Europe Fishery And Aquaculture Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.53 Billion

USD

22.08 Billion

2024

2032

USD

12.53 Billion

USD

22.08 Billion

2024

2032

| 2025 –2032 | |

| USD 12.53 Billion | |

| USD 22.08 Billion | |

|

|

|

|

Segmentación del mercado europeo de la pesca y la acuicultura por tipo de producto (equipos y piensos), sistema de producción acuícola (sistemas terrestres, sistemas acuáticos, sistemas de reciclaje, sistemas agrícolas integrados, etc.), entorno (agua marina, dulce y salobre), aplicación (larvas, juveniles y adultos), escala de producción (pequeña, mediana y gran escala), categoría (orgánica y convencional), origen (vegetal y animal), forma (seca, húmeda y húmeda), función (valor racional de la pesca y la acuicultura, potenciador de la energía, mejora de la digestibilidad, conservación de piensos, gestión de citotóxicos, etc.), tecnología (pesca y acuicultura inteligentes, pesca y acuicultura convencionales), especias (pescado, crustáceos y moluscos): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de la pesca y la acuicultura en Europa

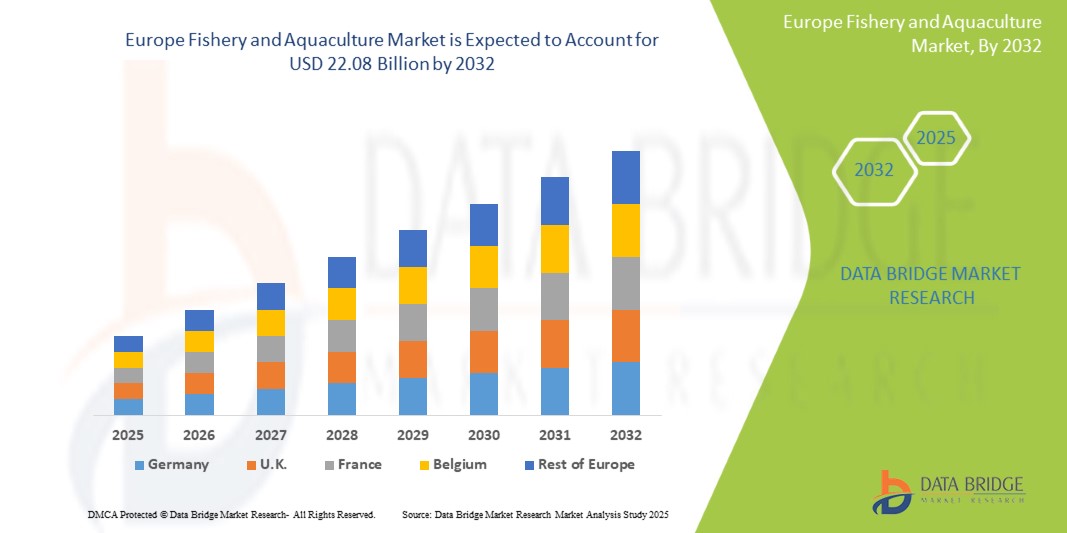

- El tamaño del mercado europeo de pesca y acuicultura se valoró en USD 12,53 mil millones en 2024 y se espera que alcance los USD 22,08 mil millones para 2032 , con una CAGR del 7,4% durante el período de pronóstico.

- El mercado europeo de la pesca y la acuicultura está impulsado por la creciente demanda de productos del mar en Europa, el crecimiento de la población, los avances en la tecnología de la acuicultura y la creciente concienciación sobre la salud.

- Las prácticas sostenibles, el apoyo gubernamental y la expansión de las oportunidades de exportación impulsan aún más el crecimiento del mercado y atraen inversiones significativas al sector.

Análisis del mercado europeo de la pesca y la acuicultura

- El mercado europeo de la pesca y la acuicultura es un segmento vital de la industria agroalimentaria europea, que abarca la cría, la recolección y el procesamiento de organismos acuáticos, como peces, mariscos y algas. Constituye una importante fuente de proteínas y medios de vida, especialmente en las regiones costeras y en desarrollo. Este mercado incluye la pesca de captura silvestre y la acuicultura (cría de peces), esta última cobrando importancia debido a la preocupación por la sobrepesca y las exigencias de sostenibilidad.

- Los actores del mercado se centran en innovaciones tecnológicas como los sistemas de recirculación acuícola (RAS), la cría selectiva y el manejo de enfermedades para mejorar la productividad y la eficiencia ambiental. Estos avances son cruciales para satisfacer la creciente demanda europea de productos del mar, impulsada por el crecimiento demográfico, la urbanización y la transición hacia opciones alimentarias ricas en proteínas y bajas en grasas.

- Se proyecta que Noruega dominará el mercado europeo de la pesca y la acuicultura con una cuota de mercado del 24,19 % para 2025, y se prevé que muestre el crecimiento más rápido durante el período de pronóstico. La acuicultura noruega prospera gracias a sus extensas y limpias zonas costeras, su I+D pionera y su tecnología avanzada. Las exportaciones centradas en el salmón, un sólido ecosistema de proveedores de valor añadido y la confianza de los inversores globales, en un contexto de sólida regulación e innovación sostenible, impulsan el crecimiento.

- Se prevé que el segmento de alimentos acuícolas lidere el mercado europeo de la pesca y la acuicultura para 2025, con la mayor cuota de mercado (60,81 %), gracias a su escalabilidad, potencial de sostenibilidad y capacidad para satisfacer una demanda constante. Este segmento se ve cada vez más influenciado por la preferencia de los consumidores por productos del mar trazables, ecoetiquetados y de cultivo, lo que refuerza su papel en la seguridad alimentaria europea.

Alcance del informe y segmentación del mercado de la pesca y la acuicultura en Europa

|

Atributos |

Mercado europeo de la pesca y la acuicultura: Perspectivas clave |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado pesquero y acuícola europeo

Innovación en productos de acuicultura funcional y nutrición personalizada

- El mercado europeo de pesca y acuicultura está experimentando una transformación notable a medida que aumenta la demanda de productos del mar funcionales y una nutrición personalizada adaptada a las necesidades de salud individuales, estilos de vida dietéticos y preferencias de sostenibilidad.

