Middle East And Africa Butylated Hydroxytoluene Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

14.27 Million

USD

21.30 Million

2024

2032

USD

14.27 Million

USD

21.30 Million

2024

2032

| 2025 –2032 | |

| USD 14.27 Million | |

| USD 21.30 Million | |

|

|

|

|

Mercado de butilhidroxitolueno en Oriente Medio y África: por grado de pureza (técnico, industrial, alimentario, cosmético, farmacéutico, etc.), por funcionalidad (conservante de alimentos y piensos, estabilizador de polímeros y combustibles, cosmético y farmacéutico, etc.), por formulación (líquido, polvo), por formato de envasado (contenedores IBC, bidones a granel, etc.), por aplicación (estabilizadores de polímeros/industria del plástico, industria alimentaria, piensos, ingredientes cosméticos, aditivos para combustibles/aceites, formulaciones de pesticidas, caucho, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África

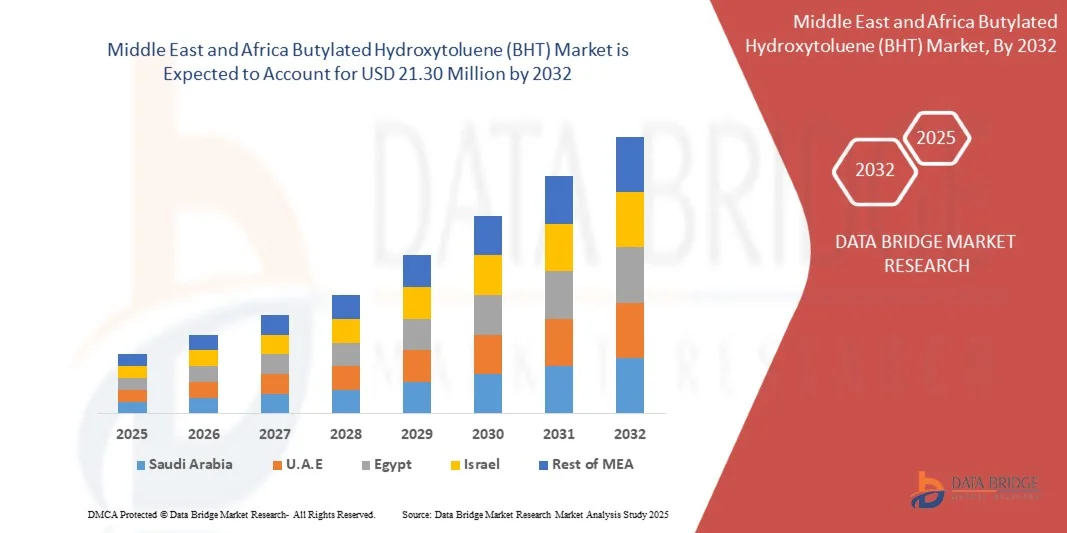

- El tamaño del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África se valoró en 14,27 millones de USD en 2024 y se espera que alcance los 21,30 millones de USD en 2032 , con una CAGR del 5,31 % durante el período de pronóstico.

- El crecimiento del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África se debe principalmente a la creciente demanda de antioxidantes sintéticos eficaces para prevenir la degradación oxidativa en productos de diversas industrias, como la alimentaria, la cosmética, la del plástico, la de la alimentación animal y la farmacéutica. La capacidad del BHT para mejorar la estabilidad del producto, prolongar su vida útil y preservar sus cualidades sensoriales y nutricionales lo ha convertido en un aditivo predilecto entre los fabricantes. Además, los continuos avances tecnológicos en los procesos de síntesis química y estabilización están mejorando la pureza y el rendimiento de los productos, lo que fomenta una mayor adopción en los sectores de consumo final.

- Además, la creciente necesidad de soluciones de conservación rentables en el contexto de la expansión de las industrias de alimentos procesados y cuidado personal refuerza el uso del BHT como antioxidante fiable. La creciente concienciación sobre el deterioro de la calidad relacionado con la oxidación, junto con los marcos regulatorios favorables que permiten el uso controlado del BHT, impulsa aún más la penetración en el mercado. Estos factores contribuyen en conjunto a la constante expansión del mercado del butilhidroxitolueno (BHT) en Oriente Medio y África.

Análisis del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África

- El butilhidroxitolueno (BHT), un antioxidante fenólico sintético, se utiliza ampliamente en industrias como la de alimentos y bebidas, cosméticos, plásticos, piensos y productos farmacéuticos debido a su excepcional capacidad para inhibir la oxidación, prolongar la vida útil y mantener la calidad del producto. Su estabilidad química y versatilidad lo convierten en un aditivo clave para proteger los productos del deterioro causado por la exposición al calor, la luz y el oxígeno.

