Asia Pacific Replaceable Filter Dust Masks Market

Taille du marché en milliards USD

TCAC :

%

USD

656.79 Million

USD

1,142.76 Million

2025

2033

USD

656.79 Million

USD

1,142.76 Million

2025

2033

| 2026 –2033 | |

| USD 656.79 Million | |

| USD 1,142.76 Million | |

|

|

|

|

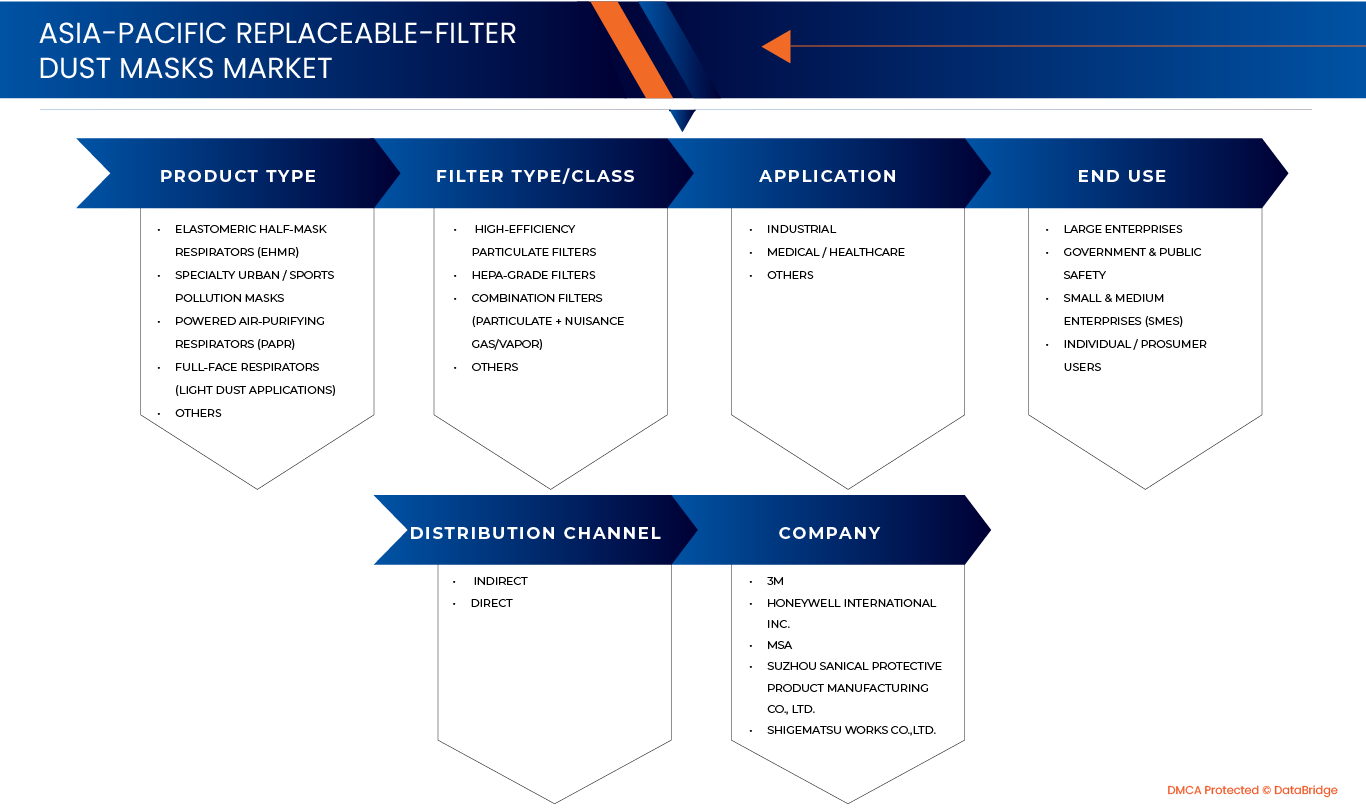

Marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique : analyse par type de produit (demi-masques respiratoires élastomères, masques anti-pollution urbains/sportifs spécialisés, appareils respiratoires à ventilation assistée, masques complets pour poussières légères, autres), par type/classe de filtre (filtres à particules haute efficacité, filtres HEPA, filtres combinés [particules + gaz/vapeurs nocifs], autres), par application (industrielle, médicale/santé, autres), par utilisateur final (grandes entreprises, administrations et sécurité publique, PME, particuliers/consommateurs professionnels), par canal de distribution (direct, indirect) – Tendances du secteur et prévisions jusqu’en 2033

