North America Pet Ct Scanning Services Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.76 Billion

USD

11.46 Billion

2025

2033

USD

7.76 Billion

USD

11.46 Billion

2025

2033

| 2026 –2033 | |

| USD 7.76 Billion | |

| USD 11.46 Billion | |

|

|

|

|

Segmentación del mercado de servicios de escaneo PET-CT en Norteamérica, por tipo de servicio (servicios de escaneo PET-CT independientes, servicios de escaneo PET-CT in situ y servicios de escaneo PET-CT móviles), tipo de escaneo (escaneos de cuerpo entero, escaneos de cuerpo parcial), tipo de trazador (FDG [fluorodesoxiglucosa], trazadores no FDG, trazadores nuevos/emergentes), aplicación (oncología, neurología, cardiología, enfermedades infecciosas, enfermedades inflamatorias, otros [ortopedia, pediatría]), usuario final (hospitales, centros de diagnóstico por imágenes, clínicas especializadas, institutos de investigación, otros), canal de distribución (directo e indirecto) - Tendencias de la industria y pronóstico hasta 2033

Tamaño del mercado de servicios de escaneo PET-CT en América del Norte

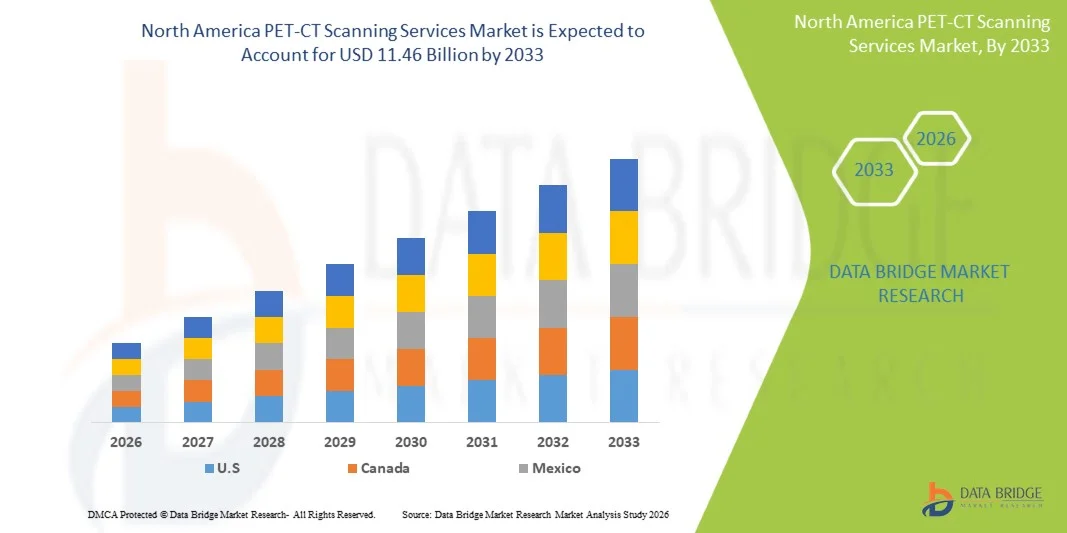

- El tamaño del mercado de servicios de escaneo PET-CT de América del Norte se valoró en USD 7,76 mil millones en 2025 y se espera que alcance los USD 11,46 mil millones para 2033 , con una CAGR del 5,2% durante el período de pronóstico.

- Los servicios de tomografía PET-TC se refieren a soluciones de diagnóstico por imagen que combinan las tecnologías de Tomografía por Emisión de Positrones (PET) y Tomografía Computarizada (TC) en un único sistema integrado. Esta técnica de imagen híbrida captura la actividad metabólica mediante PET y los detalles anatómicos mediante TC, lo que permite a los médicos detectar, estadificar y monitorizar enfermedades con alta precisión. El servicio incluye procedimientos de escaneo, administración de radiotrazadores, interpretación de imágenes y generación de informes en hospitales, centros de diagnóstico y centros especializados en imagenología.

- El mercado norteamericano de servicios de escaneo PET-CT está experimentando un crecimiento constante a medida que los sistemas de salud priorizan cada vez más el diagnóstico temprano y preciso de enfermedades, en particular el cáncer, los trastornos cardiovasculares y las afecciones neurológicas. La demanda se debe principalmente al aumento de la incidencia de cáncer en Norteamérica, la expansión de las aplicaciones de imágenes híbridas en la medicina de precisión y la creciente preferencia de los médicos por la combinación de imágenes metabólicas y anatómicas para mejorar la precisión diagnóstica.

Análisis del mercado de servicios de escaneo PET-CT en América del Norte

- Los avances tecnológicos, como la PET digital, la reconstrucción de imágenes con IA y la tomografía computarizada de baja dosis, están mejorando la calidad de las exploraciones y la eficiencia operativa, lo que fortalece aún más su adopción en el mercado. Además, la transición hacia centros de diagnóstico por imágenes ambulatorios, la ampliación de los reembolsos en los mercados desarrollados y la creciente inversión en infraestructura de diagnóstico en las economías emergentes están impulsando la disponibilidad de los servicios.

