Asia Pacific Aftermarket Combustion Engine Repairs Market

Taille du marché en milliards USD

TCAC :

%

USD

22.34 Billion

USD

34.36 Billion

2024

2032

USD

22.34 Billion

USD

34.36 Billion

2024

2032

| 2025 –2032 | |

| USD 22.34 Billion | |

| USD 34.36 Billion | |

|

|

|

Segmentation du marché des réparations de moteurs à combustion du marché secondaire de l'Asie-Pacifique, par type de service (entretien de routine, réparations, diagnostic, révision ou reconstruction du moteur et autres), type (moteur normal, moteur de sport et moteur vintage), type de carburant (essence et diesel), type de moteur (moteurs de voiture, moteurs de véhicules commerciaux et moteurs de motos), utilisateur final (propriétaire de véhicule individuel, exploitants de flottes, OEM et constructeurs automobiles, sociétés de transport maritime et maritime, et autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché des réparations de moteurs à combustion de rechange

Le marché de la réparation des moteurs à combustion de rechange en Asie-Pacifique est une industrie dynamique et essentielle qui prend en charge la maintenance, l'entretien et la réparation des moteurs à combustion dans un large éventail de secteurs, notamment l'automobile, les véhicules commerciaux et les machines industrielles. Ce marché prospère grâce à la demande de pièces et de services qui garantissent la performance et la longévité continues des moteurs à combustion après leur vente initiale. Avec la croissance des flottes de véhicules, le besoin de solutions de réparation efficaces et rentables et la poussée vers la durabilité environnementale, le marché connaît une augmentation des innovations telles que des pièces de moteur améliorées et des solutions de réparation respectueuses de l'environnement. Le marché est fortement influencé par les avancées technologiques dans le diagnostic des moteurs, la disponibilité de pièces de rechange de haute qualité et l'accent croissant mis sur la réduction des temps d'arrêt et des coûts de réparation. En outre, l'expansion des véhicules électriques et des réglementations plus strictes en matière d'émissions façonnent l'avenir du marché, poussant à des technologies et des pratiques de réparation plus sophistiquées. Le marché continue d'évoluer avec une concurrence accrue et une attention croissante portée à la fourniture de services à valeur ajoutée aux utilisateurs finaux.

Taille du marché des réparations de moteurs à combustion de rechange

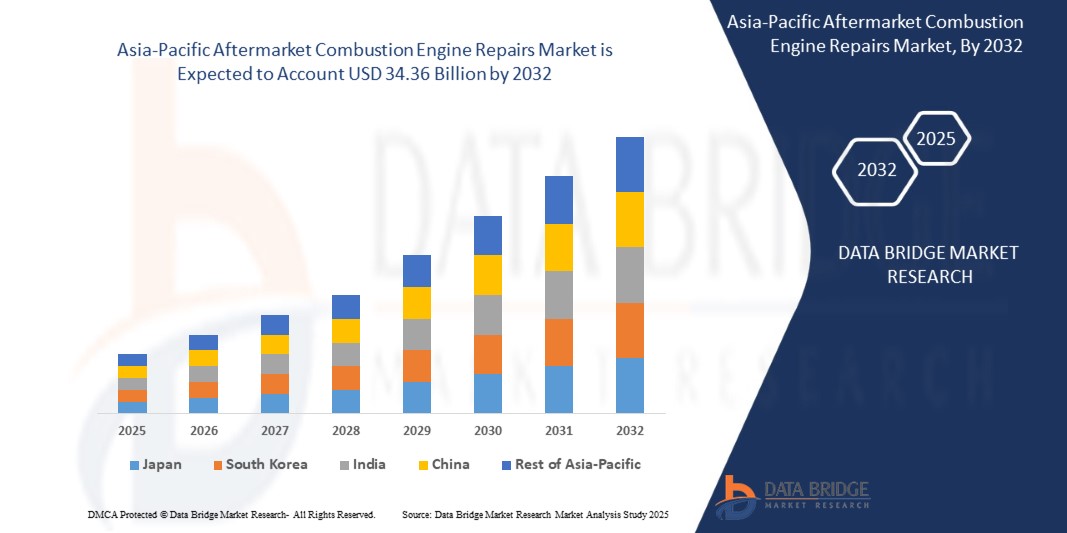

Français La taille du marché des réparations de moteurs à combustion du marché secondaire de l'Asie-Pacifique était évaluée à 22,34 milliards USD en 2024 et devrait atteindre 34,36 milliards USD d'ici 2032, avec un TCAC de 5,6 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE.

