Middle East And Africa E Commerce Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.82 Billion

USD

6.06 Billion

2025

2033

USD

2.82 Billion

USD

6.06 Billion

2025

2033

| 2026 –2033 | |

| USD 2.82 Billion | |

| USD 6.06 Billion | |

|

|

|

|

Por embalaje (cajas de cartón corrugado, bolsas, sobres, etiquetas, embalaje protector, cajas para palés, cintas, embalaje postal, film retráctil), por material (plásticos de fibra, plásticos reciclados posconsumo, materiales de origen biológico, plásticos convencionales, otros), por usuario final (ropa y accesorios, electrónica y electricidad, textiles, hogar, cuidado personal, alimentos y bebidas, productos farmacéuticos, automoción, productos metálicos, productos químicos, agricultura, muebles, madera y productos derivados de la madera, cuero y artículos de cuero, materiales de construcción, productos de tabaco, otros). Por canal de distribución (directo, indirecto): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de embalajes para comercio electrónico en Oriente Medio y África

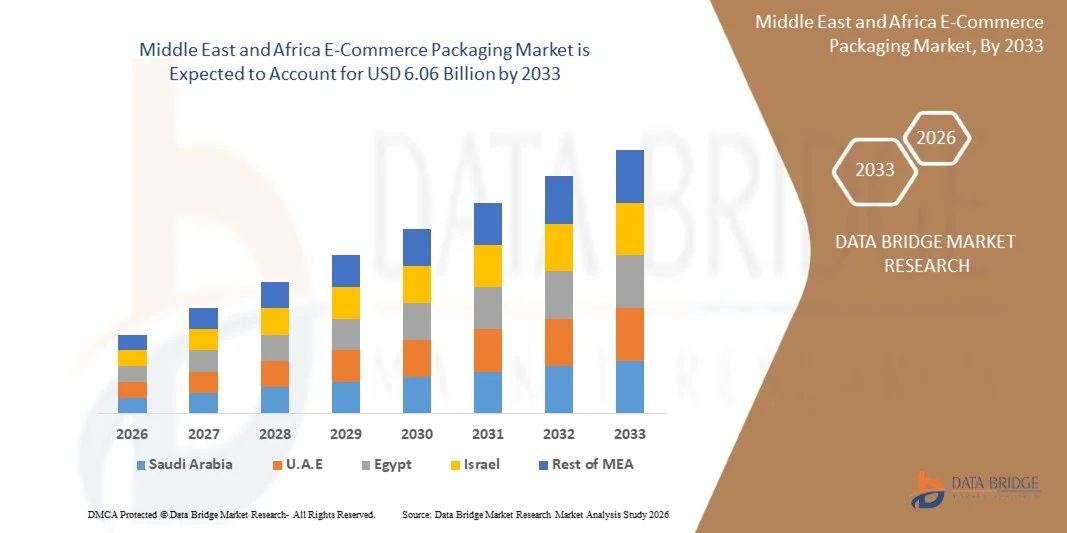

- El mercado de embalajes para comercio electrónico en Oriente Medio y África se valoró en 2.820 millones de dólares en 2025 y se espera que alcance los 6.060 millones de dólares en 2033.

- Durante el período de pronóstico de 2026 a 2033, es probable que el mercado crezca a una CAGR del 10,1%, impulsado principalmente por la creciente participación de los consumidores en actividades recreativas, sociales y familiares, lo que ha expandido significativamente la demanda de juegos de mesa educativos y basados en estrategia, categorías clave que a menudo se basan en formatos de embalaje especializados, duraderos y estéticamente atractivos.

- Además, la expansión de la infraestructura manufacturera y de transporte de Oriente Medio y África, sumada al aumento del volumen comercial en los mercados nacionales e internacionales, está acelerando la adopción de soluciones de embalaje avanzadas. El fuerte énfasis de la región en la logística moderna, las iniciativas de sostenibilidad y la comodidad del consumidor impulsa aún más el impulso constante del mercado.

Análisis del mercado de embalajes para comercio electrónico en Oriente Medio y África

- El mercado de embalajes para comercio electrónico en Oriente Medio y África está en rápida expansión a medida que las marcas integran tecnologías avanzadas para mejorar la eficiencia, la sostenibilidad y la interacción con el consumidor. Si bien la automatización se asocia tradicionalmente con las operaciones logísticas y portuarias, tendencias similares, como la digitalización, el análisis basado en IA, los mecanismos de apilado automatizados y la gestión inteligente de inventarios, están configurando cada vez más las operaciones de embalaje en sectores como el químico, el alimentario y de bebidas, el farmacéutico, el agrícola, el de la construcción, el de la minería y los minerales, el de los residuos y el reciclaje, y el de los bienes de consumo.

- Estas tecnologías están fortaleciendo la cadena de suministro de la región al reducir los procesos manuales, acelerar los plazos de entrega, optimizar el espacio de almacenamiento y respaldar extensas redes de venta minorista en línea. Las grúas apiladoras automatizadas (ASC), los sistemas guiados por IA y las herramientas avanzadas de monitoreo permiten optimizar el almacenamiento, reducir el tiempo de manipulación y tener una visibilidad continua de los niveles de inventario, lo que ayuda a fabricantes, distribuidores y plataformas de comercio electrónico a mantener la consistencia del suministro y reducir los costos operativos.

- La adopción de plataformas de distribución inteligentes y de planificación predictiva de la demanda está mejorando aún más los ciclos de reposición, en particular durante los picos de ventas, los lanzamientos de nuevos productos y los eventos promocionales.

- Se prevé que Arabia Saudita domine el mercado de embalajes para comercio electrónico en Oriente Medio y África, con la mayor cuota de ingresos, un 16,06 %, en 2026, gracias a importantes inversiones en automatización logística, infraestructura digital e iniciativas de resiliencia de la cadena de suministro. Puertos importantes como Los Ángeles, Long Beach y Nueva York/Nueva Jersey ya han implementado ASC, AGV y sistemas operativos de terminal (TOS) avanzados para mejorar el rendimiento y reducir la congestión, mientras que operadores clave como APM Terminals, SSA Marine y DP World continúan modernizando sus equipos y operaciones de manipulación.

- Se espera que los Emiratos Árabes Unidos sean la región de más rápido crecimiento en el mercado de embalaje de comercio electrónico de Medio Oriente y África durante el período de pronóstico, con una CAGR del 10,7 %, respaldada por el aumento del comercio en contenedores, la modernización de los centros logísticos y la adopción de seguimiento de inventario habilitado por IA, vehículos autónomos y grúas controladas a distancia.

