Global Chemical Licensing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

14.57 Billion

USD

25.31 Billion

2025

2033

USD

14.57 Billion

USD

25.31 Billion

2025

2033

| 2026 –2033 | |

| USD 14.57 Billion | |

| USD 25.31 Billion | |

|

|

|

|

Global Chemical Licensing Market Segmentation, By Type (C2 Derivatives, C1 Derivatives, C3 Derivatives, C4 Derivatives, and Others), End-use Industry (Petrochemicals, Oil & Gas, Inorganic Chemicals, Agrochemicals, Organic Chemicals, Pharmaceuticals, and Others)- Industry Trends and Forecast to 2033

Chemical Licensing Market Size

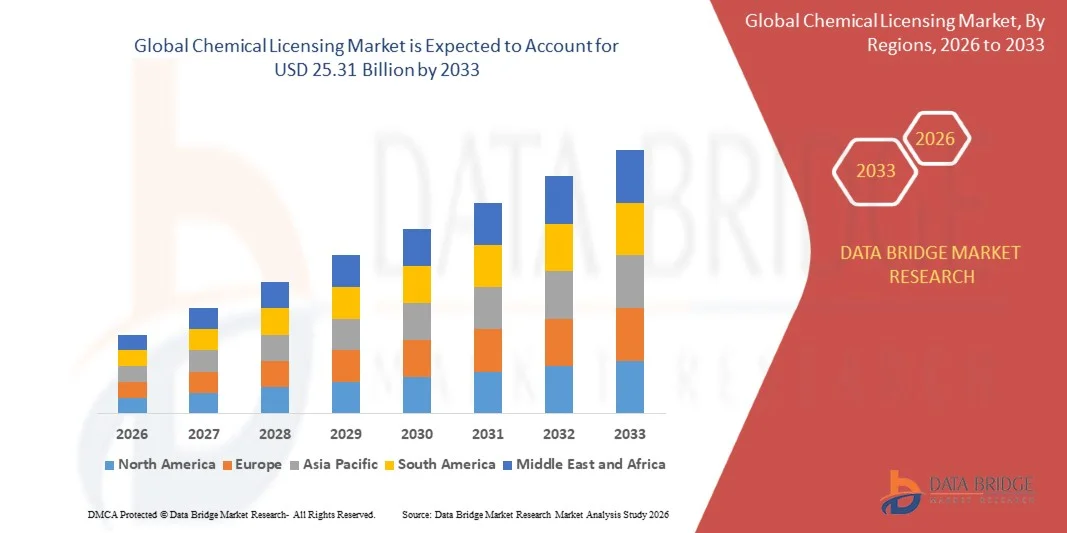

- The global chemical licensing market size was valued at USD 14.57 billion in 2025 and is expected to reach USD 25.31 billion by 2033, at a CAGR of 7.15% during the forecast period

- The market growth is largely fuelled by increasing demand for advanced chemical processes, sustainable production technologies, and rapid expansion of specialty and performance chemicals

- Rising investments in petrochemicals, polymers, and green chemistry, along with the need for cost-effective and efficient manufacturing solutions, are further supporting market growth

Chemical Licensing Market Analysis

- The chemical licensing market is witnessing steady growth as manufacturers increasingly rely on licensed technologies to reduce R&D costs, shorten commercialization timelines, and improve operational efficiency

- Growing focus on sustainability, regulatory compliance, and adoption of innovative process technologies is encouraging collaborations between licensors and chemical producers across multiple end-use industries

- North America dominated the chemical licensing market with the largest revenue share in 2025, driven by the strong presence of major chemical producers, advanced R&D capabilities, and early adoption of licensed technologies across petrochemicals and specialty chemicals

- Asia-Pacific region is expected to witness the highest growth rate in the global chemical licensing market, driven by rising chemical production, foreign investments, and growing demand for efficient and sustainable technologies

