Aislamiento de tuberías en Norteamérica por tipo de producto (películas delgadas, láminas, envolturas, productos aislantes rígidos, cubiertas aislantes de lana de roca, material de revestimiento y otros), tipo de material (lana de roca, fibra de vidrio, poliuretano , poliestireno, poliolefina, polipropileno, policarbonato, cloruro de polivinilo, urea formaldehído, espuma fenólica, espuma elastomérica y otros), temperatura (aislamiento en caliente y aislamiento en frío), aplicación (construcción, electrónica, industria química, energía y electricidad, petróleo y gas, automoción, transporte, alimentos y bebidas y otros) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado de aislamiento de tuberías de América del Norte

La mezcla caliente de petróleo y gas fluye hacia arriba desde la boca del pozo y se dirige a través de los XMT, colectores, varios instrumentos críticos, carretes y líneas de flujo antes de llegar a la superficie a través del tubo ascendente. Para evitar la formación de tapones de hidratos y la acumulación de cera, se requiere aislamiento (parafina). Cuando la composición de petróleo y gas se despresuriza y se expone a la baja temperatura del agua de mar en el fondo marino, comienza la formación de cera e hidratos. Los materiales de aislamiento de alto rendimiento tienen una gran demanda en la industria del petróleo y el gas, debido principalmente a la creciente demanda de aplicaciones de tuberías submarinas.

