North America Sensors Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

65,414.17 Million

USD

152,795.44 Million

2024

2032

USD

65,414.17 Million

USD

152,795.44 Million

2024

2032

| 2025 –2032 | |

| USD 65,414.17 Million | |

| USD 152,795.44 Million | |

|

|

|

|

Segmentación del mercado de sensores en Norteamérica por tipo ( sensor de temperatura , sensor de imagen, sensor de movimientosensor de presiónsensor táctil , sensor de proximidad y desplazamiento , acelerómetro y sensor de velocidad, sensor de humedad, sensor de gas, sensor óptico, sensor de fuerza, sensor de flujo, sensor de nivel, biosensorsensor de posición , etc.), tecnología (MEMS, CMOS, NEMS, etc.), usuario final (automotriz, electrónica de consumo, atención médica, fabricación, aeroespacial y defensa, energía, TI y telecomunicaciones, petróleo y gas, química, alimentos y bebidas, construcción, minería, papel y pulpa, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de sensores

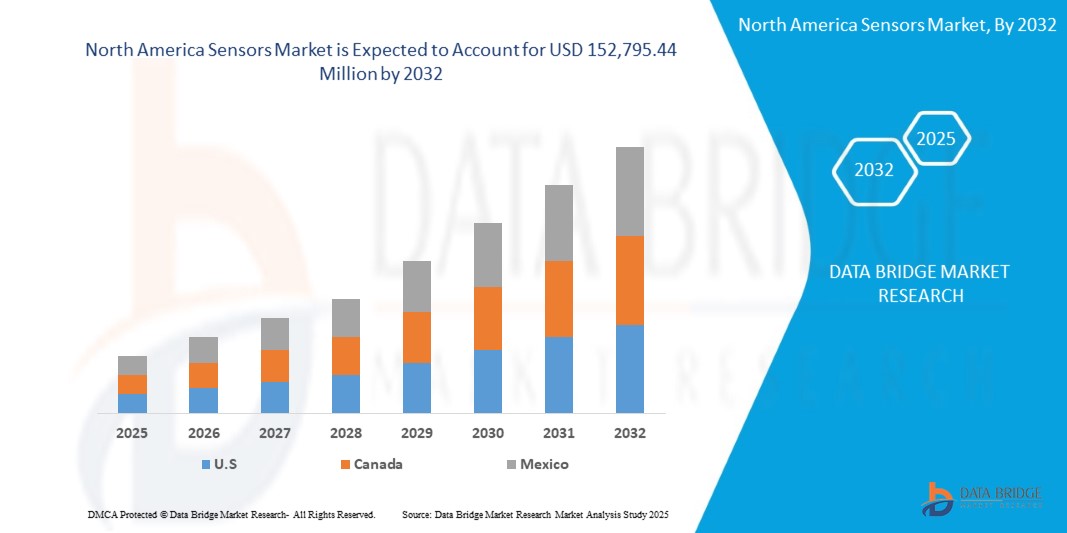

- El tamaño del mercado de sensores de América del Norte se valoró en USD 65.414,17 millones en 2024 y se proyecta que alcance los USD 152.795,44 millones para 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 11,3 %, impulsado principalmente por la creciente demanda en industrias como la automotriz, la atención médica, la electrónica de consumo y la automatización industrial.

- Este crecimiento está impulsado por factores como el auge de la IoT, los dispositivos inteligentes y las aplicaciones impulsadas por IA que han impulsado la adopción de sensores avanzados para el monitoreo y la recopilación de datos en tiempo real.

Análisis del mercado de sensores

- El mercado norteamericano de sensores ha experimentado un crecimiento significativo, impulsado por la creciente demanda de soluciones de embalaje sostenibles, ligeras y duraderas en diversas industrias. Sectores clave como el comercio electrónico, la alimentación y bebidas, la industria farmacéutica y los bienes de consumo.

- Las innovaciones en la impresión digital y las tecnologías de embalaje inteligente están mejorando aún más las oportunidades de marca y personalización, atendiendo las preferencias cambiantes de los consumidores.

- El futuro de la industria está determinado por los avances en automatización, innovación de materiales e iniciativas de economía circular, lo que garantiza una mayor eficiencia y sostenibilidad en la producción de envases.

- Por ejemplo, en marzo de 2023, Sony Semiconductor Solutions presentó un sensor de profundidad SPAD (diodo de avalancha de fotón único) diseñado para smartphones , que ofrece alta precisión y bajo consumo de energía en la medición de distancias. Este sensor cuenta con la mayor eficiencia de detección de fotones de la industria, lo que permite una detección de profundidad precisa y capacidades 3D mejoradas.

- Además, las estrictas regulaciones ambientales y el impulso hacia soluciones de embalaje ecológicas están acelerando la expansión del mercado.

Alcance del informe y segmentación del mercado de sensores

|

Atributos |

Perspectivas clave del mercado de sensores |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencia del mercado de sensores

Los avances en IA y ML mejoran las capacidades de los sensores para el análisis predictivo.

- La integración de la IA y el aprendizaje automático con sensores está transformando las industrias al permitir el procesamiento de datos en tiempo real, la detección de anomalías y el mantenimiento predictivo. Estas tecnologías permiten que los sensores proporcionen información inteligente, reduciendo el tiempo de inactividad operativa y mejorando la eficiencia.

- A medida que los algoritmos de IA se vuelven más sofisticados, los sensores evolucionan para gestionar conjuntos de datos complejos , lo que permite una toma de decisiones más rápida y precisa. La demanda de sensores con IA está creciendo en sectores como las redes inteligentes, los vehículos autónomos y el IoT industrial, donde las capacidades predictivas mejoran la seguridad y la eficiencia operativas.

- Por ejemplo, en agosto de 2024, según digit7, los algoritmos de aprendizaje automático se aplicaron en situaciones reales. La regresión logística ayudó a detectar fraudes con tarjetas de crédito, los árboles de decisión mejoraron la atención al cliente y el bosque aleatorio facilitó el mantenimiento predictivo. Las redes neuronales impulsaron los vehículos autónomos y el reconocimiento de voz, mientras que el filtrado colaborativo mejoró las recomendaciones personalizadas. Los avances en IA y ML mejoraron las capacidades de los sensores para el análisis predictivo, lo que permitió a las industrias analizar datos de sensores en tiempo real para la monitorización de equipos, el análisis del cambio climático y la evaluación de riesgos sanitarios.

- Como resultado, las industrias que adoptan soluciones inteligentes basadas en datos y sensores mejorados con IA están impulsando un crecimiento significativo en el mercado de sensores de América del Norte.

- La adopción generalizada de tecnologías de hogares inteligentes y soluciones de mantenimiento predictivo está impulsando aún más la implementación de sensores.

Dinámica del mercado de sensores

Conductor

La expansión de la atención médica inteligente aumenta la demanda de biosensores y dispositivos portátiles.

