Global Automated Container Terminal Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.84 Billion

USD

19.16 Billion

2025

2033

USD

10.84 Billion

USD

19.16 Billion

2025

2033

| 2026 –2033 | |

| USD 10.84 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Segmentación global de terminales automatizadas de contenedores, por grado de automatización (terminales semiautomatizadas, terminales totalmente automatizadas), tipo de proyecto (proyectos en terrenos baldíos, proyectos en terrenos no baldíos), oferta (equipos, software, servicios), usuario final (público, privado), canal de distribución (canal directo e indirecto): tendencias del sector y pronóstico hasta 2033

Tamaño del mercado de terminales de contenedores automatizadas

- El mercado global de terminales automatizadas de contenedores se valoró en USD 10.84 mil millones en 2025 y se espera que alcance los USD 19.16 mil millones para 2033.

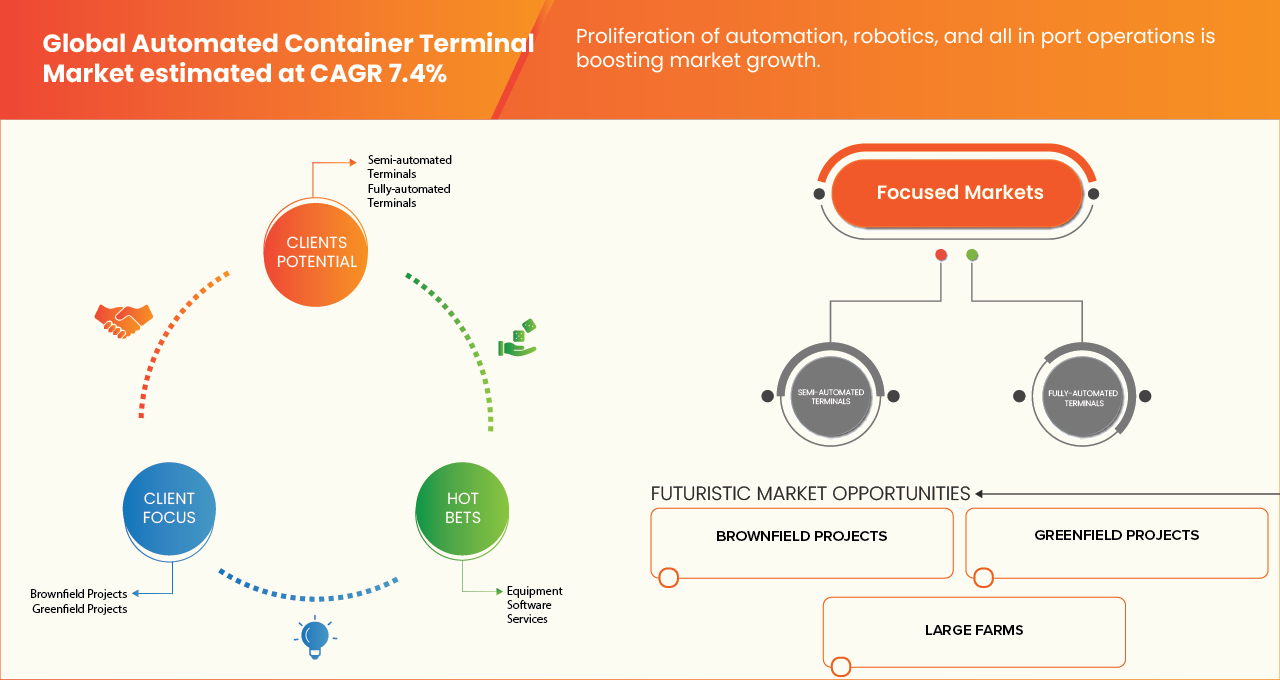

- Durante el período de pronóstico de 2026 a 2033, es probable que el mercado crezca a una CAGR del 7,4%, impulsado principalmente por la necesidad de mejorar la eficiencia operativa y la capacidad portuaria.

- El crecimiento del mercado de terminales de contenedores automatizadas está impulsado por factores como el aumento de los volúmenes del comercio mundial, la creciente demanda de equipos de manipulación de contenedores de alto rendimiento, los avances tecnológicos en automatización e inteligencia artificial, y la expansión de los sectores de fabricación y transporte en todo el mundo.

Análisis del mercado de terminales automatizadas de contenedores

- Las terminales automatizadas de contenedores son instalaciones portuarias avanzadas que utilizan tecnología y software automatizados para operar equipos de manipulación de contenedores, minimizando la mano de obra, maximizando el rendimiento y mejorando la seguridad y la previsibilidad de las operaciones de carga. Desempeñan un papel crucial en la cadena de suministro global, prestando servicio a las compañías navieras, las autoridades portuarias y las redes logísticas, al permitir escalas de buques más rápidas y una gestión optimizada de los patios.

- Una de las principales tecnologías en las terminales automatizadas de contenedores es el uso de grúas apiladoras automatizadas (ASC), que almacenan y recuperan contenedores de forma autónoma en el patio, optimizando el uso del espacio y reduciendo los tiempos de manipulación. La creciente tendencia hacia buques portacontenedores de mayor tamaño también impulsa el desarrollo de software especializado y vehículos guiados automáticamente (AGV), diseñados para coordinar el complejo movimiento de contenedores entre el muelle y la pila. En las operaciones de la terminal, esta automatización es esencial para el procesamiento en las puertas, la planificación de los buques y el mantenimiento de los equipos, garantizando un rendimiento constante y una reducción de los costes operativos.