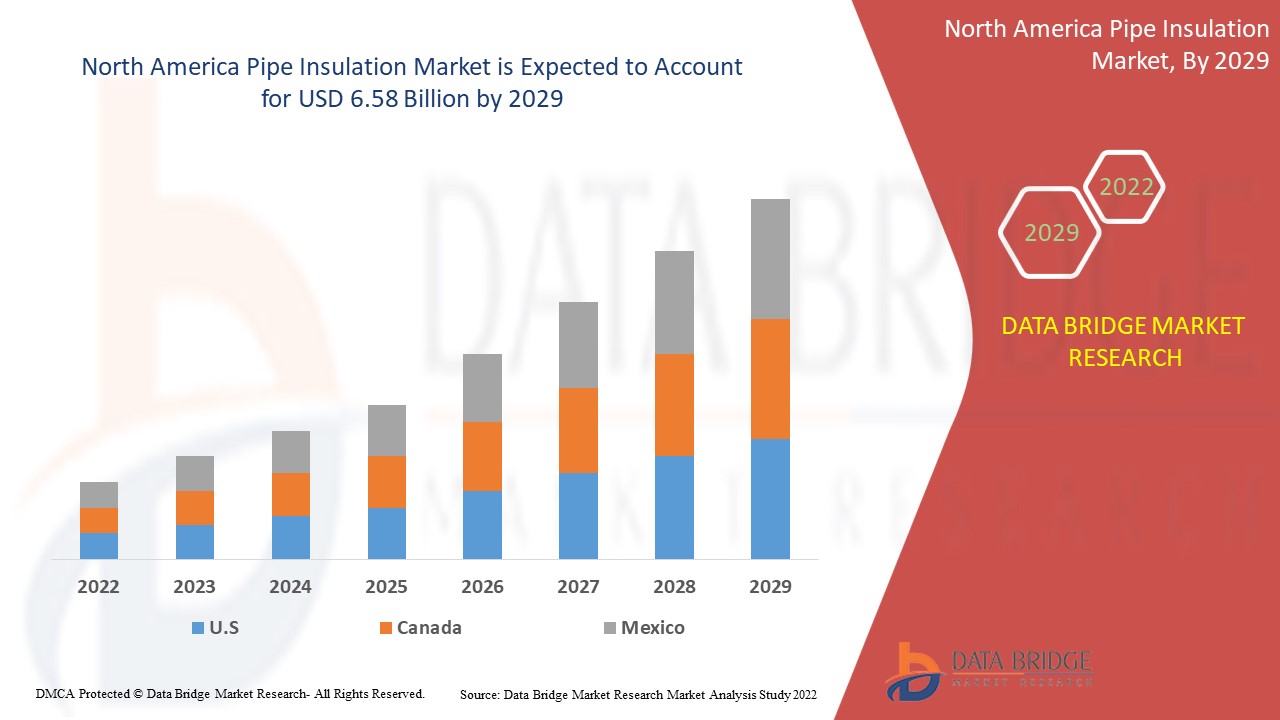

Data Bridge Market Research analiza que el mercado de aislamiento de tuberías crecerá a una CAGR del 4,5% durante el período de pronóstico y alcanzará un valor estimado de 4.63 mil millones en 2021 y llegará a USD 6.58 mil millones al final del período de pronóstico que es 2022-2029. El informe de Data Bridge Market Research sobre el mercado de materiales de aislamiento de tuberías proporciona análisis e información sobre los diversos factores que se espera que prevalezcan durante el período de pronóstico, al tiempo que proporciona sus impactos en el crecimiento del mercado. La creciente industrialización en un rango más amplio está impulsando el mercado de aislamiento de tuberías en un rango más amplio.

Definición de mercado

Los materiales aislantes para tuberías son aquellos que pueden funcionar a altas temperaturas. Estos materiales contribuyen a mejorar el rendimiento, la consistencia y la seguridad. Se utilizan en una variedad de industrias, incluidas la petroquímica, la cerámica, el cemento, el hierro y el acero, la pulvimetalurgia y otras.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de producto (películas delgadas, láminas, envolturas, productos aislantes rígidos, cubiertas aislantes de lana de roca, material de revestimiento y otros), tipo de material (lana de roca, fibra de vidrio, poliuretano, poliestireno, poliolefina, polipropileno, policarbonato, cloruro de polivinilo, urea formaldehído, espuma fenólica, espuma elastomérica y otros), temperatura (aislamiento térmico y aislamiento térmico), aplicación (construcción, electrónica, industria química, energía y electricidad, petróleo y gas, automoción, transporte, alimentos y bebidas y otros) |

|

Países cubiertos |

Estados Unidos, Canadá y México |

|

Actores del mercado cubiertos |

3M (EE. UU.), XPEL, Inc. (EE. UU.), Dow (EE. UU.), Eastman Chemical Company (EE. UU.), Hexis SAS (Francia), PremiumShield (EE. UU.), STEK-USA (EE. UU.), Reflek Technologies Corporation (EE. UU.), GRAFITYP (Bélgica), ORAFOL Europe GmbH (Alemania), DuPont (EE. UU.), DAIKIN (Japón), Optic Shield (República Checa), Solvay (Bélgica), SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (EE. UU.), Saint-Gobain (Francia) y Avery Dennison Corporation (EE. UU.) |

|

Oportunidades |

|

Dinámica del mercado del aislamiento de tuberías

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

- Crecientes preocupaciones medioambientales

La creciente conciencia ambiental sobre las emisiones de gases de efecto invernadero está impulsando la demanda de materiales de aislamiento de alto rendimiento por parte de industrias de uso final como petróleo y gas, pinturas y revestimientos, construcción y edificación, y otras, porque el aislamiento actúa como una barrera para el flujo de calor y, por lo tanto, ayuda a reducir las emisiones de gases de efecto invernadero.

Demanda creciente de diversos usuarios finales

creciente demanda en las industrias petrolera y química, donde las temperaturas de operación son muy altas, lo que resulta en pérdida de calor térmico, y se requieren tuberías con aislamiento adecuado para el transporte y la exportación seguros de productos químicos.

Oportunidad

Se espera que el rápido desarrollo de materiales de baja biopermanencia, el surgimiento de aplicaciones en las industrias aeroespacial y automotriz y el aumento de las preocupaciones sobre la conservación de energía y las emisiones de gases de efecto invernadero en varios países brinden una variedad de oportunidades de crecimiento para el mercado de materiales de aislamiento de alta temperatura durante el período de pronóstico .