- Los biosensores y dispositivos portátiles están revolucionando la atención médica al permitir el monitoreo en tiempo real de signos vitales como la frecuencia cardíaca, los niveles de glucosa y la temperatura corporal.

- Los avances en miniaturización y conectividad inalámbrica hacen que estos dispositivos sean más accesibles, mejorando la atención y el diagnóstico del paciente . La creciente adopción de soluciones de monitorización basadas en IoT e IA impulsa aún más la demanda de biosensores.

- Además, los biosensores portátiles integrados con plataformas en la nube permiten un intercambio fluido de datos entre pacientes y profesionales sanitarios. Este avance mejora la detección temprana de enfermedades, optimiza el manejo de enfermedades crónicas y apoya las intervenciones médicas proactivas para obtener mejores resultados de salud.

- Por ejemplo, en febrero de 2025, el futurista médico informó que las tecnologías de salud digital, incluyendo sensores inteligentes, podrían mejorar la atención a las personas mayores mediante la monitorización de sus condiciones de salud y el análisis de datos mediante IA. A pesar de desafíos como la asequibilidad y la falta de innovaciones específicas, la demanda de esta tecnología está creciendo a medida que los sistemas de salud priorizan la calidad de vida. Dado que los sensores desempeñan un papel crucial en el seguimiento de las constantes vitales y el apoyo a la atención remota, se espera que su adopción aumente, contribuyendo así a los avances en las soluciones de atención médica para personas mayores.

- A medida que la atención médica avanza hacia el monitoreo remoto y las soluciones basadas en datos, la adopción de sensores avanzados está acelerando el mercado.

- Con los avances continuos que mejoran la precisión, la eficiencia y la accesibilidad, se espera que la integración de soluciones basadas en sensores aumente aún más.

Oportunidad

La expansión de la Industria 4.0 acelerará la implementación de sensores en la automatización y la fabricación.

- El rápido avance de la Industria 4.0 impulsa la demanda de sensores inteligentes en la automatización y la fabricación. A medida que las industrias adoptan el IoT, la IA y el aprendizaje automático, los sensores desempeñan un papel crucial para facilitar la recopilación de datos en tiempo real, el mantenimiento predictivo y la toma de decisiones automatizada.

- Con la creciente adopción de la robótica, los gemelos digitales y las fábricas inteligentes, la necesidad de sensores de alta precisión sigue creciendo en diversos sectores, como la automoción, la electrónica y la salud. Las empresas que invierten en sistemas automatizados y conectados dependen de los sensores para supervisar los procesos, garantizar el control de calidad y optimizar el uso de recursos.

- Esta tendencia no solo acelera la innovación, sino que también amplía las oportunidades para que los fabricantes de sensores desarrollen soluciones de próxima generación, energéticamente eficientes y altamente integradas.

- Por ejemplo, en diciembre de 2023, según Oracle, la Industria 4.0 está transformando la manufactura al integrar la automatización, la IA y el análisis de datos para crear fábricas inteligentes que mejoran la eficiencia, reducen costos y mejoran la calidad. Empresas como BMW, Siemens y LG están aprovechando sensores, robótica y análisis en tiempo real para optimizar la producción. Esta expansión está impulsando una mayor demanda de sensores, incluyendo sensores de proximidad, visión, temperatura y movimiento, que permiten la recopilación de datos en tiempo real, el mantenimiento predictivo y una automatización fluida.

- La creciente integración de tecnologías avanzadas en los procesos industriales presenta una oportunidad significativa para la innovación y expansión de sensores.

- A medida que la adopción de la automatización, la IA y la IoT continúa aumentando, la demanda de sensores inteligentes, confiables y de alto rendimiento solo aumentará.

Restricción/Desafío

Los altos costos de implementación limitan la adopción de sensores en las pequeñas y medianas empresas.

- Si bien los sensores brindan beneficios significativos, la alta inversión inicial requerida para su instalación, calibración e integración en sistemas existentes sigue siendo un desafío, especialmente para las pequeñas y medianas empresas.

- Los sensores avanzados, en particular los que funcionan con IA y el IoT, suelen requerir costosas actualizaciones de infraestructura y personal cualificado para su funcionamiento. Esta carga financiera limita su adopción generalizada, retrasando la transformación digital en sectores como la manufactura, la sanidad y el comercio minorista.

- Muchas pymes tienen dificultades para justificar el retorno de la inversión en la costosa automatización basada en sensores, lo que resulta en tasas de adopción más lentas. Los esfuerzos para desarrollar soluciones de sensores asequibles y listas para usar podrían ayudar a las pequeñas empresas a superar esta situación.

- Por ejemplo, en noviembre de 2024, el análisis de Qviro BV demostró que el coste de la automatización industrial varió en 2025 según el tipo de sistema, las necesidades de la industria y las personalizaciones. Los gastos incluyeron hardware, software, instalación, formación y mantenimiento. El precio de los robots oscilaba entre 20.000 y 500.000 USD, con costes adicionales de integración y soporte. Los elevados costes de implementación limitaron el crecimiento del mercado de sensores, ya que las pequeñas empresas se enfrentaban a obstáculos financieros para adoptar tecnologías de automatización avanzadas.

- Sin embargo, la carga financiera que supone implementar sensores sigue siendo un desafío importante para las PYME, lo que limita su capacidad para adoptar la automatización y las tecnologías inteligentes.

- Los altos costos asociados con la instalación, el mantenimiento y la integración del sistema ralentizan la expansión del mercado y restringen el acceso a aplicaciones de sensores avanzados.

Alcance del mercado de sensores

El mercado está segmentado en tres segmentos notables según el tipo, la tecnología y el usuario final.

|

Segmentación |

Subsegmentación |

|

Por tipo |

|

|

Por tecnología |

|

|

Por el usuario final |

|

Análisis regional del mercado de sensores

Se espera que EE. UU. domine el mercado de sensores de América del Norte.

- Se espera que Estados Unidos domine el mercado de sensores de América del Norte debido a la rápida industrialización, la creciente adopción de la automatización y la creciente demanda de dispositivos habilitados para IoT.

- El sector manufacturero en expansión de la región, junto con las iniciativas gubernamentales que promueven las fábricas inteligentes y la Industria 4.0, está impulsando la demanda de sensores avanzados en diversas industrias.

- Además, la creciente penetración de dispositivos inteligentes, vehículos eléctricos y sistemas de monitorización sanitaria está impulsando el crecimiento del mercado. La sólida presencia de fabricantes de semiconductores y los avances en tecnologías de sensores basadas en IA contribuyen aún más al liderazgo de la región en el mercado de sensores de Norteamérica.

Cuota de mercado de sensores

El panorama competitivo del mercado proporciona detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Norteamérica, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Compañía de fabricación de semiconductores de Taiwán limitada (China)

- Bosch Sensortec GmbH (Alemania)

- Sony Semiconductor Solutions Corporation (Japón)

- Mitsubishi Electric Corporation (Japón)

- Honeywell International Inc (EE. UU.)

- Qualcomm Technologies, Inc. (EE. UU.)

