Europe Cocoa Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.89 Billion

USD

16.24 Billion

2024

2032

USD

10.89 Billion

USD

16.24 Billion

2024

2032

| 2025 –2032 | |

| USD 10.89 Billion | |

| USD 16.24 Billion | |

|

|

|

|

Segmentación del mercado europeo del cacao por tipo de producto (cacao en polvo y torta, manteca de cacao, granos de cacao, licor y pasta de cacao, nibs de cacao y otros), naturaleza (convencional y orgánico), tipo de cacao (cacao forastero, cacao trinitario y cacao criollo), canal de distribución (directo e indirecto) y aplicación (suplementos dietéticos, alimentos y bebidas, productos farmacéuticos y cosméticos y cuidado personal): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado europeo del cacao

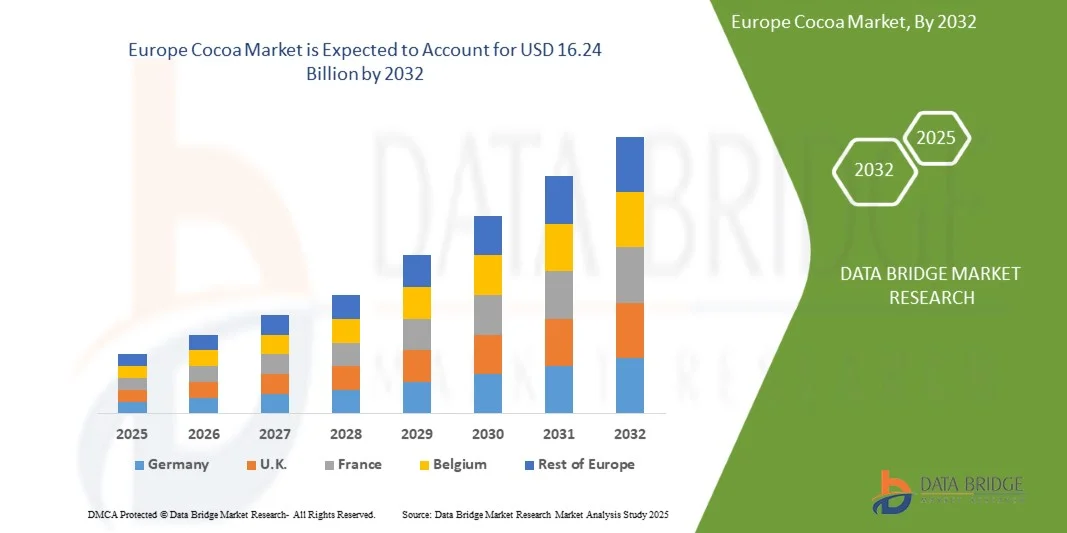

- El mercado europeo del cacao se valoró en 10.890 millones de dólares en 2024 y se espera que alcance los 16.240 millones de dólares en 2032, con una tasa de crecimiento anual compuesta (TCAC) del 5,2% durante el período de previsión.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de los consumidores por productos de cacao prémium, orgánicos y de origen sostenible, impulsada por una mayor conciencia de los beneficios para la salud asociados al chocolate negro y al cacao rico en flavonoides. La creciente preferencia por ingredientes con etiquetas limpias y producidos éticamente está incentivando a los fabricantes a adoptar cadenas de suministro transparentes y trazables, lo que mejora la confianza del consumidor y el valor de la marca.

- Además, la creciente aplicación del cacao en confitería, bebidas, cosméticos y nutracéuticos, junto con las constantes innovaciones en formulaciones de productos como las variantes de chocolate vegetal y bajas en azúcar, están acelerando su adopción en el mercado. Estos factores convergentes están impulsando significativamente el crecimiento de la industria del cacao y posicionándola como un segmento clave dentro del sector de alimentos y bebidas.

Análisis del mercado europeo del cacao

- El mercado europeo del cacao está impulsado significativamente por la creciente demanda de chocolate y productos de confitería en diversos segmentos de consumidores. El chocolate sigue siendo uno de los productos de consumo más populares a nivel mundial, con un aumento constante tanto en las economías desarrolladas como en las emergentes. El cacao, principal materia prima para la producción de chocolate, experimenta un incremento directo de la demanda en consonancia con el crecimiento de la industria chocolatera. Factores como la evolución de los estilos de vida de los consumidores, el aumento de la renta disponible y la expansión de los segmentos de chocolate premium y artesanal impulsan aún más esta tendencia.

- Entre las tendencias emergentes se incluyen la creciente demanda de productos veganos y de origen vegetal a base de cacao, la innovación en alimentos funcionales y fortificados a base de cacao y la creciente popularidad de las variedades de cacao de origen único y especiales.

- Se prevé que Alemania domine el mercado europeo del cacao, con una cuota de mercado del 24,63 % en 2025, debido a la creciente demanda de productos veganos y de origen vegetal a base de cacao.

