Global Packaging Products Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

24.40 Billion

USD

33.65 Billion

2025

2033

USD

24.40 Billion

USD

33.65 Billion

2025

2033

| 2026 –2033 | |

| USD 24.40 Billion | |

| USD 33.65 Billion | |

|

|

|

|

Global Packaging Products Market Segmentation, By Material Type (Paper and Cardboard, Rigid Plastic, Metal, Flexible Plastic, Glass, Wood, Textile, and Other Types), Product (Bottles and Can, Containers and Jars, Bags, Pouches, and Wraps), By End-Users (Food, Beverages, Healthcare, Cosmetics, Household Products, and Chemicals) - Industry Trends and Forecast to 2033

Packaging Products Market Size

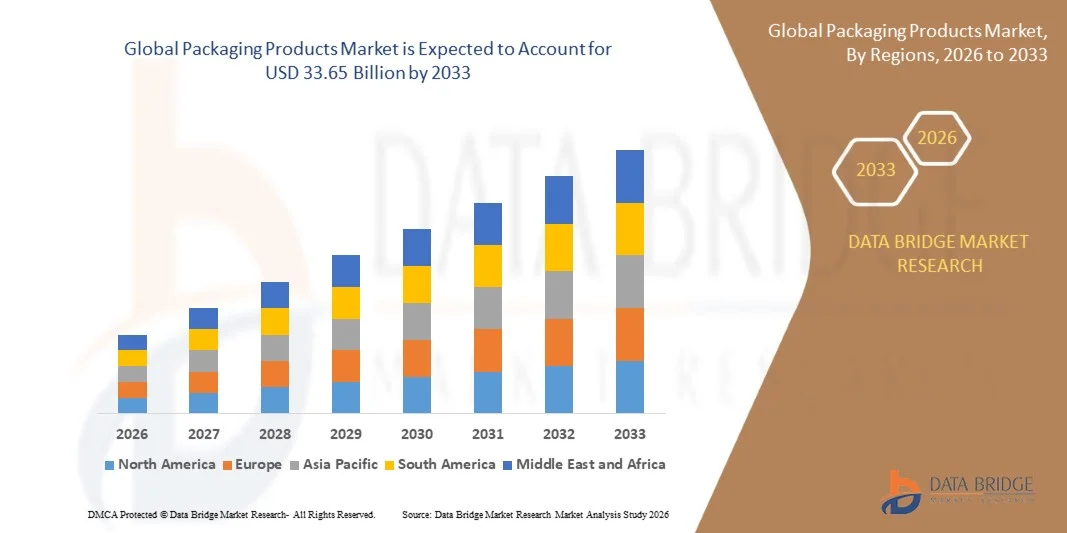

- The global packaging products market size was valued at USD 24.4 billion in 2025 and is expected to reach USD 33.65 billion by 2033, at a CAGR of 4.10% during the forecast period

- The market growth is largely driven by rising demand for packaged food, beverages, pharmaceuticals, and consumer goods, supported by changing lifestyles, urbanization, and increasing preference for convenience and ready-to-use products across both developed and emerging economies

- Furthermore, growing emphasis on sustainability, recycling, and lightweight packaging materials, along with advancements in packaging technologies, is accelerating the adoption of innovative and eco-friendly packaging solutions, thereby significantly boosting overall market growth

Packaging Products Market Analysis

- Packaging products include materials and solutions used to protect, preserve, transport, and present goods across industries such as food, beverages, healthcare, cosmetics, and chemicals, ensuring product safety, extended shelf life, and regulatory compliance

- The increasing demand for packaging products is primarily fueled by expansion of e-commerce, growth of organized retail, rising consumption of packaged goods, and continuous innovation in flexible, recyclable, and sustainable packaging formats

- Asia-Pacific dominated the packaging products market with a share of over 40% in 2025, due to rapid urbanization, expanding food and beverage industries, and strong growth in e-commerce and consumer goods manufacturing

- North America is expected to be the fastest growing region in the packaging products market during the forecast period due to high consumption of packaged food and beverages, strong presence of multinational consumer goods companies, and growing demand for convenience packaging

