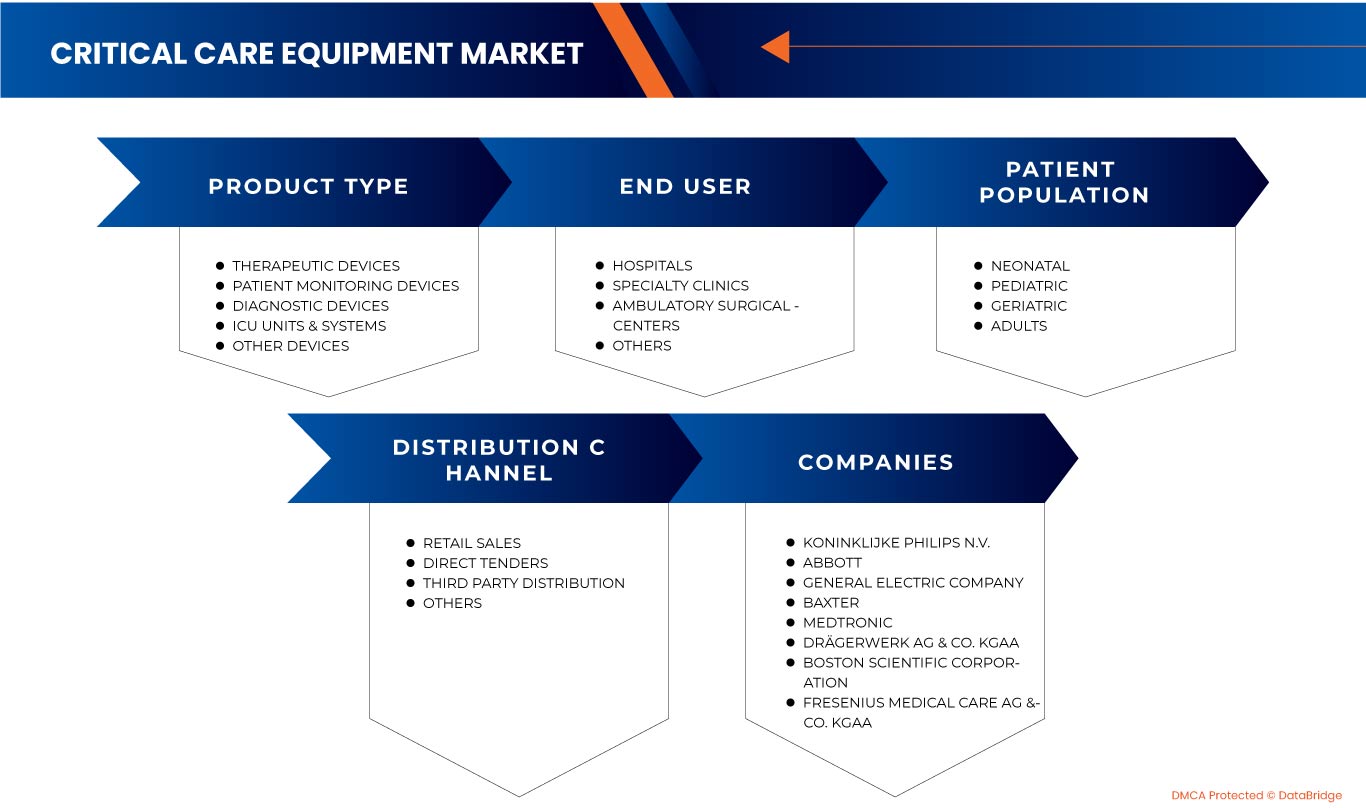

Mercado de equipos de cuidados críticos de América del Norte, por tipo de producto (dispositivos terapéuticos, dispositivos de monitoreo de pacientes, dispositivos de diagnóstico, unidades y sistemas de UCI y otros dispositivos), población de pacientes (neonatales, pediátricos, adultos y geriátricos), usuario final (hospitales, clínicas especializadas, centros quirúrgicos ambulatorios y otros), canal de distribución (licitaciones directas, ventas minoristas, distribución de terceros y otros), tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de equipos de cuidados intensivos de América del Norte

Los pacientes ingresados en una UCI pueden estar allí por diferentes motivos, pero lo que todos tienen en común es que necesitan atención y vigilancia minuciosas, y necesitan equipos avanzados, a menudo soporte vital y respiratorio.

