Asia Pacific Hyaluronic Acid Market For Knee Osteoarthritis Treatment Market

Taille du marché en milliards USD

TCAC :

%

USD

501.42 Million

USD

1,051.92 Million

2024

2032

USD

501.42 Million

USD

1,051.92 Million

2024

2032

| 2025 –2032 | |

| USD 501.42 Million | |

| USD 1,051.92 Million | |

|

|

|

|

Marché de l'acide hyaluronique Asie-Pacifique pour le traitement de l'arthrose du genou Segmentation du marché, par type de produit (injection unique (monophasique), schéma à trois injections (triphasique), schéma à cinq injections (pentaphasique)), formulation ( acide hyaluronique réticulé , acide hyaluronique non réticulé), poids moléculaire (AH de haut poids moléculaire (HMW), AH de bas poids moléculaire (LMW), AH de poids moléculaire intermédiaire), objectifs de traitement (viscosupplémentation, anti-inflammatoire et réduction de la douleur, protection et régénération du cartilage), utilisateur final (hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, centres spécialisés de gestion de la douleur), canal de distribution (appel d'offres direct, pharmacies de détail et en ligne, autres), pays (Chine, Inde, Japon, Corée du Sud, Australie, Indonésie, Thaïlande, Malaisie, Vietnam, Philippines, Taïwan, Singapour, Nouvelle-Zélande, Philippines, Kazakhstan, Brunei et reste de l'Asie-Pacifique) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

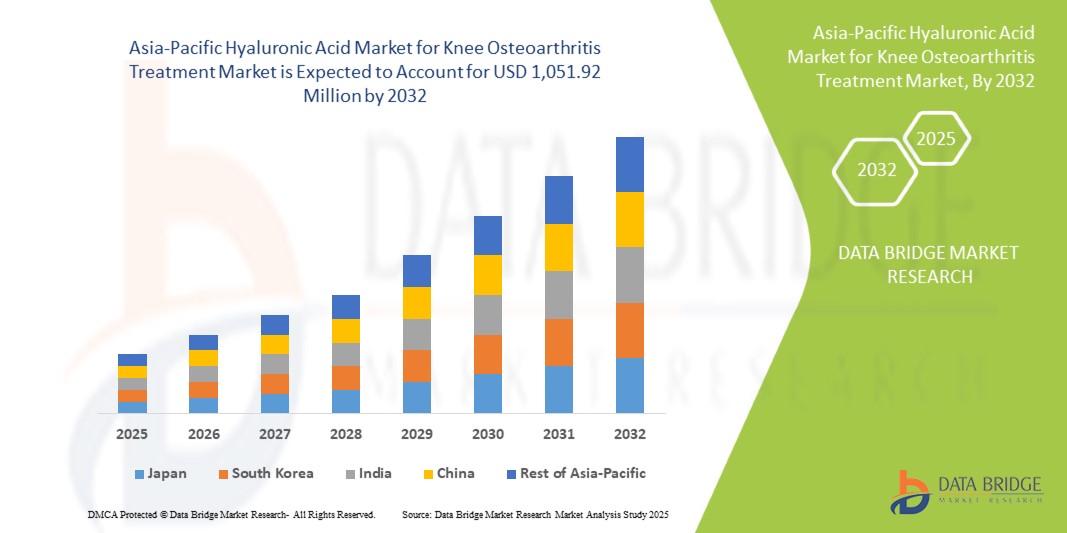

- Le marché de l'acide hyaluronique pour le traitement de l'arthrose du genou en Asie-Pacifique était évalué à 501,42 millions USD en 2024 et devrait atteindre 1 051,92 millions USD d'ici 2032.

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 9,8 %, principalement grâce au lancement prévu de thérapies.

- La prévalence croissante de l'arthrose du genou et la préférence croissante pour les traitements mini-invasifs stimulent la demande de thérapies à base d'acide hyaluronique. De plus, la sensibilisation croissante aux bienfaits de la viscosupplémentation stimule la croissance du marché.