- The C2 derivatives segment held the largest market revenue share in 2025, driven by extensive demand for ethylene-based products such as polyethylene and ethylene oxide across petrochemicals and plastics manufacturing. Licensed C2 derivative technologies are widely adopted due to their proven efficiency, scalability, and strong integration with downstream chemical value chains

Report Scope and Chemical Licensing Market Segmentation

|

Attributes |

Chemical Licensing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Licensing Market Trends

“Rising Demand for Advanced, Sustainable, and Cost-Effective Chemical Technologies”

• The increasing focus on efficiency, sustainability, and rapid commercialization is significantly shaping the chemical licensing market, as manufacturers seek proven technologies to reduce capital expenditure and operational risks. Chemical licensing is gaining traction due to its ability to provide access to advanced process technologies, improve yield, and ensure regulatory compliance without extensive in-house R&D. This trend strengthens adoption across petrochemicals, specialty chemicals, and performance materials, encouraging licensors to expand and upgrade their technology portfolios

• Growing emphasis on sustainable manufacturing and emission reduction has accelerated the demand for licensed technologies that support green chemistry, energy efficiency, and lower environmental impact. Chemical producers are increasingly adopting licensed processes to meet stricter environmental regulations and corporate sustainability goals, prompting collaboration between technology providers and chemical manufacturers to develop cleaner and more efficient solutions

• Digitalization and process optimization trends are influencing licensing decisions, with licensors integrating digital tools, process automation, and performance monitoring into licensed packages. These factors help licensees enhance operational efficiency, minimize downtime, and improve overall plant performance, while also enabling licensors to differentiate offerings in a competitive market

• For instance, in 2024, technology licensors in the U.S. and Europe expanded licensing agreements for advanced polymer, hydrogen, and specialty chemical processes to support sustainable production initiatives. These agreements were driven by rising demand for low-emission and high-efficiency technologies, with adoption across new projects and capacity expansion initiatives globally

• While demand for chemical licensing continues to grow, sustained market expansion depends on continuous innovation, protection of intellectual property, and the ability to adapt technologies to diverse feedstocks and regional regulations. Licensors are also focusing on flexible licensing models and long-term technical support to enhance value for licensees

Chemical Licensing Market Dynamics

Driver

“Growing Need for Efficient and Sustainable Chemical Production”

• Rising demand for efficient, scalable, and environmentally compliant chemical processes is a major driver for the chemical licensing market. Manufacturers are increasingly relying on licensed technologies to meet production targets, reduce development timelines, and comply with evolving regulatory standards. This trend is also driving innovation in process intensification and modular plant design

• Expanding applications across petrochemicals, polymers, fertilizers, specialty chemicals, and green hydrogen are influencing market growth. Licensed technologies enable producers to optimize feedstock utilization, improve product quality, and enhance safety, supporting large-scale industrial deployment. The global shift toward sustainable and circular chemical production further reinforces this trend

• Chemical producers are actively engaging in licensing partnerships to access proprietary technologies, technical expertise, and ongoing process support. These collaborations help reduce technological risk and ensure faster project execution, while also encouraging long-term relationships between licensors and licensees

• For instance, in 2023, major chemical companies in Asia and the Middle East entered licensing agreements with European and U.S.-based technology providers for advanced petrochemical and specialty chemical processes. These agreements supported capacity expansions and modernization projects aligned with sustainability and efficiency goals

• Although strong demand supports market growth, wider adoption depends on favorable investment conditions, technology adaptability, and long-term economic viability. Continued investment in innovation, digital integration, and sustainable process development will be critical for maintaining competitiveness in the global chemical licensing market

Restraint/Challenge

“High Licensing Costs and Intellectual Property Risks”

• The high cost associated with licensing fees, royalties, and technology customization remains a key challenge, particularly for small and mid-sized chemical producers. These costs can limit adoption in price-sensitive markets and impact project feasibility, especially during periods of economic uncertainty

