Asia Pacific Blood Collection And Sampling Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

985.91 Million

USD

1,825.06 Million

2024

2032

USD

985.91 Million

USD

1,825.06 Million

2024

2032

| 2025 –2032 | |

| USD 985.91 Million | |

| USD 1,825.06 Million | |

|

|

|

Asia-Pacific Blood Collection And Sampling Devices Market Segmentation, By Product (Venous Blood Collection and Sampling Devices and Capillary Blood Collection and Sampling Devices) – Industry Trends and Forecast to 2032

Blood Collection And Sampling Devices Market Analysis

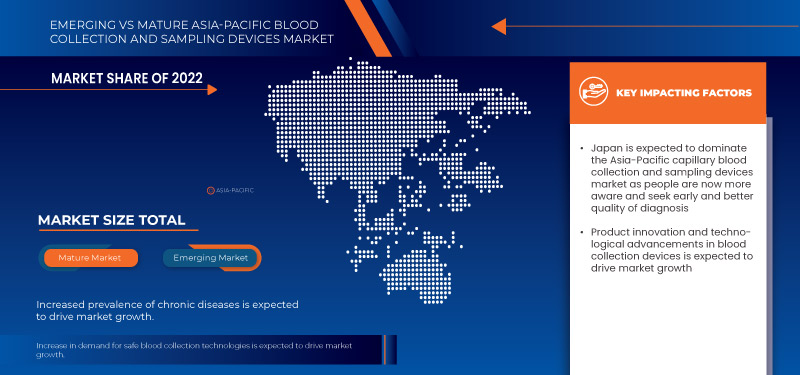

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disordersIn May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Blood Collection And Sampling Devices Market Size

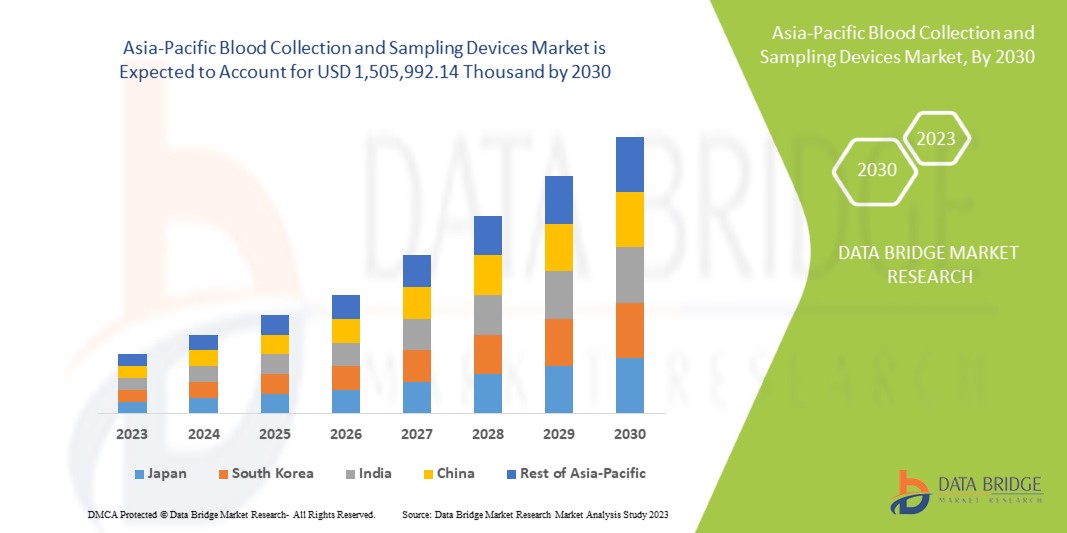

Asia-Pacific blood collection and sampling devices market size was valued at USD 985.91 million in 2024 and is projected to reach USD 1,825.06 million by 2032, with a CAGR of 8.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Blood Collection And Sampling Devices Market Trends

“Increased Prevalence Of Chronic Diseases”

Increased Prevalence of Chronic Diseases is a significant driver in the growth of the Blood Collection and Sampling Devices market, particularly in Japan and other countries in the Asia-Pacific region. The trend of rising chronic conditions, such as diabetes, cardiovascular diseases, and hypertension, is contributing to the growing demand for regular diagnostic testing. As more individuals suffer from these long-term health issues, healthcare providers are increasingly relying on blood collection and sampling devices to monitor and manage these conditions. As the burden of chronic diseases increases, healthcare systems are becoming more reliant on accurate, consistent, and frequent testing, which requires advanced blood collection and sampling devices. These devices are essential for early detection, disease management, and ongoing monitoring of chronic conditions, as regular blood tests help in tracking the progression of diseases, adjusting treatments, and improving patient outcomes.