Restricciones

Sin embargo, es probable que la naturaleza cancerígena de las fibras cerámicas y las estrictas regulaciones con respecto al uso de materiales de aislamiento actúen como restricciones clave en la tasa de crecimiento del mercado de materiales de aislamiento de alta temperatura en el período de pronóstico de 2021 a 2028, mientras que los diversos efectos nocivos como resultado de la exposición pueden desafiar el crecimiento.

Este informe sobre el mercado de aislamiento de tuberías proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de aislamiento de tuberías, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto posterior al COVID-19 en el mercado del aislamiento de tuberías

El mercado de materiales de aislamiento de tuberías se vio afectado de diversas formas como resultado de la pandemia de Covid-19. Existieron varias restricciones legales en todo el mundo, que tuvieron un impacto significativo en la demanda y el crecimiento del mercado de aislamiento de tuberías. Las actividades de producción y ventas se vieron significativamente interrumpidas, lo que ralentizó el crecimiento del mercado de aislamiento de tuberías. Sin embargo, el mercado de aislamiento de tuberías creció de manera constante a fines de 2020 y se espera que crezca aún más y cubra las pérdidas de la industria a fines de 2022.

Alcance del mercado de aislamiento de tuberías en América del Norte

El mercado de aislamiento de tuberías está segmentado en función del tipo de producto, tipo de material, temperatura y aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Películas delgadas

- Láminas

- Envolturas

- Productos con aislamiento rígido

- Cubiertas aislantes de lana de roca

- Material de revestimiento

- Otros

Tipo de material

- Lana de roca

- Fibra de vidrio

- Poliuretano

- Poliestireno

- Poliolefina

- Polipropileno

- Policarbonato

- Cloruro de polivinilo

- Urea formaldehído

- Espuma fenólica

- Espuma elastomérica

- Otros

Temperatura

- Aislamiento térmico

- Aislamiento del frío

Solicitud

- Construcción y edificación

- Electrónica

- Industria química

- Energía y potencia

- Petróleo y gas

- Automotor

- Transporte

- Alimentos y bebidas

- Otros

Análisis y perspectivas regionales del mercado de aislamiento de tuberías

Se analiza el mercado de aislamiento de tuberías y se proporcionan información y tendencias del tamaño del mercado por tipo de producto, tipo de material, temperatura y aplicación del país, como se menciona anteriormente.

Los países cubiertos en el informe del mercado de aislamiento de tuberías son EE. UU., Canadá, México,

Estados Unidos está dominando América del Norte debido a la creciente demanda en las industrias petrolera y química, donde las temperaturas de operación son muy altas, lo que resulta en pérdida de calor térmico, y se requieren tuberías con aislamiento adecuado para el transporte y la exportación seguros de productos químicos.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas de América del Norte y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del aislamiento de tuberías

El panorama competitivo del mercado de aislamiento de tuberías proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en América del Norte, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de aislamiento de tuberías.

Algunos de los principales actores que operan en el mercado de aislamiento de tuberías son:

- 3M (Estados Unidos)

- XPEL, Inc. (Estados Unidos)

- Dow (Estados Unidos)

- Compañía química Eastman (Estados Unidos)

- Hexis SAS (Francia)

- PremiumShield (Estados Unidos)

- STEK-USA (Estados Unidos)

- Reflek Technologies Corporation (Estados Unidos)

- GRAFITYP (Bélgica)

- ORAFOL Europe GmbH (Alemania)

- DuPont (Estados Unidos)

- DAIKIN (Japón)

- Escudo óptico (República Checa)

- Solvay (Bélgica)

- SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (EE. UU.)

- Saint-Gobain (Francia)

- Avery Dennison Corporation (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PIPE INSULATION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING BUILDING CONSTRUCTION IN DEVELOPING NATIONS