Tendances du marché des réparations de moteurs à combustion de rechange

« Demande croissante pour des moteurs à durée de vie prolongée et des initiatives en matière de développement durable »

L’importance croissante accordée à la durabilité et à la rentabilité a entraîné une demande croissante de réparations de moteurs à combustion de rechange, créant ainsi d’importantes opportunités de croissance pour ce marché. Dans un contexte mondial axé sur la réduction des émissions de carbone et l’amélioration du rendement énergétique, de nombreuses industries cherchent des moyens de prolonger la durée de vie de leurs moteurs à combustion existants plutôt que de les remplacer. Les services de réparation et de maintenance de rechange, notamment les révisions, les remplacements de pièces et les mises à niveau des performances, sont essentiels pour répondre à ces demandes. En outre, alors que les entreprises cherchent à réduire leurs coûts d’exploitation et leur impact sur l’environnement, le besoin de réparations de moteurs fiables et de haute qualité devient de plus en plus important. Les réglementations gouvernementales encourageant l’entretien et la modernisation des moteurs plus anciens pour se conformer à des normes d’émission plus strictes stimulent également la croissance du marché de la réparation de pièces de rechange. Cette tendance devrait se poursuivre, car les entreprises de tous les secteurs, du transport aux applications industrielles, accordent de plus en plus d’importance à la durabilité et aux performances à long terme des moteurs.

Portée du rapport et segmentation du marché des réparations de moteurs à combustion de rechange

|

Attributs |

Informations clés sur le marché des réparations de moteurs à combustion de rechange |

|

Segments couverts |

|

|

Pays couverts |

Chine, Japon, Inde, Corée du Sud, Australie, Indonésie, Thaïlande, Malaisie, Singapour, Philippines et reste de l'Asie-Pacifique |

|

Principaux acteurs du marché |

Denso Corporation (Japon), ZF Friedrichshafen AG (Allemagne), ROBERT BOSCH GMBH (Allemagne), MAHLE GmbH (Allemagne), AISIN CORPORATION (Japon), BORGWARNER INC. (États-Unis), Cummins Inc. (États-Unis), Continental Automotive Technologies GMBH (filiale de Continental AG) (Allemagne), Honeywell International Inc. (États-Unis), JASPER ENGINES & TRANSMISSIONS (États-Unis), LKQ CORPORATION (États-Unis), MANN+HUMMEL (Allemagne), Niterra Co., Ltd. (Japon), PHINIA INC. (États-Unis), Schaeffler AG (Allemagne) et Tenneco Inc. (États-Unis) |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché des réparations de moteurs à combustion de rechange

Les réparations de moteurs à combustion de rechange font référence à la réparation, à l'entretien et au remplacement des composants des systèmes de moteurs à combustion des véhicules et des machines qui ont lieu après la vente initiale par le fabricant d'équipement d'origine (OEM). Ces services, généralement fournis par des prestataires de services tiers, comprennent un large éventail d'activités telles que l'entretien de routine, les diagnostics, les révisions de moteurs et le remplacement de pièces essentielles du moteur comme les bougies d'allumage, les injecteurs de carburant, les filtres et d'autres composants critiques. Les principaux objectifs des réparations de moteurs à combustion de rechange sont d'améliorer les performances du moteur, de prolonger sa durée de vie et de garantir la conformité aux normes environnementales et réglementaires, tout en offrant des solutions rentables aux utilisateurs finaux.

Dynamique du marché des réparations de moteurs à combustion de rechange

Conducteurs

- Croissance de l'utilisation des véhicules commerciaux dans la logistique et le transport

La croissance de l'utilisation des véhicules commerciaux dans la logistique et le transport est un moteur important du marché mondial des réparations de moteurs à combustion. À mesure que les industries se développent et que la demande de transport de marchandises augmente, le nombre de véhicules commerciaux sur la route continue d'augmenter. Ces véhicules nécessitent un entretien et des réparations fréquents, en particulier pour leurs moteurs à combustion, qui sont essentiels à leurs performances et à leur efficacité. Cette augmentation de l'utilisation des véhicules alimente le besoin de pièces de rechange et de services de réparation, créant une forte demande du marché pour des solutions de maintenance afin de garantir des performances optimales et de minimiser les temps d'arrêt.

Par exemple,

Selon un article publié par l'Organisation internationale des constructeurs automobiles, la production mondiale de véhicules commerciaux a connu des fluctuations importantes entre 2019 et 2023, largement influencées par la pandémie de COVID-19. La production est passée de 27,26 millions d'unités en 2019 à 24,92 millions en 2020 en raison de la perturbation des chaînes d'approvisionnement et de la baisse de la demande. Elle a rebondi à 26,36 millions en 2021, mais a de nouveau chuté à 24,22 millions en 2022 avant de se redresser à 27,45 millions en 2023. Cette reprise s'aligne sur la croissance des activités de logistique et de transport, entraînant une utilisation accrue des véhicules commerciaux. Par conséquent, le marché des réparations de moteurs à combustion de rechange a connu une croissance, alimentée par le besoin d'entretien et de réparations pour répondre à la demande croissante des opérations logistiques.

