Middle East And Africa Soil Health Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.11 Billion

USD

2.38 Billion

2025

2033

USD

1.11 Billion

USD

2.38 Billion

2025

2033

| 2026 –2033 | |

| USD 1.11 Billion | |

| USD 2.38 Billion | |

|

|

|

|

Segmentación del mercado de la salud del suelo en Oriente Medio y África, por tipo (productos de mejora del suelo y productos de prueba y monitoreo), tipo de suelo (suelos aluviales, suelos rojos, francos, suelos negros, suelos áridos, suelos arenosos, suelos limosos, suelos arcillosos, suelos amarillos, suelos lateríticos, suelos salinos/alcalinos, suelos de turba, suelos calcáreos, otros), tecnología (gestión convencional del suelo, gestión integrada de la fertilidad del suelo (ISFM), gestión precisa de la salud del suelo, prácticas de agricultura regenerativa, otros), aplicación (suelos de cultivo y suelos no agrícolas), usuario final (agricultores y productores, empresas agroindustriales, empresas de paisajismo y silvicultura, organismos gubernamentales y reguladores, institutos de investigación, universidades, otros), canal de distribución (venta directa, posventa) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de salud del suelo en Oriente Medio y África

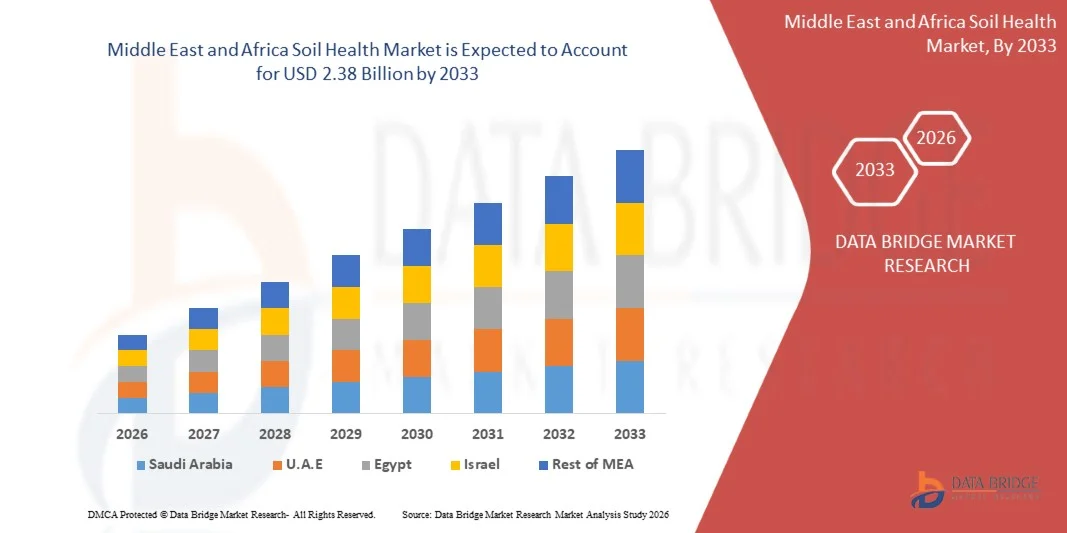

- Se espera que el mercado de salud del suelo de Medio Oriente y África alcance los USD 2,38 mil millones para 2033 desde los USD 1,11 mil millones en 2025 , creciendo con una CAGR del 5,5% en el período de pronóstico de 2026 a 2033.

- El mercado de la salud del suelo en Oriente Medio y África experimenta un crecimiento constante, impulsado por el creciente uso de soluciones para la salud del suelo en sectores como la agricultura, la horticultura, el paisajismo y la silvicultura. Estas soluciones son valoradas por su capacidad para mejorar la fertilidad del suelo, la retención de nutrientes y apoyar prácticas sostenibles de gestión del suelo.

- Los continuos avances en las tecnologías de enmiendas de suelo, las técnicas de formulación y la eficacia de los productos, junto con la mejora de los estándares de calidad, están facilitando una mayor adopción de productos innovadores para la salud del suelo en aplicaciones de alto rendimiento, como la mejora de la productividad de los cultivos, la remediación de suelos y la agricultura de precisión. Esto contribuye a una mejor calidad del suelo, el rendimiento de los cultivos y la sostenibilidad ambiental a largo plazo.

- Los marcos regulatorios de apoyo que promueven insumos agrícolas ecológicos y de baja toxicidad, combinados con mayores requisitos de cumplimiento ambiental, están alentando a las partes interesadas a adoptar soluciones para la salud del suelo como alternativas más seguras, sostenibles y ambientalmente responsables a las prácticas tradicionales.

Análisis del mercado de la salud del suelo en Oriente Medio y África

- El mercado de la salud del suelo en Oriente Medio y África atiende a una amplia gama de industrias, como la textil, la papelera, las resinas, la farmacéutica, la cosmética y la de tratamiento de aguas. La demanda se basa principalmente en su robusta capacidad de reticulación y su papel como intermediario crucial en formulaciones químicas especializadas y de alto rendimiento.

- El mercado de la salud del suelo en Oriente Medio y África abarca sectores similares, como el textil, el papel, las resinas, los productos farmacéuticos, los cosméticos y el tratamiento de aguas. Su adopción se ve impulsada por sus sólidas propiedades funcionales y su importancia como intermediario en aplicaciones químicas especializadas y de alto rendimiento.

- Se proyecta que en 2025 el segmento de Productos para la Mejora del Suelo domine el mercado de la salud del suelo con una participación del 89,04 %, gracias a su amplio uso en la producción de resinas, adhesivos y productos químicos para el tratamiento del papel. Este segmento se beneficia de una gran demanda en operaciones industriales a gran escala y de la rentabilidad de la producción a gran escala, lo que lo convierte en una opción preferida frente a otros grados.

- Se espera que Sudáfrica domine el mercado de salud del suelo de Medio Oriente y África con una participación del 21,67% en 2026, impulsada por la rápida industrialización, la fuerte demanda de las industrias textil y papelera, una infraestructura de fabricación química bien establecida y aplicaciones crecientes en recubrimientos, adhesivos y productos químicos especiales, lo que refuerza su posición como el principal contribuyente al crecimiento del mercado regional.

- Se prevé que Arabia Saudita crezca a una tasa de crecimiento anual compuesta (TCAC) de alrededor del 10,9 % entre 2026 y 2033, impulsada por la creciente demanda de los sectores textil y agroquímico, así como por un mayor uso de resinas y recubrimientos para aplicaciones industriales. La aceleración de la industrialización y el desarrollo urbano en la región impulsan aún más la expansión del mercado.

- La creciente adopción de tecnologías avanzadas, como sistemas de monitoreo de suelo habilitados por IA, riego automatizado y análisis de nutrientes en tiempo real, está mejorando la eficiencia operativa y respaldando el crecimiento del mercado en aplicaciones agrícolas comerciales e industriales.

- Las políticas gubernamentales favorables, el desarrollo de infraestructura y las inversiones en iniciativas de agricultura sostenible están impulsando aún más el crecimiento del mercado, fomentando la adopción de soluciones avanzadas para la salud del suelo y reforzando las perspectivas de crecimiento a largo plazo de la industria.