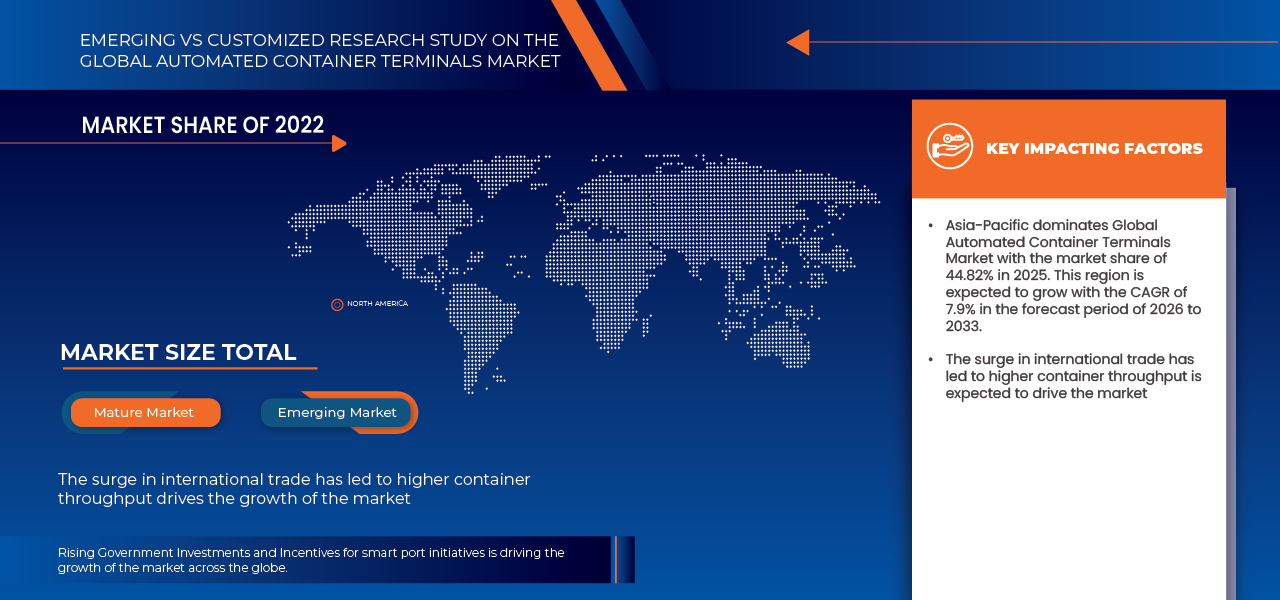

- Se prevé que Asia-Pacífico domine el mercado de terminales de contenedores automatizadas, con la mayor participación en ingresos, un 45,02 %, en 2026. Esto se debe a la rápida modernización de la infraestructura portuaria, las sólidas inversiones gubernamentales en iniciativas portuarias inteligentes y el aumento del volumen del comercio contenedorizado en economías clave como China, Japón, Corea del Sur y Singapur. Además, el enfoque de la región en la automatización, la digitalización y la sostenibilidad —mediante tecnologías como las operaciones de terminales basadas en IA, las grúas autónomas y los sistemas de seguimiento basados en el IoT— refuerza aún más su liderazgo en el mercado global.

- Se prevé que Asia-Pacífico sea la región de mayor crecimiento en el mercado de terminales automatizadas de contenedores durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 7,9 %, impulsada por la expansión del comercio marítimo, la rápida adopción de tecnologías de automatización y las grandes inversiones en proyectos de desarrollo de puertos inteligentes en China, India, Corea del Sur y el Sudeste Asiático. El creciente enfoque de la región en mejorar la eficiencia portuaria, reducir los tiempos de respuesta y minimizar los costos laborales, junto con iniciativas estratégicas como la Iniciativa de la Franja y la Ruta de China y el Programa Sagarmala de India, está impulsando la implementación acelerada de sistemas automatizados de manejo de contenedores.

- Se espera que en 2026, el segmento de terminales semiautomatizadas domine el mercado con una participación de mercado del 53,93% debido a su equilibrio óptimo entre inversión de capital y beneficios operativos, ofreciendo una ruta de transición de menor riesgo para los puertos existentes, importantes ganancias de productividad y mayor flexibilidad operativa en comparación con los sistemas totalmente automatizados.

Alcance del informe y segmentación del mercado de terminales automatizadas de contenedores

|

Atributos |

Perspectivas clave del mercado de terminales de contenedores automatizadas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de terminales automatizadas de contenedores

Expansión de terminales automatizadas en mercados emergentes

- El rápido crecimiento del volumen comercial y la creciente demanda de operaciones portuarias eficientes en los mercados emergentes están creando una importante oportunidad para los actores del mercado del Territorio de la Capital Australiana (ACT). Mediante el desarrollo de terminales de contenedores automatizadas, tanto nuevas como existentes, estas regiones pueden mejorar la eficiencia portuaria, recibir buques de mayor tamaño y fortalecer su integración en las cadenas de suministro globales.

- La expansión hacia mercados emergentes permite a fabricantes de equipos, proveedores de software e integradores de servicios aprovechar las ventajas de ser pioneros, implementar tecnologías de automatización modernas y lograr una mayor escalabilidad operativa. Las inversiones en grúas avanzadas, vehículos de guiado automático (AGV), sistemas operativos de terminales (TOS) y plataformas logísticas digitales están transformando los puertos en centros modernos y eficientes capaces de gestionar el creciente tráfico de contenedores, a la vez que reducen los costos y los tiempos de espera.

- En julio de 2025, según el Times of India, Vizhinjam International Seaport (India) comenzó a operar utilizando operaciones portuarias basadas en IA y grúas automatizadas, capacitó a las primeras operadoras de grúas automatizadas de la India y manipuló más de 830.000 contenedores en su primer año.

- En septiembre de 2025, Reuters informó que la Terminal Internacional Colombo Oeste (Sri Lanka), operada por un consorcio liderado por Adani Group, amplió su capacidad de terminal totalmente automatizada para manejar hasta 3,2 millones de contenedores al año, antes de lo previsto, fortaleciendo las capacidades logísticas regionales.

- Por lo tanto, la expansión de terminales automatizadas en los mercados emergentes está consolidando a estas regiones como motores clave del crecimiento del mercado del Territorio de la Capital Australiana (ACT). Mediante la implementación de tecnologías avanzadas de automatización, los puertos de estos mercados están modernizando su infraestructura, reduciendo los cuellos de botella operativos y mejorando su competitividad global, allanando el camino para un crecimiento sostenido del sector.