- Adoption croissante de pièces de rechange pour réduire les coûts

L’adoption croissante de pièces de rechange pour réduire les coûts est un facteur clé de la croissance du marché des réparations de moteurs à combustion. Alors que les entreprises et les propriétaires de véhicules recherchent des alternatives plus abordables aux pièces d’origine, les pièces de rechange offrent une solution rentable sans compromettre la qualité. Avec une prise de conscience croissante des avantages, tels que des prix plus bas et des performances compétitives, de plus en plus de consommateurs et d’exploitants de flottes optent pour des solutions de rechange pour réduire les dépenses de maintenance. Cette tendance devrait se poursuivre à mesure que la demande de pièces abordables, fiables et performantes augmente, alimentant davantage l’expansion du marché de la réparation après-vente.

Par exemple,

En février 2023, Reliance Industries a dévoilé la première technologie indienne de moteur à combustion interne à hydrogène (H2ICE) pour les camions lourds, développée en collaboration avec Ashok Leyland et d'autres partenaires. Cette technologie développée localement vise à redéfinir la mobilité verte avec des émissions proches de zéro et des performances comparables à celles des camions diesel traditionnels. Elle promet également une réduction du bruit et des économies potentielles. À mesure que l'adoption des camions à hydrogène se développe, le marché des pièces de rechange pourrait connaître un changement, car ces véhicules pourraient nécessiter une maintenance et des pièces spécialisées pour des performances optimales, ce qui stimulerait encore davantage la demande de solutions de rechange rentables.

- Expansion des plateformes de commerce électronique pour la disponibilité des produits de rechange

L’expansion des plateformes de commerce électronique pour la disponibilité des produits de rechange est un moteur clé de la croissance du marché des pièces de rechange. Avec l’évolution croissante vers les achats en ligne, les consommateurs et les entreprises peuvent désormais accéder facilement à une large gamme de pièces et d’accessoires de rechange dans le confort de leur domicile ou de leur bureau. Les plateformes de commerce électronique offrent une commodité, des prix compétitifs et des options de livraison plus rapides, ce qui permet aux exploitants de flottes, aux ateliers de réparation et aux propriétaires de véhicules individuels de trouver et d’acheter plus facilement les composants nécessaires. Ce marché numérique en pleine croissance améliore non seulement la disponibilité des produits, mais génère également des économies de coûts, accélérant encore l’adoption de solutions de rechange.

Par exemple,

Alibaba propose une large gamme de pièces détachées pour moteurs via sa plateforme de commerce électronique, notamment des articles tels que le tuyau de débordement 02232342 et des pièces détachées pour moteurs diesel telles que le tuyau de retour de carburant pour moteurs FL912. Ces produits sont disponibles directement auprès de fournisseurs tels que Hebei Keluo Construction Machinery Co., Ltd., avec des options de retour et de garantie faciles. La plateforme permet aux entreprises d'accéder à des pièces de rechange d'origine de haute qualité à des prix compétitifs, améliorant ainsi la disponibilité et la commodité de l'approvisionnement en composants de réparation de moteurs pour diverses industries. Cette expansion des plateformes de commerce électronique améliore considérablement l'accessibilité des produits de rechange en Asie-Pacifique.

Opportunités

- Intégration de l'IA et de l'IoT dans les systèmes de réparation après-vente

L’intégration de l’intelligence artificielle (IA) et de l’Internet des objets (IoT) représente une opportunité de transformation pour le marché de la réparation des moteurs à combustion. Les diagnostics avancés basés sur l’IA permettent une détection précise des pannes, une maintenance prédictive et des processus de réparation efficaces, réduisant ainsi les temps d’arrêt et améliorant la fiabilité des véhicules. Les systèmes connectés à l’IoT facilitent la surveillance en temps réel des performances du moteur, permettant aux prestataires de services de résoudre les problèmes de manière proactive avant qu’ils ne s’aggravent. Ces technologies améliorent non seulement la précision et l’efficacité des réparations, mais créent également des services à valeur ajoutée, positionnant les entreprises à la pointe de l’innovation sur un marché concurrentiel.

Par exemple,

Selon SPIE RODIAS GmbH, Verusen a mis en œuvre sa solution basée sur l'IA pour la criticité des pièces de rechange, conçue pour optimiser la gestion des stocks en évaluant l'importance des pièces de rechange et les risques opérationnels. Cet outil évalue des facteurs tels que l'utilisation des actifs, les conditions de la chaîne d'approvisionnement et les risques, permettant aux entreprises de hiérarchiser les composants critiques, ce qui entraîne des économies de coûts importantes et une efficacité opérationnelle accrue. La solution promet une réduction allant jusqu'à 45 % des dépenses d'inventaire. L'intégration de l'IA et de l'IoT dans les systèmes de réparation après-vente représente une opportunité majeure pour le marché de la réparation des moteurs à combustion après-vente. Cette technologie peut améliorer la gestion des pièces de rechange, réduire les coûts des stocks et améliorer les opérations des systèmes de réparation, permettant aux entreprises de répondre aux demandes croissantes des clients pour des services de réparation plus rapides et plus fiables.

