Middle East And Africa Corrugated Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

27.65 Million

USD

39.17 Million

2024

2032

USD

27.65 Million

USD

39.17 Million

2024

2032

| 2025 –2032 | |

| USD 27.65 Million | |

| USD 39.17 Million | |

|

|

|

Segmentación del mercado de embalajes de cartón corrugado en Oriente Medio y África, por producto (contenedor ranurado regular (RSC), contenedor ranurado medio (HSC), contenedor ranurado superpuesto (OSC), contenedor ranurado superpuesto completo (FOL), contenedor ranurado especial central (CSSC), contenedor de fondo 1-2-3 o de fondo con cierre automático (ALB), cajas telescópicas (bandejas de diseño, bandejas plegadas, bandejas plegables), carpetas y cajas envolventes), tipo de flauta (flauta C, flauta B, flauta E, flauta A, flauta F y flauta D), estilo de cartón (pared simple, pared doble, pared triple, una cara y cartón de revestimiento), capacidad (hasta 100 lb, 100-300 lb y más de 300 lb), tamaño (0-10 pulgadas, 10-20 pulgadas, 20-30 pulgadas y más de 30 pulgadas), tipo de impresión (impresa y no impresa), aplicación (comercio electrónico) Tendencias de la industria y pronóstico hasta 2032 (venta minorista, alimentación, electrónica, electrodomésticos automoción, atención médica y farmacéutica, bebidas, cristalería y cerámica, cuidado personal, cuidado del hogar, agricultura y horticultura, petróleo y gas, juguetes, productos para bebés y otros).

Tamaño del mercado de embalajes de cartón ondulado

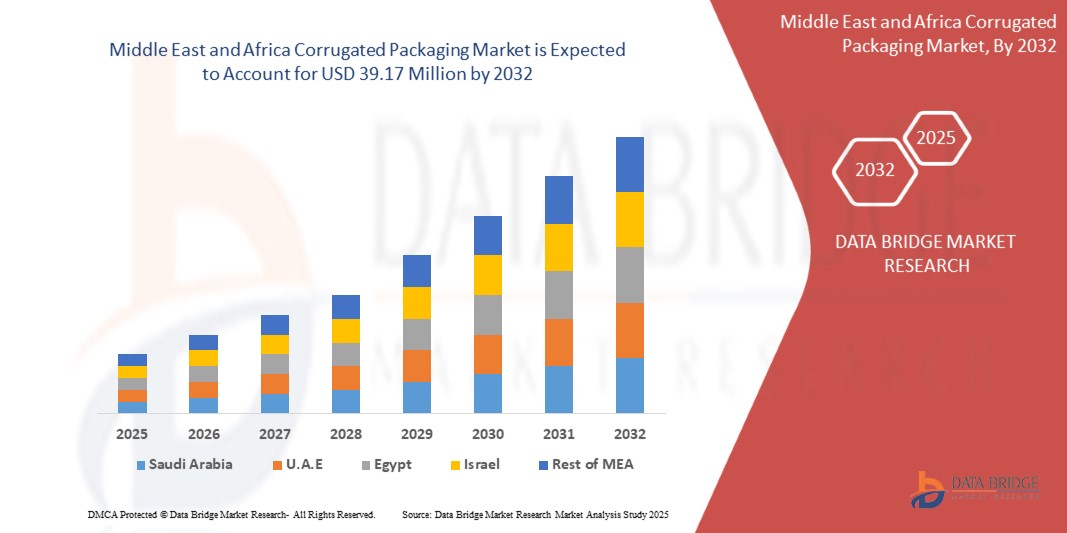

- El mercado de embalajes de cartón ondulado en Oriente Medio y África se valoró en 27,65 millones de dólares en 2024 y se espera que alcance los 39,17 millones de dólares en 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 4,6 %, impulsado principalmente por el avance de la tecnología.

- Este crecimiento está impulsado por factores como la personalización en productos, embalajes sostenibles, adopción de materiales reciclables y renovables, comercio electrónico en embalajes de cartón ondulado.

Análisis del mercado de embalajes de cartón ondulado

- El embalaje de cartón ondulado es un material ampliamente utilizado en industrias como el comercio electrónico, la alimentación y bebidas, la farmacéutica y los bienes de consumo gracias a su durabilidad, reciclabilidad y rentabilidad. Ofrece una protección superior durante el envío y el almacenamiento, lo que lo hace esencial para las cadenas de suministro de Oriente Medio y África.

- La creciente demanda de soluciones de embalaje sostenibles y el auge del comercio electrónico han impulsado significativamente la expansión del mercado de embalajes de cartón ondulado. Con las empresas centradas en la reducción de residuos plásticos, los materiales de cartón ondulado han cobrado relevancia como alternativa ecológica.

