Global Contact Lenses Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

14.18 Billion

USD

22.10 Billion

2024

2032

USD

14.18 Billion

USD

22.10 Billion

2024

2032

| 2025 –2032 | |

| USD 14.18 Billion | |

| USD 22.10 Billion | |

|

|

|

|

Global Contact Lenses Market Segmentation, By Model (Daily Wear Contact Lenses, Extended Wear Contact Lenses, and Traditional Wear Contact Lenses), Design (Spherical Contact Lenses, Toric Contact Lenses, Multifocal Contact Lenses, Monovision Contact Lenses, and Cosmetic Contact Lenses), Material (Silicone Hydrogel Contact Lenses, Hydrogel Contact Lenses, Hybrid Contact Lenses, Gas-Permeable Contact Lenses, and Polymethyl Methacrylate Contact Lenses), Color Variation (Opaque Contact Lenses, Enhancers/Tinted Contact Lenses, and Visibility Tinted Contact Lenses), Distribution Channel (Retail Stores, Hospitals and Clinics, and E-Commerce), Application (Conventional Contact Lenses, Orthokeratology Contact Lenses, and Decorative (Plano) Contact Lenses) - Industry Trends and Forecast to 2032

Contact Lenses Market Size

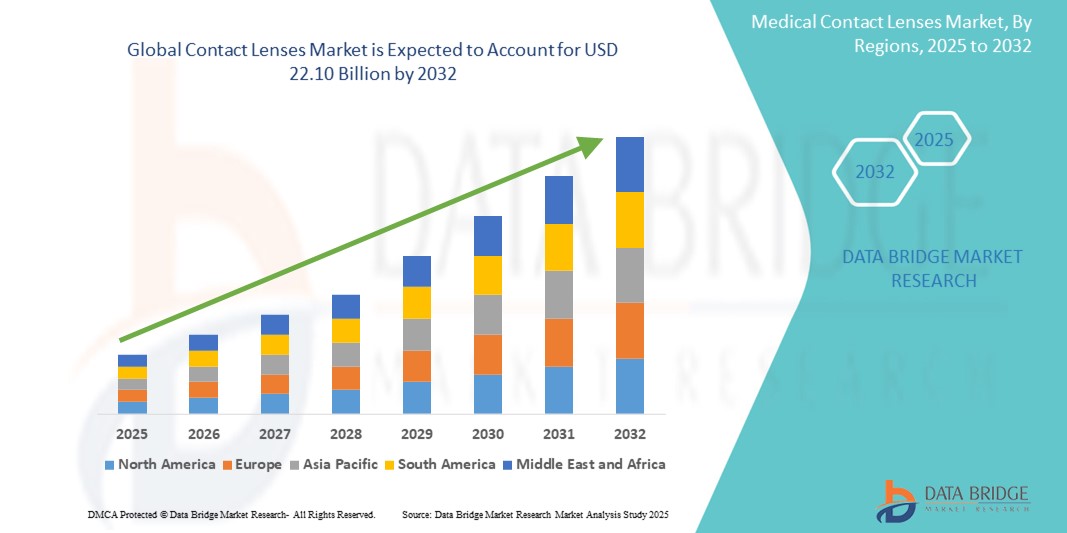

- The global contact lenses market size was valued at USD 14.18 billion in 2024 and is expected to reach USD 22.10 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced vision correction technologies and increasing consumer interest in aesthetic eye care, leading to the widespread acceptance of contact lenses across both medical and cosmetic applications

- Furthermore, rising consumer demand for convenient, comfortable, and lifestyle-compatible vision correction solutions is positioning contact lenses as a preferred alternative to traditional eyeglasses. These converging factors are accelerating the uptake of contact lens products, thereby significantly boosting the industry's growth

Contact Lenses Market Analysis

- Contact lenses, offering non-invasive and aesthetically appealing vision correction, are increasingly vital components of modern eye care in both medical and lifestyle settings due to their enhanced comfort, convenience, and advancements in material technology

- The escalating demand for contact lenses is primarily fueled by the rising prevalence of refractive errors (such as myopia and astigmatism), increasing awareness of eye health, growing geriatric population, and consumer preference for alternatives to eyeglasses—particularly among younger and active demographics

- North America dominated the contact lenses market with the largest revenue share of 38.7% in 2024, characterized by high awareness levels, strong penetration of daily disposable and silicone hydrogel lenses, and the presence of major market players such as Johnson & Johnson Vision Care, Bausch + Lomb, and CooperVision

