Global Saturated Kraft Paper Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.76 Billion

USD

2.60 Billion

2024

2032

USD

1.76 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.76 Billion | |

| USD 2.60 Billion | |

|

|

|

|

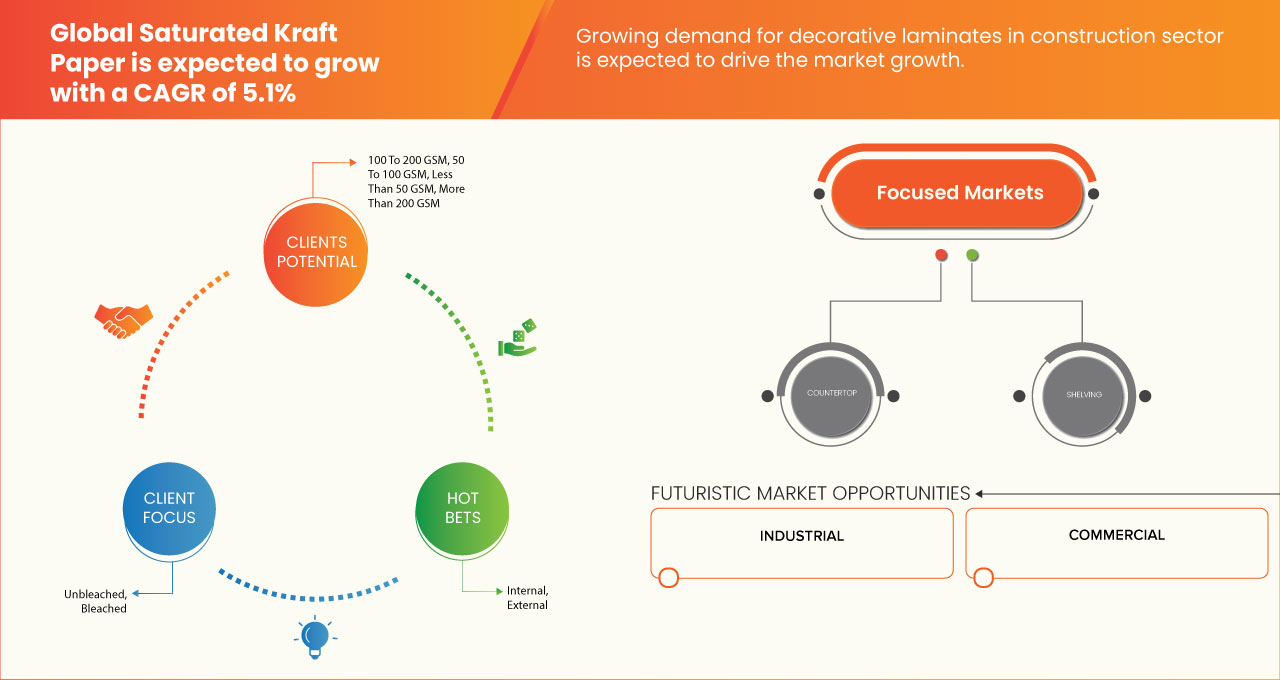

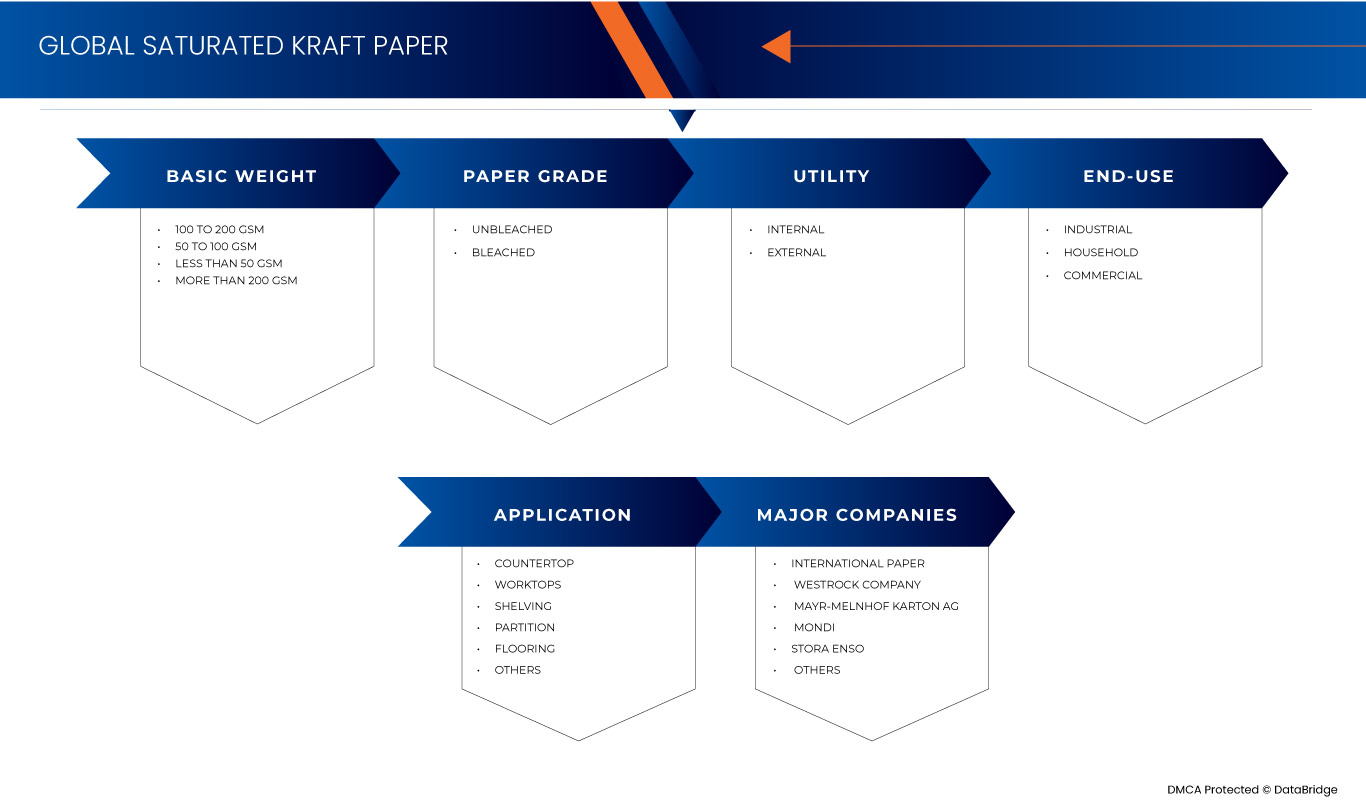

Segmentación del mercado global de papel kraft saturado, gramaje básico (100 a 200 g/m², 50 a 100 g/m², menos de 50 g/m² y más de 200 g/m²), grado de papel (sin blanquear y blanqueado), aplicación (encimeras, encimeras, estanterías, tabiques y suelos), utilidad (interna y externa), uso final (industrial, doméstico y comercial): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado del papel kraft saturado

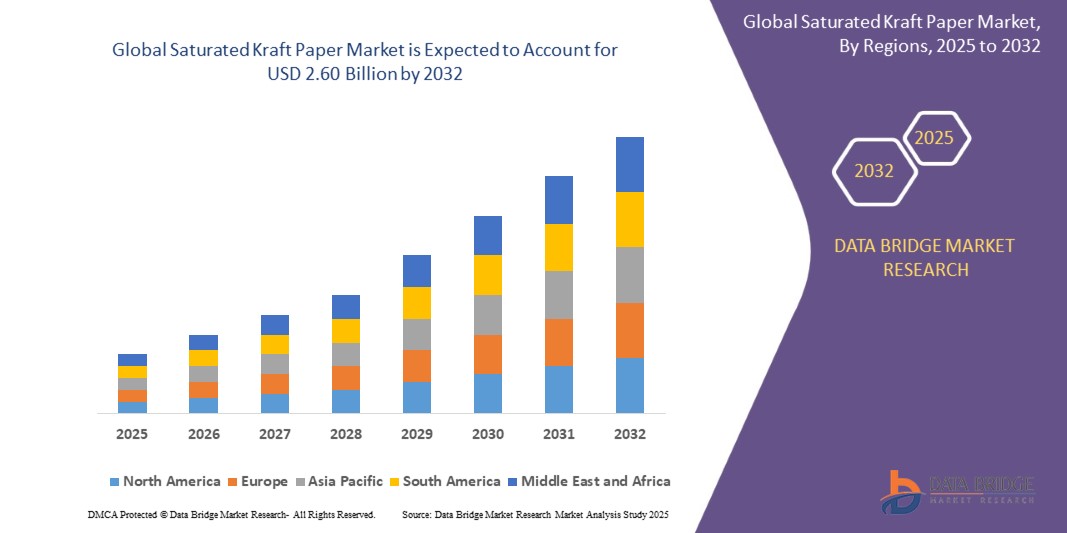

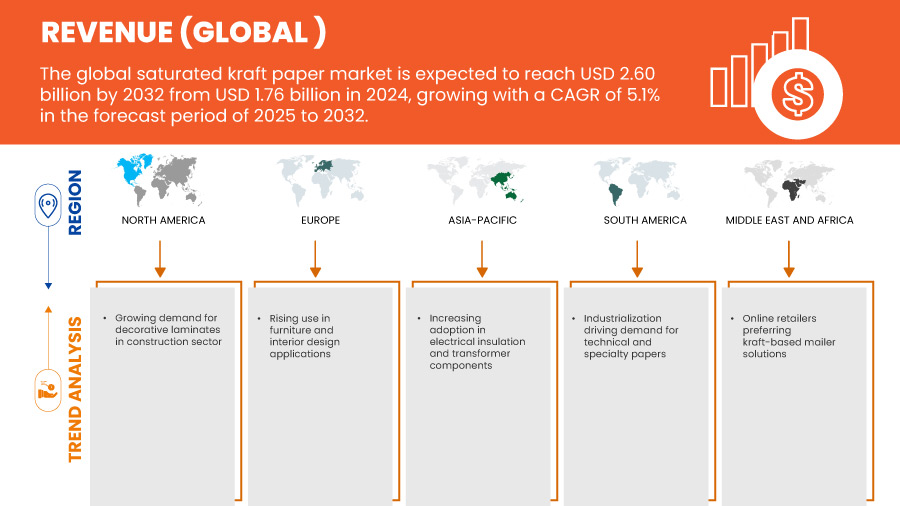

- El mercado mundial de papel kraft saturado se valoró en USD 1.760 millones en 2024 y se espera que alcance los USD 2.600 millones en 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 5,1%, impulsado principalmente por la rápida industrialización y urbanización.

- Este crecimiento está impulsado por factores como la expansión del comercio electrónico, las alternativas ecológicas, la rentabilidad y la creciente demanda de envases sostenibles.

Análisis del mercado del papel kraft saturado

- El mercado mundial de papel kraft saturado está experimentando un crecimiento constante impulsado por la creciente demanda en las industrias de la construcción, el mobiliario y el diseño de interiores, donde el material es valorado por su resistencia, flexibilidad y resistencia a la humedad y los productos químicos.

