Asia Pacific Unmanned Ground Vehicle Market

Taille du marché en milliards USD

TCAC :

%

USD

1.82 Billion

USD

3.44 Billion

2025

2033

USD

1.82 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.82 Billion | |

| USD 3.44 Billion | |

|

|

|

|

Segmentation du marché des véhicules terrestres sans pilote en Asie-Pacifique, par application (militaire, commerciale et forces de l'ordre fédérales), taille (grand (227 à 454 kg), moyen (91 à 227 kg), très grand (454 à 907 kg), extrêmement grand ( 907 kg) et petit (4,5 à 91 kg)), système (charges utiles, unités de contrôle, connecteurs, câbles électriques, actionneurs et éléments mécaniques), mobilité (chenillé, à roues, à pattes et autres), mode de fonctionnement (télécommandé, autonome et filaire) - Tendances du secteur et prévisions jusqu'en 2032

Quelle est la taille et le taux de croissance du marché des véhicules terrestres sans pilote en Asie-Pacifique ?

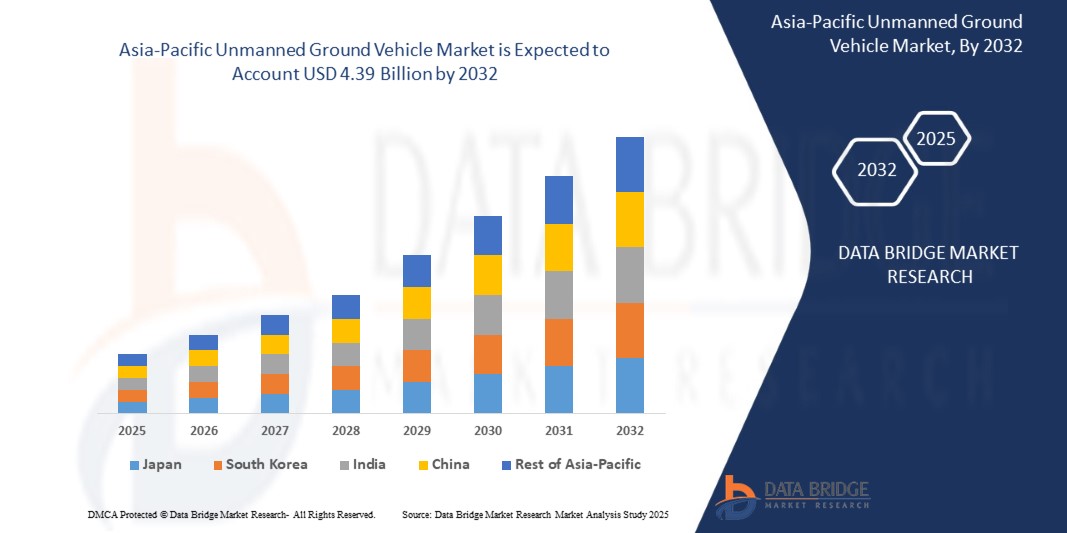

- Le marché des véhicules terrestres sans pilote en Asie-Pacifique était évalué à 1,50 milliard de dollars américains en 2024 et devrait atteindre 4,39 milliards de dollars américains d'ici 2032 , avec un TCAC de 14,30 % au cours de la période de prévision.

- La demande croissante de véhicules terrestres sans pilote pour le secteur agricole est l'un des principaux facteurs de croissance du marché. L'industrie propose de nouveaux produits pour améliorer la connectivité réseau des véhicules et des plateformes robotiques, ce qui stimule le développement du marché.

- La demande croissante de systèmes autonomes dans les secteurs de la défense et du commerce stimule la croissance du marché.

Quels sont les principaux enseignements du marché des véhicules terrestres sans pilote ?

- L'intensification des programmes de modernisation de la défense, la priorité accordée à la réduction des pertes humaines et l'accélération de l'automatisation dans les secteurs de la logistique et des mines contribuent conjointement à l'augmentation de la demande. Le marché des véhicules terrestres sans pilote bénéficie également de la baisse des coûts des capteurs et de l'informatique, permettant une autonomie sophistiquée sans augmentation proportionnelle des prix.

- Le marché chinois des véhicules terrestres sans pilote a décroché la plus grande part de marché en Asie-Pacifique en 2024, grâce à l'expansion du complexe militaro-industriel du pays, à d'importants investissements dans l'IA et la robotique, et à l'importance croissante accordée aux systèmes sans pilote pour la logistique et la surveillance.

- Le marché indien des véhicules terrestres sans pilote devrait connaître une forte croissance annuelle composée jusqu'en 2032, portée par l'initiative « Make in India », l'augmentation des dépenses de défense et les besoins urgents en matière de surveillance des frontières et de capacités de lutte contre l'insurrection.

- Le segment militaire a dominé le marché en 2024, représentant la plus grande part de revenus (61,5 %), grâce au déploiement accru de véhicules terrestres sans pilote pour la surveillance, le soutien au combat, la logistique et la déminage.

Portée du rapport et segmentation du marché des véhicules terrestres sans pilote

|

Attributs |

Principaux enseignements du marché des véhicules terrestres sans pilote |

|

Segments couverts |

|

|

Pays couverts |

Asie-Pacifique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des véhicules terrestres sans pilote ?

« Capacités autonomes et intégration de l’IA : redéfinir les opérations au sol »

- L'une des tendances dominantes qui façonnent le marché des véhicules terrestres sans pilote (UGV) est l'intégration rapide de l' IA , de l'apprentissage automatique et des technologies de navigation autonome, permettant une cartographie avancée du terrain, l'évitement des obstacles et une prise de décision en temps réel dans des scénarios critiques pour la mission.