- Expansion des applications dans les moteurs à combustion marins et industriels

L’expansion des applications des moteurs à combustion dans les secteurs maritime et industriel représente une opportunité importante pour le marché de la réparation des moteurs à combustion de rechange. Alors que des secteurs tels que le transport maritime, la production d’électricité et la fabrication continuent de s’appuyer sur des moteurs à combustion hautes performances, la demande de services de réparation spécialisés après-vente devrait augmenter. Les progrès de la technologie des moteurs, associés au besoin d’une maintenance efficace, créent un terrain fertile pour des solutions de réparation innovantes. Cette croissance des applications des moteurs industriels et marins offre aux prestataires de réparation la possibilité d’offrir des services sur mesure, d’améliorer l’efficacité opérationnelle et de soutenir la longévité des machines critiques dans divers secteurs.

Par exemple,

La société VOcean Ship Spares propose une large gamme de pièces détachées de moteurs marins de haute qualité, adaptées à différents types de moteurs marins pour un entretien et des réparations efficaces. Leurs produits comprennent des pièces essentielles telles que des culasses, des arbres à cames, des vilebrequins, des bielles et des soupapes de moteur, garantissant que les navires sont équipés de composants durables et fiables. En s'associant à VOcean, les entreprises du marché des réparations de moteurs à combustion de rechange peuvent bénéficier d'un accès à des pièces de qualité supérieure, améliorant les performances et prolongeant la durée de vie des moteurs. Cette collaboration offre la possibilité d'améliorer l'efficacité opérationnelle et de réduire les temps d'arrêt dans les secteurs maritime et industriel

- Innovations dans les outils de diagnostic pour améliorer l'efficacité des réparations

Les innovations en matière d’outils de diagnostic améliorent considérablement l’efficacité des réparations sur le marché des pièces de rechange pour moteurs à combustion. Grâce à l’introduction de systèmes de diagnostic avancés, les ateliers de réparation peuvent rapidement identifier les causes profondes des problèmes de moteur, réduisant ainsi les temps d’arrêt et garantissant des réparations précises. Ces outils permettent des diagnostics plus rapides, des flux de travail optimisés et une maintenance plus précise, améliorant ainsi l’efficacité opérationnelle et réduisant les coûts de réparation pour les entreprises. À mesure que ces innovations sont de plus en plus adoptées, elles offrent aux entreprises une opportunité précieuse d’améliorer la qualité de service, d’accroître la satisfaction des clients et de conserver un avantage concurrentiel dans un secteur de la réparation après-vente en constante évolution.

Par exemple,

En décembre 2024, VDIAGTOOL a présenté le VD70S, un outil de diagnostic avancé d'un prix inférieur à 400 USD, destiné à plus de 10 000 modèles de véhicules et doté d'une connectivité Wi-Fi et USB. Cet outil prend en charge les fonctions de maintenance clés telles que la régénération du FAP et la purge de l'ABS, tandis que l'analyse des données en temps réel améliore la précision et l'efficacité du diagnostic. En permettant des réparations plus rapides et plus précises à moindre coût, cette innovation s'aligne sur la demande croissante de solutions de diagnostic avancées dans le secteur des pièces de rechange. Elle met en évidence l'évolution vers des services axés sur la technologie, améliorant la compétitivité des entreprises de réparation et répondant aux besoins évolutifs du marché.

Contraintes/ Défis

- Le déclin de la croissance du marché accélère la transition vers l'adoption des véhicules électriques

Le déclin du marché dans les régions qui favorisent l’adoption des véhicules électriques (VE) constitue un frein important pour le marché des réparations de moteurs à combustion après-vente. À mesure que les VE deviennent plus populaires en raison de leurs avantages environnementaux et de leurs besoins d’entretien moindres, la demande de réparations de moteurs à combustion traditionnels devrait diminuer. Cette évolution vers les VE réduit le besoin de pièces de rechange et de services de réparation associés aux moteurs à combustion interne, limitant ainsi les opportunités de croissance pour les entreprises du secteur des pièces de rechange pour moteurs à combustion. En conséquence, le marché doit s’adapter à cette transition, en se concentrant sur les tendances émergentes en matière de pièces et de services liés aux VE pour soutenir la croissance à long terme

Par exemple,

In 2024, electric car sales saw significant growth, with China accounting for the majority of the additional 3 million sales compared to 2023. Despite the phase-out of NEV purchase subsidies, sales in China grew by nearly 25%, reaching around 10 million units, making up 45% of total car sales. The United States also saw a 20% increase, with electric car sales rising by almost half a million units, while Europe experienced more modest growth of less than 10%. Other regions, such as Southeast Asia and India, also contributed to the rise in EV sales, with a 40% increase outside of the major markets. This strong growth in EV adoption presents a restraint to the aftermarket combustion engine repairs market, as the shift towards electric vehicles reduces the demand for traditional combustion engine parts and repair services, slowing down the growth market in the combustion engine aftermarket sector.