Taille du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

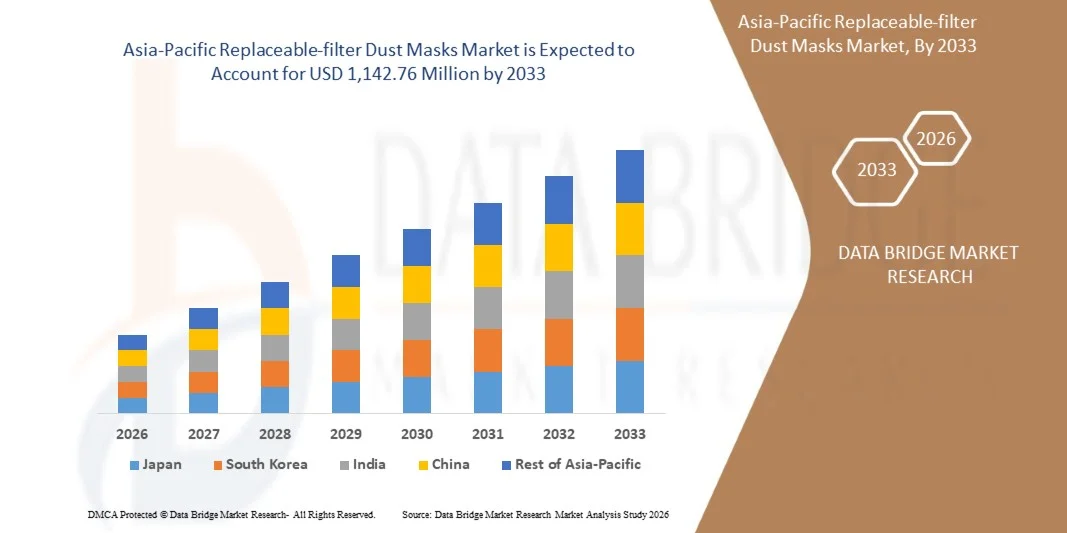

- Le marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique était évalué à 656,79 millions de dollars en 2025 et devrait atteindre 1 142,76 millions de dollars d’ici 2033.

- Au cours de la période de prévision allant de 2026 à 2033, le marché devrait croître à un TCAC de 7,3 %, principalement sous l'effet de l'intérêt croissant pour les boîtes en carton ondulé léger.

- Cette croissance est alimentée par des facteurs tels que l'industrialisation continue qui exige des cartons et des matériaux uniques, la demande croissante d'emballages durables et esthétiques, et d'autres encore.

Analyse du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

- Le marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique connaît une expansion soutenue, portée par une sensibilisation accrue à la santé au travail, des réglementations plus strictes en matière de sécurité sur les lieux de travail et une exposition croissante aux particules en suspension dans les environnements industriels et urbains. Les masques anti-poussière à filtre remplaçable offrent des avantages tels que la rentabilité, une durée de vie prolongée, des performances de filtration constantes et une réduction des déchets par rapport aux masques jetables. Leur utilisation se généralise dans les secteurs de la construction, de la fabrication, des mines, de la chimie, de la pharmacie, de l'agriculture et des projets de développement d'infrastructures. Toutefois, des défis persistent : une application inégale de la réglementation dans les pays en développement, une sensibilisation limitée des petites entreprises, la sensibilité aux prix et le besoin de formations adéquates sur le remplacement et l'entretien des filtres.

- Les secteurs de la construction et de l'industrie demeurent les principaux moteurs de croissance, car les travailleurs y sont exposés en permanence à la poussière, aux fumées et aux particules fines, ce qui exige une protection respiratoire fiable et réutilisable. L'industrialisation rapide, l'expansion des infrastructures et le développement urbain dans les principales économies de la région Asie-Pacifique renforcent la demande. Parallèlement, les activités manufacturières, les opérations minières et les installations de traitement chimique privilégient de plus en plus la protection respiratoire certifiée afin de se conformer aux normes de sécurité au travail en constante évolution. Les préoccupations croissantes concernant la pollution de l'air et les risques pour la santé au travail encouragent également le passage aux masques anti-poussière à filtre remplaçable.

- L'Indonésie joue un rôle crucial dans la dynamique des marchés régionaux, grâce à ses importants pôles de production et à l'essor du secteur de la construction qui accélèrent l'adoption des produits. Parallèlement, l'alignement sur les normes de sécurité internationales, impulsé par des industries tournées vers l'exportation et la présence de multinationales, influence les spécifications des produits et les critères de qualité. Les économies émergentes d'Asie du Sud-Est et d'Asie du Sud gagnent également du terrain en tant que marchés de croissance, soutenues par la hausse de l'emploi industriel et l'amélioration progressive de la sensibilisation à la sécurité des travailleurs.

- Les principaux fabricants misent sur l'innovation produit, notamment les matériaux de filtration avancés, la conception ergonomique des masques, les coques réutilisables légères et les mécanismes d'étanchéité améliorés pour un confort et une protection accrus. Les filtres multicouches remplaçables, la compatibilité avec différentes normes de particules et une meilleure respirabilité gagnent en importance. Parmi les différentes catégories de produits, les masques réutilisables à filtres remplaçables détiennent une part de marché significative en raison de leur utilisation répandue dans les secteurs à haut risque d'exposition. Les collaborations stratégiques avec les distributeurs industriels, les fournisseurs d'équipements de sécurité et les organismes de réglementation influencent la pénétration du marché. Face au renforcement continu des réglementations en matière de sécurité au travail dans la région, un investissement soutenu dans la qualité, la certification et la formation des utilisateurs sera essentiel à la compétitivité à long terme.

