Global Hvdc Transmission Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

13.28 Billion

USD

21.17 Billion

2024

2032

USD

13.28 Billion

USD

21.17 Billion

2024

2032

| 2025 –2032 | |

| USD 13.28 Billion | |

| USD 21.17 Billion | |

|

|

|

|

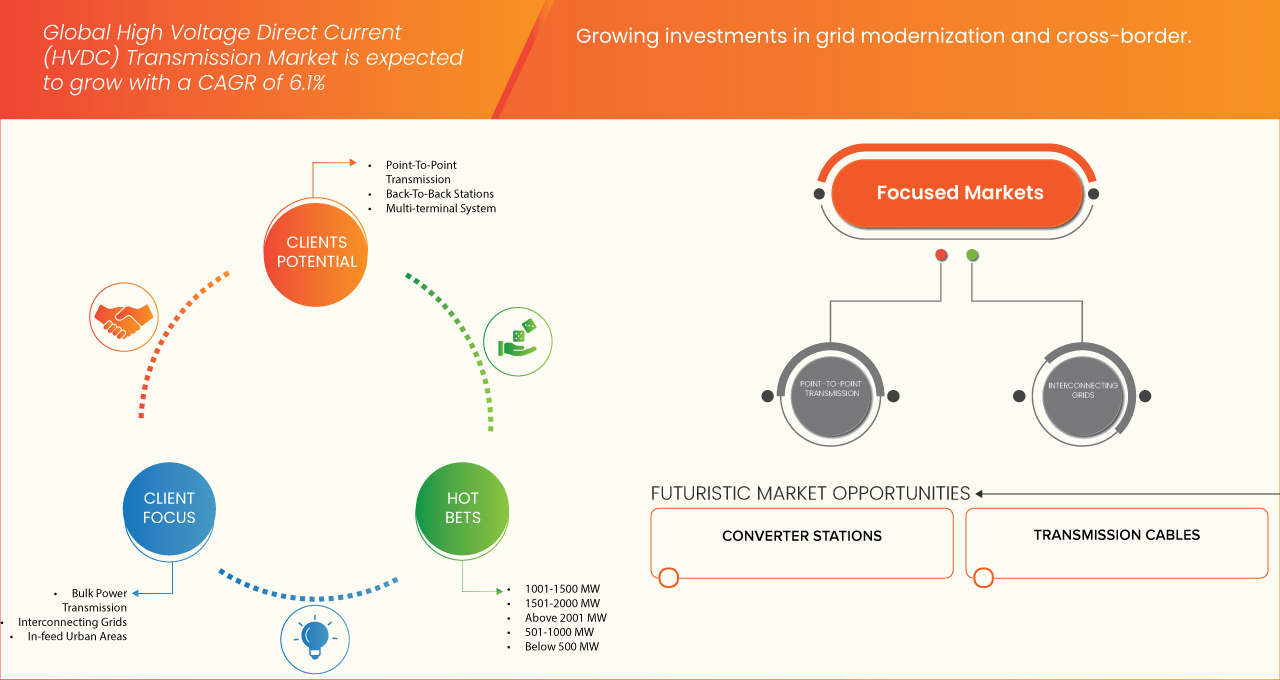

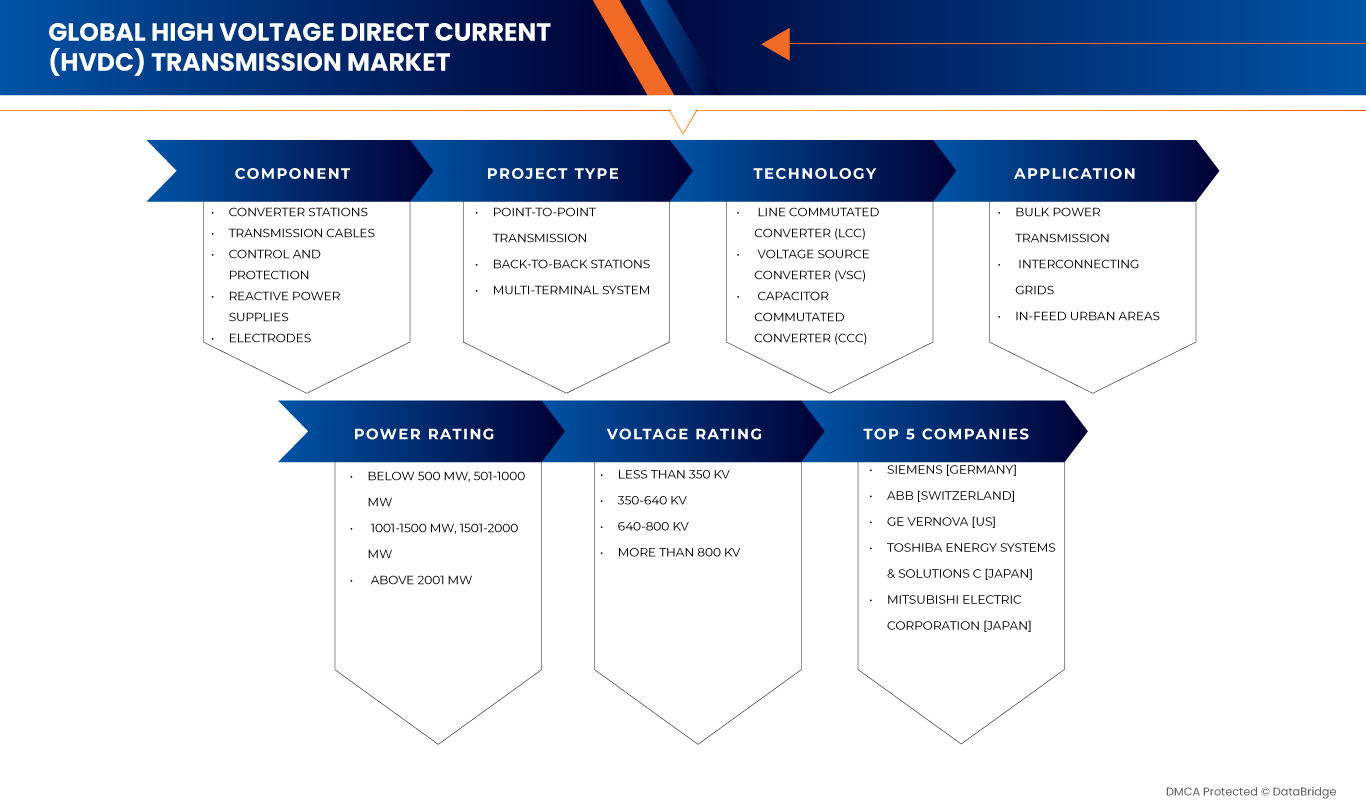

Mercado global de transmisión de corriente continua de alto voltaje (HVDC) por componente (estaciones convertidoras, cables de transmisión, control y protección, fuentes de alimentación reactiva, electrodos), tipo de proyecto (transmisión punto a punto, estaciones adosadas y sistema multiterminal), tecnología (convertidor de línea conmutada, convertidor de fuente de voltaje y convertidor de condensador conmutado), aplicación (transmisión de energía a granel, interconexión de redes y áreas urbanas de alimentación), potencia nominal (1001-1500 MW, 1501-2000 MW, más de 2001 MW, 501-1000 MW y menos de 500 MW), tensión nominal (350-640 kV, 640-800 kV, menos de 350 kV y más de 800 kV): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de transmisión de corriente continua de alto voltaje (HVDC)

