Germany Safety Footwear Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

954.94 Million

USD

1,706.01 Million

2025

2033

USD

954.94 Million

USD

1,706.01 Million

2025

2033

| 2026 –2033 | |

| USD 954.94 Million | |

| USD 1,706.01 Million | |

|

|

|

|

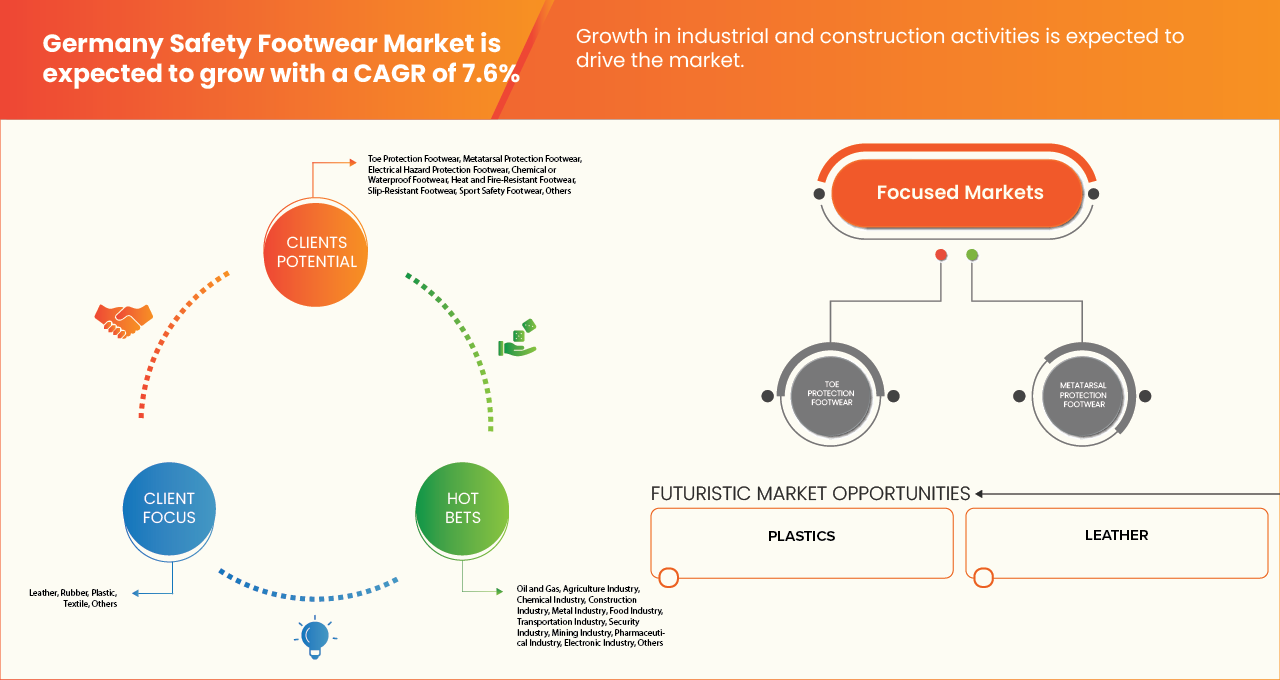

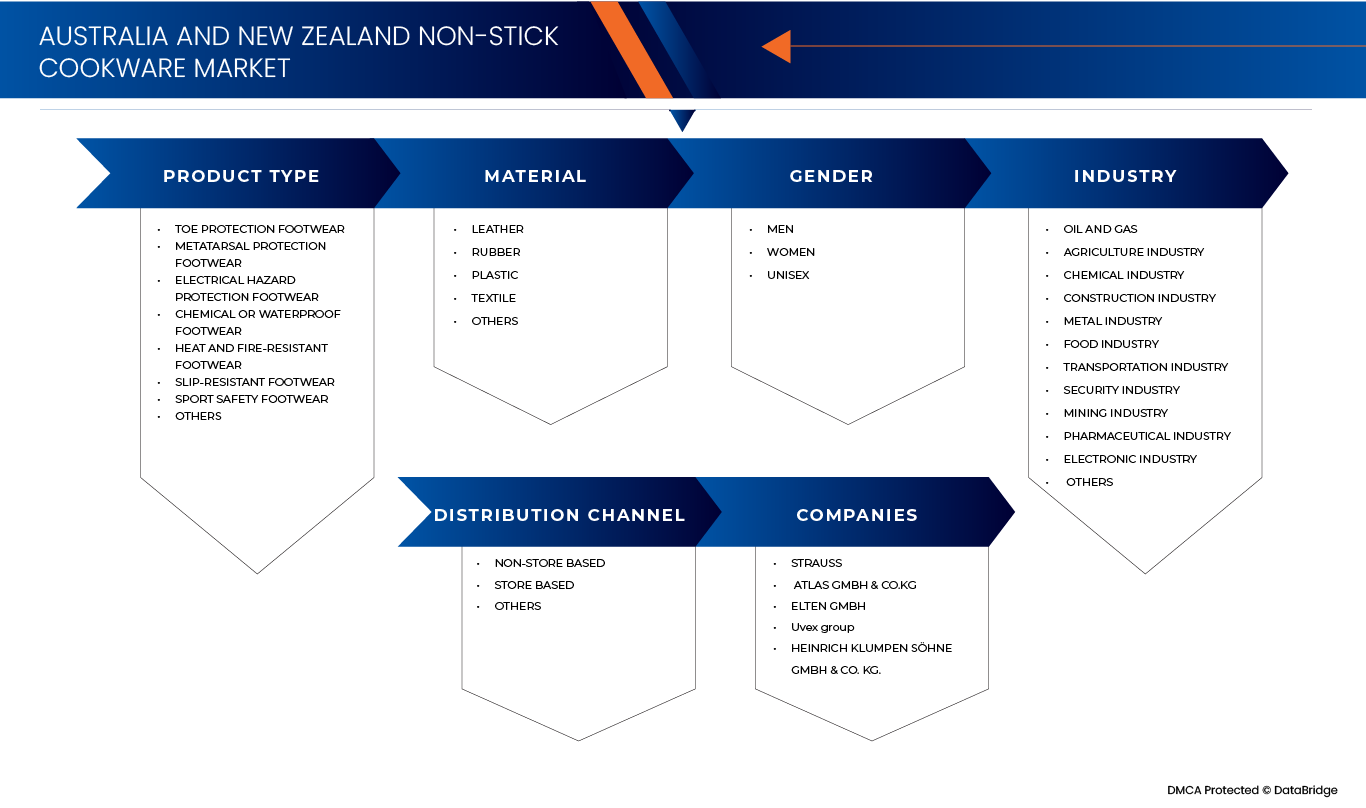

Mercado alemán de calzado de seguridad, por tipo de producto (calzado con protección para los dedos, calzado con protección metatarsiana, calzado con protección contra riesgos eléctricos, calzado químico o impermeable, calzado resistente al calor o al fuego, calzado antideslizante, calzado deportivo de seguridad, otros), material (cuero, caucho, plástico, textil, otros), género (hombre, mujer, unisex), industria (petróleo y gas, agricultura, química, construcción, metalurgia, alimentaria, transporte, seguridad, minería, farmacéutica, electrónica, otros), canal de distribución (sin presencia física, presencia física, otros): tendencias y pronóstico del sector hasta 2033

Tamaño del mercado de calzado de seguridad en Alemania

- Se espera que el mercado alemán de calzado de seguridad alcance los USD 1706,01 millones para 2033 desde USD 954,94 millones en 2026, creciendo con una CAGR sustancial del 7,6% en el período de pronóstico de 2026 a 2033.