Dinámica del mercado de terminales automatizadas de contenedores

Conductor

“ El aumento del comercio internacional ha provocado un mayor volumen de contenedores ”

- La continua expansión del comercio global ha incrementado significativamente el volumen de carga en contenedores que se mueve a través de las fronteras internacionales, impulsando así la demanda de soluciones eficientes y automatizadas para el manejo de contenedores. Dado que el comercio marítimo sigue siendo la columna vertebral del comercio global, los puertos de todo el mundo se ven sometidos a una creciente presión para aumentar la capacidad de procesamiento, reducir el tiempo de escala de los buques y mejorar la eficiencia general de las terminales. Las Terminales Automatizadas de Contenedores (ACT) se han convertido en una solución vital para abordar estas demandas operativas mediante el uso de la robótica, la inteligencia artificial y las tecnologías logísticas avanzadas.

- La creciente globalización, sumada al crecimiento del comercio electrónico y las cadenas de suministro transfronterizas, está acelerando aún más la necesidad de automatización en las operaciones portuarias. Grúas automatizadas, vehículos sin conductor y sistemas digitales de gestión portuaria se están implementando cada vez más para gestionar grandes volúmenes de contenedores con precisión y mínima intervención humana.

- En octubre de 2024, según la Conferencia de las Naciones Unidas sobre Comercio y Desarrollo (UNCTAD, 2024), los volúmenes del comercio marítimo mundial crecieron un 2,4% en 2023, y el comercio en contenedores representó más del 60% de la carga transportada por mar, lo que pone de relieve la necesidad crítica de una infraestructura portuaria automatizada.

- En noviembre de 2024, un informe de Hamburg Port Consulting destaca que la automatización y la digitalización se están volviendo esenciales para las operaciones portuarias modernas, ya que el aumento de los volúmenes de carga exige una mayor eficiencia.

- Además, la creciente complejidad de las redes logísticas globales y la expansión de las zonas francas obligan a los puertos a adoptar sistemas automatizados de última generación para mantener su competitividad. La automatización no solo permite un mayor rendimiento de los contenedores, sino que también garantiza mayor precisión operativa, sostenibilidad y adaptabilidad a las fluctuantes demandas comerciales. A medida que el comercio marítimo internacional continúa en auge, las tecnologías de automatización como los AGV, las grúas apiladoras automatizadas y los sistemas de monitorización basados en gemelos digitales se vuelven indispensables para optimizar el rendimiento y reducir los cuellos de botella operativos.

- Por lo tanto, el aumento de los volúmenes del comercio internacional y la creciente necesidad de un manejo eficiente de contenedores están impulsando la adopción de terminales de contenedores automatizadas a nivel mundial, consolidando la automatización como un pilar clave para operaciones portuarias resilientes, de alto rendimiento y preparadas para el futuro.

Restricción/Desafío

“Altos costos de inversión inicial e instalación”

A pesar de la creciente adopción de tecnologías de automatización en los puertos globales, los elevados costos iniciales de inversión e instalación siguen siendo un factor limitante importante en el mercado de terminales de contenedores automatizadas. El desarrollo de terminales total o semiautomatizadas requiere un capital sustancial para maquinaria avanzada, como vehículos de guiado automático (AGV), grúas apiladoras automatizadas (ASC) y sofisticados sistemas operativos de terminal (TOS), así como para la integración de infraestructura digital y sistemas energéticos de apoyo. Estos gastos suelen superar los cientos de millones de dólares, lo que supone una importante limitación, especialmente para puertos medianos y pequeños con presupuestos limitados o un volumen de carga incierto.

- Además, los proyectos de automatización suelen implicar modernizaciones complejas y largos plazos de instalación, lo que puede interrumpir las operaciones en curso y prolongar el retorno de la inversión (ROI). Si bien la automatización promete eficiencia operativa a largo plazo y ahorro en mano de obra, el elevado gasto de capital inicial (CAPEX) y los riesgos de integración suelen disuadir a los operadores de terminales de adoptar soluciones de automatización integrales. En consecuencia, muchos puertos optan por modelos de automatización por fases o híbridos en lugar de renovaciones completas.

- En enero de 2024, Port Technology International informó que el 62% de los profesionales de terminales identificaron los altos requisitos de inversión inicial como la principal barrera para la implementación de la automatización en las terminales de contenedores.

- En junio de 2023, PortEconomics destacó que las renovaciones de automatización en terminales existentes a menudo enfrentan problemas de integración complejos, lo que aumenta aún más los costos del proyecto y limita la flexibilidad posterior a la instalación.

- Por lo tanto, si bien la automatización de terminales promete beneficios a largo plazo, como mayor productividad, optimización laboral y sostenibilidad, la considerable carga financiera inicial y los complejos procesos de instalación siguen siendo obstáculos clave para el crecimiento del mercado. Superar estos desafíos dependerá de la adopción de mecanismos de financiación innovadores, modelos de automatización por fases y una mayor colaboración público-privada para que la automatización sea financieramente viable para puertos de todos los tamaños en los próximos años.

Alcance del mercado de terminales de contenedores automatizadas

El mercado está segmentado según el grado de automatización, el tipo de proyecto, la oferta, el usuario final y el canal de distribución.

- Por grado de automatización

Según el grado de automatización, el mercado se segmenta en terminales semiautomatizadas y terminales totalmente automatizadas. En 2026, se prevé que el segmento de terminales semiautomatizadas domine el mercado con una cuota de mercado del 53,93 %, impulsado por su rentabilidad, flexibilidad operativa, la integración gradual de la automatización con la supervisión manual y la creciente adopción de grúas apiladoras automatizadas (ASC) y equipos de patio controlados a distancia, que mejoran la eficiencia, la seguridad y la productividad, a la vez que minimizan los riesgos de transición y los costes de implementación.