5.1.2 MINIMIZED HEAT LOSS IN MANUFACTURING SITES

5.1.3 STRENGTHENING OF REGULATIONS TO INSULATE OIL & GAS PIPELINES

5.1.4 INCREASING SUPPLY OF OIL THROUGH PIPELINES OWING TO INCREASED MARINE POLLUTION CAUSED BY SHIPS

5.1.5 RISING MODERN AGRICULTURAL METHODS BOOSTS THE DEMAND FOR INSULATION OF PIPES

5.2 RESTRAINTS

5.2.1 DAMAGE CAUSED TO THE ENVIRONMENT DUE TO CONSTRUCTION OF PIPES AND ITS INSULATION

5.2.2 CHANGE OF CHEMICAL STRUCTURE DUE TO ADULTERATION THROUGH INSULATING MATERIAL IN OIL & PETROCHEMICALS AND CHEMICALS

5.2.3 ADVERSE EFFECTS ON MARINE LIFE

5.3 OPPORTUNITIES

5.3.1 GROWING PETROCHEMICALS INDUSTRY IN ASIA-PACIFIC

5.3.2 UTILIZATION OF PIPE INSULATION IN THE MECHANICAL MANAGEMENT OF THE FOOD AS WELL AS PHARMACEUTICAL INDUSTRY

5.4 CHALLENGES

5.4.1 FIRE AND EXPLOSION DUE TO CHEMICALS REACTION WITH INSULATING MATERIAL IN PIPES

5.4.2 THE AVAILABILITY OF SUBSTITUTES LIKE ELECTRIC TRACE HEATING

5.4.3 HIGH COST AND HIGH TIME CONSUMPTION IN REPLACEMENT

6 NORTH AMERICA PIPE INSULATION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 RIGID INSULATION PRODUCTS

6.2.1 RIGID FOAM

6.2.2 FIBER GLASS COVER

6.2.3 WOOD

6.2.4 OTHERS

6.3 STONE WOOL INSULATION COVERS

6.4 COATING MATERIAL

6.5 THIN FILMS

6.6 WRAPS

6.7 FOILS

6.8 OTHERS

7 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 POLYURETHANE

7.3 ROCKWOOL

7.4 FIBERGLASS

7.5 POLYSTYRENE

7.5.1 EXPANDED POLYSTYRENE

7.5.2 EXTRUDED POLYSTYRENE

7.6 POLYOLEFIN

7.7 POLYPROPYLENE

7.8 POLYCARBONATE

7.9 POLYVINYL CHLORIDE

7.1 UREA FORMALDEHYDE

7.11 PHENOLIC FOAM

7.12 ELASTOMERIC FOAM

7.13 OTHERS

8 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE

8.1 OVERVIEW

8.2 COLD INSULATION

8.3 HOT INSULATION

9 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OIL & GAS

9.2.1 OIL & GAS, BY END-USER

9.2.1.1 OIL

9.2.1.1.1 CRUDE OIL

9.2.1.1.2 PETROCHEMICAL

9.2.1.1.3 OTHER CRUDE OIL DERIVATIVES

9.2.1.2 GAS

9.2.1.2.1 NATURAL GAS

9.2.1.2.2 SYNTHETIC GAS

9.2.2 OIL & GAS, BY PRODUCT TYPE

9.2.2.1 RIGID INSULATION PRODUCTS

9.2.2.1.1 OIL & GAS, BY RIGID INSULATION PRODUCTS

9.2.2.1.1.1 RIGID FOAM

9.2.2.1.1.2 FIBER GLASS COVER

9.2.2.1.1.3 WOOD

9.2.2.1.1.4 OTHERS

9.2.2.2 STONE WOOL INSULATION COVERS

9.2.2.3 COATING MATERIAL

9.2.2.4 THIN FILMS

9.2.2.5 WRAPS

9.2.2.6 FOILS

9.2.2.7 OTHERS

9.3 CHEMICAL INDUSTRY

9.3.1 CHEMICAL INDUSTRY, BY PRODUCT TYPE

9.3.1.1 RIGID INSULATION PRODUCTS

9.3.1.1.1 CHEMICAL INDUSTRY, BY RIGID INSULATION PRODUCTS

9.3.1.1.1.1 RIGID FOAM

9.3.1.1.1.2 FIBER GLASS COVER

9.3.1.1.1.3 WOOD

9.3.1.1.1.4 OTHERS

9.3.1.2 STONE WOOL INSULATION COVERS

9.3.1.3 COATING MATERIAL

9.3.1.4 THIN FILMS

9.3.1.5 WRAPS

9.3.1.6 FOILS

9.3.1.7 OTHERS

9.4 FOOD AND BEVERAGE

9.4.1 FOOD AND BEVERAGE, BY END-USER

9.4.1.1 BEVERAGE

9.4.1.1.1 ALCOHOLIC BEVERAGE

9.4.1.1.2 DAIRY

9.4.1.1.3 AERATED DRINKS