- El mercado alemán de calzado de seguridad está impulsado por una gran fuerza laboral calificada, un cumplimiento obligatorio de las normas de seguridad y sólidas redes industriales y logísticas que respaldan una demanda continua.

- Redes

Análisis del mercado alemán de calzado de seguridad

- La creciente actividad en los sectores manufacturero, automovilístico, de la construcción, de la logística, de la energía y de los productos químicos está incrementando significativamente la demanda de calzado de seguridad certificado en toda Alemania, respaldada por estrictos requisitos de cumplimiento de la seguridad en el lugar de trabajo.

- La aplicación por parte de los gobiernos y la industria de las normas de seguridad laboral (EN ISO 20345 y Reglamento EPI de la UE) sigue exigiendo el uso de calzado de protección en entornos de trabajo peligrosos, lo que mantiene una demanda de reemplazo constante.

- Los altos costos laborales y de producción, sumados a la presión por equilibrar la comodidad, la durabilidad y la sostenibilidad, plantean desafíos de costos para los fabricantes que operan en Alemania.

- Los avances tecnológicos en materiales y diseño, incluidos compuestos livianos, suelas antifatiga, suelas antideslizantes y construcción ergonómica, están mejorando la comodidad y la productividad de los trabajadores, lo que impulsa las actualizaciones de productos.

- La creciente adopción de canales de venta digitales, incluidas las plataformas de comercio electrónico y los modelos directos al consumidor, está mejorando la accesibilidad al mercado y permitiendo que las marcas lleguen a las pymes y a los trabajadores individuales de manera más eficiente.

- Las tendencias de sustentabilidad y ecodiseño están transformando el desarrollo de productos, y los fabricantes utilizan cada vez más materiales reciclados, cuero responsable con el medio ambiente y procesos de producción energéticamente eficientes para cumplir con los objetivos ESG corporativos.

- Se espera que el segmento de calzado de seguridad domine el mercado de calzado de seguridad de Alemania, representando la mayor participación de mercado del 29,82% en 2026, impulsado por un alto uso en las industrias de construcción, fabricación, logística y automotriz, donde se prefiere el calzado liviano y cómodo durante todo el día sobre las botas resistentes.

Alcance del informe y segmentación del mercado de calzado de seguridad en Alemania

|

Atributos |

Perspectivas del mercado alemán de calzado de seguridad |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de calzado de seguridad en Alemania

“ Aumento de las actividades de desarrollo de infraestructura y construcción sostenida ”

- El aumento de las actividades de desarrollo de infraestructura y la inversión sostenida en construcción en Alemania son factores clave que impulsan el crecimiento del mercado alemán de calzado de seguridad, ya que los proyectos a gran escala aumentan la necesidad de protección laboral en las obras. Se espera que la creciente adopción de calzado de seguridad en las instalaciones de fabricación, logística, servicios públicos y gestión de residuos y agua, junto con su papel en la reducción de lesiones laborales y los costos de indemnización asociados, impulse aún más la expansión del mercado.

- Las principales limitaciones que pueden afectar negativamente al mercado alemán de calzado de seguridad incluyen preocupaciones relacionadas con la comodidad de uso prolongado, posibles problemas de salud o ambientales relacionados con los materiales y la adopción inconsistente de diseños de protección avanzados en las empresas más pequeñas. La falta de conocimiento sobre la selección de calzado adecuado para riesgos laborales específicos también puede limitar la penetración óptima en el mercado.

- Se espera que el creciente énfasis en las prácticas de fabricación sostenibles y el creciente interés en materiales ecológicos, reciclables y ligeros para el calzado de seguridad generen nuevas oportunidades en el mercado alemán de calzado de seguridad. Además, las normativas de seguridad laboral más estrictas y la atención gubernamental al bienestar de los trabajadores animan a los empleadores a actualizar sus equipos de protección. Sin embargo, se prevé que la selección o el uso inadecuados del calzado de seguridad, las variaciones en las prácticas de cumplimiento normativo y las fluctuaciones en los precios de materias primas como el cuero, el caucho y los polímeros representen obstáculos para el crecimiento del mercado.

- En marzo de 2022, el grupo uvex amplió su catálogo de calzado de seguridad en Alemania con la introducción de calzado de seguridad ergonómicamente optimizado, fabricado en sus instalaciones de Lüneburg. Los nuevos productos se diseñaron para mejorar la comodidad del usuario durante largas jornadas laborales, cumpliendo con las normas de seguridad EN ISO, y apoyando a sectores como la construcción, la fabricación y la logística. Esta expansión consolidó la posición de uvex como proveedor nacional especializado en soluciones de calzado de protección de alta calidad y centradas en el trabajador.

- En octubre de 2021, Elten GmbH, fabricante alemán de calzado de seguridad, lanzó una nueva gama de calzado de seguridad ligero con materiales transpirables y suela antideslizante. Esta línea de productos se desarrolló en respuesta a la creciente demanda de calzado que reduce la fatiga sin comprometer la seguridad en los sectores industrial y de almacenamiento. Esta introducción mejoró el cumplimiento normativo en materia de seguridad en el trabajo, a la vez que abordó las preocupaciones de los trabajadores en cuanto a comodidad.

Dinámica del mercado del calzado de seguridad en Alemania

Conductor

Fuerte base industrial y cumplimiento de la normativa de seguridad

- La posición de Alemania como la mayor economía industrial de Europa, respaldada por una sólida base manufacturera que abarca los sectores de la automoción, la maquinaria, la construcción, la química, la logística y la energía, ha sido un factor clave en la demanda sostenida de calzado de seguridad. Una proporción significativa de la fuerza laboral trabaja en entornos con alto riesgo laboral, donde el calzado de protección no es opcional, sino un requisito normativo. Esto ha llevado a que el calzado de seguridad se integre como un componente esencial del cumplimiento normativo y las estrategias de mitigación de riesgos en el lugar de trabajo en todos los sectores.

