Mercado de sistemas de automatización de edificios de América del Norte, por tipo de sistema (sistemas de gestión de instalaciones (FMS), sistemas de protección contra incendios , sistemas de seguridad y control de acceso, sistemas de gestión de energía, software de gestión de edificios (BMS) y otros), tecnología (tecnologías inalámbricas y tecnologías cableadas), aplicación (comercial, residencial e industrial), país (EE. UU., Canadá, México), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado de sistemas de automatización de edificios en América del Norte

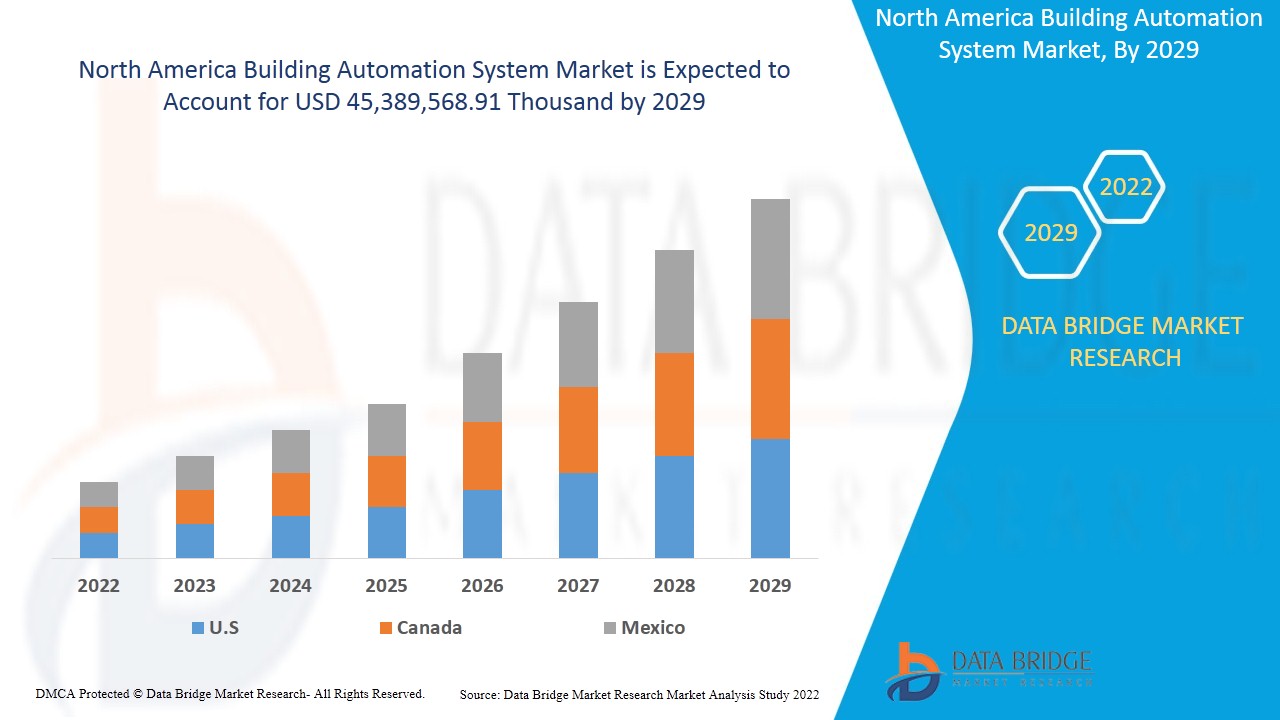

Se espera que el mercado de sistemas de automatización de edificios de América del Norte gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 9,5% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 45 389 568,91 mil para 2029. Se espera que la creciente adopción de sistemas de seguridad automatizados en edificios comerciales impulse el mercado.

El sistema de automatización de edificios es el sistema y la aplicación/software que se utiliza para mantener la automatización en el edificio y brindar seguridad a los usuarios autorizados. Se implementa principalmente en proyectos grandes con amplios sistemas mecánicos, de calefacción, ventilación y aire acondicionado y eléctricos. Ayuda a reducir el consumo de energía en el edificio. Tiene herramientas y servicios de gestión de desastres y ayuda a prevenir accidentes como incendios. Es un sistema de control distribuido que se utiliza para administrar dispositivos electrónicos diseñados para monitorear y controlar los sistemas de un edificio.