Además, se proyecta que este segmento registre una CAGR más alta durante el período de pronóstico de 2026 a 2033, debido a la creciente preferencia entre los operadores portuarios por estrategias de automatización en fases, menores requisitos de capital inicial, facilidad de modernización de terminales existentes, menor resistencia laboral, retorno de la inversión más rápido y creciente implementación de sistemas de control inteligente en proyectos portuarios industriales.

- Por tipo de proyecto

Según el tipo de proyecto, el mercado se segmenta en proyectos en desarrollo y en fase nueva. En 2026, se prevé que el segmento de proyectos en desarrollo domine con una cuota de mercado del 64,59 %, impulsado por la modernización de la infraestructura portuaria existente, la integración de tecnologías avanzadas de automatización en las terminales operativas, la rentabilidad en comparación con la construcción de nuevas terminales y la necesidad de mejorar la eficiencia, reducir los tiempos de escala de los buques y satisfacer la creciente demanda de tráfico de contenedores.

El segmento Greenfield es el segmento de más rápido crecimiento en el mercado, con una CAGR de 7,9%, impulsado por el desarrollo de nuevas terminales de última generación equipadas con tecnologías de automatización avanzadas, el aumento de los volúmenes de comercio internacional, el fuerte apoyo del gobierno a la expansión de la infraestructura portuaria y la necesidad de operaciones de terminales eficientes, escalables y sostenibles.

- Ofreciendo

En función de la oferta, el mercado global de terminales automatizadas de contenedores se segmenta en equipos, software y servicios. En 2026, se prevé que el segmento de equipos domine el mercado con una cuota de mercado del 54,58 %, impulsado por la creciente implantación de grúas apiladoras automatizadas (ASC), vehículos guiados automáticamente (AGV), equipos de patio teledirigidos y grúas de muelle, así como por el aumento de las inversiones en la modernización portuaria, el aumento del volumen de contenedores y la demanda de mayor eficiencia operativa y seguridad en las operaciones de las terminales.

El software es el segmento de más rápido crecimiento con una CAGR de 8,3% en el mercado impulsado por la creciente adopción de sistemas operativos de terminales (TOS) avanzados, análisis de datos en tiempo real, soluciones habilitadas para IA e IoT, y la creciente necesidad de una gestión de carga eficiente, mantenimiento predictivo e integración perfecta de la comunidad portuaria.

- Por el usuario final

Según el usuario final, el mercado se segmenta en público y privado. En 2026, se prevé que el segmento público domine el mercado con una cuota de mercado del 56,28 %, impulsada por las autoridades portuarias lideradas por el gobierno, las inversiones en infraestructura a gran escala, las iniciativas nacionales de facilitación del comercio, la modernización de puertos estratégicos, la adopción de la automatización para mejorar la eficiencia y la seguridad, la estabilidad financiera a largo plazo y el apoyo político para mejorar la conectividad global y el crecimiento económico.

El segmento privado es el de más rápido crecimiento con una CAGR del 7,6 % en el mercado, impulsado por el aumento de las concesiones de terminales privadas, las asociaciones público-privadas, la demanda de eficiencia operativa, una toma de decisiones más rápida, un enfoque en el retorno de la inversión, la adopción de tecnologías de automatización avanzadas, la presión competitiva para reducir costos, mejorar el rendimiento y brindar una mayor confiabilidad del servicio.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en canal directo e indirecto. En 2026, se prevé que el canal directo domine el mercado con una cuota de mercado del 68,65 %, impulsado por las sólidas relaciones entre los operadores de terminales y los proveedores de soluciones de automatización, los requisitos de integración de sistemas personalizados, la reducción de los costes de adquisición, el soporte técnico directo, los contratos de servicio a largo plazo y la necesidad de una implementación fluida de soluciones de automatización complejas y de alto valor.

Análisis regional del mercado de terminales automatizadas de contenedores

- Se prevé que Asia-Pacífico domine el mercado de terminales automatizadas de contenedores, con la mayor participación en ingresos, con un 45,02 %, en 2026. Esto se debe al sólido crecimiento comercial de la región, los amplios proyectos de expansión portuaria y la creciente adopción de tecnologías digitales y de automatización avanzada. Economías clave como China, Japón, Corea del Sur y Singapur lideran la integración de sistemas de gestión de terminales basados en IA, vehículos guiados automáticamente (AGV) y grúas teledirigidas para mejorar la eficiencia operativa. Además, las iniciativas de puertos inteligentes impulsadas por los gobiernos, junto con la creciente inversión de operadores portuarios globales como PSA International, Hutchison Ports y DP World, siguen consolidando el dominio de Asia-Pacífico en el mercado global.

- Se prevé que Asia-Pacífico sea la región de mayor crecimiento en el mercado de terminales automatizadas de contenedores durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 7,9 %, impulsada por la expansión del comercio marítimo, la rápida adopción de tecnologías de automatización y las grandes inversiones en proyectos de desarrollo de puertos inteligentes en China, India, Corea del Sur y el Sudeste Asiático. El creciente enfoque de la región en mejorar la eficiencia portuaria, reducir los tiempos de respuesta y minimizar los costos laborales, junto con iniciativas estratégicas como la Iniciativa de la Franja y la Ruta de China y el Programa Sagarmala de India, está impulsando la implementación acelerada de sistemas automatizados de manejo de contenedores.

Análisis del mercado de terminales automatizadas de contenedores en Europa

El mercado europeo de terminales de contenedores automatizadas se vio impulsado por la adopción temprana de tecnologías de automatización de terminales, una infraestructura portuaria consolidada y la sólida presencia de proveedores líderes de soluciones de automatización como Konecranes, ABB y Kalmar. Puertos europeos como Róterdam (Países Bajos), Hamburgo (Alemania) y Amberes (Bélgica) han sido pioneros en la implementación de operaciones de terminales totalmente automatizadas, impulsados por un enfoque en la mejora de la eficiencia operativa, la reducción de emisiones y la optimización de los costes laborales. Además, las estrictas normativas ambientales de la región y el creciente énfasis en sistemas logísticos sostenibles y digitalizados consolidaron aún más su liderazgo en el mercado global.