- Se prevé que Alemania sea el país de mayor crecimiento en el mercado europeo del cacao durante el período de pronóstico, con una tasa de crecimiento anual compuesto (TCAC) del 5,7%, impulsada por la creciente popularidad de las bebidas a base de cacao y su amplia gama de productos, que incluye chocolate caliente tradicional, bebidas de cacao listas para consumir, leche saborizada, batidos de proteínas y bebidas funcionales para el bienestar.

- Se prevé que el segmento de cacao en polvo y en torta domine el mercado europeo del cacao, con una cuota de mercado del 35,06 % en 2025, debido a la creciente aplicación del cacao en cosméticos y productos de cuidado personal.

Alcance del informe y segmentación del mercado europeo del cacao

|

Atributos |

Información clave del mercado del cacao |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de cuota de mercado de marcas, encuestas a consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado europeo del cacao

“Aumento de la demanda de chocolate y productos de confitería”

- Una de las tendencias más destacadas en el mercado europeo del cacao está impulsada significativamente por la creciente demanda de productos de chocolate y confitería en diversos segmentos de consumidores.

- El cacao, materia prima principal para la producción de chocolate, experimenta un aumento directo en la demanda, en consonancia con el crecimiento de la industria chocolatera. Factores como la evolución de los estilos de vida de los consumidores, el aumento de la renta disponible y la expansión de los segmentos de chocolate premium y artesanal impulsan aún más esta tendencia.

- La innovación de productos por parte de los fabricantes de confitería, incluyendo la introducción de sabores exóticos, chocolates funcionales con beneficios para la salud y afirmaciones sobre el origen sostenible, ha ampliado el atractivo para el consumidor.

Dinámica del mercado europeo del cacao

Conductor

“Mayor concienciación sobre los beneficios del cacao para la salud y sus propiedades antioxidantes”

- Una de las tendencias clave que impulsan el mercado europeo del cacao es la creciente concienciación sobre las propiedades beneficiosas del cacao para la salud, que se ha convertido en un fuerte motor para el mercado.

- El cacao es naturalmente rico en flavonoides, polifenoles y otros antioxidantes que están relacionados con diversos beneficios para la salud, incluyendo una mejor salud cardiovascular, una mejor circulación sanguínea y un menor riesgo de enfermedades crónicas.

- Por ejemplo, en noviembre de 2024, investigadores de la Universidad de Birmingham revelaron que consumir cacao con alto contenido de flavonoles después de una comida rica en grasas mejoraba considerablemente el flujo sanguíneo y el rendimiento vascular hasta por 90 minutos, incluso durante situaciones de estrés mental, lo que sugiere un papel protector para la salud cardiovascular en condiciones dietéticas difíciles.

- La tendencia hacia el bienestar, junto con el auge de la atención médica preventiva, está ampliando las aplicaciones del cacao a categorías como bebidas a base de cacao, proteínas en polvo y productos de belleza que promueven el cuidado personal. A medida que los consumidores se informan más sobre el valor nutricional del cacao, se espera que el mercado se beneficie de una demanda sostenida, creando nuevas oportunidades de crecimiento en múltiples industrias más allá de la fabricación tradicional de chocolate.

- Los fabricantes están aprovechando esta tendencia para promocionar productos de “chocolate negro” y con “alto contenido de cacao”, que contienen niveles más elevados de compuestos beneficiosos en comparación con el chocolate con leche.

Oportunidades

“Aumento de la demanda de productos veganos y de origen vegetal a base de cacao”

- La creciente adopción de estilos de vida veganos y basados en plantas, impulsada por factores éticos, ambientales y de salud, está aumentando la demanda de productos a base de cacao sin lácteos.

- El cacao, al ser de origen vegetal, se alinea bien con las tendencias veganas en las industrias de confitería, panadería y bebidas.

- Las innovaciones de productos como los chocolates negros sin lácteos, las bebidas de cacao de origen vegetal y las cremas de cacao aptas para veganos están ganando popularidad.

- El auge de las alternativas vegetales a la leche (leche de almendras, avena y soja) favorece el desarrollo de bebidas cremosas y deliciosas a base de cacao sin lácteos.

- En 2023, Barry Callebaut informó de una fuerte aceptación de las marcas de chocolate vegano que utilizan manteca de cacao y leches vegetales, atrayendo a consumidores preocupados por la salud y la sostenibilidad.

- Las marcas prémium ofrecen productos de cacao veganos, orgánicos, de origen ético y envasados de forma sostenible, un mercado que está prosperando especialmente en Europa.

Restricción/Desafío

“Creciente competencia de ingredientes alternativos en la producción de confitería”

- Una de las principales limitaciones que afectan al mercado europeo del cacao es la creciente competencia de ingredientes alternativos utilizados en la producción de confitería. El aumento de los precios del cacao, junto con la incertidumbre en el suministro causada por el cambio climático y las enfermedades de los cultivos, ha impulsado a los fabricantes a buscar sustitutos rentables.

