Asia Pacific Biological Buffers Market

Taille du marché en milliards USD

TCAC :

%

USD

177.82 Million

USD

445.89 Million

2024

2035

USD

177.82 Million

USD

445.89 Million

2024

2035

| 2025 –2035 | |

| USD 177.82 Million | |

| USD 445.89 Million | |

|

|

|

|

Asia-PacificBiological Buffers Market Segmentation, By Buffers Type (Goods Buffers and Other Salt-Based Buffers), Formulation (Powder and Liquid), Application (Pharmaceutical & Biopharmaceuticals, Cell Culture & Molecular Biology, Clinical & Diagnostic Applications, and Chemical & Industrial Applications, Others), End User (Pharmaceutical & Biopharmaceutical Companies, Biotechnology Companies, Research & Academic Institutes, Diagnostic Laboratories, Contract Research Organizations (CROs) & CMOs) - Industry Trends and Forecast to 2035

Asia-Pacific Biological Buffers Market Analysis and Size

The Asia-Pacific biological buffers market refers to a market focused on the production, distribution, and sales of biological buffers, which are solutions containing a weak acid and its conjugate base (or a weak base and its conjugate acid) used to maintain a stable pH environment in laboratory and bio-medical settings. The market encompasses a wide range of biological buffers, including phosphate buffers, Tris buffers, HEPES buffers, and others, catering to various applications in fields such as life sciences research, biotechnology, pharmaceuticals, and diagnostics, among others.

Asia-Pacific Biological Buffers Market Size

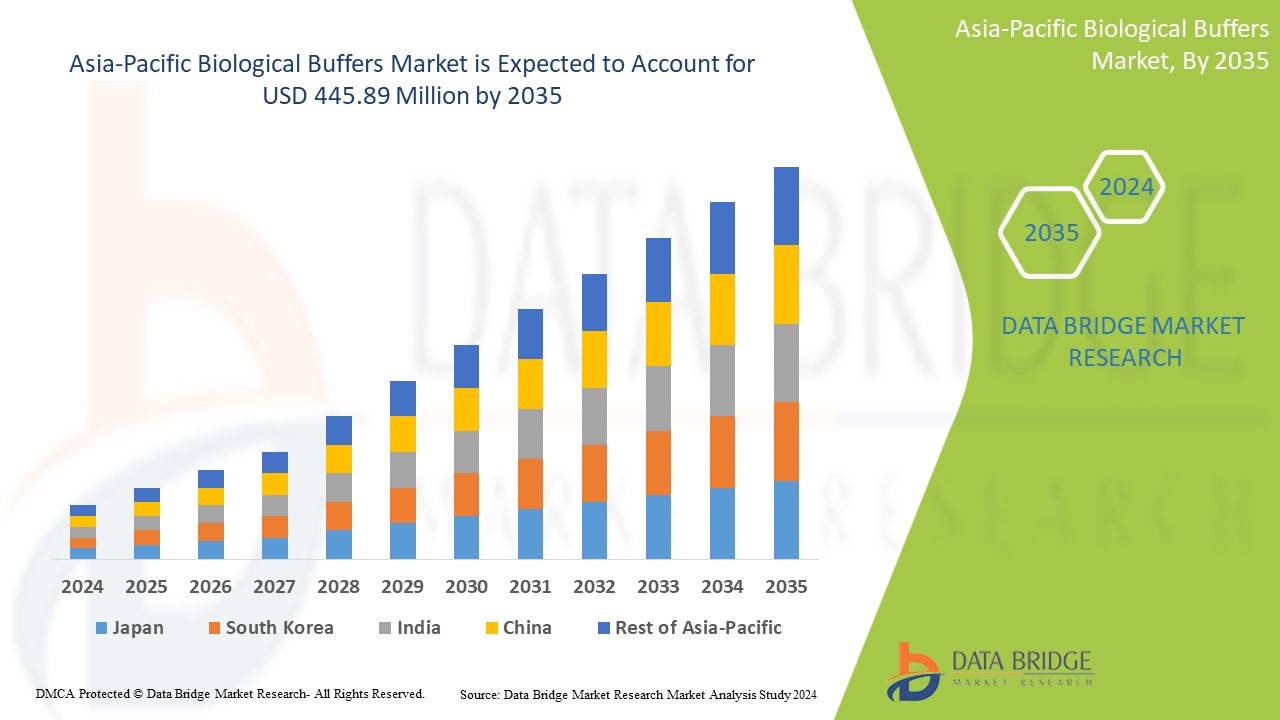

Data Bridge Market Research analyzes that the Asia-Pacific biological buffers market is expected to reach USD 445.89 million by 2035 from USD 177.82 million in 2024, growing at a substantial CAGR of 8.8% in the forecast period of 2025 to 2035. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Biological Buffers Market Trends