- El creciente enfoque en materiales sostenibles y reciclables también está impulsando la expansión del mercado, ya que el papel kraft saturado a menudo se produce a partir de pulpa de madera renovable y está certificado bajo etiquetas ecológicas como FSC y PEFC.

- Los fabricantes están innovando con formulaciones de resina y tecnologías de procesamiento para mejorar el rendimiento del producto y satisfacer diversos requisitos de uso final.

- Las regiones clave que contribuyen al crecimiento del mercado incluyen América del Norte, Europa y Asia-Pacífico, con economías emergentes que muestran un potencial significativo debido a la rápida urbanización y el desarrollo de infraestructura.

- Por ejemplo,

- En diciembre de 2023, Mondi anunció la ampliación de su gama de papel kraft de saturación y un aumento de su capacidad para ofrecer un mejor servicio a los fabricantes de paneles de construcción, encimeras, muebles y películas técnicas. Con una nueva máquina de papel en su planta de Štĕtí (República Checa) y una producción optimizada en Frantschach (Austria) y Dynäs (Suecia), Mondi garantiza plazos de entrega cortos, un suministro fiable y una mayor producción de Advantage MF Boost para aplicaciones laminadas en toda Europa.

- En diciembre de 2021, Nordic Paper Holding AB completó la adquisición de Glassine Canada Inc. por un precio preliminar de 46,3 millones de dólares. La empresa adquirida se especializa en papel antigrasa para aplicaciones alimentarias y atiende principalmente al mercado norteamericano. Esta adquisición fortaleció la presencia de Nordic Paper Holding AB en Norteamérica y amplió su gama de productos y su proximidad a los clientes.

- Apoyó el crecimiento en el saturado mercado del papel kraft mejorando las capacidades de producción y abordando la creciente demanda de papeles especiales y de calidad alimentaria.

Alcance del informe y segmentación del mercado de papel kraft saturado

|

Atributos |

Perspectivas clave del mercado del papel kraft saturado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

América del norte

Europa

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del papel kraft saturado

Expansión del embalaje para el comercio electrónico

- El mercado saturado del papel kraft está experimentando un fuerte auge, especialmente debido al crecimiento del comercio electrónico. A medida que más personas compran en línea, aumenta la demanda de soluciones de embalaje sostenibles, lo que convierte al papel kraft en una opción popular.

- Este tipo de papel es ecológico, duradero y perfecto para embalar productos que necesitan protección adicional durante el envío.

- Con la rápida expansión del comercio electrónico, las empresas están recurriendo al papel kraft por su capacidad para gestionar productos de diversos tamaños y ofrecer una entrega segura. La tendencia a reducir el uso de plástico también impulsa el mercado, ya que el papel kraft ofrece una alternativa ecológica.

- Por ejemplo,

- En octubre de 2023, la industria del comercio electrónico experimenta un rápido crecimiento, impulsado por nuevas tecnologías e innovaciones orientadas a la sostenibilidad. Los fabricantes están optimizando sus procesos para crear soluciones de embalaje más ecológicas. Con la creciente disponibilidad de teléfonos inteligentes y acceso a internet a nivel mundial, más personas que nunca compran en línea. Esto ha impulsado un cambio significativo en la forma de empaquetar y entregar productos, priorizando la sostenibilidad. El futuro del comercio electrónico y el embalaje se presenta prometedor, impulsado por estos avances y la creciente demanda de prácticas ecológicas.

- En marzo de 2024, según Mondi Group, a medida que evoluciona el embalaje del comercio electrónico, es crucial comprender cómo los consumidores lo gestionan tras recibir sus pedidos. Una encuesta revela que la sostenibilidad es una preocupación importante para los consumidores, y muchos están deseosos de reducir el desperdicio de embalaje. Curiosamente, el 47 % de los baby boomers tiende a reciclar los embalajes, mientras que solo el 32 % de la generación Z hace lo mismo. La generación más joven, que suele comprar ropa en embalajes de plástico, tiende a desecharla en la basura general. Esto pone de manifiesto la necesidad de opciones de embalaje más sostenibles, especialmente para los productos populares entre los compradores más jóvenes.

- En general, el crecimiento del comercio electrónico está impulsando la adopción de papel kraft saturado en los envases de todas las industrias.

Dinámica del mercado del papel kraft saturado

Conductor

Creciente demanda de laminados decorativos en el sector de la construcción

- El papel kraft saturado sirve como material fundamental en la producción de laminados de alta presión (HPL), que se utilizan ampliamente para mejorar superficies como pisos, encimeras y paneles de pared.

- A medida que la urbanización se acelera y las preferencias de los consumidores cambian hacia interiores estéticamente agradables y duraderos, aumenta la necesidad de dichos laminados.

- Esta tendencia impulsa directamente el consumo de papel kraft saturado, dado su papel esencial en la producción de laminados. Además, el énfasis de la industria de la construcción en materiales sostenibles y rentables intensifica aún más esta demanda, ya que el papel kraft saturado ofrece reciclabilidad y beneficios ambientales.

- En consecuencia, la relación simbiótica entre el crecimiento de los laminados decorativos en la construcción y el saturado mercado del papel kraft subraya la expansión de este último en respuesta a la evolución de las preferencias arquitectónicas y de diseño.

Por ejemplo,

- En diciembre de 2024, NBM Media Pvt. Ltd. destacó que CenturyPly reafirmó su liderazgo en el mercado indio de contrachapado y chapa decorativa, con una valoración de USD 1640,97 millones. La compañía se está expandiendo agresivamente con inversiones en nuevas instalaciones y en instalaciones abandonadas en Andhra Pradesh para impulsar su capacidad de producción de MDF y laminados. Innovaciones como laminados antihuellas, chapas de diseño y Century Cubicles destacan su enfoque innovador en el diseño. CenturyPly también está ampliando su red de distribuidores en ciudades de nivel 2 a 4 y aspira a duplicar las exportaciones de laminados hasta alcanzar los USD 34,62 millones en tres años, lo que refleja la sólida demanda nacional e internacional.

