Middle East And Africa Branded Generics Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

20.89 Billion

USD

34.25 Billion

2024

2032

USD

20.89 Billion

USD

34.25 Billion

2024

2032

| 2025 –2032 | |

| USD 20.89 Billion | |

| USD 34.25 Billion | |

|

|

|

|

Segmentación del mercado de genéricos de marca en Oriente Medio y África: por clase de fármaco (antihipertensivos, hormonas, antimetabolitos, hipolipemiantes, antiepilépticos, alquilantes, antidepresivos, antipsicóticos, otros), por aplicación (enfermedades cardiovasculares, analgésicos y antiinflamatorios, oncología, diabetes, neurología, enfermedades gastrointestinales, dermatología, otros), por vía de administración (oral, inyectable, tópica, otros), por tipo de producto (genéricos de marca con valor añadido, genéricos con nombre comercial), por demografía de pacientes (adultos, geriátricos, pediátricos), por usuario final (hospitales, clínicas, atención domiciliaria, institutos académicos y de investigación, otros), por canal de distribución (farmacias minoristas, farmacias hospitalarias, licitaciones directas, otros): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de genéricos de marca en Oriente Medio y África

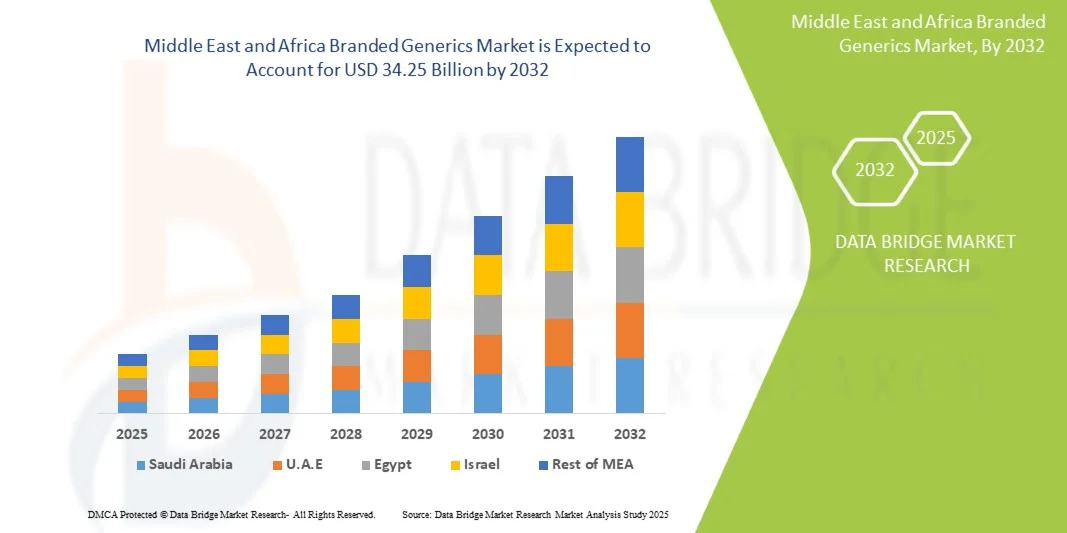

- El mercado de genéricos de marca de Oriente Medio y África se valoró en 20.890 millones de dólares en 2024 y se espera que alcance los 34.250 millones de dólares en 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 6,4%, impulsado principalmente por el aumento del gasto en atención médica, la creciente prevalencia de enfermedades crónicas y la demanda de medicamentos asequibles y de alta calidad tanto en los mercados desarrollados como en los emergentes.

- Este crecimiento se ve impulsado aún más por el vencimiento de patentes de medicamentos originales, las políticas gubernamentales que apoyan tratamientos rentables, la expansión del acceso a la atención médica en las economías emergentes y la creciente adopción de canales de salud digital y farmacias electrónicas. También se espera que las continuas innovaciones en las formulaciones de medicamentos, la mejora de las estrategias de adherencia al tratamiento y la expansión de las carteras de genéricos de marca por parte de las principales compañías farmacéuticas aceleren la expansión del mercado a nivel mundial.

Análisis del mercado de medicamentos genéricos de marca en Oriente Medio y África

- El mercado de genéricos de marca en Oriente Medio y África está experimentando un sólido crecimiento, impulsado por la creciente demanda de productos farmacéuticos rentables y de alta calidad que combinan la asequibilidad de los genéricos con el reconocimiento de marca. Los genéricos de marca desempeñan un papel fundamental para mejorar la adherencia terapéutica, ampliar el acceso a medicamentos esenciales y generar oportunidades de ingresos para las compañías farmacéuticas, tanto en mercados emergentes como desarrollados. El mercado se enfrenta a desafíos como las variaciones regulatorias entre países, la presión sobre los precios y la necesidad de innovación continua para mantener la fidelidad a la marca.

- Los segmentos de gestión de enfermedades crónicas, oncología, enfermedades cardiovasculares y terapia de enfermedades infecciosas son motores clave del crecimiento. La creciente prevalencia de enfermedades no transmisibles, la mayor concienciación sobre la salud y la ampliación del acceso a la atención médica en las economías emergentes están impulsando la demanda de genéricos de marca. Además, la creciente adopción de biosimilares y genéricos especializados está configurando la dinámica del mercado, ofreciendo alternativas a los costosos medicamentos originales, manteniendo la eficacia y la seguridad. Las compañías farmacéuticas están aprovechando las estrategias de marketing, la educación del paciente y las alianzas estratégicas para impulsar la adopción de genéricos de marca.