- En 2026, le segment des demi-masques respiratoires élastomères (DRE) devrait détenir la plus grande part de marché, soit environ 37,36 %, principalement grâce à la croissance de l'activité industrielle dans la région et à l'adoption croissante d'équipements respiratoires durables et économiques. L'expansion des activités de construction, de fabrication et d'exploitation minière dans des pays comme la Chine, l'Inde et l'Asie du Sud-Est génère une demande accrue de respirateurs résistants à filtres remplaçables. Ces masques sont privilégiés car ils offrent une protection optimale, réduisent les coûts d'acquisition à long terme et sont faciles à entretenir grâce au remplacement périodique des filtres. Leur conception modulaire, qui permet un changement rapide des filtres en fonction du niveau de particules ou de l'exposition chimique, en fait le choix idéal pour les lieux de travail exigeant à la fois protection et facilité d'utilisation.

Portée du rapport et segmentation du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

|

Attributs |

Emballages en carton ondulé : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

« Accroître les acquisitions stratégiques et les collaborations entre les principaux acteurs du marché »

- Le secteur des masques anti-poussière à filtre remplaçable en Asie-Pacifique connaît une forte croissance des fusions, acquisitions et partenariats entre les principaux fabricants. Les grandes entreprises renforcent leur présence sur le marché en acquérant des acteurs régionaux, en créant des coentreprises et en développant leurs capacités de production dans les pays émergents à forte demande. Ces initiatives stratégiques sont principalement motivées par la nécessité d'enrichir les gammes de produits, d'étendre les réseaux de distribution et de mieux s'adapter à l'évolution des exigences réglementaires et de sécurité.

Ces collaborations permettent également une adoption plus rapide des technologies de filtration avancées, des conceptions ergonomiques améliorées et des matériaux innovants et durables au sein du secteur. En mutualisant leur expertise technique et leurs ressources de production, les entreprises accélèrent les cycles de développement des produits et améliorent l'efficacité globale de leurs chaînes d'approvisionnement .

Dynamique du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

Conducteur

« La persistance de niveaux élevés de pollution dans les principales villes de la région Asie-Pacifique renforce la dépendance à long terme aux masques anti-poussière à filtre remplaçable. »