- El estricto cumplimiento de las normas de seguridad laboral, en particular la norma EN ISO 20345 de la Ley Alemana de Seguridad y Salud en el Trabajo (Arbeitsschutzgesetz), exige el uso de calzado de seguridad certificado que ofrezca características como protección para los dedos, resistencia al deslizamiento, resistencia a la penetración, propiedades antiestáticas y absorción de energía. Los empleadores tienen la responsabilidad legal de proporcionar equipos de protección individual (EPI) que cumplan con la normativa, lo que se traduce directamente en la adquisición constante y recurrente de calzado de seguridad. Además, la fuerte presencia de grandes empleadores y sindicatos industriales en Alemania refuerza aún más el cumplimiento de las normas de seguridad, limitando la sustitución por alternativas no certificadas o de baja calidad.

- En enero de 2024, el Instituto Federal Alemán de Seguridad y Salud en el Trabajo (BAuA) reiteró que, según la Ley de Seguridad y Salud en el Trabajo (ArbSchG) y la Ordenanza sobre el Uso de EPI (PSA-BV), los empleadores están obligados legalmente a proporcionar gratuitamente equipos de protección individual certificados, incluido el calzado de seguridad, a los empleados expuestos a riesgos laborales. Esta obligación regulatoria sustenta directamente la demanda continua de calzado de seguridad conforme en los sectores industrial, de la construcción, logístico y manufacturero de Alemania.

- En marzo de 2023, la Dirección General de Accidentes de Trabajo (DGUV) actualizó sus normas técnicas para la protección de pies y piernas, recalcando el uso obligatorio de calzado de seguridad conforme a la norma EN ISO 20345 en entornos laborales de alto riesgo. Estas normas de la DGUV constituyen un referente legal para el cumplimiento normativo, reforzando la adquisición estandarizada de calzado de seguridad certificado por parte de los empleadores alemanes.

- En octubre de 2022, la Comisión Europea, mediante su Reglamento (UE) 2016/425 sobre EPI, reafirmó que todo el calzado de seguridad comercializado en los Estados miembros de la UE, incluida Alemania, debe cumplir normas armonizadas como la EN ISO 20345 y contar con la certificación CE. Este marco regulatorio garantiza requisitos uniformes de rendimiento de seguridad y respalda la reputación de Alemania como proveedor de equipos de seguridad industrial de alta calidad y regulados.

- En abril de 2024, uvex Safety Group, fabricante alemán de calzado de seguridad, destacó en su sitio web corporativo que todo el calzado de seguridad uvex se desarrolla y prueba de acuerdo con las normas EN ISO 20345 y DGUV. La empresa hizo hincapié en las pruebas internas, el diseño ergonómico y la innovación orientada al cumplimiento normativo para cumplir con las estrictas normativas alemanas de seguridad laboral, lo que refleja cómo los fabricantes nacionales armonizan el desarrollo de sus productos con la aplicación de la normativa.

- En conclusión, el amplio panorama industrial alemán, combinado con una normativa de seguridad laboral rigurosamente aplicada, crea un entorno de demanda estructuralmente resiliente y no discrecional para el calzado de seguridad. La obligación legal de cumplir con la norma EN ISO 20345, reforzada por las autoridades nacionales y la normativa de la UE, garantiza que el calzado de seguridad certificado siga siendo una categoría esencial de adquisición, en lugar de un artículo opcional. Esta certeza regulatoria, respaldada por una sólida supervisión institucional y un comportamiento empresarial orientado al cumplimiento normativo, no solo mantiene una demanda estable de repuestos, sino que también fomenta la innovación continua de productos por parte de los fabricantes nacionales, consolidando el calzado de seguridad como un segmento a largo plazo, impulsado por el cumplimiento normativo, dentro del ecosistema industrial alemán.

Restricción/Desafío

Altos costos de producción y certificación

- Los elevados costes de producción y certificación siguen siendo una limitación importante para el mercado alemán de calzado de seguridad, ya que los fabricantes incurren en gastos sustanciales para garantizar que sus productos cumplan con las estrictas normas de seguridad y las expectativas de calidad. El calzado de seguridad que se vende en Alemania debe cumplir con la norma EN ISO 20345 y el Reglamento (UE) 2016/425 sobre EPI, lo que exige exhaustivas pruebas de laboratorio para evaluar la resistencia al impacto, la compresión, la resistencia a la penetración, el comportamiento antideslizante y otros criterios de protección. Estos procesos de certificación implican repetidas pruebas, auditorías de calidad y documentación, lo que incrementa los plazos de desarrollo y los costes, especialmente para diseños nuevos o innovadores.

- Los fabricantes también se enfrentan a costos elevados de material debido al uso de componentes de alta calidad, como punteras ligeras de composite, entresuelas antiperforación, sistemas de amortiguación ergonómicos y suelas antideslizantes avanzadas. Estos materiales, junto con las inversiones en tecnologías de fabricación automatizadas y la capacitación de personal cualificado, incrementan los costos de producción en comparación con el calzado sin certificación. Los productores pequeños y medianos, en particular, pueden tener dificultades para absorber estos gastos, lo que reduce su capacidad para competir en precio con alternativas importadas que ofrecen protección básica a costos unitarios más bajos.

- En 2024, según uvex Safety Group, la inversión en pruebas de laboratorio de varias etapas y auditorías de calidad internas para zapatos con certificación EN ISO 20345 S3 aumentó los costos de producción en más del 10%, lo que destaca la carga financiera de garantizar el cumplimiento manteniendo características ergonómicas y de seguridad avanzadas.

- En 2023, ELTEN GmbH informó en su revisión anual que el aumento de los costos de las punteras compuestas, las entresuelas resistentes a las perforaciones y los sistemas de amortiguación ergonómicos llevaron a un aumento del 12 al 15 % en los costos de producción unitarios promedio para los modelos con clasificación S3 y ESD, lo que demuestra las presiones de costos asociadas con la adopción de materiales de primera calidad.

- En 2023, el Ministerio Federal de Economía y Acción Climática de Alemania (BMWK) confirmó que los fabricantes de EPI regulados, incluido el calzado de seguridad, destinan una mayor proporción de sus presupuestos de I+D a procesos de certificación y cumplimiento que los segmentos de calzado no regulado, lo que indica desafíos de costos operativos a largo plazo para los productores más pequeños.

- En 2025, según HAIX Group, las inversiones continuas en instalaciones de prueba, capacitación de empleados y organismos de certificación externos acreditados aumentaron los costos generales, lo que afectó particularmente la flexibilidad de precios de los modelos de calzado de seguridad orientados a la exportación.

- En 2024, el Instituto Federal Alemán de Seguridad y Salud en el Trabajo (BAuA) informó que las actualizaciones de las normas EN ISO 20345 y las reglas técnicas DGUV relacionadas requieren que los fabricantes realicen reevaluaciones y recertificaciones periódicas, lo que impone cargas financieras y administrativas recurrentes a los productores de calzado de seguridad.