- Esta tendencia está impulsando a los productores a ir más allá de las ofertas tradicionales y desarrollar productos acuícolas enriquecidos que contengan ácidos grasos omega-3, probióticos, colágeno y otros ingredientes bioactivos que promueven la salud del corazón, la función cerebral, la inmunidad y el bienestar general.

- Por ejemplo, las empresas están innovando con alimentos fortificados para peces y métodos de cultivo controlados que mejoran los perfiles nutricionales de especies cultivadas como el salmón, la tilapia y el camarón, haciéndolos más atractivos para los consumidores preocupados por la salud.

- Un creciente interés en los alimentos acuícolas de origen vegetal, los ingredientes derivados de algas y la acuicultura libre de antibióticos está reforzando esta tendencia, alineándose con las demandas de los consumidores de etiquetas limpias y conciencia ecológica.

- El auge de la nutrición personalizada en el sector de los productos del mar también está impulsado por los avances en inteligencia artificial y genómica, que permiten soluciones dietéticas personalizadas que incorporan tipos de productos del mar o nutrientes específicos para objetivos de salud individuales.

- Esto refleja un cambio más amplio del consumidor hacia la atención médica preventiva, la transparencia de las etiquetas limpias y las fuentes de alimentos ricos en nutrientes, posicionando a la acuicultura funcional como un contribuyente fundamental a las dietas modernas y alineadas con la salud.

Dinámica del mercado de la pesca y la acuicultura en Europa

Conductor

Creciente demanda en Europa de fuentes de alimentos sostenibles y ricos en proteínas

- A medida que la población europea crece y los ingresos aumentan, particularmente en los mercados emergentes, el consumo de productos del mar se está acelerando debido a su alto contenido de proteínas, su bajo perfil de grasas y sus nutrientes esenciales como los omega-3.

- La acuicultura ha surgido como la fuente de proteína animal de más rápido crecimiento en Europa, respaldada por avances tecnológicos que permiten una piscicultura eficiente y a gran escala con un impacto ambiental mínimo.

- Los consumidores buscan cada vez más productos del mar certificados y de origen sostenible, lo que impulsa a los principales minoristas y marcas a invertir en cadenas de suministro de acuicultura rastreables y con etiqueta ecológica.

- En enero de 2025, según un informe de la Alianza Europea de Acuicultura, más del 55% de los productos del mar consumidos en Europa procederán de la acuicultura, lo que refleja su creciente dominio y fiabilidad en comparación con la pesca de captura salvaje.

- Además, las empresas están adoptando sistemas de recirculación de acuicultura (RAS), acuicultura en alta mar y monitoreo basado en inteligencia artificial para mejorar los rendimientos y al mismo tiempo reducir la huella ecológica, factores clave en la expansión del mercado.

- La acuicultura también ofrece estabilidad en la producción, evitando problemas estacionales y de sobrepesca que afectan a las poblaciones silvestres, convirtiéndola en una fuente de proteínas más confiable y escalable para el futuro.

Restricción/Desafío

Altos costos operativos y de cumplimiento para los pequeños productores acuícolas

- Si bien la demanda de productos acuícolas premium y sustentables está aumentando, el costo de cumplir con los estándares de calidad, seguridad y sustentabilidad presenta desafíos importantes, especialmente para los productores pequeños y medianos.

- Los gastos incluyen alimentación especializada, sistemas de filtración de agua, medidas de prevención de enfermedades, monitoreo ambiental, mano de obra y certificaciones (por ejemplo, ASC, BAP, Orgánico).

- En septiembre de 2024, un estudio del Banco Mundial señaló que el costo de establecer un sistema de acuicultura de recirculación de escala media podría superar el millón de dólares, lo que lo hace inaccesible para operadores más pequeños sin respaldo financiero.

- Además, los frecuentes cambios regulatorios en torno al impacto ambiental, el uso de antibióticos y el bienestar animal aumentan la carga sobre los productores, particularmente en regiones con apoyo institucional limitado.

- Las barreras tecnológicas y la falta de infraestructura digital también obstaculizan la adopción de herramientas de agricultura inteligente, como el monitoreo mediante inteligencia artificial, la alimentación automatizada y el control preciso de la calidad del agua.

- Estos desafíos restringen la innovación, la escalabilidad de la producción y la capacidad de los actores más pequeños de participar en mercados de exportación de alto valor, lo que conduce a una concentración del mercado entre empresas más grandes y bien capitalizadas.

- Sin un mejor acceso a la financiación, la capacitación y los incentivos gubernamentales, muchas pequeñas empresas de acuicultura corren el riesgo de quedar rezagadas en el esfuerzo de modernización de la industria.

Alcance del mercado europeo de la pesca y la acuicultura

El mercado está segmentado en función del tipo de producto, sistema de producción acuícola, entorno, aplicación, venta de producción, categoría, fuente, forma, función, tecnología y especie.

• Por tipo de producto

Según el tipo de producto, el mercado europeo de la pesca y la acuicultura se segmenta en piensos y equipos para la acuicultura. Se espera que los piensos para la acuicultura dominen la cuota de mercado con un 60,81 % en 2025 y se prevé que presenten el crecimiento más rápido durante el período de pronóstico. La creciente demanda mundial de piensos para peces de alta calidad y ricos en nutrientes impulsa este crecimiento. Las innovaciones en proteínas vegetales, probióticos y aditivos funcionales están mejorando la salud de los peces, incrementando las tasas de crecimiento y promoviendo prácticas acuícolas sostenibles. Estos avances satisfacen las necesidades de los sistemas de cultivo intensivo, a la vez que se alinean con las preferencias de los consumidores con conciencia ecológica, impulsando su adopción generalizada en las operaciones comerciales. La presión regulatoria para reducir la sobrepesca y la dependencia del pescado silvestre como ingrediente para piensos ha acelerado la transición hacia formulaciones alternativas. Los fabricantes de piensos para la acuicultura están invirtiendo fuertemente en I+D para mejorar la digestibilidad y minimizar la escorrentía de nutrientes, que contribuye a la contaminación del agua. La integración de herramientas digitales para la formulación de piensos y el control de la dosificación optimiza aún más la eficiencia. Los equipos, aunque en menor proporción, respaldan la automatización en la alimentación, la aireación y el monitoreo, especialmente en configuraciones de acuicultura inteligente.