- En 2026, se prevé que el segmento de cajas de cartón corrugado domine el mercado con una cuota de mercado del 36,53 %, ya que estas soluciones de embalaje ofrecen un equilibrio ideal entre asequibilidad, durabilidad, escalabilidad y flexibilidad operativa. Su capacidad para satisfacer la demanda de comercio electrónico de alto volumen, manteniendo al mismo tiempo la rentabilidad, las convierte en la opción preferida de fabricantes, distribuidores y empresas de reparto de última milla en toda la región.

Alcance del informe y segmentación del mercado de embalajes para comercio electrónico en Oriente Medio y África

|

Atributos |

Perspectivas clave del mercado de embalajes para comercio electrónico en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de embalajes para comercio electrónico en Oriente Medio y África

Adopción de sistemas de automatización y dimensionamiento adecuado en el cumplimiento

- La adopción de sistemas de automatización y dimensionamiento adecuado en el cumplimiento de pedidos se ha convertido en una oportunidad significativa para el mercado de embalajes para comercio electrónico en Oriente Medio y África. A medida que aumenta el volumen de pedidos y la diversidad de SKU, los procesos manuales de embalaje y cumplimiento se han vuelto más costosos, lentos y propensos a errores. La automatización mediante robótica, sistemas de picking/embalaje basados en IA y maquinaria de embalaje de tamaño adecuado ofrece mayor eficiencia, menor dependencia de la mano de obra, un rendimiento constante y un uso optimizado de materiales, todo lo cual se alinea estrechamente con la demanda del comercio electrónico y los objetivos de sostenibilidad. Este cambio posiciona la automatización del embalaje como una herramienta de valor añadido para que las empresas reduzcan los costes logísticos, mejoren la velocidad de cumplimiento y permitan un crecimiento escalable.

- En enero de 2025, Smart-Robotics.io informó que para 2025 se estima que se instalarán cuatro millones de robots de almacén en 50.000 almacenes en Medio Oriente y África, y que la penetración de la automatización aumentará del 18 % a fines de 2021 al 26 % para 2027.

- En septiembre de 2024, un comunicado de prensa señaló que se proyectaba que el mercado de automatización de envases de Medio Oriente y África (que abarca los sistemas automatizados de embalaje, sellado y etiquetado) aumentaría de USD 64,70 mil millones en 2022 a USD 136,47 mil millones en 2032.

- En julio de 2025, un blog de automatización de almacenes en eShipz citó que la automatización en las operaciones de almacén puede reducir los costos hasta en un 30 % y aumentar el rendimiento en más del 40 %, lo que convierte a la automatización en una necesidad estratégica en mercados dinámicos y de gran volumen como India.

- La creciente adopción de sistemas de automatización y dimensionamiento adecuado en el cumplimiento del comercio electrónico está creando una oportunidad estructural para los proveedores de embalaje y tecnología. La automatización reduce el coste por paquete, acelera el rendimiento, mejora la precisión y facilita la escalabilidad. A medida que los centros logísticos invierten en robótica y tecnología de dimensionamiento adecuado, se prevé un aumento sustancial de la demanda de líneas de embalaje automatizadas, sistemas de embalaje modulares y soluciones de embalaje inteligente, impulsando el crecimiento y la innovación en el mercado de embalajes para el comercio electrónico en Oriente Medio y África.

Dinámica del mercado de embalajes para comercio electrónico en Oriente Medio y África

Conductor

Penetración regional de Internet y teléfonos inteligentes en mercados emergentes

- El aumento regional de la penetración de internet y teléfonos inteligentes en los mercados emergentes se ha convertido en un motor clave del crecimiento del mercado de embalajes para el comercio electrónico en Oriente Medio y África. A medida que más consumidores obtienen acceso fiable a internet móvil —y los teléfonos inteligentes se convierten en la principal puerta de entrada a las compras en línea—, la penetración del comercio minorista en línea se expande rápidamente, generando una mayor demanda de embalajes en diversas geografías. Esta penetración digital impulsa mayores volúmenes de envíos de paquetes pequeños, ciclos de pedidos frecuentes y un mayor comercio transfronterizo, todo lo cual aumenta la necesidad de soluciones de embalaje variadas y escalables, alineadas con los requisitos logísticos del comercio electrónico.

- En octubre de 2023, la Unión Internacional de Telecomunicaciones (UIT) informó que el 78 por ciento de la población de Oriente Medio y África de 10 años o más poseía un teléfono móvil, una proporción 11 puntos porcentuales superior a la penetración del uso de Internet en Oriente Medio y África.

- En octubre de 2024, el informe Estado de la conectividad a Internet móvil de la GSMA indicó que 4.600 millones de personas (aproximadamente el 57 por ciento de la población de Medio Oriente y África) usaban Internet móvil en dispositivos personales, lo que apunta a una aceleración de la penetración digital en las regiones emergentes.

- En julio de 2025, el Rastreador de Conectividad Digital Findex para Oriente Medio y África del Banco Mundial reveló que en los países de ingresos bajos y medios, la adopción de teléfonos inteligentes y el uso de pagos digitales aumentaron notablemente, lo que refleja capacidades de comercio digital más amplias y permite el crecimiento del comercio electrónico fuera de las regiones de altos ingresos.

- En octubre de 2025, las estimaciones para Oriente Medio y África indicaron que aproximadamente 6.040 millones de personas (aproximadamente el 73 por ciento de la población mundial) utilizaban Internet, lo que pone de relieve la creciente base de consumidores digitales que sustenta la demanda de envases para el comercio electrónico.

- La creciente penetración de internet y teléfonos inteligentes en los mercados emergentes está ampliando la base de clientes potenciales para el comercio minorista en línea, impulsando así una mayor demanda de embalajes para el comercio electrónico. A medida que se amplía la inclusión digital, los proveedores de embalajes pueden anticipar un crecimiento sostenido del volumen y la diversificación de los formatos, lo que refuerza la expansión del volumen de embalajes como palanca de crecimiento estructural para el mercado de embalajes para el comercio electrónico en Oriente Medio y África.

