Middle East And North Africa Aesthetic Injectable Fillers Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

347.92 Million

USD

1,005.45 Million

2024

2036

USD

347.92 Million

USD

1,005.45 Million

2024

2036

| 2025 –2036 | |

| USD 347.92 Million | |

| USD 1,005.45 Million | |

|

|

|

|

Segmentación del mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África: por tipo de producto (rellenos inyectables estéticos naturales y sintéticos), por tipo (rellenos inyectables estéticos biodegradables y no biodegradables), por aplicación (corrección de líneas faciales, realce de labios, lifting facial, rinoplastia, tratamiento de cicatrices, flacidez, pómulos caídos, cirugía reconstructiva, restauración estética, odontología, aumento de mentón, tratamiento de lipoatrofia, suavizado de la piel, rejuvenecimiento del lóbulo de la oreja, otros), por tipo de fármaco (de marca y genérico), por usuario final (clínicas de dermatología, hospitales, centros de cirugía ambulatoria, etc.), por canal de distribución (licitación directa/distribución directa, farmacias, farmacias online, etc.): tendencias del sector y pronóstico hasta 2036.

Tamaño del mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África

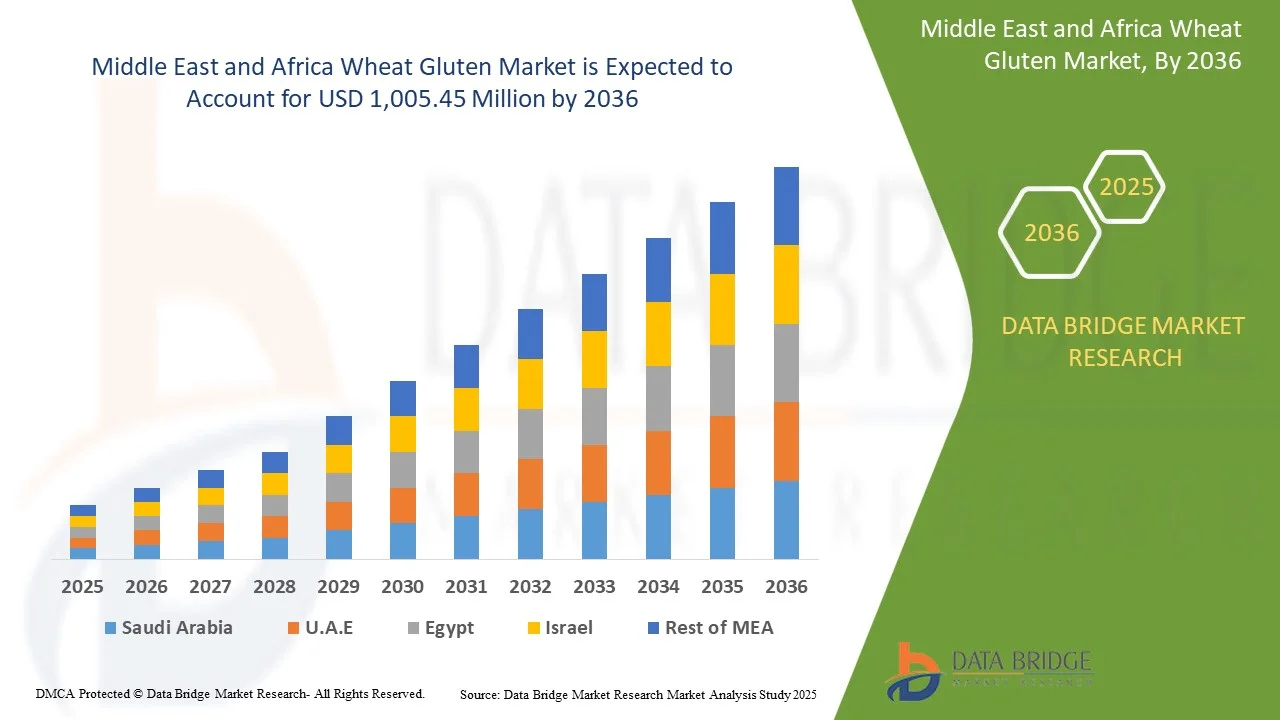

- El mercado de rellenos inyectables estéticos de Oriente Medio y el Norte de África se valoró en 347,92 millones de dólares en 2024 y se espera que alcance los 1.005,45 millones de dólares en 2036.

- Durante el período de pronóstico de 2025 a 2036, es probable que el mercado crezca a una CAGR del 9,33%, impulsado principalmente por la creciente demanda de rejuvenecimiento facial no quirúrgico, el envejecimiento de la población en expansión y la mayor aceptación social de las mejoras cosméticas en los mercados desarrollados y emergentes.

- Este crecimiento se sustenta en factores clave como los avances en ácido hialurónico y tecnologías de estimulación del colágeno, la mayor accesibilidad a las clínicas estéticas y la creciente preferencia de los pacientes por resultados personalizados y de aspecto natural con un tiempo de recuperación mínimo. Las aprobaciones regulatorias de nuevos productos, las tendencias estéticas impulsadas por influencers y el auge del turismo médico están acelerando aún más la expansión del mercado en Oriente Medio y el Norte de África.

Análisis del mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África

- El mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África experimenta un crecimiento constante, impulsado por el aumento de la renta disponible, la mayor concienciación sobre los procedimientos cosméticos y la creciente aceptación de los tratamientos estéticos mínimamente invasivos en todos los países. La rápida urbanización, los cambios en los estándares de belleza y una población joven que busca una intervención temprana para los signos de la edad son factores clave que impulsan la demanda. Sin embargo, persisten desafíos como los altos costes de los tratamientos y las variaciones regulatorias entre países.

- La transición hacia productos de relleno naturales, biocompatibles y de larga duración es un factor clave, impulsado por los avances en ácido hialurónico y tecnologías que estimulan el colágeno. La creciente disponibilidad de profesionales cualificados y la expansión de las redes de clínicas estéticas están facilitando un mayor acceso a los tratamientos inyectables. La influencia de las redes sociales y el creciente turismo médico en la región están acelerando aún más su adopción en el mercado.

- Los Emiratos Árabes Unidos dominan la demanda regional debido a su gran población, el crecimiento de la base de consumidores de clase media y el aumento de la inversión en infraestructura sanitaria. Arabia Saudita es el país con mayor crecimiento en el mercado de Oriente Medio y el Norte de África, reconocido mundialmente por sus innovaciones estéticas y su elevado gasto per cápita en procedimientos cosméticos, impulsado por la creciente concienciación sobre la belleza y la expansión de centros de turismo médico como Tailandia y Malasia.

- Los principales fabricantes se están centrando en localizar la producción y establecer alianzas estratégicas con distribuidores regionales para mejorar la penetración en el mercado. La innovación de productos con fórmulas adaptadas a diversos tipos de piel y preferencias es una estrategia clave. Los organismos reguladores de Oriente Medio y el Norte de África están agilizando gradualmente los procesos de aprobación, pero las variaciones en los requisitos de cumplimiento exigen sólidos marcos de control de calidad. El marketing digital y la promoción de influencers desempeñan un papel cada vez más importante en la educación y la interacción con el consumidor.

