Asia Pacific Textured Butter Market

Taille du marché en milliards USD

TCAC :

%

USD

364.21 Million

USD

465.27 Million

2024

2032

USD

364.21 Million

USD

465.27 Million

2024

2032

| 2025 –2032 | |

| USD 364.21 Million | |

| USD 465.27 Million | |

|

|

|

Segmentation du marché du beurre texturé en Asie-Pacifique, par type (beurre texturé non salé et beurre texturé salé), type de produit (beurre d'origine animale (lait) et beurre d'origine végétale), catégorie (biologique et conventionnelle), application (boulangerie, glaces, sauces et condiments, confiserie et autres) – Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du beurre texturé

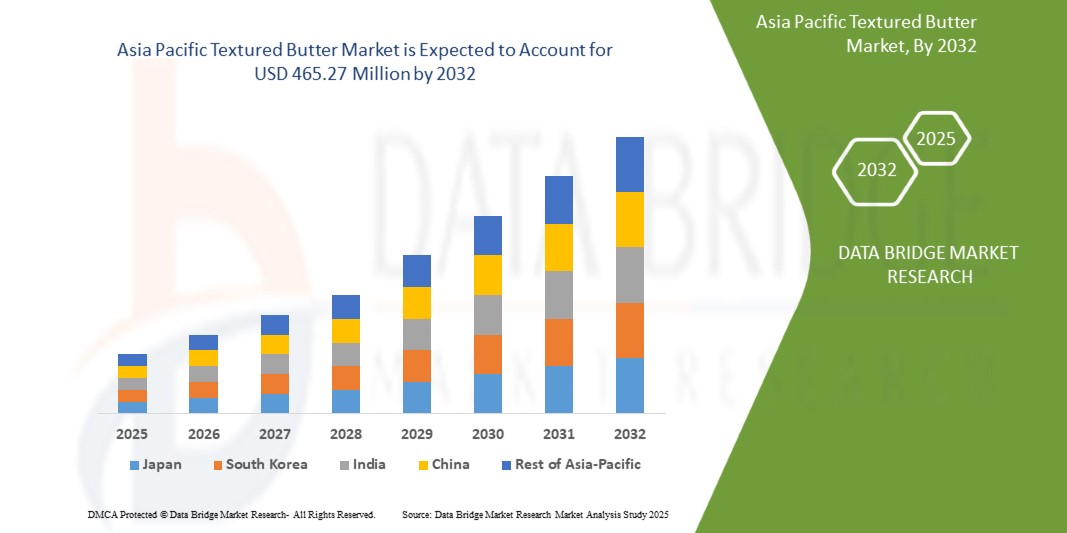

- Le marché du beurre texturé en Asie-Pacifique était évalué à 364,21 millions USD en 2024 et devrait atteindre 465,27 millions USD d'ici 2032.

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 3,17 %, principalement grâce à la demande croissante des consommateurs pour des expériences alimentaires sensorielles améliorées, aux tendances en matière d'étiquettes propres et à la préférence croissante pour les options de beurre tartinable de qualité supérieure dans les secteurs de la vente au détail et de la restauration.

- Cette croissance est tirée par des facteurs tels que la demande croissante de produits laitiers haut de gamme, la préférence accrue des consommateurs pour les ingrédients naturels et de marque propre, ainsi que l'innovation dans la transformation des aliments et les textures du beurre.

Analyse du marché du beurre texturé en Asie-Pacifique

- L'intérêt croissant des consommateurs pour les produits laitiers artisanaux et haut de gamme stimule la demande de beurre texturé. Cette tendance est alimentée par l'évolution des préférences gustatives, le souci de la santé et l'attrait des textures riches et onctueuses pour les applications gastronomiques et familiales, notamment sur les marchés développés et urbains.

- Les progrès des technologies de transformation alimentaire ont permis aux fabricants de proposer du beurre à la texture, à la tartinabilité et à la texture en bouche améliorées. Ces innovations répondent à des usages culinaires spécifiques, notamment en pâtisserie et en confiserie, renforçant ainsi leur attrait auprès des producteurs et des consommateurs.

- Le marché du beurre texturé connaît une croissance croissante, les consommateurs recherchant de plus en plus de produits aux labels propres, certifiés bio et soumis à une transformation minimale. Le beurre, notamment issu de pâturages ou de sources biologiques, est perçu comme une matière grasse plus saine, ce qui renforce sa popularité tant sur les marchés traditionnels que végétaux.