Análisis del mercado de terminales automatizadas de contenedores en Alemania

El mercado alemán de terminales automatizadas de contenedores obtuvo la mayor participación en los ingresos en 2026 dentro de la región europea, impulsado por la avanzada infraestructura portuaria del país, el fuerte enfoque en la integración de la Industria 4.0 y la adopción temprana de tecnologías de automatización y digitalización en la logística marítima. Puertos importantes como Hamburgo y Bremerhaven han implementado grúas automatizadas, sistemas operativos de terminal (TOS) y vehículos de transporte autónomos para mejorar la eficiencia y reducir los costos operativos. Además, las iniciativas gubernamentales que apoyan la logística inteligente, junto con las inversiones de importantes operadores como HHLA (Hamburger Hafen und Logistik AG) y Eurogate, han impulsado el liderazgo de Alemania en el mercado europeo de terminales automatizadas de contenedores.

Perspectiva del mercado de terminales automatizadas de contenedores en América del Norte

El mercado de terminales automatizadas de contenedores en Norteamérica se ve impulsado por el aumento del volumen de comercio en contenedores, el aumento de las inversiones en modernización portuaria y la creciente necesidad de eficiencia operativa y tiempos de respuesta más cortos. Puertos importantes como Los Ángeles, Long Beach y Vancouver han estado a la vanguardia en la adopción de sistemas de terminales semiautomatizados y totalmente automatizados, respaldados por logística avanzada basada en IA, robótica y análisis de datos. Además, el énfasis de la región en la sostenibilidad, la optimización laboral y la transformación digital, junto con las inversiones de operadores clave como SSA Marine, DP World y APM Terminals, han consolidado aún más el liderazgo de Norteamérica en el mercado global de terminales automatizadas de contenedores.

Perspectiva del mercado de terminales automatizadas de contenedores en EE. UU.

El mercado estadounidense de terminales automatizadas de contenedores captó la mayor participación en los ingresos en 2026 en la región de Norteamérica, impulsado por importantes inversiones en automatización portuaria, infraestructura digital y sistemas logísticos inteligentes. Puertos importantes como Los Ángeles, Long Beach y Nueva York/Nueva Jersey han adoptado grúas apiladoras automatizadas, vehículos guiados automáticamente (AGV) y sistemas operativos de terminal avanzados (TOS) para mejorar la productividad y reducir la congestión. Además, el sólido apoyo de las iniciativas federales y estatales destinadas a mejorar la resiliencia y la sostenibilidad de la cadena de suministro, junto con la presencia de operadores portuarios globales clave como APM Terminals, SSA Marine y DP World, ha consolidado aún más la posición de EE. UU. como líder en el desarrollo de terminales automatizadas de contenedores en Norteamérica.

Análisis del mercado de terminales automatizadas de contenedores en China

El mercado chino de terminales automatizadas de contenedores captó la mayor participación en los ingresos en 2026 en Asia Pacífico, impulsado por inversiones masivas en automatización portuaria, transformación digital e infraestructura logística inteligente. China alberga algunos de los puertos automatizados más avanzados del mundo, como el Puerto de Aguas Profundas de Yangshan (Shanghái), el Puerto de Qingdao y el Puerto de Tianjin, que utilizan sistemas de control basados en IA, conectividad 5G, vehículos autónomos y grúas automatizadas para lograr una alta eficiencia operativa. Las iniciativas gubernamentales en el marco de la Iniciativa de la Franja y la Ruta (BRI) y la estrategia "Hecho en China 2025" han acelerado aún más la adopción de la automatización, promoviendo la innovación tecnológica, la eficiencia y la sostenibilidad en las operaciones portuarias. Además, las colaboraciones con proveedores tecnológicos líderes como Huawei, ZPMC y Shanghai International Port Group (SIPG) han reforzado la posición dominante de China en el mercado regional de terminales automatizadas de contenedores.

Análisis del mercado de terminales automatizadas de contenedores en Japón

El mercado japonés de terminales automatizadas de contenedores se ha visto impulsado por la temprana adopción de tecnologías de automatización, el sólido respaldo gubernamental a las iniciativas portuarias inteligentes y la continua modernización de la infraestructura marítima. Puertos líderes como Yokohama, Tokio y Kobe han integrado grúas apiladoras automatizadas, sistemas operativos de terminales inteligentes (TOS) y plataformas logísticas basadas en IA para mejorar el rendimiento y la eficiencia operativa. Además, el compromiso de Japón con la sostenibilidad, la eficiencia laboral y la transformación digital, respaldado por iniciativas del Ministerio de Tierras, Infraestructura, Transporte y Turismo (MLIT) y alianzas con proveedores tecnológicos como Mitsui OSK Lines, NEC e Hitachi, ha consolidado significativamente su liderazgo en el mercado regional de terminales automatizadas de contenedores.

Análisis del mercado de terminales automatizadas de contenedores en Sudáfrica

Se proyecta un crecimiento sostenido del mercado sudafricano de terminales automatizadas de contenedores, impulsado por las iniciativas de modernización de Transnet Port Terminals (TPT), la adopción de grúas apiladoras automatizadas (ASC) y grúas de muelle teledirigidas, la implementación de tecnologías portuarias inteligentes y soluciones de mantenimiento predictivo, la inversión en infraestructura logística digital y las alianzas estratégicas con proveedores globales de automatización como Kalmar, ABB y Siemens. Puertos clave como el puerto de Durban, el puerto de Ngqura y la terminal de contenedores de Ciudad del Cabo lideran esta transformación para mejorar la eficiencia, reducir los tiempos de escala de los buques y respaldar el creciente volumen comercial de la región.

Los principales líderes del mercado que operan en el mercado son:

- TOTAL SOFT BANK LTD. (Corea del Sur)

- INFORM SOFTWARE (Alemania)

- Logstar ERP (India)

- infyz.com (India)

- Tideworks (EE. UU.)