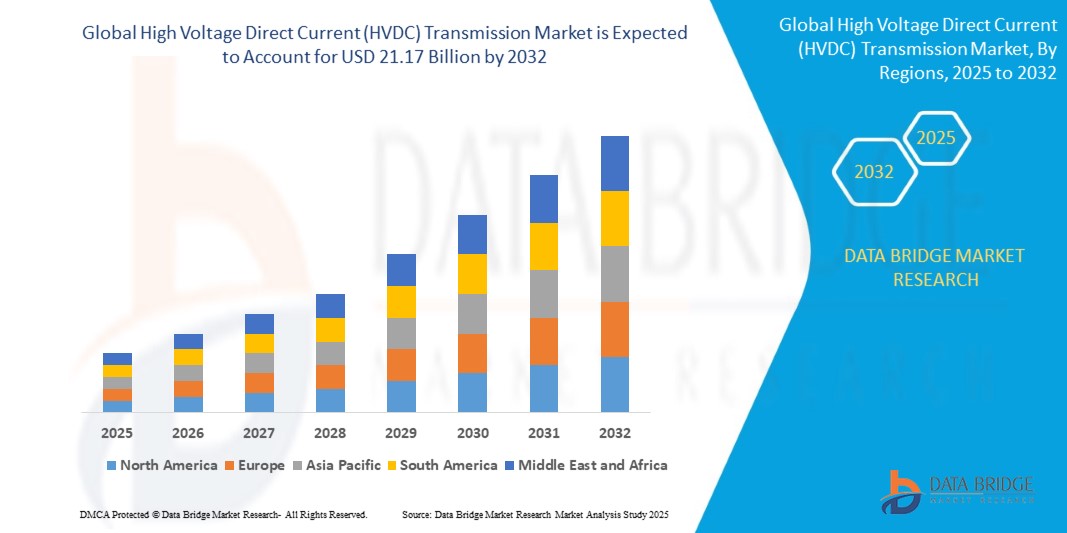

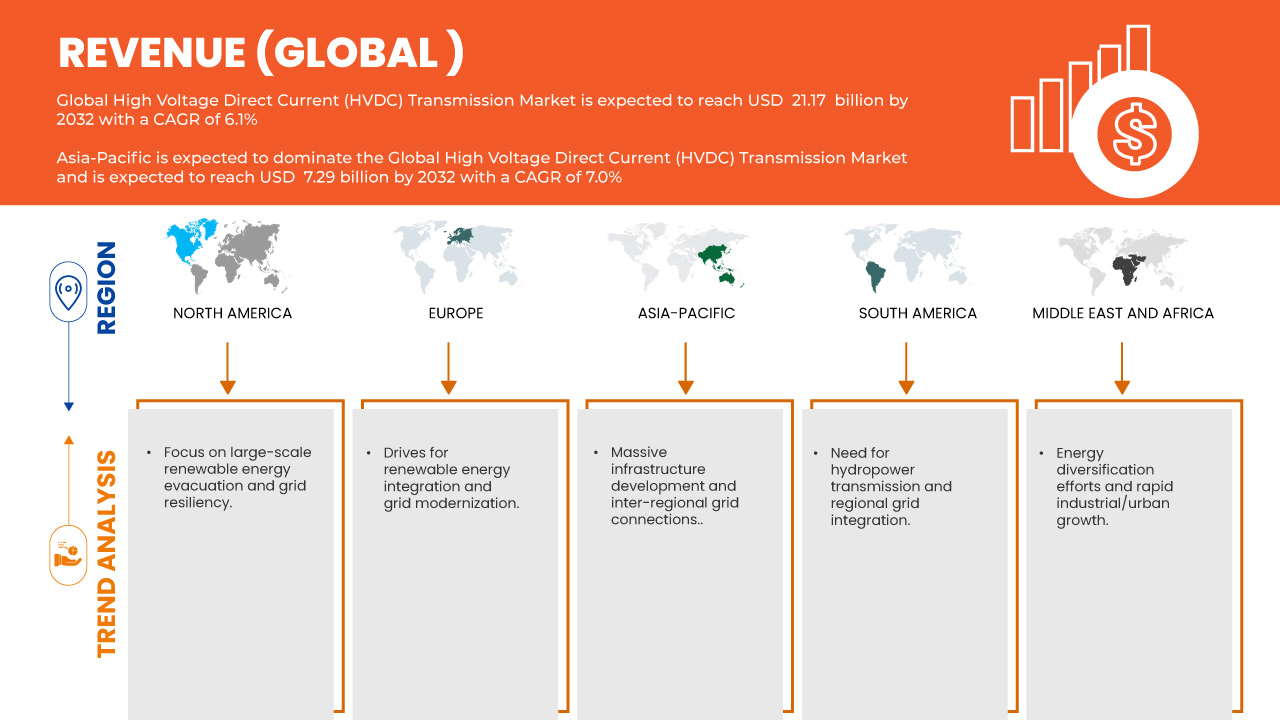

- El tamaño del mercado global de transmisión de corriente continua de alto voltaje (HVDC) se valoró en USD 13,28 mil millones en 2024 y se espera que alcance los USD 21,17 mil millones para 2032 , con una CAGR del 6,1% durante el período de pronóstico.

- Este crecimiento se debe a la rápida adopción de sistemas eficientes de transmisión de energía a larga distancia, la creciente integración de fuentes de energía renovables y la necesidad global de mejorar la estabilidad e interconectividad de la red eléctrica nacional y regional. El auge de los proyectos de modernización y expansión de la red impulsa aún más la expansión del mercado.

- Los avances en las tecnologías HVDC, incluido el cambio a convertidores de fuente de voltaje (VSC) para un control y una flexibilidad superiores, junto con iniciativas gubernamentales que promueven la energía limpia e inversiones en interconexiones transfronterizas, están impulsando el crecimiento del mercado, particularmente en regiones con un sólido desarrollo de energía renovable y grandes áreas geográficas que requieren una transferencia de energía a granel.

Análisis del mercado de transmisión de corriente continua de alto voltaje (HVDC)

- Los componentes HVDC son sistemas críticos que permiten la transmisión eficiente y estable de energía a gran escala a largas distancias, especialmente para la integración de energías renovables y la interconexión de redes. Estos componentes, incluyendo estaciones convertidoras (con convertidores, transformadores y filtros), cables de transmisión (aéreos, subterráneos y submarinos) y sistemas de control y protección, son esenciales para aplicaciones como la transferencia de energía a gran escala, la interconexión de redes y la alimentación de energía urbana.