- El país de los Emiratos Árabes Unidos se destaca como uno de los países dominantes en embalajes de cartón ondulado, impulsado por su creciente industrialización, urbanización y el auge de los sectores minoristas en línea.

Alcance del informe y segmentación del mercado de embalajes de cartón ondulado

|

Atributos |

Perspectivas clave del mercado de embalajes de cartón ondulado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de embalajes de cartón ondulado

Creciente demanda de soluciones de embalaje sostenibles e inteligentes

- Una tendencia destacada en el mercado de embalajes de cartón ondulado de Oriente Medio y África es el cambio creciente hacia soluciones de embalaje sostenibles e inteligentes impulsadas por las regulaciones ambientales y las preferencias de los consumidores.

- Las empresas están invirtiendo en embalajes de cartón ondulado ecológicos, reciclables y biodegradables para reducir la huella de carbono y alinearse con los objetivos de la economía circular.

- Por ejemplo, Smurfit Kappa se asoció con Mindful Chef para desarrollar paquetes de aislamiento de cartón corrugado 100 % reciclables, lo que redujo la huella de carbono en un 30 %. El embalaje sostenible mantuvo las temperaturas requeridas durante más de 30 horas durante las pruebas. Esta innovación sustituyó las bolsas de aislamiento no reciclables, impulsando así el reparto de alimentos ecológico.

- Las tecnologías de embalaje inteligente, como las etiquetas RFID, los códigos QR y la impresión digital, se están integrando en las cajas de cartón corrugado para mejorar la visibilidad de la cadena de suministro, el seguimiento de los productos y la participación del consumidor.

- Esta tendencia está transformando la industria del embalaje de cartón ondulado, fomentando la innovación, la rentabilidad y el cumplimiento de las normas de Oriente Medio y África.

- estándares de sostenibilidad, que en última instancia impulsan el crecimiento del mercado a largo plazo

Dinámica del mercado de embalajes de cartón ondulado

Conductor

El crecimiento de los sectores minorista y de bienes de consumo de alta rotación acelera la adopción de envases de cartón ondulado.

- Con el aumento de las compras en línea, las marcas están priorizando los embalajes duraderos y ecológicos para mejorar la seguridad del producto y satisfacer las expectativas cambiantes de los consumidores.

- Además, las regulaciones gubernamentales que promueven los materiales reciclables contribuyen aún más a la creciente preferencia por los envases de cartón corrugado.

- Las cataratas, en particular, son una de las causas más comunes de ceguera en todo el mundo, lo que requiere procedimientos quirúrgicos que exigen altos niveles de precisión.

- A medida que las empresas de bienes de consumo de alta rotación (FMCG) amplían sus líneas de productos y exploran formatos de embalaje innovadores, las láminas corrugadas ofrecen versatilidad y opciones de personalización. Desde alimentos y bebidas hasta productos de cuidado personal, estas láminas ofrecen una excelente resistencia estructural y oportunidades para el desarrollo de marcas.

Por ejemplo,

- En febrero de 2020, según Business Wire, SpendEdge ayudó a una empresa de bienes de consumo masivo (FMCG) a desarrollar un enfoque estratégico de abastecimiento de embalajes, logrando un ahorro anual de 15 millones de dólares. Al optimizar la selección de proveedores, la agregación de gastos y los factores de coste, la empresa mejoró la eficiencia de su cadena de suministro y fortaleció su posición en el mercado. Dado que las empresas de FMCG priorizan la optimización de costes y la eficiencia operativa, la demanda de embalajes de cartón ondulado sostenibles y rentables está en aumento. El enfoque en el abastecimiento estratégico, la evaluación de proveedores y la optimización del coste total impulsa aún más la adopción de embalajes de cartón ondulado en los sectores minorista y de FMCG.

- En un artículo publicado en marzo de 2025 por Fresh Plaza, se destacó que Klabin introdujo el transporte marítimo fluvial para optimizar el transporte de cartón corrugado en Brasil, reduciendo costos, plazos de entrega e impacto ambiental. La empresa también está invirtiendo en cartón resistente a la humedad, apoyando así el crecimiento de los sectores minorista y de bienes de consumo de alta rotación (FMCG), impulsado por el comercio electrónico, la exportación de productos frescos y las demandas de sostenibilidad.

- La rápida expansión de los sectores minorista y de bienes de consumo de alta rotación (FMCG) es un factor clave que impulsa la creciente adopción de embalajes de cartón ondulado. A medida que crece la demanda de comercio electrónico, embalajes sostenibles y logística rentable, las empresas optan por soluciones de cartón ondulado ligeras, duraderas y reciclables. La transición hacia embalajes ecológicos y la necesidad de una gestión eficiente de la cadena de suministro refuerzan aún más esta tendencia. Dado que los minoristas y las marcas de FMCG priorizan la sostenibilidad y la protección del producto, se prevé que el mercado de embalajes de cartón ondulado experimente un crecimiento e innovación continuos.