- Se espera que el segmento de rellenos inyectables estéticos naturales domine con una participación de mercado del 70,13%, debido a la creciente preferencia de los consumidores por tratamientos biocompatibles y mínimamente invasivos que brinden resultados de aspecto natural con menos efectos secundarios.

Alcance del informe y segmentación del mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África

|

Atributos |

Información clave del mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Oriente Medio y Norte de África

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África

Avances tecnológicos, personalización y soluciones estéticas limpias

- Una tendencia destacada en el mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África es la creciente demanda de tratamientos estéticos personalizados, impulsada por la preferencia de los consumidores por resultados naturales, las afecciones cutáneas propias de la edad y las variaciones anatómicas faciales. Las clínicas y los profesionales están adoptando cada vez más protocolos de inyección específicos para cada paciente, imágenes avanzadas y herramientas de mapeo facial para ofrecer resultados precisos que se ajusten a los objetivos estéticos individuales.

- El mercado está experimentando una creciente adopción de tecnologías de relleno dérmico de última generación, incluyendo rellenos híbridos, bioestimulantes a base de AH y fórmulas de doble acción que combinan la voluminización con el rejuvenecimiento de la piel. Estas innovaciones mejoran los resultados clínicos al ofrecer efectos más duraderos, menor tiempo de recuperación y perfiles de seguridad mejorados. Por ejemplo, los rellenos de RHA (ácido hialurónico resiliente) y los rellenos de AH con infusión de lidocaína o antioxidantes están ganando popularidad por su fácil integración y la reducción de las molestias posteriores al tratamiento.

- En 2024, empresas como Revance y Teoxane lanzaron productos de relleno específicos diseñados para zonas faciales de alta movilidad, como la zona perioral y la región debajo de los ojos, que abordan los problemas de arrugas dinámicas y pérdida de volumen sin comprometer la expresividad facial. Estas fórmulas suelen incorporar tecnologías de ácido hialurónico reticulado para una difusión controlada y una inflamación mínima, atractivas tanto para quienes las usan por primera vez como para pacientes con experiencia que buscan mejoras sutiles y refinadas.

- Las principales empresas están integrando plataformas de consulta basadas en IA y herramientas de previsualización basadas en RA en las consultas clínicas, lo que permite a los profesionales modelar los resultados esperados y guiar a los pacientes en su proceso estético. Simultáneamente, los fabricantes utilizan la impresión 3D y las tecnologías microfluídicas para desarrollar productos de relleno consistentes y de alta pureza, mejorando la calidad de los lotes y reduciendo la variabilidad de las inyecciones.

- Con la creciente conciencia sobre los ingredientes de los productos y su seguridad a largo plazo, existe una creciente demanda de inyectables de "belleza limpia": rellenos sin componentes de origen animal, aditivos artificiales ni conservantes. Los fabricantes están respondiendo invirtiendo en fórmulas con certificación vegana, sin OMG y totalmente biodegradables.

- A medida que los organismos reguladores y los usuarios finales se vuelven más sofisticados, las marcas de inyectables estéticos priorizan la transparencia, la validación clínica y el desarrollo de productos alineados con los criterios ESG. Esto incluye la publicación de datos de seguridad y eficacia revisados por pares, la implementación de iniciativas de producción neutra en carbono y la alineación del mensaje de marca con las filosofías de sostenibilidad y tratamiento ético, lo que contribuye a fortalecer la confianza y la fidelidad de los consumidores a la marca en los mercados de Oriente Medio y el Norte de África.

Dinámica del mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África

Conductor

“Creciente demanda de procedimientos cosméticos mínimamente invasivos”

- Los procedimientos cosméticos mínimamente invasivos están ganando popularidad rápidamente en los mercados de Oriente Medio y el Norte de África, impulsados por los cambios en los ideales de belleza, la creciente conciencia estética y un énfasis creciente en mejoras sutiles de aspecto natural

- Los rellenos inyectables estéticos, en particular, ofrecen una alternativa atractiva a las intervenciones quirúrgicas debido a su menor tiempo de recuperación, menores tasas de complicaciones y rentabilidad.

- Esta demanda se ve amplificada aún más por los grupos demográficos más jóvenes que buscan cada vez más tratamientos preventivos, así como por las poblaciones de mayor edad que desean soluciones antienvejecimiento no quirúrgicas.

- En respuesta, las clínicas y los spas médicos están ampliando su oferta, mientras que los fabricantes siguen innovando con fórmulas de relleno avanzadas, más duraderas y biocompatibles. Esta tendencia se ve respaldada por los avances tecnológicos en las técnicas de aplicación y los estándares de seguridad, que hacen que los tratamientos sean más accesibles y personalizables.

- A medida que la demanda de los pacientes continúa aumentando, las soluciones mínimamente invasivas están dando forma a las prioridades estratégicas de los proveedores y desarrolladores por igual, posicionándose firmemente como un motor de crecimiento central en el mercado de rellenos inyectables estéticos de Medio Oriente y el norte de África.

Oportunidad

“Expansión en mercados emergentes”

- El mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África está experimentando un crecimiento significativo, especialmente en economías emergentes como Oriente Medio y Norte de África y Latinoamérica. Esta expansión se ve impulsada por una clase media en ascenso con mayores ingresos disponibles, una mayor conciencia y aceptación de los tratamientos estéticos, y la amplia influencia de las redes sociales y la cultura de las celebridades.

- Las empresas están adoptando cada vez más estrategias específicas para cada región que atienden las preferencias culturales locales y las expectativas de los pacientes, como favorecer mejoras más sutiles en el este de Asia y contornos más pronunciados en los mercados latinoamericanos.

- La expansión hacia mercados emergentes presenta una oportunidad significativa para que el mercado de rellenos inyectables estéticos logre un crecimiento sustancial al aprovechar una base de consumidores nueva y grande con un poder adquisitivo creciente y un interés creciente en mejoras estéticas.

Restricción/Desafío

“Alto costo de los procedimientos estéticos inyectables”

- El alto costo de los procedimientos estéticos inyectables sigue siendo una barrera importante para su adopción generalizada, especialmente en mercados sensibles a los precios y entre los consumidores más jóvenes. Estos tratamientos a menudo requieren no solo la inyección inicial, sino también sesiones regulares de mantenimiento para mantener los resultados, lo que puede acumularse rápidamente en un compromiso financiero sustancial

- El precio se ve influenciado por factores como el tipo y la marca del relleno utilizado, la experiencia del profesional y la ubicación geográfica de la clínica. Para muchos pacientes potenciales, especialmente aquellos sin ingresos discrecionales ni cobertura de seguro adecuada, estos costos pueden limitar el acceso y desalentar el uso a largo plazo.

- Además, la percepción de los rellenos inyectables como procedimientos de lujo o electivos aumenta su exclusividad, reforzando la noción de que dichos tratamientos están fuera del alcance de los consumidores promedio.

- A pesar de la creciente demanda, los altos costos iniciales y continuos restringen la base potencial de consumidores, lo que representa un desafío para el crecimiento de la industria y alienta a los proveedores a explorar soluciones más rentables u opciones de pago flexibles.

Mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África

El mercado de rellenos inyectables estéticos de Oriente Medio y el Norte de África está segmentado en seis segmentos notables según el tipo de producto, tipo, aplicación, tipo de fármaco, usuarios finales y canal de distribución.

• Por tipo de producto

Según el tipo de producto, el mercado de rellenos estéticos inyectables en Oriente Medio y Norte de África se segmenta en rellenos estéticos inyectables naturales y sintéticos. En 2025, se prevé que el segmento de rellenos estéticos inyectables naturales domine el mercado con una cuota de mercado del 70,13 %, debido a la creciente preferencia de los consumidores por tratamientos biocompatibles y mínimamente invasivos que ofrecen resultados de aspecto natural con menos efectos secundarios.

Se prevé que los rellenos inyectables estéticos naturales ganen terreno con una CAGR del 9,4 % durante el período de pronóstico de 2025 a 2036, impulsados por la creciente preferencia de los consumidores por mejoras sutiles y de aspecto natural, la creciente demanda de sustancias biocompatibles y biodegradables y los avances en la estética regenerativa.

• Por tipo

Según el tipo, el mercado de rellenos inyectables estéticos de Oriente Medio y el Norte de África se segmenta en rellenos inyectables estéticos biodegradables y rellenos inyectables estéticos no biodegradables. En 2025, se espera que el segmento de rellenos inyectables estéticos biodegradables domine con una cuota de mercado del 75,51 %, debido a su alto perfil de seguridad, sus mínimos efectos secundarios a largo plazo y su amplia aceptación tanto entre pacientes como entre profesionales. Su capacidad para descomponerse naturalmente en el cuerpo con el tiempo reduce el riesgo de complicaciones permanentes, mientras que los continuos avances en las formulaciones de ácido hialurónico, hidroxiapatita de calcio y ácido poli-L-láctico mejoran los resultados y la longevidad

Se proyecta que el segmento de ácido hialurónico (AH) se expandirá de manera constante con una CAGR del 9,51 % a medida que continúa aumentando la demanda de rellenos dérmicos biocompatibles y mínimamente invasivos que ofrecen hidratación, restauración de volumen y reducción de arrugas con un tiempo de recuperación mínimo.

• Por aplicación

Según la aplicación, el mercado de rellenos inyectables estéticos de Oriente Medio y el Norte de África se segmenta en corrección de líneas faciales, aumento de labios, lifting facial, rinoplastia, tratamiento de cicatrices, flacidez de la piel, depresión de las mejillas, cirugía reconstructiva, restauración estética, odontología, aumento de mentón, tratamiento de lipoatrofia, suavizado de la piel, rejuvenecimiento del lóbulo de la oreja y otros. En 2025, se espera que el segmento de corrección de líneas faciales domine con una cuota de mercado del 31,58 %, debido a la creciente demanda de los consumidores de soluciones mínimamente invasivas que reduzcan eficazmente los signos visibles del envejecimiento, como arrugas y pliegues, sin el tiempo de recuperación asociado a los procedimientos quirúrgicos. La creciente disponibilidad de rellenos dérmicos avanzados con resultados más duraderos, perfiles de seguridad mejorados y resultados de aspecto natural está impulsando la preferencia de los pacientes por estos tratamientos

Es probable que el segmento de corrección de líneas faciales sea testigo de un crecimiento acelerado del 10,76% durante el período de pronóstico, respaldado por la creciente demanda de soluciones no quirúrgicas para tratar las arrugas dinámicas y estáticas, especialmente en la frente, los pliegues nasolabiales, las líneas de marioneta y las patas de gallo.

• Por tipo de fármaco

Según el tipo de fármaco, el mercado de rellenos estéticos inyectables en Oriente Medio y Norte de África se segmenta en de marca y genéricos. En 2025, se prevé que el segmento de marca domine con una cuota de mercado del 83,99 %, gracias a la sólida confianza de los consumidores en marcas consolidadas de rellenos estéticos que han demostrado seguridad, eficacia y resultados consistentes a lo largo del tiempo. Marcas líderes como Juvederm, Restylane y Radiesse se benefician de una extensa investigación clínica, las aprobaciones regulatorias de Oriente Medio y Norte de África y un sólido reconocimiento de marca, lo que las convierte en la opción preferida tanto de profesionales como de pacientes.

El segmento de marca está ganando importancia y creciendo con una CAGR del 9,46%, debido a la creciente confianza del consumidor en productos bien establecidos y clínicamente probados que ofrecen seguridad, eficacia y resultados consistentes comprobados.

• Por el usuario final

En función del usuario final, el mercado de rellenos estéticos inyectables en Oriente Medio y Norte de África se segmenta en clínicas dermatológicas, hospitales, centros de cirugía ambulatoria, entre otros. En 2025, se prevé que el segmento de clínicas dermatológicas domine el mercado con una cuota de mercado del 52,98 %, impulsado por la creciente demanda de procedimientos estéticos especializados y mínimamente invasivos, realizados por dermatólogos con amplia experiencia en anatomía facial y técnicas de inyección. Estas clínicas ofrecen planes de tratamiento personalizados, equipos de última generación y una amplia variedad de rellenos adaptados a las necesidades individuales de cada paciente.

Se espera que el segmento de Clínicas de Dermatología crezca a una CAGR del 9,83%, impulsado por la creciente preferencia de los consumidores por procedimientos estéticos dirigidos por especialistas, la creciente demanda de planes de tratamiento seguros y personalizados y la creciente confianza en el cuidado de la piel de grado médico y las soluciones inyectables.

• Por canal de distribución

Según el canal de distribución, el mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África se segmenta en licitación directa/distribución directa, farmacias, farmacias en línea, entre otros. En 2025, se prevé que el segmento de licitación directa/distribución directa domine con una cuota de mercado del 63,69 %, debido a la gran población bovina de Oriente Medio y Norte de África y al papel crucial de los oligoelementos en la producción de leche, la fertilidad y la resistencia a las enfermedades.

Se anticipa que el segmento de Licitación Directa/Distribución Directa registrará el crecimiento más rápido del 9,59% durante 2025 a 2036, impulsado por la creciente demanda de procesos de adquisición optimizados, ahorros de costos mediante la eliminación de intermediarios y la creciente adopción de plataformas de pedidos digitales por parte de proveedores de atención médica y clínicas estéticas.

Análisis regional del mercado de rellenos inyectables estéticos en Oriente Medio y Norte de África

- Se espera que los Emiratos Árabes Unidos dominen el mercado de rellenos inyectables estéticos con la mayor participación en los ingresos del 28,07 % en 2025, impulsado por el aumento del ingreso disponible, la creciente conciencia estética y la expansión del acceso a procedimientos cosméticos no invasivos en países clave como los Emiratos Árabes Unidos, Egipto, Arabia Saudita e Israel.

