North America Traumatic Brain Injury Treatment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.50 Billion

USD

2.54 Billion

2024

2032

USD

1.50 Billion

USD

2.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.50 Billion | |

| USD 2.54 Billion | |

|

|

|

Segmentación del mercado norteamericano de tratamiento de lesiones cerebrales traumáticas, por tratamiento (cirugía, atención de urgencias y medicamentos), vía de administración (parenteral, oral y otras), edad del paciente (niños, adolescentes y adultos mayores), género (masculino y femenino), causa de la lesión (caídas, accidentes de tráfico, deportes y otras), usuario final (hospitales, clínicas de neurología, farmacias independientes y otros): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de tratamiento de lesiones cerebrales traumáticas

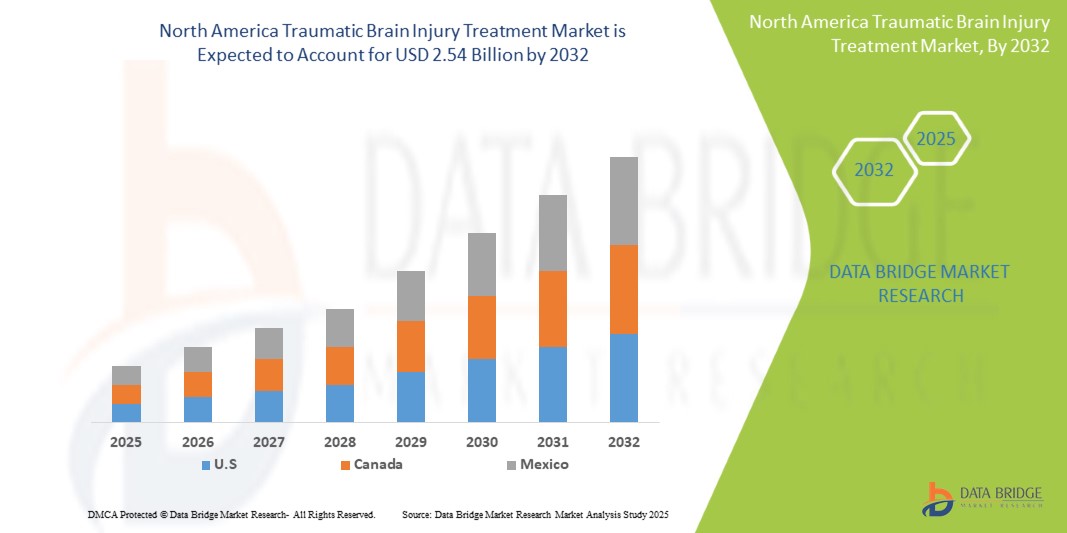

- El mercado de tratamiento de lesiones cerebrales traumáticas de América del Norte se valoró en USD 1.500 millones en 2024 y se espera que alcance los USD 2.540 millones para 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 6,8 %, impulsado principalmente por la creciente incidencia de lesiones cerebrales traumáticas (TBI).

- Este crecimiento está impulsado por factores como la creciente incidencia de lesiones cerebrales traumáticas (LCT) y la creciente adopción de procedimientos mínimamente invasivos en el tratamiento de las LCT, lo que impulsa la demanda de tratamiento de lesiones cerebrales traumáticas.

Análisis del mercado de tratamiento de lesiones cerebrales traumáticas

- Se proyecta que el mercado de tratamiento de lesiones cerebrales traumáticas (TCE) se expandirá significativamente debido a la creciente conciencia sobre las TCE , los avances en las tecnologías de diagnóstico y la creciente incidencia de accidentes y lesiones relacionadas con los deportes, lo que impulsa la demanda de opciones de tratamiento efectivas y terapias de rehabilitación.

- El mercado está presenciando un aumento en los tratamientos innovadores , incluidos agentes neuroprotectores, terapias con células madre y tecnologías de rehabilitación avanzadas, que están mejorando los resultados de recuperación y expandiendo el panorama terapéutico para los pacientes con TCE.

- Estados Unidos se destaca como uno de los países dominantes en el mercado de tratamiento de lesiones cerebrales traumáticas, impulsado por una infraestructura de atención médica avanzada, importantes inversiones en investigación y una alta prevalencia de TCE.