Oportunidad

La expansión del comercio electrónico en Oriente Medio y África impulsa la demanda de embalajes de cartón ondulado ligeros y duraderos.

- La rápida expansión del comercio electrónico en Oriente Medio y África impulsa significativamente la demanda de embalajes ligeros y duraderos que protejan los productos durante el transporte.

- El auge del comercio minorista en línea crea una necesidad de soluciones confiables y rentables como los embalajes de cartón ondulado, conocidos por su resistencia y reciclabilidad.

- Los fabricantes adoptan cada vez más diseños avanzados para optimizar la logística de la cadena de suministro y reducir las tasas de daños. Esta tendencia promete un crecimiento constante de los ingresos y un potencial de mercado considerable a medida que el comercio digital continúa evolucionando.

Por ejemplo,

- En mayo de 2024, según un artículo publicado por Baywater Packaging & Supply, el rápido crecimiento del comercio electrónico en 2024 incrementó significativamente la demanda de cajas de cartón corrugado debido al auge de las compras en línea. Las empresas necesitaban embalajes más duraderos, ligeros y sostenibles para satisfacer el creciente volumen de envíos. Las innovaciones en materiales ecológicos y soluciones de embalaje inteligentes se volvieron esenciales para satisfacer las preferencias de los consumidores y las normas regulatorias. La expansión de las redes logísticas y los avances en la cadena de suministro impulsaron aún más la demanda. Las empresas se centraron en optimizar la producción, el reciclaje y el diseño eficiente de embalajes para adaptarse a las cambiantes necesidades del mercado.

- En marzo de 2024, Mondi publicó un informe sobre las tendencias de embalaje en el comercio electrónico, basado en una encuesta a 6.000 consumidores de Europa y Turquía. El estudio exploró los hábitos de compra, las preferencias de embalaje, los comportamientos de reciclaje y las tendencias futuras. Hizo hincapié en la colaboración entre las marcas de comercio electrónico y los proveedores de embalajes para satisfacer las expectativas de los consumidores y los objetivos de sostenibilidad. Ante la creciente demanda de embalajes sostenibles, el comercio electrónico representó una gran oportunidad para que los embalajes de cartón ondulado impulsaran soluciones ecológicas y eficientes.

- La rápida expansión del comercio electrónico en Oriente Medio y África está impulsando una importante demanda de embalajes de cartón ondulado ligeros y duraderos. A medida que las ventas minoristas en línea siguen creciendo, las empresas están adoptando soluciones de embalaje innovadoras y sostenibles para satisfacer la demanda de envíos. Los avances en logística, ciencia de materiales y embalaje inteligente fortalecerán aún más el mercado de embalajes de cartón ondulado, garantizando la eficiencia y la sostenibilidad ambiental.

Restricción/Desafío

“La fluctuación de los precios de las materias primas eleva los costos de producción y reduce los márgenes de ganancia”

- Los precios volátiles de las materias primas, en particular del papel kraft y la fibra reciclada, aumentan significativamente los costos de producción y comprimen los márgenes de ganancia en la industria del embalaje de cartón ondulado.

- Las fluctuaciones en los precios de la pulpa y el papel generan inestabilidad financiera, lo que dificulta que los fabricantes planifiquen sus presupuestos y mantengan la rentabilidad.

- Para afrontar el aumento de los costes, las empresas suelen adoptar medidas de reducción de costes, lo que puede afectar a la calidad de los productos y a la eficiencia operativa. Muchas mitigan estos desafíos mediante contratos de suministro a largo plazo e invirtiendo en tecnologías de fabricación avanzadas para mejorar la eficiencia y reducir el desperdicio.

Por ejemplo,

- En julio de 2024, según un artículo publicado por JohnsByrne, los costos de empaquetado para el comercio electrónico aumentaron debido al aumento de los precios de las materias primas, la escasez de mano de obra y el aumento de los gastos de transporte. El mercado de empaquetado de cartón corrugado enfrentó desafíos a medida que la demanda crecía y las expectativas de sostenibilidad crecían. Para abordar estos problemas, las empresas adoptaron empaquetado de tamaño adecuado, utilizaron materiales sostenibles y rentables, automatizaron el cumplimiento y optimizaron la gama de productos. Estas estrategias ayudaron a reducir gastos, manteniendo la eficiencia y la satisfacción del cliente.

- En octubre de 2024, según un artículo publicado por THG PUBLISHING PVT LTD., la Asociación de Fabricantes de Cajas de Cartón Corrugado de Kerala (KeCBMA) aumentó los precios de las cajas de cartón corrugado un 15 % debido al aumento del coste del papel kraft. Los fabricantes se enfrentaron a dificultades para mantener la rentabilidad ante el aumento de los gastos en materias primas, lo que afectó al mercado de embalajes de cartón corrugado.

