Global Rotomolding Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.90 Billion

USD

3.03 Billion

2024

2032

USD

1.90 Billion

USD

3.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.90 Billion | |

| USD 3.03 Billion | |

|

|

|

|

Segmentación del mercado global de rotomoldeo por material (polietileno, polipropileno, PVC, policarbonato, nailon, poliuretano, elastómeros y otros), forma (polvo y líquido), utilidad (suelo radiante, techos, paredes, etc.), tipo de máquina (máquina de roca y rollo, biaxial, lanzadera, bivalva, vertical, de llama abierta, de carrusel, de brazo oscilante y otras), aplicación (con y sin tanque): tendencias y pronóstico del sector hasta 2032.

Análisis del mercado del rotomoldeo

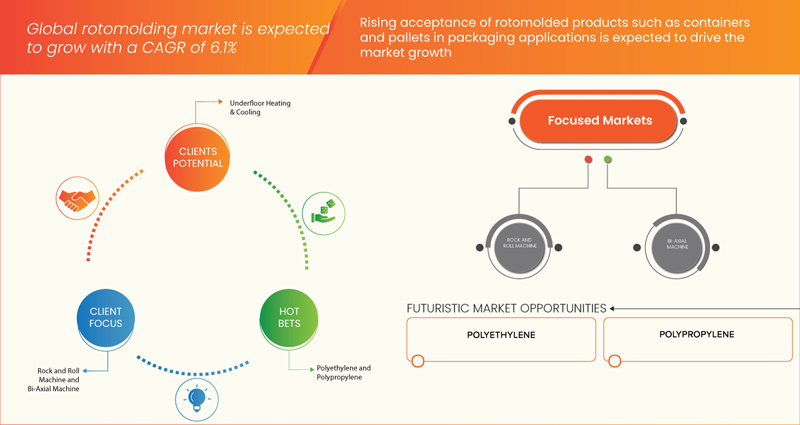

El mercado global del rotomoldeo está experimentando un crecimiento significativo impulsado por la creciente aceptación de productos rotomoldeados, como contenedores y palés, en aplicaciones de manipulación y embalaje de materiales. La manipulación y el embalaje de materiales se encuentran entre las cinco funciones logísticas interconectadas que contribuyen significativamente a la logística. El transporte, el almacenamiento, el control y la protección de materiales, productos y artículos empacados durante los procesos de fabricación, distribución y eliminación forman parte de la manipulación de materiales. Los componentes rotomoldeados también son una mejor alternativa a las piezas de acero convencionales. El rotomoldeo es el proceso ideal para producir piezas y componentes que pueden utilizarse para recolectar, almacenar o transportar prácticamente cualquier sustancia gracias a su menor peso, mayor resistencia a la corrosión y fabricación sin juntas. Dado que las perspectivas positivas para el sector de la construcción se asocian con la construcción, reparación, renovación y mantenimiento de infraestructuras, la industria de la construcción contribuye al desarrollo socioeconómico y al crecimiento económico del país.

Tamaño del mercado del rotomoldeo

El tamaño del mercado global de rotomoldeo se valoró en USD 1.90 mil millones en 2024 y se proyecta que alcance los USD 3.03 mil millones para 2032, con un crecimiento anual compuesto (CAGR) del 6,1% durante el período de pronóstico de 2025 a 2032. Además de la información del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos de mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado seleccionado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación y exportación, análisis de precios, análisis de consumo de producción y análisis PESTLE.

Tendencias del mercado del rotomoldeo

Los avances tecnológicos están mejorando la eficiencia y versatilidad del proceso de rotomoldeo, permitiendo la producción de formas complejas y diseños intrincados con mayor precisión. Cabe destacar que se espera que el segmento del polietileno domine el mercado gracias a su excelente durabilidad y rentabilidad, con una cuota de mercado significativa. Además, existe un creciente énfasis en la sostenibilidad dentro del sector, y las empresas exploran cada vez más materiales reciclables y biodegradables para cumplir con las normas ambientales.

El sector automotriz es particularmente influyente, ya que los fabricantes buscan componentes rotomoldeados ligeros para mejorar la eficiencia del combustible y reducir el peso total del vehículo. Además, la región Asia-Pacífico continúa liderando la cuota de mercado, impulsada por una sólida actividad de construcción e industrialización. En general, el mercado del rotomoldeo está posicionado para un crecimiento continuo, caracterizado por innovaciones tecnológicas, iniciativas de sostenibilidad y una mayor inversión en sectores clave. Se espera que esta tendencia contribuya significativamente al crecimiento de los mercados de rotomoldeo a medida que el mundo avanza hacia productos y servicios de rotomoldeo.