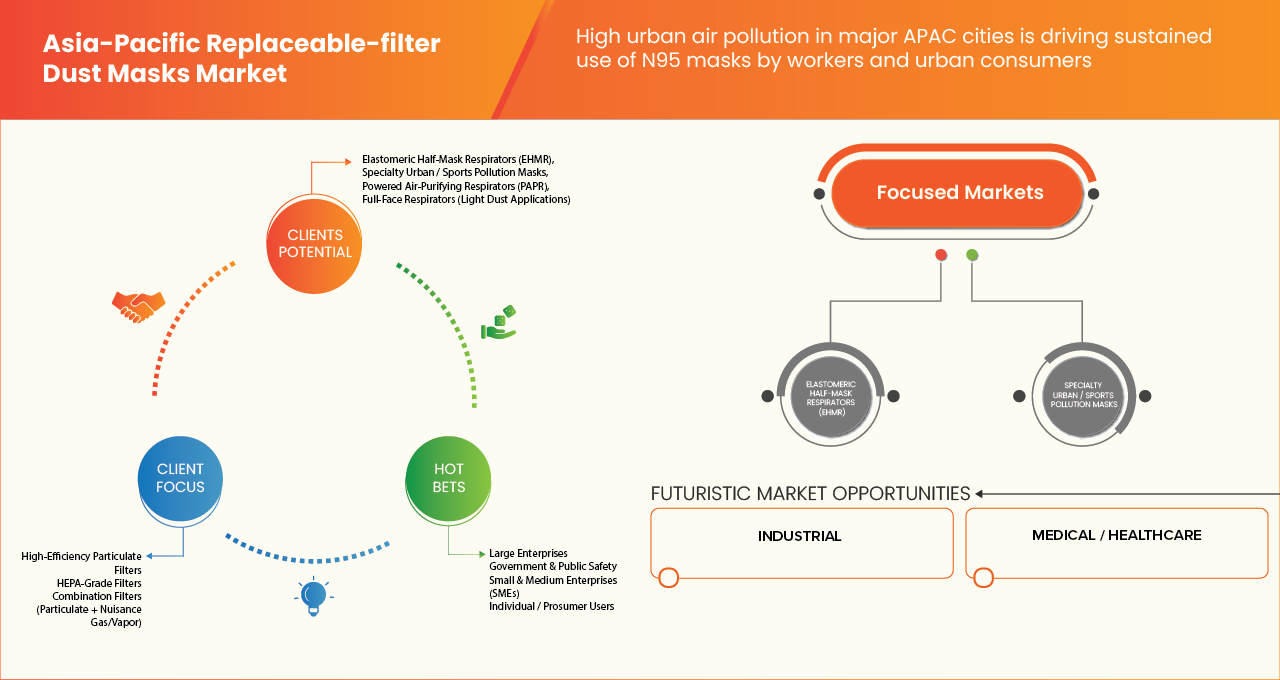

- La pollution atmosphérique urbaine croissante dans les principales métropoles de la région Asie-Pacifique renforce le besoin constant de protections respiratoires haute performance, notamment de masques anti-poussière à filtre remplaçable. Les épisodes de smog récurrents, la croissance industrielle rapide, la circulation automobile dense, l'expansion des chantiers de construction et la brume saisonnière ont engendré une mauvaise qualité de l'air chronique, entraînant de fréquentes alertes de santé publique. Alors que les gouvernements et les experts médicaux continuent de recommander le port de masques respiratoires à filtre à particules lors des périodes de pollution atmosphérique « mauvaise » à « très mauvaise », les travailleurs et les citadins recherchent des solutions plus durables et réutilisables, offrant une filtration constante tout en réduisant les déchets et les coûts de remplacement à long terme.

- Cette évolution renforce la demande structurelle de masques respiratoires à filtre remplaçable, qui offrent une durée d'utilisation prolongée et une protection efficace contre les particules fines lors d'épisodes de pollution récurrents. À terme, le port de ces masques devient une pratique de prévention à long terme plutôt qu'une réaction ponctuelle à des pics de pollution épisodiques.

- En novembre 2025, India Today rapportait que des spécialistes de la santé à Delhi conseillaient aux citoyens de porter des masques de type N95 ou N99 en raison des épisodes de pollution atmosphérique dangereux. Ces recommandations répétées soulignent le besoin constant d'une filtration performante des particules et encouragent l'adoption de masques anti-poussière à filtre remplaçable, offrant une protection durable lors de périodes de pollution prolongées.

- En juillet 2024, dans le cadre du Programme national pour un air pur, le ministère de l'Environnement, des Forêts et du Changement climatique (MoEF&CC) a recensé 131 villes indiennes nécessitant des initiatives ciblées de lutte contre la pollution, reconnaissant ainsi les problèmes chroniques de qualité de l'air. La prise de conscience croissante des risques liés à la pollution à long terme encourage l'utilisation quotidienne de masques respiratoires à filtre remplaçable, notamment au sein des populations urbaines à la recherche de solutions de protection durables et réutilisables.

- En novembre 2023, un article du World Resources Institute a mis en lumière une analyse environnementale régionale des principales villes d'Asie du Sud-Est, notant explicitement que lors des pics de pollution — dus aux émissions des véhicules et à l'activité industrielle — les agences de santé de villes comme Jakarta et Bangkok publient régulièrement des avis publics exhortant les habitants à rester à l'intérieur autant que possible ou à porter des masques à l'extérieur, soulignant ainsi que l'utilisation de respirateurs est devenue un comportement de protection récurrent.

Retenue/Défi

« La présence de produits contrefaits mine la confiance et réduit les marges des fabricants respectueux de la loi. »

- La présence persistante de masques respiratoires contrefaits et non conformes dans plusieurs pays d'Asie-Pacifique constitue un frein important au marché des masques anti-poussière à filtre remplaçable. Des alternatives illicites et bon marché inondent fréquemment les circuits de distribution informels et parallèles, compromettant la compétitivité des fabricants certifiés qui investissent dans des cartouches filtrantes validées, les autorisations réglementaires et des processus de contrôle qualité rigoureux. Cet afflux de produits de substitution non réglementés réduit non seulement les marges des producteurs légitimes, mais aussi la confiance des consommateurs dans les systèmes de respirateurs haut de gamme à filtre remplaçable. Les actions de répression en cours, notamment les saisies de produits, les opérations de lutte contre la contrefaçon et les mises en demeure émises par les autorités régionales, indiquent que l'infiltration de contrefaçons demeure un obstacle structurel qui ralentit la formalisation du marché, freine l'adoption de modèles de filtres remplaçables de meilleure qualité et alourdit la charge de travail en matière de conformité et de surveillance pour les acteurs établis du secteur.

- En février 2025, l’Institut national de la sécurité et de la santé au travail (NIOSH) a publié un avertissement intitulé « Masques et autres produits de protection du visage contrefaits ou présentant des caractéristiques trompeuses », soulignant que ces masques peuvent ne pas offrir une protection respiratoire adéquate aux travailleurs et aux consommateurs. Cet avis officiel met en évidence le problème persistant que représentent les masques bon marché et de qualité inférieure pour les marges des fabricants.

- En février 2022, les douanes de Hong Kong ont mené une opération spéciale et saisi environ 15 000 masques faciaux contrefaits présumés de qualité médicale — dont beaucoup étaient étiquetés N95 ou de qualité médicale — sur un étal temporaire dans un centre commercial de Ho Man Tin ; une femme de 41 ans a été arrêtée dans le cadre de cette affaire.