Se prevé que la creciente popularidad de los sistemas de automatización de edificios basados en IoT impulse el mercado de sistemas de automatización de edificios de América del Norte. La principal limitación que puede afectar negativamente al mercado de sistemas de automatización de edificios de América del Norte es el alto costo de mantenimiento de los sistemas de automatización de edificios.

Se espera que el cambio en la preferencia de los consumidores hacia los sistemas de control de calefacción, ventilación y aire acondicionado (HVAC) brinde una oportunidad en el mercado de sistemas de automatización de edificios de América del Norte. Sin embargo, se prevé que la noción falsa sobre los altos costos de instalación de los sistemas de automatización de edificios suponga un desafío para el crecimiento del mercado de sistemas de automatización de edificios de América del Norte.

Este informe sobre el mercado de sistemas de automatización de edificios de América del Norte proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de sistemas de automatización de edificios en América del Norte

El mercado de sistemas de automatización de edificios de América del Norte está segmentado en tres segmentos notables según el tipo de sistema, la tecnología y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo de sistema, el mercado de sistemas de automatización de edificios de América del Norte se segmenta en sistemas de gestión de instalaciones (FMS), sistemas de protección contra incendios, sistemas de seguridad y control de acceso, sistemas de gestión de energía, software de gestión de edificios (BMS) y otros. En 2022, se espera que el segmento de sistemas de gestión de instalaciones (FMS) domine el mercado de sistemas de automatización de edificios de América del Norte, ya que mantiene la sostenibilidad de los edificios al proporcionar soluciones de automatización que aumentan su demanda en el mercado.

- En términos de tecnología, el mercado de sistemas de automatización de edificios de América del Norte se segmenta en tecnologías inalámbricas y tecnologías cableadas. En 2022, se espera que el segmento de tecnologías inalámbricas domine el mercado de sistemas de automatización de edificios de América del Norte, ya que la transmisión de datos es más rápida en las tecnologías inalámbricas y, por lo tanto, aumenta su demanda en la región.

- En función de la aplicación, el mercado de sistemas de automatización de edificios de América del Norte se segmenta en comercial, industrial y residencial. En 2022, se espera que el segmento residencial domine el mercado de sistemas de automatización de edificios de América del Norte, ya que mantiene los edificios seguros y sostenibles, lo que aumenta su demanda en la región.

Análisis a nivel de país del mercado de sistemas de automatización de edificios de América del Norte

El mercado de sistemas de automatización de edificios de América del Norte está segmentado en tres segmentos notables según el tipo de sistema, la tecnología y la aplicación.

Los países incluidos en el informe sobre el mercado de sistemas de automatización de edificios de América del Norte son Estados Unidos, Canadá y México. Se espera que Estados Unidos domine el mercado norteamericano debido al creciente uso de sistemas de automatización de edificios en el sector residencial de la región. Se espera que Canadá domine, ya que los consumidores prefieren edificios comerciales y residenciales modernos y de alta tecnología.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas norteamericanas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Aumenta la atención en el diseño de edificios energéticamente eficientes y respetuosos con el medio ambiente

El ahorro de energía a través de la eficiencia energética en la construcción ha adquirido una importancia primordial en todo el mundo. Los aspectos principales de la eficiencia energética en un edificio incluyen el diseño de edificios energéticamente pasivos antes de la construcción propiamente dicha y el uso de materiales de construcción de bajo consumo energético durante la construcción. El enfoque principal de la construcción de edificios ecológicos es la integración de tecnologías de energía renovable y el uso de equipos eficientes con bajos requisitos de energía operativa.

El consumo de energía en edificios e infraestructuras aumenta exponencialmente, lo que sugiere la necesidad de desarrollar alternativas para ahorrar energía y operar los edificios de manera sustentable. La eficiencia energética se puede lograr con aislamiento, técnicas de construcción mejoradas y métodos de construcción modificados para edificios, lo que aumenta la demanda de sistemas de automatización sustentables.

Además, la creciente conciencia de los consumidores sobre el diseño de edificios energéticamente eficientes durante cualquier nueva construcción es eficaz para hacer que una casa sea más eficiente. También es menos costoso para el propietario a largo plazo. Como resultado, aumenta la demanda de sistemas de automatización de edificios y, por lo tanto, contribuye al crecimiento del mercado de sistemas de automatización de edificios en América del Norte.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de automatización de edificios en América del Norte

El panorama competitivo del mercado de sistemas de automatización de edificios de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de sistemas de automatización de edificios de América del Norte.

