Asia Pacific Track Management System Market

Taille du marché en milliards USD

TCAC :

%

USD

1.87 Billion

USD

4.14 Billion

2024

2032

USD

1.87 Billion

USD

4.14 Billion

2024

2032

| 2025 –2032 | |

| USD 1.87 Billion | |

| USD 4.14 Billion | |

|

|

|

|

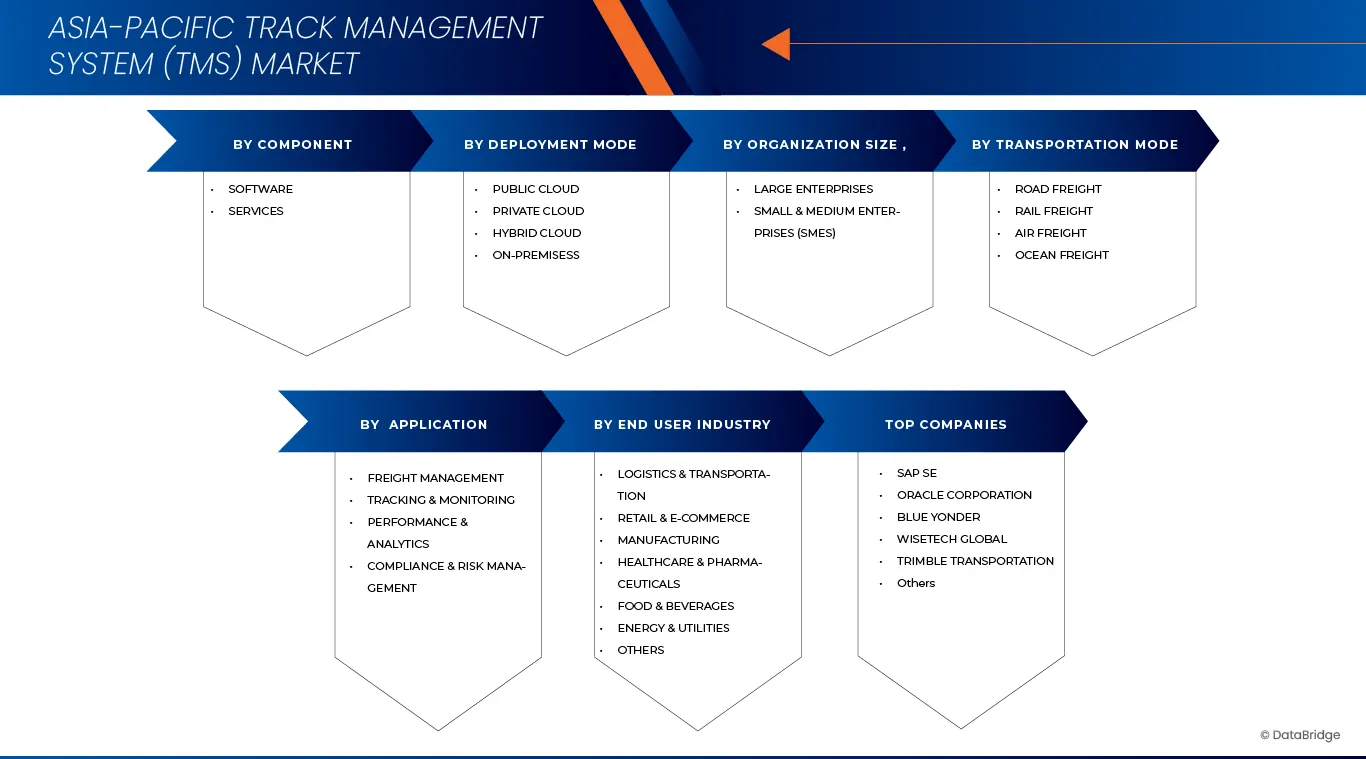

Segmentation du marché des systèmes de gestion du transport (TMS) en Asie-Pacifique, par composants (logiciels, services), mode de transport (fret routier, fret ferroviaire, fret aérien, fret maritime), mode de déploiement (cloud public, cloud privé, cloud hybride, sur site), application (gestion du fret, suivi et surveillance, conformité et gestion des risques, performance et analyse), taille de l'organisation (grandes entreprises, petites et moyennes entreprises (PME)), utilisateur final (logistique et transport, commerce de détail et commerce électronique, industrie manufacturière, santé et industrie pharmaceutique, agroalimentaire, énergie et services publics, autres) - Tendances du secteur et prévisions jusqu'en 2032

Taille du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

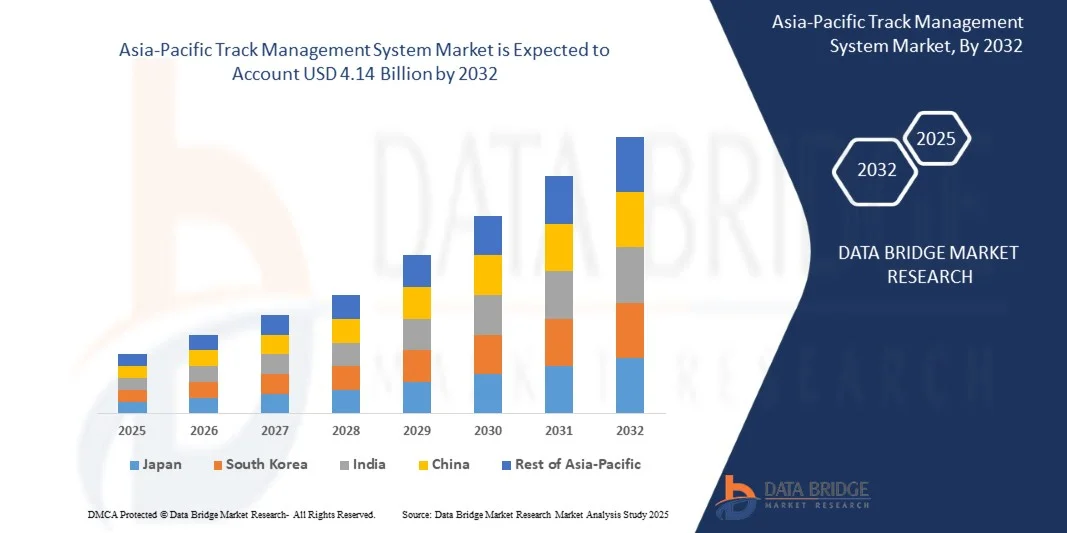

- Le marché des systèmes de gestion de voies ferrées en Asie-Pacifique était évalué à 1,87 milliard de dollars américains en 2024 et devrait atteindre 4,14 milliards de dollars américains d'ici 2032 , avec un TCAC de 10,7 % au cours de la période de prévision.