- Endress+Hauser Group Services AG (Suiza)

- NXP Semiconductors (Países Bajos)

- TE Connectivity (Irlanda)

- Renesas Electronics Corporation (Japón)

- Teledyne Technologies Incorporated (EE. UU.)

- Rockwell Automation (EE. UU.)

- Infineon Technologies AG (Alemania)

- ams-OSRAM AG (Austria)

- Corporación TDK (Japón)

- Sensirion AG (Suiza)

- Figaro Engineering Inc. (Japón)

- Omega Engineering Inc. (EE. UU.)

- First Sensor AG (Alemania)

- Dwyer Instruments, LLC. (EE. UU.)

- Azafrán (Francia)

- Corporación Amphenol (EE. UU.)

- Panasonic Holdings Corporation (Japón)

- Emerson Electric Co. (EE. UU.)

- STMicroelectronics (Países Bajos)

- Microchip Technology Inc. (EE. UU.)

- Siemens (Alemania)

- Texas Instruments Incorporated (EE. UU.)

- Corporación Eléctrica Yokogawa (Japón)

Últimos avances en el mercado de sensores

- En febrero de 2025, Medical Futurist informó que las tecnologías de salud digital, incluyendo sensores inteligentes, podrían mejorar la atención a las personas mayores mediante la monitorización de sus condiciones de salud y el análisis de datos mediante IA. A pesar de desafíos como la asequibilidad y la falta de innovaciones específicas, la demanda de esta tecnología está creciendo a medida que los sistemas de salud priorizan la calidad de vida. Dado que los sensores desempeñan un papel crucial en el seguimiento de las constantes vitales y el apoyo a la atención remota, se espera que su adopción aumente, contribuyendo así a los avances en las soluciones de atención médica para personas mayores.

- En diciembre de 2023, datos compartidos por TriMedika revelaron que se integraron sensores en diversos dispositivos médicos, desde monitores de glucosa hasta rastreadores de salud portátiles, lo que mejoró la atención al paciente. El termómetro sin contacto TRITEMP demostró cómo la tecnología de sensores mejoró la precisión y la comodidad. A medida que el sector sanitario adoptó sensores más avanzados, la demanda de soluciones basadas en sensores aumentó, impulsando la expansión del mercado de sensores.

- En junio de 2021 , Honeywell International Inc. informó que los sensores médicos mejoraron significativamente la atención médica al optimizar el diagnóstico, la monitorización y el tratamiento. Se integraron en dispositivos como respiradores, bombas de infusión y camas de hospital para proporcionar datos precisos en tiempo real. La monitorización de la salud en el hogar también avanzó con la tecnología de sensores, lo que permitió la atención remota al paciente. A medida que el sector sanitario adoptó cada vez más dispositivos basados en sensores, la demanda de estos aumentó, impulsando el mercado de sensores.

- En octubre de 2024, Spirit Electronics firmó un acuerdo de distribución en franquicia para los productos de sensores de TE Connectivity, ofreciendo soluciones de alta fiabilidad para la industria aeroespacial y de defensa . Los sensores de TE se utilizaron en controles de cabina, sistemas de vuelo, motores y misiones espaciales, incluyendo proyectos de la NASA. Su avanzada tecnología y durabilidad en entornos hostiles incrementaron la demanda de aplicaciones de detección en satélites y operaciones militares. Esta colaboración contribuyó al crecimiento del mercado de sensores al expandir las soluciones especializadas para las industrias aeroespacial y de defensa.

- En septiembre de 2023 , AMETEK Sensors and Fluid Management Systems suministró sensores avanzados para aeronaves militares, incluyendo sensores de presión, temperatura, nivel de fluido y movimiento . Estos sensores mejoraron el rendimiento, la seguridad y la eficiencia de las misiones de las aeronaves en entornos hostiles del campo de batalla. La tecnología de AMETEK prestó servicio a importantes aeronaves militares como el F-35 y el F/A-18. La creciente demanda de sensores fiables y de alto rendimiento en aplicaciones de defensa contribuyó al crecimiento del mercado norteamericano de sensores.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 COMPETITOR KEY PRICING STRATEGIES

4.3 TECHNOLOGY ANALYSIS OF THE NORTH AMERICA SENSOR MARKET

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.5 GROWTH PROSPECT ANALYSIS:

4.6 COMPETITIVE INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVANCEMENTS IN AI AND ML ENHANCE SENSOR CAPABILITIES FOR PREDICTIVE ANALYTICS

5.1.2 EXPANSION OF SMART HEALTHCARE INCREASES DEMAND FOR BIOSENSORS AND WEARABLE DEVICES

5.1.3 INCREASING DEFENSE AND AEROSPACE INVESTMENTS ACCELERATE THE ADOPTION OF HIGH-PRECISION SENSORS

5.1.4 DEMAND FOR SMART RETAIL SOLUTIONS IS DRIVING THE EXPANSION OF RFID AND TRACKING SENSOR TECHNOLOGY

5.1.5 EXPANSION OF PRECISION FARMING INCREASES DEMAND FOR SOIL MOISTURE, TEMPERATURE, NUTRIENT, AND REMOTE SENSING SENSORS

5.2 RESTRAINTS

5.2.1 HIGH IMPLEMENTATION COSTS LIMIT SENSOR ADOPTION IN SMALL AND MID-SIZED BUSINESSES

5.2.2 HARSH ENVIRONMENTAL CONDITIONS REDUCE SENSOR DURABILITY AND LONG-TERM EFFICIENCY

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF INDUSTRY 4.0 WILL ACCELERATE SENSOR DEPLOYMENT IN AUTOMATION AND MANUFACTURING