- Los altos costos de los equipos, la escasez de radiólogos cualificados y especialistas en medicina nuclear, y el acceso limitado a radiofármacos en regiones de bajos ingresos siguen dificultando su uso generalizado. En general, el mercado está evolucionando hacia servicios de PET-CT más accesibles, de alta precisión y con flujo de trabajo optimizado en Norteamérica.

- Se espera que EE. UU. domine con una participación de mercado del 83,07 % y que crezca con la CAGR más alta del 5,3 % en el período de pronóstico de 2026 a 2033 debido a su infraestructura de diagnóstico por imágenes bien establecida, la alta adopción de tecnologías PET-CT avanzadas y una fuerte demanda clínica impulsada por la creciente prevalencia del cáncer y las enfermedades crónicas.

- En 2026, se prevé que el segmento de servicios de tomografía PET-CT independiente domine el mercado con una cuota de mercado del 63,51 % gracias a su mayor capacidad de atención, mayor accesibilidad y la fuerte preferencia de los profesionales sanitarios por centros de diagnóstico por imagen dedicados que ofrecen citas más rápidas y experiencia diagnóstica especializada. Los centros independientes suelen operar con horarios extendidos, equipos avanzados y modelos de flujo de trabajo eficientes, lo que les permite ofrecer tiempos de respuesta más rápidos y servicios más rentables en comparación con las unidades hospitalarias.

Alcance del informe y segmentación del mercado de servicios de escaneo PET-CT en América del Norte

|

Atributos |

Perspectivas clave del mercado de servicios de escaneo PET-CT en América del Norte |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de servicios de escaneo PET-CT en América del Norte

“ Integración rápida de análisis de imágenes impulsados por IA y automatización del flujo de trabajo ”

- Los proveedores están adoptando cada vez más plataformas PET-CT habilitadas con IA que ayudan a los radiólogos a detectar cánceres en etapa temprana, anomalías cardiovasculares y condiciones neurodegenerativas con mayor precisión al analizar automáticamente datos metabólicos y anatómicos, identificar características sutiles de las lesiones y reducir la variabilidad de la interpretación.

- Esta tendencia está impulsada por la creciente carga de casos de oncología, el cambio en América del Norte hacia una atención basada en el valor y la necesidad de resultados de imágenes más rápidos y confiables.

- Los algoritmos de reconstrucción impulsados por IA están reduciendo significativamente la dosis de radiación al tiempo que mejoran la calidad de la imagen, lo que hace que los servicios PET-CT sean más seguros y accesibles para una población de pacientes más amplia.

- Además, las herramientas automatizadas de programación, generación de informes y compartición de imágenes están ayudando a los centros de imágenes a gestionar grandes volúmenes de pacientes, reducir los tiempos de respuesta y mejorar la comunicación entre departamentos.

- La combinación de IA, plataformas de imágenes basadas en la nube y flujos de trabajo de diagnóstico híbridos está posicionando los servicios de exploración PET-CT como un pilar fundamental de la medicina de precisión avanzada, respaldando la planificación personalizada del tratamiento, el seguimiento del tratamiento en tiempo real y la mejora de los resultados de los pacientes en todo el mundo.

Dinámica del mercado de servicios de escaneo PET-CT en América del Norte

Conductor

“Aumento de la incidencia del cáncer y de los trastornos neurológicos”

- La creciente incidencia del cáncer y los trastornos neurológicos se ha convertido en un factor clave que impulsa el crecimiento del mercado de servicios de tomografía PET-CT en Norteamérica. A medida que aumenta la prevalencia del cáncer y las enfermedades neurodegenerativas o neurológicas a nivel mundial, se ha intensificado la demanda de imágenes diagnósticas de alta precisión, como la PET-CT.

- La PET-CT ofrece ventajas cruciales en la detección temprana, la estadificación precisa, la planificación del tratamiento y el seguimiento de la oncología y ciertas indicaciones neurológicas, lo que la convierte en la modalidad diagnóstica preferida donde aumenta la carga de enfermedad. En consecuencia, el aumento de casos de cáncer y trastornos neurológicos en América del Norte se ha traducido en mayores tasas de utilización de los servicios de PET-CT y está impulsando la expansión geográfica de la infraestructura diagnóstica.

- Por ejemplo, en febrero de 2024, la Organización Mundial de la Salud informó que hubo aproximadamente 20 millones de nuevos casos de cáncer en todo el mundo en 2022, y proyectó que la incidencia de cáncer en América del Norte alcanzaría alrededor de 35 millones para 2050, lo que indica un aumento sustancial en el volumen de pacientes oncológicos en América del Norte.

- El aumento de la prevalencia del cáncer y las enfermedades neurológicas en América del Norte se está consolidando como un motor de crecimiento estructural permanente para los servicios de tomografía PET-CT. El aumento continuo de nuevos diagnósticos de cáncer, sumado al crecimiento de la población con trastornos neurológicos crónicos, está creando una necesidad sostenida y acíclica de imágenes moleculares de alta precisión.

