Mercado de agentes antiaglomerantes alimentarios de América del Norte, por tipo (compuestos de silicio, celulosa microcristalina, compuestos de calcio, compuestos de sodio, compuestos de magnesio y otros), fuente (agentes sintéticos/artificiales y agentes naturales), categoría de producto (sin OGM y OGM), forma (polvo y líquido), aplicación (confitería, productos de panadería, productos lácteos, alimentos preparados, nutrición dietética, nutrición deportiva , productos cárnicos procesados, bebidas, sopas y salsas, condimentos y condimentos, fórmula infantil y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de agentes antiaglomerantes alimentarios en América del Norte

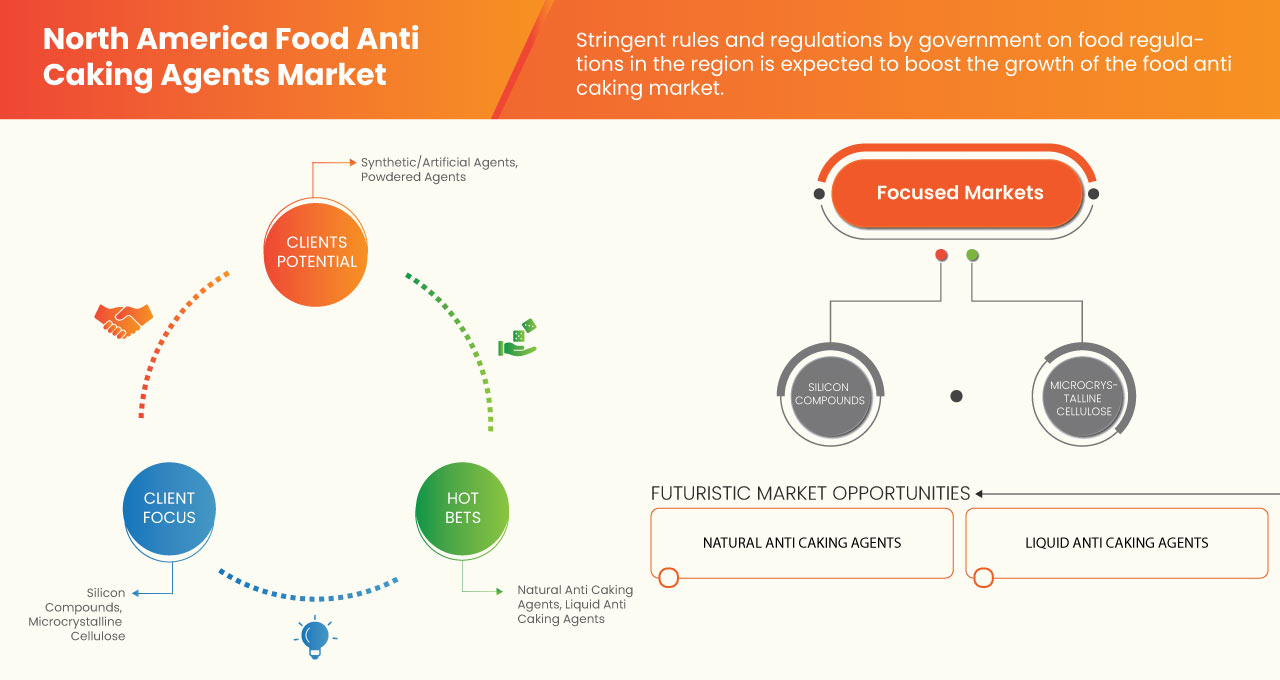

Los agentes antiaglomerantes son compuestos anhidros que se añaden a los alimentos secos en pequeñas cantidades para evitar que las partículas se aglomeren y mantener el producto seco y fluido. Se espera que la creciente demanda de alimentos preparados y listos para consumir, que conduce a una mayor demanda de agentes antiaglomerantes, impulse el mercado de agentes antiaglomerantes alimentarios de América del Norte. Además, también se espera que el aumento de la demanda de productos alimenticios de mejor calidad y una mayor vida útil impulse el crecimiento del mercado. Sin embargo, las estrictas normas y regulaciones sobre los agentes antiaglomerantes pueden obstaculizar el crecimiento del mercado. El aumento de las innovaciones nanotecnológicas en los agentes antiaglomerantes alimentarios puede servir como una oportunidad para el mercado de América del Norte. Los crecientes riesgos para la salud debido al uso excesivo de agentes antiaglomerantes pueden suponer un grave desafío para el crecimiento del mercado de agentes antiaglomerantes alimentarios de América del Norte.

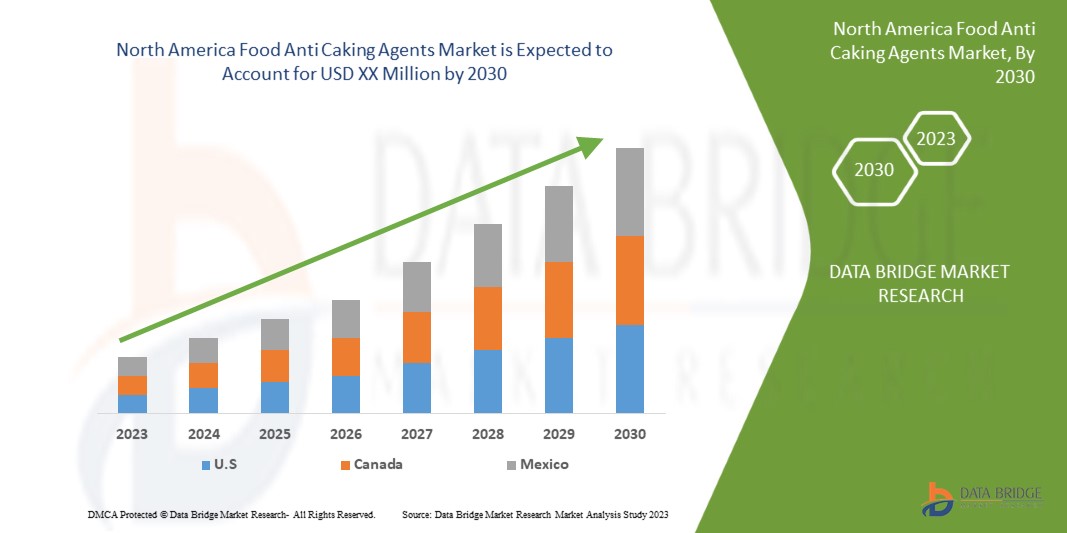

Data Bridge Market Research analiza que el mercado de agentes antiaglomerantes alimentarios de América del Norte crecerá a una CAGR del 5,3 % entre 2023 y 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2019 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Tipo (compuestos de silicio, celulosa microcristalina , compuestos de calcio, compuestos de sodio, compuestos de magnesio y otros), origen (agentes sintéticos/artificiales y agentes naturales), categoría de producto (no modificados genéticamente y modificados genéticamente), forma (polvo y líquido), aplicación (confitería, productos de panadería, productos lácteos, alimentos preparados, nutrición dietética, nutrición deportiva, productos cárnicos procesados, bebidas, sopas y salsas, condimentos y aderezos, fórmulas infantiles y otros) |

|

Países cubiertos |

Estados Unidos, Canadá, México |

|

Actores del mercado cubiertos |

Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co., Ltd, RanQ, Fabricante de celulosa: Ankit Pulps, Ltd, MUBY CHEMICALS, JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation |

Definición de mercado

Los agentes antiaglomerantes son aditivos que se utilizan en materiales en polvo o granulados, como la sal de mesa o los dulces, para evitar la formación de grumos (apelmazamiento) y mejorar el envasado, el transporte, la fluidez y el consumo. Los mecanismos de apelmazamiento varían según el material. Los sólidos cristalinos se apelmazan con frecuencia debido a la formación de un puente líquido y la posterior fusión de microcristales. Las transiciones vítreas y los cambios de viscosidad pueden provocar que los materiales amorfos se apelmazen. Las transiciones de fase polimórficas también pueden provocar apelmazamiento. Algunos agentes antiaglomerantes absorben el exceso de humedad o recubren las partículas con un revestimiento repelente al agua. El silicato de calcio (CaSiO3), un agente antiaglomerante común, absorbe agua y aceite cuando se añade a productos como la sal de mesa.

Dinámica del mercado de agentes antiaglomerantes alimentarios en América del Norte

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, los desafíos y las limitaciones del mercado. Todo esto se analiza en detalle a continuación:

Conductores

-

Aumento de la demanda de alimentos preparados y listos para consumir

La creciente demanda de alimentos preparados, como alimentos envasados y listos para consumir, se debe al aumento de la población activa, las mejoras económicas y los horarios excesivamente ocupados y estresantes. Estos alimentos, que incluyen productos estables, productos refrigerados o congelados, mezclas secas que no requieren preparación y otros, están diseñados para facilitar su consumo. La industria de alimentos y bebidas está experimentando un aumento de la demanda debido a la creciente urbanización, el aumento del nivel de vida y los cambios en las preferencias alimentarias y el estilo de vida. Además, se espera que el mercado de agentes antiaglomerantes crezca significativamente a la par del aumento de la demanda de cocina tradicional, ya que estas comidas contienen una variedad de espesantes como harina de maíz, arrurruz, mandioca, agar-agar, gelatina y huevos.

Los agentes antiaglomerantes se pueden añadir a los productos alimenticios para mejorar la viscosidad, la textura, la densidad, la estabilidad y otras propiedades. Además, el ingrediente principal en la industria de la panadería es un agente antiaglomerante. Los ingredientes para productos horneados como las galletas (azúcar, harina, levadura en polvo, etc.) acabarían solidificándose como bloques de tiza si no se utilizaran productos químicos antiaglomerantes. Estas sustancias secas absorben gradualmente la humedad del aire con el tiempo. Debido al agua, las partículas pueden unirse.

-

Aumento de la demanda de productos alimenticios con mejor calidad y mayor vida útil

Los agentes antiaglomerantes alimentarios son conservantes que se encuentran en los alimentos en polvo o granulados y que impiden que estos fluyan perfectamente fuera del envase, lo que impide que el polvo o los gránulos se aglomeren o se peguen entre sí. Los productos de confitería pueden contener agentes antiaglomerantes para evitar la formación de grumos (apelmazamiento) y facilitar el envasado. Se espera que el aumento del consumo de ingredientes alimentarios como el polvo para hornear, la leche y la nata en polvo, las mezclas para tartas y el polvo para sopas instantáneas tenga un impacto positivo en el desarrollo de agentes antiaglomerantes alimentarios debido a su función fundamental de mantener la fluidez, la textura y otras características organolépticas, así como una larga vida útil.

El agua, el alcohol y el etanol son disolventes orgánicos en los que son solubles los compuestos antiaglomerantes. Estos actúan absorbiendo el exceso de humedad o recubriendo las partículas con un revestimiento hidrófugo que prolonga la vida útil del producto.

Oportunidad

-

Aumento de las innovaciones nanotecnológicas en antiaglomerantes alimentarios

La nanotecnología alimentaria se considera una frontera tecnológica para la industria alimentaria en el siglo XXI. La nanotecnología se utiliza ampliamente en el procesamiento de alimentos, la trazabilidad de los envases y la conservación. Además, los avances en nanodetección e ingredientes nanoestructurados son muy prometedores en la industria alimentaria. Los avances tecnológicos recientes han transformado el uso de nanopartículas (NP) en la industria alimentaria. Se reconoce que estas NP tienen propiedades distintivas, como agentes antiaglomerantes, antibacterianos, bioterapéuticos y prolongación de la vida útil, que se espera que impulsen el crecimiento del mercado.

La nanotecnología en el procesamiento de alimentos puede contribuir a generar sabores, texturas y sensaciones en la boca nuevos o mejorados mediante el procesamiento a escala nanométrica de los alimentos o una mejor absorción, biodisponibilidad y captación de nutrientes mediante formulaciones a escala nanométrica. Varios aditivos alimentarios están compuestos de nanopartículas o contienen una fracción de tamaño nanométrico. La sílice amorfa sintética (SAS) se utiliza en muchos alimentos en polvo como agente antiaglomerante y de flujo libre y para el recubrimiento de superficies de materiales de envasado. Está formada por agregados de partículas primarias de tamaño nanométrico.

Restricción/Desafío

- Normas y reglamentos estrictos sobre los agentes antiaglomerantes

Los gobiernos de todo el mundo establecen normas y reglamentos estrictos para el uso y consumo de agentes antiaglomerantes en la industria alimentaria. Los reglamentos garantizan que los alimentos no tengan efectos nocivos o tóxicos. El gobierno ha establecido reglamentos específicos para el tipo y la cantidad de agentes antiaglomerantes alimentarios. El Reglamento sobre seguridad y normas alimentarias (normas de productos alimentarios y aditivos alimentarios) de 2011 establece que no se pueden utilizar agentes antiaglomerantes a menos que lo permitan específicamente los reglamentos.

Impacto posterior al COVID-19 en el mercado de agentes antiaglomerantes alimentarios de América del Norte

La COVID-19 ha afectado significativamente al mercado. Debido al confinamiento, se detuvo la fabricación y producción de muchas empresas pequeñas y grandes, se interrumpió la logística y la cadena de suministro y la demanda de agentes antiaglomerantes también disminuyó, lo que influyó en el mercado. Debido al cambio en muchos mandatos y regulaciones, los fabricantes están diseñando y lanzando nuevos productos, lo que puede ayudar a impulsar el crecimiento del mercado.

Desarrollo reciente

- En julio de 2022, WR Grace & Co. anunció la ampliación de su planta de fabricación y desarrollo por contrato en el sur de Michigan. La ampliación incluye un tren de reactores multiuso de 4000 galones y una centrífuga HASTELLOY, que mejorará la capacidad comercial de la planta que cumple con las normas c-GMP.

Alcance del mercado de agentes antiaglomerantes en América del Norte

El mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en segmentos notables según el tipo, la fuente, la categoría del producto, la forma y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Compuestos de silicio

- Celulosa microcristalina

- Compuestos de calcio

- Compuestos de sodio

- Compuestos de magnesio

- Otros

Según el tipo, el mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en compuestos de silicio, celulosa microcristalina, compuestos de calcio, compuestos de sodio, compuestos de magnesio y otros.

Fuente

- Agentes sintéticos/artificiales

- Agentes naturales

Según la fuente, el mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en agentes sintéticos/artificiales y agentes naturales.

Categoría de producto

- Sin OGM

- OGM

Según la categoría de producto, el mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en no transgénicos y transgénicos.

Forma

- Polvo

- Líquido

Según la forma, el mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en polvo y líquido.

Solicitud

- Confitería

- Productos de panadería

- Productos lácteos

- Comida preparada

- Nutrición dietética

- Nutrición deportiva

- Productos cárnicos procesados

- Bebidas

- Sopas y salsas

- Aderezos y condimentos

- Fórmula infantil

- Otros

Según la aplicación, el mercado de agentes antiaglomerantes alimentarios de América del Norte está segmentado en confitería, productos de panadería, productos lácteos, alimentos preparados, nutrición dietética, nutrición deportiva, productos cárnicos procesados, bebidas, sopas y salsas, condimentos y aderezos, fórmulas infantiles y otros.

Análisis y perspectivas regionales del mercado de agentes antiaglomerantes de América del Norte

Se analizan los agentes antiaglomerantes de América del Norte y se proporcionan información y tendencias sobre el tamaño del mercado según lo mencionado anteriormente.

Los países cubiertos en el informe del mercado de agentes antiaglomerantes alimentarios de América del Norte son Estados Unidos, México y Canadá.

Se espera que Estados Unidos domine el mercado de agentes antiaglomerantes alimentarios de América del Norte en términos de participación de mercado e ingresos. Se estima que mantendrá su dominio durante el período de pronóstico debido al aumento creciente de los agentes antiaglomerantes alimentarios en varias industrias de alimentos y bebidas.

La sección de regiones del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para cada país.

Análisis del panorama competitivo y de la cuota de mercado de los agentes antiaglomerantes alimentarios en América del Norte

El panorama competitivo del mercado de agentes antiaglomerantes alimentarios de América del Norte proporciona detalles sobre los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo se relacionan con el enfoque de la empresa en el mercado de agentes antiaglomerantes alimentarios de América del Norte.

Algunos de los principales actores que operan en el mercado de agentes antiaglomerantes alimentarios de América del Norte son Evonik Industries AG, PPG Industries, In, PQ, WR Grace & Co.-Conn, Solvay, Huber Engineered Materials, REMEDY LABS, Sigachi Industries, Konoshima Chemical Co., Ltd, Cellulose Manufacturer-Ankit Pulps, Ltd, MUBY CHEMICALS, JELU-WERK J. Ehrler GmbH & Co. KG, Jinsha Precipitated Silica Manufacturing Co., Ltd, Astrra Chemicals, SBF Pharma, Foodchem International Corporation y RanQ, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA ANTI CAKING AGENTS MARKET

4.2 VALUE CHAIN ANALYSIS: NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.3 FACTORS INFLUENCING PURCHASE DECISION OF END-USER

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 OTHER BENEFITS OF ANTI CAKING AGENTS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.7.2 DISTRIBUTION

4.7.3 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT IN THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

4.9 TRADE ANALYSIS

4.1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.10.1 ABSORBENT POWDER

4.10.2 BASE LIQUID

4.10.3 FLOW AGENTS

5 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

6 PRICING INDEX (PRICE AT FOB & PRICES AT B2B)

7 PRODUCTION CAPACITY OF KEY MANUFACTURERS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS ON NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

8.2 PRODUCT VS BRAND OVERVIEW

9 REGULATORY GUIDELINES AND FRAMEWORK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 RISING DEMAND FOR CONVENIENCE FOOD AND READY-TO-EAT FOOD ITEMS

10.1.2 RISE IN DEMAND FOR FOOD PRODUCTS WITH BETTER QUALITY AND INCREASED SHELF LIFE

10.1.3 INCREASE IN DEMAND FOR ANTI-CAKING AGENTS IN SPICES AND CONDIMENTS

10.1.4 MULTIFUNCTIONAL CHARACTERISTICS OF ANTI-CAKING AGENTS

10.2 RESTRAINTS

10.2.1 STRINGENT RULES AND REGULATIONS ON ANTI-CAKING AGENTS

10.2.2 MANUFACTURERS LIMITING USAGE OF ADDITIVES FALLING UNDER THE E-NUMBER CATEGORY

10.3 OPPORTUNITIES

10.3.1 INCREASING NANO-TECHNOLOGICAL INNOVATIONS IN FOOD ANTI-CAKING AGENTS

10.3.2 MANUFACTURERS LAUNCHING NEW AND INNOVATIVE ANTI-CAKING AGENTS

10.3.3 RISING DEMAND FOR ORGANIC ANTI-CAKING AGENTS

10.4 CHALLENGES

10.4.1 INCREASING HEALTH HAZARDS DUE TO EXCESSIVE USE OF ANTI-CAKING AGENTS

10.4.2 IMPACT OF ANTI-CAKING AGENTS ON NUTRITIVE VALUE OF FOOD ITEMS

11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE

11.1 OVERVIEW

11.2 SILICON COMPOUNDS

11.2.1 SILICON DIOXIDE

11.2.2 CALCIUM SILICATE

11.2.3 ALUMINUM SILICATE

11.2.4 SODIUM ALUMINOSILICATE

11.2.5 POTASSIUM ALUMINUM SILICATE

11.2.6 CALCIUM ALUMINOSILICATE

11.2.7 POLYDIMETHYLSILOXANE

11.3 MICROCRYSTALLINE CELLULOSE

11.3.1 POWDERED CELLULOSE

11.3.2 TALCUM POWDER

11.4 CALCIUM COMPOUNDS

11.4.1 CALCIUM CARBONATES

11.4.2 TRI CALCIUM PHOSPHATE

11.4.3 CALCIUM FERROCYANIDE

11.4.4 CALCIUM PHOSPHATE

11.5 SODIUM COMPOUNDS

11.5.1 SODIUM BICARBONATE

11.5.2 SODIUM FERROCYANIDE

11.6 MAGNESIUM COMPOUNDS

11.6.1 MAGNESIUM CARBONATE

11.6.2 MAGNESIUM STEARATE

11.6.3 MAGNESIUM OXIDE

11.6.4 MAGNESIUM TRISILICATE

11.6.5 MAGNESIUM HYDROXIDE

11.7 OTHERS

11.7.1 ZEOLITES

11.7.2 BENTONITE

11.7.3 STEARIC ACID

11.7.4 OTHERS

12 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE

12.1 OVERVIEW

12.2 SYNTHETIC/ARTIFICIAL AGENTS

12.3 NATURAL AGENTS

13 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 NON GMO

13.3 GMO

14 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM

14.1 OVERVIEW

14.2 POWDER

14.3 LIQUID

15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 CONFECTIONARY

15.2.1 CONFECTIONARY, BY TYPE

15.2.1.1 CHOCOLATE

15.2.1.2 HARD & SOFT CANDY

15.2.1.3 TOFFEES

15.2.1.4 CARAMEL & NOUGATS

15.2.1.5 GUMS& JELLY

15.2.1.6 CREAM FILLINGS

15.2.1.7 OTHERS

15.3 BAKERY PRODUCTS

15.3.1 BAKERY PRODUCTS, BY TYPE

15.3.1.1 BREAD AND ROLLS

15.3.1.2 CAKES AND PASTRIES

15.3.1.3 BISCUITS

15.3.1.4 MUFFINS

15.3.1.5 COOKIES

15.3.1.6 DOUGHNUTS

15.3.1.7 OTHERS

15.4 DAIRY PRODUCTS

15.4.1 DAIRY PRODUCTS, BY TYPE

15.4.1.1 CHEESE

15.4.1.1.1 SHREDDED CHEESE

15.4.1.1.2 CUBED CHEESE

15.4.1.1.3 HIGH MOISTURE CRUMBLED CHEESE

15.4.1.2 ICE-CREAM

15.4.1.2.1 IMPULSE ICE-CREAM

15.4.1.2.2 TAKE HOME ICE-CREAM

15.4.1.3 MILK POWDER

15.4.1.4 DAIRY SPREAD

15.4.1.5 YOGURT

15.4.1.6 OTHERS

15.5 CONVENIENCE FOOD

15.5.1 CONVENIENCE FOOD, BY TYPE

15.5.1.1 PIZZA

15.5.1.2 READY TO EAT PRODUCTS

15.5.1.3 PASTA

15.5.1.4 NOODLES

15.5.1.5 SOUPS & SAUCES

15.5.1.6 SEASONINGS & DRESSINGS

15.5.1.7 NUTS

15.5.1.8 SEEDS

15.5.1.9 PREMIXES

15.5.1.10 TRAIL MIXES

15.5.1.11 OTHERS

15.6 DIETARY NUTRITION

15.7 SPORT NUTRITION

15.8 PROCESSED MEAT PRODUCTS

15.8.1 PROCESSED MEAT, BY TYPE

15.8.1.1 BEEF

15.8.1.2 PORK

15.8.1.3 POULTRY

15.8.1.4 SWINE

15.8.1.5 MUTTON

15.8.1.6 OTHERS

15.9 BEVERAGES

15.9.1 BEVERAGES, BY TYPE

15.9.1.1 RTD BEVERAGES

15.1 SOUPS AND SAUCES

15.11 SEASONINGS AND CONDIMENTS

15.12 INFANT FORMULA

15.13 OTHERS

15.13.1 OTHERS, BY TYPE

15.13.1.1 SPICES POWDERED

15.13.1.2 HERBS EXTRACTS POWDERED

16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 EVONIK INDUSTRIES AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 PPG INDUSTRIES, INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 PQ

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 W.R. GRACE & CO.-CONN

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLIED BLENDING

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENT

19.6 ANMOL CHEMICALS

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 ASTTRA CHEMICALS

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 BIMAL PHARMA PVT. LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 CELLULOSE MANUFACTURER- ANKIT PULPS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 FOODCHEM INTERNATIONAL CORPORATION

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FUJI CHEMICAL INDUSTRIES CO., LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HUBER ENGINEERED MATERIALS

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 JELU-WERK J. EHRLER GMBH & CO. KG

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 JINSHA PRECIPITATED SILICA MANUFACTURING CO., LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 KONOSHIMA CHEMICAL CO., LTD.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENT

19.17 MUBY CHEMICALS

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENT

19.18 NB ENTREPRENEURS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 RANQ

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

19.2 REGOJ CHEMICAL INDUSTRIES

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 REMEDY LABS GROUP

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 SAPTHAGIRI AROMATICS

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENT

19.23 SBF PHARMA

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

19.24 SIGACHI INDUSTRIES

19.24.1 COMPANY SNAPSHOT

19.24.2 REVENUE ANALYSIS

19.24.3 PRODUCT PORTFOLIO

19.24.4 RECENT DEVELOPMENT

19.25 SINTHESIS GREENCHEM PVT. LTD.

19.25.1 COMPANY SNAPSHOT

19.25.2 PRODUCT PORTFOLIO

19.25.3 RECENT DEVELOPMENT

19.26 SOLVAY

19.26.1 COMPANY SNAPSHOT

19.26.2 REVENUE ANALYSIS

19.26.3 PRODUCT PORTFOLIO

19.26.4 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA IMPORTERS OF SILICON DIOXIDE HS CODE OF PRODUCT: 28112 (UNIT US DOLLAR THOUSAND)

TABLE 2 NORTH AMERICA EXPORTERS OF SILICON DI OXIDE, HS CODE OF PRODUCT: 28112 (UNIT: US DOLLAR THOUSAND)

TABLE 3 NORTH AMERICA IMPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 4 NORTH AMERICA EXPORTERS OF CALCIUM CARBONATE, HS CODE OF PRODUCT: 283650 (UNIT US DOLLAR THOUSAND)

TABLE 5 NORTH AMERICA IMPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 6 NORTH AMERICA EXPORTERS OF CALCIUM PHOSPHATE, HS CODE OF PRODUCT: 283526 (UNIT US DOLLAR THOUSAND)

TABLE 7 NORTH AMERICA IMPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 8 NORTH AMERICA EXPORTERS OF SODIUM BICARBONATE, HS CODE OF PRODUCT: 283630 (UNIT US DOLLAR THOUSAND)

TABLE 9 FREE ON BOARD (FOB) OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

TABLE 10 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 12 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TONS)

TABLE 14 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 16 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 18 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 20 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 22 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 24 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 26 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 28 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 30 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 32 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 34 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 37 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA SYNTHETIC/ARTIFICIAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 39 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA NATURAL AGENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 41 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 43 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA NON-GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 45 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA GMO IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 47 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY FORM, 2021-2030 (TON)

TABLE 49 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA POWDER IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 51 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LIQUID IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 53 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 55 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 57 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA CONFECTIONARY IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 59 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 61 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 63 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TONS)

TABLE 67 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 69 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 71 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 73 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 75 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA DIETARY NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 77 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA SPORT NUTRITION IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 79 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 81 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PROCESSED MEAT IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 83 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 85 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA BEVERAGES IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 87 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA SOUPS & SAUCES IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 89 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA SEASONING & CONDIMENTS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 91 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA INFANT FORMULA IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 93 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY REGION, 2021-2030 (TON)

TABLE 95 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENTS MARKET, BY TYPE, 2021-2030 (TON)

TABLE 97 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (TON)

TABLE 99 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 100 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 102 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 103 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 105 NORTH AMERICA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 106 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 108 NORTH AMERICA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 109 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 111 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 113 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 115 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 117 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 118 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 120 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 121 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 123 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 124 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 126 NORTH AMERICA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 127 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 129 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 131 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 133 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 135 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 137 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 139 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 141 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 143 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 145 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 147 U.S. FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 148 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 150 U.S. CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 151 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 153 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 155 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 157 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 159 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 161 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 163 U.S. FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 164 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 165 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 166 U.S. FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 167 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 168 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 169 U.S. FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 170 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 172 U.S. FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 173 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 175 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 177 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 179 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 181 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 183 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 185 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 187 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 U.S. BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 189 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 191 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 193 CANADA FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 194 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 196 CANADA CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 197 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 199 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 CANADA MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 201 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 CANADA MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 203 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 CANADA SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 205 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 207 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 209 CANADA FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 210 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 211 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 212 CANADA FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 213 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 214 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 215 CANADA FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 216 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 217 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 218 CANADA FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 219 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 221 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 223 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 225 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 CANADA BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 227 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 229 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 CANADA PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 231 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 CANADA CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 233 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 235 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 237 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 239 MEXICO FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 240 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 242 MEXICO CALCIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 243 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 MEXICO SODIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 245 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 MEXICO MAGNESIUM COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 247 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO MICROCRYSTALLINE CELLULOSE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 249 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO SILICON COMPOUNDS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 251 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 253 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (TON)

TABLE 255 MEXICO FOOD ANTI CAKING AGENT MARKET, BY SOURCE, 2021-2030 (ASP)

TABLE 256 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (USD MILLION)

TABLE 257 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (TON)

TABLE 258 MEXICO FOOD ANTI CAKING AGENT MARKET, BY PRODUCT CATEGORY, 2021-2030 (ASP)

TABLE 259 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 260 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (TON)

TABLE 261 MEXICO FOOD ANTI CAKING AGENT MARKET, BY FORM, 2021-2030 (ASP)

TABLE 262 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 263 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (TON)

TABLE 264 MEXICO FOOD ANTI CAKING AGENT MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 265 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO DAIRY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 267 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO CHEESE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 269 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO ICE-CREAM IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 271 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO BAKERY PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 273 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO CONVENIENCE FOOD IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 275 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO PROCESSED MEAT PRODUCTS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 277 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO CONFECTIONERY IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 279 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO BEVERAGE IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

TABLE 281 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO OTHERS IN FOOD ANTI CAKING AGENT MARKET, BY TYPE, 2021-2030 (TON)

Lista de figuras

FIGURE 1 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SEGMENTATION

FIGURE 10 THE RISE IN DEMAND FOR CONVENIENCE FOOD PRODUCTS ACROSS THE GLOBE, LEADING TO THE RISE IN THE DEMAND FOR FOOD ANTI CAKING AGENTS, IS EXPECTED TO DRIVE THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE SILICON COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET IN 2023 AND 2030

FIGURE 12 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET

FIGURE 15 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY SOURCE, 2022

FIGURE 17 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY PRODUCT CATEGORY, 2022

FIGURE 18 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY FORM, 2022

FIGURE 19 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: BY TYPE (2023-2030)

FIGURE 25 NORTH AMERICA FOOD ANTI CAKING AGENTS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.