In response to this trend, medical device manufacturers are focusing on developing innovative blood collection technologies that ensure better patient comfort, higher accuracy, and quicker results. Additionally, the trend towards preventive healthcare further amplifies the need for blood tests as individuals seek early diagnosis and monitoring, thus propelling the demand for blood collection devices in both hospitals and home-care settings.

Overall, the rising prevalence of chronic diseases and the shift towards more frequent and advanced diagnostic testing are key factors driving the rapid expansion of the blood collection and sampling devices market. This trend emphasizes the need for accurate, efficient, and minimally invasive devices to collect blood samples for diagnostic testing and ongoing health management, driving market growth.

Report Scope and Blood Collection And Sampling Devices Market Segmentation

|

Attributes |

Blood Collection And Sampling Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (United Kingdom), Abbott (U.S.), Nipro Europe Group Companies (Japan), Greiner Bio-One International GmbH (Austria), SARSTEDT AG & Co. KG (Germany), Bio-Rad Laboratories, Inc. (U.S.), ICU Medical, Inc. (U.S.), CML Biotech (India), Narang Medical Limited (India), Hindustan Syringes & Medical Devices Ltd (India), Sparsh Mediplus (India), and B. Braun Medical Ltd (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Collection And Sampling Devices Market Definition

Capillary blood collection devices are defined as devices that are used for capillary blood withdrawal. Capillary blood can be obtained by puncturing in finger, earlobe, or heel. It can also be performed by giving an incision on the skin. Its procedure gained wide attention as it withdraws an accurate amount of blood and reduces the chances of anemia. There are various kinds of needles, lancets, and syringes offered by market players for capillary blood collection. The need for blood tests is increasing as the prevalence of chronic disease increases. Moreover, the rising geriatric population and neonates have put a challenge for invasive blood-collecting procedures. This is why minimal invasive capillary blood collection procedure has gained wide attention. Nowadays volumetric micro sampling technique has gained attention for capillary blood collection. Moreover, new technological advancements are taking place to fulfill the needs of physicians and consumers.

Blood Collection And Sampling Devices Market Dynamics

Drivers

- Increased Prevalence Of Chronic Diseases

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary and venous blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management or any other blood test.

For instance,

In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders

In May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Lower middle-income countries are the worst affected by chronic diseases therefore, the disease also becomes a financial burden for the underprivileged countries. The disease must be diagnosed accurately for the early detection and timely treatment of the disease. For this, efficient blood collection and sampling are necessary, creating a demand for technologically advanced capillary and venous blood testing devices. Thus, the increased prevalence of infectious and chronic diseases is expected to drive market growth.

