North America Stainless Steel Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

50.12 Billion

USD

71.13 Billion

2024

2032

USD

50.12 Billion

USD

71.13 Billion

2024

2032

| 2025 –2032 | |

| USD 50.12 Billion | |

| USD 71.13 Billion | |

|

|

|

|

Segmentación del mercado de acero inoxidable en Norteamérica, por tipo de producto (productos planos, productos largos, tuberías, accesorios y bridas, entre otros), tipo de grado (acero inoxidable austenítico, acero inoxidable ferrítico, acero inoxidable dúplex, acero inoxidable martensítico, acero inoxidable endurecido por precipitación (PH) y otros), proceso de fabricación (laminado en caliente, laminado en frío, fundición, forjado y extrusión), método de producción (producción primaria, procesamiento secundario y procesamiento final), resistencia (acero inoxidable de baja resistencia, acero inoxidable de resistencia media y acero inoxidable de alta resistencia), recubrimiento y acabado superficial (recubrimientos y acabados superficiales), sector vertical (construcción e infraestructura, automoción y transporte, bienes de consumo y electrodomésticos, equipos y maquinaria industrial, medicina y atención sanitaria, aeroespacial y defensa, energía y electricidad, procesamiento de alimentos y bebidas, electrónica y tecnología, y aplicaciones ambientales): tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado del acero inoxidable

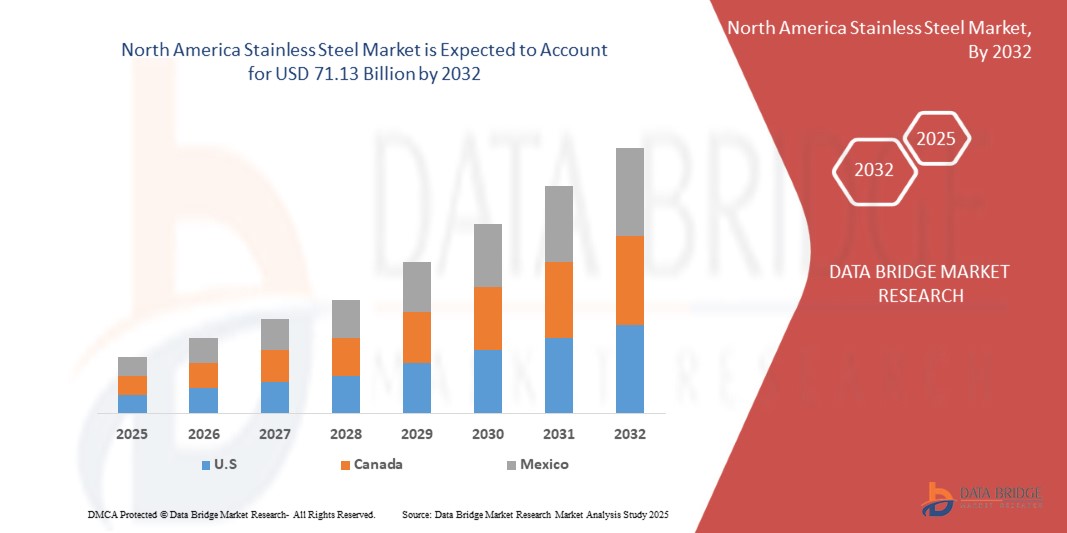

- El mercado de acero inoxidable de América del Norte se valoró en 50.120 millones de dólares en 2024 y se espera que alcance los 71.130 millones de dólares en 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 4,68%, impulsado principalmente por la creciente industrialización y la expansión de la infraestructura.

- Este crecimiento se ve impulsado además por el uso creciente de acero inoxidable en aplicaciones de energía limpia, la creciente preferencia por materiales resistentes a la corrosión y duraderos, y regulaciones ambientales y de seguridad más estrictas que favorecen los materiales reciclables y de bajas emisiones.

Análisis del mercado del acero inoxidable

- El mercado del acero inoxidable está experimentando un sólido crecimiento, impulsado por el creciente desarrollo de infraestructuras, la urbanización y la demanda en los sectores automotriz, de la construcción y energético. Su resistencia a la corrosión, durabilidad y atractivo estético lo convierten en un material predilecto tanto para aplicaciones estructurales como decorativas. Sin embargo, la expansión del mercado se ve obstaculizada por la fluctuación de los precios de las materias primas, especialmente el níquel y el cromo, y las preocupaciones ambientales asociadas a los métodos de producción tradicionales.