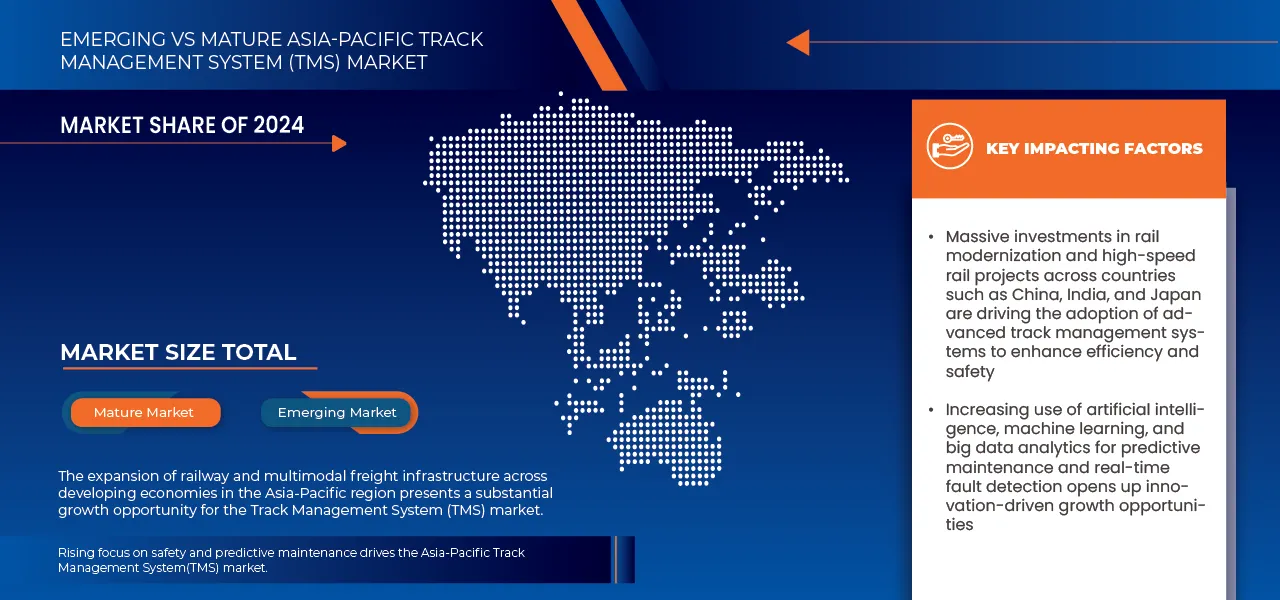

- La croissance du marché des systèmes de gestion des voies (TMS) en Asie-Pacifique est principalement tirée par l'expansion rapide des infrastructures ferroviaires, la hausse des investissements dans les projets de lignes à grande vitesse et la modernisation des réseaux ferroviaires existants dans les économies émergentes et développées de la région. L'augmentation du trafic ferroviaire, la demande croissante de métros liée à l'urbanisation et l'accent mis sur l'amélioration de la sécurité d'exploitation accélèrent encore l'adoption des technologies TMS. Les préoccupations croissantes concernant les accidents ferroviaires, la dégradation des infrastructures et les perturbations de service incitent les gouvernements et les opérateurs ferroviaires à adopter des solutions avancées de surveillance, de signalisation et de maintenance prédictive.

- Par ailleurs, la numérisation généralisée des écosystèmes de transport, soutenue par le déploiement croissant de capteurs IoT, d'analyses pilotées par l'IA, de systèmes d'inspection automatisés et d'outils de surveillance en temps réel de l'état des voies, contribue significativement à la croissance du marché. Les pays de la région Asie-Pacifique, notamment la Chine, l'Inde, le Japon et la Corée du Sud, sont à la pointe de l'intégration des technologies ferroviaires intelligentes afin d'améliorer la fiabilité du réseau et de réduire les coûts de maintenance. Le besoin croissant de contrôle centralisé, de gestion efficace des actifs et d'exploitation fluide basée sur les données fait du TMS un élément essentiel de la mobilité ferroviaire de nouvelle génération.

Analyse du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

- Le marché des systèmes de gestion des voies ferrées en Asie-Pacifique connaît une forte croissance, la modernisation des réseaux ferroviaires, l'amélioration de la sécurité et l'optimisation des actifs étant devenues des priorités absolues dans la région. Face à l'expansion rapide des métros, des lignes à grande vitesse et des itinéraires de fret, les solutions TMS avancées sont de plus en plus indispensables pour garantir la fiabilité opérationnelle, réduire les pannes liées aux voies et minimiser les interruptions de service. Leur capacité à prendre en charge la maintenance prédictive, la surveillance en temps réel et la préservation de l'intégrité des infrastructures à long terme favorise leur adoption généralisée dans les économies ferroviaires développées et émergentes.

- La demande croissante en Asie-Pacifique est fortement soutenue par la densification du trafic ferroviaire, l'expansion de la mobilité urbaine et une nette évolution vers des opérations ferroviaires rentables et axées sur la technologie. Les innovations technologiques, notamment l'analyse de données basée sur l'IA, les capteurs de voie connectés à l'Internet des objets (IoT), les systèmes d'inspection automatisés et les interfaces logicielles conviviales, accélèrent le déploiement des systèmes de gestion des voies par les autorités ferroviaires publiques et les opérateurs ferroviaires privés. Ces avancées améliorent la précision de la maintenance, réduisent les temps d'arrêt et renforcent la sécurité globale des voyageurs et des marchandises.

- La Chine a dominé le marché des systèmes de gestion des voies ferrées en Asie-Pacifique avec une part de revenus de 35,70 % en 2025, grâce à d'importants programmes d'expansion ferroviaire, un soutien politique renforcé aux technologies ferroviaires intelligentes et une attention accrue portée à la sécurité des infrastructures et à la maintenance prédictive. Son vaste réseau ferroviaire, le développement continu des lignes à grande vitesse et la priorité accordée à la transformation numérique du secteur ferroviaire contribuent significativement à l'adoption croissante de solutions TMS avancées.

- La Chine devrait connaître la croissance la plus rapide sur le marché au cours de la période de prévision, enregistrant un fort TCAC (taux de croissance annuel composé) porté par l'augmentation des budgets de transport, les initiatives nationales de mobilité intelligente et la demande croissante d'exploitation ferroviaire efficace et basée sur les données. L'amélioration de la connectivité régionale, les projets de modernisation menés par le gouvernement et une sensibilisation accrue à la sécurité des infrastructures positionnent la Chine comme le principal moteur de croissance du marché des systèmes de gestion des voies ferrées en Asie-Pacifique.