- Asia-Pacific is expected to be the fastest-growing region in the contact lenses market, projected to grow at a CAGR of 7.6% from 2025 to 2032, due to increasing urbanization, expanding middle-class population, and rising adoption of corrective and cosmetic lenses, particularly in countries such as China, India, South Korea, and Japan

- Daily wear contact lenses segment dominated the contact lenses market with a market share of 54.2% in 2024, driven by ease of use, reduced risk of eye infections, and increasing preference for disposable lenses among users seeking comfort and hygiene

Report Scope and Contact Lenses Market Segmentation

|

Attributes |

Contact Lenses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Contact Lenses Market Trends

“Enhanced Comfort and Customization Driving Contact Lenses Adoption”

- A significant and accelerating trend in the global contact lenses market is the increasing focus on comfort, breathability, and customization, which is enhancing user satisfaction and expanding market adoption. Innovations in lens material, moisture retention, and oxygen permeability are making contact lenses more suitable for extended and daily wear, particularly among first-time users and individuals with sensitive eyes

- For instance, leading brands are developing next-generation silicone hydrogel lenses that offer improved hydration and reduced eye dryness. These advances are especially beneficial for people who wear lenses for long hours or work in screen-heavy environments, helping to reduce digital eye strain

- The growing popularity of colored and cosmetic lenses is also reshaping consumer behavior. Lenses that combine vision correction with aesthetic appeal—such as enhancing eye color or offering special effects—are gaining traction among younger demographics and in emerging markets

- Customization is another critical trend, with lenses now available in multiple designs and fits, including toric lenses for astigmatism, multifocal lenses for presbyopia, and specialty lenses for orthokeratology. These tailored solutions are expanding access for patients with complex vision needs who previously had limited options

- Furthermore, advancements in lens durability and hygiene, such as daily disposable models and UV-blocking features, are boosting adoption by minimizing infection risk and improving convenience for users

- This trend toward comfort-focused, personalized, and multifunctional contact lenses is fundamentally transforming user expectations. As awareness of eye health and vision care continues to grow, contact lenses are becoming a preferred choice for both corrective and cosmetic purposes across global markets

Contact Lenses Market Dynamics

Driver

“Growing Need Due to Rising Vision Impairment and Cosmetic Preferences”

- The increasing prevalence of vision disorders such as myopia, hyperopia, astigmatism, and presbyopia, coupled with the rising preference for aesthetic enhancements, is significantly driving the demand for contact lenses

- For instance, in April 2024, Alcon Inc. launched a new range of silicone hydrogel daily disposable lenses with enhanced moisture retention technology, aiming to address the growing need for all-day comfort and eye health. Such product innovations are expected to accelerate the Contact Lenses market growth during the forecast period

- As consumers seek alternatives to eyeglasses for vision correction or cosmetic appeal, contact lenses offer clear advantages such as a wider field of vision, suitability for sports, and aesthetic freedom

- Furthermore, the surge in digital screen usage and increased awareness of eye care are prompting consumers to explore more comfortable and breathable lens materials. This trend is pushing manufacturers to innovate in oxygen-permeable and hydrating lens technologies

- The convenience of daily disposables, availability of colored and cosmetic lenses, and the ability to customize lenses for complex conditions such as astigmatism and presbyopia are all key drivers fueling market expansion across both developed and emerging economies

Restraint/Challenge

“Concerns Regarding Eye Infections and High Cost of Specialty Lenses”

- Despite growing adoption, concerns about hygiene, eye infections, and potential misuse of contact lenses remain key challenges restraining market penetration. Inadequate lens care, overuse, or non-compliance with replacement schedules can increase the risk of eye complications such as keratitis

- For instance, a study published in 2023 by the American Academy of Ophthalmology highlighted that poor hygiene practices among first-time contact lens users were a leading cause of corneal infections globally

- In response, companies such as Johnson & Johnson and CooperVision are emphasizing proper lens education and have rolled out digital platforms and packaging that guide users on lens hygiene and safe usage

- In addition, the relatively high cost of specialty lenses—such as multifocal, hybrid, or ortho-k lenses—can be a barrier for cost-sensitive users, particularly in low- and middle-income regions. While basic daily lenses have become more affordable, advanced and personalized solutions remain out of reach for many

Contact Lenses Market Scope

The market is segmented on the basis of model, design, material, color variation , distribution channel and application.