- A medida que los protocolos de tratamiento se vuelven cada vez más personalizados y el monitoreo de la terapia se vuelve obligatorio en oncología y neurología, se está fortaleciendo intensamente la dependencia de la PET-CT para la estadificación de la enfermedad, la evaluación del pronóstico y el monitoreo terapéutico.

Restricción/Desafío

“ Desafíos operativos en los hospitales del sector público ”

- Los hospitales públicos de muchas regiones enfrentan desafíos operativos persistentes que afectan directamente la prestación de servicios, la gestión de pacientes y la eficiencia general de la atención médica. Las asignaciones presupuestarias limitadas a menudo provocan escasez de equipos esenciales, retrasos en el mantenimiento y limitaciones en la infraestructura de diagnóstico, incluidos los servicios de imagenología.

- La escasez de personal, especialmente en áreas especializadas como radiología, medicina nuclear y operaciones de imagenología avanzada, sobrecarga aún más la capacidad, lo que resulta en largos tiempos de espera para los pacientes y una reducción en la productividad. Los procesos burocráticos de adquisición ralentizan la adopción de tecnologías avanzadas y limitan la disponibilidad oportuna de consumibles y radiofármacos.

- Por ejemplo, en febrero de 2025, un informe del Contralor y Auditor General de la India (CAG) sobre la infraestructura de salud pública de Delhi reveló que aproximadamente el 21% de los puestos de personal en el departamento de salud estaban vacantes, con una escasez de especialistas (superespecialistas) de hasta el 30%. La auditoría también detectó la falta de equipos y consumibles esenciales, la infrautilización de los servicios de diagnóstico radiológico y los largos tiempos de espera para cirugías mayores, lo que evidencia graves cuellos de botella operativos en los hospitales terciarios.

- Las limitaciones operativas destacadas en los hospitales del sector público (como equipos de diagnóstico no funcionales, tiempos de espera prolongados, escasez de especialistas y desarrollo incompleto de la infraestructura) subrayan una brecha estructural cada vez mayor entre la demanda de diagnóstico y la capacidad del sector público.

- Desde una perspectiva de mercado, esto crea una vía importante para el crecimiento de los servicios de imágenes avanzadas, ya que los sistemas públicos dependen cada vez más de redes de diagnóstico externas, modelos PPP e instalaciones privadas para satisfacer los crecientes volúmenes clínicos.

Alcance del mercado de servicios de escaneo PET-CT en América del Norte

El mercado de servicios de escaneo PET-CT de América del Norte se clasifica en seis segmentos notables que se basan en el tipo de servicio, tipo de escaneo, tipo de trazador, aplicación, usuarios finales y canal de distribución.

- Por tipo de servicio

Según el tipo de servicio, el mercado norteamericano de servicios de PET-CT se segmenta en servicios de PET-CT independientes, servicios de PET-CT in situ y servicios de PET-CT móviles. En 2026, se prevé que el segmento de servicios de PET-CT independientes domine el mercado con una cuota de mercado del 63,51% gracias a su infraestructura consolidada, el mayor volumen de escaneos, la rentabilidad por escaneo y la fuerte preferencia de los profesionales sanitarios por centros de diagnóstico por imagen fijos que ofrecen capacidades de diagnóstico avanzadas.

El segmento de servicios de escaneo PET-CT móvil está creciendo con la CAGR más alta del 6,1% debido a la creciente demanda en áreas remotas y desatendidas, la creciente adopción por parte de hospitales y clínicas más pequeños, la flexibilidad logística mejorada y la menor inversión de capital en comparación con las instalaciones fijas.

- Por tipo de escaneo

Según el tipo de escaneo, el mercado norteamericano de servicios de escaneo PET-CT se segmenta en escaneos de cuerpo completo y escaneos de cuerpo parcial. En 2026, se espera que el segmento de escaneos de cuerpo completo domine con una participación de mercado del 85,81% gracias a su amplia aplicabilidad clínica, su capacidad para proporcionar una evaluación integral de la enfermedad en un solo procedimiento y su sólida adopción para la estadificación del cáncer y el seguimiento del tratamiento.

El segmento de exploraciones de cuerpo completo está creciendo con la CAGR más alta del 5,2 % debido a su papel fundamental en la detección integral de enfermedades, la estadificación y la evaluación de la respuesta a la terapia en aplicaciones de oncología, cardiología y neurología.

- Por tipo de trazador

Según el tipo de trazador, el mercado norteamericano de servicios de escaneo PET-CT se segmenta en FDG (fluorodesoxiglucosa), trazadores sin FDG y trazadores nuevos/emergentes. En 2026, se prevé que el segmento FDG (fluorodesoxiglucosa) domine con una cuota de mercado del 77,48 % gracias a su larga aceptación clínica, su amplia utilidad diagnóstica en diversas enfermedades y su amplia disponibilidad en centros de diagnóstico por PET-CT a nivel mundial.