- Arabia Saudita domina el mercado y Emiratos Árabes Unidos es el país de más rápido crecimiento, debido a las capacidades bien establecidas de fabricación de medicamentos genéricos de la región, las políticas gubernamentales favorables y el creciente gasto en atención médica.

- Se espera que el segmento antihipertensivo domine el mercado con una participación de mercado del 30,52%, impulsado por la preferencia de los pacientes por una dosificación conveniente, rentabilidad y amplia aplicabilidad en todas las áreas terapéuticas.

Alcance del informe y segmentación del mercado de genéricos de marca en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de genéricos de marca en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de genéricos de marca en Oriente Medio y África

La creciente demanda de medicamentos asequibles y de alta calidad impulsa el crecimiento del mercado de genéricos de marca en Oriente Medio y África.

- El aumento de los costos de la atención médica, el envejecimiento de la población y la creciente prevalencia de enfermedades crónicas y relacionadas con el estilo de vida impulsan la demanda en Oriente Medio y África de medicamentos asequibles y de alta calidad, lo que impulsa el crecimiento de los genéricos de marca. Estos medicamentos ofrecen una alternativa rentable a los medicamentos originales, manteniendo altos estándares de eficacia y seguridad, lo que los hace esenciales tanto en los mercados desarrollados como en los emergentes.

- Los gobiernos y las aseguradoras sanitarias promueven activamente el uso de genéricos de marca mediante políticas, marcos de reembolso y programas de sustitución de genéricos para contener el gasto sanitario, ampliar el acceso al tratamiento y mejorar la adherencia del paciente. Estas medidas están impulsando la adopción en el mercado en diversas áreas terapéuticas, como las cardiovasculares, la diabetes, la oncología y los trastornos del sistema nervioso central.

- Por ejemplo, en marzo de 2024, la FDA estadounidense aprobó múltiples formulaciones nuevas de genéricos de marca para categorías terapéuticas de alta demanda, como la diabetes y la hipertensión, lo que demuestra la creciente actividad en el mercado de medicamentos y el apoyo regulatorio a las alternativas rentables a los medicamentos de marca. Esto ilustra la continua expansión del mercado de genéricos de marca en Oriente Medio y África en respuesta a las necesidades de los pacientes y del sistema sanitario.

- Las economías emergentes, en particular Arabia Saudita y Latinoamérica, están experimentando una adopción acelerada de medicamentos genéricos de marca debido a la expansión de la infraestructura sanitaria, el aumento de la clase media y las iniciativas gubernamentales destinadas a mejorar el acceso a los tratamientos. Las empresas están ampliando la producción local, invirtiendo en I+D y mejorando las redes de distribución para satisfacer la creciente demanda en estas regiones.

- A medida que los sistemas de salud de Medio Oriente y África continúan enfatizando la asequibilidad, la accesibilidad y la adherencia al tratamiento, el papel de los genéricos de marca será cada vez más crítico para garantizar una prestación de atención médica sostenible e impulsar la innovación en la fabricación, el envasado y el desarrollo de medicamentos centrados en el paciente.

Dinámica del mercado de genéricos de marca en Oriente Medio y África

Conductor

Vencimiento de patentes de medicamentos de gran éxito

- La inminente expiración de patentes de medicamentos de gran éxito se encuentra entre los impulsores estructurales más poderosos de la expansión del mercado de genéricos de marca en Oriente Medio y África. Cuando un medicamento innovador de alto rendimiento pierde la exclusividad, abre la puerta a que los fabricantes de genéricos y biosimilares introduzcan versiones competidoras, lo que erosiona la cuota de mercado del innovador y redirige la demanda hacia alternativas más económicas.

- Este “precipicio de patentes” desencadena una cascada de efectos posteriores: los fabricantes se apresuran a presentar solicitudes abreviadas de nuevos medicamentos (ANDA) o solicitudes de biosimilares, las autoridades regulatorias aceleran la revisión, los pagadores favorecen cada vez más los genéricos y los pacientes obtienen acceso a genéricos de marca más asequibles.

- Durante la última década, la ola de pérdida de exclusividad en las grandes compañías terapéuticas ha generado recurrentes oportunidades para los genéricos tradicionales y los nuevos participantes, transformando la dinámica de precios, fomentando la consolidación en la fabricación de genéricos y acelerando la expansión geográfica hacia los mercados emergentes. De hecho, la magnitud de los ingresos en juego por la expiración de patentes a menudo justifica económicamente la inversión en genéricos y biosimilares complejos.

- Es importante destacar que el momento y la previsibilidad de los abismos de patentes brindan oportunidades de planificación estratégica para que las empresas de genéricos anticipen lanzamientos, inviertan en líneas de desarrollo, formen alianzas y presenten expedientes regulatorios con antelación a la pérdida de exclusividad.

- En consecuencia, el sector de los genéricos de marca se convierte en una frontera cíclica de impulso competitivo, íntimamente ligada a las expiraciones de patentes de gran éxito.

Restricción/Desafío

Litigios de patentes y riesgos de propiedad intelectual

- Los litigios de patentes y los riesgos de propiedad intelectual suponen una importante limitación para el mercado de genéricos de marca en Oriente Medio y África. La complejidad y la duración de las disputas sobre patentes pueden retrasar la entrada de alternativas genéricas, lo que dificulta la competencia en el mercado y mantiene altos los precios de los medicamentos.

- Estas batallas legales a menudo involucran múltiples capas de reclamos de patentes, incluidas patentes de métodos de uso y patentes secundarias, que pueden extender el período de exclusividad de los medicamentos de marca más allá del vencimiento de su patente original.