- La demanda de acero inoxidable está fuertemente impulsada por la apuesta de la industria de la construcción por materiales duraderos y de bajo mantenimiento. Además, su creciente adopción en vehículos eléctricos (VE), gracias a su ligereza y resistencia, está impulsando la demanda en el sector automotriz. Las industrias de procesamiento de alimentos y equipos médicos también siguen dependiendo en gran medida del acero inoxidable por sus características higiénicas y no reactivas.

- Los aceros inoxidables austeníticos dominan el mercado. Mientras tanto, los aceros dúplex y ferríticos están ganando terreno en aplicaciones específicas como el procesamiento químico y la desalinización gracias a su resistencia y a los cloruros. Se espera que las innovaciones tecnológicas, como los métodos de producción con bajas emisiones de carbono y las tecnologías de reciclaje mejoradas, transformen el panorama competitivo e impulsen la sostenibilidad en la industria del acero inoxidable.

Alcance del informe y segmentación del mercado del acero inoxidable

|

Atributos |

Perspectivas clave del mercado del acero inoxidable |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del acero inoxidable

Innovación impulsada por la sostenibilidad y desarrollo de aleaciones avanzadas

- Una tendencia destacada en el mercado de acero inoxidable de América del Norte es el enfoque creciente en la innovación impulsada por la sostenibilidad y el desarrollo de aleaciones avanzadas de acero inoxidable.

- El mercado está experimentando una mayor demanda de productos de acero inoxidable resistentes a la corrosión, ligeros y de alto rendimiento en diversas industrias, especialmente en los sectores de la automoción, la construcción y las energías renovables. Esta tendencia está estrechamente vinculada a los objetivos de descarbonización y los principios de la economía circular.

Por ejemplo, en agosto de 2023, Outokumpu presentó una nueva línea de acero inoxidable de bajas emisiones, producido con alto contenido reciclado y energía renovable. Esta iniciativa apoya los objetivos del Pacto Verde Europeo y refuerza el papel del acero inoxidable en las infraestructuras resilientes al clima.

- Los fabricantes invierten cada vez más en tecnología de hornos de arco eléctrico (EAF), producción a partir de chatarra y métodos de captura de carbono para reducir la huella ambiental del acero inoxidable. Simultáneamente, se están adaptando formulaciones de aleaciones avanzadas para aplicaciones críticas como el almacenamiento de hidrógeno, los vehículos eléctricos y la construcción naval.

- A medida que las normas ambientales se endurecen a nivel mundial, especialmente en Norteamérica, los usuarios finales priorizan el acero inoxidable con certificación ambiental. Esta tendencia impulsa la innovación de productos, la adopción de certificaciones (p. ej., EPD, materiales que cumplen con LEED) y una mayor integración de la cadena de suministro para cumplir con los objetivos de sostenibilidad en todas las industrias.

Dinámica del mercado del acero inoxidable

Conductor

“Aumento de la industrialización y expansión de la infraestructura”

- Una de las tendencias clave que impulsa el mercado norteamericano del acero inoxidable es el ritmo creciente de las actividades industriales y la expansión de la infraestructura en las economías emergentes y desarrolladas. El acero inoxidable es un material fundamental en maquinaria industrial, equipos de proceso y aplicaciones de construcción debido a su robustez, resistencia a la corrosión y larga vida útil.

- La actual ola de modernización industrial, que incluye la fabricación inteligente, los proyectos de energía renovable y las iniciativas de desarrollo urbano, está impulsando una demanda constante de acero inoxidable en la fabricación de equipos, componentes estructurales y sistemas de manipulación de fluidos.

- Sectores como la construcción, la generación de energía, el procesamiento químico y el petróleo y el gas están aumentando sus gastos de capital para cumplir con los objetivos de crecimiento pospandémico, lo que lleva a un mayor uso de acero inoxidable en entornos de trabajo pesado, de alta temperatura y corrosivos.

- A medida que los gobiernos invierten en planes nacionales de infraestructura —como ciudades inteligentes, corredores energéticos y parques industriales—, el papel del acero inoxidable para garantizar el rendimiento, la seguridad y la sostenibilidad cobra mayor relevancia. Se espera que esta tendencia acelere la adopción del acero inoxidable en las economías industriales de alto crecimiento de América Latina.

Oportunidad

Integración en industrias verdes y aplicaciones sostenibles

- La integración en industrias ecológicas se está convirtiendo en una tendencia transformadora en el mercado norteamericano del acero inoxidable, impulsada por la sostenibilidad, la adopción de energías renovables y las prácticas de economía circular. Su 100 % reciclabilidad, durabilidad y resistencia a la corrosión lo convierten en un material ideal para infraestructuras de energía limpia e industrias responsables con el medio ambiente.