- En diciembre de 2021, según Techbullion, se prevé que el mercado del papel crezca debido a la creciente demanda de laminados decorativos para suelos, muebles y aplicaciones de interior. El auge de los muebles listos para ensamblar y las superficies laminadas en la industria de la construcción, sumado a las continuas innovaciones en diseño, está impulsando la expansión del mercado. Además, el crecimiento del comercio electrónico está abriendo nuevas fuentes de ingresos. La durabilidad, reciclabilidad y resistencia a la humedad del papel kraft saturado lo hacen ideal para diversas aplicaciones de construcción e interiorismo.

- El papel kraft saturado, esencial para la producción de laminados de alta presión para superficies como suelos y encimeras, se beneficia directamente de esta tendencia. Esta simbiosis subraya la importancia del papel kraft saturado para satisfacer las demandas modernas de la construcción y el diseño.

Oportunidad

Los minoristas en línea prefieren las soluciones de envío basadas en papel kraft.

- El papel kraft saturado ofrece importantes oportunidades, especialmente con la creciente adopción de soluciones de envío basadas en kraft por parte de los minoristas en línea. A medida que el comercio electrónico continúa expandiéndose, existe una mayor demanda de embalajes sostenibles y duraderos.

- Los sobres de papel kraft, al ser biodegradables y ligeros, cumplen estos criterios, convirtiéndolos en la opción preferida para el envío de diversos productos. Además, los avances en el diseño de sobres de papel kraft, como su mayor resistencia al agua y al desgarro, amplían aún más su aplicabilidad en diferentes sectores.

- Los fabricantes que se centran en estas innovaciones pueden satisfacer eficazmente las necesidades cambiantes de la industria del comercio electrónico y aprovechar el potencial del mercado.

Por ejemplo,

- En enero de 2021, según un artículo publicado por NewsPackaging, Mondi inauguró una máquina de papel kraft de 72,2 millones de dólares en su fábrica de Štětí, República Checa, convirtiéndose en la primera de Europa dedicada a la producción de papel kraft especial a partir de fibras frescas y recicladas para bolsas de compra en tiendas minoristas y online. La máquina producía hasta 130.000 toneladas anuales de papel EcoVantage 100 % reciclable, que ofrece alta resistencia, fácil de imprimir y un aspecto natural. Este desarrollo generó una oportunidad en el saturado mercado del papel kraft, impulsando la transición de los minoristas online hacia soluciones de envío basadas en kraft, sostenibles y adecuadas para las necesidades de branding y embalaje del comercio electrónico.

- En junio de 2023, según GIE Media, Inc., Walmart anunció que adoptaría el uso de sobres de papel kraft para entregas a domicilio y que ofrecería la opción de no usar bolsas en los pedidos de recogida en línea, con el objetivo de una implementación más amplia para finales de año. Con un crecimiento del 27 % en sus operaciones de comercio electrónico, la compañía se propuso impulsar el procesamiento de pedidos utilizando alternativas en papel en toda su red. Se esperaba que esta medida impulsara la demanda de papel kraft en más de 2000 toneladas anuales. Esta decisión representó una clara oportunidad en el saturado mercado del papel kraft, lo que apunta a una creciente adopción de soluciones de sobres de papel kraft por parte de los principales minoristas en línea.

- La rápida expansión del comercio electrónico ha generado una mayor demanda de materiales de embalaje fiables y adaptables. El papel kraft, conocido por su resistencia y versatilidad, es ideal para satisfacer estas necesidades.

- Este cambio permite a los fabricantes de papel kraft innovar y diversificar su oferta de productos, por ejemplo, desarrollando variantes mejoradas de papel kraft para satisfacer las necesidades específicas de los minoristas en línea.

Restricción/Desafío

Disponibilidad de materiales sustitutos con menores costos de producción

- El mercado enfrenta una restricción significativa debido a la creciente disponibilidad de materiales sustitutos que ofrecen un rendimiento similar o mejorado a costos de producción más bajos.

- Alternativas como los compuestos biogénicos (por ejemplo, PaperShell), los laminados sintéticos y las láminas de plástico de bajo costo están ganando terreno en industrias como la del mueble, el embalaje y la construcción.

- Estos sustitutos suelen ofrecer mayor durabilidad, resistencia a la humedad o flexibilidad estética, además de ser rentables. A medida que las industrias priorizan la sostenibilidad y la rentabilidad, la demanda de papel kraft saturado tradicional podría disminuir, lo que afectaría el crecimiento del mercado.

Por ejemplo,

- En febrero de 2025, según un artículo publicado por Wood Central, la creciente tendencia hacia materiales biogénicos innovadores como PaperShell se perfila como un posible obstáculo para el mercado. Desarrollado a partir de papel kraft virgen o reciclado, PaperShell ofrece una alternativa ligera, moldeable y muy duradera para su uso en arquitectura, automoción y bienes de consumo. Su capacidad para sustituir materiales tradicionales con un menor impacto ambiental y el creciente interés de las industrias que buscan soluciones rentables y sostenibles ponen de manifiesto la creciente disponibilidad de materiales sustitutos, desafiando el dominio de los productos convencionales de papel kraft saturado.