- Le segment des logiciels a dominé le marché mondial, représentant 70,08 % du chiffre d'affaires total en 2025, grâce à sa grande efficacité dans le drainage continu des plaies et le contrôle des infections.

Portée du rapport et segmentation du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

|

Attributs |

Principaux enseignements du marché des systèmes de gestion de voies en Asie-Pacifique |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie d'experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse PESTEL. |

Tendances du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

« L’Asie-Pacifique accorde une importance croissante à la sécurité des passagers, à l’automatisation et aux technologies de pointe en matière d’infrastructures ferroviaires »

- Une tendance majeure et croissante sur le marché des systèmes de gestion des voies ferrées en Asie-Pacifique est l'accent mis sur l'amélioration de la sécurité ferroviaire, de l'efficacité opérationnelle et de la fiabilité des infrastructures. Les gouvernements et les opérateurs ferroviaires de la région adoptent des technologies avancées de surveillance des voies, d'inspection automatisée et de maintenance prédictive afin de réduire les accidents, de minimiser les interruptions de service et de soutenir le développement rapide des réseaux ferroviaires à grande vitesse et de métro.

- Par exemple, des pays comme la Chine, le Japon, l'Inde et l'Australie déploient de plus en plus de systèmes d'inspection des voies ferrées pilotés par l'IA, de systèmes de surveillance de l'état des voies par capteurs et de jumeaux numériques pour détecter précocement les défauts et optimiser les programmes de maintenance. Les principaux acteurs du secteur intègrent des capteurs IoT, l'analyse de données dans le cloud et des outils de reporting en temps réel afin d'accélérer la prise de décision et de réduire la charge de travail liée aux inspections manuelles.

- L'évolution vers une infrastructure ferroviaire performante et rentable accélère l'innovation dans les solutions de gestion des voies. Les opérateurs ferroviaires de la région Asie-Pacifique privilégient les systèmes automatisés de mesure géométrique, les inspections par drones et les plateformes de surveillance intelligentes qui prolongent la durée de vie des actifs tout en réduisant les coûts de maintenance. Ces systèmes permettent également aux autorités ferroviaires de répondre à la demande croissante de services voyageurs et marchandises fiables et à haute fréquence.

- L'intérêt croissant pour l'automatisation, la maintenance basée sur les données et les technologies de pointe en matière de sécurité ferroviaire redessine le paysage concurrentiel du marché des systèmes de gestion des voies en Asie-Pacifique. Alors que les gouvernements investissent massivement dans la modernisation et l'expansion du réseau ferroviaire, la demande de solutions sophistiquées de gestion des voies, capables de soutenir des réseaux ferroviaires plus sûrs, plus intelligents et plus résilients dans toute la région, ne cesse de croître.

Dynamique du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

Conducteur

« Expansion rapide des réseaux ferroviaires et intensification des efforts de modernisation des infrastructures »

- L'expansion rapide des réseaux ferroviaires en Asie-Pacifique, alimentée par la demande croissante de passagers, le transport de marchandises et l'urbanisation, est un moteur essentiel du marché des systèmes de gestion des voies. Des pays comme la Chine, l'Inde, le Japon et l'Australie investissent massivement dans des infrastructures ferroviaires modernes, ce qui favorise l'adoption de technologies avancées de surveillance et de maintenance des voies afin de garantir la sécurité et la fiabilité d'exploitation.

- Par exemple, en 2024, les chemins de fer indiens ont accéléré leurs initiatives de modernisation en déployant des outils automatisés d'inspection des voies et des systèmes de surveillance basés sur l'IA sur les principaux axes afin d'améliorer l'efficacité de la maintenance et de réduire les risques de déraillement. De même, la Chine poursuit l'expansion de son réseau ferroviaire à grande vitesse, intégrant des plateformes numériques de gestion des voies pour permettre la détection des défauts en temps réel et la maintenance prédictive. Ces évolutions soulignent la dépendance croissante aux systèmes intelligents pour la modernisation à grande échelle des réseaux.

- Par ailleurs, l'importance croissante accordée dans la région aux projets de lignes ferroviaires à grande vitesse et de métro accroît le besoin de mesures précises de la géométrie des voies, d'analyses vibratoires et de solutions de surveillance de l'état des infrastructures. Alors que les gouvernements font de la sécurité et de la performance ferroviaires une priorité, la demande de systèmes intégrés de gestion des voies ne cesse de croître.

- La dynamique de transformation numérique, soutenue par les initiatives régionales de mobilité intelligente, les investissements dans les infrastructures publiques et l'adoption de l'Internet des objets, des drones et des technologies de capteurs, accélère le déploiement d'outils de maintenance automatisée et prédictive. Les autorités ferroviaires privilégient de plus en plus les systèmes qui améliorent la fiabilité, réduisent les inspections manuelles et minimisent les interruptions de service.

- La volonté de moderniser les infrastructures de manière rentable et grâce à la technologie contribue à une forte croissance du marché dans les économies développées et émergentes de la région Asie-Pacifique.

Retenue/Défi

« Coûts de mise en œuvre élevés et complexité des infrastructures sur différents réseaux ferroviaires »

- Malgré des perspectives de croissance solides, les investissements importants nécessaires au déploiement de systèmes de gestion de voies ferrées avancés demeurent un défi majeur sur le marché Asie-Pacifique. De nombreux pays de la région, notamment les marchés émergents d'Asie du Sud-Est, sont confrontés à des contraintes budgétaires qui limitent l'adoption des technologies modernes d'inspection et de surveillance.

- Par exemple, plusieurs opérateurs ferroviaires régionaux ont signalé des retards dans la modernisation de leurs systèmes existants en raison des coûts importants liés à l'intégration de capteurs IoT, de véhicules d'inspection automatisés et de plateformes numériques sur de vastes réseaux ferroviaires. Ce défi est accentué par le besoin de techniciens qualifiés capables d'assurer la maintenance et l'exploitation des équipements de surveillance avancés.

- De plus, la diversité et la complexité des infrastructures ferroviaires en Asie-Pacifique — des voies vieillissantes en Inde aux métropoles urbaines en pleine expansion en Indonésie et aux Philippines — rendent difficile la normalisation des pratiques de gestion des voies. Les variations de terrain, de climat et d'état des voies augmentent les besoins de maintenance et compliquent l'adoption de solutions de surveillance uniformes.

- Le faible niveau de préparation numérique, notamment dans les pays en développement, freine également la généralisation des technologies de maintenance prédictive et de surveillance en temps réel. Des problèmes tels que la connectivité irrégulière, les systèmes de signalisation obsolètes et la formation insuffisante du personnel limitent davantage l'efficacité du système.