- El mercado se ve impulsado por el aumento global de la demanda de electricidad, lo que impulsa la necesidad de una transmisión más eficiente. El mercado global de transmisión HVDC se valoró en 13.280 millones de dólares en 2022 y se proyecta que alcance los 21.170 millones de dólares para 2032, con una tasa de crecimiento anual compuesta (TCAC) del 6,1 % entre 2023 y 2032. La creciente integración de fuentes de energía renovables, especialmente las provenientes de ubicaciones remotas y parques eólicos marinos, impulsa aún más la demanda de HVDC.

- La adopción de tecnologías avanzadas como los Convertidores de Fuente de Voltaje (VSC) mejora el rendimiento de HVDC, ofreciendo un control superior, flexibilidad y compatibilidad con fuentes de energía renovables. La tecnología VSC obtuvo la mayor cuota de mercado en ingresos, con más del 32,26 % en estaciones convertidoras de HVDC, en 2024. El creciente enfoque en la modernización de la red y la interconectividad transfronteriza es un importante motor de crecimiento.

- Asia-Pacífico lideró el mercado global de transmisión HVDC con una cuota de mercado superior al 32,26 % en 2024 (específicamente para estaciones convertidoras HVDC), impulsada por un sólido crecimiento económico, una rápida industrialización, una creciente urbanización y una importante inversión pública en la modernización de la red y la integración de energías renovables en países como China, India y Corea del Sur. China domina gracias a sus enormes inversiones en infraestructura de UHVDC (corriente continua de ultra alta tensión).

- Se anticipa que Asia-Pacífico será testigo de un crecimiento significativo durante el período de pronóstico (la CAGR no se indica específicamente para 2025-2032, pero se proyecta una CAGR general del mercado HVDC para 2025-2032 de alrededor del 6,1%), impulsada por la necesidad de modernizar la infraestructura energética obsoleta, aumentar la integración de las energías renovables (especialmente la eólica marina) e inversiones en I+D en resiliencia de la red.

- Entre los componentes, el segmento de estaciones convertidoras suele ser el que mayor cuota de mercado tiene en proyectos de HVDC, debido a su papel crucial en la conversión de CA a CC y viceversa, así como a su complejidad y elevado coste. Otros componentes clave incluyen cables de transmisión y sistemas de control y protección.