• By Model

On the basis of model, the contact lenses market is segmented into daily wear contact lenses, extended wear contact lenses, and traditional wear contact lenses. The daily wear contact lenses segment dominated the market with the largest revenue share of 54.2% in 2024, due to ease of use, reduced risk of eye infections, and growing preference for disposable lenses.

The extended wear contact lenses segment is expected to witness the fastest CAGR of 6.9% from 2025 to 2032, owing to their long-lasting wear and growing demand among users with active lifestyles.

• By Design

On the basis of design, the contact lenses market is segmented into spherical contact lenses, toric contact lenses, multifocal contact lenses, monovision contact lenses, and cosmetic contact lenses. The spherical contact lenses segment held the largest market share of 41.7% in 2024, driven by their wide use in correcting common refractive errors such as myopia and hyperopia.

The multifocal contact lenses segment is projected to register the fastest CAGR of 7.4% from 2025 to 2032, fueled by increasing presbyopia cases and a growing aging population.

• By Material

On the basis of material, the contact lenses market is segmented into silicone hydrogel contact lenses, hydrogel contact lenses, hybrid contact lenses, gas-permeable contact lenses, and polymethyl methacrylate (PMMA) contact lenses. The silicone hydrogel contact lenses segment dominated with a market share of 47.6% in 2024, supported by their superior oxygen permeability and comfort.

The hybrid contact lenses segment is anticipated to witness the fastest CAGR of 7.8% from 2025 to 2032, due to their enhanced visual clarity and increasing adoption for corneal disorders.

• By Color Variation

On the basis of color variation, the contact lenses market is segmented into opaque contact lenses, enhancers/tinted contact lenses, and visibility tinted contact lenses. The visibility tinted contact lenses segment accounted for the largest share of 38.9% in 2024, owing to ease of handling and preference among first-time users.

The opaque contact lenses segment is expected to grow at the fastest CAGR of 8.1% from 2025 to 2032, due to rising demand for cosmetic and theatrical applications globally.

• By Distribution Channel

On the basis of distribution channel, the contact lenses market is segmented into retail stores, hospitals and clinics, and E-commerce. Retail stores held the dominant market share of 49.5% in 2024, attributed to broad brand availability and consumer trust in physical outlets.

The E-Commerce segment is projected to record the highest CAGR of 9.2% from 2025 to 2032, driven by digital convenience, home delivery, and growing adoption of online eye care platforms.

• By Application

On the basis of application, the contact lenses market is segmented into conventional contact lenses, orthokeratology contact lenses, and decorative (plano) contact lenses. Conventional contact lenses held the largest market share of 62.8% in 2024, owing to their primary use for refractive error correction.

The orthokeratology contact lenses segment is anticipated to grow at the fastest CAGR of 8.5% from 2025 to 2032, due to their increasing use in myopia control and non-surgical vision correction.

Contact Lenses Market Regional Analysis

- North America dominated the contact lenses market with the largest revenue share of 38.7% in 2024, driven by increasing prevalence of vision disorders, rising awareness of advanced eye care products, and strong consumer preference for aesthetic and corrective lenses

- Consumers in the region highly value the availability of a wide range of contact lens types, including daily disposables and cosmetic lenses, offered through well-established retail and e-commerce channels

- This widespread adoption is further supported by a high level of eye health consciousness, strong presence of key industry players, and technological advancements in lens materials and design, positioning contact lenses as a preferred alternative to eyeglasses across diverse age groups and demographics

U.S. Contact Lenses Market Insight

The U.S. contact lenses market captured the largest revenue share of 81% in 2024 within North America, driven by the high prevalence of myopia and astigmatism, increasing preference for contact lenses over eyeglasses, and robust presence of key manufacturers such as Johnson & Johnson and Bausch & Lomb. Rising adoption of daily disposable and cosmetic lenses, coupled with strong optometric services and insurance coverage, continues to propel growth. Technological advancements in lens materials and the growing popularity of e-commerce platforms are also contributing significantly to market expansion.

Europe Contact Lenses Market Insight

The Europe contact lenses market is projected to expand at a substantial CAGR of 7.8% during the forecast period, fueled by rising vision correction needs, strong regulatory oversight for eye health products, and growing awareness of eye aesthetics. Increasing use of toric and multifocal lenses, along with the development of eco-friendly packaging and materials, is supporting demand across major countries such as Germany, France, and Italy. Widespread adoption of daily and monthly wear lenses is particularly prominent in urban centers with aging populations.