- En junio de 2022, Stora Enso lanzó AvantForte WhiteTop, un soporte kraft 100 % virgen a base de fibra y sin OBA, diseñado para aplicaciones de embalaje premium, como alimentos frescos y comercio electrónico. Diseñado con tecnología Tri-Ply, ofrece una resistencia y una calidad de impresión superiores, lo que permite un uso eficiente del material. Producido en la planta modernizada de Oulu (Finlandia), el producto refleja la transición del mercado hacia alternativas renovables, sin plástico y de alto rendimiento. Esta innovación aumenta la presión sobre los productores convencionales de papel kraft saturado, ya que los soportes más nuevos y de alta resistencia pueden servir como sustitutos eficientes en determinados casos de uso final.

- La creciente adopción de materiales sustitutos de bajo costo y alto rendimiento representa una limitación considerable para el saturado mercado del papel kraft. A medida que las industrias optan cada vez más por alternativas más económicas y sostenibles, la demanda de papel kraft convencional podría disminuir. Esta creciente competencia de los sustitutos podría frenar la expansión del mercado, impulsando a los fabricantes a innovar y mejorar la propuesta de valor del papel kraft saturado.

Alcance del mercado del papel kraft saturado

El mercado está segmentado en función del peso básico, el tipo de papel, la aplicación, la utilidad y el uso final.

|

Segmentación |

Subsegmentación |

|

Por peso básico |

|

|

Por grado de papel |

|

|

Por aplicación |

|

|

Por utilidad |

|

|

Por uso final |

|

Análisis regional del mercado del papel kraft saturado

Asia-Pacífico es la región dominante en el saturado mercado del papel Kraft.

- Asia-Pacífico domina el saturado mercado mundial del papel kraft por varias razones clave. En primer lugar, la región alberga algunas de las economías manufactureras más grandes del mundo, como China e India, donde la demanda de materiales de embalaje está en auge.

- El rápido crecimiento del comercio electrónico en estos países ha aumentado significativamente la necesidad de soluciones de embalaje sostenibles y duraderas como el papel kraft saturado.

- La región Asia-Pacífico prioriza la sostenibilidad, y gobiernos y empresas impulsan alternativas ecológicas a los envases de plástico tradicionales. Esto impulsa a los fabricantes a adoptar materiales más sostenibles, fácilmente disponibles en la región.

- Otra razón es el amplio mercado de consumo de la región, que muestra una creciente preferencia por productos ecológicos. La creciente concienciación sobre los problemas ambientales ha generado una demanda de envases reciclables y biodegradables, lo que impulsa aún más la adopción del papel kraft.

Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento.

- Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento en el mercado mundial de papel kraft saturado debido a varios factores. El sector del comercio electrónico en rápida expansión de la región es un factor clave, y el aumento de las compras en línea se traduce en una mayor demanda de soluciones de embalaje duraderas y ecológicas, como el papel kraft saturado.

- Países como China e India son grandes centros de fabricación, lo que permite una producción rentable de papel kraft saturado.

- A medida que la sostenibilidad se convierte en una mayor prioridad, tanto los consumidores como las empresas en Asia-Pacífico están impulsando alternativas de embalaje al plástico, lo que hace del papel kraft una opción atractiva.

- Estos países también están adoptando regulaciones ambientales más estrictas, lo que impulsa a las empresas a utilizar materiales de embalaje reciclables y biodegradables. La creciente concienciación sobre los problemas ambientales entre los consumidores de la región impulsa aún más la demanda de embalajes sostenibles.

Cuota de mercado del papel Kraft saturado

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- International Paper (EE. UU.)

- Compañía WestRock (EE. UU.)

- Mayr-Melnhof Karton AG (Austria)

- Mundial (Austria)

- Ahlström

- Stora Enso (Finlandia)

- SCG International Corporation (Tailandia)

- Nordic Paper (Suecia)

- Mayr-Melnhof Karton AG

- Ranheim

- WARAQ, (Arabia Saudita)

- Fortune Paper Mills LLP (India)

- Papel especial Potsdam Inc. (EE. UU.)

- Productos de papel Pudumjee (India)

- Gordon Paper Company, Inc. (EE. UU.)

- Corporación Internacional de Tecnologías del Norte (NTIC). (EE. UU.)

- Compañía papelera Fleenor

- Smurfit Kappa (EE. UU.)

- Venkraft Paper Mills Pvt. Ltd. (India)

- Papeles Onyx. (EE. UU.)

- Namibia Critical Metals Inc. (Canadá)

Últimos avances en el mercado mundial del papel kraft saturado

- En diciembre de 2021, MM Group anunció sus planes de entrar en el mercado del papel kraft para sacos, aprovechando su fábrica de Kwidzyn en Polonia para satisfacer la creciente demanda de envases sostenibles a base de fibra. La empresa se centrará en el papel kraft blanqueado para sacos, a la vez que ampliará su capacidad de producción de papel kraft de saturación ABSORBEX. El director ejecutivo, Peter Oswald, destacó el sólido crecimiento de las ventas de IPACK y sus planes para seguir innovando en el sector del papel kraft.

- En marzo de 2025, Mondi anunció su colaboración con Hans Schmid KG para el suministro de Ad/Vantage Boost, un papel kraft saturado para laminados de muebles y suelos. Conocido por su resistencia y capacidad de absorción, Ad/Vantage Boost actúa como soporte de resina, garantizando aplicaciones de laminado de alto rendimiento. Producido con fibras largas de origen 100 % responsable en Suecia y Austria, está disponible con certificación FSC o PEFC. Esta colaboración refuerza el suministro europeo de papel impregnado de primera calidad para encimeras, muebles y usos industriales.