El segmento de trazadores nuevos/emergentes está creciendo con la CAGR más alta del 6,1 % debido a los crecientes avances en la investigación, la creciente adopción de diagnósticos específicos y personalizados y la expansión de aplicaciones en neurología y oncología de precisión.

- Por aplicación

Según la aplicación, el mercado norteamericano de servicios de escaneo PET-CT se segmenta en oncología, neurología, cardiología, enfermedades infecciosas, enfermedades inflamatorias y otros (ortopedia, pediatría). Se prevé que en 2026, el segmento de oncología domine con una cuota de mercado del 63,97 % debido a la alta prevalencia del cáncer, el uso generalizado del PET-CT para la detección y estadificación de tumores, y su papel crucial en la planificación y el seguimiento del tratamiento.

El segmento de neurología está creciendo con la CAGR más alta del 5,8% debido a la creciente incidencia de trastornos neurológicos, el uso creciente de PET-CT en el diagnóstico temprano de enfermedades y la creciente demanda de técnicas avanzadas de imágenes cerebrales.

- Por el usuario final

En función del usuario final, el mercado norteamericano de servicios de escaneo PET-CT se segmenta en hospitales, centros de diagnóstico por imagen, clínicas especializadas, institutos de investigación y otros. Se prevé que en 2026, el segmento hospitalario domine con una participación de mercado del 54,64 % gracias a la disponibilidad de una infraestructura sanitaria integrada, una mayor afluencia de pacientes y la capacidad de ofrecer servicios PET-CT como parte de estrategias integrales de diagnóstico y tratamiento.

El segmento de centros de diagnóstico por imágenes está creciendo con la CAGR más alta del 5,7 % debido al aumento de los volúmenes de derivaciones, la expansión de las instalaciones de diagnóstico por imágenes independientes y la creciente preferencia de los pacientes por centros especializados que ofrecen tiempos de respuesta más rápidos.

- Por canal de distribución

Según el canal de distribución, el mercado de servicios de escaneo PET-CT en Norteamérica se segmenta en directo e indirecto. En 2026, se espera que el segmento directo domine el mercado con una participación del 76,11% gracias a un mejor control operativo, la interacción directa con el paciente y una mejor coordinación entre los proveedores de servicios de imagenología y las instituciones sanitarias.

El segmento indirecto está creciendo con la CAGR más alta del 6,1% debido a la expansión de las asociaciones con proveedores de servicios externos, un alcance regional más amplio y una mayor dependencia de las redes de referencia para mejorar la accesibilidad al servicio.

Análisis regional del mercado de servicios de escaneo PET-CT en América del Norte

- Estados Unidos domina el mercado de servicios de escaneo PET-CT en Norteamérica, representando el 83,07% de la participación total en 2026. Este liderazgo regional se basa en su infraestructura de salud altamente avanzada, la adopción temprana de tecnologías de imagen innovadoras, la sólida presencia de proveedores líderes de servicios de diagnóstico y las sustanciales inversiones en imágenes oncológicas y cardiológicas. La región se beneficia de la amplia disponibilidad de escáneres PET-CT híbridos, una alta cobertura de reembolso para el diagnóstico de cáncer y continuos avances tecnológicos como la imagenología asistida por IA, las técnicas PET de baja dosis y la innovación en radiotrazadores. Además, la creciente carga de enfermedades crónicas, la mayor concienciación sobre el diagnóstico temprano y el sólido apoyo gubernamental y privado a la investigación en imágenes moleculares refuerzan aún más la posición dominante de Norteamérica en el mercado durante el período de pronóstico.

- EE. UU. registra la tasa de crecimiento anual compuesta (TCAC) más alta de todos los países, con un 5,3 %. Este crecimiento se debe a la rápida expansión de la infraestructura sanitaria, el aumento de las inversiones en diagnóstico por imagen avanzado y la creciente adopción de la tecnología PET-CT para la detección temprana del cáncer en las economías emergentes. La región se beneficia de una creciente prevalencia de trastornos oncológicos y neurológicos, un mejor acceso a las instalaciones de medicina nuclear y las iniciativas gubernamentales destinadas a fortalecer las capacidades radiológicas y diagnósticas. Además, la creciente participación del sector privado, el aumento del turismo médico, la expansión de centros de diagnóstico por imagen especializados y la mayor asequibilidad de los procedimientos PET-CT contribuyen significativamente a la aceleración del mercado estadounidense durante el período de pronóstico.

Análisis del mercado de servicios de escaneo PET-CT en América del Norte

El mercado de servicios de escaneo PET-CT en Norteamérica experimenta un crecimiento sólido y sostenido, impulsado por su infraestructura sanitaria altamente avanzada, la adopción temprana de tecnologías de imagen innovadoras, la sólida presencia de proveedores líderes de servicios de diagnóstico y las sustanciales inversiones en imágenes oncológicas y cardiológicas. La región se beneficia de la amplia disponibilidad de escáneres PET-CT híbridos, una alta cobertura de reembolso para el diagnóstico del cáncer y continuos avances tecnológicos como la imagenología asistida por IA, las técnicas PET de baja dosis y la innovación en radiotrazadores. Además, la creciente carga de enfermedades crónicas, la mayor concienciación sobre el diagnóstico precoz y el sólido apoyo gubernamental y privado a la investigación en imágenes moleculares refuerzan aún más la posición dominante de Norteamérica en el mercado durante el período de pronóstico.

