North America Dark Fiber Networks Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.32 Billion

USD

5.66 Billion

2025

2033

USD

2.32 Billion

USD

5.66 Billion

2025

2033

| 2026 –2033 | |

| USD 2.32 Billion | |

| USD 5.66 Billion | |

|

|

|

|

Segmentación del mercado de redes de fibra oscura en Norteamérica , por tipo de fibra (fibra multimodo [MMF] y fibra monomodo [SMF]), tipo de red (fibra oscura metropolitana y fibra oscura de larga distancia), material (fibra de vidrio y fibra óptica plástica [POF]), aplicación (conectividad de retorno, interconexión de centros de datos [DCI], redes empresariales y privadas, transporte de larga distancia, redundancia y resiliencia de red, entre otros), usuario final (TI y telecomunicaciones, BFSI, gobierno y sector público, atención médica, universidades e institutos de investigación, industria y manufactura, medios y entretenimiento, entre otros), canal de ventas (ventas directas e indirectas): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de redes de fibra oscura en América del Norte

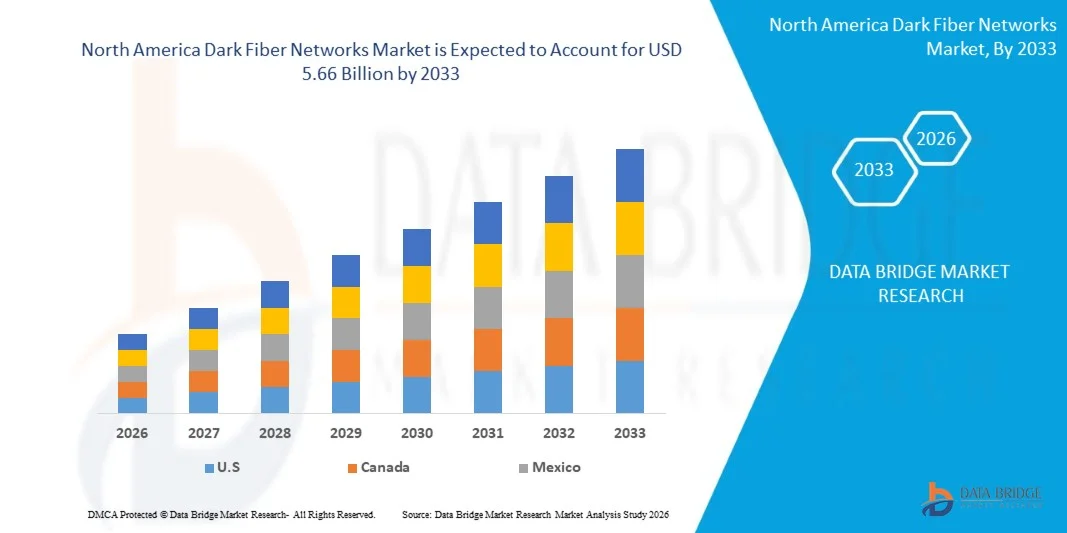

- El tamaño del mercado de redes de fibra oscura de América del Norte se valoró en USD 2.32 mil millones en 2025 y se espera que alcance los USD 5.66 mil millones para 2033 , con una CAGR del 11,9% durante el período de pronóstico.

- El crecimiento del mercado se debe principalmente a la creciente demanda de fibra multimodo (MMF) y fibra monomodo (SMF) en sectores clave como BFSI, TI y telecomunicaciones, gobierno y sector público, y sanidad. La creciente inversión en conectividad de alta velocidad, el creciente despliegue de infraestructuras 5G y el rápido crecimiento de los centros de datos impulsan aún más la adopción de la fibra oscura. Además, la creciente transformación digital empresarial y la creciente necesidad de entornos de red seguros, escalables y de baja latencia están fortaleciendo la demanda general de redes de fibra oscura a nivel regional.

- La creciente preferencia de los consumidores por la fibra oscura metropolitana y de larga distancia está consolidando la posición de las redes de fibra oscura. Este cambio se debe a la creciente demanda de ancho de banda, el auge de las aplicaciones en la nube y la necesidad de rutas de red privadas dedicadas para operaciones críticas. A medida que las organizaciones priorizan la conectividad resiliente y con visión de futuro, la fibra oscura se considera cada vez más un activo estratégico, acelerando su implementación entre operadores de telecomunicaciones, hiperescaladores, empresas y proyectos de ciudades inteligentes, contribuyendo así significativamente a la expansión regional del mercado de redes de fibra oscura en Norteamérica.

Análisis del mercado de redes de fibra oscura en América del Norte

- Las redes de fibra oscura, infraestructura de fibra óptica sin uso ni iluminación, alquilada o en propiedad de operadores de telecomunicaciones, centros de datos y empresas, son cada vez más vitales en diversos sectores, como TI y telecomunicaciones, BFSI, salud, medios de comunicación y entretenimiento, y redes gubernamentales. Sus ventajas inherentes, como la alta capacidad de ancho de banda, la latencia ultrabaja, la seguridad mejorada y la escalabilidad, las hacen esenciales para soportar aplicaciones digitales modernas como el backhaul 5G, los ecosistemas del IoT, la computación en la nube y el procesamiento de datos en el borde.

- La creciente demanda de redes de fibra oscura se debe principalmente al aumento del consumo de datos, la rápida transformación digital en las empresas, la expansión de los centros de datos a gran escala y la creciente necesidad de rutas de red seguras, dedicadas y de alto rendimiento. Además, el aumento de las inversiones en infraestructura 5G, el fomento regulatorio para el despliegue de banda ancha de alta velocidad y la presión de toda la industria para garantizar la fiabilidad, la redundancia y la continuidad operativa de la red están acelerando la adopción de la fibra oscura en los mercados regionales.