Analyse du marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

- L'acide hyaluronique est une substance naturellement présente dans l'organisme, notamment dans les tissus conjonctifs, la peau et le liquide synovial qui lubrifie les articulations. Dans le cadre du traitement de l'arthrose du genou, l'acide hyaluronique est utilisé comme viscosupplément pour améliorer la fonction articulaire et soulager la douleur. Injecté directement dans l'articulation du genou, il renforce l'effet amortisseur, réduit les frottements lors des mouvements et favorise la régénération du cartilage, soulageant ainsi les symptômes de l'arthrose. Ce traitement vise à restaurer la mobilité, à améliorer la qualité de vie et à retarder la progression de la maladie.

- L'Asie-Pacifique émerge comme une région leader sur le marché de l'acide hyaluronique pour le traitement de l'arthrose du genou, grâce à son système de santé bien établi et à son adoption élevée d'options avancées de soins articulaires non chirurgicales.

- Par exemple, les États-Unis affichent une forte adoption des injections intra-articulaires d'acide hyaluronique, soutenue par une sensibilisation croissante des patients et des politiques de remboursement favorables.

- L’accent mis par la région sur l’amélioration de la mobilité et de la qualité de vie des patients souffrant d’arthrose continue de stimuler l’innovation et l’expansion du marché des thérapies à base d’acide hyaluronique.

Portée du rapport et segmentation du marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

|

Attributs |

Marché de l'acide hyaluronique pour le traitement de l'arthrose du genou : principales perspectives |

|

Segments couverts |

|

|

Pays couverts |

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

« Préférence croissante pour les thérapies mini-invasives et ciblées »

- A key trend in the Asia-Pacific hyaluronic acid market for knee osteoarthritis treatment is the increasing preference for minimally invasive, targeted treatment options.

- Hyaluronic acid injections, also known as viscosupplementation, offer localized pain relief and improved joint mobility without the need for surgical intervention, making them highly attractive to both patients and clinicians

- For instance, single and multi-injection formulations tailored to patient needs are gaining traction, offering flexibility and convenience in treatment regimens

- The trend is further supported by advancements in injection techniques, improved formulation stability, and extended duration of therapeutic effects.

- Additionally, the integration of imaging technologies such as ultrasound-guided injections enhances precision and patient comfort.

- This shift towards non-surgical, effective, and patient-centric treatment options is shaping the future of knee osteoarthritis care and fueling growth in the hyaluronic acid market.

Hyaluronic Acid Market for Knee Osteoarthritis Treatment Market Dynamics

Driver

“Increasing Prevalence of Knee Osteoarthritis”

- As the Asia-Pacific population increasingly comprises older adults, the prevalence of osteoarthritis, a degenerative joint condition characterized by the breakdown of cartilage, is expected to grow significantly. This growing demographic trend is particularly alarming since osteoarthritis leads to symptoms such as chronic pain, stiffness, and decreased mobility, which can severely impact the quality of life for individuals affected. The rising incidence of osteoarthritis is prompting a surge in the demand for effective treatment solutions, as many patients are seeking alternatives to invasive surgical options. Hyaluronic acid (HA) injections have emerged as a highly favored minimally invasive treatment option that effectively alleviates symptoms by providing lubrication to the affected joint, thus enhancing joint function and mobility.

- These injections work by supplementing the naturally occurring hyaluronic acid in the synovial fluid, reducing friction between joints and promoting better shock absorption. This dual action not only helps to relieve pain but also improves overall joint health, making HA an appealing choice for both patients and healthcare providers.

For instance,

- In December 2023, NCBI stated that studies continue to illustrate the high prevalence of OA worldwide, with a greater burden among older individuals, women, some racial and ethnic groups, and individuals with lower socioeconomic status. Modifiable risk factors for OA with the strongest evidence are obesity and joint injury

- In November 2024, according an article published by Frontiers, an Indian study reported increasing KOA prevalence rates across different age groups: 19.2% for those under 50, 30.7% for those aged 50–60, 39.7% for those aged 60–70, and 54.1% for those over 70 (23). Another study revealed that both the prevalence and incidence of knee osteoarthritis significantly rise after age 55. Among individuals over 55, the average prevalence rate is 13.2%, with 9.4% for men and 18.0% for women

- The growing awareness of hyaluronic acid's benefits has contributed to its adoption among healthcare professionals and patients alike. As clinical studies and research continue to demonstrate the efficacy of hyaluronic acid in reducing pain and enhancing quality of life for those suffering from knee osteoarthritis, more healthcare providers are incorporating these treatments into their practice. This increasing acceptance, coupled with the rise in osteoarthritis cases, creates a favorable environment for market growth, driving innovation and competition among manufacturers to develop advanced formulations and delivery methods for hyaluronic acid therapies.

Opportunity

“Advancements In Hyaluronic Acid Formulations and Delivery Systems”

- Improved high-molecular-weight and cross-linked hyaluronic acid products provide longer-lasting pain relief and require fewer injections. This appeals to patients seeking effective and convenient solutions for managing their condition. Innovative delivery methods, such as hydrogels and nanoparticle systems, enhance the durability and performance of hyaluronic acid in the joint. These developments meet the rising demand from an aging population. Companies can leverage these technologies to stand out in a competitive market and attract more customers. The focus on reducing treatment frequency while improving patient outcomes strengthens the market’s growth potential. This makes the hyaluronic acid sector for knee osteoarthritis treatment a highly attractive area for investment and expansion

For instance,

- As per IBSA Institut Biochimique SA, Sanofi, Seikagaku Corporation, each company has developed unique formulations to enhance joint lubrication, pain relief, and treatment durability. These innovations focus on improved retention, cross-linking technology, and patient convenience, offering long-lasting symptom relief

- In April 2024 article by sciencedirect highlighted that hyaluronic acid-based liposomes for osteoarthritis drug delivery include surface functionalization after liposome preparation using coupling chemistry or pre-synthesized hyaluronic acid-lipid conjugates through reductive amination. These methods improve biocompatibility, enable simultaneous delivery of various drugs, and enhance control over conjugation, optimizing liposomal systems for effective arthritis treatment

- Advancements in hyaluronic acid formulations and delivery systems significantly enhance the effectiveness and convenience of knee osteoarthritis treatment. By improving product longevity and reducing the frequency of injections, these innovations cater to the growing demand for minimally invasive solutions among an aging population. Companies that embrace these technologies can strengthen their market presence, attract more patients, and capitalize on industry growth. This makes investment in hyaluronic acid-based treatments a strategic opportunity for long-term success in the evolving healthcare landscape.

Restraint/Challenge

“Cost-Related Challenges and Accessibility Concerns For Hyaluronic Acid Therapy In Knee Osteoarthritis”

- Hyaluronic acid (HA) injections for knee osteoarthritis can be prohibitively expensive, particularly when insurance plans either do not cover them fully or exclude them entirely from their benefits. This financial burden often forces patients to pay out-of-pocket, which can be a significant challenge, especially for those with limited financial resources.

- Moreover, multiple injections may be required over time, increasing the cost of treatment. As a result, patients may delay or forgo HA therapy altogether, despite its potential to alleviate pain and improve joint function. The high cost of treatment and lack of insurance coverage often limit accessibility, creating disparities in care. Addressing these financial challenges is vital for making HA therapy more accessible to a wider range of patients, ensuring that more people can benefit from this effective treatment for knee osteoarthritis.

For instance,

- In February 2024, Findings from Pain Physician indicate that Patients receiving HA injections faced significantly higher median costs, especially with multiple injections, compared to those receiving Cortico-Steroid (CS) injections or no injections. Additionally, those requiring Total Knee Arthroplasty (TKA) had higher costs with HA treatment, highlighting the financial barriers associated with this therapy

- As per Sanofi, Enovis and biovico , the high cost of Hyaluronic Acid (HA) therapy for knee osteoarthritis, such as Synvisc One (USD 232.81) and Biolevox Ha (USD 323.53), limits accessibility. Many patients struggle with affordability, especially without insurance. Lower-cost options, better coverage, and pricing reforms are essential for improving access to these treatments

- Le coût élevé des injections d'acide hyaluronique (AH) et la couverture maladie limitée constituent des obstacles importants pour de nombreux patients souffrant d'arthrose du genou. Ces difficultés financières, notamment la nécessité de multiples injections, incitent souvent les patients à retarder ou à abandonner le traitement par AH, malgré ses bénéfices avérés pour le soulagement de la douleur et l'amélioration de la fonction articulaire. Pour améliorer l'accessibilité et permettre à un plus grand nombre de personnes de bénéficier de ce traitement, il est essentiel de s'attaquer à ces problèmes de coût. L'élargissement de la couverture maladie et la réduction des frais à la charge des patients contribueront à rendre le traitement par AH plus accessible, et donc à améliorer la prise en charge des personnes souffrant d'arthrose du genou.

Marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

Le marché est segmenté en fonction du type, du type de produit, du site d'absorption, de la tranche d'âge, de la source, du mode de livraison, du sexe et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par type de produit |

|

|

Par formulation |

|

|

Par poids moléculaire |

|

|

Par objectifs de traitement

|

|

|

Par utilisateur final |

|

|

Par canal de distribution |

|

Analyse régionale du marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

« La Chine est le pays dominant et à la croissance la plus rapide sur le marché de l'acide hyaluronique pour le traitement de l'arthrose du genou. »

- La Chine est leader sur le marché de l'acide hyaluronique pour le traitement de l'arthrose du genou, grâce à son infrastructure de soins de santé avancée, à l'adoption précoce de thérapies articulaires non chirurgicales et à la forte présence d'acteurs clés du marché.

- La Chine détient une part de marché importante en raison de l’incidence croissante de l’arthrose du genou, du vieillissement de la population et de la préférence croissante pour les traitements mini-invasifs comme les injections intra-articulaires d’acide hyaluronique.

- Des politiques de remboursement favorables, des cadres réglementaires bien établis et des dépenses de santé accrues contribuent également à la croissance du marché dans la région.

- En outre, l'accent mis sur l'amélioration de la mobilité et de la qualité de vie des patients, combiné aux innovations dans les formulations d'AH et les techniques d'administration, continue de stimuler l'expansion du marché dans la région Asie-Pacifique.

Part de marché de l'acide hyaluronique pour le traitement de l'arthrose du genou

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence en Asie-Pacifique , ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- LG Chem (Corée du Sud)

- Bioventus LLC (États-Unis)

- Seikagaku Corporation (Japon)

- Sanofi (France)

- Anika Therapeutics, Inc. (États-Unis)

- IBSA Biochemical Institute SA (Suisse)

- Viatris (États-Unis)

- Zimmer Biomet (États-Unis)

- Fidia Pharmaceuci SpA (Italie)

- Ferring Pharmaceuticals (Suisse)

- TRB CHEMEDICA SA (Suisse)

- Hangzhou Singclean Medical Products Co., Ltd. (Chine)

- Hanmi Pharm. Co., Ltd. (Corée du Sud)

- Virchow Biotech (Inde)

- Eupraxia Pharmaceuticals (Canada)

Derniers développements sur le marché de l'acide hyaluronique pour le traitement de l'arthrose du genou en Asie-Pacifique

- En juillet 2024, LG Chem a fait son entrée sur le marché chinois du traitement de l'arthrose. L'entreprise s'est associée à Yifan Pharmaceutical pour lancer l'injection de synovie contre l'arthrose en Chine. Cela lui a permis d'élargir son portefeuille de produits.

- En mai 2023, Eupraxia Pharmaceuticals a annoncé la fin de la dernière visite de patient dans le cadre de son essai clinique de phase 2 pour l'EP-104IAR, destiné au traitement de l'arthrose. La société est en bonne voie pour publier des données préliminaires au deuxième trimestre, avec l'espoir de démontrer un soulagement significatif de la douleur et une amélioration fonctionnelle des patients, ainsi qu'un profil de sécurité prometteur.

- En mars 2025, IBSA s'est associé au distributeur Lunatus pour étendre ses traitements ostéoarticulaires en Arabie saoudite et aux Émirats arabes unis. Cette collaboration stratégique vise à améliorer les solutions de prise en charge de la douleur et pourrait s'étendre à d'autres pays de la région, répondant ainsi à la demande croissante de soins avancés parmi les populations touchées par les troubles ostéoarticulaires.

- En juin 2023, Eupraxia Pharmaceuticals a annoncé que la FDA américaine avait accordé la désignation « Fast Track » à l'EP-104IAR pour le traitement de l'arthrose du genou. Cette désignation vise à accélérer le développement et l'examen réglementaire, facilitant ainsi des interactions plus fréquentes avec la FDA. La société poursuit son essai de phase 2 et les premières données sont attendues au deuxième trimestre 2023.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 AVERAGE SELLING PRICE (ASP) ANALYSIS

4.4 MICRO AND MACRO ECONOMIC FACTORS

4.5 KEY PRICING STRATEGIES

4.6 HEALTHCARE ECONOMY

4.7 PENETRATION AND GROWTH PROSPECT MAPPING

4.8 TECHNOLOGY ROADMAP

4.9 VALUE CHAIN ANALYSIS

5 COMPANY-WISE OVERVIEW OF INTRA-ARTICULAR HYALURONIC ACID (HA) INJECTION PRODUCTS BASED ON MOLECULAR WEIGHT -

6 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, REGULATORY FRAMEWORK

6.1 NORTH AMERICA

6.2 EUROPE

6.3 ASIA-PACIFIC

6.4 MIDDLE EAST AND AFRICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF KNEE OSTEOARTHRITIS

7.1.2 GROWING PREFERENCE FOR MINIMALLY INVASIVE AND NON-SURGICAL TREATMENT OPTIONS

7.1.3 CLINICAL VALIDATION OF HYALURONIC ACID IN OSTEOARTHRITIS TREATMENT

7.1.4 RECENT LAUNCHES OF HYALURONIC ACID FOR OSTEOARTHRITIS TREATMENT

7.2 RESTRAINTS

7.2.1 COMPETITION OF ALTERNATIVE THERAPIES FOR KNEE OSTEOARTHRITIS

7.2.2 REGULATORY CHALLENGES FACED BY THE MANUFACTURERS IN THE HYALURONIC ACID MARKET

7.3 OPPORTUNITIES

7.3.1 ADVANCEMENTS IN HYALURONIC ACID FORMULATIONS AND DELIVERY SYSTEMS

7.3.2 RAISING AWARENESS AND ACCEPTANCE OF HYALURONIC ACID FOR KNEE OSTEOARTHRITIS TREATMENT AMONG PHYSICIANS AND PATIENTS

7.3.3 THE IMPACT OF COMBINING HYALURONIC ACID WITH OTHER THERAPEUTIC OPTIONS FOR KNEE OSTEOARTHRITIS

7.4 CHALLENGES

7.4.1 COST-RELATED CHALLENGES AND ACCESSIBILITY CONCERNS FOR HYALURONIC ACID THERAPY IN KNEE OSTEOARTHRITIS

7.4.2 SHORT-TERM BENEFITS WITH LIMITED LASTING EFFICACY OF HYALURONIC ACID FOR KNEE OA

8 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SINGLE INJECTION (MONOPHASIC)

8.3 THREE-INJECTION REGIMEN (TRIPHASIC)

8.4 FIVE-INJECTION REGIMEN (PENTAPHASIC)

9 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION

9.1 OVERVIEW

9.2 CROSS-LINKED HYALURONIC ACID

9.3 NON-CROSS-LINKED HYALURONIC ACID

10 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT

10.1 OVERVIEW

10.2 HIGH MOLECULAR WEIGHT (HMW) HA

10.3 LOW MOLECULAR WEIGHT (LMW) HA

10.4 INTERMEDIATE MOLECULAR WEIGHT HA

11 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS

11.1 OVERVIEW

11.2 VISCOSUPPLEMENTATION

11.3 ANTI-INFLAMMATORY & PAIN REDUCTION

11.4 CARTILAGE PROTECTION & REGENERATION

12 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 ORTHOPEDIC CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 SPECIALTY PAIN MANAGEMENT CENTERS

13 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL & ONLINE PHARMACIES

13.4 OTHERS

14 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 INDONESIA

14.1.9 MALAYSIA

14.1.10 TAIWAN

14.1.11 NEW ZEALAND

14.1.12 PHILIPPINES

14.1.13 VIETNAM

14.1.14 KAZAKHSTAN

14.1.15 BRUNEI

14.1.16 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 LG CHEM

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BIOVENTUS

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 SEIKAGAKU CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 SANOFI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ANIKA THERAPEUTICS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 EUPRAXIA PHARMACEUTICALS

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 FIDIA FARMACEUTICI S.P.A.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 FERRING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 HANGZHOU SINGCLEAN MEDICAL PRODUCTS CO.,LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 HANMI PHARM.CO., LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 IBSA INSTITUT BIOCHIMIQUE SA.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 TRB CHEMEDICA INTERNATIONAL SA

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 VIATRIS INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 VIRCHOW BIOTECH

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 ZIMMER BIOMET

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANY PRODUCT AND ADVANCEMENT IN FORMULATION

TABLE 2 COMPANY PRODUCT AND COMBINATION THERAPY

TABLE 3 PRICE OF THE HYALURONIC ACID INJECTION

TABLE 4 COMPANY PRODUCT AND LASTING EFFICACY

TABLE 5 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC SINGLE INJECTION (MONOPHASIC) IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC THREE-INJECTION REGIMEN (TRIPHASIC) IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC FIVE-INJECTION REGIMEN (PENTAPHASIC IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC CROSS-LINKED HYALURONIC ACID IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC NON-CROSS-LINKED HYALURONIC ACID IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC HIGH MOLECULAR WEIGHT (HMW) HA IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC LOW MOLECULAR WEIGHT (LMW) HA IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC INTERMEDIATE MOLECULAR WEIGHT HA IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC VISCOSUPPLEMENTATION IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC ANTI-INFLAMMATORY & PAIN REDUCTION IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC CARTILAGE PROTECTION & REGENERATION IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC HOSPITALS IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC ORTHOPEDIC CLINICS IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC AMBULATORY SURGICAL CENTERS IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC SPECIALTY PAIN MANAGEMENT CENTERS IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC DIRECT TENDER IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC RETAIL & ONLINE PHARMACIES IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC OTHERS IN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 36 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 38 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 39 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 40 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 CHINA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 42 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 44 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 45 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 46 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 47 JAPAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 48 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 50 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 51 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 52 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 INDIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 60 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 62 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 63 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 64 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 65 AUSTRALIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 68 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 69 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 70 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 SINGAPORE HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 74 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 75 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 76 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 77 THAILAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 80 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 81 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 82 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 83 INDONESIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 84 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 86 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 87 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 88 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 89 MALAYSIA HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 90 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 92 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 93 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 94 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 TAIWAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 96 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 98 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 99 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 100 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 101 NEW ZEALAND HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 102 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 104 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 105 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 106 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 107 PHILIPPINES HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 110 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 111 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 112 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 113 VIETNAM HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 116 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 117 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 118 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 119 KAZAKHSTAN HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 120 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 122 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY MOLECULAR WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 123 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY TREATMENT GOALS, 2018-2032 (USD THOUSAND)

TABLE 124 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 125 BRUNEI HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 REST OF ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: SEGMENTATION

FIGURE 2 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: LIFELINE CURVE

FIGURE 7 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: MARKET END USER COVERAGE GRID

FIGURE 10 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: SEGMENTATION

FIGURE 12 THREE SEGMENTS COMPRISE THE ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT, BY PRODUCT TYPE

FIGURE 13 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING PREVALENCE OF KNEE OSTEOARTHRITIS IS EXPECTED TO DRIVE THE GROWTH OF ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT FROM 2025 TO 2032

FIGURE 16 THE SINGLE INJECTION (MONOPHASIC) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT IN 2025 - 2032

FIGURE 17 DROC ANALYSIS

FIGURE 18 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY PRODUCT TYPE, 2024

FIGURE 19 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 20 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 21 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY FORMULATION, 2024

FIGURE 23 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY FORMULATION, 2025-2032 (USD THOUSAND)

FIGURE 24 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY FORMULATION, CAGR (2025-2032)

FIGURE 25 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY FORMULATION, LIFELINE CURVE

FIGURE 26 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY MOLECULAR WEIGHT, 2024

FIGURE 27 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY MOLECULAR WEIGHT, 2025-2032 (USD THOUSAND)

FIGURE 28 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY MOLECULAR WEIGHT, CAGR (2025-2032)

FIGURE 29 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY TREATMENT GOALS, 2024

FIGURE 31 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY TREATMENT GOALS, 2025-2032 (USD THOUSAND)

FIGURE 32 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY TREATMENT GOALS, CAGR (2025-2032)

FIGURE 33 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY TREATMENT GOALS, LIFELINE CURVE

FIGURE 34 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY END USER, 2024

FIGURE 35 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 36 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY END USER, CAGR (2025-2032)

FIGURE 37 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY END USER, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY DISTRIBUTION CHANNEL, 2024

FIGURE 39 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 40 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 41 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC HYALURONIC ACID MARKET FOR KNEE OSTEOARTHRITIS TREATMENT: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.