- High Costs Associated with Advanced Repair Technologies

High costs associated with advanced repair technologies pose a significant restraint to the aftermarket combustion engine repairs Market. As the automotive industry increasingly adopts complex systems and sophisticated diagnostic tools for engine repairs, the expenses related to acquiring and maintaining these advanced technologies can be prohibitive for smaller repair shops. This financial burden will limit the accessibility and affordability of specialized repair services, especially in emerging markets, hindering the growth of the aftermarket sector. Consequently, the high cost of repair technologies may restrict the ability of service providers to meet rising demands efficiently, affecting overall market expansion.

For instance,

Laptops mentioned the Universal Diesel Truck Diagnostic Tool & Scanner Kit as a comprehensive solution for diesel diagnostics, designed to connect with various vehicles and equipment types. However, its high cost of USD 2,895, coupled with the specialized software and advanced technology it includes, underscores the financial barrier faced by repair service providers. Such expensive tools and equipment required for modern diagnostics act as a restraint to the aftermarket combustion engine repairs market, as smaller shops and independent service providers may struggle to afford these technologies, limiting their ability to compete and meet repair demands effectively.

- Maintaining Quality and Reliability in Low-Cost Aftermarket Parts

Maintaing quality and reliability in low-cost aftermarket parts presents a significant challenge to the aftermarket combustion engine repairs market. While affordability drives demand for these components, inconsistent quality, lack of adherence to OEM standards, and shorter lifespans can lead to frequent replacements and compromised engine performance. This creates hurdles for repair businesses to balance cost-effectiveness with customer satisfaction, making it essential to implement stricter quality control measures and foster trust in aftermarket solutions.

For instance,

In April 2024, according to the blog published by the PDM highlighted the challenges of maintaining quality and reliability in low-cost aftermarket parts for the aftermarket combustion engine repairs market. Despite the growing demand for such parts due to aging vehicles, ensuring adherence to certifications such as ISO 9001, CAPA, and NSF remained critical. The blog emphasized that inconsistent quality, safety concerns, and lack of compliance with industry standards hindered trust and long-term performance. Manufacturers faced pressure to balance affordability with stringent quality assurance to sustain market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Aftermarket Combustion Engine Repairs Market Scope

The market is segmented into five notable segments based on the service type, type, fuel type, engine type, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Routine Maintenance

- Oil change

- Filter replacements

- Oil

- Air

- Fuel

- Spark plug replacement

- Others

- Repairs

- Pistons

- Valves

- Timing Valves

- Others

- Diagnosis

- Engine Overhaul or Rebuilding

- Other Services

Type

- Normal Engine

- Sports Engine

- Vintage Engine

- Others

Fuel Type

- Petrol

- Diesel

Engine Type

- Car engines

- Commercial Vehicle Engines

- Motor Cycles engines

- Other Engines

Aftermarket Combustion Engine Repairs Market Regional Analysis

The market is segmented into five notable segments based on the country, service type, type, fuel type, engine type, and end-user as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, and rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific aftermarket combustion engine repairs market due to its vast engine fleet across various sectors, a strong manufacturing base for replacement parts, and government regulations driving engine retrofitting and repairs. In addition, China’s advanced repair technologies and cost-effective services further bolster its market leadership. These factors combine to make China the key player in the region’s aftermarket repair industry.

China is the fastest growing Country in the Asia-Pacific aftermarket combustion engine repairs market due to its large and expanding vehicle fleet, which drives significant demand for repair and maintenance services.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aftermarket Combustion Engine Repairs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Aftermarket Combustion Engine Repairs Market Leaders Operating in the Market Are:

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- ROBERT BOSCH GMBH (Germany)

- MAHLE GmbH (Germany)

- AISIN CORPORATION (Japan)

- BORGWARNER INC. (U.S.)

- Cummins Inc. (U.S.)

- Continental Automotive Technologies GMBH (Subsidiary of Continental AG) (Germany)

- Honeywell International Inc. (U.S)

- JASPER ENGINES & TRANSMISSIONS (U.S)

- LKQ CORPORATION (U.S)

- MANN+HUMMEL (Germany)

- Niterra Co., Ltd. (Japan)

- PHINIA INC. (U.S.)