Alcance del informe y segmentación del mercado de transmisión de corriente continua de alto voltaje (HVDC)

|

Atributos |

Perspectivas clave del mercado de transmisión de corriente continua de alto voltaje (HVDC) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de transmisión de corriente continua de alto voltaje (HVDC)

Avances en la integración de energías renovables, la modernización de la red y la digitalización

- Adopción generalizada de la tecnología de convertidor de fuente de voltaje (VSC): más del 60 % de los nuevos proyectos HVDC en 2023 y 2024 utilizaron tecnología VSC por su mejor control, flexibilidad y compatibilidad con fuentes de energía renovables, lo que respalda una integración eficiente de la red.

- Integración de la digitalización y la IoT: la adopción de la IoT y las tecnologías digitales en los sistemas HVDC creció un 25 % en 2024, lo que permite el monitoreo en tiempo real, el mantenimiento predictivo y la detección avanzada de fallas para mejorar la confiabilidad de la red.

- Miniaturización de componentes HVDC: los avances en tecnologías de conversión, como los convertidores multinivel modulares (MMC), han llevado a un aumento del 20% en los sistemas HVDC compactos, ideales para aplicaciones con limitaciones de espacio como los parques eólicos marinos.

- Aumento de los sistemas HVDC multiterminal: la implementación de sistemas HVDC multiterminal aumentó un 15 % en 2024, mejorando la flexibilidad del sistema y apoyando el comercio de energía transfronterizo y la integración de energías renovables.

- Enfoque en diseños HVDC energéticamente eficientes: más del 30 % de los nuevos sistemas HVDC en 2024 priorizaron la transmisión de baja pérdida, alineándose con los objetivos globales de sostenibilidad y reduciendo la huella de carbono en el suministro de energía.

- Crecimiento de los canales de adquisición en línea: las ventas en línea de componentes HVDC crecieron un 10 % anualmente, impulsadas por plataformas de comercio electrónico dirigidas a empresas de servicios públicos y desarrolladores de infraestructura.

Dinámica del mercado de transmisión de corriente continua de alto voltaje (HVDC)

Conductor

Crecimiento de las energías renovables, interconexión de redes y demandas de eficiencia energética

- Expansión global de la energía renovable: con una capacidad de energía renovable que superará los 3.700 GW a nivel mundial en 2023, los sistemas HVDC son fundamentales para integrar la energía eólica y solar, lo que impulsa la demanda de transmisión de larga distancia y con bajas pérdidas.

- Proliferación de proyectos eólicos marinos: la capacidad eólica marina mundial alcanzó los 64 GW en 2023, lo que impulsó la demanda de sistemas HVDC para conectar parques eólicos remotos a las redes continentales y mejorar la seguridad energética.

- Aumento de las interconexiones transfronterizas a la red: las inversiones en proyectos HVDC transfronterizos, como la interconexión entre Arabia Saudita y Egipto (3.000 MW), están impulsando la demanda de un intercambio eficiente de energía y resiliencia de la red.

- Auge de las redes inteligentes y la urbanización: las inversiones globales en redes inteligentes alcanzaron los USD 105 mil millones en 2023, y los sistemas HVDC permitieron una distribución eficiente de la energía en regiones que se urbanizan rápidamente, como Asia-Pacífico.

- Creciente demanda de electricidad: la demanda mundial de electricidad aumentó un 2,4 % en 2022, lo que impulsó la necesidad de que los sistemas HVDC transmitan grandes volúmenes de energía con pérdidas mínimas a largas distancias.

- Políticas e incentivos gubernamentales: Iniciativas como el objetivo de la UE de utilizar un 40% de energía renovable para 2030 y la inversión de 1 billón de dólares de China en líneas de transmisión para 2030 están acelerando la adopción de HVDC a través de financiación y apoyo regulatorio.

Restricción/Desafío

“ Altos costos, complejidad técnica y problemas de estandarización ”

- Altos costos de inversión inicial: El alto costo de las estaciones convertidoras HVDC, con distancias de equilibrio de 37 millas para líneas submarinas y 124 millas para líneas aéreas, limita su adopción en regiones sensibles a los costos.

- Riesgos de ciberseguridad en sistemas digitalizados: el uso creciente de IoT en sistemas HVDC ha incrementado las preocupaciones sobre ciberseguridad, y el mercado de ciberseguridad para infraestructura energética crece a una CAGR del 15,2 % para abordar las amenazas.

- Complejidades técnicas en la integración de sistemas: la integración de HVDC con redes de CA existentes requiere experiencia especializada, lo que aumenta los costos de desarrollo y los plazos de los proyectos para las empresas de servicios públicos.

- Requisitos regulatorios estrictos: el cumplimiento de estándares como IEC y códigos de red regionales aumenta los costos y la complejidad para los fabricantes de HVDC, en particular para proyectos transfronterizos.

- Desafíos de interoperabilidad: La falta de estandarización entre las tecnologías VSC y Convertidor de Línea Conmutada (LCC) dificulta una integración perfecta, lo que requiere adaptaciones costosas para entornos de redes mixtas.

- Obsolescencia tecnológica rápida: la necesidad de innovación continua para cumplir con los estándares cambiantes de la red y de las energías renovables presiona a los fabricantes a realizar fuertes inversiones en I+D, lo que afecta la rentabilidad de los actores más pequeños.

Alcance del mercado de transmisión de corriente continua de alto voltaje (HVDC)

- El mercado global de transmisión HVDC está segmentado por componente, tipo de proyecto, tecnología, aplicación, clasificación de potencia y clasificación de voltaje.