- La industria del embalaje de cartón ondulado sigue enfrentándose a importantes desafíos debido a la fluctuación de los precios de las materias primas, en particular el aumento del coste del papel kraft. Estos aumentos repentinos de precios han incrementado los gastos de producción, reducido los márgenes de beneficio y obligado a los fabricantes a implementar estrategias de ahorro como la automatización y la optimización del embalaje. Para mantener la rentabilidad, las empresas están adoptando acuerdos de suministro a largo plazo y explorando materiales alternativos. Abordar estas presiones de costes sigue siendo crucial para mantener la estabilidad y la competitividad del mercado.

Alcance del mercado de embalajes de cartón ondulado

El mercado está segmentado según el producto, el tipo de flauta, el estilo de tablero, la capacidad, el tamaño, el tipo de impresión y la aplicación.

|

Segmentación |

Subsegmentación |

|

Por producto |

|

|

Por tipo de flauta |

|

|

Por estilo de tablero |

|

|

Por capacidad |

|

|

Por tamaño |

|

|

Por tipo de impresión

|

|

|

Por aplicación |

|

Análisis regional del mercado de embalajes de cartón ondulado

Emiratos Árabes Unidos es el país dominante en el mercado de embalajes de cartón ondulado.

- Los Emiratos Árabes Unidos dominan el mercado de embalajes de cartón ondulado , impulsados por el auge del sector del comercio electrónico, la rápida industrialización y la alta demanda de soluciones de embalaje rentables y sostenibles.

- La región se beneficia de bajos costos de fabricación, una sólida cadena de suministro y grandes mercados de consumo como China e India, lo que impulsa una mayor producción y consumo.

Se proyecta que Arabia Saudita se convertirá en el país de más rápido crecimiento.

- Arabia Saudita está experimentando un rápido crecimiento en el mercado de embalajes de cartón ondulado, impulsado por las regulaciones de sostenibilidad, la creciente adopción del comercio electrónico y un cambio hacia soluciones de embalaje ecológicas.

- Además, la creciente presencia de servicios minoristas y de entrega de alimentos en la región impulsa la demanda de soluciones de embalaje de cartón corrugado rentables y duraderas.

Cuota de mercado de los embalajes de cartón ondulado

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia regional, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Smurfit Kappa (Irlanda)

- Oji Holdings Corporation (Japón)

- Mundial (Reino Unido)

- Stora Enso (Finlandia)

- Sonoco Products Company (EE. UU.)

- WestRock Company (EE. UU.)

- Compañía Rengo, Ltd. (Japón)

- SCG Packaging (Tailandia)

Últimos avances en el mercado de embalajes de cartón ondulado en Oriente Medio y África

- En enero de 2025, International Paper adquirirá DS Smith para crear una empresa líder en Oriente Medio y África en soluciones de embalaje sostenible. El objetivo es ofrecer una experiencia de cliente excepcional y potenciar la innovación en la industria del embalaje. Al aunar las capacidades de ambas empresas, planean ofrecer soluciones de embalaje más sostenibles, eficientes e innovadoras, satisfaciendo la creciente demanda de productos ecológicos y consolidando su liderazgo en el sector.

- En mayo de 2023, Stora Enso presenta un nuevo tipo de cartón de embalaje fácilmente reciclable para alimentos congelados y refrigerados. Tambrite Aqua+ es un nuevo material de embalaje circular para alimentos congelados y refrigerados que reduce la necesidad de plásticos fósiles y mejora la reciclabilidad tras su uso.

- En junio de 2024, Smurfit Kappa adquiere una planta de Bag-in-Box en Bulgaria. Esta adquisición fortalecerá la posición de Smurfit Kappa en el mercado de embalajes de Oriente Medio y África, ampliando su oferta de productos y mejorando su capacidad para ofrecer soluciones sostenibles y de alta calidad a sus clientes.

- En agosto de 2019, Elsons International, bajo la dirección de Andrew Jackson, director ejecutivo, colabora activamente con la comunidad para mejorar las oportunidades de empleo en el sector manufacturero. La compañía continúa sus esfuerzos para mejorar el mercado laboral en esta industria. Esto significa que el sector del cartón corrugado se beneficiará de la colaboración y generará más empleo. Es probable que esto genere una mayor demanda de mano de obra y recursos en la producción de productos corrugados, lo que generará más empleo en ese sector.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL:

4.2.2 ECONOMIC:

4.2.3 SOCIAL:

4.2.4 TECHNOLOGICAL:

4.2.5 LEGAL:

4.2.6 ENVIRONMENTAL:

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 SMART PACKAGING INTEGRATION