Perspectiva del mercado de servicios de escaneo PET-CT en América del Norte de EE. UU.

Estados Unidos es el país dominante en el mercado de servicios de escaneo PET-CT en Norteamérica, representando el 83,07% de la participación regional en 2026, y se proyecta que crezca a una sólida tasa de crecimiento anual compuesta (TCAC) del 5,3% entre 2026 y 2033, impulsado por su sofisticado ecosistema de atención médica, la amplia disponibilidad de escáneres PET-CT y la sólida adopción de imágenes moleculares avanzadas en oncología, cardiología y neurología. El país se beneficia de sólidos marcos de reembolso, la rápida integración de herramientas de diagnóstico basadas en IA y una importante inversión en medicina de precisión y desarrollo de radiofármacos.

Información sobre el mercado de servicios de escaneo PET-CT en Canadá y América del Norte

Canadá posee el 10,72 % del mercado norteamericano de servicios de tomografía PET-CT en 2026 y se prevé que crezca a una tasa de crecimiento anual compuesta (TCAC) del 4,7 % entre 2026 y 2033, impulsado por el aumento de las inversiones en infraestructura de diagnóstico por imagen avanzado, la creciente adopción de la tecnología PET-CT para aplicaciones oncológicas, neurológicas y cardiológicas, y un mayor énfasis en la detección temprana de enfermedades dentro del sistema de salud pública. El país está experimentando una expansión constante de las instalaciones de medicina nuclear, un mejor acceso a radiotrazadores y una mayor colaboración entre hospitales, centros de diagnóstico por imagen e instituciones de investigación. Además, las iniciativas gubernamentales de apoyo, las políticas de reembolso favorables y la continua modernización de los equipos de diagnóstico por imagen en todas las provincias contribuyen al crecimiento sostenido del mercado canadiense durante el período de pronóstico.

Cuota de mercado de servicios de escaneo PET-CT en América del Norte

El mercado de servicios de escaneo PET-CT de América del Norte está liderado principalmente por empresas bien establecidas, entre las que se incluyen:

- C-HCA, Inc. (EE. UU.)

- Siemens Healthineers AG (Alemania)

- RadNet, Inc. (EE. UU.)

- GenesisCare (Australia)

- Red de Radiología I-MED (Australia)

- Medica Group Ltd (Reino Unido)

- Servicios de imágenes del Capitolio (EE. UU.)

- Shared Medical Services Inc. (EE. UU.)

- Circle Health Group Ltd (Reino Unido)

- Fortis Healthcare (India)

- Alliance Medical Limited (Reino Unido)

- Grupo InHealth (Reino Unido)

- Dignity Health (EE. UU.)

- Apollo Hospitals Enterprises Ltd. (India)

- NM Medical (India)

- Nuclear (India)

- Cobalt Health (Reino Unido)

- DMS Health (EE. UU.)

- Cardiac Imaging, Inc. (EE. UU.)

- Servicios de atención médica Alliance-HNI (EE. UU.)

Últimos avances en el mercado de servicios de escaneo PET-CT en América del Norte

- En octubre de 2025, la división DeepHealth de RadNet firmó una carta de intención con GE Healthcare para impulsar conjuntamente la innovación y la adopción de imágenes basadas en IA en múltiples modalidades. El acuerdo busca ampliar el acceso a tecnologías avanzadas de imagenología, facilitar los flujos de trabajo de escaneo remoto e integrar herramientas de IA para mejorar la precisión diagnóstica y la eficiencia de los informes.

- En noviembre de 2025, RadNet adquirió Cimar UK, empresa británica de servicios de imagenología, lo que fortalece las capacidades de DeepHealth en la generación de informes de imagenología con IA y el cribado basado en imágenes. Se espera que la adquisición impulse la presencia de RadNet en Europa y acelere su ambición de ofrecer diagnósticos remotos y servicios de imagenología con IA en Norteamérica.

- En noviembre de 2025, RadNet amplió sus servicios de escaneo remoto mediante la adquisición de activos de Alpha-RT. Esta expansión mejora la oferta integral de imágenes remotas de RadNet, lo que permite una mayor disponibilidad del servicio y una mayor capacidad para flujos de trabajo de diagnóstico distribuidos.

- En octubre de 2025, I‑MED inauguró su primer centro de tomografía por emisión de positrones (TEP/TC) en el Hospital Privado Mater de Rockhampton, lo que permitió ofrecer imágenes diagnósticas avanzadas por TEP/TC a Queensland Central. Este desarrollo elimina la necesidad de que los pacientes viajen más de 300 km para someterse a TEP/TC en otras ciudades, mejorando así el acceso al diagnóstico oportuno de cáncer, enfermedades cardíacas y neurológicas. La instalación de I‑MED representa un impulso más amplio hacia una atención médica regional equitativa al extender los servicios de imagenología de alta calidad más allá de los centros metropolitanos.