Portée du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

Le marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique est segmenté en cinq segments notables qui sont basés sur le type de produit, le type/classe de filtre, l'application, l'utilisation finale et le canal de distribution.

- Par type de produit

Selon le type de produit, le marché est segmenté en demi-masques respiratoires élastomères (EHMR), masques anti-pollution spécialisés pour environnements urbains et sportifs, appareils respiratoires à ventilation assistée (PAPR), masques complets (pour les applications en cas de poussières légères) et autres. En 2026, le segment des demi-masques respiratoires élastomères (EHMR) détenait la plus grande part de marché. La demande d'EHMR en Asie-Pacifique est stimulée par le renforcement des normes de sécurité industrielle, la préférence pour une durabilité accrue et la rentabilité pour une utilisation à long terme. L'adoption croissante dans les secteurs de la fabrication, des mines et de la construction, conjuguée aux obligations de protection respiratoire, contribue significativement à la pénétration des EHMR sur les lieux de travail de la région.

- Par type/classe de filtre

Selon le type/la classe de filtre, le marché est segmenté en filtres à particules haute efficacité (HEPA), filtres HEPA, filtres combinés (particules + gaz/vapeurs nocifs) et autres. En 2026, le segment des filtres à particules haute efficacité dominera le marché. La croissance de ce segment est soutenue par des normes de qualité de l'air plus strictes, une sensibilisation accrue aux risques professionnels et l'expansion des industries chimiques, pharmaceutiques et électroniques. Le besoin croissant d'une filtration efficace contre les poussières fines, les fumées et les particules dangereuses accélère l'adoption de ces filtres dans les secteurs industriel et de la santé.

- Sur demande

En fonction de l'application, le marché est segmenté en trois secteurs : industriel, médical/santé et autres. En 2026, le secteur industriel sera en forte croissance en raison du renforcement des réglementations en matière de sécurité, de l'expansion de la production à grande échelle et d'une exposition accrue aux poussières et aux particules chimiques. L'augmentation des investissements dans les programmes de protection des travailleurs et la multiplication des audits dans les usines, les raffineries et sur les chantiers de construction renforcent la demande de masques respiratoires à filtres remplaçables dans l'ensemble des industries de la région Asie-Pacifique.

- Par l'utilisateur final

En fonction de l'utilisation finale, le marché est segmenté en grandes entreprises, administrations et sécurité publique, petites et moyennes entreprises (PME) et particuliers/consommateurs-producteurs. En 2026, le segment des grandes entreprises sera dominé par une adoption accrue grâce à des protocoles de sécurité standardisés, des achats groupés et une plus grande importance accordée au respect des normes internationales de santé au travail. Leurs programmes SSE structurés, leurs budgets stables et leur préférence pour des respirateurs de haute qualité alimentent une consommation plus élevée dans les principaux centres de production de la région Asie-Pacifique.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en distribution directe et indirecte. Le segment indirect se subdivise en plateformes de commerce électronique, distributeurs industriels et vente au détail. En 2026, le segment indirect domine grâce à des réseaux de distribution performants, une couverture de marché étendue et la disponibilité de marques diversifiées via les fournisseurs d'équipements de sécurité. Les acheteurs industriels privilégient les distributeurs pour la fiabilité des stocks, la rapidité de livraison et les prix compétitifs, ce qui contribue à dynamiser les ventes indirectes de masques anti-poussière à filtre remplaçable en Asie-Pacifique.

Part de marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

L'analyse concurrentielle du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique offre une vision globale du positionnement des principaux fabricants. Cette section présente des informations essentielles sur chaque acteur du marché, notamment son historique, ses performances financières, son chiffre d'affaires global et son potentiel de marché. Elle met également en lumière l'ampleur de ses investissements en recherche et développement, ses initiatives stratégiques récentes, sa présence régionale et la taille de son infrastructure de production.

Les principaux acteurs du marché sont :

- Shigematsu Works Co., Ltd. (Japon)

- KOKEN LTD. (Japon)

- Cambridge Mask Co. (Royaume-Uni)

- Suzhou Sanical Protective Product Manufacturing Co., Ltd. (Chine)

- Shanghai Dasheng Health Products Manufacturing Co., Ltd. (Chine)

- Société 3M (États-Unis)

- Honeywell International Inc. (États-Unis)

- MSA Safety Incorporated (États-Unis)

- Drägerwerk AG & Co. KGaA (Allemagne)

- Moldex-Metric, Inc. (États-Unis)

- GVS SpA (Italie)

- Markrite (Chine)

Dernières évolutions du marché des masques anti-poussière à filtre remplaçable en Asie-Pacifique

- En avril 2024, les fabricants des principaux centres de production de la région Asie-Pacifique ont constaté une forte hausse de la demande en solutions d'emballage légères et économiques pour les masques anti-poussière à filtre remplaçable. Cette évolution a été principalement impulsée par les entreprises de commerce électronique et de biens de consommation courante (FMCG) qui cherchaient à réduire leurs coûts logistiques et de livraison du dernier kilomètre, notamment sur les marchés à fort volume.