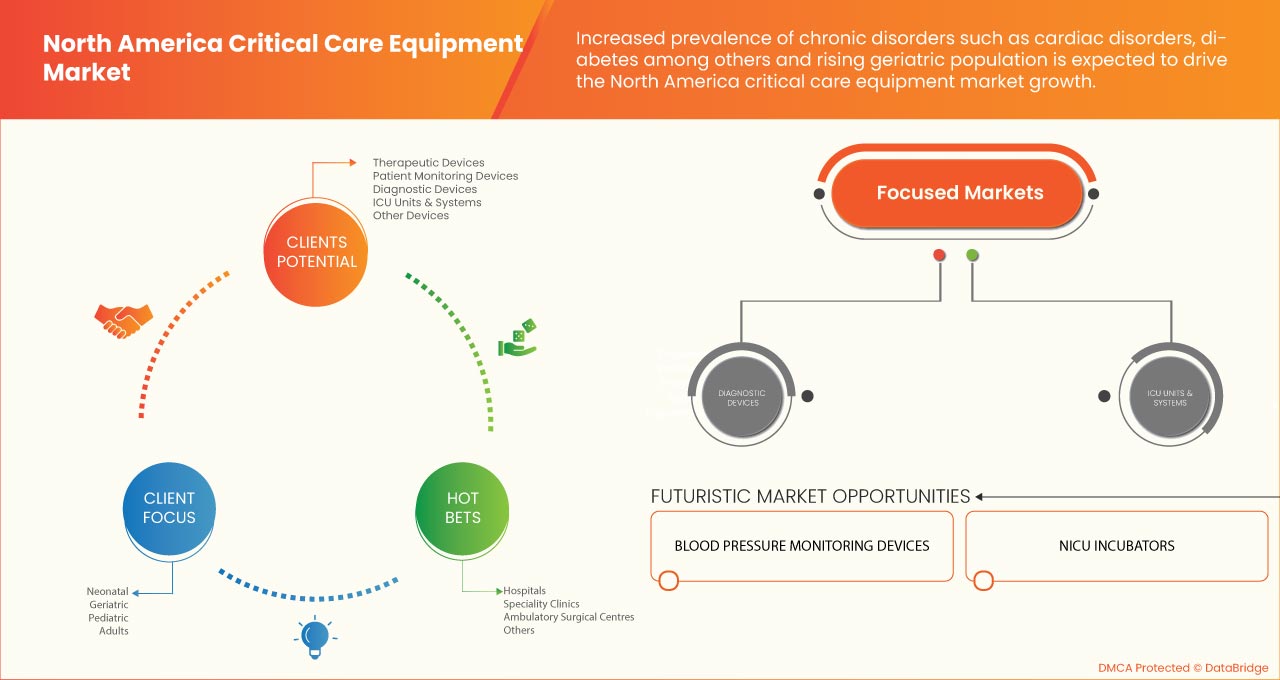

El mercado de equipos de cuidados intensivos de América del Norte está creciendo enormemente debido al aumento de enfermedades crónicas como diabetes, enfermedades cardiovasculares y enfermedades renales, entre otras, lo que está provocando un aumento en el número de pacientes en cuidados intensivos. Sin embargo, las estrictas regulaciones y las malas políticas de reembolso pueden restringir el mercado durante el período de pronóstico. Además, el alto costo de los equipos de cuidados intensivos es uno de los factores más importantes que pueden obstaculizar el crecimiento del mercado a largo plazo.

El desarrollo de la tecnología es una oportunidad para los actores clave durante el período de pronóstico. Por otro lado, la falta de personal y capacitación adecuados está actuando como un desafío para el crecimiento del mercado.