- Par exemple, le retour des produits laitiers entiers au Royaume-Uni. Des distributeurs comme Marks & Spencer et Yeo Valley signalent une hausse des ventes de lait entier et de beurre, stimulée par la préférence des consommateurs pour des textures plus onctueuses et leur scepticisme envers les alternatives allégées et transformées.

- Le beurre texturé gagne en popularité dans divers segments alimentaires, tels que la boulangerie, la confiserie, les sauces et les plats cuisinés. Sa polyvalence et sa capacité à rehausser la saveur et la consistance en font un ingrédient essentiel dans les cuisines domestiques et industrielles, élargissant son marché en Asie-Pacifique.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché du beurre texturé en Asie-Pacifique |

|

Segments couverts |

|

|

Countries Covered |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Textured Butter Market Trends

“Rising Demand For Premium, Artisanal Dairy Products”

- The Asia-Pacific textured butter market is being shaped by increasing consumer demand for gourmet and artisanal products. As people shift toward premium food experiences, textured butter—with its rich taste and visual appeal—is finding favor in both household kitchens and high-end culinary establishments, especially in urban and developed markets where quality and aesthetics influence buying decisions

- Health-conscious consumers are driving the growth of the textured butter market, with a notable preference for organic and clean-label options. Rich in natural fats and often minimally processed, textured butter aligns with current nutritional trends that favor whole foods over low-fat alternatives, reinforcing its inclusion in balanced, high-quality diets

- The surge in home baking and cooking, accelerated by lifestyle changes post-pandemic, has boosted the demand for specialty ingredients like textured butter. Its enhanced flavor and consistency make it a preferred choice for bakery products, sauces, and spreads, contributing to the diversification of usage across food categories

- For instance, rising consumer preference for artisanal, locally-made products—indicating a broader trend toward gourmet food, including textured butter

- Manufacturers are innovating within the textured butter market by introducing plant-based and lactose-free alternatives to cater to vegan and lactose-intolerant consumers. These product innovations, combined with sustainable packaging and sourcing initiatives, are expanding the consumer base and supporting long-term market growth

Asia-Pacific Textured Butter Market Dynamics

Drivers

“Rising Demand For Premium Dairy Products”

- Consumers today are more conscious about the ingredients and processing methods used in their food, leading to a surge in demand for premium dairy products that offer superior taste, texture, and nutritional benefits

- Textured butter, known for its enhanced spreadability, smoothness, and consistency, is becoming a preferred choice among both home cooks and professional chefs. The rise of fine dining, bakery, and confectionery industries has further fueled this trend, as textured butter enhances the quality of pastries, desserts, and premium food offerings. In addition, health-conscious consumers are opting for high-quality butter alternatives that contain fewer additives and preservatives while retaining natural richness

- For instance, In October 2024, Danone announced a USD 21.60 million investment to expand its operations in Punjab, capitalizing on the rising demand for premium dairy products in India. As consumers increasingly seek healthier and high-quality dairy options, Danone aims to grow its market share, competing with established players such as Amul

- In August 2024,edairynews published an article which states that the demand for premium dairy products in India surged as health-conscious consumers prioritized quality over cost. Driven by a growing awareness of natural ingredients, organic, grass-fed, and hormone-free options, the market is seeing increasing consumer preference for products offering superior taste and health benefits, reshaping the dairy sector

- The growth of organic and grass-fed dairy products has contributed to the increasing demand for premium butter varieties. Consumers are willing to pay a premium for products that are ethically sourced, environmentally friendly, and free from artificial ingredients. As a result, dairy manufacturers are innovating with different textures, flavors, and organic certifications to cater to this expanding market segment, further driving the textured butter market’s growth

Opportunities

“Shifting Consumer Inclination Towards Sustainable And Ethical Sourced Products”

- Consumers are increasingly shifting towards sustainable and ethically sourced textured butter, creating significant opportunities for the market. With rising awareness of environmental impact and ethical farming, buyers prefer butter made from responsibly sourced dairy. They look for certifications such as organic, fair trade, and grass-fed, ensuring that the product aligns with their values

- Sustainable sourcing involves eco-friendly farming practices that protect natural resources, reduce carbon footprints, and support biodiversity. Ethical sourcing ensures fair wages for farmers and humane treatment of animals. Many brands are now adopting transparent supply chains to meet these consumer expectations

- La demande croissante pour ces produits incite les fabricants à investir dans un approvisionnement responsable et des méthodes de production durables. Les entreprises qui privilégient les emballages écologiques, la réduction des déchets et l'approvisionnement en ingrédients éthiques peuvent acquérir un avantage concurrentiel sur le marché du beurre texturé en Asie-Pacifique. Avec l'évolution des préférences des consommateurs, les entreprises qui adhèrent aux normes de durabilité et d'éthique bénéficieront probablement d'une fidélité accrue à leur marque et d'une croissance du marché. Cette tendance représente une opportunité lucrative pour les fabricants d'élargir leur gamme de produits tout en répondant à la demande de choix alimentaires responsables.