- Par exemple, en février 2024, Rheinmetall AG a dévoilé son dernier modèle de véhicule terrestre autonome sans pilote, doté d'un système de reconnaissance de cibles et d'adaptation au terrain piloté par l'IA, conçu pour des missions de logistique et de surveillance dans les zones de conflit.

- Les véhicules terrestres sans pilote (UGV) sont de plus en plus souvent équipés de systèmes de fusion de capteurs, combinant LiDAR , radar, GPS et imagerie thermique pour améliorer la connaissance de la situation, notamment dans les environnements sans GPS et sur les terrains complexes.

- Les agences de défense et les acteurs du secteur privé se concentrent sur les plateformes modulaires de véhicules terrestres sans pilote, qui permettent d'adapter des charges utiles interchangeables telles que des armes, des capteurs ou des modules logistiques aux exigences variables des missions.

- De plus, les progrès réalisés dans le domaine de la communication V2X (véhicule-à-tout) permettent le partage de données en temps réel entre les véhicules terrestres sans pilote et les centres de commandement, améliorant ainsi la coordination et l'efficacité des opérations multi-unités.

- Cette transition vers des véhicules terrestres sans pilote plus intelligents et autonomes transforme les opérations militaires, minières et agricoles en réduisant les risques humains, en améliorant l'efficacité et en augmentant les taux de réussite des missions.

Quels sont les principaux moteurs du marché des véhicules terrestres sans pilote ?

- La demande croissante de systèmes automatisés de défense et de surveillance, associée à la nécessité de réduire l'exposition des soldats en milieu hostile, est un facteur clé de l'adoption des véhicules terrestres sans pilote dans les secteurs militaire et de la sécurité intérieure.

- En octobre 2023, Northrop Grumman Corporation a annoncé le succès des essais sur le terrain d'un système de véhicule terrestre sans pilote semi-autonome destiné à la surveillance périmétrique et aux missions de ravitaillement autonome, soulignant ainsi l'investissement croissant du secteur de la défense dans les systèmes robotiques.

- L'utilisation croissante de véhicules terrestres sans pilote dans des secteurs commerciaux tels que l'agriculture, les mines et l'industrie pétrolière et gazière stimule également la croissance du marché. Ces véhicules contribuent notamment à la surveillance des cultures, à la cartographie du terrain et à la manutention des matières dangereuses.

- Les initiatives gouvernementales et les programmes de modernisation de la défense dans les pays de l'OTAN et de la région Asie-Pacifique alimentent la demande de systèmes sans pilote capables d'assurer des rôles de logistique, de reconnaissance et de soutien au combat.

- L'importance croissante accordée à la sécurité des frontières, aux opérations antiterroristes et aux interventions en cas de catastrophe encourage davantage l'acquisition de véhicules terrestres sans pilote dotés de capacités de mobilité et de détection avancées.

- Ensemble, ces facteurs accélèrent l'intégration des véhicules terrestres sans pilote (UGV) dans les opérations multidomaines, transformant ainsi le paysage de l'automatisation terrestre et des stratégies de défense.

Quel facteur freine la croissance du marché des véhicules terrestres sans pilote ?

- L'un des principaux obstacles à la généralisation des véhicules terrestres sans pilote est le manque d'infrastructures de recharge, notamment dans les régions rurales ou sous-développées. L'autonomie reste une préoccupation majeure pour les consommateurs habitués à trouver des stations-service à chaque coin de rue.

- Par exemple, malgré les progrès réalisés, de nombreux pays ne disposent toujours pas des réseaux de recharge rapide nécessaires à une adoption à grande échelle, ce qui affecte la viabilité des voyages longue distance et l'utilisation des flottes.

- De plus, le coût initial élevé des véhicules terrestres sans pilote haut de gamme, dû à l'utilisation de batteries et de systèmes de moteurs avancés, peut constituer un obstacle, notamment sur les marchés sensibles aux prix comme l'Inde et l'Asie du Sud-Est.

- Les préoccupations liées à la durée de vie des batteries, à leur coût de remplacement et à l'impact environnemental de leur élimination constituent également des obstacles en matière de développement durable.

- De plus, certains consommateurs sont dissuadés par le choix limité de modèles et leur disponibilité par rapport aux motos traditionnelles, notamment dans les catégories sport et tourisme.

- Pour relever ces défis, il faudra une collaboration entre les gouvernements, les fabricants et les fournisseurs d'énergie afin d'améliorer les infrastructures, de réduire les coûts grâce à l'innovation et de mieux informer les consommateurs sur les avantages et l'utilité des véhicules terrestres sans pilote.

Comment le marché des véhicules terrestres sans pilote est-il segmenté ?

Le marché est segmenté en fonction du type de motorisation, du type de batterie et de l'utilisation finale.

• Sur demande

Selon l'application, le marché des véhicules terrestres sans pilote (UAV) se divise en trois segments : militaire, commercial et forces de l'ordre fédérales. Le segment militaire a dominé le marché en 2024, représentant 61,5 % des revenus, grâce au déploiement accru de UAV pour la surveillance, le soutien au combat, la logistique et le déminage. Les forces armées du monde entier investissent dans des systèmes robotisés afin d'améliorer leurs capacités opérationnelles et de réduire les risques pour leur personnel en milieu hostile.

Le segment commercial devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par une adoption croissante dans des secteurs tels que les mines, l'agriculture et l'inspection des infrastructures. Avec les progrès des technologies autonomes, les véhicules terrestres sans pilote (UGV) sont de plus en plus utilisés pour des tâches exigeantes en main-d'œuvre ou dangereuses dans tous les secteurs commerciaux.