“Rising Adoption of AI-Driven Technology”

The biological buffering market is experiencing a significant shift towards AI-driven solutions. As laboratories and biopharmaceutical companies prioritize precision, efficiency, and regulatory compliance, artificial intelligence and machine learning are being integrated into buffer formulation and quality control processes. These technologies help optimize pH stabilization, enhance buffer performance predictions, and streamline production workflows. Additionally, the increasing need for real-time monitoring and automated adjustments in sectors like drug development, clinical research, and bioprocessing is driving demand. As regulatory standards tighten and digital transformation accelerates, AI-powered biological buffering solutions are poised to become a standard in the industry

Report Scope and Biological Buffers Market Segmentation

|

Attributes |

Informations clés sur le marché des tampons biologiques |

|

Segments couverts |

|

|

Pays couverts |

Japon, Chine, Corée du Sud, Inde, Singapour, Thaïlande, Indonésie, Malaisie, Philippines, Australie, Nouvelle-Zélande, Taïwan, reste de l'Asie-Pacifique |

|

Principaux acteurs du marché |

F. Hoffmann-La Roche Ltd (Suisse), Bio-Rad Laboratories, Inc. (États-Unis), Thermo Fisher Scientific Inc. (États-Unis), Takara Bio Inc. (Japon) et Merck KGaA (Allemagne), entre autres |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse d'import/export, une analyse des prix, une analyse de la consommation de production et une analyse PESTLE. |

Définition du marché des tampons biologiques

Les tampons biologiques sont des solutions contenant un acide faible et sa base conjuguée (ou une base faible et son acide conjugué) qui résistent aux variations de pH lors de l'ajout d'un acide ou d'une base. Ils sont essentiels dans les systèmes biologiques et les laboratoires pour maintenir un pH stable, car les enzymes et autres biomolécules sont très sensibles aux fluctuations de pH. Les tampons biologiques courants comprennent le phosphate, le Tris et l'HEPES, chacun ayant une plage de tampons spécifique adaptée à différentes applications.

Dynamique du marché des tampons biologiques en Asie-Pacifique

Cette section vise à comprendre les moteurs, les avantages, les opportunités, les contraintes et les défis du marché. Tous ces éléments sont détaillés ci-dessous :

Conducteurs

- Prévalence croissante des maladies chroniques

La prévalence croissante des maladies chroniques, telles que le diabète, le cancer et les maladies cardiovasculaires, est un moteur important du marché des tampons biologiques en Asie-Pacifique. Cette croissance nécessite des efforts accrus de recherche et développement pour comprendre les mécanismes des maladies, développer des outils de diagnostic et formuler des traitements efficaces. Les tampons biologiques jouent un rôle crucial dans ces efforts, car ils fournissent les environnements de pH stables indispensables à la réalisation d'expériences et de tests précis dans divers domaines, notamment la culture cellulaire, la découverte de médicaments et l'analyse des protéines.

Par exemple,

- En janvier 2024, selon un article publié dans le NCBI, les maladies chroniques telles que le diabète, les maladies cardiaques, les accidents vasculaires cérébraux et le cancer contribuent depuis longtemps et continuent de contribuer de manière significative aux taux mondiaux de morbidité et de mortalité. Non seulement ces maladies affectent des millions de vies, mais elles pèsent également lourdement sur les systèmes de santé du monde entier. L'impact financier de la prise en charge des maladies chroniques devrait augmenter considérablement, leur coût mondial étant estimé à 47 000 milliards de dollars d'ici 2030. Ce chiffre alarmant met en évidence le fardeau croissant des maladies chroniques, qui nécessitent des soins médicaux continus, des traitements de pointe et des ressources de santé importantes.

- En juillet 2024, selon les données publiées par l'OMS, on estimait que 39,9 millions [36,1–44,6 millions] de personnes vivaient avec le VIH à la fin de 2023, dont 1,4 million [1,1–1,7 million] d'enfants (0–14 ans) et 38,6 [34,9–43,1 millions] d'adultes (15 ans et plus). 1,3 million [1,0–1,7 million] de personnes ont contracté le VIH en 2023. 120 000 [83 000–170 000] enfants ont contracté le VIH en 2023. 1,2 million [950 000–1,5 million] d'adultes ont contracté le VIH en 2023.