• Por Sistema de Producción Acuícola

Según el sistema de producción acuícola, el mercado europeo de la pesca y la acuicultura se segmenta en sistemas acuáticos, terrestres, de reciclaje, integrados y otros. Los sistemas acuáticos representaron la mayor participación (69,94%) en 2025 y se prevé que presenten el mayor crecimiento durante el período de pronóstico. Este segmento incluye estanques, tanques y jaulas marinas que utilizan cuerpos de agua naturales para la piscicultura. Estos sistemas son favorecidos por su rentabilidad, escalabilidad y capacidad para proporcionar entornos naturales de cría. Con un control de calidad del agua manejable y menores costos de infraestructura, atraen importantes inversiones de operadores comerciales. Su adaptabilidad a diversas especies y regiones permite altos rendimientos, lo que los convierte en la opción preferida para la expansión sostenible y a gran escala de la acuicultura. Los estanques siguen siendo el método más común en los países en desarrollo debido a las bajas barreras de entrada y al uso de los recursos hídricos existentes. Los países costeros invierten cada vez más en sistemas de jaulas marinas para reducir el impacto ambiental y aumentar la capacidad de producción. Los subsidios gubernamentales y las colaboraciones público-privadas apoyan la modernización de las piscifactorías tradicionales acuáticas. Estos sistemas se benefician del intercambio natural de agua, reduciendo la necesidad de filtración artificial.

• Por medio ambiente

En función del entorno, el mercado europeo de la pesca y la acuicultura se segmenta en agua dulce, marina y salobre. El agua dulce representó la mayor participación (57,06%) en 2025 y se prevé que presente el mayor crecimiento durante el período de pronóstico. Este crecimiento se debe a la abundancia de recursos hídricos continentales, como ríos, lagos y embalses, especialmente en las regiones en desarrollo. Los sistemas de agua dulce enfrentan menos desafíos técnicos en comparación con los entornos marinos o salobres, lo que los hace accesibles y rentables. Especies como la tilapia, la carpa y el bagre prosperan en estas condiciones y se consumen ampliamente a nivel local. Los bajos costos operativos, junto con la fuerte demanda interna y el apoyo gubernamental, hacen de la acuicultura de agua dulce un factor clave para la seguridad alimentaria y los medios de vida rurales. China, India y Egipto son productores líderes, que aprovechan vastas cuencas fluviales y redes de riego. Los pequeños agricultores a menudo integran la piscicultura con el cultivo de arroz, lo que aumenta la productividad por unidad de superficie. Se están adoptando sistemas de recirculación en las granjas de agua dulce para conservar el agua y mejorar la bioseguridad.

• Por aplicación

Según la aplicación, el mercado europeo de la pesca y la acuicultura se segmenta en adultos, juveniles y larvas. Los adultos representaron la mayor participación (75,23%) en 2025 y se prevé que presenten el crecimiento más rápido durante el período de pronóstico. Este predominio se debe a la alta demanda de peces maduros, listos para el mercado y aptos para el consumo directo y la exportación. Los peces adultos se suelen vender enteros o procesados, lo que los convierte en la principal fuente de ingresos de la acuicultura. Las estrategias de alimentación eficientes, la gestión sanitaria optimizada y las técnicas de cría mejoradas garantizan altas tasas de supervivencia y una ganancia de peso óptima. Los grandes productores se centran en esta etapa para maximizar la rentabilidad, lo que la convierte en la fase económicamente más significativa de la cadena de valor de la acuicultura. La fase de engorde (etapa adulta) representa más del 70% de los costos totales de producción, lo que subraya la necesidad de eficiencia. Los sistemas de alimentación automatizados y el monitoreo de oxígeno se utilizan ampliamente para promover un crecimiento rápido. Los brotes de enfermedades en esta etapa pueden provocar pérdidas masivas, lo que impulsa la inversión en vacunas y bioseguridad.

• Por escala de producción

En función de la escala de producción, el mercado europeo de la pesca y la acuicultura se segmenta en gran escala, mediana escala y pequeña escala. La gran escala tuvo la mayor participación, con un 51,27 %, en 2025, y se prevé que muestre el crecimiento más rápido durante el período de pronóstico. Estas operaciones se benefician de la automatización industrial, los sistemas avanzados de monitoreo y las cadenas de suministro integradas que garantizan una producción y un control de calidad consistentes. Las grandes granjas logran economías de escala, reduciendo los costos unitarios y aumentando la rentabilidad. Están adoptando cada vez más tecnologías de cultivo inteligente para la alimentación, la gestión del agua y la prevención de enfermedades. Con la creciente demanda de productos del mar en Oriente Medio y África, los grandes productores están bien posicionados para satisfacer las necesidades del mercado de forma eficiente y sostenible, atrayendo una importante inversión privada y pública. Las corporaciones multinacionales y las empresas agropecuarias están entrando en el sector, aportando capital y experiencia.

• Por categoría

Según la categoría, el mercado europeo de la pesca y la acuicultura se segmenta en convencional y orgánico. El convencional tuvo la mayor participación, con un 88,06 %, en 2025, y se prevé que presente el crecimiento más rápido durante el período de pronóstico. Sigue siendo el método preferido debido a la menor inversión inicial, las prácticas agrícolas consolidadas y la amplia disponibilidad de insumos como piensos y semillas. Si bien persiste la preocupación por el impacto ambiental, los sistemas convencionales son altamente productivos y accesibles, especialmente en las regiones rurales y en desarrollo. La mayoría de los productores dependen de este modelo debido al acceso limitado a la certificación orgánica o a tecnologías avanzadas. Su familiaridad y escalabilidad lo convierten en la columna vertebral de la industria acuícola regional, impulsando el suministro de alimentos y el desarrollo económico. La acuicultura convencional a menudo utiliza tratamientos químicos y antibióticos, lo que genera preocupación por los residuos y la resistencia a los antimicrobianos.