Alcance del informe y segmentación del mercado de rotomoldeo

|

Atributos |

Perspectivas clave del mercado del rotomoldeo |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Polonia, Países Bajos, Bélgica, Turquía, Suiza, Suecia, Rusia, Dinamarca y resto de Europa, China, Japón, India, Corea del Sur, Indonesia, Tailandia, Singapur, Australia, Filipinas, Malasia, Vietnam, Nueva Zelanda, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Omán, Catar, Kuwait, resto de Oriente Medio y África. |

|

Actores clave del mercado |

Centro Incorporated (EE. UU.), Rototech (India), Prisma Colour Limited (Reino Unido), Arkema (Francia), LyondellBasell Industries Holdings BV (EE. UU.), ROTOPLAST INC. (Canadá), Green Age Industries (India), Phychem Technologies Pvt. Ltd. (India), KK Nag Pvt. Ltd (Apparatus Solutions) (India), Dutchland Plastics (EE. UU.), ROTOVIA (Islandia), Centro Incorporated (EE. UU.), Rotomachinery Group (Italia), Naroto (India), Loopa (Brasil), Ferry Industries, Inc. (EE. UU.), Granger Industries Inc. (EE. UU.), Shandong Zhongtian Rubber & Plastic Technology Co., Ltd. (China), Persisco SPA (Italia), Fixopan (India), Orex (Polonia), Rotomachines Ltd. (Reino Unido) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de producción y consumo y análisis PESTLE. |

Definición del mercado del rotomoldeo

El rotomoldeo, también conocido como moldeo rotacional, es un proceso de fabricación diseñado específicamente para producir piezas y productos plásticos huecos. Esta técnica implica el uso de un molde calentado, generalmente de metal, que se llena con material plástico en polvo. Posteriormente, el molde gira a lo largo de múltiples ejes, permitiendo que el plástico se funda y cubra uniformemente sus superficies internas. Este proceso permite la creación de formas complejas y piezas grandes y sin juntas con espesores de pared variables. El rotomoldeo es especialmente valorado por su rentabilidad en la producción de componentes plásticos de gran tamaño, lo que lo hace ampliamente utilizado en diversas aplicaciones, como piezas de automóviles, tanques de agua, mobiliario de exterior y juegos infantiles. La industria está experimentando actualmente un crecimiento debido a la creciente demanda en sectores como la construcción, así como a los avances en las tecnologías de materiales que mejoran el rendimiento de los productos rotomoldeados.

Dinámica del mercado del rotomoldeo

Conductores

- Creciente aceptación de productos rotomoldeados, como contenedores y palés, en aplicaciones de manipulación y embalaje de materiales

La manipulación de materiales y el embalaje se encuentran entre las cinco funciones logísticas interconectadas que contribuyen significativamente a la logística. El transporte, el almacenamiento, el control y la protección de materiales, productos y artículos empacados durante los procesos de fabricación, distribución y eliminación forman parte de la manipulación de materiales. El embalaje cumple una función crucial al contener materiales y mercancías para su distribución y transporte.

Los productos fabricados mediante tecnología de rotomoldeo ofrecen soluciones asequibles, seguras y duraderas para aplicaciones de manipulación y embalaje de materiales en diversas industrias. Presentan una alta capacidad de carga gracias a su diseño monobloque sin costuras. Los componentes rotomoldeados también son una mejor alternativa a las piezas de acero convencionales. El rotomoldeo es el proceso ideal para producir piezas y componentes que pueden utilizarse para recolectar, almacenar o transportar prácticamente cualquier sustancia gracias a su menor peso, mayor resistencia a la corrosión y fabricación sin juntas.

Por ejemplo,

- En noviembre de 2024, según Globe Newswire, el mercado global de envases rotomoldeados experimentó un sólido crecimiento, con ventas proyectadas de 4.500 millones de dólares en 2024, según los últimos análisis del mercado. Esta trayectoria de crecimiento se sustenta en la continua expansión de los envases de polietileno, que se espera que representen más del 60 % de la cuota de mercado en 2024. La versatilidad estructural del polietileno es clave para su dominio, permitiendo a los fabricantes producir una amplia gama de envases duraderos, rentables y reciclables. La adaptabilidad del material garantiza un alto rendimiento y una integridad duradera, lo que lo convierte en la opción preferida para las industrias que buscan soluciones de envasado sostenibles y de alta calidad. Con una tasa de crecimiento anual constante del 3,4 %, se prevé que el mercado alcance un valor total de 6.300 millones de dólares para 2034.

Perspectivas positivas hacia el sector de la construcción

El sector de la construcción se asocia con la construcción, reparación, renovación y mantenimiento de infraestructuras. Contribuye al desarrollo socioeconómico y al crecimiento económico del país. Genera actividad y empleo en otros sectores de la economía, como la manufactura, la logística, el comercio y los servicios financieros. El crecimiento poblacional, la creciente urbanización, el mercado inmobiliario y el desarrollo de infraestructuras son los principales impulsores de la construcción.

La industria de la construcción tiene el potencial de ser un importante impulsor de la expansión de los productos rotomoldeados. Estos productos tienen diversas aplicaciones en proyectos de construcción, como tanques de almacenamiento de agua y fosas sépticas, entre otros. Asimismo, productos como barricadas y conos de tráfico, utilizados en la construcción de carreteras y autopistas, también se fabrican mediante tecnología de rotomoldeo. Estos productos son duraderos, resistentes a la corrosión y requieren poco mantenimiento, lo que los hace ideales para aplicaciones de infraestructura. Además, gracias a su bajo peso, son fáciles de transportar, lo que se traduce en menores costos de combustible para el usuario final. Además, son fáciles de transportar y reubicar en comparación con otros productos fabricados con materiales como el metal. El creciente enfoque en el desarrollo de infraestructuras eficientes y duraderas contribuye al crecimiento de las aplicaciones de productos rotomoldeados en el sector de la construcción.