• Par taille

En fonction de leur taille, le marché est segmenté en quatre catégories : petits (4,5 à 90 kg), moyens (90 à 225 kg), grands (225 à 450 kg), très grands (450 à 900 kg) et extrêmement grands (plus de 900 kg). Le segment des petits drones terrestres (UGV) détenait la plus grande part de marché (38,2 %) en 2024, grâce à sa polyvalence, son prix abordable et son adéquation aux applications de reconnaissance, de surveillance et tactiques, tant dans le domaine militaire que civil.

Le segment des véhicules extrêmement lourds (>2 000 LBS) devrait enregistrer le taux de croissance le plus rapide au cours de la période de prévision, en raison de la demande croissante de véhicules autonomes lourds utilisés dans la logistique, les missions de ravitaillement et les opérations de construction.

• Par système

Le marché des véhicules terrestres sans pilote (UGV) est segmenté, selon le système, en charges utiles, unités de contrôle, connecteurs, câbles électriques, actionneurs et éléments mécaniques. Le segment des charges utiles représentait la plus grande part de revenus (33,7 %) en 2024, grâce à la demande croissante de capteurs, caméras, systèmes d'armement et outils de communication avancés intégrés aux véhicules terrestres sans pilote pour diverses missions opérationnelles.

Le segment des unités de contrôle devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, grâce aux innovations dans les technologies de contrôle à distance et autonomes, notamment la navigation pilotée par l'IA et les interfaces de commande en temps réel.

• Par mobilité

En fonction de leur mobilité, le marché est segmenté en véhicules chenillés, à roues, à pattes et autres. Le segment des véhicules terrestres sans pilote chenillés représentait la plus grande part de marché (45,1 %) en 2024, grâce à ses capacités tout-terrain supérieures, sa stabilité et sa capacité de charge, notamment pour les opérations de défense et minières.

Le segment des véhicules terrestres sans pilote à pattes devrait connaître la croissance la plus rapide au cours de la période prévisionnelle en raison des progrès de la robotique biomimétique et de la demande de systèmes capables de naviguer sur des terrains complexes où les systèmes à roues ou à chenilles sont moins efficaces.

• Par mode de fonctionnement

Selon leur mode de fonctionnement, le marché des véhicules terrestres sans pilote (UAV) se divise en trois segments : téléopérés, autonomes et filaires. Le segment téléopéré a dominé le marché en 2024, représentant la plus grande part de revenus (52,6 %), grâce à une utilisation généralisée dans les secteurs militaire et industriel, où le contrôle humain demeure essentiel à la flexibilité des missions et à la réactivité face aux situations.

Le segment des systèmes autonomes devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, porté par les progrès rapides de l'IA, de la vision par ordinateur et des systèmes de navigation autonome. La confiance accrue dans les systèmes sans pilote et leur utilisation croissante dans la logistique, l'agriculture et la défense sont des facteurs clés de cette croissance.

Quel pays détient la plus grande part du marché des véhicules terrestres sans pilote ?

- Le marché chinois des véhicules terrestres sans pilote a décroché la plus grande part de marché en Asie-Pacifique en 2024, grâce à l'expansion du complexe militaro-industriel du pays, à d'importants investissements dans l'IA et la robotique, et à l'importance croissante accordée aux systèmes sans pilote pour la logistique et la surveillance.

- L'Armée populaire de libération (APL) teste et déploie activement des véhicules terrestres sans pilote pour la surveillance des frontières et l'entraînement au combat urbain.

- En outre, le secteur commercial chinois intègre les véhicules terrestres sans pilote à l'agriculture intelligente et à l'inspection industrielle, stimulant ainsi leur adoption intersectorielle.

Analyse du marché indien des véhicules terrestres sans pilote

Le marché indien des véhicules terrestres sans pilote (UGV) devrait connaître une forte croissance annuelle composée jusqu'en 2032, portée par l'initiative « Make in India », l'augmentation des dépenses de défense et les besoins urgents en matière de surveillance des frontières et de lutte contre l'insurrection. Les agences de défense indiennes collaborent avec des start-ups et des entreprises publiques pour développer des technologies de véhicules terrestres sans pilote de conception locale, adaptées aux terrains accidentés et aux environnements hostiles. Par ailleurs, les entreprises minières expérimentent des UGV semi-autonomes pour le transport de matériaux dans des zones reculées.

Analyse du marché japonais des véhicules terrestres sans pilote

Le marché japonais des véhicules terrestres sans pilote connaît une croissance soutenue, portée par les capacités robotiques avancées du pays, son engagement fort en faveur de la résilience face aux catastrophes et l'évolution de sa stratégie de défense. Les Forces d'autodéfense japonaises étudient l'utilisation de ces véhicules pour les missions de recherche et de sauvetage, le déminage et la sécurité périmétrique. Dans le secteur civil, le recours par le Japon à des robots mobiles compacts pour l'inspection des infrastructures et l'automatisation agricole contribue également à la pénétration du marché.

Aperçu du marché des véhicules terrestres sans pilote en Corée du Sud

Le marché sud-coréen des véhicules terrestres sans pilote (UGV) est en pleine expansion, porté par l'innovation croissante dans le secteur de la défense, les besoins en surveillance des frontières et la collaboration entre les entreprises de défense et les instituts de recherche locaux. La Corée du Sud investit dans des UGV dotés d'intelligence artificielle pour la logistique, la surveillance et le soutien au combat. Des applications civiles émergent également, avec des essais d'UGV dans le secteur de la construction et pour les patrouilles de sécurité. La volonté du gouvernement de stimuler les exportations de défense devrait positionner la Corée du Sud comme un acteur majeur de la production régionale de véhicules terrestres sans pilote.