La prévalence de ces maladies varie selon le lieu : environ 17 % des personnes âgées en milieu rural et 29 % en milieu urbain sont touchées par des maladies chroniques. Parmi ces affections, l'hypertension et le diabète sont particulièrement répandus, représentant ensemble environ 68 % de l'ensemble des maladies chroniques chez les personnes âgées. Cela souligne l'urgence d'interventions de santé ciblées et de stratégies de prise en charge pour faire face au fardeau croissant des maladies chroniques au sein de la population vieillissante de l'Inde.

Adoption accrue des techniques Western BLOT et Elisa

Les techniques de Western Blot et d'Elisa sont fondamentales pour la recherche et le diagnostic en sciences de la vie, permettant la détection et la quantification de protéines et d'autres biomolécules. Avec l'expansion des efforts de recherche, notamment dans des domaines comme la découverte de médicaments, le diagnostic des maladies et l'identification de biomarqueurs, la demande pour ces techniques augmente, ce qui accroît le besoin de tampons fiables et de haute qualité, essentiels à des performances d'analyse optimales.

Par exemple,

- En avril 2023, un article publié dans la Bibliothèque nationale de médecine souligne l'utilisation croissante de la méthode ELISA (dosage immuno-enzymatique) en raison de sa polyvalence, de sa sensibilité et de sa spécificité pour la détection et la quantification des substances biologiques. Cette adoption croissante est due à son applicabilité au diagnostic médical, à la sécurité alimentaire et à la recherche. La capacité de la méthode ELISA à détecter un large éventail d'antigènes et d'anticorps, associée aux progrès de l'automatisation et du multiplexage, en fait une méthode privilégiée en milieu clinique et en laboratoire. La simplicité, la reproductibilité et la rentabilité de ce test contribuent également à son utilisation croissante.

- In April 2021, according to the article published in IUBMB Journals, Western Blot (WB), also known as immunoblot, is a fundamental method frequently employed by biologists to study various aspects of protein biomolecules. Beyond research, it is widely utilized in disease diagnosis due to its ability to directly detect proteins, making it a highly effective diagnostic tool routinely used in clinical settings. Its versatility and reliability have led to its widespread adoption in biology labs, establishing it as one of the most essential techniques for both research and clinical applications

Opportunities

- Increase in Public-Private Funding in Biomedical Research

As more financial resources allocated to scientific research and development, companies have the potential to invest in innovative formulations and technologies that enhance blocking buffer performance. This funding supports the creation of customized solutions tailored to specific applications, improving specificity and reducing background noise in assays. Additionally, it fosters collaboration with research institutions, leading to breakthroughs in buffer technology. Increased investment facilitates the development of environmentally friendly and sustainable products, aligning with growing consumer demand for eco-conscious solutions. Overall, tapping into this funding trend propels advancements in the blocking buffer market and fosters a competitive edge in a rapidly evolving landscape.

For instance,

- In May 2021, according to the article published in NCBI, the upsurge in public-private funding for biomedical research, coupled with the increasing applications of western blotting techniques and rising product innovations, creates a favorable environment for growth. This trend acts as a significant opportunity for the blocking buffer market to expand and evolve

- In March 2023, according to the article published in NCBI, Target 2035, an international federation of biomedical scientists, is leveraging open principles to create pharmacological tools for every human protein, essential for studying health and disease. As pharmaceutical companies contribute knowledge and reagents, this initiative presents a valuable opportunity for the blocking buffer market to grow and innovate

The recent surge in public-private funding offers a substantial opportunity for the blocking buffer market. Increased financial support for scientific research allows companies to invest in innovative formulations that improve buffer performance. This funding encourages the development of customized solutions, enhances specificity, and promotes collaboration with research institutions, ultimately advancing eco-friendly products. This trend positions the blocking buffer market for significant growth.

- Analytical Methods for Food Safety and Environmental Testing

Industries such as food safety and environmental testing increasingly rely on precise analytical methods, where high-quality blocking buffers play a critical role in minimizing background noise and enhancing assay sensitivity. As regulatory standards become more stringent, the demand for effective blocking solutions in these sectors is set to rise. By developing specialized buffers tailored to the unique requirements of food safety testing—such as allergen detection and pathogen identification—and environmental monitoring—such as pollutant analysis—manufacturers may tap into a growing market. This targeted approach not only addresses specific industry needs but also helps establish a competitive advantage. Companies that innovate and offer customizable solutions for these niche applications may position themselves for significant growth within the broader blocking buffer market.