Par exemple,

- En janvier 2023, une étude publiée sur le thème « Beurre produit durablement : l'effet de la connaissance des produits, de l'intérêt pour le développement durable et des caractéristiques des consommateurs sur la fréquence d'achat » souligne que la connaissance des consommateurs, leur intérêt pour le développement durable et les certifications de produits, telles que le bio et le commerce équitable, influencent significativement la fréquence d'achat et les préférences pour le beurre issu de sources éthiques. Cette tendance souligne la demande croissante de produits laitiers issus de sources responsables.

- En août 2024, un article publié par Ethical Consumer Research Association Ltd souligne que les consommateurs optent de plus en plus pour du beurre et des pâtes à tartiner bénéficiant de certifications éthiques telles que le commerce équitable et le bio, privilégiant la durabilité et l'approvisionnement responsable dans leurs décisions d'achat.

- Un article publié par le Fonds mondial pour la nature (WWF) indique que les pratiques agricoles durables, notamment les méthodes d'élevage laitier respectueuses de l'environnement et l'approvisionnement responsable, sont essentielles pour protéger les ressources naturelles, réduire l'empreinte carbone et promouvoir la biodiversité.

Les consommateurs exigent de plus en plus de beurre texturé issu de sources durables et éthiques, ce qui crée des opportunités de marché. Grâce à une sensibilisation croissante à l'impact environnemental et à l'agriculture éthique, les marques qui privilégient un approvisionnement responsable, des emballages écologiques et des chaînes d'approvisionnement transparentes acquièrent un avantage concurrentiel. Cette tendance stimule la croissance du marché et encourage les fabricants à se conformer aux normes de durabilité et d'éthique.

Contraintes/Défis

« Coûts de production élevés du beurre texturé »

- Le beurre texturé, en raison de son procédé de production spécialisé, nécessite une technologie plus avancée et des matières premières de meilleure qualité, comme la crème biologique ou de pâturage. Ces facteurs contribuent à son coût plus élevé que celui du beurre ordinaire. La nécessité de techniques de fabrication précises pour obtenir la consistance et la texture souhaitées accroît encore les coûts de production.

- Pour les fabricants, les coûts plus élevés liés à l'approvisionnement en ingrédients de qualité supérieure, au contrôle qualité et à l'investissement en équipements spécialisés peuvent limiter l'évolutivité et l'accessibilité du beurre texturé, notamment sur les marchés sensibles aux prix. Cela peut également freiner son adoption généralisée, notamment parmi les PME du secteur agroalimentaire, qui peuvent avoir du mal à absorber les coûts supplémentaires.

Par exemple,

- En décembre 2024, un rapport de Fast Company soulignait la flambée des prix du beurre due aux perturbations de la chaîne d'approvisionnement, aux pénuries de main-d'œuvre et à la hausse des coûts de production. Ces facteurs, notamment pour le beurre texturé, ont mis à rude épreuve les chefs et les consommateurs, renchérissant encore davantage le beurre et les matières premières de haute qualité.

- En avril 2024, William Reed Ltd a souligné que la hausse des prix du beurre était due à des facteurs tels que les conditions météorologiques extrêmes, l'instabilité politique et la hausse des coûts de l'énergie, qui font grimper les prix des produits laitiers et, par conséquent, les coûts de production du beurre. Cette hausse devrait persister grâce à une demande soutenue.

La sensibilité des consommateurs aux prix, notamment sur les marchés en développement, peut freiner la demande de beurre texturé, les consommateurs privilégiant des alternatives plus abordables. Par conséquent, la croissance du marché du beurre texturé est confrontée à des défis, notamment face à la concurrence des matières grasses et huiles moins chères dans l'industrie alimentaire au sens large.