- Loginno Logistic Innovation Ltd. (Israel)

- Servicios de grúas mundiales FZE (EAU)

- SISTEMAS STARCOMM (REINO UNIDO)

- Corporación Kalmar (Finlandia)

- Cargotec Corporation (Finlandia)

- Konecranes Plc (Finlandia)

- Industrias Pesadas Shanghai Zhenhua Co., Ltd. (China)

- Grupo LIEBHERR (Suiza)

- ABB Ltd. (Suiza)

- HAPAG LLOYD (Alemania)

- Terminales APM (Países Bajos)

- BECKHOFF AUTOMATION GMBH & CO. KG (Alemania)

- Künz GmbH (Austria)

- CyberLogitec Co., Ltd. (Corea)

- Camco Technologies NV (Bélgica)

- IDENTEC SOLUTIONS AG (Austria)

- ORBCOMM Inc. (EE. UU.)

- ORBITA PORTS & TERMINALS adquirida por TMEIC PORT TECHNOLOGIES, SL (Japón)

- PACECO Corp. (EE. UU.)

Últimos avances en terminales automatizadas globales de contenedores

- En octubre de 2025, Hapag-Lloyd y DP World renovaron su alianza a largo plazo en el Puerto de Santos, Brasil. Esta extensión garantiza la colaboración para la próxima década e incluye una importante expansión de la terminal, aumentando la longitud del muelle y la capacidad anual de manejo, lo que permitirá a Hapag-Lloyd manejar buques de mayor tamaño y ofrecer nuevos servicios a sus clientes.

- En septiembre de 2025, Hiab Corporation firmó un acuerdo de colaboración con Forterra para acelerar el desarrollo de soluciones autónomas de transporte y manipulación de carga. El objetivo es ampliar las capacidades de la autonomía, mejorando la sostenibilidad y la seguridad en los flujos de trabajo logísticos.

- En septiembre de 2025, Liebherr y TPT firmaron un acuerdo de colaboración estratégica de 10 años para modernizar y mejorar la eficiencia de las operaciones portuarias de Sudáfrica. El acuerdo incluye el suministro de cuatro grúas STS de gran tamaño para el puerto de Durban y 48 grúas pórtico sobre neumáticos (RTG) para las terminales de Durban y Ciudad del Cabo, junto con un programa de gestión de activos de 20 años para garantizar la fiabilidad a largo plazo de los equipos.

- En noviembre de 2024, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) firmó un acuerdo de cooperación estratégica con Cavotec SA, lo que marca un paso significativo hacia el avance de la sostenibilidad y la innovación en la infraestructura portuaria y de terminales a nivel mundial. Esta alianza combina la experiencia de ZPMC en la fabricación de equipos portuarios de alta resistencia con las tecnologías especializadas de Cavotec en automatización y electrificación. Juntos, buscan desarrollar soluciones de vanguardia que mejoren la eficiencia y el rendimiento ambiental de los puertos, como la reducción de emisiones mediante equipos electrificados y la optimización de la automatización operativa. Al aprovechar las fortalezas de ambas empresas, la colaboración busca impulsar la transición de la industria marítima global hacia operaciones portuarias más ecológicas, inteligentes y sostenibles.

- En diciembre de 2024, Konecranes completó la adquisición de Peinemann Port Services BV y Peinemann Container Handling BV, con sede en Róterdam, tras recibir la aprobación de la autoridad de competencia neerlandesa. La adquisición, cuyo valor no se ha revelado, sumó aproximadamente 100 empleados y fortaleció la posición de Konecranes en los Países Bajos, especialmente en la zona de Róterdam.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 COMPETITOR KEY PRICING STRATEGIES (PROMINENT PLAYERS)

4.4 TECHNOLOGY ANALYSIS – GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

4.5 COMPANY PROFILING

4.5.1 HAPAG-LLOYD AG

4.5.1.1 LIST OF ACQUISITION

4.5.1.2 SHAREHOLDING PATTERN

4.5.1.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.1.4 BUSINESS MODEL

4.5.1.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.1.5.1 COMPANY CUSTOMER SEGMENTS

4.5.1.5.2 COMPANY VALUE PROPOSITIONS

4.5.1.5.3 COMPANY CHANNELS

4.5.1.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.1.5.5 COMPANY REVENUE STREAMS

4.5.1.5.6 COMPANY KEY RESOURCES

4.5.1.5.7 COMPANY KEY ACTIVITIES

4.5.1.5.8 COMPANY KEY PARTNERS

4.5.1.5.9 COMPANY A COST STRUCTURE

4.5.1.5.10 COMPANY SWOT ANALYSIS

4.5.2 KONECRANES

4.5.2.1 LIST OF ACQUISITION

4.5.2.2 SHAREHOLDING PATTERN

4.5.2.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.2.4 BUSINESS MODEL

4.5.2.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.2.5.1 COMPANY CUSTOMER SEGMENTS

4.5.2.5.2 COMPANY VALUE PROPOSITIONS

4.5.2.5.3 COMPANY CHANNELS

4.5.2.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.2.5.5 COMPANY REVENUE STREAMS

4.5.2.5.6 COMPANY KEY RESOURCES

4.5.2.5.7 COMPANY KEY ACTIVITIES

4.5.2.5.8 COMPANY KEY PARTNERS

4.5.2.5.9 COMPANY A COST STRUCTURE

4.5.2.5.10 COMPANY SWOT ANALYSIS

4.6 COMPETITIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT

5.1.2 PROLIFERATION OF AUTOMATION, ROBOTICS, AND AI IN PORT OPERATIONS

5.1.3 SUSTAINABILITY INITIATIVES PROMOTING ENERGY-EFFICIENT AND LOW-EMISSION TERMINALS

5.1.4 RISING GOVERNMENT INVESTMENTS AND INCENTIVES FOR SMART PORT INITIATIVES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT INVESTMENT AND INSTALLATION COSTS