- Ingredientes como la algarroba, los aromas sintéticos de cacao y otras alternativas de origen vegetal se están adoptando cada vez más para sustituir parcial o totalmente al cacao en la elaboración de chocolates, productos de panadería y bebidas.

- La tecnología alimentaria avanzada ha permitido el desarrollo de imitadores del sabor del cacao y mezclas que utilizan menos cacao sin sacrificar el sabor ni la textura. Este cambio se observa especialmente entre las marcas de confitería de gran consumo que buscan mantener precios competitivos sin renunciar al atractivo para el consumidor.

- Si bien estas alternativas tal vez no reproduzcan por completo las cualidades premium del cacao, su creciente aceptación en ciertos segmentos de consumidores supone un desafío para la demanda de cacao.

Alcance del mercado europeo del cacao

El mercado europeo del cacao se segmenta por tipo de producto, naturaleza, tipos de cacao, canal de distribución y aplicación.

- Tipo de producto

Según el tipo de producto, el mercado se segmenta en cacao en polvo y torta, manteca de cacao, granos de cacao, licor y pasta de cacao, nibs de cacao y otros. Se prevé que en 2025, el segmento de cacao en polvo y torta domine el mercado con una cuota del 35,06 %. Este dominio se debe a su uso generalizado en la fabricación de chocolate, panadería y elaboración de bebidas. Su facilidad de almacenamiento, larga vida útil y compatibilidad con procesos de producción a gran escala lo convierten en una opción muy popular entre las empresas procesadoras de alimentos.

Se prevé que el segmento de granos de cacao crezca con la mayor tasa de crecimiento anual compuesto (TCAC) del 6,1% durante el período de pronóstico debido a la creciente demanda de chocolates premium y de origen único, el mayor uso de cacao crudo en aplicaciones artesanales y la creciente preferencia de los consumidores por ingredientes naturales mínimamente procesados.

- Naturaleza

Según su origen, el mercado se divide en convencional y orgánico. Se prevé que en 2025 el segmento convencional domine el mercado con una cuota del 93,07 %. Este dominio se debe principalmente a su rentabilidad, sus cadenas de suministro consolidadas y su capacidad de producción a gran escala. El cacao convencional ofrece una calidad constante, lo que lo convierte en la opción ideal para los fabricantes que se dirigen al mercado de masas.

Se prevé que el segmento orgánico crezca con la mayor tasa de crecimiento anual compuesto (TCAC) del 5,9% durante el período de pronóstico, debido a la creciente conciencia de los consumidores sobre la salud y el bienestar.

- Tipo de cacao

Según el tipo de cacao, el mercado se segmenta en cacao forastero, cacao trinitario y cacao criollo. Se prevé que en 2025 el segmento del cacao forastero domine el mercado con una cuota del 82,91 %. Este dominio se debe a su resistencia, calidad constante e idoneidad para la producción en masa. Su cultivo regional favorece las economías de escala y satisface las necesidades de los grandes productores de chocolate. Su robustez también lo hace menos susceptible a enfermedades, lo que garantiza un suministro estable y precios asequibles, impulsando su rápida adopción y un crecimiento sostenido del mercado.

El cacao Forastero experimentará el mayor crecimiento anual compuesto (CAGR) del 5,3% durante el período de previsión, debido a su alto rendimiento, menor coste de producción y cultivo generalizado.

- Canal de distribución

Según el canal de distribución, el mercado se segmenta en indirecto y directo. Se prevé que en 2025 el segmento indirecto domine con una cuota de mercado del 77,34 %. Este dominio se sustenta en la presencia de redes consolidadas de venta minorista, mayorista y distribución que facilitan el acceso a los productos de cacao tanto en mercados desarrollados como emergentes. Los canales indirectos ofrecen una logística más eficiente, una mayor cobertura geográfica y economías de escala, especialmente para los fabricantes que distribuyen a través de supermercados, mayoristas y proveedores de servicios de alimentación, lo que impulsa su rápida adopción y un crecimiento sostenido del mercado.

Se prevé que el segmento indirecto crezca con la mayor tasa de crecimiento anual compuesto (CAGR) del 5,7% durante el período de pronóstico, impulsado por la rápida expansión de las plataformas de comercio electrónico y la creciente demanda de conveniencia.

- Solicitud

Según su aplicación, el mercado se segmenta en suplementos dietéticos, alimentos y bebidas, productos farmacéuticos, cuidado personal y cosméticos. Se prevé que en 2025, el segmento de suplementos dietéticos domine el mercado con una cuota del 37,53 %. Este dominio se atribuye al creciente reconocimiento de los beneficios del cacao para la salud, como sus propiedades antioxidantes, su efecto positivo en el estado de ánimo y su apoyo cardiovascular. Los suplementos a base de cacao se integran cada vez más en dietas saludables y productos de nutrición funcional, sobre todo en los mercados desarrollados, donde el bienestar preventivo es una tendencia importante, lo que impulsa su rápida adopción y un crecimiento constante del mercado.