Alcance del informe y segmentación del mercado de tratamiento de lesiones cerebrales traumáticas

|

Atributos |

Perspectivas del mercado del tratamiento de lesiones cerebrales traumáticas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del tratamiento de lesiones cerebrales traumáticas

Creciente adopción de la telemedicina en el tratamiento del TCE

- La telemedicina permite a los pacientes recibir consultas remotas y servicios de rehabilitación, mejorando el acceso a atención especializada para personas en zonas rurales o marginadas, facilitando así la intervención oportuna para pacientes con TCE.

- El uso de la telesalud reduce los costos asociados con las visitas en persona, incluidos los gastos de viaje y la pérdida de productividad, lo que la convierte en una opción financieramente viable tanto para los pacientes como para los proveedores de atención médica.

- En marzo de 2021, el NCBI declaró que las consultas de telesalud para pacientes con lesiones cerebrales adquiridas y sus cuidadores pueden aliviar la carga del transporte, mejorar el cumplimiento terapéutico y aumentar la satisfacción general. Las estrategias de manejo se ven prácticamente inalteradas en el entorno de telesalud, y se ha demostrado que las opciones de telerehabilitación son iguales o superiores a la terapia presencial para tratar muchos déficits asociados.

- Las plataformas de telemedicina permiten el monitoreo continuo y el seguimiento de la atención, lo que permite a los profesionales de la salud rastrear el progreso del paciente de forma remota, brindar comentarios en tiempo real y ajustar los planes de tratamiento según sea necesario, mejorando en última instancia los resultados del paciente en el manejo del TCE.

Dinámica del mercado del tratamiento de lesiones cerebrales traumáticas

Conductor

Aumento de la incidencia de traumatismos craneoencefálicos (TCE)

- A medida que el número de casos continúa aumentando debido a diversos factores contribuyentes, como accidentes de tráfico, lesiones deportivas y caídas, especialmente entre la población de edad avanzada, los accidentes de tráfico siguen siendo una de las principales causas de TCE en todo el mundo, debido al creciente número de vehículos en circulación y las conductas imprudentes al volante.

- Sports-related injuries, particularly in contact sports like football, boxing, and rugby, have further fueled the surge in TBI cases, with increasing awareness of concussion-related complications prompting the need for advanced treatment solutions

For instance,

- In March 2025, as per the article published by ScienceDirect, there were 20.84 million incident cases and 37.93 million prevalent cases of Traumatic Brain Injury (TBI) globally, leading to 5.48 million, Years Lived With Disability (YLDs). The rising burden of TBI increases the demand for advanced treatments, driving investments in diagnostics, neurosurgery, and rehabilitation, ultimately fueling the growth of the global TBI treatment market

- In October 2024, according to the data published by Centers for Disease Control and Prevention, In 2021, there were 69,473 TBI-related deaths, and in 2020, approximately 214,110 hospitalizations occurred. This equates to over 586 hospitalizations and 190 deaths per day, with individuals aged 75+ and males being the most affected. The rising burden of TBI necessitates advanced treatment solutions, driving growth in the global TBI treatment market

- Factors such as road accidents, sports injuries, and falls—especially among the elderly—contribute to increase in TBI. Growing awareness and demand for advanced treatments, including neurosurgery, drug therapies, and rehabilitation, are fuelling market expansion and technological advancements in TBI management

Opportunity

“Rising Personalized and Targeted Therapies in Traumatic Brain Injury (TBI)”

- TBI is a highly variable condition influenced by severity, location, and patient-specific factors, making traditional treatments less effective. Advances in biomarker discovery, neuroimaging, and computational modeling help identify distinct injury patterns, enabling more targeted therapies. Pharmacogenomics enhances drug selection and dosing, minimizing side effects while maximizing effectiveness. Personalized rehabilitation strategies, tailored to cognitive and motor impairments, further optimize recovery by aligning treatments with individual healing trajectories

For instance,

- In February 2022, as per NCBI, researchers have discovered genetic risk factors like APOE4 and BDNF Val66Met polymorphisms that impact TBI recovery. By focusing on these variations, personalized treatments can lower harmful biomarkers, enhance neuroprotection, and improve rehabilitation. This approach tailors’ therapies to individual needs, ultimately leading to better long-term functional outcomes for TBI patients

- In February 2024, article by MDPI TBI presents a significant opportunity to enhance patient outcomes. Advancements in biomarker discovery, pharmacogenomics, and neuroimaging enable precision treatments tailored to individual injury profiles. Emerging therapies, including neurostimulation and stem cell treatments, further expand possibilities for effective, patient-specific interventions in TBI management

- Personalized and targeted therapies present a transformative approach to managing Traumatic Brain Injury (TBI) by tailoring interventions to individual genetic and molecular profiles. These strategies focus on specific biomarkers and cellular processes to reduce secondary damage and improve recovery. By optimizing treatment, personalized therapies enhance outcomes and promote long-term functional recovery for TBI patients.