- Estados Unidos domina el mercado de redes de fibra oscura de América del Norte, representando el 81,25 % de los ingresos totales en 2025, impulsado por fuertes inversiones en infraestructura de fibra, rápida expansión de 5G, alta concentración de centros de datos de hiperescala y creciente adopción de redes de fibra privadas por parte de empresas de tecnología y proveedores de servicios en la nube.

- Se prevé que Canadá sea la región de mayor crecimiento en el mercado de redes de fibra oscura de Norteamérica durante el período de pronóstico, impulsado por la rápida expansión de los centros de datos, el amplio despliegue de 5G, la creciente adopción de la nube y las sólidas inversiones de los operadores de telecomunicaciones y las empresas de gran escala. La región se beneficia de una infraestructura de red avanzada, la creciente demanda empresarial de conectividad privada y segura, y el importante apoyo gubernamental a la modernización de la banda ancha. Estados Unidos y Canadá son los principales contribuyentes, debido al alto consumo de ancho de banda, los densos despliegues de fibra metropolitana y la presencia de importantes empresas tecnológicas y proveedores de servicios en la nube a gran escala.

- Se proyecta que el segmento de fibra multimodo (MMF) domine el mercado con una participación del 63,15 % en 2026, debido a su relación costo-beneficio, su capacidad de alto ancho de banda en distancias cortas y su creciente implementación en centros de datos, redes LAN empresariales y redes de campus donde la fibra multimodo admite conectividad de alta velocidad escalable y económica.

Alcance del informe y segmentación del mercado de redes de fibra oscura en América del Norte

|

Atributos |

Perspectivas clave del mercado de las redes de fibra oscura en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de redes de fibra oscura en América del Norte

La aceleración del tráfico digital impulsa la transición hacia una infraestructura de fibra oscura de alta capacidad .

- Una tendencia importante y emergente en el mercado norteamericano de redes de fibra oscura es la rápida expansión de la infraestructura óptica de alta capacidad, impulsada por la aceleración del tráfico digital a nivel mundial. El crecimiento explosivo de la transmisión de video, las cargas de trabajo en la nube, la digitalización empresarial y las aplicaciones de datos en tiempo real está impulsando a operadores y empresas a adoptar rutas de fibra oscura que ofrecen ancho de banda escalable, latencia ultrabaja y un rendimiento resiliente a larga distancia.

- Los principales proveedores regionales, como Zayo Group, Lumen Technologies, Colt Technology Services, Verizon y varios operadores regionales, están intensificando sus inversiones en transporte óptico a escala de terabits, sistemas DWDM abiertos, herramientas de aprovisionamiento optimizadas con IA y soluciones de capacidad bajo demanda. El auge de la orquestación inteligente del tráfico, la optimización automatizada de rutas y la monitorización predictiva de la red permite a los operadores gestionar sin problemas el rápido crecimiento de las cargas de datos, minimizando al mismo tiempo la congestión y las fluctuaciones de latencia.

- Los despliegues de fibra oscura a nivel metropolitano, regional e internacional se están acelerando, gracias a actualizaciones de redes troncales multiterabit, ampliaciones de rutas y arquitecturas de fibra altamente redundantes. Este crecimiento se ve impulsado por la creciente demanda de ancho de banda de los centros de datos de hiperescala, las iniciativas de densificación 5G, los requisitos de conectividad transfronteriza en la nube y las cargas de trabajo empresariales, como el entrenamiento de modelos de IA, el análisis de big data, la telemetría del IoT y la computación en el borde.

- Los sistemas ópticos basados en IA, con sintonización adaptativa de longitud de onda, amplificadores inteligentes, formatos de modulación autoajustables y optimización de señal en tiempo real, se están volviendo esenciales para gestionar el creciente rendimiento de datos. Estos sistemas mejoran la eficiencia espectral y garantizan un rendimiento constante de la red sin intervención manual frecuente, lo que los hace cruciales para los ecosistemas de fibra oscura preparados para el futuro.

- La fibra oscura se integra cada vez más con instalaciones edge, redes empresariales privadas, entornos de IoT industrial y sectores de misión crítica como BFSI, salud, manufactura, medios de comunicación e infraestructura inteligente. Su capacidad para soportar el transporte rápido de datos, el procesamiento localizado y las operaciones ininterrumpidas de alto volumen se vuelve indispensable a medida que se intensifican las cargas de trabajo digitales.

- Esta transición hacia una infraestructura de fibra oscura optimizada para IA, con gran ancho de banda y preparada para la expansión está transformando la dinámica del mercado, trasladando la industria de los modelos tradicionales de arrendamiento estático a redes ópticas inteligentes, escalables y programables. Ante el crecimiento sin precedentes del tráfico digital, los operadores están acelerando las inversiones en sistemas de fibra oscura con garantía de futuro, diseñados para satisfacer la creciente necesidad mundial de transmisión de datos de alta capacidad y alta velocidad.

Dinámica del mercado de redes de fibra oscura en América del Norte

Conductor

El creciente consumo de datos impulsa la demanda de redes de alta capacidad.

