Global Non Destructive Testing Inspection Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

10.30 Billion

USD

18.20 Billion

2024

2032

USD

10.30 Billion

USD

18.20 Billion

2024

2032

| 2025 –2032 | |

| USD 10.30 Billion | |

| USD 18.20 Billion | |

|

|

|

|

Global Non-Destructive Testing and Inspection Market Segmentation, By Technique (Ultrasonic Testing, Visual Inspection Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy-Current Testing, Radiographic Testing, Acoustic Emission Testing, Others), Method (Visual Inspection, Surface Inspection, Volumetric Inspection, Other Methods), Service (Inspection Services, Equipment Rental Services, Calibration Services, Training Services), Vertical (Manufacturing, Oil & Gas, Aerospace, Public Infrastructure, Automotive, Power Generation, Others), Distribution Channel (Direct Sales and Distributor Sales) - Industry Trends and Forecast to 2032

Non-Destructive Testing and Inspection Market Size

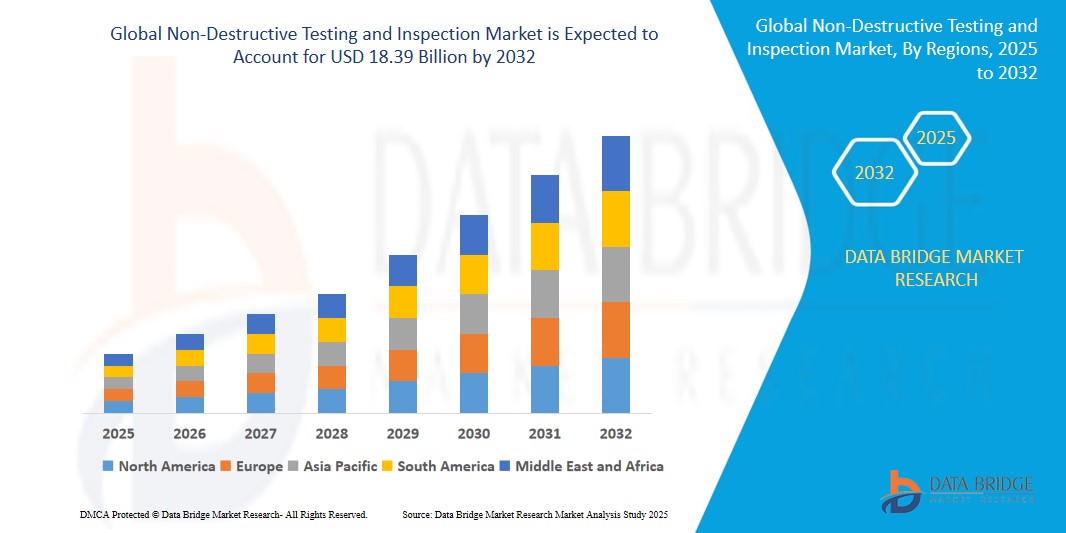

- The Global Non-Destructive Testing and Inspection Market size was valued atUSD 4.67 billion in 2024 and is expected to reachUSD 18.39 billion by 2032, at aCAGR of 6.1%during the forecast period

- This growth is driven by factors such as the Technological Advancements in NDT Equipment, Expansion in Infrastructure Development Projects, and Integration of AI and Machine Learning in NDT Processes

Non-Destructive Testing and Inspection Market Analysis

- Non-destructive testing and inspection market will reach at an estimated value of USD 18.39 billion by 2032 and grow at a CAGR of 6.1% in the forecast period of 2025 to 2032. Rise in the continuous technological advancement in automation, robotics, and electronics acts as an essential factor driving the non-destructive testing and inspection market.

- Non-destructive testing (NDT) methods are basically used primarily in engineering industries to assess the numerous properties of structures, equipment, materials, and components without causing damage.

- Asia-Pacific dominates the non-destructive testing and inspection market due to rise in the rapid infrastructural development and automation adoption in manufacturing industries in countries such as India and China in this region.

- North america is expected to be the fastest growing region in the Non-Destructive Testing and Inspection Market during the forecast period due to Increasing Demand for Asset Integrity Management

- Ultrasonic Testing segment is expected to dominate the market with a market share of 48.63% due to its high accuracy in detecting internal flaws without damaging materials.

Report Scope and Non-Destructive Testing and Inspection Market Segmentation

|

Attributes |

Non-Destructive Testing and Inspection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Destructive Testing and Inspection Market Trends

“Growing Use of NDT in Oil & Gas and Power Sectors Driving Market Expansion”

- The demand for non-destructive testing (NDT) methods is rapidly increasing in the oil & gas and power industries, playing a major role in market growth. NDT techniques, including ultrasonic, magnetic particle, liquid penetrant, and visual inspections, are widely used to assess pipeline corrosion and material integrity without causing any damage.