Restricción/Desafío

“ Regulaciones sobre residuos de envases y costes de cumplimiento”

- Las regulaciones sobre residuos de envases y los costos de cumplimiento se han convertido en un factor limitante importante para el mercado de envases de comercio electrónico en Oriente Medio y África. A medida que los reguladores mundiales endurecen las normas sobre diseño de envases, composición de materiales, reciclabilidad y responsabilidad por los residuos, las empresas de comercio electrónico se enfrentan a crecientes presiones, desde el rediseño de envases para cumplir con los nuevos estándares, el aumento del uso de materiales reciclados, la reducción del espacio vacío y la ampliación de la responsabilidad del productor (REP). Estas cargas regulatorias aumentan los costos de cumplimiento, complican los envíos transfronterizos y pueden obligar a las empresas a rediseñar las cadenas de suministro o a repercutir los costos a los consumidores. En un mercado impulsado por la velocidad, la comodidad y los envíos económicos, unas leyes más estrictas sobre residuos de envases pueden frenar el crecimiento o limitar la expansión de los márgenes.

- En diciembre de 2024, el Ministerio de Medio Ambiente de la India presentó un borrador de las Normas de Protección Ambiental (Responsabilidad Extendida del Productor de Envases) de 2024, que, una vez implementadas a partir de abril de 2026, requerirán que los productores, importadores y propietarios de marcas gestionen el ciclo de vida completo de los envases.

- En abril de 2024, el Parlamento Europeo llegó a un acuerdo provisional para adoptar normas de envasado más estrictas, incluidos objetivos de reducción de los residuos de envases en un 5% para 2030 (10% para 2035, 15% para 2040), prohibiciones de muchos formatos de envases de plástico de un solo uso y requisitos de que todos los envases sean reciclables.

- En marzo de 2024, el Consejo de la Unión Europea y el Parlamento Europeo llegaron a un acuerdo provisional para revisar la normativa sobre envases y residuos de envases, endureciendo los estándares de diseño, reciclabilidad y etiquetado para todos los envases, incluidos los envíos de comercio electrónico.

- En diciembre de 2024, el Consejo adoptó formalmente el nuevo Reglamento sobre envases y residuos de envases 2025/40 (PPWR), que establece objetivos vinculantes de reutilización y contenido reciclado, restringe los plásticos de un solo uso y exige minimizar el peso y volumen de los envases.

- El 11 de febrero de 2025 entró en vigor el PPWR, estableciendo así un marco jurídico armonizado en toda la UE para todos los envases comercializados, incluidos los envases de comercio electrónico, y señalando un cambio hacia cargas de cumplimiento de la economía circular para los minoristas en línea.

- Las regulaciones sobre residuos de envases se han endurecido en las principales economías, incrementando los requisitos obligatorios de reciclabilidad, reutilización, presentación de informes y reducción de materiales. Estas medidas incrementan los costos de cumplimiento para los fabricantes de envases de comercio electrónico debido a estándares de diseño más estrictos, obligaciones de trazabilidad, requisitos de contenido reciclado y una mayor responsabilidad del productor. A medida que aumentan los umbrales regulatorios, las empresas enfrentan mayores gastos operativos, de auditoría y de rediseño, lo que reduce los márgenes y dificulta la entrada al mercado de proveedores más pequeños. En consecuencia, se espera que el aumento de las exigencias de cumplimiento actúe como una restricción estructural en el mercado de envases de comercio electrónico de Oriente Medio y África, al aumentar los costos y limitar la flexibilidad en la selección de materiales y formatos.

Alcance del mercado de embalajes para comercio electrónico en Oriente Medio y África

El mercado de embalaje de comercio electrónico de Oriente Medio y África está segmentado en cuatro segmentos según el embalaje, el material, el usuario final y el canal de distribución.

- Por embalaje

En cuanto al embalaje, el mercado de embalajes para comercio electrónico en Oriente Medio y África se segmenta en cajas de cartón ondulado, bolsas, sobres, etiquetas, embalajes protectores, cajas para palés, cintas adhesivas, embalajes postales y film retráctil. En 2026, se prevé que el segmento de cajas de cartón ondulado domine el mercado con una cuota de mercado del 36,53 %, impulsado por el aumento del volumen de compras online, la creciente demanda de embalajes duraderos y rentables, y la rápida expansión de las redes minoristas omnicanal. Las cajas de cartón ondulado siguen siendo la opción preferida gracias a su alta resistencia, reciclabilidad, flexibilidad de personalización y su idoneidad para una amplia gama de productos, desde electrónica y artículos para el hogar hasta ropa, cosméticos y productos básicos de consumo. Además, el auge de los modelos de comercio electrónico por suscripción, las mejoras en las tecnologías de impresión y los mayores requisitos de sostenibilidad están reforzando el liderazgo del segmento.

El segmento de cajas de cartón corrugado es el de mayor crecimiento en el mercado de embalajes para comercio electrónico en Oriente Medio y África, con una tasa de crecimiento anual compuesta (TCAC) del 10,7 %, impulsado por el aumento de los envíos de paquetería, la creciente adopción de soluciones de embalaje sostenibles y ligeras, y las crecientes expectativas de los consumidores de una entrega segura y sin daños. La expansión de los centros logísticos, los avances en los sistemas automatizados de fabricación de cajas y la transición hacia embalajes de tamaño adecuado están impulsando aún más la demanda. Además, se espera que el mayor énfasis en los materiales reciclables, las exigencias de embalaje ecológico y la creciente presencia de importantes empresas de comercio electrónico en Estados Unidos, Canadá y México fortalezcan el dominio del embalaje de cartón corrugado en los próximos años.

- Por material

En función del material, el mercado de embalajes para comercio electrónico en Oriente Medio y África se segmenta en plásticos basados en fibra, con contenido reciclado y reciclados posconsumo (PCR), materiales de origen biológico, plásticos convencionales (plásticos vírgenes) y otros. En 2026, se espera que el segmento basado en fibra domine con una cuota de mercado del 49,85 %, impulsado por la fuerte demanda de soluciones de embalaje sostenibles, reciclables y ligeras en las principales categorías de comercio electrónico. La transición hacia embalajes ecológicos, la creciente conciencia ambiental entre los consumidores y la implementación de normativas de sostenibilidad más estrictas en Estados Unidos y Canadá están acelerando la adopción de materiales basados en fibra. Además, la expansión de la producción de embalajes de cartón ondulado, los avances en la resistencia del papel y las tecnologías de aligeramiento, y la creciente preferencia por los embalajes sin plástico entre las marcas y los minoristas refuerzan aún más el liderazgo del segmento.