- El mercado se beneficia cada vez más de la aplicación del acero inoxidable en estructuras de paneles solares, componentes de turbinas eólicas, sistemas de almacenamiento de hidrógeno e instalaciones de tratamiento de agua. Estos sectores priorizan materiales que ofrecen longevidad y un impacto ambiental mínimo.

- Por ejemplo, en 2024, Aperam lanzó una nueva gama de soluciones de acero inoxidable diseñadas específicamente para su uso en sistemas de hidrógeno y energía limpia, reforzando el papel de la aleación en las estrategias de descarbonización.

- Además, el acero inoxidable se está volviendo parte integral de las certificaciones de construcción ecológica (como LEED y BREEAM) y se utiliza cada vez más en proyectos de construcción sustentable debido a su bajo costo de ciclo de vida y su desempeño ambiental.

- La alineación del acero inoxidable con las iniciativas ecológicas no solo abre nuevas verticales de uso final, sino que también fomenta la innovación colaborativa entre las siderúrgicas y las industrias de tecnologías limpias. Se espera que esta integración aumente la relevancia del acero inoxidable en la transición hacia cero emisiones netas, impulsando el crecimiento del mercado a largo plazo.

Restricción/Desafío

Altos costos y volatilidad de las materias primas en la producción de acero inoxidable

- El mercado del acero inoxidable se ve significativamente afectado por la fluctuación de los costos de materias primas esenciales como el níquel, el cromo y el molibdeno. Estos insumos están sujetos a la volatilidad de precios debido a tensiones geopolíticas, restricciones comerciales, desequilibrios entre la oferta y la demanda, y fluctuaciones en los precios de la energía, lo que genera importantes presiones de costos para los fabricantes.

- La inestabilidad de precios no solo afecta la economía de la producción, sino que también altera las estrategias de abastecimiento a largo plazo, reduce los márgenes de beneficio y perjudica la competitividad de los pequeños y medianos productores. Estas fluctuaciones de costos suelen provocar ajustes de precios posteriores, lo que influye en la asequibilidad y la adopción del acero inoxidable en sectores clave de uso final.

- Por ejemplo, a fines de 2023, la Bolsa de Metales de Londres informó un aumento del 20% en los precios del níquel luego de las restricciones a las exportaciones de los principales países productores, incluidos Indonesia y Filipinas, lo que afectó directamente los precios del acero inoxidable.

- Además, el Foro Internacional del Acero Inoxidable (ISSF) destacó en el primer trimestre de 2024 que los precios del molibdeno se dispararon debido a la oferta limitada y la creciente demanda de los sectores de energía y procesamiento químico, lo que generó efectos de transmisión de costos a lo largo de la cadena de valor del acero inoxidable.

- El elevado e impredecible coste de las materias primas supone una importante limitación para los productores de acero inoxidable. Limita la inversión en I+D, afecta a la estabilidad de precios y complica la presupuestación de proyectos para los usuarios finales en los sectores de infraestructura, automoción e industria pesada. Los fabricantes exploran cada vez más alternativas como la producción a partir de chatarra y la diversificación del suministro para mitigar estos desafíos y mantener la resiliencia del mercado.

Alcance del mercado del acero inoxidable

El mercado está segmentado en función del tipo de producto, tipo de grado, método de producción, resistencia, revestimiento y acabado de la superficie, y proceso vertical y de fabricación.

• Por producto

Según el producto, el mercado del acero inoxidable se segmenta en productos planos, productos largos, tubos, accesorios y bridas, entre otros. Se prevé que este segmento domine el mercado con una cuota del 45,69 % en 2025, gracias a su amplio uso en la automoción, la construcción y la industria, gracias a su excelente conformabilidad, resistencia a la corrosión y soldabilidad. Estas características los hacen ideales para componentes estructurales, electrodomésticos e infraestructura.

Se prevé que el segmento de productos planos sea testigo de la tasa de crecimiento más rápida del 5,10 % entre 2025 y 2032, respaldado por la creciente demanda de los sectores comercial y hotelero de láminas y bobinas de acero inoxidable estéticamente atractivas y duraderas para aplicaciones arquitectónicas y de diseño de interiores.

• Por tipo de grado

Según el tipo de calidad, el mercado del acero inoxidable se segmenta en acero inoxidable austenítico, acero inoxidable ferrítico, acero inoxidable dúplex, acero inoxidable martensítico, acero inoxidable endurecido por precipitación (PH), entre otros. Se prevé que el acero inoxidable austenítico crezca hasta alcanzar la mayor cuota de mercado, con un 33,19 %, en 2025, gracias a su superior resistencia a la corrosión, buena conformabilidad y versatilidad en aplicaciones como menaje de cocina, equipos de procesamiento químico y fachadas de edificios.