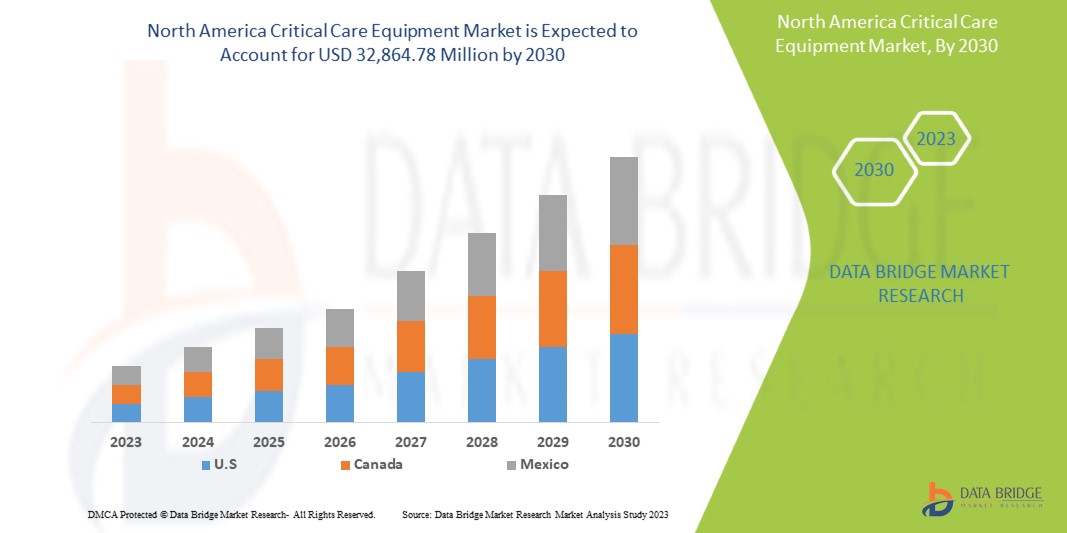

Data Bridge Market Research analiza que se espera que el mercado de equipos de cuidados intensivos de América del Norte alcance un valor de USD 32.864,78 millones para 2030, con una CAGR del 8,8 % durante el período de pronóstico. El tipo de producto representa el segmento de tipo más grande en el mercado debido a la rápida demanda de equipos de cuidados intensivos en América del Norte. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2016) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (dispositivos terapéuticos, dispositivos de monitoreo de pacientes, dispositivos de diagnóstico, unidades y sistemas de UCI y otros dispositivos), población de pacientes (neonatales, pediátricos, adultos y geriátricos), usuario final (hospitales, clínicas especializadas, centros quirúrgicos ambulatorios y otros), canal de distribución (licitaciones directas, ventas minoristas, distribución de terceros y otros). |

|

Países cubiertos |

Estados Unidos, Canadá y México. |

|

Actores del mercado cubiertos |

Koninklijke Philips NV, General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribución de dispositivos médicos GmbH, Masimo y Compumedics Limited, entre otros. |

Definición de mercado

Los equipos críticos son esenciales para la atención de pacientes en condiciones normales de funcionamiento y su falla podría causar lesiones graves o la muerte inminentes a pacientes o usuarios. Los cuidados críticos también se conocen como cuidados intensivos. Es un tipo de atención que implica el tratamiento y manejo de lesiones y enfermedades que son muy graves y pueden poner en peligro la vida. Las complicaciones quirúrgicas, las lesiones por accidentes, las infecciones graves y los problemas respiratorios graves son algunos ejemplos de afecciones que pueden requerir cuidados críticos.

Los pacientes que reciben este nivel de atención pueden mejorar y pasar a otros tipos de atención, pero muchas personas mueren en cuidados intensivos. El equipo utilizado para cuidados intensivos se conoce como equipo de cuidados intensivos, que incluye dispositivos de monitoreo de pacientes, unidades y sistemas de UCI y dispositivos terapéuticos, entre otros. La unidad de cuidados intensivos o unidad de cuidados intensivos (UCI) es una unidad altamente especializada y dedicada del hospital para pacientes que requieren un monitoreo intensivo de servicios médicos, quirúrgicos y de atención al paciente. Los cuidados intensivos se administran en una unidad de cuidados intensivos, que en algunos lugares se denomina unidad de cuidados intensivos.

Dinámica del mercado de equipos de cuidados intensivos en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la prevalencia de trastornos crónicos

El cambio en los hábitos de vida, como fumar tabaco, beber alcohol, el estilo de vida sedentario y muchos otros, han aumentado los casos de pacientes que sufren enfermedades constantes. La creciente prevalencia de enfermedades crónicas está impulsando el mercado e influyendo positivamente en el mercado de equipos de cuidados intensivos.

- Aumento de la población geriátrica

El aumento de los problemas de enfermedades junto con el rápido crecimiento de la población geriátrica afectará significativamente el mercado de equipos de cuidados intensivos. Además, la población geriátrica es vulnerable y tiene pocas enfermedades irresistibles y constantes. El aumento de la población geriátrica influirá positivamente en el mercado y actuará como un impulsor del crecimiento del mercado de equipos de cuidados intensivos.