El segmento de materiales de origen biológico es el de mayor crecimiento en el mercado de embalajes para comercio electrónico en Oriente Medio y África, con una tasa de crecimiento anual compuesta (TCAC) del 10,9 %, impulsado por la creciente inversión en embalajes biodegradables y compostables, un mayor compromiso corporativo con la sostenibilidad y la preferencia de los consumidores por alternativas de bajo impacto. Los sobres, películas, materiales de amortiguación y soluciones de fibra moldeada de origen biológico están cobrando impulso a medida que las empresas trabajan para reducir su huella de carbono y cumplir con los objetivos ESG. Además, las innovaciones en polímeros de origen vegetal, las iniciativas verdes respaldadas por los gobiernos y la rápida expansión de marcas ecológicas de venta directa al consumidor están acelerando su adopción en toda la región.

- Por el usuario final

En función del usuario final, el mercado de embalajes para comercio electrónico en Oriente Medio y África se segmenta en prendas de vestir y accesorios (excluyendo los de cuero), electrónica y electricidad, textiles, artículos para el hogar, cuidado personal, alimentos y bebidas, productos farmacéuticos, automoción, productos metálicos fabricados, productos químicos, agricultura, muebles, madera y productos de madera (excluyendo muebles), cuero y artículos de cuero, materiales de construcción, productos de tabaco y otros. En 2026, se espera que el segmento de prendas de vestir y accesorios (excluyendo los de cuero) domine el mercado con una cuota de mercado del 14,50%, impulsado por el rápido crecimiento del comercio minorista de moda online, las marcas de moda rápida y las empresas de ropa D2C. La creciente preferencia de los consumidores por devoluciones cómodas, suscripciones de moda personalizadas y lanzamientos de productos de temporada está impulsando la demanda de soluciones de embalaje duraderas y ligeras. El auge del comercio social, las promociones de ropa dirigidas por influencers y los ciclos de envío de alto volumen refuerzan aún más el liderazgo del segmento en la industria del embalaje para comercio electrónico en Oriente Medio y África.

El segmento de Electrónica y Electricidad es el de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 11,0 %, en el mercado de embalajes para comercio electrónico de Oriente Medio y África, impulsado por el aumento de las ventas en línea de electrónica de consumo, dispositivos inteligentes, productos de domótica y pequeños electrodomésticos. Dado que estos artículos requieren embalajes protectores, resistentes a golpes y a prueba de manipulaciones, la demanda de materiales especializados, como sobres protectores, insertos de fibra moldeada, cajas de cartón corrugado y embalajes multicapa, sigue en aumento. Además, la rápida innovación de productos, las frecuentes actualizaciones de dispositivos y la creciente adopción de plataformas de comercio electrónico para productos electrónicos de alto valor, junto con la expansión de los mercados de productos electrónicos reacondicionados, están acelerando la necesidad de soluciones de embalaje avanzadas y sostenibles en toda la región.

- Por canal de distribución

Según el canal de distribución, el mercado de embalajes para comercio electrónico en Oriente Medio y África se segmenta en canales directos e indirectos. En 2026, se prevé que el segmento directo domine el mercado con una cuota de mercado del 68,94 %, impulsado por un fuerte volumen de compras de grandes empresas de comercio electrónico, proveedores de logística externa (3PL) y grandes minoristas que prefieren adquirir materiales de embalaje directamente a los fabricantes. Los canales directos ofrecen ventajas como precios al por mayor, soluciones de embalaje personalizadas, plazos de entrega más rápidos y colaboraciones a largo plazo con proveedores, cada vez más populares entre los operadores de comercio electrónico de alto volumen. Además, la creciente tendencia hacia cadenas de suministro integradas verticalmente, la adquisición de embalajes por suscripción y las líneas de embalaje automatizadas refuerzan aún más el dominio del canal de distribución directa.

La compra directa es el segmento de mayor crecimiento, con una tasa de crecimiento anual compuesta (TCAC) del 10,2%, en el mercado de embalajes para comercio electrónico de Oriente Medio y África, impulsado por la creciente preferencia de las empresas de comercio electrónico, centros logísticos y proveedores 3PL por obtener materiales de embalaje directamente de los fabricantes para lograr una mayor rentabilidad, una calidad constante y fiabilidad en el suministro. La compra directa permite a los grandes compradores obtener pedidos al por mayor, beneficiarse de precios negociados, acceder a soluciones de embalaje personalizadas y optimizar la gestión del inventario: ventajas cruciales en un mercado donde el volumen de pedidos y la frecuencia de envíos siguen aumentando.

Análisis regional del mercado de embalajes para comercio electrónico en Oriente Medio y África

- Se prevé que Arabia Saudita domine el mercado de embalajes para comercio electrónico en Oriente Medio y África, con la mayor cuota de mercado, un 16,06%, en 2026. Esto se debe a la sólida trayectoria del ecosistema minorista y de comercio electrónico del país, su sólido poder adquisitivo y la presencia de importantes minoristas en línea, proveedores de logística y fabricantes de embalajes. Las operaciones a gran escala de empresas como Amazon, Walmart, Target, UPS y FedEx impulsan una demanda sustancial de cajas de cartón corrugado, sobres, embalajes protectores y materiales sostenibles. Además, Estados Unidos continúa invirtiendo fuertemente en automatización, optimización de almacenes, digitalización de la cadena de suministro y embalajes responsables con el medio ambiente, consolidando aún más su posición dominante en la región.

- Se prevé que los Emiratos Árabes Unidos (EAU) sean la región de mayor crecimiento en el mercado de embalajes para comercio electrónico en Oriente Medio y África durante el período de pronóstico, con una tasa de crecimiento anual compuesta (TCAC) del 10,7 %, impulsada por la rápida expansión de la penetración del comercio electrónico, el aumento del comercio transfronterizo, la creciente adopción de sistemas de pago digitales y la mejora de la infraestructura de entrega de última milla. Las inversiones en centros logísticos modernos, plantas de producción de embalajes y las iniciativas gubernamentales que impulsan la competitividad de la industria manufacturera impulsan aún más el desarrollo del mercado. Además, el crecimiento de las pymes y las marcas D2C en México contribuye a un mayor consumo de sobres flexibles, cajas de cartón corrugado y embalajes protectores.

- En general, la creciente adopción del comercio minorista digital, el crecimiento del comercio electrónico transfronterizo, la innovación de productos impulsada por la sostenibilidad y las inversiones continuas en tecnologías de logística y cumplimiento están fortaleciendo colectivamente el mercado de embalajes para el comercio electrónico en Oriente Medio y África.

Los principales líderes del mercado que operan en el mercado son:

- International Paper Company (EE. UU.)

- Amcor PLC (Suiza)

- DS Smith PLC (Reino Unido)

- Smurfit WestRock (EE. UU.)

- Packaging Corporation of America (PCA) (EE. UU.)