- In the oil and gas sector, these methods help ensure the safety and reliability of pipelines by detecting internal and external defects. Similarly, in the power industry—especially nuclear—NDT is essential for inspecting steam and gas turbines, pressure systems, small valves, and waste management components. These services are crucial for preventing failures, reducing downtime, and maintaining safety standards.

- For instance, in early 2024, several power plants in Europe adopted advanced NDT techniques to extend the life of aging infrastructure and reduce operational risks. As industries aim for safer, more efficient operations, the reliance on NDT is only expected to grow, pushing the market to expand at a steady pace in the coming years

Non-Destructive Testing and Inspection Market Dynamics

Driver

“Technological Advancements Driving Non-Destructive Testing (NDT) Market Growth”

- The Non-Destructive Testing (NDT) market is experiencing accelerated growth, primarily due to significant technological advancements that enhance the accuracy, efficiency, and cost-effectiveness of inspection processes. Innovations in ultrasonic, radiographic, and eddy current testing methods have improved the precision of defect detection without compromising material integrity.

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) has further revolutionized NDT by enabling automated defect recognition and predictive maintenance, thereby reducing human error and downtime.

For instance,

- AI algorithms can analyze vast amounts of inspection data to identify patterns and predict potential failures before they occur. These technological advancements are especially significant in sectors like aerospace, automotive, oil and gas, and infrastructure, where product quality and safety are paramount. The adoption of drones and robotic inspection technologies has expanded the scope of NDT, enabling safer and more efficient inspections of complex structures.

- Moreover, the advent of 3D and computed tomography (CT) scanning technologies allows for in-depth analysis of complex structures, providing more comprehensive insights into material integrity. Such innovations not only improve inspection accuracy but also increase the overall speed of testing, making it more cost-efficient for industries. These advancements are driving demand for NDT services, as industries seek to leverage cutting-edge technologies to enhance operational efficiency and ensure product safety.

Opportunity

“Growing Renewable Energy Sector Boosts NDT Demand”

- The rising focus on renewable energy across the globe is creating strong growth opportunities for the Non-Destructive Testing (NDT) industry. As countries work toward reducing emissions and achieving clean energy targets, the demand for efficient inspection and maintenance of infrastructure like wind turbines and solar plants is rising.

- NDT methods play a crucial role in ensuring these systems remain safe, reliable, and efficient throughout their operational life. With more investments in sustainable energy projects, there's a growing need for NDT solutions tailored specifically for renewable energy applications. These include techniques for detecting faults in turbine blades, solar modules, and structural components.

- The industry’s push for safety and cost-efficiency is also encouraging the development of advanced, automated NDT technologies. Companies offering targeted NDT services for renewables are well-positioned to benefit from this shift. As energy producers scale up their clean energy operations, quality control through NDT becomes even more critical. The combination of sustainability goals and infrastructure scaling will continue to fuel NDT market growth in this sector.

For instance,

- For instance, in China, the combined capacity of wind and solar power surpassed that of thermal power for the first time by the end of March 2025, reflecting the country's commitment to renewable energy. This shift underscores the growing importance of NDT in maintaining the integrity of renewable energy assets.

- This growth is driven by the increasing number of wind farms and the need for effective inspection and maintenance services to ensure the durability and peak performance of turbine assets. Inspection services are essential for identifying issues such as mechanical defects and blade erosion, which improve turbine dependability and efficiency.

Restraint/Challenge

“Regulatory and Compliance Challenges Affecting NDT Market Expansion”

- Despite the technological advancements propelling the NDT market, the industry faces significant challenges related to stringent regulatory and compliance requirements.

- NDT processes are subject to rigorous regulations and standards that vary across industries and regions, including safety standards, environmental regulations, and quality assurance requirements.

For Example,

- The aviation, energy, and manufacturing sectors face particularly stringent regulations regarding safety and performance, making NDT a crucial but burdensome process. The need to meet these evolving regulations can be costly for companies, especially as they must invest in training, certification, and the acquisition of the latest inspection technologies. Ensuring compliance often requires frequent audits, documentation, and upgrades to existing systems, adding to operational complexity.

- Therefore, while technological innovations present significant opportunities, navigating the complex regulatory environment remains a critical factor influencing the growth trajectory of the NDT market.

Non-Destructive Testing and Inspection Market Scope

Non-destructive testing and inspection market is analysed and market size, volume information is provided by country, technique, method, service and vertical as referenced above.

|

Segmentation |

Sub-Segmentation |

|

By Technique |

|

|

Method |

|

|

Service |

|

|

Vertical |

|

In 2025, the Ultrasonic Testing is projected to dominate the market with a largest share in Technology segment

Ultrasonic Testing segment is expected to dominate the market with a market share of 48.63% due to its high accuracy in detecting internal flaws without damaging materials.

The Visual Inspection Testing is expected to account for the largest share during the forecast period in this market

In 2025, the Visual Inspection Testing segment is expected to dominate the market with the largest market share of 41.76% because it is one of the most cost-effective, simple, and widely used inspection methods across industries. It allows for quick identification of surface defects such as cracks, corrosion, and misalignments without needing complex equipment.

