Europe Cancer Photodynamic Therapy Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

872.14 Million

USD

1,353.25 Million

2024

2032

USD

872.14 Million

USD

1,353.25 Million

2024

2032

| 2025 –2032 | |

| USD 872.14 Million | |

| USD 1,353.25 Million | |

|

|

|

|

Segmentación del mercado europeo de terapia fotodinámica contra el cáncer, por tipo de producto (fármacos fotosensibilizantes, dispositivos de terapia fotodinámica), por indicación oncológica (piel y oncología cutánea, cabeza y cuello, esófago, pulmón, vejiga, cuello uterino, próstata), por modalidad terapéutica (terapia única, terapia adyuvante, terapia paliativa, otras), por técnica de procedimiento (radioterapia externa, administración intracavitaria (endoscópica), administración intersticial (interna), otras), por estadio de la enfermedad (cáncer en estadio temprano, cáncer en estadio avanzado), por datos demográficos del paciente (geriátrico, adultos, pediátrico), por usuario final (hospitales, clínicas de dermatología y cáncer de piel, centros quirúrgicos ambulatorios, instituciones académicas y de investigación, otros), por canal de distribución (licitaciones directas, distribuidores externos, en línea, otros) - Tendencias del sector y previsiones hasta 2032

Tamaño del mercado europeo de terapia fotodinámica contra el cáncer

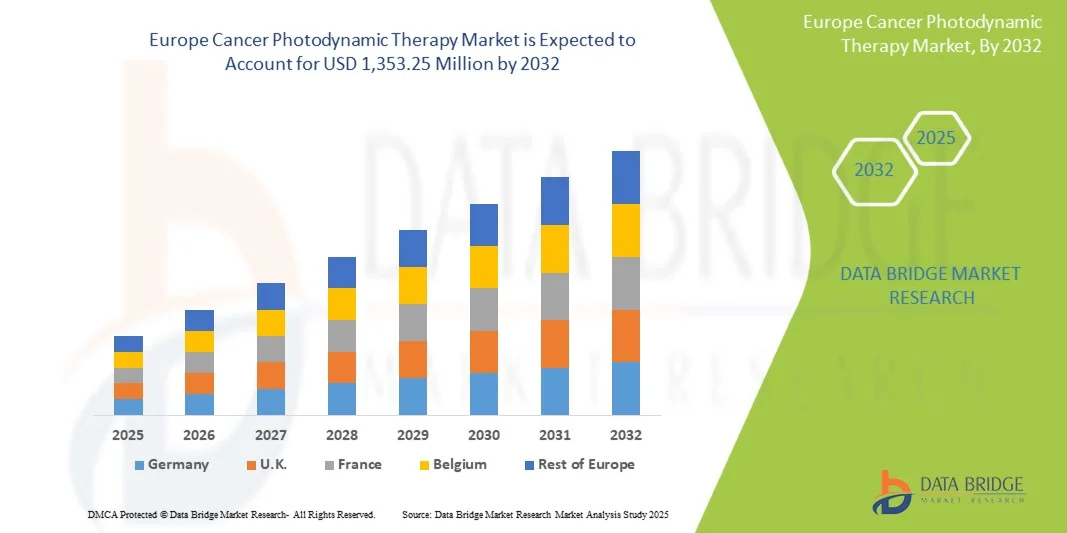

- El mercado europeo de terapia fotodinámica contra el cáncer se valoró en 872,14 millones de dólares en 2024 y se espera que alcance los 1.353,25 millones de dólares en 2032, con una tasa de crecimiento anual compuesta (TCAC) del 5,8% durante el período de previsión.

- El mercado está impulsado principalmente por la creciente prevalencia del cáncer, el aumento del gasto sanitario y la mayor concienciación sobre las opciones de tratamiento avanzadas. Las rápidas mejoras en la infraestructura sanitaria y la expansión de los centros especializados en el tratamiento del cáncer también contribuyen a este crecimiento.

- Este crecimiento se debe a factores como las iniciativas gubernamentales que promueven el diagnóstico precoz y las terapias innovadoras, la gran cantidad de pacientes y el aumento de las inversiones de empresas internacionales y locales en tecnologías de terapia fotodinámica.

Análisis del mercado europeo de terapia fotodinámica contra el cáncer

- El mercado de la terapia fotodinámica (TFD) contra el cáncer está experimentando un crecimiento constante, impulsado por la creciente prevalencia del cáncer, la mayor concienciación sobre los tratamientos no invasivos y los avances en fármacos fotosensibilizadores y tecnologías láser.

- Los mercados emergentes están experimentando una rápida adopción de la terapia fotodinámica (TFD), impulsada por iniciativas gubernamentales, el creciente gasto sanitario y el envejecimiento de la población. Sin embargo, los elevados costes del tratamiento y las limitaciones en el reembolso siguen siendo obstáculos importantes, mientras que las innovaciones en terapias combinadas y fotosensibilizadores específicos presentan importantes oportunidades de crecimiento.

- Se prevé que Alemania domine el mercado europeo de terapia fotodinámica contra el cáncer con la mayor cuota de ingresos, un 19,26%, en 2025. Este crecimiento se debe a su avanzada infraestructura sanitaria, la alta adopción de tratamientos innovadores, las fuertes inversiones en I+D, las políticas de reembolso favorables y el conocimiento de las terapias mínimamente invasivas.

- Se prevé que Alemania sea la región de mayor crecimiento en el mercado europeo de terapia fotodinámica contra el cáncer durante el período de pronóstico, con una tasa de crecimiento anual compuesto (TCAC) del 8,9%. Este crecimiento se debe al aumento de la prevalencia del cáncer, la expansión de la infraestructura sanitaria, la mayor concienciación sobre las terapias avanzadas y las iniciativas gubernamentales que promueven el diagnóstico precoz. Además, la creciente adopción de tecnologías innovadoras y el aumento de la renta disponible impulsan la demanda de terapia fotodinámica en la región.

