Global Alpha And Beta Emitters Based Radiopharmaceuticals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

801.45 Million

USD

1,769.20 Million

2024

2032

USD

801.45 Million

USD

1,769.20 Million

2024

2032

| 2025 –2032 | |

| USD 801.45 Million | |

| USD 1,769.20 Million | |

|

|

|

|

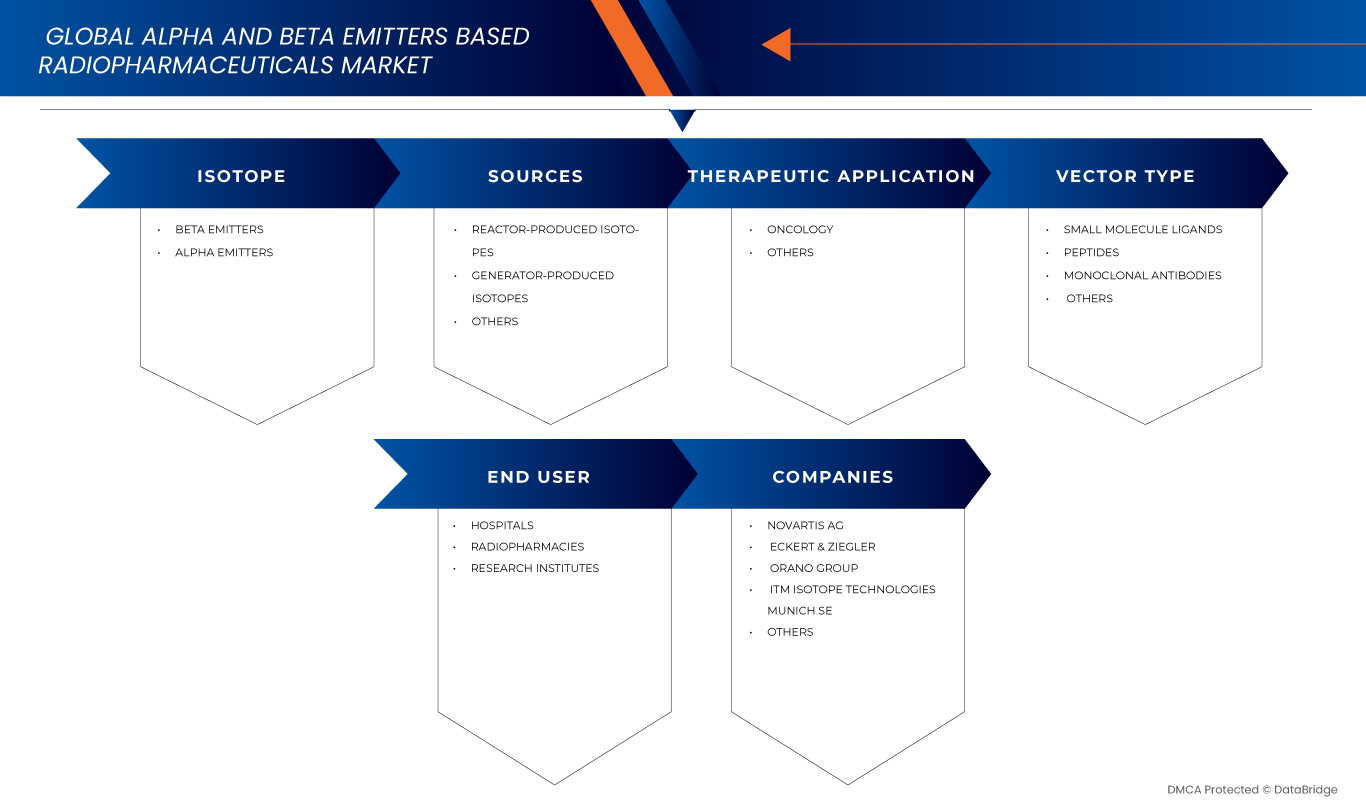

Segmentación del mercado global de radiofármacos basados en emisores alfa y beta, por isótopo (emisores beta y alfa), fuentes (isótopos producidos en reactor, isótopos producidos en generador y otros), aplicación terapéutica (oncología y otros), tipo de vector (ligandos de moléculas pequeñas, péptidos, anticuerpos monoclonales y otros), usuario final (hospitales, radiofarmacias e institutos de investigación): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de radiofármacos basados en emisores alfa y beta