- Pour relever ces défis, les gouvernements et les exploitants ferroviaires explorent de plus en plus des plans de modernisation par étapes, des partenariats public-privé et des solutions de surveillance rentables. Les fabricants développent des systèmes évolutifs et faciles à intégrer, adaptés aux limitations des infrastructures régionales, contribuant ainsi à améliorer la sécurité d'exploitation tout en réduisant les coûts globaux de modernisation.

Portée du marché des systèmes de gestion de voies en Asie-Pacifique

Le marché est segmenté en six segments notables qui reposent sur les composants, le mode de transport, le mode de déploiement, l'application, la taille de l'organisation et l'utilisateur final.

• Par composant

Le marché des systèmes de gestion des voies (TMS) en Asie-Pacifique est segmenté, selon les composants, en logiciels et services. Le segment des logiciels a dominé le marché mondial, représentant 70,08 % du chiffre d'affaires total en 2025, grâce à l'adoption croissante de solutions avancées de surveillance des voies, de maintenance prédictive et d'évaluation en temps réel de l'état des infrastructures. Ces solutions permettent aux opérateurs ferroviaires d'améliorer la sécurité, de réduire les temps d'arrêt et d'optimiser l'efficacité opérationnelle.

Le segment des logiciels devrait connaître le taux de croissance annuel composé le plus rapide, soit 11,0 %, entre 2025 et 2032, grâce à la croissance des investissements dans l'infrastructure ferroviaire numérique, l'intégration des technologies d'IA et d'IoT pour l'inspection automatisée des voies et la demande croissante d'outils de prise de décision basés sur les données pour améliorer la planification de la maintenance et réduire les coûts d'exploitation sur les réseaux ferroviaires de la région Asie-Pacifique.

• Par mode de transport

En fonction du mode de transport, le marché des systèmes de gestion du suivi en Asie-Pacifique est segmenté en fret routier, fret ferroviaire, fret aérien et fret maritime. Le segment du fret routier détenait la part de marché dominante de 45,09 % en 2025, principalement en raison de la croissance rapide des activités logistiques et de commerce électronique en Asie-Pacifique, de l'augmentation des volumes de transport routier pour la livraison de marchandises et du besoin de surveillance en temps réel des flottes et des cargaisons afin d'améliorer l'efficacité opérationnelle et de réduire les retards de transit.

Le segment du transport routier de marchandises devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 11,2 %, entre 2025 et 2032, en raison de l'adoption croissante de systèmes avancés de suivi et de gestion, de l'intégration des technologies de surveillance GPS et IoT, et de la demande croissante de solutions de visibilité de la chaîne d'approvisionnement, d'optimisation des itinéraires et de maintenance prédictive dans le transport routier à travers les économies émergentes et développées de la région.

• Par mode de déploiement

Selon le mode de déploiement, le marché des systèmes de gestion des voies (TMS) en Asie-Pacifique se segmente en cloud public, cloud privé, cloud hybride et solutions sur site. Le segment du cloud public a dominé le marché en 2025 avec une part de revenus de 49,60 %, grâce à son rapport coût-efficacité, son évolutivité et sa facilité de déploiement, permettant aux opérateurs ferroviaires de mettre en œuvre rapidement des solutions avancées de surveillance et de gestion des voies sans investissements initiaux importants dans l'infrastructure.

Le segment du cloud public devrait enregistrer le TCAC le plus rapide, soit 11,6 %, entre 2025 et 2032, grâce à l'adoption croissante de la maintenance prédictive basée sur le cloud, de l'analyse des données en temps réel, de l'intégration de l'IoT et des capacités de surveillance à distance, permettant aux opérateurs ferroviaires de la région Asie-Pacifique d'améliorer leur efficacité opérationnelle, de réduire les temps d'arrêt et d'optimiser la gestion des actifs ferroviaires.

• Sur demande

Selon l'application, le marché des systèmes de gestion du transport (TMS) en Asie-Pacifique est segmenté en gestion du fret, suivi et surveillance, conformité et gestion des risques, performance et analyse. Le segment de la gestion du fret dominait le marché en 2025 avec une part de revenus de 42,15 %, en raison de la demande croissante d'opérations de fret ferroviaire et routier efficaces, de l'augmentation des volumes de marchandises transportées dans la région Asie-Pacifique et du besoin de gérer en temps réel le mouvement des marchandises afin de réduire les retards, d'optimiser les itinéraires et de garantir une livraison ponctuelle.

Le segment de la gestion du fret devrait enregistrer le TCAC le plus rapide, soit 11,3 %, entre 2025 et 2032, grâce à l'adoption croissante de solutions TMS avancées intégrant l'IA.

• Par taille d'organisation

En fonction de la taille de l'organisation, le marché des systèmes de gestion du trafic (TMS) en Asie-Pacifique se divise en grandes entreprises et petites et moyennes entreprises (PME). Le segment des grandes entreprises dominait le marché en 2025 avec une part de revenus de 63,61 %, grâce à leurs budgets informatiques plus importants et à leur besoin de solutions de gestion du trafic avancées pour optimiser leurs opérations et garantir la conformité réglementaire.

Le segment des grandes entreprises devrait enregistrer le TCAC le plus rapide, soit 11,6 %, entre 2025 et 2032, grâce à l'adoption croissante de solutions TMS basées sur le cloud et l'IA pour améliorer la visibilité et l'efficacité des chaînes d'approvisionnement complexes.

• Par secteur d'activité de l'utilisateur final

Selon l'utilisateur final, le marché des systèmes de gestion du suivi (TMS) en Asie-Pacifique se segmente en logistique et transport, distribution et e-commerce, industrie manufacturière, santé et produits pharmaceutiques, agroalimentaire, énergie et services publics, et autres. Le segment de la logistique et du transport a dominé le marché en 2025 avec une part de revenus de 31,39 %, grâce à la demande croissante de suivi en temps réel, d'optimisation des itinéraires et de gestion efficace des flottes au sein des réseaux logistiques et de transport en expansion de la région Asie-Pacifique.

Le segment de la logistique et du transport devrait enregistrer le TCAC le plus rapide, soit 11,5 %, entre 2025 et 2032, grâce à la demande croissante de commerce électronique, à la numérisation des chaînes d'approvisionnement et à l'adoption de solutions TMS avancées pour une efficacité opérationnelle accrue.

Analyse régionale du marché des systèmes de gestion de voies en Asie-Pacifique

- La Chine a dominé le marché des systèmes de gestion des voies ferrées en Asie-Pacifique avec la plus grande part de revenus (35,70 %) en 2025, grâce à son vaste réseau ferroviaire à grande vitesse – le plus étendu au monde – et à ses investissements continus dans la modernisation numérique du réseau, les technologies d'inspection automatisées et les systèmes de surveillance par capteurs qui améliorent la sécurité et l'efficacité opérationnelles.