For instance,

- In September 2021, according to the article published in Springer Nature, the use of Enzyme-Linked Immunosorbent Assay (ELISA) techniques in food analysis highlights a significant opportunity for the blocking buffer market. Their sensitivity and specificity allow for the detection of various components, including pesticides and toxins. This versatility creates a valuable opportunity for specialized blocking buffers tailored to food safety applications

- In May 2020, according to the article published in Science Direct, the prevalence of chemical contamination in food presents a significant opportunity for the blocking buffer market. The competitive enzyme-linked immunosorbent assay (Cp-ELISA) is widely used for detecting these contaminants due to its high throughput and low cost, highlighting the need for effective blocking buffers to enhance assay performance

- In February 2020, according to the article published in Springer Nature, The monitoring of pharmaceuticals in aquatic environments using enzyme-linked immunosorbent assay (ELISA) techniques creates a valuable opportunity for the blocking buffer market. As the demand for accurate detection of contaminants grows, effective blocking buffers become essential for improving assay sensitivity and reliability in environmental testing

The rising geriatric population is a key driver in the Asia-Pacific biological buffers market, as older adults are more susceptible to various eye conditions that can lead to corneal damage and the need for transplants. Age-related eye diseases, such as Fuchs' endothelial dystrophy, bullous keratopathy, and other degenerative corneal disorders, become more prevalent with advancing age, significantly increasing the demand for Biological Bufferss. Also, older adults are more likely to experience complications from cataract surgery or develop chronic conditions like diabetes, which can further contribute to corneal deterioration. As the Asia-Pacific population ages, the number of individuals requiring biological bufferss is expected to rise, particularly in regions with rapidly aging demographics. This trend is further fueled by increased awareness about the availability and success rates of Biological Bufferss, as well as advancements in surgical techniques that offer better outcomes and faster recovery times for older patients. As a result, the growing geriatric population is a major factor driving the expansion of the Asia-Pacific biological buffers market, highlighting the need for accessible and effective treatment options for age-related corneal diseases.

Restraint/Challenge

- Alternative Technologies and Approaches for Inhibiting Biological Buffers

The biological buffer market faces substantial challenges due to the rise of alternative methodologies and advanced techniques, such as label-free detection and microfluidics, which allow for precise interactions without the need for traditional blocking buffers, thereby reducing background noise. Innovations in immunoassays, including multiplexing, improve specificity and further lessen dependence on conventional blocking strategies. Moreover, the application of nanotechnology for targeted binding complicates the traditional role of biological buffers. As these alternatives gain traction, offering cost-effective solutions, they may introduce background noise in sensitive assays, creating a dual challenge. As these methods become more widely accepted in research and clinical applications, the market is under pressure to innovate and adapt, potentially shifting demand and altering the competitive landscape.

For instance,

- In July 2021, according to the article published in Springer Nature Limited, Cell-free gene expression (CFE) offers an alternative to traditional cell-based methods for protein synthesis and labeling in structural biology and proteomics. This innovative approach enhances specificity and reduces non-specific interactions, presenting a challenge in the blocking buffer market as demand shifts towards more efficient methodologies

- In March 2024, according to the article published in MDPI, the synthesis of fully synthetic copolymers based on pHPMA or poly(2-oxazoline), designed to suppress non-specific interactions. These copolymers could serve as potential replacements for BSA or other proteins in diagnostic assays, presenting a significant challenge in the blocking buffer market

- In August 2023, according to the article published in MDPI, the enhanced immunoblotting process by simplifying gel preparation, optimizing the electrophoresis buffer, and substituting methanol with ethanol to improve safety. These modifications boost efficiency nearly four-fold, allowing even low-quality antibodies to be visualized effectively. This innovation presents a challenge in the blocking buffer market.