• Por fuente

Según el origen, el mercado europeo de la pesca y la acuicultura se segmenta en productos de origen vegetal y animal. Los productos de origen vegetal alcanzaron la mayor cuota de mercado, con un 61,51%, en 2025, y se prevé que presenten el crecimiento más rápido durante el período de pronóstico. Este crecimiento se debe a la necesidad de alternativas sostenibles a la harina y el aceite de pescado, que consumen muchos recursos y son perjudiciales para el medio ambiente. Ingredientes como la soja, las algas, el maíz y las legumbres aportan proteínas y nutrientes esenciales, a la vez que reducen la dependencia del pescado silvestre. Los piensos de origen vegetal también se ajustan a prácticas acuícolas ecológicas y éticas, lo que resulta atractivo para consumidores y organismos reguladores con conciencia ambiental. La investigación continua sobre proteínas alternativas continúa mejorando la eficiencia alimentaria y la salud de los peces, impulsando su adopción en todo el sector. Se están mezclando harinas de microalgas e insectos con proteínas vegetales para mejorar los perfiles de aminoácidos. Se están utilizando tecnologías de modificación genética y fermentación para desarrollar cultivos ricos en proteínas adaptados a los piensos acuícolas. Los índices de conversión alimenticia (IC) han mejorado significativamente gracias a las formulaciones optimizadas de origen vegetal.

• Por formulario

En función de su forma, el mercado europeo de la pesca y la acuicultura se segmenta en seco, húmedo y húmedo. El alimento seco registró la mayor participación (57,35%) en 2025 y se prevé que presente el mayor crecimiento durante el período de pronóstico. Se prefiere por su larga vida útil, facilidad de almacenamiento y resistencia al deterioro, lo que lo hace ideal para operaciones a gran escala. Los alimentos secos ofrecen una formulación nutricional precisa, lo que garantiza una alimentación constante y un crecimiento óptimo de los peces. Son compatibles con sistemas de alimentación automatizados, lo que reduce los costes de mano de obra y el desperdicio de alimento. Su durabilidad durante el transporte y la manipulación los hace adecuados tanto para granjas remotas como comerciales. A medida que la acuicultura moderna se mecaniza, el alimento seco sigue siendo la solución de alimentación más práctica y eficiente. La tecnología de extrusión permite la producción de pellets flotantes, que se hunden o se hunden lentamente, adaptados al comportamiento de las especies. Esta forma minimiza la contaminación del agua al reducir la desintegración. Por el contrario, los alimentos húmedos son más perecederos y requieren almacenamiento en frío, lo que limita su uso. El alimento seco predomina en el cultivo de camarón, tilapia y bagre, que son sectores de gran volumen.

• Por función

En función de su función, el mercado europeo de la pesca y la acuicultura se segmenta en valor racional, potenciador energético, mejora de la digestibilidad, conservación de piensos, gestión de citotóxicos, entre otros. El valor racional de la pesca y la acuicultura alcanzó la mayor cuota de mercado (36,95 %) en 2025 y se prevé que presente el mayor crecimiento durante dicho período. El valor racional se centra en la rentabilidad, la optimización de recursos y el retorno de la inversión en acuicultura. Los productores priorizan métodos que maximizan la producción, minimizando los costes de los insumos y el impacto ambiental. Esto incluye estrategias de alimentación eficiente, prevención de enfermedades y optimización del rendimiento. Al equilibrar los objetivos económicos y ecológicos, el valor racional fomenta la rentabilidad y la sostenibilidad a largo plazo. Resulta atractivo tanto para pequeños productores como para explotaciones comerciales que buscan modelos de acuicultura resilientes, escalables y financieramente viables en mercados competitivos. El concepto integra el análisis del coste del ciclo de vida, los índices de conversión alimenticia y las tasas de mortalidad en la toma de decisiones.

• Por tecnología

En función de la tecnología, el mercado europeo de la pesca y la acuicultura se segmenta en pesca y acuicultura convencionales, pesca y acuicultura inteligentes. La pesca y acuicultura convencionales tuvieron la mayor participación, un 73,86 %, en 2025, y se prevé que muestren el crecimiento más rápido durante el período de pronóstico. Estos métodos incluyen la captura salvaje tradicional, el cultivo en estanques y el cultivo en jaulas, que siguen siendo dominantes debido a las bajas barreras tecnológicas y su amplia adopción. Apoyan el empleo rural y la seguridad alimentaria local en Oriente Medio y África. A pesar de los desafíos ambientales, los sistemas convencionales son confiables y bien comprendidos por los productores. Si bien la acuicultura inteligente está emergiendo, el alto costo y la complejidad de las herramientas digitales limitan su alcance, lo que permite que las prácticas convencionales mantengan su liderazgo a corto plazo. Los pescadores artesanales y los pequeños agricultores dependen del conocimiento generacional y de insumos de bajo costo. Más del 90 % de la acuicultura en África y el sur de Asia se realiza mediante métodos convencionales.

• Por especie

Por especies, el mercado europeo de la pesca y la acuicultura se segmenta en peces, crustáceos y moluscos. El pescado alcanzó la mayor participación, con un 61,87%, en 2025 y se prevé que presente el crecimiento más rápido durante el período de pronóstico. Peces como la tilapia, el salmón, el bagre y la carpa son los más cultivados debido a su rápido crecimiento, alta aceptación por parte del consumidor y adaptabilidad a diversos sistemas de cultivo. Sirven como fuente principal de proteína animal asequible, especialmente en las regiones en desarrollo. La creciente demanda de productos del mar, sumada a la sobrepesca de las poblaciones silvestres, ha acelerado la producción acuícola. La piscicultura contribuye a la seguridad alimentaria, los ingresos por exportaciones y el desarrollo económico, convirtiéndola en la piedra angular de la industria acuícola mundial. La tilapia es popular en África y América por su resistencia y el bajo costo de sus necesidades de alimentación. La salmonicultura en Noruega y Chile impulsa exportaciones de alto valor a Europa y Asia.

Análisis regional del mercado europeo de la pesca y la acuicultura

- Noruega domina el mercado europeo de pesca y acuicultura con la mayor participación en ingresos, un 24,19 % en 2025.

- La acuicultura noruega prospera gracias a sus extensas y limpias zonas costeras, su investigación y desarrollo pioneros y su tecnología avanzada. Las exportaciones centradas en el salmón, un sólido ecosistema de proveedores de valor añadido y la confianza de los inversores globales, en un contexto de sólida regulación e innovación sostenible, impulsan el crecimiento.

