Global Wireless Audio Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

9.50 Billion

USD

18.20 Billion

2024

2032

USD

9.50 Billion

USD

18.20 Billion

2024

2032

| 2025 –2032 | |

| USD 9.50 Billion | |

| USD 18.20 Billion | |

|

|

|

|

Global Wireless Audio Market, By Product (Speaker Systems, Sound bars, Headsets, Headphones, Microphones, and Others), Technology (Bluetooth, Wi-Fi, Radio Frequency, Airplay, Bluetooth +Wi-Fi, and Others), Application (Home Audio, Consumer, Commercial, Automotive and Others). Industry Trends and Forecast to 2032

Wireless Audio Market Size

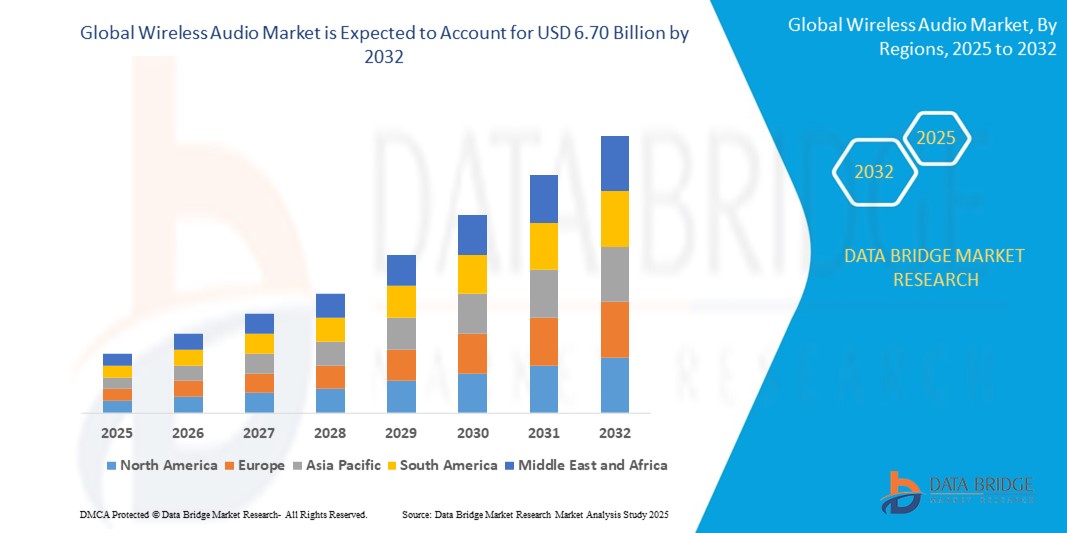

- The global Wireless Audio market size was valued atUSD 4.12 billion in 2024and is expected to reachUSD 6.70 billion by 2032, at aCAGR of 6.4%during the forecast period

- This growth is driven by factors such as rising consumer demand for portable and smart audio devices, advancements in Bluetooth and Wi-Fi connectivity, and the increased adoption of wireless audio in infotainment systems, smart homes, and fitness applications.

Wireless Audio Market Analysis

- Wireless audio is a technology that involves wireless transmission of audio signals from one place to another. A few examples of products that use wireless audio technology are microphone adapters, microphones, integrated audio system, music pickups, wireless transmitters, and much more.

- Increasing adoption of connected devices coupled with rising product innovations by the major manufacturers is one of the major factors fostering the growth of wireless audio market. Increment in the user preference for a wide range of portable devices coupled with increased focus on technological advancements in the field of the wireless audio technology are some other indirect wireless audio market growth determinants.

- North America is expected to dominate the Wireless Audio market due to high disposable income of consumers, higher adoption rate of electronic devices, and prevalence of advanced wireless technologies are the major factors fostering the market growth rate in this region.

- Asia-Pacific is expected to be the fastest growing region in the Wireless Audio market during the forecast period driven by rapid urbanization, increasing smartphone and internet penetration, and rising disposable incomes across emerging economies like China, India, and Southeast Asia

- The headphones and headsets segment is expected to dominate the Wireless Audio market, with a market share 35% during the forecast period. This leadership is attributed to the soaring demand for wireless and truly wireless audio devices, growing popularity of streaming services, and rising consumer preference for hands-free communication and immersive audio experiences in both personal and professional settings.

Report Scope and Wireless Audio Market Segmentation

|

Attributes |

Wireless Audio Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wireless Audio Market Trends

“Emergence of AI-Enabled Acoustic Intelligence & Connected Audio Ecosystems”

- Wireless audio systems are evolving with AI-driven features like adaptive sound, voice control, and contextual sound management—enhancing user experiences across diverse environments.