Alcance del informe y segmentación del mercado de salud del suelo en Oriente Medio y África

|

Atributos |

Perspectivas del mercado de la salud del suelo en Oriente Medio y África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de la salud del suelo

Integración con ecosistemas de agricultura inteligente, gestión del suelo y agricultura de precisión

- Las soluciones para la salud del suelo se integran cada vez más en entornos de agricultura inteligente, lo que favorece la productividad de los cultivos, la optimización de nutrientes y la gestión sostenible de las tierras. Estas soluciones permiten un monitoreo constante del suelo, la aplicación precisa de enmiendas y la toma de decisiones basada en datos, alineada con los principios de la Industria 4.0 en la agricultura.

- En las instalaciones de procesamiento y almacenamiento de suelo, los mejoradores y acondicionadores de suelo ayudan a retener la humedad, estabilizar los nutrientes y mejorar la estructura del suelo, mejorando la eficiencia de manejo, la durabilidad del almacenamiento y la confiabilidad de las aplicaciones posteriores.

- La creciente adopción de productos para la salud del suelo en equipos de agricultura de precisión, sistemas de riego controlado y plataformas automatizadas de monitoreo de campo respalda la eficiencia agrícola a gran escala al mejorar el suministro de nutrientes, reducir el desperdicio y promover la sostenibilidad del suelo a largo plazo en todas las operaciones agrícolas.

Por ejemplo,

- En enero de 2025, las tecnologías avanzadas de enmienda del suelo se integraron cada vez más en los sistemas automatizados de riego y monitoreo de campos. Estos sistemas, combinados con sensores de nutrientes del suelo en tiempo real y plataformas de análisis digital, mejoraron la eficiencia operativa, la consistencia y la sostenibilidad en las operaciones agrícolas, destacando el papel de las soluciones para la salud del suelo en los ecosistemas agrícolas de próxima generación.

- Los recientes avances en la industria indican una creciente adopción de acondicionadores de suelo especializados, inóculos microbianos y productos húmicos en aplicaciones de agricultura de alto rendimiento y agricultura de precisión. La creciente mecanización, las prácticas agrícolas basadas en datos y los requisitos de sostenibilidad refuerzan la creciente importancia de las soluciones para la salud del suelo más allá de las aplicaciones agrícolas tradicionales.

Dinámica del mercado de la salud del suelo

Conductor

“ Aumento de la modernización agrícola y de las necesidades de soluciones de suelo orientadas al rendimiento ”

- El sector agrícola de Oriente Medio y África está experimentando una adopción acelerada de soluciones avanzadas para la salud del suelo, impulsada por requisitos de rendimiento cada vez más complejos en la producción de cultivos, la horticultura, el paisajismo y la silvicultura. Los agricultores y las agroindustrias priorizan estas soluciones por su capacidad para mejorar la estructura del suelo, la retención de nutrientes, la capacidad de retención de agua y la fertilidad a largo plazo. A medida que los procesos agrícolas evolucionan hacia una mayor eficiencia, consistencia en el rendimiento y sostenibilidad, crece la demanda de enmiendas del suelo que favorezcan una distribución optimizada de nutrientes, un mejor rendimiento de los cultivos y prácticas responsables con el medio ambiente.

- El creciente papel de los productos para la salud del suelo en las iniciativas de modernización agrícola ha creado un entorno dinámico para la innovación, lo que ha impulsado avances en la formulación de productos, la versatilidad de sus aplicaciones y la compatibilidad con equipos de agricultura de precisión. En respuesta a este cambio impulsado por la demanda, los fabricantes están invirtiendo en el desarrollo de soluciones de suelo personalizadas, adaptadas a tipos de cultivos, condiciones del suelo y zonas climáticas específicas, incluyendo enmiendas húmicas, bioestimulantes y fertilizantes que mejoran el rendimiento.

- Estas innovaciones se deben en gran medida a las necesidades operativas de la agricultura moderna, que requiere soluciones de suelo adaptables capaces de funcionar de forma fiable en diversas condiciones de campo y requisitos regulatorios. A medida que las explotaciones agrícolas y las agroindustrias continúan integrando productos avanzados para la salud del suelo en los flujos de trabajo de riego, fertilización y gestión de tierras, este impulso no solo influye en las estrategias de inversión de los proveedores, sino que también refuerza el papel de las soluciones para la salud del suelo como un factor clave para una producción agrícola sostenible, de alto rendimiento y de calidad.

Por ejemplo,

- En septiembre de 2023, los informes agrícolas destacaron una mayor adopción de enmiendas húmicas y microbianas del suelo en operaciones avanzadas de horticultura y cultivos de campo con el objetivo de mejorar la estructura del suelo, la disponibilidad de nutrientes y la retención de agua, cumpliendo al mismo tiempo con estándares ambientales más estrictos.

- En febrero de 2024, los datos regionales indicaron que las granjas de toda Europa intensificaron el uso de bioestimulantes y acondicionadores de suelo ricos en nutrientes para apoyar prácticas de producción sostenibles y reducir la dependencia de fertilizantes químicos convencionales con mayor impacto ambiental.

- En febrero de 2025, los acontecimientos en Medio Oriente y África enfatizaron las crecientes inversiones en productos especiales para la salud del suelo, incluidos ácidos húmicos, enmiendas orgánicas e inóculos microbianos, para satisfacer la creciente demanda de la agricultura a gran escala, la agricultura de precisión y las iniciativas de gestión sostenible de la tierra.

- La creciente adopción de soluciones avanzadas para la salud del suelo en el sector agrícola de Oriente Medio y África subraya su creciente importancia como productos multifuncionales, alineados con los requisitos cambiantes de rendimiento, eficiencia y sostenibilidad. A medida que la agricultura avanza hacia productos de mayor calidad, un suministro controlado de nutrientes y una gestión optimizada del suelo, las capacidades funcionales de estas soluciones las posicionan como facilitadores cruciales para mejorar el rendimiento de los cultivos, la fertilidad del suelo y la productividad de la tierra a largo plazo.

Restricción/Desafío

Falta de marcos regulatorios armonizados en Oriente Medio y África para soluciones de salud del suelo.

- La ausencia de regulaciones armonizadas en Medio Oriente y África que regulen la fabricación, aplicación y manipulación de enmiendas del suelo representa un desafío notable para el mercado de salud del suelo de Medio Oriente y África, ya que los requisitos regulatorios difieren significativamente entre países y regiones.

- Las autoridades reguladoras aplican diferentes estándares relacionados con la composición del producto, los límites permisibles de ingredientes activos, el cumplimiento ambiental, el etiquetado, el transporte y la gestión de residuos. Esta fragmentación regulatoria obliga a los fabricantes de soluciones para la salud del suelo y a los usuarios agrícolas posteriores a modificar las formulaciones, la documentación, los protocolos de seguridad y las estrategias de cumplimiento para cada mercado, lo que aumenta la complejidad operativa, los costos de cumplimiento y el tiempo de adopción.

- Como resultado, las empresas enfrentan limitaciones para ampliar la escala de fabricación y distribución de productos para la salud del suelo en Medio Oriente y África, en particular para el comercio transfronterizo y las cadenas de suministro multinacionales que atienden aplicaciones agrícolas, hortícolas, paisajísticas y forestales.