Perspectivas del mercado de la pesca y la acuicultura en Europa (España)

El mercado de la pesca y la acuicultura en España y Europa capturó la segunda mayor cuota de mercado en Europa, con más del 14,48 % en 2025. La pesca y la acuicultura españolas prosperan gracias a sus ricas tradiciones costeras y a la fuerte demanda de productos del mar saludables y de origen local. Las inversiones estratégicas en los sectores de piensos para acuicultura y pescado fresco impulsan el crecimiento. Sin embargo, desafíos como el agotamiento de las poblaciones y la presión climática impulsan la inversión hacia soluciones sostenibles y la innovación en acuicultura.

Perspectivas del mercado pesquero y acuícola de Rusia y Europa

El mercado de pesca y acuicultura de Rusia y Europa capturó la tercera mayor participación en ingresos del segmento, con más del 12,07 % en Europa en 2025. La acuicultura rusa experimenta un auge, duplicando la producción hasta alcanzar las 380.000 toneladas en 2024, impulsada por el auge de la salmonicultura, la expansión de las exportaciones a Asia y los objetivos de autosuficiencia del gobierno. Sin embargo, persisten la dependencia de piensos importados, la compleja burocracia, las deficiencias en infraestructura y la fluctuante demanda interna.

Cuota de mercado de la pesca y la acuicultura en Europa

El mercado europeo de la pesca y la acuicultura está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- Nireo (Grecia)

- Pentair (EE. UU.)

- AES International Healthcare (Reino Unido)

- ASAKUA (Noruega)

- Corbion (Países Bajos)

- LINN Gerätebau GmbH (Alemania)

- CPI Equipment Inc. (Canadá)

- Fish Treatment Ltd (Reino Unido)

- Aquaculture Equipment Ltd (Reino Unido)

- Grupo AKVA (Noruega)

- Skretting (Noruega)

- GaelForce Marine Equipment (Reino Unido)

- Syndel (Canadá)

- Comedero para piscifactorías (Dinamarca)

- Nanrong Shanghai Co., Ltd. (China)

- Grupo Baader (Alemania)

- Grupo Faivre (Francia)

- Hesy (Italia)

- Veramaris (Países Bajos)

- Imenco AS (Noruega)

- Mustad Fishing (Noruega)

- PHARMAQ (Noruega)

- AquaByte (Noruega)

- CageEye (Noruega)

- Hipra (España)

- VAKI AQUACULTURE SYSTEMS LTD. (Dinamarca)

- Vaxxinova Norway AS (Noruega)

Últimos avances en el mercado europeo de la pesca y la acuicultura

- El 28 de mayo de 2025, Wildtype recibió la autorización regulatoria de la FDA estadounidense para vender su salmón coho cultivado en Estados Unidos. Se convirtió en la primera startup autorizada a comercializar mariscos cultivados en células en el país, que ahora se ofrecen en restaurantes selectos.

- En julio de 2025, la noruega Grieg Seafood anunció la venta de sus operaciones de cultivo de salmón en Canadá a Cermaq. Esta operación marca una reestructuración estratégica, ya que la empresa continúa centrándose en sus operaciones principales en Noruega, Columbia Británica y Shetland.

- En junio de 2024, Huon Aquaculture anunció planes para una instalación de Sistema de Recirculación de Acuicultura (RAS) de 110 millones de dólares australianos en Whale Point, Tasmania, cuya construcción comenzará a principios de 2025. Una vez operativa, se ubicará entre las instalaciones RAS más grandes del hemisferio sur, permitiendo el cultivo de salmón en tierra hasta el 60% del ciclo de vida del pez para 2027.

- En abril de 2023, la empresa japonesa Nissui (Nippon Suisan Kaisha) inauguró su primera granja comercial de camarones en tierra en Ei, Kagoshima, y está planeando una granja de caballa en tierra que comenzará a operar en 2026, lo que indica su cambio hacia una acuicultura más sustentable.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE TO HIGH

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 REGION PATENT LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VALUE CHAIN

4.3.1 EUROPE FISHERY AND AQUACULTURE MARKET VALUE CHAIN

4.3.2 PRODUCTION:

4.3.3 PROCESSING:

4.3.4 MARKETING/DISTRIBUTION:

4.3.5 BUYERS:

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 HATCHERIES AND FISH SEED SUPPLIERS

4.4.2 FISH FARMERS / AQUACULTURE PRODUCERS

4.4.3 CAPTURE FISHERIES (WILD CATCH)

4.4.4 FEED PRODUCERS

4.4.5 PROCESSORS

4.4.6 PACKAGERS

4.4.7 DISTRIBUTORS / WHOLESALERS

4.4.8 EXPORTERS

4.4.9 RETAIL CHANNELS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 VERTICAL INTEGRATION FOR SUPPLY CHAIN EFFICIENCY

4.5.2 SUSTAINABLE AQUACULTURE CERTIFICATIONS AND ECO-LABELING

4.5.3 STRATEGIC MERGERS AND ACQUISITIONS

4.5.4 INVESTMENT IN R&D AND BIOTECHNOLOGICAL ADVANCEMENTS

4.5.5 EXPANSION INTO NUTRITION

4.5.6 INNOVATION AND SMART AQUACULTURE

4.5.7 PUBLIC-PRIVATE PARTNERSHIPS AND GOVERNMENT COLLABORATIONS

4.6 RAW MATERIAL SOURCING IN THE EUROPE FISHERY AND AQUACULTURE MARKET

4.6.1 OVERVIEW OF RAW MATERIALS IN AQUACULTURE

4.6.2 SOURCING OF AQUAFEED RAW MATERIALS

4.6.2.1 Protein and Amino Acid Sources

4.6.2.2 Lipid Sources

4.6.2.3 Functional Additives and Micronutrients

4.6.3 RAW MATERIALS IN AQUACULTURE EQUIPMENT MANUFACTURING

4.6.3.1 Polymer Materials

4.6.3.2 Metal Components

4.6.3.3 Sensor and Electronic Inputs

4.6.4 RAW MATERIAL INPUTS FOR PHARMACEUTICALS AND HEALTH MANAGEMENT

4.6.4.1 Active Pharmaceutical Ingredients (APIs)

4.6.4.2 Excipients and Carriers

4.6.4.3 Diagnostic Reagents

4.6.5 SOURCING OF WATER TREATMENT AND BIOSECURITY INPUTS

4.6.5.1 Disinfectants and Oxidizing Agents

4.6.5.2 Mineral and pH Modifiers

4.6.5.3 Biological Agents

4.6.6 SUPPLY CHAIN CONSIDERATIONS AND CHALLENGES

4.6.6.1 Globalization and Regional Dependencies

4.6.6.2 Sustainability and Ethical Sourcing

4.6.6.3 Quality Assurance and Traceability

4.6.7 CONCLUSION

4.7 BRAND OUTLOOK

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 JOINT VENTURES

4.8.2 MERGERS AND ACQUISITIONS

4.8.3 LICENSING AND PARTNERSHIP

4.8.4 TECHNOLOGY COLLABORATIONS

4.8.5 STRATEGIC DIVESTMENTS

4.8.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.7 STAGE OF DEVELOPMENT

4.8.8 TIMELINES AND MILESTONES

4.8.9 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.10 RISK ASSESSMENT AND MITIGATION