- En 2024, la Comisión Europea (Reglamento EPI UE 2016/425) señaló que los cambios en las normas de seguridad armonizadas a menudo requieren la recertificación de los modelos de calzado de seguridad existentes, lo que genera costos de cumplimiento recurrentes que restringen la agilidad del mercado, especialmente para los fabricantes pequeños y medianos.

- En conclusión, el impacto combinado de los estrictos requisitos de certificación, las obligaciones recurrentes de cumplimiento normativo y el uso de materiales de protección de primera calidad sigue ejerciendo una importante presión financiera sobre los fabricantes de calzado de seguridad en Alemania. Si bien estos costos garantizan un calzado de alta calidad que cumple con la normativa y protege a los trabajadores de los sectores industrial y de la construcción, también limitan la flexibilidad de precios y la agilidad del mercado, especialmente para los productores pequeños y medianos. Como resultado, los altos costos de producción y certificación siguen siendo una limitación persistente que configura la dinámica competitiva e influye en la estrategia de producto dentro del mercado alemán de calzado de seguridad.

Análisis del mercado del calzado de seguridad en Alemania

El mercado alemán de calzado de seguridad está segmentado en cinco segmentos notables según el tipo de producto, el género del material, la industria y el canal de distribución.

- Por tipo de producto

Según el tipo de producto, el mercado alemán de calzado de seguridad está segmentado en calzado de protección de dedos, calzado de protección metatarsiana, calzado de protección contra riesgos eléctricos, calzado químico o impermeable, calzado resistente al calor y al fuego, calzado antideslizante, calzado de seguridad deportiva, otros.

En 2026, se prevé que el segmento de calzado con protección para los dedos domine el mercado alemán de calzado de seguridad con una cuota del 29,82%, impulsado por su amplia adopción en los sectores de la construcción, la fabricación, el procesamiento de metales y la logística, donde la protección contra impactos y presiones es obligatoria. Además de ostentar la mayor cuota de mercado, el calzado con protección para los dedos es también el segmento de mayor crecimiento, impulsado por el aumento de la aplicación de normativas y la creciente concienciación sobre la seguridad laboral. Estos productos ofrecen mayor durabilidad, un estricto cumplimiento de las normas europeas de seguridad y una mayor confianza de los trabajadores, lo que convierte al calzado con protección para los dedos en un requisito fundamental en entornos industriales de alto riesgo.

- Por material

En función del material, el mercado alemán de calzado de seguridad está segmentado en cuero, caucho, plástico, textil y otros.

En 2026, se prevé que el cuero domine el mercado alemán de calzado de seguridad con una cuota de mercado del 51,39% gracias a su excelente durabilidad, transpirabilidad y comodidad, lo que lo hace ideal para un uso industrial prolongado. El calzado de seguridad de cuero ofrece mayor resistencia a la abrasión, mantiene la flexibilidad en diversas condiciones de trabajo y favorece un diseño ergonómico, lo que refuerza su adopción generalizada en los sectores de la construcción, la manufactura y la industria pesada.

- Por género

En función del género, el mercado alemán de calzado de seguridad está segmentado en hombres, mujeres y unisex.

En 2026, se prevé que el segmento masculino domine la cuota de mercado del calzado de seguridad en Alemania, con un 71,63 %, debido a la mayor concentración de mano de obra masculina en los sectores de la construcción, la manufactura, el procesamiento de metales y la industria pesada. El calzado de seguridad masculino goza de una amplia adopción gracias a su disponibilidad en una gama más amplia de diseños de protección, su capacidad de carga y su cumplimiento de las estrictas normativas de seguridad laboral. Sin embargo, los segmentos femenino y unisex están ganando terreno gracias al aumento de la participación femenina en la fuerza laboral y a la creciente demanda de calzado de seguridad ergonómico y de tallas ajustables en diversas industrias alemanas.

- Por industria

Sobre la base de la industria, el mercado alemán de calzado de seguridad está segmentado en petróleo y gas, industria agrícola, industria química, industria de la construcción, industria metalúrgica, industria alimentaria, industria del transporte, industria de la seguridad, industria minera, industria farmacéutica, industria electrónica y otros.

En 2026, se prevé que el segmento de la industria de la construcción domine la cuota de mercado de calzado de seguridad de Alemania con un 31,83 % debido al desarrollo continuo de la infraestructura, las estrictas normas de seguridad en el lugar de trabajo y la alta exposición de los trabajadores a peligros mecánicos, eléctricos y relacionados con resbalones en diversos entornos de construcción.

- Por canal de distribución

Sobre la base del canal de distribución, el mercado de calzado de seguridad de Alemania se segmenta en calzado sin tienda, calzado con tienda y otros.

En 2026, se prevé que el segmento sin tiendas domine la cuota de mercado de calzado de seguridad de Alemania del 63,51% debido a la fuerte presencia de redes minoristas organizadas, la fácil accesibilidad para compradores industriales y comerciales y la capacidad de proporcionar demostraciones y ajustes personalizados, mientras que el segmento sin tiendas está experimentando un crecimiento constante debido a la creciente adopción de plataformas en línea y canales de comercio electrónico para una adquisición conveniente y una selección de productos más amplia.

Cuota de mercado del calzado de seguridad en Alemania

A continuación se enumeran algunos de los principales actores que operan en el mercado de calzado de seguridad de Alemania:

- Engelbert Strauss Inc. (Alemania)

- ATLAS GmbH & Co.KG (Alemania)

- ELTEN GmbH (Alemania)

- Grupo de seguridad UVEX (Alemania)

- Heinrich Klumpen Söhne GmbH & Co. KG (Alemania)

- Bata Industrials (Países Bajos)

- Aigle (Francia)

- Stabilus Safety GmbH (Alemania)

- LUPOS® GmbH, (Alemania)

- Calzado de seguridad FTG Srl, (Italia)

- Portwest UC (Irlanda)

- calzado talan,

- GRUPO HAIX (Alemania)

- COFRA Srl (Italia)

Últimos avances en el mercado alemán de calzado de seguridad

- Durante 2024, Engelbert Strauss continuó con su estrategia de lanzamientos semestrales de calzado de seguridad, en consonancia con las colecciones de primavera/verano y otoño/invierno. Estos lanzamientos priorizaron el diseño moderno, los materiales ligeros y el cumplimiento de la norma EN ISO 20345, centrándose en los sectores de la construcción, la logística y los oficios especializados. En 2025, la empresa reforzó aún más su modelo de venta directa al consumidor y comercio electrónico en Alemania, con el apoyo de inversiones en infraestructura logística y centros de experiencia de marca. Las iniciativas de sostenibilidad, como las colaboraciones a largo plazo con proveedores y el abastecimiento responsable, siguieron siendo un enfoque fundamental durante este período.