- El consumo explosivo de datos es uno de los principales impulsores del mercado norteamericano de redes de fibra oscura. Con el rápido crecimiento de la computación en la nube, la transmisión de video, las cargas de trabajo de IA/ML, los dispositivos IoT y las aplicaciones en tiempo real, el tráfico de datos ha aumentado exponencialmente. Las empresas y los proveedores de servicios ahora requieren un ancho de banda masivo, una latencia ultrabaja y conexiones de alta capacidad que los servicios tradicionales de fibra oscura a menudo tienen dificultades para ofrecer. La fibra oscura permite a los usuarios "iluminar" su propia infraestructura de fibra con equipos ópticos avanzados, lo que les permite escalar libremente el ancho de banda y gestionar grandes volúmenes de datos sin depender de redes compartidas. Esto hace que la fibra oscura sea muy atractiva para industrias con uso intensivo de datos, como centros de datos de hiperescala, operadores de telecomunicaciones, servicios financieros y empresas de medios.

- Además, la transición hacia la transformación digital, el teletrabajo y las estrategias que priorizan la nube aumentan la presión sobre la capacidad de la red. A medida que las aplicaciones se vuelven más exigentes con los datos, desde la transmisión en 4K/8K hasta el entrenamiento de modelos de IA, la computación en el borde y las implementaciones masivas de IoT, las organizaciones necesitan una conectividad dedicada, segura y de alto rendimiento. La fibra oscura proporciona la base ideal para satisfacer estas crecientes y fluctuantes demandas de datos, ofreciendo una escalabilidad superior, capacidad con garantía de futuro y control operativo. Como resultado, el crecimiento explosivo de los datos sigue siendo un factor clave que acelera la adopción de la fibra oscura en todo el mundo.

- Por ejemplo, en 2024, según la UIT, el tráfico regional de internet alcanzó la escala de zettabytes, con redes de banda ancha fija transportando aproximadamente 6 zettabytes (ZB) de datos, frente a los aproximadamente 5,1 ZB de 2023, mientras que el tráfico de banda ancha móvil superó 1 ZB por primera vez en 2023. Este aumento sin precedentes pone de manifiesto cómo el uso intensivo de datos se está desplazando cada vez más hacia redes fijas de alta capacidad que admiten streaming, servicios en la nube y cargas de trabajo de IA. Dado que las redes fijas absorben la mayor parte del tráfico regional, la fibra oscura se ha vuelto esencial para operadores y empresas que buscan una infraestructura escalable, de alto ancho de banda y baja latencia.

Restricción/Desafío

“ Un alto gasto de capital (CAPEX) requiere una gran inversión inicial ”

- Los elevados gastos de capital (CapEx) representan una importante barrera de entrada al mercado norteamericano de redes de fibra oscura. Establecer una infraestructura de fibra oscura implica importantes inversiones iniciales en el tendido de cables de fibra óptica, la adquisición de derechos de paso, la compra de equipos de red y la implementación de tecnologías de soporte. Estos costos iniciales pueden ascender a millones de dólares, lo que dificulta la entrada al mercado de nuevos actores o empresas más pequeñas sin un respaldo financiero sustancial. Como resultado, las empresas pueden mostrarse reticentes a invertir recursos, lo que frena la expansión de las redes de fibra oscura a pesar de la creciente demanda de conectividad fiable y de alta velocidad.

- Además, el largo periodo de recuperación asociado a las inversiones en fibra oscura acentúa aún más esta limitación. A diferencia de los servicios de red activos, la fibra oscura suele generar ingresos solo cuando se arrienda a terceros, lo que puede tardar varios años en recuperar la inversión inicial. Este riesgo financiero desalienta las inversiones, especialmente en regiones con demanda incierta o obstáculos regulatorios. En consecuencia, los elevados requisitos de inversión en capital (CapEx) limitan el crecimiento del mercado al restringir el número de actores dispuestos o capaces de invertir en proyectos de despliegue de fibra oscura a gran escala a nivel regional.

- Por ejemplo, en julio de 2024, el Financial Express publicó un artículo sobre la fibra óptica de torres en las telecomunicaciones indias, en el que se indicaba que se necesitarían entre 2 y 3 billones de rupias indias (2-3 billones de rupias indias) para la fibra óptica completa de las torres de telecomunicaciones en todo el país. Una inversión de capital tan sustancial subraya que la ampliación de la infraestructura de fibra oscura y backhaul —crucial para el 5G y la conectividad de alta velocidad— requiere una inversión de capital muy alta, lo que a menudo frena a los operadores para una expansión rápida.

Alcance del mercado de redes de fibra oscura en América del Norte

El mercado de redes de fibra oscura de América del Norte está segmentado en seis segmentos notables según el tipo de fibra, el tipo de red, el material, la aplicación, el usuario final y el canal de ventas.

- Por tipo de fibra

Según el tipo de fibra, el mercado norteamericano de redes de fibra oscura se segmenta en fibra monomodo (SMF) y fibra multimodo (MMF). En 2026, se prevé que la fibra multimodo (MMF) domine el mercado con una cuota de mercado del 63,15 % gracias a su rentabilidad, su alto ancho de banda en distancias cortas y su creciente implementación en centros de datos, redes LAN empresariales y redes de campus, donde la fibra multimodo permite una conectividad de alta velocidad escalable y económica.

El segmento de fibra monomodo (SMF) es el de más rápido crecimiento, registrando una CAGR del 12,2 % durante el período de pronóstico de 2026 a 2033, debido a su capacidad para soportar transmisiones de gran ancho de banda y larga distancia con una pérdida de señal mínima.

- Por tipo de red

Según el tipo de red, el mercado norteamericano de redes de fibra oscura se segmenta en fibra oscura metropolitana y fibra oscura de larga distancia. En 2026, se prevé que la fibra oscura metropolitana domine el mercado con una cuota del 58,56 % debido a la rápida digitalización urbana, la densificación de las redes de celdas pequeñas 5G, la creciente demanda empresarial de conectividad metropolitana de alta capacidad y la creciente necesidad de rutas de fibra de baja latencia dentro de las áreas metropolitanas.