5.2.2 COMPLIANCE WITH STRINGENT REGIONAL REGULATIONS AND SAFETY STANDARDS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF AUTOMATED TERMINALS IN EMERGING MARKETS

5.3.2 INTEGRATION WITH SMART LOGISTICS SOLUTIONS AND PORT COMMUNITY SYSTEMS

5.3.3 GROWING ADOPTION OF ELECTRIC AND HYBRID AUTOMATED EQUIPMENT FOR SUSTAINABILITY

5.4 CHALLENGES

5.4.1 CYBERSECURITY RISKS ASSOCIATED WITH DIGITAL PORT INFRASTRUCTURE

5.4.2 SYSTEM INTEROPERABILITY WITH LEGACY EQUIPMENT AND MULTI-VENDOR SOLUTIONS

6 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION

6.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

6.1.1 SEMI-AUTOMATED TERMINALS

6.1.2 FULLY AUTOMATED TERMINALS

7 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

7.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

7.1.1 BROWNFIELD PROJECTS

7.1.1.1 BROWNFIELD PROJECTS, BY TYPE

7.1.1.1.1 END-TO-END BROWNFIELD PROJECTS TERMINAL AUTOMATION

7.1.1.1.2 YARD-ONLY AUTOMATION RETROFITS

7.1.1.1.3 LANDSIDE / GATE AUTOMATION UPGRADES

7.1.1.1.4 QUAY CRANE AUTOMATION RETROFITS

7.1.2 GREENFIELD PROJECTS

7.1.2.1 GREENFIELD PROJECTS, BY TYPE

7.1.2.1.1 FULLY AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.2 SEMI-AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.3 PHASED GREENFIELD PROJECTS AUTOMATION

8 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING

8.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

8.1.1 EQUIPMENT

8.1.1.1 EQUIPMENT, BY TYPE

8.1.1.1.1 AUTOMATED & REMOTE-CONTROLLED CRANES

8.1.1.1.2 AUTOMATED HORIZONTAL TRANSPORT

8.1.1.1.3 GATE & LANDSIDE AUTOMATION EQUIPMENT

8.1.1.1.4 OTHERS

8.1.2 SOFTWARE

8.1.2.1 SOFTWARE, BY TYPE

8.1.2.1.1 EQUIPMENT CONTROL SYSTEMS (ECS) & FLEET MANAGEMENT

8.1.2.1.2 TERMINAL OPERATING SYSTEMS (TOS)

8.1.2.1.3 AUTOMATION & ORCHESTRATION PLATFORMS

8.1.2.1.4 DIGITAL TWIN & SIMULATION TOOLS

8.1.2.1.5 GATE & COMMUNITY PLATFORMS

8.1.2.1.6 OTHERS

8.1.3 SERVICES

8.1.3.1 SERVICE, BY TYPE

8.1.3.1.1 PROFESSIONAL SERVICES

8.1.3.1.2 MANAGED SERVICES

9 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER

9.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

9.1.1 PUBLIC

9.1.1.1 PUBLIC, BY APPLICATION

9.1.1.1.1 PORT INFRASTRUCTURE MODERNIZATION

9.1.1.1.2 TRADE FACILITATION & CUSTOMS AUTOMATION

9.1.1.1.3 SAFETY & COMPLIANCE AUTOMATION

9.1.1.1.4 SMART NATIONAL LOGISTICS CORRIDORS

9.1.1.1.5 PUBLIC–PRIVATE PARTNERSHIP (PPP) CO-MANAGED TERMINALS

9.1.1.1.6 OTHERS

9.1.2 PRIVATE

9.1.2.1 PRIVATE, BY APPLICATION

9.1.2.1.1 HIGH-VOLUME AUTOMATED CONTAINER HANDLING

9.1.2.1.2 AUTOMATED LOGISTICS & INTERMODAL HUBS

9.1.2.1.3 CARRIER-OWNED SMART TERMINALS

9.1.2.1.4 SUBSCRIPTION & MANAGED TERMINAL AUTOMATION SERVICES

10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL

10.1 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

10.1.1 DIRECT CHANNEL

10.1.2 INDIRECT CHANNEL

10.1.2.1 INDIRECT CHANNEL, BY TYPE

10.1.2.1.1 SYSTEM INTEGRATORS

10.1.2.1.2 VALUE-ADDED RESELLERS (VAR)

10.1.2.1.3 OTHERS

11 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 SINGAPORE

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 INDIA

11.2.6 AUSTRALIA

11.2.7 MALAYSIA (

11.2.8 INDONESIA

11.2.9 THAILAND

11.2.10 PHILIPPINES (

11.2.11 REST OF ASIA PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 NETHERLANDS

11.3.3 BELGIUM

11.3.4 UNITED KINGDOM

11.3.5 FRANCE

11.3.6 ITALY

11.3.7 SPAIN

11.3.8 RUSSIA

11.3.9 TURKEY

11.3.10 SWITZERLAND

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 CHILE

11.5.3 COLOMBIA

11.5.4 PERU

11.5.5 ARGENTINA

11.5.6 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 U.A.E

11.6.2 SAUDI ARABIA

11.6.3 SOUTH AFRICA

11.6.4 EGYPT

11.6.5 ISRAEL

11.6.6 REST OF MIDDLE EAST & AFRICA

12 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIEBHERR

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BECKHOFF AUTOMATION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 SHANGHAI ZHENHUA HEAVY INDUSTRIES CO., LTD.

14.3.1 COMPANY SNAPSHOTS

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 KONECRANES

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 KALMAR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APM TERMINALS

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CAMCO TECHNOLOGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CLT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HIAB CORPORATION (SUBSIDIARY OF CARGOTEC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 HAPAG-LLOYD AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 INFYZ.COM.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INFORM SOFTWARE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 IDENTEC SOLUTIONS AG

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KÜNZ GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LOGSTAR ERP.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 LOGINNO LOGISTIC INNOVATION LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORBCOMM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PACECO CORP.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STARCOM GPS GLOBAL SOLUTIONS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 ECENT DEVELOPMENT

14.21 TMEIC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TIDEWORKS.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 TOTAL SOFT BANK LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.24 WCS CONSULTANCY

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 INDUSTRY ANALYSIS AND FUTURISTIC SCENARIO OF THE GLOBAL AUTOMATED CONTAINER TERMINAL MARKET

TABLE 2 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL SEMI-AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 GLOBAL FULLY AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL DIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 CHINA (USD THOUSAND)

TABLE 44 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 45 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 CHINA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 CHINA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 49 CHINA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 CHINA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 CHINA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 CHINA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 54 CHINA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 CHINA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 57 CHINA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 SINGAPORE (USD THOUSAND)

TABLE 59 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 60 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 SINGAPORE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 SINGAPORE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 64 SINGAPORE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SINGAPORE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SINGAPORE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SINGAPORE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 69 SINGAPORE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 70 SINGAPORE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 71 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 SINGAPORE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH KOREA (USD THOUSAND)

TABLE 74 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 75 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 SOUTH KOREA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 SOUTH KOREA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 79 SOUTH KOREA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 SOUTH KOREA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 SOUTH KOREA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 SOUTH KOREA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 84 SOUTH KOREA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 85 SOUTH KOREA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 86 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 87 SOUTH KOREA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 JAPAN (USD THOUSAND)

TABLE 89 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 90 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 JAPAN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 JAPAN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 94 JAPAN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 JAPAN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 JAPAN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 JAPAN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 99 JAPAN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 100 JAPAN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 101 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 102 JAPAN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 INDIA (USD THOUSAND)

TABLE 104 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 105 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 INDIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 INDIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 109 INDIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 INDIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 INDIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 INDIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 114 INDIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 115 INDIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 117 INDIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 AUSTRALIA (USD THOUSAND)

TABLE 119 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 120 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 AUSTRALIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 AUSTRALIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 132 AUSTRALIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 MALAYSIA (USD THOUSAND)

TABLE 134 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 135 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 MALAYSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MALAYSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 139 MALAYSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 MALAYSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 MALAYSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 MALAYSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 144 MALAYSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 MALAYSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 146 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 147 MALAYSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 INDONESIA (USD THOUSAND)

TABLE 149 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 150 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDONESIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 INDONESIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 154 INDONESIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDONESIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 INDONESIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 INDONESIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 159 INDONESIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 160 INDONESIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 161 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 162 INDONESIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 THAILAND (USD THOUSAND)

TABLE 164 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 165 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 THAILAND BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 THAILAND GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 169 THAILAND EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 THAILAND SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 THAILAND SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 THAILAND PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 174 THAILAND PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 175 THAILAND PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 176 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 177 THAILAND INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 PHILIPPINES (USD THOUSAND)

TABLE 179 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 180 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 PHILIPPINES BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 PHILIPPINES GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 184 PHILIPPINES EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 PHILIPPINES SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 PHILIPPINES SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 PHILIPPINES PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 189 PHILIPPINES PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 190 PHILIPPINES PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 191 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 192 PHILIPPINES INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 REST OF ASIA PACIFIC (USD THOUSAND)

TABLE 194 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 195 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 REST OF ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 REST OF ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 REST OF ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 204 REST OF ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 205 REST OF ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 206 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 REST OF ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 209 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 210 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 EUROPE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 EUROPE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 214 EUROPE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 EUROPE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 EUROPE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 EUROPE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 219 EUROPE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 220 EUROPE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 221 EUROPE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 222 EUROPE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 GERMANY (USD THOUSAND)

TABLE 224 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 225 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 GERMANY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 GERMANY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 229 GERMANY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 GERMANY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 GERMANY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 GERMANY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 234 GERMANY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 235 GERMANY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 236 GERMANY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 237 GERMANY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 NETHERLANDS (USD THOUSAND)

TABLE 239 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 240 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 NETHERLANDS BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 NETHERLANDS GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 244 NETHERLANDS EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 NETHERLANDS SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 NETHERLANDS SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 NETHERLANDS PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 249 NETHERLANDS PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 250 NETHERLANDS PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 251 NETHERLANDS AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 252 NETHERLANDS INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 BELGIUM (USD THOUSAND)

TABLE 254 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 255 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 BELGIUM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 BELGIUM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 259 BELGIUM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 BELGIUM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 BELGIUM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 BELGIUM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 264 BELGIUM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 265 BELGIUM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 266 BELGIUM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 267 BELGIUM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 UNITED KINGDOM (USD THOUSAND)

TABLE 269 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 270 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 UNITED KINGDOM BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 UNITED KINGDOM GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 274 UNITED KINGDOM EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 UNITED KINGDOM SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 UNITED KINGDOM SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 UNITED KINGDOM PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 279 UNITED KINGDOM PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 280 UNITED KINGDOM PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 281 UNITED KINGDOM AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 282 UNITED KINGDOM INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 FRANCE (USD THOUSAND)

TABLE 284 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 285 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 FRANCE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 FRANCE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 289 FRANCE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 FRANCE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 FRANCE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 FRANCE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 294 FRANCE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 295 FRANCE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 296 FRANCE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 297 FRANCE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 ITALY (USD THOUSAND)

TABLE 299 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 300 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 ITALY BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 ITALY GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 304 ITALY EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 ITALY SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 ITALY SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 ITALY PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 309 ITALY PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 310 ITALY PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 311 ITALY AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 312 ITALY INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 SPAIN (USD THOUSAND)

TABLE 314 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 315 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 SPAIN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 SPAIN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 319 SPAIN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 SPAIN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 SPAIN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 SPAIN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 324 SPAIN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 SPAIN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 326 SPAIN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 327 SPAIN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 RUSSIA (USD THOUSAND)

TABLE 329 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 330 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 RUSSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 RUSSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 334 RUSSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 RUSSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 RUSSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 RUSSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 339 RUSSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 340 RUSSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 341 RUSSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)