- En 2024, ATLAS mantuvo su posición como uno de los mayores fabricantes de calzado de seguridad de Europa, centrándose en la producción de alta capacidad en sus instalaciones de Dortmund, lo que reforzó su posicionamiento "Hecho en Alemania". A lo largo de 2025, la empresa priorizó la optimización de procesos, la automatización y una calidad constante, en lugar de realizar cambios importantes en su cartera de productos. ATLAS continuó abasteciendo a grandes clientes industriales de los sectores de la construcción, la automoción, la fabricación y la logística, beneficiándose de la creciente demanda de calzado de seguridad certificado, impulsada por el cumplimiento normativo.

- En 2024, ELTEN aceleró la implementación de su estrategia de sostenibilidad ELTEN LOOP, introduciendo nuevos modelos de calzado de seguridad fabricados con materiales reciclados y responsables con el medio ambiente. La empresa reforzó su posicionamiento ESG, obteniendo reconocimiento gracias a sus altas calificaciones de sostenibilidad y RSE, lo que incrementó su atractivo entre los compradores corporativos e industriales. En 2025, ELTEN reforzó la visibilidad de su marca participando en importantes ferias del sector, como la A+A de Düsseldorf, a la vez que continuó innovando en comodidad, durabilidad y ecodiseño dentro de su gama de calzado de seguridad premium.

- Durante 2024, UVEX amplió su enfoque en calzado de seguridad ligero y ergonómico, integrando sistemas de suela avanzados y diseños que reducen la fatiga para soportar largas jornadas laborales en entornos industriales. En 2025, tras una inversión de capital privado, UVEX inició una nueva fase estratégica con el objetivo de acelerar el crecimiento, la innovación y la expansión internacional. Se espera que este desarrollo fortalezca la cartera de calzado de seguridad de UVEX mediante una mayor inversión en I+D, la innovación en materiales sostenibles y una mayor presencia en el mercado, manteniendo al mismo tiempo su tradición de ingeniería alemana.

- A lo largo de 2024, HAIX continuó centrándose en el calzado de seguridad de alto rendimiento, especialmente para aplicaciones industriales, de servicios públicos y de emergencia. El desarrollo de productos priorizó el rendimiento técnico, la durabilidad, la resistencia al deslizamiento y la comodidad ergonómica. En 2025, HAIX mantuvo su estrategia de perfeccionamiento progresivo de productos en lugar de grandes cambios corporativos, lo que consolidó su reputación como fabricante especializado. La producción europea continua y los estrictos estándares de calidad respaldaron la fuerte demanda de los usuarios profesionales e industriales en Alemania.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GERMANY SAFETY FOOTWEAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 COMPETITIVE RIVALRY

4.2 INNOVATION TRACKER AND STRATEGIC ANALYSIS – GERMANY SAFETY FOOTWEAR MARKET

4.2.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.2.2 JOINT VENTURES

4.2.3 MERGERS AND ACQUISITIONS

4.2.4 LICENSING AND PARTNERSHIP

4.2.5 TECHNOLOGY COLLABORATIONS

4.2.6 STRATEGIC DIVESTMENTS

4.2.7 NUMBER OF PRODUCTS IN DEVELOPMENT

4.2.8 STAGE OF DEVELOPMENT

4.2.9 TIMELINES AND MILESTONES

4.2.10 INNOVATION STRATEGIES AND METHODOLOGIES

4.2.11 RISK ASSESSMENT AND MITIGATION

4.2.12 FUTURE OUTLOOK

4.2.13 CONCLUSION

4.2.14 EXPLANATION: -

4.2.15 EXPLANATION: -

4.2.16 EXPLANATION: -

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 INTRODUCTION

4.3.2 OVERVIEW

4.3.3 RAW MATERIAL SOURCING & PROCUREMENT

4.3.4 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.3.5 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.3.6 LOGISTIC COST SCENARIO

4.3.7 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.3.8 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.3.9 CONCLUSION

4.4 RAW MATERIAL COVERAGE

4.4.1 LEATHER

4.4.2 RUBBER AND THERMOPLASTIC POLYURETHANE (TPU)

4.4.3 METALS AND COMPOSITE MATERIALS

4.4.4 TEXTILE AND SYNTHETIC FABRICS

4.4.5 CUSHIONING AND SHOCK-ABSORBING MATERIALS

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 DESIGN AND PRODUCT DEVELOPMENT