5.3.2 GROWTH OF AUTONOMOUS AND ELECTRIC VEHICLES WILL INCREASE DEMAND FOR LIDAR AND RADAR SENSORS

5.3.3 INCREASING INTEGRATION OF SENSORS IN BUILDINGS AND INFRASTRUCTURE TO DETECT STRESS POINTS

5.3.4 ONGOING ADVANCEMENTS IN SENSOR TECHNOLOGIES, ALONG WITH GOVERNMENT INVESTMENTS

5.4 CHALLENGES

5.4.1 SECURITY AND PRIVACY CONCERNS POSE RISKS FOR IOT-ENABLED SENSORS

5.4.2 COMPLEX INTEGRATION WITH EXISTING SYSTEMS INCREASES DEPLOYMENT DIFFICULTIES

6 NORTH AMERICA SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 TEMPERATURE SENSOR

6.2.1 TEMPERATURE SENSOR, BY TYPE

6.2.1.1 CONTACT

6.2.1.1.1 CONTACT, BY TYPE

6.2.1.1.1.1 THERMISTORS

6.2.1.1.1.2 THERMOCOUPLES

6.2.1.1.1.3 RESISTIVE TEMPERATURE DETECTORS (RTDS)

6.2.1.1.1.4 TEMPERATURE SENSOR ICS

6.2.1.1.1.5 BIMETALLIC TEMPERATURE SENSORS

6.2.1.2 NON-CONTACT

6.2.1.2.1 NON-CONTACT, BY TYPE

6.2.1.2.1.1 INFRARED TEMPERATURE SENSORS

6.2.1.2.1.2 FIBER OPTIC TEMPERATURE SENSORS

6.2.2 TEMPERATURE SENSOR, BY OUTPUT

6.2.2.1 DIGITAL

6.2.2.1.1 DIGITAL, BY TYPE

6.2.2.1.1.1 SINGLE CHANNEL

6.2.2.1.1.2 MULTI CHANNEL

6.2.2.2 ANALOG

6.2.3 TEMPERATURE SENSOR, BY CONNECTIVITY

6.2.3.1 WIRED

6.2.3.2 WIRELESS

6.2.4 TEMPERATURE SENSOR, BY MATERIAL

6.2.4.1 IRON/CONSTANTAN (CODE J)

6.2.4.2 NICKEL CHROMIUM/CONSTANTAN (CODE E)

6.2.4.3 COPPER/CONSTANTAN (CODE T)

6.2.4.4 CERAMIC

6.2.4.5 POLYMER

6.2.4.6 NICKEL MOLYBDENUM-NICKEL COBALT THERMOCOUPLES (TYPE M)

6.2.4.7 OTHERS

6.3 IMAGE SENSOR

6.3.1 IMAGE SENSOR, BY TECHNOLOGY

6.3.1.1 CMOS

6.3.1.2 CCD

6.3.1.3 OTHERS

6.3.2 IMAGE SENSOR, BY PROCESSING TECHNIQUE

6.3.2.1 2D IMAGE SENSORS

6.3.2.2 3D IMAGE SENSORS

6.3.3 IMAGE SENSOR, BY RESOLUTION

6.3.3.1 12 MP TO 16 MP

6.3.3.2 5 MP TO 10 MP

6.3.3.3 LESS THAN 3MP

6.3.3.4 MORE THAN 16 MP

6.3.4 IMAGE SENSOR, BY SPECTRUM

6.3.4.1 VISIBLE

6.3.4.2 NON-VISIBLE

6.3.5 IMAGE SENSOR, BY ARRAY TYPE

6.3.5.1 AREA IMAGE SENSOR

6.3.5.2 LINEAR IMAGE SENSOR

6.4 MOTION SENSOR

6.4.1 MOTION SENSOR, BY MOTION TECHNOLOGY

6.4.1.1 PASSIVE

6.4.1.1.1 PASSIVE, BY TYPE

6.4.1.1.1.1 INFRARED MOTION SENSOR

6.4.1.1.1.2 DUAL OR HYBRID TECHNOLOGY

6.4.1.1.1.3 OTHERS

6.4.1.2 ACTIVE

6.4.1.2.1 ACTIVE, BY TYPE

6.4.1.2.1.1 MICROWAVE SENSOR

6.4.1.2.1.2 ULTRASONIC SENSOR

6.4.1.2.1.3 TOMOGRAPHIC SENSOR

6.4.2 MOTION SENSOR, BY FUNCTION

6.4.2.1 FULLY-AUTOMATIC

6.4.2.2 SEMI-AUTOMATIC

6.5 PRESSURE SENSOR

6.5.1 PRESSURE SENSOR, BY TYPE

6.5.1.1 WIRED

6.5.1.2 WIRELESS

6.5.2 PRESSURE SENSOR, BY PRODUCT

6.5.2.1 GAUGE PRESSURE SENSORS

6.5.2.2 DIFFERENTIAL PRESSURE SENSORS

6.5.2.3 ABSOLUTE PRESSURE SENSORS

6.5.2.4 VACUUM PRESSURE SENSORS

6.5.2.5 SEALED PRESSURE SENSORS

6.5.3 PRESSURE SENSOR, BY TECHNOLOGY

6.5.3.1 PIEZORESISTIVE

6.5.3.2 CAPACITIVE

6.5.3.3 PIEZOELECTRIC

6.5.3.4 OPTICAL

6.5.3.5 RESONANT SOLID-STATE

6.5.3.6 THERMAL

6.5.3.7 ELECTROMAGNETIC

6.5.3.8 POTENTIOMETRIC

6.6 TOUCH SENSOR

6.7 PROXIMITY AND DISPLACEMENT SENSOR

6.7.1 PROXIMITY AND DISPLACEMENT SENSOR, BY TYPE

6.7.1.1 ADJUSTABLE DISTANCE PROXIMITY SENSOR

6.7.1.2 FIXED DISTANCE PROXIMITY SENSOR TYPE

6.7.2 PROXIMITY AND DISPLACEMENT SENSOR, BY TECHNOLOGY

6.7.2.1 INDUCTIVE

6.7.2.2 CAPACITIVE

6.7.2.3 PHOTOELECTRIC

6.7.2.4 MAGNETIC

6.8 ACCELEROMETER AND SPEED SENSOR

6.8.1 ACCELEROMETER AND SPEED SENSOR, BY DIMENSION

6.8.1.1 1-AXIS

6.8.1.2 2-AXIS

6.8.1.3 3-AXIS

6.8.2 ACCELEROMETER AND SPEED SENSOR, BY TYPE

6.8.2.1 PIEZORESISTIVE

6.8.2.2 MEMS

6.8.2.3 PIEZOELECTRIC

6.8.2.4 OTHERS

6.9 HUMIDITY AND MOISTURE SENSOR

6.9.1 HUMIDITY AND MOISTURE SENSOR, BY TYPE

6.9.1.1 DIGITAL

6.9.1.1.1 DIGITAL, BY TYPE

6.9.1.1.1.1 RELATIVE HUMIDITY AND TEMPERATURE (RHT) SENSORS

6.9.1.1.1.2 RELATIVE HUMIDITY SENSOR (RHS)

6.9.1.2 ANALOG

6.9.2 HUMIDITY AND MOISTURE SENSOR, BY PRODUCT

6.9.2.1 RELATIVE HUMIDITY SENSORS

6.9.2.2 OSCILLATING HYGROMETER

6.9.2.3 ABSOLUTE HUMIDITY SENSORS

6.9.2.4 OPTICAL HYGROMETER

6.9.2.5 GRAVIMETRIC HYGROMETER

6.1 GAS SENSOR

6.10.1 GAS SENSOR, BY GAS TYPE

6.10.1.1 CARBON MONOXIDE

6.10.1.2 METHANE

6.10.1.3 CARBON DIOXIDE

6.10.1.4 OXYGEN

6.10.1.5 HYDROGEN SULFIDE