- Integration of Bluetooth LE Audio, Wi-Fi 6E, and Zigbee allows seamless multi-device connectivity and low-latency audio streaming across smart homes and entertainment ecosystems.

- For instance, On January 2025, Generative AI is advancing rapidly, with computing power demand soaring as models grow to billions of parameters. By 2025, global data is projected to reach 175 zettabytes. Dr. Zhou Zhenyu stresses the importance of Hybrid AI, where cloud and edge devices collaborate for efficient AI deployment. Challenges include balancing performance, power, cost, and building a unified ecosystem for AI adoption.

- The trend is fueled by growing demand for smart speakers, earbuds, and soundbars that offer immersive, intelligent, and energy-efficient acoustic performance

Wireless Audio Market Dynamics

Driver

“Rising Demand for Energy-Conscious Smart Audio Devices”

- Consumers are demanding energy-efficient wireless audio products that offer longer battery life without compromising sound quality, especially for portable and wearable devices.

- Regulatory bodies like ENERGY STAR and Ecodesign are expanding efficiency norms to consumer electronics, pushing manufacturers to develop greener, smarter devices.

- Advances in low-power audio chipsets and energy-saving algorithms are enabling reduced power consumption in speakers, earbuds, and smart displays.

For instance,

- On April 2025, Nulaxy's Air in-Flight Bluetooth Wireless Audio Transmitter is available for $17 (40% off). This compact adapter lets you wirelessly stream audio from wired devices, like airplane seats or gym equipment, to Bluetooth earbuds. It offers up to 20 hours of battery life, dual headphone pairing, and supports Bluetooth 5.3 for high-quality audio transmission.

- As a result, advancements in wireless controls and AI-powered Wireless Audio systems further boost adoption, making energy-efficient motor solutions a major growth driver in the market.

Opportunity

“Next-Gen AI-Powered Audio Experiences & Seamless Wireless Integration”

- AI is enabling next-gen audio features such as dynamic sound profiling, intelligent noise cancellation, and real-time voice assistant optimization.

- Emerging wireless protocols (UWB, Wi-Fi 6E, Bluetooth Mesh) are making it possible to support synchronized audio across rooms, zones, and devices with minimal latency.

- AI-driven insights can help manufacturers offer predictive diagnostics, usage analytics, and firmware upgrades—making smart audio systems more proactive and interactive.

For instance,

- On April 2025, Sennheiser launched the Accentum Wireless SE special edition in India, priced at Rs 10,990 (down from Rs 20,990). This bundle includes the Accentum Wireless headphones and the BTD600 dongle (Rs 5,990), enhancing sound quality. Offering excellent audio with ANC and a sleek design, the headphones feature a companion app for customization and firmware updates.

- These innovations are accelerating adoption in homes, retail spaces, hospitality, and automotive infotainment, opening up new market segments.

Restraint/Challenge

“Cost Barriers & Ecosystem Fragmentation in Smart Audio Systems”

- High initial costs of AI-integrated wireless audio systems—due to smart chipsets, advanced sensors, and software licensing—limit access for price-sensitive segments.

- Lack of universal standards causes ecosystem fragmentation; platforms like AirPlay, AlexaCast, and Chromecast often don’t interoperate smoothly, confusing consumers.

- Complex installation and compatibility issues discourage adoption, especially in multi-brand environments or setups involving legacy devices

For instance,

- On July 2021, data-localization measures worldwide more than doubled in four years, with 62 countries imposing 144 restrictions. These measures harm economies, reducing trade, productivity, and raising prices. China, Indonesia, Russia, and South Africa are the most data-restrictive. Policymakers must balance data concerns with fostering an open digital economy, promoting international cooperation to address data localization challenges.

- Cybersecurity requirements for connected audio systems add further cost and technical complexity, requiring constant firmware updates and secure data protocols.

Wireless Audio Market Scope

The market is segmented on the basis product, technology, application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Application |

|

In 2025, the retrofit installations is projected to dominate the market with a largest share in by product segment

The headphones and headsets segment is expected to dominate the Wireless Audio market, with a market share 35% during the forecast period. This leadership is attributed to the soaring demand for wireless and truly wireless audio devices, growing popularity of streaming services, and rising consumer preference for hands-free communication and immersive audio experiences in both personal and professional settings

Thebluetoothmicroscopes is expected to account for the largest share during the forecast period in Wireless Audio market

In 2025, the Bluetooth segment in the Wireless Audio Market is projected to hold the largest share of approximately 35.23%. This dominance is driven by the growing adoption of smart technologies, automation, and energy-efficient solutions across both consumer and commercial sectors. Bluetooth's seamless integration with a wide range of devices, including smartphones, tablets, laptops, and smart TVs, has made it the preferred choice for wireless audio connectivity.