- Schaeffler AG (Germany)

- Tenneco Inc. (U.S.)

Latest Developments in Aftermarket Combustion Engine Repairs Market

- En septembre 2024, DENSO a annoncé son intention de construire une nouvelle usine dans son usine de Zenmyo, dans la ville de Nishio, dans la préfecture d'Aichi. La construction devrait débuter au cours de l'exercice 2025 et la production devrait débuter au cours de l'exercice 2028. La nouvelle installation, qui représente un investissement de 69 milliards de yens, se concentrera sur la fabrication d'ECU intégrés à grande échelle pour les produits d'électrification et ADAS. Elle intégrera une infrastructure numérique, l'automatisation et un fonctionnement sans pilote 24 heures sur 24, améliorant ainsi l'efficacité de la production. L'usine visera également à être neutre en carbone, en utilisant l'énergie solaire et l'hydrogène. DENSO en tirera profit en améliorant la flexibilité de fabrication, l'automatisation et la durabilité, renforçant ainsi sa position de fournisseur leader dans le secteur de la mobilité

- En août 2024, ZF Aftermarket a lancé 25 kits de réparation de transmission d'essieu électrique pour voitures et SUV aux États-Unis et au Canada, simplifiant les réparations de transmission d'essieu électrique en éliminant le besoin de retirer des composants. Ce lancement élargit le portefeuille de ZF pour les véhicules électriques et hybrides, renforçant sa présence sur le marché des pièces de rechange et améliorant sa capacité à prendre en charge les réparations de moteurs électriques et à combustion avec une gamme de produits diversifiée

- En janvier 2024, Robert Bosch GmbH a annoncé le lancement d'un moteur à combustion à hydrogène. Bosch a pour objectif de devenir un fournisseur majeur des constructeurs automobiles et de camions alors que l'industrie du transport lourd passe des moteurs diesel à une propulsion à hydrogène à zéro émission. L'entreprise applique également sa technologie au secteur de l'hydrogène stationnaire et prévoit d'investir 2,6 milliards de dollars dans des initiatives liées à l'hydrogène entre 2021 et 2026.

- En novembre 2024, AISIN a annoncé le lancement d'AISIN Aftermarket & Service of America, Inc., née de la fusion d'AWTEC et de la division aftermarket d'AISIN World Corp. of America. La société prévoit d'élargir sa gamme de produits et de devenir un fournisseur complet de pièces et de services. Ce développement renforce la position d'AISIN sur le marché de la réparation des moteurs à combustion en élargissant son offre et en améliorant sa portée régionale

- En janvier 2020, MAHLE Aftermarket s'est associée à Grant Brothers Sales Ltd. pour élargir sa présence produit sur les principaux marchés canadiens, en s'appuyant sur le vaste réseau et l'expertise de Grant Brothers. Cette collaboration renforce la position de MAHLE GmbH sur le marché de la réparation de moteurs à combustion de rechange en élargissant sa portée, en améliorant les processus de distribution et en offrant un soutien approfondi avec une formation technique et une approche de service holistique dans les industries

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 REGULATORY STANDARDS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN COMMERCIAL VEHICLE USAGE IN LOGISTICS AND TRANSPORTATION

5.1.2 RISING ADOPTION OF AFTERMARKET PARTS FOR COST SAVINGS

5.1.3 EXPANSION OF E-COMMERCE PLATFORMS FOR AFTERMARKET PRODUCT AVAILABILITY

5.1.4 AVAILABILITY OF AUTOMOTIVE REPAIR NETWORKS IN RURAL AREAS

5.2 RESTRAINT

5.2.1 DECLINING MARKET GROWTH ACCELERATING THE SHIFT TOWARDS EV ADOPTION

5.2.2 HIGH COSTS ASSOCIATED WITH ADVANCED REPAIR TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 INTEGRATION OF AI AND IOT IN AFTERMARKET REPAIR SYSTEMS