- La creciente demanda de BHT se debe principalmente al creciente consumo de alimentos procesados, la expansión de las industrias del cuidado personal y de polímeros, y la necesidad de conservantes y estabilizadores eficaces. Además, los avances en las tecnologías de producción y la expansión de las aplicaciones en lubricantes y materiales de envasado están impulsando el crecimiento del mercado en Oriente Medio y África.

- Se espera que Arabia Saudita domine el mercado de butilhidroxitolueno (BHT) en Medio Oriente y África y también tenga el crecimiento más rápido con una CAGR del 6,56%, debido a la rápida industrialización, el aumento de la producción de alimentos procesados y la fuerte demanda de los sectores de fabricación de cosméticos y plásticos en China, India y Japón.

- Se prevé que el segmento de grado técnico domine el mercado de BHT en Oriente Medio y África, con una cuota de mercado superior al 46,27 % en 2025, gracias a su amplia aplicación en plásticos, caucho, lubricantes, biodiésel y aceites industriales. Su excelente estabilidad térmica, su alta pureza y su capacidad para prevenir la degradación oxidativa en productos no alimentarios lo convierten en la opción preferida en los procesos de fabricación industrial. La creciente demanda de antioxidantes poliméricos y estabilizadores de combustibles refuerza aún más el dominio del segmento de grado técnico en el mercado de Oriente Medio y África.

Alcance del informe y segmentación del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado del butilhidroxitolueno (BHT) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen seguimiento de innovación y análisis estratégico, avances tecnológicos, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, criterios de selección de proveedores, análisis PESTLE, análisis de Porter, análisis de patentes, análisis del ecosistema de la industria, cobertura de materia prima, aranceles y su impacto en el mercado, cobertura regulatoria, comportamiento de compra del consumidor, perspectiva de marca, desglose del análisis de costos y marco regulatorio. |

Tendencias del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África

Innovación y expansión funcional mediante I+D y alternativas antioxidantes más seguras

- Una tendencia significativa y en auge en el mercado del butilhidroxitolueno (BHT) en Oriente Medio y África es el creciente enfoque en la innovación y la I+D para desarrollar soluciones antioxidantes más seguras, eficientes y específicas para cada aplicación. Industrias como la de alimentos y bebidas, la farmacéutica, la cosmética y la de polímeros invierten cada vez más en formulaciones avanzadas para mejorar la estabilidad oxidativa, prolongar la vida útil y optimizar el rendimiento del producto, garantizando al mismo tiempo el cumplimiento de las normas de seguridad y medioambientales en constante evolución.

- Por ejemplo, empresas líderes como Eastman Chemical Company, LANXESS y Kemin Industries invierten en investigación para producir formulaciones de BHT de alta pureza y baja toxicidad, y exploran mezclas sinérgicas con antioxidantes naturales como los tocoferoles y el palmitato de ascorbilo. Estas innovaciones están diseñadas para mantener la eficacia del producto y, al mismo tiempo, reducir los posibles problemas de salud y ambientales asociados con los antioxidantes tradicionales.

- En el sector de alimentos y bebidas, los continuos esfuerzos de I+D se centran en optimizar las concentraciones de BHT y los sistemas de administración para mejorar la eficacia antioxidante en matrices alimentarias complejas, aceites y grasas. De igual manera, en la industria cosmética y del cuidado personal, el BHT se está incorporando en formulaciones avanzadas para productos antienvejecimiento, hidratantes y de protección UV, donde ayuda a estabilizar los ingredientes activos y a prevenir el daño oxidativo de los compuestos para el cuidado de la piel.

- En aplicaciones farmacéuticas y nutracéuticas, se están evaluando formulaciones de BHT controladas por su capacidad para mejorar la estabilidad de los medicamentos, proteger los ingredientes activos de la oxidación y extender la vida útil del producto, lo que respalda la producción de formulaciones más confiables y duraderas.

- Los sectores industrial y de polímeros también están experimentando una expansión tecnológica, con fabricantes que desarrollan estabilizadores personalizados basados en BHT para caucho, plásticos, lubricantes y combustibles. Estas innovaciones buscan mejorar la resistencia al calor, prevenir la degradación de los polímeros y garantizar la durabilidad a largo plazo de los materiales sintéticos.