También se espera que el segmento de acero inoxidable austenítico sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por una creciente adopción en los sectores de alimentos y bebidas, atención médica y marino, donde la alta higiene y la resistencia a la corrosión son fundamentales.

• Por proceso de fabricación

Según el proceso de fabricación, el mercado del acero inoxidable se segmenta en laminado en caliente, laminado en frío, fundición, forjado y extrusión. Se prevé que el segmento de laminado en caliente crezca hasta alcanzar la mayor cuota de mercado, con un 42,46%, en 2025, gracias a su rentabilidad y a su capacidad para producir componentes a gran escala utilizados en la construcción, la construcción naval y las tuberías.

También se espera que el laminado en caliente experimente la CAGR más rápida entre 2025 y 2032, debido a su uso cada vez mayor en la fabricación de componentes de servicio pesado y la creciente demanda de proyectos de desarrollo de infraestructura que requieren secciones de acero gruesas.

• Por método de producción

Según el método de producción, el mercado del acero inoxidable se segmenta en producción primaria (producción de acero inoxidable en bruto), procesamiento secundario (refinación y aleación) y procesamiento final. El segmento de producción primaria (producción de acero inoxidable en bruto) representó la mayor participación en los ingresos del mercado, con un 63,34 % en 2025, impulsado por la creciente demanda de acero, la urbanización y las inversiones en infraestructura industrial y de transporte.

Se espera que el segmento de producción primaria sea testigo de la CAGR más rápida entre 2025 y 2032, respaldada por expansiones de capacidad, avances tecnológicos en procesos de fusión y aleación de acero y una creciente adopción de hornos de arco eléctrico para cumplir con los objetivos de sostenibilidad.

• Por fuerza

En función de su resistencia, el mercado del acero inoxidable se segmenta en acero inoxidable de resistencia media, acero inoxidable de resistencia baja y acero inoxidable de resistencia alta. El segmento de acero inoxidable de resistencia media representó la mayor cuota de mercado, con un 65,72 % en 2025, gracias a sus propiedades equilibradas que lo hacen adecuado para una amplia gama de aplicaciones, como utensilios de cocina, paneles arquitectónicos y componentes de transporte.

Se espera que el segmento de resistencia media sea testigo de la CAGR más rápida entre 2025 y 2032, impulsado por su uso creciente en estructuras de soporte de carga media y entornos de corrosión moderada, lo que proporciona ventajas tanto en costos como en rendimiento.

• Por recubrimiento y acabado de superficie

En cuanto a recubrimientos y acabados superficiales, el mercado del acero inoxidable se segmenta en acabados superficiales y recubrimientos. Se prevé que el segmento de acabados superficiales domine el mercado con una cuota del 73,25 % en 2025, debido a la creciente demanda de acabados visualmente atractivos y funcionales en arquitectura, equipamiento de cocina y electrónica de consumo. Estos acabados mejoran tanto la estética como la resistencia a la corrosión.

Se espera que el segmento de acabados de superficies sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por los avances en técnicas de pulido, cepillado y texturizado, y la creciente demanda de superficies de acero inoxidable de aspecto premium en aplicaciones industriales y de consumo.

• Por Vertical

Por sector, el mercado del acero inoxidable se segmenta en construcción e infraestructura, automoción y transporte, procesamiento de alimentos y bebidas, equipos y maquinaria industrial, medicina y salud, energía y electricidad, bienes de consumo y electrodomésticos, aeroespacial y defensa, electrónica y tecnología, aplicaciones ambientales, entre otros. Se prevé que el segmento de construcción e infraestructura domine el mercado con la mayor participación, un 21,41 %, en 2025, gracias a su durabilidad, resistencia a la corrosión y bajo mantenimiento, lo que lo hace ideal para estructuras, puentes, revestimientos y sistemas de techado.

También se espera que el segmento de construcción e infraestructura sea testigo de la CAGR más rápida entre 2025 y 2032, respaldada por inversiones en infraestructura, expansión urbana y un enfoque creciente en materiales de construcción sostenibles y resilientes.

Análisis regional del mercado del acero inoxidable

- Se espera que América del Norte crezca en el mercado del acero inoxidable con una participación de mercado del 23,28% en 2025, impulsada por la rápida industrialización, el desarrollo de infraestructura y el aumento de las inversiones en construcción y fabricación.

- La fuerte demanda de la región también se atribuye a la presencia de importantes productores de acero inoxidable, sectores crecientes de automoción y bienes de consumo, y políticas gubernamentales favorables que apoyan el crecimiento industrial.