- Se prevé que el segmento de fármacos fotosensibilizantes domine el mercado europeo de terapia fotodinámica contra el cáncer con una cuota de mercado del 75,15 % en 2025, impulsado por su papel fundamental en el tratamiento, su alta especificidad para atacar las células cancerosas, la creciente aprobación de nuevos fármacos, su mayor adopción en terapias combinadas y la continua I+D que impulsa una mayor eficacia y reduce los efectos secundarios.

Alcance del informe y segmentación del mercado europeo de terapia fotodinámica contra el cáncer

|

Atributos |

Información clave del mercado de la seda |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de la tendencia de los precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo de terapia fotodinámica contra el cáncer

“Integración con otras terapias contra el cáncer”

- La capacidad de la terapia fotodinámica (TFD) para producir la destrucción localizada de células tumorales al tiempo que estimula las respuestas inmunitarias la posiciona como un socio atractivo para el tratamiento multimodal del cáncer.

- Cada vez hay más evidencia que demuestra que la terapia fotodinámica (TFD) puede aumentar la liberación de antígenos tumorales, modular el microambiente tumoral y mejorar la infiltración o activación de células inmunitarias; mecanismos que pueden actuar en sinergia con los inhibidores de puntos de control inmunitario, las vacunas terapéuticas contra el cáncer, la quimioterapia o la radioterapia.

- La combinación de la terapia fotodinámica con terapias sistémicas puede convertir el control local en respuestas sistémicas duraderas, permitir reducciones de dosis de agentes tóxicos y ampliar las indicaciones (por ejemplo, enfermedad irresecable o metastásica).

- A medida que se multiplican las investigaciones clínicas y traslacionales, la integración con otras modalidades representa una vía de gran valor para ampliar la relevancia clínica y la comercialización de la PDT.

Dinámica del mercado europeo de terapia fotodinámica contra el cáncer

Conductor

“Aumento de la prevalencia del cáncer”

- La creciente prevalencia del cáncer a nivel mundial es uno de los principales factores que impulsan la demanda de terapias como la terapia fotodinámica (TFD).

- A medida que las poblaciones crecen y envejecen, y a medida que mejoran las herramientas de diagnóstico, se detectan más casos de cáncer cada año.

- Las mayores tasas de factores de riesgo como el consumo de tabaco, la obesidad, el sedentarismo, la contaminación atmosférica y las infecciones en los países de ingresos bajos y medios también están contribuyendo al aumento de la incidencia.

- Con un número creciente de pacientes que requieren modalidades de tratamiento localizado eficaces, menos invasivas y rentables, la terapia fotodinámica (TFD) se vuelve más atractiva.

- Esta creciente carga de cáncer ejerce presión sobre los sistemas de salud, creando una necesidad urgente de terapias que puedan mejorar los resultados, reducir los efectos secundarios y aplicarse de forma más generalizada.

Restricción/Desafío

“Profundidad limitada de penetración de la luz”

- Una limitación importante que dificulta la adopción generalizada y la eficacia de la terapia fotodinámica es la penetración restringida de la luz activadora en los tejidos humanos.

- Dado que los fotosensibilizadores deben activarse mediante luz de longitudes de onda específicas, la absorción y dispersión de la luz por el tejido reducen la profundidad a la que puede llegar la iluminación.

- Los fotosensibilizadores de luz visible suelen ser eficaces solo para tumores superficiales o de fácil acceso; los tumores más profundos o de mayor tamaño siguen presentando dificultades.

- Esta limitación conlleva una destrucción incompleta del tumor, requiere la administración de luz invasiva (por ejemplo, sondas de fibra, endoscopia), aumenta la complejidad del procedimiento y puede provocar malos resultados o recurrencia.

- Hasta que se logren avances que superen este obstáculo, la terapia fotodinámica (TFD) sigue estando limitada en cuanto al tipo de cánceres que puede tratar de forma no invasiva y eficaz.

Alcance del mercado europeo de terapia fotodinámica contra el cáncer

El mercado está segmentado en función del tipo de producto, la indicación del cáncer, la modalidad de terapia, la técnica del procedimiento, el estadio de la enfermedad, la demografía del paciente, el usuario final y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado europeo de terapia fotodinámica contra el cáncer se segmenta en fármacos fotosensibilizadores y dispositivos de terapia fotodinámica. Se prevé que en 2025, los fármacos fotosensibilizadores dominen el mercado con una cuota del 75,15 %, debido a su papel fundamental en la eficacia del tratamiento, su amplia aplicabilidad en diversos tipos de cáncer y sus versátiles formulaciones (intravenosa, tópica, oral, intravesical e intraperitoneal). Entre los factores clave que impulsan este dominio se encuentran la creciente prevalencia del cáncer, la mayor adopción de terapias mínimamente invasivas, las continuas innovaciones farmacológicas y las aprobaciones regulatorias, que en conjunto convierten a los fotosensibilizadores en la principal fuente de ingresos por encima de los dispositivos de terapia fotodinámica.

Los fármacos fotosensibilizantes constituyen el segmento de mayor crecimiento en el mercado europeo de terapia fotodinámica contra el cáncer, con una tasa de crecimiento anual compuesto (TCAC) del 5,9%, debido a la creciente adopción de tratamientos oncológicos dirigidos y mínimamente invasivos. La mayor concienciación sobre la eficacia de la terapia fotodinámica, sus menores efectos secundarios en comparación con las terapias convencionales y el desarrollo de fotosensibilizadores de última generación con mayor selectividad tumoral y penetración tisular más profunda impulsan la demanda. Asimismo, la investigación clínica y las aprobaciones de nuevos agentes fotosensibilizantes contribuyen a la expansión del mercado.