Restricción

- Falta de profesionales cualificados

La falta de profesionales de laboratorio capacitados no es una novedad en el ámbito del diagnóstico y la atención sanitaria. Al igual que con el aumento de la carga de enfermedades crónicas, el envejecimiento de la población y el desarrollo de los seguros de salud han aumentado la demanda de profesionales de laboratorio de atención sanitaria. Otra razón es la falta de sesiones de formación para los profesionales.

Factores como la tasa de retención, la carga de trabajo y la falta de certificación son motivos de la falta de recursos humanos de laboratorio capacitados, falta de educación y de un título pertinente. Estos factores obstaculizan el crecimiento del mercado de equipos de cuidados intensivos de América del Norte.

- Alto costo del equipo

En todos los departamentos, como cirugía, ortopedia, medicina respiratoria y otros, se necesitan equipos para fines médicos. Se requieren equipos mecánicos, como respiradores, para brindar asistencia respiratoria externa a los pacientes. Además, el costo principal del equipo depende de su mantenimiento.

Según la Fundación Supervasi, el gasto diario en una unidad de cuidados intensivos en la India es de unos 67,17 dólares, incluidos los profesionales médicos altamente capacitados. Además, lo ideal sería que el departamento de cuidados intensivos comprendiera entre 2 y 5 equipos de cuidados intensivos en cada hospital, pero debido al alto costo de los sistemas de equipamiento y el alto costo de mantenimiento de las unidades en países con economías pobres o áreas rurales, esto obstaculiza el crecimiento.

Oportunidad

-

Crecimiento del gasto sanitario

El crecimiento de la infraestructura sanitaria ayuda a proporcionar una mejor atención crítica, lo que conduce a una recuperación y rehabilitación más rápidas para volver a la vida normal. Además, a medida que aumenta la inversión en atención sanitaria, más personas toman conciencia y desean equipos de atención crítica avanzados y diagnosticar su salud para tomar precauciones y curarlas.

El aumento del gasto sanitario en tratamientos de cuidados intensivos también ayuda a los pacientes a recibir un tratamiento avanzado sin complicaciones para un mejor diagnóstico y una recuperación rápida. El gasto en salud se compone de autopagos o de una combinación de gastos gubernamentales de planes y fuentes de bienestar, incluidos los seguros de salud y las actividades de organizaciones no gubernamentales, por lo que una recuperación más rápida y la rehabilitación para una vida normal actúan como una oportunidad para aumentar la demanda del mercado.

El aumento del gasto en atención sanitaria lleva a la implementación de equipos y productos de tecnología avanzada y a un mejor tratamiento para los pacientes en cuidados críticos, lo que conduce a una recuperación más rápida. Por este motivo, se espera que una recuperación más rápida y la rehabilitación para una vida normal actúen como una oportunidad para el crecimiento de la demanda del mercado de equipos para cuidados críticos en América del Norte.

-

Aumento de los avances técnicos en equipos

Los cuidados críticos siempre han sido un campo dependiente de la tecnología y los datos. A medida que los macrodatos y la tecnología pueden revolucionar la práctica de los cuidados críticos, las sociedades profesionales están bien posicionadas para asociarse con pacientes, familias, profesionales, investigadores, líderes de la industria, formuladores de políticas y administradores para garantizar que la atención al paciente humanista, de alto valor y en constante mejora siga siendo el objetivo central para el futuro de la medicina de cuidados críticos.

Las recientes innovaciones tecnológicas son la especulación prevista sobre el futuro de los cuidados intensivos. Los crecientes avances técnicos en cuidados intensivos seguirán siendo multiprofesionales, con diversos generalistas, terapeutas, especialistas y subespecialistas que colaborarán sin problemas hacia el objetivo común de una atención al paciente óptima y humanizada en un sistema de atención sanitaria que aprende. La tecnología portátil optimizará los patrones de dotación de personal mediante el seguimiento y la mitigación de las cargas de trabajo excesivas, al tiempo que controla la fatiga mental y física y las distracciones que podrían empeorar la atención al paciente.

Desafío

- Escasez de personal sanitario

Mantener una dotación de personal adecuada en los centros de atención de la salud es esencial para proporcionar un entorno de trabajo seguro para la atención de los pacientes. Cuando se prevé una escasez de personal, los centros de atención de la salud y los empleadores, en colaboración con los servicios de recursos humanos y de salud ocupacional, utilizan estrategias de capacidad de contingencia para planificar y prepararse para mitigar los problemas, como ajustar los horarios del personal, contratar personal calificado adicional y rotar los puestos que respaldan las actividades de atención al paciente.