4.8.11 FUTURE OUTLOOK

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.9.1 PRODUCT QUALITY AND FRESHNESS

4.9.2 PRICE COMPETITIVENESS AND VALUE

4.9.3 SUSTAINABILITY AND CERTIFICATIONS

4.9.4 AVAILABILITY AND SUPPLY RELIABILITY

4.9.5 TECHNOLOGICAL INTEGRATION AND TRANSPARENCY

4.9.6 BRAND REPUTATION AND CONSUMER PREFERENCES

4.1 IMPACT OF ECONOMIC SLOWDOWN ON MARKET EUROPE FISHERY AND AQUACULTURE MARKET

4.10.1 IMPACT OF PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 OVERVIEW OF TECHNOLOGICAL ANALYSIS.

4.11.1 DATA ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

4.11.2 THE INTERNET OF THINGS (IOT) AND SENSOR TECHNOLOGY

4.11.3 AUTOMATION AND ROBOTICS

4.11.4 BLOCKCHAIN FOR TRACEABILITY AND SUPPLY CHAIN MANAGEMENT

4.11.5 CONCLUSION:

4.12 IMPORT EXPORT SCENARIO

4.13 PRODUCTION CONSUMPTION ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.3.1 COMPLIANCE AND COST EFFICIENCY

5.3.2 SUSTAINABILITY PRACTICES

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5.7 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 POPULATION GROWTH IS ACCELERATING SEAFOOD DEMAND

7.1.2 TECHNOLOGICAL ADVANCES IN AQUACULTURE SYSTEMS ADOPTION

7.1.3 CONSUMER PREFERENCE SHIFTING TOWARD HEALTHFUL PROTEINS

7.1.4 TECHNOLOGICAL IMPROVEMENTS IN COLD CHAIN LOGISTICS AND DISTRIBUTION

7.2 RESTRAINTS

7.2.1 COST VOLATILITY FOR FEED AND PRODUCTION OPERATIONS

7.2.2 INCREASING REGULATORY REQUIREMENTS FOR MARKET COMPLIANCE

7.3 OPPORTUNITIES

7.3.1 EXPANSION OF SUSTAINABLE AND ECO-FRIENDLY PRACTICES

7.3.2 INNOVATION IN VALUE-ADDED SEAFOOD PRODUCT OFFERINGS

7.3.3 GROWING MARKET ACCESS IN EMERGING ECONOMIES

7.4 CHALLENGES

7.4.1 CLIMATE CHANGE IS DISRUPTING MARINE ECOSYSTEMS STABILITY

7.4.2 DISEASE OUTBREAKS HEAVILY IMPACTING FARMED SPECIES

8 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 AQUAFEED

8.3 EQUIPMENT

9 EUROPE FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM

9.1 OVERVIEW

9.2 WATER-BASED SYSTEMS

9.3 LAND-BASED SYSTEMS

9.4 RECYCLING SYSTEMS

9.5 INTEGRATED FARMING SYSTEM

9.6 OTHERS

10 EUROPE FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT

10.1 OVERVIEW

10.2 FRESH WATER

10.3 MARINE WATER

10.4 BRACKISH WATER

11 EUROPE FISHERY AND AQUACULTURE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ADULT

11.3 JUVENILE

11.4 LARVA

12 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE

12.1 OVERVIEW

12.2 LARGE-SCALE

12.3 MEDIUM-SCALE

12.4 SMALL-SCALE

13 EUROPE FISHERY AND AQUACULTURE MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 EUROPE FISHERY AND AQUACULTURE MARKET, BY SOURCE

14.1 OVERVIEW

14.2 PLANT-BASED

14.3 ANIMAL-BASED

15 EUROPE FISHERY AND AQUACULTURE MARKET, BY FORM

15.1 OVERVIEW

15.2 DRY

15.3 WET FORM

15.4 MOIST FORM

16 EUROPE FISHERY AND AQUACULTURE MARKET, BY FUNCTION

16.1 OVERVIEW

16.2 FISHERY AND AQUACULTURE RATIONAL VALUE

16.3 ENERGY BOOSTER

16.4 IMPROVE DIGESTIBILITY

16.5 FEED PRESERVATION

16.6 CYTOTOXIC MANAGEMENT

16.7 OTHERS

17 EUROPE FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 CONVENTIONAL FISHERY & AQUACULTURE

17.3 SMART FISHERY & AQUACULTURE

18 EUROPE FISHERY AND AQUACULTURE MARKET, BY SPECIES

18.1 OVERVIEW

18.2 FISH

18.3 CRUSTACEANS

18.4 MOLLUSKS

19 EUROPE FISHERY AND AQUACULTURE MARKET, BY REGION

19.1 EUROPE

19.1.1 NORWAY

19.1.2 SPAIN

19.1.3 RUSSIA

19.1.4 ITALY

19.1.5 U.K.

19.1.6 NETHERLANDS

19.1.7 TURKEY

19.1.8 POLAND

19.1.9 GERMANY

19.1.10 DENMARK

19.1.11 FINLAND

20 EUROPE FISHERY AND AQUACULTURE MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 SKRETTING

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENT

22.2 ALLTECH

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 PENTAIRAES

22.3.1 COMPANY SNAPSHOT

22.3.2 COMPANY SHARE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 KEMIN INDUSTRIES, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CORBION

22.5.1 COMPANY SNAPSHOT

22.5.2 RECENT FINANCIALS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AKVA GROUP ASA

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 REC.ENT DEVELOPMENTS/NEWS

22.7 AQ1 SYSTEMS PTY LTD

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT UPDATES

22.8 AQUABYTE

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 AQUACULTURE EQUIPMENT LTD

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 ASAKUA

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 BAADER

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 BHUVAN BIOLOGICALS

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS/NEWS

22.13 CAGE EYE

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 CPI EQUIPMENT INC

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS/NEWS

22.15 DEEP TREKKER INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 DURA TECH INDUSTRIAL & MARINE LIMITED

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENTS/NEWS

22.17 ERUVAKA TECHNOLOGIES

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 FAIVRE SASU

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS/NEWS

22.19 FISHFARMFEEDER

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 FISH TREATMENT

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 FLUVAL

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 GAEL FORCE GROUP LIMITED

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 GAMAKATSU CO., LTD.