- En septiembre de 2024, Ahlstrom inició un estudio de viabilidad para incorporar la capacidad de recubrimiento de saturación y liberación para papeles base de cinta, atendiendo así la creciente demanda, especialmente en América. La inversión ampliaría su gama de productos, incluyendo papeles base crepados, para industrias como la automotriz, la aeroespacial, la construcción y el embalaje. Se alinea con los objetivos de sostenibilidad de Ahlstrom al mejorar la reciclabilidad y utilizar más materiales renovables. Se espera una decisión poco después de la finalización del estudio.

- En octubre de 2024, MM Kotkamills presentó ALASKA KRAFT, un nuevo cartón de fibra virgen totalmente recubierto, producido en su planta MM Količevo en Eslovenia. El cartón presentaba una capa superior blanca con un 10 % de fibras recicladas y un reverso kraft marrón, lo que le ofrecía resistencia y atractivo visual. Fue diseñado para aplicaciones de embalaje como bandejas de fruta, fundas y envases para llevar. El producto combinaba alta rigidez, durabilidad y sostenibilidad gracias al uso de fibras vírgenes y recicladas de origen responsable. Con este lanzamiento, la empresa reforzó su cartera de productos ecológicos y mejoró la flexibilidad de sus servicios en los mercados europeos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SATURATED KRAFT PAPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 BASIC WEIGHT TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 RAW MATERIAL COVERAGE

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 IMPORT EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 TARIFFS & IMPACT ON THE MARKET

4.6.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.6.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.6.3 VENDOR SELECTION CRITERIA DYNAMICS

4.6.4 IMPACT ON SUPPLY CHAIN

4.6.4.1 RAW MATERIAL PROCUREMENT

4.6.4.2 MANUFACTURING AND PRODUCTION

4.6.4.3 LOGISTICS AND DISTRIBUTION

4.6.4.4 PRICE PITCHING AND POSITION OF MARKET

4.6.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.6.5.1 SUPPLY CHAIN OPTIMIZATION

4.6.5.2 JOINT VENTURE ESTABLISHMENTS

4.6.6 IMPACT ON PRICES

4.6.7 REGULATORY INCLINATION

4.6.7.1 GEOPOLITICAL SITUATION

4.6.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

4.6.7.2.1 FREE TRADE AGREEMENTS

4.6.7.3 DOMESTIC COURSE OF CORRECTION

4.6.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.7 VENDOR SELECTION CRITERIA

4.8 PESTEL ANALYSIS

4.8.1 POLITICAL FACTORS

4.8.2 ECONOMIC FACTORS

4.8.3 SOCIAL FACTORS

4.8.4 TECHNOLOGICAL FACTORS

4.8.5 ENVIRONMENTAL FACTORS

4.8.6 LEGAL FACTORS

4.9 REGULATION COVERAGE

4.1 POTENTIAL BUYER LIST

4.11 SUPPLY VS DEMAND ANALYSIS

4.12 LAMINATE PRODUCERS

4.13 SKB PRODUCERS

4.14 PRODUCTION CAPACITY OVERVIEW

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR DECORATIVE LAMINATES IN CONSTRUCTION SECTOR

5.1.2 RISING USE IN FURNITURE AND INTERIOR DESIGN APPLICATIONS

5.1.3 INCREASING ADOPTION IN ELECTRICAL INSULATION AND TRANSFORMER COMPONENTS

5.1.4 INDUSTRIALIZATION DRIVING DEMAND FOR TECHNICAL AND SPECIALTY PAPERS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTE MATERIALS WITH LOWER PRODUCTION COSTS

5.2.2 ENVIRONMENTAL REGULATIONS ON CHEMICAL USAGE IN PAPER TREATMENT

5.3 OPPORTUNITIES

5.3.1 ONLINE RETAILERS PREFER KRAFT-BASED MAILER SOLUTIONS

5.3.2 FLEXIBLE PACKAGING INNOVATIONS USING KRAFT LAYERS

5.3.3 RISING INTEREST IN RENEWABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 FLUCTUATING WOOD PULP PRICES IMPACT PRODUCTION COST

5.4.2 HIGH COMPETITION FROM LOW-COST ASIAN SUPPLIERS

6 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT

6.1 OVERVIEW

6.2 100 TO 200 GSM

6.3 50 TO 100 GSM

6.4 LESS THAN 50 GSM

6.5 MORE THAN 200 GSM

7 GLOBAL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE

7.1 OVERVIEW

7.2 UNBLEACHED

7.2.1 UNBLEACHED, BY TYPE

7.3 BLEACHED

7.3.1 BLEACHED, BY TYPE

8 GLOBAL SATURATED KRAFT PAPER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COUNTERTOP

8.3 WORKTOPS

8.4 SHELVING

8.5 PARTITION

8.6 FLOORING

8.7 OTHERS

9 GLOBAL SATURATED KRAFT PAPER MARKET, BY UTILITY

9.1 OVERVIEW

9.2 INTERNAL

9.3 EXTERNAL

10 GLOBAL SATURATED KRAFT PAPER MARKET, BY END-USE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 HOUSEHOLD

10.4 COMMERCIAL

11 GLOBAL SATURATED KRAFT PAPER MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 SOUTH KOREA

11.2.5 INDONESIA

11.2.6 THAILAND

11.2.7 SINGAPORE

11.2.8 AUSTRALIA AND NEW ZEALAND

11.2.9 MALAYSIA

11.2.10 PHILIPPINES

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 U.K

11.4.3 FRANCE

11.4.4 ITALY

11.4.5 NETHERLANDS

11.4.6 BELGIUM

11.4.7 RUSSIA

11.4.8 TURKEY

11.4.9 LUXEMBOURG

11.4.10 SWITZERLAND

11.4.11 REST OF EUROPE

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 UNITED ARAB EMIRATES

11.6.2 SAUDI ARABIA

11.6.3 SOUTH AFRICA

11.6.4 ISRAEL

11.6.5 EGYPT

11.6.6 REST OF MIDDLE EAST AND AFRICA

12 GLOBAL SATURATED KRAFT PAPER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTERNATIONAL PAPERS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 WESTROCK COMPANY