Por ejemplo,

- En febrero de 2024, según un artículo de Rotoline, el proceso de rotomoldeo está cobrando gran importancia en el sector de la construcción civil, donde se aplica para la fabricación de una amplia gama de componentes esenciales. Desde lavabos y bañeras hasta bloques de aislamiento térmico, la versatilidad del rotomoldeo desempeña un papel crucial en la producción de piezas que cumplen con estrictos estándares funcionales y de durabilidad. La capacidad de crear elementos de construcción duraderos, rentables y fiables mediante esta innovadora técnica contribuye a su creciente adopción en la industria, aportando importantes beneficios en términos de rendimiento y valor a largo plazo para los proyectos de construcción.

Oportunidades

- Posibilidad de inclusión de nuevas tecnologías de impresión y etiquetado

Con el tiempo, las nuevas demandas de los clientes en materia de etiquetas y la dinámica cambiante del mercado influirán en la elección del tipo de etiqueta impresa y en los nuevos desarrollos tecnológicos. La industria del embalaje y sus clientes trabajan constantemente para reducir el peso de los envases, ya sea mediante el uso de envases rígidos más pequeños de metal, vidrio o plástico, o mediante la transición a formatos de plástico flexible.

La incorporación de nuevas tecnologías de impresión y etiquetado en el rotomoldeo ofrece una gran oportunidad para incorporar diseños, textos y logotipos en productos rotomoldeados. Avances tecnológicos como la impresión directa sobre objeto, la impresión digital y las tecnologías de etiquetado facilitan la aplicación de una imagen de marca personalizada en productos rotomoldeados. La incorporación de logotipos y etiquetas de marca en el producto tiene el potencial de aumentar la popularidad de la marca. Existen otras oportunidades asociadas con las nuevas tecnologías de impresión y etiquetado, ya que facilitan la trazabilidad al incorporar información como la fecha de fabricación, el número de lote y la información de uso directamente en los productos.

Por ejemplo,

- El 9 de septiembre de 2024, un blog de MANN SUPPLY destacó los rápidos avances en la impresión de etiquetas, impulsados por innovaciones como las etiquetas inteligentes con tecnología RFID y materiales ecológicos. Para mantenerse competitivas, las empresas deben adoptar estas tendencias para mejorar la eficiencia y la interacción con el cliente. Para el mercado global de productos de rotomoldeo, estas innovaciones ofrecen soluciones de etiquetado avanzadas que impulsan la trazabilidad y la sostenibilidad de los productos, satisfaciendo así las cambiantes demandas regulatorias y del mercado.

Aumentar el acceso a los polímeros de base biológica

Bio- El creciente acceso a polímeros de origen biológico representa una oportunidad significativa para el mercado global de productos de rotomoldeo. Los polímeros de origen biológico, derivados de recursos renovables como plantas, algas o biomasa, ofrecen una alternativa ecológica a los plásticos tradicionales derivados del petróleo. A medida que la sostenibilidad ambiental se convierte en una prioridad clave para las industrias de todo el mundo, la demanda de materiales de origen biológico aumenta constantemente. Para el mercado del rotomoldeo, estos materiales se alinean con la creciente tendencia hacia la reducción de la huella de carbono y la minimización del impacto ambiental.

La adopción de polímeros de origen biológico puede mejorar aún más la versatilidad y el rendimiento de los productos rotomoldeados. Estos polímeros ofrecen ventajas como mayor resistencia, flexibilidad y resistencia al desgaste, lo que los hace ideales para diversas aplicaciones, desde la automoción y la construcción hasta los bienes de consumo. A medida que la cadena de suministro de polímeros de origen biológico se vuelve más accesible y rentable, los fabricantes de la industria del rotomoldeo tendrán más oportunidades para innovar y producir productos sostenibles y de alta calidad.

Por ejemplo,

- Según un informe publicado por Nova-Institute GmbH Renewable Carbon News, el 13 de enero de 2025 se prevé un sólido crecimiento de la capacidad global de polímeros de origen biológico, impulsado por importantes inversiones en China, Europa y Oriente Medio. Esta expansión se ve respaldada por nuevas regulaciones políticas en Europa, que están impulsando la demanda de plásticos biodegradables. Se espera que el mercado de polímeros de origen biológico experimente una tasa de crecimiento anual compuesta (TCAC) del 18 % entre 2024 y 2029, superando significativamente a los polímeros de origen fósil. A medida que aumente la cuota de capacidad de los polímeros de origen biológico, su mayor utilización en aplicaciones como los productos de rotomoldeo desempeñará un papel fundamental en el crecimiento de este mercado.

Restricciones/Desafíos

- Limitaciones respecto al procesamiento de otros materiales, a saber, metales y cerámicas

El rotomoldeo se utiliza para procesar materiales poliméricos termoplásticos como el polietileno y el polipropileno. Además, la materia prima utilizada en la formación de productos rotomoldeados se puede convertir fácilmente de gránulos a polvo fino y debe tener una alta estabilidad térmica. Esto limita la selección de materiales a resinas de base polimérica para la formación de productos rotomoldeados. El alto requisito de estabilidad térmica conlleva un alto costo de las materias primas y un aumento en el costo de la molienda del material para convertirlo en polvo.

Si bien el rotomoldeo ofrece diversas ventajas al procesar productos plásticos, presenta limitaciones al procesar otros materiales como metales y cerámicas. Estos presentan puntos de fusión elevados en comparación con los polímeros, lo que supone una desventaja, ya que requieren altas temperaturas. Además, la cerámica y los metales poseen una alta resistencia estructural y capacidad de carga, menos comunes en los plásticos rotomoldeados. Los metales y las cerámicas poseen alta resistencia y conductividad térmica, por lo que se utilizan en aplicaciones industriales donde se requieren propiedades de resistencia térmica. Por lo tanto, se prevé que la imposibilidad de procesar materiales como metales y cerámicas mediante rotomoldeo limite el crecimiento del mercado global de productos de rotomoldeo.