4.4.2 MAX LAMINATION TECHNOLOGY

4.4.3 HIGH-PRECISION DIGITAL PRINTING

4.4.4 3 D & AI-DRIVEN PACKAGING DESIGN

4.4.5 AUTOMATED PRODUCTION & ROBOTICS

4.4.6 FLEXO PRINTING AND DIGITAL TECHNOLOGY

4.4.7 FIT-TO-PRODUCT (FTP)

4.5 RAW MATERIAL COVERAGE

4.5.1 CELLULOSE FIBERS

4.5.2 STARCH-BASED ADHESIVES

4.5.3 SPECIALTY COATINGS & ADDITIVES

4.5.4 REINFORCEMENT MATERIALS

4.5.5 RECYCLED MATERIALS & SUSTAINABILITY INNOVATIONS

4.6 IMPORT EXPORT SCENARIO

4.7 SUPPLY CHAIN ANALYSIS

4.8 LOGISTICS COST SCENARIO

4.9 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY & COMPLIANCE

4.11.2 COST & PRICING STRUCTURE

4.11.3 SUSTAINABILITY PRACTICES

4.11.4 PRODUCTION CAPACITY & LEAD TIME

4.11.5 CUSTOMIZATION & DESIGN CAPABILITIES

4.11.6 SUPPLY CHAIN RELIABILITY & LOGISTICS

4.11.7 TECHNOLOGICAL CAPABILITIES & INNOVATION

4.11.8 CUSTOMER SUPPORT & AFTER-SALES SERVICE

4.12 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN RETAIL AND FMCG SECTORS ACCELERATES CORRUGATED PACKAGING ADOPTION

6.1.2 SURGE IN DEMAND FOR PROTECTIVE PACKAGING ENHANCES INNOVATION IN CORRUGATED BOX DESIGNS

6.1.3 GROWING HEALTHCARE & PHARMACEUTICAL SECTOR DRIVES DEMAND FOR STERILE AND SECURE PACKAGING

6.1.4 INNOVATIONS IN DIGITAL PRINTING ENHANCE BRANDING AND CUSTOMIZATION IN CORRUGATED PACKAGING

6.2 RESTRAINTS

6.2.1 LIMITED RECYCLABILITY OF MULTI-LAYERED CORRUGATED PACKAGING HAMPERS SUSTAINABLE ADOPTION AND RAISING ENVIRONMENTAL CONCERNS

6.2.2 LIMITED DURABILITY COMPARED TO RIGID PACKAGING MATERIALS RESTRICTS ADOPTION FOR HEAVY-DUTY APPLICATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR SUSTAINABLE PACKAGING CREATES OPPORTUNITIES FOR CORRUGATED SOLUTIONS

6.3.2 EXPANDING MIDDLE EAST AND AFRICA E-COMMERCE BOOSTS DEMAND FOR LIGHTWEIGHT, DURABLE CORRUGATED PACKAGING

6.3.3 ADVANCEMENT IN TECHNOLOGY VIA RFID AND QR CODES BOOSTS SMART PACKAGING TRACEABILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES ELEVATE PRODUCTION COSTS AND COMPRESS PROFIT MARGINS

6.4.2 INTENSE COMPETITION FROM ALTERNATIVE PACKAGING MATERIALS REDUCES MARKET SHARE AND COMPRESSES PRICING

7 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 REGULAR SLOTTED CONTAINER (RSC)

7.2.1 REGULAR SLOTTED CONTAINER (RSC), BY FLUTE TYPE

7.2.2 REGULAR SLOTTED CONTAINER (RSC), BY BOARD TYPE

7.3 HALF SLOTTED CONTAINER (HSC)

7.3.1 HALF SLOTTED CONTAINER (HSC), BY FLUTE TYPE

7.3.2 HALF SLOTTED CONTAINER (HSC), BY BOARD TYPE

7.4 OVERLAP SLOTTED CONTAINER (OSC)

7.4.1 OVERLAP SLOTTED CONTAINER (OSC), BY FLUTE TYPE

7.4.2 OVERLAP SLOTTED CONTAINER (OSC), BY BOARD TYPE

7.5 FULL OVERLAP SLOTTED CONTAINER (FOL)

7.5.1 FULL OVERLAP SLOTTED CONTAINER (FOL), BY FLUTE TYPE

7.5.2 FULL OVERLAP SLOTTED CONTAINER (FOL), BY BOARD TYPE

7.6 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.6.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.6.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.7 CENTER SPECIAL SLOTTED CONTAINER (CSSC)

7.7.1 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY FLUTE TYPE

7.7.2 CENTER SPECIAL SLOTTED CONTAINER (CSSC), BY BOARD TYPE

7.8 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.8.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.8.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.9 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB)

7.9.1 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY FLUTE TYPE

7.9.2 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB), BY BOARD TYPE

7.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS)