Se prevé que el segmento de alimentos y bebidas crezca con la mayor tasa de crecimiento anual compuesto (TCAC) del 5,9% durante el período de pronóstico, impulsado por la creciente demanda de bocadillos a base de cacao, productos de panadería y alternativas lácteas.

Análisis regional del mercado europeo del cacao

- Se prevé que Alemania domine el mercado europeo del cacao, ostentando la mayor cuota de ingresos con un 24,63% en 2025, debido a la creciente demanda de productos veganos y de origen vegetal a base de cacao.

- Se prevé que Alemania sea el país de mayor crecimiento en el mercado durante el período de pronóstico, con una tasa de crecimiento anual compuesto (TCAC) del 5,7%, impulsada por la creciente popularidad de las bebidas a base de cacao y su amplia gama de productos, que incluye chocolate caliente tradicional, bebidas de cacao listas para beber, leche saborizada, batidos de proteínas y bebidas funcionales para el bienestar.

- El mercado europeo del cacao experimenta un crecimiento sostenido gracias a varios factores clave. Uno de los principales impulsores es la creciente demanda de productos derivados del cacao, como chocolate, confitería y productos de panadería, impulsada por el aumento de la población urbana y el incremento de la renta disponible. A medida que las preferencias de los consumidores se inclinan hacia dietas de estilo occidental y alimentos indulgentes, el consumo de chocolate y productos con cacao se está generalizando, sobre todo en los centros urbanos de la región. Además, la expansión del sector de alimentos y bebidas, junto con un creciente interés en alimentos funcionales y suplementos dietéticos, está impulsando aún más el uso del cacao en diversas aplicaciones. La región también está presenciando un aumento en el consumo de cacao orgánico y de origen ético, impulsado por una mayor concienciación sobre la salud y la sostenibilidad entre los consumidores. Asimismo, los avances en la infraestructura de la cadena de suministro y el aumento de las inversiones en plantas de procesamiento de cacao locales están favoreciendo el crecimiento del mercado al mejorar la disponibilidad del producto y reducir la dependencia de las importaciones.

Perspectivas del mercado europeo del cacao

Se prevé que Europa crezca a una tasa de crecimiento anual compuesta (TCAC) del 5,2% entre 2025 y 2032, impulsada principalmente por la alta y constante demanda de los consumidores de chocolate y productos derivados del cacao, respaldada por una cultura del chocolate profundamente arraigada y una industria de procesamiento de alimentos altamente desarrollada.

Perspectivas del mercado del cacao en Alemania y Europa

Alemania sigue dominando el mercado gracias a su elevado consumo per cápita de chocolate y a su consolidada industria de confitería. Alberga a algunos de los mayores fabricantes de chocolate de Europa y funciona como un importante centro de procesamiento y distribución. Se prevé que Alemania experimente el mayor crecimiento, con una tasa de crecimiento anual compuesto (TCAC) del 5,7 % entre 2025 y 2032, debido a la creciente demanda de productos de cacao orgánicos, de comercio justo y de origen sostenible. Los consumidores alemanes están cada vez más preocupados por el origen ético, la sostenibilidad ambiental y el impacto social del cultivo de cacao.

Perspectivas del mercado del cacao en los Países Bajos y Europa

Los Países Bajos siguen siendo un actor clave en el mercado europeo del cacao gracias a su posición como el mayor importador y procesador de granos de cacao del mundo. El puerto de Ámsterdam constituye una puerta de entrada fundamental para las importaciones de cacao a Europa, lo que convierte al país en un importante centro para el comercio, el almacenamiento y el procesamiento de este cereal. Se prevé que los Países Bajos registren un crecimiento sostenido con una tasa de crecimiento anual compuesto (TCAC) del 5,5 % entre 2025 y 2032, impulsado por el aumento de las inversiones en el abastecimiento sostenible de cacao, la innovación en ingredientes derivados del cacao y la fuerte demanda de los fabricantes de alimentos y bebidas de toda Europa. Las empresas neerlandesas lideran los esfuerzos mundiales en materia de trazabilidad y abastecimiento ético, en consonancia con las preferencias de los consumidores por la transparencia, el comercio justo y la responsabilidad ambiental.

Cuota de mercado del cacao en Europa

La industria del cacao está liderada principalmente por empresas bien establecidas, entre las que se incluyen :

- Neogric Limited (Reino Unido)

- Fábrica de chocolate Macofa (India)

- Toutan SA (Francia)

- Olam International Limited (Singapur)

- Compañía de chocolate Blommer (EE. UU.)

- Cacao Deprama (Indonesia)

- PT GRAND KAKAO INDONESIA (Indonesia)

- Jaya Saliem Industri (Indonesia)

- INDCRE SA (España)

- PT ANDOW NGENSOWIDJAJA (Indonesia)

- INDOCOCOA (PT KENDO AGRI NUSANTARA) (Indonesia)

- Guan Chong Berhad (Malasia)

- GRUPO ECUAKAO LTD (Ecuador)

- CocoaCraft (India)

- Sucden (Francia)

- Cargill, Incorporated (EE. UU.)