El segmento de fibra oscura metropolitana es el de más rápido crecimiento, registrando una CAGR del 12,1 % durante el período de pronóstico de 2026 a 2033, debido a la creciente demanda de conectividad de alta capacidad y baja latencia en las redes urbanas.

- Por material

En cuanto al material, el mercado norteamericano de redes de fibra oscura se segmenta en fibra de vidrio y fibra óptica plástica (POF). En 2026, se prevé que la fibra de vidrio domine el mercado con una cuota de mercado del 62,41 % gracias a su excelente rendimiento de transmisión, baja atenuación, alta durabilidad y amplio uso en redes de larga distancia, metropolitanas y de centros de datos de alta capacidad, donde la fiabilidad y la integridad de la señal son fundamentales.

El segmento de fibra de vidrio es el de más rápido crecimiento, registrando una CAGR del 12,2% durante el período de pronóstico de 2026 a 2033, debido a su capacidad de ancho de banda superior, baja pérdida de señal y creciente adopción en redes de comunicación de alta velocidad.

- Por aplicación

Según su aplicación, el mercado norteamericano de redes de fibra oscura se segmenta en conectividad de backhaul, interconexión de centros de datos (DCI), redes empresariales y privadas, transporte de larga distancia, redundancia y resiliencia de red, entre otros. En 2026, se prevé que la conectividad de backhaul domine el mercado con un 38,65 % debido a la creciente demanda de redes de transporte móvil de alta velocidad, la expansión de la implementación de 5G, el creciente tráfico de IoT y servicios en la nube, y la necesidad de infraestructura de backhaul de baja latencia y alta capacidad por parte de operadores de telecomunicaciones y empresas.

El segmento de conectividad de backhaul es el de más rápido crecimiento, registrando una CAGR de 12,3% durante el período de pronóstico de 2026 a 2033, debido al creciente despliegue de redes 5G y la creciente necesidad de transporte de datos de alta capacidad.

- Por el usuario final

En función del usuario final, el mercado norteamericano de redes de fibra oscura se segmenta en BFSI, TI y telecomunicaciones, gobierno y sector público, salud, universidades e institutos de investigación, medios y entretenimiento, industria y manufactura, entre otros. En 2026, se prevé que TI y telecomunicaciones dominen el mercado con un 46,74 % debido al aumento exponencial del tráfico de datos, la mayor inversión en infraestructura 5G y en la nube, y la necesidad de conectividad de fibra segura, escalable y de alto ancho de banda para operadores de telecomunicaciones, hiperescaladores y proveedores de servicios de internet.

El segmento de TI y telecomunicaciones es el de más rápido crecimiento, registrando una CAGR de 12,4% durante el período de pronóstico de 2026 a 2033, debido a la creciente digitalización, el aumento del tráfico de datos y la creciente adopción de tecnologías de comunicación avanzadas.

- Por canal de venta

Según el canal de venta, el mercado norteamericano de redes de fibra oscura se segmenta en ventas directas e indirectas. En 2026, se prevé que las ventas directas dominen el mercado con una cuota del 60,30 % gracias a la adquisición de fibra a gran escala por parte de operadores de telecomunicaciones, proveedores de servicios en la nube y empresas, que prefieren acuerdos directos para rutas de fibra oscura personalizadas, arrendamientos a largo plazo y un mayor control sobre el rendimiento y la seguridad de la red.

El segmento de ventas directas es el de más rápido crecimiento, registrando una CAGR del 12,1% durante el período de pronóstico de 2026 a 2033, debido a la creciente preferencia por la interacción personalizada con el cliente y una mayor eficiencia de conversión.

Perspectiva del mercado de redes de fibra oscura en América del Norte

Norteamérica crece a una sólida tasa de crecimiento anual compuesta (TCAC) del 11,9 %. El crecimiento de la región es constante y sólido, impulsado por fuertes inversiones en infraestructura de fibra, la rápida expansión del 5G, la alta concentración de centros de datos a gran escala y la creciente adopción de redes privadas de fibra por parte de empresas tecnológicas y proveedores de servicios en la nube.

Perspectiva del mercado de redes de fibra oscura en América del Norte y EE. UU.

Estados Unidos es la fuerza dominante en el mercado norteamericano de redes de fibra oscura, con proyecciones de expansión a una sólida tasa de crecimiento anual compuesta (TCAC) del 12,1 % entre 2026 y 2033. Este crecimiento se debe a la rápida expansión de aplicaciones con uso intensivo de datos, la creciente demanda de servicios en la nube y coubicación, el despliegue a gran escala de 5G y las continuas inversiones de operadores de telecomunicaciones y centros de datos de hiperescala. Además, la creciente demanda de redes de alta capacidad, seguras y de baja latencia, especialmente en los sectores empresarial, de servicios de TI, BFSI, salud, gobierno y medios de comunicación y entretenimiento, continúa acelerando la adopción del mercado.

Cuota de mercado de las redes de fibra oscura en América del Norte

La industria de redes de fibra oscura está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Lumen Technologies (EE. UU.)

- Crown Castle (EE. UU.)

- Zayo Group, LLC (EE. UU.)

- Charter Communications (EE. UU.)

- CIRION (EE. UU.)

- Cogent Communications (EE. UU.)

- Comunicaciones DQE (EE. UU.)

- Everstream Solutions, LLC (EE. UU.)

- Fiber Light, LLC (EE. UU.)