Algunos de los principales actores cubiertos en el informe del mercado de sistemas de automatización de edificios de América del Norte son Vipond Inc., EnOcean GmbH, Intel Corporation, Microchip Technology Inc., Qualcomm Technologies, Inc., Creston Electronics, Tech Automation Inc., Stanley Black & Decker, Inc., Legrand, Siemens, General Electric, BuildingIQ, Honeywell International Inc., Robert Bosch GmbH, Johnson Controls, Securitas AB, Convergint Technologies LLC, Beckhoff Automation, Delta Controls, Ingersoll Rand, Chubb Fire & Security, Snap One, LLC, Schneider Electric, Hitachi, Ltd., Hubbell. G4S Limited, Lutron Electronics Co., Inc, PALADIN SECURITY, ACUITY BRANDS LIGHTING, INC., ADT, Emerson Electric Co., PHOENIX CONTACT, ABB, Mitsubishi Electric Corporation, BuildingLogiX, Viking Controls, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En enero de 2022, Johnson Controls adquirió FogHorn, el desarrollador líder de software de inteligencia artificial de borde para soluciones de Internet de las cosas (IoT) industriales y comerciales. Esto ayudará a la empresa a expandir su negocio y acelerar su innovación y visión de edificios autónomos inteligentes.

- En octubre de 2021, Robert Bosch GmbH, Escrypt, Kapsch, Nokia y Deutsche Telekom colaboraron como socios en el proyecto CONCORDA, financiado con fondos públicos, en un consorcio encabezado por Ertico. Esta tecnología permite una transmisión de datos continua y segura, apoyando a los sistemas de asistencia en situaciones de conducción críticas para la seguridad. Esto ha ayudado a la empresa a ampliar su negocio.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 SYSTEM TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BUILDING AUTOMATION SYSTEM REGULATIONS

4.1.1 GSA: U.S. GENERAL SERVICES ADMINISTRATION

4.1.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (COUNTRY OF ORIGIN: SWITZERLAND)

4.2 BUILDING AUTOMATION SYSTEM ECOSYSTEM

4.2.1 IOT SENSORS

4.2.2 ANALYTICS SOFTWARE

4.2.3 USER INTERFACE

4.2.4 COMMUNICATION

4.3 GOVERNMENT REGULATION- FAIR AND TRANSPARENT USE OF BIOMETRIC SYSTEM-POWERED ACCESS CONTROL

4.3.1 GENERAL DATA PROTECTION REGULATION (GDPR)

4.3.2 CALIFORNIA CONSUMER PRIVACY ACT

4.3.3 U.K. DATA PROTECTION BILL AND BIOMETRIC DATA

4.3.4 FEDERAL TRADE COMMISSION FOR DATA SECURITY WITH THE F.T.C. ACT

4.3.5 ISO/IEC JOINT TECHNICAL COMMITTEE 1

4.4 AVERAGE SELLING PRICE ANALYSIS

4.5 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: ATTRACTIVE OPPORTUNITIES

4.6 VALUE CHAIN ANALYSIS:

4.7 PORTER’S FIVE FORCES:

4.8 TRADE AND TARIFF ANALYSIS

4.9 VIDEO SURVEILLANCE PRIVACY AND WIRETAPPING REGULATIONS

4.9.1 U.K.

4.9.2 SPAIN

4.9.3 U.S.

4.9.4 AUSTRALIA

4.9.5 9-7.000 - ELECTRONIC SURVEILLANCE

4.9.6 FEDERAL AND STATE LAWS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 UPSURGE IN THE FOCUS FOR DESIGNING ENERGY-EFFICIENT AND ECO-FRIENDLY BUILDINGS

5.1.2 RISING ADOPTION OF AUTOMATED SECURITY SYSTEMS IN COMMERCIAL BUILDINGS

5.1.3 GROWING POPULARITY OF IOT BASED BUILDING AUTOMATION SYSTEMS

5.1.4 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY

5.2 RESTRAINTS

5.2.1 EMERGENCE OF SECURITY ISSUES

5.2.2 HIGH MAINTENANCE COST OF BUILDING AUTOMATION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 FAVOURABLE GOVERNMENT INITIATIVES AND INCENTIVES FOR EMERGING SMART CITIES