9.4.1.1.4 JUICES AND FLAVORED WATER

9.4.1.1.5 OTHERS

9.4.1.2 FOOD

9.4.2 FOOD AND BEVERAGE, BY PRODUCT TYPE

9.4.2.1 RIGID INSULATION PRODUCTS

9.4.2.1.1 FOOD AND BEVERAGE, BY RIGID INSULATION PRODUCTS

9.4.2.1.1.1 RIGID FOAM

9.4.2.1.1.2 FIBER GLASS COVER

9.4.2.1.1.3 WOOD

9.4.2.1.1.4 OTHERS

9.4.2.2 STONE WOOL INSULATION COVERS

9.4.2.3 COATING MATERIAL

9.4.2.4 THIN FILMS

9.4.2.5 WRAPS

9.4.2.6 FOILS

9.4.2.7 OTHERS

9.5 BUILDING AND CONSTRUCTION

9.5.1 BUILDING AND CONSTRUCTION, BY END-USER

9.5.1.1 COMMERCIAL

9.5.1.2 RESIDENTIAL

9.5.1.3 INSTITUTIONAL

9.5.1.4 INFRASTRUCTURE

9.5.2 BUILDING AND CONSTRUCTION, BY PRODUCT TYPE

9.5.2.1 RIGID INSULATION PRODUCTS

9.5.2.1.1 BUILDING AND CONSTRUCTION, BY RIGID INSULATION PRODUCTS

9.5.2.1.1.1 RIGID FOAM

9.5.2.1.1.2 FIBER GLASS COVER

9.5.2.1.1.3 WOOD

9.5.2.1.1.4 OTHERS

9.5.2.2 STONE WOOL INSULATION COVERS

9.5.2.3 COATING MATERIAL

9.5.2.4 THIN FILMS

9.5.2.5 WRAPS

9.5.2.6 FOILS

9.5.2.7 OTHERS

9.6 ENERGY AND POWER

9.6.1 ENERGY AND POWER, BY PRODUCT TYPE

9.6.1.1 RIGID INSULATION PRODUCTS

9.6.1.2 STONE WOOL INSULATION COVERS

9.6.1.2.1 ENERGY AND POWER, BY RIGID INSULATION PRODUCTS

9.6.1.2.1.1 RIGID FOAM

9.6.1.2.1.2 FIBER GLASS COVER

9.6.1.2.1.3 WOOD

9.6.1.2.1.4 OTHERS

9.6.1.3 COATING MATERIAL

9.6.1.4 THIN FILMS

9.6.1.5 WRAPS

9.6.1.6 FOILS

9.6.1.7 OTHERS

9.7 ELECTRONICS

9.7.1 ELECTRONICS, BY PRODUCT TYPE

9.7.1.1 RIGID INSULATION PRODUCTS

9.7.1.1.1 ELECTRONICS, BY RIGID INSULATION PRODUCTS

9.7.1.1.1.1 RIGID FOAM

9.7.1.1.1.2 FIBER GLASS COVER

9.7.1.1.1.3 WOOD

9.7.1.1.1.4 OTHERS

9.7.1.2 STONE WOOL INSULATION COVERS

9.7.1.3 COATING MATERIAL

9.7.1.4 THIN FILMS

9.7.1.5 WRAPS

9.7.1.6 FOILS

9.7.1.7 OTHERS

9.8 AUTOMOTIVE

9.8.1 AUTOMOTIVE, BY END-USER

9.8.1.1 PASSENGER CARS

9.8.1.2 COMMERCIAL VEHICLES

9.8.1.3 AGRICULTURAL VEHICLES

9.8.1.4 OTHERS

9.8.2 AUTOMOTIVE, BY PRODUCT TYPE

9.8.2.1 RIGID INSULATION PRODUCTS

9.8.2.1.1 AUTOMOTIVE, BY RIGID INSULATION PRODUCTS

9.8.2.1.1.1 RIGID FOAM

9.8.2.1.1.2 FIBER GLASS COVER

9.8.2.1.1.3 WOOD

9.8.2.1.1.4 OTHERS

9.8.2.2 STONE WOOL INSULATION COVERS

9.8.2.3 COATING MATERIAL

9.8.2.4 THIN FILMS

9.8.2.5 WRAPS

9.8.2.6 FOILS

9.8.2.7 OTHERS

9.9 TRANSPORTATION

9.9.1 TRANSPORTATION, BY END-USER

9.9.1.1 RAILWAY

9.9.1.2 MARINE

9.9.1.3 OTHERS

9.9.2 TRANSPORTATION, BY PRODUCT TYPE

9.9.2.1 RIGID INSULATION PRODUCTS

9.9.2.1.1 TRANSPORTATION, BY RIGID INSULATION PRODUCTS

9.9.2.1.1.1 RIGID FOAM

9.9.2.1.1.2 FIBER GLASS COVER

9.9.2.1.1.3 WOOD

9.9.2.1.1.4 OTHERS

9.9.2.2 STONE WOOL INSULATION COVERS

9.9.2.3 COATING MATERIAL

9.9.2.4 THIN FILMS

9.9.2.5 WRAPS

9.9.2.6 FOILS

9.9.2.7 OTHERS

9.1 OTHERS

9.10.1 OTHERS, BY PRODUCT TYPE

9.10.1.1 RIGID INSULATION PRODUCTS

9.10.1.1.1 OTHERS, BY RIGID INSULATION PRODUCTS

9.10.1.1.1.1 RIGID FOAM

9.10.1.1.1.2 FIBER GLASS COVER