6.10.1.6 NITROGEN OXIDES

6.10.1.7 VOLATILE ORGANIC COMPOUNDS

6.10.1.8 AMMONIA

6.10.1.9 CHLORINE

6.10.1.10 HYDROCARBONS

6.10.1.11 HYDROGEN

6.10.2 GAS SENSOR, BY TECHNOLOGY

6.10.2.1 ELECTROCHEMICAL

6.10.2.2 SOLID STATE/METAL-OXIDE-SEMICONDUCTORS

6.10.2.3 CATALYTIC

6.10.2.4 INFRARED

6.10.2.5 ZIRCONIA

6.10.2.6 PHOTOIONIZATION DETECTORS (PID)

6.10.2.7 LASER-BASED

6.10.2.8 HOLOGRAPHIC

6.10.3 GAS SENSOR, BY PRODUCT TYPE

6.10.3.1 GAS DETECTORS

6.10.3.2 GAS ANALYZER AND MONITOR

6.10.3.3 AIR QUALITY MONITOR

6.10.3.4 HVAC

6.10.3.5 MEDICAL EQUIPMENT

6.10.3.6 AIR PURIFIER/AIR CLEANER

6.10.3.7 OTHERS

6.10.4 GAS SENSOR, BY OUTPUT TYPE

6.10.4.1 DIGITAL

6.10.4.2 ANALOG

6.10.5 GAS SENSOR, BY CONNECTIVITY

6.10.5.1 WIRED

6.10.5.2 WIRELESS

6.11 OPTICAL SENSOR

6.11.1 OPTICAL SENSOR, BY SENSING

6.11.1.1 INTRINSIC

6.11.1.1.1 INTRINSIC, BY TYPE

6.11.1.1.1.1 ENCODERS

6.11.1.1.1.2 OPTICAL COHERENCE TOMOGRAPHY (OCT)

6.11.1.1.1.3 SPECTROSCOPY

6.11.1.1.1.4 PYROMETERS

6.11.1.1.1.5 LASER DOPPLER VELOCIMETRY (LDV)

6.11.1.1.1.6 FABRY–PEROT INTERFEROMETERS

6.11.1.2 EXTRINSIC

6.11.1.2.1 EXTRINSIC, BY TYPE

6.11.1.2.1.1 SCATTERING BASED

6.11.1.2.1.2 SCATTERING BASED, BY TYPE

6.11.1.2.1.3 RAYLEIGH SCATTERING

6.11.1.2.1.4 RAMAN SCATTERING

6.11.1.2.1.5 BRILLOUIN SCATTERING

6.11.1.2.1.6 Fiber Bragg Grating Based

6.11.1.2.1.7 FIBER BRAGG GRATING BASED, BY TYPE

6.11.1.2.1.8 SPATIALLY CONTINUOUS BASED

6.11.1.2.1.9 POINT FBG BASED

6.11.2 OPTICAL SENSOR, BY APPLICATION

6.11.2.1 PRESSURE AND STRAIN SENSING

6.11.2.2 TEMPERATURE SENSING

6.11.2.3 BIOCHEMICAL

6.11.2.4 BIOMETRIC AND AMBIENCE

6.11.2.5 GEOLOGICAL SURVEY

6.11.2.6 OTHERS

6.12 FORCE SENSOR

6.12.1 FORCE SENSOR, BY FORCE TYPE

6.12.1.1 COMPRESSION

6.12.1.2 COMPRESSION AND TENSION

6.12.1.3 TENSION

6.12.2 FORCE SENSOR, BY TECHNOLOGY

6.12.2.1 STRAIN GAUGE

6.12.2.2 LOAD CELL

6.12.2.3 PIEZOELECTRIC

6.12.2.4 CAPACITIVE

6.12.2.5 MAGNETOELASTIC

6.12.2.6 OTHERS

6.12.3 FORCE SENSOR, BY OPERATION

6.12.3.1 DIGITAL

6.12.3.2 ANALOG

6.13 FLOW SENSOR

6.13.1 FLOW SENSOR, BY TYPE

6.13.1.1 LIQUID

6.13.1.2 GAS

6.13.2 FLOW SENSOR, BY APPLICATION

6.13.2.1 MAGNETIC

6.13.2.1.1 MAGNETIC, BY TYPE

6.13.2.1.1.1 IN-LINE MAGNETIC

6.13.2.1.1.2 LOW FLOW MAGNETIC

6.13.2.1.1.3 INSERTION MAGNETIC

6.13.2.2 ULTRASONIC

6.13.2.2.1 ULTRASONIC, BY TYPE

6.13.2.2.1.1 CLAMP-ON ULTRASONIC

6.13.2.2.1.2 INSERTION MAGNETIC

6.13.2.2.1.3 INSERTION MAGNETIC

6.13.2.3 DIFFERENTIAL FLOW

6.13.2.4 CORIOLIS

6.13.2.5 VORTEX

6.13.2.6 POSITICE DISPLACEMENT

6.13.2.7 OTHERS

6.14 LEVEL SENSOR

6.14.1 LEVEL SENSOR, BY TYPE

6.14.1.1 ULTRASONIC

6.14.1.2 RADAR/MICROWAVE

6.14.1.3 HYDROSTATIC

6.14.1.4 CAPACITANCE

6.14.1.5 MAGNETIC & MECHANICAL FLOAT

6.14.1.6 GUIDED WAVE RADAR

6.14.1.7 VIBRATORY PROBE

6.14.1.8 OPTICAL

6.14.1.9 MAGNETOSTRICTIVE

6.14.1.10 PNEUMATIC

6.14.1.11 NUCLEAR

6.14.1.12 LASER

6.14.1.13 OTHERS

6.14.2 LEVEL SENSOR, BY TECHNOLOGY

6.14.2.1 CONTACT

6.14.2.2 NON CONTACT

6.14.3 LEVEL SENSOR, BY MONITORING TYPE

6.14.3.1 CONTINUOUS LEVEL MONITORING

6.14.3.2 POINT LEVEL MONITORING

6.15 BIOSENSOR

6.15.1 BIOSENSOR, BY TYPE

6.15.1.1 ELECTROCHEMICAL

6.15.1.2 SENSOR PATCH

6.15.2 BIOSENSOR, BY TECHNOLOGY

6.15.2.1 ELECTROCHEMICAL

6.15.2.1.1 ELECTROCHEMICAL, BY TYPE

6.15.2.1.1.1 AMPEROMETRIC SENSORS

6.15.2.1.1.2 CONDUCTOMETRIC SENSORS

6.15.2.1.1.3 POTENTIOMETRIC SENSORS

6.15.2.2 OPTICAL BIOSENSORS

6.15.2.2.1 OPTICAL BIOSENSORS, BY TYPE

6.15.2.2.1.1 COLORIMETRIC BIOSENSORS

6.15.2.2.1.2 SPR

6.15.2.2.1.3 FLUORESCENCE BIOSENSORS

6.15.2.3 PIEZOELECTRIC BIOSENSORS

6.15.2.3.1 PIEZOELECTRIC BIOSENSORS, BY TYPE

6.15.2.3.1.1 ACOUSTIC BIOSENSORS

6.15.2.3.1.2 MICROCANTILEVER BIOSENSORS

6.15.3 BIOSENSOR, BY COMPONENT

6.15.3.1 BIORECEPTOR MOLECULES

6.15.3.2 TRANSDUCER

6.15.3.3 BIOLOGICAL ELEMENT

6.15.3.4 OTHERS

6.15.4 BIOSENSOR, BY PRODUCT TYPE

6.15.4.1 NON-WEARABLE BIOSENSORS

6.15.4.2 WEARABLE BIOSENSORS

6.15.4.2.1 WEARABLE BIOSENSOR, BY TYPE

6.15.4.2.1.1 WRISTWEAR

6.15.4.2.1.2 FOOTWEAR

6.15.4.2.1.3 BODYWEAR

6.15.4.2.1.4 EYEWEAR