- Compañía Procesadora de Cacao Limitada (CPC) (Ghana)

- Cacao poco común (EE. UU.)

- Puratos (Bélgica)

- ECOM Agroindustrial Corp. Limited (Suiza)

- Kokoa Kamili (Tanzania)

- Barry Callebaut (Suiza)

- JB Cocoa (Malasia)

- Centro del cacao (Reino Unido)

- Duque de O (Parte del grupo Baronie.com) (Bélgica)

- Natra (España)

- MONER CACAO, SA (España)

- Chocolate Pacari (Ecuador)

- Spa Icam (Italia)

- ALTINMARKA (Turquía)

Últimos avances en el mercado europeo del cacao

- En octubre de 2024, ICAM Cioccolato lanzó una tienda online rediseñada, desarrollada en Shopify, que ofrece una experiencia de compra intuitiva, segura y optimizada para dispositivos móviles. La plataforma exhibe los productos de ICAM, Vanini y Otto, haciendo hincapié en la sostenibilidad y la inclusión. Con la posibilidad de crear perfiles de clientes para un marketing personalizado, el proyecto se desarrolló en colaboración con Ecommerce School y contó con el apoyo de campañas promocionales para impulsar la visibilidad y las ventas online.

- En junio de 2025, Kokoa Kamili, empresa que opera en el valle de Kilombero, Tanzania, desde 2013, reafirmó su misión de posicionar al país como líder europeo en cacao de alta calidad. El cofundador Siman Bindra destacó que, si bien Tanzania produce solo unas 14.000 toneladas anuales —muy por debajo de los principales productores como Costa de Marfil y Ghana—, la fortaleza del país reside en su genética, clima y calidad. Kokoa Kamili colabora con 1.500 agricultores con certificación orgánica, ha distribuido más de 600.000 plantones y está desarrollando programas de injerto a partir de árboles de alto rendimiento y sabor excepcional. La empresa ha ganado el premio Cacao de Excelencia en tres ocasiones y busca el reconocimiento de la Organización Internacional del Cacao por su estatus de cacao de alta calidad para asegurar mejores precios para todo el cacao tanzano. Ante los desafíos del cambio climático, Kokoa Kamili explora el riego con energía solar y aboga por que las estrategias nacionales de riego incluyan el cacao. Bindra también pretende romper la idea errónea de que África solo produce cacao a granel y de baja calidad, haciendo hincapié en la probada excelencia de Tanzania en los mercados premium.

- En marzo de 2025, Natra Cacao SL lanzó un proyecto, con el apoyo del Fondo Europeo de Desarrollo Regional (FEDER) y la Agencia Valenciana de Innovación, para desarrollar productos fermentados análogos al cacao para la producción de chocolate. La iniciativa explora materias primas vegetales alternativas con el mismo perfil organoléptico y funcionalidad que el cacao fermentado, con el objetivo de crear productos de valor añadido con beneficios para la salud, cadenas de suministro más cortas y resilientes, y una menor dependencia de los volátiles mercados europeos del cacao. El proyecto también busca reducir la huella de carbono, mitigar los riesgos de deforestación e impulsar la innovación en toda la cadena de valor del grupo Natra.

- En junio de 2025, Touton muestra cómo la colaboración, la inteligencia operativa y la innovación focalizada han impulsado resultados significativos en la protección forestal, la producción sostenible y la participación comunitaria durante el ciclo agrícola 2023-2024. El informe destaca logros como la distribución de cientos de miles de árboles mejorados de cacao y de usos múltiples en Ghana y Costa de Marfil, y la capacitación de más de 112.000 agricultores en prácticas climáticamente inteligentes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 SOURCE: DBMR ANALYSIS