- Portée par la modernisation à grande échelle des infrastructures ferroviaires, l'augmentation du trafic passagers et les initiatives gouvernementales en faveur de la mobilité intelligente, la croissance du marché chinois est renforcée par de solides capacités de production nationales, l'adoption rapide de véhicules d'inspection automatisés des voies et l'intégration de l'IA, de l'IoT et de l'analyse prédictive dans les programmes nationaux de maintenance ferroviaire.

- En particulier, le déploiement à grande échelle de systèmes avancés de mesure de la géométrie des voies, de plateformes de surveillance en temps réel de l'état des infrastructures et de technologies de diagnostic à distance améliore considérablement la fiabilité et la résilience du réseau. Cette évolution technologique favorise l'adoption par le marché dans toute la région, les opérateurs privilégiant la sécurité, la réduction des temps d'arrêt et la rentabilité à long terme.

Analyse du marché des systèmes de gestion de voies en Asie-Pacifique

Le marché des systèmes de gestion des voies ferrées en Asie-Pacifique devrait enregistrer une croissance annuelle composée (TCAC) soutenue par l'expansion rapide des réseaux ferroviaires, l'augmentation des investissements dans les infrastructures de transport intelligentes et l'adoption croissante des technologies de surveillance automatisée des voies par capteurs. Des pays comme la Chine, l'Inde et le Japon sont les principaux moteurs de la demande régionale, grâce à d'importants programmes de modernisation financés par les gouvernements, à une urbanisation rapide et au besoin croissant de systèmes ferroviaires performants et à haute capacité pour le transport de passagers et de marchandises. Les progrès réalisés dans les technologies de sécurité ferroviaire, notamment les outils de maintenance prédictive, les systèmes d'inspection basés sur l'intelligence artificielle et les solutions de surveillance connectées, contribuent également à accélérer la croissance du marché dans toute la région.

Analyse du marché des systèmes de gestion de voies ferrées en Asie-Pacifique (Japon)

Le marché des systèmes de gestion des voies ferrées en Asie-Pacifique, au Japon, connaît une forte croissance, le pays faisant de la sécurité ferroviaire, de la maintenance de précision et de la modernisation des infrastructures vieillissantes une priorité. Les vastes réseaux ferroviaires à grande vitesse et urbains du Japon exigent des systèmes d'inspection, de mesure géométrique et de maintenance prédictive de haute précision, ce qui favorise l'adoption de technologies avancées de surveillance des voies. L'accent mis par le pays sur l'automatisation, la robotique et la maintenance basée sur les données, conjugué à la nécessité d'optimiser l'efficacité opérationnelle dans un contexte de diminution des effectifs, accélère la transition vers des solutions de gestion des voies intelligentes et automatisées.

Analyse du marché des systèmes de gestion de voies ferrées en Chine et en Asie-Pacifique

Le marché des systèmes de gestion des voies ferrées en Asie-Pacifique, en Chine, a généré la plus grande part de revenus de la région en 2025. Cette situation est portée par l'expansion continue du plus grand réseau ferroviaire à grande vitesse au monde, la demande croissante de fret ferroviaire et d'importants investissements publics dans la modernisation numérique du réseau ferroviaire. La Chine intègre rapidement la détection des défauts par intelligence artificielle, les véhicules d'inspection automatisés et les capteurs de voie connectés à l'Internet des objets (IoT) sur l'ensemble de son réseau. La forte présence de fabricants chinois de technologies ferroviaires proposant des systèmes de surveillance performants et économiques favorise également l'adoption du marché. Par ailleurs, les vastes programmes de modernisation du réseau ferroviaire chinois et l'accent mis sur la résilience à long terme des infrastructures positionnent le pays comme un acteur majeur du marché régional des systèmes de gestion des voies ferrées.

Part de marché des systèmes de gestion de voies en Asie-Pacifique

Le secteur des systèmes de gestion des voies ferrées est principalement dominé par des entreprises bien établies, notamment :

- SAP SE (Allemagne)

- Oracle (États-Unis)

- Blue Yonder Group, Inc. (États-Unis)

- WiseTech Global (Australie)

- Trimble (États-Unis)

- Groupe Alpega (Belgique)

- CH Robinson Worldwide, Inc. (États-Unis)

- Le groupe Descartes Systems Inc. (Canada)

- FarEye (États-Unis)

- FourKites, Inc. (États-Unis)

- Infios US, Inc. (États-Unis)

- Mara Labs Inc. (États-Unis)

- LogiNext Solutions (États-Unis)

- Manhattan Associates (États-Unis)

- Mobisoft Infotech (États-Unis)

- Projet44 (États-Unis)

- Ramco Systems (Inde)

- Shipsy.io (Inde)

- Shipwell (États-Unis)

- Softlink Global (Inde)

Dernières évolutions du marché des systèmes de gestion de voies ferrées en Asie-Pacifique

- En février 2025, LG CNS a été annoncée comme membre de l'initiative SAP SE Regional Strategic Services Partner (RSSP) pour la région Asie-Pacifique (APAC). Grâce à cette collaboration, SAP apportera à LG CNS un soutien stratégique, notamment en matière de planification conjointe de la commercialisation, de solutions sectorielles et d'accès à l'expertise régionale de SAP. De son côté, LG CNS déploiera ses services de migration ERP cloud et SAP S/4HANA dans toute la région APAC en s'appuyant sur ses capacités en IA, cloud et big data. Ce partenariat fait de LG CNS la première entreprise coréenne et la quatrième de la région APAC à rejoindre l'initiative RSSP de SAP, témoignant ainsi des fortes ambitions de croissance régionale des deux organisations.

- En juillet 2024, SAP SE et Capgemini ont annoncé l'extension de leur partenariat stratégique de longue date afin d'intégrer l'IA générative aux processus métiers clés tels que les RH, les achats, le développement durable et les ventes. Cette collaboration associe l'expertise reconnue de Capgemini en matière de transformations SAP à grande échelle et ses capacités en matière de données et d'IA au portefeuille d'IA métier de SAP, basé sur la plateforme SAP Business Technology Platform (SAP BTP).

- En avril 2025, Oracle a été désigné comme leader du Magic Quadrant de Gartner, Inc. pour les systèmes de gestion des transports pour la 18e fois. L'entreprise a obtenu le meilleur classement pour sa capacité d'exécution et le plus haut niveau pour sa vision stratégique. Cette distinction souligne le leadership constant d'Oracle dans le domaine de la gestion des transports grâce à sa plateforme Oracle Fusion Cloud Transportation Management, qui fait partie de sa suite Cloud Supply Chain & Manufacturing (SCM).