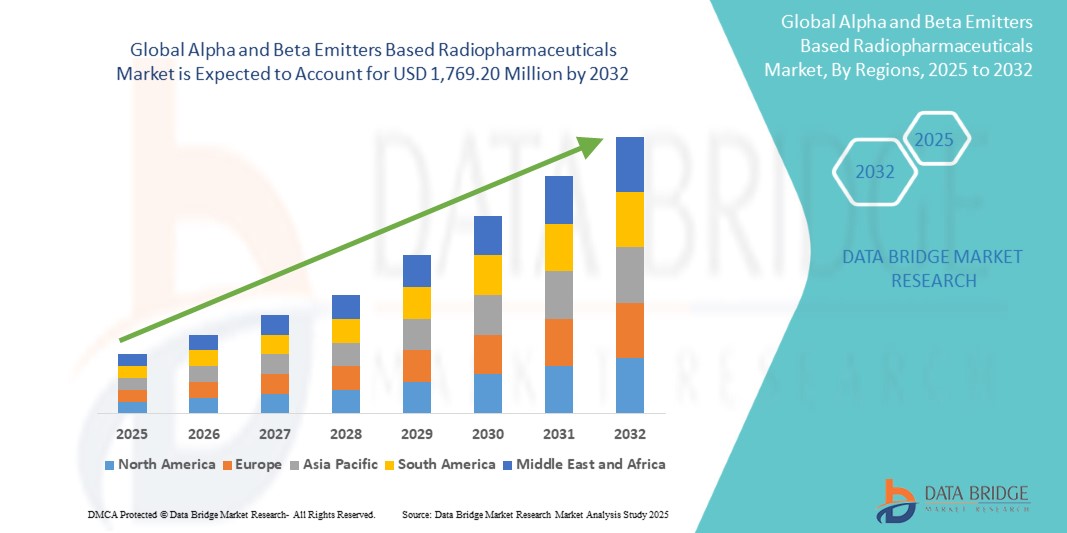

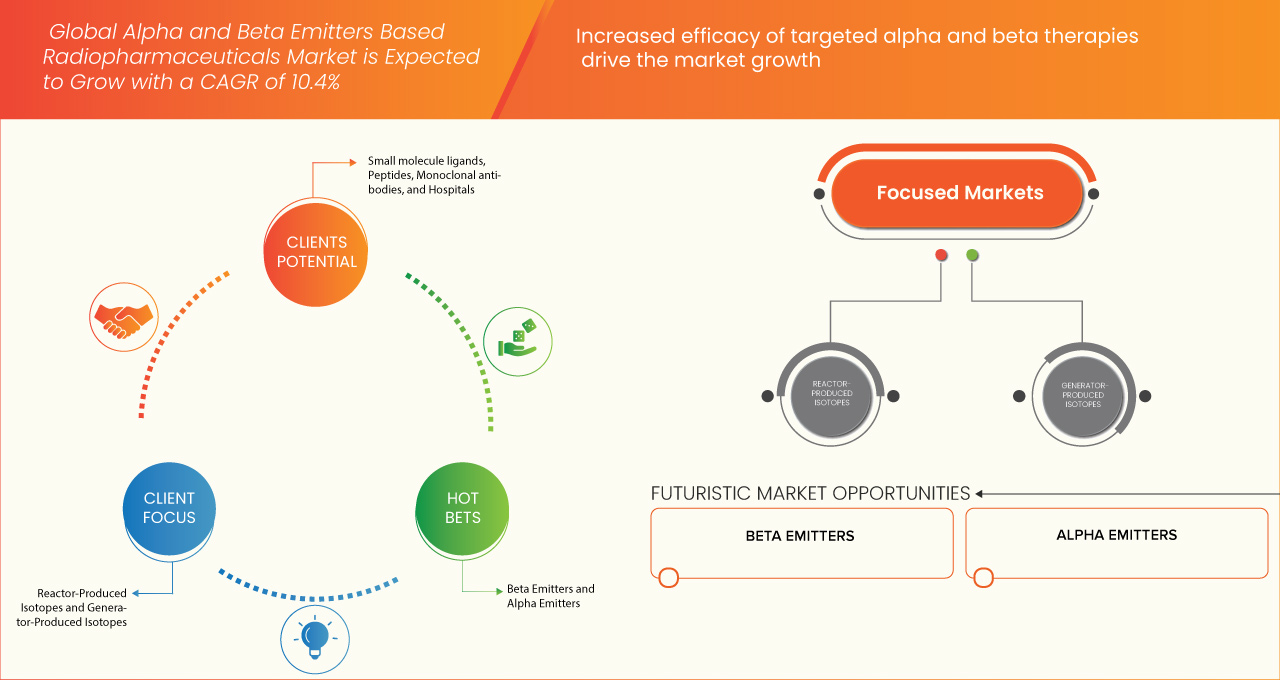

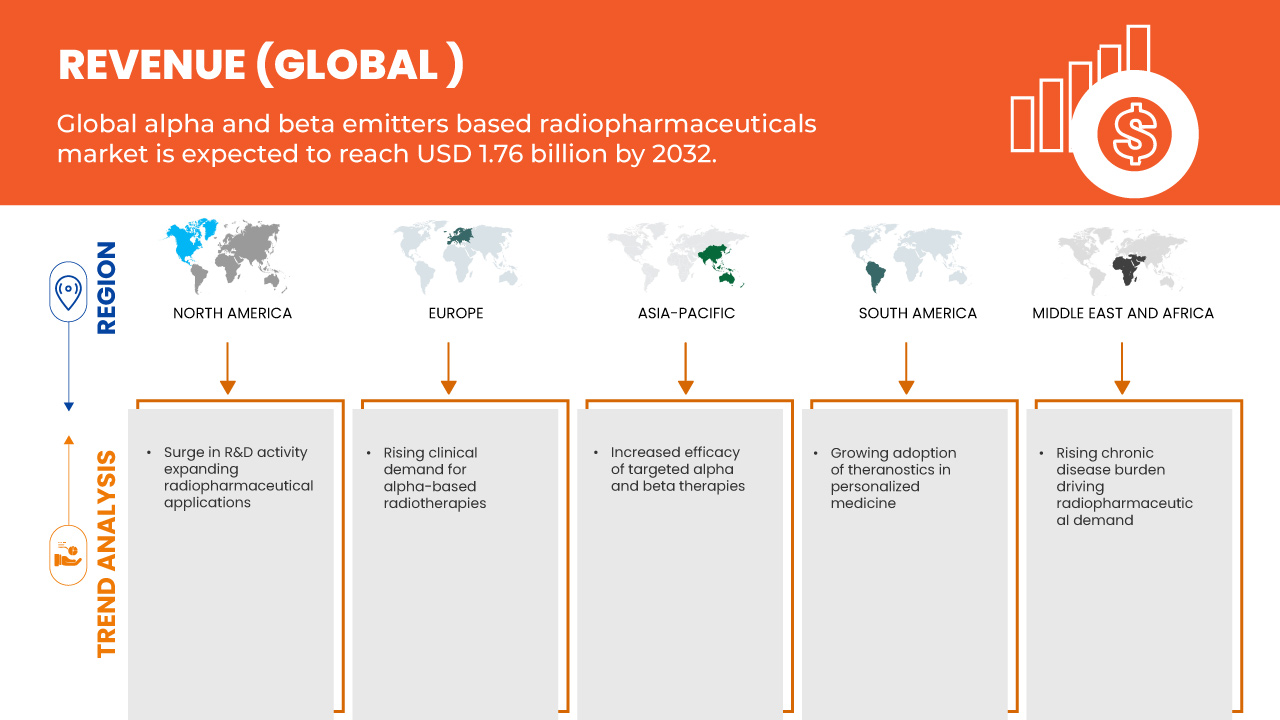

- El tamaño del mercado global de radiofármacos basados en emisores alfa y beta se valoró en USD 801,45 millones en 2024 y se espera que alcance los USD 1.769,20 millones para 2032 , con una CAGR del 10,4% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la mayor eficacia de las terapias alfa y beta dirigidas.

- Además, la creciente adopción de la teranóstica en la medicina personalizada. Estos factores convergentes están acelerando la adopción de soluciones radiofarmacéuticas basadas en emisores alfa y beta, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de radiofármacos basados en emisores alfa y beta

- Los radiofármacos basados en emisores alfa y beta son cada vez más reconocidos por su precisión en la terapia dirigida, especialmente en oncología y medicina nuclear, proporcionando opciones de diagnóstico y tratamiento eficaces con efectos secundarios mínimos.

- La creciente incidencia del cáncer en todo el mundo, junto con la creciente conciencia sobre la medicina personalizada y los avances en la tecnología radiofarmacéutica, está impulsando la demanda mundial de radiofármacos basados en emisores alfa y beta.

- América del Norte tiene una participación significativa en el mercado mundial de radiofármacos basados en emisores alfa y beta, que representa aproximadamente el 42,59 % de los ingresos en 2025, respaldada por una infraestructura de atención médica avanzada, amplias actividades de I+D y la adopción temprana de nuevas tecnologías terapéuticas.

- Se anticipa que la región de América del Norte será el mercado de radiofármacos basados en emisores alfa y beta de más rápido crecimiento durante el período de pronóstico, impulsado por la expansión de la infraestructura de atención médica, el aumento de la prevalencia del cáncer y las iniciativas gubernamentales para mejorar la atención médica.

- Se espera que el segmento de emisores beta domine el mercado con una participación del 84,78% en 2025, impulsado por su alta eficacia en la terapia alfa dirigida (TAT), mejores resultados para los pacientes y una creciente investigación centrada en isótopos emisores alfa como el actinio-225 y el radio-223 para el tratamiento del cáncer.