Por ejemplo,

- A fines de 2025, las autoridades ambientales regionales de Asia y Europa introdujeron diferentes requisitos de cumplimiento para los acondicionadores de suelo, las enmiendas húmicas y los inóculos microbianos, con variaciones en los componentes activos permitidos y las obligaciones de presentación de informes, lo que ilustra inconsistencias regulatorias que complican las estrategias estandarizadas de producción y exportación.

- En mayo de 2025, los organismos reguladores nacionales y locales de los mercados emergentes implementaron restricciones más estrictas de manipulación, almacenamiento y transporte más allá de las pautas centrales existentes, lo que creó interrupciones operativas temporales para los fabricantes y distribuidores de soluciones para la salud del suelo, quienes debieron obtener aprobaciones adicionales y modificar los flujos de trabajo logísticos durante el período de aplicación.

- La falta de marcos regulatorios armonizados en Medio Oriente y África sigue representando un desafío estructural para el mercado de la salud del suelo, limitando la facilidad de la producción, distribución y comercio transfronterizo estandarizados y aumentando la necesidad de estrategias de cumplimiento específicas para cada región.

Alcance del mercado de la salud del suelo

El mercado de salud del suelo de Medio Oriente y África está segmentado en seis segmentos según el tipo, el tipo de suelo, la tecnología, la aplicación, el usuario final y el canal de distribución.

• Por tipo

Según el tipo, el mercado se segmenta en productos para la mejora del suelo y productos de prueba y monitoreo.

En 2026, se prevé que el segmento de productos para la mejora del suelo domine el mercado de la salud del suelo en Oriente Medio y África, con la mayor cuota de mercado (89,04 %), lo que refleja su profunda integración en una amplia gama de aplicaciones agrícolas y hortícolas. Este predominio se debe principalmente al uso extensivo de enmiendas de suelo de grado industrial, productos húmicos y bioestimulantes en la producción de cultivos, la agricultura de precisión, el paisajismo y la rehabilitación de tierras, donde la aplicación continua a gran escala es esencial para mantener la fertilidad del suelo, el equilibrio de nutrientes y el rendimiento de los cultivos. Su capacidad para ofrecer una retención fiable de nutrientes, capacidad de retención de agua y propiedades de acondicionamiento del suelo a escala de campo los convierte en la opción preferida por agricultores y agroindustrias que gestionan operaciones agrícolas de alto rendimiento.

Además, la sólida posición de mercado del segmento de Productos de Prueba y Monitoreo se ve reforzada por su rentabilidad y disponibilidad a granel, lo que se alinea perfectamente con las estrategias de compra de los grandes usuarios agrícolas que buscan optimizar los costos operativos sin comprometer la productividad del suelo ni los resultados de los cultivos. A medida que los sectores agrícola y hortícola continúan expandiéndose rápidamente tanto en las economías desarrolladas como en las emergentes, se espera que la demanda de soluciones estandarizadas y de gran volumen para la salud del suelo se mantenga sólida.

Esta demanda sostenida, combinada con la versatilidad y compatibilidad de los productos de mejora del suelo con diversos tipos de suelo, ciclos de cultivo y condiciones climáticas, posiciona al segmento de grado industrial como el principal contribuyente de ingresos al mercado de salud del suelo de Medio Oriente y África en 2026.

Por tipo de suelo

Sobre la base del tipo de suelo, el mercado se segmenta en suelos aluviales, suelos rojos, francos, suelos negros, suelos áridos, suelos arenosos, suelos limosos, suelos arcillosos, suelos amarillos, suelos lateríticos, suelos salinos/alcalinos, suelos de turba, suelos calcáreos, otros.

En 2026, se prevé que el segmento de suelos aluviales domine el mercado de la salud del suelo en Oriente Medio y África, con una cuota de mercado del 15,85%, gracias a sus características de rendimiento superiores y a su mayor fiabilidad funcional en aplicaciones avanzadas de agricultura y gestión del territorio. Las soluciones de salud del suelo diseñadas para suelos aluviales ofrecen una mejor retención de nutrientes, capacidad de retención de agua y estabilización de la estructura del suelo, lo que las hace especialmente adecuadas para aplicaciones donde el acondicionamiento preciso del suelo y la consistencia de los resultados de los cultivos son cruciales. Estas propiedades mejoran significativamente su adopción en la agricultura de precisión, la horticultura de alto valor, la producción de cultivos especializados y los proyectos de rehabilitación de tierras, donde la optimización del rendimiento del suelo se traduce directamente en un mejor rendimiento de los cultivos, la sostenibilidad y la eficiencia de los recursos.

Además, la sólida posición de mercado del segmento de suelos aluviales se ve reforzada por su calidad constante y su cumplimiento de rigurosos estándares regulatorios y agronómicos. Los agricultores y las empresas agropecuarias prefieren cada vez más soluciones de suelo a medida para suelos aluviales que satisfagan las cambiantes necesidades de seguridad del suelo, gestión ambiental y transparencia en los procesos. A medida que las prácticas agrícolas se orientan hacia cultivos de alto valor y orientados al rendimiento, se prevé que la demanda de soluciones de alta calidad para la salud del suelo aluvial se mantenga sólida, consolidando el dominio de este segmento en el mercado de la salud del suelo en Oriente Medio y África en 2026.

Por tecnología

Sobre la base de la tecnología, el mercado está segmentado en Manejo Convencional del Suelo, Manejo Integrado de la Fertilidad del Suelo (ISFM), Manejo de Precisión de la Salud del Suelo, Prácticas de Agricultura Regenerativa, Otros.

En 2026, se prevé que el segmento de Gestión Convencional de Suelos domine el mercado de la salud del suelo en Oriente Medio y África, con una cuota de mercado del 32,11%, gracias a su superior eficiencia operativa y a su sólida adaptación a las exigencias modernas de la agricultura y la gestión del territorio. Este enfoque de gestión permite un mejor aporte de nutrientes, un acondicionamiento uniforme del suelo y resultados predecibles para los cultivos, lo que lo hace especialmente adecuado para aplicaciones que exigen soluciones fiables y estandarizadas de mejora del suelo. En comparación con las prácticas de suelo tradicionales o específicas, las técnicas de gestión convencional estructurada proporcionan un marco controlado para el tratamiento del suelo, lo que favorece un cultivo estable a gran escala con una variabilidad reducida y un rendimiento optimizado del campo.

Además, la sólida posición de mercado del segmento de Prácticas de Agricultura Regenerativa se ve reforzada por su mayor seguridad operativa, rentabilidad y cumplimiento de las normas ambientales y de sostenibilidad, cada vez más cruciales para los proveedores de soluciones para el suelo. Este enfoque reduce la dependencia de insumos químicos peligrosos, contribuye a un menor impacto ambiental y permite el cumplimiento de las estrictas normativas regionales. A medida que la demanda de soluciones para la salud del suelo en Oriente Medio y África continúa creciendo en aplicaciones de producción agrícola, horticultura, paisajismo y agricultura de precisión, los agricultores y las empresas agropecuarias están adoptando cada vez más este método escalable y sostenible, consolidando su liderazgo en el mercado en 2026.