- First Light Fiber, Inc. (EE. UU.)

- Frontier Communications Parent, Inc. (EE. UU.)

- LIGHTPATH (EE. UU.)

- PS Lightwave LLC (EE. UU.)

- Segra (EE. UU.)

- Servicios de Comunicaciones Stealth, LLC. (EE. UU.)

- Corporación Uniti (EE. UU.)

- Verizon (EE. UU.)

Últimos avances en el mercado de redes de fibra oscura en América del Norte

- En julio de 2025, Lumen Technologies anunció que proporcionará la red de retorno terrestre de fibra oscura para el sistema de cable transpacífico JUNO, que conecta Japón con EE. UU. La red de Lumen conecta el cable JUNO en Grover Beach, California, con los principales puntos de presencia (PoP) en San José y Los Ángeles, lo que permite el transporte de red privada de alta capacidad a centros de datos en la nube y redes empresariales clave en EE. UU. La alianza respalda la capacidad de 350 Tbps de JUNO a través de 20 pares de fibra, aprovechando la tecnología SDM, y tiene como objetivo facilitar la IA de próxima generación, la innovación basada en datos y una conectividad transpacífica fluida para empresas globales.

- En mayo de 2025, Cirion amplió su capacidad de red al agregar más de 1.580 km de rutas de fibra de larga distancia y 447 km de rutas de fibra metropolitana en América Latina, impulsando la capacidad de la red óptica terrestre a 668 Tb/s y mejorando la interconexión de centros de datos y las capacidades de peering.

- En marzo de 2025, Crown Castle cerró un acuerdo para vender su negocio de Soluciones de Fibra a Zayo Group Holdings Inc. por aproximadamente 4.250 millones de dólares, como parte de una operación más amplia de 8.500 millones de dólares que también incluyó la venta de su negocio de celdas pequeñas al fondo EQT Active Core Infrastructure. Esta desinversión representa el reenfoque estratégico de Crown Castle en su negocio principal de infraestructura de torres, al tiempo que permite a Zayo expandir su cobertura de fibra y mejorar las soluciones de conectividad esenciales para impulsar el 5G, el crecimiento de la IA, los servicios en la nube y a los clientes empresariales en áreas metropolitanas clave de EE. UU.

- En febrero de 2025, LuxConnect firmó un importante acuerdo de Derecho de Uso Indefectible (IRU) con LuxNetwork, que le permite ampliar su red nacional en más de 400 km utilizando la infraestructura de fibra oscura de LuxConnect. Este acuerdo garantiza el servicio durante 10 años y respalda la conectividad de última generación a 400 Gbps, lo que mejora la infraestructura digital de Luxemburgo y las interconexiones europeas.

- En enero de 2023, Global Connect Carrier se asoció con ConnectiviTree para ofrecer servicios de fibra oscura, larga distancia y acceso en el norte de Europa. ConnectiviTree proporciona servicios de valor añadido. Esta colaboración facilita rutas con redundancia múltiple, alta seguridad y conectividad de baja latencia, a la vez que apoya futuros proyectos de centros de datos y la expansión geográfica. Esta alianza fortalecerá el alcance internacional de la red de Global Connect Carrier y consolidará su posición como operador líder en los países nórdicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DARK FIBER NETWORKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FIBER TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPETITIVE ANALYSIS – NORTH AMERICA DARK FIBER NETWORKS MARKET (DETAILED VERSION)

4.2 COMPETITOR PRICING STRATEGIES IN THE NORTH AMERICA DARK FIBER MARKET

4.3 PENETRATION AND GROWTH PROSPECT MAPPING – NORTH AMERICA DARK FIBRE NETWORKS MARKET

4.4 TECHNOLOGY ANALYSIS — NORTH AMERICA DARK FIBER NETWORKS MARKET

4.5 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR:

4.6 USED CASES & THEIR ANALYSIS

4.7 GROSSE POINTE PUBLIC SCHOOL SYSTEM DARK FIBER DEPLOYMENT:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DATA CONSUMPTION IS DRIVING DEMAND FOR HIGH-CAPACITY NETWORKS

5.1.2 DEPLOYMENT OF 5G NETWORKS BOOSTS DARK FIBER DEMAND

5.1.3 GROWTH OF HYPERSCALE DATA CENTERS AND CLOUD INFRASTRUCTURE

5.1.4 INCREASING NEED FOR SECURE AND PRIVATE NETWORK

5.2 RESTRAINTS

5.2.1 HIGH CAPITAL EXPENDITURE (CAPEX) REQUIRES A LARGE UPFRONT INVESTMENT

5.2.2 SHORTAGE OF TECHNICAL EXPERTISE

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR ENTERPRISE PRIVATE NETWORKS

5.3.2 EXPANSION OF CROSS-BORDER AND LONG-HAUL CONNECTIVITY

5.3.3 THE EXPANSION OF SMART CITIES AND IOT

5.4 CHALLENGES

5.4.1 MARKET COMPETITION AND PRICING PRESSURE

5.4.2 REGULATORY & RIGHT-OF-WAY (ROW) CHALLENGES

6 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE.

6.1 OVERVIEW

6.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

6.2.1 MULTI-MODE FIBER (MMF)

6.2.2 SINGLE-MODE FIBER (SMF)

6.3 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.3.1 OM3/OM4 FIBER

6.3.2 OM5 FIBER

6.3.3 OM2 FIBER

6.3.4 OM1 FIBER

6.4 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.5.1 OS2 FIBER

6.5.2 OS1 FIBER

6.6 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

6.7.1 METRO DARK FIBER

6.7.2 LONG-HAUL DARK FIBER

6.8 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.8.1 URBAN CONNECTIVITY

6.8.2 5G BACKHAUL

6.8.3 CAMPUS NETWORKS

6.9 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.1 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

6.10.1 INTER-CITY NETWORKS

6.10.2 TRANS-REGIONAL/INTER-COUNTRY NETWORKS

6.10.3 SUBMARINE FIBER NETWORKS

6.11 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL.