- Por indicación de cáncer

Según la indicación oncológica, el mercado europeo de terapia fotodinámica (TFD) para el cáncer se segmenta en oncología cutánea, cabeza y cuello, esófago, pulmón, vejiga, cuello uterino y próstata. Se prevé que en 2025, el segmento de oncología cutánea domine el mercado con una cuota del 52,21%, debido a la alta prevalencia del cáncer de piel, la creciente concienciación sobre la detección precoz y la eficacia de la TFD para lograr resultados estéticos superiores. Este segmento se beneficia de la amplia adopción de fármacos fotosensibilizantes y dispositivos de TFD, especialmente en pacientes geriátricos y adultos, que representan el mayor grupo demográfico. Además, la creciente demanda de terapias mínimamente invasivas y dirigidas para la queratosis actínica, el carcinoma basocelular y el carcinoma espinocelular, junto con políticas de reembolso favorables en regiones clave, refuerza aún más su liderazgo en el mercado frente a otras indicaciones oncológicas.

El segmento de Oncología Cutánea es el de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 6,3 % en el mercado europeo de terapia fotodinámica para el cáncer. Esto se debe a la creciente prevalencia del cáncer de piel, la mayor concienciación sobre el diagnóstico precoz y la preferencia por tratamientos mínimamente invasivos con menos efectos secundarios. La terapia fotodinámica ofrece una acción dirigida, una recuperación rápida y mejores resultados estéticos, lo que la convierte en una opción muy favorable para la oncología dermatológica. Además, los avances tecnológicos en fotosensibilizadores y sistemas de administración de luz están impulsando su adopción en este segmento.

- Por modalidad de terapia

Según la modalidad terapéutica, el mercado europeo de terapia fotodinámica (TFD) para el cáncer se segmenta en terapia independiente, terapia adyuvante, terapia paliativa y otras. Se prevé que en 2025, el segmento de terapia independiente domine el mercado con una cuota del 41,20 %, debido a su eficacia como tratamiento primario para cánceres localizados, incluidos los de piel, esófago y pulmón. Los factores clave que impulsan este dominio incluyen su alta eficacia, mínima invasividad, excelentes resultados estéticos y una creciente preferencia clínica por las terapias dirigidas. A nivel regional, Norteamérica y Europa lideran la adopción de la TFD independiente gracias a su avanzada infraestructura sanitaria, sus marcos de reembolso establecidos y la alta concienciación de los pacientes, mientras que los mercados emergentes de Asia-Pacífico experimentan una creciente adopción impulsada por el aumento de la prevalencia del cáncer, la expansión de las redes hospitalarias y el mayor acceso a tratamientos oncológicos modernos. Estas dinámicas regionales, junto con una mayor educación y concienciación sobre los beneficios de la TFD, refuerzan el dominio de la terapia independiente a nivel mundial.

La terapia fotodinámica oncológica en monoterapia es el segmento de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 6,2%, debido a su simplicidad, rentabilidad y menores efectos secundarios en comparación con las terapias combinadas. Permite el tratamiento dirigido de tumores sin necesidad de fármacos o intervenciones adicionales, lo que mejora la adherencia al tratamiento. Su creciente adopción en entornos ambulatorios, la mayor concienciación sobre los tratamientos mínimamente invasivos y los avances en fotosensibilizadores y sistemas de administración de luz impulsan aún más el rápido crecimiento de este segmento.

- Mediante técnica de procedimiento

Según la técnica empleada, el mercado europeo de terapia fotodinámica contra el cáncer se segmenta en haz externo, administración intracavitaria (endoscópica), administración intersticial (interna) y otras. Se prevé que en 2025, el segmento de haz externo domine el mercado con una cuota del 68,97 %, debido a su carácter no invasivo, facilidad de uso y eficacia en tumores superficiales. Su sólida adopción en Norteamérica y Europa, respaldada por una infraestructura sanitaria avanzada y políticas de reembolso favorables, junto con la creciente demanda en Asia-Pacífico derivada del aumento de la prevalencia y la concienciación sobre el cáncer, impulsa su liderazgo en el mercado.

El segmento de administración intracavitaria (endoscópica) es el de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 6,3 % en el mercado europeo de terapia fotodinámica contra el cáncer, ya que permite la administración mínimamente invasiva y dirigida de luz y fotosensibilizador a tumores de órganos huecos, reduce la exposición sistémica y los efectos secundarios, permite tratamientos repetibles, mejora el acceso al tumor en cánceres de esófago, bronquios y vejiga, y acorta el tiempo de recuperación.

- Por etapa de la enfermedad

Según la etapa de la enfermedad, el mercado europeo de terapia fotodinámica contra el cáncer se divide en cáncer en etapa temprana y cáncer en etapa avanzada. Se prevé que en 2025, el segmento de cáncer en etapa temprana domine el mercado con una cuota del 81,51 %, debido a la eficacia de la terapia fotodinámica para tratar tumores localizados, minimizar el daño al tejido sano y ofrecer mejores resultados estéticos. Este segmento se beneficia de una alta concienciación por parte de los pacientes, la preferencia por tratamientos mínimamente invasivos y su amplia adopción en Norteamérica y Europa, mientras que el aumento de las tasas de diagnóstico de cáncer y la expansión de la infraestructura oncológica en Asia-Pacífico refuerzan aún más su liderazgo en el mercado.

El cáncer en estadio temprano es el segmento de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 5,8 % en el mercado europeo de terapia fotodinámica oncológica. Esto se debe a la creciente adopción de tratamientos mínimamente invasivos, la mayor concienciación sobre la detección precoz y la mejora de los resultados para los pacientes con la terapia fotodinámica. Los cánceres en estadio temprano responden mejor a las terapias dirigidas, lo que se traduce en una mayor eficacia y menos efectos secundarios. Además, las iniciativas gubernamentales de apoyo y los avances en fotosensibilizadores y sistemas de administración de luz están impulsando una mayor penetración en el mercado de este segmento.