- En décembre 2023, plusieurs grands fabricants de masques de la région ont renforcé leur collaboration avec des fournisseurs d'emballages situés dans les principales zones industrielles. Ces partenariats ont permis de développer des emballages de protection robustes et personnalisés, spécialement conçus pour le transport en vrac de respirateurs réutilisables et de filtres remplaçables, améliorant ainsi la sécurité des produits lors des transports longue distance.

- En mars 2024, les fabricants de masques anti-poussière destinés aux secteurs agricole et d'exportation ont sollicité des fournisseurs d'emballages afin de se procurer des solutions de carton résistantes à l'humidité et durables. Ces matériaux d'emballage améliorés étaient essentiels pour garantir la qualité et la durée de conservation des masques transportés dans des climats humides et des environnements de stockage courants sur les marchés agroalimentaires de la région Asie-Pacifique.

- En septembre 2023, les entreprises des secteurs de la chimie, de la pharmacie et de la sécurité industrielle ont élargi leurs gammes d'emballages pour inclure des solutions haute résistance aux chocs. Cet élargissement a permis une distribution sécurisée des respirateurs et cartouches filtrantes haut de gamme utilisés dans les environnements opérationnels dangereux, témoignant d'une demande croissante de la part de secteurs privilégiant la sécurité des travailleurs et la conformité réglementaire.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CONSUMER BUYING BEHAVIOUR IN THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.2.1 HEALTH AND SAFETY CONSCIOUSNESS

4.2.2 BRAND TRUST AND REPUTATION

4.2.3 PRODUCT FEATURES AND INNOVATION

4.2.4 PRICE SENSITIVITY AND VALUE PERCEPTION

4.2.5 AWARENESS OF CERTIFICATIONS AND COMPLIANCE

4.2.6 ACCESSIBILITY AND DISTRIBUTION CHANNELS

4.2.7 SOCIAL INFLUENCE AND RECOMMENDATIONS

4.2.8 ENVIRONMENTAL AND SUSTAINABILITY CONSIDERATIONS

4.2.9 PURCHASE FREQUENCY AND USAGE PATTERNS

4.2.10 CONCLUSION

4.3 VENDOR SELECTION CRITERIA – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.3.1 PRODUCT QUALITY & TECHNICAL COMPETENCE

4.3.1.1 MATERIAL INTEGRITY AND FILTRATION EFFICIENCY

4.3.1.2 DESIGN ADAPTABILITY AND USER COMFORT

4.3.1.3 BATCH CONSISTENCY AND QUALITY TESTING MECHANISMS

4.3.2 REGULATORY COMPLIANCE AND CERTIFICATION STANDARDS

4.3.2.1 ADHERENCE TO REGIONAL STANDARDS

4.3.2.2 PARTICIPATION IN VOLUNTARY CERTIFICATIONS

4.3.2.3 REGULATORY TRANSPARENCY

4.3.3 COST EFFICIENCY AND COMMERCIAL VIABILITY

4.3.3.1 PRICING STRUCTURE AND LONG-TERM AFFORDABILITY

4.3.3.2 COST-TO-PERFORMANCE RATIO

4.3.3.3 FLEXIBILITY IN CONTRACT TERMS

4.3.4 PRODUCTION CAPACITY AND SUPPLY RELIABILITY

4.3.4.1 MANUFACTURING FOOTPRINT AND AUTOMATION LEVEL

4.3.4.2 LEAD TIME AND ON-TIME DELIVERY PERFORMANCE

4.3.4.3 INVENTORY PLANNING AND EMERGENCY ALLOCATION

4.3.5 INNOVATION CAPABILITY AND PRODUCT DEVELOPMENT STRENGTH

4.3.5.1 R&D INVESTMENTS AND PATENT OWNERSHIP

4.3.5.2 SPEED OF PRODUCT CUSTOMIZATION

4.3.5.3 TREND ALIGNMENT

4.3.6 SUPPLY CHAIN TRANSPARENCY AND ETHICAL PRACTICES

4.3.6.1 TRACEABILITY OF RAW MATERIALS

4.3.6.2 ENVIRONMENTAL AND SOCIAL COMPLIANCE

4.3.6.3 VENDOR GOVERNANCE AND POLICY DOCUMENTATION

4.3.7 MARKET REPUTATION AND CLIENT FEEDBACK

4.3.7.1 INDUSTRY FEEDBACK AND PEER ENDORSEMENTS

4.3.7.2 AFTER-SALES RESPONSIVENESS

4.3.7.3 LONGEVITY IN THE MARKET

4.3.8 TECHNOLOGICAL INTEGRATION AND DIGITAL CAPABILITY

4.3.8.1 INTEGRATION OF DIGITAL QUALITY MONITORING SYSTEMS

4.3.8.2 USE OF ERP AND LOGISTICS PLATFORMS

4.3.8.3 DATA-SHARING WILLINGNESS

4.3.9 CONCLUSION

4.4 RAW MATERIAL COVERAGE – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.4.1 FILTRATION MEDIA (MELT-BLOWN & ELECTROSTATIC LAYERS)