Quelles sont les principales entreprises du marché des véhicules terrestres sans pilote ?

L'industrie des véhicules terrestres sans pilote est principalement dominée par des entreprises bien établies, notamment :

- Honda Motor Co., Ltd. (Japon)

- Harley-Davidson, Inc. (États-Unis)

- Zero Motorcycles, Inc. (États-Unis)

- KTM AG (Autriche)

- BMW Motorrad (Allemagne)

- Maeving (Royaume-Uni)

- Energica Motor Company SpA (Italie)

- GÂTEAU (Suède)

- SUR-RON USA (États-Unis)

- Mouvement électrique (France)

- Fonz Moto Pty Limited (Australie)

- Arc Vector (Royaume-Uni)

- Emflux Motors (Inde)

- Motos Evoke (Chine)

- Fuell Flow (États-Unis)

- Kawasaki Heavy Industries, Ltd. (Japon)

- Savic Motorcycles (Australie)

- Suzuki Motor Corporation (Japon)

- Motos Tacita (Italie)

- Tarform Luna (États-Unis)

Quels sont les développements récents sur le marché des véhicules terrestres sans pilote en Asie-Pacifique ?

- En juin 2025, l'Administration suédoise du matériel de défense (FMV) a attribué à Rheinmetall un contrat de 563 000 USD pour évaluer son véhicule terrestre sans pilote (UGV) Mission Master dans le cadre du programme DAMM. Cette initiative témoigne de l'engagement continu de la Suède à intégrer des systèmes autonomes dans ses futures opérations de défense.

- En mai 2025, Huawei a déployé 100 camions miniers électriques autonomes compatibles 5G-A à la mine de charbon de Yimin en Chine, affichant une efficacité opérationnelle supérieure de 120 % à celle des flottes traditionnelles à conduite manuelle. Ce déploiement souligne la viabilité commerciale croissante et les gains de productivité des technologies de véhicules autonomes en milieu industriel.

- En mars 2025, l'Ukraine a mené avec succès sa première offensive de grande envergure en utilisant uniquement des véhicules terrestres sans pilote (UGV) et des drones FPV, démontrant ainsi l'efficacité sur le champ de bataille des tactiques interarmes autonomes. Cet événement marque une étape importante dans la guerre moderne et souligne le potentiel opérationnel des scénarios de combat terrestre entièrement automatisés.

- En janvier 2025, la Direction générale de l'armement (DGA) a lancé le programme DROIDE en partenariat avec KNDS et Safran, visant à développer des robots terrestres multi-missions déployables d'ici 2035. Ce programme souligne l'importance stratégique à long terme accordée par la France à la robotique et à l'autonomie dans sa planification de défense nationale.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SIZE TIMELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 CASE STUDY ANALYSIS

4.2.1 CASE STUDY: DEPLOYMENT OF THEMIS UNMANNED GROUND VEHICLE AND ITS IMPACT ON MILITARY LOGISTICS AND COMBAT SUPPORT OPERATIONS