5.3.2 SHIFTING CONSUMER’S PREFERENCE TOWARDS HVAC (HEATING, VENTILATION, AND AIR CONDITIONING) CONTROL SYSTEMS

5.4 CHALLENGES

5.4.1 INVOLVEMENT OF VARIOUS LENGTHY COMMUNICATION PROTOCOLS DURING INSTALLATION PROCEDURE

5.4.2 FALSE NOTION ABOUT HIGH INSTALLATION COSTS OF BUILDING AUTOMATION SYSTEMS

6 IMPACT OF COVID-19 ON THE NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE BUILDING AUTOMATION SYSTEM MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE

7.1 OVERVIEW

7.2 FACILITY MANAGEMENT SYSTEMS (FMS)

7.2.1 FACILITY MANAGEMENT SYSTEMS (FMS), BY TYPE

7.2.1.1 HVAC CONTROL SYSTEMS

7.2.1.1.1 HVAC CONTROL SYSTEMS, BY TYPE

7.2.1.1.1.1 SENSORS

7.2.1.1.1.2 ACTUATORS

7.2.1.1.1.2.1 ACTUATORS BY TYPE

7.2.1.1.1.2.1.1 ELECTRIC

7.2.1.1.1.2.1.2 HYDRAULIC

7.2.1.1.1.2.1.3 PNEUMATIC

7.2.1.1.1.3 CONTROL VALVES

7.2.1.1.1.4 HEATING AND COOLING COILS

7.2.1.1.1.5 SMART THERMOSTATS

7.2.1.1.1.6 PUMPS AND FANS

7.2.1.1.1.7 DAMPERS

7.2.1.1.1.7.1 DAMPERS, BY TYPE

7.2.1.1.1.7.1.1 PARALLEL AND OPPOSED BLADE DAMPERS

7.2.1.1.1.7.1.2 LOW-LEAKAGE DAMPERS

7.2.1.1.1.7.1.3 ROUND DAMPERS

7.2.1.1.1.8 OTHERS

7.2.1.2 SMART DEVICES

7.2.1.2.1 SMART DEVICES, BY TYPE

7.2.1.2.1.1 SMART APPLIANCES

7.2.1.2.1.2 ENVIRONMENT AND AIR QUALITY MONITORING SYSTEMS

7.2.1.2.1.3 SMART METER

7.2.1.3 LIGHTING CONTROL SYSTEMS

7.2.1.3.1 LIGHTING CONTROL SYSTEMS, BY TYPE

7.2.1.3.1.1 HARDWARE

7.2.1.3.1.1.1 LIGHTING CONTROL SYSTEMS-HARDWARE

7.2.1.3.1.1.1.1 RECEIVERS

7.2.1.3.1.1.1.2 ACTUATORS

7.2.1.3.1.1.1.3 TRANSMITTERS

7.2.1.3.1.1.1.4 SENSORS

7.2.1.3.1.1.1.5 TIMERS

7.2.1.3.1.1.1.6 RELAY

7.2.1.3.1.2 SOFTWARE

7.2.1.3.1.3 SERVICES

7.2.1.3.1.3.1 LIGHTING CONTROL SYSTEMS-SERVICES

7.2.1.3.1.3.1.1 INSTALLATION

7.2.1.3.1.3.1.2 SUPPORT AND MAINTENANCE

7.3 SECURITY AND ACCESS CONTROL SYSTEMS

7.3.1 SECURITY AND ACCESS CONTROL SYSTEMS, BY SYSTEMS TYPE

7.3.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS

7.3.1.1.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS, BY SYSTEM

7.3.1.1.1.1 HARDWARE

7.3.1.1.1.2 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS-HARDWARE

7.3.1.1.1.2.1 MULTI FACTOR AUTHENTICATION

7.3.1.1.1.2.2 SINGLE FACTOR AUTHENTICATION

7.3.1.1.1.3 SOFTWARE

7.3.1.1.1.4 SERVICES

7.3.1.1.1.4.1 BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS, BY SERVICES

7.3.1.1.1.4.1.1 INSTALLATION

7.3.1.1.1.4.1.2 SUPPORT & MAINTENANCE

7.3.1.1.1.4.1.3 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.3.1.1.1.4.1.3.1 VIDEO SURVEILLANCE SYSTEMS, BY SYSTEM TYPE