Por ejemplo,

- En febrero de 2024, según GVL POLY, si bien el rotomoldeo es ideal para producir piezas huecas de plástico, sus largos tiempos de ciclo, las limitaciones de material y su idoneidad para la producción a pequeña escala pueden ser limitantes. Si bien avances como la tecnología de moldeo inteligente mejoran la eficiencia, el proceso sigue siendo más lento que otros. Además, la escasez de resinas y las mayores tolerancias pueden hacerlo menos adecuado para aplicaciones de gran volumen o precisión. Las empresas deben evaluar estos factores y consultar con expertos para determinar si el rotomoldeo es la solución adecuada para sus necesidades.

Amenaza sustitutiva de otros materiales moldeados

El rotomoldeo es el proceso de fabricación mediante el cual se crean productos plásticos huecos. Si bien el rotomoldeo ofrece diversas ventajas en la producción de componentes plásticos duraderos, rentables y sin juntas, existen otras tecnologías de moldeo, como el moldeo por inyección y el moldeo por soplado, que constituyen una alternativa al rotomoldeo. Mediante el moldeo por inyección se producen componentes a partir de diversos materiales, como polímeros, cerámica y metales. El proceso de moldeo por soplado también se utiliza para fabricar envases huecos, como botellas de refrescos y agua . Sin embargo, el rotomoldeo solo puede procesar materiales poliméricos para formar productos rotomoldeados.

El moldeo por inyección permite crear una gran cantidad de productos en poco tiempo en comparación con el rotomoldeo. El rotomoldeo ofrece la ventaja de crear materiales flexibles. Sin embargo, es lento y menos efectivo para grandes producciones en comparación con otras tecnologías alternativas.

Por ejemplo,

- En 2022, según un blog de Industrial Custom Products, tanto el termoformado como el rotomoldeo son métodos eficaces para el conformado de plásticos especiales, pero cada uno tiene sus propias ventajas. Si bien el rotomoldeo es conocido por su durabilidad y versatilidad para producir piezas de plástico huecas de mayor tamaño, el termoformado suele ser más adecuado para proyectos que exigen mayor precisión, detalle o flexibilidad en el utillaje. El termoformado es especialmente ideal para la producción de piezas repetidas o para proyectos que requieren un diseño complejo. Para las empresas que no están seguras de qué método elegir, consultar con un profesional de la producción de plásticos puede ayudar a determinar el enfoque más adecuado para los requisitos específicos del proyecto.

Alcance del mercado del rotomoldeo

El mercado se divide en cinco segmentos principales según el material, la forma, la utilidad, el tipo de máquina y la aplicación. El crecimiento de estos segmentos le ayudará a analizar los segmentos con menor crecimiento en las industrias y proporcionará a los usuarios una valiosa visión general del mercado y perspectivas que les ayudarán a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Por material