- En septembre 2024, JP Morgan Payments et Oracle Corporation ont annoncé un partenariat élargi renforçant l'intégration de leurs services de paiement, de trésorerie et de financement du commerce international aux applications cloud d'Oracle. Cette collaboration s'appuie sur leurs travaux antérieurs et propose de nouveaux modules, tels que la visibilité en temps réel des soldes de trésorerie, la gestion automatisée des dépenses via Oracle Fusion Cloud et les cartes commerciales JP Morgan, le financement intégré de la chaîne d'approvisionnement pour l'optimisation des paiements fournisseurs et la connectivité des points de vente en magasin pour le commerce de détail et la restauration via la suite Oracle Commerce.

- En 2025, Blue Yonder a lancé une solution de gestion des transports améliorée, intégrant l'intelligence artificielle et un réseau multi-entreprises afin de renforcer la résilience de la logistique et de la chaîne d'approvisionnement. La plateforme comprenait un agent d'opérations logistiques pour des informations en temps réel, un calculateur d'émissions logistiques pour une optimisation du développement durable et une IA conversationnelle pour une prise de décision simplifiée. Ce développement visait à offrir une visibilité de bout en bout, une efficacité opérationnelle et une durabilité accrues au sein des réseaux d'approvisionnement mondiaux.

- En mars 2025, Alpega a renforcé sa plateforme de transport numérique avec Alpega Ocean Booking, un nouveau module de fret maritime intégré directement à son TMS. Cette solution a été conçue pour offrir aux expéditeurs un accès direct et complet aux transporteurs maritimes via INTTRA, améliorer la maîtrise des coûts et garantir une visibilité en temps réel sans intermédiaires. La durabilité a été renforcée grâce à l'optimisation des itinéraires multimodaux, la dématérialisation des processus et la prise en charge du transport maritime à faibles émissions. Ce lancement a permis à Alpega de proposer un flux de travail logistique de bout en bout plus complet, couvrant la planification, l'exécution, l'approvisionnement et la conformité.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND APPLICATION

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 COMPANY SERVICE PLATFORM MATRIX

4.3 NEW BUSINESS AND EMERGING BUSINESSES' REVENUE OPPORTUNITIES & FUTURE OUTLOOK

4.3.1 NEW BUSINESS & EMERGING BUSINESS OPPORTUNITIES IN SOFTWARE & HARDWARE DEVELOPMENT

4.3.2 NEW BUSINESS & EMERGING BUSINESS OPPORTUNITIES IN DATA ACQUISITION & INTEGRATION

4.3.3 NEW BUSINESS & EMERGING BUSINESS OPPORTUNITIES IN SYSTEM CUSTOMIZATION & SOLUTION DESIGN

4.3.4 NEW BUSINESS & EMERGING BUSINESS OPPORTUNITIES IN DEPLOYMENT & INSTALLATION

4.3.5 CONCLUSION

4.4 PENETRATION AND GROWTH PROSPECT MAPPING – ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET

4.4.1 MARKET PENETRATION LANDSCAPE

4.4.1.1 HIGH-PENETRATION MARKETS

4.4.1.2 MODERATE-PENETRATION MARKETS

4.4.1.3 LOW-PENETRATION MARKETS

4.4.2 GROWTH PROSPECT MAPPING

4.4.2.1 HIGH-GROWTH POTENTIAL MARKETS

4.4.2.2 MODERATE-GROWTH POTENTIAL MARKETS

4.4.2.3 LOW-GROWTH POTENTIAL MARKETS

4.4.3 PENETRATION VS. GROWTH OUTLOOK MATRIX

4.4.4 STRATEGIC IMPLICATIONS FOR STAKEHOLDERS

4.4.4.1 FOR TECHNOLOGY VENDORS

4.4.4.2 FOR REGULATORS AND RAIL OPERATORS

4.4.4.3 FOR INVESTORS

4.4.5 CONCLUSION

4.5 PRICING ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.6.1 SOFTWARE & HARDWARE DEVELOPMENT

4.6.2 DATA ACQUISITION & INTEGRATION

4.6.3 SYSTEM CUSTOMIZATION & SOLUTION DESIGN

4.6.4 DEPLOYMENT & INSTALLATION

4.6.5 OPERATIONAL MONITORING & MAINTENANCE

4.6.6 DISTRIBUTION & LOGISTICS INTEGRATION

4.6.7 END-USE APPLICATIONS (FREIGHT OPERATORS AND GOVERNMENTS)

4.6.8 CONCLUSION

5 TARIFF & ITS ANALYSIS

5.1 OVERVIEW OF RELEVANT TARIFFS

5.2 TRADE POLICIES INFLUENCING THE MARKET

5.3 COST IMPACT ON STAKEHOLDERS

5.4 SUPPLY CHAIN DISRUPTIONS

5.5 STRATEGIC RESPONSE BY OEM

6 REGULATORY STANDARDS — ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET

6.1 SAFETY, SIGNALLING AND OPERATIONAL COMPLIANCE

6.2 INTEROPERABILITY AND TECHNICAL STANDARDS

6.3 ASSET-MANAGEMENT, RECORDKEEPING AND AUDITABILITY

6.4 DATA PROTECTION & PRIVACY (CROSS-BORDER DATA FLOWS)

6.5 CYBERSECURITY & CRITICAL-INFRASTRUCTURE REQUIREMENTS

6.6 PROCUREMENT, CERTIFICATION & SUPPLIER DUE DILIGENCE

6.7 ENVIRONMENTAL, SAFETY & OCCUPATIONAL HEALTH REGULATIONS

6.8 INCIDENT REPORTING & REGULATORY NOTIFICATION

6.9 STANDARDS BODIES, GUIDANCE AND REFERENCES (EXAMPLES TO CONSULT)

6.1 COUNTRY-SPECIFIC HIGH-LEVEL NOTES (ILLUSTRATIVE, NON-EXHAUSTIVE)

6.11 COMPLIANCE CHECKLIST (TO BE REQUIRED IN RFP / PROCUREMENT)

6.12 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID RAILWAY INFRASTRUCTURE EXPANSION