- Por datos demográficos del paciente

Según las características demográficas de los pacientes, el mercado europeo de terapia fotodinámica oncológica se segmenta en geriátrico, adultos y pediátrico. Se prevé que en 2025 el segmento geriátrico domine el mercado con una cuota del 67,12 %, debido a la mayor prevalencia de cáncer en adultos mayores, la mayor susceptibilidad a los cánceres de piel y cutáneos, y la preferencia por tratamientos mínimamente invasivos y dirigidos. La fuerte adopción de esta terapia en Norteamérica y Europa se ve respaldada por una infraestructura sanitaria avanzada y una mayor concienciación, junto con el creciente envejecimiento de la población.

El segmento geriátrico es el de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 6,0 % en el mercado europeo de terapia fotodinámica oncológica, debido a la mayor prevalencia de cáncer entre los adultos mayores. El envejecimiento debilita el sistema inmunitario y aumenta la susceptibilidad a diversos tipos de cáncer, lo que impulsa la demanda de tratamientos eficaces y mínimamente invasivos como la TFD. Además, la TFD ofrece menos efectos secundarios y una recuperación más rápida, lo que la hace idónea para pacientes de edad avanzada que podrían no tolerar terapias agresivas, impulsando así el crecimiento del mercado en este grupo demográfico.

- Por usuario final

Según el usuario final, el mercado europeo de terapia fotodinámica oncológica se segmenta en hospitales, clínicas de dermatología y cáncer de piel, centros quirúrgicos ambulatorios, instituciones académicas y de investigación, y otros. Se prevé que en 2025, el segmento de hospitales domine el mercado con una cuota del 41,33 %, gracias a su infraestructura integral, la disponibilidad de departamentos de oncología especializados y su capacidad para ofrecer tratamientos de terapia fotodinámica integrados. Tanto los hospitales públicos como los privados, en particular los de nivel 1 y 2 en Norteamérica y Europa, lideran la adopción de esta terapia debido a sus sistemas sanitarios avanzados y al apoyo de los sistemas de reembolso. El crecimiento de las redes hospitalarias y la expansión de los servicios oncológicos en Asia-Pacífico refuerzan aún más el dominio de los hospitales como principales usuarios finales de la terapia fotodinámica oncológica a nivel mundial.

El sector hospitalario es el de mayor crecimiento en el mercado europeo de terapia fotodinámica oncológica, con una tasa de crecimiento anual compuesto (TCAC) del 6,5%. Esto se debe a la creciente adopción de tratamientos oncológicos avanzados, el mayor flujo de pacientes y la disponibilidad de departamentos de oncología especializados. Los hospitales ofrecen servicios integrales de TFD, que incluyen diagnóstico, tratamiento y cuidados posteriores, lo que los convierte en la opción preferida frente a las clínicas independientes. Además, la creciente concienciación, las iniciativas gubernamentales y la cobertura de los seguros impulsan aún más la adopción de la TFD en el ámbito hospitalario.

- Por canal de distribución

Según el canal de distribución, el mercado europeo de terapia fotodinámica contra el cáncer se segmenta en licitación directa, distribuidores externos, venta en línea y otros. Se prevé que en 2025, el segmento de licitación directa domine el mercado con una cuota del 50,79 %, debido a las compras al por mayor realizadas por hospitales, programas de salud pública y grandes centros oncológicos, lo que garantiza la rentabilidad y el suministro fiable de fotosensibilizadores y dispositivos de terapia fotodinámica. La fuerte adopción en Norteamérica y Europa, respaldada por sistemas estructurados de compras hospitalarias y licitaciones de salud pública, junto con una creciente demanda institucional, también contribuye a este crecimiento.

El segmento de licitación directa es el de mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 6,0 % en el mercado europeo de terapia fotodinámica oncológica, debido al aumento de las adquisiciones de dispositivos PDT avanzados por parte de gobiernos y hospitales mediante contratos directos. Este enfoque garantiza la rentabilidad, una adquisición más rápida y un suministro fiable para programas de tratamiento oncológico a gran escala. Además, el aumento del gasto público en sanidad, las iniciativas gubernamentales para la atención oncológica y la preferencia por las compras centralizadas impulsan la adopción de la licitación directa frente a los distribuidores o los canales en línea.

Análisis regional del mercado europeo de terapia fotodinámica contra el cáncer

- Se prevé que Alemania domine el mercado europeo de terapia fotodinámica contra el cáncer con la mayor cuota de ingresos, un 19,26%, en 2025. Este crecimiento se debe a su avanzada infraestructura sanitaria, la alta adopción de tratamientos innovadores, las fuertes inversiones en I+D, las políticas de reembolso favorables y el conocimiento de las terapias mínimamente invasivas.

- Se prevé que Alemania sea la región de mayor crecimiento en el mercado europeo de terapia fotodinámica contra el cáncer durante el período de pronóstico, con una tasa de crecimiento anual compuesto (TCAC) del 8,9%. Este crecimiento se debe al aumento de la prevalencia del cáncer, la expansión de la infraestructura sanitaria, la mayor concienciación sobre las terapias avanzadas y las iniciativas gubernamentales que promueven el diagnóstico precoz. Además, la creciente adopción de tecnologías innovadoras y el aumento de la renta disponible impulsan la demanda de terapia fotodinámica en la región.

- Además, la presencia de los principales actores del mercado y de marcos regulatorios favorables acelera el crecimiento del mercado y las tasas de adopción en la región.

