Global Industrial Lubricants Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

54.76 Billion

USD

78.17 Billion

2024

2032

USD

54.76 Billion

USD

78.17 Billion

2024

2032

| 2025 –2032 | |

| USD 54.76 Billion | |

| USD 78.17 Billion | |

|

|

|

|

Global Industrial Lubricants Market, By Grade (Group I, Group II, Group III, Group IV and Group V), Base Oil (Bio-based, Mineral Oil and Synthetic and Semi-synthetic), Product Type (Process Oils, Compressor Lubricants, Turbine Lubricants, Circulation and Transmission Oils, Hydraulic Fluids, Metalworking Fluids, Gear Oils, Greases, and Others), End Use Industry (Metalworking, Textiles, Energy, Chemical Manufacturing, Food Processing, Hydraulic, and Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa)- Industry Trends and Forecast to 2032

Industrial Lubricants Market Size

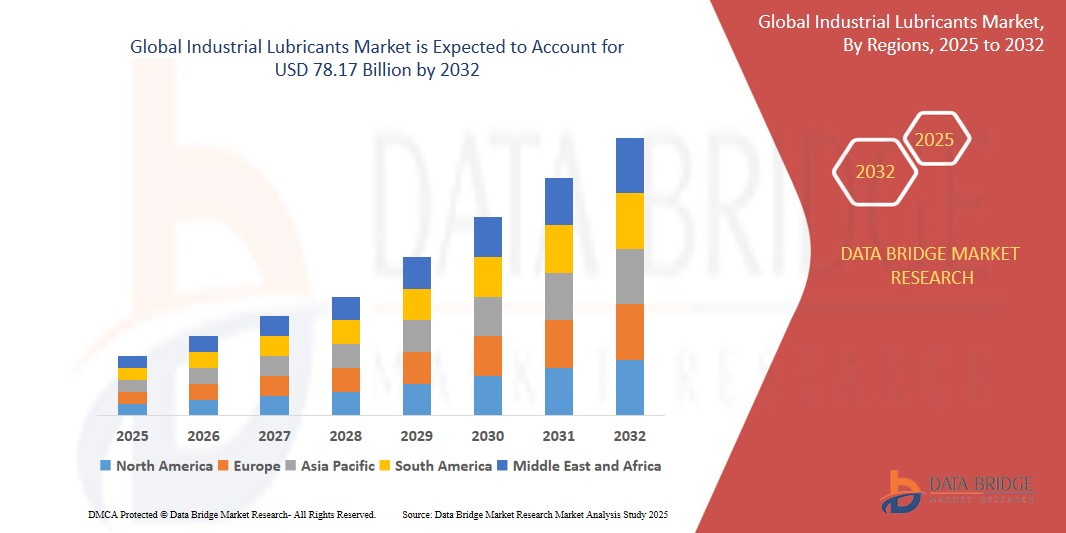

- The Global Industrial Lubricants Market was valued atUSD 54.76 Billion in 2024 and is expected to reachUSD 78.17 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.6%, primarily driven by technological advancements, increasing industrialization, demand for eco-friendly solutions, automation in manufacturing, energy efficiency needs, and rising awareness of equipment maintenance and longevity.

- The growth of the global Industrial Lubricants market is driven by technological innovations, industrial expansion, eco-friendly solutions, and maintenance demand.

Industrial Lubricants Market Analysis

- The Industrial Lubricants market is evolving due to innovations like AI integration, sensor-embedded lubricants, and real-time monitoring, improving efficiency, reducing maintenance costs, and enhancing machinery performance.

- Increasing awareness about environmental sustainability drives demand for biodegradable, renewable, and eco-friendly lubricants, influencing industries to adopt lubricants that minimize ecological footprints and comply with regulatory standards.

- With growing industries such as automotive, construction, and power generation, industrial lubricants are essential for ensuring smooth operations, reducing wear, and extending the life of machinery in diverse applications.

Report Scope and Industrial Lubricants Market Segmentation

|

Attributes |

Industrial Lubricants Key Market Insights |

|

Segments Covered |

•By Grade:Group I, Group II, Group III, Group IV and Group V •By Base Oil:Bio-based, Mineral Oil and Synthetic and Semi-synthetic •By Product Type:• Process Oils, Compressor Lubricants, Turbine Lubricants, Circulation and Transmission Oil, Hydraulic Fluids, Metalworking Fluids, Gear Oil, Greases, and Others •By End Use Industry:Metalworking, Textiles, Energy, Chemical Manufacturing, Food Processing, Hydraulic, and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Lubricants Market Trends

“Shift towards bio-based lubricants for sustainability and performance”

- Growing environmental concerns and stringent regulations are pushing manufacturers to adopt bio-based lubricants, which offer reduced toxicity, biodegradability, and competitive performance compared to traditional mineral-based oils.

- Industrial sectors are increasingly integrating IoT-enabled sensors with lubrication systems to monitor equipment health in real-time, reduce downtime, and optimize lubricant usage through predictive maintenance strategies.

- For instance, a notable instance of the industry's shift towards bio-based lubricants is ExxonMobil's launch of the Mobil SHC™ Elite Series. These synthetic lubricants are engineered to deliver exceptional performance in high-temperature industrial applications, offering up to 12 times the oil life of mineral oils and double that of previous synthetic oils. They also provide up to a 3.6% improvement in energy efficiency, contributing to both sustainability and operational cost savings..

- Industries are shifting to synthetic lubricants due to their superior thermal stability, longer service life, and enhanced performance in extreme temperatures, supporting operational efficiency and reducing maintenance frequency.