4.2.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.1.2 OPERATIONAL CHALLENGES PRIOR TO UGV INTEGRATION

4.2.1.2.1 HIGH PERSONNEL RISK IN FRONTLINE AND SUPPORT MISSIONS

4.2.1.2.2 LOGISTICAL CONSTRAINTS IN CONTESTED AND REMOTE TERRAIN

4.2.1.2.3 DEMAND FOR ENHANCED SITUATIONAL AWARENESS

4.2.1.3 TECHNOLOGICAL AND OPERATIONAL MEASURES INTRODUCED

4.2.1.3.1 MODULAR UGV ARCHITECTURE

4.2.1.3.2 REMOTE AND SEMI-AUTONOMOUS OPERATION

4.2.1.3.3 INTEGRATION WITH EXISTING FORCE STRUCTURES

4.2.1.4 IMPACT ON MILITARY OPERATIONS AND LOGISTICS EFFICIENCY

4.2.1.4.1 IMPROVED LOGISTICS CONTINUITY

4.2.1.4.2 REDUCED EXPOSURE OF HUMAN PERSONNEL

4.2.1.4.3 ENHANCED OPERATIONAL FLEXIBILITY

4.2.1.4.4 SUPPORT FOR MULTI-DOMAIN OPERATIONS

4.2.1.5 LIMITATIONS AND LESSONS LEARNED

4.2.1.5.1 DEPENDENCE ON COMMUNICATIONS AND CONTROL SYSTEMS

4.2.1.5.2 CONSTRAINTS ON FULL AUTONOMY IN COMPLEX ENVIRONMENTS

4.2.2 CASE STUDY: MULTIFUNCTIONAL UNMANNED GROUND VEHICLES IN EMERGENCY RESPONSE AND PUBLIC SAFETY OPERATIONS

4.2.2.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.2.2 OPERATIONAL CHALLENGES BEFORE UGV DEPLOYMENT

4.2.2.2.1 HIGH RISK TO FIRST RESPONDERS

4.2.2.2.2 DELAYS IN INCIDENT ASSESSMENT

4.2.2.3 TECHNOLOGICAL MEASURES INTRODUCED

4.2.2.3.1 INTEGRATED SENSORS AND MANIPULATION TOOLS

4.2.2.3.2 REMOTE COMMAND AND CONTROL OPERATIONS

4.2.2.4 IMPACT ON EMERGENCY RESPONSE EFFECTIVENESS

4.2.2.4.1 IMPROVED RESPONDER SAFETY

4.2.2.4.2 FASTER AND MORE INFORMED DECISION-MAKING

4.3 CONSUMER BUYING BEHAVIOUR

4.4 CONSUMER PURCHASE DECISION PROCESS

4.4.1 PROBLEM RECOGNITION

4.4.2 INFORMATION SEARCH

4.4.3 ALTERNATIVE EVALUATION

4.4.4 PURCHASE DECISION

4.4.5 POST-PURCHASE BEHAVIOR

4.4.6 INFLUENCING FACTORS

4.5 KEY STRATEGIC INITIATIVES

4.5.1 INTEGRATION OF UGVS INTO MULTI-DOMAIN DEFENCE AND SECURITY ARCHITECTURES

4.5.1.1 CONVERGENCE OF LAND, AIR, AND COMMAND-AND-CONTROL SYSTEMS

4.5.1.2 INTEROPERABILITY WITH EXISTING MILITARY AND HOMELAND SECURITY ASSETS

4.5.1.3 Coordination of Multimodal Transport Networks

4.5.2 EMPHASIS ON AUTONOMY, ARTIFICIAL INTELLIGENCE AND ADVANCED SENSING

4.5.2.1 ADVANCEMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS NAVIGATION

4.5.2.2 INTEGRATION OF MULTI-SENSOR AND PERCEPTION SYSTEMS

4.5.3 PLATFORM MODULARITY AND MISSION-SPECIFIC CONFIGURABILITY

4.5.3.1 DEVELOPMENT OF MODULAR PAYLOAD AND CHASSIS DESIGNS

4.5.3.2 SUPPORT FOR DUAL-USE AND CIVIL–MILITARY APPLICATIONS

4.5.4 LOCALISATION, DOMESTIC MANUFACTURING AND SUPPLY CHAIN RESILIENCE

4.5.4.1 ALIGNMENT WITH NATIONAL DEFENCE INDUSTRIAL POLICIES

4.5.4.2 STRENGTHENING OF REGIONAL SUPPLY AND MAINTENANCE ECOSYSTEMS

4.5.5 CYBERSECURITY, RELIABILITY AND OPERATIONAL RESILIENCE

4.5.5.1 INTEGRATION OF SECURE COMMUNICATION AND CYBER HARDENING

4.5.5.2 DESIGN FOR HARSH AND CONTESTED ENVIRONMENTS

4.5.6 EXPANSION OF INTERNATIONAL COLLABORATIONS AND DEFENCE PARTNERSHIPS

4.5.6.1 CROSS-BORDER TECHNOLOGY COLLABORATION AND JOINT PROGRAMS

4.5.6.2 PARTICIPATION IN ASIA-PACIFIC DEFENCE MODERNISATION PROGRAMS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 NORTH AMERICA — ADVANCED DEFENCE DOCTRINE AND TECHNOLOGY LEADERSHIP

4.6.1.1 INSTITUTIONALISATION OF ROBOTIC AND AUTONOMOUS GROUND SYSTEMS

4.6.1.2 BORDER SECURITY, BASE PROTECTION AND HOMELAND APPLICATIONS

4.6.2 EUROPE — MULTINATIONAL COOPERATION AND TERRITORIAL SECURITY

4.6.2.1 COLLECTIVE DEFENCE AND INTEROPERABILITY-DRIVEN DEMAND

4.6.2.2 HEIGHTENED FOCUS ON BORDER SURVEILLANCE AND INFRASTRUCTURE PROTECTION

4.6.3 ASIA–PACIFIC — STRATEGIC TENSIONS AND DUAL-USE EXPANSION

4.6.3.1 BORDER MANAGEMENT AND TERRAIN-INTENSIVE OPERATIONS

4.6.3.2 DISASTER RESPONSE, URBAN SAFETY AND CIVIL APPLICATIONS

4.6.4 MIDDLE EAST — BORDER CONTROL AND CRITICAL ASSET SECURITY

4.6.4.1 PROTECTION OF ENERGY AND STRATEGIC INFRASTRUCTURE

4.6.4.2 LOCAL DEFENCE INDUSTRIAL DEVELOPMENT

4.6.5 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS

4.7.1 OVERVIEW

4.7.2 AUTONOMOUS NAVIGATION AND ADVANCED SLAM CAPABILITIES

4.7.3 ARTIFICIAL INTELLIGENCE–DRIVEN PERCEPTION AND SENSOR FUSION

4.7.4 EDGE COMPUTING AND ON-BOARD AUTONOMY

4.7.5 SWARMING TECHNOLOGIES AND MULTI-VEHICLE COORDINATION

4.7.6 MODULAR DESIGN AND OPEN-SYSTEM ARCHITECTURES

4.7.7 DIGITAL TWINS, SIMULATION, AND SYNTHETIC TRAINING ENVIRONMENTS

4.7.8 CONCLUSION

4.8 PRICING ANALYSIS

4.9 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.1 IMPORT EXPORT SCENARIO