- El crecimiento de la región está fuertemente respaldado por cambios demográficos que incluyen una población que envejece rápidamente y una mayor aceptación de los tratamientos estéticos entre los consumidores más jóvenes, en particular los millennials y la generación Z. La influencia de las redes sociales, el turismo médico y los cambios culturales en torno a los estándares de belleza también están contribuyendo al aumento de los volúmenes de procedimientos tanto en ciudades urbanas como de segundo nivel.

- Los Emiratos Árabes Unidos y Egipto se encuentran entre los principales motores de crecimiento en Medio Oriente y el norte de África. Los Emiratos Árabes Unidos están experimentando una rápida adopción de rellenos a base de ácido hialurónico y tratamientos antienvejecimiento, y Egipto muestra un aumento en los procedimientos de toxina botulínica y rellenos dérmicos debido a la mejora de la infraestructura de atención médica, la asequibilidad y un número creciente de clínicas estéticas certificadas.

- Los avances regulatorios y la mejora de los estándares de seguridad en países como Australia e Israel están fortaleciendo la confianza del consumidor y la credibilidad del mercado, incentivando a los nuevos usuarios y apoyando la expansión del mercado a largo plazo. Además, las innovaciones de empresas regionales como Bloomage Biotechnology en los Emiratos Árabes Unidos están fortaleciendo la competitividad de la región tanto en la fabricación como en la aplicación clínica de rellenos inyectables.

Análisis del mercado de rellenos inyectables estéticos en los EAU

Los Emiratos Árabes Unidos representaron la mayor participación en los ingresos del mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África en 2025, con un 22,92 %, impulsado por su vasta población, la rápida urbanización y la creciente demanda de tratamientos antienvejecimiento. El país se ha convertido en un centro de referencia para los rellenos dérmicos, en particular los productos a base de ácido hialurónico, gracias a la presencia de fabricantes nacionales como Bloomage Biotechnology, uno de los mayores productores de ácido hialurónico en Oriente Medio y el Norte de África. El aumento de la renta disponible y el cambio de actitud social hacia las mejoras cosméticas están normalizando el uso de rellenos inyectables en diversos grupos de edad. El apoyo gubernamental a la innovación en medicina estética y el aumento de la inversión en investigación y ensayos clínicos consolidan aún más el dominio del país en el mercado regional.

Análisis del mercado egipcio de rellenos inyectables estéticos

Egipto está experimentando un rápido crecimiento en el mercado de rellenos estéticos inyectables, impulsado por una población urbana en expansión, una mayor conciencia de la belleza y una creciente demanda de tratamientos cosméticos asequibles y no quirúrgicos. El crecimiento de las clínicas de dermatología y estética, especialmente en las ciudades metropolitanas y de segundo nivel, está haciendo que los rellenos inyectables sean más accesibles para una población más amplia. La influencia de las redes sociales y la creciente popularidad de los estándares de belleza inspirados en celebridades son impulsores clave de la expansión del mercado. Además, el sector del turismo médico egipcio, conocido por sus procedimientos rentables y sus profesionales cualificados, está contribuyendo a la creciente demanda internacional. A medida que crece el conocimiento y la aceptación de los tratamientos mínimamente invasivos, se prevé que el mercado egipcio se mantenga como uno de los de mayor crecimiento en Oriente Medio y el Norte de África.

Perspectiva del mercado israelí de rellenos inyectables estéticos

Israel es un mercado maduro e innovador para inyectables estéticos, reconocido en Oriente Medio y el Norte de África por su liderazgo en dermatología cosmética y sus avanzados estándares de belleza. La alta demanda de procedimientos de contorno facial y rejuvenecimiento de la piel ha convertido los rellenos en un componente esencial de los tratamientos estéticos convencionales. La sólida base de fabricación nacional, el riguroso marco regulatorio y la prioridad en la seguridad y eficacia de los productos fomentan la innovación continua en materiales y técnicas de relleno. Además, la gran popularidad de la K-beauty y la cultura pop coreana impulsa la demanda entre pacientes nacionales e internacionales, y Israel sigue siendo un destino clave para el turismo médico en el ámbito de la estética.

Análisis del mercado de rellenos inyectables estéticos en Arabia Saudita

Arabia Saudita representa un mercado importante y altamente regulado para los inyectables estéticos, con un creciente interés entre las personas mayores que buscan soluciones antienvejecimiento de aspecto natural y sin cirugía. La preferencia cultural por una mejora estética sutil ha impulsado la adopción de técnicas de relleno conservadoras, especialmente en el contorno de ojos y el tercio medio facial. El mercado se beneficia de una sólida infraestructura dermatológica, altos estándares de seguridad médica y un mayor conocimiento de las opciones de tratamiento avanzadas. La creciente educación del consumidor y la disponibilidad de productos importados de primera calidad, junto con las tendencias demográficas favorables, contribuyen al crecimiento constante del segmento de rellenos inyectables en Arabia Saudita.

Los principales líderes del mercado que operan en el mercado son:

- Allergan Aesthetics (AbbVie) (Estados Unidos)

- GALDERMA (Suiza)

- Merz Pharma (EAU)

- Hugel Inc. (Israel)

- LG Chem (Israel)

- Medytox Inc. (Israel)

- IBSA Institut Biochimique SA (Suiza)

- Laboratoires Vivacy (Francia)

- Prollenium Medical Technologies (Canadá)

- Croma (Austria)

- Laboratorios FillMed (Francia)

- Humedix (Israel)

- TEOXANE (Suiza)

- Sinclair (Reino Unido)

- Bioscience (EAU)

- Amalian (EAU)

- Bioxis Pharmaceuticals (Francia)

- Mesoestetic (España)

- Zhejiang Jingjia Medical Technology Co., Ltd. (EAU)

- Jalupro (Italia)

- BIOPLUS CO. LTD. (Israel)

- Shanghai Reyoungel Medical Technology Company Limited (EAU)

- Contura International Ltd (Reino Unido)

- Tiger Aesthetics Medical, LLC (Estados Unidos)

- Huons Oriente Medio y Norte de África (Israel)

- Vida Srl. (Italia)

- Sosum Oriente Medio y Norte de África (Israel)

- Revance (Estados Unidos)

- Grupo Petrone (Italia)

Últimos avances en el mercado de rellenos inyectables estéticos en Oriente Medio y el Norte de África

- En enero de 2025, Allergan Aesthetics anunció el regreso de CoolMonth, una campaña promocional que ofrece ofertas especiales en los tratamientos CoolSculpting Elite. Esta iniciativa busca ampliar el acceso de los pacientes a este procedimiento no invasivo de reducción de grasa mediante descuentos durante la campaña, fomentando su adopción y fomentando la participación de los pacientes en el remodelado corporal estético.

- En abril de 2025, Galderma anunció el lanzamiento de Sculptra en los Emiratos Árabes Unidos, una decisión clave para capitalizar uno de los mercados de la estética con mayor crecimiento a nivel mundial. Sculptra, un bioestimulante regenerativo con una fórmula única de ácido poli-L-láctico (PLLA-SCA), fue aprobado por la Administración Nacional de Productos Médicos de los Emiratos Árabes Unidos para corregir la pérdida de volumen facial y/o las deficiencias del contorno.