- Esta continua evolución del BHT, impulsada por la I+D, está permitiendo su transición de un conservante convencional a un antioxidante multifuncional de alto rendimiento con una aplicabilidad más amplia en las industrias modernas. Por lo tanto, el mercado se está transformando gracias a los esfuerzos por equilibrar la eficacia, la seguridad y la sostenibilidad, lo que promueve una transición hacia formulaciones ecológicas y sistemas antioxidantes híbridos que se ajustan a los objetivos regulatorios y ambientales de Oriente Medio y África.

Dinámica del mercado del butilhidroxitolueno (BHT) en Oriente Medio y África

Conductor

Creciente demanda de soluciones antioxidantes más seguras, sostenibles y de alto rendimiento

- Una clara transición hacia aditivos químicos sostenibles, seguros y de alto rendimiento está transformando el mercado del butilhidroxitolueno (BHT) en Oriente Medio y África, a medida que las industrias buscan equilibrar la eficiencia del producto con consideraciones ambientales y de salud. Si bien el BHT sigue siendo un antioxidante sintético clave debido a su superior estabilidad oxidativa y rentabilidad, los fabricantes se centran cada vez más en el desarrollo de formulaciones más ecológicas y en la exploración de mezclas híbridas que combinan el BHT con antioxidantes naturales para cumplir con las expectativas de etiquetado limpio y regulatorio.

- Por ejemplo, varias empresas, como Eastman Chemical Company y LANXESS, invierten activamente en innovaciones de química verde para mejorar la seguridad de los productos basados en BHT y reducir su impacto ambiental. Estas iniciativas se alinean con la creciente tendencia del sector de adoptar procesos de fabricación sostenibles y materias primas de origen biológico, manteniendo al mismo tiempo la eficiencia del rendimiento en aplicaciones alimentarias, de polímeros y cosméticas.

- En el sector de alimentos y bebidas, el BHT se utiliza cada vez más en concentraciones precisas y reguladas para prevenir la oxidación en aceites, cereales y snacks. La I+D en curso se centra en la integración de coantioxidantes naturales para lograr formulaciones más seguras. De igual manera, las industrias del cuidado personal y la cosmética están incorporando variantes refinadas del BHT en productos para el cuidado de la piel, protectores solares y cosméticos de color para garantizar la estabilidad del producto sin comprometer la seguridad del consumidor, respondiendo así a la creciente preferencia por ingredientes más limpios y sostenibles.

- Los sectores industrial y de polímeros también están experimentando una mayor demanda de estabilizadores basados en BHT debido a su probada capacidad para proteger materiales como caucho, plásticos y lubricantes del daño oxidativo. Sin embargo, la atención se está desplazando hacia métodos de producción de bajas emisiones y eficiencia energética, así como hacia sistemas estabilizadores no tóxicos que cumplan con los estándares de sostenibilidad de Oriente Medio y África.

- Se espera que esta transición constante hacia soluciones antioxidantes respetuosas con el medio ambiente y con seguridad defina la trayectoria futura del mercado del BHT. A medida que los marcos regulatorios se endurezcan y los consumidores se concienticen más, la demanda de formulaciones de BHT optimizadas, sostenibles y multifuncionales seguirá creciendo, posicionando a este compuesto como un puente entre los antioxidantes sintéticos tradicionales y las tecnologías de conservación ecológicas de última generación.

Restricción/Desafío

Dependencia de las materias primas de fuentes petroquímicas

- El mercado del butilhidroxitolueno (BHT) en Oriente Medio y África sigue dependiendo en gran medida de materias primas derivadas de petroquímicos, como el p-cresol y el isobutileno, para su síntesis. Esta dependencia de materias primas no renovables plantea importantes desafíos para la sostenibilidad y la cadena de suministro, especialmente en un contexto de fluctuaciones en los precios del petróleo crudo y la creciente presión regulatoria para reducir la huella de carbono. Si bien el BHT sigue siendo un antioxidante sintético esencial en diversas industrias, la disponibilidad limitada de intermediarios derivados del petróleo y las preocupaciones ambientales en torno a su producción impulsan la búsqueda de métodos de abastecimiento alternativos y más ecológicos.

- Según diversos análisis de la industria, el desarrollo de análogos de BHT de origen biológico y rutas sintéticas renovables está cobrando impulso, lo que refleja una tendencia más amplia en Oriente Medio y África hacia la química sostenible. Investigadores y fabricantes están explorando el uso de fenoles y olefinas de origen biológico obtenidos a partir de biomasa agrícola o lignocelulósica como posibles sustitutos de las materias primas petroquímicas. Sin embargo, la producción a escala comercial de estas alternativas de origen biológico se encuentra en sus primeras etapas debido a los altos costos de producción, la limitada eficiencia de rendimiento y la necesidad de optimización tecnológica.