4.10.1 COUNTRY-LEVEL PATTERNS

4.10.2 COMPANY-LEVEL TRADE BEHAVIOR

4.11 SUSTAINABILITY INITIATIVES

4.11.1 SUSTAINABILITY DRIVERS IN THE UGV MARKET:

4.11.2 REAL-TIME EXAMPLES: SUSTAINABILITY IN PRACTICE

4.11.2.1 Defense Sector: Hybridization and Fuel Reduction

4.11.2.2 Active Combat Logistics: Resource Optimization

4.11.2.3 Agriculture: Direct Environmental Sustainability Impact

4.11.2.4 Disaster Response & Hazard Mitigation

4.11.3 CROSS-CUTTING SUSTAINABILITY THEMES

4.11.4 STRATEGIC IMPLICATIONS FOR THE UGV MARKET

4.12 TECHNOLOGICAL TRENDS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIALS AND FOUNDATIONAL INPUTS

4.13.2 CORE COMPONENT MANUFACTURING

4.13.3 SENSORS, ELECTRONICS, AND SUBSYSTEMS

4.13.4 SOFTWARE, AUTONOMY, AND CONTROL SYSTEMS

4.13.5 SYSTEM INTEGRATION AND FINAL ASSEMBLY

4.13.6 DISTRIBUTION, DEPLOYMENT, AND LIFECYCLE SUPPORT

5 REGULATORY STANDARDS

5.1 DEFENSE AND MILITARY PROCUREMENT FRAMEWORKS

5.1.1 NATIONAL DEFENSE ACQUISITION SYSTEMS

5.1.2 REGULATIONS ON WEAPONIZATION AND AUTONOMOUS ENGAGEMENT

5.2 SAFETY AND OPERATIONAL COMPLIANCE STANDARDS

5.2.1 INTERNATIONAL ROBOTICS AND FUNCTIONAL SAFETY STANDARDS

5.2.2 SECTOR-SPECIFIC OPERATIONAL SAFETY REQUIREMENTS

5.3 COMMUNICATION, SPECTRUM, AND CYBERSECURITY REGULATIONS

5.3.1 RADIOFREQUENCY SPECTRUM GOVERNANCE

5.3.2 CYBERSECURITY AND ENCRYPTION COMPLIANCE

5.4 ARTIFICIAL INTELLIGENCE, AUTONOMY AND ETHICAL GOVERNANCE

5.4.1 INTERNATIONAL AI PRINCIPLES AND HUMAN-CONTROL REQUIREMENTS

5.4.2 NATIONAL AND REGIONAL AI REGULATORY POLICIES

5.5 EXPORT CONTROL AND CROSS-BORDER TRADE REGULATIONS

5.5.1 CONTROL OF DUAL-USE TECHNOLOGIES

5.5.2 SANCTIONS AND MARKET ACCESS LIMITATIONS

5.6 CERTIFICATION, TESTING, AND FIELD DEPLOYMENT STANDARDS

5.6.1 DEFENSE OPERATIONAL TESTING AND EVALUATION

5.6.2 INDUSTRIAL AND COMMERCIAL COMPLIANCE PATHWAYS

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 DEFENCE MODERNIZATION PROGRAMS ACCELERATING ASIA-PACIFIC UGV PROCUREMENT MOMENTUM