- Además, la carga financiera que supone defenderse de demandas por infracción de patentes puede disuadir a los fabricantes de genéricos, especialmente a las pequeñas empresas, de entrar en el mercado. La evolución del panorama de las leyes de patentes y el uso estratégico de las carteras de patentes por parte de las empresas originales complican aún más la dinámica del mercado, lo que podría dar lugar a un mercado global de genéricos de marca.

- Por ejemplo, en octubre de 2025, The Economic Times informó que Natco Pharma, con sede en Hyderabad, ganó una disputa de patentes contra la compañía farmacéutica suiza Roche con respecto al medicamento Risdiplam, utilizado para tratar la atrofia muscular espinal.

- Estas barreras legales y financieras afectan tanto la rentabilidad de los fabricantes como el acceso de los pacientes a medicamentos asequibles. En general, los litigios de patentes y los riesgos de propiedad intelectual siguen siendo restricciones clave que influyen en la competencia y el crecimiento del mercado de genéricos de marca en Oriente Medio y África.

Alcance del mercado de genéricos de marca en Oriente Medio y África

El mercado de genéricos de marca de Medio Oriente y África está segmentado en siete segmentos notables que se basan en la clase de medicamento, la aplicación, la vía de administración, el tipo de producto, la demografía del paciente, el usuario final y el canal de distribución.

• Por clase de fármaco

Según la clase de medicamento, el mercado de genéricos de marca en Oriente Medio y África se segmenta en antihipertensivos, hormonas, antimetabolitos, hipolipemiantes, antiepilépticos, alquilantes, antidepresivos, antipsicóticos, entre otros. En 2025, se prevé que el segmento de antihipertensivos domine el mercado con una cuota de mercado del 30,52 %, impulsado por la creciente prevalencia de enfermedades cardiovasculares, la mayor concienciación sobre el manejo de la hipertensión y la creciente preferencia por alternativas genéricas rentables por parte de pacientes y profesionales sanitarios.

Se prevé que el segmento de medicamentos antihipertensivos gane impulso con una CAGR del 8,0 % durante el período de pronóstico de 2025 a 2032, impulsado por la innovación continua en terapias de combinación de dosis fija, iniciativas gubernamentales que promueven medicamentos asequibles y la expansión del acceso a la atención médica en las economías emergentes, que colectivamente impulsan la adopción de genéricos de marca antihipertensivos.

• Por aplicación

Según la aplicación, el mercado se segmenta en enfermedades cardiovasculares, manejo del dolor y antiinflamatorios, oncología, diabetes, neurología, enfermedades gastrointestinales, dermatología, entre otros. En 2025, se prevé que el segmento de enfermedades cardiovasculares domine el mercado con una cuota de mercado del 36,62 %, debido a la creciente prevalencia de enfermedades cardíacas a nivel mundial, el aumento de la población geriátrica y la creciente concienciación sobre la atención cardiovascular preventiva, junto con la disponibilidad de medicamentos genéricos de marca rentables.

Se proyecta que el segmento de enfermedades cardiovasculares se expandirá de manera constante con una CAGR del 7,4%, a medida que los sistemas de atención médica en los mercados emergentes mejoran el acceso a medicamentos esenciales, las terapias combinadas de dosis fija ganan popularidad y la investigación y el desarrollo en curso mejoran la eficacia y el perfil de seguridad de los genéricos de marca para el tratamiento cardiovascular.

• Por vía de administración

Según la vía de administración, el mercado de genéricos de marca en Oriente Medio y África se segmenta en administración oral, inyectable, tópica, etc. En 2025, se prevé que el segmento oral domine el mercado con una cuota de mercado del 60,45 %, gracias a la comodidad de la administración oral, la alta adherencia al tratamiento por parte de los pacientes, la amplia disponibilidad de formulaciones orales y la rentabilidad en comparación con otras vías de administración.

Es probable que el segmento oral sea testigo de un crecimiento acelerado del 6,6% durante el período de pronóstico, respaldado por la creciente prevalencia de enfermedades crónicas que requieren medicación a largo plazo, la creciente preferencia por terapias autoadministradas y la introducción continua de formulaciones orales innovadoras con biodisponibilidad mejorada y diseños amigables para el paciente.

• Por tipo de producto

Según el tipo de producto, el mercado se segmenta en genéricos de marca de valor añadido y genéricos de marca. En 2025, se prevé que el segmento de genéricos de marca de valor añadido domine el mercado con una cuota de mercado del 70,32 %, gracias a su mayor eficacia, perfiles de seguridad optimizados, formulaciones centradas en el paciente y su capacidad para ofrecer beneficios terapéuticos diferenciados en comparación con los genéricos estándar.

El segmento de genéricos de marca de valor agregado está ganando importancia y creciendo con una CAGR del 6,5 % debido a la creciente preferencia de los proveedores de atención médica por formulaciones que mejoran la adherencia del paciente, la creciente demanda de terapias combinadas, la innovación continua en tecnologías de administración de medicamentos y el enfoque en abordar necesidades médicas no satisfechas en tratamientos de enfermedades crónicas y complejas.

• Por demografía del paciente

Según la demografía de los pacientes, el mercado se segmenta en adultos, geriátricos y pediátricos. En 2025, se prevé que el segmento adulto domine el mercado con una cuota de mercado del 68,75 %, debido a la mayor prevalencia de enfermedades crónicas y relacionadas con el estilo de vida, como trastornos cardiovasculares, diabetes e hipertensión, en la población adulta, lo que impulsa una demanda constante de genéricos de marca.