- En agosto de 2020, I‑MED Radiology Network anunció la adquisición de Alfred Medical Imaging, un proveedor consolidado de imágenes que ofrece una gama completa de servicios de diagnóstico, incluyendo resonancia magnética y PET/CT. Esta operación amplió significativamente la presencia de I‑MED en Nueva Gales del Sur, añadiendo seis clínicas en el Inner West de Sídney, una en el Hospital Mater de Sídney Norte, además de los contratos existentes para proporcionar servicios de informes radiológicos a las autoridades sanitarias.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PET-CT SCANNING SERVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.2.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.2.1.1 JOINT VENTURES

4.2.1.2 MERGERS AND ACQUISITIONS

4.2.1.3 LICENSING AND PARTNERSHIP

4.2.1.4 TECHNOLOGY COLLABORATIONS

4.2.1.5 STRATEGIC DIVESTMENTS

4.2.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.2.3 STAGE OF DEVELOPMENT

4.2.4 TIMELINES AND MILESTONES

4.2.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.2.6 RISK ASSESSMENT AND MITIGATION

4.2.7 FUTURE OUTLOOK

4.3 PRICING ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS – NORTH AMERICA PET-CT SCANNING SERVICES MARKET

4.4.1 RADIOTRACER & ISOTOPE PRODUCTION

4.4.2 RADIOPHARMACY COMPOUNDING, QC & DISTRIBUTION

4.4.3 PET-CT SCANNER MANUFACTURING, INSTALLATION & SERVICE SUPPORT

4.4.4 IMAGING FACILITY OPERATIONS (HOSPITALS, INDEPENDENT CENTERS & MOBILE UNITS)

4.4.5 CLINICAL WORKFLOW, SCHEDULING & REFERRER INTERFACE

4.4.6 DATA MANAGEMENT, REPORTING & ARCHIVING

4.4.7 PAYERS, REIMBURSEMENT & REGULATORY OVERSIGHT

4.4.8 BOTTLENECKS, RISKS & STRATEGIC RESPONSES

4.5 VALUE CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 RAW MATERIAL SUPPLY

4.5.3 COMPONENT MANUFACTURING AND PROCESSING

4.5.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.5.5 DISTRIBUTION AND LOGISTICS

4.5.6 END-USERS (PROVIDERS & CLINICAL SECTORS)

4.5.7 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.3 FREE TRADE AGREEMENTS & ALLIANCES

5.7.4 DOMESTIC COURSE OF CORRECTION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCE OF CANCER AND NEUROLOGICAL DISORDERS