4.4.1.1 TECHNICAL RELEVANCE

4.4.1.2 ELECTROSTATIC ENHANCEMENT

4.4.1.3 SUPPLY RELIABILITY

4.4.2 NONWOVEN OUTER AND INNER LAYERS (SPUN-BOND FABRICS)

4.4.2.1 FUNCTIONAL CHARACTERISTICS

4.4.2.2 REAL-WORLD APPLICABILITY

4.4.2.3 REGIONAL PRODUCTION STRENGTH

4.4.3 ELASTOMERS AND HEAD STRAPS

4.4.3.1 USER-CENTRIC IMPORTANCE

4.4.3.2 MATERIAL ADAPTABILITY

4.4.3.3 SUSTAINABILITY SHIFTS

4.4.4 NOSE CLIPS AND STRUCTURAL SUPPORT COMPONENTS

4.4.4.1 PERFORMANCE SIGNIFICANCE

4.4.4.2 COMFORT ENHANCEMENTS

4.4.4.3 EMERGENCE OF POLYMER-BASED ALTERNATIVES

4.4.5 EXHALATION VALVES AND FILTER CARTRIDGES

4.4.5.1 OPERATIONAL ROLE

4.4.5.2 MATERIAL INNOVATIONS

4.4.5.3 CARTRIDGE HOUSING

4.4.6 ACTIVATED CARBON LAYERS

4.4.6.1 PRACTICAL USE CASES

4.4.6.2 MATERIAL ADVANTAGES

4.4.7 PACKAGING MATERIALS

4.4.7.1 INDUSTRY PRACTICE

4.4.7.2 LOGISTICAL IMPORTANCE

4.4.8 CONCLUSION

4.5 BRAND OUTLOOK – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.5.1 TRUST AND SAFETY ASSURANCE

4.5.2 DESIGN AND COMFORT AS DIFFERENTIATORS

4.5.3 INNOVATION AND VALUE-ADDED FUNCTIONALITY

4.5.4 LOCALIZATION AND REGIONAL RELEVANCE

4.5.5 DIGITAL ENGAGEMENT AND BRAND VISIBILITY

4.5.6 INDUSTRIAL AND INSTITUTIONAL ENDORSEMENT

4.5.7 PRICING STRATEGY AND PERCEIVED VALUE

4.5.8 CONCLUSION

4.6 SUPPLY CHAIN EXPLANATION FOR THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.6.1 RAW MATERIAL SOURCING AND PREPARATION

4.6.2 MANUFACTURING AND ASSEMBLY

4.6.3 PACKAGING AND LABELLING

4.6.4 DISTRIBUTION AND LOGISTICS

4.6.5 RETAIL ACCESS AND END-USER ENGAGEMENT

4.6.6 POST-PURCHASE SUPPORT AND DISPOSAL MECHANISMS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 KEY COST COMPONENTS

4.7.1.1 RAW MATERIALS

4.7.1.2 COMPONENTS & REPLACEABLE FILTERS

4.7.1.3 LABOR COSTS

4.7.1.4 MANUFACTURING & EQUIPMENT (DEPRECIATION/OVERHEADS)

4.7.1.5 TESTING, CERTIFICATION & QUALITY ASSURANCE

4.7.1.6 PACKAGING & ACCESSORIES

4.7.1.7 DISTRIBUTION, LOGISTICS & SUPPLY CHAIN

4.7.1.8 OVERHEADS, SG&A, R&D, AND COMPLIANCE

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.8.2 ACTIVE DEVELOPMENT

4.8.3 STAGE OF DEVELOPMENT

4.8.4 TIMELINES AND MILESTONES

4.8.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.6 RISK ASSESSMENT AND MITIGATION

4.8.6.1 RISKS

4.8.6.2 MITIGATION STRATEGIES

4.8.7 FUTURE OUTLOOK

4.9 VALUE CHAIN ANALYSIS

4.9.1 RAW MATERIALS & PRIMARY COMPONENTS

4.9.2 COMPONENT MANUFACTURING & MASK/FILTER CONVERSION

4.9.3 EQUIPMENT & TECHNOLOGY PROVIDERS

4.9.4 QUALITY, STANDARDS & REGULATORY INTERFACE

4.9.5 DISTRIBUTION & INDUSTRIAL SUPPLY LOGISTICS

4.9.6 OEMS, CDMOS, TESTING LABS & SERVICE LAYER

4.9.7 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S)

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 PERSISTENT HIGH POLLUTION LEVELS ACROSS MAJOR APAC CITIES ARE STRENGTHENING LONG-TERM RELIANCE ON REPLACEABLE-FILTER DUST MASKS

7.1.2 STRENGTHENING OCCUPATIONAL SAFETY REGULATIONS IN CONSTRUCTION AND MINING, MANDATING CERTIFIED RESPIRATORY PROTECTION