Por aplicación

Según su aplicación, el mercado se segmenta en suelos de cultivo y suelos no agrícolas. El suelo de cultivo se subdivide, a su vez, según su aplicación, en cereales y granos, oleaginosas y legumbres, frutas y hortalizas, cultivos comerciales, cultivos de plantación y otros.

En 2026, se prevé que el segmento de suelos agrícolas domine el mercado, con una cuota de mercado del 70,13%, gracias a su versatilidad y ventajas prácticas en una amplia gama de aplicaciones agrícolas y de gestión del suelo. Las soluciones de suelos agrícolas gozan de gran popularidad gracias a su fácil manejo, su almacenamiento seguro y su idoneidad para una aplicación precisa, lo que las hace especialmente adecuadas para las necesidades de la producción agrícola, la horticultura y los cultivos especializados de alto valor, donde el uso controlado y la prevención de la contaminación son fundamentales.

Además, la sólida posición de mercado del segmento de suelos agrícolas se ve reforzada por su amplia disponibilidad y producción rentable, lo que facilita una distribución y adquisición fluidas tanto en mercados desarrollados como emergentes. Los agricultores y las empresas agropecuarias recurren cada vez más a formatos estandarizados de productos para el suelo que simplifican el almacenamiento, el transporte y el cumplimiento normativo, a la vez que garantizan la calidad y el rendimiento del producto. Dado que el sector agrícola sigue demandando soluciones prácticas, fiables y de alto rendimiento para la salud del suelo, se prevé que el segmento de suelos agrícolas mantenga su liderazgo en el mercado de salud del suelo de Oriente Medio y África en 2026.

Por el usuario final

Sobre la base del usuario final, el mercado se segmenta en agricultores y productores, empresas de agronegocios, empresas de paisajismo y silvicultura, organismos gubernamentales y reguladores, institutos de investigación, universidades y otros.

En 2026, se prevé que el segmento de Agricultores y Cultivadores domine el mercado, con una cuota de mercado del 53,26%, gracias a su amplia aplicación para mejorar la fertilidad del suelo, la productividad de los cultivos y el rendimiento del campo. Las soluciones avanzadas para la salud del suelo desempeñan un papel fundamental en la mejora de la retención de nutrientes, la capacidad de retención de agua y la estabilidad estructural del suelo, lo que las hace esenciales en múltiples cadenas de valor agrícolas y hortícolas.

Además, el segmento de Empresas Agroindustriales, con el mayor crecimiento, se ve reforzado por la fuerte demanda de enmiendas de suelo especializadas, bioestimulantes y productos húmicos, especialmente en la agricultura de precisión, la producción de cultivos de alto valor y las explotaciones agrícolas a gran escala. Estas soluciones para la salud del suelo mejoran su rendimiento, a la vez que permiten prácticas de cultivo eficientes, rentables y sostenibles. A medida que el sector agrícola continúa centrándose en la optimización del rendimiento, la sostenibilidad del suelo y la fiabilidad operativa, se prevé que este segmento siga siendo un motor clave de crecimiento en el mercado de la salud del suelo en Oriente Medio y África en 2026.

Por canal de distribución

Sobre la base del canal de distribución, el mercado está segmentado en venta directa y posventa.

En 2026, se prevé que el segmento de Ventas Directas domine el mercado, con la mayor participación (70,01 %), gracias a su amplia utilización en la producción de cultivos, la horticultura y el acondicionamiento de suelos. Las soluciones para la salud del suelo en este segmento desempeñan un papel fundamental en la mejora de la fertilidad del suelo, la retención de nutrientes y la resiliencia de los cultivos, lo que las convierte en una opción preferida en explotaciones agrícolas a gran escala y entornos agrícolas de alto rendimiento.

Además, el segmento de posventa, con el mayor crecimiento, se ve reforzado por la superior eficiencia, estabilidad y compatibilidad de los mejoradores de suelo avanzados con las prácticas y equipos agrícolas existentes, lo que garantiza un rendimiento constante en diversas condiciones climáticas y edáficas. A medida que aumenta la demanda de soluciones fiables, de alto rendimiento y sostenibles para la salud del suelo en diversos sectores agrícolas, se prevé que este segmento mantenga una sólida adopción y mantenga su liderazgo en el mercado en 2026.

Análisis regional del mercado de la salud del suelo

- En 2025, Sudáfrica representará la mayor participación en el mercado de salud del suelo en Oriente Medio y África, con el 21,67 % de la demanda de este sector. Con una tasa de crecimiento anual compuesta (TCAC) proyectada del 9,8 %, el crecimiento se ve impulsado por la rápida modernización agrícola, la expansión de la producción de cultivos de alto valor, la creciente adopción de técnicas de agricultura de precisión y la creciente demanda de soluciones para la mejora del suelo en diversas aplicaciones agrícolas.

- El país se beneficia de la mejora de la infraestructura agrícola, las políticas gubernamentales de apoyo y la creciente inversión en prácticas agrícolas sostenibles y tecnologías avanzadas de gestión del suelo. La expansión de las aplicaciones finales en la producción de cultivos, la horticultura, la rehabilitación de tierras y la agricultura especializada continúa impulsando una sólida penetración en el mercado y un potencial de crecimiento a largo plazo en Oriente Medio y África.

Perspectivas del mercado de la salud del suelo en Arabia Saudita

El mercado sudafricano de la salud del suelo se encuentra en rápida expansión, impulsado por la producción agrícola a gran escala, la alta adopción de técnicas de agricultura de precisión y las iniciativas gubernamentales de apoyo que promueven la gestión sostenible del suelo. Los avances tecnológicos en el monitoreo del suelo, los bioestimulantes y las enmiendas húmicas, junto con la fabricación rentable de soluciones para la salud del suelo, posicionan a Sudáfrica como un importante centro de productos para la mejora del suelo en Oriente Medio y África, con un importante potencial de crecimiento.

Perspectivas del mercado de la salud del suelo en Arabia Saudita

El mercado de la salud del suelo en Arabia Saudita está experimentando un sólido crecimiento, impulsado por la expansión de la producción agrícola, la creciente adopción de productos acondicionadores y bioestimulantes, y el creciente uso de soluciones avanzadas de gestión del suelo en la agricultura de alto valor. Los programas gubernamentales que promueven la agricultura sostenible, la mejora de la fertilidad del suelo y la mejora del suelo a escala industrial continúan impulsando el mercado.

Análisis del mercado egipcio de la salud del suelo.

El mercado egipcio de la salud del suelo contribuye de forma clave a Oriente Medio y África, gracias a una infraestructura agrícola consolidada, prácticas avanzadas de gestión del suelo y la adopción constante de bioestimulantes, ácidos húmicos y soluciones microbianas para el suelo. La alta integración de tecnologías de agricultura de precisión, la optimización de procesos y las enmiendas de suelo ambientalmente sostenibles continúa impulsando el crecimiento y la innovación del mercado.

Cuota de mercado de la salud del suelo

El programa de Salud del Suelo está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- BASF (Alemania)

- Bayer AG (Alemania)

- Corteva (EE. UU.)

- Mosaico Arabia Saudita (Arabia Saudita)

- UPL (Arabia Saudita)

- Corporación FMC (EE. UU.)

- Syngenta Crop Protection AG (Suiza)

- EarthOptics (EE. UU.)