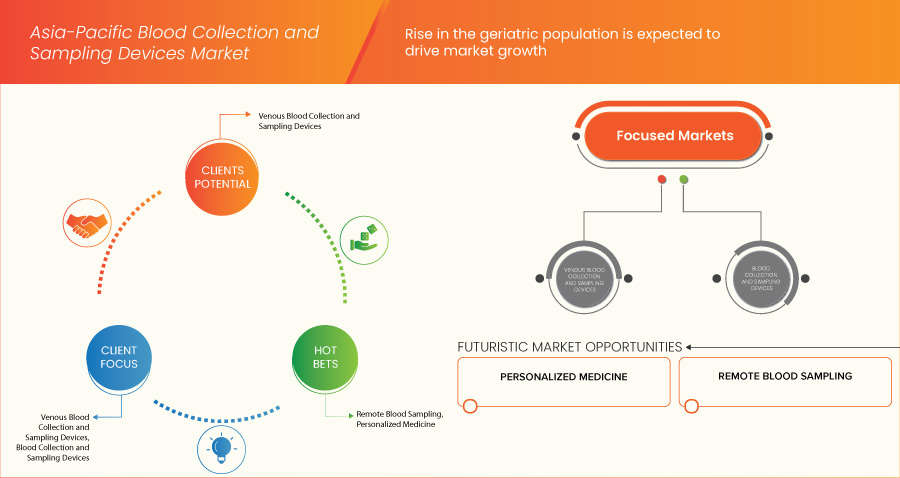

- Rise In The Geriatric Population

The population is experiencing a significant demographic shift characterized by an increasing number of older adults. The rising geriatric population in the Asia-Pacific is primarily attributed to several factors, such as increased life expectancy, advancements in healthcare, improved living conditions, and better access to medical services, which have contributed to increased life expectancy in China. This means that people are living longer, leading to a more significant proportion of older adults in the population.

The older generation is prone to more chronic disease that requires regular blood tests and diagnostics tests.

For instance,

In March 2019, according to Japan's Internal Affairs and Communications Ministry, the population of people aged 65 years and above was 35.88 million in 2019, up by 3,20,000 from the previous year by 2050, the population of people who are 60

In July 2021, According to WHO, 69% of adults have two or more chronic conditions. These diseases can lower the quality of life of adults and can be a leading cause of death in this population and adults who are 65 years and above experience a higher risk of chronic diseases than the younger generation

In June 2019, According to the Census of India, the population aged 60 years and above accounted for approximately 8.6% of the total population at that time India's geriatric population will reach around 319 million, accounting for nearly 20% of the country's total population

It is essential to diagnose the disease at an early stage to treat adults with chronic disease. Regular, proper, and accurate blood tests must be done. The capillary and venous blood testing technique is preferred for them. Hence, the rising geriatric population is expected to drive market growth.

- Rising Availability Of Point-Of-Care Diagnostics

Point-of-care testing is a type of diagnostic testing that can be performed at home or anywhere at any time. Therefore, it is commonly known as bedside testing. Earlier, testing was only limited to laboratories and hospitals, where the specimen was sent and then it took hours to days to obtain the sample.

For instance,

According to various reports, the total worth of the market was USD 40.00 billion to USD 45.00 billion, out of which the contribution of POC diagnostics is USD 12.00 billion to USD 13.00 billion

Selon une étude de la banque d'investissement Morgan Stanley, 37 % du marché POC de 3 milliards de dollars US est consacré aux tests de maladies infectieuses

Avec la sensibilisation croissante aux questions de santé et l'incidence croissante des maladies infectieuses, la demande de tests sur le lieu de soins a augmenté. Les méthodes conventionnelles de prélèvement sanguin sont douloureuses et invasives et présentent un risque plus élevé de blessures par piqûre d'aiguille et de contamination si elles ne sont pas effectuées par du personnel qualifié.

Les dispositifs POC sont peu invasifs, provoquent moins de douleur et ont beaucoup moins d'effets secondaires. De plus, ils ne nécessitent pas de professionnels qualifiés pour effectuer la procédure de prélèvement et de collecte de sang. Avec l'augmentation des tests POC, des progrès ont également été réalisés dans les dispositifs de collecte capillaire et veineuse.

Par exemple,

Neoteryx, LLC a développé un dispositif à cartouche Mitra utilisé pour le prélèvement de sang capillaire n'importe où, n'importe quand et par n'importe qui

Elabscience, Inc. fabrique et distribue le test rapide COVID-19 IgG/IgM pour tester les symptômes du COVID-19

La réduction du temps de traitement et l'amélioration de l'efficacité améliorent les performances des soins de santé, ce qui se traduit par des avantages économiques plus importants pour les prestataires de soins de santé et les patients. Ainsi, des techniques telles que le prélèvement de sang capillaire, qui peuvent être utilisées au POC, sont privilégiées. Par conséquent, la disponibilité croissante des diagnostics POC devrait stimuler la croissance du marché.

Opportunités

- Réglementation favorable aux dispositifs médicaux

La Food and Drug Administration des États-Unis réglemente tous les dispositifs médicaux aux États-Unis. Tout dispositif médical fabriqué, réétiqueté, importé ou reconditionné par une entreprise pour être vendu en Inde doit respecter les réglementations de la Central Drugs Standard Control Organization (CDSCO).