7.10.1 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY FLUTE TYPE

7.10.2 TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS), BY BOARD TYPE

7.11 FOLDERS

7.11.1 FOLDERS, BY FLUTE TYPE

7.11.2 FOLDERS, BY BOARD TYPE

7.12 WRAPAROUND BLANK

7.12.1 WRAPAROUND BLANK, BY FLUTE TYPE

7.12.2 WRAPAROUND BLANK, BY BOARD TYPE

8 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE

8.1 OVERVIEW

8.2 C FLUTE

8.3 B FLUTE

8.4 E FLUTE

8.5 A FLUTE

8.6 F FLUTE

8.7 D FLUTE

9 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BOARD STYLE

9.1 OVERVIEW

9.2 SINGLE WALL

9.3 DOUBLE WALL

9.4 TRIPLE WALL

9.5 SINGLE FACE

9.6 LINER BOARD

10 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 UPTO 100 LBS

10.3 100-300 LBS

10.4 ABOVE 300 LBS

11 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE

11.1 OVERVIEW

11.2 0-10 INCHES

11.3 10-20 INCHES

11.4 20-30 INCHES

11.5 ABOVE 30 INCHES

12 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE

12.1 OVERVIEW

12.2 PRINTED

12.3 NON-PRINTED

13 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 E-COMMERCE & RETAIL

13.3 FOOD

13.3.1 FOOD, BY APPLICATION

13.4 ELECTRONICS GOODS

13.4.1 ELECTRIC GOODS, BY APPLICATION

13.4.1.1 CONSUMER ELECTRONICS, BY TYPE

13.4.1.2 COMPUTER AND IT HARDWARE, BY TYPE

13.5 HOME APPLIANCES

13.5.1 HOME APPLIANCES, BY APPLICATION

13.5.1.1 MAJOR HOME APPLIANCES, BY TYPE

13.5.1.2 HEATING AND COOLING DEVICES, BY TYPE

13.5.1.3 SMALL KITCHEN, BY TYPE

13.6 AUTOMOTIVE

13.6.1 AUTOMOTIVE, BY APPLICATION

13.7 HEALTHCARE & PHARMACEUTICALS

13.7.1 HEALTHCARE, BY APPLICATION

13.7.1.1 PHARMACEUTICALS, BY TYPE

13.7.1.2 HEALTHCARE, BY TYPE

13.8 BEVERAGE

13.8.1 BEVERAGE, BY APPLICATION

13.9 GLASSWARE AND CERAMICS

13.9.1 GLASSWARE AND CERAMICS, BY APPLICATION

13.9.1.1 GLASSWARE, BY TYPE

13.9.1.2 CERAMICS, BY TYPE

13.1 PERSONAL CARE

13.10.1 PERSONAL CARE, BY APPLICATION

13.11 HOME CARE

13.11.1 HOME CARE, BY APPLICATION

13.12 AGRICULTURE & HORTICULTURE

13.12.1 AGRICULTURE & HORTICULTURE, BY APPLICATION

13.13 OIL AND GAS

13.13.1 OIL AND GAS, BY APPLICATION

13.14 TOYS

13.14.1 TOYS, BY APPLICATION

13.15 BABY PRODUCTS

13.15.1 BABY PRODUCTS, BY APPLICATION

13.16 OTHERS

14 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 UNITED ARAB EMIRATES

14.1.2 SAUDI ARABIA

14.1.3 SOUTH AFRICA

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 WESTROCK COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT/NEWS

17.2 INTERNATIONAL PAPER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT/NEWS

17.3 STORA ENSO

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT/NEWS

17.4 SMURFIT KAPPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT/NEWS

17.5 PACKAGING CORPORATION OF AMERICA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT NEWS

17.6 AMERIPAC INDUSTRIES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ELSONS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT/NEWS

17.8 GEORGIA-PACIFIC

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT/NEWS

17.9 MONDI

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT/NEWS

17.1 OJI HOLDINGS CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT/NEWS

17.11 PRATT INDUSTRIES, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 RENGO CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT/NEWS

17.13 SCG PACKAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT/NEWS

17.14 SONOCO PRODUCTS COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT/NEWS

17.15 TGIPACKAGING.IN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 VPK GROUP NV

17.16.1 COMPANY SNAPSHOT

17.16.2 1.1.4 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT/NEWS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 GREENHOUSE GAS EMISSIONS FOR COMMON BOX SIZES