6.1.2 ADVANCEMENTS IN AI AND SENSORS ENABLING HIGHER-AUTONOMY CAPABILITIES

6.1.3 EXPANDING COMMERCIAL ADOPTION ACROSS MINING, AGRICULTURE, AND LOGISTICS

6.1.4 GROWING USAGE OF UNMANNED GROUND VEHICLES IN AREAS AFFECTED BY CBRN ATTACKS

6.2 RESTRAINT

6.2.1 HIGH DEVELOPMENT AND INTEGRATION COSTS LIMITING WIDER DEPLOYMENT

6.2.2 EXPORT CONTROLS AND POLICY RESTRICTIONS CONSTRAINING ASIA-PACIFIC SALES

6.3 OPPORTUNITIES

6.3.1 MODULAR MISSION-PAYLOAD DESIGNS UNLOCKING DIVERSIFIED APPLICATION SEGMENTS OF UGV

6.3.2 EXPANDING ROLE OF UNMANNED SYSTEMS IN MULTI-DOMAIN OPERATIONS

6.3.3 AFTERMARKET SERVICE AND SOFTWARE EXPANDING UGV PROFITABILITY POTENTIAL

6.4 CHALLENGES

6.4.1 CYBERSECURITY VULNERABILITIES CREATING OPERATIONAL AND SAFETY RISKS

6.4.2 RELIABILITY ISSUES IN HARSH, CONTESTED, AND REMOTE ENVIRONMENTS

7 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE

7.1 OVERVIEW

7.2 MICRO UGVS (<10 LBS)

7.3 SMALL (10 - 200 LBS)

7.4 MEDIUM (200 - 500 LBS)

7.5 LARGE (500 – 1,000 LBS)

7.6 VERY LARGE (1,000 – 2,000 LBS)

7.7 EXTREMELY LARGE (>2,000 LBS)

7.8 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 EUROPE

7.8.3 NORTH AMERICA

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST & AFRICA

7.9 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.9.1 ASIA-PACIFIC

7.9.2 EUROPE

7.9.3 NORTH AMERICA

7.9.4 SOUTH AMERICA

7.9.5 MIDDLE EAST & AFRICA

7.1 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.10.1 ASIA-PACIFIC

7.10.2 EUROPE

7.10.3 NORTH AMERICA

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST & AFRICA

7.11 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.11.1 ASIA-PACIFIC

7.11.2 EUROPE

7.11.3 NORTH AMERICA

7.11.4 SOUTH AMERICA

7.11.5 MIDDLE EAST & AFRICA

7.12 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.12.1 ASIA-PACIFIC

7.12.2 EUROPE

7.12.3 NORTH AMERICA

7.12.4 SOUTH AMERICA

7.12.5 MIDDLE EAST & AFRICA

7.13 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.13.1 ASIA-PACIFIC

7.13.2 EUROPE

7.13.3 NORTH AMERICA

7.13.4 SOUTH AMERICA

7.13.5 MIDDLE EAST & AFRICA

8 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM

8.1 OVERVIEW

8.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

8.2.1 PAYLOADS

8.2.2 CONTROLLER UNITS

8.2.3 POWER SYSTEM

8.2.4 NAVIGATION SYSTEM

8.2.5 CHASSIS SYSTEM

8.2.6 COMMUNICATION SYSTEM

8.2.7 OTHERS

8.3 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.3.1 CAMERAS

8.3.2 SENSORS

8.3.3 GPS ANTENNAS

8.3.4 LASERS

8.3.5 RADARS

8.3.6 MOTOR ENCODERS

8.3.7 ARTICULATED ARMS

8.3.8 OTHERS

8.4 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 EUROPE

8.4.3 NORTH AMERICA

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 EUROPE

8.5.3 NORTH AMERICA

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.6.1 ELECTRIC NON SOLAR RECHARGEABLE BATTERY

8.6.2 SOLAR RECHARGEABLE BATTERY

8.7 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.7.1 LITHIUM ION

8.7.2 LEAD ACID

8.7.3 NICKEL METAL HYDRIDE

8.7.4 NICKEL CADMIUM

8.8 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 EUROPE

8.8.3 NORTH AMERICA

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.10.1 MOTOR

8.10.2 ACTUATOR

8.11 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 EUROPE

8.11.3 NORTH AMERICA

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.12.1 RF COMMUNICATION

8.12.2 SATELLITE COMMUNICATION

8.12.3 4G/5G COMMUNICATION

8.13 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 EUROPE

8.13.3 NORTH AMERICA

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

9 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY

9.1 OVERVIEW

9.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

9.2.1 WHEELED

9.2.2 TRACKED

9.2.3 LEGGED

9.2.4 HYBRID

9.2.5 SNAKE/ARTICULATED MOBILITY

9.3 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 EUROPE

9.3.3 NORTH AMERICA

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 EUROPE

9.4.3 NORTH AMERICA

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 EUROPE

9.5.3 NORTH AMERICA

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 EUROPE

9.6.3 NORTH AMERICA

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION

10.1 OVERVIEW

10.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

10.2.1 TELEOPERATED

10.2.2 TETHERED

10.2.3 AUTONOMOUS

10.3 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

10.5.1 SEMI-AUTONOMOUS

10.5.2 FULLY AUTONOMOUS

10.6 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

11.2.1 LIGHT DUTY (LESS THAN 50 KG

11.2.2 MEDIUM DUTY (50–200 KG)

11.2.3 HEAVY DUTY (200–1,000 KG)

11.2.4 ULTRA-HEAVY DUTY (>1,000 KG)

11.3 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 EUROPE

11.3.3 NORTH AMERICA

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 EUROPE

11.4.3 NORTH AMERICA

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 EUROPE

11.5.3 NORTH AMERICA

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 EUROPE

11.6.3 NORTH AMERICA

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION

12.1 OVERVIEW

12.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

12.2.1 ELECTRIC

12.2.2 HYBRID

12.2.3 DIESEL/GASOLINE POWERED

12.2.4 HYDROGEN FUEL CELL UGVS

12.2.5 SOLAR-ASSISTED UGVS

12.3 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 EUROPE

12.3.3 NORTH AMERICA

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST & AFRICA

12.4 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

13.2.1 COMMERCIAL

13.2.2 MILITARY

13.2.3 FEDERAL LAW ENFORCEMENT

13.2.4 LAW ENFORCEMENT

13.3 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.3.1 FIREFIGHTING

13.3.2 AUTONOMOUS DELIVERY

13.3.3 CBRN

13.3.4 PHYSICAL SECURITY

13.3.5 AGRICULTURE

13.3.6 DOMESTIC

13.3.7 OIL & GAS

13.3.8 WAREHOUSE & LOGISTICS

13.3.9 OTHERS

13.4 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.4.1 SPRAYING

13.4.2 MOWING

13.4.3 TILLING

13.5 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.5.1 INSPECTION

13.5.2 HAULAGE

13.6 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.6.1 SORTING ROBOTS

13.6.2 PALLET MOVERS

13.7 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 EUROPE

13.7.3 NORTH AMERICA

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST & AFRICA

13.8 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.8.1 TRANSPORTATION

13.8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13.8.3 EXPLOSIVE ORDNANCE DISPOSAL

13.8.4 SEARCH & RESCUE

13.8.5 FIREFIGHTING

13.8.6 COMBAT SUPPORT

13.8.7 MINE CLEARANCE

13.8.8 OTHERS

13.9 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 EUROPE

13.9.3 NORTH AMERICA

13.9.4 SOUTH AMERICA

13.9.5 MIDDLE EAST & AFRICA

13.1 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.10.1 ASIA-PACIFIC

13.10.2 EUROPE

13.10.3 NORTH AMERICA

13.10.4 SOUTH AMERICA

13.10.5 MIDDLE EAST & AFRICA

13.11 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.11.1 BOMB DISPOSAL UNITS

13.11.2 RIOT CONTROL ROBOTS

13.11.3 URBAN SURVEILLANCE ROBOTS

13.12 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.12.1 ASIA-PACIFIC

13.12.2 EUROPE

13.12.3 NORTH AMERICA

13.12.4 SOUTH AMERICA

13.12.5 MIDDLE EAST & AFRICA

14 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 JAPAN

14.1.2 CHINA

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 NEW ZEALAND

14.1.12 VIETNAM

14.1.13 TAIWAN

14.1.14 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GENERAL DYNAMICS LAND SYSTEMS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 RHEINMETALL AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ELBIT SYSTEMS LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TEXTRON SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 THALES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AEROVIRONMENT, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASELSAN A.Ş.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DOK-ING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EDGEFORCE