Biological Buffers Market Scope

The Asia-Pacific biological buffers market is categorized into four notable segments based on buffers type, formulation, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Buffers Type

- Goods Buffers

- Tris Buffers

- Tris (Tris(Hydroxymethyl)Aminomethane)

- Tris NA

- Tris-HCL

- Hepes Buffers

- Hepes

- Hepes NA

- Mops Buffers

- Mops

- Mops NA

- Mes Buffers

- MES

- MES NA

- Bis-Tris Buffers

- BIS-TRIS

- Bis-TRIS HCL

- Others

- Tris Buffers

- Other Salt-Based Buffers

- Phosphate Buffers

- Phosphate Buffered Saline (PBS)

- Sodium Phosphate

- Potassium Phosphate

- Acetate Buffers

- Sodium Acetate

- Potassium Acetate

- Citrate Buffers

- Sodium Citrate

- Citric Acid

- Amino Acid Buffers

- Glycine Buffer

- Histidine Buffer

- Phosphate Buffers

Formulation

- Powder

- Liquid

Application

- Pharmaceutical & Biopharmaceuticals

- Drug Development

- Vaccine Formulation

- Biologics Manufacturing

- Cell Culture & Molecular Biology

- PCR & Electrophoresis

- Cell Culture Media Preparation

- DNA & RNA Isolation

- Protein Purification

- Clinical & Diagnostic Applications

- In-Vitro Diagnostics (IVD)

- Clinical Testing Kits

- Chemical & Industrial Applications

- Biotechnology Research

- Food & Beverage Processing

- Others

End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Research & Academic Institutes

- Diagnostic Laboratories

- Contract Research Organizations (CROS) & CMOS

Biological Buffers Market Regional Analysis

Biological buffers market is analyzed, and market size insights and trends are provided by based on buffer type, formulation, application, and end user.

The countries covered in this market report are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, New Zealand, Taiwan, and rest of Asia-Pacific.

Japan is expected to dominate the Asia-Pacific market although China is expected to be the fastest growing country in the region due to its increasing healthcare spending, expanding pharmaceutical industry with a developing healthcare infrastructure and a rising prevalence.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les changements de réglementation qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques régionales et les difficultés auxquelles elles sont confrontées en raison de la forte ou de la faible concurrence des marques locales et nationales, de l'impact des tarifs douaniers nationaux et des routes commerciales sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Part de marché des tampons biologiques en Asie-Pacifique

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence régionale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché des tampons biologiques opérant sur le marché sont :

- F. Hoffmann-La Roche SA (Suisse)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Thermo Fisher Scientific Inc. (États-Unis)

- Takara Bio Inc. (Japon), Merck KGaA (Allemagne),

- Avantor, Inc. (États-Unis)

- Advancion Corporation (États-Unis)

- Santa Cruz Biotechnology Inc. (États-Unis)

- MP Biomedicals (États-Unis)

- Promega Corporation (États-Unis)

- Beckman Coulter, Inc. (États-Unis)

- QIAGEN (Allemagne)

- Laboratoires HiMedia (Inde)

- Cayman Chemical (États-Unis)

- Biosynth (Suisse)

- SERVA Electrophoresis GmbH (Allemagne)

- FUJIFILM Wako Pure Chemical Corporation (Japon)

- Reagecon Diagnostics Ltd (Irlande)

- GoldBio (États-Unis)

- nacalai.com (Japon)

- HOPAX (Taïwan)

Dernières évolutions du marché des tampons biologiques

- En février 2024, Roche a conclu un accord de collaboration avec PathAI afin d'étendre les capacités de pathologie numérique pour les diagnostics compagnons. Cette collaboration permet à Roche de bénéficier de la technologie d'IA avancée de PathAI pour améliorer les diagnostics compagnons. Elle garantit des solutions exclusives et sur mesure et accélère le développement d'algorithmes, tout en permettant à Roche de poursuivre le développement de ses propres diagnostics.

- En juillet 2024, Roche a annoncé l'acquisition réussie de la technologie Point of Care de LumiraDx, suite à l'obtention des autorisations antitrust et réglementaires nécessaires. Cette intégration a enrichi le portefeuille de diagnostics de Roche grâce à une plateforme conviviale qui consolide divers tests d'immuno-analyse et de chimie clinique. Cette acquisition visait à améliorer l'accès aux tests diagnostiques, notamment en médecine générale et dans les régions mal desservies, conformément à l'engagement de Roche en faveur de solutions de santé décentralisées.

- En juillet 2023, Bio-Rad et QIAGEN ont annoncé un accord de règlement de brevets et de licences croisées mettant fin à des litiges en cours concernant des technologies spécifiques. Ce partenariat permet aux deux entreprises d'enrichir leurs portefeuilles de produits et d'accélérer l'innovation dans le secteur des sciences de la vie, bénéficiant ainsi à leurs clients en leur offrant un accès plus large à des technologies de pointe et à des solutions améliorées en recherche et en diagnostic.