Restraint/Challenge

“Difficulties in Overcoming the Blood-Brain Barrier for TBI Treatment”

- A significant challenge in Traumatic Brain Injury (TBI) treatment is the disruption of the Blood-Brain Barrier (BBB). After a TBI, the Blood-Brain Barrier (BBB )often becomes compromised, allowing harmful substances to enter the brain, which can worsen injury and hinder recovery. This creates difficulty in delivering therapeutic agents effectively, limiting the success of many treatments designed to aid recovery and protect brain tissue.

- Furthermore, restoring the integrity of the Blood-Brain Barrier (BBB) without causing additional harm remains a major challenge. Developing targeted delivery systems that can bypass the damaged barrier without introducing further risks is crucial for improving TBI treatment outcomes.

For instance,

- In January 2022, Springer Nature Publishing Inc reported that Blood-Brain Barrier (BBB) it restricts the delivery of therapeutic agents to the brain. Even when the BBB is compromised after injury, many drugs, particularly large molecules, still struggle to penetrate it, limiting the effectiveness of treatments and complicating targeted therapies.

- In June 2024, nature reviews neurology reported that BBB dysfunction can persist from days to years after TBI, contributing to long-term neurological complications. This dysfunction is linked to oedema, neuroinflammation, and alterations in neuronal networks, complicating treatment strategies and leading to cognitive impairments, depression, and post-traumatic epilepsy, thus challenging effective recovery and therapeutic approaches

- The Blood-Brain Barrier (BBB) disruption presents a significant challenge in treating Traumatic Brain Injury (TBI), as it restricts the effective delivery of treatments and aggravates brain damage. Persistent BBB dysfunction can lead to long-term complications, including inflammation, brain swelling, and cognitive disorders. While approaches like ROS-scavenging therapy show promise in improving brain function, the fluctuating nature of BBB damage complicates therapeutic strategies. To improve TBI outcomes, there is a critical need for innovative drug delivery systems and better methods for monitoring BBB integrity, enabling more effective treatments and reducing long-term neurological impairments

Traumatic Brain Injury Treatment Market Scope

The market is segmented on the basis treatment, patient age, gender, cause of injury, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Treatment |

|

|

By Patient Age |

|

|

Por género |

|

|

Por causa de la lesión |

|

|

Por el usuario final |

|

Análisis regional del mercado de tratamiento de lesiones cerebrales traumáticas

EE. UU. es la región dominante y se proyecta que registre la mayor tasa de crecimiento en el mercado de tratamiento de lesiones cerebrales traumáticas.

- Se espera que Estados Unidos domine y sea testigo de la mayor tasa de crecimiento en el mercado de tratamiento de lesiones cerebrales traumáticas, impulsado por una infraestructura de atención médica avanzada, una mayor conciencia sobre el manejo de las lesiones cerebrales y una inversión significativa en investigación y desarrollo.

- Estados Unidos tiene una participación significativa en el mercado de tratamiento de lesiones cerebrales traumáticas, impulsado por los avances en tecnología médica, la creciente incidencia de lesiones cerebrales y una sólida infraestructura de atención médica.

- América del Norte se beneficia de sistemas de atención sanitaria bien establecidos y acceso a instalaciones médicas de vanguardia, que facilitan la implementación de protocolos y tecnologías de tratamiento innovadores para lesiones cerebrales traumáticas.

- La región cuenta con importantes inversiones en investigación y desarrollo de trastornos neurológicos, lo que conduce al desarrollo de nuevas terapias y mejores opciones de tratamiento, mejorando así los resultados de los pacientes en el manejo de lesiones cerebrales traumáticas.

Cuota de mercado del tratamiento de lesiones cerebrales traumáticas

El panorama competitivo del mercado proporciona detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Norteamérica, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Pfizer Inc. (EE. UU.)