- Paper and cardboard segment dominated the market with a market share of 39.1% in 2025, due to growing demand for sustainable, recyclable, and lightweight packaging solutions across food, beverages, and consumer goods industries. Brand owners increasingly prefer paper-based materials due to favorable regulatory support, lower environmental impact, and strong consumer perception toward eco-friendly packaging. In addition, advancements in coating and barrier technologies have improved the durability and moisture resistance of paper and cardboard packaging, further supporting their widespread adoption

Report Scope and Packaging Products Market Segmentation

|

Attributes |

Packaging Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Products Market Trends

“Sustainability and Shift Toward Recyclable Packaging”

- A major trend in the packaging products market is the accelerating shift toward sustainable and recyclable packaging materials, driven by increasing environmental awareness, regulatory pressure, and changing consumer preferences across food, beverages, healthcare, and consumer goods industries. Manufacturers are actively transitioning away from conventional plastics toward paper-based, recyclable, and mono-material packaging formats to reduce environmental impact and improve circularity

- For instance, Mondi plc has expanded its recyclable paper-based packaging portfolio for food and consumer goods, focusing on solutions that replace plastic while maintaining product protection and shelf life. Such initiatives are strengthening demand for fiber-based and recyclable packaging while aligning brands with sustainability goals

- The growing adoption of flexible recyclable packaging is reshaping product design, as companies prioritize lightweight materials that reduce transportation emissions and material usage. This trend is influencing packaging suppliers to invest in material innovation and redesign existing formats for improved recyclability

- Brand owners in food and beverage sectors are increasingly committing to sustainability targets, driving higher demand for packaging products that meet recyclability and compostability standards. This is accelerating collaboration between packaging manufacturers and material suppliers to develop compliant solutions

- Regulatory frameworks across Europe and North America are reinforcing this trend by mandating reductions in plastic waste and encouraging the use of recyclable materials. These policies are shaping long-term demand patterns and influencing packaging strategies across global markets

- The sustained focus on sustainability is positioning recyclable packaging as a core growth area, reinforcing its role in shaping future packaging designs and strengthening the market’s transition toward environmentally responsible solutions

Packaging Products Market Dynamics

Driver

“Rising Demand for Packaged Food and Beverages”

- The rising consumption of packaged food and beverages is a key driver of growth in the packaging products market, supported by urbanization, changing lifestyles, and increasing preference for convenience and ready-to-consume products. Packaging plays a critical role in ensuring food safety, extending shelf life, and enabling efficient distribution across domestic and international markets

- For instance, Tetra Pak Inc. continues to expand its aseptic carton packaging solutions to support global dairy and beverage producers, enabling long shelf life without refrigeration. These solutions are driving consistent demand for advanced food and beverage packaging formats

- Growth in organized retail and e-commerce food delivery platforms is increasing reliance on robust and hygienic packaging solutions that protect products during storage and transportation. This is strengthening demand for flexible, rigid, and protective packaging across multiple food categories

- The expansion of processed and frozen food segments is further boosting packaging requirements, as these products require specialized materials to maintain freshness and quality. Packaging manufacturers are responding with improved barrier properties and enhanced sealing technologies

- The continued expansion of the global food and beverage industry is reinforcing this driver, positioning packaging products as essential enablers of food safety, convenience, and large-scale distribution

Restraint/Challenge

“Volatility in Raw Material Prices”

- The packaging products market faces challenges from fluctuating prices of key raw materials such as paper pulp, plastics, aluminum, and glass, which directly impact production costs and profit margins. Price volatility creates uncertainty for manufacturers and complicates long-term pricing and supply planning

- For instance, International Paper Co. has highlighted the impact of pulp and fiber price fluctuations on packaging production costs, reflecting broader challenges faced by paper-based packaging manufacturers. Such variability affects cost stability and pricing strategies across the value chain

- Dependence on petrochemical-based inputs exposes plastic packaging producers to crude oil price fluctuations, increasing cost pressure during periods of market instability. This can limit manufacturers’ ability to offer competitively priced packaging solutions

- Supply chain disruptions and geopolitical factors further amplify raw material price volatility, affecting material availability and lead times. These issues increase operational risk for packaging manufacturers operating at scale

- Overall, raw material price volatility remains a persistent challenge, influencing profitability, pricing flexibility, and long-term planning within the packaging products market

Packaging Products Market Scope

The market is segmented on the basis of material type, product, and end-users.