El personal sanitario y la profesión de enfermería siguen enfrentándose a una escasez de personal debido a la falta de posibles educadores, la alta rotación de personal y la distribución desigual de la fuerza laboral. Las causas de la escasez de enfermeras son numerosas y los problemas que preocupan son que algunas regiones tienen un excedente de enfermeras y un menor potencial de crecimiento, mientras que otras tienen dificultades para satisfacer las necesidades básicas de la población local.

Impacto posterior a la COVID-19 en el mercado de equipos de cuidados intensivos de América del Norte

Se prevé que el aumento de la incidencia de pacientes con COVID-19 impulse la demanda de dispositivos médicos como respiradores, espirómetros, concentradores de oxígeno, máquinas de anestesia, CPAP/BIPAP y otros. Además, el avance de la tecnología actúa como un motor para su crecimiento en el mercado. Sin embargo, el alto costo de los dispositivos y el riesgo asociado con el uso de respiradores actúan como una restricción para su crecimiento en el mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D y lanzamientos de productos, y alianzas estratégicas para mejorar la tecnología y los resultados de las pruebas involucradas en el mercado de equipos de cuidados intensivos de América del Norte.

Acontecimientos recientes

- En septiembre de 2021, SensaCore anunció el lanzamiento del analizador de gases en sangre ST-200 CC Ultra Smart, que es el modelo de gases en sangre altamente avanzado de Sensacore, y es un sistema de electrolitos totalmente automatizado y controlado por microprocesador que utiliza medición directa de corriente con electrodo selectivo de iones (ISE), impedancia (Hct) y tecnología de amperometría (pO2) para realizar análisis de gases en sangre arterial y mediciones de electrolitos.

- En agosto de 2021, Dixion Distribution of Medical Devices GMBH anunció que había completado con éxito el registro de la FDA. La primera serie de equipos, concretamente las mesas de operaciones y las lámparas quirúrgicas Convelar, había recibido certificaciones de la FDA además de la certificación CE ya existente.

Alcance del mercado de equipos de cuidados intensivos en América del Norte

El mercado de equipos de cuidados intensivos de América del Norte está segmentado por tipo de producto, población de pacientes, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

POR TIPO DE PRODUCTO

- Dispositivos terapéuticos

- Dispositivos de monitorización de pacientes

- Dispositivos de diagnóstico

- Unidades y sistemas de UCI

- Otros dispositivos

Según el tipo de producto, el mercado de equipos de cuidados críticos de América del Norte está segmentado en dispositivos terapéuticos, dispositivos de monitoreo de pacientes, dispositivos de diagnóstico, sistemas y unidades de UCI y otros dispositivos.

POR POBLACIÓN DE PACIENTES

- Neonatal

- Pediátrico

- Adultos

- Geriátrico

Sobre la base de la población de pacientes, el mercado de equipos de cuidados críticos de América del Norte está segmentado en neonatos, pediátricos, adultos y geriátricos.

POR USUARIO FINAL

- Hospitales

- Clínicas especializadas

- Centros de cirugía ambulatoria

- Otros

Sobre la base del usuario final, el mercado de equipos de cuidados críticos de América del Norte está segmentado en hospitales, clínicas especializadas, centros quirúrgicos ambulatorios y otros.

POR CANAL DE DISTRIBUCIÓN

- Licitación directa

- Ventas al por menor

- Distribución de terceros

- Otros

Sobre la base del canal de distribución, el mercado de equipos de cuidados críticos de América del Norte está segmentado en licitación directa, ventas minoristas, distribución a terceros y otros.

Análisis y perspectivas regionales del mercado de equipos de cuidados intensivos de América del Norte

Se analiza el mercado de equipos de cuidados críticos de América del Norte y se proporciona información sobre el tamaño del mercado, el tipo de producto, la población de pacientes, el usuario final y el canal de distribución.

Los países cubiertos en este informe de mercado son Estados Unidos, Canadá y México.

- En 2023, se espera que Estados Unidos domine el mercado de equipos de cuidados intensivos de América del Norte debido a la presencia de actores clave del mercado en el mercado de consumo más grande con un PIB alto. Se espera que crezca debido a los nuevos avances tecnológicos en el mercado de equipos de cuidados intensivos.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de equipos de cuidados intensivos en América del Norte

El panorama competitivo del mercado de equipos de cuidados intensivos de América del Norte proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado de equipos de cuidados intensivos de América del Norte.