- La alta demanda en aplicaciones de construcción, transporte y energía, junto con las ventajas de costos y la abundancia de materias primas, posiciona a América del Norte como una región clave para el consumo de acero inoxidable.

Perspectiva del mercado del acero inoxidable en EE. UU.

Se prevé que el mercado estadounidense del acero inoxidable alcance una cuota de mercado del 63,58 % en 2025, impulsado por el aumento de la demanda en los sectores de la construcción, el petróleo y el gas, y la automoción. Las inversiones en la modernización de infraestructuras, junto con un enfoque en la sostenibilidad y la eficiencia de los materiales, impulsan la expansión del mercado. El acero inoxidable se utiliza por su robustez, resistencia a la corrosión y atractivo estético en proyectos tanto del sector público como del privado.

Cuota de mercado del acero inoxidable

La industria del acero inoxidable está liderada principalmente por empresas bien establecidas, entre las que se incluyen :

- Shandong Baosteel Industry Co., Ltd. (China)

- Ternium (Luxemburgo/México/Argentina)

- ArcelorMittal (Luxemburgo)

- MITSUI & CO., LTD. (Japón)

- NUCOR (EE. UU.)

- NIPPON STEEL CORPORATION (Japón)

- Tata Steel (India)

- JINDAL INOXIDABLE (India)

- Outokumpu (Finlandia)

- China Ansteel Group Corporation Limited (China)

- China BaoWu Steel Group Corporation Limited (China)

- Acciai Speciali Terni SpA (Italia)

- Universal Stainless (EE. UU.)

- Daido Steel Co., Ltd. (Japón)

- Delong Metal (China)

- Acerinox (España)

- Yieh Corp. (Taiwán)

- Nitech Stainless Inc (India)

- JFE Steel Corporation (Japón)

- SSG Standard Solutions Group AB (Suecia)

- Paz del Río (Colombia)

- POSCO (Corea del Sur)

Últimos avances en el mercado del acero inoxidable en América del Norte

- En febrero, Nippon Steel Corporation anunció sus planes de adquirir US Steel en una operación de 14.900 millones de dólares, con el objetivo de fortalecer su competitividad y presencia productiva en Norteamérica. Esta operación forma parte de la estrategia de Nippon Steel para asegurar capacidades de fabricación avanzadas y cadenas de suministro estables. La empresa amplía su presencia internacional, mejora su escala operativa e impulsa su crecimiento futuro mediante la consolidación transfronteriza.

- En mayo, Aperam anunció el desarrollo de la primera línea de productos circulares de acero inoxidable de Europa, que utiliza insumos derivados de chatarra y métodos de reciclaje de circuito cerrado en todas sus plantas de fabricación. La iniciativa respalda la normativa medioambiental de la UE y los objetivos de economía circular. La empresa innova en metalurgia sostenible, capta cuota de mercado con conciencia ecológica y reduce las emisiones derivadas de la producción.

- En marzo, Outokumpu firmó un acuerdo de energía renovable a largo plazo en Finlandia, garantizando energía baja en carbono para sus procesos de producción de acero inoxidable. Esta medida se alinea con sus objetivos climáticos para 2030 y apoya la reducción de la huella de carbono. La empresa impulsa sus objetivos de sostenibilidad, mejora la imagen de marca ecológica y garantiza la estabilidad de los costos energéticos a largo plazo.

- En abril, Nitech Stainless Inc. lanzó una nueva línea de productos de tuberías y tubos de acero inoxidable dúplex y súper dúplex, dirigida a las industrias química, de petróleo y gas, y de desalinización. La nueva línea cumple con estrictos estándares de resistencia a la corrosión y amplía las opciones de personalización. La empresa amplía su cartera de productos, satisface la demanda de la industria especializada y consolida su marca como proveedor de aleaciones de alto rendimiento.

- En enero, Gibbs Wire & Steel Company LLC amplió su capacidad de distribución con la apertura de un nuevo centro de servicio en el sureste de EE. UU., lo que permite una entrega más rápida de bobinas y alambres de corte de precisión a los clientes de la región. Estas instalaciones mejoran la flexibilidad logística y la capacidad de respuesta de la empresa. La empresa mejora los niveles de servicio al cliente, impulsa el crecimiento regional y optimiza la eficiencia de la cadena de suministro.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTENSITY FOR COMPETITIVE RIVAL

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 CARBON EMISSIONS AND REGULATORY PRESSURES

4.3.3 SHIFT TOWARDS LOW-CARBON AND GREEN STEEL

4.3.4 CLIMATE-RESILIENT SUPPLY CHAINS

4.3.5 INVESTOR AND CONSUMER EXPECTATIONS

4.3.6 NORTH AMERICA COOPERATION AND INDUSTRY INITIATIVES

4.3.7 CONCLUSION

4.4 COMPARATIVE OVERVIEW OF GLOBAL

4.5 RAW MATERIAL COVERAGE

4.5.1 NICKEL

4.5.2 IRON ORE

4.5.3 CHROMIUM

4.5.4 SILICON

4.5.5 MOLYBDENUM

4.5.6 OTHERS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.1.4 INCREASED DEMAND FROM AUTOMOTIVE AND TRANSPORTATION MANUFACTURING SECTORS.