- Miraterra Technologies Corporation (EE. UU.)

- Soil Scout Oy (Finlandia)

- Stevens Water Monitoring Systems Inc. (EE. UU.)

- METRO (EE.UU.)

- Campbell Scientific, Inc. (EE. UU.)

- Sentek Technologies (Australia)

- Tecsoil, Inc. (EE. UU., estimación; verificar)

- Nutrien Ag Solutions, Inc. (Canadá)

- ICL (Israel)

- CropX Inc. (Israel)

- AgroCares (Países Bajos)

- Soilwiz Ltd (Reino Unido/Europa)

- Growindigo / Indigo Ag (EE. UU.)

- Langley Fertilizers (Reino Unido)

- Humintech (Alemania)

- Coromandel International Ltd. (Arabia Saudita)

- Evonik (Alemania)

- ADM (Archer Daniels Midland Company) (EE. UU.)

- HUMA GRO (EE. UU.)

- The Scotts Company LLC (EE. UU.)

Últimos avances en el mercado de la salud del suelo en Oriente Medio y África

- En octubre de 2025, Multichem Specialities Private Limited fue reconocida entre los 10 Mejores Distribuidores de Productos Químicos Especializados de 2025 por la revista Industry Outlook, lo que destaca su compromiso con la calidad, la innovación y la fiabilidad del servicio en el sector. En julio de 2025, la empresa también organizó una campaña de donación de sangre en colaboración con Breach Candy Hospital Trust, involucrando a sus empleados y a la comunidad en el apoyo a iniciativas sanitarias.

- En febrero de 2024, Multichem Specialities Private Limited participó en Vitafoods Arabia Saudita, fortaleciendo su presencia en el segmento de nutracéuticos e ingredientes especiales mientras interactuaba con clientes y socios para mostrar su cartera en expansión de soluciones químicas.

- En octubre de 2024, Otto Chemie Pvt. Ltd. amplió su cartera de productos químicos y reactivos de laboratorio de alta pureza, consolidando su presencia en los sectores farmacéutico, de investigación e industrial. La empresa también reforzó su red de distribución y la capacidad de su cadena de suministro para satisfacer la creciente demanda en Arabia Saudita y los mercados internacionales.

- En julio de 2024, Otto Chemie Pvt. Ltd. organizó una campaña de donación de sangre y concientización sobre la salud en colaboración con hospitales locales, lo que refleja el compromiso de la empresa con el bienestar de la comunidad y las iniciativas de responsabilidad social corporativa.

- En marzo de 2025, Oxford Lab Fine Chem LLP implementó soluciones de embalaje ecológicas y optimizó las prácticas de gestión de residuos en sus procesos de producción y distribución, reforzando el compromiso de la empresa con la fabricación de productos químicos sostenibles y responsables.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS – MODERATE

4.1.1.1 Capital Requirement – Moderate

4.1.1.2 Product Knowledge – Moderate to High

4.1.1.3 Technical Knowledge – High

4.1.1.4 Customer Relationship – High

4.1.1.5 Access to Application and Technology – Moderate

4.1.2 THREAT OF SUBSTITUTES – MODERATE

4.1.2.1 Cost – High

4.1.2.2 Performance – Moderate

4.1.2.3 Availability – High

4.1.2.4 Technical Knowledge – Low to Moderate

4.1.2.5 Durability – Low

4.1.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.1.3.1 Number of Buyers Relative to Suppliers – High

4.1.3.2 Product Differentiation – Moderate

4.1.3.3 Threat of Forward Integration – Low

4.1.3.4 Buyer Volume – High

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.4.1 Supplier Concentration – Moderate to High

4.1.4.2 Buyer Switching Cost to Other Suppliers – Moderate

4.1.4.3 Threat of Backward Integration – Low to Moderate

4.1.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY – HIGH

4.1.5.1 Industry Concentration – Moderate

4.1.5.2 Industry Growth Rate – High

4.1.5.3 Product Differentiation – Moderate

4.1.6 STRATEGIC SUMMARY

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 GROUP 1: LARGE COMMERCIAL & CORPORATE FARMING OPERATIONS

4.3.2 GROUP 2: PROGRESSIVE MEDIUM-TO-LARGE FARMERS AND AGRIBUSINESS CLIENTS

4.3.3 GROUP 3: COST-CONSCIOUS COMMERCIAL FARMERS

4.3.4 GROUP 4: SMALLHOLDER AND TRADITIONAL FARMERS

4.3.5 GROUP 5: INPUT-DEPENDENT AND SUBSIDY-ORIENTED BUYERS

4.3.6 GROUP 6: SPECIALIZED, HIGH-VALUE CROP GROWERS AND INNOVATORS

4.3.7 STRATEGIC INSIGHT

4.4 COMPANY PRODUCTION CAPACITY ANALYSIS

4.5 PRICING ANALYSIS

4.5.1 PRICES OF NITROGEN-FIXING BACTERIA

4.5.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.2.1 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 VALUE CHAIN ANALYSIS – MIDDLE EAST AND AFRICA SOIL HEALTH MARKET

4.7.1 RAW MATERIAL SOURCING & INPUT GENERATION

4.7.2 PROCESSING & FORMULATION

4.7.3 QUALITY CONTROL, CERTIFICATION & REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION & SUPPLY CHAIN LOGISTICS