- Polietileno

- Por tipo

- LDPE

- HDPE

- Por tipo

- Polipropileno

- Por tipo

- Homopolímero

- Copolímero aleatorio

- Copolímero de impacto

- Por tipo

- Cloruro de polivinilo

- Policarbonato

- Nylon

- Poliuretano

- Elastómeros

- Por tipo

- Caucho de nitrilo

- caucho de butilo

- Polibutadieno

- Caucho de cloropreno

- Por tipo

- Otros

- Por tipo

- Poliéster

- Epoxy

- Acrílicos

- Por tipo

Por formulario

- Polvo

- Líquido

Por utilidad

- Calefacción y refrigeración por suelo radiante

- Calefacción y refrigeración de techo

- Calefacción y refrigeración de pared

- Otros

- Finanzas y Contabilidad

Por tipo de máquina

- Máquina de rock and roll

- Máquina biaxial

- Máquina lanzadera

- Máquina de concha

- Máquina de ruedas verticales

- Máquina de llama abierta

- Máquina de carrusel

- Máquina de brazo oscilante

- Otros

Por aplicación

- Sin tanque

- Por categoría

- Automotor

- Por uso final

- Consolas

- Paneles

- Parachoques

- Guardabarros

- Otros

- Por categoría

- Agricultura

- Por uso final

- Tractores

- Cosechadoras

- Sembradoras

- Pulverizadores

- Otros

- Por uso final

- Construcción y edificación

- Por uso final

- Casas unifamiliares

- Edificio industrial

- Edificios de oficinas

- Hoteles

- Por aplicación

- Barreras viales

- Tubería

- Conductos

- Otros

- Por uso final

- Embalaje

- Por uso final

- Paletas

- Contenedores industriales

- Contenedores de almacenamiento para el consumidor

- Contenedores de transporte

- Otros

- Por uso final

- Bienes de consumo

- Muebles

- Por uso final

- Silla

- Mesa

- Salones

- Otros

- Marina

- Por uso final

- Silla

- Mesa

- Salones

- Otros

- Por uso final

- Tratamiento de agua

- Deportes y ocio

- Cámaras subterráneas

- Otros

- Por uso final

- Tanque

- Por tipo

- Tanques de agua

- Tanques químicos

- Tanques de agua de lluvia

- Tanques de combustible

- Tanques de urea

- Tanques de aceite hidráulico

- Tanques de Adbue

- Otros

- Por tipo

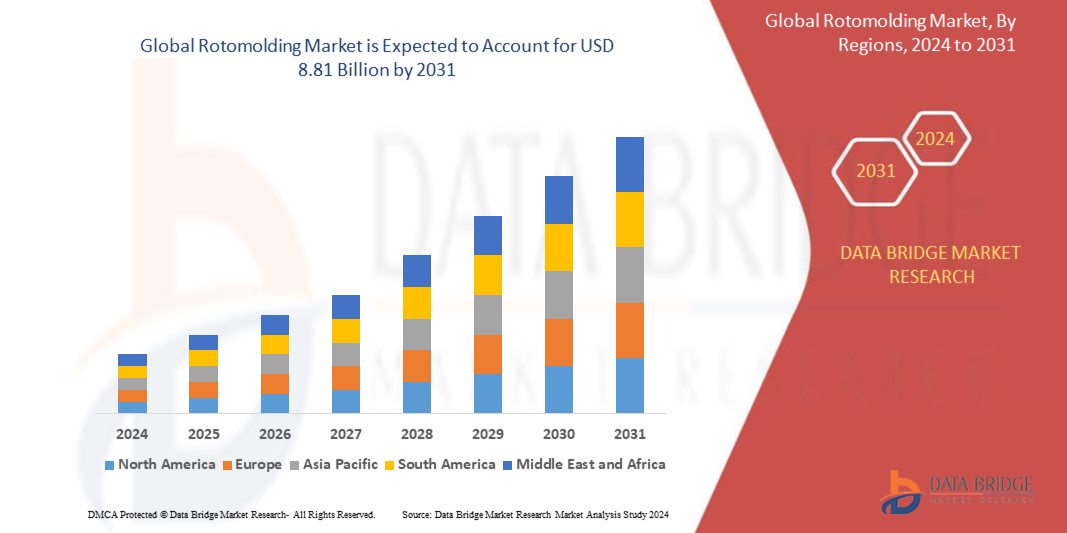

Análisis regional del mercado del rotomoldeo

El mercado está segmentado en cinco segmentos notables según el material, la forma, la utilidad, el tipo de máquina y la aplicación, como se mencionó anteriormente.

Los países cubiertos en el mercado son EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Polonia, Países Bajos, Bélgica, Turquía, Suiza, Suecia, Rusia, Dinamarca y el resto de Europa, China, Japón, India, Corea del Sur, Indonesia, Tailandia, Singapur, Australia, Filipinas, Malasia, Vietnam, Nueva Zelanda, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Arabia Saudita, Sudáfrica, Emiratos Árabes Unidos, Omán, Qatar, Kuwait y el resto de Medio Oriente y África.

Se espera que Asia-Pacífico domine y sea la región de más rápido crecimiento en el mercado global de rotomoldeo debido a las importantes inversiones en productos de rotomoldeo, también al aumento en las actividades de construcción, impulsadas por la urbanización y el desarrollo de infraestructura, lo que aumenta la demanda de productos rotomoldeados como tanques, contenedores y autopartes .

La sección de países del informe también presenta los factores que impactan en cada mercado y los cambios en la regulación nacional que impactan las tendencias actuales y futuras del mercado. Datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de caso son algunos de los indicadores utilizados para pronosticar el escenario del mercado en cada país. Asimismo, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta o escasa competencia de marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales, al proporcionar un análisis de pronóstico de los datos nacionales.

Cuota de mercado del rotomoldeo

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los líderes del mercado de rotomoldeo que operan en el mercado son:

- Centro Incorporated (EE. UU.)

- Rototech (India), Prisma Colour Limited (Reino Unido)

- Arkema (Francia), LyondellBasell Industries Holdings BV (EE. UU.)

- ROTOPLAST INC. (Canadá)

- Industrias de la Era Verde (India)

- Phychem Technologies Pvt. Ltd. (India)

- KK Nag Pvt. Ltd (Soluciones de aparatos) (India)

- Dutchland Plastics (EE. UU.)

- ROTOVIA (Islandia)

- Centro Incorporated (EE. UU.)

- Grupo Rotomachinery (Italia)

Últimos avances en el mercado del rotomoldeo

- En abril de 2023, según Shandong Zhongtian Rubber & Plastic Technology Co., Ltd., las ventajas del proceso de rotomoldeo para embarcaciones pesqueras de plástico son su seguridad, resistencia a la corrosión y bajos costos de mantenimiento. Las embarcaciones de plástico fabricadas mediante rotomoldeo tienen una gravedad específica baja en comparación con el agua, lo que garantiza que la embarcación no se hunda incluso si vuelca. Además, al estar hechas de plástico, presentan una alta resistencia a la corrosión, especialmente en el entorno marino.

- En febrero de 2023, según Marine Technology News, la empresa española Almarin actualizó el diseño de su conocida boya Balizamar y la relanzó con el nombre de EVO. Los componentes modulares de polietileno rotomoldeado mejoran la visibilidad y ahorran costes de mantenimiento en las boyas Balizamar EVO. La estructura interior está fabricada en acero galvanizado por inmersión, mientras que la marca superior es de acero inoxidable. Por lo tanto, para mantener la flotabilidad, el casco está rotomoldeado y relleno de espuma EPS de celda cerrada, lo que proporciona durabilidad y un rendimiento a largo plazo.