- La dependencia de fuentes petroquímicas también expone el mercado de BHT a la volatilidad del suministro, las perturbaciones geopolíticas y la inestabilidad de precios, lo que puede afectar la planificación de la producción y la rentabilidad de los actores clave. Además, el endurecimiento de las regulaciones ambientales relacionadas con las emisiones de COV y la gestión de residuos petroquímicos obliga a los fabricantes a reevaluar sus estrategias de abastecimiento e invertir en modelos de producción más limpios y circulares.

- Si bien la síntesis química del BHT está relativamente consolidada, el alto consumo energético de su producción y la huella ambiental de sus precursores químicos siguen siendo motivo de preocupación. La transición a sistemas antioxidantes de base biológica o híbridos se considera una solución a largo plazo; sin embargo, la ampliación de estas tecnologías requerirá una inversión sustancial en I+D, políticas de apoyo y colaboración intersectorial.

- Hasta que se establezcan vías renovables rentables y comercialmente viables, la dependencia de la industria del BHT de las materias primas petroquímicas seguirá presentando desafíos operativos, económicos y ambientales, lo que restringirá su capacidad para alinearse plenamente con los objetivos de sostenibilidad de Medio Oriente y África y la creciente demanda de soluciones de química verde.

Alcance del mercado del butilhidroxitolueno (BHT) en Oriente Medio y África

El mercado está segmentado según el grado de pureza, la funcionalidad, la formulación, el formato de envasado y la aplicación.

- Por grado de pureza

Según el grado de pureza, el mercado de butilhidroxitolueno (BHT) en Oriente Medio y África se segmenta en grado técnico, grado industrial, grado alimentario, grado cosmético, grado farmacéutico y otros. Se prevé que el segmento de grado técnico domine la mayor cuota de mercado, con un 46,27 %, en 2025, gracias a su amplio uso en aplicaciones industriales como plásticos, caucho y lubricantes, donde la protección antioxidante es fundamental, y también presenta el crecimiento más rápido, con una tasa de crecimiento anual compuesta (TCAC) del 5,75 %.

- Por funcionalidad

En función de su funcionalidad, el mercado de butilhidroxitolueno (BHT) en Oriente Medio y África se segmenta en conservantes para alimentos y piensos, estabilizadores de polímeros y combustibles, estabilizadores cosméticos y farmacéuticos, y otros. Se prevé que el mercado de conservantes para alimentos y piensos domine en 2025 y presente el mayor crecimiento debido a la creciente demanda de prolongación de la vida útil de los alimentos envasados y procesados, el creciente consumo de alimentos en Oriente Medio y África, y el mayor uso de BHT como antioxidante autorizado en piensos para animales, con el fin de mantener la frescura y la calidad nutricional de los productos.

- Por formulación

Según la formulación, el mercado del butilhidroxitolueno (BHT) en Oriente Medio y África se segmenta en líquido y polvo. Se prevé que el líquido domine la mayor cuota de mercado en 2025 y presente el mayor crecimiento gracias a su superior solubilidad, su facilidad de mezcla en diversas formulaciones y su creciente preferencia en industrias como la de lubricantes, combustibles y cosméticos, donde la dispersión uniforme y la mezcla rápida son cruciales para el rendimiento y la estabilidad.

- Por formato de embalaje

Según el formato de envasado, el mercado de butilhidroxitolueno (BHT) en Oriente Medio y África se segmenta en contenedores IBC, bidones a granel y otros. El segmento de contenedores IBC representó la mayor cuota de mercado en 2024 y también fue el de mayor crecimiento gracias a su alta capacidad de almacenamiento, facilidad de transporte y rentabilidad para uso industrial a gran escala. Los contenedores IBC ofrecen un mejor manejo, menor riesgo de derrames y son ideales para industrias que requieren grandes cantidades con una logística eficiente.

- Por aplicación

Según su aplicación, el mercado del butilhidroxitolueno (BHT) en Oriente Medio y África se segmenta en estabilizadores de polímeros/industria del plástico, industria alimentaria, piensos, ingredientes cosméticos, aditivos para combustibles/aceites, formulaciones de pesticidas, caucho y otros. Este segmento representó la mayor cuota de mercado en 2024, debido a la creciente demanda de productos plásticos duraderos en sectores como el del embalaje, la automoción y la construcción. La eficacia del BHT para prevenir la degradación de los polímeros y mejorar la estabilidad de los materiales impulsa su uso generalizado, impulsando el crecimiento de la industria en un contexto de creciente producción y consumo de plásticos en Oriente Medio y África.