4.7.2 PRODUCT QUALITY AND CERTIFICATION

4.7.3 SOURCING AND TRACEABILITY

4.7.4 PRICING AND COST COMPETITIVENESS

4.7.5 SUSTAINABILITY AND ETHICAL PRACTICES

4.7.6 PRODUCTION CAPACITY AND RELIABILITY

4.7.7 COMPLIANCE WITH REGULATIONS

4.7.8 LOGISTICS AND SUPPLY CHAIN EFFICIENCY

4.7.9 REPUTATION AND REFERENCES

4.8 BRAND OUTLOOK

4.8.1 MARKET ROLES & POSITIONING (WHO PLAYS WHICH ROLE?)

4.8.2 PRODUCT & PACKAGING DIFFERENCES

4.8.3 SUSTAINABILITY & FARMER PROGRAMS (CRITICAL FOR REPUTATION & SUPPLY SECURITY)

4.8.4 STRENGTHS, COMPETITIVE EDGES, AND CUSTOMER FIT

4.8.5 RISKS & MARKET PRESSURES (INDUSTRY-WIDE)

4.8.6 STRATEGIC TAKEAWAYS FOR REPORT READERS

4.8.7 WHY THIS LAYOUT?

4.8.8 BARRY CALLEBAUT — FULL-SPECTRUM CHOCOLATE LEADER

4.8.9 CARGILL — CUSTOM SOLUTIONS + INDUSTRY SCALE

4.8.10 OLAM — ORIGINATION & PROCESSING BACKBONE

4.8.11 GUAN CHONG (GCB) — EFFICIENT PROCESSOR

4.8.12 BLOMMER — NORTH AMERICA PROCESSOR & SERVICE

4.9 CONSUMER BUYING BEHAVIOUR

4.9.1 PROBLEM RECOGNITION AND AWARENESS

4.9.2 INFORMATION SEARCH

4.9.3 EVALUATION OF ALTERNATIVES

4.9.4 PURCHASE DECISION

4.9.5 POST-PURCHASE BEHAVIOUR

4.9.6 DEMOGRAPHIC INSIGHTS

4.9.7 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 INITIAL INVESTMENT AND CAPITAL EXPENDITURE (CAPEX)

4.10.2 INSTALLATION AND INFRASTRUCTURE ADAPTATION

4.10.3 ENERGY CONSUMPTION AND OPERATIONAL COST (OPEX)

4.10.4 MAINTENANCE AND SERVICING

4.10.5 OVERHEAD AND INDIRECT COSTS

4.10.6 STRATEGIC INVESTMENT CONSIDERATIONS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGINS SCENARIO

4.12.1 FACTORS INFLUENCING PROFITABILITY

4.12.2 VALUE ADDITION:

4.12.3 QUALITY & CERTIFICATION:

4.12.4 MARKET DEMAND:

4.12.5 BUSINESS MODEL:

4.13 RAW MATERIAL COVERAGE

4.13.1 COCOA BEANS (PRIMARY RAW MATERIAL)

4.13.2 SUGAR (SWEETENING AGENT)

4.13.3 COCOA BUTTER (FAT COMPONENT)

4.13.4 MILK POWDER (DAIRY INGREDIENT)

4.13.5 LECITHIN (EMULSIFIER)

4.14 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.14.1 ADVANCED COCOA BEAN ROASTING TECHNOLOGIES

4.14.2 AUTOMATED COCOA PROCESSING AND PRODUCTION SYSTEMS

4.14.3 AI-DRIVEN QUALITY CONTROL AND DEFECT DETECTION

4.14.4 ENERGY-EFFICIENT GRINDING AND CONCHING EQUIPMENT

4.14.5 SMART PACKAGING AND SHELF-LIFE EXTENSION SOLUTIONS

4.14.6 DIGITAL SUPPLY CHAIN AND TRACEABILITY INTEGRATION

4.15 PATENT ANALYSIS –

4.15.1 PATENT QUALITY AND STRENGTH

4.15.2 PATENT FAMILIES

4.15.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.15.4 REGION PATENT LANDSCAPE

4.15.5 IP STRATEGY AND MANAGEMENT

4.15.6 PATENT ANALYSIS – TOP APPLICANTS

5 TARIFFS & IMPACT ON THE EUROPE COCOA MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 BEANS AND RATIOS FOR HISTORY AND FORECAST AND WITH CONCRETE DATA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS

8.1.2 GROWING AWARENESS OF COCOA’S HEALTH AND ANTIOXIDANT BENEFITS

8.1.3 EXPANDING USE OF COCOA IN COSMETICS AND PERSONAL CARE

8.1.4 GROWTH IN COCOA-BASED BEVERAGES

8.2 RESTRAINTS

8.2.1 GROWING COMPETITION FROM ALTERNATIVE INGREDIENTS IN CONFECTIONERY PRODUCTION

8.2.2 STRINGENT REGULATORY STANDARDS FOR COCOA QUALITY AND SAFETY COMPLIANCE

8.3 OPPORTUNITIES

8.3.1 RISING DEMAND FOR VEGAN AND PLANT-BASED COCOA-BASED PRODUCTS

8.3.2 INNOVATION IN COCOA-BASED FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

8.3.3 INCREASING POPULARITY OF SINGLE-ORIGIN AND SPECIALTY COCOA VARIETIES

8.4 CHALLENGE

8.5 CLIMATE CHANGE REDUCING COCOA YIELDS AND AFFECTING QUALITY

8.5.1 LIMITED FARMER ACCESS TO MODERN FARMING TOOLS AND TRAINING

9 EUROPE COCOA MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 COCOA POWDER & CAKE

9.3 COCOA BUTTER

9.4 COCOA BEANS

9.5 COCOA LIQUOR & PASTE

9.6 COCOA NIBS

9.7 OTHERS

10 EUROPE COCOA MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 EUROPE COCOA MARKET, BY TYPE OF COCOA

11.1 OVERVIEW

11.2 FORASTERO COCOA

11.3 TRINITARIO COCOA

11.4 CRIOLLO COCOA

12 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.3 DIRECT

13 EUROPE COCOA MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 DIETARY SUPPLEMENTS

13.3 FOOD AND BEVERAGE

13.4 BEVERAGE

13.5 PHARMACEUTICALS

13.6 PERSONAL CARE AND COSMETICS

14 EUROPE COCOA MARKET, BY REGION

14.1 EUROPE

14.1.1 GERMANY

14.1.2 NETHERLANDS

14.1.3 FRANCE

14.1.4 U.K.

14.1.5 BELGIUM

14.1.6 ITALY

14.1.7 SWITZERLAND

14.1.8 SPAIN

14.1.9 POLAND

14.1.10 RUSSIA

14.1.11 TURKEY

14.1.12 SWEDEN

14.1.13 DENMARK

14.1.14 NORWAY

14.1.15 FINLAND

14.1.16 REST OF EUROPE

15 EUROPE COCOA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 OLAM GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 BARRY CALLEBAUT

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ECOM AGROINDUSTRIAL CORP. LIMITED.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS/NEWS

17.4 PURATOS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 GUAN CHONG BERHAD (GCB)

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS/NEWS

17.6 JB COCOA

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 RECENT DEVELOPMENT

17.7 ALTINMARKA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 BLOMMER CHOCOLATE COMPANY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CARGILL, INCORPORATED.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 COCOA HUB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS/NEWS

17.11 COCOA PROCESSING COMPANY LIMITED (CPC)

17.11.1 COMPANY SNAPSHOT

17.11.2 RECENT FINANCIALS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 COCOACRAFT

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS/NEWS

17.13 DEPRAMA COCOA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 DUC D’O

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS/NEWS

17.15 ECUAKAO GROUP LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS/NEWS

17.16 ICAM SPA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 INDCRE S.A

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATES

17.18 INDOCOCOA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS/NEWS

17.19 JAYA SALIEM INDUSTRI

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KOKOA KAMILI

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS/NEWS

17.21 MACOFA CHOCOLATE FACTORY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MONER COCOA, S.A.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 NATRA

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS/NEWS

17.24 NEOGRIC LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 PACARI

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT UPDATES

17.26 PT ANDOW NGENSOWIDJAJA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS/NEWS

17.27 PT GRAND KAKAO INDONESIA

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TOUTON S.A.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 UNCOMMON CACOA .

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 FIGURE 2. COMPANY VS BRAND OVERVIEW

TABLE 3 NUMBER OF PATENTS PER YEAR

TABLE 4 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 5 TOP PATENT APPLICANTS.

TABLE 6 REGULATORY COVERAGE

TABLE 7 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 9 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 10 EUROPE COCOA BUTTER IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (TONS)

TABLE 13 EUROPE COCOA MARKET, BY NATURE, 2025-2032 (PRICE USD/KG)

TABLE 14 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (TONS)

TABLE 16 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (PRICE USD/KG)

TABLE 17 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 18 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (TONS)

TABLE 19 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (PRICE USD/KG)

TABLE 20 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE BEVERAGES IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (TONS)

TABLE 35 EUROPE COCOA MARKET, BY APPLICATION, 2025-2032 (PRICE USD/KG)