- En febrero de 2024, según un artículo de Rotoline, el proceso de rotomoldeo está cobrando gran importancia en el sector de la construcción civil, donde se aplica para la fabricación de una amplia gama de componentes esenciales. Desde lavabos y bañeras hasta bloques de aislamiento térmico, la versatilidad del rotomoldeo desempeña un papel crucial en la producción de piezas que cumplen con estrictos estándares funcionales y de durabilidad. La capacidad de crear elementos de construcción duraderos, rentables y fiables mediante esta innovadora técnica contribuye a su creciente adopción en la industria, aportando importantes beneficios en términos de rendimiento y valor a largo plazo para los proyectos de construcción.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ROTOMOLDING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ACCEPTANCE OF ROTOMOLDED PRODUCTS SUCH AS CONTAINERS AND PALLETS IN MATERIAL HANDLING AND PACKAGING APPLICATIONS

6.1.2 POSITIVE OUTLOOK TOWARDS THE CONSTRUCTION SECTOR

6.1.3 GROWTH IN THE POPULARITY OF ATHLETICS AND WATER SPORTS

6.1.4 IMPROVEMENT IN THE SHIPBUILDING INDUSTRY

6.2 RESTRAINTS

6.2.1 LIMITATIONS IN PROCESSING MATERIALS SUCH AS METALS AND CERAMICS

6.2.2 RESTRICTIVE COMPETITION FROM ALTERNATIVE MOLDED MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION OF ADVANCED PRINTING AND LABELING TECHNOLOGIES FOR ENHANCED PRODUCT CUSTOMIZATION AND BRANDING