5.3.2 EXPANDING APPLICATIONS IN MARINE AND INDUSTRIAL COMBUSTION ENGINES

5.3.3 INNOVATIONS IN DIAGNOSTIC TOOLS BOOSTING REPAIR EFFICIENCY

5.4 CHALLENGES

5.4.1 MAINTAINING QUALITY AND RELIABILITY IN LOW-COST AFTERMARKET PARTS

5.4.2 COMPETITION FROM ORIGINAL EQUIPMENT MANUFACTURER-AUTHORIZED SERVICE PROVIDERS

6 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE

6.1 OVERVIEW

6.2 ROUTINE MAINTENANCE

6.2.1 OIL CHANGE

6.2.2 FILTER REPLACEMENTS

6.2.2.1 OIL

6.2.2.2 AIR

6.2.2.3 FUEL

6.2.3 SPARK PLUG REPLACEMENT

6.2.4 OTHERS

6.3 REPAIRS

6.3.1 PISTONS

6.3.2 VALVES

6.3.3 TIMING VALVES

6.3.4 OTHERS

6.4 DIAGNOSIS

6.5 ENGINE OVERHAUL OR REBUILDING

6.6 OTHER SERVICES

7 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE

7.1 OVERVIEW

7.2 CAR ENGINES

7.3 COMMERCIAL VEHICLE ENGINES

7.4 MOTOR CYCLES ENGINES

7.5 OTHER ENGINES

8 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE

8.1 OVERVIEW

8.2 NORMAL ENGINE

8.3 SPORTS ENGINE

8.4 VINTAGE ENGINE

8.5 OTHERS

9 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE

9.1 OVERVIEW

9.2 PETROL

9.3 DIESEL

10 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END USER

10.1 OVERVIEW

10.2 INDIVIDUAL VEHICLE OWNER

10.2.1 ROUTINE MAINTENANCE

10.2.1.1 OIL CHANGE

10.2.1.2 FILTER REPLACEMENTS

10.2.1.2.1 OIL

10.2.1.2.2 AIR

10.2.1.2.3 FUEL

10.2.1.3 SPARK PLUG REPLACEMENT

10.2.1.4 OTHERS

10.2.2 REPAIRS

10.2.2.1 PISTONS

10.2.2.2 VALVES

10.2.2.3 TIMING VALVES

10.2.2.4 OTHERS

10.2.3 DIAGNOSIS

10.2.4 ENGINE OVERHAUL OR REBUILDING

10.2.5 OTHER SERVICES

10.3 FLEET OPERATORS

10.3.1 ROUTINE MAINTENANCE

10.3.1.1 OIL CHANGE

10.3.1.2 FILTER REPLACEMENTS

10.3.1.2.1 OIL

10.3.1.2.2 AIR

10.3.1.2.3 FUEL

10.3.1.3 SPARK PLUG REPLACEMENT

10.3.1.4 OTHERS

10.3.2 REPAIRS

10.3.2.1 PISTONS

10.3.2.2 VALVES

10.3.2.3 TIMING VALVES

10.3.2.4 OTHERS

10.3.3 DIAGNOSIS

10.3.4 ENGINE OVERHAUL OR REBUILDING

10.3.5 OTHER SERVICES

10.4 OEMS AND AUTO MANUFACTURERS

10.4.1 ROUTINE MAINTENANCE

10.4.1.1 OIL CHANGE

10.4.1.2 FILTER REPLACEMENTS

10.4.1.2.1 OIL

10.4.1.2.2 AIR

10.4.1.2.3 FUEL

10.4.1.3 SPARK PLUG REPLACEMENT

10.4.1.4 OTHERS

10.4.2 REPAIRS

10.4.2.1 PISTONS

10.4.2.2 VALVES

10.4.2.3 TIMING VALVES

10.4.2.4 OTHERS

10.4.3 DIAGNOSIS

10.4.4 ENGINE OVERHAUL OR REBUILDING

10.4.5 OTHER SERVICES

10.5 SHIPPING AND MARINE COMPANIES

10.5.1 ROUTINE MAINTENANCE

10.5.1.1 OIL CHANGE

10.5.1.2 FILTER REPLACEMENTS

10.5.1.2.1 OIL

10.5.1.2.2 AIR

10.5.1.2.3 FUEL

10.5.1.3 SPARK PLUG REPLACEMENT

10.5.1.4 OTHERS

10.5.2 REPAIRS

10.5.2.1 PISTONS

10.5.2.2 VALVES

10.5.2.3 TIMING VALVES

10.5.2.4 OTHERS

10.5.3 DIAGNOSIS

10.5.4 ENGINE OVERHAUL OR REBUILDING

10.5.5 OTHERS SERVICES

10.6 OTHERS

11 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION

11.1 ASIA PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 THAILAND

11.1.6 MALAYSIA

11.1.7 SINGAPORE

11.1.8 AUSTRALIA

11.1.9 TAIWAN

11.1.10 INDONESIA

11.1.11 PHILIPPINES

11.1.12 NEW ZEALAND

11.1.13 VIETNAM

11.1.14 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ZF FRIEDRICHSHAFEN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 ROBERT BOSCH GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 MAHLE GMBH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AISIN CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BORGWARNER INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 CUMMINS INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CONTINENTAL AUTOMOTIVE TECHNOLOGIES GMBH (SUBSIDIARY OF CONTINENTAL AG)

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 HONEYWELL INTERNATIONAL INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 JASPER ENGINES & TRANSMISSIONS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 LKQ CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 MANN+HUMMEL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NITERRA CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PHINIA INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 SCHAEFFLER AG