• By Material Type

On the basis of material type, the packaging products market is segmented into paper and cardboard, rigid plastic, metal, flexible plastic, glass, wood, textile, and other types. The paper and cardboard segment dominated the largest market revenue share of 39.1% in 2025, driven by growing demand for sustainable, recyclable, and lightweight packaging solutions across food, beverages, and consumer goods industries. Brand owners increasingly prefer paper-based materials due to favorable regulatory support, lower environmental impact, and strong consumer perception toward eco-friendly packaging. In addition, advancements in coating and barrier technologies have improved the durability and moisture resistance of paper and cardboard packaging, further supporting their widespread adoption.

The flexible plastic segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for cost-efficient, lightweight, and high-barrier packaging formats. Flexible plastics offer superior protection, extended shelf life, and design versatility, making them highly suitable for food, healthcare, and personal care applications. The growing popularity of convenience packaging and reduced transportation costs continues to accelerate the adoption of flexible plastic materials.

• By Product

On the basis of product, the packaging products market is segmented into bottles and cans, containers and jars, bags, pouches, and wraps. The bottles and cans segment dominated the market in 2025, driven by their extensive usage in beverage, food, and household product packaging. These formats offer strong structural integrity, excellent product protection, and compatibility with automated filling and sealing processes, making them a preferred choice for large-scale manufacturers. In addition, the high recyclability of metal cans and glass bottles supports their continued demand across both developed and emerging markets.

The pouches segment is expected to register the fastest growth during the forecast period, supported by increasing consumer preference for lightweight, portable, and resealable packaging solutions. Pouches require less material compared to rigid packaging, reducing production and logistics costs while enhancing shelf appeal. Their adaptability across food, beverages, and personal care products continues to drive rapid market expansion.

• By End-Users

On the basis of end-users, the packaging products market is segmented into food, beverages, healthcare, cosmetics, household products, and chemicals. The food segment accounted for the largest revenue share in 2025, driven by the high volume consumption of packaged food products and the need for effective protection against contamination and spoilage. Packaging plays a critical role in preserving freshness, extending shelf life, and ensuring regulatory compliance, which sustains strong demand from food manufacturers. The rise of processed and ready-to-eat food products further reinforces the dominance of this segment.

The healthcare segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing pharmaceutical production and rising demand for safe, tamper-evident, and compliant packaging solutions. Strict regulatory requirements and the growing focus on patient safety have accelerated the adoption of specialized healthcare packaging. Expanding global healthcare access and increased consumption of medicines and medical devices continue to support rapid growth in this end-user segment.

Packaging Products Market Regional Analysis

- Asia-Pacific dominated the packaging products market with the largest revenue share of over 40% in 2025, driven by rapid urbanization, expanding food and beverage industries, and strong growth in e-commerce and consumer goods manufacturing

- The region’s cost-efficient manufacturing base, availability of raw materials, and rising investments in flexible and sustainable packaging solutions are accelerating overall market expansion

- Increasing population, changing consumption patterns, and supportive government initiatives promoting industrial growth are contributing to higher demand for packaging products across multiple end-use sectors

China Packaging Products Market Insight

China held the largest share in the Asia-Pacific packaging products market in 2025, owing to its massive manufacturing ecosystem, strong presence of food, beverage, and consumer goods producers, and well-established packaging supply chains. The country’s dominance is further supported by large-scale production capabilities, continuous innovation in flexible and sustainable packaging, and strong domestic as well as export demand. Rapid growth in online retail and ready-to-consume products continues to reinforce packaging consumption across industries.

India Packaging Products Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising demand for packaged food, beverages, pharmaceuticals, and personal care products. Increasing urbanization, growth of organized retail, and expansion of e-commerce platforms are significantly boosting packaging requirements. Government initiatives supporting manufacturing and food processing industries are further strengthening long-term market growth.

Europe Packaging Products Market Insight

The Europe packaging products market is growing steadily, supported by strong regulatory emphasis on sustainability, recycling, and eco-friendly materials. High demand for premium and innovative packaging in food, beverages, cosmetics, and pharmaceuticals is driving consistent adoption across the region. Technological advancements in recyclable and biodegradable packaging solutions are further supporting market expansion.

Germany Packaging Products Market Insight

Germany’s packaging products market is driven by its strong industrial base, advanced manufacturing technologies, and leadership in sustainable packaging solutions. The country places high importance on quality, compliance, and innovation, particularly in food, beverage, and healthcare packaging. Strong collaboration between manufacturers and material suppliers continues to enhance product development and efficiency.