Análisis regional del mercado de butilhidroxitolueno (BHT) en Oriente Medio y África

El mercado de butilhidroxitolueno en Oriente Medio y África (MEA) experimenta un crecimiento estable, impulsado por la expansión de las aplicaciones del BHT en los sectores de alimentación y bebidas, cosmética, farmacéutica e industrial. Se prevé que el mercado crezca de forma sostenida entre 2025 y 2032, impulsado por la creciente industrialización, la creciente demanda de alimentos procesados y la creciente concienciación sobre los aditivos antioxidantes para la conservación de productos.

Arabia Saudita

Arabia Saudita domina el mercado de BHT en Oriente Medio y África, representando el 24,14% de la cuota regional en 2025. Se proyecta que el mercado crezca de USD 3.261,80 mil en 2024 a USD 5.244,22 mil en 2032, registrando la tasa de crecimiento anual compuesta (TCAC) más alta, del 6,56%. Los sólidos sectores de procesamiento de alimentos, petroquímicos y fabricación de cosméticos del país, junto con la alta inversión en la producción de productos químicos industriales, contribuyen a su liderazgo en el mercado. Las iniciativas gubernamentales en el marco de la Visión 2030 que apoyan la fabricación local y la seguridad alimentaria impulsan aún más la expansión del mercado.

Sudáfrica

Sudáfrica ocupará la segunda mayor cuota (19,68 %) en 2025, con un crecimiento de USD 2.678,45 mil en 2024 a USD 4.101,19 mil en 2032, con una tasa de crecimiento anual compuesta (TCAC) del 5,93 %. Este crecimiento se debe a un mayor enfoque en la conservación de alimentos, la expansión de la industria cosmética y el creciente uso de antioxidantes en piensos y envases. Una sólida infraestructura comercial y la presencia de empresas mundiales de alimentos y productos químicos impulsan la penetración en el mercado.

Emiratos Árabes Unidos (EAU)

Los EAU representan el 14,76 % del mercado regional en 2025, con una expansión de USD 2.023,90 mil en 2024 a USD 2.928,00 mil en 2032, con una tasa de crecimiento anual compuesta (TCAC) del 5,18 %. La posición del país como centro comercial regional y su avanzada base de fabricación de cosméticos, ingredientes alimentarios y productos de cuidado personal contribuyen a una demanda constante del mercado. Además, el énfasis regulatorio en la seguridad alimentaria y la prolongación de la vida útil respalda la adopción de aditivos basados en BHT.

Cuota de mercado del butilhidroxitolueno (BHT) en Oriente Medio y África

La industria del butilhidroxitolueno (BHT) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- HONSHU CHEMICAL INDUSTRY CO., LTD. (Japón)

- Azelis (Bélgica)

- KEMIN INDUSTRIES, INC. (EE. UU.)

- Eastman Chemical Company (EE. UU.)

- Sasol (Sudáfrica)

- LANXESS (Alemania)

- Grupo de Tecnología Química Anhui Haihua Co., Ltd. (China)

- VDH CHEM TECH PVT. LTD. (India)

- IMPEXTRACO NV (Bélgica)

- Shandong Hosea Chemical Co., Ltd. (China)

- OXIRIS CHEMICALS SA (España)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Ingredientes de Sinofi (China)

Últimos avances en el mercado del butilhidroxitolueno (BHT) en Oriente Medio y África

- En diciembre de 2024, Clean Fino-Chem Limited inició la producción a escala comercial de butilhidroxitolueno (BHT) en su planta de fabricación de MIDC Kurkumbh, Pune. Esta producción, basada en campañas, aprovecha su infraestructura existente, lo que permite un escalamiento eficiente sin una inversión adicional significativa. Esta medida fortalece la presencia de Clean Fino-Chem en el mercado de antioxidantes, complementando sus antioxidantes existentes, como BHA, TBHQ y palmitato de ascorbilo. La empresa aspira a producir entre 2000 y 3000 toneladas de BHT al año, con destino a los mercados de Oriente Medio y África, incluyendo Europa, Estados Unidos y Latinoamérica, y espera que esta expansión aumente sus ingresos entre 60 y 80 millones de rupias indias. Este desarrollo refuerza su posición competitiva en el creciente mercado de BHT de Oriente Medio y África.