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 TENNECO INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 HIGH COST OF DIAGNOSTIC TOOLS FOR ENGINE REPAIRS

TABLE 4 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC DIAGNOSIS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC ENGINE OVERHAUL OR REBUILDING IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC OTHER SERVICES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CAR ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC COMMERCIAL VEHICLE ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 16 ASIA-PACIFIC MOTOR CYCLES ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC OTHER ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 18 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NORMAL ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC SPORTS ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 ASIA-PACIFIC VINTAGE ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PETROL IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC DIESEL IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 26 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC OTHERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CHINA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 JAPAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 105 JAPAN INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 JAPAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 JAPAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 JAPAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 JAPAN FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 JAPAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 JAPAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 JAPAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 JAPAN OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 JAPAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 JAPAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 JAPAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 JAPAN SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 JAPAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 JAPAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 JAPAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 INDIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 INDIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 INDIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 INDIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 INDIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 INDIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 129 INDIA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 INDIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 INDIA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 INDIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 INDIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 INDIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDIA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 INDIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 INDIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 INDIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDIA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 INDIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 INDIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 INDIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH KOREA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH KOREA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH KOREA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SOUTH KOREA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH KOREA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH KOREA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH KOREA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH KOREA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH KOREA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH KOREA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH KOREA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SOUTH KOREA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SOUTH KOREA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SOUTH KOREA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH KOREA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH KOREA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SOUTH KOREA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SOUTH KOREA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SOUTH KOREA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SOUTH KOREA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 SOUTH KOREA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SOUTH KOREA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 SOUTH KOREA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SOUTH KOREA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 THAILAND AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 THAILAND ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 THAILAND FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 THAILAND REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 THAILAND AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 THAILAND AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 THAILAND AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 THAILAND AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 177 THAILAND INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 THAILAND ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 THAILAND FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 THAILAND REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 THAILAND FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 THAILAND ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 THAILAND FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 THAILAND REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 THAILAND OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 THAILAND ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 THAILAND FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 THAILAND REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 THAILAND SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 THAILAND ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 THAILAND FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 THAILAND REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MALAYSIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MALAYSIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MALAYSIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MALAYSIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MALAYSIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 MALAYSIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 MALAYSIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MALAYSIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 201 MALAYSIA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MALAYSIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MALAYSIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 MALAYSIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MALAYSIA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 MALAYSIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 MALAYSIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MALAYSIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 MALAYSIA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MALAYSIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 MALAYSIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MALAYSIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MALAYSIA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MALAYSIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MALAYSIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MALAYSIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SINGAPORE AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SINGAPORE ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SINGAPORE FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SINGAPORE REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SINGAPORE AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SINGAPORE AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SINGAPORE AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 SINGAPORE AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 225 SINGAPORE INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SINGAPORE ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SINGAPORE FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SINGAPORE REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SINGAPORE FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SINGAPORE ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SINGAPORE FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SINGAPORE REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SINGAPORE OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SINGAPORE ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SINGAPORE FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SINGAPORE REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SINGAPORE SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SINGAPORE ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SINGAPORE FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 SINGAPORE REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 AUSTRALIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 AUSTRALIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 AUSTRALIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 AUSTRALIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 AUSTRALIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 249 AUSTRALIA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 AUSTRALIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 AUSTRALIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 AUSTRALIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 AUSTRALIA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 AUSTRALIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 AUSTRALIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 AUSTRALIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 AUSTRALIA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 AUSTRALIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 AUSTRALIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 AUSTRALIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 AUSTRALIA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 AUSTRALIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 AUSTRALIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 AUSTRALIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 TAIWAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 TAIWAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 TAIWAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 TAIWAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 TAIWAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 TAIWAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 TAIWAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 TAIWAN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 273 TAIWAN INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 TAIWAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 TAIWAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 TAIWAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 TAIWAN FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 TAIWAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 TAIWAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 TAIWAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 TAIWAN OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 TAIWAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 TAIWAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 TAIWAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 TAIWAN SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 TAIWAN ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 TAIWAN FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 TAIWAN REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 INDONESIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 INDONESIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 INDONESIA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 297 INDONESIA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 INDONESIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 INDONESIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 INDONESIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 INDONESIA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 INDONESIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 INDONESIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 INDONESIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 INDONESIA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 INDONESIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 INDONESIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 INDONESIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 INDONESIA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 INDONESIA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 INDONESIA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 INDONESIA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 PHILIPPINES AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 PHILIPPINES ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 PHILIPPINES FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 PHILIPPINES REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 PHILIPPINES AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 PHILIPPINES AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 PHILIPPINES AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 PHILIPPINES AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 321 PHILIPPINES INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 PHILIPPINES ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)