6.15.4.2.1.5 NECKWEAR

6.15.4.2.1.6 OTHERS

6.16 POSITION SENSOR

6.16.1 POSITION SENSOR, BY TYPE

6.16.1.1 PROXIMITY SENSORS

6.16.1.2 DISPLACEMENT SENSORS

6.16.1.3 LINEAR SENSORS

6.16.1.3.1 LINEAR SENSOR, BY TYPE

6.16.1.3.1.1 MAGNETOSTRICTIVE SENSORS

6.16.1.3.1.2 LINEAR VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.3.1.3 LASER POSITION SENSORS

6.16.1.3.1.4 LINEAR ENCODERS

6.16.1.3.1.5 LINEAR POTENTIOMETERS

6.16.1.4 PHOTOELECTRIC SENSORS

6.16.1.5 ROTARY SENSORS

6.16.1.5.1 ROTARY SENSORS, BY TYPE

6.16.1.5.1.1 ROTARY ENCODERS

6.16.1.5.1.2 ROTARY POTENTIOMETERS

6.16.1.5.1.3 ROTARY VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.5.1.4 RESOLVERS

6.16.1.6 3D SENSORS

6.16.2 POSITION SENSOR, BY CONTACT TYPE

6.16.2.1 CONTACT

6.16.2.2 NON CONTACT

6.16.3 POSITION SENSOR, BY OUTPUT

6.16.3.1 ANALOG

6.16.3.2 DIGITAL

6.16.4 POSITION SENSOR, BY APPLICATION

6.16.4.1 MATERIAL HANDLING

6.16.4.2 MOTION SYSTEMS

6.16.4.3 ROBOTICS

6.16.4.4 TEST EQUIPMENT

6.16.4.5 MACHINE TOOLS

6.16.4.6 OTHERS

6.17 OTHERS

7 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MEMS

7.3 CMOS

7.4 NEMS

7.5 OTHERS

8 NORTH AMERICA SENSORS MARKET, BY END USER

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 AUTOMOTIVE, BY APPLICATION

8.2.1.1 POWERTRAIN

8.2.1.2 DRIVER ASSISTANCE & APPLICATION

8.2.1.3 SAFETY & CONTROLS SYSTEMS

8.2.1.4 CHASSIS

8.2.1.5 TELEMATICS SYSTEMS

8.2.1.6 VEHICLE BODY ELECTRONICS

8.2.1.7 EXHAUST SYSTEMS

8.2.1.8 OTHERS

8.2.2 AUTOMOTIVE, BY VEHICLE TYPE

8.2.2.1 PASSENGER CAR

8.2.2.2 LIGHT COMMERCIAL VEHICLE

8.2.2.3 HEAVY COMMERCIAL VEHICLE

8.2.3 AUTOMOTIVE, BY SALES CHANNEL

8.2.3.1 OEMS

8.2.3.2 AFTERMARKETS

8.2.4 AUTOMOTIVE, BY TYPE

8.2.4.1 RADAR SENSORS

8.2.4.2 IMAGE SENSORS

8.2.4.3 LIDAR SENSORS

8.2.4.4 CURRENT SENSORS

8.2.4.5 LEVEL SENSORS

8.2.4.6 INERTIAL SENSORS

8.2.4.7 ULTRASONIC SENSORS

8.2.4.8 TEMPERATURE SENSORS

8.2.4.9 PRESSURE SENSORS

8.2.4.10 OXYGEN SENSORS

8.2.4.11 POSITION SENSORS

8.2.4.12 SPEED SENSORS

8.2.4.13 CHEMICAL SENSORS

8.2.4.14 NOX SENSORS

8.2.4.15 OTHERS

8.3 CONSUMER ELECTRONICS

8.3.1 CONSUMER ELECTRONICS, BY TYPE

8.3.1.1 IMAGE SENSOR

8.3.1.2 MOTION SENSOR

8.3.1.3 TEMPERATURE SENSOR

8.3.1.4 PRESSURE SENSOR

8.3.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.3.1.6 OPTICAL SENSOR

8.3.1.7 ACCELEROMETER & SPEED SENSOR

8.3.1.8 HUMIDITY AND MOISTURE SENSOR

8.3.1.9 GAS SENSOR

8.3.1.10 FLOW SENSOR

8.3.1.11 LEVEL SENSOR

8.3.1.12 POSITION SENSOR

8.3.1.13 BIOSENSOR

8.3.1.14 FORCE SENSOR

8.3.1.15 OTHERS

8.4 HEALTHCARE

8.4.1 HEALTHCARE, BY TYPE

8.4.1.1 BIOSENSOR

8.4.1.2 TEMPERATURE SENSOR

8.4.1.3 PRESSURE SENSOR

8.4.1.4 IMAGE SENSOR

8.4.1.5 FLOW SENSOR

8.4.1.6 OPTICAL SENSOR

8.4.1.7 GAS SENSOR

8.4.1.8 ACCELEROMETER & SPEED SENSOR

8.4.1.9 MOTION SENSOR

8.4.1.10 PROXIMITY AND DISPLACEMENT SENSOR

8.4.1.11 FORCE SENSOR

8.4.1.12 HUMIDITY AND MOISTURE SENSOR

8.4.1.13 LEVEL SENSOR

8.4.1.14 POSITION SENSOR

8.4.1.15 OTHERS

8.5 MANUFACTURING

8.5.1 MANUFACTURING, BY TYPE

8.5.1.1 IMAGE SENSOR

8.5.1.2 FLOW SENSOR

8.5.1.3 TEMPERATURE SENSOR

8.5.1.4 PRESSURE SENSOR

8.5.1.5 LEVEL SENSOR

8.5.1.6 HUMIDITY AND MOISTURE SENSOR

8.5.1.7 GAS SENSOR

8.5.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.5.1.9 BIOSENSOR

8.5.1.10 OPTICAL SENSOR

8.5.1.11 MOTION SENSOR

8.5.1.12 FORCE SENSOR

8.5.1.13 ACCELEROMETER & SPEED SENSOR

8.5.1.14 POSITION SENSOR

8.5.1.15 OTHERS

8.6 AEROSPACE & DEFENCE

8.6.1 AEROSPACE & DEFENCE, BY TYPE

8.6.1.1 IMAGE SENSOR

8.6.1.2 PRESSURE SENSOR

8.6.1.3 TEMPERATURE SENSOR

8.6.1.4 ACCELEROMETER & SPEED SENSOR

8.6.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.6.1.6 OPTICAL SENSOR

8.6.1.7 POSITION SENSOR

8.6.1.8 MOTION SENSOR

8.6.1.9 FLOW SENSOR

8.6.1.10 GAS SENSOR

8.6.1.11 FORCE SENSOR

8.6.1.12 HUMIDITY AND MOISTURE SENSOR

8.6.1.13 LEVEL SENSOR

8.6.1.14 BIOSENSOR

8.6.1.15 OTHERS

8.7 ENERGY & POWER

8.7.1 ENERGY & POWER, BY TYPE

8.7.1.1 CURRENT SENSOR

8.7.1.2 PRESSURE SENSOR

8.7.1.3 TEMPERATURE SENSOR

8.7.1.4 FLOW SENSOR

8.7.1.5 GAS SENSOR