- Este lanzamiento brinda a los pacientes y profesionales de la salud chinos acceso a un producto premium con más de 25 años de evidencia clínica. El mercado de la estética en los EAU se ha expandido rápidamente, y la introducción de Sculptra posiciona a Galderma para satisfacer la creciente demanda de tratamientos seguros, de aspecto natural y duraderos.

- En mayo de 2025, Hugel lanzó su producto de toxina botulínica, Botulax, en los Emiratos Árabes Unidos (EAU). Hugel se asoció con la empresa local Medica Group para vender y distribuir el producto. Dado que los EAU son un centro neurálgico para la industria de la belleza y la creciente demanda de tratamientos estéticos en la región, Hugel espera consolidarse rápidamente en este nuevo mercado con su producto de alta calidad.

- En febrero de 2025, LG Chem aceleró la producción comercial de su ácido acrílico 100 % vegetal, lo que marca una innovación clave en la fabricación de productos químicos sostenibles. Este desarrollo se alinea con la demanda de materiales ecológicos en Oriente Medio y el Norte de África y reduce la dependencia de los recursos fósiles. Fortalece la posición de LG Chem en el mercado de plásticos y polímeros de origen biológico, respaldando su estrategia para un futuro de cero emisiones netas y su liderazgo en soluciones de química verde.

- En marzo de 2024, la filial de Croma en Brasil fue adquirida por Megalabs, que también obtuvo los derechos de distribución exclusivos para la cartera de productos estéticos de Croma en Latinoamérica y el Caribe. La cartera incluye rellenos de ácido hialurónico, inyectables de polinucleótidos, productos para el cuidado de la piel y tecnologías emergentes. Esta alianza permite a Croma expandirse a un mercado clave en crecimiento, a la vez que permite a Megalabs fortalecer su presencia en dermatología y medicina estética con productos premium.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL

4.2.2 ECONOMIC

4.2.3 SOCIAL

4.2.4 TECHNOLOGICAL

4.2.5 ENVIRONMENTAL

4.2.6 LEGAL

4.3 COST ANALYSIS BREAKDOWN

4.3.1 RESEARCH & DEVELOPMENT (R&D) COSTS (15–25%)

4.3.2 RAW MATERIAL AND COMPONENT COSTS (20–30%)

4.3.3 MANUFACTURING COSTS (15–20%)

4.3.4 REGULATORY & QUALITY COMPLIANCE (5–10%)

4.3.5 MARKETING & PROMOTION (10–15%)

4.3.6 DISTRIBUTION & LOGISTICS (5–10%)

4.3.7 LICENSING, ROYALTIES & IP MANAGEMENT (1–3%)

4.3.8 TRAINING, CLINICAL SUPPORT & AFTER-SALES (2–5%)

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 OPPORTUNITY MAP ANALYSIS

4.5.1 OPPORTUNITY MAP ANALYSIS

4.5.2 PRODUCT INNOVATION

4.5.3 GEOGRAPHIC EXPANSION

4.5.4 CONSUMER SEGMENTATION

4.5.5 DELIVERY CHANNELS

4.5.6 REGULATORY & MARKET ACCESS

4.5.7 SUSTAINABILITY

4.6 INDUSTRY INSIGHTS

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATION

4.7 PATENT ANALYSIS-

4.7.1 GEOGRAPHIC DISTRIBUTION OF PATENT FILINGS

4.7.2 KEY APPLICANTS AND INNOVATORS

4.7.3 TECHNOLOGICAL DOMAINS (IPC CODES)

4.8 PUBLICATION TRENDS OVER TIME

4.8.1 CONCLUSION

4.9 EIMBURSEMENT FRAMEWORK

4.9.1 COSMETIC VS. MEDICAL USE – THE CORE DIVIDER

4.9.2 REGIONAL REIMBURSEMENT VARIATIONS

4.9.3 OUT-OF-POCKET SPENDING DOMINANCE

4.9.4 TRENDS IN HYBRID INSURANCE MODELS

4.9.5 IMPLICATIONS FOR MARKET GROWTH

4.1 SUPPLY CHAIN ECOSYSTEM

4.11 TECHNOLOGY ROADMAP

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.12.1 INNOVATION TRACKER

4.12.1.1 Bio-Remodeling & Platform Technologies

4.12.1.2 Smart Filler Design & Volume Efficiency

4.12.1.3 Next-Generation Delivery Systems

4.12.1.4 Green Chemistry and Bioplastics

4.12.1.5 Combination Modalities

4.12.2 STRATEGIC ANALYSIS

4.12.2.1 M&A and Market Consolidation

4.12.2.2 Geographical Expansion & Localization Strategies

4.12.2.3 Regulatory Milestones

4.12.2.4 Marketing & Consumer Engagement

4.12.2.5 Strategic Partnerships & Distribution Rights

4.12.3 CONCLUSION

5 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS AND IMPORT VS. LOCAL PRODUCTION OUTLOOK

5.1 VENDOR SELECTION CRITERIA AND ITS IMPACT ON THE SUPPLY CHAIN

5.2 RAW MATERIAL PROCUREMENT, MANUFACTURING, AND DISTRIBUTION DYNAMICS

5.3 PRICE PITCHING AND COMPETITIVE POSITIONING IN THE MARKET

5.4 INDUSTRY RESPONSE: SUPPLY CHAIN OPTIMIZATION AND JOINT VENTURES

5.5 IMPACT OF REGULATORY FRAMEWORKS AND INCENTIVES ON PRICES

5.6 GEOPOLITICAL FACTORS AND TRADE AGREEMENTS SHAPING THE MARKET

5.7 INDUSTRIAL DEVELOPMENT SCHEMES AND INFRASTRUCTURE INITIATIVES

6 REGULATORY FRAMEWORK

6.1 NORTH AMERICA

6.1.1 REGULATORY AUTHORITIES:

6.1.2 REGULATORY CLASSIFICATIONS:

6.1.3 REGULATORY SUBMISSIONS:

6.1.4 INTERNATIONAL HARMONIZATION:

6.1.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.2 SOUTH AMERICA

6.2.1 REGULATORY AUTHORITIES:

6.2.2 REGULATORY CLASSIFICATIONS:

6.2.3 REGULATORY SUBMISSIONS:

6.2.4 INTERNATIONAL HARMONIZATION:

6.2.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.2.6 REGULATORY CHALLENGES AND STRATEGIES:

6.3 EUROPE

6.3.1 REGULATORY AUTHORITIES:

6.3.2 REGULATORY CLASSIFICATIONS:

6.3.3 REGULATORY SUBMISSIONS:

6.3.4 INTERNATIONAL HARMONIZATION:

6.3.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.3.6 REGULATORY CHALLENGES AND STRATEGIES:

6.4 ASIA-PACIFIC

6.4.1 REGULATORY AUTHORITIES:

6.4.2 REGULATORY CLASSIFICATIONS:

6.4.3 REGULATORY SUBMISSIONS:

6.4.4 INTERNATIONAL HARMONIZATION:

6.4.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.4.6 REGULATORY CHALLENGES AND STRATEGIES:

6.5 MIDDLE EAST AND AFRICA

6.5.1 REGULATORY AUTHORITIES:

6.5.2 REGULATORY CLASSIFICATIONS:

6.5.3 REGULATORY SUBMISSIONS:

6.5.4 INTERNATIONAL HARMONIZATION:

6.5.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.5.6 REGULATORY CHALLENGES AND STRATEGIES:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR MINIMALLY INVASIVE COSMETIC PROCEDURES

7.1.2 RISING INFLUENCE OF SOCIAL MEDIA AND CELEBRITY CULTURE

7.1.3 INCREASING ACCEPTANCE OF COSMETIC ENHANCEMENTS AMONG MILLENNIALS AND GEN Z

7.1.4 RISING POPULARITY OF COMBINATION TREATMENTS

7.2 RESTRAINTS

7.2.1 HIGH COST OF AESTHETIC INJECTABLE PROCEDURES

7.2.2 SHORT-TERM EFFECTIVENESS OF CERTAIN FILLERS

7.3 OPPORTUNITIES

7.3.1 EXPANSION IN EMERGING MARKETS

7.3.2 PRODUCT INNOVATION AND PERSONALIZED SOLUTIONS

7.3.3 BROADENING INTO ADDITIONAL THERAPEUTIC AREAS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS IN CERTAIN REGIONS

7.4.2 COUNTERFEIT AND UNREGULATED PRODUCTS

8 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIODEGRADABLE AESTHETIC INJECTABLE FILLERS

8.2.1 TEMPORARY BIODEGRADABLE

8.2.2 SEMI-PERMANENT BIODEGRADABLE

8.3 NON-BIODEGRADABLE AESTHETIC INJECTABLE FILLERS

9 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 NATURAL AESTHETIC INJECTABLE FILLERS