9.10.1.1.1.3 WOOD

9.10.1.1.1.4 OTHERS

9.10.1.2 STONE WOOL INSULATION COVERS

9.10.1.3 COATING MATERIAL

9.10.1.4 THIN FILMS

9.10.1.5 WRAPS

9.10.1.6 FOILS

9.10.1.7 OTHERS

10 NORTH AMERICA PIPE INSULATION MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA PIPE INSULATION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 MERGER & ACQUISITION

11.3 EXPANSIONS

11.4 NEW PRODUCT DEVELOPMENT

12 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

12.1 SWOT ANALYSIS

12.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 SAINT-GOBAIN

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 3M

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 BASF PLC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 DOW IZOLAN

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 HUNTSMAN INTERNATIONAL LLC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ALL AMERICAN INSULATION SERVICES, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 SERVICE PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARMACELL

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CELLOFOAM GMBH & CO. KG

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COMMERCIAL THERMAL SOLUTIONS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 COVESTRO AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DUNMORE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 GILSULATE INTERNATIONAL, INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 GREAT LAKES TEXTILES

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 GULF COOL THERM FACTORY LTD

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 JOHNS MANVILLE

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 KINGSPAN GROUP

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 KNAUF INSULATION

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 L'ISOLANTE K-FLEX S.P.A.

13.18.1 COMPANY SNAPSHOT

13.18.2 APPLICATION PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 MAYES COATINGS & INSULATION, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 SERVICE PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 NMC SA

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 OWENS CORNING

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCT PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

13.22 POLARCLAD TANK INSULATION

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

13.23 RÖCHLING

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 ROCKWOOL INTERNATIONAL A/S

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENT

13.25 SYNAVAX

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF TUBES, PIPES AND HOSES, AND FITTINGS THEREFORE, E.G. JOINTS, ELBOWS, FLANGES, OF PLASTICS, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS) OF HEADING 3918 AND STERILE SURGICAL OR DENTAL ADHESION BARRIERS; HS CODE: 39217 (USD THOUSAND)