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GHOSTROBOTICS.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HANWHA AEROSPACE

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 HYUNDAI ROTEM COMPANY.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 IAI

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LEONARDO S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MILREM AS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERATON

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 QINETIQ

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ROBOTEAM

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ST ENGINEERING

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TELEDYNE FLIR DEFENSE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGICAL DEVELOPMENT

TABLE 3 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC

TABLE 57 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC

TABLE 59 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 78 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 79 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 80 JAPAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 81 JAPAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 82 JAPAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 83 JAPAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 84 JAPAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 85 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 86 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 87 JAPAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 88 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 89 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 90 JAPAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 91 JAPAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 92 JAPAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 93 JAPAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 94 JAPAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 95 JAPAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 96 JAPAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 97 CHINA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 98 CHINA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 99 CHINA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 100 CHINA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 101 CHINA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 102 CHINA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 103 CHINA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 104 CHINA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 105 CHINA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 106 CHINA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 107 CHINA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 108 CHINA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 109 CHINA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 110 CHINA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 111 CHINA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 112 CHINA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 113 CHINA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 114 CHINA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 115 CHINA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 116 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 117 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 118 SOUTH KOREAPAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 119 SOUTH KOREAPOWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 120 SOUTH KOREAELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 121 SOUTH KOREA CASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 122 SOUTH KOREACOMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 123 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 124 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 125 SOUTH KOREA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 126 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 127 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 128 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 129 SOUTH KOREACOMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 130 SOUTH KOREAAGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 131 SOUTH KOREAOIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 132 SOUTH KOREAWAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 133 SOUTH KOREA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 134 SOUTH KOREALAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 135 INDIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 136 INDIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 137 INDIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 138 INDIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 139 INDIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 140 INDIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 141 INDIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 142 INDIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 143 INDIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 144 INDIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 145 INDIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 146 INDIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 147 INDIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 148 INDIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 149 INDIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 150 INDIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 151 INDIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 152 INDIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 153 INDIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 154 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 155 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 156 AUSTRALIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 157 AUSTRALIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 158 AUSTRALIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 159 AUSTRALIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 160 AUSTRALIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 161 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 162 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 163 AUSTRALIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 164 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 165 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 166 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 167 AUSTRALIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 168 AUSTRALIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 169 AUSTRALIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 170 AUSTRALIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 171 AUSTRALIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 172 AUSTRALIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 173 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 174 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 175 SINGAPORE PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 176 SINGAPORE POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 177 SINGAPORE ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 178 SINGAPORE CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 179 SINGAPORE COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 180 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 181 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 182 SINGAPORE AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 183 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 184 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 185 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 186 SINGAPORE COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 187 SINGAPORE AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 188 SINGAPORE OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 189 SINGAPORE WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 190 SINGAPORE MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 191 SINGAPORE LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 192 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 193 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 194 THAILAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 195 THAILAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 196 THAILAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 197 THAILAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 198 THAILAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 199 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 200 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 201 THAILAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 202 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 203 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 204 THAILAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 205 THAILAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 206 THAILAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 207 THAILAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 208 THAILAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 209 THAILAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 210 THAILAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 211 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 212 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 213 MALAYSIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 214 MALAYSIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 215 MALAYSIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 216 MALAYSIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 217 MALAYSIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 218 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 219 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 220 MALAYSIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 221 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 222 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 223 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 224 MALAYSIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 225 MALAYSIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 226 MALAYSIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 227 MALAYSIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 228 MALAYSIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 229 MALAYSIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 230 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 231 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 232 INDONESIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 233 INDONESIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 234 INDONESIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 235 INDONESIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 236 INDONESIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 237 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 238 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 239 INDONESIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 240 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 241 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 242 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 243 INDONESIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 244 INDONESIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 245 INDONESIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 246 INDONESIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 247 INDONESIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 248 INDONESIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 249 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 250 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 251 PHILIPPINES PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 252 PHILIPPINES POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 253 PHILIPPINES ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 254 PHILIPPINES CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 255 PHILIPPINES COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 256 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 257 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 258 PHILIPPINES AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 259 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 260 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 261 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 262 PHILIPPINES COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 263 PHILIPPINES AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 264 PHILIPPINES OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 265 PHILIPPINES WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 266 PHILIPPINES MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 267 PHILIPPINES LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 268 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 269 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 270 NEW ZEALAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 271 NEW ZEALAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 272 NEW ZEALAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 273 NEW ZEALAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 274 NEW ZEALAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 275 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 276 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 277 NEW ZEALAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 278 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 279 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 280 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 281 NEW ZEALAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 282 NEW ZEALAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 283 NEW ZEALAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 284 NEW ZEALAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 285 NEW ZEALAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 286 NEW ZEALAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 287 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 288 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 289 VIETNAM PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 290 VIETNAM POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 291 VIETNAM ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 292 VIETNAM CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 293 VIETNAM COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 294 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 295 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 296 VIETNAM AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 297 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 298 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 299 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 300 VIETNAM COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 301 VIETNAM AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 302 VIETNAM OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 303 VIETNAM WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 304 VIETNAM MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 305 VIETNAM LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 306 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 307 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 308 TAIWAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 309 TAIWAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 310 TAIWAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 311 TAIWAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 312 TAIWAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 313 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 314 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 315 TAIWAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 316 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 317 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 318 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 319 TAIWAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 320 TAIWAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 321 TAIWAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 322 TAIWAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 323 TAIWAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 324 TAIWAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)