TABLE 3 FIBERBOARD PERFORMANCE STANDARDS

TABLE 4 TIME TAKEN FOR GARBAGE TO DECOMPOSE IN THE ENVIRONMENT

TABLE 5 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 7 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA C FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA B FLUTE IN CORRUGATED PACKAGING MARKETMARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA E FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA A FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA F FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA D FLUTE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SINGLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA DOUBLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA TRIPLE WALL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA SINGLE FACE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA LINER BOARD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA UPTO 100 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA 100-300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ABOVE 300 LBS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA 0-10 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA 10-20 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA 20-30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA ABOVE 30 INCHES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA NON-PRINTED IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA E-COMMERCE & RETAIL IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 98 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 100 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA OTHERS IN CORRUGATED PACKAGING MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 106 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 153 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 154 UNITED ARAB EMIRATES REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 155 UNITED ARAB EMIRATES REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 156 UNITED ARAB EMIRATES HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 157 UNITED ARAB EMIRATES HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 158 UNITED ARAB EMIRATES OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 159 UNITED ARAB EMIRATES OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 160 UNITED ARAB EMIRATES FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 161 UNITED ARAB EMIRATES FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 162 UNITED ARAB EMIRATES CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 163 UNITED ARAB EMIRATES CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 164 UNITED ARAB EMIRATES 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 165 UNITED ARAB EMIRATES 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 166 UNITED ARAB EMIRATES TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 167 UNITED ARAB EMIRATES TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 168 UNITED ARAB EMIRATES FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 169 UNITED ARAB EMIRATES FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 170 UNITED ARAB EMIRATES WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 171 UNITED ARAB EMIRATES WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 172 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 173 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 177 UNITED ARAB EMIRATES CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 178 UNITED ARAB EMIRATES FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 179 UNITED ARAB EMIRATES ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 180 UNITED ARAB EMIRATES CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 181 UNITED ARAB EMIRATES COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 182 UNITED ARAB EMIRATES HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 184 UNITED ARAB EMIRATES HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 185 UNITED ARAB EMIRATES SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 UNITED ARAB EMIRATES AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 187 UNITED ARAB EMIRATES HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 UNITED ARAB EMIRATES HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 UNITED ARAB EMIRATES BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 191 UNITED ARAB EMIRATES GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 192 UNITED ARAB EMIRATES GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 UNITED ARAB EMIRATES CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 UNITED ARAB EMIRATES PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 195 UNITED ARAB EMIRATES HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 196 UNITED ARAB EMIRATES AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 197 UNITED ARAB EMIRATES OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 UNITED ARAB EMIRATES TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 199 UNITED ARAB EMIRATES BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 200 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 201 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 202 SAUDI ARABIA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 203 SAUDI ARABIA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 204 SAUDI ARABIA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 205 SAUDI ARABIA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 206 SAUDI ARABIA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 207 SAUDI ARABIA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 208 SAUDI ARABIA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 209 SAUDI ARABIA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 210 SAUDI ARABIA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 211 SAUDI ARABIA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 212 SAUDI ARABIA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 213 SAUDI ARABIA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 214 SAUDI ARABIA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 215 SAUDI ARABIA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 216 SAUDI ARABIA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 217 SAUDI ARABIA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 218 SAUDI ARABIA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 219 SAUDI ARABIA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 220 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 221 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 222 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 223 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 224 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 225 SAUDI ARABIA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 226 SAUDI ARABIA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 SAUDI ARABIA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 228 SAUDI ARABIA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 SAUDI ARABIA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 SAUDI ARABIA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 231 SAUDI ARABIA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 232 SAUDI ARABIA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 SAUDI ARABIA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 SAUDI ARABIA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 235 SAUDI ARABIA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 236 SAUDI ARABIA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 SAUDI ARABIA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 SAUDI ARABIA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 239 SAUDI ARABIA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 240 SAUDI ARABIA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 241 SAUDI ARABIA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 SAUDI ARABIA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 SAUDI ARABIA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 244 SAUDI ARABIA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 245 SAUDI ARABIA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 246 SAUDI ARABIA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 247 SAUDI ARABIA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 248 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 249 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 250 SOUTH AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 251 SOUTH AFRICA REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 252 SOUTH AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 253 SOUTH AFRICA HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 254 SOUTH AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 255 SOUTH AFRICA OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 256 SOUTH AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 257 SOUTH AFRICA FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 258 SOUTH AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 259 SOUTH AFRICA CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 260 SOUTH AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 261 SOUTH AFRICA 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 262 SOUTH AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 263 SOUTH AFRICA TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 264 SOUTH AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 265 SOUTH AFRICA FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 266 SOUTH AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 267 SOUTH AFRICA WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 268 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 269 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 270 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 271 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 272 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 273 SOUTH AFRICA CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 274 SOUTH AFRICA FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 275 SOUTH AFRICA ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 276 SOUTH AFRICA CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 SOUTH AFRICA COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 SOUTH AFRICA HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 279 SOUTH AFRICA MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 SOUTH AFRICA HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 SOUTH AFRICA SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 SOUTH AFRICA AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 283 SOUTH AFRICA HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 284 SOUTH AFRICA PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 SOUTH AFRICA HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 SOUTH AFRICA BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 287 SOUTH AFRICA GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 288 SOUTH AFRICA GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 289 SOUTH AFRICA CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 SOUTH AFRICA PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 291 SOUTH AFRICA HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 292 SOUTH AFRICA AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 293 SOUTH AFRICA OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 294 SOUTH AFRICA TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 295 SOUTH AFRICA BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 296 ISRAEL CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 297 ISRAEL CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 298 ISRAEL REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 299 ISRAEL REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 300 ISRAEL HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 301 ISRAEL HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 302 ISRAEL OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 303 ISRAEL OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 304 ISRAEL FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 305 ISRAEL FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 306 ISRAEL CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 307 ISRAEL CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 308 ISRAEL 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 309 ISRAEL 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 310 ISRAEL TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 311 ISRAEL TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 312 ISRAEL FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 313 ISRAEL FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 314 ISRAEL WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 315 ISRAEL WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 316 ISRAEL CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 317 ISRAEL CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 318 ISRAEL CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 319 ISRAEL CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 320 ISRAEL CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 321 ISRAEL CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 322 ISRAEL FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 ISRAEL ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 324 ISRAEL CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 ISRAEL COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 ISRAEL HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 327 ISRAEL MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 328 ISRAEL HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 ISRAEL SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 330 ISRAEL AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 ISRAEL HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 332 ISRAEL PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 ISRAEL HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 ISRAEL BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 335 ISRAEL GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 336 ISRAEL GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 ISRAEL CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 ISRAEL PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 339 ISRAEL HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 340 ISRAEL AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 341 ISRAEL OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 342 ISRAEL TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 343 ISRAEL BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 344 EGYPT CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 345 EGYPT CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