Se espera que el segmento de adultos crezca a una CAGR del 6,5%, impulsado por la creciente conciencia sobre la atención médica, el aumento del acceso a medicamentos asequibles, la creciente población de clase media en las economías emergentes y la preferencia por genéricos de marca de valor agregado que ofrecen mejor eficacia y adherencia entre los pacientes adultos.

• Por el usuario final

En función del usuario final, el mercado se segmenta en hospitales, clínicas, atención domiciliaria, institutos académicos y de investigación, entre otros. En 2025, se prevé que el segmento hospitalario domine el mercado con una cuota de mercado del 56,55 %, impulsado por el alto volumen de tratamientos para pacientes, la preferencia por medicamentos genéricos de marca y de alta calidad para cuidados intensivos, y las prácticas de adquisición centralizadas de los hospitales que garantizan un suministro constante de medicamentos esenciales.

Se anticipa que el segmento de hospitales registrará el crecimiento más rápido del 6,7% durante 2025 a 2032, impulsado por la expansión de la infraestructura hospitalaria, el creciente número de hospitales especializados y multidisciplinarios, el aumento de las admisiones hospitalarias por enfermedades crónicas y agudas, y la creciente adopción de genéricos de marca de valor agregado en la atención hospitalaria para mejorar los resultados terapéuticos.

• Por canal de distribución

Según el canal de distribución, el mercado se segmenta en farmacias minoristas, farmacias hospitalarias, licitaciones directas y otros. En 2025, se prevé que el segmento de farmacias minoristas domine el mercado con una cuota de mercado del 57,45 %, impulsado por la amplia disponibilidad de genéricos de marca en los puntos de venta, la preferencia de los consumidores por un acceso cómodo a los medicamentos y la fuerte presencia de cadenas de farmacias y droguerías independientes tanto en zonas urbanas como semiurbanas.

Se anticipa que el segmento de farmacias minoristas registrará el crecimiento más rápido del 6,6% durante 2025 a 2032, impulsado por las crecientes tendencias de automedicación, la creciente conciencia de los genéricos de marca rentables, la expansión de las redes de farmacias y las iniciativas gubernamentales que apoyan el acceso asequible a medicamentos esenciales a través de canales minoristas.

Análisis regional del mercado de medicamentos genéricos de marca en Oriente Medio y África

- Se espera que Arabia Saudita domine el mercado de genéricos de marca de Medio Oriente y África con la mayor participación en los ingresos del 28,55% en 2025, impulsada por la fuerte demanda de productos farmacéuticos asequibles pero de alta calidad y el creciente gasto en atención médica en toda la región.

- La expansión está impulsada por el creciente apoyo del gobierno a la infraestructura de atención médica, la creciente prevalencia de enfermedades crónicas y la creciente conciencia sobre la adherencia al tratamiento, todos los cuales impulsan la adopción de genéricos de marca.

- Países como India, China, Japón y Corea del Sur lideran la región debido a sus bien establecidas capacidades de fabricación farmacéutica, su apoyo regulatorio a los genéricos y su creciente inversión en la producción nacional de atención médica.

- Además, las políticas favorables que promueven la producción local de medicamentos, el acceso a la atención médica y las exportaciones farmacéuticas aceleran aún más el crecimiento del mercado en Arabia Saudita.

Perspectiva del mercado de genéricos de marca en Oriente Medio y África

Oriente Medio y África representa una región de crecimiento emergente para el mercado de genéricos de marca en Oriente Medio y África, impulsada por un mayor acceso a la atención médica, la expansión de la infraestructura y las crecientes iniciativas gubernamentales para mejorar la asequibilidad de los tratamientos. Países como Arabia Saudita, Emiratos Árabes Unidos y Sudáfrica están invirtiendo en la producción farmacéutica local, la modernización de la atención médica y programas de salud digital, lo que está impulsando la adopción en el mercado. Si bien aún se encuentra en una fase de desarrollo en comparación con otras regiones, se espera que el creciente conocimiento de los tratamientos rentables, la mejora de la cobertura médica y las reformas regulatorias impulsen un crecimiento sostenido a largo plazo de los genéricos de marca en Oriente Medio y África.

Análisis del mercado de genéricos de marca en Arabia Saudita, Oriente Medio y África

Arabia Saudita ocupa una posición destacada en el mercado de genéricos de marca en Oriente Medio y África, gracias a su sólida infraestructura sanitaria, su avanzada capacidad de fabricación farmacéutica y las iniciativas gubernamentales que fomentan la producción nacional de medicamentos. El enfoque del país en el manejo de enfermedades crónicas, la oncología y las terapias cardiovasculares está incrementando la demanda de genéricos de marca. Además, las alianzas estratégicas entre compañías farmacéuticas e instituciones de investigación impulsan la innovación en genéricos de alto valor y terapias especializadas. El creciente énfasis de Francia en el acceso a la atención médica, la asequibilidad y la adherencia al tratamiento refuerza aún más su importancia en el panorama farmacéutico europeo.

Perspectiva del mercado de genéricos de marca en Egipto, Oriente Medio y África

Egipto se perfila como un mercado en crecimiento dentro de la industria de genéricos de marca en Oriente Medio y África, impulsado por la expansión de la cobertura sanitaria, la creciente demanda de terapias asequibles y la creciente adopción de soluciones para el manejo de enfermedades crónicas. El enfoque del país en la modernización de la atención sanitaria, las iniciativas de salud digital y la producción farmacéutica regional han acelerado el uso de genéricos de marca. Además, las colaboraciones entre fabricantes locales, instituciones de investigación y farmacéuticas internacionales impulsan la innovación y la comercialización de productos genéricos de alta calidad. Las inversiones de España en infraestructura sanitaria y las campañas de concienciación para pacientes contribuyen al crecimiento sostenido del mercado.

Perspectiva del mercado de genéricos de marca en Sudáfrica, Oriente Medio y África

Se proyecta que Sudáfrica registre la tasa de crecimiento anual compuesta (TCAC) más alta en Oriente Medio y África durante el período de pronóstico, impulsada por el aumento del gasto sanitario, la rápida industrialización de la industria farmacéutica y la creciente prevalencia de enfermedades crónicas y relacionadas con el estilo de vida. Países como India, China y Japón lideran el crecimiento, impulsados por la expansión de la capacidad de producción nacional, la fabricación rentable de medicamentos y políticas regulatorias favorables. La sólida capacidad de exportación farmacéutica de la región, el creciente acceso a la atención médica y las iniciativas para la producción local de medicamentos están acelerando aún más el crecimiento del mercado. La creciente concienciación sobre la adherencia al tratamiento y la demanda de medicamentos asequibles y de alta calidad continúan fortaleciendo el dominio de la región en el mercado de Oriente Medio y África.

Los principales líderes del mercado que operan en el mercado son:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (EE. UU.)

- Sandoz Group AG (Suiza)

- Laboratorios Dr. Reddy Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma (India)

- Cipla Pharmaceuticals (India)

- Fresenius Kabi (Alemania)

- Abbott (EE. UU.)

- Productos farmacéuticos Glenmark (India)

- Hikma Pharmaceuticals PLC (Reino Unido)

- Lupin Pharmaceuticals (India)

- Emcure Pharmaceuticals (India)

- Bausch Health Companies Inc. (Canadá)

- Mankind Pharma (India)

- Jubilant Pharma (India)

- Natco Pharma (India)

- ARISTO Pharmaceuticals Private Limited (India)

- Biocon Limited (India)

- Torrent Pharmaceuticals Ltd. (India)

- Endo, Inc. (EE. UU.)

- Alembic Pharmaceuticals Limited (India)

- SAGENT Pharmaceuticals (EE. UU.)

- Panacea Biotec (India)

Últimos avances en el mercado de genéricos de marca en Oriente Medio y África

- En octubre de 2025, la FDA estadounidense aprobó una indicación ampliada para la suspensión inyectable de liberación prolongada UZEDY (risperidona). Ahora está aprobada para el tratamiento de la esquizofrenia en niños y adolescentes de 13 a 17 años, además de adultos. Esto ofrece una opción de tratamiento de acción prolongada para pacientes más jóvenes que padecen esta enfermedad crónica.

- En agosto de 2025, Teva recibió la aprobación de la FDA estadounidense y lanzó la primera versión genérica de Saxenda (liraglutida) inyectable. Este agonista genérico del receptor GLP-1 está aprobado como herramienta para el control de peso en adultos y niños, ofreciendo una opción más accesible para el control de peso crónico.

- En agosto de 2025, Viatris recibió la aprobación de la FDA estadounidense para la primera versión genérica de la inyección de hierro sacarosa, un medicamento utilizado para tratar la anemia ferropénica. Este desarrollo ofrece una opción de tratamiento más asequible para pacientes y profesionales de la salud en Estados Unidos. La aprobación fortalece la cartera de medicamentos inyectables genéricos de Viatris y mejora el acceso de los pacientes a esta terapia crucial.

- En abril de 2025, Viatris presentó solicitudes complementarias de nuevo medicamento ante el Ministerio de Salud, Trabajo y Bienestar Social de Japón para obtener la aprobación de EFFEXOR (venlafaxina) para el tratamiento del trastorno de ansiedad generalizada. Esta medida regulatoria busca expandir el uso terapéutico de este medicamento en el mercado japonés. De aprobarse, brindaría una nueva opción de tratamiento para los pacientes japoneses que padecen esta afección.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES ANALYSIS