Perspectivas del mercado de la terapia fotodinámica contra el cáncer en el Reino Unido y Europa

El mercado de la terapia fotodinámica (TFD) contra el cáncer en el Reino Unido y Europa desempeña un papel fundamental en la industria europea de plásticos médicos, impulsado por su sólida infraestructura sanitaria, sus avanzadas capacidades de investigación y sus centros oncológicos de gran prestigio. La alta adopción de terapias innovadoras, el firme apoyo gubernamental al tratamiento del cáncer y los ensayos clínicos en curso impulsan el crecimiento del mercado. Además, la colaboración entre empresas farmacéuticas e instituciones de investigación en el Reino Unido acelera el desarrollo y la comercialización de la TFD, convirtiéndolo en un actor clave del mercado europeo.

Perspectivas del mercado de la terapia fotodinámica contra el cáncer en Alemania y Europa

Se prevé que el mercado de terapia fotodinámica (TFD) para el cáncer en Alemania y Europa experimente un crecimiento sostenido, impulsado por una infraestructura sanitaria avanzada, la alta adopción de tratamientos oncológicos innovadores y un sólido apoyo gubernamental a la investigación oncológica. La creciente concienciación sobre las terapias mínimamente invasivas, la mayor incidencia de cánceres como el de piel y pulmón, y las políticas de reembolso para terapias novedosas fomentan aún más su adopción. Además, la presencia de fabricantes clave de dispositivos de TFD y las colaboraciones en investigación aceleran la penetración en el mercado y el crecimiento sostenido.

Los principales líderes del mercado que operan en el mercado son:

- Novartis Pharma AG (Suiza)

- Galderma SA (Suiza)

- Bausch Health Companies Inc. (Canadá)

- Fotocurado ASA (Noruega)

- ADVANZ PHARMA Corp. (Reino Unido)

- Sun Pharmaceutical Industries Ltd. (India)

- Biofrontera AG (Alemania)

- LUMIBIRD SA (Francia)

- LUZITIN SA (Portugal)

- Lumeda Inc. (Suecia)

- ImPact Biotech (Israel)

- biolitec Holding GmbH & Co KG (Alemania)

- Corporación Modulight (Finlandia)

- (Canadá)

Últimos avances en el mercado europeo de la terapia fotodinámica contra el cáncer

- En febrero de 2023, la colaboración entre Galderma y German Medical Engineering (GME) representa un avance estratégico en el mercado de la dermatología y la terapia fotodinámica (TFD). Al combinar Metvix de Galderma, un fotosensibilizador líder para lesiones precancerosas y cánceres de piel no melanoma, con el dispositivo MultiLite de GME, esta alianza fortalece la oferta de tratamientos integrados de Galderma y amplía su capacidad para administrar tanto la TFD convencional con luz roja (TFD-C) como la TFD con luz diurna artificial (TFD-LDA), más cómoda para el paciente.

- En 2025, McKesson completó la adquisición de Core Ventures (Community Oncology Revitalization Enterprise Ventures), adquiriendo aproximadamente el 70% de la participación mayoritaria por unos 2.490 millones de dólares estadounidenses, para fortalecer su atención oncológica comunitaria a través de Florida Cancer Specialists & Research Institute.

- En 2025, Biofrontera AG transfirió todos los activos estadounidenses relacionados con Ameluz y RhodoLED a Biofrontera Inc., recibiendo una participación accionaria del 10% y regalías del 12-15% sobre las ventas de Ameluz en Estados Unidos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CANCER PHOTODYNAMIC THERAPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 INTRODUCTION