- En octubre de 2023, la empresa destacó que el BHT se utiliza principalmente como aditivo para alimentos y piensos, lo que resaltó su papel como fabricante líder de BHT con una capacidad de producción ampliada. También introdujeron el envasado en bidones (90 kg/bidón) para satisfacer la demanda de los clientes, mejorando así el envasado y la logística para las exportaciones de BHT en el mercado de Oriente Medio y África. Estas actualizaciones reflejan el enfoque continuo de Shanghai Exquisite en fortalecer su presencia en el mercado de BHT en Oriente Medio y África mediante innovaciones en la calidad de sus productos y el envasado.

- En julio de 2025, KANEBO lanzará un nuevo dúo de cremas, "CREAM IN DAY II" y "CREAM IN NIGHT II", inspiradas en el vérnix caseoso, la capa cremosa y protectora de la piel de los recién nacidos. Esta innovación, basada en el nuevo complejo TAISHI™, imita las funciones del vérnix: retener la humedad y fortalecer la barrera cutánea. La crema de día protege la piel de los rayos UV y la sequedad, a la vez que actúa como base de maquillaje, y la crema de noche actúa durante la noche para reafirmar y reducir las arrugas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PATENT ANALYSIS

4.1.1 PATENT FILING LANDSCAPE & VOLUME TRENDS

4.1.2 KEY ASSIGNEES AND ACTIVE FILERS

4.1.3 TECHNOLOGY FOCUS AREAS (WHAT PATENT FAMILIES COVER)

4.1.4 GEOGRAPHIC DISTRIBUTION & JURISDICTIONAL STRATEGY

4.1.5 PATENTABILITY CHALLENGES & FREEDOM-TO-OPERATE (FTO) NOTES

4.1.6 LICENSING, COMMERCIALIZATION & PARTNERSHIP OPPORTUNITIES

4.1.7 IP TRENDS & STRATEGIC RECOMMENDATIONS (NEXT 3–5 YEARS)

4.2 VALUE CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING & PROCESSING

4.2.3 PACKAGING & STORAGE

4.2.4 DISTRIBUTION & LOGISTICS

4.2.5 END-USE INDUSTRIES

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.4 BRAND OUTLOOK

4.4.1 BRAND COMPETITIVE ANALYSIS OF MIDDLE EAST AND AFRICA URO-GYNECOLOGY MARKET

4.4.2 PRODUCT VS BRAND OVERVIEW

4.4.2.1 PRODUCT OVERVIEW

4.4.2.2 BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 CONSUMERS BUYING BEHAVIOUR

4.6.1 PRICE SENSITIVITY

4.6.2 HEALTH & SAFETY CONCERNS

4.6.3 SUSTAINABILITY PREFERENCE

4.6.4 BRAND & TRUST FACTOR

4.6.5 REGIONAL PREFERENCES

4.6.6 INDUSTRIAL VS. CONSUMER DEMAND

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING & PROCESSING COSTS

4.7.3 LOGISTICS & DISTRIBUTION COSTS

4.7.4 REGULATORY COMPLIANCE COSTS

4.7.5 MARGIN & PROFITABILITY CONSIDERATIONS

4.8 INDUSTRY ECO-SYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM SIZE COMPANIES

4.8.3 END USERS

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.9.1.1 JOINT VENTURES

4.9.1.2 MERGERS AND ACQUISITIONS

4.9.1.3 LICENSING AND PARTNERSHIP

4.9.1.4 TECHNOLOGY COLLABORATIONS

4.9.1.5 STRATEGIC DIVESTMENTS

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 RAW MATERIAL COVERAGE

4.10.1 TOLUENE

4.10.2 P-CRESOL

4.10.3 ISOBUTYLENE

4.10.4 CATALYSTS

4.10.5 SOLVENTS

4.10.6 ADDITIVES & PROCESSING AIDS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTICS COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS

4.12.1 ADVANCED SYNTHESIS METHODS

4.12.2 GREEN CHEMISTRY & SUSTAINABILITY

4.12.3 AUTOMATION & DIGITALIZATION

4.12.4 APPLICATION INNOVATIONS

4.12.5 QUALITY ENHANCEMENT & SAFETY TECHNOLOGIES

4.13 TARIFFS AND THEIR IMPACT ON MARKET

4.13.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.13.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.13.3 VENDOR SELECTION CRITERIA DYNAMICS