7.3.1.1.1.4.1.3.2 HARDWARE

7.3.1.1.1.4.1.3.3 VIDEO SURVEILLANCE SYSTEMS BY HARDWARE

7.3.1.1.1.4.1.3.4 CAMERAS

7.3.1.1.1.4.1.3.5 STORAGE SYSTEMS

7.3.1.1.1.4.1.3.6 ACCESSORIES

7.3.1.1.1.4.1.3.7 MONITORS

7.3.1.1.1.5 SOFTWARE

7.3.1.1.1.6 SERVICES

7.3.1.1.1.6.1 VIDEO SURVEILLANCE SYSTEMS BY SERVICES

7.3.1.1.1.6.1.1 INSTALLATION

7.3.1.1.1.6.1.2 SUPPORT & MAINTENANCE

7.3.1.1.1.6.1.3 VIDEO SURVEILLANCE AS A SERVICE (VSAAS)

7.4 ENERGY MANAGEMENT SYSTEMS

7.5 BUILDING MANAGEMENT SOFTWARE (BMS)

7.6 FIRE PROTECTION SYSTEMS

7.6.1 FIRE PROTECTION SYSTEMS, BY TYPE

7.6.1.1 SENSORS AND DETECTORS

7.6.1.1.1 SENSORS AND DETECTORS, BY TYPE

7.6.1.1.1.1 SMOKE DETECTORS

7.6.1.1.1.2 FLAME DETECTORS

7.6.1.1.1.2.1 FLAME DETECTORS, BY TYPE

7.6.1.1.1.2.1.1 SINGLE IR /SINGLE UV

7.6.1.1.1.2.1.2 DUAL IR /SINGLE UV

7.6.1.1.1.2.1.3 MULTI IR /SINGLE UV

7.6.1.2 EMERGENCY LIGHTING AND PUBLIC ALERT DEVICES

7.6.1.3 FIRE ALARMS

7.6.1.4 FIRE SPRINKLERS

7.7 OTHERS

8 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 WIRELESS TECHNOLOGIES

8.2.1 WIRELESS TECHNOLOGIES

8.2.1.1 ZIGBEE

8.2.1.2 Z–WAVE

8.2.1.3 ENOCEAN

8.2.1.4 WI-FI

8.2.1.5 THREAD

8.2.1.6 BLUETOOTH

8.2.1.7 INFRARED

8.3 WIRED TECHNOLOGIES

8.3.1 WIRED TECHNOLOGIES

8.3.1.1 KNX

8.3.1.2 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

8.3.1.3 BUILDING AUTOMATION AND CONTROL NETWORK (BACNET)

8.3.1.4 LONWORKS

8.3.1.5 MODBUS

9 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 RESIDENTIAL, BY TYPE

9.2.1.1 APARTMENTS

9.2.1.2 MULTI-FAMILY HOME

9.2.1.3 SINGLE-FAMILY HOME

9.2.1.4 OTHERS

9.2.2 RESIDENTIAL, BY SYSTEM

9.2.2.1 DOOR ENTRY SYSTEM

9.2.2.2 VIDEO SURVEILLANCE

9.2.2.3 INTRUSION ALARM SYSTEM

9.2.2.4 ACCESS CONTROL

9.2.2.5 OTHERS

9.2.3 RESIDENTIAL, BY SYSTEM TYPE

9.2.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.2.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.2.3.3 ENERGY MANAGEMENT SYSTEMS

9.2.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.2.3.5 FIRE PROTECTION SYSTEMS

9.2.3.6 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL, BY TYPE

9.3.1.1 AIRPORTS AND RAILWAY STATIONS

9.3.1.2 GOVERNMENT

9.3.1.3 HOSPITALS AND HEALTHCARE FACILITIES

9.3.1.4 HOSPITALITY

9.3.1.5 OFFICE BUILDINGS

9.3.1.6 RETAIL AND PUBLIC ASSEMBLY BUILDINGS

9.3.1.7 EDUCATION

9.3.1.8 OTHERS

9.3.2 COMMERCIAL, BY TECHNOLOGY

9.3.2.1 VENTILATION AND AIR CONDITIONING (HVAC)

9.3.2.2 LIGHTING

9.3.2.3 HEATING

9.3.2.4 SECURITY AND ACCESS CONTROLS

9.3.2.5 FIRE AND LIFE SAFETY

9.3.3 COMMERCIAL, BY SYSTEM TYPE

9.3.3.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.3.3.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.3.3.3 ENERGY MANAGEMENT SYSTEMS