4.7.5 APPLICATION, TESTING & MONITORING (END USE)

4.7.6 FEEDBACK LOOP & VALUE REINFORCEMENT

4.7.7 VALUE CHAIN INSIGHT

4.8 SUPPLY CHAIN ANALYSIS – MIDDLE EAST AND AFRICA SOIL HEALTH MARKET

4.8.1 CORE SUPPLY-CHAIN STAGES (FLOW + KEY ACTORS)

4.8.1.1 Raw-material sourcing

4.8.1.2 Processing & formulation

4.8.1.3 Quality control & compliance

4.8.1.4 Distribution & logistics

4.8.1.5 Retail & advisory

4.8.1.6 End use & monitoring

4.8.2 KEY CONSTRAINTS & BOTTLENECKS

4.8.2.1 Logistics & last-mile delivery

4.8.2.2 Cold-chain & shelf-life for biologicals

4.8.2.3 Raw-material seasonality & feedstock quality —

4.8.2.4 Regulatory fragmentation

4.8.2.5 Concentration & geopolitical exposure in mineral supply

4.8.3 OPERATIONAL & COMMERCIAL RISKS

4.8.4 ENABLERS

4.8.4.1 Public programmes & procurement

4.8.4.2 Digital platforms & logistics aggregation

4.8.4.3 Circular-economy feedstock integration

4.8.4.4 Harmonized standards & MRV

4.8.5 STRATEGIC OPPORTUNITIES

4.8.6 PRACTICAL RECOMMENDATIONS (FOR SUPPLIERS, INVESTORS, POLICY MAKERS)

4.9 RAW MATERIAL COVERAGE

4.9.1 ORGANIC AND BIOMASS-DERIVED RAW MATERIALS

4.9.1.1 Livestock Manure: Reactive Organic–Mineral Complexes

4.9.2 CROP RESIDUES AND GREEN BIOMASS

4.9.3 COMPOST FEEDSTOCKS AND STABILIZED ORGANIC MATTER

4.9.4 THERMOCHEMICAL CARBON MATERIALS

4.9.5 MINERAL AND GEOLOGICAL RAW MATERIALS

4.9.6 GYPSUM AND SULFUR MINERALS

4.9.7 PHOSPHATE ROCK AND SILICATE MINERALS

4.9.8 HUMIC SUBSTANCES AND CARBON EXTRACTS

4.9.8.1 Leonardite, Lignite, and Peat Resources

4.9.9 MICROBIAL AND BIOLOGICAL RAW MATERIALS

4.9.9.1 Microbial Biomass and Fermentation Inputs

4.9.10 CARRIER AND STABILIZATION MATERIALS

4.9.11 MARINE AND AQUATIC BIOMASS RESOURCES

4.9.11.1 Seaweed and Algal Feedstocks

4.9.12 RAW MATERIALS FOR SOIL TESTING AND DIGITAL MONITORING

4.9.12.1 Chemical and Biological Analytical Inputs

4.9.13 ELECTRONIC AND SENSOR MATERIALS

4.9.14 STRATEGIC IMPLICATIONS AND CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 TECHNOLOGICAL ADVANCEMENTS IN RAW MATERIAL SOURCING AND CHARACTERIZATION

4.10.2 MANUFACTURING-CENTRIC TECHNOLOGICAL ADVANCEMENTS

4.10.3 MATERIAL ENGINEERING IN ORGANIC–MINERAL AND CARBON-BASED INPUTS

4.10.4 EXTRACTION AND REFINEMENT OF HUMIC SUBSTANCES

4.10.5 QUALITY CONTROL, AUTOMATION, AND DIGITAL MANUFACTURING INTEGRATION

4.10.6 PACKAGING, STABILITY, AND LOGISTICS TECHNOLOGIES

4.10.7 SMART LOGISTICS AND TRACEABILITY SYSTEMS

4.10.8 CUSTOMER DELIVERY, PRECISION APPLICATION, AND FEEDBACK LOOPS

4.10.9 DATA-ENABLED ADVISORY AND CONTINUOUS IMPROVEMENT

4.10.10 STRATEGIC IMPLICATIONS AND CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 RAW MATERIAL GOVERNANCE AS THE FIRST FILTER OF VENDOR CREDIBILITY

4.11.2 MANUFACTURING DEPTH AND PROCESS ENGINEERING CAPABILITY

4.11.3 SCIENTIFIC VALIDATION AS A MEASURE OF TECHNICAL INTEGRITY

4.11.4 REGULATORY READINESS AND STEWARDSHIP DISCIPLINE

4.11.5 SUPPLY CHAIN RESILIENCE AND SCALABILITY

4.11.6 DIGITAL CAPABILITY, DATA INTEGRITY, AND VALUE EXPANSION

4.11.7 FINANCIAL STRENGTH, UNIT ECONOMICS, AND CAPITAL EFFICIENCY

4.11.8 STRATEGIC ALIGNMENT AND LONG-TERM PARTNERSHIP VALUE

4.11.9 CONCLUSION: VENDOR SELECTION AS A LONG-TERM VALUE SAFEGUARD

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.1.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.1.2 VENDOR SELECTION CRITERIA DYNAMICS

5.1.3 IMPACT ON SUPPLY CHAIN

5.1.3.1 RAW MATERIAL PROCUREMENT

5.1.3.2 MANUFACTURING AND PRODUCTION

5.1.3.3 LOGISTICS AND DISTRIBUTION

5.1.3.4 PRICE PITCHING AND MARKET POSITIONING

5.1.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.1.4.1 SUPPLY CHAIN OPTIMIZATION

5.1.4.2 JOINT VENTURE ESTABLISHMENTS

5.1.5 MPACT ON PRICES

5.1.6 REGULATORY INCLINATION

5.1.7 GEOPOLITICAL SITUATION

5.1.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.1.8.1 FREE TRADE AGREEMENTS

5.1.9 ALLIANCES ESTABLISHMENTS

5.1.9.1 STATUS ACCREDITATION (INCLUDING MFTN)

5.1.9.2 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.1.9.3 SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 REGULATORY FRAMEWORK COVERAGE – MACRO & MICRO ANALYSIS

6.1.1 PRODUCT CODES – CLASSIFICATION LOGIC & COMPLIANCE CONSEQUENCES

6.1.2 CERTIFIED STANDARDS – MARKET ACCESS & QUALITY CONTROL

6.1.3 SAFETY STANDARDS – OPERATIONAL RISK MANAGEMENT

6.1.3.1 MATERIAL HANDLING & STORAGE – DETAILED ANALYSIS

6.1.3.2 TRANSPORT & PRECAUTIONS – REGULATORY DEPTH

6.1.3.3 HAZARD IDENTIFICATION – RISK DISCLOSURE & LIABILITY

6.1.4 REGULATORY ENFORCEMENT & MONITORING

6.1.5 REGULATORY IMPACT ON COST STRUCTURE

6.1.6 REGULATORY TRENDS & FUTURE OUTLOOK

6.1.7 STRATEGIC IMPLICATIONS FOR MARKET PARTICIPANTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING ADOPTION OF REGENERATIVE AGRICULTURE AND SUSTAINABLE FARMING PRACTICES

7.1.2 INCREASING DEPLOYMENT OF PRECISION SOIL MONITORING AND DIGITAL AGRICULTURE TECHNOLOGIES

7.1.3 GOVERNMENT POLICIES AND CONSUMER DEMAND SUPPORTING SUSTAINABLE FOOD SYSTEMS

7.2 RESTRAINTS

7.2.1 HIGH COST AND LIMITED ACCESS TO COMPREHENSIVE SOIL TESTING AND MONITORING INFRASTRUCTURE

7.2.2 LIMITED FARMER AWARENESS AND TECHNICAL CAPACITY TO INTERPRET SOIL HEALTH DATA

7.3 OPPORTUNITIES

7.3.1 EMERGENCE OF SOIL CARBON AND CLIMATE FINANCE PROGRAMS CREATING NEW REVENUE STREAMS

7.3.2 GROWING NEED FOR MONITORING, REPORTING, AND VERIFICATION (MRV) SYSTEMS FOR SOIL HEALTH

7.3.3 EXPANSION OF BIO-BASED AND NATURE-BASED SOIL AMENDMENTS

7.4 CHALLENGES

7.4.1 LACK OF STANDARDIZATION AND REGULATORY CONSENSUS IN SOIL HEALTH AND SOIL CARBON MEASUREMENT

7.4.2 SCIENTIFIC VARIABILITY AND INCONSISTENT FIELD PERFORMANCE OF BIOLOGICAL SOIL SOLUTIONS

8 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOIL ENHANCEMENT PRODUCTS

8.3 TESTING & MONITORING PRODUCTS

8.4 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 SOIL AMENDMENTS

8.4.2 SOIL FERTILITY ENHANCERS

8.4.3 BIOLOGICALS / MICROBIAL SOLUTIONS

8.4.4 SOIL CONDITIONERS

8.4.5 PEAT

8.4.6 OTHERS

8.5 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

8.6 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 ORGANIC AMENDMENTS

8.6.2 INORGANIC AMENDMENTS

8.7 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 MANURE

8.7.2 COMPOST

8.7.3 GREEN MANURE

8.7.4 BIOCHAR

8.7.5 OTHERS

8.8 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 LIME

8.8.2 GYPSUM

8.8.3 MINERAL ADDITIVES

8.8.4 OTHERS

8.9 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 BIOFERTILIZERS

8.9.2 ORGANIC-MINERAL FERTILIZERS

8.1 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 NITROGEN-FIXING BACTERIA