• Concerns related to intellectual property protection and technology leakage also restrain market growth. Licensors must ensure robust IP safeguards, while licensees may face restrictions on process modification and technology transfer, affecting operational flexibility

• Regulatory complexity and regional differences in compliance requirements further impact licensing adoption. Adapting licensed technologies to local regulations, feedstock availability, and infrastructure can increase project timelines and costs. Companies often need additional engineering and consulting support to address these challenges

• For instance, in 2024, chemical producers in parts of Southeast Asia and Africa reported delays in licensing adoption due to high upfront costs, regulatory approvals, and concerns over long-term royalty obligations. These factors also influenced investment decisions for new chemical plants and expansions

• Addressing these challenges will require flexible licensing models, improved IP protection frameworks, and stronger collaboration between licensors, regulators, and manufacturers. Developing cost-effective technologies, offering modular and adaptable solutions, and enhancing technical support will be essential for unlocking the long-term growth potential of the global chemical licensing market

Chemical Licensing Market Scope

The market is segmented on the basis of type and end-use industry

• By Type

On the basis of type, the chemical licensing market is segmented into C2 derivatives, C1 derivatives, C3 derivatives, C4 derivatives, and others. The C2 derivatives segment held the largest market revenue share in 2025, driven by extensive demand for ethylene-based products such as polyethylene and ethylene oxide across petrochemicals and plastics manufacturing. Licensed C2 derivative technologies are widely adopted due to their proven efficiency, scalability, and strong integration with downstream chemical value chains.

The C1 derivatives segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising investments in methanol-based chemicals, hydrogen, and sustainable fuels. C1 derivative licensing is gaining traction due to increasing focus on carbon utilization, energy transition initiatives, and demand for flexible technologies that can operate on diverse feedstocks.

• By End-use Industry

On the basis of end-use industry, the chemical licensing market is segmented into petrochemicals, oil & gas, inorganic chemicals, agrochemicals, organic chemicals, pharmaceuticals, and others. The petrochemicals segment held the largest market revenue share in 2025, driven by continuous capacity expansions, modernization of existing plants, and strong demand for polymers and intermediates. Licensing enables petrochemical producers to adopt advanced processes while reducing development risks and time-to-market.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for high-purity chemicals, active pharmaceutical ingredients, and specialized intermediates. Licensed technologies support compliance with stringent regulatory standards and enable efficient, consistent, and scalable pharmaceutical production.

Chemical Licensing Market Regional Analysis

• North America dominated the chemical licensing market with the largest revenue share in 2025, driven by the strong presence of major chemical producers, advanced R&D capabilities, and early adoption of licensed technologies across petrochemicals and specialty chemicals

• Companies in the region emphasize process efficiency, regulatory compliance, and access to proprietary technologies to maintain competitiveness and reduce time-to-market

• This dominance is further supported by high capital investment, a mature industrial base, and continuous innovation in process technologies, positioning chemical licensing as a critical strategy for large-scale and specialty chemical production

U.S. Chemical Licensing Market Insight

The U.S. chemical licensing market captured the largest revenue share in 2025 within North America, supported by extensive investments in petrochemical capacity expansions and process optimization. Chemical manufacturers increasingly rely on licensed technologies to improve yield, energy efficiency, and sustainability performance. Strong collaboration between technology providers and producers, along with strict environmental regulations, continues to accelerate the adoption of advanced licensed processes across multiple chemical segments.

Europe Chemical Licensing Market Insight

The Europe chemical licensing market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and the growing demand for low-emission and energy-efficient chemical processes. European manufacturers are actively adopting licensed technologies to comply with sustainability targets while maintaining high production efficiency. The region shows strong demand across specialty chemicals, pharmaceuticals, and advanced materials industries.