U.K. Packaging Products Market Insight

The U.K. market is supported by rising demand for sustainable and lightweight packaging, driven by stringent environmental regulations and changing consumer preferences. Growth in online retail, packaged food consumption, and personal care products is increasing the need for innovative packaging formats. Investments in recyclable materials and circular economy initiatives are further shaping market development.

North America Packaging Products Market Insight

North America is projected to grow at a significant CAGR from 2026 to 2033, driven by high consumption of packaged food and beverages, strong presence of multinational consumer goods companies, and growing demand for convenience packaging. Technological advancements, automation in packaging processes, and increasing focus on sustainable materials are key growth drivers. The region also benefits from well-established distribution and logistics infrastructure.

U.S. Packaging Products Market Insight

The U.S. accounted for the largest share in the North America packaging products market in 2025, supported by its large consumer base, high demand for packaged and ready-to-eat products, and strong presence of food, beverage, and healthcare manufacturers. The country’s emphasis on innovation, smart packaging, and sustainable solutions is driving continuous product evolution. Robust investments in packaging technology and material innovation further strengthen the U.S.’s leading position in the regional market.

Packaging Products Market Share

The packaging products industry is primarily led by well-established companies, including:

- Mondi plc (U.K.)

- Bosch Packaging Technology (Germany)

- Avery Dennison Corporation (U.S.)

- Aetna Group (Italy)

- Huhtamaki Oyj (Finland)

- Graham Packaging Company (U.S.)

- Stora Enso Oyj (Finland)

- Fuji Machinery Co. Ltd. (Japan)

- Packaging Corporation of America (U.S.)

- Marchesini Group (Italy)

- Ball Corporation (U.S.)

- Adelphi Group of Companies (U.K.)

- Gerresheimer AG (Germany)

- International Paper Co. (U.S.)

- Coesia Group (Italy)

- Crown Holdings Inc. (U.S.)

- Yunnan Energy New Material Co. Ltd. (China)

- Sealed Air Corp (U.S.)

- Berry Global plc (U.S.)

- Merlin Packaging Technologies (U.K.)

Latest Developments in Global Packaging Products Market

- In November 2025, Mondi strengthened its competitive position in the packaging products market by expanding its food packaging portfolio through the acquisition of Schumacher Packaging. This development enhanced Mondi’s capabilities in solid board packaging and digital printing, allowing the company to better serve food industry customers across Europe. The move reflects growing demand for high-quality, sustainable, and customized food packaging solutions and reinforces Mondi’s role as a key partner for large-scale food manufacturers

- In August 2025, ProAmpac advanced innovation in the flexible packaging segment with the commercial launch of its ProActive Recycle-Ready polyolefin-based platform for high-speed chunk cheese applications. This development addresses increasing regulatory and consumer pressure for recyclable dairy packaging without compromising shelf life or operational efficiency. The launch strengthens ProAmpac’s position in sustainable flexible packaging while supporting food producers’ transition toward circular economy-compliant materials

- In October 2024, FUCHS Group introduced new automotive aftermarket product packaging made entirely from 100% post-consumer recycled materials. This initiative highlights the rising emphasis on sustainable packaging within industrial and automotive sectors. By shifting to PCR-based packaging, FUCHS reduces its environmental footprint and also aligns its brand with evolving sustainability expectations from regulators and customers, influencing broader adoption of recycled packaging materials

- In September 2024, Bostik, part of the Arkema Group, launched a new range of advanced packaging adhesives focused on sustainability and performance improvement. This development supports the packaging industry’s transition toward recyclable and lightweight materials by enabling stronger bonding solutions compatible with modern packaging substrates. The launch enhances Arkema’s position in value-added packaging solutions and responds to growing demand for eco-efficient adhesive technologies

- In March 2024, Greif, Inc. expanded its global footprint in rigid plastic packaging through the acquisition of Ipackchem Group SAS for US$ 538 million. This strategic move strengthened Greif’s presence in high-performance small rigid plastic containers and jerrycans, particularly for chemicals, pharmaceuticals, and agrochemicals. The acquisition enhances Greif’s sustainable and UN-certified packaging offerings, improving its ability to serve regulated end markets and reinforcing its competitive position in specialty industrial packaging

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.