7.1.3 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS

7.2 RESTRAINT

7.2.1 PRESENCE OF COUNTERFEIT PRODUCTS UNDERMINING TRUST AND SQUEEZING MARGINS OF COMPLIANT MANUFACTURERS

7.2.2 COMFORT AND FIT ISSUES REDUCING CONSISTENT MASK USAGE

7.3 OPPORTUNITES

7.3.1 SMART RESPIRATORS CREATING PREMIUM TECHNOLOGY-DRIVEN MARKET NICHES

7.3.2 EXPANDING HEALTHCARE INFRASTRUCTURE IN CHINA, INDIA, AND SOUTHEAST ASIA DRIVING HIGHER INSTITUTIONAL DEMAND FOR ADVANCED REPLACEABLE-FILTER RESPIRATORS

7.3.3 RISING ADOPTION OF INDUSTRIAL-GRADE AND SECTOR-SPECIFIC REPLACEABLE-FILTER MASK VARIANTS

7.4 CHALLENGES

7.4.1 NAVIGATING HETEROGENEOUS REGULATORY AND CERTIFICATION FRAMEWORKS

7.4.2 MANAGING INVENTORY PLANNING AND DEMAND VOLATILITY, WITH SUDDEN SPIKES DURING OUTBREAKS, POLLUTION EPISODES, OR DISASTERS

8 TABLE

9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

9.2.1 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR)

9.2.2 SPECIALTY URBAN / SPORTS POLLUTION MASKS

9.2.3 POWERED AIR-PURIFYING RESPIRATORS (PAPR)

9.2.4 FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS)

9.2.5 OTHERS

9.3 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 DUAL-FILTER PORT

9.3.2 SINGLE-FILTER PORT

9.4 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 STANDARD FULL-FACE

9.4.2 LOW-PROFILE / PANORAMIC

9.4.3 CHEMICAL-RESISTANT FULL FACE

10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS

10.1 OVERVIEW

10.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

10.2.1 HIGH-EFFICIENCY PARTICULATE FILTERS

10.2.2 HEPA-GRADE FILTERS

10.2.3 COMBINATION FILTERS (PARTICULATE + NUISANCE GAS/VAPOR)

10.2.4 OTHERS

11 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 INDUSTRIAL

11.2.2 MEDICAL / HEALTHCARE

11.2.3 OTHERS

11.3 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 CONSTRUCTION

11.3.2 MINING

11.3.3 AUTOMOTIVE

11.3.4 SMELTING / METALLURGY

11.3.5 SHIPBUILDING

11.3.6 AGRICULTURE & FORESTRY

11.3.7 OTHERS

12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, END USE

12.1 OVERVIEW

12.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 LARGE ENTERPRISES

12.2.2 GOVERNMENT & PUBLIC SAFETY

12.2.3 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.4 INDIVIDUAL / PROSUMER USERS

13 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 INDIRECT

13.2.2 DIRECT

13.3 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 E‑COMMERCE MARKETPLACES

13.3.2 INDUSTRIAL DISTRIBUTORS

13.3.3 RETAIL

14 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY

14.1 ASIA PACIFIC

14.1.1 INDONESIA

14.1.2 VIETNAM

14.1.3 THAILAND

15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 3M

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HONEYWELL INTERNATIONAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MSA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 SUZHOU SANICAL PROTECTIVE PRODUCT MANUFACTURING CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SHIGEMATSU WORKS CO., LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 CAMBRIDGE MASK CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 DRÄGERWERK AG & CO. KGAA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 GVS S.P.A.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 KOKEN LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 MARKRITE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MOLDEX-METRIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGHAI DASHENG HEALTH PRODUCTS MANUFACTURING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 CONSUMER PROFILES AND PURCHASING BEHAVIOR FOR RESPIRATORY PROTECTION PRODUCTS

TABLE 2 SUMMARY OF KEY RAW MATERIALS AND THEIR FUNCTIONAL IMPACT

TABLE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET – BRAND OUTLOOK

TABLE 4 KEY PRODUCTS AND COMPETITIVE LANDSCAPE OF TOP GLOBAL RESPIRATOR AND DUST MASK BRANDS

TABLE 5 TYPICAL COST SHARES OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET:

TABLE 6 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 7 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 8 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 9 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 10 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 11 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC

TABLE 24 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 INDONESIA ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 INDONESIA FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 37 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 INDONESIA INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 40 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 INDONESIA INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 VIETNAM ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 VIETNAM FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 46 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 47 VIETNAM INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 49 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 VIETNAM INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 THAILAND ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 THAILAND FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 55 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 THAILAND INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 58 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 THAILAND INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FIVE SEGMENTS COMPRISE THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MARKET, BY PRODUCT TYPE (2025)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS IS A MAJOR FACTOR BOOSTING THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN 2026 & 2033

FIGURE 16 DROC

FIGURE 17 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2025

FIGURE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2025

FIGURE 20 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2025

FIGURE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, SNAPSHOT (2025)

FIGURE 23 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY SHARE 2025 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.