7.1 OVERVIEW

7.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

7.2.1 GLASS FIBER

7.2.2 PLASTIC OPTICAL FIBER (POF)

7.3 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.3.1 DOPED SILICA FIBER

7.3.2 PURE SILICA CORE

7.4 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.5.1 STEP-INDEX POF

7.5.2 GRADED-INDEX POF

7.6 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER.

8.1 OVERVIEW

8.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

8.2.1 IT & TELECOMMUNICATIONS

8.2.2 BFSI

8.2.3 GOVERNMENT & PUBLIC SECTOR

8.2.4 HEALTHCARE

8.2.5 UNIVERSITIES & RESEARCH INSTITUTES

8.2.6 INDUSTRIAL & MANUFACTURING

8.2.7 MEDIA & ENTERTAINMENT

8.2.8 OTHERS

8.3 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.3.1 BACKHAUL CONNECTIVITY

8.3.2 DATA CENTER INTERCONNECT (DCI)

8.3.3 ENTERPRISE & PRIVATE NETWORKS

8.3.4 LONG-HAUL TRANSPORT

8.3.5 REDUNDANCY & NETWORK RESILIENCY

8.3.6 OTHERS

8.4 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 MOBILE BACKHAUL

8.4.2 ENTERPRISE BACKHAUL

8.4.3 METRO BACKHAUL

8.5 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 2G/3G/4G NETWORKS

8.5.2 5G SMALL-CELL NETWORKS

8.5.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.6 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 INTRA-CITY DCI

8.6.2 INTER-CITY DCI

8.6.3 CLOUD PROVIDER NETWORKS

8.7 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 PRIVATE WAN/LAN NETWORKS

8.7.2 CAMPUS NETWORKS

8.7.3 INDUSTRIAL IOT NETWORKS

8.8 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 INTER-CITY NETWORKS

8.8.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.9 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 DISASTER RECOVERY NETWORKS

8.9.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.9.3 CARRIER REDUNDANCY

8.1 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.11 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.11.1 BACKHAUL CONNECTIVITY

8.11.2 DATA CENTER INTERCONNECT (DCI)

8.11.3 ENTERPRISE & PRIVATE NETWORKS

8.11.4 LONG-HAUL TRANSPORT

8.11.5 REDUNDANCY & NETWORK RESILIENCY

8.11.6 OTHERS

8.12 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 ENTERPRISE BACKHAUL

8.12.2 MOBILE BACKHAUL

8.12.3 METRO BACKHAUL

8.13 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 2G/3G/4G NETWORKS

8.13.2 5G SMALL-CELL NETWORKS

8.13.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.14 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 INTRA-CITY DCI

8.14.2 INTER-CITY DCI

8.14.3 CLOUD PROVIDER NETWORKS

8.15 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 PRIVATE WAN/LAN NETWORKS

8.15.2 CAMPUS NETWORKS

8.15.3 INDUSTRIAL IOT NETWORKS

8.16 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 INTER-CITY NETWORKS

8.16.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.17 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.17.1 DISASTER RECOVERY NETWORKS

8.17.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.17.3 CARRIER REDUNDANCY

8.18 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.19 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.19.1 BACKHAUL CONNECTIVITY

8.19.2 DATA CENTER INTERCONNECT (DCI)

8.19.3 ENTERPRISE & PRIVATE NETWORKS

8.19.4 LONG-HAUL TRANSPORT

8.19.5 REDUNDANCY & NETWORK RESILIENCY

8.19.6 OTHERS

8.2 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.20.1 MOBILE BACKHAUL

8.20.2 ENTERPRISE BACKHAUL

8.20.3 METRO BACKHAUL

8.21 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 2G/3G/4G NETWORKS

8.21.2 5G SMALL-CELL NETWORKS

8.21.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.22 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 INTRA-CITY DCI

8.22.2 INTER-CITY DCI

8.22.3 CLOUD PROVIDER NETWORKS

8.23 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.23.1 PRIVATE WAN/LAN NETWORKS

8.23.2 CAMPUS NETWORKS

8.23.3 INDUSTRIAL IOT NETWORKS

8.24 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.24.1 INTER-CITY NETWORKS

8.24.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.25 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.25.1 DISASTER RECOVERY NETWORKS

8.25.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.25.3 CARRIER REDUNDANCY

8.26 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.27 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.27.1 BACKHAUL CONNECTIVITY

8.27.2 DATA CENTER INTERCONNECT (DCI)

8.27.3 ENTERPRISE & PRIVATE NETWORKS

8.27.4 LONG-HAUL TRANSPORT

8.27.5 REDUNDANCY & NETWORK RESILIENCY

8.27.6 OTHERS

8.28 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.28.1 ENTERPRISE BACKHAUL

8.28.2 MOBILE BACKHAUL

8.28.3 METRO BACKHAUL

8.29 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.29.1 2G/3G/4G NETWORKS

8.29.2 5G SMALL-CELL NETWORKS

8.29.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.3 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.30.1 INTRA-CITY DCI

8.30.2 INTER-CITY DCI

8.30.3 CLOUD PROVIDER NETWORKS

8.31 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.31.1 PRIVATE WAN/LAN NETWORKS