- Por componente

El mercado se segmenta en estaciones convertidoras, cables de transmisión, control y protección, fuentes de alimentación reactiva y electrodos. Las estaciones convertidoras representaron la mayor cuota de ingresos, con un 49,07 %, en 2024, gracias a su papel esencial en la conversión CA-CC. Se prevé que el segmento de cables de transmisión crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 6,0 %, entre 2025 y 2032, impulsado por la demanda de cables submarinos y subterráneos para proyectos eólicos marinos y transfronterizos.

- Por tipo de proyecto

El mercado está segmentado en transmisión punto a punto, estaciones adosadas y sistemas multiterminal. La transmisión punto a punto dominó el mercado con una participación del 44,94 % en 2024, impulsada por las necesidades de transferencia de energía a granel a larga distancia. Se prevé que los sistemas de transmisión punto a punto crezcan a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 6,4 %, entre 2025 y 2032, impulsada por el aumento de las interconexiones a la red.

- Por tecnología

El mercado se segmenta en convertidores de línea conmutada (LCC), convertidores de fuente de voltaje (VSC) y convertidores de condensador conmutado (CCC). El segmento de convertidores de línea conmutada (LCC) lideró el mercado con una participación del 50,61 % en 2024, gracias a su control superior y compatibilidad con energías renovables. Se prevé que el segmento de convertidores de fuente de voltaje crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 5,9 %, entre 2025 y 2032.

- Por aplicación

El mercado se segmenta en transmisión de energía a granel, interconexión de redes y zonas urbanas de alimentación. La transmisión de energía a granel representó la mayor participación, con un 59,49 %, en 2024, impulsada por la necesidad de un suministro eficiente de energía a larga distancia. Se prevé que la interconexión de redes crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 5,9 %, entre 2025 y 2032, impulsada por el comercio transfronterizo de energía y las iniciativas de resiliencia de la red.

- Por potencia nominal

El mercado está segmentado en menos de 1001-1500 MW, 1501-2000 MW, más de 2001 MW.

501-1000 MW, Menos de 500 MW. El segmento de entre 1001 y 1500 MW representó la mayor participación, con un 34,47%, en 2024, impulsado por proyectos de energías renovables a gran escala y de UHVDC. Se espera que el segmento de más de 2001 MW crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 6,7%, entre 2025 y 2032, debido a proyectos de modernización de la red de tamaño mediano.

- Por clasificación de voltaje

El mercado está segmentado en menos de 350-640 kV, 640-800 kV, menos de 350 kV y más de 800 kV. El segmento de más de 350-640 kV dominó con una participación del 42,36 % en 2024, impulsado por proyectos de UHVDC en Asia-Pacífico. Se espera que el segmento de 350-640 kV crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 6,5 %, entre 2025 y 2032, gracias a la energía eólica marina y las interconexiones regionales .

Análisis regional del mercado de transmisión de corriente continua de alto voltaje (HVDC)

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en América del Norte

Se proyecta que América del Norte crecerá a una tasa de crecimiento anual compuesta (TCAC) del 5,9 % entre 2025 y 2032, impulsada por proyectos eólicos marinos y la modernización de la red eléctrica. Estados Unidos representó el 75,87 % del mercado regional en 2024, gracias a la financiación de 10 millones de dólares del Departamento de Energía (DOE) para la innovación en HVDC y proyectos como Sunrise Wind.

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en EE. UU.

Estados Unidos lidera el mercado norteamericano, impulsado por su enfoque en la energía eólica marina (por ejemplo, Sunrise Wind) y las actualizaciones de la red para apoyar la integración de energía renovable y mejorar la confiabilidad de la red.

Perspectiva del mercado europeo de transmisión de corriente continua de alto voltaje (HVDC)

Europa obtuvo una cuota de ingresos significativa del 22,74% en 2024, impulsada por interconectores transfronterizos y proyectos de energías renovables. Entre los principales contribuyentes se encuentran Alemania, el Reino Unido y Noruega, con iniciativas como NordLink que impulsan la adopción de HVDC.

Perspectivas del mercado de transmisión de corriente continua de alto voltaje (HVDC) en el Reino Unido

El Reino Unido está experimentando un crecimiento constante, impulsado por su capacidad eólica marina (12,7 GW en 2023) y por interconectores HVDC como el North Sea Link, que mejoran el comercio de energía y la estabilidad de la red.

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en Alemania

El mercado alemán está creciendo a una CAGR notable, impulsado por su liderazgo en la integración de energías renovables, en particular la energía eólica marina en los mares del Norte y Báltico, respaldada por empresas como Siemens Energy.

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en Asia-Pacífico

Asia-Pacífico dominó el mercado global de HVDC con una participación en los ingresos del 32,26 % en 2024, impulsada por la rápida urbanización, la industrialización y las importantes inversiones en infraestructura eléctrica en China, India y Corea del Sur.

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en Japón

El mercado de Japón se está expandiendo a una CAGR constante, impulsado por su énfasis en la energía renovable y las tecnologías HVDC avanzadas, con empresas como Toshiba impulsando la innovación.

Perspectiva del mercado de transmisión de corriente continua de alto voltaje (HVDC) en China

China tuvo la mayor participación en los ingresos, con un 26,96 %, dentro de Asia-Pacífico en 2024, impulsada por su liderazgo en proyectos de UHVDC, la integración masiva de energías renovables y las inversiones en infraestructura respaldadas por el gobierno.

Cuota de mercado de transmisión de corriente continua de alto voltaje (HVDC)

- La industria de transmisión de corriente continua de alto voltaje (HVDC) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Siemens [Alemania]

- ABB [Suiza]

- GE Vernova [EE. UU.]