U.K. Contact Lenses Market Insight

The U.K. contact lenses market is anticipated to grow at a noteworthy CAGR of 7.2% from 2025 to 2032, supported by a rising number of people requiring vision correction and a growing trend toward cosmetic lens usage. The country’s well-established optometry infrastructure, coupled with increasing online retail penetration and consumer preference for subscription-based lens delivery models, is expected to drive continued expansion.

Germany Contact Lenses Market Insight

The Germany contact lenses market is expected to expand at a considerable CAGR of 6.9% during the forecast period, driven by technological innovation in lens design, the introduction of silicone hydrogel materials, and the rising adoption of contact lenses for sports and active lifestyles. High awareness of hygiene and eye health among consumers, coupled with the strong influence of ophthalmologists and optometrists in recommending lenses, is further supporting market growth.

Asia-Pacific Contact Lenses Market Insight

The Asia-Pacific contact lenses market is poised to grow at the fastest CAGR of 7.6% from 2025 to 2032, attributed to rising myopia rates, particularly among younger populations in China, South Korea, and Japan. Increasing disposable income, fashion consciousness, and expanding e-commerce access are also accelerating adoption of cosmetic and corrective contact lenses. Government-led vision care initiatives and improving optometric infrastructure are further enabling market penetration in developing economies such as India and Southeast Asia.

Japan Contact Lenses Market Insight

The Japan contact lenses market is gaining momentum, with a projected CAGR of 8.1%, driven by high urbanization, cultural preference for discreet vision correction, and an aging population demanding convenient and comfortable solutions. Premium lenses such as hybrid and multifocal contact lenses are seeing increasing uptake, and consumers are showing growing interest in innovative features such as moisture retention and UV protection.

China Contact Lenses Market Insight

The China contact lenses market accounted for the largest revenue share in Asia-Pacific in 2024 at 38.2%, supported by a rapidly expanding middle class, high digital adoption, and booming demand for colored and cosmetic lenses. Aggressive marketing by domestic brands, the rise of influencer-led beauty trends, and the expansion of online platforms such as JD and Tmall are enhancing accessibility and consumer engagement across both Tier 1 and Tier 2 cities.

Contact Lenses Market Share

The contact lenses industry is primarily led by well-established companies, including:

- Bausch & Lomb (U.S.)

- Alcon Inc. (U.S.)

- The Cooper Companies Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Carl Zeiss AG (Germany)

- Contamac (U.K.)

- Essilor Ltd. (France)

- HOYA Corporation (Japan)

- STAAR SURGICAL (U.S.)

- SynergEyes (U.S.)

- BENQ MATERIALS CORPORATION (Taiwan)

- Menicon Co., Ltd. (Japan)

- SEED Co Limited (Japan)

- X-Cel Specialty Contacts (U.S.)

- Bausch Health Companies Inc. (Canada)

- Novartis AG (Switzerland)

- Abbott (U.S.)

Latest Developments in Global Contact Lenses Market

- In May 2024, Johnson & Johnson Vision announced the expansion of its ACUVUE OASYS MAX 1-Day contact lenses across additional international markets. These lenses, featuring TearStable Technology and OptiBlue Light Filter, aim to reduce eye fatigue from digital devices and provide all-day comfort. This strategic move strengthens the company’s global market position and addresses the rising demand for daily disposables optimized for digital lifestyles

- In March 2024, Alcon Inc., a global leader in eye care, introduced PRECISION1 for Astigmatism contact lenses in several emerging markets. These daily disposable lenses utilize SMARTSURFACE Technology, offering superior comfort and vision correction for astigmatic patients. The launch reinforces Alcon’s commitment to innovation and expanding its reach in high-growth regions

- In February 2024, The Cooper Companies Inc. announced a USD 500 million investment to expand its manufacturing facilities in Costa Rica and the U.K., targeting the growing global demand for silicone hydrogel lenses and specialty contact lenses. This expansion supports the company's long-term growth strategy and aims to improve supply chain resilience

- In January 2024, HOYA Corporation revealed a partnership with tech firms to integrate smart contact lens prototypes equipped with sensors for glucose monitoring and intraocular pressure measurement. Although still in development, this initiative reflects the company’s push into next-gen biomedical applications and wearable vision technology

- In December 2023, Menicon Co., Ltd. launched Magic 1Day Flat Pack Lenses in European markets. These ultra-slim daily lenses offer enhanced portability and hygiene, appealing to eco-conscious and travel-friendly consumers. The launch emphasizes Menicon’s innovation in packaging design and its focus on sustainability in the contact lens industry

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.