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 GILIOCEAN TECHNOLOGY

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 GROWEL

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENT

22.26 HESY AQUACULTURE B.V.

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 HIPRA, S.A.

22.27.1 COMPANY SNAPSHOT

22.27.2 PRODUCT PORTFOLIO

22.27.3 RECENT DEVELOPMENT

22.28 HUNG STAR ENTERPRISE CORP.

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 IMENCO AQUA AS

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 INNOVASEA SYSTEMS INC.

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENT

22.31 IN- SITU INC.

22.31.1 COMPANY SNAPSHOT

22.31.2 PRODUCT PORTFOLIO

22.31.3 RECENT DEVELOPMENT

22.32 INTEGRATED AQUA SYSTEMS, INC

22.32.1 COMPANY SNAPSHOT

22.32.2 PRODUCT PORTFOLIO

22.32.3 RECENT DEVELOPMENTS/NEWS

22.33 INTERNATIONAL HEALTHCARE

22.33.1 COMPANY SNAPSHOT

22.33.2 PRODUCT PORTFOLIO

22.33.3 RECENT DEVELOPMENTS/NEWS

22.34 INVE AQUACULTURE

22.34.1 COMPANY SNAPSHOT

22.34.2 PRODUCT PORTFOLIO

22.34.3 RECENT DEVELOPMENT

22.35 KAI CHUANG MARINE INTERNATIONAL

22.35.1 COMPANY SNAPSHOT

22.35.2 PRODUCT PORTFOLIO

22.35.3 RECENT DEVELOPMENT

22.36 LIFEGARD AQUATICS

22.36.1 COMPANY SNAPSHOT

22.36.2 PRODUCT PORTFOLIO

22.36.3 RECENT DEVELOPMENT

22.37 LINN GERATEBAU

22.37.1 COMPANY SNAPSHOT

22.37.2 PRODUCT PORTFOLIO

22.37.3 RECENT DEVELOPMENTS/NEWS

22.38 MUSTAD FISHING

22.38.1 COMPANY SNAPSHOT

22.38.2 PRODUCT PORTFOLIO

22.38.3 RECENT DEVELOPMENT

22.39 NANRONG SHANGHAI CO., LTD.

22.39.1 COMPANY SNAPSHOT

22.39.2 PRODUCT PORTFOLIO

22.39.3 RECENT DEVELOPMENT

22.4 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

22.40.1 COMPANY SNAPSHOT

22.40.2 PRODUCT PORTFOLIO

22.40.3 RECENT DEVELOPMENTS/NEWS

22.41 NIREUS

22.41.1 COMPANY SNAPSHOT

22.41.2 PRODUCT PORTFOLIO

22.41.3 RECENT DEVELOPMENT

22.42 PHARMAQ AS (SUBSIDIARY OF ZOETIS INC.)

22.42.1 COMPANY SNAPSHOT

22.42.2 PRODUCT PORTFOLIO

22.42.3 RECENT DEVELOPMENT

22.43 PIONEER GROUP

22.43.1 COMPANY SNAPSHOT

22.43.2 PRODUCT PORTFOLIO

22.43.3 RECENT DEVELOPMENT

22.44 PROTEON PHARMACEUTICALS S.A.

22.44.1 COMPANY SNAPSHOT

22.44.2 PRODUCT PORTFOLIO

22.44.3 RECENT DEVELOPMENT

22.45 PT JALA AKUAKULTUR LESTARI ALAMKU

22.45.1 COMPANY SNAPSHOT

22.45.2 PRODUCT PORTFOLIO

22.45.3 RECENT DEVELOPMENT

22.46 SAGAR AQUACULTURE PVT LTD

22.46.1 COMPANY SNAPSHOT

22.46.2 PRODUCT PORTFOLIO

22.46.3 RECENT DEVELOPMENT

22.47 SINO-AQUA CORPORATION

22.47.1 COMPANY SNAPSHOT

22.47.2 PRODUCT PORTFOLIO

22.47.3 RECENT DEVELOPMENTS/NEWS

22.48 SREEMA’S FEEDS

22.48.1 COMPANY SNAPSHOT

22.48.2 PRODUCT PORTFOLIO

22.48.3 RECENT DEVELOPMENT

22.49 SRR AQUA SUPPLIERS LLP

22.49.1 COMPANY SNAPSHOT

22.49.2 PRODUCT PORTFOLIO

22.49.3 RECENT DEVELOPMENTS/NEWS

22.5 SYNDEL

22.50.1 COMPANY SNAPSHOT

22.50.2 PRODUCT PORTFOLIO

22.50.3 RECENT DEVELOPMENTS/NEWS

22.51 THAI UNION FEEDMILL PUBLIC COMPANY LIMITED.

22.51.1 COMPANY SNAPSHOT

22.51.2 REVENUE ANALYSIS

22.51.3 PRODUCT PORTFOLIO

22.51.4 RECENT DEVELOPMENT

22.52 VAKI AQUACULTURE SYSTEMS LTD. (SUBSIDIARY OF MERCK & CO., INC. )

22.52.1 COMPANY SNAPSHOT

22.52.2 PRODUCT PORTFOLIO

22.52.3 RECENT DEVELOPMENT

22.53 VAXXINOVA INTERNATIONAL BV

22.53.1 COMPANY SNAPSHOT

22.53.2 PRODUCT PORTFOLIO

22.53.3 RECENT DEVELOPMENTS/NEWS

22.54 VERAMARIS

22.54.1 COMPANY SNAPSHOT

22.54.2 PRODUCT PORTFOLIO

22.54.3 RECENT DEVELOPMENT

22.55 VIJAYA SARADHI FEEDS

22.55.1 COMPANY SNAPSHOT

22.55.2 PRODUCT PORTFOLIO

22.55.3 RECENT DEVELOPMENT

22.56 IAERATOR (ZHEJIANG FORDY IMP. & EXP. CO.,LTD.)

22.56.1 COMPANY SNAPSHOT

22.56.2 PRODUCT PORTFOLIO

22.56.3 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tablas

TABLE 1 PATENT BY COUNTRY

TABLE 2 APPLICANTS OF PATENTS

TABLE 3 INVENTORS OF PATENTS

TABLE 4 IPC CODES OF PATENTS

TABLE 5 PUBLICATION OF PATENTS YEARLY

TABLE 6 BRAND OUTLOOK: KEY COMPANIES IN THE EUROPE FISHERY AND AQUACULTURE EQUIPMENT MARKET

TABLE 7 REGULATORY COVERAGE

TABLE 8 COST OF FEED AND PRODUCTION OPERATIONS

TABLE 9 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 11 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 12 EUROPE AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE INTEGRATED FARMING SYSTEM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE FRESH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE MARINE WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE BRACKISH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE ADULT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE JUVENILE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE LARVA IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE LARGE-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE MEDIUM-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE SMALL-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE CONVENTIONAL IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE ORGANIC IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE PLANT-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE ANIMAL-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE DRY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE WET FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE MOIST FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE FISHERY AND AQUACULTURE RATIONAL VALUE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE ENERGY BOOSTER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE IMPROVE DIGESTIBILITY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE FEED PRESERVATION IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE CYTOTOXIC MANAGEMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 EUROPE FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 84 EUROPE CONVENTIONAL FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 EUROPE SMART FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 EUROPE FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 87 EUROPE FISH IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 EUROPE FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 EUROPE CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 EUROPE CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 EUROPE MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 EUROPE MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 EUROPE

TABLE 94 EUROPE FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 95 EUROPE FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND METRIC TONS)

TABLE 96 EUROPE FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 97 EUROPE

TABLE 98 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 100 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 101 EUROPE AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 EUROPE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 EUROPE LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 EUROPE BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 EUROPE AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 EUROPE AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 EUROPE VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EUROPE TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EUROPE PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 EUROPE ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EUROPE ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EUROPE FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EUROPE CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 EUROPE PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EUROPE ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 EUROPE MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 EUROPE PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 EUROPE EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 EUROPE CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 EUROPE WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 EUROPE WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 EUROPE FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 EUROPE MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 EUROPE SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 EUROPE SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 EUROPE FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 EUROPE OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 EUROPE CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 EUROPE UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 EUROPE AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 EUROPE FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 132 EUROPE WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 EUROPE LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 EUROPE RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 EUROPE FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 136 EUROPE FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 EUROPE FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 138 EUROPE FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 139 EUROPE FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 140 EUROPE FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 141 EUROPE DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 EUROPE FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 143 EUROPE FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 144 EUROPE FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 145 EUROPE FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 EUROPE CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 EUROPE MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 