4.13.4 IMPACT ON SUPPLY CHAIN

4.13.4.1 RAW MATERIAL PROCUREMENT

4.13.4.2 MANUFACTURING AND PRODUCTION

4.13.4.3 LOGISTICS AND DISTRIBUTION

4.13.4.4 PRICE PITCHING AND POSITION OF MARKET

4.13.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.13.5.1 SUPPLY CHAIN OPTIMIZATION

4.13.5.2 JOINT VENTURE ESTABLISHMENTS

4.13.6 IMPACT ON PRICES

4.13.7 REGULATORY INCLINATION

4.13.7.1 GEOPOLITICAL SITUATION

4.13.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.13.7.2.1 FREE TRADE AGREEMENTS

4.13.7.2.2 ALLIANCE ESTABLISHMENTS

4.13.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.13.8 DOMESTIC COURSE OF CORRECTION

4.13.8.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.13.8.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.14 REGULATORY COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR ANTIOXIDANTS IN PROCESSED FOOD AND BEVERAGES

5.1.2 GROWING CONSUMPTION OF PLASTIC AND RUBBER PRODUCTS IN AUTOMOTIVE AND PACKAGING INDUSTRIES

5.1.3 INCREASING USAGE OF BHT IN PERSONAL CARE AND COSMETIC FORMULATIONS

5.1.4 EXPANSION OF FUEL AND LUBRICANT ADDITIVE MARKETS IN EMERGING ECONOMIES

5.2 RESTRAINTS

5.2.1 HEALTH AND ENVIRONMENTAL CONCERNS RELATED TO SYNTHETIC ANTIOXIDANTS

5.2.2 STRINGENT REGULATORY RESTRICTIONS IN REGIONS LIKE THE EU AND JAPAN

5.3 OPPORTUNITY

5.3.1 RISING ADOPTION OF BHT IN ANIMAL FEED ADDITIVES FOR SHELF-LIFE ENHANCEMENT

5.3.2 GROWTH IN DEMAND FROM PHARMACEUTICAL EXCIPIENT APPLICATIONS

5.3.3 EXPANSION OF BHT APPLICATIONS IN EMERGING SECTORS LIKE BIOFUELS AND AGROCHEMICALS

5.4 CHALLENGES

5.4.1 VOLATILITY IN RAW MATERIAL PRICES IMPACTING PRODUCTION COSTS

5.4.2 INCREASING SHIFT TOWARD NATURAL ANTIOXIDANTS SUCH AS TOCOPHEROLS AND ROSEMARY EXTRACT

6 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE

6.1 OVERVIEW

6.2 TECHNICAL GRADE

6.3 INDUSTRIAL GRADE

6.4 FOOD GRADE

6.5 COSMETIC GRADE

6.6 PHARMACEUTICAL GRADE

6.7 OTHERS

7 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY

7.1 OVERVIEW

7.2 FOOD AND FEED PRESERVATIVES

7.3 POLYMER & FUEL STABILIZER

7.4 COSMETIC & PHARMACEUTICAL STABILIZER

7.5 OTHERS

8 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 LIQUID

8.3 POWDER

9 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT

9.1 OVERVIEW

9.2 IBC TOTES

9.3 BULK DRUMS

9.4 OTHERS

10 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 POLYMER STABILIZERS/PLASTIC INDUSTRY

10.3 FOOD INDUSTRY

10.4 ANIMAL FEED

10.5 COSMETIC INGREDIENTS

10.6 FUEL/OIL ADDITIVES

10.7 PESTICIDE FORMULATIONS

10.8 RUBBER

10.9 OTHERS

11 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 SOUTH AFRICA

11.1.3 UNITED ARAB EMIRATES

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 KUWAIT

11.1.7 OMAN

11.1.8 QATAR

11.1.9 BAHRAIN

11.1.10 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 EASTMAN CHEMICAL COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 SASOL

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 JIANGXI ALPHA HI-TECH PHARMACEUTICAL CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 AARNEE INTERNATIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ASESCHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ANHUI HAIHUA CHEMICAL TECHNOLOGY GROUP CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CLEAN FINO-CHEM LIMITED.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EABC GLOBAL

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 GUANGZHOU ZIO CHEMICAL CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HANGZHOU KEYING CHEM CO.,LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 JINAN FUTURE CHEMICAL CO.,LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LANXESS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SCIMPLIFY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHANDONG HOSEA CHEMICAL CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHANGHAI DEBORN CO., LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SHANGHAI EXQUISITE BIOCHEMICAL CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SIGMA ALDRICH (SUBSIDIARY OF MERCK KGAA)