Portée du marché du beurre texturé en Asie-Pacifique

Le marché est segmenté en fonction du type, du type de produit, de la catégorie et de l’application.

|

Segmentation |

Sous-segmentation |

|

Par type |

|

|

Par type de produit |

|

|

Par catégorie |

|

|

Par application |

|

Analyse régionale du marché du beurre texturé en Asie-Pacifique

« La Chine est le pays dominant sur le marché du beurre texturé en Asie-Pacifique »

- La Chine est en passe de dominer le marché du beurre texturé en raison de la demande croissante de produits laitiers de ses consommateurs, stimulée par l'adoption des régimes alimentaires occidentaux et l'essor de la classe moyenne. Cette évolution a entraîné une hausse significative des importations de beurre, notamment en provenance de Nouvelle-Zélande et de l'Union européenne, afin de répondre aux normes de qualité exigées par les boulangeries et les transformateurs alimentaires haut de gamme. De plus, l'expansion des secteurs nationaux de la boulangerie et de la confiserie a encore accru la demande de beurre de haute qualité.

« La Chine devrait enregistrer le taux de croissance le plus élevé »

- La Chine devrait enregistrer la plus forte croissance sur le marché du beurre texturé, en raison de la demande croissante des consommateurs en produits laitiers, stimulée par l'adoption des régimes alimentaires occidentaux et l'essor de la classe moyenne. Cette tendance a entraîné une hausse significative des importations de beurre, notamment en provenance de Nouvelle-Zélande et de l'Union européenne, afin de répondre aux normes de qualité exigées par les boulangeries et les transformateurs alimentaires haut de gamme. De plus, l'expansion des secteurs nationaux de la boulangerie et de la confiserie a encore accru la demande de beurre de haute qualité.

Part de marché du beurre texturé

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence régionale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les leaders du marché du beurre texturé en Asie-Pacifique opérant sur le marché sont :

- Flechard SAS (France)

- FrieslandCampina Professional (Pays-Bas)

- Royal VIVBuisman (Pays-Bas)

- Ingrédients Uelzena (Allemagne)

- LACTALIS (France)

- NUMIDIA BV (Pays-Bas)

- Lakeland Dairies (Irlande)

- CORMAN (Belgique)

Derniers développements sur le marché du beurre texturé en Asie-Pacifique

- En janvier, Lactalis Ingredients déploie une nouvelle identité graphique pour l'emballage de sa gamme de beurres. Cette mise à jour s'inscrit dans le cadre des efforts continus de l'entreprise pour améliorer la visibilité de sa marque et moderniser la présentation de ses produits. Ce nouveau design vise à refléter l'engagement de Lactalis en matière de qualité, d'innovation et de développement durable, tout en rendant l'emballage plus attrayant pour les consommateurs. Cette évolution permet à Lactalis Ingredients de renforcer la notoriété de sa marque, d'améliorer l'attrait auprès des consommateurs et de consolider son engagement en faveur de la qualité, de l'innovation et du développement durable.

- En mars, Lakeland Dairies a finalisé l' acquisition de De Brandt Dairy International NV, une entreprise belge spécialisée dans la matière grasse butyrique , afin d'accroître sa valeur ajoutée et d'étendre sa présence sur le marché européen. Elle a également renforcé sa position sur le marché européen du beurre, ouvrant de nouveaux marchés et de nouvelles catégories de produits. Cette opération stratégique devrait permettre d'améliorer la rentabilité de ses exploitations agricoles familiales et de développer son offre de produits de classe mondiale pour ses clients actuels et futurs.

- En février, FrieslandCampina a annoncé son intention de délocaliser sa production de beurre à Lochem, aux Pays-Bas, dans le cadre de ses efforts d'amélioration de l'efficacité et de la durabilité. Cette décision prévoit la fermeture de l'usine de Den Bosch d'ici début 2025, ce qui impactera environ 90 employés, auxquels l'entreprise offrira un soutien et des opportunités d'emploi alternatives. Ce déménagement vise à optimiser les processus de production tout en garantissant des améliorations opérationnelles à long terme. FrieslandCampina souligne que la décision est encore soumise à des consultations avec les employés et à l'approbation des autorités réglementaires avant sa mise en œuvre définitive.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 VIETNAM

11.1.12 INDONESIA

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 129 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 131 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 146 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 148 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 150 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 165 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 167 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 169 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 184 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 186 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 188 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 203 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 205 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 207 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 222 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 224 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 239 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 241 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 243 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 245 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 260 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 262 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 264 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 279 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 281 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 283 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 REST OF ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 2 ASIA-PACIFIC TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 21 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.