- Toshiba Energy Systems & Solutions C [Japón]

- Mitsubishi Electric Corporation [Japón]

- Emerson Electric Co. [EE. UU.]

- Schneider Electric [Francia]

- Nexans [Francia]

- NKT A/S [Dinamarca]

- Hitachi, Ltd. [Japón]

- Sumitomo Electric Industries, Ltd. [Japón]

- Prysmian SpA [Italia]

- Superconductor americano [EE. UU.]

- LS ELECTRIC Co., Ltd. [Corea del Sur]

- Stantec [Canadá]

- Infineon Technologies AG [Alemania]

- ATCO Ltd [Canadá]

- ESCO Technologies Inc. [EE. UU.]

- Laboratorios de Ingeniería Schweitzer [EE. UU.]

- Delta Electronics, Inc. [Taiwán]

Últimos avances en el mercado global de transmisión de corriente continua de alto voltaje (HVDC)

- En junio de 2025, ABB implementó su interruptor automático de media tensión VD4-AF1 en la acería de Duferco Travi e Profilati en Italia para garantizar la continuidad del negocio. Este interruptor, diseñado específicamente para operaciones en hornos de arco, soporta más de 150.000 operaciones sin mantenimiento y proporciona diagnósticos avanzados para reducir la tensión del transformador, mejorando así la fiabilidad operativa y minimizando el tiempo de inactividad. ABB consolida su posición en aplicaciones de la industria pesada, mientras que su avanzada tecnología de red contribuye a una mayor eficiencia y estabilidad en el mercado global de transmisión HVDC.

- En junio de 2025, ABB enfatizó la importancia de las alianzas estratégicas para acelerar la transición a celdas sin SF₆, lo que marca un cambio importante en la infraestructura de media tensión ante la creciente presión de la red y las exigencias regulatorias. Al desarrollar conjuntamente soluciones adaptables y confiables con las compañías eléctricas, ABB fomenta la colaboración a largo plazo y la confianza en la tecnología sostenible. ABB se beneficia al posicionarse como un socio de innovación de confianza, mientras que el enfoque colaborativo impulsa la modernización del mercado global de transmisión HVDC mediante soluciones de red escalables y de bajas emisiones.

- En enero de 2025, ABB avanzó en la automatización de subestaciones con la introducción de su sistema virtualizado de protección y control centralizado (VPC), SSC600 SW, que integra múltiples funciones de relé en una única plataforma digital. Esta innovación mejora la resiliencia de la red, reduce los costes del ciclo de vida hasta en un 15 % y mejora la escalabilidad para las compañías eléctricas que se adaptan a la integración de energías renovables y a la creciente complejidad de la red. ABB se beneficia al liderar la evolución de las subestaciones digitales, mientras que la solución respalda el mercado global de transmisión HVDC con un control de red mejorado, flexibilidad y capacidades de protección en tiempo real.

- En agosto de 2024, GE Vernova Grid Solutions lanzó la cartera GRiDEA en la conferencia CIGRE de París, donde presentó equipos de conmutación de alta tensión sin SF₆ y tecnologías de red sostenibles para impulsar la descarbonización. Esta cartera busca reducir las emisiones, minimizar el uso de materias primas y prolongar la vida útil de los equipos mediante un diseño y una monitorización avanzados. GE Vernova se beneficia al consolidar su liderazgo en electrificación sostenible, a la vez que contribuye significativamente al mercado global de transmisión HVDC con soluciones de transmisión ecológicas y preparadas para el futuro.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL

4.1.2 ECONOMIC

4.1.3 SOCIAL

4.1.4 TECHNOLOGICAL

4.1.5 ENVIRONMENTAL

4.1.6 LEGAL

4.2 PORTERS FIVE FORCES

4.2.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.2.2 BARGAINING POWER OF BUYERS / CONSUMERS – HIGH

4.2.3 THREAT OF NEW ENTRANTS – LOW

4.2.4 THREAT OF SUBSTITUTE PRODUCTS – LOW TO MODERATE

4.2.5 BARGAINING POWER OF SUPPLIERS – MODERATE

4.3 PATENT ANALYSIS

4.3.1 PATENT QUALITY AND STRENGTH

4.3.2 PATENT FAMILIES

4.3.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.3.4 LICENSING AND COLLABORATIONS

4.3.5 COMPANY PATENT LANDSCAPE

4.3.6 REGION PATENT LANDSCAPE

4.3.7 IP STRATEGY AND MANAGEMENT

4.3.8 PATENT ANALYSIS

4.4 VALUE CHAIN

4.4.1 COMPONENT MANUFACTURING:

4.4.2 SYSTEM INTEGRATION:

4.4.3 TRANSMISSION INFRASTRUCTURE DEVELOPMENT:

4.4.4 END-USERS:

4.5 SUPPLY CHAIN ANALYSIS

4.6 PENETRATION & GROWTH PROSPECT MAPPING FOR HVDC MARKET

4.7 OVERVIEW OF TECHNOLOGICAL INNOVATIONS IN THE GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET

4.8 TARIFFS & IMPACT ON THE MARKET

4.8.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.8.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.8.3 VENDOR SELECTION CRITERIA DYNAMICS

4.8.4 IMPACT ON SUPPLY CHAIN

4.8.5 RAW MATERIAL PROCUREMENT

4.8.6 MANUFACTURING AND PRODUCTION

4.8.7 LOGISTICS AND DISTRIBUTION

4.8.8 PRICE PITCHING AND POSITION OF MARKET

4.8.9 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.8.10 SUPPLY CHAIN OPTIMIZATION