TABLE 2 EXPORT DATA TUBES, PIPES AND HOSES, AND FITTINGS THEREFORE, E.G. JOINTS, ELBOWS, FLANGES, OF PLASTICS, UNWORKED OR MERELY SURFACE-WORKED OR MERELY CUT INTO SQUARES OR RECTANGLES (EXCLUDING SELF-ADHESIVE PRODUCTS, FLOOR, WALL AND CEILING COVERINGS) OF HEADING 3918 AND STERILE SURGICAL OR DENTAL ADHESION BARRIERS; HS CODE: 3917 (EURO THOUSAND)

TABLE 3 INSULATION IMPORT GROWTH RATE, 2014-2015 (%)

TABLE 4 NORTH AMERICA PIPE INSULATION MARKET, BY TYPE, 2018-2027 (KILO TONS)

TABLE 5 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 6 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 7 NORTH AMERICA STONE WOOL INSULATION COVERS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 8 NORTH AMERICA COATING MATERIAL IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 9 NORTH AMERICA THIN FILMS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 10 NORTH AMERICA WRAPS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 11 NORTH AMERICA FOILS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 13 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 14 NORTH AMERICA POLYURETHANE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 15 NORTH AMERICA ROCKWOOL MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 16 NORTH AMERICA FIBERGLASS MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 17 NORTH AMERICA POLYSTYRENE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 18 NORTH AMERICA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 19 NORTH AMERICA POLYOLEFIN MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 20 NORTH AMERICA POLYPROPYLENE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 21 NORTH AMERICA POLYCARBONATE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 22 NORTH AMERICA POLYVINYL CHLORIDE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 23 NORTH AMERICA UREA FORMALDEHYDE MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 24 NORTH AMERICA PHENOLIC FOAM MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 25 NORTH AMERICA ELASTOMERIC FOAM MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 26 NORTH AMERICA OTHERS MATERIAL TYPE IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 27 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 28 NORTH AMERICA COLD INSULATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 29 NORTH AMERICA HOT INSULATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 30 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 31 NORTH AMERICA OIL & GAS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 32 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 33 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 34 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 35 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 36 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 37 NORTH AMERICA CHEMICAL INDUSTRY APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 38 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 39 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 40 NORTH AMERICA FOOD AND BEVERAGE APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 41 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 42 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 43 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 44 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 45 NORTH AMERICA BUILDING AND CONSTRUCTION APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 46 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 47 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 48 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 49 NORTH AMERICA ENERGY AND POWER APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 50 NORTH AMERICA ENERGY AND POWERIN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND POWERIN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 52 NORTH AMERICA ELECTRONICS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 53 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 54 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 55 NORTH AMERICA AUTOMOTIVE APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 56 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 59 NORTH AMERICA TRANSPORTATION APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 60 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 61 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 62 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 63 NORTH AMERICA OTHERS APPLICATION IN PIPE INSULATION MARKET, BY REGION, 2018-2027 (EURO THOUSAND)

TABLE 64 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 65 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 66 NORTH AMERICA PIPE INSULATION MARKET, BY COUNTRY, 2018-2027 (EURO THOUSAND)

TABLE 67 NORTH AMERICA PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 68 NORTH AMERICA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 69 NORTH AMERICA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 70 NORTH AMERICA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 71 NORTH AMERICA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 72 NORTH AMERICA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 73 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 74 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 75 NORTH AMERICA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 76 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 77 NORTH AMERICA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 78 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 79 NORTH AMERICA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 80 NORTH AMERICA ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 81 NORTH AMERICA ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 82 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 83 NORTH AMERICA OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 84 NORTH AMERICA GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 85 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 86 NORTH AMERICA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 87 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 88 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 89 NORTH AMERICA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 90 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 91 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 92 NORTH AMERICA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 93 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 94 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 95 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 96 NORTH AMERICA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 97 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 98 NORTH AMERICA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 99 U.S. PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 100 U.S. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE , 2018-2027 (EURO THOUSAND)

TABLE 101 U.S. PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 102 U.S. POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 103 U.S. PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 104 U.S. PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 105 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 106 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 107 U.S. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 108 U.S. ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT YPE, 2018-2027 (EURO THOUSAND)