6.3.2 INCREASING ACCESS TO BIO-BASED POLYMERS

6.3.3 INCREASING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY MATERIALS

6.4 CHALLENGES

6.4.1 STRINGENT RULES AND REGULATIONS AIMED AT POLYMERS PROCESSING

6.4.2 EXCESSIVE ENERGY CONSUMPTION DURING MANUFACTURING PROCESSES

7 GLOBAL ROTOMOLDING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYETHYLENE

7.2.1 LDPE

7.2.2 HDPE

7.3 POLYPROPYLENE

7.3.1 HOMOPOLYMER

7.3.2 RANDOM COPOLYMER

7.3.3 IMPACT COPOLYMER

7.4 PVC

7.5 POLYCARBONATE

7.6 NYLON

7.7 POLYURETHANE

7.8 ELASTOMERS

7.8.1 NITRILE RUBBER

7.8.2 BUTYL RUBBER

7.8.3 POLYBUTADIENE

7.8.4 CHILOROPRENE RUBBER

7.9 OTHERS

7.9.1 POLYESTER

7.9.2 EPOXY

7.9.3 ACRYLICS

8 GLOBAL ROTOMOLDING MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 GLOBAL ROTOMOLDING MARKET, BY UTILITY

9.1 OVERVIEW

9.2 UNDERFLOOR HEATING & COOLING

9.3 CEILING HEATING & COOLING

9.4 WALL HEATING & COOLING

9.5 OTHERS

10 GLOBAL ROTOMOLDING MARKET, BY MACHINE TYPE

10.1 OVERVIEW

10.2 ROCK AND ROLL MACHINE

10.3 BI-AXIAL MACHINE

10.4 SHUTTLE MACHINE

10.5 CLAMSHELL MACHINE

10.6 VERTICAL WHEEL MACHINE

10.7 OPEN FLAME MACHINE

10.8 CAROUSEL MACHINE

10.9 SWING ARM MACHINE

10.1 OTHERS

11 GLOBAL ROTOMOLDING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NON-TANK

11.2.1 AUTOMOTIVE

11.2.1.1 CONSOLES

11.2.1.2 PANELS

11.2.1.3 BUMPERS

11.2.1.4 MUDGUARDS

11.2.1.5 OTHERS

11.2.2 AGRICULTURE

11.2.2.1 TRACTORS

11.2.2.2 HARVESTERS

11.2.2.3 SEEDERS

11.2.2.4 SPRAYERS

11.2.2.5 OTHERS

11.2.3 BUILDING & CONSTRUCTION

11.2.3.1 SINGLE FAMILY HOMES

11.2.3.2 INDUSTRIAL BUILDING

11.2.3.3 OFFICE BUILDINGS

11.2.3.4 HOTELS

11.2.3.5 ROAD BARRIERS

11.2.3.6 PIPES

11.2.3.7 CONDUITS

11.2.3.8 OTHERS

11.2.4 PACKAGING

11.2.4.1 PALLETS

11.2.4.2 INDUSTRIAL CONTAINERS

11.2.4.3 CONSUMER STORAGE BINS

11.2.4.4 TRANSPORT CONTAINERS

11.2.4.5 OTHERS

11.2.5 CONSUMER GOODS

11.2.6 FURNITURE

11.2.6.1 CHAIR

11.2.6.2 TABLE

11.2.6.3 LOUNGES

11.2.6.4 OTHERS

11.2.7 MARINE

11.2.7.1 MOORING AND MARKER BUOYS

11.2.7.2 BOOM FLOATS

11.2.7.3 SOLAS-APPROVED LIFEBUOYS

11.2.7.4 AVIGATION AIDS

11.2.7.5 OTHERS

11.2.8 WATER TREATMENT

11.2.9 SPORTS AND LEISURE

11.2.10 UNDERGROUND CHAMBERS

11.2.11 OTHERS

11.3 TANK

11.3.1 WATER TANKS

11.3.2 CHEMICAL TANKS

11.3.3 RAINWATER TANKS

11.3.4 FUEL TANKS

11.3.5 UREA TANKS

11.3.6 HYDRAULIC OIL TANKS

11.3.7 ADBUE TANKS

11.3.8 OTHERS

12 GLOBAL ROTOMOLDING MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.2.1 CHINA

12.2.2 INDIA

12.2.3 JAPAN

12.2.4 SOUTH KOREA

12.2.5 INDONESIA

12.2.6 THAILAND

12.2.7 SINGAPORE

12.2.8 AUSTRALIA

12.2.9 PHILIPPINES

12.2.10 MALAYSIA

12.2.11 VIETNAM

12.2.12 NEW ZEALAND

12.2.13 REST OF ASIA-PACIFIC

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 U.K.

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 POLAND

12.3.7 NETHERLANDS

12.3.8 BELGIUM

12.3.9 TURKEY

12.3.10 SWITZERLAND

12.3.11 SWEDEN

12.3.12 RUSSIA

12.3.13 DENMARK

12.3.14 REST OF EUROPE

12.4 NORTH AMERICA

12.4.1 U.S.

12.4.2 CANADA

12.4.3 MEXICO

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 SAUDI ARABIA

12.6.3 U.A.E

12.6.4 OMAN

12.6.5 QATAR

12.6.6 KUWAIT

12.6.7 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL ROTOMOLDING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 GRANGER INDUSTRIES INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ARKEMA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CENTRO INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 DUTCHLAND PLASTICS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 FERRY INDUSTRIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 FIXOPAN

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GREEN AGE INDUSTRIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 K.K NAG PVT. LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 LOOPA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 NAROTO

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 OREX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 PERSICO S.P.A.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PHYCHEM TECHNOLOGIES PVT. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PRISMA COLOUR LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROTO DYNAMICS

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ROTOMACHINERY GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ROTO MACHINES LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 ROTOPLAST INC

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 ROTOTECH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ROTOVIA.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SHANDONG ZHONGTIAN RUBBER & PLASTIC TECHNOLOGY CO., LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCT CODES:

TABLE 2 GLOBAL ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL POLYETHYLENE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL POLYPROPYLENE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL PVC IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL POLYCARBONATE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL NYLON IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL POLYURETHANE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL ELASTOMERS IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL OTHERS IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL POWDER IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL LIQUID IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL UNDERFLOOR HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL CEILING HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL WALL HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL OTHERS SEGMENT IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL ROTOMOLDING MARKET: BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL ROCK AND ROLL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL BI-AXIAL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL SHUTTLE MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL CLAMSHELL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL VERTICAL WHEEL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL OPEN FLAME MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL CAROUSEL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL SWING ARM MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS SEGMENT IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL NON-TANK IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL NON TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL AUTOMOTIVE IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL AGRICULTURE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 43 GLOBAL TANK IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 GLOBAL TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GLOBAL ROTOMOLDING MARKET, BY REGION 2018-2032, USD (THOUSAND)