4.5.3 MANUFACTURING AND PRODUCTION

4.5.4 DISTRIBUTION AND LOGISTICS

4.5.5 MARKETING AND SALES

4.5.6 AFTER-SALES SUPPORT

4.5.7 CONCLUSION

4.6 COST ANALYSIS BREAKDOWN OF THE GERMANY SAFETY FOOTWEAR MARKET

4.6.1 INTRODUCTION

4.6.2 RAW MATERIAL AND MANUFACTURING COSTS

4.6.3 PACKAGING AND LOGISTICS COSTS

4.6.4 RESEARCH, QUALITY, AND REGULATORY COMPLIANCE COSTS

4.6.5 ENVIRONMENTAL, ENERGY, AND SUSTAINABILITY COSTS

4.6.6 EMERGING COST TRENDS

4.6.7 CONCLUSION

4.7 PROFIT MARGINS SCENARIO OF THE GERMANY SAFETY FOOTWEAR MARKET

4.7.1 INTRODUCTION

4.7.2 COST MANAGEMENT AND MARGIN FORMATION

4.7.3 TECHNOLOGY DIFFERENTIATION AND PRODUCT STRATEGY

4.7.4 SUPPLY CHAIN AND DISTRIBUTION INFLUENCE

4.7.5 REGULATORY AND MACROECONOMIC INFLUENCES

4.7.6 EMERGING TRENDS AND STRATEGIC RESPONSES

4.7.7 CONCLUSION

4.8 PRICING ANALYSIS

4.9 VENDOR SELECTION CRITERIA

4.9.1 CERTIFICATION COMPLIANCE

4.9.2 PRODUCT QUALITY

4.9.3 CUSTOMIZATION ABILITY

4.9.4 COST & COMMERCIAL COMPETITIVENESS

4.9.5 REGULATORY, SAFETY & SUSTAINABILITY PRACTICES

4.9.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.1 BRAND OUTLOOK

4.10.1 COMPANY VS BRAND OVERVIEW

4.11 CLIMATE CHANGE SCENARIO

4.11.1 ENVIRONMENTAL CONCERNS

4.11.2 INDUSTRY RESPONSE

4.11.3 GOVERNMENT’S ROLE

4.11.4 ANALYST RECOMMENDATIONS

4.12 CONSUMER BUYING BEHAVIOUR

4.13 INTRODUCTION

4.13.1 SHIFT TOWARDS COMFORT, ERGONOMICS AND ADVANCE PROTECTION

4.13.2 STRONG EMPHASIS ON REGULATORY COMPLIANCE AND BRAND CREDIBILITY

4.13.3 PRICE SENSITIVITY AND PROCUREMENT-BASED PURCHASING

4.13.4 INFLUENCE OF DISTRIBUTION CHANNELS AND DIGITAL PROCUREMENT

4.13.5 IMPORTANCE OF SUPPLY RELIABILITY AND PRODUCT CONSISTENCY

4.13.6 ROLE OF VALUE-ADDED SERVICES

4.13.7 SUSTAINABILITY, ETHICAL PRACTICES, AND PREMIUM PREFERENCES

4.13.8 INFLUENCE OF INDUSTRY TYPE AND WORKPLACE CULTURE

4.13.9 CONCLUSION

4.14 INDUSTRY ECOSYSTEM ANALYSIS

4.14.1 PROMINENT COMPANIES

4.14.2 SMALL & MEDIUM SIZE COMPANIES

4.14.3 END USERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 ADVANCED MATERIALS AND LIGHTWEIGHT PROTECTION

4.15.2 ERGONOMIC AND BIOMECHANICAL ENHANCEMENTS

4.15.3 SMART TECHNOLOGIES AND SENSOR INTEGRATION

4.15.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.15.5 PRECISION MANUFACTURING AND DIGITAL DESIGN TOOLS

5 TARIFFS & THEIR IMPACT ON THE GERMANY SAFETY FOOTWEAR MARKET

5.1 INTRODUCTION

5.2 CURRENT TARIFF RATE(S) IN GERMANY AND KEY TRADING PARTNER COUNTRIES

5.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE IN GERMANY

5.4 VENDOR SELECTION CRITERIA DYNAMICS IN GERMANY

5.5 IMPACT ON THE GERMANY SAFETY FOOTWEAR SUPPLY CHAIN

5.5.1 RAW MATERIAL PROCUREMENT

5.5.2 MANUFACTURING AND PRODUCTION

5.5.3 LOGISTICS AND DISTRIBUTION

5.5.4 PRICE PITCHING AND MARKET POSITIONING IN GERMANY

5.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES IN GERMANY

5.6.1 SUPPLY CHAIN OPTIMIZATION

5.6.2 JOINT VENTURE ESTABLISHMENTS

5.7 IMPACT ON PRICES IN GERMANY

5.7.1 REGULATORY INCLINATION AFFECTING GERMANY

5.7.1.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS RELEVANT TO GERMANY

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION IN GERMANY

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF INDUSTRIAL PARKS AND MANUFACTURING CLUSTERS

5.8 CONCLUSION

5.8.1 EXPLANATION:-

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 STRONG INDUSTRIAL BASE AND SAFETY REGULATION COMPLIANCE

7.1.2 GROWTH IN INDUSTRIAL AND CONSTRUCTION ACTIVITIES

7.1.3 INCREASING ADOPTION OF LIGHTWEIGHT COMPOSITE TOE CAPS AND ERGONOMIC SOLE TECHNOLOGIES IMPROVING USER ACCEPTANCE

7.1.4 RISING EMPLOYER FOCUS ON WORKER HEALTH, ERGONOMICS, AND INJURY PREVENTION

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION AND CERTIFICATION COSTS

7.2.2 LONGER APPROVAL CYCLES FOR NEW DESIGNS

7.3 OPPORTUNITY

7.3.1 GROWING DEMAND FOR SUSTAINABLE AND ECO FRIENDLY FOOTWEAR

7.3.2 EXPANSION OF PREMIUM, ROLE-SPECIFIC SAFETY SHOES

7.3.3 GROWTH OF DIGITAL B2B PROCUREMENT AND E-COMMERCE

7.4 CHALLENGES

7.4.1 INTENSE COMPETITION FROM INTERNATIONAL BRANDS AND PRIVATE-LABEL SUPPLIERS

7.4.2 MANAGING SUPPLY CHAIN DISRUPTIONS AND RAW MATERIAL COST VOLATILITY

8 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TOE PROTECTION FOOTWEAR

8.3 METATARSAL PROTECTION FOOTWEAR

8.4 ELECTRICAL HAZARD PROTECTION FOOTWEAR

8.5 CHEMICAL / WATERPROOF FOOTWEAR

8.6 HEAT & FIRE-RESISTANT FOOTWEAR

8.7 SLIP-RESISTANT FOOTWEAR

8.8 SPORT SAFETY FOOTWEAR

8.9 OTHERS

9 GERMANY SAFETY FOOTWEAR MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 LEATHER

9.3 RUBBER

9.4 PLASTIC

9.5 TEXTILE

9.6 OTHERS

9.6.1 GENUINE LEATHER

9.6.2 SYNTHETIC LEATHER

9.6.3 SYNTHETIC RUBBER

9.6.4 NATURAL RUBBER

9.6.5 POLYURETHANE (PU) AND POLYURETHANE FOAM

9.6.6 POLYESTER

9.6.7 ETHYLENE-VINYL ACETATE (EVA)

9.6.8 POLYVINYL CHLORIDE (PVC)

9.6.9 OTHERS

10 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER

10.1 OVERVIEW

10.2 MEN

10.3 WOMEN

10.4 UNISEX

11 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 OIL & GAS

11.2.1 OIL AND GAS, BY APPLICATION

11.2.1.1 ON SHORE

11.2.1.2 OFF SHORE

11.2.2 OIL AND GAS, BY PRODUCT

11.2.2.1 TOE PROTECTION FOOTWEAR

11.2.2.2 METATARSAL PROTECTION FOOTWEAR

11.2.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.2.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.2.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.2.2.6 SLIP-RESISTANT FOOTWEAR

11.2.2.7 SPORT SAFETY FOOTWEAR

11.2.2.8 OTHERS

11.3 AGRICULTURE INDUSTRY

11.3.1 TOE PROTECTION FOOTWEAR

11.3.2 METATARSAL PROTECTION FOOTWEAR

11.3.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.3.4 CHEMICAL / WATERPROOF FOOTWEAR

11.3.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.3.6 SLIP-RESISTANT FOOTWEAR

11.3.7 SPORT SAFETY FOOTWEAR

11.3.8 OTHERS

11.4 CHEMICAL INDUSTRY

11.4.1 TOE PROTECTION FOOTWEAR

11.4.2 METATARSAL PROTECTION FOOTWEAR

11.4.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.4.4 CHEMICAL / WATERPROOF FOOTWEAR

11.4.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.4.6 SLIP-RESISTANT FOOTWEAR