En Inde, les dispositifs de prélèvement sanguin capillaire et veineux utilisés à des fins de diagnostic sont réglementés par le CDSCO, qui relève du ministère de la Santé et de la Protection de la famille. Le cadre réglementaire des dispositifs médicaux en Inde a évolué et des changements récents ont été introduits pour renforcer la réglementation et garantir la sécurité et l'efficacité des dispositifs médicaux, y compris les dispositifs de prélèvement sanguin capillaire et veineux.

En Inde, les dispositifs médicaux sont classés en différentes catégories en fonction du niveau de risque et les exigences réglementaires varient en conséquence. Les dispositifs de prélèvement sanguin capillaire et veineux relèvent généralement de la catégorie des dispositifs de diagnostic in vitro (DIV).

Les règles relatives aux dispositifs médicaux constituent la principale réglementation régissant les dispositifs médicaux en Inde. En vertu de ces règles, les fabricants, importateurs et distributeurs de dispositifs médicaux, y compris les dispositifs de prélèvement sanguin capillaire et veineux, sont tenus de se conformer aux exigences d'enregistrement et de licence en fonction de la classification des risques du dispositif. Le processus réglementaire comprend la soumission de la documentation technique, des données cliniques (le cas échéant) et le respect des exigences du système de gestion de la qualité. Toutefois, ces réglementations ne s'appliquent pas aux tests personnels auto-administrés par les employés ou les résidents d'un établissement. Par conséquent, les personnes qui prennent régulièrement leur glycémie à l'aide de lancettes ne sont pas couvertes par cette loi.

Il est important de noter que les cadres réglementaires peuvent changer au fil du temps. Il est recommandé de se référer aux directives et réglementations les plus récentes publiées par le CDSCO et d'autres autorités réglementaires compétentes pour obtenir les informations les plus récentes sur les réglementations favorables aux dispositifs de prélèvement sanguin capillaire et veineux en Inde, qui offrent une meilleure opportunité aux fabricants de lancer leurs produits sur le marché.

- Innovation produit et avancées technologiques dans les dispositifs de prélèvement sanguin

La collecte de sang est une étape de la plus haute importance dans la prestation de soins de santé. 70 à 80 % des décisions cliniques prises portent sur l'analyse d'échantillons de sang. Avec la tendance croissante à l'innovation dans la collecte de sang, de nombreuses entreprises utilisent des méthodes sûres, simples et plus efficaces pour collecter des échantillons de sang.

Le prélèvement sanguin capillaire et veineux est une technique idéale pour les cliniques pharmaceutiques. Cette méthode est préférée à la ponction veineuse en raison de sa facilité d'utilisation et de sa sécurité. De plus, elle élimine le besoin de techniciens qualifiés. Cependant, l'un des inconvénients des prélèvements au doigt est qu'il existe des variations entre les gouttelettes de sang. Cela peut être surmonté par le lancement de produits nouveaux et innovants.

Par exemple,

En décembre 2024, selon un article d'IMetropolis Healthcare Limited, l'un des principaux fournisseurs de services de diagnostic en Inde, a lancé le kit de prélèvement sanguin à bouton-poussoir UltraTouch (PBBCS), une technologie innovante inédite dans le pays. Cet appareil de pointe est doté d'une aiguille plus fine conçue pour réduire considérablement la douleur à l'insertion, rendant le prélèvement sanguin plus confortable, en particulier pour les nouveaux patients, les enfants et les personnes âgées. L'introduction d'UltraTouch s'inscrit dans la mission de Metropolis Healthcare d'améliorer les soins aux patients grâce à l'innovation et à la technologie

En janvier 2023, selon un article de la National Library Medicine, les techniques d'échantillonnage mini-invasives, telles que l'échantillonnage de sang capillaire, sont couramment utilisées pour les tests au point de service dans le cadre des soins à domicile et des milieux cliniques tels que l'unité de soins intensifs, avec moins de douleur et de blessures que la ponction veineuse conventionnelle

La collecte de sang capillaire et veineux implique l'utilisation de technologies modernes et de méthodes de collecte innovantes pour des résultats meilleurs et plus efficaces. Ainsi, l'innovation des produits et les avancées technologiques dans les dispositifs de collecte de sang devraient offrir des opportunités de croissance du marché.