TABLE 109 U.S. ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 110 U.S. CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 111 U.S. CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 112 U.S. ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 113 U.S. ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 114 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 115 U.S. OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 116 U.S. GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 117 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 118 U.S. OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 119 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 120 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 121 U.S. AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 122 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 123 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 124 U.S. TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 125 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 126 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 127 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 128 U.S. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 129 U.S. OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 130 U.S. OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 131 CANADA PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (TONS)

TABLE 132 CANADA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 133 CANADA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 134 CANADA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 135 CANADA PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 136 CANADA PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 137 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 138 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 139 CANADA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 140 CANADA ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 141 CANADA ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 142 CANADA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 143 CANADA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 144 CANADA ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 145 CANADA ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 146 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 147 CANADA OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 148 CANADA GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 149 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 150 CANADA OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 151 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 152 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 153 CANADA AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 154 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 155 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 156 CANADA TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 157 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 158 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 159 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 160 CANADA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 161 CANADA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 162 CANADA OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 163 MEXICO PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 164 MEXICO RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 165 MEXICO PIPE INSULATION MARKET, BY MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 166 MEXICO POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2018-2027 (EURO THOUSAND)

TABLE 167 MEXICO PIPE INSULATION MARKET, BY TEMPERATURE, 2018-2027 (EURO THOUSAND)

TABLE 168 MEXICO PIPE INSULATION MARKET, BY APPLICATION, 2018-2027 (EURO THOUSAND)

TABLE 169 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 170 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 171 MEXICO BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 172 MEXICO ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 173 MEXICO ELECTRONICS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 174 MEXICO CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 175 MEXICO CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 176 MEXICO ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 177 MEXICO ENERGY & POWER IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 178 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 179 MEXICO OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2018-2027 (EURO THOUSAND)

TABLE 180 MEXICO GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2018-2027 (EURO THOUSAND)

TABLE 181 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 182 MEXICO OIL & GAS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 183 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 184 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 185 MEXICO AUTOMOTIVE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 186 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2018-2027 (EURO THOUSAND)

TABLE 187 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 188 MEXICO TRANSPORTATION IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 189 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 190 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2018-2027 (EURO THOUSAND)

TABLE 191 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 192 MEXICO FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

TABLE 193 MEXICO OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2018-2027 (EURO THOUSAND)

TABLE 194 MEXICO OTHERS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS, 2018-2027 (EURO THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA PIPE INSULATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PIPE INSULATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PIPE INSULATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PIPE INSUALTION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PIPE INSUALTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PIPE INSULATION MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PIPE INSULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA PIPE INSULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PIPE INSULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PIPE INSULATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PIPE INSULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA PIPE INSULATION MARKET: SEGMENTATION

FIGURE 13 RAPID INDUSTRILIZATION IS DRIVING THE NORTH AMERICA PIPE INSULATION MARKET IN THE FORECAST PERIOD OF 2020-2027

FIGURE 14 RIGID INSULATION PRODUCTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PIPE INSULATION MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA PIPE INSULATION MARKET

FIGURE 16 NORTH AMERICA PIPE INSULATION MARKET: BY PRODUCT TYPE, 2019

FIGURE 17 NORTH AMERICA PIPE INSULATION MARKET: BY MATERIAL TYPE, 2019

FIGURE 18 NORTH AMERICA PIPE INSULATION MARKET: BY TEMPERATURE, 2019

FIGURE 19 NORTH AMERICA PIPE INSULATION MARKET: BY APPLICATION, 2019

FIGURE 20 NORTH AMERICA PIPE INSULATION MARKET : SNAPSHOT (2019)

FIGURE 21 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2019)

FIGURE 22 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2020 & 2027)

FIGURE 23 NORTH AMERICA PIPE INSULATION MARKET : BY COUNTRY (2019 & 2027)

FIGURE 24 NORTH AMERICA PIPE INSULATION MARKET BY PRODUCT TYPE (2020-2027)

FIGURE 25 NORTH AMERICA PIPE INSULATION MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.