TABLE 36 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE COCOA MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 38 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 40 EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 41 EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 44 EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 45 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 47 EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 48 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 50 EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 51 EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 56 EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 69 GERMANY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 70 GERMANY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 72 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 73 GERMANY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 74 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 76 GERMANY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 77 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 79 GERMANY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 80 GERMANY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 84 GERMANY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 85 GERMANY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 98 NETHERLANDS COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 99 NETHERLANDS COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 101 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 102 NETHERLANDS COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 103 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 104 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 105 NETHERLANDS COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 106 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 108 NETHERLANDS COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 109 NETHERLANDS INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 113 NETHERLANDS COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 114 NETHERLANDS FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NETHERLANDS PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 FRANCE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 128 FRANCE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 131 FRANCE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 132 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 134 FRANCE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 135 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 137 FRANCE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 138 FRANCE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 FRANCE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 142 FRANCE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 143 FRANCE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 FRANCE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 FRANCE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 FRANCE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 FRANCE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 FRANCE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 FRANCE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 FRANCE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 FRANCE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 FRANCE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 FRANCE PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 156 U.K. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 157 U.K. COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 160 U.K. COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 161 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 162 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 163 U.K. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 164 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 166 U.K. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 167 U.K. INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.K. OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 171 U.K. COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 172 U.K. FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.K. BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.K. CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.K. CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.K. CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 U.K. WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.K. DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.K. PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 U.K. BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.K. DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.K. PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 185 BELGIUM COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 186 BELGIUM COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 188 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 189 BELGIUM COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 190 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 192 BELGIUM COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 193 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 194 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 195 BELGIUM COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 196 BELGIUM INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 200 BELGIUM COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 201 BELGIUM FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 BELGIUM BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 BELGIUM CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BELGIUM CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BELGIUM CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 206 BELGIUM WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 BELGIUM DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BELGIUM PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 BELGIUM BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 BELGIUM DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 BELGIUM PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 214 ITALY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 215 ITALY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 ITALY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 217 ITALY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 218 ITALY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 219 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 221 ITALY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 222 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 224 ITALY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 225 ITALY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 229 ITALY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 230 ITALY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ITALY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 ITALY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 ITALY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ITALY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 235 ITALY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 ITALY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ITALY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 ITALY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ITALY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 ITALY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 243 SWITZERLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 244 SWITZERLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 246 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 247 SWITZERLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 248 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 250 SWITZERLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 251 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 253 SWITZERLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 254 SWITZERLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 258 SWITZERLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 259 SWITZERLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SWITZERLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 264 SWITZERLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SWITZERLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWITZERLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 272 SPAIN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 273 SPAIN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 275 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 276 SPAIN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 277 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 279 SPAIN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 280 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 281 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 282 SPAIN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 283 SPAIN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 287 SPAIN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 288 SPAIN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SPAIN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SPAIN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SPAIN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SPAIN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 301 POLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 302 POLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 POLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 304 POLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 305 POLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 306 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 307 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 308 POLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 309 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 311 POLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 312 POLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 POLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 316 POLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 317 POLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 330 RUSSIA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 331 RUSSIA COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 333 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 334 RUSSIA COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 335 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 336 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 337 RUSSIA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 338 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 339 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 340 RUSSIA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 341 RUSSIA INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 RUSSIA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 344 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 345 RUSSIA COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 346 RUSSIA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 RUSSIA BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 RUSSIA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 RUSSIA CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 RUSSIA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 351 RUSSIA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 RUSSIA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 RUSSIA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 RUSSIA BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 RUSSIA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 RUSSIA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 359 TURKEY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 360 TURKEY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 362 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 363 TURKEY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 364 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 365 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 366 TURKEY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 367 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 368 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 369 TURKEY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 370 TURKEY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 TURKEY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 373 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 374 TURKEY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 375 TURKEY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 TURKEY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 TURKEY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 TURKEY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 TURKEY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 380 TURKEY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 TURKEY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 TURKEY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 TURKEY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 TURKEY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 TURKEY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 388 SWEDEN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 389 SWEDEN COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 391 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 392 SWEDEN COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 393 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 394 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 395 SWEDEN COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 396 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 397 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 398 SWEDEN COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 399 SWEDEN INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 SWEDEN OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 402 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 403 SWEDEN COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 404 SWEDEN FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 SWEDEN BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 SWEDEN CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 SWEDEN CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 SWEDEN CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 409 SWEDEN WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 SWEDEN DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 SWEDEN PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 SWEDEN BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 SWEDEN DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 SWEDEN PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 417 DENMARK COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 418 DENMARK COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 420 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 421 DENMARK COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 422 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 423 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 424 DENMARK COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 425 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 426 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 427 DENMARK COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 428 DENMARK INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 DENMARK OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 431 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 432 DENMARK COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 433 DENMARK FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 DENMARK BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 DENMARK CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 DENMARK CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 DENMARK CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 438 DENMARK WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 DENMARK DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 DENMARK PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 DENMARK BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 DENMARK DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 DENMARK PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 446 NORWAY COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 447 NORWAY COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 449 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 450 NORWAY COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 451 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 452 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 453 NORWAY COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 454 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 455 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 456 NORWAY COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 457 NORWAY INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 NORWAY OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 460 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 461 NORWAY COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 462 NORWAY FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 NORWAY BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 NORWAY CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 465 NORWAY CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 466 NORWAY CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 467 NORWAY WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 468 NORWAY DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 469 NORWAY PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 NORWAY BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 NORWAY DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 NORWAY PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 474 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 475 FINLAND COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 476 FINLAND COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 477 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 478 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 479 FINLAND COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 480 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 481 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 482 FINLAND COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 483 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 484 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 485 FINLAND COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 486 FINLAND INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 FINLAND OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 489 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 490 FINLAND COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 491 FINLAND FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 FINLAND BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 493 FINLAND CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 FINLAND CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 FINLAND CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 496 FINLAND WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 FINLAND DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 FINLAND PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 FINLAND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 FINLAND DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 501 FINLAND PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 502 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 503 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 504 REST OF EUROPE COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 505 REST OF EUROPE COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 506 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 507 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 508 REST OF EUROPE COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 509 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 510 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 511 REST OF EUROPE COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 512 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 513 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 514 REST OF EUROPE COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 515 REST OF EUROPE INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 516 REST OF EUROPE OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 517 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 518 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 519 REST OF EUROPE COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 520 REST OF EUROPE FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 521 REST OF EUROPE BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 522 REST OF EUROPE CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 523 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 524 REST OF EUROPE CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 525 REST OF EUROPE WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 526 REST OF EUROPE DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 527 REST OF EUROPE PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 528 REST OF EUROPE BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 529 REST OF EUROPE DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)