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.3.3 RISING DEMAND FOR SUSTAINABLE AND RECYCLABLE MATERIALS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLAT PRODUCTS

7.2.1 FLAT PRODUCTS, BY TYPE

7.2.1.1 SHEETS, BY TYPE

7.2.1.2 SHEETS, BY THICKNESS

7.2.1.3 COILS, BY TYPE

7.2.1.4 PLATES, BY TYPE

7.2.1.5 STRIPS, BY TYPE

7.3 LONG PRODUCTS

7.3.1 LONG PRODUCTS, BY TYPE

7.3.1.1 BARS, BY TYPE

7.3.1.2 BARS, BY SIZE/WIDTH

7.3.1.3 BARS, BY GRADE

7.3.1.4 RODS, BY TYPE

7.3.1.5 WIRES, BY TYPE

7.3.1.6 ANGLES, BY TYPE

7.4 PIPES & TUBES

7.4.1 PIPES & TUBES, BY TYPE

7.4.1.1 SEAMLESS PIPES, BY PRODUCT

7.4.1.2 WELDED PIPES, BY PRODUCT

7.4.1.3 TUBES, BY PRODUCT

7.5 FITTINGS & FLANGES

7.5.1 FITTINGS & FLANGES, BY TYPE

7.5.1.1 PIPE FITTINGS, BY PRODUCT

7.5.1.1.1 ELBOWS, BY PRODUCT

7.5.1.2 FLANGES, BY TYPE

7.6 OTHERS

8 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE

8.1 OVERVIEW

8.2 AUSTENITIC STAINLESS STEEL

8.3 FERRITIC STAINLESS STEEL

8.4 DUPLEX STAINLESS STEEL

8.5 MARTENSITIC STAINLESS STEEL

8.6 PRECIPITATION-HARDENED (PH) STAINLESS STEEL

8.7 OTHERS

9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD

9.1 OVERVIEW

9.2 PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION)

9.3 SECONDARY PROCESSING

9.4 FINAL PROCESSING

10 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH

10.1 OVERVIEW

10.2 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

10.3 MEDIUM STRENGTH STAINLESS STEEL

10.4 LOW STRENGTH STAINLESS STEEL

10.5 HIGH STRENGTH STAINLESS STEEL

11 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 CONSTRUCTION & INFRASTRUCTURE

11.2.1 CONSTRUCTION & INFRASTRUCTURE, BY PRODUCT TYPE

11.2.2 CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION

11.2.2.1 STRUCTURAL COMPONENTS, BY TYPE

11.2.2.2 BRIDGES & TRANSPORTATION INFRASTRUCTURE, BY TYPE

11.2.2.3 PUBLIC BUILDINGS & URBAN INFRASTRUCTURE, BY TYPE

11.2.2.4 WATER SUPPLY & SEWAGE TREATMENT, BY TYPE

11.3 AUTOMOTIVE & TRANSPORTATION

11.3.1 AUTOMOTIVE & TRANSPORTATION, BY PRODUCT TYPE

11.3.2 AUTOMOTIVE & TRANSPORTATION, BY APPLICATION

11.3.2.1 AUTOMOTIVE INDUSTRY, BY TYPE

11.3.2.2 RAILWAYS, BY TYPE

11.3.2.3 MARINE INDUSTRY, BY TYPE

11.3.2.4 AEROSPACE INDUSTRY, BY TYPE

11.4 FOOD & BEVERAGE PROCESSING

11.4.1 FOOD & BEVERAGES, BY PRODUCT TYPE, BY PRODUCT TYPE

11.4.2 FOOD & BEVERAGES PROCESSING, BY APPLICATION

11.4.2.1 DAIRY INDUSTRY, BY TYPE

11.4.2.2 BREWING & DISTILLATION, BY TYPE

11.4.2.3 MEAT & POULTRY PROCESSING, BY TYPE

11.4.2.4 PACKAGING & STORAGE, BY TYPE

11.5 INDUSTRIAL EQUIPMENT & MACHINERY

11.5.1 INDUSTRIAL EQUIPMENT & MACHINERY, BY PRODUCT TYPE, BY PRODUCT TYPE

11.5.2 INDUSTRIAL EQUIPMENT & MACHINERY, BY APPLICATION

11.5.2.1 CHEMICAL & PETROCHEMICAL INDUSTRY, BY TYPE

11.5.2.2 HEAVY MACHINERY & MANUFACTURING, BY TYPE

11.5.2.3 MINING & METALLURGY, BY TYPE

11.5.2.4 TEXTILE INDUSTRY, BY TYPE

11.6 MEDICAL & HEALTHCARE

11.6.1 MEDICAL & HEALTHCARE, BY PRODUCT TYPE

11.6.2 MEDICAL & HEALTHCARE, BY APPLICATION

11.6.2.1 SURGICAL INSTRUMENTS, BY TYPE

11.6.2.2 MEDICAL IMPLANTS & PROSTHETICS, BY TYPE

11.6.2.3 HOSPITAL INFRASTRUCTURE, BY TYPE

11.7 ENERGY & POWER

11.7.1 ENERGY & POWER, BY PRODUCT TYPE

11.7.2 ENERGY & POWER, BY APPLICATION

11.7.2.1 OIL AND GAS INDUSTRY, BY TYPE

11.7.2.2 POWER GENERATION, BY TYPE

11.7.2.3 RENEWABLE ENERGY, BY TYPE

11.8 CONSUMER GOODS & HOME APPLIANCES

11.8.1 CONSUMER GOODS & HOME APPLIANCES, BY PRODUCT TYPE

11.8.2 CONSUMER GOODS & HOME APPLIANCES, BY APPLICATION

11.8.2.1 HOME APPLIANCES, BY TYPE

11.8.2.2 KITCHEN & COOKWARE, BY TYPE

11.8.2.3 FURNITURE & DÉCOR, BY TYPE

11.9 AEROSPACE & DEFENSE

11.9.1 AEROSPACE & DEFENSE, BY PRODUCT TYPE

11.9.2 AEROSPACE & DEFENSE, BY APPLICATION

11.9.2.1 DEFENSE EQUIPMENT, BY TYPE

11.9.2.2 SPACE INDUSTRY, BY TYPE

11.1 ELECTRONICS & TECHNOLOGY

11.10.1 ELECTRONICS & TECHNOLOGY, BY PRODUCT TYPE

11.10.2 ELECTRONICS & TECHNOLOGY, BY APPLICATION

11.10.2.1 SEMICONDUCTOR INDUSTRY, BY TYPE

11.10.2.2 CONSUMER ELECTRONICS, BY TYPE

11.11 ENVIRONMENTAL APPLICATIONS

11.11.1 ENVIRONMENTAL APPLICATIONS, BY PRODUCT TYPE

11.11.2 ENVIRONMENTAL APPLICATIONS, BY APPLICATION

11.11.2.1 WATER TREATMENT, BY TYPE

11.11.2.2 WASTE MANAGEMENT & RECYCLING, BY TYPE

11.12 OTHERS

12 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH

12.1 OVERVIEW

12.2 SURFACE FINISHES

12.2.1 SURFACE FINISHES, BY TYPE

12.2.2 MILL FINISHES, BY TYPE

12.2.3 POLISHED FINISHES, BY TYPE

12.2.4 PATTERNED & TEXTURED FINISHES, BY TYPE

12.3 COATINGS

12.3.1 COATINGS, BY TYPE

13 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS

13.1 OVERVIEW

13.2 HOT ROLLING

13.3 COLD ROLLING

13.4 CASTING

13.5 FORGING

13.6 EXTRUSION

14 NORTH AMERICA STAINLESS STEEL MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA STAINLESS STEEL MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 SHANDONG BAOSTEEL INDUSTRY CO., LTD

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 TERNIUM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ARCELORMITTAL

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MITSUI & CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NUCOR CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ACCIAI SPECIALI TERNI S.P.A

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ACERINOX

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS/NEWS

17.8 CHINA ANSTEEL GROUP CORPORATION LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 RECENT FINANCIALS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 CHINA BAOWU STEEL GROUP CORPORATION LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 DAIDO STEEL CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 DELONG METAL

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 JFE STEEL CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 JINDAL STAINLESS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NIPPON STEEL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 OUTOKUMPU

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 PAZDELRIO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 TATA STEEL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 UNIVERSAL STAINLESS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 YIEH CORP.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 POSCO

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 KEY EN STANDARDS FOR STAINLESS STEEL:

TABLE 2 KEY STANDARDS FOR STAINLESS STEEL

TABLE 3 KEY STAINLESS STEEL STANDARDS:

TABLE 4 KEY STAINLESS STEEL STANDARDS

TABLE 5 KEY STAINLESS STEEL STANDARDS

TABLE 6 KEY STAINLESS STEEL STANDARDS

TABLE 7 KEY STAINLESS STEEL STANDARDS

TABLE 8 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 10 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 12 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 20 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 29 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 35 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 41 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA AUSTENITIC STAINLESS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA FERRITIC STAINLESS STEEL POLYMERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA DUPLEX STAINLESS-STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA MARTENSITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA SECONDARY PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA MEDIUM STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA LOW STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 145

TABLE 64 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA AEROSPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD & BEVERAGE PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA FOOD & BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA FOOD & BEVERAGES PROCESSING IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DAIRY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA STAINLESS STEEL MARKET, BY COATINGS & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 148 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 150 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 160 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 168 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 172 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 174 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 175 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 178 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 179 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 180 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 181 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 182 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 183 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 184 BY PRODUCTION METHOD

TABLE 185 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 187 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 189 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 190 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 196 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 197 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 203 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 204 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 207 NORTH AMERICA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 208 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 209 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 210 NORTH AMERICA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 211 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 213 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 215 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 216 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 220 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 221 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 222 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 226 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 231 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 232 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 236 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 237 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 240 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 241 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 247 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 248 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 249 U.S. FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 U.S. SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 U.S. SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 252 U.S. COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 U.S. PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 254 U.S. STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 255 U.S. LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 U.S. BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 U.S. BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 258 U.S. BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 259 U.S. RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 260 U.S. WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 U.S. ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 262 U.S. PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 263 U.S. SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 264 U.S. WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 U.S. TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 U.S. FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 267 U.S. PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 U.S. ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 U.S. FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 U.S. STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 271 U.S. AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 U.S. 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 U.S. 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 U.S. FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 U.S. DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 U.S. PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 277 U.S. STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 278 U.S. HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 279 U.S. COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 280 U.S. CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 281 U.S. FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 282 U.S. EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 283 BY PRODUCTION METHOD

TABLE 284 U.S. PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 U.S. SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 U.S. FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 287 U.S. STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 288 U.S. STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 289 U.S. SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 U.S. MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 291 U.S. POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 U.S. PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 293 U.S. COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 294 U.S. STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 295 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 296 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 297 U.S. STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 U.S. BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 U.S. PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 300 U.S. WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 302 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 303 U.S. AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 U.S. RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 U.S. MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 U.S. AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 308 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 309 U.S. DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 310 U.S. BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 U.S. MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 U.S. PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 313 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 314 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 315 U.S. CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 U.S. HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 U.S. MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 318 U.S. TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 320 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 U.S. SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 U.S. MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 U.S. HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 325 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 326 U.S. OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 327 U.S. POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 328 U.S. RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 330 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 U.S. HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 U.S. KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 U.S. FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 335 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 336 U.S. DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 U.S. SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 339 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 340 U.S. SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 341 U.S. CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 342 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 343 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 344 U.S. WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 345 U.S. WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 347 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 348 CANADA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 CANADA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 CANADA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 351 CANADA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 CANADA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 CANADA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 CANADA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 CANADA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 CANADA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 357 CANADA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 358 CANADA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 CANADA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 CANADA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 CANADA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 CANADA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 CANADA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 CANADA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 365 CANADA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 366 CANADA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 367 CANADA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 368 CANADA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 369 CANADA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 370 CANADA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 371 CANADA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 372 CANADA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 CANADA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 CANADA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 375 CANADA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 376 CANADA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 377 CANADA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 378 CANADA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 379 CANADA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 380 CANADA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 381 CANADA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 382 BY PRODUCTION METHOD

TABLE 383 CANADA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 384 CANADA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 CANADA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 CANADA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 387 CANADA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 388 CANADA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 389 CANADA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 390 CANADA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 391 CANADA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 392 CANADA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 393 CANADA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 394 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 395 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 396 CANADA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 397 CANADA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 398 CANADA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 399 CANADA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 400 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 401 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 402 CANADA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 403 CANADA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 404 CANADA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 CANADA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 406 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 407 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 408 CANADA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 409 CANADA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 410 CANADA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 411 CANADA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 412 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 413 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 414 CANADA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 415 CANADA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 416 CANADA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 417 CANADA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 418 CANADA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 419 CANADA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 420 CANADA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 421 CANADA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 422 CANADA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)