- Mondi PLC (Reino Unido)

- Klabin SA (Brasil)

- Oji Holdings Corporation (Japón)

- Sealed Air Corporation (EE. UU.)

- Nine Dragons Paper Holdings Ltd. (Hong Kong)

- Compañía 3M (EE. UU.)

- Avery Dennison Corporation (EE. UU.)

- Green Bay Packaging Inc. (EE. UU.)

- Cosmo Films (India)

- Georgia-Pacific LLC (EE. UU.)

- Ranpak Holdings Corp. (EE. UU.)

- Boxon Group AB (Suecia)

- Stora Enso (Finlandia)

- Industrias Pratt (EE. UU.)

- Prem Industries India Limited (India)

- Pregis LLC (EE. UU.)

- Packtek (India)

- Packman Packaging Private Limited (India)

- Packhelp (Polonia)

- IPG (EE.UU.)

- Grupo Filmar (Polonia)

- BCE (EE.UU.)

- Embalaje de comercio electrónico (India)

- Embalaje de caja azul (EE. UU.)

- Altpac (India)

Últimos avances en el embalaje para comercio electrónico en Oriente Medio y África

- En julio de 2022, Packhelp lanzó el etiquetado de carbono para sus productos de embalaje, que permite a los clientes ver la huella de carbono estimada de sus pedidos. Esto se alinea con la creciente demanda de embalajes sostenibles en el comercio electrónico. Packhelp continúa posicionándose como una plataforma de embalajes personalizados con pedidos mínimos bajos, lo que resulta atractivo para vendedores de comercio electrónico, startups y pequeñas marcas D2C que necesitan embalajes personalizados pero no realizan pedidos en grandes cantidades.

- En abril de 2025, Pratt Industries, Inc. anunció su compromiso de invertir 5.000 millones de dólares en reciclaje, infraestructura de energía limpia y empleos manufactureros en Estados Unidos, apoyando así un amplio impulso de reindustrialización.

- En septiembre de 2025, Pregis inauguró un nuevo centro de conversión de papel de 477,000 pies cuadrados en Elgin, Illinois. La instalación generará más de 500 empleos en el sector manufacturero y podrá producir más de mil millones de soluciones de embalaje de papel reciclable para entrega en la acera al año.

- En agosto de 2025, Ranpak Holdings Corp. anunció una importante expansión de su relación con Walmart. Según los términos de este acuerdo estratégico, Walmart instalará numerosos sistemas Ranpak AutoFill en sus cinco Centros de Distribución de Próxima Generación, optimizando su proceso de distribución, reduciendo el desperdicio de envases y simplificando el trabajo de los empleados.

- En septiembre de 2025, Sealed Air Corporation avanzará en su estrategia como ventanilla única para operaciones de cumplimiento con el lanzamiento de la máquina embolsadora híbrida AUTOBAG 850HB, un nuevo sistema de embolsado automatizado diseñado para ejecutar correos de polietileno y papel.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PATENT ANALYSIS

4.3.1 PATENT FILING DISTRIBUTION BY COUNTRY

4.3.2 KEY APPLICANTS (TOP INNOVATORS)

4.3.3 TECHNOLOGY SEGMENTATION BY IPC CODES

4.3.4 PATENT TREND OVER TIME (2016–2025)

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Packaging waste volumes and landfill pressure

4.7.1.2 Plastic pollution & microplastics

4.7.1.3 Deforestation and pulp supply stress

4.7.1.4 Greenhouse gas (GHG) emissions across the lifecycle

4.7.1.5 Water and chemical pollution

4.7.1.6 Supply chain vulnerability to extreme weather

4.7.1.7 Regulatory and consumer pressure

4.7.2 INDUSTRY RESPONSE

4.7.2.1 Material substitution and lightweighting

4.7.2.2 Design for recycling & circularity

4.7.2.3 Adoption of recycled and bio-based feedstocks

4.7.2.4 Investment in recycling & recovery partnerships

4.7.2.5 Supply-chain optimization & right-sizing

4.7.2.6 Process & energy efficiency at converters

4.7.2.7 Certification & eco-labeling

4.7.2.8 Innovation in protective solutions

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 Regulation & mandates

4.7.3.2 Standards, labelling & transparency

4.7.3.3 Fiscal instruments & incentives

4.7.3.4 Infrastructure investment

4.7.3.5 Public procurement leadership

4.7.3.6 R&D & standards support

4.7.4 ANALYST RECOMMENDATIONS

4.8 CONSUMER BUYING BEHAVIOR

4.8.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.8.2 PREFERENCE FOR SECURE AND DAMAGE-RESISTANT PACKAGING

4.8.3 RISING IMPORTANCE OF CONVENIENCE AND EASE OF UNBOXING

4.8.4 INFLUENCE OF AESTHETIC APPEAL AND BRAND IDENTITY

4.8.5 INCREASING CONSUMER NEED FOR TRANSPARENCY AND INFORMATION

4.8.6 SHIFT TOWARD PERSONALIZED PACKAGING EXPERIENCES

4.8.7 CONCERNS ABOUT PACKAGING WASTE AND RECYCLING CONVENIENCE

4.8.8 WILLINGNESS TO PAY FOR PREMIUM PACKAGING IN CERTAIN CATEGORIES

4.8.9 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN

4.9.1 TOP-LEVEL COST BUCKETS

4.9.1.1 Raw Materials

4.9.1.2 Manufacturing & Converting

4.9.1.3 Protective Inserts & Cushioning

4.9.1.4 Labour & Fulfilment Handling

4.9.1.5 Packaging Design / Customization / Printing

4.9.1.6 Logistics & Dimensional Weight Impact

4.9.1.7 Returns & Reverse Logistics

4.9.1.8 Sustainability Premium & Compliance Costs

4.9.1.9 Overheads & CAPEX Amortization

4.9.1.10 Supplier Margin / Distributor Markup

4.9.2 TYPICAL COST SHARES

4.9.2.1 Raw Materials + Converting: 50-65% of Total Packaging Cost

4.9.2.2 Labour & Fulfilment Handling: 10-20%

4.9.2.3 Protective Inserts & Void Fill: 5-15%

4.9.2.4 Design / Printing / Customization: 3-10%

4.9.2.5 Sustainability Premium / Compliance: 5-15%

4.9.2.6 Packaging as % of Fulfilment Cost: 15-20%

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM-SIZED COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 17.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGIN OUTLOOK AND SCENARIO ASSESSMENT