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 REVENUE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MAYR-MELNHOF KARTON AG

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 RECENT DEVELOPMENT

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 AHLSTROM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 FLEENOR PAPER COMPANY

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 FORTUNE PAPER MILLS LLP

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GORDON PAPER COMPANY, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HAL INDUSTRIES INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 MM KOTKAMILLS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS/NEWS

14.11 NORDIC PAPER HOLDING AB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NORTHERN TECHNOLOGIES INTERNATIONAL CORPORATION (NTIC) (A PART OF ZERUST)

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ONYX PAPERS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 POTSDAM SPECIALTY PAPER INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PUDUMJEE PAPER PRODUCTS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 RANHEIM PAPER & BOARD

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SCG INTERNATIONAL CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 STORA ENSO

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 VENKRAFT PAPER MILLS PVT. LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WARAQ

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 SATURATED KRAFT PAPER TOP EXPORTS IN 12 MONTHS

TABLE 2 REGULATORY STANDARDS RELATED TO GLOBAL SATURATED KRAFT PAPER MARKET

TABLE 3 POTENTIAL BUYER LIST IN THE GLOBAL SATURATED KRAFT PAPER MARKET

TABLE 4 KEY SUPPLY ACROSS THE REGIONS

TABLE 5 SUPPLY VS DEMAND GAPS: KEY OBSERVATIONS

TABLE 6 LAMINATE PRODUCERS

TABLE 7 SKB PRODUCERS

TABLE 8 CHINA LOW PRICE SATURATED KRAFT PAPER

TABLE 9 ASIAN LOW-COST SATURATED KRAFT PAPER SUPPLIERS

TABLE 10 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 12 GLOBAL 100 TO 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL 50 TO 100 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL LESS THAN 50 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL MORE THAN 200 GSM IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL COUNTERTOP IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL WORKTOPS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL SHELVING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL PARTITION IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL FLOORING IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL OTHERS IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL INTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL EXTERNAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL SATURATED KRAFT PAPER MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 40 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 43 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 55 CHINA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 56 CHINA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CHINA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 60 CHINA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 62 CHINA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 63 CHINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 64 CHINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 65 INDIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 66 INDIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 67 INDIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 72 INDIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 77 JAPAN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 78 JAPAN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 79 JAPAN SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 80 JAPAN UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 JAPAN BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 JAPAN SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 JAPAN SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND).

TABLE 84 JAPAN SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 90 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 91 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH KOREA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH KOREA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH KOREA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH KOREA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 101 INDONESIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 102 INDONESIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 103 INDONESIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 104 INDONESIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDONESIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 INDONESIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 INDONESIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 108 INDONESIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 109 INDONESIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 110 INDONESIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 111 INDONESIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 112 INDONESIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 113 THAILAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 114 THAILAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 115 THAILAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 116 THAILAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 THAILAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 THAILAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 THAILAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 120 THAILAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 121 THAILAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 125 SINGAPORE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 126 SINGAPORE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 127 SINGAPORE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 128 SINGAPORE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SINGAPORE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SINGAPORE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 SINGAPORE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 132 SINGAPORE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 133 SINGAPORE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 134 SINGAPORE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 135 SINGAPORE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 136 SINGAPORE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 137 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 138 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 139 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 140 AUSTRALIA AND NEW ZEALAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 AUSTRALIA AND NEW ZEALAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 144 AUSTRALIA AND NEW ZEALAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA AND NEW ZEALAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 146 AUSTRALIA AND NEW ZEALAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA AND NEW ZEALAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 148 AUSTRALIA AND NEW ZEALAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 149 MALAYSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 150 MALAYSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 151 MALAYSIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 152 MALAYSIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MALAYSIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MALAYSIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 MALAYSIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 156 MALAYSIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 158 MALAYSIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 163 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 174 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 175 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 176 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 177 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 178 NORTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NORTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 182 NORTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 183 NORTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 184 NORTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 185 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 186 NORTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 187 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 189 U.S. SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 U.S. BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 U.S. SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)..

TABLE 195 U.S. INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 196 U.S. HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 197 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 198 U.S. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 201 CANADA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 213 MEXICO SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 223 EUROPE SATURATED KRAFT PAPER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 224 EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 225 EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 226 EUROPE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 227 EUROPE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 EUROPE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 EUROPE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 EUROPE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 231 EUROPE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 232 EUROPE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 233 EUROPE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 234 EUROPE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 235 EUROPE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 236 GERMANY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 237 GERMANY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 238 GERMANY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 239 GERMANY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 GERMANY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 GERMANY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 242 GERMANY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 243 GERMANY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 244 GERMANY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 245 GERMANY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 246 GERMANY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 247 GERMANY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 248 U.K. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 249 U.K. SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 250 U.K. SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 251 U.K. UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 U.K. BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 U.K. SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 254 U.K. SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 255 U.K. SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)..

TABLE 256 U.K. INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 257 U.K. HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 258 U.K. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 259 U.K. COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 260 FRANCE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 261 FRANCE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 262 FRANCE SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 263 FRANCE UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 FRANCE BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 FRANCE SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 266 FRANCE SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 267 FRANCE SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 268 FRANCE INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 269 FRANCE HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 270 FRANCE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 271 FRANCE COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 272 ITALY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 273 ITALY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 274 ITALY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 275 ITALY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ITALY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 ITALY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 278 ITALY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)…

TABLE 279 ITALY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 280 ITALY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 281 ITALY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 282 ITALY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 283 ITALY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 285 SPAIN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 286 SPAIN SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 287 SPAIN UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SPAIN BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 SPAIN SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 290 SPAIN SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)..