Alcance del informe y segmentación del mercado de radiofármacos basados en emisores alfa y beta

|

Atributos |

Perspectivas clave del mercado de radiofármacos basados en emisores alfa y beta |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Asia-Pacífico

Europa

Sudamerica

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de radiofármacos basados en emisores alfa y beta

Mayor eficacia de las terapias dirigidas alfa y beta

- Una fuerza impulsora importante detrás del mercado global de radiofármacos basados en emisores alfa y beta es la creciente adopción clínica de terapias con radionúclidos dirigidos, debido a su eficacia comprobada en el tratamiento de cánceres avanzados como los tumores neuroendocrinos y el cáncer de próstata metastásico resistente a la castración (mCRPC).

- Por ejemplo, en mayo de 2023, según el artículo publicado por el NCBI, el régimen aprobado de [177Lu]Lu-PSMA-617 (7,4 GBq por ciclo cada 6 semanas durante un máximo de 6 ciclos) ha demostrado una alta seguridad y eficacia antitumoral en el uso en la práctica clínica, con dosis flexibles (6-9,3 GBq) e intervalos de tratamiento (4-10 semanas). Este rendimiento clínico consistente refuerza la confianza de los médicos y acelera su adopción en el mercado.

- Los radiofármacos como Lu-177, particularmente cuando se utilizan en la terapia con radionúclidos de receptores peptídicos (PRRT), han demostrado un éxito notable en el tratamiento de tumores neuroendocrinos, al administrar una potente radiación beta directamente a los sitios del tumor y al mismo tiempo preservar los tejidos sanos, lo que conduce a mejores resultados y una mayor demanda.

- Los avances tecnológicos y la validación clínica de isótopos emisores de alfa, como el Ac-225, han impulsado aún más el mercado. El Ac-225 ha demostrado ser altamente eficaz para atacar las células de cáncer de próstata resistentes a las terapias tradicionales, con mínimos efectos secundarios y un fuerte impacto terapéutico.