7.1.2 RISING FOCUS ON SAFETY AND PREDICTIVE MAINTENANCE

7.1.3 GOVERNMENT INITIATIVES AND SMART RAIL PROGRAMS

7.1.4 INTEGRATION OF IOT, AI, AND CLOUD TECHNOLOGIES

7.2 RESTRAINTS

7.2.1 HIGH INITIAL INVESTMENT AND IMPLEMENTATION COSTS

7.2.2 DATA SECURITY AND PRIVACY CONCERNS

7.3 OPPORTUNITIES

7.3.1 EXPANSION INTO DEVELOPING ECONOMIES

7.3.2 ADVANCEMENTS IN AI AND PREDICTIVE ANALYTICS

7.3.3 INTEGRATION OF MULTIMODAL FREIGHT MANAGEMENT

7.4 CHALLENGES

7.4.1 LENGTHY REGULATORY APPROVAL PROCESSES

7.4.2 INTENSE MARKET COMPETITION

8 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET: BY COMPONENT

8.1 OVERVIEW

8.2 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

8.3 SOFTWARE

8.4 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

8.4.1 CLOUD-BASED

8.4.2 ON-PREMISES

8.4.3 HYBRID

8.5 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.5.1 ROUTE PLANNING & OPTIMIZATION

8.5.2 ANALYTICS & REPORTING DASHBOARDS

8.5.3 LOAD PLANNING & CONSOLIDATION

8.5.4 FLEET & ASSET TRACKING

8.5.5 FREIGHT AUDIT & PAYMENT

8.5.6 ORDER MANAGEMENT SYSTEM INTEGRATION

8.5.7 RISK & COMPLIANCE MANAGEMENT

8.6 ASIA-PACIFIC SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.6.1 PROFESSIONAL SERVICES

8.6.2 MANAGED SERVICES

8.7 ASIA-PACIFIC PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.7.1 IMPLEMENTATION & INTEGRATION

8.7.2 CONSULTING

8.7.3 TRAINING & CERTIFICATION

8.8 ASIA-PACIFIC IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.8.1 API/EDI CONNECTIVITY

8.8.2 LEGACY SYSTEM MIGRATION

8.9 ASIA-PACIFIC CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.9.1 PROCESS OPTIMIZATION CONSULTING

8.9.2 TECHNOLOGY ROADMAP CONSULTING

8.1 ASIA-PACIFIC MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

8.10.1 24/7 MONITORING & HELPDESK

8.10.2 OUTSOURCED IT SUPPORT

8.10.3 END-TO-END SYSTEM ADMINISTRATION

9 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE

9.1 OVERVIEW

9.2 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

9.3 ROAD FREIGHT

9.4 OCEAN FREIGHT

9.5 RAIL FREIGHT

9.6 AIR FREIGHT

9.7 ASIA-PACIFIC ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.7.1 LONG-HAUL TRUCKING

9.7.2 LAST-MILE DELIVERY

9.7.3 COURIER, EXPRESS & PARCEL (CEP)

9.8 ASIA-PACIFIC OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.8.1 FULL CONTAINER LOAD (FCL)

9.8.2 LESS THAN CONTAINER LOAD (LCL)

9.8.3 BULK CARRIERS

9.9 ASIA-PACIFIC RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.9.1 BULK COMMODITY MOVEMENT

9.9.2 CONTAINERIZED FREIGHT

9.1 ASIA-PACIFIC AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.10.1 INTERNATIONAL CARGO

9.10.2 DOMESTIC CARGO

9.10.3 EXPRESS SHIPMENTS

9.11 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

9.11.1 PUBLIC CLOUD

9.11.2 ON-PREMISES

9.11.3 PRIVATE CLOUD

9.11.4 HYBRID CLOUD

10 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 FREIGHT MANAGEMENT

10.4 TRACKING & MONITORING

10.5 PERFORMANCE & ANALYTICS

10.6 COMPLIANCE & RISK MANAGEMENT

10.7 ASIA-PACIFIC FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.7.1 LOAD CONSOLIDATION & OPTIMIZATION

10.7.2 ORDER PROCESSING & BILLING AUTOMATION

10.7.3 CARRIER SELECTION & RATE MANAGEMENT

10.8 ASIA-PACIFIC TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.8.1 REAL-TIME VEHICLE TRACKING

10.8.2 FLEET MANAGEMENT

10.8.3 SHIPMENT VISIBILITY

10.9 ASIA-PACIFIC REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.9.1 GPS-BASED TRACKING

10.9.2 RFID-BASED TRACKING

10.1 ASIA-PACIFIC FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.10.1 FUEL USAGE MONITORING

10.10.2 MAINTENANCE SCHEDULING

10.11 ASIA-PACIFIC SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.11.1 END-TO-END CARGO TRACKING

10.11.2 CUSTOMER PORTAL ACCESS

10.12 ASIA-PACIFIC PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.12.1 KPI DASHBOARDING

10.12.2 PREDICTIVE ANALYTICS

10.12.3 BENCHMARKING & SCORECARDS

10.13 ASIA-PACIFIC COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

10.13.1 CUSTOMS & REGULATORY COMPLIANCE

10.13.2 SAFETY MONITORING

10.13.3 INCIDENT & RISK REPORTING

10.14 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

11 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE

11.1 OVERVIEW

11.2 LARGE ENTERPRISES

11.3 SMALL & MEDIUM ENTERPRISES (SMES)

11.4 ASIA-PACIFIC LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

11.4.1 MULTINATIONAL LOGISTICS PROVIDERS

11.4.2 LARGE RETAIL & MANUFACTURING ENTERPRISES

11.5 ASIA-PACIFIC SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

11.5.1 REGIONAL 3PL/4PL PROVIDERS

11.5.2 SMES IN E-COMMERCE & RETAIL

11.6 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

12 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY END USER

12.1 OVERVIEW

12.2 LOGISTICS & TRANSPORTATION

12.3 RETAIL & E-COMMERCE

12.4 MANUFACTURING

12.5 HEALTHCARE & PHARMACEUTICALS

12.6 FOOD & BEVERAGES

12.7 ENERGY & UTILITIES

12.8 OTHERS

12.9 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.9.1 3PL PROVIDERS

12.9.2 FREIGHT FORWARDERS

12.9.3 POSTAL & PARCEL OPERATORS

12.1 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.10.1 SOFTWARE

12.10.2 SERVICES

12.11 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.11.1 OMNI-CHANNEL RETAILERS

12.11.2 ONLINE MARKETPLACES

12.12 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.12.1 SOFTWARE

12.12.2 SERVICES

12.13 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.13.1 AUTOMOTIVE OEMS & SUPPLIERS

12.13.2 ELECTRONICS & HIGH-TECH

12.13.3 INDUSTRIAL GOODS

12.14 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.14.1 SOFTWARE

12.14.2 SERVICES

12.15 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.15.1 COLD CHAIN LOGISTICS PROVIDERS

12.15.2 SPECIALTY DRUG TRANSPORT

12.16 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.16.1 SOFTWARE

12.16.2 SERVICES

12.17 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.17.1 PERISHABLE GOODS TRANSPORT