8.10.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

8.10.3 POTASH-MOBILIZING MICROORGANISMS

8.11 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 NPK-ENRICHED ORGANIC FERTILIZERS

8.11.2 COMPOST-BASED MINERAL FORTIFIED PRODUCTS

8.11.3 HUMIC ACID AND NPK BLENDS

8.12 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 COMPOST + NPK BLENDS

8.12.2 BIO-ORGANIC NPK GRANULES / PELLETS

8.12.3 LIQUID ORGANIC + NPK FORMULATIONS

8.12.4 SLOW-RELEASE / CONTROLLED RELEASE ORGANIC-MINERAL NPKS

8.12.5 SPECIALTY / CROP-SPECIFIC ENRICHED ORGANIC NPKS

8.13 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 BIO-COMPOST + MINERAL BLENDS

8.13.2 GRANULATED COMPOST-BASED FERTILIZERS

8.13.3 VERMICOMPOST FORTIFIED WITH MINERALS

8.13.4 CO-COMPOSTED MINERAL + WASTE BLENDS

8.13.5 LIQUID COMPOST EXTRACTS FORTIFIED WITH NUTRIENTS

8.14 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 HUMIC + NPK SOLID BLENDS

8.14.2 LIQUID HUMIC + NPK FORMULATIONS

8.14.3 POTASSIUM HUMATE ENRICHED BLENDS

8.14.4 HIGH HUMIC FRACTION BLENDS

8.14.5 HUMIC + FULVIC + MINERAL BLENDS

8.15 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 TRICHODERMA

8.15.2 BACILLUS SPECIES

8.15.3 MYCORRHIZAL FUNGI

8.15.4 RHIZOBIA

8.15.5 OTHERS

8.16 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 HUMIC ACID

8.16.2 SEAWEED EXTRACTS

8.16.3 FULVIC ACID

8.16.4 POTASSIUM HUMATE ENRICHED BLENDS

8.16.5 HUMIC + FULVIC + MINERAL BLENDS

8.16.6 HIGH HUMIC FRACTION BLENDS

8.16.7 LIQUID HUMIC + NPK FORMULATIONS

8.17 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

8.19 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.19.1 SOIL TESTING KITS

8.19.2 LABORATORY ANALYTICAL SOLUTIONS (BIOLOGICAL ANALYSIS)

8.19.3 DIGITAL AND REMOTE MONITORING

8.2 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.21 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 PH KITS

8.21.2 NUTRIENT TEST KITS

8.22 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 IOT SENSORS

8.22.2 REMOTE SENSING & DRONES

8.22.3 GIS & MAPPING TOOLS

8.23 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

9 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE

9.1 OVERVIEW

9.2 ALLUVIAL SOILS

9.3 RED SOILS

9.4 LOAMS

9.5 BLACK SOILS

9.6 ARID SOILS

9.7 SANDY SOILS

9.8 SILT SOILS

9.9 CLAY SOILS

9.1 YELLOW SOILS

9.11 LATERITE SOILS

9.12 SALINE/ALKALINE SOILS

9.13 PEAT SOILS

9.14 CHALKY SOILS

9.15 OTHERS

9.16 MIDDLE EAST AND AFRICA ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 MIDDLE EAST AND AFRICA RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.17.1 ASIA-PACIFIC

9.17.2 NORTH AMERICA

9.17.3 EUROPE

9.17.4 SOUTH AMERICA

9.17.5 MIDDLE EAST & AFRICA

9.18 MIDDLE EAST AND AFRICA LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.18.1 ASIA-PACIFIC

9.18.2 NORTH AMERICA

9.18.3 EUROPE

9.18.4 SOUTH AMERICA

9.18.5 MIDDLE EAST & AFRICA

9.19 MIDDLE EAST AND AFRICA BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.19.1 ASIA-PACIFIC

9.19.2 NORTH AMERICA

9.19.3 EUROPE

9.19.4 SOUTH AMERICA

9.19.5 MIDDLE EAST & AFRICA

9.2 MIDDLE EAST AND AFRICA ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.20.1 ASIA-PACIFIC

9.20.2 NORTH AMERICA

9.20.3 EUROPE

9.20.4 SOUTH AMERICA

9.20.5 MIDDLE EAST & AFRICA

9.21 MIDDLE EAST AND AFRICA SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.21.1 ASIA-PACIFIC

9.21.2 NORTH AMERICA

9.21.3 EUROPE

9.21.4 SOUTH AMERICA

9.21.5 MIDDLE EAST & AFRICA

9.22 MIDDLE EAST AND AFRICA SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.22.1 ASIA-PACIFIC

9.22.2 NORTH AMERICA

9.22.3 EUROPE

9.22.4 SOUTH AMERICA

9.22.5 MIDDLE EAST & AFRICA

9.23 MIDDLE EAST AND AFRICA CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.23.1 ASIA-PACIFIC

9.23.2 NORTH AMERICA

9.23.3 EUROPE

9.23.4 SOUTH AMERICA

9.23.5 MIDDLE EAST & AFRICA

9.24 MIDDLE EAST AND AFRICA YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.24.1 ASIA-PACIFIC

9.24.2 NORTH AMERICA

9.24.3 EUROPE

9.24.4 SOUTH AMERICA

9.24.5 MIDDLE EAST & AFRICA

9.25 MIDDLE EAST AND AFRICA LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.25.1 ASIA-PACIFIC

9.25.2 NORTH AMERICA

9.25.3 EUROPE

9.25.4 SOUTH AMERICA

9.25.5 MIDDLE EAST & AFRICA

9.26 MIDDLE EAST AND AFRICA SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.26.1 ASIA-PACIFIC

9.26.2 NORTH AMERICA

9.26.3 EUROPE

9.26.4 SOUTH AMERICA

9.26.5 MIDDLE EAST & AFRICA

9.27 MIDDLE EAST AND AFRICA PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.27.1 ASIA-PACIFIC

9.27.2 NORTH AMERICA

9.27.3 EUROPE

9.27.4 SOUTH AMERICA

9.27.5 MIDDLE EAST & AFRICA

9.28 MIDDLE EAST AND AFRICA CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.28.1 ASIA-PACIFIC

9.28.2 NORTH AMERICA

9.28.3 EUROPE

9.28.4 SOUTH AMERICA

9.28.5 MIDDLE EAST & AFRICA

9.29 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.29.1 ASIA-PACIFIC

9.29.2 NORTH AMERICA

9.29.3 EUROPE

9.29.4 SOUTH AMERICA

9.29.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CONVENTIONAL SOIL MANAGEMENT

10.3 INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM)

10.4 PRECISION SOIL HEALTH MANAGEMENT

10.5 REGENERATIVE AGRICULTURE PRACTICES

10.6 OTHERS

10.7 MIDDLE EAST AND AFRICA CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 MIDDLE EAST AND AFRICA INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.9.1 REMOTE SENSING & DRONES