TABLE 291 SPAIN SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 292 SPAIN INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 293 SPAIN HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 294 SPAIN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 295 SPAIN COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 296 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 297 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 298 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 299 NETHERLANDS UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 NETHERLANDS BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 302 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 303 NETHERLANDS SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 304 NETHERLANDS INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 305 NETHERLANDS HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 306 NETHERLANDS COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 307 NETHERLANDS COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 308 BELGIUM SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 309 BELGIUM SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 310 BELGIUM SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 311 BELGIUM UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 BELGIUM BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 BELGIUM SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 314 BELGIUM SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 315 BELGIUM SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 316 BELGIUM INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 317 BELGIUM HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 318 BELGIUM COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 319 BELGIUM COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 320 RUSSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 321 RUSSIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 322 RUSSIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 323 RUSSIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 RUSSIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 RUSSIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 326 RUSSIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 327 RUSSIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 328 RUSSIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 329 RUSSIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 330 RUSSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 331 RUSSIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 332 TURKEY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 333 TURKEY SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 334 TURKEY SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 335 TURKEY UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 TURKEY BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 TURKEY SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 338 TURKEY SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 339 TURKEY SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 340 TURKEY INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 341 TURKEY HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 342 TURKEY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 343 TURKEY COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 344 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 345 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 346 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 347 LUXEMBOURG UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 LUXEMBOURG BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 350 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 351 LUXEMBOURG SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 352 LUXEMBOURG INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 353 LUXEMBOURG HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 354 LUXEMBOURG COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 355 LUXEMBOURG COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 356 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 357 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 358 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 359 SWITZERLAND UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 SWITZERLAND BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 362 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 363 SWITZERLAND SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 364 SWITZERLAND INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 365 SWITZERLAND HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 366 SWITZERLAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 367 SWITZERLAND COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 368 REST OF EUROPE SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 369 SOUTH AMERICA SATURATED KRAFT PAPER, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 370 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 371 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 372 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 373 SOUTH AMERICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 SOUTH AMERICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 376 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 377 SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 378 SOUTH AMERICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 379 SOUTH AMERICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 380 SOUTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 381 SOUTH AMERICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 382 BRAZIL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 383 BRAZIL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 384 BRAZIL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 385 BRAZIL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 BRAZIL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 BRAZIL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 388 BRAZIL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 389 BRAZIL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 390 BRAZIL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 391 BRAZIL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 392 BRAZIL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 393 BRAZIL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 394 ARGENTINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 395 ARGENTINA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 396 ARGENTINA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 397 ARGENTINA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 ARGENTINA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 ARGENTINA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 400 ARGENTINA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 401 ARGENTINA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 402 ARGENTINA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 403 ARGENTINA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 404 ARGENTINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 405 ARGENTINA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 406 REST OF SOUTH AMERICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 407 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 408 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 409 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 410 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 411 MIDDLE EAST AND AFRICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 MIDDLE EAST AND AFRICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 414 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 415 MIDDLE EAST AND AFRICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 416 MIDDLE EAST AND AFRICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 417 MIDDLE EAST AND AFRICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 418 MIDDLE EAST AND AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 419 MIDDLE EAST AND AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 420 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 421 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 422 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 423 UNITED ARAB EMIRATES UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 UNITED ARAB EMIRATES BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 426 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 427 UNITED ARAB EMIRATES SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 428 UNITED ARAB EMIRATES INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 429 UNITED ARAB EMIRATES HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 430 UNITED ARAB EMIRATES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 431 UNITED ARAB EMIRATES COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 432 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 433 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 434 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 435 SAUDI ARABIA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 SAUDI ARABIA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 438 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 439 SAUDI ARABIA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 440 SAUDI ARABIA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 441 SAUDI ARABIA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 442 SAUDI ARABIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 443 SAUDI ARABIA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 444 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 445 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 446 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 447 SOUTH AFRICA UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 SOUTH AFRICA BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 449 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 450 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 451 SOUTH AFRICA SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 452 SOUTH AFRICA INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 453 SOUTH AFRICA HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 454 SOUTH AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 455 SOUTH AFRICA COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 456 ISRAEL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 457 ISRAEL SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 458 ISRAEL SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 459 ISRAEL UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 ISRAEL BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 ISRAEL SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 462 ISRAEL SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 463 ISRAEL SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 464 ISRAEL INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 465 ISRAEL HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 466 ISRAEL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 467 ISRAEL COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)

TABLE 468 EGYPT SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 469 EGYPT SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (THOUSAND TONS)

TABLE 470 EGYPT SATURATED KRAFT PAPER MARKET, BY PAPER GRADE, 2018-2032 (USD THOUSAND)

TABLE 471 EGYPT UNBLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 EGYPT BLEACHED IN SATURATED KRAFT PAPER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 473 EGYPT SATURATED KRAFT PAPER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 474 EGYPT SATURATED KRAFT PAPER MARKET, BY UTILITY, 2018-2032 (USD THOUSAND).

TABLE 475 EGYPT SATURATED KRAFT PAPER MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 476 EGYPT INDUSTRIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 477 EGYPT HOUSEHOLD IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 478 EGYPT COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BASIC WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 479 EGYPT COMMERCIAL IN SATURATED KRAFT PAPER MARKET, BY BUILDING, 2018-2032 (USD THOUSAND)