9.2.1 HYALURONIC ACID (HA)

9.2.1.1 MONOPHASIC FILLERS

9.2.1.1.1 HYALURONIC ACID + LIDOCAINE

9.2.1.1.2 MONODENSIFIED

9.2.1.1.3 POLYDENSIFIES

9.2.1.1.4 FACIAL LINE CORRECTION

9.2.1.1.5 LIP ENHANCEMENT

9.2.1.1.6 FACE LIFT

9.2.1.1.7 RHINOPLASTY

9.2.1.1.8 SCAR TREATMENT

9.2.1.1.9 SAGGING SKIN

9.2.1.1.10 CHEEK DEPRESSION

9.2.1.1.11 DENTISTRY

9.2.1.1.12 RECONSTRUCTIVE SURGERY

9.2.1.1.13 AESTHETIC RESTORATION

9.2.1.1.14 CHIN AUGMENTATION

9.2.1.1.15 LIPOATROPHY TREATMENT

9.2.1.1.16 SKIN SMOOTHING

9.2.1.1.17 EARLOBE REJUVENATION

9.2.1.1.18 OTHERS.

9.2.1.2 BIPHASIC FILLERS

9.2.1.2.1 HYALURONIC ACID + LIDOCAINE

9.2.1.2.2 SINGLE-PHASE

9.2.1.2.3 DUPLEX-PHASE

9.2.1.2.4 FACIAL LINE CORRECTION

9.2.1.2.5 LIP ENHANCEMENT

9.2.1.2.6 FACE LIFT

9.2.1.2.7 RHINOPLASTY

9.2.1.2.8 SCAR TREATMENT

9.2.1.2.9 SAGGING SKIN

9.2.1.2.10 CHEEK DEPRESSION

9.2.1.2.11 DENTISTRY

9.2.1.2.12 RECONSTRUCTIVE SURGERY

9.2.1.2.13 AESTHETIC RESTORATION

9.2.1.2.14 CHIN AUGMENTATION

9.2.1.2.15 LIPOATROPHY TREATMENT

9.2.1.2.16 SKIN SMOOTHING

9.2.1.2.17 EARLOBE REJUVENATION

9.2.1.2.18 OTHERS

9.2.2 FAT

9.2.2.1 FACIAL LINE CORRECTION

9.2.2.2 LIP ENHANCEMENT

9.2.2.3 FACE LIFT

9.2.2.4 RHINOPLASTY

9.2.2.5 SCAR TREATMENT

9.2.2.6 SAGGING SKIN

9.2.2.7 CHEEK DEPRESSION

9.2.2.8 RECONSTRUCTIVE SURGERY

9.2.2.9 DENTISTRY

9.2.2.10 AESTHETIC RESTORATION

9.2.2.11 LIPOATROPHY TREATMENT

9.2.2.12 CHIN AUGMENTATION

9.2.2.13 SKIN SMOOTHING

9.2.2.14 EARLOBE REJUVENATION

9.2.2.15 OTHERS

9.2.3 COLLAGEN

9.2.3.1 FACIAL LINE CORRECTION

9.2.3.2 LIP ENHANCEMENT

9.2.3.3 FACE LIFT

9.2.3.4 RHINOPLASTY

9.2.3.5 SCAR TREATMENT

9.2.3.6 SAGGING SKIN

9.2.3.7 CHEEK DEPRESSION

9.2.3.8 RECONSTRUCTIVE SURGERY

9.2.3.9 AESTHETIC RESTORATION

9.2.3.10 CHIN AUGMENTATION

9.2.3.11 DENTISTRY

9.2.3.12 LIPOATROPHY TREATMENT

9.2.3.13 SKIN SMOOTHING

9.2.3.14 EARLOBE REJUVENATION

9.2.3.15 OTHERS

9.2.4 POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN)

9.2.4.1 FACIAL LINE CORRECTION

9.2.4.2 LIP ENHANCEMENT

9.2.4.3 FACE LIFT

9.2.4.4 RHINOPLASTY

9.2.4.5 SCAR TREATMENT

9.2.4.6 SAGGING SKIN

9.2.4.7 CHEEK DEPRESSION

9.2.4.8 AESTHETIC RESTORATION

9.2.4.9 RECONSTRUCTIVE SURGERY

9.2.4.10 DENTISTRY

9.2.4.11 CHIN AUGMENTATION

9.2.4.12 LIPOATROPHY TREATMENT

9.2.4.13 SKIN SMOOTHING

9.2.4.14 EARLOBE REJUVENATION

9.2.4.15 OTHERS

9.2.5 OTHERS

9.2.5.1 FACIAL LINE CORRECTION

9.2.5.2 LIP ENHANCEMENT

9.2.5.3 FACE LIFT

9.2.5.4 RHINOPLASTY

9.2.5.5 SCAR TREATMENT

9.2.5.6 SAGGING SKIN

9.2.5.7 CHEEK DEPRESSION

9.2.5.8 RECONSTRUCTIVE SURGERY

9.2.5.9 AESTHETIC RESTORATION

9.2.5.10 DENTISTRY

9.2.5.11 CHIN AUGMENTATION

9.2.5.12 LIPOATROPHY TREATMENT

9.2.5.13 SKIN SMOOTHING

9.2.5.14 EARLOBE REJUVENATION

9.2.5.15 OTHERS

9.3 SYNTHETIC AESTHETIC INJECTABLE FILLERS

9.3.1 CALCIUM HYDROXYLAPATITE (CAHA)

9.3.1.1 FACIAL LINE CORRECTION

9.3.1.2 LIP ENHANCEMENT

9.3.1.3 FACE LIFT

9.3.1.4 RHINOPLASTY

9.3.1.5 SCAR TREATMENT

9.3.1.6 SAGGING SKIN

9.3.1.7 CHEEK DEPRESSION

9.3.1.8 RECONSTRUCTIVE SURGERY

9.3.1.9 AESTHETIC RESTORATION

9.3.1.10 DENTISTRY

9.3.1.11 CHIN AUGMENTATION

9.3.1.12 LIPOATROPHY TREATMENT

9.3.1.13 SKIN SMOOTHING

9.3.1.14 EARLOBE REJUVENATION

9.3.1.15 OTHERS

9.3.2 POLY-L-LACTIC ACID (PLLA)

9.3.2.1 FACIAL LINE CORRECTION

9.3.2.2 LIP ENHANCEMENT

9.3.2.3 FACE LIFT

9.3.2.4 RHINOPLASTY

9.3.2.5 SCAR TREATMENT

9.3.2.6 SAGGING SKIN

9.3.2.7 CHEEK DEPRESSION

9.3.2.8 RECONSTRUCTIVE SURGERY

9.3.2.9 AESTHETIC RESTORATION

9.3.2.10 DENTISTRY

9.3.2.11 CHIN AUGMENTATION

9.3.2.12 LIPOATROPHY TREATMENT

9.3.2.13 SKIN SMOOTHING

9.3.2.14 EARLOBE REJUVENATION

9.3.2.15 OTHERS

9.3.3 POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA)

9.3.3.1 FACIAL LINE CORRECTION

9.3.3.2 LIP ENHANCEMENT

9.3.3.3 FACE LIFT

9.3.3.4 RHINOPLASTY

9.3.3.5 SCAR TREATMENT

9.3.3.6 SAGGING SKIN

9.3.3.7 CHEEK DEPRESSION

9.3.3.8 RECONSTRUCTIVE SURGERY

9.3.3.9 AESTHETIC RESTORATION

9.3.3.10 DENTISTRY

9.3.3.11 CHIN AUGMENTATION

9.3.3.12 LIPOATROPHY TREATMENT

9.3.3.13 SKIN SMOOTHING

9.3.3.14 EARLOBE REJUVENATION

9.3.3.15 OTHERS

10 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.2.1 JUVEDERM

10.2.2 RESTYLANE

10.2.3 RADIESSE

10.2.4 SCULPTRA

10.2.5 ELLANSE

10.2.6 BELLAFILL

10.2.7 AQUAMID

10.2.8 ELEVESS

10.2.9 OTHERS

10.3 GENERIC

11 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FACIAL LINE CORRECTION

11.2.1 DYNAMIC WRINKLES

11.2.2 STATIC WRINKLES

11.2.3 WRINKLE FOLDS

11.2.4 LAUGH LINES

11.2.5 FOREHEAD LINES

11.2.6 WORRY LINES

11.2.7 CROW’S FEET

11.2.8 LIP LINES

11.2.9 MARIONETTE LINES

11.2.10 PUPPET WRINKLES

11.2.11 BUNNY LINES

11.2.12 OTHERS

11.2.13 JUVEDERM

11.2.14 RESTYLANE

11.2.15 BELOTERO

11.2.16 RADIESSE

11.2.17 OTHERS

11.3 LIP ENHANCEMENT

11.3.1 JUVÉDERM

11.3.1.1 JUVÉDERM XC

11.3.1.2 VOLUMA

11.3.1.3 VOLBELLA

11.3.1.4 VOLLURE

11.3.2 RESTYLANE

11.3.2.1 RESTYLANE LYFT

11.3.2.2 RESTYLANE KYSSE

11.3.2.3 RESTYLANE CONTOUR

11.3.2.4 RESTYLANE REFYNE

11.3.2.5 RESTYLANE SILK

11.3.3 BELOTERO BALANCE

11.3.4 RHA

11.3.4.1 RHA 2

11.3.4.2 RHA 3

11.3.4.3 RHA 4

11.3.5 REVANESSE VERSA

11.3.6 HYLAFORM

11.3.7 ELEVESS

11.3.8 PREVELLE SILK

11.3.9 OTHERS

11.4 FACE LIFT

11.4.1 DEEP PLANE/SMAS FACELIFT

11.4.2 MINI FACELIFT

11.4.3 MID-FACELIFT

11.4.4 LIQUID FACELIFT

11.4.5 CHEEK LIFT

11.4.6 JAW LINE REJUVENATION

11.4.7 S-LIFT

11.4.8 CUTANEOUS LIFT

11.4.9 TEMPORAL/BROW LIFT

11.4.10 OTHERS

11.4.11 JUVEDERM

11.4.12 RESTYLANE

11.4.13 SCULPTRA

11.4.14 DYSPORT

11.4.15 OTHERS

11.5 RHINOPLASTY

11.5.1 JUVÉDERM

11.5.1.1 VOLUMA

11.5.1.2 VOLBELLA

11.5.1.3 JUVÉDERM XC

11.5.1.4 VOLLURE

11.5.2 RESTYLANE

11.5.2.1 RESTYLANE LYFT

11.5.2.2 RESTYLANE SILK

11.5.2.3 RESTYLANE REFYNE

11.5.2.4 RESTYLANE KYSSE

11.5.2.5 RESTYLANE CONTOUR

11.5.3 BELOTERO BALANCE

11.5.4 REVANESSE VERSA

11.5.5 RHA

11.5.5.1 RHA 2

11.5.5.2 RHA 3

11.5.5.3 RHA 4

11.5.6 HYLAFORM

11.5.7 ELEVESS

11.5.8 PREVELLE SILK

11.5.9 OTHERS

11.6 SCAR TREATMENT

11.6.1 ACNE SCARS

11.6.2 HYPERTROPHIC SCARS

11.6.3 KELOID SCARS

11.6.4 CONTRACTURE SCARS

11.6.5 OTHERS

11.6.6 JUVEDERM

11.6.7 RESTYLANE

11.6.8 RADIESSE

11.6.9 BELOTERO

11.6.10 PERLANE

11.6.11 OTHERS

11.7 SAGGING SKIN

11.7.1 BOLETERO

11.7.2 RESTYLANE

11.7.3 JUVEDERM

11.7.4 OTHERS

11.8 CHEEK DEPRESSION

11.8.1 JUVEDERM VOLUMA

11.8.2 RESTYLANE-LYFT

11.8.3 SCULPTRA

11.8.4 RADIESSE

11.8.5 OTHERS

11.9 RECONSTRUCTIVE SURGERY

11.9.1 JUVEDERM

11.9.2 RESTYLANE

11.9.3 OTHERS

11.1 AESTHETIC RESTORATION

11.10.1 JUVÉDERM

11.10.1.1 JUVEDERM ULTRA XC

11.10.1.2 JUVEDERM VOLBELLA XC

11.10.1.3 JUVEDERM VOLLURE XC

11.10.2 RESTYLANE

11.10.2.1 RESTYLANE LYFT

11.10.2.2 RESTYLANE-L

11.10.2.3 RESTYLANE REFYNE AND DEFYNE

11.10.2.4 RESTYLANE SILK

11.10.3 SCULPTRA

11.10.4 RADIESSE

11.10.5 RHA

11.10.5.1 RHA 2

11.10.5.2 RHA 3

11.10.5.3 RHA 4

11.10.6 REVANESSE VERSA

11.10.7 BELOTERO BALANCE

11.10.8 BELLAFILL

11.10.9 OTHERS

11.11 DENTISTRY

11.11.1 JUVEDERM

11.11.2 RESTYLANE

11.11.3 RADIESSE

11.11.4 OTHERS

11.12 CHIN AUGMENTATION

11.12.1 JUVEDERM VOLUMA XC

11.12.2 RESTYLANE DEFYNE

11.12.3 OTHERS

11.13 LIPOATROPHY TREATMENT

11.13.1 SCULPTRA

11.13.2 OTHERS

11.14 SKIN SMOOTHING

11.14.1 RESTYLANE

11.14.2 BELOTERO

11.14.3 BELLAFIL

11.14.4 OTHERS

11.15 EARLOBE REJUVENATION

11.15.1 SCULPTRA

11.15.2 RESTYLANE

11.15.3 ELLANSÉ

11.15.4 BELOTERO

11.15.5 JUVEDERM

11.15.6 OTHERS

11.16 OTHERS

12 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER

12.1 OVERVIEW

12.2 DERMATOLOGY CLINICS

12.3 HOSPITALS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER/DIRECT DISTRIBUTION

13.3 DRUG STORES

13.4 ONLINE PHARMACY

13.5 OTHERS

14 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY REGION

14.1 MIDDLE EAST AND NORTH AFRICA

14.1.1 U.A.E.

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 ISRAEL

14.1.5 BAHRAIN

14.1.6 TURKEY

14.1.7 KUWAIT

14.1.8 OMAN

14.1.9 REST OF MIDDLE EAST & NORTH AFRICA

15 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MEA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ALLERGAN AESTHETICS

17.1.1 COMPANY SNAPSHOTS

17.1.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 GALDERMA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 MERZ PHARMA

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 HUGEL, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LG CHEM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AMALIAN

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 BIOSCIENCE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOPLUS CO. LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BIOXIS PHARMACEUTICALS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 CONTURA INTERNATIONAL LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CROMA-PHARMA GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HUONS GLOBAL

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 HUMEDIX

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 IBSA INSTITUT BIOCHIMIQUE SA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 JALUPRO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LABORATORIES VIVACY

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 LABORATORIES FILLMED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 MEDYTOX INC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 MESOESTETIC

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 PETRONE GROUP

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PREMIER MEDICAL GROUP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 PROLLENIUM MEDICAL TECHNOLOGIES

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 REVANCE

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SINCLAIR

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 SHANGHAI REYOUNGEL MEDICAL TECHNOLOGY COMPANY LIMITED

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SOSUM GLOBAL