Industrial Lubricants Market Dynamics

Driver

“Rising industrialization boosts demand for efficient, high-performance lubricants globally”

- Rapid growth in manufacturing industries across Asia and Africa increases the need for industrial lubricants to ensure machinery efficiency, minimize downtime, and extend equipment life under high-load operations.

- Massive infrastructure projects, including smart cities, transportation networks, and power plants, require reliable, high-performance lubricants to support construction equipment and continuous operations in harsh environments.

- As industries adopt automated and high-precision machinery, demand rises for lubricants that maintain performance under tight tolerances, high speeds, and extreme temperatures to avoid breakdowns and production losses.

- Companies globally are prioritizing cost-effective operations. High-performance lubricants reduce maintenance frequency, energy consumption, and wear-and-tear, aligning with industrial goals for sustainability and improved productivity across sectors.

Opportunity

“Growing industrialization creates demand for advanced, eco-friendly lubricant solutions worldwide.”

- Industries are increasingly adopting eco-friendly lubricants due to growing environmental awareness, stricter regulations, and the need to reduce carbon footprints, leading to heightened demand for sustainable, biodegradable, and recyclable lubricants.

- As industries become more reliant on high-performance machinery, the demand for advanced lubricants that enhance efficiency, extend equipment life, and reduce downtime is driving the growth of specialized, eco-friendly formulations.

- Rapid industrial growth in emerging markets, especially in manufacturing and energy sectors, requires high-quality lubricants for smooth operations. This expansion boosts the need for lubricants that are both efficient and environmentally safe.

- Governments worldwide are implementing stricter environmental regulations, compelling industries to shift towards eco-friendly lubricants. These innovations help companies comply with regulations while minimizing their environmental impact in sectors like automotive, manufacturing, and mining.

For instance,

- In May 2019 Shell India has launched the Rimula R5 LE 10W-40 and 10W-30 synthetic engine oils, formulated to meet India's BS-VI emission norms. These oils offer enhanced engine protection, excellent oxidation control, and are compatible with both existing and future BS-VI vehicles. Developed with superior CK-4 technology, they aim to reduce CO₂ emissions and contribute to a cleaner environment. Shell's initiative supports the government's air pollution control efforts and aligns with the transition to a low-emission economy.

Restraint/Challenge

“High cost of eco-friendly lubricants limits widespread industry adoption”

- Industries focused on minimizing operational costs find it challenging to adopt eco-friendly lubricants due to their higher price compared to conventional options, impacting their willingness to transition.

- Eco-friendly lubricants often require specialized raw materials and advanced production processes, which increases their manufacturing cost. This limited availability can restrict the mass adoption of these lubricants in industries worldwide.

- Small and medium-sized businesses, especially in developing regions, may struggle to afford the premium cost of eco-friendly lubricants, limiting their adoption despite growing environmental awareness and regulatory pressure to reduce emissions.

Industrial Lubricants Market Scope

The market is segmented on the basis grade, base oil, product type and end-use industry

|

Segmentation |

Sub-Segmentation |

|

By Grade |

|

|

By Base Oil |

|

|

By Product Type |

|

|

By End Use Industry

|

|

Industrial Lubricants Market Regional Analysis

“The Asia Pacific (APAC) is the Dominant Region in the Industrial Lubricants Market”

- Asia Pacific leads the global market, driven by industrialization, manufacturing growth, and key economies like China and India.

- China and India, as major industrial hubs, significantly contribute to the rising demand for lubricants.

- The region's booming manufacturing industries, particularly in automotive and heavy machinery, fuel lubricant consumption and growth.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific's accelerated industrialization and urbanization, particularly in China and India, drive robust demand for industrial lubricants across diverse sectors, including manufacturing, automotive, and energy production, fueling market growth.

- The region's rapidly expanding manufacturing and automotive industries, coupled with ongoing infrastructure development, significantly increase lubricant consumption, especially as industries focus on advanced technologies and high-performance machinery.

- Government initiatives, along with increased foreign and domestic investments in the region's industrial sectors, are expected to further stimulate demand for industrial lubricants, contributing to a projected high CAGR in the market.

Industrial Lubricants Market Share

The competitive landscape of the Industrial Lubricants market offers insights into key players and their market positioning. Key details include company overview, financial performance, revenue generation, market potential, and investment in research and development. Additionally, the analysis covers new market initiatives, global presence, production facilities, manufacturing capacities, and strategic expansions. Companies are evaluated based on their strengths, weaknesses, product innovation, and competitive advantages in nutraceuticals, pharmaceuticals, cosmetics, and functional foods.

The Major Market Leaders Operating in the Market Are:

- Shell (Netherlands)

- ExxonMobil (U.S.)

- BP (U.K.)

- Chevron (U.S.)

- TotalEnergies (France)

- FUCHS Petrolub SE (Germany)

- Valvoline (U.S.)

- Sinopec (China)

- Indian Oil Corporation (India)

- Idemitsu Kosan (Japan)

- Lukoil (Russia)

- Petrobras (Brazil)

- SK Lubricants (South Korea)

- Klüber Lubrication (Germany)

- Castrol (U.K.)

- HF Sinclair Corporation (U.S.)

- Quaker Chemical Corporation (U.S.)

- Blaser Swisslube, Inc. (Germany)

- PETRONAS Lubricants International (Malaysia)

Latest Developments in Global Industrial Lubricants Market

- In July 2024, Castrol India launched new lubricants under the brand name, Castrol EDGE. This new product line contributed to a 3.1% increase in the company's Q2 profit for 2024, driven by sustained demand in the automobile lubricants market. The launch reflects Castrol's commitment to innovation and meeting the evolving needs of the automotive sector.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.