- Teva Pharmaceuticals US, Inc. (EE. UU.)

- Fresenius SE & Co. KGaA (Fresenius Kabi AG) (Alemania)

- Viatris Inc. (EE. UU.)

- Amneal Pharmaceuticals LLC. (EE. UU.)

- Laboratorios Dr. Reddy Ltd. (India)

- Sun Pharmaceutical Industries, Inc. (India)

- Lupino (India)

- Hikma (Jordania)

- Aurobindo Pharma US (India)

- UCI Médica (EE. UU.)

- B. Braun Medical Inc. (Alemania)

- Alembic Pharmaceuticals Limited (India)

- Merz Therapeutics (Alemania)

- Advacare (Sudáfrica)

- Maxzimaa (India)

- Jedux Parenteral Private Limited (India)

- Sagent Pharmaceuticals, Inc. (EE. UU.)

- Swiss Pharma Nigeria Limited (Nigeria)

Últimos avances en el mercado del tratamiento de lesiones cerebrales traumáticas

- In February 2024, Viatris and Idorsia have entered a major North America research and development collaboration to advance innovative therapies across multiple therapeutic areas. This partnership leverages Idorsia’s drug discovery expertise and Viatris’ North America reach, accelerating the development of groundbreaking treatments and expanding both companies’ pipelines, reinforcing their commitment to addressing unmet medical needs worldwide

- In February 2021, Fresenius Kabi has expanded its facilities in Austria, strengthening its production capabilities and innovation in pharmaceuticals and medical technologies. This expansion enhances manufacturing efficiency, ensures a steady supply of critical care products, and supports research advancements. By increasing capacity and operational excellence, the company reinforces its market presence and meets the growing North America demand for healthcare solutions

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 TECHNOLOGY ROADMAP

4.4 VALUE CHAIN ANALYSIS

4.5 OPPUTUNITY MAP ANALYSIS

4.6 REIMBURSEMENT FRAMEWORK

4.7 COST ANALYSIS BREAKDOWN

4.8 PENETRATION AND GROWTH PROSPECT MAPPING: NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET

4.9 KEY PRICING STRATEGIES: NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET

4.1 MICRO AND MACRO-ECONOMIC FACTORS: NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET

5 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCE OF TRAUMATIC BRAIN INJURY (TBI)

6.1.2 GROWING ADOPTION OF MINIMALLY INVASIVE PROCEDURES IN TBI TREATMENT

6.1.3 TECHNOLOGICAL ADVANCEMENT FOR DIAGNOSIS OF TRAUMATIC BRAIN INJURIES (TBI)

6.1.4 ADVANCEMENTS IN NEUROPROTECTION AND PHARMACOTHERAPY FOR TBI TREATMENT

6.2 RESTRAINTS

6.2.1 SHORTAGE OF TRAINED NEUROLOGISTS AND NEUROSURGEONS

6.2.2 HIGH COST OF TRAUMATIC BRAIN INJURY (TBI) TREATMENT

6.3 OPPORTUNITIES

6.3.1 RISING PERSONALIZED & TARGETED THERAPIES IN TRAUMATIC BRAIN INJURY (TBI)

6.3.2 GROWING BRAIN STIMULATION TECHNIQUES IN TRAUMATIC BRAIN INJURY (TBI) TREATMENT

6.3.3 RISING ARTIFICIAL INTELLIGENCE (AI) APPLICATIONS IN DIAGNOSING TRAUMATIC BRAIN INJURY (TBI)

6.4 CHALLENGES

6.4.1 DIFFICULTIES IN OVERCOMING THE BLOOD-BRAIN BARRIER FOR TBI TREATMENT

6.4.2 ABSENCE OF STANDARDIZED TREATMENT PROTOCOLS IN TRAUMATIC BRAIN INJURY MANAGEMENT

7 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT

7.1 OVERVIEW

7.2 SURGERY

7.2.1 BRAIN BLEEDING TREATMENT

7.2.2 REHABILITATION

7.2.3 CLOTTED BLOOD REMOVAL

7.2.4 WINDOW OPENING IN SKULL

7.2.5 REPAIRING SKULL FRACTURES

7.3 IMMEDIATE EMERGENCY CARE

7.4 MEDICATIONS

7.4.1 DIURETICS

7.4.2 ANTI-SEIZURE DRUGS (ANTI-CONVULSANT)

7.4.3 ANALGESIC

7.4.4 COMA-INDUCING DRUGS

7.4.5 ANTI-DEPRESSANTS

7.4.6 ANTI-ANXIETY AGENT

7.4.7 ANTI-PSYCHOTICS

7.4.8 ANTI-COAGULANTS

7.4.9 OTHERS

7.4.9.1 Parenteral

7.4.9.2 Oral

7.4.9.3 Others

8 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY PATIENT AGE

8.1 OVERVIEW

8.2 CHILDREN

8.3 TEENAGER

8.4 ELDER

9 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY GENDER

9.1 OVERVIEW

9.2 MALE

9.3 FEMALE

10 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, CAUSE OF INJURY

10.1 OVERVIEW

10.2 FALLS

10.3 MOTOR VEHICLE TRAFFIC

10.4 SPORTS

10.5 OTHERS

11 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 NEUROLOGY CLINICS

11.4 INDEPENDENT PHARMACIES

11.5 OTHERS

12 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 PFIZER INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 TEVA PHARMACEUTICALS USA, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT/NEWS

15.3 FRESENIUS SE & CO. KGAA (FRESENIUS KABI AG)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 VIATRIS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 AMNEAL PHARMACEUTICALS LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ADVACARE PHARMA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AUROBINDO PHARMA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ALEMBIC PHARMACEUTICALS LIMITED

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 B. BRAUN SE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 DR. REDDY’S LABORATORIES LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PIPELINE PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 ICU MEDICAL, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT/NEWS

15.12 HIKMA PHARMACEUTICALS PLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PIPELINE PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 JEDUX PARENTERAL PRIVATE LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 LUPIN

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MERZ THERAPEUTICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PIPELINE PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 MAXZIMAA

15.16.1 COMPANY SNAPSHOT

15.16.2 PIPELINE PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SUN PHARMACEUTICAL INDUSTRIES LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SWISS PHARMA NIGERIA LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SAGENT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 NON-INVASIVE THERAPEUTIC APPROACHES’ EFFICIENCY IN DIFFERENT PHASES OF TBI

TABLE 2 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA SURGERY IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SURGERY IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA IMMEDIATE EMERGENCY CARE IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY PATIENT AGE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA CHILDREN IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA TEENAGER IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ELDER IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MALE IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA FEMALE IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY CAUSE OF INJURY, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA FALLS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA MOTOR VEHICLE TRAFFIC IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA SPORTS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA HOSPITALS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA NEUROLOGY CLINICS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA INDEPENDENT PHARMACIES IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA SURGERY IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY PATIENT AGE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY CAUSE OF INJURY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. SURGERY IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY PATIENT AGE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY CAUSE OF INJURY, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 43 CANADA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 44 CANADA SURGERY IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 CANADA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 CANADA MEDICATIONS IN TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 47 CANADA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY PATIENT AGE, 2018-2032 (USD THOUSAND)

TABLE 48 CANADA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY CAUSE OF INJURY, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 51 MEXICO TRAUMATIC BRAIN INJURY TREATMENT MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

Lista de figuras

FIGURE 1 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING INCIDENCE OF TRAUMATIC BRAIN INJURY (TBI) IS EXPECTED TO DRIVE THE NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SURGERY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 13 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC ANALYSIS

FIGURE 16 TBI-RELATED DEATHS FROM 2018 TO 2024

FIGURE 17 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY TREATMENT, 2024

FIGURE 18 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY TREATMENT, 2025 TO 2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY TREATMENT, CAGR (2025- 2032)

FIGURE 20 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 21 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY PATIENT AGE, 2024

FIGURE 22 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY PATIENT AGE, 2025 TO 2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY PATIENT AGE, CAGR (2025- 2032)

FIGURE 24 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY PATIENT AGE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY GENDER, 2024

FIGURE 26 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY GENDER CAGR (2025-2032)

FIGURE 28 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 29 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY CAUSE OF INJURY, 2024

FIGURE 30 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY CAUSE OF INJURY, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY CAUSE OF INJURY, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY CAUSE OF INJURY, LIFELINE CURVE

FIGURE 33 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 38 NORTH AMERICA TRAUMATIC BRAIN INJURY TREATMENT MARKET: COMPANY SHARE 2024 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.