6.1.2 EXPANSION OF NORTH AMERICA HEALTHCARE INFRASTRUCTURE

6.1.3 INCREASING AWARENESS ABOUT EARLY DIAGNOSIS

6.1.4 GROWING PREFERENCE FOR HYBRID IMAGING TECHNIQUES

6.2 RESTRAINS

6.2.1 HIGH COST OF PET-CT PROCEDURES AND LIMITED REIMBURSEMENT

6.2.2 LACK OF SKILLED RADIOLOGISTS AND TECHNOLOGISTS

6.3 OPPORTUNITIES

6.3.1 EXPANSION IN EMERGING MARKETS SUCH AS ASIA-PACIFIC AND MIDDLE EAST

6.3.2 DEVELOPMENT OF MOBILE OR DECENTRALIZED PET-CT SERVICES

6.3.3 NEW CLINICAL APPLICATIONS AND TECHNOLOGICAL ADVANCEMENTS IN PET-CT IMAGING

6.4 CHALLENGES

6.4.1 OPERATIONAL CHALLENGES IN PUBLIC SECTOR HOSPITALS

6.4.2 REGULATORY AND DATA PRIVACY CONCERNS

7 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

7.2.1 STANDALONE PET-CT SCANNING SERVICES

7.2.2 ONSITE PET-CT SCANNING SERVICES

7.2.3 MOBILE PET-CT SCANNING SERVICES

7.3 NORTH AMERICA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.3.1 OUTPATIENT SERVICES

7.3.2 INPATIENT SERVICES

7.4 NORTH AMERICA OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.4.1 INDEPENDENT IMAGING CENTERS

7.4.2 HOSPITAL-BASED OUTPATIENT

7.5 NORTH AMERICA INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.5.1 GENERAL HOSPITALS

7.5.2 SPECIALTY HOSPITALS

7.5.3 DIAGNOSTIC CENTERS

7.6 NORTH AMERICA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.6.1 NORTH AMERICA

7.6.2 EUROPE

7.6.3 ASIA-PACIFIC

7.6.4 SOUTH AMERICA

7.6.5 MIDDLE EAST AND AFRICA

7.7 NORTH AMERICA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.7.1 TERTIARY CARE HOSPITALS

7.7.2 ACADEMIC MEDICAL CENTERS

7.7.3 OTHERS

7.8 NORTH AMERICA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.8.1 NORTH AMERICA

7.8.2 EUROPE

7.8.3 ASIA-PACIFIC

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST AND AFRICA

7.9 NORTH AMERICA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

7.9.1 RURAL OUTREACH INITIATIVES

7.9.2 PUBLIC HEALTH PROGRAMS

7.9.3 CORPORATE HEALTH CHECK-UP CAMPS

7.1 NORTH AMERICA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.10.1 NORTH AMERICA

7.10.2 EUROPE

7.10.3 ASIA-PACIFIC

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST AND AFRICA

8 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE

8.1 OVERVIEW

8.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

8.3 WHOLE BODY SCANS

8.3.1 PARTIAL BODY SCANS

8.4 NORTH AMERICA WHOLE BODY SCANS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 NORTH AMERICA

8.4.2 EUROPE

8.4.3 ASIA-PACIFIC

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST AND AFRICA

8.5 NORTH AMERICA PARTIAL BODY SCANS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.5.1 NORTH AMERICA

8.5.2 EUROPE

8.5.3 ASIA-PACIFIC

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST AND AFRICA

9 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE

9.1 OVERVIEW

9.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

9.2.1 FDG (FLUORODEOXYGLUCOSE)

9.2.2 NON-FDG TRACERS

9.2.3 NEW/EMERGING TRACERS

9.3 NORTH AMERICA FDG (FLUORODEOXYGLUCOSE) IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.3.1 NORTH AMERICA

9.3.2 EUROPE

9.3.3 ASIA-PACIFIC

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST AND AFRICA

9.4 NORTH AMERICA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 DOTATATE

9.4.2 CHOLINE

9.4.3 FLUOROTHYMIDINE

9.4.4 OTHERS (GA-68, AMMONIA)

9.5 NORTH AMERICA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 NORTH AMERICA

9.5.2 EUROPE

9.5.3 ASIA-PACIFIC

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST AND AFRICA

9.6 NORTH AMERICA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 PSMA

9.6.2 FAPI

9.7 NORTH AMERICA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 NORTH AMERICA

9.7.2 EUROPE

9.7.3 ASIA-PACIFIC

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST AND AFRICA

10 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

10.2.1 ONCOLOGY

10.2.2 NEUROLOGY

10.2.3 CARDIOLOGY

10.2.4 INFECTIOUS DISEASES

10.2.5 INFLAMMATORY DISEASES

10.2.6 OTHERS (ORTHOPEDIC, PEDIATRICS)

10.3 NORTH AMERICA ONCOLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 NORTH AMERICA

10.3.2 EUROPE

10.3.3 ASIA-PACIFIC

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST AND AFRICA

10.4 NORTH AMERICA NEUROLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 NORTH AMERICA

10.4.2 EUROPE

10.4.3 ASIA-PACIFIC

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST AND AFRICA

10.5 NORTH AMERICA CARDIOLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 NORTH AMERICA

10.5.2 EUROPE

10.5.3 ASIA-PACIFIC

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST AND AFRICA

10.6 NORTH AMERICA INFECTIOUS DISEASES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 NORTH AMERICA

10.6.2 EUROPE

10.6.3 ASIA-PACIFIC

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST AND AFRICA

10.7 NORTH AMERICA INFLAMMATORY DISEASES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 NORTH AMERICA

10.7.2 EUROPE

10.7.3 ASIA-PACIFIC

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST AND AFRICA

10.8 NORTH AMERICA OTHERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 NORTH AMERICA

10.8.2 EUROPE

10.8.3 ASIA-PACIFIC

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST AND AFRICA

11 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER

11.1 OVERVIEW

11.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.2.1 HOSPITALS

11.2.2 DIAGNOSTIC IMAGING CENTERS

11.2.3 SPECIALTY CLINICS

11.2.4 RESEARCH INSTITUTES

11.2.5 OTHERS

11.3 NORTH AMERICA HOSPITALS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.3.1 NORTH AMERICA

11.3.2 EUROPE

11.3.3 ASIA-PACIFIC

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST AND AFRICA

11.4 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.4.1 NORTH AMERICA

11.4.2 EUROPE

11.4.3 ASIA-PACIFIC

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST AND AFRICA

11.5 NORTH AMERICA SPECIALTY CLINICS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 NORTH AMERICA

11.5.2 EUROPE

11.5.3 ASIA-PACIFIC

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST AND AFRICA

11.6 NORTH AMERICA RESEARCH INSTITUTES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 NORTH AMERICA

11.6.2 EUROPE

11.6.3 ASIA-PACIFIC

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST AND AFRICA

11.7 NORTH AMERICA OTHERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 NORTH AMERICA

11.7.2 EUROPE

11.7.3 ASIA-PACIFIC

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST AND AFRICA

12 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.2.1 DIRECT

12.2.2 INDIRECT

12.3 NORTH AMERICA DIRECT IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.3.1 NORTH AMERICA

12.3.2 EUROPE

12.3.3 ASIA-PACIFIC

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST AND AFRICA

12.4 NORTH AMERICA INDIRECT IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 NORTH AMERICA

12.4.2 EUROPE

12.4.3 ASIA-PACIFIC

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST AND AFRICA

13 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 C-HCA, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 SIEMENS HEALTHINEERS AG