4.8.11 JOINT VENTURE ESTABLISHMENTS

4.8.12 IMPACT ON PRICES

4.8.13 REGULATORY INCLINATION

4.8.14 GEOPOLITICAL SITUATION

4.8.15 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.8.16 FREE TRADE AGREEMENTS

4.8.17 ALLIANCES ESTABLISHEMENTS

4.8.18 STATUS ACCREDITION (INCLUDING MFTN)

4.8.19 DOMESTIC COURSE OF CORRECTION

4.8.20 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.8.21 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

4.9 IMPACT ON PRICES

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED TO TRANSMIT RENEWABLE ENERGY OVER LONG DISTANCES

6.1.2 GROWING INVESTMENTS IN GRID MODERNIZATION AND CROSS-BORDER

6.1.3 IMPROVED TECHNOLOGICAL CAPABILITIES IN HVDC SYSTEMS

6.1.4 STRONG POLICY PUSH FOR DECARBONIZATION AND ENERGY EFFICIENCY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL CAPITAL INVESTMENT

6.2.2 COMPLEX AND LENGTHY REGULATORY APPROVALS

6.3 OPPORTUNITIES

6.3.1 GOVERNMENTS WORLDWIDE ARE BOOSTING HVDC INVESTMENT TO ACHIEVE ENERGY TRANSITION AND ENHANCE GRID RELIABILITY

6.3.2 EMERGING APPLICATIONS IN HIGH-SPEED RAIL AND ELECTRIC VEHICLE CHARGING INFRASTRUCTURE.

6.3.3 ADVANCEMENTS IN CABLE TECHNOLOGY, CONVERTERS AND DIGITAL CONTROLS EXPAND USE CASES.

6.4 CHALLENGES

6.4.1 HVDC FACES TECHNICAL HURDLES IN AC GRID CONNECTIONS, MULTI-TERMINAL DC MANAGEMENT/FAULTS, AND ADVANCED MODELING.

6.4.2 HVDC FACES FINANCIAL HURDLES: HIGH UPFRONT COSTS AND SLOW RETURNS REQUIRE GOVERNMENT AND INVESTOR SUPPORT.

7 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 CONVERTER STATIONS

7.3 TRANSMISSION CABLES

7.4 CONTROL AND PROTECTION

7.5 REACTIVE POWER SUPPLIES

7.6 ELECTRODES

7.7 OTHERS

8 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE

8.1 OVERVIEW

8.2 POINT-TO-POINT TRANSMISSION

8.3 BACK-TO-BACK STATIONS

8.4 MULTI-TERMINAL SYSTEM

9 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 LINE COMMUTATED CONVERTER

9.3 VOLTAGE SOURCE CONVERTER

9.4 CAPACITOR COMMUTATED CONVERTER

10 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BULK POWER TRANSMISSION

10.2.1 CONVERTER STATIONS

10.2.2 TRANSMISSION CABLES

10.2.3 CONTROL AND PROTECTION

10.2.4 REACTIVE POWER SUPPLIES

10.2.5 ELECTRODES

10.2.6 OTHERS

10.3 INTERCONNECTING GRIDS

10.3.1 CONVERTER STATIONS

10.3.2 TRANSMISSION CABLES

10.3.3 CONTROL AND PROTECTION

10.3.4 REACTIVE POWER SUPPLIES

10.3.5 ELECTRODES

10.3.6 OTHERS

10.4 IN-FEED URBAN AREAS

10.4.1 CONVERTER STATIONS

10.4.2 TRANSMISSION CABLES

10.4.3 CONTROL AND PROTECTION

10.4.4 REACTIVE POWER SUPPLIES

10.4.5 ELECTRODES

10.4.6 OTHERS

11 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING

11.1 OVERVIEW

11.2 1001-1500 MW

11.3 1501-2000 MW

11.4 ABOVE 2001 MW

11.5 501-1000 MW

11.6 BELOW 500 MW

12 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING

12.1 OVERVIEW

12.2 350-640 KV

12.3 640-800 KV

12.4 LESS THAN 350 KV

12.5 MORE THAN 800 KV

13 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA-PACIFIC

13.2.1 CHINA

13.2.2 INDIA

13.2.3 SOUTH KOREA

13.2.4 JAPAN

13.2.5 SINGAPORE

13.2.6 AUSTRALIA

13.2.7 MALAYSIA

13.2.8 THAILAND

13.2.9 INDONESIA

13.2.10 PHILIPPINES

13.2.11 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 UNITED KINGDOM

13.4.3 FRANCE

13.4.4 ITALY

13.4.5 SPAIN

13.4.6 NETHERLANDS

13.4.7 BELGIUM

13.4.8 SWITZERLAND

13.4.9 TURKEY

13.4.10 RUSSIA

13.4.11 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 U.A.E

13.6.3 SOUTH ARABIA

13.6.4 EGYPT

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NA

14.3 COMPANY SHARE ANALYSIS: APAC

14.4 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ABB

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS/NEWS

16.2 SIEMENS

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS/NEWS

16.3 GE VERNOVA

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS/NEWS

16.4 PRYSMIAN GROUP

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 HITACHI, LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS/NEWS

16.6 AMERICAN SUPERCONDUCTOR

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ATCO LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 DELTA ELECTRONICS, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT/NEWS

16.9 EMERSON ELECTRIC CO.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS/NEWS

16.1 ESCO TECHNOLOGIES INC. (DOBLE ENGINEERING COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 INFINEON TECHNOLOGIES AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT/NEWS