Algunos de los principales actores que operan en el mercado de equipos de cuidados críticos de América del Norte son Koninklijke Philips NV, General Electric Company, COOK MEDICAL LLC, Abbott, Medtronic, Getinge AB, heyer medical AG, Drägerwerk AG & Co. KGaA, ICU Medical, Inc., NIHON KOHDEN CORPORATION., Fresenius Medical Care AG & Co. KGaA, Skanray Technologies Ltd., Boston Scientific Corporation, STERIS, Advin Health Care, Baxter, SS TECHNOMED (P) LTD., SCHILLER, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nonin, Dixion distribución de dispositivos médicos GmbH, Masimo y Compumedics Limited, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 CONCLUSION:

6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISORDERS

7.1.2 INCREASED NUMBER OF PATIENTS TREATED IN EMERGENCY CARE AND INTENSIVE CARE UNITS

7.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES AND ADVANCE IN TECHNOLOGY.

7.1.4 RISE IN THE GERIATRIC POPULATION

7.2 RESTRAINTS

7.2.1 LACK OF SKILLED PROFESSIONALS

7.2.2 STRINGENT REGULATION FOR PRODUCT APPROVAL

7.2.3 HIGH COST OF EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 GROWTH IN HEALTHCARE EXPENDITURE

7.3.2 RISE IN TECHNICAL DEVELOPMENTS IN EQUIPMENTS

7.3.3 STRATEGIC INITIATIVES BY KEY PLAYERS

7.4 CHALLENGES

7.4.1 HEALTHCARE STAFF SHORTAGES

7.4.2 LACK OF TRAINING AND IMPROPER CARE BY STAFF

8 IMPACT OF COVID-19 ON THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

8.1 AFTERMATH OF COVID-19 AND THE GOVERNMENT ROLE

8.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.3 PRICE IMPACT

8.4 IMPACT ON SUPPLY CHAIN

8.5 IMPACT ON DEMAND

8.6 CONCLUSION

9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 THERAPEUTIC DEVICES

9.2.1 VENTILATOR

9.2.1.1 VENTILATOR, BY TYPE

9.2.1.1.1 INVASIVE

9.2.1.1.1.1 VOLUME-CYCLED VENTILATORS

9.2.1.1.1.2 PRESSURE-CYCLED VENTILATORS

9.2.1.1.1.3 CONTINUOUS POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.4 BI-LEVEL POSITIVE AIRWAY PRESSURE VENTILATORS

