Global Oil Field Communications Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.10 Million

USD

4.10 Million

2024

2032

USD

2.10 Million

USD

4.10 Million

2024

2032

| 2025 –2032 | |

| USD 2.10 Million | |

| USD 4.10 Million | |

|

|

|

|

Global Oil Field Communications Market, By Solution (M2M Communication, Asset Performance Communication, Unified Communication, VoIP Solutions, Video Conferencing, Pipeline Supervisory Control and Data Acquisition, Fleet Management Communication, Oilfield to Control Centre Data Communication, Wi-Fi Hotspot and Others), Communication Network Technology (Cellular Communication Network, VSAT Communication Network, Fibre Optic-Based Communication Network, Microwave Communication Network and Tetra Network), Field Site (Onshore Communications and Offshore Communications), Service (Professional Services and Managed Services) - Industry Trends and Forecast to 2032

Oil Field Communications Market Size

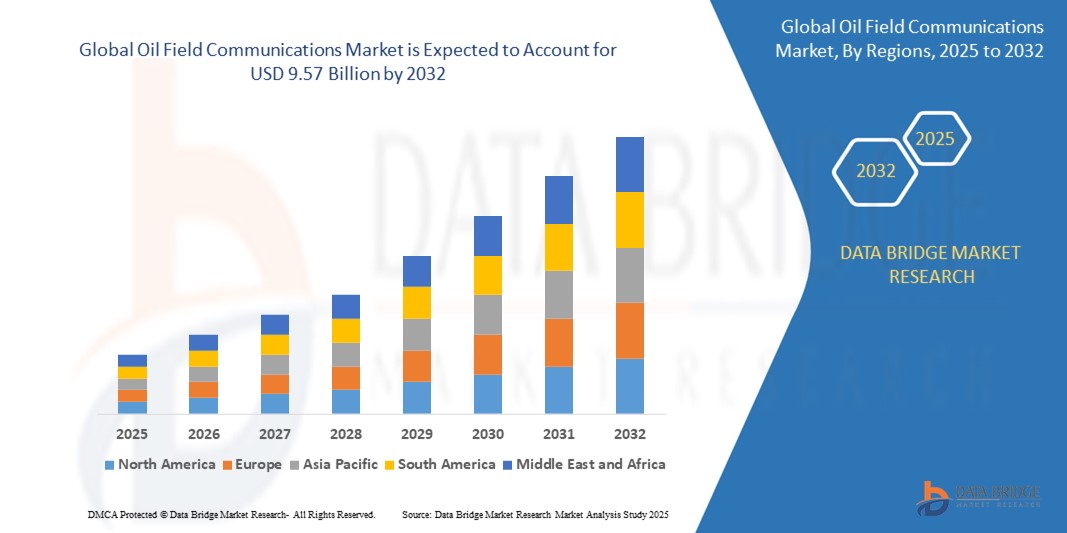

- The Global Oil Field Communications Market size was valued atUSD 5.25 billion in 2024and is expected to reachUSD 9.57 billion by 2032, at aCAGR of 7.80%during the forecast period

- This growth is driven by factors such as the rapidly increasing adoption of effective communication technologies

Oil Field Communications Market Analysis

- Oil field communications systems are essential for enabling real-time data exchange, remote monitoring, and operational coordination across upstream, midstream, and downstream oil & gas operations. These systems ensure safety, efficiency, and productivity in remote and hazardous environments.

- Market growth is driven by increasing digitalization in oilfield operations, rising investments in offshore exploration, and the growing need for reliable communication infrastructure in harsh environments.

- North America is expected to dominate the global oil field communications market, fueled by advanced shale drilling activities, strong technological adoption, and the presence of major energy companies.

- The Asia Pacific region is anticipated to witness the fastest growth, owing to large-scale oil field development projects and increasing government support for digital oilfield initiatives.

- The M2M Communication segment holds the largest market share of 65.40% due to the high demand for communication systems in drilling, exploration, and production processes where real-time data and remote operations are critical.

Report Scope and Oil Field Communications Market Segmentation

|

Attributes |

Oil Field Communications Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oil Field Communications Market Trends

“Rise of Edge Computing, IoT, and 5G in Oilfield Communications”

- A key trend transforming the global oilfield communication market is the integration of edge computing, Internet of Things (IoT), and 5G connectivity to support real-time monitoring and data transmission in remote and offshore environments.