11.4.7 SPORT SAFETY FOOTWEAR

11.4.8 OTHERS

11.5 CONSTRUCTION INDUSTRY

11.5.1 CONSTRUCTION INDUSTRY, BY APPLICATION

11.5.1.1 RESIDENTIAL CONSTRUCTION

11.5.1.2 ENGINEERING CONSTRUCTION

11.5.1.2.1 ENGINEERING CONSTRUCTION, BY TYPE

11.5.1.2.1.1 ROADWAYS

11.5.1.2.1.2 PIPELINES

11.5.1.2.1.3 BRIDGES

11.5.1.2.1.4 TUNNELS AND DAMS

11.5.1.2.1.5 RAILWAYS

11.5.1.2.1.6 AIRPORT CONSTRUCTION

11.5.1.2.1.7 OTHERS

11.5.1.3 COMMERCIAL CONSTRUCTION

11.5.1.3.1 COMMERCIAL CONSTRUCTION, BY TYPE

11.5.1.3.1.1 OFFICES

11.5.1.3.1.2 HEALTHCARE FACILITIES

11.5.1.3.1.3 EDUCATION INSTITUTIONS

11.5.1.3.1.4 HOTELS

11.5.1.3.1.5 RESTAURANTS & BARS

11.5.1.3.1.6 WAREHOUSES

11.5.1.3.1.7 RESEARCH LABORATORIES

11.5.1.3.1.8 OTHERS

11.5.2 CONSTRUCTION INDUSTRY, BY PRODUCT

11.5.2.1 TOE PROTECTION FOOTWEAR

11.5.2.2 METATARSAL PROTECTION FOOTWEAR

11.5.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.5.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.5.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.5.2.6 SLIP-RESISTANT FOOTWEAR

11.5.2.7 SPORT SAFETY FOOTWEAR

11.5.2.8 OTHERS

11.6 METAL INDUSTRY

11.6.1 TOE PROTECTION FOOTWEAR

11.6.2 METATARSAL PROTECTION FOOTWEAR

11.6.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.6.4 CHEMICAL / WATERPROOF FOOTWEAR

11.6.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.6.6 SLIP-RESISTANT FOOTWEAR

11.6.7 SPORT SAFETY FOOTWEAR

11.6.8 OTHERS

11.7 FOOD INDUSTRY

11.7.1 FOOD

11.7.1.1 MEAT AND ALTERNATIVES

11.7.1.2 MILK AND MILK PRODUCTS

11.7.1.3 FRUITS AND VEGETABLES

11.7.1.4 GRAIN PRODUCTS

11.7.1.5 OTHERS

11.7.1.6 BEVERAGES

11.7.1.6.1 BEVERAGE, BY TYPE

11.7.1.6.1.1 NON - ALCOHOLIC

11.7.1.6.1.1.1 BOTTLED WATER

11.7.1.6.1.1.2 CARBONATED SOFT DRINKS (CSDS)

11.7.1.6.1.1.3 FUNCTIONAL BEVERAGES

11.7.1.6.1.1.4 FRUIT BEVERAGES

11.7.1.6.1.1.5 SPORTS DRINKS

11.7.1.6.1.1.6 OTHERS

11.7.1.6.1.2 ALCOHOLIC

11.7.1.6.1.2.1 BEER

11.7.1.6.1.2.2 SPIRITS

11.7.1.6.1.2.3 WINES

11.7.1.6.1.2.4 TEQUILA & COCKTAILS

11.7.1.6.1.2.5 CHAMPAGNE

11.7.1.6.1.2.6 OTHERS

11.7.2 FOOD INDUSTRY, BY PRODUCT

11.7.2.1 TOE PROTECTION FOOTWEAR

11.7.2.2 METATARSAL PROTECTION FOOTWEAR

11.7.2.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.7.2.4 CHEMICAL / WATERPROOF FOOTWEAR

11.7.2.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.7.2.6 SLIP-RESISTANT FOOTWEAR

11.7.2.7 SPORT SAFETY FOOTWEAR

11.7.2.8 OTHERS

11.8 TRANSPORT INDUSTRY

11.8.1 TOE PROTECTION FOOTWEAR

11.8.2 METATARSAL PROTECTION FOOTWEAR

11.8.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.8.4 CHEMICAL / WATERPROOF FOOTWEAR

11.8.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.8.6 SLIP-RESISTANT FOOTWEAR

11.8.7 SPORT SAFETY FOOTWEAR

11.8.8 OTHERS

11.9 SECURITY INDUSTRY

11.9.1 TOE PROTECTION FOOTWEAR

11.9.2 METATARSAL PROTECTION FOOTWEAR

11.9.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.9.4 CHEMICAL / WATERPROOF FOOTWEAR

11.9.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.9.6 SLIP-RESISTANT FOOTWEAR

11.9.7 SPORT SAFETY FOOTWEAR

11.9.8 OTHERS

11.1 MINING INDUSTRY

11.10.1 TOE PROTECTION FOOTWEAR

11.10.2 METATARSAL PROTECTION FOOTWEAR

11.10.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.10.4 CHEMICAL / WATERPROOF FOOTWEAR

11.10.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.10.6 SLIP-RESISTANT FOOTWEAR

11.10.7 SPORT SAFETY FOOTWEAR

11.10.8 OTHERS

11.11 PHARMACEUTICAL INDUSTRY

11.11.1 TOE PROTECTION FOOTWEAR

11.11.2 METATARSAL PROTECTION FOOTWEAR

11.11.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.11.4 CHEMICAL / WATERPROOF FOOTWEAR

11.11.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.11.6 SLIP-RESISTANT FOOTWEAR

11.11.7 SPORT SAFETY FOOTWEAR

11.11.8 OTHERS

11.12 ELECTRONIC INDUSTRY

11.12.1 TOE PROTECTION FOOTWEAR

11.12.2 METATARSAL PROTECTION FOOTWEAR

11.12.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.12.4 CHEMICAL / WATERPROOF FOOTWEAR

11.12.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.12.6 SLIP-RESISTANT FOOTWEAR

11.12.7 SPORT SAFETY FOOTWEAR

11.12.8 OTHERS

11.13 OTHERS

11.13.1 TOE PROTECTION FOOTWEAR

11.13.2 METATARSAL PROTECTION FOOTWEAR

11.13.3 ELECTRICAL HAZARD PROTECTION FOOTWEAR

11.13.4 CHEMICAL / WATERPROOF FOOTWEAR

11.13.5 HEAT & FIRE-RESISTANT FOOTWEAR

11.13.6 SLIP-RESISTANT FOOTWEAR

11.13.7 SPORT SAFETY FOOTWEAR

11.13.8 OTHERS

12 GERMANY SAFETY FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 NON-STORE BASED

12.2.1 COMPANY OWNED WEBSITES

12.2.2 THIRD PARTY E COMMERCE PLATFORM

12.3 STORE BASED

12.3.1 SUPERMARKETS/HYPERMARKETS

12.3.2 INDUSTRIAL STORES

12.3.3 BRAND EXCLUSIVE STORES

12.3.4 INDEPENDENT RETAILERS

12.3.5 MULTI BRAND STORE

12.3.6 OTHERS

12.4 OTHERS

13 GERMANY SAFETY FOOTWEAR MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GERMANY

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ENGELBERT STRAUSS INC

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ATLAS

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVEOPMENT

15.3 ELTEN

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVEOPMENT

15.4 UVEX SAFETY GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVEOPMENT

15.5 HKS GMBH & CO. KG

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVEOPMENT

15.6 AIGLE (A SUBSIDIARY OF MAUS FRÈRES SA)

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALBATROS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVEOPMENT

15.8 ALPHA-TEX ARBEITSSCHUTZ GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVEOPMENT

15.9 ARBEITSSCHUTZ-EXPRESS (ASX)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVEOPMENT

15.1 BATA INDUSTRIALS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COFRA S.R.L.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOOTWEAR TALAN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FTG SAFETY SHOES SRL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HAIX GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 LUPOS® GMBH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LAYER GROBHANDEL

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVEOPMENT

15.17 PORTWEST UC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SCENOLIA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 STABILUS SAFETY GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TEXTIL-GROSSHANDEL EU

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVEOPMENT

15.21 HASTEDT ECOMMERCE GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 STOCKETIK GROBHANDE

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVEOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 GERMANY SAFETY FOOTWEAR COST MODEL

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 COMPANY VS BRAND OVERVIEW

TABLE 4 CONSUMER PREFERENCE MATRIX

TABLE 5 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 7 GERMANY SAFETY FOOTWEAR MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 8 GERMANY LEATHER IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 GERMANY RUBBER IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GERMANY PLASTIC IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER, 2018-2033 (USD THOUSAND)

TABLE 12 GERMANY SAFETY FOOTWEAR MARKET, BY GENDER, 2018-2033 (THOUSAND UNITS)

TABLE 13 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 14 GERMANY SAFETY FOOTWEAR MARKET, BY INDUSTRY, 2018-2033 (THOUSAND UNITS)

TABLE 15 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 16 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (THOUSAND UNITS)

TABLE 17 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 18 GERMANY OIL & GAS IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 19 GERMANY AGRICULTURE INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 20 GERMANY AGRICULTURE INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 21 GERMANY CHEMICAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 22 GERMANY CHEMICAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 23 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 24 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 25 GERMANY ENGINEERING CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GERMANY ENGINEERING CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 27 GERMANY COMMERCIAL CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 GERMANY COMMERCIAL CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 29 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 30 GERMANY CONSTRUCTION INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 31 GERMANY METAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 32 GERMANY METAL INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 33 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 35 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY FOOD TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY FOOD TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 37 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY BEVERAGES TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY BEVERAGES TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 39 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY NON-ALCOHOLIC, 2018-2033 (USD THOUSAND)

TABLE 40 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY NON-ALCOHOLIC, 2018-2033 (THOUSAND UNITS)

TABLE 41 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY ALCOHOLIC, 2018-2033 (USD THOUSAND)

TABLE 42 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY ALCOHOLIC, 2018-2033 (THOUSAND UNITS)

TABLE 43 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 44 GERMANY FOOD INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 45 GERMANY TRANSPORT INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 46 GERMANY TRANSPORT INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 47 GERMANY SECURITY INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 48 GERMANY SECURITY INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 49 GERMANY MINING INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 50 GERMANY MINING INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 51 GERMANY PHARMACEUTICALS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 52 GERMANY PHARMACEUTICALS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 53 GERMANY ELECTRONICS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 54 GERMANY ELECTRONICS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 55 GERMANY OTHERS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 56 GERMANY OTHERS INDUSTRY IN SAFETY FOOTWEAR MARKET, BY PRODUCT, 2018-2033 (THOUSAND UNITS)

TABLE 57 GERMANY SAFETY FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 58 GERMANY NON-STORE BASED IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 GERMANY STORE BASED IN SAFETY FOOTWEAR MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

Lista de figuras

FIGURE 1 GERMANY SAFETY FOOTWEAR MARKET

FIGURE 2 GERMANY SAFETY FOOTWEAR MARKET: DATA TRIANGULATION

FIGURE 3 GERMANY SAFETY FOOTWEAR MARKET: DROC ANALYSIS

FIGURE 4 GERMANY SAFETY FOOTWEAR MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 GERMANY SAFETY FOOTWEAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GERMANY SAFETY FOOTWEAR MARKET: MULTIVARIATE MODELLING

FIGURE 7 GERMANY SAFETY FOOTWEAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GERMANY SAFETY FOOTWEAR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GERMANY SAFETY FOOTWEAR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GERMANY SAFETY FOOTWEAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GERMANY SAFETY FOOTWEAR MARKET: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 GERMANY SAFETY FOOTWEAR MARKET: SEGMENTATION

FIGURE 14 SEVEN SEGMENTS COMPRISE THE GERMANY SAFETY FOOTWEAR MARKET, BY PRODUCT TYPE (2025)

FIGURE 15 STRONG INDUSTRIAL BASE AND SAFETY REGULATION COMPLIANCE EXPECTED TO DRIVE THE GERMANY SAFETY FOOTWEAR MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 TOE PROTECTION FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GERMANY SAFETY FOOTWEAR MARKET IN 2026 & 2033

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 YEAR-WISE STRATEGIC DEAL ACTIVITY IN THE GERMANY SAFETY FOOTWEAR MARKET (2019–2024)

FIGURE 19 BREAKDOWN OF STRATEGIC DEALS BY TYPE IN THE GERMANY SAFETY FOOTWEAR MARKET

FIGURE 20 DISTRIBUTION OF STRATEGIC DEALS BY BUSINESS SEGMENT

FIGURE 21 GERMANY SAFETY FOOTWEAR MARKET, 2018-2033, AVERAGE PRICE (USD/UNIT)

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 PRODUCTION CAPACITY OUTLOOK AND MARKET SHARE DISTRIBUTION OF KEY MANUFACTURERS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GERMANY SAFETY FOOTWEAR MARKET

FIGURE 25 GERMANY SAFETY FOOTWEAR MARKET: BY PRODUCT TYPE, 2025

FIGURE 26 GERMANY SAFETY FOOTWEAR MARKET: BY MATERIAL, 2025

FIGURE 27 GERMANY SAFETY FOOTWEAR MARKET: BY GENDER, 2025

FIGURE 28 GERMANY SAFETY FOOTWEAR MARKET: BY INDUSTRY, 2025

FIGURE 29 GERMANY SAFETY FOOTWEAR MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 30 GERMANY SAFETY FOOTWEAR MARKET: COMPANY SHARE 2025 (%)

FIGURE 31 GERMANY SAFETY FOOTWEAR MARKET, SNAPSHOT (2025)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.