Contraintes/Défis

- Risque élevé associé aux technologies d'assortiment sanguin

Les innovations en matière d’échantillonnage à distance et de tests sur le lieu de soins ont contribué à la popularité du prélèvement sanguin par piqûre au doigt. Ce procédé présente plusieurs avantages par rapport aux pratiques traditionnelles de prélèvement sanguin dans les laboratoires cliniques, les laboratoires hospitaliers et les lieux nécessitant un échantillonnage sur place. Bien qu’ils soient plus sûrs et plus faciles à utiliser que les dispositifs conventionnels, ils ont leurs effets secondaires. Le nombre de prélèvements au doigt étant en augmentation, les cas de blessures accidentelles et de transmission d’agents pathogènes à partir de sang infecté augmentent également.

En piquant les doigts des patients et en manipulant leurs bandelettes de test usagées, le clinicien est exposé à des agents infectieux transmissibles par le sang, qui peuvent entraîner la transmission de maladies telles que l’hépatite B.

Ces risques découlent de multiples facteurs, notamment les risques de contamination, les manipulations inappropriées et les risques d’erreurs lors du prélèvement, du stockage et du transport des échantillons, qui peuvent tous compromettre l’intégrité des échantillons sanguins et conduire à des résultats de diagnostic inexacts. De telles inexactitudes sont particulièrement problématiques dans des situations critiques, telles que le diagnostic de maladies chroniques, le suivi d’interventions thérapeutiques ou la réalisation de tests génétiques, où des résultats précis et fiables sont primordiaux. De plus, la nature invasive des méthodes traditionnelles de prélèvement sanguin entraîne souvent un inconfort, de la peur et de l’anxiété chez les patients, ce qui les décourage encore plus de se soumettre à des procédures de diagnostic régulières.

Pour les systèmes de santé de la région Asie-Pacifique, les différents niveaux d’infrastructure et d’expertise d’un pays à l’autre exacerbent ces problèmes, car les établissements de santé sous-développés peuvent ne pas avoir accès à des technologies avancées ou à des programmes de formation adéquats, ce qui entraîne des pratiques incohérentes et des risques accrus. Ces défis contribuent collectivement au scepticisme des utilisateurs finaux, notamment des hôpitaux, des laboratoires de diagnostic et des patients, ce qui affecte en fin de compte le rythme d’adoption et la trajectoire de croissance globale du marché des dispositifs de prélèvement sanguin dans cette région. La gestion de ces risques nécessite un effort concerté de la part des parties prenantes de tous horizons, notamment les prestataires de soins de santé, les fabricants de dispositifs, les organismes de réglementation et les décideurs politiques, pour mettre en œuvre des mesures de sécurité solides, investir dans la recherche et le développement de technologies peu invasives ou non invasives et assurer une éducation généralisée sur les bonnes pratiques de prélèvement sanguin .

- Augmentation des rappels de produits

Les dispositifs de prélèvement sanguin sont essentiels au secteur de la santé. Si ces produits ne sont pas sûrs ou défectueux, ils peuvent avoir des effets nocifs. C'est pourquoi la FDA édicte des réglementations strictes concernant l'utilisation de ces produits. Malgré ces lois strictes, il existe des cas où le produit a été lancé sur le marché et est rappelé ultérieurement pour la sécurité des personnes contre ses effets dangereux.