9.3.3.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.3.3.5 FIRE PROTECTION SYSTEMS

9.3.3.6 OTHERS

9.4 INDUSTRIAL

9.4.1 INDUSTRIAL, BY TYPE

9.4.1.1 OIL AND GAS

9.4.1.2 ENERGY AND UTILITIES

9.4.1.3 AUTOMOTIVE

9.4.1.4 FOOD AND BEVERAGES

9.4.1.5 METAL AND MINING

9.4.1.6 OTHERS

9.4.2 INDUSTRIAL, BY SYSTEM TYPE

9.4.2.1 FACILITY MANAGEMENT SYSTEMS(FMS)

9.4.2.2 SECURITY AND ACCESS CONTROL SYSTEMS

9.4.2.3 ENERGY MANAGEMENT SYSTEMS

9.4.2.4 BUILDING MANAGEMENT SOFTWARE (BMS)

9.4.2.5 FIRE PROTECTION SYSTEMS

9.4.2.6 OTHERS

10 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 MERGERS & ACQUISITIONS

11.3 EXPANSION

11.4 NEW PRODUCT DEVELOPMENTS

11.5 PARTNERSHIPS

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 JOHNSON CONTROLS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 EMERSON ELECTRIC CO.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATES

13.4 GENERAL ELECTRIC

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATES

13.5 SECURITAS AB

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 ACUITY BRANDS LIGHTING, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ADT

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 BECKHOFF AUTOMATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 BUILDINGIQ

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 BUILDINGLOGIX

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 CHUBB FIRE & SECURITY

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 CONVERGINT TECHNOLOGIES LLC

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATES

13.14 CRESTON ELECTRONICS

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 DELTA CONTROLS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