- These technologies are enabling faster decision-making, predictive maintenance, and improved safety by processing data closer to the source and reducing latency.

- For instance, In March 2024, oil and gas firms in the North Sea began integrating 5G and edge computing at offshore platforms to improve real-time monitoring. These technologies enabled faster data processing, reduced latency, and enhanced safety. Companies used IoT sensors and AI analytics to monitor equipment health and environmental data onsite. The trend is accelerating digital transformation and operational efficiency across the industry.

- Edge computing combined with IoT networks also supports AI-based analytics at the site level, helping companies reduce downtime and lower operational costs while ensuring regulatory compliance.

Oil Field Communications Market Dynamics

Driver

“Increasing Focus on Operational Efficiency and Safety in Remote Oilfields”

- Growing demand for reliable communication infrastructure in remote and harsh oilfield environments is a key driver boosting the market.

- As oil and gas companies push operations into deeper offshore regions and unconventional fields, seamless communication between field units, control centers, and offshore rigs becomes essential.

- Modern communication systems are critical for real-time data transmission, remote asset management, and emergency response coordination

For instance,

- In July 2024, major producers in the Middle East upgraded their communication networks across remote desert oilfields to reduce failures and enhance worker safety. Real-time data transmission helped in predictive maintenance and improved emergency response. This growing need for robust communication infrastructure is driving the market, especially in geographically isolated operations

- This push toward digital oilfields is accelerating the adoption of rugged, high-bandwidth, and secure communication technologies across upstream and midstream segments

Opportunity

“Growing Demand for Managed Network Services and Cloud-Based Communication Solutions”

- The shift toward cloud-based and managed communication services presents a major opportunity for vendors in the oilfield communication market.

- Oil and gas companies are increasingly outsourcing their communication infrastructure to reduce capital expenditure, improve scalability, and ensure cybersecurity compliance.

- These solutions offer centralized management, automatic updates, and remote diagnostics, which are especially valuable for geographically dispersed operations.

For instance,

- In January 2025, energy firms in Brazil adopted managed LTE and satellite networks to reduce capital costs and improve scalability in remote sites. Cloud-based systems offered real-time diagnostics, centralized management, and better cybersecurity. This shift is opening opportunities for vendors offering flexible, service-based communication solutions for dispersed oil operations.

- As the industry moves towards more agile and cost-effective operations, providers of cloud-enabled communication platforms are poised for significant growth

Restraint/Challenge

“Complex Regulatory and Compliance Requirements Across Regions”

- A key challenge in the oilfield communication market is navigating the diverse and evolving regulatory requirements across different countries and regions.

- Companies must ensure communication systems comply with local spectrum licensing, cybersecurity standards, and data privacy laws, which can vary widely.

For instance,

- In February 2024, a U.S. based oilfield services provider faced deployment delays while setting up communication systems in offshore fields in Southeast Asia due to conflicting local data compliance laws. Navigating region-specific telecom regulations and cybersecurity standards slowed down implementation by over two months. These varied compliance requirements increase legal complexity and operational delays. While they don’t halt market growth, they present a key challenge for multinational expansion.

- These compliance complexities can slow down deployment timelines and require additional investments in legal and regulatory expertise but they do not stop market growth

Oil Field Communications Market Scope

The market is segmented on the basis deployment, type, application, enterprise type, industry.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Communication Network Technology |

|

|

By Field Site

|

|

|

By Service

|

|

In 2025, M2M (Machine-to-Machine) Communication is projected to dominate the solution segment with the largest share

The increasing need for real-time data exchange between remote devices and sensors in oilfields is driving this trend. M2M communication enables improved monitoring and control of oilfield operations, enhancing operational efficiency, safety, and productivity. This demand is further accelerated by the growing reliance on automated systems and digital transformation in the oil and gas industry.

The VSAT Communication Network is expected to account for the largest share in the communication network technology segment during the forecast period.

VSAT networks offer reliable, high-speed internet access to remote and offshore oilfield locations, which is crucial for seamless data transmission, voice communication, and video conferencing. As oilfields are increasingly located in remote areas, VSAT technology remains a critical enabler of communication in these regions.