9.2.1.1.1.5 FLOW-CYCLED VENTILATORS

9.2.1.1.1.6 TIME-CYCLED VENTILATORS

9.2.1.1.2 NON-INVASIVE

9.2.1.1.2.1 CONTINUOUS POSITIVE AIRWAY PRESSURE (CPAP)

9.2.1.1.2.2 AUTOTITRATING (ADJUSTABLE) POSITIVE AIRWAY PRESSURE (APAP)

9.2.1.1.2.3 BILEVEL POSITIVE AIRWAY PRESSURE (BIPAP)

9.2.1.2 VENTILATOR, BY PRODUCT

9.2.1.2.1 HIGH-END VENTILATORS

9.2.1.2.2 BASIC VENTILATORS

9.2.1.2.3 MID-END VENTILATORS

9.2.2 DEFIBRILLATOR & SUCTION PUMP

9.2.3 PHOTOTHERAPY EQUIPMENT

9.2.4 SYRINGE PUMPS

9.3 PATIENT MONITORING DEVICES

9.3.1 CARDIAC MONITORING DEVICES

9.3.1.1 EVENT MONITORS

9.3.1.2 ECG DEVICES

9.3.1.3 IMPLANTABLE LOOP RECORDERS

9.3.2 RESPIRATORY MONITORING DEVICES

9.3.2.1 PULSE OXIMETERS

9.3.2.2 SPIROMETERS

9.3.2.3 CAPNOGRAPHS

9.3.2.4 PEAK FLOW METERS

9.3.3 NEUROMONITORING DEVICES

9.3.3.1 ELECTROENCEPHALOGRAPH MACHINES

9.3.3.2 ELECTROMYOGRAPHY MACHINE

9.3.3.3 MAGNETOENCEPHALOGRAPH MACHINES

9.3.3.4 CEREBRAL OXIMETERS

9.3.3.5 INTRACRANIAL PRESSURE MONITORS

9.3.3.6 TRANSCRANIAL DOPPLER MACHINES

9.3.4 TEMPERATURE MONITORING DEVICES

9.3.4.1 HANDHELD TEMPERATURE MONITORING DEVICES

9.3.4.2 TABLE-TOP TEMPERATURE MONITORING DEVICES

9.3.4.3 INVASIVE TEMPERATURE MONITORING DEVICES

9.3.5 HEMODYNAMIC/PRESSURE MONITORING DEVICES

9.3.5.1 HEMODYNAMIC MONITORS

9.3.5.2 BLOOD PRESSURE MONITORING DEVICES

9.3.5.3 DISPOSABLES

9.3.6 MULTI-PARAMETER MONITORING DEVICES

9.3.6.1 HIGH-ACUITY MONITORING DEVICES

9.3.6.2 LOW-ACUITY MONITORING DEVICES

9.3.6.3 MID-ACUITY MONITORING DEVICES

9.4 DIAGNOSTIC DEVICES

9.4.1 ELECTROCARDIOGRAM (ECG) MACHINE

9.4.2 MOBILE X-RAY MACHINE

9.4.3 ULTRASONOGRAPHY MACHINE

9.4.4 ABG MACHINE

9.5 ICU UNITS & SYSTEMS

9.5.1 MEDICAL SUPPLY SYSTEMS

9.5.1.1 CEILING SUPPLY UNITS

9.5.1.2 WALL-MOUNT SUPPLY UNITS

9.5.2 SURGICAL AND EXAMINATION LIGHTS

9.5.2.1 SURGICAL LIGHT

9.5.2.2 EXAMINATION LIGHT

9.5.3 OTHERS

9.6 OTHER DEVICES

9.6.1 MEDICAL ACCESSORIES AND CONSUMABLES

9.6.1.1 CATHETERS

9.6.1.2 ECG LEADS

9.6.1.3 BABYFLOW PLUS

9.6.1.4 ANESTHESIA CIRCUIT KITS

9.6.1.5 POSITIVE AIRWAYS PRESSURE (PAP) SYSTEM

9.6.1.6 OTHERS

9.6.2 INFANT WARMERS & INCUBATORS

9.6.2.1 NICU WARMERS

9.6.2.2 TRANSPORT INCUBATOR

9.6.2.3 LABOR AND DELIVERY WARMER

9.6.3 INFUSION PUMP

9.6.4 ANESTHESIA MACHINE

9.6.5 BLOOD WARMER

9.6.6 SLEEP APNEA DEVICES

9.6.7 OTHERS

10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION

10.1 OVERVIEW

10.2 NEONATAL

10.3 PEDIATRIC

10.4 GERIATRIC

10.5 ADULTS

11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ACUTE CARE HOSPITALS

11.2.2 LONG TERM CARE HOSPITALS

11.3 SPECIALTY CLINICS

11.4 AMBULATORY SURGICAL CENTRES

11.5 OTHERS

12 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 RETAIL SALES

12.3 DIRECT TENDER

12.4 THIRD PARTY DISTRIBUTION

12.5 OTHERS

13 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KONINKLIJKE PHILIPS N.V.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ABBOTT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL ELECTRIC COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BAXTER

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 MEDTRONIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVIN HEALTH CARE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOSTON SCIENTIFIC CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 COMPUMEDICS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COOK

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DRÄGERWERK AG & CO. KGAA.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIXION DISTRIBUTION OF MEDICAL DEVICES GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FRESENIUS SE & CO. KGAA

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 GETING AB

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HEYER MEDICAL AG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ICU MEDICAL

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 MASIMO

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS.