4.2 BRAND OUTLOOK

4.2.1 PRODUCT VS BRAND OVERVIEW

4.2.1.1 PRODUCT OVERVIEW

4.2.1.2 BRAND OVERVIEW

4.3 CONSUMER BUYING BEHAVIOUR – MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 RISK ASSESSMENT AND MITIGATION

4.4.7 FUTURE OUTLOOK

4.5 PATENT ANALYSIS – MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

4.5.1 PATENT QUALITY AND STRENGTH

4.5.2 PATENT FAMILIES

4.5.3 LICENSING AND COLLABORATIONS

4.5.4 REGIONAL PATENT LANDSCAPE

4.5.5 IP STRATEGY AND MANAGEMENT

4.6 PRICING ANALYSIS

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL SUPPLY

4.7.3 COMPONENT MANUFACTURING AND PROCESSING

4.7.4 EQUIPMENT AND TECHNOLOGY PROVIDERS

4.7.5 DISTRIBUTION AND LOGISTICS

4.7.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.7.7 CONCLUSION

5 REGULATION COVERAGE

5.1 REGULATION COVERAGE (NORTH AMERICA)

5.2 REGULATION COVERAGE (SOUTH AMERICA)

5.3 REGULATION COVERAGE (EUROPE)

5.4 REGULATION COVERAGE (MIDDLE EAST & AFRICA)

5.5 REGULATION COVERAGE (ASIA-PACIFIC)

5.6 SUPPLY CHAIN ANALYSIS OF MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

5.6.1 OVERVIEW

5.6.2 LOGISTIC COST SCENARIO

5.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5.6.4 CONCLUSION

5.7 TECHNOLOGICAL ADVANCEMENTS– MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

5.7.1 ADVANCED FORMULATION TECHNOLOGIES

5.7.2 CONTINUOUS MANUFACTURING AND PROCESS OPTIMIZATION

5.7.3 ANTI-COUNTERFEITING AND SMART PACKAGING TECHNOLOGIES

5.7.4 MODIFIED DRUG DELIVERY SYSTEMS

5.7.5 DIGITAL TRANSFORMATION AND E-PRESCRIPTION INTEGRATION

5.7.6 ADVANCED ANALYTICAL AND QUALITY ASSURANCE TOOLS

5.7.7 PERSONALIZED GENERIC THERAPY DEVELOPMENT

5.7.8 SUSTAINABILITY AND ECO-FRIENDLY MANUFACTURING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 PATENT EXPIRATIONS OF BLOCKBUSTER DRUGS

6.1.2 RISING PREVALENCE OF CHRONIC DISEASES

6.1.3 COST-EFFECTIVE ALTERNATIVE TO INNOVATOR DRUGS

6.1.4 SIMPLIFIED APPROVAL PATHWAYS FOR BRANDED GENERICS

6.2 RESTRAINS

6.2.1 PATENT LITIGATION AND INTELLECTUAL PROPERTY RISKS

6.2.2 COUNTERFEIT AND SUBSTANDARD DRUGS

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF BRANDED GENERIC DRUG IN EMERGING MARKETS

6.3.2 PATENT CLIFF OF MAJOR DRUGS

6.3.3 EXPANSION INTO SPECIALTY AND COMPLEX GENERICS

6.4 CHALLENGES

6.4.1 INTENSE PRICE PRESSURE AMONG COMPETITORS

6.4.2 QUALITY PERCEPTION & PHYSICIAN/PATIENT TRUST IN BRANDED GENERIC DRUG

7 MIDDLE EAST AND AFRICA BRANDED GENERIC MARKET, BY DRUG CLASS

7.1 OVERVIEW

7.2 ANTI-HYPERTENSIVE

7.2.1 DIURETICS

7.2.2 CE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS)

7.2.3 ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS)

7.2.4 BETA BLOCKERS (BBS)

7.2.5 CALCIUM CHANNEL BLOCKERS (CCBS)

7.2.6 DIRECT VASODILATORS

7.2.7 ALPHA-1 BLOCKERS

7.2.8 CENTRAL ALPHA-2 AGONISTS

7.2.9 HORMONES

7.2.10 STEROID HORMONES

7.2.11 SEX HORMONES

7.2.12 ESTROGENS

7.2.13 PROGESTOGENS

7.2.14 ANDROGENS

7.2.15 THYROID HORMONES

7.2.16 OTHER HORMONES

7.3 ANTIMETABOLITES

7.3.1 PURINE ANALOGUES

7.3.2 PYRIMIDINE ANALOGUES

7.3.3 FOLATE ANTAGONISTS

7.4 LIPID LOWERING DRUGS

7.4.1 STATINS (HMG-COA REDUCTASE INHIBITORS)

7.4.2 COMBINATION PRODUCTS AND OTHER AGENTS

7.4.3 FIBRATES

7.4.4 BILE ACID SEQUESTRANTS

7.4.5 PCSK9 INHIBITORS

7.5 ANTI-EPILEPTICS

7.6 ALKYLATING AGENTS

7.6.1 NITROGEN MUSTARDS

7.6.2 NITROSOUREAS

7.6.3 ALKYL SULFONATES

7.6.4 TRIAZENES

7.6.5 ETHYLENIMINES

7.7 ANTI-DEPRESSANTS

7.7.1 SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS)

7.7.2 SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS)

7.7.3 TRICYCLIC ANTIDEPRESSANTS (TCAS)

7.7.4 ATYPICAL ANTIDEPRESSANTS

7.7.5 MONOAMINE OXIDASE INHIBITORS (MAOIS)

7.7.6 NMDA RECEPTOR ANTAGONISTS

7.8 ANTI-PSYCHOTICS

7.8.1 SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS

7.8.2 FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS

7.8.3 PHENOTHIAZINES

7.8.4 THIOXANTHENES

7.8.5 NEXT-GENERATION ANTIPSYCHOTICS

7.9 OTHERS

8 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CARDIOVASCULAR DISEASES

8.3 PAIN MANAGEMENT AND ANTI-INFLAMMATORY

8.4 ONCOLOGY

8.5 DIABETES

8.6 NEUROLOGY

8.7 GASTROINTESTINAL DISEASES

8.8 DERMATOLOGY

8.9 OTHERS

9 MIDDLE EAST AND AFRICA BRANDED GENERIC MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 ORAL

9.3 INJECTABLEA

9.4 TOPICAL ADMINISTRATION

9.5 OTHERS

10 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 VALUE-ADDED BRANDED GENERICS

10.3 TRADE NAMED GENERICS

11 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULT

11.3 GERIATRIC

11.4 PEDIATRIC

12 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 HOMECARE

12.5 ACADEMIC & RESEARCH INSTITUTES

12.6 OTHERS

13 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL PHARMACIES

13.3 HOSPITAL PHARMACIES

13.4 DIRECT TENDERS

13.5 OTHERS

14 MIDDLE EAST AND AFRICA SHIP REPAIR AND MAINTENANCE SERVICES MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES

14.1.3 EGYPT

14.1.4 SOUTH AFRICA

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 BAHRAIN

14.1.8 QATAR

14.1.9 OMAN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 TEVA PHARMACEUTICAL INDUSTRIES LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 VIATRIS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SANDOZ GROUP AG