Dinámica del mercado de radiofármacos basados en emisores alfa y beta

Conductor

Creciente adopción de la teranóstica en la medicina personalizada

- La creciente adopción de radiofármacos teranósticos de emisores alfa y beta, como el lutecio-177 (Lu-177) y el terbio-161 (Tb-161), es un factor clave que impulsa el mercado mundial de radiofármacos. Al combinar la imagenología diagnóstica con la terapia dirigida en un único flujo de trabajo clínico, estos agentes ofrecen una atención precisa y específica para cada paciente que mejora los resultados y agiliza la planificación del tratamiento.

- Por ejemplo, en julio de 2023, una revisión publicada en el NCBI informó sobre el aumento del uso clínico de regímenes teranósticos basados en Lu-177 (p. ej., ¹⁷⁷Lu-DOTATATE para tumores neuroendocrinos y ¹⁷⁷Lu-PSMA para cáncer de próstata). Las aprobaciones de la FDA para estos agentes validaron su seguridad y eficacia, acelerando su adopción y destacando la poderosa sinergia de los pares diagnóstico-terapéuticos compatibles.

- La creciente conciencia entre los oncólogos y los especialistas en medicina nuclear sobre la eficiencia del flujo de trabajo, la precisión del tratamiento y la toxicidad reducida asociada con los enfoques teranósticos está impulsando la demanda, ya que los médicos buscan herramientas confiables para el manejo personalizado del cáncer.

- Además, a medida que los sistemas de atención sanitaria enfrentan presiones crecientes para mejorar las tasas de supervivencia y controlar los costos, las soluciones integradas de terapia por imágenes como Lu-177 y Tb-161 reducen el tiempo de tratamiento, evitan intervenciones ineficaces y mejoran la calidad de vida, lo que consolida su propuesta de valor.

- La creciente preferencia por la oncología de precisión, junto con la I+D en curso en isótopos de próxima generación como Tb-149, Tb-152/155 y Ac-225, posiciona a los radiofármacos teranósticos como una piedra angular de la atención oncológica moderna y un motor de crecimiento clave para el mercado global.

Restricción/Desafío

Desafíos de la cadena de suministro y la escalabilidad derivados de las vidas medias cortas de los isótopos

- La corta vida media de los radionucleidos como el plomo-212 (~10,6 horas) crea importantes obstáculos logísticos y operativos: la producción debe realizarse cerca de los sitios de tratamiento, las ventanas de transporte son de solo unas pocas horas y se requieren cadenas de suministro "justo a tiempo" altamente coordinadas, lo que limita colectivamente la fabricación a gran escala y el alcance del mercado.

- Por ejemplo, en abril de 2025, LEK Consulting señaló que la vida media de 10,6 horas del Pb-212 obliga a una producción descentralizada, cercana al paciente y a una infraestructura de generadores in situ, lo que limita las economías de escala y complica la logística de distribución.

- Además, los intrincados sistemas generadores necesarios para extraer Pb-212 (y otros isótopos de vida corta) agregan capas de cumplimiento normativo, requisitos de seguridad radiológica y gastos de capital, lo que dificulta su implementación amplia para hospitales y radiofarmacias.

- Si bien los avances en generadores compactos, métodos de purificación más rápidos y centros de producción regionales podrían eventualmente aliviar estas presiones, la naturaleza fundamentalmente sensible al tiempo de los isótopos de vida corta sigue siendo una restricción importante para la adopción generalizada y el crecimiento del mercado de radiofármacos.

Alcance del mercado de radiofármacos basados en emisores alfa y beta

El mercado está segmentado según el isótopo, las fuentes, la aplicación terapéutica, el tipo de vector y el usuario final.

- Por isótopo

Según el tipo de isótopo, el mercado se segmenta en emisores beta y emisores alfa. En 2025, se prevé que el segmento de emisores beta domine el mercado con una cuota de mercado del 84,78 %, gracias a la amplia adopción clínica de isótopos como el lutecio-177 (Lu-177) y el itrio-90 (Y-90) para el tratamiento de tumores neuroendocrinos, cáncer de hígado y cáncer de próstata. Los emisores beta son los preferidos por sus vidas medias relativamente más largas, sus perfiles de seguridad consolidados y su compatibilidad con los procesos clínicos existentes.

Se proyecta que el segmento de emisores beta experimentará la tasa de crecimiento más rápida, del 9,1 %, entre 2025 y 2032, impulsada por el creciente uso de actinio-225 (Ac-225) y plomo-212 (Pb-212) en tratamientos oncológicos avanzados. Los emisores alfa ofrecen una alta transferencia lineal de energía (LET) y una mayor eficacia en la destrucción tumoral con mínimos daños colaterales, lo que los hace muy adecuados para cánceres resistentes y metastásicos.

- Por fuentes

Según las fuentes, el mercado se clasifica en isótopos producidos por reactor, isótopos producidos por generador y otros. En 2025, los isótopos producidos por reactor liderarán el mercado debido al alto volumen de suministro y la amplia disponibilidad de emisores beta clave, como el Lu-177 y el yodo-131.

Sin embargo, se prevé que los isótopos producidos en reactores sean el segmento de mayor crecimiento, impulsado por la creciente demanda de isótopos como el Pb-212 y el Ra-223, que requieren una producción descentralizada y cercana al paciente. El auge de los generadores in situ también coincide con el creciente interés en las terapias alfa y los radiofármacos de vida corta.

- Por aplicación terapéutica

En cuanto a las aplicaciones terapéuticas, el mercado se segmenta en oncología y otros. En 2025, la oncología dominará el mercado, ya que los radiofármacos desempeñan un papel fundamental en las terapias dirigidas para el cáncer de próstata, los tumores neuroendocrinos y el linfoma. El creciente éxito de las terapias dirigidas al PSMA y basadas en PRRT refuerza el liderazgo de la oncología en este campo.