8.31.2 CAMPUS NETWORKS

8.31.3 INDUSTRIAL IOT NETWORKS

8.32 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.32.1 INTER-CITY NETWORKS

8.32.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.33 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.33.1 DISASTER RECOVERY NETWORKS

8.33.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.33.3 CARRIER REDUNDANCY

8.34 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.35 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.35.1 BACKHAUL CONNECTIVITY

8.35.2 DATA CENTER INTERCONNECT (DCI)

8.35.3 ENTERPRISE & PRIVATE NETWORKS

8.35.4 LONG-HAUL TRANSPORT

8.35.5 REDUNDANCY & NETWORK RESILIENCY

8.35.6 OTHERS

8.36 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.36.1 MOBILE BACKHAUL

8.36.2 ENTERPRISE BACKHAUL

8.36.3 METRO BACKHAUL

8.37 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.37.1 2G/3G/4G NETWORKS

8.37.2 5G SMALL-CELL NETWORKS

8.37.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.38 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.38.1 INTRA-CITY DCI

8.38.2 INTER-CITY DCI

8.38.3 CLOUD PROVIDER NETWORKS

8.39 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.39.1 PRIVATE WAN/LAN NETWORKS

8.39.2 CAMPUS NETWORKS

8.39.3 INDUSTRIAL IOT NETWORKS

8.4 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.40.1 INTER-CITY NETWORKS

8.40.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.41 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.41.1 DISASTER RECOVERY NETWORKS

8.41.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.41.3 CARRIER REDUNDANCY

8.42 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.43 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.43.1 BACKHAUL CONNECTIVITY

8.43.2 DATA CENTER INTERCONNECT (DCI)

8.43.3 ENTERPRISE & PRIVATE NETWORKS

8.43.4 LONG-HAUL TRANSPORT

8.43.5 REDUNDANCY & NETWORK RESILIENCY

8.43.6 OTHERS

8.44 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.44.1 ENTERPRISE BACKHAUL

8.44.2 MOBILE BACKHAUL

8.44.3 METRO BACKHAUL

8.45 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.45.1 2G/3G/4G NETWORKS

8.45.2 5G SMALL-CELL NETWORKS

8.45.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.46 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.46.1 INTRA-CITY DCI

8.46.2 INTER-CITY DCI

8.46.3 CLOUD PROVIDER NETWORKS

8.47 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.48 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.48.1 INTER-CITY NETWORKS

8.48.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.49 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.49.1 DISASTER RECOVERY NETWORKS

8.49.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.49.3 CARRIER REDUNDANCY

8.5 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.51 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.51.1 BACKHAUL CONNECTIVITY

8.51.2 DATA CENTER INTERCONNECT (DCI)

8.51.3 ENTERPRISE & PRIVATE NETWORKS

8.51.4 LONG-HAUL TRANSPORT

8.51.5 REDUNDANCY & NETWORK RESILIENCY

8.51.6 OTHERS

8.52 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.52.1 ENTERPRISE BACKHAUL

8.52.2 MOBILE BACKHAUL

8.52.3 METRO BACKHAUL

8.53 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.53.1 2G/3G/4G NETWORKS

8.53.2 5G SMALL-CELL NETWORKS

8.53.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.54 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.54.1 INTRA-CITY DCI

8.54.2 INTER-CITY DCI

8.54.3 CLOUD PROVIDER NETWORKS

8.55 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.55.1 PRIVATE WAN/LAN NETWORKS

8.55.2 CAMPUS NETWORKS

8.55.3 INDUSTRIAL IOT NETWORKS

8.56 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.56.1 INTER-CITY NETWORKS

8.56.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.57 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.57.1 DISASTER RECOVERY NETWORKS

8.57.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.57.3 CARRIER REDUNDANCY

8.58 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.59 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.59.1 BACKHAUL CONNECTIVITY

8.59.2 DATA CENTER INTERCONNECT (DCI)

8.59.3 ENTERPRISE & PRIVATE NETWORKS

8.59.4 LONG-HAUL TRANSPORT

8.59.5 REDUNDANCY & NETWORK RESILIENCY

8.59.6 OTHERS

8.6 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.60.1 MOBILE BACKHAUL

8.60.2 ENTERPRISE BACKHAUL

8.60.3 METRO BACKHAUL

8.61 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.61.1 2G/3G/4G NETWORKS

8.61.2 5G SMALL-CELL NETWORKS

8.61.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

8.62 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.62.1 INTRA-CITY DCI

8.62.2 INTER-CITY DCI

8.62.3 CLOUD PROVIDER NETWORKS

8.63 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.63.1 PRIVATE WAN/LAN NETWORKS

8.63.2 CAMPUS NETWORKS

8.63.3 INDUSTRIAL IOT NETWORKS

8.64 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.64.1 INTER-CITY NETWORKS

8.64.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

8.65 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.65.1 DISASTER RECOVERY NETWORKS

8.65.2 HIGH AVAILABILITY ENTERPRISE LINKS

8.65.3 CARRIER REDUNDANCY

8.66 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL.

9.1 OVERVIEW

9.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

9.2.1 DIRECT SALES

9.2.2 INDIRECT SALES

9.3 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 TELECOM OPERATORS & NETWORK PROVIDERS

9.3.2 DATA CENTER & CLOUD PROVIDERS

9.3.3 ENTERPRISE & CORPORATE DIRECT SALES

9.3.4 OTHERS

9.4 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.5.1 SYSTEM INTEGRATORS (SIS)

9.5.2 MANAGED SERVICE PROVIDERS (MSPS)

9.5.3 VALUE-ADDED RESELLERS (VARS)

9.6 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE

10.1 OVERVIEW

10.2 METRO DARK FIBER

10.3 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE

10.3.1 URBAN CONNECTIVITY

10.3.2 5G BACKHAUL

10.3.3 CAMPUS NETWORKS

10.4 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 LONG-HAUL DARK FIBER

10.5 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE

10.5.1 INTER-CITY NETWORKS

10.5.2 TRANS-REGIONAL/INTER-COUNTRY NETWORKS

10.5.3 SUBMARINE FIBER NETWORKS

10.6 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION

11.2.1 BACKHAUL CONNECTIVITY

11.3 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE

11.3.1 MOBILE BACKHAUL

11.3.2 ENTERPRISE BACKHAUL

11.3.3 METRO BACKHAUL

11.4 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE

11.4.1 2G/3G/4G NETWORKS

11.4.2 5G SMALL-CELL NETWORKS

11.4.3 FIBER-TO-THE-TOWER (FTTT) SOLUTIONS

11.5 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY REGION

11.5.1 DATA CENTER INTERCONNECT (DCI)

11.6 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE

11.6.1 INTRA-CITY DCI

11.6.2 INTER-CITY DCI

11.6.3 CLOUD PROVIDER NETWORKS

11.7 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY REGION

11.7.1 ENTERPRISE & PRIVATE NETWORKS

11.8 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE

11.8.1 CAMPUS NETWORKS

11.8.2 PRIVATE WAN/LAN NETWORKS

11.8.3 INDUSTRIAL IOT NETWORKS

11.9 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY REGION

11.9.1 LONG-HAUL TRANSPORT

11.1 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE

11.10.1 INTER-CITY NETWORKS

11.10.2 SUBMARINE/TRANSCONTINENTAL NETWORKS

11.11 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY REGION

11.11.1 REDUNDANCY & NETWORK RESILIENCY

11.12 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE

11.12.1 DISASTER RECOVERY NETWORKS

11.12.2 HIGH AVAILABILITY ENTERPRISE LINKS

11.12.3 CARRIER REDUNDANCY

11.13 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY REGION

11.14 OTHERS

11.15 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION

12 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA DARK FIBER NETWORKS MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LUMEN TECHNOLOGIES

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CROWN CASTLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ZAYO GROUP, LLC

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 COLT TECHNOLOGY SERVICES GROUP LIMITED

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CHARTER COMMUNICATIONS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ARELION.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CIRION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 COGENT COMMUNICATIONS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 DQE COMMUNICATIONS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 EUNETWORKS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EUROFIBER

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 EVERSTREAM SOLUTIONS, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EXA INFRASTRUCTURE.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FIBERLIGHT, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 FIRSTLIGHT FIBER, INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 FRONTIER COMMUNICATIONS PARENT, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 GLOBALCONNECT GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 LIGHTPATH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 LUXCONNECT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 LYNTIA NETWORKS.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 PS LIGHTWAVE LLC

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 RELINED B.V.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 RETELIT S.P.A.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 RETN NETWORKS LTD.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SEGRA.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 STEALTH COMMUNICATIONS SERVICES, LLC.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 STERLITE POWER

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 UFINET

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 UNITI CORPORATION

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 VERIZON

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 83 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 85 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 96 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 98 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 100 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 102 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 104 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 105 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 106 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 NORTH AMERICA MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 NORTH AMERICA SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 NORTH AMERICA METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 NORTH AMERICA LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 113 NORTH AMERICA GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 NORTH AMERICA PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 116 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 123 NORTH AMERICA IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 124 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 NORTH AMERICA BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 131 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 138 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 NORTH AMERICA HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 NORTH AMERICA UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 152 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 NORTH AMERICA INDUSTRIAL & MANUFACTURING IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 159 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 NORTH AMERICA MEDIA & ENTERTAINMENT IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 166 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 NORTH AMERICA OTHERS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 173 NORTH AMERICA BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 NORTH AMERICA MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 NORTH AMERICA DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 NORTH AMERICA ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 NORTH AMERICA LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 NORTH AMERICA REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 NORTH AMERICA DARK FIBER NETWORKS MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 180 NORTH AMERICA DIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 NORTH AMERICA INDIRECT SALES IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 U.S. DARK FIBER NETWORKS MARKET, BY FIBER TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 U.S. MULTI-MODE FIBER (MMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 U.S. SINGLE-MODE FIBER (SMF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 U.S. DARK FIBER NETWORKS MARKET, BY NETWORK TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 U.S. METRO DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 U.S. LONG-HAUL DARK FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 U.S. DARK FIBER NETWORKS MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 189 U.S. GLASS FIBER IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 U.S. PLASTIC OPTICAL FIBER (POF) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 U.S. DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 192 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 U.S. DARK FIBER NETWORKS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 199 U.S. IT & TELECOMMUNICATIONS IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 200 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 U.S. BFSI IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 207 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 U.S. GOVERNMENT & PUBLIC SECTOR IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 214 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 U.S. HEALTHCARE IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 221 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 U.S. REDUNDANCY & NETWORK RESILIENCY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 U.S. UNIVERSITIES & RESEARCH INSTITUTES IN DARK FIBER NETWORKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 U.S. BACKHAUL CONNECTIVITY IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 U.S. MOBILE BACKHAUL IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 U.S. DATA CENTER INTERCONNECT (DCI) IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 U.S. ENTERPRISE & PRIVATE NETWORKS IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 U.S. LONG-HAUL TRANSPORT IN DARK FIBER NETWORKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)