4.12.1 INTRODUCTION

4.12.2 EXPECTED MARGIN PERFORMANCE (BASE CASE)

4.12.3 MARGIN UPSIDE POTENTIAL (FAVOURABLE MARKET ENVIRONMENT)

4.12.4 MARGIN COMPRESSION RISKS (ADVERSE MARKET CONDITIONS)

4.12.5 EXPOSURE TO RAW MATERIAL PRICE VOLATILITY

4.12.6 MARGIN VARIATION BY PRODUCT CATEGORY

4.12.7 INFLUENCE OF SCALE AND AUTOMATION ON COST EFFICIENCY

4.12.8 SENSITIVITY TO DEMAND CYCLICALITY AND PRICING DYNAMICS

4.12.9 FINANCIAL IMPACT OF SUSTAINABILITY REQUIREMENTS

4.12.10 COMPETITIVE INTENSITY AND ITS EFFECT ON MARGIN STRUCTURE

4.12.11 STRATEGIC MARGIN ENHANCEMENT OPPORTUNITIES

4.12.12 CONCLUSION

4.13 RAW MATERIAL COVERAGE

4.13.1 PAPER AND PAPERBOARD: THE DOMINANT RAW MATERIAL

4.13.2 PLASTICS: FLEXIBLE, PROTECTIVE, AND LIGHTWEIGHT

4.13.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.13.4 MOLDED FIBER AND PULP-BASED MATERIALS

4.13.5 FOAMS AND CUSHIONING MATERIALS

4.13.6 ADHESIVES, COATINGS, AND INKS

4.13.7 EMERGING RAW MATERIALS FOR SMARTER PACKAGING

4.13.8 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 SMART PACKAGING AND IOT INTEGRATION

4.15.2 AUTOMATION AND ROBOTICS IN FULFILMENT CENTRES

4.15.3 RIGHT-SIZING AND ON-DEMAND PACKAGING TECHNOLOGIES

4.15.4 SUSTAINABLE AND ADVANCED MATERIAL INNOVATIONS

4.15.5 ARTIFICIAL INTELLIGENCE AND DATA-DRIVEN DESIGN

4.15.6 ANTI-COUNTERFEIT AND SECURITY TECHNOLOGIES

4.15.7 ENHANCED CUSTOMIZATION AND DIGITAL PRINTING

4.15.8 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 PRODUCT QUALITY, DURABILITY, AND COMPLIANCE

4.17.2 SUSTAINABILITY AND ENVIRONMENTAL CERTIFICATIONS

4.17.3 TECHNOLOGICAL CAPABILITIES AND INNOVATION

4.17.4 CUSTOMIZATION, BRANDING, AND CONSUMER EXPERIENCE

4.17.5 COST EFFICIENCY AND TOTAL COST OF OWNERSHIP (TCO)

4.17.6 SUPPLY CHAIN STRENGTH AND MIDDLE EAST AND AFRICA REACH

4.17.7 CERTIFICATIONS, SAFETY STANDARDS, AND INDUSTRY EXPERTISE

4.17.8 AFTER-SALES SUPPORT AND TECHNICAL ASSISTANCE

4.17.9 CONCLUSION

5 TARIFFS AND IMPACT ANALYSIS

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 REGIONAL INTERNET & SMARTPHONE PENETRATION IN EMERGING MARKETS

7.1.2 RISING CONSUMER EXPECTATIONS FOR PRODUCT PROTECTION AND DELIVERY EXPERIENCE

7.1.3 RAPID GROWTH OF ONLINE RETAIL AND FULFILLMENT NETWORKS

7.1.4 SUSTAINABILITY SHIFT TOWARD RECYCLABLE AND FIBER-BASED FORMATS

7.2 RESTRAINS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES (PAPER, RESINS, ADHESIVES)

7.2.2 PACKAGING WASTE REGULATIONS AND COMPLIANCE COSTS

7.3 OPPORTUNITY

7.3.1 ADOPTION OF AUTOMATION AND RIGHT-SIZING SYSTEMS IN FULFILLMENT

7.3.2 PREMIUMIZATION VIA DIGITAL PRINTING AND BRAND PERSONALIZATION

7.4 CHALLENGES

7.4.1 BALANCING PROTECTION WITH MATERIAL REDUCTION TARGETS

7.4.2 REVERSE LOGISTICS AND RETURNS PACKAGING OPTIMIZATION

8 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING.

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

8.2.1 CORRUGATED BOXES

8.2.2 BAGS

8.2.3 MAILER

8.2.4 LABELS

8.2.5 PROTECTIVE PACKAGING

8.2.6 PALLET BOXES

8.2.7 TAPES

8.2.8 POSTAL PACKAGING

8.2.9 SHRINK FILM

8.3 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

8.3.1 CORRUGATED BOXES

8.3.2 BAGS

8.3.3 MAILER

8.3.4 LABELS

8.3.5 PROTECTIVE PACKAGING

8.3.6 PALLET BOXES

8.3.7 TAPES

8.3.8 POSTAL PACKAGING

8.3.9 SHRINK FILM

8.4 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 POLYTHENE BAGS

8.6.2 COURIER BAGS

8.6.3 WOVEN SACK BAGS

8.6.4 FOAM BAGS

8.6.5 TEMPER PROOF BAGS

8.6.6 LOCK BAGS

8.6.7 OTHERS

8.7 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.7.1 POLYTHENE BAGS

8.7.2 COURIER BAGS

8.7.3 WOVEN SACK BAGS

8.7.4 FOAM BAGS

8.7.5 TEMPER PROOF BAGS

8.7.6 LOCK BAGS

8.7.7 OTHERS

8.8 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA-PACIFIC

8.12.2 NORTH AMERICA

8.12.3 EUROPE

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 SELF-ADHESIVE BOPP TAPES

8.14.2 PRINTED TAPES

8.14.3 REINFORCED PAPER TAPES

8.14.4 PVC PACKING TAPES

8.14.5 PACKAGING SEALING ADHESIVE TAPES

8.14.6 RESEALABLE BAG SEALING TAPES

8.14.7 OTHERS

8.15 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.15.1 SELF-ADHESIVE BOPP TAPES