El segmento de oncología incluye trastornos cardiovasculares, endocrinos y neurológicos y se anticipa que experimentará un crecimiento constante con el desarrollo de nuevos radioligandos y la expansión hacia indicaciones no oncológicas.

- Por tipo de vector

Según el tipo de vector, el mercado se segmenta en ligandos de moléculas pequeñas, péptidos, anticuerpos monoclonales y otros. En 2025, se prevé que los ligandos de moléculas pequeñas ocupen la mayor cuota de mercado debido a su rápida penetración tisular y su uso generalizado en terapias dirigidas al PSMA y la somatostatina.

Se prevé un crecimiento significativo de los ligandos de moléculas pequeñas durante el período de pronóstico gracias a los avances en las tecnologías de conjugación y a su capacidad para ofrecer una mayor selectividad tumoral, tiempos de circulación más prolongados y una mayor eficiencia de unión. Estos vectores son especialmente cruciales para las terapias con emisores alfa, donde la precisión es fundamental.

- Por el usuario final

El mercado está segmentado por usuario final en hospitales, radiofarmacias e institutos de investigación. En 2025, los hospitales representarán la mayor parte, impulsados por el mayor acceso de los pacientes a la medicina nuclear, el crecimiento de los departamentos de teranóstico y los sólidos marcos de reembolso en los países desarrollados.

Se prevé un rápido crecimiento del segmento de radiofarmacias debido a la creciente demanda de compuestos centralizados y descentralizados de radiofármacos, especialmente aquellos con vidas medias cortas. Los institutos de investigación seguirán desempeñando un papel fundamental en la innovación y los ensayos clínicos, en particular para isótopos de nueva generación como el terbio-161 y el actinio-225.

Análisis regional del mercado de radiofármacos basados en emisores alfa y beta

- América del Norte domina el mercado de radiofármacos basados en emisores alfa y beta con la mayor participación en los ingresos del 42,59 % en 2025 y se proyecta que se expandirá a una CAGR sólida hasta 2032.

- Con el respaldo de una amplia cartera de productos oncológicos, una rápida adopción de la terapia y una densa red de instalaciones PET/SPECT y radiofarmacia, la sólida financiación federal de la región para la investigación en medicina nuclear, el reembolso favorable para la terapia con radioligandos y las continuas inversiones de los productores de Lu-177 y Ac-225 establecen una sólida cadena de suministro nacional y mantienen el liderazgo en el mercado.

- Las principales economías, como Estados Unidos y Canadá, aprovechan la infraestructura madura de producción de isótopos, la amplia actividad de ensayos clínicos y las asociaciones público-privadas para ampliar la fabricación y permitir el acceso rápido de los pacientes.

Análisis del mercado estadounidense de radiofármacos basados en emisores alfa y beta

Estados Unidos tendrá la mayor parte de los ingresos de América del Norte en 2025, impulsado por un ecosistema de atención médica avanzado, aprobaciones tempranas de la FDA (por ejemplo, Lu-177 PSMA-617) y continuas expansiones de capacidad por parte de proveedores como PharmaLogic y SHINE.

Análisis del mercado canadiense de radiofármacos basados en emisores alfa y beta

Canadá registra un crecimiento de dos dígitos gracias a que nuevas actualizaciones de ciclotrones y reactores respaldan la producción nacional de Lu-177, mientras que una red cada vez más amplia de centros teranósticos ambulatorios satisface la creciente demanda de oncología de precisión.

Análisis del mercado de radiofármacos basados en emisores alfa y beta de Asia-Pacífico

Asia-Pacífico es la región en crecimiento, que captará una parte significativa de los ingresos mundiales en 2025, impulsada por el aumento de la incidencia del cáncer, la gran cantidad de pacientes y la fuerte inversión gubernamental en capacidad de medicina nuclear. Los programas nacionales de control del cáncer, la expansión de las flotas de ciclotrones y la localización de la producción de Lu-177 y Ac-225 impulsan el impulso de la región, mientras que la mejora de los reembolsos amplía el acceso de los pacientes. Las principales economías, China, India, Japón y Corea del Sur, están ampliando rápidamente la fabricación de radiofármacos mediante iniciativas estatales y colaboraciones con proveedores globales de isótopos.

Análisis del mercado de radiofármacos basados en emisores alfa y beta de China

China tendrá la mayor participación en Asia y el Pacífico en 2025, impulsada por un enfoque estratégico en la autosuficiencia isotópica nacional y empresas conjuntas (por ejemplo, terapia de protones IBA y colaboraciones isotópicas con CGN) que refuerzan la seguridad de la cadena de suministro.

Análisis del mercado de radiofármacos basados en emisores alfa y beta en India

India registra el ritmo de crecimiento más rápido de la región gracias a los programas del Departamento de Energía Atómica que han ampliado la producción autóctona de Lu-177 y ligando PSMA en BARC, reduciendo drásticamente la dependencia de las importaciones e impulsando los volúmenes de terapia.

Análisis del mercado de radiofármacos basados en emisores alfa y beta de Corea del Sur

La hoja de ruta del Ministerio de Ciencia de Corea del Sur para fomentar una industria de exportación de radiofármacos para 2035, incluida la producción nacional de Lu-177, posiciona al país para un alto crecimiento a mediano plazo y un estatus de centro de suministro regional.