Par exemple,

En juillet 2021, selon l'article publié par le Laboratory Outreach Communication System (LOCS) du CDC, Magellan Diagnostics a étendu le rappel de ses kits de test de plomb sanguin LeadCare après avoir identifié un risque important de résultats faussement bas. Ce défaut a potentiellement retardé l'identification et le traitement de l'exposition au plomb chez les populations vulnérables, en particulier les enfants

En mars 2019, selon l'article publié par Becton Dickinson (BD), la société a rappelé certains lots de ses tubes de prélèvement sanguin Vacutainer® en raison de rapports faisant état de fausses élévations des niveaux de carboxyhémoglobine (COHb) lors de l'analyse des échantillons à l'aide d'instruments spécifiques. Ce problème présentait des risques d'erreur de diagnostic et de traitement inapproprié pour les patients

Les rappels de produits constituent un obstacle pour les fabricants de dispositifs médicaux car ils coûtent trop cher aux fabricants. De plus, les fabricants doivent également verser une compensation, ce qui coûte très cher. Ainsi, les coûts élevés et la diffamation du nom de l'entreprise sur le marché devraient constituer un défi à la croissance du marché.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché des dispositifs de prélèvement et d'échantillonnage de sang

Le marché est segmenté en fonction des produits. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Dispositifs de prélèvement et d'échantillonnage de sang veineux

- Par type

- Poc

- Par groupe d'âge

- Nourrissons

- Pédiatrie

- Gériatrie

- Adultes

- Par application

- Maladies cardiovasculaires

- Maladies respiratoires

- Maladie infectieuse

- Troubles métaboliques

- Autres

- Conventionnel

- Par groupe d'âge

- Nourrissons

- Pédiatrie

- Gériatrie

- Adultes

- Par application

- Maladies cardiovasculaires

- Maladies respiratoires

- Maladie infectieuse

- Troubles métaboliques

- Autres

- Par utilisateur final

- Hôpitaux

- Laboratoires de pathologie

- Cliniques

- Banques de sang

- Cadres de soins à domicile

- Instituts de recherche et d'enseignement

- Autres

- Dispositifs de prélèvement et d'échantillonnage de sang capillaire

- Par type

- Poc

- Par groupe d'âge

- Nourrissons

- Pédiatrie

- Gériatrie

- Adultes

- Par application

- Maladies cardiovasculaires

- Maladies respiratoires

- Maladie infectieuse

- Troubles métaboliques

- Autres

- Par type de crevaison

- Incision

- Ponction

- Perforation du doigt

- Perforation du talon

- Conventionnel

- Par groupe d'âge

- Nourrissons

- Pédiatrie

- Gériatrie

- Adultes

- Par application

- Maladies cardiovasculaires

- Maladies respiratoires

- Maladie infectieuse

- Troubles métaboliques

- Autres

- Par type de crevaison

- Incision

- Ponction

- Perforation du doigt

- Perforation du talon

- Par utilisateur final

- Hôpitaux

- Laboratoires de pathologie

- Cliniques

- Banques de sang

- Cadres de soins à domicile

- Instituts de recherche et d'enseignement

- Autres

Blood Collection And Sampling Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country and product as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to its large aging population, high prevalence of cardiovascular diseases, and increased government investments in healthcare infrastructure and technology.

Japan is expected to be the fastest growing due to the rising health awareness, and strong government support for healthcare advancements.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Blood Collection And Sampling Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Blood Collection And Sampling Devices Market Leaders Operating in the Market Are:

- BD (U.S.)

- Terumo BCT, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (United Kingdom)

- Abbott (U.S.)

- Nipro Europe Group Companies (Japan)

- Greiner Bio-One International GmbH (Austria)

- SARSTEDT AG & Co. KG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- CML Biotech (India)

- Narang Medical Limited (India)

- Hindustan Syringes & Medical Devices Ltd (India)

- Sparsh Mediplus (India)

- B. Braun Medical Ltd (Germany)

Latest Developments in Blood Collection And Sampling Devices Market

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY

5.1 JAPAN –

5.2 CHINA –

5.3 INDIA –

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN THE GERIATRIC POPULATION

6.1.3 RISING AVAILABILITY OF POINT-OF-CARE DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH RISK ASSOCIATED WITH BLOOD ASSORTMENT TECHNOLOGIES