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 RADNET INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GENESISCARE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 I-MED RADIOLOGY NETWORK

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALLIANCE-HNI HEALTH CARE SERVICES

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ALLIANCE MEDICAL LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 APOLLO HOSPITALS ENTERPRISES LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 CAPITOL IMAGING SERVICES

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CARDIAC IMAGING, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CIRCLE HEALTH GROUP LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 COBALT HEALTH

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DIGNITY HEALTH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 DMS HEALTH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 FORTIS HEALTHCARE

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 INHEALTH GROUP

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 MEDICA GROUP LTD (SUBSIDIARY OF MEDICA GROUP)

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 NM MEDICAL

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NUECLEAR

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHARED MEDICAL SERVICES INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 NORTH AMERICA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 3 NORTH AMERICA OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 4 NORTH AMERICA INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 NORTH AMERICA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 NORTH AMERICA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA WHOLE BODY SCANS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA PARTIAL BODY SCANS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA FDG (FLUORODEOXYGLUCOSE) IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA ONCOLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA NEUROLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA CARDIOLOGY IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA INFECTIOUS DISEASES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA INFLAMMATORY DISEASES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA HOSPITALS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA SPECIALTY CLINICS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA RESEARCH INSTITUTES IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA DIRECT IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA INDIRECT IN PET-CT SCANNING SERVICES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA

TABLE 38 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 U.S. PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 U.S. STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 U.S. OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 U.S. INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 U.S. ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 U.S. MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 U.S. PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 U.S. PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 U.S. NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 U.S. NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 U.S. PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 62 U.S. PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 63 U.S. PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 64 CANADA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 CANADA STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 CANADA OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 CANADA INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 CANADA ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 CANADA MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 CANADA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 CANADA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 CANADA NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 CANADA NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 CANADA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 75 CANADA PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 CANADA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 77 MEXICO PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MEXICO STANDALONE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MEXICO OUTPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MEXICO INPATIENT SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MEXICO ONSITE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 MEXICO MOBILE PET-CT SCANNING SERVICES IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 MEXICO PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 MEXICO PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 MEXICO NON-FDG TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 MEXICO NEW/EMERGING TRACERS IN PET-CT SCANNING SERVICES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 MEXICO PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 88 MEXICO PET-CT SCANNING SERVICES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 89 MEXICO PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: SEGMENTATION

FIGURE 13 THREE SEGMENTS COMPRISE THE NORTH AMERICA MEDICAL PACKAGING FILMS MARKET, BY SERVICE TYPE

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA PET-CT SCANNING SERVICES MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 INCREASING INCIDENCE OF CANCER AND NEUROLOGICAL DISORDERS EXPECTED TO DRIVE THE NORTH AMERICA PET-CT SCANNING SERVICES MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 STANDALONE PET-CT SCANNING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PET-CT SCANNING SERVICES MARKET IN 2026 & 2033

FIGURE 17 NORTH AMERICA IS THE FASTEST GROWING MARKET FOR PET-CT SCANNING SERVICES MANUFACTURERS IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 18 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, 2024-2033, AVERAGE PRICE (USD/SERVICE)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PET-CT SCANNING SERVICES MARKET

FIGURE 20 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2025

FIGURE 21 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, 2026 TO 2033 (USD THOUSAND)

FIGURE 22 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: BY SERVICE TYPE, CAGR (2026- 2033)

FIGURE 23 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SERVICE TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE,

FIGURE 25 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, 2026 TO 2033 (USD THOUSAND)

FIGURE 26 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, CAGR (2025- 2036)

FIGURE 27 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY SCAN TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2025

FIGURE 29 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, 2026 TO 2033 (USD THOUSAND)

FIGURE 30 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, CAGR (2025- 2036)

FIGURE 31 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY TRACER TYPE, LIFELINE CURVE

FIGURE 32 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2025

FIGURE 33 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, 2026 TO 2033 (USD THOUSAND)

FIGURE 34 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, CAGR (2025- 2036)

FIGURE 35 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, 2025

FIGURE 37 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, 2026 TO 2033 (USD THOUSAND)

FIGURE 38 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, CAGR (2025- 2036)

FIGURE 39 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 41 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, 2026 TO 2033 (USD THOUSAND)

FIGURE 42 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, CAGR (2025- 2036)

FIGURE 43 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA PET-CT SCANNING SERVICES MARKET, SNAPSHOT (2025)

FIGURE 45 NORTH AMERICA PET-CT SCANNING SERVICES MARKET: COMPANY SHARE 2025 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.