Perspectiva del mercado europeo de radiofármacos basados en emisores alfa y beta

Europa representa algo más de una cuarta parte de los ingresos mundiales (≈ 25 %) en 2025 y se proyecta que crezca a una tasa de crecimiento anual compuesta (TCAC) constante hasta 2032, respaldada por estrictas regulaciones ambientales y de calidad que favorecen la generación interna de isótopos y la adopción generalizada de la teranóstica. Los consorcios de investigación financiados por la UE, los ensayos paneuropeos de compuestos Ac-225 y Tb-161, y la rápida expansión de radiofarmacias centralizadas impulsan el crecimiento regional, mientras que el marco EURATOM de la UE garantiza el suministro de isótopos de origen nuclear.

Economías como Alemania, Francia y el Reino Unido son líderes en instalaciones teranósticas, líneas de producción GMP y redes de investigación clínica.

Análisis del mercado alemán de radiofármacos basados en emisores alfa y beta

Alemania encabezará los ingresos europeos en 2025, impulsada por su densa red de clínicas de medicina nuclear, incentivos de inversión para plantas GMP Lu-177 y el crecimiento continuo de los centros de terapia por imágenes, elevando el valor del mercado a USD 39,29 millones para 2024.

Análisis del mercado francés de radiofármacos basados en emisores alfa y beta

Francia muestra una sólida expansión a medida que las políticas de atención médica resilientes al clima incentivan terapias de dosis baja y alta eficacia, y los grupos en torno a Orano y CEA canalizan la financiación hacia programas de emisores alfa de próxima generación y el despliegue de generadores descentralizados.

Cuota de mercado de radiofármacos basados en emisores alfa y beta

El mercado de radiofármacos basados en emisores alfa y beta está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- Novartis AG (Suiza)

- Eckert & Ziegler (Alemania)

- ITM Isotope Technologies Munich SE (Alemania)

- SHINE Technologies, LLC (EE. UU.)

- Actinium Pharmaceuticals, Inc. (EE. UU.)

- Alpha Tau Medical Ltd. (Israel)

- ARICEUM THERAPEUTICS (Alemania)

- Bayer AG (Alemania)

- Curio (EE. UU.)

- Corporación IONETIX (EE. UU.)

- Isotopía (Israel)

- Lantheus (Estados Unidos)

- Lilly (Estados Unidos)

- Niowave (EE. UU.)

- RMN (EE. UU.)

- Oncoinvent (Noruega)

- Grupo Orano (París)

- Radiopharm Theranostics Limited (Australia)

- Telix Pharmaceuticals Limited (Australia)

- Terthera (Países Bajos)

Últimos avances en el mercado de radiofármacos basados en emisores alfa y beta

- En mayo de 2025, ITM Isotope Technologies Munich SE y Radiopharm Theranostics anunciaron un acuerdo de suministro de lutecio-177 sin portador añadido (nca-177Lu). Esta colaboración apoya el desarrollo clínico de Radiopharm de terapias basadas en Lu-177, como RAD 204, RAD 202 y RV01, lo que garantiza un acceso isotópico de alta calidad para el tratamiento radiofarmacéutico dirigido de tumores sólidos en ensayos clínicos en curso y futuros.

- En marzo de 2025, la FDA aprobó Pluvicto (Lu-177 vipivotida tetraxetan) de Novartis para su uso precoz en el cáncer de próstata metastásico resistente a la castración con PSMA positivo, lo que permite su administración después de un ARPI y antes de la quimioterapia. Según los resultados del ensayo de fase III PSMAfore, Pluvicto redujo el riesgo de progresión o muerte en un 59 %, duplicando la mediana de supervivencia libre de progresión radiográfica, manteniendo un perfil de seguridad favorable y ampliando significativamente el acceso de los pacientes.

- En marzo de 2025, Eckert & Ziegler y AtomVie Global Radiopharma firmaron un acuerdo global de suministro de lutecio-177 (Theralugand) sin adición de portadores. Esta alianza garantiza un suministro estable y de alta calidad de Lu-177 para las operaciones de radiofármacos CDMO de AtomVie, apoyando el desarrollo en etapas tempranas y avanzadas a nivel mundial y mejorando las capacidades de ambas compañías en innovación radiofarmacéutica, cumplimiento normativo y soluciones de medicina nuclear centradas en el paciente.

- En marzo de 2025, Eckert & Ziegler y Actinium Pharmaceuticals firmaron un acuerdo de suministro de actinio-225 (Ac-225) de alta pureza. Esta colaboración garantiza una fuente confiable de Ac-225 para apoyar el desarrollo de Actimab-A y otros candidatos radioterapéuticos dirigidos a la leucemia mieloide aguda (LMA) y los tumores sólidos, fortaleciendo la cartera de productos clínicos de Actinium y abordando los desafíos globales de suministro de isótopos en la terapia con radiofármacos de precisión.