TABLE 46 ASIA-PACIFIC ROTOMOLDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CHINA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 CHINA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CHINA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 72 CHINA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 CHINA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 INDIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 89 INDIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 90 INDIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 INDIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 INDIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 93 INDIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 94 INDIA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 95 INDIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 96 INDIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 INDIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 98 INDIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 99 INDIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 100 INDIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 JAPAN ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 JAPAN OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 JAPAN ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 107 JAPAN ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 108 JAPAN ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 JAPAN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 JAPAN NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 JAPAN AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 112 JAPAN AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 113 JAPAN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 114 JAPAN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 JAPAN PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 116 JAPAN FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 117 JAPAN MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 118 JAPAN TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH KOREA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 120 SOUTH KOREA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH KOREA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH KOREA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 125 SOUTH KOREA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SOUTH KOREA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH KOREA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH KOREA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDONESIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 138 INDONESIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 INDONESIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 INDONESIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 149 INDONESIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 153 INDONESIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 154 INDONESIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 THAILAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 156 THAILAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 THAILAND POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 THAILAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 THAILAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 THAILAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 161 THAILAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 162 THAILAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 THAILAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 164 THAILAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 165 THAILAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 166 THAILAND AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 167 THAILAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 168 THAILAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 THAILAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 170 THAILAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 171 THAILAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 THAILAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SINGAPORE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 174 SINGAPORE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SINGAPORE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SINGAPORE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SINGAPORE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SINGAPORE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 179 SINGAPORE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 SINGAPORE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 184 SINGAPORE AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 186 SINGAPORE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 188 SINGAPORE FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 AUSTRALIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 192 AUSTRALIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 AUSTRALIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 AUSTRALIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 AUSTRALIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 AUSTRALIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 197 AUSTRALIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 198 AUSTRALIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 AUSTRALIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 AUSTRALIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 201 AUSTRALIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 202 AUSTRALIA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 203 AUSTRALIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 204 AUSTRALIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 AUSTRALIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 206 AUSTRALIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 207 AUSTRALIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 208 AUSTRALIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 PHILIPPINES ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 210 PHILIPPINES POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 PHILIPPINES POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 PHILIPPINES ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 PHILIPPINES OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 PHILIPPINES ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 215 PHILIPPINES ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 216 PHILIPPINES ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 PHILIPPINES ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 218 PHILIPPINES NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 219 PHILIPPINES AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 220 PHILIPPINES AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 221 PHILIPPINES BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 222 PHILIPPINES BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 223 PHILIPPINES PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 224 PHILIPPINES FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 225 PHILIPPINES MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 226 PHILIPPINES TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 237 MALAYSIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 238 MALAYSIA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 239 MALAYSIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 240 MALAYSIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 241 MALAYSIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 242 MALAYSIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 243 MALAYSIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 244 MALAYSIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 VIETNAM ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 246 VIETNAM POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 VIETNAM POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 VIETNAM ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 VIETNAM OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 VIETNAM ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 251 VIETNAM ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 252 VIETNAM ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 VIETNAM ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 254 VIETNAM NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 255 VIETNAM AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 258 VIETNAM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 260 VIETNAM FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 262 VIETNAM TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 NEW ZEALAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 264 NEW ZEALAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 NEW ZEALAND POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 NEW ZEALAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 NEW ZEALAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 NEW ZEALAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 269 NEW ZEALAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 270 NEW ZEALAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 NEW ZEALAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 272 NEW ZEALAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 273 NEW ZEALAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 274 NEW ZEALAND AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 275 NEW ZEALAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 276 NEW ZEALAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 277 NEW ZEALAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 278 NEW ZEALAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 279 NEW ZEALAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 280 NEW ZEALAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 REST OF ASIA-PACIFIC ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 282 EUROPE ROTOMOLDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 283 EUROPE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 284 EUROPE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 EUROPE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 EUROPE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 EUROPE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 EUROPE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 289 EUROPE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 290 EUROPE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 EUROPE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 292 EUROPE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 293 EUROPE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 294 EUROPE AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 295 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 296 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 297 EUROPE PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 298 EUROPE FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 299 EUROPE MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 300 EUROPE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 GERMANY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 302 GERMANY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 GERMANY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 GERMANY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 GERMANY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 GERMANY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 307 GERMANY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 308 GERMANY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 GERMANY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 310 GERMANY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 311 GERMANY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 312 GERMANY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 313 GERMANY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 314 GERMANY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 315 GERMANY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 316 GERMANY FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 317 GERMANY MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 318 GERMANY TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 FRANCE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 320 FRANCE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 FRANCE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 FRANCE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 FRANCE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 FRANCE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 325 FRANCE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 326 FRANCE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 FRANCE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 328 FRANCE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 329 FRANCE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 330 FRANCE AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 331 FRANCE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 332 FRANCE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 333 FRANCE PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 334 FRANCE FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 335 FRANCE MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 336 FRANCE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 U.K. ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 338 U.K. POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 U.K. POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 U.K. ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 U.K. OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 U.K. ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 343 U.K. ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 344 U.K. ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 U.K. ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 346 U.K. NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 347 U.K. AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 348 U.K. AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 349 U.K. BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 350 U.K. BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 351 U.K. PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 352 U.K. FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 353 U.K. MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 354 U.K. TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 ITALY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 356 ITALY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 ITALY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 ITALY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 ITALY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 ITALY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 361 ITALY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 362 ITALY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 ITALY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 364 ITALY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 365 ITALY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 366 ITALY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 367 ITALY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 368 ITALY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 369 ITALY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 370 ITALY FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 371 ITALY MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 372 ITALY TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 SPAIN ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 374 SPAIN POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SPAIN POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 SPAIN ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 SPAIN OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 SPAIN ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 379 SPAIN ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 380 SPAIN ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 SPAIN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 382 SPAIN NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 383 SPAIN AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 384 SPAIN AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 385 SPAIN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 386 SPAIN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 387 SPAIN PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 388 SPAIN FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 389 SPAIN MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 390 SPAIN TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 POLAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 392 POLAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 POLAND POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 POLAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 POLAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 POLAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 397 POLAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 398 POLAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 POLAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 400 POLAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 401 POLAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 402 POLAND AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 403 POLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 404 POLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 405 POLAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 406 POLAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 407 POLAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 408 POLAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 NETHERLANDS ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 410 NETHERLANDS POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 NETHERLANDS POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 NETHERLANDS ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 NETHERLANDS OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 NETHERLANDS ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 415 NETHERLANDS ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 416 NETHERLANDS ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 NETHERLANDS ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 418 NETHERLANDS NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 419 NETHERLANDS AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 420 NETHERLANDS AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 421 NETHERLANDS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 422 NETHERLANDS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 423 NETHERLANDS PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 424 NETHERLANDS FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 425 NETHERLANDS MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 426 NETHERLANDS TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 BELGIUM ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 428 BELGIUM POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 BELGIUM POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 BELGIUM ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 431 BELGIUM OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 432 BELGIUM ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 433 BELGIUM ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 434 BELGIUM ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 BELGIUM ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 436 BELGIUM NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 437 BELGIUM AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 438 BELGIUM AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 439 BELGIUM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 440 BELGIUM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 441 BELGIUM PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 442 BELGIUM FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 443 BELGIUM MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 444 BELGIUM TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 TURKEY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 446 TURKEY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 TURKEY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 TURKEY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 449 TURKEY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 450 TURKEY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 451 TURKEY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 452 TURKEY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 453 TURKEY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 454 TURKEY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 455 TURKEY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 456 TURKEY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 457 TURKEY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 458 TURKEY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 459 TURKEY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)