10.9.2 VARIABLE RATE TECHNOLOGY (VRT)

10.9.3 GPS & GIS MAPPING

10.1 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.11.1 GPS & GIS MAPPING

10.11.2 VARIABLE RATE TECHNOLOGY (VRT)

10.11.3 REMOTE SENSING & DRONES

10.12 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 SOUTH AMERICA

10.13.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CROP SOIL

11.3 NON-CROP SOIL

11.4 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.4.1 CEREALS & GRAINS

11.4.2 OILSEEDS & PULSES

11.4.3 FRUITS & VEGETABLES

11.4.4 COMMERCIAL CROPS

11.4.5 PLANTATION CROPS

11.4.6 OTHERS

11.5 MIDDLE EAST AND AFRICA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 CORN

11.5.2 WHEAT

11.5.3 RICE

11.5.4 BARLEY

11.5.5 OATS

11.5.6 OTHERS

11.6 MIDDLE EAST AND AFRICA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SOYBEAN

11.6.2 RAPESEED/CANOLA

11.6.3 SUNFLOWER

11.6.4 CHICKPEAS

11.6.5 GROUNDNUT

11.6.6 LENTILS

11.6.7 OTHERS

11.7 MIDDLE EAST AND AFRICA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 FRUIT CROPS

11.7.2 ROOT CROPS

11.7.3 LEAFY GREENS

11.7.4 NIGHTSHADES

11.7.5 CUCURBITS

11.7.6 OTHERS

11.8 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 SUGARCANE

11.8.2 COTTON

11.8.3 COFFEE

11.8.4 COCOA

11.8.5 TEA

11.8.6 TOBACCO

11.8.7 OTHERS

11.9 MIDDLE EAST AND AFRICA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 PALM OIL

11.9.2 RUBBER

11.9.3 COCONUT

11.9.4 OTHERS

11.1 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 TURF & LANDSCAPING

11.11.2 FORESTRY

11.11.3 SOIL RECLAMATION & RESTORATION

11.11.4 OTHERS

11.12 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY END-USER

12.1 OVERVIEW

12.2 FARMERS & GROWERS

12.3 AGRIBUSINESS COMPANIES

12.4 LANDSCAPING & FORESTRY COMPANIES

12.5 GOVERNMENT & REGULATORY BODIES

12.6 RESEARCH INSTITUTES

12.7 UNIVERSITIES

12.8 OTHERS

12.9 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.9.1 SOIL AMENDMENTS

12.9.2 SOIL FERTILITY ENHANCERS

12.9.3 SOIL CONDITIONERS

12.9.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.9.5 TESTING & MONITORING PRODUCTS

12.9.6 PEAT

12.9.7 OTHERS

12.1 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.11.1 SOIL AMENDMENTS

12.11.2 SOIL FERTILITY ENHANCERS

12.11.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.11.4 SOIL CONDITIONERS

12.11.5 TESTING & MONITORING PRODUCTS

12.11.6 PEAT

12.11.7 OTHERS

12.12 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.13.1 SOIL AMENDMENTS

12.13.2 SOIL CONDITIONERS

12.13.3 PEAT

12.13.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.13.5 SOIL FERTILITY ENHANCERS

12.13.6 TESTING & MONITORING PRODUCTS

12.13.7 OTHERS

12.14 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.15.1 SOIL AMENDMENTS

12.15.2 TESTING & MONITORING PRODUCTS

12.15.3 SOIL CONDITIONERS

12.15.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.15.5 SOIL FERTILITY ENHANCERS

12.15.6 PEAT

12.15.7 OTHERS

12.16 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 SOUTH AMERICA

12.16.5 MIDDLE EAST & AFRICA

12.17 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.17.1 TESTING & MONITORING PRODUCTS

12.17.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.17.3 SOIL AMENDMENTS

12.17.4 SOIL FERTILITY ENHANCERS

12.17.5 SOIL CONDITIONERS

12.17.6 PEAT

12.17.7 OTHERS

12.18 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 SOUTH AMERICA

12.18.5 MIDDLE EAST & AFRICA

12.19 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.19.1 TESTING & MONITORING PRODUCTS

12.19.2 SOIL AMENDMENTS

12.19.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.19.4 SOIL FERTILITY ENHANCERS

12.19.5 SOIL CONDITIONERS

12.19.6 PEAT

12.19.7 OTHERS

12.2 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 SOUTH AMERICA

12.20.5 MIDDLE EAST & AFRICA

12.21 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.21.1 TESTING & MONITORING PRODUCTS

12.21.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.21.3 SOIL AMENDMENTS

12.21.4 SOIL CONDITIONERS

12.21.5 SOIL FERTILITY ENHANCERS

12.21.6 PEAT

12.21.7 OTHERS

12.22 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 SOUTH AMERICA

12.22.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 AFTERMARKET

13.4 MIDDLE EAST AND AFRICA DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 MIDDLE EAST AND AFRICA AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 UNITED ARAB EMIRATES

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 QATAR

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 MANUFACTURER COMPANY PROFILE

17.1 BASF

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BAYER AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CORTEVA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 SYNGENTA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 NUTRIEN AG SOLUTIONS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ADM

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 AGROCARES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CAMPBELL SCIENTIFIC, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 COROMANDEL INTERNATIONAL LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 CROPX INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EARTHOPTICS.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 EVONIK

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FMC CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 INDIGO AG, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVEOPMENT

17.15 HUMA GRO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HUMINTECH

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 ICL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 METER GROUP.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MIRATERRA TECHNOLOGIES CORPORATION

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 MOSAIC INDIA

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PLANTBIOTIX

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SENTEK TECHNOLOGIES.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 SOIL SCOUT.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SOILWIZ LT

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 STEVENS WATER MONITORING SYSTEMS INC.

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SUNPALM AUSTRALIA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 TECSOIL, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 THE SCOTTS COMPANY LLC

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 UPL

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENT

17.3 UTKARSH AGROCHEM PVT LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 DISTRIBUTOR COMPANY PROFILE

18.1 CALIFORNIA AG SOLUTIONS

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 ENLIGHTENED SOIL CORP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 GETDISTRIBUTORS.COM

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 ORGANIC DISTRIBUTORS, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 SEACOLE

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 BRAND OUTLOOK BY PRODUCT CATEGORY

TABLE 2 CONSUMER PREFERENCES BY DECISION PARAMETER

TABLE 3 ESTIMATED OUTPUT

TABLE 4 EFFECTIVE TARIFF BURDEN (NOT JUST NOMINAL)

TABLE 5 PRODUCT-LEVEL IMPORT DEPENDENCY

TABLE 6 WEIGHTED DECISION MATRIX (INDICATIVE)

TABLE 7 MANUFACTURING ECONOMICS

TABLE 8 PRICE SEGMENTATION

TABLE 9 COST STACK CONTRIBUTION

TABLE 10 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

TABLE 26 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 28 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 32 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR SOIL ENHANCEMENT PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 88 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 89 MIDDLE EAST AND AFRICA

TABLE 90 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 93 MIDDLE EAST AND AFRICA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 106 MIDDLE EAST AND AFRICA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)