6.2.2 DISADVANTAGES OF MICRO-COLLECTION OF BLOOD

6.3 OPPORTUNITIES

6.3.1 FAVORABLE MEDICAL DEVICE REGULATIONS

6.3.2 PRODUCT INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN BLOOD COLLECTION DEVICES

6.4 CHALLENGE

6.4.1 INCREASING PRODUCT RECALLS

7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 VENOUS BLOOD COLLECTION AND SAMPLING DEVICES

7.2.1 CONVENTIONAL

7.2.2 GERIATRICS

7.2.3 INFANTS

7.2.4 PEDIATRICS

7.2.5 ADULT

7.2.6 INFECTIOUS DISEASES

7.2.7 METABOLIC DISORDERS

7.2.8 CARDIOVASCULAR DISEASE

7.2.9 RESPIRATORY DISEASES

7.2.10 OTHERS

7.2.11 POC

7.2.12 GERIATRICS

7.2.13 INFANTS

7.2.14 PEDIATRICS

7.2.15 ADULT

7.2.16 INFECTIOUS DISEASES

7.2.17 METABOLIC DISORDERS

7.2.18 CARDIOVASCULAR DISEASE

7.2.19 RESPIRATORY DISEASES

7.2.20 OTHERS

7.2.21 HOSPITALS

7.2.22 PATHOLOGY LABORATORIES

7.2.23 CLINICS

7.2.24 BLOOD BANKS

7.2.25 HOME CARE SETTINGS

7.2.26 RESEARCH & ACADEMIC LABORATORIES

7.2.27 OTHERS

7.3 CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES

7.3.1 POC

7.3.2 GERIATRICS

7.3.3 INFANTS

7.3.4 PEDIATRICS

7.3.5 ADULT

7.3.6 INFECTIOUS DISEASES

7.3.7 METABOLIC DISORDERS

7.3.8 CARDIOVASCULAR DISEASE

7.3.9 RESPIRATORY DISEASES

7.3.10 OTHERS

7.3.11 PUNCTURE

7.3.12 INCISION

7.3.13 FINGER PUNCTURE

7.3.14 HEEL PUNCTURE

7.3.15 CONVENTIONAL

7.3.16 GERIATRICS

7.3.17 INFANTS

7.3.18 PEDIATRICS

7.3.19 ADULT

7.3.20 INFECTIOUS DISEASES

7.3.21 METABOLIC DISORDERS

7.3.22 CARDIOVASCULAR DISEASE

7.3.23 RESPIRATORY DISEASES

7.3.24 OTHERS

7.3.25 PUNCTURE

7.3.26 INCISION

7.3.27 FINGER PUNCTURE

7.3.28 HEEL PUNCTURE

7.3.29 HOSPITALS

7.3.30 PATHOLOGY LABORATORIES

7.3.31 CLINICS

7.3.32 BLOOD BANKS

7.3.33 HOME CARE SETTINGS

7.3.34 RESEARCH & ACADEMIC LABORATORIES

7.3.35 OTHERS

8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET BY COUNTRIES

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 AUSTRALIA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 MALAYSIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 INDONESIA

8.1.9 PHILIPPINES

8.1.10 REST OF ASIA

9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BD

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CARDINAL HEALTH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENTS

11.3 THERMO FISHER SCIENTIFIC INC.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 TERUMO MEDICAL CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENTS

11.5 ABBOTT

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 BIO-RAD LABORATORIES INC

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 B. BRAUN SE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 CML BIOTECH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 GREINER BIO-ONE INTERNATIONAL GMBH

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ICUMEDICAL INC

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 NARANG MEDICAL LIMITED

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 NIPRO

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENT

11.14 OWEN MUMFORD LTD

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 SARSTEDT AG & CO. KG

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 SPARSH MEDIPLUS

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

Liste des tableaux

TABLE 1 CLINICAL LAB TESTS THAT ARE INFLUENCED BY HEMOLYSIS

TABLE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 20 JAPAN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 23 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 AUSTRALIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH KOREA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MALAYSIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 89 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 91 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 93 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MALAYSIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 101 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 108 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 110 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 114 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SINGAPORE PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 118 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 125 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 PHILIPPINES BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 163 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 INCREASED PREVALENCE OF CHRONIC DISEASES AND RISE IN THE GERIATRIC POPULATION ARE FACTORS EXPECTED TO DRIVE THE GROWTH OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 13 THE BLOOD SAMPLING DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN 2025 AND 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

FIGURE 15 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2024

FIGURE 16 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SNAPSHOT

FIGURE 20 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.