TABLE 346 EGYPT REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 347 EGYPT REGULAR SLOTTED CONTAINER (RSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 348 EGYPT HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 349 EGYPT HALF SLOTTED CONTAINER (HSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 350 EGYPT OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 351 EGYPT OVERLAP SLOTTED CONTAINER (OSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 352 EGYPT FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 353 EGYPT FULL OVERLAP SLOTTED CONTAINER (FOL) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 354 EGYPT CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 355 EGYPT CENTER SPECIAL SLOTTED CONTAINER (CSSC) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 356 EGYPT 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 357 EGYPT 1-2-3-BOTTOM OR AUTO-LOCK BOTTOM CONTAINER (ALB) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 358 EGYPT TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 359 EGYPT TELESCOPING BOXES (DESIGN STYLE TRAYS, INFOLD TRAYS AND OUTFOLD TRAYS) IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 360 EGYPT FOLDERS IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 361 EGYPT FOLDERS IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 362 EGYPT WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 363 EGYPT WRAPAROUND BLANK IN CORRUGATED PACKAGING MARKET, BY BOARD TYPE, 2018-2032 (USD MILLION)

TABLE 364 EGYPT CORRUGATED PACKAGING MARKET, BY FLUTE TYPE, 2018-2032 (USD MILLION)

TABLE 365 EGYPT CORRUGATED PACKAGING MARKET, BY BOARD STYLE, 2018-2032 (USD MILLION)

TABLE 366 EGYPT CORRUGATED PACKAGING MARKET, BY CAPACITY, 2018-2032 (USD MILLION)

TABLE 367 EGYPT CORRUGATED PACKAGING MARKET, BY SIZE, 2018-2032 (USD MILLION)

TABLE 368 EGYPT CORRUGATED PACKAGING MARKET, BY PRINT TYPE, 2018-2032 (USD MILLION)

TABLE 369 EGYPT CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 370 EGYPT FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 371 EGYPT ELECTRONICS GOODS IN FOOD IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 372 EGYPT CONSUMER ELECTRONICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 EGYPT COMPUTER & IT HARDWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 EGYPT HOME APPLIANCES IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 375 EGYPT MAJOR HOME APPLIANCES (WHITE GOODS) IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 376 EGYPT HEATING & COOLING DEVICES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 377 EGYPT SMALL KITCHEN APPLIANCES IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 378 EGYPT AUTOMOTIVE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 379 EGYPT HEALTHCARE & PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 380 EGYPT PHARMACEUTICALS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 381 EGYPT HEALTHCARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 382 EGYPT BEVERAGE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 383 EGYPT GLASSWARE AND CERAMICS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 384 EGYPT GLASSWARE IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 EGYPT CERAMICS IN CORRUGATED PACKAGING MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 EGYPT PERSONAL CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 387 EGYPT HOME CARE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 388 EGYPT AGRICULTURE & HORTICULTURE IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 389 EGYPT OIL AND GAS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 390 EGYPT TOYS PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 391 EGYPT BABY PRODUCTS IN CORRUGATED PACKAGING MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 392 REST OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 393 REST OF MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT, 2018-2032 (MILLION UNITS)

Lista de figuras

FIGURE 1 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: SEGMENTATION

FIGURE 13 NINE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET, BY PRODUCT (2024)

FIGURE 14 MIDDLE EAST AND AFRICA CORRUGATED PACKAGING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS