North America Liver Fibrosis Treatment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.55 Billion

USD

16.87 Billion

2024

2032

USD

7.55 Billion

USD

16.87 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 16.87 Billion | |

|

|

|

Mercado norteamericano de tratamiento de la fibrosis hepática, por tipo de tratamiento (medicamentos y cirugía/terapia), estadios (F2, F1, F3 y F4), indicación (esteatohepatitis no alcohólica [EHNA], fibrosis inducida por hepatitis B y C, hepatopatía alcohólica [EHA], enfermedades hepáticas autoinmunes, trastornos genéticos y otros), género (masculino y femenino), usuario final (hospitales, clínicas especializadas, clínicas, centros ambulatorios y de investigación, entre otros), canal de distribución (licitación directa y venta minorista): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de tratamiento de la fibrosis hepática en América del Norte

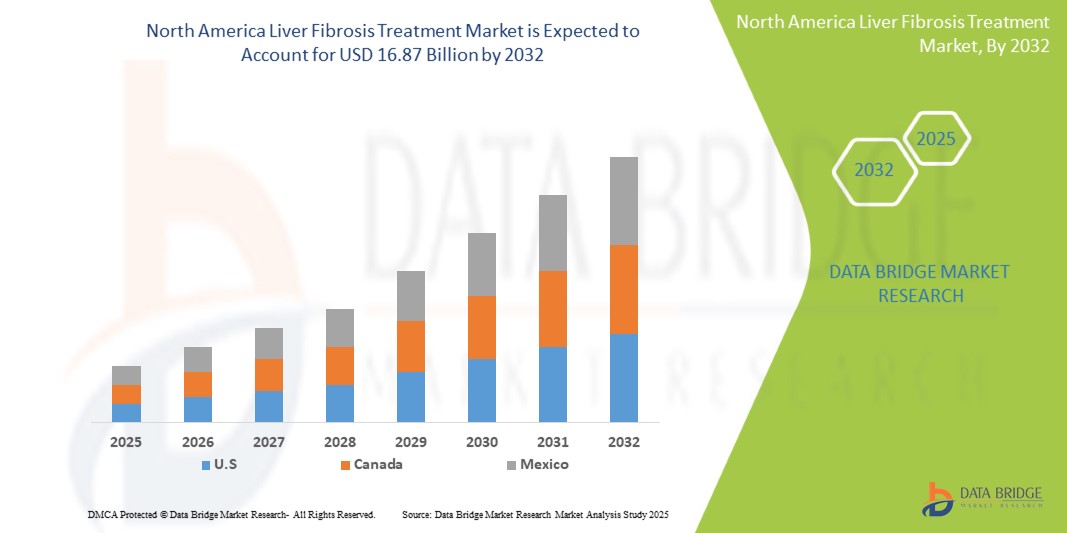

- El mercado de tratamiento de la fibrosis hepática en América del Norte se valoró en USD 7.550 millones en 2024 y se espera que alcance los USD 16.870 millones en 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 10,8 %, impulsado principalmente por la creciente conciencia de los consumidores sobre las soluciones de salud naturales.

- Este crecimiento está impulsado por factores como la creciente prevalencia de enfermedades hepáticas. Además, la asequibilidad impulsa el aumento del consumo de alcohol.

Análisis del mercado de tratamiento de la fibrosis hepática en América del Norte

- El creciente número de enfermedades hepáticas crea una mayor población de pacientes que necesitan opciones terapéuticas efectivas, en particular para afecciones como la hepatitis B y C. Factores contribuyentes como el aumento del consumo de alcohol, los hábitos alimenticios poco saludables y el aumento en las tasas de obesidad han llevado a que más personas sean diagnosticadas con estas afecciones hepáticas.

- A medida que el daño hepático avanza, aumenta el riesgo de desarrollar fibrosis hepática, lo que supone una carga significativa para los sistemas de salud a la hora de ofrecer opciones de tratamiento eficaces. Esta creciente demanda impulsa el desarrollo y la disponibilidad de terapias dirigidas, impulsando el crecimiento del mercado a medida que los profesionales sanitarios buscan soluciones innovadoras para el manejo de esta afección.

- Además, la mayor concienciación entre los profesionales sanitarios y el público en general ha llevado a que más personas se sometan a pruebas de detección y diagnóstico en etapas más tempranas de la enfermedad hepática. Los avances en las técnicas de diagnóstico, como la imagenología no invasiva y los análisis de sangre, han facilitado la identificación de la fibrosis hepática en etapas más tempranas de la enfermedad. Esta detección temprana permite intervenciones oportunas, lo que estimula la demanda de tratamientos innovadores que reviertan o controlen eficazmente la fibrosis hepática.

- Por ejemplo, en agosto de 2023, según un artículo publicado por el NCBI, las enfermedades hepáticas causan dos millones de muertes al año y son responsables del 4 % de todas las muertes (1 de cada 25 muertes a nivel mundial); aproximadamente dos tercios de todas las muertes relacionadas con el hígado ocurren en hombres. Esta alarmante estadística subraya la urgente necesidad de opciones de tratamiento eficaces y destaca la importante carga que representan las enfermedades hepáticas para la salud pública, lo que motiva aún más a los sistemas de salud y a las compañías farmacéuticas a priorizar el desarrollo de terapias innovadoras dirigidas específicamente a la fibrosis hepática y sus causas subyacentes.

- En consecuencia, las compañías farmacéuticas y los investigadores médicos se ven obligados a invertir en el desarrollo de nuevas opciones terapéuticas, impulsando así el mercado a medida que las partes interesadas buscan combatir la creciente incidencia de enfermedades hepáticas y sus complicaciones asociadas.

Alcance del informe y segmentación del mercado de tratamiento de la fibrosis hepática en América del Norte

|

Atributos |

Perspectivas clave del mercado mundial de tratamiento de la fibrosis hepática |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de tratamiento de la fibrosis hepática en América del Norte

“Aumento de la prevalencia de enfermedades hepáticas”

- La creciente prevalencia de enfermedades hepáticas está surgiendo como un importante problema de salud en América del Norte, contribuyendo sustancialmente a las cargas de atención médica en todo el mundo.

- Factores como el consumo excesivo de alcohol, las crecientes tasas de obesidad, las infecciones de hepatitis viral y los estilos de vida poco saludables están provocando un aumento de enfermedades como la enfermedad del hígado graso, la cirrosis y el cáncer de hígado.

- La creciente incidencia de la enfermedad del hígado graso no alcohólico (EHGNA), especialmente relacionada con la diabetes y el síndrome metabólico, también es alarmante. Como resultado, existe una mayor demanda de diagnóstico temprano, opciones de tratamiento eficaces e iniciativas de salud pública. Se espera que esta tendencia impulse la innovación y el crecimiento en el mercado del tratamiento de enfermedades hepáticas.

Dinámica del mercado del tratamiento de la fibrosis hepática en América del Norte

Conductores

“Aumento del consumo de alcohol”

- El aumento del consumo de alcohol contribuye significativamente al mercado de tratamiento de la fibrosis hepática en América del Norte debido a su correlación directa con la incidencia de enfermedades hepáticas, en particular la enfermedad hepática alcohólica (EHA).

- A medida que más personas consumen alcohol regularmente y en grandes cantidades, el riesgo de desarrollar complicaciones relacionadas con el hígado, incluidas fibrosis hepática y cirrosis, aumenta significativamente.

- El alcoholismo crónico conduce a inflamación, acumulación de grasa y, en última instancia, fibrosis a medida que el hígado sufre daños y reparaciones repetidos.

- Esta creciente prevalencia de enfermedades hepáticas relacionadas con el alcohol crea una demanda apremiante de tratamientos efectivos y estrategias de manejo para ayudar a mitigar el daño hepático y mejorar los resultados de los pacientes.

Por ejemplo,

- En octubre de 2024, según un artículo publicado por la Revista Internacional de Sistemas de Salud Mental, la prevalencia del consumo de alcohol fue del 54,5 % y del 47,7 % al inicio y en el seguimiento, respectivamente. Además, el 12 % de los hombres reportó haber comenzado a beber recientemente. Esta prevalencia del consumo de alcohol conlleva una mayor incidencia de fibrosis hepática en Norteamérica, lo que podría afectar el crecimiento del mercado.

- En junio de 2024, según STAT, las muertes relacionadas con el alcohol están en aumento, y los expertos están especialmente preocupados por este incremento entre jóvenes y mujeres. En EE. UU., las muertes relacionadas con el alcohol aumentaron un 25,5 % entre 2019 y 2020, lo que representa el 3 % del total de muertes. Además, los mayores aumentos en las muertes relacionadas con el alcohol se registraron entre las personas de 25 a 34 y de 35 a 44 años, donde las muertes en ambos grupos aumentaron más del 37 %.

- Además, la creciente aceptación social y la normalización del consumo de alcohol, en particular en grupos demográficos más jóvenes, agravan aún más el problema, lo que lleva a un mayor número de personas en riesgo de sufrir cambios fibróticos en el hígado.

- Esta tendencia promueve el crecimiento del mercado de tratamiento de la fibrosis hepática y enfatiza la importancia de las iniciativas de salud pública destinadas a reducir el consumo de alcohol y prevenir la enfermedad hepática.

Oportunidades

Tecnologías emergentes y tratamientos avanzados para el manejo de la fibrosis hepática

-

Las tecnologías emergentes como la terapia génica, las terapias moleculares dirigidas y los agentes biológicos están transformando el panorama del tratamiento.

-

Las innovaciones recientes se centran en fármacos que actúan específicamente sobre las vías de progresión de la fibrosis, como los agonistas del receptor FXR, los inhibidores del factor de crecimiento tumoral (TGF-β) y los antiinflamatorios. Además, las herramientas de diagnóstico no invasivo, como la elastografía, están mejorando la detección temprana.

-

Estos avances ofrecen tratamientos más efectivos y personalizados para afecciones como la EHNA (esteatohepatitis no alcohólica) y la cirrosis, lo que conduce a mejores resultados para los pacientes.

-

En febrero de 2024, se publicó un artículo en Springer Nature. El artículo analiza los enfoques emergentes para diagnosticar e inhibir la fibrogénesis hepática. Los avances incluyen biomarcadores no invasivos, tecnologías de imagen y terapias celulares como las células madre mesenquimales. Los prometedores fármacos antifibróticos, como la pirfenidona y el ácido obeticólico, junto con las innovaciones en ingeniería de tejidos, nanotecnología y modelos microfluídicos, muestran potencial para tratamientos personalizados y de precisión.

-

Un artículo del NCBI de septiembre de 2021 destacó que las tecnologías emergentes en el tratamiento de la fibrosis hepática se centran en terapias avanzadas dirigidas a vías moleculares como la activación de las células estrelladas hepáticas. Innovaciones como la terapia génica, los productos biológicos, los inhibidores de moléculas pequeñas y los diagnósticos no invasivos mejoran la detección temprana y el tratamiento. Las terapias con células madre y la ingeniería tisular también ofrecen perspectivas prometedoras para revertir la fibrosis y mejorar la recuperación.

-

Con la evolución continua de las estrategias de tratamiento y las tecnologías de diagnóstico, las terapias para la fibrosis hepática están avanzando rápidamente.

-

Estas innovaciones brindan esperanza para un mejor manejo de las enfermedades hepáticas, garantizando que los pacientes tengan acceso a tratamientos más efectivos y personalizados con menos efectos secundarios, mejorando en última instancia los resultados de salud en América del Norte.

Restricciones/Desafío

“ Conocimiento limitado de las enfermedades hepáticas”

- Limited awareness of liver diseases hinders early diagnosis and appropriate intervention. Many individuals remain unaware of the risk factors and symptoms associated with liver conditions, often attributing vague signs of illness to other, less serious issues

- This lack of knowledge delays medical consultations until the disease progresses to advanced stages, such as liver fibrosis or cirrhosis, where treatment options become more complex and less effective

- Consequently, late-stage diagnoses reduce the potential for successful treatment outcomes and restrict the overall market growth by limiting the patient population seeking timely care

For instance,

- In April 2024, Lupin stated that the patients are unaware of their condition until the disease reaches a critical stage, triggering an urgent need to reassess the approach to liver health awareness, detection, and management. However, a significant hurdle in liver health management lies in the limited understanding of liver diseases and associated risk factors

- In July 2021, according to a study that included 11,700 adults (18+ years old) from five National Health and Nutrition Examination Surveys, nearly 96% of adults with NAFLD in the U.S. were unaware they had liver disease, especially among young adults. Therefore, enhancing awareness and education about liver health is crucial for improving patient outcomes and fostering a more proactive approach to liver fibrosis management and treatment market expansion

- In January 2021, Springer Nature reported that among the 825 patients included in the research analysis carried out in the research paper, ‘Lack of awareness of liver organ damage in patients with type 2 diabetes’, 8.1% (95% CI 5.1%-12.7%) of patients with steatosis were aware of having a liver condition. Moreover, in a nationally representative sample of U.S. adults with T2DM, the prevalence of advanced liver fibrosis is high. Less than 20% of those with advanced fibrosis are aware of having any liver condition

- Limited awareness hampers potential treatment outcomes for patients and stifles market growth by reducing the number of individuals engaging with healthcare services early on

- Thus, increasing awareness and education about liver health is crucial for improving early diagnosis, enhancing treatment efficacy, and ultimately fostering a more robust market for liver fibrosis therapies

North America Liver Fibrosis Treatment Market Scope

The market is segmented on the basis product type, treatment, basis of source, application, route of administration, mode of purchase, age group, gender, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Treatment Type |

|

|

By Stages |

|

|

By Indication |

|

|

By End User |

|

|

Por canal de distribución |

|

Análisis regional del mercado de tratamiento de la fibrosis hepática en América del Norte

Estados Unidos es el país dominante en el mercado del tratamiento de la fibrosis hepática.

- Estados Unidos lidera el mercado de tratamiento de la fibrosis hepática en América del Norte, impulsado por su sólida infraestructura de atención médica, alta prevalencia de enfermedades relacionadas con el hígado y un fuerte enfoque en el diagnóstico temprano y las estrategias de intervención.

- El país se beneficia de una amplia cobertura de atención médica, políticas de reembolso bien establecidas y una creciente demanda de opciones de diagnóstico y tratamiento no invasivos.

- El liderazgo de EE. UU. en investigación clínica y su participación activa en campañas de concientización sobre enfermedades hepáticas respaldan aún más el crecimiento del mercado.

- La creciente adopción de terapias avanzadas, la mayor concienciación de los pacientes y las iniciativas gubernamentales para abordar las enfermedades hepáticas crónicas contribuyen al dominio de Estados Unidos en la región.

“Se proyecta que EE. UU. registre la tasa de crecimiento más alta”

- Estados Unidos también es el mercado de más rápido crecimiento, impulsado por la innovación continua en biomarcadores de fibrosis, el aumento de las inversiones en I+D de las compañías farmacéuticas y las crecientes tasas de enfermedades del hígado graso relacionadas con el alcohol y no alcohólico.

- Estos factores posicionan colectivamente a Estados Unidos como un centro central para el tratamiento de la fibrosis hepática en América del Norte, lo que lo convierte en el mercado más grande y de más rápida expansión en la región.

Cuota de mercado del tratamiento de la fibrosis hepática en América del Norte

El panorama competitivo del mercado proporciona detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Norteamérica, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- F. Hoffmann-La Roche Ltd (Suiza)

- Abbott (EE. UU.)

- La Renon Healthcare Pvt. Ltd. (India)

- GENFIT SA (Francia)

- Madrigal Pharmaceuticals (EE. UU.)

- Aligos Therapeutics (EE. UU.)

- Pfizer Inc. (EE. UU.)

- Enanta Pharmaceuticals, Inc. (EE. UU.)

- Bristol-Myers Squibb Company (EE. UU.)

- Vertex Pharmaceuticals Incorporated (EE. UU.)

- Takeda Pharmaceutical Company Limited (Japón)

- Hepion Pharmaceuticals (EE. UU.)

- Echosens (Francia)

- Galectin Therapeutics, Inc. (EE. UU.)

- Conatus Pharmaceuticals (EE. UU.)

- Tvardi Therapeutics (EE. UU.)

- Viking Therapeutics (EE. UU.)

- Calliditas Therapeutics AB (Suecia)

- Novomedix (EE. UU.)

- Galecto Biotech (Dinamarca)

- Pilant Therapeutics, Inc. (EE. UU.)

- Sagimet Biosciences (EE. UU.)

- Gyre Therapeutics, Inc. (EE. UU.)

- Akero Therapeutics, Inc. (EE. UU.)

- CureVac SE (Alemania)

- Novo Nordisk A/S (Dinamarca)

- Ipsen Pharma (Francia)

- AdAlta Limited (Australia)

- Alentis Therapeutics AG (Suiza)

- Gilead Sciences, Inc. (EE. UU.)

- AbbVie Inc. (EE. UU.)

- Merck & Co., Inc. (EE. UU.)

- Novartis AG (Suiza)

- Intercept Pharmaceuticals, Inc. (EE. UU.)

Últimos avances en el mercado norteamericano de tratamiento de la fibrosis hepática

- En junio de 2024, Gilead Sciences presentó la nueva investigación en el Congreso de la Asociación Europea para el Estudio del Hígado (EASL) de 2024 en Milán, centrándose en enfermedades hepáticas como la colangitis biliar primaria (CBP), la hepatitis B (VHB), el virus de la hepatitis delta (VHD) y otras. Las presentaciones clave incluirán datos a largo plazo del estudio ASSURE sobre seladelpar para la CBP, resultados de tenofovir para la prevención del cáncer de hígado en pacientes con VHB y hallazgos de los estudios MYR204 y MYR301 sobre Hepcludex para el VHD. Esta investigación destaca el compromiso de Gilead con el avance de las opciones de tratamiento para las enfermedades hepáticas.

- En octubre de 2024, Intercept Pharmaceuticals, Inc. presentó sus esfuerzos continuos para explorar las diferencias y disparidades raciales en la atención de la colangitis biliar primaria (CBP). La compañía está abordando cómo las distintas poblaciones pueden enfrentar diferentes desafíos en el diagnóstico, tratamiento y manejo de la CBP. Al explorar estas disparidades, Intercept busca mejorar el acceso a la atención y los resultados del tratamiento para todos los pacientes, reduciendo potencialmente las barreras para el tratamiento eficaz de las enfermedades hepáticas, incluida la fibrosis.

- En noviembre de 2022, la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) aprobó Vemlidy (tenofovir alafenamida) para el tratamiento de la infección crónica por el virus de la hepatitis B (VHB) en pacientes pediátricos mayores de 12 años con enfermedad hepática compensada. Esta aprobación amplía el uso de Vemlidy, inicialmente aprobado en 2016 para adultos con VHB crónica. La aprobación se basa en un ensayo clínico de fase 2 que demuestra la eficacia y seguridad de Vemlidy en este grupo de pacientes más jóvenes.

- En septiembre de 2022, Gilead Sciences completó la adquisición de MiroBio, una empresa biotecnológica con sede en el Reino Unido centrada en restablecer el equilibrio inmunitario mediante agonistas dirigidos a los receptores inmunoinhibidores. La adquisición, valorada en aproximadamente 405 millones de dólares, proporciona a Gilead la plataforma de descubrimiento de MiroBio y su cartera de agonistas de receptores inmunoinhibidores. El principal anticuerpo en investigación de MiroBio, MB272, actúa sobre las células inmunitarias para suprimir las respuestas inmunitarias inflamatorias y se encuentra actualmente en ensayos clínicos de fase 1. Esta adquisición refuerza los esfuerzos de Gilead para abordar las enfermedades crónicas inmunomediadas.

- En marzo de 2021, Gilead Sciences y Novo Nordisk ampliaron su colaboración en el tratamiento de la esteatohepatitis no alcohólica (EHNA) con el inicio de un ensayo clínico de fase 2b. El estudio investiga la seguridad y eficacia de semaglutida, un agonista del receptor GLP-1 de Novo Nordisk, en combinación con cilofexor (un agonista del FXR) y firsocostat (un inhibidor del ACC) de Gilead en pacientes con cirrosis por EHNA. El ensayo evaluará el impacto de los tratamientos en la fibrosis hepática y la resolución de la EHNA, y se prevé que el reclutamiento comience en el segundo semestre de 2021.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.2.1 LIVER TRANSPLANTATION VOLUME AND THEIR COST FOR LIVER FIBROSIS BY COUNTRY

4.2.2 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES FOR LIVER FIBROSIS: VOLUME AND COST BY COUNTRY

4.2.3 PARTIAL HEPATECTOMY (LIVER RESECTION) COST BY COUNTRY

4.2.4 CELL-BASED THERAPY COST FOR LIVER FIBROSIS TREATMENT BY COUNTRY

4.3 EPIDEMIOLOGY

4.3.1 INCIDENCE OF ALL BY GENDER

4.3.2 TREATMENT RATE

4.3.3 TREATMENT RATE

4.3.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.3.5 PATIENT TREATMENT SUCCESS RATES

4.4 MARKETED DRUG ANALYSIS

4.5 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5.1 PATIENT FLOW DIAGRAM

4.5.2 KEY PRICING STRATEGIES

4.5.3 KEY PATIENT ENROLLMENT STRATEGIES

5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF LIVER DISEASES

6.1.2 RISING CONSUMPTION OF ALCOHOL

6.1.3 RISING LIVER TRANSPLANTATION RATES

6.1.4 GROWING INCIDENCE OF NON-ALCOHOLIC FATTY LIVER DISEASE (NAFLD) & NASH

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF LIVER DISEASES

6.2.2 REGULATORY CHALLENGES

6.3 OPPORTUNITIES

6.3.1 EMERGING TECHNOLOGIES AND ADVANCED TREATMENTS IN LIVER FIBROSIS MANAGEMENT

6.3.2 PROGRESS IN PIPELINE PRODUCTS FOR LIVER FIBROSIS TREATMENT

6.3.3 STRATEGIC MERGERS AND ACQUISITIONS AMONG THE KEY PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF EFFECTIVE AND APPROVED ANTI-FIBROTIC DRUGS

6.4.2 HIGH COST OF TREATMENTS IN LIVER FIBROSIS CARE

7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 ANTIVIRAL AGENTS

7.2.1.1 VELPATASVIR/SOFOSBUVIR

7.2.1.2 TENOFOVIR

7.2.1.3 LEDIPASVIR/SOFOSBUVIR

7.2.1.4 SOFOSBUVIR

7.2.1.5 ENTECAVIR

7.2.2 ANTIFIBROTIC AGENTS

7.2.2.1 OBETICHOLIC ACID

7.2.2.2 TGF-Β INHIBITORS

7.2.2.3 CONNECTIVE TISSUE GROWTH FACTOR (CTGF) INHIBITORS

7.2.2.4 LYSYL OXIDASE-LIKE 2 (LOXL2) INHIBITORS

7.2.2.5 OTHERS

7.2.3 ANTI-INFLAMMATORY DRUGS

7.2.3.1 CORTICOSTEROIDS

7.2.3.1.1 PREDNISONE

7.2.3.1.2 DEXAMETHASONE

7.2.3.2 TUMOR NECROSIS FACTOR (TNF) INHIBITORS

7.2.3.2.1 INFLIXIMAB

7.2.3.2.2 ETANERCEPT

7.2.3.3 INTERLEUKIN (IL) INHIBITORS

7.2.3.3.1 IL-6 INHIBITORS (TOCILIZUMAB)

7.2.3.3.2 IL-1 INHIBITORS (ANAKINRA)

7.2.4 IMMUNOSUPPRESSANTS

7.2.4.1 MYCOPHENOLATE MOFETIL

7.2.4.2 TACROLIMUS

7.2.4.3 CYCLOSPORINE

7.2.5 MARKETED DRUGS

7.2.5.1 VELPATASVIR/SOFOSBUVIR

7.2.5.2 TENOFOVIR

7.2.5.3 LEDIPASVIR/SOFOSBUVIR

7.2.5.4 OBETICHOLIC ACID (OCA)

7.2.5.5 SOFOSBUVIR

7.2.5.6 PIRFENIDONE

7.2.5.7 OTHERS

7.2.6 PIPELINE DRUGS

7.2.7 BRANDED DRUGS

7.2.7.1 EPCLUSA

7.2.7.2 VIREAD AND VEMLIDY

7.2.7.3 OCALIVA

7.2.7.4 HARVONI

7.2.7.5 SOVALDI

7.2.7.6 BARACLUDE

7.2.7.7 ACTOS

7.2.7.8 OTHERS

7.2.8 GENERIC DRUGS

7.2.9 ORAL

7.2.10 PARENTERAL

7.2.11 OTHERS

7.3 SURGERY/THERAPY

7.3.1 LIVER TRANSPLANTATION

7.3.2 ORTHOTOPIC LIVER TRANSPLANT (OLT)

7.3.3 LIVING DONOR LIVER TRANSPLANT (LDLT)

7.3.4 SPLIT LIVER TRANSPLANTATION

7.3.5 DOMINO LIVER TRANSPLANT

7.3.6 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES

7.3.6.1 ENDOSCOPIC VARICEAL LIGATION (EVL)

7.3.6.2 TRANSJUGULAR INTRAHEPATIC PORTOSYSTEMIC SHUNT (TIPS)

7.3.6.3 LIVER ABLATION PROCEDURES

7.3.6.3.1 RADIOFREQUENCY ABLATION (RFA)

7.3.6.3.2 MICROWAVE ABLATION (MWA)

7.3.7 PARTIAL HEPATECTOMY (LIVER RESECTION)

7.3.7.1 SEGMENTAL RESECTION

7.3.7.2 LOBECTOMY

7.3.7.3 WEDGE RESECTION

7.3.8 CELL-BASED THERAPY

7.3.8.1 STEM CELL THERAPY

7.3.8.1.1 MESENCHYMAL STEM CELLS (MSCS)

7.3.8.1.2 HEMATOPOIETIC STEM CELLS (HSCS)

7.3.8.2 GENE THERAPY

7.3.8.2.1 CRISPR-BASED LIVER REGENERATION

7.3.8.2.2 HEPATIC STELLATE CELL (HSC) INHIBITORS

7.3.8.2.3 SIRNA-BASED THERAPIES

7.3.8.2.4 HEPATOCYTE APOPTOSIS INHIBITORS

7.3.8.2.4.1 OXIDATIVE STRESS INHIBITORS

7.3.8.2.4.2 EMRICASAN

7.3.8.2.4.3 PENTOXIFYLLINE

7.3.8.2.4.4 LOSARTAN

7.3.8.2.4.5 METHYL FERULIC ACID

7.3.8.2.4.6 OTHERS

7.4 OTHERS

8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES

8.1 OVERVIEW

8.2 F2

8.3 F1

8.4 F3

8.5 F4

9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 NON-ALCOHOLIC STEATOHEPATITIS (NASH)

9.3 HEPATITIS B & C-INDUCED FIBROSIS

9.3.1 CHRONIC HEPATITIS B VIRUS (HBV) FIBROSIS

9.3.2 CHRONIC HEPATITIS C VIRUS (HCV) FIBROSIS

9.4 ALCOHOLIC LIVER DISEASE (ALD)

9.5 AUTOIMMUNE LIVER DISEASES

9.5.1 AUTOIMMUNE HEPATITIS (AIH)

9.5.2 PRIMARY BILIARY CHOLANGITIS (PBC)

9.5.3 PRIMARY SCLEROSING CHOLANGITIS (PSC)

9.6 GENETIC DISORDERS

9.6.1 HEMOCHROMATOSIS

9.6.2 WILSON’S DISEASE

9.6.3 ALPHA-1 ANTITRYPSIN DEFICIENCY

9.7 OTHERS

10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER

10.1 OVERVIEW

10.2 MALE

10.2.1 40-55 YEARS

10.2.2 ABOVE 55 YEARS

10.2.3 BELOW 40 YEARS

10.3 FEMALE

10.3.1 ABOVE 55 YEARS

10.3.2 40-55 YEARS

10.3.3 BELOW 40 YEARS

11 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC HOSPITALS

11.2.2 PRIVATE HOSPITALS

11.3 SPECIALTY CLINICS

11.3.1 HEPATOLOGY CLINICS

11.3.2 GASTROENTEROLOGY CLINICS

11.4 CLINICS

11.5 AMBULATORY AND RESEARCH CENTERS

11.6 OTHERS

12 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.2.1 RETAIL SALES

12.2.1.1 HOSPITAL PHARMACY

12.2.1.2 RETAIL PHARMACY

12.2.1.3 ONLINE PHARMACY

13 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 GILEAD SCIENCES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 ABBVIE, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MERCK & CO, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NOVARTIS AG

16.4.1 COMPANY SNAPSHOTS

16.4.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 PIPELINE PRODUCT PORTFOLIO

16.4.6 RECENT DEVELOPMENT

16.5 INTERCEPT PHARMACEUTICALS, INC.

16.5.1 COMPANY SNAPSHOTS

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 PIPELINE PRODUCT PORTFOLIO

16.5.6 RECENT NEWS

16.6 ABBOTT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 1.1.5 RECENT DEVELOPMENT

16.7 ALIGOS THERAPEUTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ALNICHE LIFE SCIENCES PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ALENTIS THERAPEUTICS AG

16.9.1 COMPANY SNAPSHOT

16.9.2 PIPELINE PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ADALTA LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PIPELINE PRODUCT PORTFOLIO

16.10.4 RECENT NEWS

16.11 AKERO THERAPEUTICS, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PIPELINE PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BRISTOL-MYERS SQUIBB

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CALLIDITAS THERAPEUTICS AB

16.13.1 COMPANY SNAPSHOT

16.13.2 PIPELINE PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CUREVAC SE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 CONATUSPHARMA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT/NEWS

16.16 ENANTA PHARMACEUTICALS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 ECHOSENS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT/NEWS

16.18 F. HOFFMANN-LA ROCHE LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 GALECTO BIOTECH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PIPELINE PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT/NEWS

16.2 GALECTIN THERAPEUTICS, INC.

16.20.1 COMPANY SNAPSHOTS

16.20.2 REVENUE ANALYSIS AND SEGMENTAL ANALYSIS

16.20.3 PIPELINE PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 GYRE THERAPEUTICS, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT/NEWS

16.22 GENFIT SA

16.22.1 COMPANY SNAPSHOTS

16.22.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.22.3 PIPELINE PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 HEPION PHARMACEUTICALS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PIPELINE PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 IPSEN PHARMA

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PIPELINE PRODUCT PORTFOLIO

16.24.4 RECENT NEWS/DEVELOPMENTS

16.25 LA RENON HEALTHCARE PVT. LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 MADRIGAL PHARMACEUTICALS

16.26.1 COMPANY SNAPSHOTS

16.26.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 NOVO NORDISK A/S

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PIPELINE PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 NOVOMEDIX

16.28.1 COMPANY SNAPSHOT

16.28.2 PIPELINE PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 PILANT THERAPEUTICS, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PIPELINE PRODUCT PORTFOLIO

16.29.4 RECENT NEWS

16.3 PFIZER INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PIPELINE PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT/NEWS

16.31 SAGIMET BIOSCIENCES

16.31.1 COMPANY SNAPSHOTS

16.31.2 REVENUE ANALYSIS

16.31.3 1.1.4 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT/NEWS

16.32 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 PIPELINE PRODUCT PORTFOLIO

16.32.4 PRODUCT PORTFOLIO

16.32.5 RECENT DEVELOPMENT

16.33 TVARDI THERAPEUTICS

16.33.1 COMPANY SNAPSHOT

16.33.2 PIPELINE PRODUCT PORTFOLIO

16.33.3 RECENT DEVELOPMENT/NEWS

16.34 VERTEX PHARMACEUTICALS INCORPORATED

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 PRODUCT PORTFOLIO

16.34.4 RECENT DEVELOPMENT

16.35 VIKING THERAPEUTICS

16.35.1 COMPANY SNAPSHOT

16.35.2 REVENUE ANALYSIS

16.35.3 PIPELINE PRODUCT PORTFOLIO

16.35.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA INCIDENCE OF CIRRHOSIS BY GENDER (2019)

TABLE 2 TREATMENT ADHERENCE LEVELS IN LIVER DISEASE PATIENTS

TABLE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 16 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 17 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 24 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA F2 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA F1 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA F3 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA F4 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA NON-ALCOHOLIC STEATOHEPATITIS (NASH) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ALCOHOLIC LIVER DISEASE (ALD) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA AMBULATORY AND RESEARCH CENTERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA DIRECT TENDER IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 78 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 86 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 88 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 89 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 91 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 92 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 94 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 95 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 97 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 98 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 130 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 131 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 133 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 134 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 136 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 138 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 139 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 141 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 142 U.S. INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 144 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 145 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 147 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 148 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 180 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 181 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 183 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 184 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 186 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 188 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 189 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 191 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 192 CANADA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 195 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 197 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 198 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 228 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 230 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 231 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 233 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 234 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 236 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 238 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 239 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 241 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 242 MEXICO INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 244 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 245 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 247 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 248 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 249 MEXICO MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LIVER DISEASES IS EXPECTED TO DRIVE THE GROWTH OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET FROM 2025 TO 2032

FIGURE 12 THE MEDICATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET IN 2025-2032

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

FIGURE 14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

FIGURE 17 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2024

FIGURE 22 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2024

FIGURE 26 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2024

FIGURE 30 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL 2024

FIGURE 38 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.