8.15.2 PRINTED TAPES

8.15.3 REINFORCED PAPER TAPES

8.15.4 PVC PACKING TAPES

8.15.5 PACKAGING SEALING ADHESIVE TAPES

8.15.6 RESEALABLE BAG SEALING TAPES

8.15.7 OTHERS

8.16 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

8.17 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.18.1 AIR BUBBLE ROLLS

8.18.2 CORRUGATED ROLLS

8.18.3 OTHERS

8.19 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

8.19.1 AIR BUBBLE ROLLS

8.19.2 CORRUGATED ROLLS

8.19.3 OTHERS

8.2 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 SOUTH AMERICA

8.20.5 MIDDLE EAST & AFRICA

8.21 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.21.1 ASIA-PACIFIC

8.21.2 NORTH AMERICA

8.21.3 EUROPE

8.21.4 SOUTH AMERICA

8.21.5 MIDDLE EAST & AFRICA

8.22 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.22.1 ASIA-PACIFIC

8.22.2 NORTH AMERICA

8.22.3 EUROPE

8.22.4 SOUTH AMERICA

8.22.5 MIDDLE EAST & AFRICA

8.23 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.24.1 ASIA-PACIFIC

8.24.2 NORTH AMERICA

8.24.3 EUROPE

8.24.4 SOUTH AMERICA

8.24.5 MIDDLE EAST & AFRICA

8.25 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.25.1 ASIA-PACIFIC

8.25.2 NORTH AMERICA

8.25.3 EUROPE

8.25.4 SOUTH AMERICA

8.25.5 MIDDLE EAST & AFRICA

8.26 MIDDLE EAST AND AFRICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.26.1 ASIA-PACIFIC

8.26.2 NORTH AMERICA

8.26.3 EUROPE

8.26.4 SOUTH AMERICA

8.26.5 MIDDLE EAST & AFRICA

8.27 MIDDLE EAST AND AFRICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.27.1 ASIA-PACIFIC

8.27.2 NORTH AMERICA

8.27.3 EUROPE

8.27.4 SOUTH AMERICA

8.27.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL.

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

9.2.1 FIBER-BASED

9.2.2 RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS

9.2.3 BIO-BASED MATERIALS

9.2.4 CONVENTIONAL PLASTICS (VIRGIN PLASTICS)

9.2.5 OTHERS

9.3 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 CORRUGATED BOARD

9.3.2 PAPER & PAPERBOARD

9.4 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 SINGLE WALL

9.4.2 DOUBLE WALL

9.4.3 SINGLE FACE

9.4.4 TRIPLE WALL

9.4.5 OTHERS

9.5 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 MIDDLE EAST AND AFRICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 MIDDLE EAST AND AFRICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 MIDDLE EAST AND AFRICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

9.9 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER.

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

10.2.1 APPARELS AND ACCESSORIES (EX. LEATHER BASED) (0001)

10.2.2 ELECTRONICS & ELECTRICAL (2500)

10.2.3 TEXTILE (0001)

10.2.4 HOUSEHOLD (2000,0001)

10.2.5 PERSONAL CARE (2000,0001)

10.2.6 FOOD AND BEVERAGES (1000,1100)

10.2.7 PHARMACEUTICALS (2100)

10.2.8 AUTOMOTIVE (4600)

10.2.9 FABRICATED METAL PRODUCTS (2500)

10.2.10 CHEMICAL PRODUCTS (2000)

10.2.11 AGRICULTURE (0100)

10.2.12 FURNITURE (0001)

10.2.13 WOOD AND WOOD PRODUCTS (EX. FURNITURE) (0001)

10.2.14 LEATHER AND LEATHER GOODS (0001)

10.2.15 CONSTRUCTION MATERIALS (2000,0001)

10.2.16 TOBACCO PRODUCTS (0001)

10.3 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.3.1 RETAIL

10.3.2 WHOLESALE

10.4 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.4.1 CORRUGATED BOXES

10.4.2 BAGS

10.4.3 MAILER

10.4.4 LABELS

10.4.5 PROTECTIVE PACKAGING

10.4.6 PALLET BOXES

10.4.7 TAPES

10.4.8 POSTAL PACKAGING

10.4.9 SHRINK FILM

10.5 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.6.1 RETAIL

10.6.2 WHOLESALE

10.7 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.7.1 CORRUGATED BOXES

10.7.2 BAGS

10.7.3 MAILER

10.7.4 LABELS

10.7.5 PROTECTIVE PACKAGING

10.7.6 PALLET BOXES

10.7.7 TAPES

10.7.8 POSTAL PACKAGING

10.7.9 SHRINK FILM

10.8 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 COMPUTERS, ELECTRONIC AND OPTICAL PRODUCTS

10.8.2 ELECTRICAL EQUIPMENT

10.8.3 OTHERS

10.9 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.10.1 RETAIL

10.10.2 WHOLESALE

10.11 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.11.1 CORRUGATED BOXES

10.11.2 BAGS

10.11.3 MAILER

10.11.4 LABELS

10.11.5 PROTECTIVE PACKAGING

10.11.6 PALLET BOXES

10.11.7 TAPES

10.11.8 POSTAL PACKAGING

10.11.9 SHRINK FILM

10.12 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.13.1 RETAIL

10.13.2 WHOLESALE

10.14 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.14.1 CORRUGATED BOXES

10.14.2 BAGS

10.14.3 MAILER

10.14.4 LABELS

10.14.5 PROTECTIVE PACKAGING

10.14.6 PALLET BOXES

10.14.7 TAPES

10.14.8 POSTAL PACKAGING

10.14.9 SHRINK FILM

10.15 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 SOUTH AMERICA

10.15.5 MIDDLE EAST & AFRICA

10.16 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.16.1 RETAIL

10.16.2 WHOLESALE

10.17 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.17.1 CORRUGATED BOXES

10.17.2 BAGS

10.17.3 MAILER

10.17.4 LABELS

10.17.5 PROTECTIVE PACKAGING

10.17.6 PALLET BOXES

10.17.7 TAPES

10.17.8 POSTAL PACKAGING

10.17.9 SHRINK FILM

10.18 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA-PACIFIC

10.18.2 NORTH AMERICA

10.18.3 EUROPE

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.19.1 RETAIL

10.19.2 WHOLESALE

10.2 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.20.1 CORRUGATED BOXES

10.20.2 BAGS

10.20.3 MAILER

10.20.4 LABELS

10.20.5 PROTECTIVE PACKAGING

10.20.6 PALLET BOXES

10.20.7 TAPES

10.20.8 POSTAL PACKAGING

10.20.9 SHRINK FILM

10.21 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 FOOD

10.21.2 BEVERAGES

10.22 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.22.1 ASIA-PACIFIC

10.22.2 NORTH AMERICA

10.22.3 EUROPE

10.22.4 SOUTH AMERICA

10.22.5 MIDDLE EAST & AFRICA

10.23 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.23.1 RETAIL

10.23.2 WHOLESALE

10.24 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.24.1 CORRUGATED BOXES