8.7.1.6 LEVEL SENSOR

8.7.1.7 HUMIDITY AND MOISTURE SENSOR

8.7.1.8 OPTICAL SENSOR

8.7.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.7.1.10 MOTION SENSOR

8.7.1.11 ACCELEROMETER & SPEED SENSOR

8.7.1.12 POSITION SENSOR

8.7.1.13 FORCE SENSOR

8.7.1.14 BIOSENSOR

8.7.1.15 OTHERS

8.8 IT & TELECOMMUNICATION

8.8.1 IT & TELECOMMUNICATION, BY TYPE

8.8.1.1 PRESSURE SENSOR

8.8.1.2 TEMPERATURE SENSOR

8.8.1.3 OPTICAL SENSOR

8.8.1.4 PROXIMITY AND DISPLACEMENT SENSOR

8.8.1.5 ACCELEROMETER & SPEED SENSOR

8.8.1.6 HUMIDITY AND MOISTURE SENSOR

8.8.1.7 GAS SENSOR

8.8.1.8 MOTION SENSOR

8.8.1.9 FLOW SENSOR

8.8.1.10 LEVEL SENSOR

8.8.1.11 POSITION SENSOR

8.8.1.12 IMAGE SENSOR

8.8.1.13 FORCE SENSOR

8.8.1.14 BIOSENSOR

8.8.1.15 OTHERS

8.9 OIL & GAS

8.9.1 OIL & GAS, BY TYPE

8.9.1.1 GAS SENSOR

8.9.1.2 FLOW SENSOR

8.9.1.3 PRESSURE SENSOR

8.9.1.4 TEMPERATURE SENSOR

8.9.1.5 LEVEL SENSOR

8.9.1.6 HUMIDITY AND MOISTURE SENSOR

8.9.1.7 OPTICAL SENSOR

8.9.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.9.1.9 POSITION SENSOR

8.9.1.10 MOTION SENSOR

8.9.1.11 ACCELEROMETER & SPEED SENSOR

8.9.1.12 IMAGE SENSOR

8.9.1.13 FORCE SENSOR

8.9.1.14 BIOSENSOR

8.9.1.15 OTHERS

8.1 CHEMICAL

8.10.1 CHEMICAL, BY TYPE

8.10.1.1 GAS SENSOR

8.10.1.2 FLOW SENSOR

8.10.1.3 PRESSURE SENSOR

8.10.1.4 TEMPERATURE SENSOR

8.10.1.5 LEVEL SENSOR

8.10.1.6 HUMIDITY AND MOISTURE SENSOR

8.10.1.7 BIOSENSOR

8.10.1.8 OPTICAL SENSOR

8.10.1.9 POSITION SENSOR

8.10.1.10 MOTION SENSOR

8.10.1.11 IMAGE SENSOR

8.10.1.12 PROXIMITY AND DISPLACEMENT SENSOR

8.10.1.13 FORCE SENSOR

8.10.1.14 ACCELEROMETER & SPEED SENSOR

8.10.1.15 OTHERS

8.11 FOOD & BEVERAGES

8.11.1 FOOD & BEVERAGES, BY TYPE

8.11.1.1 BIOSENSOR

8.11.1.2 FLOW SENSOR

8.11.1.3 LEVEL SENSOR

8.11.1.4 TEMPERATURE SENSOR

8.11.1.5 POSITION SENSOR

8.11.1.6 HUMIDITY AND MOISTURE SENSOR

8.11.1.7 GAS SENSOR

8.11.1.8 OPTICAL SENSOR

8.11.1.9 MOTION SENSOR

8.11.1.10 ACCELEROMETER & SPEED SENSOR

8.11.1.11 FORCE SENSOR

8.11.1.12 IMAGE SENSOR

8.11.1.13 PROXIMITY AND DISPLACEMENT SENSOR

8.11.1.14 PRESSURE SENSOR

8.11.1.15 OTHERS

8.12 CONSTRUCTION

8.12.1 CONSTRUCTION, BY TYPE

8.12.1.1 PRESSURE SENSOR

8.12.1.2 TEMPERATURE SENSOR

8.12.1.3 PROXIMITY AND DISPLACEMENT SENSOR

8.12.1.4 HUMIDITY AND MOISTURE SENSOR

8.12.1.5 LEVEL SENSOR

8.12.1.6 MOTION SENSOR

8.12.1.7 FLOW SENSOR

8.12.1.8 GAS SENSOR

8.12.1.9 FORCE SENSOR

8.12.1.10 OPTICAL SENSOR

8.12.1.11 POSITION SENSOR

8.12.1.12 ACCELEROMETER & SPEED SENSOR

8.12.1.13 IMAGE SENSOR

8.12.1.14 BIOSENSOR

8.12.1.15 OTHERS

8.13 MINING

8.13.1 MINING, BY TYPE

8.13.1.1 GAS SENSOR

8.13.1.2 PRESSURE SENSOR

8.13.1.3 FLOW SENSOR

8.13.1.4 LEVEL SENSOR

8.13.1.5 TEMPERATURE SENSOR

8.13.1.6 HUMIDITY AND MOISTURE SENSOR

8.13.1.7 OPTICAL SENSOR

8.13.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.13.1.9 ACCELEROMETER & SPEED SENSOR

8.13.1.10 MOTION SENSOR

8.13.1.11 POSITION SENSOR

8.13.1.12 IMAGE SENSOR

8.13.1.13 FORCE SENSOR

8.13.1.14 BIOSENSOR

8.13.1.15 OTHERS

8.14 PAPER & PULP

8.14.1 PAPER & PULP, BY TYPE

8.14.1.1 FLOW SENSOR

8.14.1.2 TEMPERATURE SENSOR

8.14.1.3 PRESSURE SENSOR

8.14.1.4 LEVEL SENSOR

8.14.1.5 HUMIDITY AND MOISTURE SENSOR

8.14.1.6 OPTICAL SENSOR

8.14.1.7 POSITION SENSOR

8.14.1.8 GAS SENSOR

8.14.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.14.1.10 MOTION SENSOR

8.14.1.11 FORCE SENSOR

8.14.1.12 ACCELEROMETER & SPEED SENSOR

8.14.1.13 IMAGE SENSOR

8.14.1.14 BIOSENSOR

8.14.1.15 OTHERS

8.15 OTHERS

9 NORTH AMERICA SENSORS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA SENSORS MARKET

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 BOSCH SENSORTEC GMBH

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 SONY SEMICONDUCTOR SOLUTIONS CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT/NEWS

12.4 MITSUBISHI ELECTRIC CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 AMPHENOL CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 AMS-OSRAM AG

12.7.1 COMPANY SNAPSHOTS

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DWYER INSTRUMENTS, LLC.

12.8.1 COMPANY SNAPSHOTS

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EMERSON ELECTRIC CO.

12.9.1 COMPANY SNAPSHOTS

12.9.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 ENDRESS+HAUSER GROUP SERVICES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT CERTIFICATION

12.11 FIGARO ENGINEERING INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 FIRST SENSOR AG

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 INFINEON TECHNOLOGIES AG

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 MICROCHIP TECHNOLOGY INC.

12.14.1 COMPANY SNAPSHOTS

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 NXP SEMICONDUCTORS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 OMEGA ENGINEERING INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 PANASONIC HOLDINGS CORPORATION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENT

12.18 QUALCOMM TECHNOLOGIES, INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 RENESAS ELECTRONICS CORPORATION.

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 1.1.5RECENT DEVELOPMENT

12.2 ROCKWELL AUTOMATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 SAFRAN

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 PRODUCT PORTFOLIO

12.21.4 RECENT DEVELOPMENT/NEWS

12.22 SENSIRION AG

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENT

12.23 SIEMENS

12.23.1 COMPANY SNAPSHOT

12.23.2 REVENUE ANALYSIS

12.23.3 PRODUCT PORTFOLIO

12.23.4 RECENT DEVELOPMENT

12.24 STMICROELECTRONICS

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENT/NEWS

12.25 TDK CORPORATION.

12.25.1 COMPANY SNAPSHOTS

12.25.2 REVENUE ANALYSIS

12.25.3 PRODUCT PORTFOLIO

12.25.4 RECENT DEVELOPMENT

12.26 TE CONNECTIVITY

12.26.1 COMPANY SNAPSHOT

12.26.2 REVENUE ANALYSIS

12.26.3 PRODUCT PORTFOLIO

12.26.4 RECENT DEVELOPMENT

12.27 TELEDYNE TECHNOLOGIES INCORPORATED.

12.27.1 COMPANY SNAPSHOTS

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENT/NEWS

12.28 TEXAS INSTRUMENTS INCORPORATED

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENTS

12.29 WIKA INSTRUMENTS INDIA PVT. LTD.

12.29.1 COMPANY SNAPSHOT

12.29.2 PRODUCT PORTFOLIO

12.29.3 RECENT DEVELOPMENT/NEWS

12.3 YOKOGAWA ELECTRIC CORPORATION

12.30.1 COMPANY SNAPSHOTS

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT/NEWS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 KEY PLAYERS AND THEIR TECHNOLOGY ANALYSIS IN SENSOR MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

TABLE 4 SENSOR COST COMPARISON

TABLE 5 NORTH AMERICA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA NON-CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA TOUCH SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA MEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA CMOS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA NEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA OTHERS SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA AEROSPACE & DEFENCE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA AEROSPACE & DEFENCE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA MINING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA SENSORS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 148 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 150 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 160 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 161 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 163 NORTH AMERICA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 NORTH AMERICA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 167 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 168 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 170 NORTH AMERICA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 NORTH AMERICA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 172 NORTH AMERICA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 174 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 175 NORTH AMERICA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 NORTH AMERICA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 NORTH AMERICA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 179 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 180 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 181 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 182 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 183 NORTH AMERICA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 184 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 185 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 186 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 187 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 NORTH AMERICA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 197 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 NORTH AMERICA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 U.S. SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 U.S. CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 U.S. NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 204 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 205 U.S. DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 207 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 208 U.S. IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 209 U.S. IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 210 U.S. IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 211 U.S. IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 212 U.S. IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 213 U.S. MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 214 U.S. PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 215 U.S. ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 216 U.S. MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 217 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 219 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 220 U.S. PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 U.S. PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 222 U.S. ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 223 U.S. ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 U.S. HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 U.S. DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 U.S. HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 227 U.S. GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 228 U.S. GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 229 U.S. GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 230 U.S. GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 231 U.S. GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 232 U.S. OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 233 U.S. INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 U.S. EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 U.S. SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 236 U.S. FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 U.S. OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 U.S. FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 239 U.S. FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 240 U.S. FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 241 U.S. FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 U.S. FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 U.S. MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 U.S. ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 U.S. LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 U.S. LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 247 U.S. LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 248 U.S. BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 249 U.S. BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 250 U.S. ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 U.S. OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 U.S. PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 U.S. BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 254 U.S. BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 255 U.S. WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 U.S. POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 U.S. LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 258 U.S. ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 259 U.S. POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 260 U.S. POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 261 U.S. POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 U.S. SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 263 U.S. SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 264 U.S. AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 265 U.S. AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 266 U.S. AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 267 U.S. AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 U.S. CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 U.S. HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 U.S. MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 U.S. AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 U.S. ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 U.S. IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 U.S. OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 U.S. CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 U.S. FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 U.S. CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 U.S. MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 U.S. PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 CANADA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 CANADA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 CANADA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 284 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 285 CANADA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 287 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 288 CANADA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 289 CANADA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 290 CANADA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 291 CANADA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 292 CANADA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 293 CANADA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 294 CANADA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 295 CANADA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 CANADA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 297 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 299 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 300 CANADA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 CANADA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 302 CANADA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 303 CANADA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 CANADA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 CANADA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 CANADA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 307 CANADA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 308 CANADA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 309 CANADA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 310 CANADA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 311 CANADA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 312 CANADA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 313 CANADA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 314 CANADA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 CANADA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 CANADA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 CANADA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 318 CANADA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 319 CANADA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 320 CANADA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 321 CANADA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 CANADA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 CANADA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 CANADA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 CANADA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 CANADA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 327 CANADA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 328 CANADA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 CANADA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 330 CANADA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 331 CANADA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 CANADA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 CANADA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 334 CANADA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 335 CANADA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 336 CANADA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 CANADA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 CANADA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 339 CANADA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 340 CANADA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 341 CANADA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 342 CANADA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 343 CANADA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 344 CANADA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 345 CANADA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 346 CANADA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 347 CANADA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 CANADA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 CANADA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 CANADA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 CANADA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 CANADA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 CANADA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 CANADA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 CANADA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 CANADA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 357 CANADA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 358 CANADA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 CANADA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 MEXICO SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 MEXICO CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 MEXICO NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 365 MEXICO DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 366 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)