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DR.REDDY’S LABORATORIES LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SUN PHARMACEUTICAL INDUSTRIES LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ABBOTT

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALEMBIC PHARMACEUTICALS LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 AMNEAL PHARMACEUTICALS LLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ARISTO PHARMACEUTICALS PRIVATE LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ASPEN HOLDINGS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 AUROBINDO PHARMA USA (SUBSIDIARY OF AUROBINDO PHARMA LIMITED)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BAUSCH HEALTH COMPANIES INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOCON.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 CIPLA

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 EMCURE PHARMACEUTICALS LIMITED

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 ENDO, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 FRESENIUS SE & CO. KGAA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 GLENMARK PHARMACEUTICALS LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 HIKMA PHARMACEUTICALS PLC

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 INTAS PHARMACEUTICALS LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 JUBILANT GENERICS LIMITED (SUBSIDIARY OF JUBILANT PHARMA COMPANY)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LUPIN

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MANKIND PHARMA LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NATCO PHARMA LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENTS

17.25 NEULAND LABORATORIES LTD.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 ORCHIDPHARMA LTD.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENT

17.27 PANACEA BIOTEC

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENT

17.28 SAGENT

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 STRIDES PHARMA SCIENCE LIMITED.

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENT

17.3 TORRENT PHARMACEUTICALS LTD.

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

17.31 USV PRIVATE LIMITED.

17.31.1 COMPANY SNAPSHOT

17.31.2 SERVICE PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 WOCKHARDT LIMITED

17.32.1 COMPANY SNAPSHOT

17.32.2 REVENUE ANALYSIS

17.32.3 PRODUCT PORTFOLIO

17.32.4 RECENT DEVELOPMENT

17.33 MCKESSON CORPORATION

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENT

17.34 CENCORA, INC.

17.34.1 COMPANY SNAPSHOT

17.34.2 REVENUE ANALYSIS

17.34.3 PRODUCT PORTFOLIO

17.34.4 RECENT DEVELOPMENT

17.35 CARDINAL HEALTH

17.35.1 COMPANY SNAPSHOT

17.35.2 REVENUE ANALYSIS

17.35.3 PRODUCT PORTFOLIO

17.35.4 RECENT DEVELOPMENT

17.36 ALVOGEN

17.36.1 COMPANY SNAPSHOT

17.36.2 SERVICE PORTFOLIO

17.36.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 BRAND COMPARATIVE ANALYSIS OF THE MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET

TABLE 2 PATENT LANDSCAPE

TABLE 3 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ANTI-PSYCHOTICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI-INFLAMMATORY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA VALUE-ADDED BRANDED GENERICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA TRADE NAMED GENERICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA ADULT IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA GERIATRIC IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA PEDIATRIC IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA HOSPITALS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA CLINICS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA HOMECARE IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA HOSPITAL PHARMACIES IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA DIRECT TENDERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MIDDLE EAST AND AFRICA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MIDDLE EAST AND AFRICA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 MIDDLE EAST AND AFRICA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MIDDLE EAST AND AFRICA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MIDDLE EAST AND AFRICA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MIDDLE EAST AND AFRICA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 MIDDLE EAST AND AFRICA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MIDDLE EAST AND AFRICA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MIDDLE EAST AND AFRICA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 MIDDLE EAST AND AFRICA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 MIDDLE EAST AND AFRICA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MIDDLE EAST AND AFRICA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MIDDLE EAST AND AFRICA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MIDDLE EAST AND AFRICA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MIDDLE EAST AND AFRICA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MIDDLE EAST AND AFRICA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MIDDLE EAST AND AFRICA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MIDDLE EAST AND AFRICA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MIDDLE EAST AND AFRICA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 167 MIDDLE EAST AND AFRICA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MIDDLE EAST AND AFRICA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MIDDLE EAST AND AFRICA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 172 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 MIDDLE EAST AND AFRICA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 MIDDLE EAST AND AFRICA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SAUDI ARABIA BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 176 SAUDI ARABIA ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SAUDI ARABIA DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SAUDI ARABIA ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SAUDI ARABIA ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SAUDI ARABIA BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SAUDI ARABIA CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SAUDI ARABIA DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SAUDI ARABIA ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SAUDI ARABIA CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SAUDI ARABIA HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SAUDI ARABIA STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SAUDI ARABIA SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SAUDI ARABIA ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SAUDI ARABIA PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SAUDI ARABIA ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SAUDI ARABIA THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SAUDI ARABIA OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SAUDI ARABIA ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SAUDI ARABIA PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SAUDI ARABIA PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SAUDI ARABIA FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SAUDI ARABIA LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SAUDI ARABIA STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SAUDI ARABIA COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SAUDI ARABIA FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SAUDI ARABIA BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SAUDI ARABIA PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SAUDI ARABIA ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SAUDI ARABIA ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SAUDI ARABIA NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SAUDI ARABIA NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SAUDI ARABIA ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SAUDI ARABIA TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SAUDI ARABIA ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SAUDI ARABIA ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SAUDI ARABIA SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SAUDI ARABIA SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SAUDI ARABIA TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SAUDI ARABIA ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SAUDI ARABIA MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SAUDI ARABIA NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SAUDI ARABIA ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SAUDI ARABIA SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SAUDI ARABIA FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SAUDI ARABIA PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SAUDI ARABIA THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SAUDI ARABIA NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SAUDI ARABIA BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 SAUDI ARABIA CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SAUDI ARABIA PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SAUDI ARABIA ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SAUDI ARABIA SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SAUDI ARABIA HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SAUDI ARABIA DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SAUDI ARABIA NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SAUDI ARABIA GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SAUDI ARABIA DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 235 SAUDI ARABIA ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SAUDI ARABIA INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SAUDI ARABIA BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 244 UNITED ARAB EMIRATES ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 UNITED ARAB EMIRATES DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 UNITED ARAB EMIRATES ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 UNITED ARAB EMIRATES ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 UNITED ARAB EMIRATES BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 UNITED ARAB EMIRATES CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 UNITED ARAB EMIRATES DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 UNITED ARAB EMIRATES ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 UNITED ARAB EMIRATES CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 UNITED ARAB EMIRATES HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 UNITED ARAB EMIRATES STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 UNITED ARAB EMIRATES SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 UNITED ARAB EMIRATES ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 UNITED ARAB EMIRATES PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 UNITED ARAB EMIRATES ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 UNITED ARAB EMIRATES THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 UNITED ARAB EMIRATES OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 UNITED ARAB EMIRATES ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 UNITED ARAB EMIRATES PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 UNITED ARAB EMIRATES PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 UNITED ARAB EMIRATES FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 UNITED ARAB EMIRATES LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 UNITED ARAB EMIRATES STATINS (HMG-COA REDUCTASE INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 UNITED ARAB EMIRATES COMBINATION PRODUCTS AND OTHER AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 UNITED ARAB EMIRATES FIBRATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 UNITED ARAB EMIRATES BILE ACID SEQUESTRANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 UNITED ARAB EMIRATES PCSK9 INHIBITORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 UNITED ARAB EMIRATES ANTI-EPILEPTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 UNITED ARAB EMIRATES ALKYLATING AGENTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 UNITED ARAB EMIRATES NITROGEN MUSTARDS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 UNITED ARAB EMIRATES NITROSOUREAS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 UNITED ARAB EMIRATES ALKYL SULFONATES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 UNITED ARAB EMIRATES TRIAZENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 UNITED ARAB EMIRATES ETHYLENIMINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 UNITED ARAB EMIRATES ANTI-DEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 UNITED ARAB EMIRATES SELECTIVE SEROTONIN REUPTAKE INHIBITORS (SSRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 UNITED ARAB EMIRATES SEROTONIN-NOREPINEPHRINE REUPTAKE INHIBITORS (SNRIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 UNITED ARAB EMIRATES TRICYCLIC ANTIDEPRESSANTS (TCAS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 UNITED ARAB EMIRATES ATYPICAL ANTIDEPRESSANTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 UNITED ARAB EMIRATES MONOAMINE OXIDASE INHIBITORS (MAOIS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 UNITED ARAB EMIRATES NMDA RECEPTOR ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 UNITED ARAB EMIRATES ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 UNITED ARAB EMIRATES SECOND-GENERATION (ATYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 UNITED ARAB EMIRATES FIRST-GENERATION (TYPICAL) ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 UNITED ARAB EMIRATES PHENOTHIAZINES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 UNITED ARAB EMIRATES THIOXANTHENES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 UNITED ARAB EMIRATES NEXT-GENERATION ANTIPSYCHOTICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 292 UNITED ARAB EMIRATES CARDIOVASCULAR DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 UNITED ARAB EMIRATES PAIN MANAGEMENT AND ANTI‑INFLAMMATORY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 UNITED ARAB EMIRATES ONCOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 UNITED ARAB EMIRATES SOLID TUMORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 UNITED ARAB EMIRATES HEMATOLOGIC MALIGNANCIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 UNITED ARAB EMIRATES DIABETES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 UNITED ARAB EMIRATES NEUROLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 UNITED ARAB EMIRATES GASTROINTESTINAL DISEASES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 UNITED ARAB EMIRATES DERMATOLOGY IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 UNITED ARAB EMIRATES OTHERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 303 UNITED ARAB EMIRATES ORAL IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 UNITED ARAB EMIRATES INJECTABLE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 UNITED ARAB EMIRATES TOPICAL ADMINISTRATION IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 308 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 309 UNITED ARAB EMIRATES BRANDED GENERICS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 310 UNITED ARAB EMIRATES RETAIL PHARMACIES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 EGYPT BRANDED GENERICS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 312 EGYPT ANTI-HYPERTENSIVE IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 EGYPT DIURETICS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 EGYPT ACE INHIBITORS (ANGIOTENSIN-CONVERTING ENZYME INHIBITORS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 EGYPT ANGIOTENSIN II RECEPTOR BLOCKERS (ARBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 EGYPT BETA BLOCKERS (BBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 EGYPT CALCIUM CHANNEL BLOCKERS (CCBS) IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 EGYPT DIRECT VASODILATORS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 EGYPT ALPHA-1 BLOCKERS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 EGYPT CENTRAL ALPHA-2 AGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 EGYPT HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 EGYPT STEROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 EGYPT SEX HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 EGYPT ESTROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 EGYPT PROGESTOGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 EGYPT ANDROGENS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 EGYPT THYROID HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 EGYPT OTHER HORMONES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 EGYPT ANTIMETABOLITES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 EGYPT PURINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 EGYPT PYRIMIDINE ANALOGUES IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 EGYPT FOLATE ANTAGONISTS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 EGYPT LIPID LOWERING DRUGS IN BRANDED GENERICS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)