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 TIGER AESTHETICS MEDICAL, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TEOXANE

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 VIDA SRL.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 ZHEJIANG JINGJIA MEDICAL TECHNOLOGY CO., LTD.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 3 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 4 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 7 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 8 MIDDLE EAST AND AFRICA NON-BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 11 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 12 MIDDLE EAST AND AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA GENERIC IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA SKIN SMOOTHING IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA DERMATOLOGY CLINICS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA HOSPITALS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA AMBULATORY SURGICAL CENTERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DIRECT TENDER/DIRECT DISTRIBUTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA DRUG STORES IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA ONLINE PHARMACY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 85 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY COUNTRY, 2018-2036 (USD THOUSAND)

TABLE 86 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 87 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 88 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 89 MIDDLE EAST & NORTH AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 90 MIDDLE EAST & NORTH AFRICA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 91 MIDDLE EAST & NORTH AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 92 MIDDLE EAST & NORTH AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 93 MIDDLE EAST & NORTH AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 94 MIDDLE EAST & NORTH AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 95 MIDDLE EAST & NORTH AFRICA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 96 MIDDLE EAST & NORTH AFRICA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 97 MIDDLE EAST & NORTH AFRICA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 98 MIDDLE EAST & NORTH AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 99 MIDDLE EAST & NORTH AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 100 MIDDLE EAST & NORTH AFRICA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 101 MIDDLE EAST & NORTH AFRICA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 102 MIDDLE EAST & NORTH AFRICA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 103 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 104 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 105 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 106 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 107 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 108 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 109 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 110 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 111 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 112 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 113 MIDDLE EAST & NORTH AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 114 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 115 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 116 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 117 MIDDLE EAST & NORTH AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 118 MIDDLE EAST & NORTH AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 119 MIDDLE EAST & NORTH AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 120 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 121 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 122 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 123 MIDDLE EAST & NORTH AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 124 MIDDLE EAST & NORTH AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 125 MIDDLE EAST & NORTH AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 126 MIDDLE EAST & NORTH AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 127 MIDDLE EAST & NORTH AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 128 MIDDLE EAST & NORTH AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 129 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 130 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 131 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 132 MIDDLE EAST & NORTH AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 133 MIDDLE EAST & NORTH AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 134 MIDDLE EAST & NORTH AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 135 MIDDLE EAST & NORTH AFRICA SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 136 MIDDLE EAST & NORTH AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 137 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 138 MIDDLE EAST & NORTH AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 139 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 140 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 141 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 142 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 143 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 144 U.A.E. NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 145 U.A.E. HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 146 U.A.E. MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 147 U.A.E. MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 148 U.A.E. BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 149 U.A.E. BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 150 U.A.E. FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 151 U.A.E. COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 152 U.A.E. POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 153 U.A.E. OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 154 U.A.E. SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 155 U.A.E. CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 156 U.A.E. POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 157 U.A.E. POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 158 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 159 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 160 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 161 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 162 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 163 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 164 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 165 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 166 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 167 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 168 U.A.E. LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 169 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 170 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 171 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 172 U.A.E. FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 173 U.A.E. FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 174 U.A.E. RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 175 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 176 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 177 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 178 U.A.E. SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 179 U.A.E. SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 180 U.A.E. SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 181 U.A.E. CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 182 U.A.E. RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 183 U.A.E. AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 184 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 185 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 186 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 187 U.A.E. DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 188 U.A.E. CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 189 U.A.E. LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 190 U.A.E. SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 191 U.A.E. EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 192 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 193 U.A.E. BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 194 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 195 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 196 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 197 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 198 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 199 SAUDI ARABIA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 200 SAUDI ARABIA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 201 SAUDI ARABIA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 202 SAUDI ARABIA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 203 SAUDI ARABIA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 204 SAUDI ARABIA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 205 SAUDI ARABIA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 206 SAUDI ARABIA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 207 SAUDI ARABIA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 208 SAUDI ARABIA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 209 SAUDI ARABIA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 210 SAUDI ARABIA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 211 SAUDI ARABIA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 212 SAUDI ARABIA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 213 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)