14.19.1 COMPANY SNAPSHOT

14.19.2 RECENT FINANCIALS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SILVERLINE CHEMICALS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SINOFI INGREDIENTS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 KAO CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 VDH CHEM TECH PVT LTD

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 ZHENGZHOU CHORUS LUBRICANT ADDITIVE CO., LTD.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

14.25 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO.,LTD.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA TECHNICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA INDUSTRIAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FOOD GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA COSMETIC GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FOOD AND FEED PRESERVATIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYMER & FUEL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA COSMETIC & PHARMACEUTICAL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA LIQUID IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWDER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA IBC TOTES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BULK DRUMS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FRAGRANCES & PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FUEL/OIL ADDITIVE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA

TABLE 73 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 161 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 162 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 163 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 164 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 165 SOUTH AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SOUTH AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 167 SOUTH AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SOUTH AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SOUTH AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SOUTH AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SOUTH AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 172 SOUTH AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 173 SOUTH AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SOUTH AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SOUTH AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SOUTH AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SOUTH AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SOUTH AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SOUTH AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SOUTH AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 183 SOUTH AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SOUTH AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SOUTH AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SOUTH AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SOUTH AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SOUTH AFRICA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SOUTH AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SOUTH AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 192 SOUTH AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SOUTH AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 194 SOUTH AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SOUTH AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SOUTH AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SOUTH AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SOUTH AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SOUTH AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 204 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 207 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 U.A.E DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 U.A.E BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 U.A.E SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.A.E ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 226 U.A.E ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 U.A.E COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 U.A.E SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 U.A.E HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 U.A.E MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 U.A.E BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 U.A.E FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 U.A.E FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 U.A.E FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 235 U.A.E PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 U.A.E PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 237 U.A.E CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.A.E FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 U.A.E VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 U.A.E OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 U.A.E COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.A.E RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.A.E SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.A.E SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 246 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 247 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 248 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 249 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 250 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 EGYPT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 EGYPT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 253 EGYPT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 EGYPT FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 EGYPT INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 EGYPT FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 EGYPT FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 258 EGYPT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 259 EGYPT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 EGYPT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 EGYPT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 EGYPT BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 EGYPT SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 EGYPT CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 EGYPT DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 EGYPT BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 EGYPT SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 EGYPT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 269 EGYPT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 EGYPT COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 EGYPT SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 EGYPT HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 EGYPT FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 278 EGYPT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 EGYPT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 280 EGYPT CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 EGYPT FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 EGYPT VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 EGYPT OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 EGYPT COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 EGYPT RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 EGYPT SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 EGYPT SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 289 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 290 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 291 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 292 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 293 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 ISRAEL POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 ISRAEL POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 296 ISRAEL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 ISRAEL FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 ISRAEL INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 ISRAEL FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 ISRAEL FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 301 ISRAEL FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 302 ISRAEL FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 ISRAEL PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 ISRAEL PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 ISRAEL BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ISRAEL SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ISRAEL CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 ISRAEL DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ISRAEL BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 ISRAEL SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 ISRAEL ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 312 ISRAEL ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 ISRAEL COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 ISRAEL SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ISRAEL HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ISRAEL MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 ISRAEL BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 ISRAEL FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 ISRAEL FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 ISRAEL FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 321 ISRAEL PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 ISRAEL PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 323 ISRAEL CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 ISRAEL FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ISRAEL VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ISRAEL OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ISRAEL COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ISRAEL RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ISRAEL SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 ISRAEL SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 332 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 333 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 334 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 335 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 336 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 337 KUWAIT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 KUWAIT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 339 KUWAIT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 KUWAIT FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 KUWAIT INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 KUWAIT FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 KUWAIT FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 344 KUWAIT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 345 KUWAIT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 KUWAIT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 KUWAIT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 KUWAIT BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 KUWAIT SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 KUWAIT CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 KUWAIT DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 KUWAIT BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 KUWAIT SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 KUWAIT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 355 KUWAIT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 KUWAIT COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 KUWAIT SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 KUWAIT HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 KUWAIT MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 KUWAIT BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 KUWAIT FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 KUWAIT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 KUWAIT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 364 KUWAIT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 KUWAIT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 366 KUWAIT CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 KUWAIT FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 KUWAIT VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 KUWAIT OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 KUWAIT COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 KUWAIT RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 KUWAIT SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 KUWAIT SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 375 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 376 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 377 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 378 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 379 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 380 OMAN POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 OMAN POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 382 OMAN PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 OMAN FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 OMAN INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 OMAN FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 OMAN FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)