Oil Field Communications Market Regional Analysis

“North America Holds the Largest Share in the Oilfield Communications Market”

- North America dominates the global oilfield communications market due to its advanced oil and gas industry infrastructure, high adoption of cutting-edge technologies, and a large number of offshore and onshore oilfields that require reliable communication systems

- The United States is the leading country in the region, with a significant focus on offshore oil exploration and production activities in the Gulf of Mexico and shale oil extraction in various onshore oilfields. This has driven demand for efficient communication networks, including M2M communication and VSAT systems, for real-time monitoring and remote operations management

- Additionally, North America benefits from strong investments in digital transformation within the oil and gas sector, such as the integration of IoT, AI, and cloud-based communication solutions, which further strengthens the demand for advanced communication systems

“Asia-Pacific is Projected to Register the Highest CAGR in the Oilfield Communications Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global oilfield communications market, fueled by the rapid expansion of oil and gas exploration activities in countries such as China, India, and Australia.

- In particular, China and India are increasing their investments in both onshore and offshore oil exploration, which is driving the demand for efficient and secure communication systems in remote oilfields. The growing need for reliable communication networks is crucial for ensuring operational efficiency and safety in these regions

- Government initiatives to modernize the energy sector, coupled with rising demand for energy in Asia-Pacific, are further fueling the adoption of sophisticated communication technologies in the oilfields. The region is also witnessing a growing trend of remote monitoring, automation, and digitalization, all of which require advanced communication infrastructure.

Oil Field Communications Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Huawei (China)

- Siemens (Germany)

- Hitachi ABB Power Grids (Switzerland)

- Speedcast (Australia)

- Weatherford (US)

- Ceragon (US)

- RigNet (US)

- Hughes (US)

- Redline Communications (Canada)

- MR Control Systems (Canada)

- Tait Communications (New Zealand)

- Honeywell (US)

- Intel (US)

- GE Digital (US)

- PTC (US)

- Commtel (India)

- MoStar Communications (US)

- DAMM Cellular Systems (Denmark)

- BlueJeans (US)

- Nesh (US)

- Sensia (US)

- Ondaka (US)

- Sensalytx (UK)

- WellAware (US)

Latest Developments in Global Oil field communications market

- In March 2025, Honeywell launched its new Sentinel Oilfield Communications System, a high-performance communication network designed specifically for remote oil and gas operations. The product integrates satellite communication and cloud based monitoring to provide real-time data on equipment performance, safety, and environmental conditions. This launch aims to enhance operational efficiency, reduce downtime, and improve safety across offshore and onshore oilfields, responding to the increasing demand for reliable communication solutions in harsh environments.

- In February 2025, Inmarsat, a global satellite communication provider, entered into a strategic partnership with Petrofac, a leading oilfield services company, to deliver advanced communication solutions for remote oilfield operations. The collaboration focuses on deploying Inmarsat's Global Xpress (GX) network to enable high speed, secure communications in offshore and onshore oilfields. This partnership is aimed at improving real-time collaboration, asset management, and operational efficiency for Petrofac’s oil and gas projects.

- In January 2025, Schneider Electric and Halliburton announced a collaboration to integrate their technologies for smart oilfield communications. The partnership will see the deployment of Schneider’s EcoStruxure platform and Halliburton’s Digital Well Program to provide enhanced connectivity, data analytics, and automation for oil and gas operations. The goal of the partnership is to increase operational efficiency, reduce costs, and enhance safety in oilfields through better communication and data integration.

- In November 2024, Schlumberger launched its Edge Computing for Oilfield Operations solution, an innovative approach to oilfield communications that enables on site data processing and analytics. This product is designed to address the growing demand for real-time decision making in remote locations by allowing operators to process data at the edge of the network, reducing latency and improving communication reliability. The solution is expected to revolutionize how oil and gas companies manage operations, especially in remote and offshore areas.

- In October 2024, Speedcast acquired Satcom Global, a provider of satellite communications services, for USD 400 million. This acquisition allows Speedcast to strengthen its position in the oil and gas sector by enhancing its satellite communication capabilities for offshore and remote oilfield operations. By integrating Satcom Global’s expertise, Speedcast aims to offer more reliable, secure, and cost-effective communication solutions, ensuring real-time data transfer and connectivity in challenging environments. The acquisition is expected to broaden Speedcast's service offerings and improve its competitive edge in the oilfield communications market.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.