10.24.2 BAGS

10.24.3 MAILER

10.24.4 LABELS

10.24.5 PROTECTIVE PACKAGING

10.24.6 PALLET BOXES

10.24.7 TAPES

10.24.8 POSTAL PACKAGING

10.24.9 SHRINK FILM

10.25 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.25.1 ASIA-PACIFIC

10.25.2 NORTH AMERICA

10.25.3 EUROPE

10.25.4 SOUTH AMERICA

10.25.5 MIDDLE EAST & AFRICA

10.26 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.26.1 RETAIL

10.26.2 WHOLESALE

10.27 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.27.1 CORRUGATED BOXES

10.27.2 BAGS

10.27.3 MAILER

10.27.4 LABELS

10.27.5 PROTECTIVE PACKAGING

10.27.6 PALLET BOXES

10.27.7 TAPES

10.27.8 POSTAL PACKAGING

10.27.9 SHRINK FILM

10.28 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

10.28.1 SPARE PARTS

10.28.2 VEHICLE MODIFICATION PARTS

10.29 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.29.1 ASIA-PACIFIC

10.29.2 NORTH AMERICA

10.29.3 EUROPE

10.29.4 SOUTH AMERICA

10.29.5 MIDDLE EAST & AFRICA

10.3 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.30.1 RETAIL

10.30.2 WHOLESALE

10.31 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.32 ASIA-PACIFIC

10.32.1 NORTH AMERICA

10.32.2 EUROPE

10.32.3 SOUTH AMERICA

10.32.4 MIDDLE EAST & AFRICA

10.33 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.33.1 RETAIL

10.33.2 WHOLESALE

10.34 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.34.1 ASIA-PACIFIC

10.34.2 NORTH AMERICA

10.34.3 EUROPE

10.34.4 SOUTH AMERICA

10.34.5 MIDDLE EAST & AFRICA

10.35 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.35.1 RETAIL

10.35.2 WHOLESALE

10.36 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.36.1 FERTILIZERS

10.36.2 FISHING AND AQUACULTURE PRODUCTS

10.36.3 PLANTS

10.36.4 SEEDS

10.36.5 OTHERS

10.37 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.37.1 ASIA-PACIFIC

10.37.2 NORTH AMERICA

10.37.3 EUROPE

10.37.4 SOUTH AMERICA

10.37.5 MIDDLE EAST & AFRICA

10.38 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.38.1 RETAIL

10.38.2 WHOLESALE

10.39 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.39.1 ASIA-PACIFIC

10.39.2 NORTH AMERICA

10.39.3 EUROPE

10.39.4 SOUTH AMERICA

10.39.5 MIDDLE EAST & AFRICA

10.4 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.40.1 RETAIL

10.40.2 WHOLESALE

10.41 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.41.1 ASIA-PACIFIC

10.41.2 NORTH AMERICA

10.41.3 EUROPE

10.41.4 SOUTH AMERICA

10.41.5 MIDDLE EAST & AFRICA

10.42 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.42.1 RETAIL

10.42.2 WHOLESALE

10.43 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.43.1 ASIA-PACIFIC

10.43.2 NORTH AMERICA

10.43.3 EUROPE

10.43.4 SOUTH AMERICA

10.43.5 MIDDLE EAST & AFRICA

10.44 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.44.1 RETAIL

10.44.2 WHOLESALE

10.45 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.45.1 ASIA-PACIFIC

10.45.2 NORTH AMERICA

10.45.3 EUROPE

10.45.4 SOUTH AMERICA

10.45.5 MIDDLE EAST & AFRICA

10.46 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.46.1 RETAIL

10.46.2 WHOLESALE

10.47 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.47.1 ASIA-PACIFIC

10.47.2 NORTH AMERICA

10.47.3 EUROPE

10.47.4 SOUTH AMERICA

10.47.5 MIDDLE EAST & AFRICA

10.48 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.48.1 CORRUGATED BOXES

10.48.2 BAGS

10.48.3 MAILER

10.48.4 LABELS

10.48.5 PROTECTIVE PACKAGING

10.48.6 PALLET BOXES

10.48.7 TAPES

10.48.8 POSTAL PACKAGING

10.48.9 SHRINK FILM

10.49 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.49.1 ASIA-PACIFIC

10.49.2 NORTH AMERICA

10.49.3 EUROPE

10.49.4 SOUTH AMERICA

10.49.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL.

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

11.2.1 DIRECT

11.2.2 INDIRECT

11.3 MIDDLE EAST AND AFRICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 COMPANY OWNED WEBSITES

11.3.2 FIELD AGENTS

11.3.3 DIRECT CONTRACTS

11.4 MIDDLE EAST AND AFRICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 DISTRIBUTORS / WHOLESALERS

11.4.2 VALUE-ADDED RESELLERS (VARS)

11.4.3 THIRD-PARTY ONLINE MARKETPLACES

11.5 MIDDLE EAST AND AFRICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 MIDDLE EAST AND AFRICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 UNITED ARAB EMIRATES (UAE)

12.1.3 EGYPT

12.1.4 ISRAEL

12.1.5 SOUTH AFRICA

12.1.6 QATAR

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 MANUFACTURERS COMPANY PROFILE

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SMURFIT WESTROCK

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PACKAGING CORPORATION OF AMERICA.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALTPAC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AVERY DENNISON CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BLUE BOX PACKAGING

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BOXON AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COSMO FILMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ECOM PACKAGING

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ECB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILMAR GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GEORGIA-PACIFIC LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GREEN BAY PACKAGING INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IPG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 KLABIN S.A

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MONDI

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OJI HOLDINGS CORPORATION.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PACKHELP

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PACKMAN PACKAGING PRIVATE LIMITED.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PACKTEK

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 PRATT INDUSTRIES INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 PREGIS LLC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 PREM INDUSTRIES INDIA LIMITED

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 RANPAK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENT

15.29 SEALED AIR

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 STORA ENSO

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 DISTRIBUTOR COMPANY PROFILE

16.1 BUNZL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MACFARLANE PACKAGING (A SUBSIDIARY COMPANY OF MACFARLANE GROUP PLC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAJAPACK LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ULINE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VERITIV OPERATING COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 CONSUMER PREFERENCE MATRIX

TABLE 4 REGULATORY COVERAGE

TABLE 5 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 9 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 11 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 15 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 17 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 23 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 25 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 27 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 29 MIDDLE EAST AND AFRICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 31 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA

TABLE 93 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA

TABLE 95 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 96 THOUSAND

TABLE 97 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 99 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 101 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 103 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 105 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)