- En mayo de 2024, Novartis AG anunció su acuerdo para adquirir Mariana Oncology por un importe inicial de 1000 millones de dólares y hasta 750 millones de dólares en pagos por hitos. La adquisición fortalece la cartera de Novartis de terapia con radioligandos (RLT) con activos preclínicos dirigidos a tumores sólidos, incluyendo el candidato MC-339 basado en actinio para el cáncer de pulmón microcítico, y refuerza sus capacidades de investigación, suministro e innovación en RLT.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 END USER MARKET COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PIPELINE

4.4 SUPPLY CHAIN ECOSYSTEM

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.5 INDUSTRY INSIGHTS:

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 KEY PRICING STRATEGIES

4.6 MARKETED DRUG ANALYSIS

4.6.1 DRUG

4.6.1.1 BRAND NAME

4.6.1.2 GENERIC NAME

4.6.2 THERAPEUTIC INDICATION

4.6.3 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.4 DRUG PRIMARY INDICATION

4.6.5 MARKET STATUS

4.6.6 MEDICATION TYPE

4.6.7 DRUG DOSAGE FORM

4.6.8 DOSAGES AVAILABILITY

4.6.9 PACKAGING TYPE

4.6.10 DRUG ROUTE OF ADMINISTRATION

4.6.11 DOSING FREQUENCY

4.6.12 DRUG INSIGHT

4.6.13 OVERVIEW OF DRUG DEVELOPMENT ACTIVITIES

4.6.13.1 FORECAST MARKET OUTLOOK

4.6.13.2 CROSS COMPETITION

4.6.13.3 THERAPEUTIC PORTFOLIO

4.6.13.4 CURRENT DEVELOPMENT SCENARIO

4.7 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.7.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

4.7.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.7.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

4.7.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.7.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.7.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

4.8 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.8.1.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.1.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.8.1.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

4.8.2 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.8.2.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

4.8.2.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.2.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.9 EPIDEMIOLOGY OVERVIEW

4.9.1 INCIDENCE OF ALL CANCERS BY GENDER

4.9.2 TREATMENT RATE

4.9.3 MORTALITY RATE

4.9.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.9.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY FRAMEWORK

5.1 REGULATORY FRAMEWORK OVERVIEW FOR THE NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.1.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.1.2 REGULATORY APPROVAL PATHWAYS

5.1.3 LICENSING AND REGISTRATION

5.1.4 POST-MARKETING SURVEILLANCE

5.1.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.2 REGULATORY FRAMEWORK OVERVIEW FOR THE SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.2.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.2.2 REGULATORY APPROVAL PATHWAYS

5.2.3 LICENSING AND REGISTRATION

5.2.4 POST-MARKETING SURVEILLANCE

5.2.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.3 REGULATORY FRAMEWORK OVERVIEW FOR THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.3.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.3.2 REGULATORY APPROVAL PATHWAYS

5.3.3 LICENSING AND REGISTRATION

5.3.4 POST-MARKETING SURVEILLANCE

5.3.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.4 REGULATORY FRAMEWORK OVERVIEW FOR THE ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.4.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.4.2 REGULATORY APPROVAL PATHWAYS

5.4.3 LICENSING AND REGISTRATION

5.4.4 POST-MARKETING SURVEILLANCE

5.4.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

5.5 REGULATORY FRAMEWORK OVERVIEW FOR THE MIDDLE EAST AND AFRICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.5.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.5.2 REGULATORY APPROVAL PATHWAYS

5.5.3 LICENSING AND REGISTRATION

5.5.4 POST-MARKETING SURVEILLANCE

5.5.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED EFFICACY OF TARGETED ALPHA AND BETA THERAPIES

6.1.2 GROWING ADOPTION OF THERANOSTICS IN PERSONALIZED MEDICINE

6.1.3 RISING CLINICAL DEMAND FOR ALPHA-BASED RADIOTHERAPIES

6.1.4 RISING CHRONIC DISEASE BURDEN DRIVING RADIOPHARMACEUTICAL DEMAND

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN AND SCALABILITY CHALLENGES FROM SHORT ISOTOPE HALF-LIVES

6.2.2 STRINGENT REGULATORY LANDSCAPE LIMITING MARKET FLEXIBILITY

6.2.3 SAFETY AND EXPOSURE RISKS IN RADIOPHARMACEUTICAL USE

6.3 OPPORTUNITIES

6.3.1 SURGE IN R&D ACTIVITY EXPANDING RADIOPHARMACEUTICAL APPLICATIONS

6.3.2 EXPANSION OF LU-177-PSMA THERAPY IN PROSTATE CANCER TREATMENT

6.3.3 STRATEGIC COLLABORATIONS DRIVING RADIOPHARMACEUTICAL INNOVATION

6.4 CHALLENGES

6.4.1 HIGH COST OF DEVELOPMENT AND IMPLEMENTATION OF RADIOPHARMACEUTICALS

6.4.2 SHORTAGE OF SKILLED WORKFORCE IN NUCLEAR MEDICINE AND RADIOCHEMISTRY

7 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE

7.1 OVERVIEW

7.2 BETA EMITTERS

7.2.1 LUTETIUM-177

7.2.2 TERBIUM-161

7.3 ALPHA EMITTERS

7.3.1 ACTINIUM-225

7.3.2 LEAD -212

8 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES

8.1 OVERVIEW

8.2 REACTOR-PRODUCED ISOTOPES

8.3 GENERATOR-PRODUCED ISOTOPES

8.4 OTHERS

9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 PROSTATE CANCER

9.2.2 NEUROENDOCRINE TUMORS

9.2.3 LIVER CANCER

9.2.4 BRAIN TUMORS

9.2.5 BREAST CANCER

9.2.6 LEUKEMIA

9.3 OTHERS

10 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULE LIGANDS

10.3 PEPTIDES

10.4 MONOCLONAL ANTIBODIES

10.5 OTHERS

11 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ONCOLOGY CENTERS

11.2.2 NUCLEAR MEDICINE DEPARTMENTS

11.3 RADIOPHARMACIES

11.4 RESEARCH INSTITUTES

12 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 FRANCE

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 POLAND

12.3.7 RUSSIA

12.3.8 NORWAY

12.3.9 TURKEY

12.3.10 AUSTRIA

12.3.11 IRELAND

12.3.12 NETHERLANDS

12.3.13 SWITZERLAND

12.3.14 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.2 AUSTRALIA

12.4.3 JAPAN

12.4.4 SOUTH KOREA

12.4.5 SINGAPORE

12.4.6 INDIA

12.4.7 INDONESIA

12.4.8 PHILIPPINES

12.4.9 THAILAND

12.4.10 MALAYSIA

12.4.11 VIETNAM

12.4.12 TAIWAN

12.4.13 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 CHILE

12.5.4 PERU

12.5.5 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 U.A.E.

12.6.5 KUWAIT

12.6.6 ISRAEL

12.6.7 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NOVARTIS AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ECKERT & ZIEGLER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ITM ISOTOPE TECHNOLOGIES MUNICH SE

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SHINE TECHNOLOGIES, LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ACTINIUM PHARMACEUTICALS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PIPELINE PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALPHA TAU MEDICAL LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PIPELINE PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARICEUM THERAPEUTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PIPELINE PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAYER AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PIPELINE PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CURIUM

15.9.1 COMPANY SNAPSHOT

15.9.2 PIPELINE PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IONETIX CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PIPELINE PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ISOTOPIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PIPELINE PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 LANTHEUS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PIPELINE PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LILLY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PIPELINE PRODUCT PORTFOLIO

15.14 NIOWAVE

15.14.1 COMPANY SNAPSHOT

15.14.2 PIPELINE PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NMR

15.15.1 COMPANY SNAPSHOT

15.15.2 PIPELINE PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ONCOINVENT

15.16.1 COMPANY SNAPSHOT

15.16.2 PIPELINE PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ORANO GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PIPELINE PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 RADIOPHARM THERANOSTICS LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 PIPELINE PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TELIX PHARMACEUTICALS LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PIPELINE PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TERTHERA

15.20.1 COMPANY SNAPSHOT

15.20.2 PIPELINE PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 5 PENETRATION AND GROWTH PROSPECT MAPPING

TABLE 6 INCIDENCE OF CANCER BY GENDER

TABLE 7 CANCER MORTALITY RATE

TABLE 8 CANCER TREATMENT SUCCESS RATE

TABLE 9 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL REACTOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL GENERATOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL SMALL MOLECULE LIGANDS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL PEPTIDES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL MONOCLONAL ANTIBODIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL RADIOPHARMACIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL RESEARCH INSTITUTES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 65 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 69 MEXICO HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 GERMANY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.K. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.K. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 U.K. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 FRANCE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 102 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 FRANCE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 106 FRANCE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 108 ITALY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ITALY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 111 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 ITALY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 117 SPAIN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SPAIN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 120 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 SPAIN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 124 SPAIN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 126 POLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 POLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 129 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 POLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 133 POLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 135 RUSSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 RUSSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 138 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 RUSSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 142 RUSSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 144 NORWAY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORWAY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 147 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 NORWAY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 NORWAY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 153 TURKEY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 TURKEY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 156 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 TURKEY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 160 TURKEY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 165 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 AUSTRIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 169 AUSTRIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 171 IRELAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 IRELAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 174 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 IRELAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 178 IRELAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 NETHERLANDS HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 189 SWITZERLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SWITZERLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 192 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 SWITZERLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 196 SWITZERLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 REST OF EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 198 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 199 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 200 ASIA-PACIFIC BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 ASIA-PACIFIC ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 203 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 ASIA-PACIFIC ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 207 ASIA-PACIFIC HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 209 CHINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CHINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 212 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 CHINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CHINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 216 CHINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 218 AUSTRALIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 AUSTRALIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 221 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 AUSTRALIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 AUSTRALIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 225 AUSTRALIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 227 JAPAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 JAPAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 230 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 JAPAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 JAPAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 234 JAPAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 245 SINGAPORE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SINGAPORE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 248 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 SINGAPORE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SINGAPORE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 252 SINGAPORE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 254 INDIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 INDIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 257 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 INDIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 INDIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 261 INDIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 263 INDONESIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 INDONESIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 266 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 INDONESIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 INDONESIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 270 INDONESIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 272 PHILIPPINES BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 PHILIPPINES ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 275 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 PHILIPPINES ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 PHILIPPINES ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 279 PHILIPPINES HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 281 THAILAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 THAILAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 284 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 THAILAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 THAILAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 288 THAILAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 290 MALAYSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 MALAYSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 293 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 MALAYSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 MALAYSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 297 MALAYSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 299 VIETNAM BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 VIETNAM ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 302 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 303 VIETNAM ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 VIETNAM ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 306 VIETNAM HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 308 TAIWAN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 TAIWAN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 311 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 312 TAIWAN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 TAIWAN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 315 TAIWAN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 REST OF ASIA-PACIFIC ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 317 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 318 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 319 SOUTH AMERICA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 SOUTH AMERICA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AMERICA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AMERICA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AMERICA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 328 BRAZIL BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 BRAZIL ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 331 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 BRAZIL ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 BRAZIL ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 335 BRAZIL HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 337 ARGENTINA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 ARGENTINA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 340 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 341 ARGENTINA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 ARGENTINA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 344 ARGENTINA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 346 CHILE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 CHILE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 349 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 350 CHILE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 CHILE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 353 CHILE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)