NORWAY FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORWAY FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 150 NORWAY FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 151 NORWAY AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORWAY FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 NORWAY LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 NORWAY BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 NORWAY AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 NORWAY AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NORWAY VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 NORWAY TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 NORWAY PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 NORWAY ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NORWAY ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NORWAY FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 NORWAY CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NORWAY PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 NORWAY ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 NORWAY MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 NORWAY PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 NORWAY EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 NORWAY CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NORWAY WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NORWAY WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NORWAY FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NORWAY MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NORWAY SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NORWAY SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NORWAY FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NORWAY OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NORWAY CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NORWAY UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NORWAY AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NORWAY FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 182 NORWAY WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 NORWAY LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 NORWAY RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 NORWAY FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 186 NORWAY FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 NORWAY FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 188 NORWAY FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 189 NORWAY FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 190 NORWAY FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 191 NORWAY DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 NORWAY FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 193 NORWAY FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 194 NORWAY FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 195 NORWAY FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 NORWAY CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 NORWAY MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 200 SPAIN FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 201 SPAIN AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SPAIN PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SPAIN ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SPAIN MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SPAIN PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SPAIN EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SPAIN CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SPAIN WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SPAIN WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SPAIN FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SPAIN MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 SPAIN SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SPAIN SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SPAIN FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SPAIN OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SPAIN CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SPAIN UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SPAIN FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 232 SPAIN WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SPAIN LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SPAIN RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SPAIN FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 236 SPAIN FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 237 SPAIN FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 238 SPAIN FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 239 SPAIN FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 240 SPAIN FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 241 SPAIN DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SPAIN FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 243 SPAIN FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 244 SPAIN FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SPAIN CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SPAIN MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 RUSSIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 RUSSIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 249 RUSSIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 250 RUSSIA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 RUSSIA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 RUSSIA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 RUSSIA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 RUSSIA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 RUSSIA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 RUSSIA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 RUSSIA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 RUSSIA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 RUSSIA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 RUSSIA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 RUSSIA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 RUSSIA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 RUSSIA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 RUSSIA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 RUSSIA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 RUSSIA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 RUSSIA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 RUSSIA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 RUSSIA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 281 RUSSIA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 RUSSIA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 RUSSIA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 RUSSIA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 285 RUSSIA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 286 RUSSIA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 287 RUSSIA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 288 RUSSIA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 289 RUSSIA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 290 RUSSIA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 RUSSIA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 292 RUSSIA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 293 RUSSIA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 294 RUSSIA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 RUSSIA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 RUSSIA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 FRANCE

TABLE 298 FRANCE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 FRANCE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 300 FRANCE FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 301 FRANCE AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 FRANCE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 FRANCE LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 FRANCE BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 FRANCE AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 FRANCE AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 FRANCE VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 RANCE TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 FRANCE PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 FRANCE ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 FRANCE ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 FRANCE FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 FRANCE CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 FRANCE PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 FRANCE ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 FRANCE MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 FRANCE PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 FRANCE EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 FRANCE CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 FRANCE WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 FRANCE WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 FRANCE FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 FRANCE MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 FRANCE SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 FRANCE SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 FRANCE FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 FRANCE OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 FRANCE CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 FRANCE UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)