- En mai 2023, Thermo Fisher et BRIN se sont associés pour améliorer les capacités de recherche en Indonésie, en se concentrant sur l'avancement de l'innovation scientifique et de la collaboration dans les sciences de la vie, la biotechnologie et les études environnementales pour les chercheurs locaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 ASIA-PACIFIC BIOLOGICAL BUFFER MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE U.S.

5.2 REGULATORY SUBMISSIONS

5.3 INTERNATIONAL HARMONIZATION

5.4 EUROPE REGULATORY SCENARIO

5.5 REGULATORY SUBMISSIONS

5.6 INTERNATIONAL HARMONIZATION

5.7 JAPAN REGULATORY SCENARIO

5.8 REGULATORY SUBMISSIONS

5.9 INTERNATIONAL HARMONIZATION

5.1 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES

6.1.2 INCREASED ADOPTION OF WESTERN BLOT AND ELISA TECHNIQUES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN ASSAY DEVELOPMENT

6.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE OF BLOCKING BUFFERS

6.2.2 POTENTIAL OF CONTAMINATION OR BATCH INCONSISTENCIES FOR BIOLOGICAL BUFFERS

6.3 OPPORTUNITY

6.3.1 INCREASE IN PUBLIC-PRIVATE FUNDING IN BIOMEDICAL RESEARCH

6.3.2 ANALYTICAL METHODS FOR FOOD SAFETY AND ENVIRONMENTAL TESTING.

6.3.3 DIAGNOSTIC AND CLINICAL APPLICATIONS USE BLOCKING BUFFERS.

6.4 CHALLENGES

6.4.1 ALTERNATIVE TECHNOLOGIES AND APPROACHES FOR INHIBITING BIOLOGICAL BUFFERS.

6.4.2 DISRUPTIONS IN THE SUPPLY CHAIN OF BIOLOGICAL BUFFERS.

7 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE

7.1 OVERVIEW

7.2 GOODS BUFFERS

7.2.1 TRIS BUFFERS

7.2.2 HEPES BUFFERS

7.2.3 MOPS BUFFERS

7.2.4 MES BUFFERS

7.2.5 BIS-TRIS BUFFERS

7.3 OTHER SALT-BASED BUFFERS

7.3.1 PHOSPHATE BUFFERS

7.3.2 ACETATE BUFFERS

7.3.3 CITRATE BUFFERS

7.3.4 AMINO ACID BUFFERS

8 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMACEUTICAL & BIOPHARMACEUTICALS

9.3 CELL CULTURE & MOLECULAR BIOLOGY

9.4 CLINICAL & DIAGNOSTIC APPLICATIONS

9.5 CHEMICAL & INDUSTRIAL APPLICATIONS

9.6 OTHERS

10 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

10.3 BIOTECHNOLOGY COMPANIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 DIAGNOSTIC LABORATORIES

10.6 CONTRACT RESEARCH ORGANIZATIONS (CROS) & CMOS

11 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 JAPAN

11.1.2 CHINA

11.1.3 SOUTH KOREA

11.1.4 INDIA

11.1.5 SINGAPORE

11.1.6 THAILAND

11.1.7 INDONESIA

11.1.8 MALAYSIA

11.1.9 PHILIPPINES

11.1.10 AUSTRALIA

11.1.11 NEW ZEALAND

11.1.12 TAIWAN

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: APAC

13 SWOT

14 COMPANY PROFILES

14.1 F. HOFFMANN-LA ROCHE LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 BIO-RAD LABORATORIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 THERMO FISHER SCIENTIFIC, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 TAKARA BIO INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MERCK KGAA, DARMSTADT, GERMANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ADVANCION CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 AVANTOR, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 BECKMAN COULTER

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 BIOSYNTH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FUJIFILM WAKO PURE CHEMICAL CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GOLDBIO

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HOPAX

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HIMEDIA LABORATORIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NACALAI TESQUE, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PROMEGA CORPORATION

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 REAGECON DIAGNOSTICS LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SANTA CRUZ BIOTECHNOLOGY INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 SERVA ELECTROPHORESIS GMBH

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TEVA PHARMACEUTICALS USA, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND

TABLE 6 ASIA-PACIFIC MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POWDER IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC LIQUID IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY APPLICATION,2018-2035 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC CELL CULTURE & MOLECULAR BIOLOGY INBIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC CLINICAL & DIAGNOSTIC APPLICATIONS INBIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC CHEMICAL & INDUSTRIAL APPLICATIONS INBIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OTHERS IN BIOLOGICAL BUFFERS MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC BIOTECHNOLOGY COMPANIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC RESEARCH & ACADEMIC INSTITUTES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2035 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC DIAGNOSTIC LABORATORIES IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC CONTRACT RESEARCH ORGANIZATIONS (CROS) IN ORTHODONTIC SUPPLIES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 54 JAPAN BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 JAPAN GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 56 JAPAN TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 57 JAPAN HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 58 JAPAN MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 59 JAPAN MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 60 JAPAN BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 61 JAPAN OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 62 JAPAN PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 63 JAPAN ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 64 JAPAN CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 65 JAPAN AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 66 JAPAN BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 67 JAPAN BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 JAPAN PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 69 JAPAN CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 70 JAPAN CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 JAPAN CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 72 JAPAN BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 73 CHINA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 74 CHINA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 75 CHINA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 76 CHINA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 77 CHINA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 78 CHINA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 79 CHINA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 80 CHINA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 81 CHINA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 82 CHINA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 83 CHINA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 84 CHINA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 85 CHINA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 86 CHINA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 87 CHINA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 88 CHINA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 89 CHINA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 90 CHINA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 91 CHINA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 92 SOUTH KOREA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 93 SOUTH KOREA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 94 SOUTH KOREA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 95 SOUTH KOREA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 96 SOUTH KOREA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 97 SOUTH KOREA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 98 SOUTH KOREA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 99 SOUTH KOREA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 100 SOUTH KOREA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 101 SOUTH KOREA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 102 SOUTH KOREA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 SOUTH KOREA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 104 SOUTH KOREA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 105 SOUTH KOREA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 106 SOUTH KOREA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 107 SOUTH KOREA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 108 SOUTH KOREA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 109 SOUTH KOREA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 110 SOUTH KOREA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 111 INDIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 112 INDIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 113 INDIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 114 INDIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 115 INDIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 116 INDIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 117 INDIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 118 INDIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 INDIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 120 INDIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 121 INDIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 122 INDIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 123 INDIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 124 INDIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 125 INDIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 126 INDIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 127 INDIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 128 INDIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 129 INDIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 130 SINGAPORE BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 131 SINGAPORE GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 132 SINGAPORE TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 133 SINGAPORE HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 134 SINGAPORE MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 SINGAPORE MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 136 SINGAPORE BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 137 SINGAPORE OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 138 SINGAPORE PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 139 SINGAPORE ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 140 SINGAPORE CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 141 SINGAPORE AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 142 SINGAPORE BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 143 SINGAPORE BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 144 SINGAPORE PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 145 SINGAPORE CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 146 SINGAPORE CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 147 SINGAPORE CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 148 SINGAPORE BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 149 THAILAND BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 150 THAILAND GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 THAILAND TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 152 THAILAND HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 153 THAILAND MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 154 THAILAND MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 155 THAILAND BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 156 THAILAND OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 157 THAILAND PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 158 THAILAND ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 159 THAILAND CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 160 THAILAND AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 161 THAILAND BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 162 THAILAND BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 THAILAND PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 164 THAILAND CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 165 THAILAND CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 166 THAILAND CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 THAILAND BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 168 INDONESIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 169 INDONESIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 170 INDONESIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 171 INDONESIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 172 INDONESIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 173 INDONESIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 174 INDONESIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 175 INDONESIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 176 INDONESIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 177 INDONESIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 178 INDONESIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 179 INDONESIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 180 INDONESIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 181 INDONESIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 182 INDONESIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 183 INDONESIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 184 INDONESIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 185 INDONESIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 186 INDONESIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 187 MALAYSIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 188 MALAYSIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 189 MALAYSIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 190 MALAYSIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 191 MALAYSIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 192 MALAYSIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 193 MALAYSIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 194 MALAYSIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 195 MALAYSIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 196 MALAYSIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 197 MALAYSIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 198 MALAYSIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 199 MALAYSIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 200 MALAYSIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 201 MALAYSIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 202 MALAYSIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 203 MALAYSIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 204 MALAYSIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 205 MALAYSIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 206 PHILIPPINES BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 207 PHILIPPINES GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 208 PHILIPPINES TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 209 PHILIPPINES HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 210 PHILIPPINES MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 211 PHILIPPINES MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 212 PHILIPPINES BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 213 PHILIPPINES OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 214 PHILIPPINES PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 215 PHILIPPINES ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 216 PHILIPPINES CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 217 PHILIPPINES AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 218 PHILIPPINES BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 219 PHILIPPINES BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 220 PHILIPPINES PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 221 PHILIPPINES CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 222 PHILIPPINES CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 223 PHILIPPINES CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 224 PHILIPPINES BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 225 AUSTRALIA BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 226 AUSTRALIA GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 227 AUSTRALIA TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 228 AUSTRALIA HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 229 AUSTRALIA MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 230 AUSTRALIA MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 231 AUSTRALIA BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 232 AUSTRALIA OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 233 AUSTRALIA PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 234 AUSTRALIA ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 235 AUSTRALIA CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 236 AUSTRALIA AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 237 AUSTRALIA BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 238 AUSTRALIA BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 239 AUSTRALIA PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 240 AUSTRALIA CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 241 AUSTRALIA CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 242 AUSTRALIA CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 243 AUSTRALIA BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 244 NEW ZEALAND BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 245 NEW ZEALAND GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 246 NEW ZEALAND TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 247 NEW ZEALAND HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 248 NEW ZEALAND MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 249 NEW ZEALAND MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 250 NEW ZEALAND BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 251 NEW ZEALAND OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 252 NEW ZEALAND PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 253 NEW ZEALAND ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 254 NEW ZEALAND CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 255 NEW ZEALAND AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 256 NEW ZEALAND BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 257 NEW ZEALAND BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 258 NEW ZEALAND PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 259 NEW ZEALAND CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 260 NEW ZEALAND CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 261 NEW ZEALAND CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 262 NEW ZEALAND BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 263 TAIWAN BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