16.12 LS ELECTRIC CO, LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MITSUBISHI ELECTRIC CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS/NEWS

16.14 NEXANS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS/NEWS

16.15 NKT A S

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS/NEWS

16.16 SCHNEIDER ELECTRIC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS/NEWS

16.17 SCHWEITZER ENGINEERING LABORATORIES, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS/NEWS

16.18 STANTEC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 SERVICES PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 SUMITOMO ELECTRIC INDUSTRIES, LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS/NEWS

16.2 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 HVDC TRANSMISSION IMPORT TARIFF RATES IN TOP 5 MARKETS (2024)

TABLE 3 LOCAL PRODUCTION V/S IMPORT RELIANCE

TABLE 4 REGULATORY INCLINATION

TABLE 5 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

TABLE 6 ALLIANCES ESTABLISHEMENTS

TABLE 7 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES (SEZS) AND INDUSTRIAL PARKS

TABLE 8 REGULATORY COVERAGE

TABLE 9 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL CONVERTER STATIONS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL TRANSMISSION CABLES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL CONTROL AND PROTECTION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL REACTIVE POWER SUPPLIES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL ELECTRODES IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL POINT-TO-POINT TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL BACK-TO-BACK STATIONS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL MULTI-TERMINAL SYSTEM IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL LINE COMMUTATED CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL VOLTAGE SOURCE CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL CAPACITOR COMMUTATED CONVERTER IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL 1001-1500 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL 1501-2000 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL ABOVE 2001 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL 501-1000 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL BELOW 500 MW IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL 350-640 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL 640-800 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL LESS THAN 350 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL MORE THAN 800 KV IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 43 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 56 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CHINA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 62 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 63 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 65 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 INDIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH KOREA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH KOREA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH KOREA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH KOREA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 80 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 81 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 83 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 JAPAN BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 89 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 90 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 92 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 SINGAPORE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SINGAPORE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SINGAPORE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 97 SINGAPORE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 98 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 99 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 101 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 AUSTRALIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 AUSTRALIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 AUSTRALIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 106 AUSTRALIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 107 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 108 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 110 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 MALAYSIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MALAYSIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MALAYSIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 115 MALAYSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 THAILAND INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 125 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 126 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 128 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 INDONESIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 INDONESIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDONESIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 133 INDONESIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 134 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 135 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 137 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 PHILIPPINES BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 PHILIPPINES INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 PHILIPPINES IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 142 PHILIPPINES HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 143 REST OF ASIA-PACIFIC HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 144 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 146 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 148 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 NORTH AMERICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 153 NORTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 172 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 173 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 181 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 182 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 183 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 EUROPE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 EUROPE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 EUROPE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 190 EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 191 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 192 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 194 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 GERMANY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 GERMANY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 GERMANY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 199 GERMANY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 200 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 201 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 203 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 UNITED KINGDOM BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 UNITED KINGDOM INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 UNITED KINGDOM IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 208 UNITED KINGDOM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 209 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 210 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 212 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 FRANCE BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 FRANCE INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 FRANCE IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 217 FRANCE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 218 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 219 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 221 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 ITALY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 ITALY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 ITALY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 226 ITALY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 227 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 228 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 SPAIN BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SPAIN INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SPAIN IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 235 SPAIN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 236 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 237 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 239 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 NETHERLANDS BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NETHERLANDS INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NETHERLANDS IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 244 NETHERLANDS HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 245 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 246 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 248 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 249 BELGIUM BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 BELGIUM INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 BELGIUM IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 253 BELGIUM HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 254 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 SWITZERLAND BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SWITZERLAND INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SWITZERLAND IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 262 SWITZERLAND HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 264 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 266 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 TURKEY BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 TURKEY INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 TURKEY IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 271 TURKEY HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 280 RUSSIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 281 REST OF EUROPE HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 282 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 283 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 284 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 286 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 287 SOUTH AMERICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SOUTH AMERICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SOUTH AMERICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 291 SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 292 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 293 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 295 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 296 BRAZIL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 BRAZIL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 BRAZIL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 300 BRAZIL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 301 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 302 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 304 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 305 ARGENTINA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ARGENTINA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ARGENTINA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 309 ARGENTINA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 310 REST OF SOUTH AMERICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 311 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 312 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 313 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 315 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 316 MIDDLE EAST AND AFRICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 MIDDLE EAST AND AFRICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 MIDDLE EAST AND AFRICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 320 MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 321 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 322 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 324 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 325 SOUTH AFRICA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SOUTH AFRICA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SOUTH AFRICA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 329 SOUTH AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 330 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 331 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 333 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 334 U.A.E BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 U.A.E INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 U.A.E IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 338 U.A.E HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 339 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 340 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 342 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 343 SOUTH ARABIA BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SOUTH ARABIA INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SOUTH ARABIA IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 347 SOUTH ARABIA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 348 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 349 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 351 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 352 EGYPT BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 EGYPT INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 EGYPT IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 356 EGYPT HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 357 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 358 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY PROJECT TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 360 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 361 ISRAEL BULK POWER TRANSMISSION IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 ISRAEL INTERCONNECTING GRIDS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 ISRAEL IN-FEED URBAN AREAS IN HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY POWER RATING, 2018-2032 (USD THOUSAND)

TABLE 365 ISRAEL HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 366 REST OF MIDDLE EAST AND AFRICA HIGH VOLTAGE DIRECT CURRENT (HVDC) TRANSMISSION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)