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIHON KOHDEN CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 NONIN

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 STERIS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SKANRAY TECHNOLOGIES INC

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 SS TECHNOMED (P) LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SCHILLER

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 RESPIRATORY DISEASES WORLDWIDE HEALTH BURDEN IN 2019

TABLE 2 PRICES OF A FEW VENTILATORS

TABLE 3 AVERAGE DAILY COST FOR STAY IN ICU BY HOSPITAL TYPE, 2013–2014

TABLE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA NEONATAL IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PEDIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA GERIATRIC IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA ADULTS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SPECIALTY CLINICS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALES IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA THIRD PARTY DISTRIBUTION IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN CRITICAL CARE EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 49 NORTH AMERICA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 NORTH AMERICA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 59 NORTH AMERICA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 60 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 62 NORTH AMERICA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 63 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 65 NORTH AMERICA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 66 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 68 NORTH AMERICA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 69 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 71 NORTH AMERICA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 72 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 74 NORTH AMERICA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 75 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 77 NORTH AMERICA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 78 NORTH AMERICA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 81 NORTH AMERICA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 82 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 84 NORTH AMERICA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 85 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 87 NORTH AMERICA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 88 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 90 NORTH AMERICA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 91 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 93 NORTH AMERICA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 94 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 98 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 101 U.S. THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 102 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 104 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 105 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.S. INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 107 U.S. NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 U.S. PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 111 U.S. CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 112 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 114 U.S. RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 115 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 117 U.S. NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 118 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 120 U.S. TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 121 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 122 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 124 U.S. HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 125 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 127 U.S. MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 128 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 129 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 130 U.S. DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 131 U.S. ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 132 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 134 U.S. MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 135 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 137 U.S. SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 138 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 140 U.S. OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 141 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 142 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 143 U.S. MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 144 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 145 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 146 U.S. INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 147 U.S. CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 148 U.S. CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 149 U.S. HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 150 U.S. CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 151 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 152 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 153 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 154 CANADA THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 155 U.S. VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 CANADA VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 CANADA INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 160 CANADA NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 161 CANADA PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 162 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 163 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 164 CANADA CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 165 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 166 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 167 CANADA RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 168 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 169 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 170 CANADA NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 171 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 172 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 173 CANADA TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 174 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 175 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 176 CANADA HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 177 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 178 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 179 CANADA MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 180 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 181 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 182 CANADA DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 183 CANADA ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 186 CANADA MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 187 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 188 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 189 CANADA SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 190 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 191 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 192 CANADA OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 193 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 195 CANADA MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 196 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 198 CANADA INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 199 CANADA CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 200 CANADA CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 201 CANADA HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 202 CANADA CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 203 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 205 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 206 MEXICO THERAPEUTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 207 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 208 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 209 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 210 MEXICO VENTILATOR IN CRITICAL CARE EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 MEXICO INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 212 MEXICO NON-INVASIVE IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 213 MEXICO PATIENT MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 214 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 215 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 216 MEXICO CARDIAC MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 217 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 219 MEXICO RESPIRATORY MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 220 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 221 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 222 MEXICO NEUROMONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 223 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 224 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 225 MEXICO TEMPERATURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 226 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 227 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 228 MEXICO HEMODYNAMIC/PRESSURE MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 229 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 230 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 231 MEXICO MULTI-PARAMETER MONITORING DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 232 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 233 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 234 MEXICO DIAGNOSTIC DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 235 MEXICO ICU UNITS & SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 236 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 237 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 238 MEXICO MEDICAL SUPPLY SYSTEMS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 239 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 240 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 241 MEXICO SURGICAL AND EXAMINATION LIGHTS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 242 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 243 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 244 MEXICO OTHER DEVICES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 245 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 247 MEXICO MEDICAL ACCESSORIES AND CONSUMABLES IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 248 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (UNIT)

TABLE 250 MEXICO INFANT WARMERS & INCUBATORS IN CRITICAL CARE EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 251 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY PATIENT POPULATION, 2021-2030 (USD MILLION)

TABLE 252 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 253 MEXICO HOSPITALS IN CRITICAL CARE EQUIPMENT MARKET, BY END USER 2021-2030 (USD MILLION)

TABLE 254 MEXICO CRITICAL CARE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 INCREASING CHRONIC DISORDERS AND THE NUMBER OF PATIENT IN ICU AND NICU IS EXPECTED TO DRIVE THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 THERAPEUTIC DEVICES IS EXPECTED TO HAVE THE LARGEST SHARE OF NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET

FIGURE 15 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2022

FIGURE 16 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 17 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 18 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2022

FIGURE 20 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, 2023-2030 (USD MILLION)

FIGURE 21 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, CAGR (2023-2030)

FIGURE 22 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY PATIENT POPULATION, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2022

FIGURE 24 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 25 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 26 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 28 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 29 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 30 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: PRODUCT TYPE (2023-2030)

FIGURE 36 NORTH AMERICA CRITICAL CARE EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.