4.3.2 PRODUCTION SIDE ANALYSIS

4.3.2.1 PHOTOSENSITIZER MANUFACTURING

4.3.2.2 DEVICE MANUFACTURING

4.3.2.3 RESEARCH AND INNOVATION

4.3.3 CONSUMPTION SIDE ANALYSIS

4.3.3.1 CLINICAL APPLICATION

4.3.3.2 TREATMENT VOLUMES AND TRENDS

4.3.3.3 DOSAGE AND PROTOCOLS

4.3.4 PRODUCTION–CONSUMPTION DYNAMICS

4.3.4.1 SUPPLY CONSTRAINTS

4.3.4.2 REGIONAL OVERVIEW

4.3.4.3 FUTURE OUTLOOK

4.3.5 CONCLUSION

4.4 COST ANALYSIS BREAKDOWN

4.4.1 INTRODUCTION

4.4.2 DIRECT MEDICAL COSTS

4.4.2.1 COST OF PHOTOSENSITIZERS

4.4.2.2 LIGHT DELIVERY SYSTEMS

4.4.2.3 HEALTHCARE FACILITY CHARGES

4.4.3 INDIRECT COSTS

4.4.3.1 PATIENT-RELATED EXPENSES

4.4.3.2 POST-TREATMENT MONITORING

4.4.4 COMPARATIVE COST-EFFECTIVENESS

4.4.5 REIMBURSEMENT AND INSURANCE IMPACT

4.4.6 REGIONAL COST VARIATIONS

4.4.7 FUTURE COST TRENDS AND REDUCTION STRATEGIES

4.4.7.1 TECHNOLOGICAL ADVANCEMENTS

4.4.7.2 HEALTHCARE EFFICIENCY INITIATIVES

4.4.8 CONCLUSION

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 INTRODUCTION

4.5.2 NEXT-GENERATION PHOTOSENSITIZERS

4.5.3 ADVANCEMENTS IN LIGHT DELIVERY SYSTEMS

4.5.4 NANOTECHNOLOGY-ENABLED DELIVERY

4.5.5 COMBINATION THERAPIES AND IMMUNOMODULATION

4.5.6 DIGITAL INTEGRATION AND TREATMENT PLANNING

4.5.7 RECENT TRENDS AND OUTLOOK

4.5.8 CONCLUSION

4.6 VALUE CHAIN ANALYSIS

4.6.1 INTRODUCTION

4.6.2 RESEARCH & DEVELOPMENT

4.6.2.1 DISCOVERY OF PHOTOSENSITIZERS

4.6.2.2 DEVELOPMENT OF LIGHT DELIVERY SYSTEMS

4.6.2.3 CLINICAL TRIALS AND REGULATORY APPROVALS

4.6.3 MANUFACTURING

4.6.3.1 PRODUCTION OF PHOTOSENSITIZERS

4.6.3.2 FABRICATION OF LIGHT DELIVERY DEVICES

4.6.4 DISTRIBUTION & LOGISTICS

4.6.4.1 SUPPLY CHAIN MANAGEMENT

4.6.4.2 INTERNATIONAL TRADE AND MARKET ACCESS

4.6.5 CLINICAL APPLICATION

4.6.5.1 INTEGRATION INTO TREATMENT PROTOCOLS

4.6.5.2 TRAINING AND EDUCATION

4.6.6 POST-TREATMENT MONITORING & SUPPORT

4.6.6.1 FOLLOW-UP CARE

4.6.6.2 PATIENT SUPPORT SERVICES

4.6.7 TECHNOLOGICAL ADVANCEMENTS INFLUENCING THE PDT VALUE CHAIN

4.6.7.1 NANOTECHNOLOGY IN PDT

4.6.7.2 ARTIFICIAL INTELLIGENCE AND IMAGING

4.6.7.3 PERSONALIZED MEDICINE

4.6.8 CONCLUSION

4.7 VENDOR SELECTION CRITERIA

4.7.1 INTRODUCTION

4.7.2 CORE SELECTION CRITERIA

4.7.2.1 REGULATORY COMPLIANCE

4.7.2.2 CLINICAL EVIDENCE AND RESEARCH SUPPORT

4.7.2.3 TECHNICAL PERFORMANCE AND DEVICE COMPATIBILITY

4.7.2.4 QUALITY MANAGEMENT AND MANUFACTURING STANDARDS

4.7.2.5 SERVICE, TRAINING, AND AFTER-SALES SUPPORT

4.7.2.6 SUPPLY CHAIN RELIABILITY

4.7.3 RECENT TRENDS IN VENDOR SELECTION

4.7.4 RISK FACTORS AND VULNERABILITIES

4.7.5 KEY PERFORMANCE INDICATORS

4.7.6 STRATEGIC RECOMMENDATIONS

4.7.7 CONCLUSION

4.8 PATENT ANALYSIS

4.8.1 PATENT QUALITY AND STRENGTH

4.8.2 PATENT FAMILIES

4.8.3 LICENSING AND COLLABORATIONS

4.8.4 REGIONAL PATENT LANDSCAPE

4.8.5 IP STRATEGY AND MANAGEMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 INTRODUCTION

4.10.2 ECOSYSTEM ARCHITECTURE — KEY ACTORS AND ROLES

4.10.2.1 CORE TECHNOLOGY PROVIDERS

4.10.2.2 ENABLING INSTITUTIONS

4.10.3 VALUE CHAIN AND FUNCTIONAL FLOWS

4.10.3.1 RESEARCH AND DISCOVERY

4.10.3.2 CLINICAL DEVELOPMENT AND REGULATORY VALIDATION

4.10.3.3 MANUFACTURING AND QUALITY ASSURANCE

4.10.3.4 DISTRIBUTION, PROCUREMENT AND CLINICAL ADOPTION

4.10.4 MARKET ENABLERS AND INFRASTRUCTURE

4.10.4.1 SCIENTIFIC AND REGULATORY ENABLERS

4.10.4.2 REIMBURSEMENT AND HEALTH-ECONOMICS INFRASTRUCTURE

4.10.4.3 MANUFACTURING AND SUPPLY-CHAIN CAPACITY

4.10.5 INTERDEPENDENCIES AND STRATEGIC PARTNERSHIPS

4.10.5.1 ACADEMIA-INDUSTRY TECHNOLOGY TRANSFER

4.10.5.2 VERTICAL INTEGRATION AND CONTRACT MANUFACTURING

4.10.5.3 CLINICAL NETWORKS AND KOL ECOSYSTEMS

4.10.6 RISKS, CONSTRAINTS AND SYSTEMIC VULNERABILITIES

4.10.6.1 REGULATORY COMPLEXITY FOR COMBINED PRODUCTS

4.10.6.2 SUPPLY-CHAIN CONCENTRATION AND MATERIAL RISK

4.10.6.3 EVIDENCE AND REIMBURSEMENT UNCERTAINTY

4.10.6.4 CLINICAL OPERATIONAL BARRIERS

4.10.7 STRATEGIC IMPLICATIONS AND RECOMMENDATIONS

4.10.8 OUTLOOK — EVOLUTION OF THE ECOSYSTEM

4.10.9 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 INTRODUCTION

4.11.2 RECENT TECHNOLOGICAL INNOVATIONS

4.11.2.1 ADVANCED PHOTOSENSITIZERS

4.11.2.2 OXYGEN-SELF-SUFFICIENT PLATFORMS

4.11.2.3 ALTERNATIVE ACTIVATION MODALITIES

4.11.2.4 SMART NANOPLATFORMS

4.11.2.5 NOVEL CHEMICAL STRUCTURES

4.11.3 STRATEGIC INNOVATIONS IN DELIVERY SYSTEMS

4.11.3.1 LIGHT DELIVERY DEVICES

4.11.3.2 COMBINATION THERAPIES

4.11.3.3 IMAGING INTEGRATION

4.11.4 KEY CHALLENGES

4.11.5 STRATEGIC THEMES

4.11.6 STRATEGIC IMPLICATIONS FOR MARKET PLAYERS

4.11.7 RECOMMENDATIONS

4.11.8 OUTLOOK AND STRATEGIC RISKS

4.11.9 CONCLUSION

4.12 PRICING ANALYSIS

4.12.1 INTRODUCTION

4.12.2 COMPONENTS OF THE TOTAL TREATMENT PRICE

4.12.2.1 PHOTOSENSITIZING AGENT (DRUG) COSTS

4.12.2.2 DEVICE CAPITAL AND MAINTENANCE COST

4.12.2.3 CONSUMABLES AND PROCEDURAL OVERHEAD

4.12.2.4 INDIRECT AND DOWNSTREAM COSTS

4.12.3 PRICING MODELS AND APPROACHES

4.12.3.1 COST-PLUS AND MARKUP MODELS

4.12.3.2 VALUE-BASED AND OUTCOMES-LINKED PRICING

4.12.3.3 BUNDLED PAYMENTS AND PROCEDURAL TARIFFS

4.12.3.4 SUBSCRIPTION AND MANAGED-SERVICE MODELS FOR DEVICES

4.12.4 REIMBURSEMENT LANDSCAPE

4.12.4.1 UNITED STATES: MEDICARE AND COMMERCIAL PAYERS

4.12.4.2 EUROPE AND OTHER HIGH-INCOME MARKETS

4.12.4.3 EMERGING MARKETS AND OUT-OF-POCKET DYNAMICS

4.12.5 REGIONAL PRICE DIFFERENTIALS AND DRIVERS

4.12.5.1 MANUFACTURING FOOTPRINT AND SUPPLY-CHAIN EFFECTS

4.12.5.2 REGULATORY BURDEN AND MARKET ACCESS TIMELINES

4.12.5.3 CLINICAL PRACTICE PATTERNS AND REIMBURSEMENT POLICY

4.12.6 PRICE SENSITIVITY, ACCESS, AND EQUITY

4.12.6.1 PRICE ELASTICITY IN HOSPITAL PROCUREMENT

4.12.6.2 PATIENT ACCESS AND SOCIOECONOMIC BARRIERS

4.12.7 COMPETITIVE & STRATEGIC PRICING IMPLICATIONS

4.12.7.1 DIFFERENTIATION-BASED PREMIUM PRICING

4.12.7.2 PENETRATION PRICING AND VOLUME STRATEGIES

4.12.7.3 MANAGED ENTRY AGREEMENTS AND OUTCOMES GUARANTEES

4.12.8 RECOMMENDATIONS FOR STAKEHOLDERS

4.12.8.1 FOR MANUFACTURERS

4.12.8.2 FOR PROVIDERS AND HOSPITAL SYSTEMS

4.12.8.3 FOR PAYERS AND POLICYMAKERS

4.12.9 RISKS, UNCERTAINTIES, AND FUTURE PRICE PRESSURES

4.12.10 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 INTRODUCTION

5.2 TARIFF LANDSCAPE RELEVANT TO PDT PRODUCTS

5.2.1 CATEGORIES OF TRADE EXPOSURE

5.2.2 RECENT AND EMERGING TARIFF MEASURES OF CONSEQUENCE

5.3 DIRECT COST IMPACTS

5.3.1 INCREASED LANDED COSTS AND MARGIN COMPRESSION

5.3.2 PRICE VOLATILITY AND PROCUREMENT BUDGETING

5.4 SUPPLY-CHAIN & MANUFACTURING IMPLICATIONS

5.4.1 SUPPLIER DIVERSIFICATION AND RESHORING INCENTIVES

5.4.2 SOURCING OF HIGH-VALUE NANOMATERIALS AND COMPONENTS

5.4.3 REGULATORY AND QUALIFICATION COSTS FOR NEW SUPPLIERS

5.5 CLINICAL ACCESS, PRICING & REIMBURSEMENT EFFECTS

5.5.1 ACCESS RISK FOR PATIENTS AND PROVIDERS

5.5.2 REIMBURSEMENT PRESSURE AND HEALTH-ECONOMIC ASSESSMENTS

5.6 R&D, INNOVATION & COMPETITIVE IMPLICATIONS

5.6.1 DISRUPTION OF RESEARCH SUPPLIES AND COLLABORATION FLOWS

5.6.2 STRATEGIC REPOSITIONING AND COMPETITIVE ADVANTAGE

5.7 POLICY, COMPLIANCE & REGULATORY CONSIDERATIONS

5.7.1 USE OF WTO AND PREFERENTIAL TRADE RULES

5.7.2 TARIFF MITIGATION TOOLS AND ADVOCACY

5.8 RECOMMENDATIONS FOR STAKEHOLDERS

5.9 CONCLUSION

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.1.1 CERTIFIED STANDARDS

6.1.2 SAFETY STANDARDS

6.1.3 MATERIAL HANDLING & STORAGE

6.1.4 TRANSPORT & PRECAUTIONS

6.1.5 HAZARD IDENTIFICATION

6.1.6 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 GROWING PREFERENCE FOR MINIMALLY INVASIVE THERAPIES

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN PHOTOSENSITIZERS AND DEVICES

7.1.4 EXPANDING RESEARCH AND CLINICAL DEVELOPMENT PIPELINE

7.2 RESTRAINTS

7.2.1 LIMITED DEPTH OF LIGHT PENETRATION

7.2.2 HIGH COST OF TREATMENT

7.3 OPPORTUNITIES

7.3.1 INTEGRATION WITH OTHER CANCER THERAPIES

7.3.2 DEVELOPMENT OF NOVEL PHOTOSENSITIZERS

7.3.3 M&A AND PARTNERSHIPS WITH ONCOLOGY DEVICE/LASER FIRMS AND PHARMA

7.4 CHALLENGES

7.4.1 TUMOR HYPOXIA AS A BIOLOGICAL BARRIER TO PHOTODYNAMIC THERAPY EFFICACY

7.4.2 COMPETITION FROM ALTERNATIVE TREATMENTS

8 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 PHOTOSENSITIZER DRUGS

8.3 PHOTODYNAMIC THERAPY DEVICES

9 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION

9.1 OVERVIEW

9.2 SKIN & CUTANEOUS ONCOLOGY

9.3 HEAD & NECK

9.4 ESOPHAGAL

9.5 LUNG

9.6 BLADDER

9.7 CERVICAL

9.8 PROSTATE

10 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY

10.1 OVERVIEW

10.2 STANDALONE THERAPY

10.3 ADJUNCTIVE THERAPY

10.4 PALLIATION THERAPY

10.5 OTHERS

11 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE

11.1 OVERVIEW

11.2 EXTERNAL BEAM

11.3 INTRACAVITARY (ENDOSCOPIC) DELIVERY

11.4 INTERSTITIAL (INTERNAL) DELIVERY

11.5 OTHERS

12 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE

12.1 OVERVIEW

12.2 EARLY-STAGE CANCER

12.3 LATE-STAGE CANCER

13 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS

13.1 OVERVIEW

13.2 GERIATRIC

13.3 ADULTS

13.4 PEDIATRIC

14 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 DERMATOLOGY & SKIN-CANCER CLINICS

14.4 AMBULATORY SURGICAL CENTERS (ASCS)

14.5 ACADEMIC & RESEARCH INSTITUTES

14.6 OTHERS

15 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 THIRD PARTY DISTRIBUTORS

15.4 ONLINE

15.5 OTHERS

16 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION

16.1 EUROPE

16.1.1 GERMANY

16.1.2 U.K.

16.1.3 FRANCE

16.1.4 ITALY

16.1.5 SPAIN

16.1.6 RUSSIA

16.1.7 TURKEY

16.1.8 SWITZERLAND

16.1.9 BELGIUM

16.1.10 NETHERLANDS

16.1.11 SWEDEN

16.1.12 DENMARK

16.1.13 NORWAY

16.1.14 FINLAND

16.1.15 REST OF EUROPE

17 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 NOVERTIS AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 GALDERMA S. A.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 PHOTOCURE

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 ADVANZ PHARMA CORP.

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 AMERISOURCE BERGEN CORPORATION

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 BIOFRONTERA AG

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 BIOLITEC HOLDING GMBH & CO KG

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 CARDINAL HEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 HEMERION THERAPEUTICS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 IMPACT BIOTECH

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 INOVA

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 LUMIBIRD

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 LUZITIN

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 MCKESSON

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 MODULIGHT CORPORATION

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 ONCOLUX INC (FORMERLY LUMEDA INC.)

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SUN PHARMACEUTICAL INDUSTRIES LTD

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 THERALASE TECHNOLOGIES INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE STANDALONE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ADJUNCTIVE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE PALLIATION THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE EXTERNAL BEAM IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE INTRACAVITARY (ENDOSCOPIC) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE INTERSTITIAL (INTERNAL) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE EARLY-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE LATE-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE GERIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE ADULTS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE PEDIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE DERMATOLOGY & SKIN-CANCER CLINICS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE AMBULATORY SURGICAL CENTERS (ASCS) IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE ACADEMIC & RESEARCH INSTITUTES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE DIRECT TENDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE THIRD PARTY DISTRIBUTORS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE ONLINE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 GERMANY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 110 GERMANY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 GERMANY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 112 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 113 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 114 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 115 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 116 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 117 GERMANY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 GERMANY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 119 GERMANY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 120 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 U.K. PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 122 U.K. PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 123 U.K. PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.K. LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.K. ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 127 U.K. SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.K. SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 129 U.K. HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.K. ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.K. LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 FRANCE ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 156 FRANCE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 FRANCE SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 158 FRANCE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 FRANCE HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 160 FRANCE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 FRANCE ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 162 FRANCE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 FRANCE LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 164 FRANCE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 FRANCE BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 166 FRANCE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 FRANCE CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 168 FRANCE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 FRANCE PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 170 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 171 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 172 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 173 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 174 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 175 FRANCE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 FRANCE HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 FRANCE CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ITALY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 189 ITALY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ITALY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 191 ITALY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 ITALY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 193 ITALY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 ITALY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 195 ITALY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 ITALY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 197 ITALY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 ITALY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 199 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 200 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 201 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 202 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 203 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 204 ITALY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ITALY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 206 ITALY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 SPAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SPAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 216 SPAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SPAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 218 SPAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SPAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 220 SPAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SPAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 222 SPAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SPAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 224 SPAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SPAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 226 SPAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SPAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 228 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 229 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 231 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 232 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 233 SPAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SPAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 235 SPAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 238 RUSSIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 RUSSIA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 RUSSIA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 243 RUSSIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 RUSSIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 245 RUSSIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 RUSSIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 247 RUSSIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 RUSSIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 249 RUSSIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 RUSSIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 RUSSIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 TURKEY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 267 TURKEY PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 268 TURKEY PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 TURKEY LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 TURKEY ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 272 TURKEY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 TURKEY SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 274 TURKEY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 TURKEY HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 276 TURKEY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 TURKEY ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 278 TURKEY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 TURKEY LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 280 TURKEY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 TURKEY BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 282 TURKEY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 TURKEY CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 284 TURKEY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 TURKEY PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 286 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 287 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 288 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 289 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 290 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 TURKEY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 TURKEY HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 293 TURKEY CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 318 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 319 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 320 SWITZERLAND HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SWITZERLAND HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 322 SWITZERLAND CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 323 BELGIUM CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 BELGIUM PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 325 BELGIUM PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 326 BELGIUM PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)