Non-Destructive Testing and Inspection Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Non-Destructive Testing and Inspection Market”

- Asia Pacific is currently leading the global Non-Destructive Testing (NDT) and Inspection market, holding the largest share at 36.96%. This dominance is driven by rapid industrial growth across countries like China, India, Japan, and South Korea.

- These nations are seeing booming activities in sectors such as manufacturing, construction, automotive, power generation, and oil & gas—all of which heavily rely on NDT for safety and quality control. The expansion of infrastructure projects and increasing investments in renewable energy also contribute to the demand for advanced inspection methods.

- Additionally, governments are implementing stricter regulations on industrial safety and maintenance, boosting the use of NDT techniques. Technological advancements and a growing skilled workforce in the region have made NDT services more efficient and accessible.

- China, in particular, is emerging as a hub for industrial automation and testing solutions. As industries continue to modernize, Asia Pacific’s leadership in the NDT market is expected to strengthen further. This regional growth highlights the critical role NDT plays in supporting industrial safety and operational reliability.

“North america is Projected to Register the Highest CAGR in the Non-Destructive Testing and Inspection Market”

- North America is projected to experience the highest compound annual growth rate (CAGR) of 8.42% in the Non-Destructive Testing (NDT) and Inspection market. This growth is primarily driven by increased demand for NDT solutions across key industries, including aerospace, automotive, and energy, particularly oil and gas.

- The region is also seeing strong investments in infrastructure development and renewable energy projects, which require consistent quality checks. Advanced technologies like artificial intelligence (AI), machine learning, and automated systems are enhancing the efficiency and accuracy of NDT processes in North America.

- Additionally, the growing focus on safety standards and regulatory compliance in industries such as manufacturing and construction is boosting market demand. As companies prioritize operational efficiency, the need for real-time data analysis and predictive maintenance is also driving the growth of NDT services.

- North America’s technological leadership and commitment to innovation in industrial practices further support its position as a leader in the NDT market. These factors make the region a key player in the global NDT growth trajectory.

Non-Destructive Testing and Inspection Market Share

Non-destructive testing and inspection market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to non-destructive testing and inspection market.

The Major Market Leaders Operating in the Market Are:

- GENERAL ELECTRIC,

- MISTRAS Group, Inc.,

- Olympus Corporation,

- Ashtead Technology Ltd,

- Nikon Metrology NV,

- Magnaflux,

- Zetec, Inc.,

- Eddyfi,

- YXLON International,

- Sonatest,

- Fischer Measurement Technologies India Private Limited,

- NDT Global,

- FTH, LLC.,

- Bosello High Technology srl,

- Labquip NDT,

- FPrimeC Solutions Inc.,

- LynX Inspection,

- Cygnus Instruments

- Acuren

Latest Developments in Global Non-Destructive Testing and Inspection Market

- In August 2024 MISTRAS Group became an associate member of the Renewable Fuels Association (RFA) to boost safety, sustainability, and performance in the renewable fuels sector. By bringing their expertise in non-destructive testing (NDT), inline inspections, and data analytics, MISTRAS aims to support operational excellence and improve the integrity of assets in biorefineries.

- In October 2024 Creaform launched VXintegrity 3.0, a cutting-edge software update designed to streamline infrastructure assessments. The tool now integrates Finite Element Analysis (FEA) and API 579 standards, offering faster, more accurate Fitness-For-Service evaluations. It simplifies Level I and II analyses while accelerating Level III inspections—helping oil and gas companies cut costs and reduce downtime.

- In February 2024, Videray Technologies Inc. introduced the PXT, a compact 140 KB transmission X-ray generator. This new device is designed to provide enhanced safety, ease of use, and powerful inspection capabilities, catering to the diverse needs of customers. The PXT opens up new possibilities for various industries, offering improved flexibility and performance for inspection tasks that require high-quality X-ray imaging. Its versatility makes it a valuable tool for expanding applications across different sectors.

- In January 2024, Voliro, a leader in robotics for non-destructive testing (NDT), announced a strategic partnership with major inspection service providers in the U.S., including Acuren, MISTRAS, and TEAM. This collaboration strengthens Voliro’s foothold in the NDT industry, highlighting the growing demand for innovative and efficient solutions in inspection processes. By working with these key players, Voliro aims to enhance its product offerings and drive the adoption of cutting-edge robotic inspection technologies across various industries.

- In March 2024, Flyability revealed its new ultrasonic thickness measurement (UTM) payload for the Elios 3 drone. In collaboration with Sickness Instruments, experts in ultrasonic testing, this new addition aims to improve the inspection of steel thickness in hard-to-reach or hazardous areas, particularly in the Asia Pacific region. This advancement offers a safer, more efficient alternative to traditional inspection methods, allowing drones to access dangerous environments while providing accurate measurements of material integrity.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.