U.K. Chemical Licensing Market Insight

The U.K. chemical licensing market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing focus on sustainable manufacturing and innovation-led chemical production. The country’s emphasis on specialty chemicals, pharmaceuticals, and green chemistry is encouraging companies to license advanced process technologies. Supportive government initiatives and strong academic–industry collaboration further contribute to market growth.

Germany Chemical Licensing Market Insight

The Germany chemical licensing market is expected to witness the fastest growth rate from 2026 to 2033, fueled by its strong chemical manufacturing base and leadership in process engineering. German companies prioritize high-efficiency, environmentally compliant technologies, driving demand for advanced licensing solutions. The integration of licensed processes with digitalization and automation initiatives further strengthens market adoption across industrial and specialty chemical sectors.

Asia-Pacific Chemical Licensing Market Insight

The Asia-Pacific chemical licensing market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, capacity expansions, and rising demand for chemicals across end-use industries. Countries such as China, India, and Japan are increasingly adopting licensed technologies to scale production, improve quality, and meet environmental standards. The region’s cost advantages and growing manufacturing footprint continue to attract global technology licensors.

Japan Chemical Licensing Market Insight

The Japan chemical licensing market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong focus on high-value specialty chemicals and advanced materials. Japanese manufacturers emphasize precision, efficiency, and sustainability, leading to increased adoption of licensed processes. The integration of licensed technologies with automation and digital control systems is further supporting market growth.

China Chemical Licensing Market Insight

The China chemical licensing market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to massive capacity expansions, rapid industrial growth, and strong demand across petrochemicals and downstream chemicals. The country’s push toward self-sufficiency, cleaner production technologies, and modernization of chemical plants is accelerating the adoption of licensed processes. Strong domestic demand and partnerships with global licensors continue to drive market expansion in China.

Chemical Licensing Market Share

The Chemical Licensing industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- BASF SE (Germany)

- Dow Inc. (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Mitsubishi Chemical Corporation (Japan)

- Chevron Phillips Chemical Company LLC (U.S.)

- Johnson Matthey plc (U.K)

- Eastman Chemical Company (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

Latest Developments in Global Chemical Licensing Market

- In May 2025, Mitsubishi Chemical, through its subsidiary MU Ionic Solutions Corporation, entered into a patent licensing agreement with CATL. The development type is technology and patent licensing focused on lithium-ion battery innovation. The agreement allows CATL to access next-generation MP1 cathode interfacial control technology. This supports improved battery performance, efficiency, and durability. The deal strengthens competition and accelerates technological advancement in the global electric vehicle and energy storage market

- In May 2025, Himadri Speciality Chemical signed a technology licensing agreement with Australian company Sicona. The development involves exclusive licensing of silicon-carbon anode technology for India. This enables local production and commercialization of advanced lithium-ion battery materials. The agreement supports domestic manufacturing capabilities and reduces reliance on imports. It positively impacts the Indian battery ecosystem and strengthens supply chain resilience

- In March 2025, Mitsubishi Chemical Group signed a licensing agreement with SNF Group. The development type is process technology licensing for N-vinylformamide production. The agreement allows SNF to commercially manufacture NVF used in functional polymers. This enhances production capacity for specialty chemicals and downstream polymer applications. The move supports market expansion in high-performance industrial and chemical segments

- In November 2024, ExxonMobil entered into a licensing agreement with Neuvokas Corporation. The development focuses on sublicensing composite rebar manufacturing technology outside North America. This enables wider adoption of GFRP rebar in global construction markets. The agreement supports infrastructure modernization and durability improvements. It expands ExxonMobil’s reach in advanced materials and construction solutions

- In April 2024, KBR formed an alliance with Sumitomo Chemical to become the exclusive licensing partner for propylene oxide by cumene technology. The development type is strategic technology licensing. This enables broader deployment of advanced propylene oxide production processes. The agreement supports growth in polyurethane applications across construction and automotive sectors. It strengthens technology diffusion and market penetration in specialty chemicals

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.