BELGIUM PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 169 BELGIUM BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 170 BELGIUM OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 171 BELGIUM AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 172 BELGIUM TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 173 BELGIUM FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 174 BELGIUM OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 175 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 176 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 177 SPAIN ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 178 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 179 SPAIN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 180 SPAIN DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 181 SPAIN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 182 SPAIN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 183 SPAIN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 184 SPAIN BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 185 SPAIN ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 186 SPAIN AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 187 SPAIN ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 188 SPAIN PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 189 SPAIN BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 190 SPAIN OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 191 SPAIN AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 192 SPAIN TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 193 SPAIN FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 194 SPAIN OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 195 ITALY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 196 ITALY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 197 ITALY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 198 ITALY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 199 ITALY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 200 ITALY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 201 ITALY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 202 ITALY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 203 ITALY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 204 ITALY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 205 ITALY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 206 ITALY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 207 ITALY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 208 ITALY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 209 ITALY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 210 ITALY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 211 ITALY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 212 ITALY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 213 ITALY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 214 ITALY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 215 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 216 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 217 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 218 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 219 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 220 RUSSIA DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 221 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 222 RUSSIA POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 223 RUSSIA POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 224 RUSSIA BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 225 RUSSIA ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 226 RUSSIA AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 227 RUSSIA ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 228 RUSSIA PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 229 RUSSIA BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 230 RUSSIA OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 231 RUSSIA AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 232 RUSSIA TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 233 RUSSIA FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 234 RUSSIA OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 235 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 236 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 237 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 238 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 239 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 240 SWITZERLAND DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 241 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 242 SWITZERLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 243 SWITZERLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 244 SWITZERLAND BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 245 SWITZERLAND ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 246 SWITZERLAND AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 247 SWITZERLAND ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 248 SWITZERLAND PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 249 SWITZERLAND BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 250 SWITZERLAND OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 251 SWITZERLAND AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 252 SWITZERLAND TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 253 SWITZERLAND FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 254 SWITZERLAND OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 255 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 256 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 257 TURKEY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 258 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 259 TURKEY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 260 TURKEY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 261 TURKEY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 262 TURKEY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 263 TURKEY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 264 TURKEY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 265 TURKEY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 266 TURKEY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 267 TURKEY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 268 TURKEY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 269 TURKEY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 270 TURKEY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 271 TURKEY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 272 TURKEY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 273 TURKEY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 274 TURKEY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 275 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 276 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 277 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 278 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 279 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 280 SWEDEN DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 281 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 282 SWEDEN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 283 SWEDEN POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 284 SWEDEN BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 285 SWEDEN ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 286 SWEDEN AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 287 SWEDEN ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 288 SWEDEN PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 289 SWEDEN BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 290 SWEDEN OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 291 SWEDEN AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 292 SWEDEN TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 293 SWEDEN FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 294 SWEDEN OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 295 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 296 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 297 DENMARK ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 298 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 299 DENMARK ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 300 DENMARK DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 301 DENMARK ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 302 DENMARK POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 303 DENMARK POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 304 DENMARK BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 305 DENMARK ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 306 DENMARK AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 307 DENMARK ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 308 DENMARK PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 309 DENMARK BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 310 DENMARK OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 311 DENMARK AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 312 DENMARK TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 313 DENMARK FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 314 DENMARK OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 315 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 316 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 317 FINLAND ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 318 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 319 FINLAND ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 320 FINLAND DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 321 FINLAND ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 322 FINLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 323 FINLAND POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 324 FINLAND BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 325 FINLAND ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 326 FINLAND AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 327 FINLAND ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 328 FINLAND PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 329 FINLAND BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 330 FINLAND OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 331 FINLAND AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 332 FINLAND TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 333 FINLAND FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 334 FINLAND OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 335 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 336 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

TABLE 337 NORWAY ALPHA-METHYLSTYRENE MARKET, BY GRADE, 2018-2032 (USD)

TABLE 338 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING QUANTITY, 2018-2032 (USD)

TABLE 339 NORWAY ALPHA-METHYLSTYRENE MARKET, BY PACKAGING, 2018-2032 (USD)

TABLE 340 NORWAY DRUM IN ALPHA-METHYLSTYRENE MARKET, BY MATERIAL, 2018-2032 (USD)

TABLE 341 NORWAY ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 342 NORWAY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY RESIN, 2018-2032 (USD)

TABLE 343 NORWAY POLYMERS IN ALPHA-METHYLSTYRENE MARKET, BY PLASTIC, 2018-2032 (USD)

TABLE 344 NORWAY BULK AND SPECIALTY CHEMICALS IN ALPHA-METHYLSTYRENE MARKET, BY TYPE, 2018-2032 (USD)

TABLE 345 NORWAY ALPHA-METHYLSTYRENE MARKET, BY END-USE, 2018-2032 (USD)

TABLE 346 NORWAY AUTOMOTIVE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 347 NORWAY ELECTRONICS & ELECTRICAL IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 348 NORWAY PHARMACEUTICALS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 349 NORWAY BUILDING & CONSTRUCTION IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 350 NORWAY OIL & GAS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 351 NORWAY AGRICULTURE IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 352 NORWAY TEXTILES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 353 NORWAY FOOD & BEVERAGES IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 354 NORWAY OTHERS IN ALPHA-METHYLSTYRENE MARKET, BY APPLICATION, 2018-2032 (USD)

TABLE 355 REST OF EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (USD)

TABLE 356 REST OF EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY, 2018-2032 (TONS)

Lista de figuras

FIGURE 1 EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 2 EUROPE ALPHA-METHYLSTYRENE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALPHA-METHYLSTYRENE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALPHA-METHYLSTYRENE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALPHA-METHYLSTYRENE MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ALPHA-METHYLSTYRENE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ALPHA-METHYLSTYRENE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ALPHA-METHYLSTYRENE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID: EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FOUR SEGMENTS COMPRISE THE EUROPE ALPHA-METHYLSTYRENE MARKET, BY PURITY (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 EUROPE ALPHA-METHYLSTYRENE MARKET: SEGMENTATION

FIGURE 15 RISING DEMAND FOR ABS RESINS IN THE AUTOMOTIVE AND CONSUMER GOODS IS EXPECTED TO DRIVE THE EUROPE ALPHA-METHYLSTYRENE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MORE THAN 99% SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALPHA-METHYLSTYRENE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS: EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE ALPHA-METHYLSTYRENE MARKET

FIGURE 23 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PURITY, 2024

FIGURE 24 EUROPE ALPHA-METHYLSTYRENE MARKET: BY GRADE, 2024

FIGURE 25 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PACKAGING QUANTITY, 2024

FIGURE 26 EUROPE ALPHA-METHYLSTYRENE MARKET: BY PACKAGING, 2024

FIGURE 27 EUROPE ALPHA-METHYLSTYRENE MARKET: BY APPLICATION, 2024

FIGURE 28 EUROPE ALPHA-METHYLSTYRENE MARKET: BY END-USE, 2024

FIGURE 29 EUROPE ALPHA-METHYLSTYRENE MARKET: SNAPSHOT (2024)

FIGURE 30 EUROPE ALPHA-METHYLSTYRENE MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.