12.17.2 QUICK SERVICE RESTAURANT SUPPLY CHAINS

12.18 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.18.1 SOFTWARE

12.18.2 SERVICES

12.19 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

12.19.1 OIL & GAS SUPPLY CHAINS

12.19.2 UTILITY EQUIPMENT TRANSPORT

12.2 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.20.1 SOFTWARE

12.20.2 SERVICES

12.21 ASIA-PACIFIC OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

12.21.1 SOFTWARE

12.21.2 SERVICES

13 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET BY COUNTRY

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 THAILAND

13.1.7 INDONESIA

13.1.8 MALAYSIA

13.1.9 PHILIPPINES

13.1.10 SINGAPORE

13.1.11 NEWZEALAND

13.1.12 TAIWAN

13.1.13 HONG KONG

13.1.14 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 COMPANY PROFILE

15.1 SAP SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 ORACLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 BLUE YONDER GROUP, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 WISETECH GLOBAL.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TRIMBLE

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALPEGA GROUP

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 C.H. ROBINSON WORLDWIDE, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 THE DESCARTES SYSTEMS GROUP INC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 FAREYE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FOURKITES, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 INFIOS US, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 MARA LABS INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LOGINEXT SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MANHATTAN ASSOCIATES

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MOBISOFT INFOTECH

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROJECT44

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 RAMCO SYSTEMS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SHIPSY.IO

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SHIPWELL

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 SOFTLINK GLOBAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM (TMS) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 43 REGION

TABLE 44 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 45 USD THOUSAND

TABLE 46 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 85 USD THOUSAND

TABLE 86 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CHINA RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CHINA AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 100 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 CHINA FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CHINA TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CHINA REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CHINA FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CHINA SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 CHINA PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 CHINA COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 109 CHINA LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 CHINA SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CHINA TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 CHINA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CHINA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 114 CHINA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 CHINA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 116 CHINA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CHINA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 118 CHINA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CHINA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 120 CHINA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CHINA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 122 CHINA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CHINA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 124 CHINA OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 125 USD THOUSAND

TABLE 126 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 127 INDIA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 128 INDIA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 INDIA SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 INDIA PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDIA IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDIA CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 INDIA MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 135 INDIA ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 INDIA OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDIA RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 INDIA AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 140 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 INDIA FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 INDIA TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 INDIA REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 INDIA FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 INDIA SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 INDIA PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDIA COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 149 INDIA LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDIA SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INDIA TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 152 INDIA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 INDIA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 154 INDIA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 INDIA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 156 INDIA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 INDIA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 158 INDIA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 INDIA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 160 INDIA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 INDIA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 162 INDIA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 INDIA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 164 INDIA OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 165 USD THOUSAND

TABLE 166 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 167 JAPAN SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 168 JAPAN SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 JAPAN SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 JAPAN PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 JAPAN IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 JAPAN CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 JAPAN MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 175 JAPAN ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 JAPAN OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 JAPAN RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 JAPAN AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 180 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 JAPAN FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 JAPAN TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 JAPAN REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 JAPAN FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 JAPAN SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 JAPAN PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 JAPAN COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 189 JAPAN LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 JAPAN SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 JAPAN TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 192 JAPAN LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 JAPAN LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 194 JAPAN RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 JAPAN RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 196 JAPAN MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 JAPAN MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 198 JAPAN HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 JAPAN HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 200 JAPAN FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 JAPAN FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 202 JAPAN ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 JAPAN ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 204 JAPAN OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 205 USD THOUSAND

TABLE 206 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 207 SOUTH KOREA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 208 SOUTH KOREA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SOUTH KOREA SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SOUTH KOREA PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SOUTH KOREA IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SOUTH KOREA CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SOUTH KOREA MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 215 SOUTH KOREA ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SOUTH KOREA OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SOUTH KOREA RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SOUTH KOREA AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 220 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 SOUTH KOREA FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SOUTH KOREA TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SOUTH KOREA REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 SOUTH KOREA FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SOUTH KOREA SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SOUTH KOREA PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SOUTH KOREA COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 229 SOUTH KOREA LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SOUTH KOREA SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SOUTH KOREA TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 232 SOUTH KOREA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SOUTH KOREA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH KOREA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SOUTH KOREA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH KOREA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SOUTH KOREA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH KOREA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SOUTH KOREA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH KOREA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SOUTH KOREA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH KOREA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SOUTH KOREA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 244 SOUTH KOREA OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 245 USD THOUSAND

TABLE 246 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 248 AUSTRALIA SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 AUSTRALIA SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 AUSTRALIA PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 AUSTRALIA IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 AUSTRALIA CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 AUSTRALIA MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 255 AUSTRALIA ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 AUSTRALIA OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 AUSTRALIA RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 AUSTRALIA AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 260 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 AUSTRALIA FREIGHT MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 AUSTRALIA TRACKING & MONITORING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 AUSTRALIA REAL-TIME VEHICLE TRACKING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 AUSTRALIA FLEET MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 AUSTRALIA SHIPMENT VISIBILITY IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 AUSTRALIA PERFORMANCE & ANALYTICS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 AUSTRALIA COMPLIANCE & RISK MANAGEMENT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 269 AUSTRALIA LARGE ENTERPRISES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 AUSTRALIA SMALL & MEDIUM ENTERPRISES (SMES) IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 AUSTRALIA TRACK MANAGEMENT SYSTEM MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 272 AUSTRALIA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 AUSTRALIA LOGISTICS & TRANSPORTATION IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 274 AUSTRALIA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 AUSTRALIA RETAIL & E-COMMERCE IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 276 AUSTRALIA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 AUSTRALIA MANUFACTURING IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 278 AUSTRALIA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 AUSTRALIA HEALTHCARE & PHARMACEUTICALS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 280 AUSTRALIA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 AUSTRALIA FOOD & BEVERAGES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 282 AUSTRALIA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 AUSTRALIA ENERGY & UTILITIES IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 284 AUSTRALIA OTHERS IN TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 285 USD THOUSAND

TABLE 286 THAILAND TRACK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 287 THAILAND SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 288 THAILAND SOFTWARE IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 THAILAND SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 THAILAND PROFESSIONAL SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 THAILAND IMPLEMENTATION & INTEGRATION IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 THAILAND CONSULTING IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 THAILAND MANAGED SERVICES IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 THAILAND TRACK MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE, 2018-2032 (USD THOUSAND)

TABLE 295 THAILAND ROAD FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 THAILAND OCEAN FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 THAILAND RAIL FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 THAILAND AIR FREIGHT IN TRACK MANAGEMENT SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 THAILAND TRACK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 300 THAILAND TRACK MANAGEMENT SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)