13.16 G4S LIMITED

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATES

13.17 HITACHI, LTD.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT UPDATES

13.18 HONEYWELL INTERNATIONAL INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

13.19 HUBBELL

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT UPDATES

13.2 INGERSOLL RAND

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT UPDATES

13.21 LEGRAND

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCT PORTFOLIO

13.21.4 RECENT UPDATES

13.22 LUTRON ELECTRONICS CO., INC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT UPDATES

13.23 MITSUBISHI ELECTRIC CORPORATION

13.23.1 COMPANY SNAPSHOT

13.23.2 REVENUE ANALYSIS

13.23.3 PRODUCT PORTFOLIO

13.23.4 RECENT UPDATE

13.24 PALADIN SECURITY

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT UPDATE

13.25 PHOENIX CONTACT

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT UPDATE

13.26 ROBERT BOSCH GMBH

13.26.1 COMPANY SNAPSHOT

13.26.2 REVENUE ANALYSIS

13.26.3 PRODUCT PORTFOLIO

13.26.4 RECENT UPDATES

13.27 SCHNEIDER ELECTRIC

13.27.1 COMPANY SNAPSHOT

13.27.2 REVENUE ANALYSIS

13.27.3 PRODUCT PORTFOLIO

13.27.4 RECENT UPDATES

13.28 SNAP ONE, LLC

13.28.1 COMPANY SNAPSHOT

13.28.2 PRODUCT PORTFOLIO

13.28.3 RECENT UPDATE

13.29 STANLEY BLACK & DECKER, INC.

13.29.1 COMPANY SNAPSHOT

13.29.2 REVENUE ANALYSIS

13.29.3 PRODUCT PORTFOLIO

13.29.4 RECENT UPDATES

13.3 TECH AUTOMATION INC.

13.30.1 COMPANY SNAPSHOT

13.30.2 PRODUCT PORTFOLIO

13.30.3 RECENT UPDATE

13.31 VIKING CONTROLS

13.31.1 COMPANY SNAPSHOT

13.31.2 PRODUCT PORTFOLIO

13.31.3 RECENT UPDATE

13.32 VIPOND INC.

13.32.1 COMPANY SNAPSHOT

13.32.2 PRODUCT PORTFOLIO

13.32.3 RECENT UPDATE

14 COMPANY PROFILES, BY TECHNOLOGY

14.1 ENOCEAN GMBH

14.1.1 COMPANY SNAPSHOT

14.1.2 TECHNOLOGY PORTFOLIO

14.1.3 RECENT UPDATE

14.2 INFINEON TECHNOLOGIES AG

14.2.1 COMPANY SNAPSHOT

14.2.2 TECHNOLOGY PORTFOLIO

14.2.3 RECENT UPDATE

14.3 INTEL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 MICROCHIP TECHNOLOGY INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 QUALCOMM TECHNOLOGIES, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF BURGLAR OR FIRE ALARMS AND SIMILAR APPARATUS HS CODE - 853110 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BURGLAR OR FIRE ALARMS AND SIMILAR APPARATUS HS CODE - 853110 (USD THOUSAND)

TABLE 3 PENETRATION RATE OF BUILDING AUTOMATION SYSTEMS IN U.S. (2011)

TABLE 4 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA ENERGY MANAGEMENT SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA BUILDING MANAGEMENT SOFTWARE (BMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA INDUSTRIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA INDUSTRIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 75 NORTH AMERICA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NORTH AMERICA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NORTH AMERICA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 U.S. SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 85 U.S. LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 87 U.S. SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 89 U.S. BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 90 U.S. BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 91 U.S. VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 U.S. VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 93 U.S. VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 94 U.S. FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 U.S. SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 U.S. FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 U.S. BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 98 U.S. WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 U.S. WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 U.S. BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 101 U.S. RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 U.S. RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 103 U.S. RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 U.S. COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 U.S. COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 106 U.S. COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.S. INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 U.S. INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 CANADA BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 CANADA FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 CANADA HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 CANADA ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 CANADA DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 CANADA SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 CANADA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 116 CANADA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 117 CANADA LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 118 CANADA SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 CANADA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 120 CANADA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 121 CANADA BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 122 CANADA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 CANADA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 124 CANADA VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 125 CANADA FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 CANADA SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 CANADA FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 CANADA BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 129 CANADA WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 CANADA WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 CANADA BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 132 CANADA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 CANADA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 134 CANADA RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 CANADA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 CANADA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 137 CANADA COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 CANADA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 CANADA INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 MEXICO BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 MEXICO FACILITY MANAGEMENT SYSTEMS (FMS) IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 MEXICO HVAC CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 MEXICO ACTUATORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 MEXICO DAMPERS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 MEXICO SMART DEVICES IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 MEXICO LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 147 MEXICO LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 148 MEXICO LIGHTING CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 149 MEXICO SECURITY AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 MEXICO BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 151 MEXICO BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 152 MEXICO BIOMETRIC SYSTEMS AND ACCESS CONTROL SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 153 MEXICO VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 MEXICO VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY HARDWARE, 2020-2029 (USD THOUSAND)

TABLE 155 MEXICO VIDEO SURVEILLANCE SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY SERVICES, 2020-2029 (USD THOUSAND)

TABLE 156 MEXICO FIRE PROTECTION SYSTEMS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 MEXICO SENSORS AND DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 MEXICO FLAME DETECTORS IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 MEXICO BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 160 MEXICO WIRELESS TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 MEXICO WIRED TECHNOLOGIES IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 MEXICO BUILDING AUTOMATION SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 MEXICO RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 MEXICO RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM, 2020-2029 (USD THOUSAND)

TABLE 165 MEXICO RESIDENTIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 MEXICO COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 MEXICO COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 168 MEXICO COMMERCIAL IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 MEXICO INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 MEXICO INDUSTRY IN BUILDING AUTOMATION SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: SYSTEM TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 INCREASING DEMAND FOR WIRELESS SENSOR NETWORK TECHNOLOGY IS DRIVING THE NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 FACILITY MANAGEMENT SYSTEMS (FMS) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET IN 2022 & 2029

FIGURE 17 AVERAGE SELLING PRICE ANALYSIS FOR BUILDING AUTOMATION SYSTEM

FIGURE 18 BUILDING AUTOMATION SYSTEM - VALUE CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET

FIGURE 20 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE, 2021

FIGURE 21 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 22 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: BY SYSTEM TYPE (2022-2029)

FIGURE 28 NORTH AMERICA BUILDING AUTOMATION SYSTEM MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.