Wireless Audio Market Regional Analysis

“North America Holds the Largest Share in the Wireless Audio Market”

- North America dominates the Wireless Audio Market, driven by the widespread adoption of smart technologies, the strong presence of leading wireless audio providers, and robust demand for energy-efficient audio solutions across commercial, residential, and automotive sectors.

- The U.S. holds a significant share due to the rapid adoption of wireless audio technologies in consumer electronics, the automotive industry, and smart home systems. The increasing demand for high-quality, wireless sound systems and the integration of voice assistants (like Amazon Alexa, Google Assistant) further contribute to market expansion.

- The region’s well-established infrastructure, growing consumer interest in premium audio experiences, and investments in smart city and smart home projects further strengthen North America’s dominance in the market.

- Additionally, the increasing number of consumer electronics, home automation systems, and adoption of wireless audio technologies by leading tech companies continue to drive growth across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Wireless Audio Market”

- he Asia-Pacific region is expected to register the highest growth rate in the Wireless Audio Market, driven by rapid urbanization, increasing industrialization, and growing demand for wireless audio systems across residential, commercial, and entertainment sectors.

- Countries such as China, India, and Japan are emerging as key markets due to the large-scale adoption of wireless technologies, government initiatives supporting smart homes and smart cities, and increasing consumer demand for wireless audio devices like headphones, speakers, and soundbars.

- Japan, known for its advanced technological infrastructure, continues to lead in the adoption of wireless audio systems, particularly in the consumer electronics and automotive sectors. The integration of wireless audio in smart vehicles and public infrastructure contributes to the market’s growth.

- China and India, with their rapidly expanding middle class and technological advancements, are seeing substantial investments from both the government and private sector in wireless audio solutions for entertainment, personal audio devices, and smart homes. The presence of global wireless audio manufacturers and the expanding digital infrastructure in these countries are further boosting the region’s market growth.

Wireless Audio Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- HARMAN International (U.S.)

- Apple Inc. (U.S.)

- Bose Corporation (U.S.)

- Sound United (U.S.)

- Sennheiser electronic GmbH & Co. KG (Germany)

- SAMSUNG (South Korea)

- Sony Corporation (Japan)

- VOXX International Corp. (U.S.)

- DEI Holdings, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Shure Europe (Germany)

- Sonos, Inc. (U.S.)

- Pure International Limited (United Kingdom)

- Bowers & Wilkins (United Kingdom)

- Hewlett Packard Enterprise Development LP (U.S.)

- Zound Industries International AB (Sweden)

- Dell (U.S.)

- inMusic (U.S.)

- Klipsch Group, Inc. (U.S.)

- LOUD Audio, LLC (U.S.)

Latest Developments in Global Wireless Audio Market

- On April, 2025, the Shure MoveMic 88+ Receiver Kit is now available for $449 on Amazon and B&H Photo-Video. This portable audio equipment offers high-quality sound for recording on the go. Featuring customizable settings through the MOTIV app, it’s ideal for mobile recording, though not a replacement for higher-end microphones. It includes a mic, receiver, mounts, and cables.

- On April, 2025, Ultra-Wideband (UWB) technology, known for its precise ranging capabilities, is gaining traction in smartphones like Apple iOS and Samsung Galaxy. UWB is used in devices like AirTags and SmartTags for tracking. Audiophiles are hopeful for UWB’s use in wireless streaming, as Samsung files a patent for UWB wireless headphones, promising lossless music streaming without dongles or attachments.

- On April, 2025, UltraProlink launched the Air-Tunes Duo, a Bluetooth transmitter and adapter that adds wireless audio capability to devices with a 3.5mm audio jack. It allows dual audio streaming, supports wired headphones, and offers up to 15 hours of battery life. Available for ₹1,841, it is designed for users seeking wireless freedom with existing high-end headphones or earbuds.

- On December, 2024, Sennheiser launched the Profile Wireless microphone system in India, aimed at content creators. The system offers dual-channel 2.4GHz wireless audio, with up to 245 meters range, 15-hour battery life, and 30 hours of onboard recording. Priced at ₹29,900, it supports multiple configurations and includes backup recording features for enhanced audio quality during production.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.