TABLE 264 TAIWAN GOODS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 265 TAIWAN TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 266 TAIWAN HEPES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 267 TAIWAN MOPS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 268 TAIWAN MES BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 269 TAIWAN BIS-TRIS BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TREATMENT TYPE, 2018-2035 (USD THOUSAND)

TABLE 270 TAIWAN OTHER SALT-BASED BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 271 TAIWAN PHOSPHATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 272 TAIWAN ACETATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 273 TAIWAN CITRATE BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 274 TAIWAN AMINO ACID BUFFERS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 275 TAIWAN BIOLOGICAL BUFFERS MARKET, BY FORMULATION, 2018-2035 (USD THOUSAND)

TABLE 276 TAIWAN BIOLOGICAL BUFFERS MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 277 TAIWAN PHARMACEUTICAL & BIOPHARMACEUTICALS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 278 TAIWAN CELL CULTURE & MOLECULAR BIOLOGY IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 279 TAIWAN CLINICAL & DIAGNOSTIC APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 280 TAIWAN CHEMICAL & INDUSTRIAL APPLICATIONS IN BIOLOGICAL BUFFERS MARKET, BY TYPE, 2018-2035 (USD THOUSAND)

TABLE 281 TAIWAN BIOLOGICAL BUFFERS MARKET, BY END USER, 2018-2035 (USD THOUSAND)

TABLE 282 REST OF ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET, BY BUFFERS TYPE, 2018-2035 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: SEGMENTATION

FIGURE 11 RISING PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET GROWTH IN THE FORECAST PERIOD OF 2025 TO 2035

FIGURE 12 GOODS BUFFERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET IN THE FORECAST PERIOD OF 2025 & 2035

FIGURE 13 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 DROC

FIGURE 16 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2024

FIGURE 17 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, 2025-2035 (USD THOUSAND)

FIGURE 18 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, CAGR (2025-2035)

FIGURE 19 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY BUFFER TYPE, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2024

FIGURE 21 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY FORMULATION, 2025-2035 (USD THOUSAND)

FIGURE 22 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY FORMULATION, CAGR (2025-2035)

FIGURE 23 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY APPLICATION, 2025-2035 (USD THOUSAND)

FIGURE 26 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY APPLICATION, CAGR (2025-2035)

FIGURE 27 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY END USER, 2024

FIGURE 29 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY END USER, 2025-2035 (USD THOUSAND)

FIGURE 30 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY END USER, CAGR (2025-2035)

FIGURE 31 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: SNAPSHOT (2024)

FIGURE 33 ASIA-PACIFIC BIOLOGICAL BUFFERS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.